How to Edit Your Invoice Template in QuickBooks

When managing your business finances, presenting professional and personalized payment requests can leave a lasting impression on your clients. Tailoring the layout and content of these documents is an effective way to enhance your brand image while maintaining clear communication. Whether you’re adding your company logo, adjusting payment terms, or choosing a color scheme that reflects your identity, customization can make a significant impact.

Through customization, you can ensure that all the important details are included, such as specific payment instructions, taxes, and client information. Customizing your billing statements not only improves the overall client experience but also streamlines your workflow, saving you time in the long run. This flexibility allows you to maintain a professional appearance while keeping your processes efficient and aligned with your business goals.

In the following sections, we’ll explore how you can make these changes and what benefits they bring to your business operations. Whether you’re a small business owner or managing a large enterprise, the ability to modify your financial documents can be a game changer.

Why Customize Billing Documents in QuickBooks

Personalizing your payment documents can significantly improve the way your business interacts with clients. Customization offers the ability to reflect your brand’s identity while also ensuring that important details are prominently displayed. By modifying the appearance and content of your financial paperwork, you create a more professional and cohesive experience for your customers.

Enhance Brand Recognition

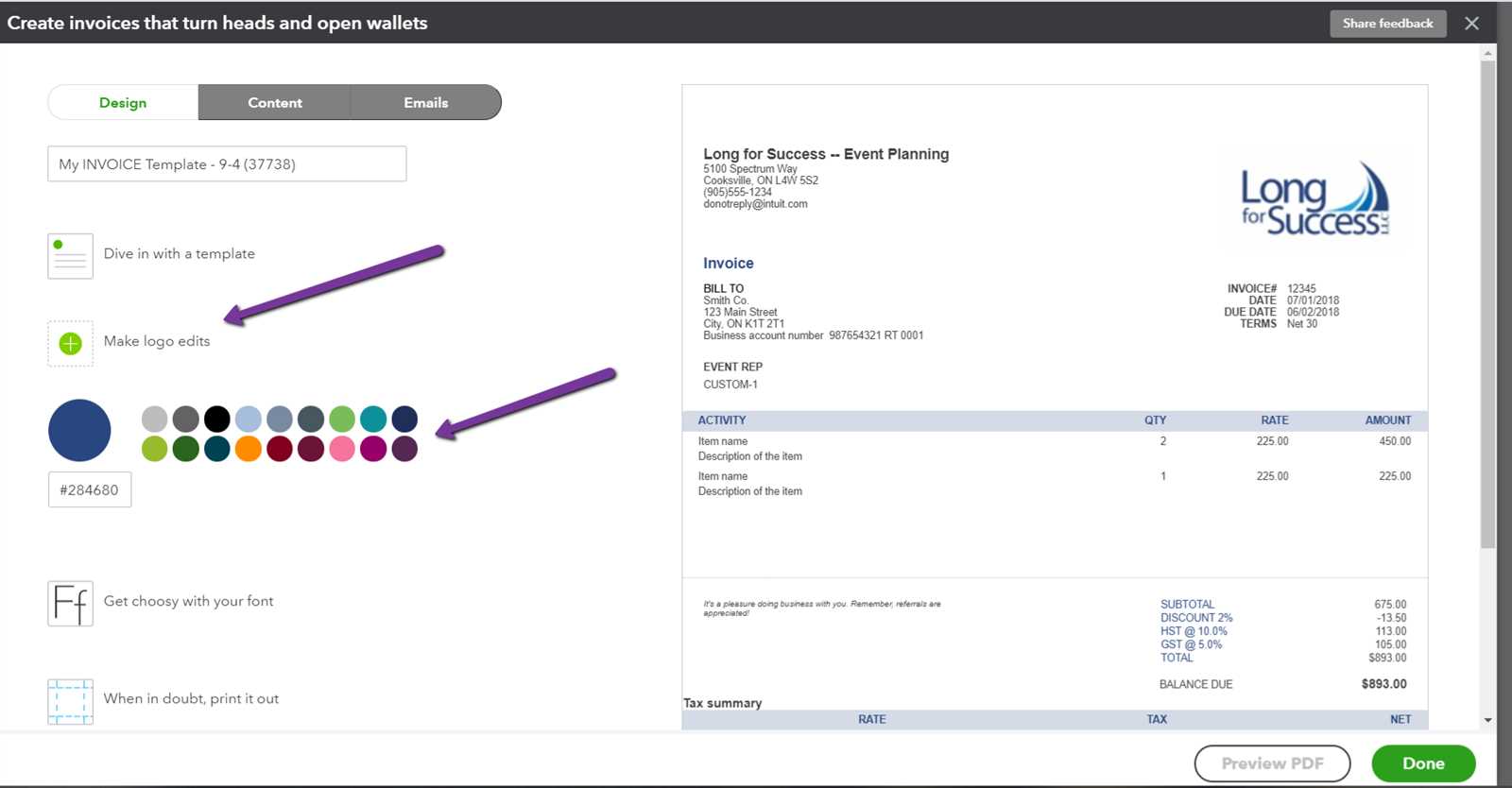

One of the main reasons for customizing your documents is to enhance brand recognition. Adding your company logo, colors, and specific fonts allows you to create consistent branding across all communications. This consistency fosters trust and makes your business appear more professional and reliable in the eyes of your clients.

Streamline Communication and Accuracy

Customizing these documents can also improve the clarity and accuracy of the information presented. By adjusting the layout, you ensure that essential details–such as payment terms, taxes, and contact information–are easy to find and clearly understood. This reduces the chances of misunderstandings and helps ensure that payments are made promptly and accurately.

Step-by-Step Guide to Customizing Billing Documents

Making changes to your business’s payment documents is a straightforward process that allows you to adjust the appearance and content to better suit your needs. By following a few simple steps, you can create professional-looking statements that align with your brand and improve communication with clients. This guide will walk you through the key stages of personalizing your payment paperwork efficiently.

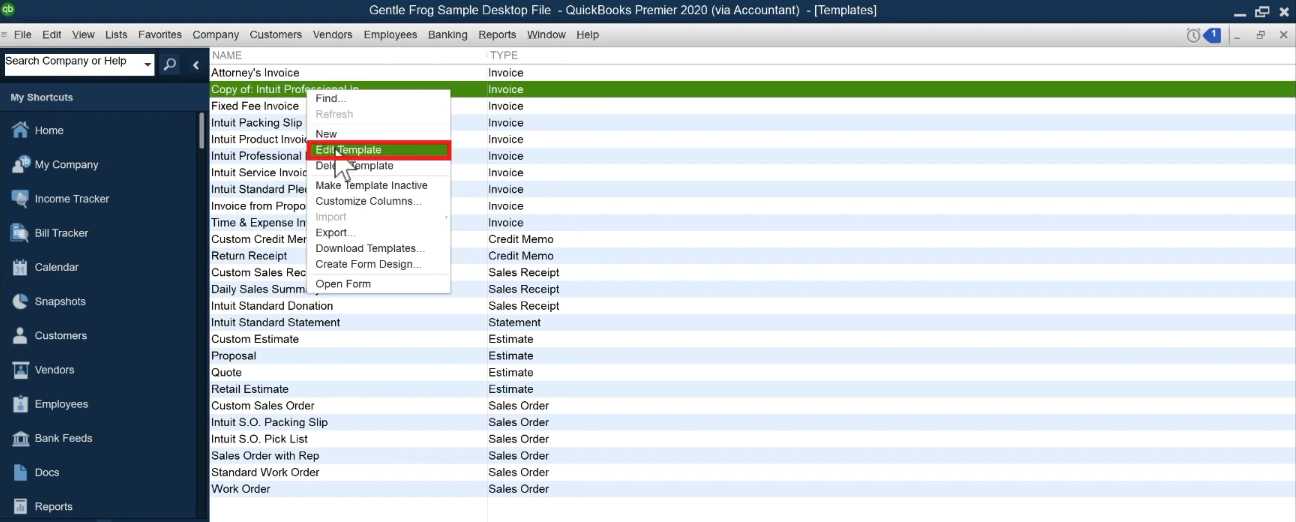

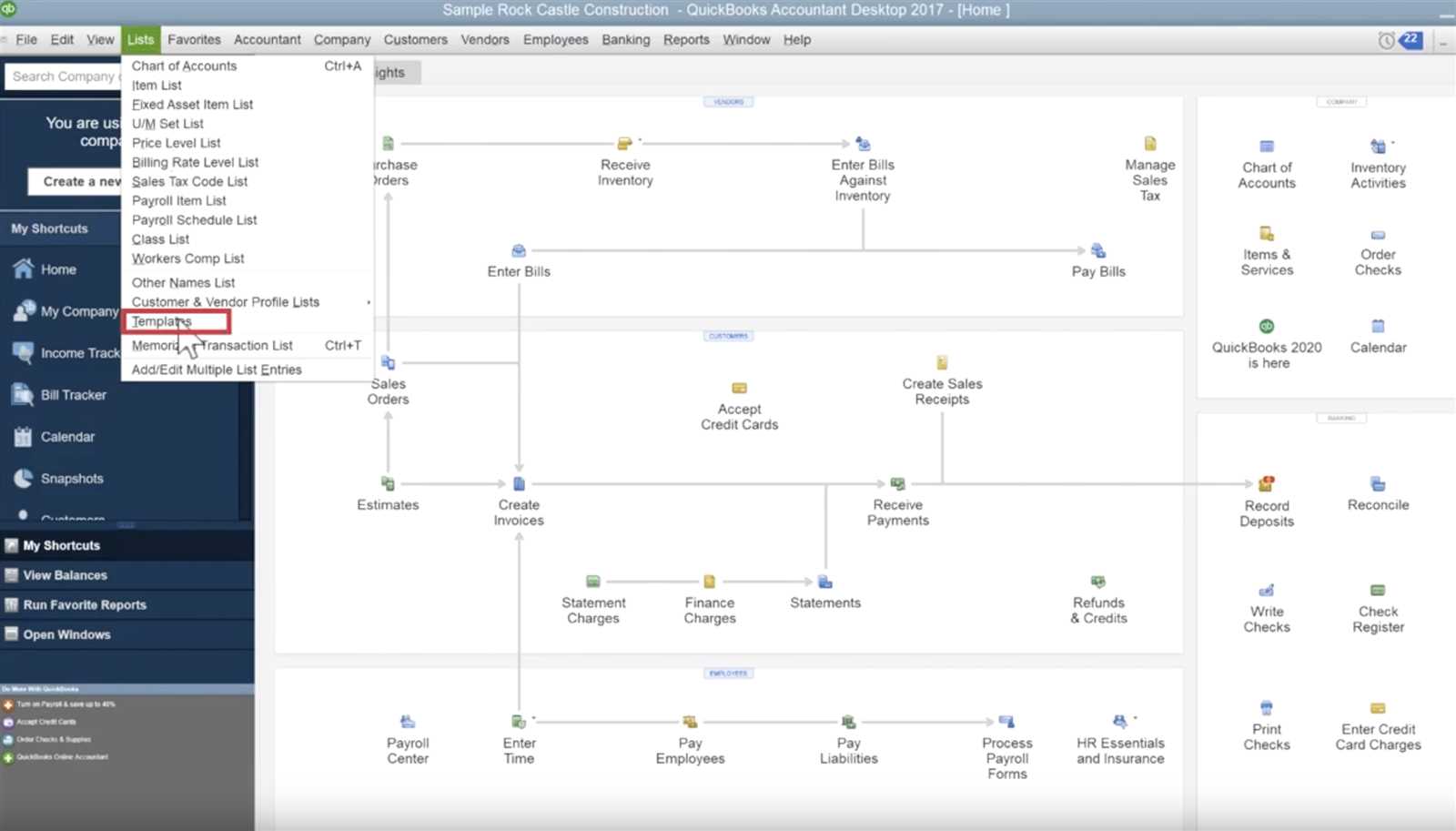

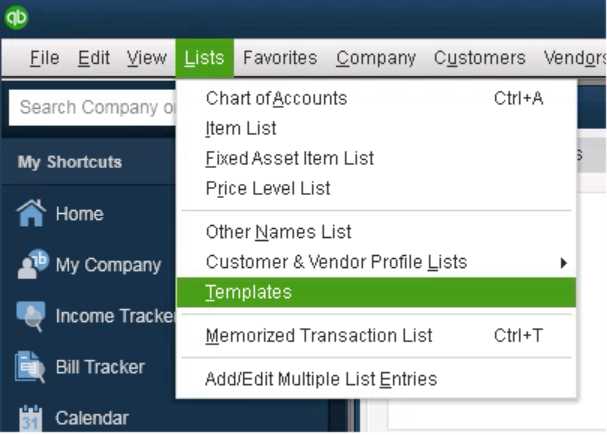

Accessing the Document Settings

To begin customizing your payment documents, first, you need to access the settings where the changes can be made. Here’s how to do it:

- Log in to your accounting software.

- Navigate to the section where financial records or documents are managed.

- Select the option for managing or adjusting billing forms.

Making Customization Changes

Once you’ve accessed the document management area, you can proceed with modifying the content and layout. Here are the steps for customization:

- Logo and Branding: Add your company logo, choose colors, and apply fonts that match your business identity.

- Payment Terms: Update the payment due dates, terms, and instructions according to your preferences.

- Client Information: Adjust how client contact details are displayed or add specific fields for custom data.

- Tax and Discount Settings: Ensure that tax calculations and discounts are correctly shown based on your current business practices.

Once you’ve made these changes, save and apply the new settings to generate documents that fit your business needs. With just a few simple steps, you’ll be able to deliver professional and personalized payment records every time.

How to Access Document Layout Settings

To begin personalizing your financial documents, the first step is to locate the settings where these adjustments can be made. Gaining access to the configuration area allows you to modify the appearance and structure of the records that you send to clients. These settings give you full control over how information is presented, ensuring that your documents reflect your business style and meet your needs.

Follow these steps to access the layout customization area:

- Log into your accounting platform and go to the dashboard.

- Look for the section related to managing financial records or client communications.

- Navigate to the area specifically for customizing documents or record layouts.

- Select the option that allows you to adjust or create new layouts for your business paperwork.

Once you’re in this section, you’ll be able to modify how your documents appear, from adding your logo to changing fonts and adjusting the overall structure. This section acts as the starting point for creating a personalized experience for both you and your clients.

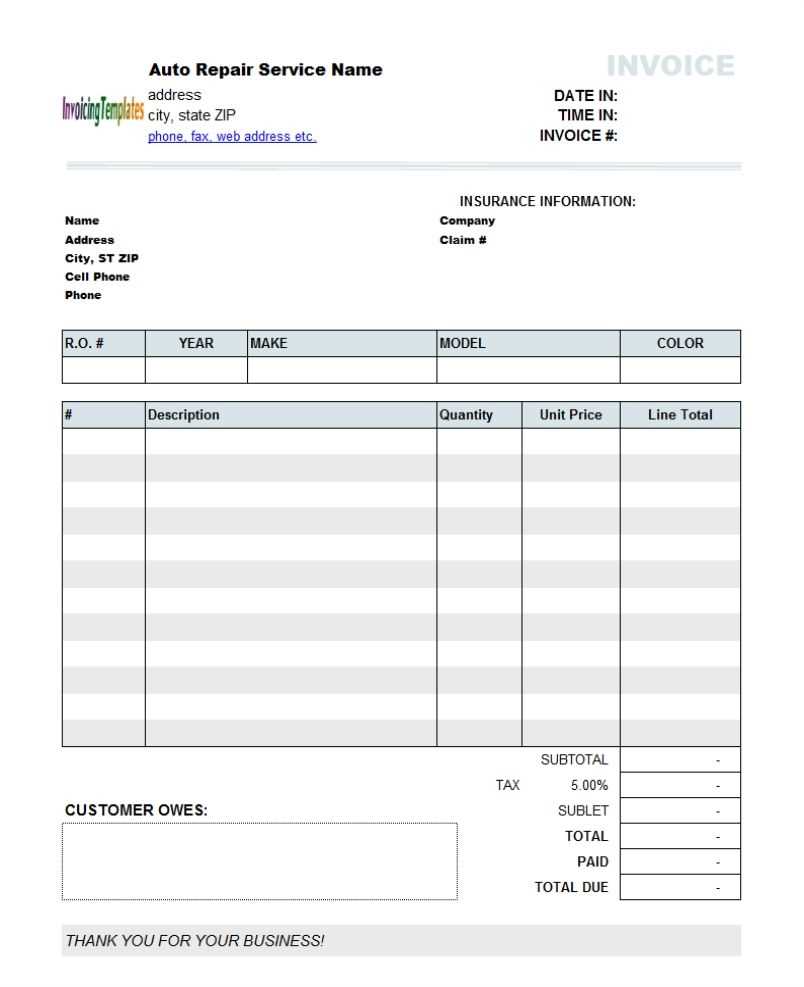

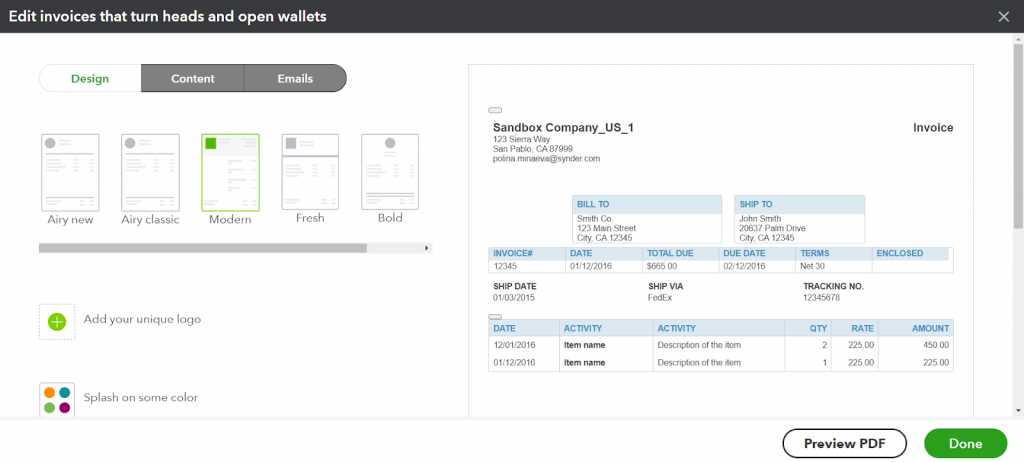

Choosing the Right Billing Style for Your Business

When it comes to managing client payments, the way you present your business documents plays a crucial role in the overall perception of your company. Choosing a style that aligns with your brand identity and meets the needs of your customers is essential for building trust and professionalism. A well-designed layout not only enhances your company’s image but also ensures clarity and ease of understanding for your clients.

Here are some key factors to consider when selecting a style for your business documents:

- Brand Consistency: Choose a design that reflects your company’s colors, logo, and fonts. Consistency in appearance builds brand recognition and professionalism.

- Clarity of Information: Ensure that key details, such as payment terms, amounts, and contact information, are easy to locate and understand. A clean, organized layout can prevent confusion.

- Client Needs: Consider what your clients value in a document. Some clients may prefer detailed breakdowns, while others may look for a simple, straightforward summary.

- Industry Standards: Depending on your industry, certain styles may be more appropriate. For example, a creative agency might opt for a modern, bold design, while a law firm might prefer a more traditional, formal style.

By carefully selecting a layout that fits both your business and your clientele, you’ll be able to create a professional and effective presentation for your transactions. The right style not only showcases your brand but also fosters stronger client relationships and smoother payment processes.

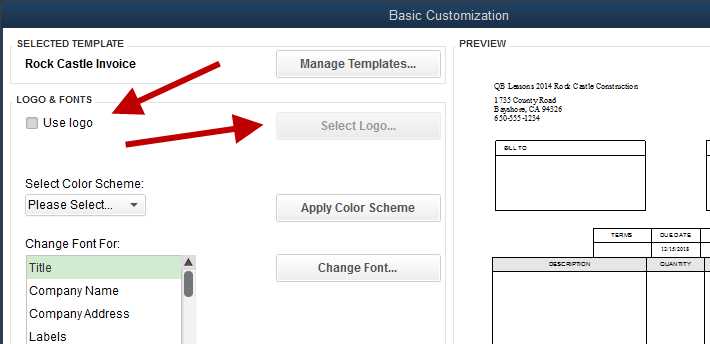

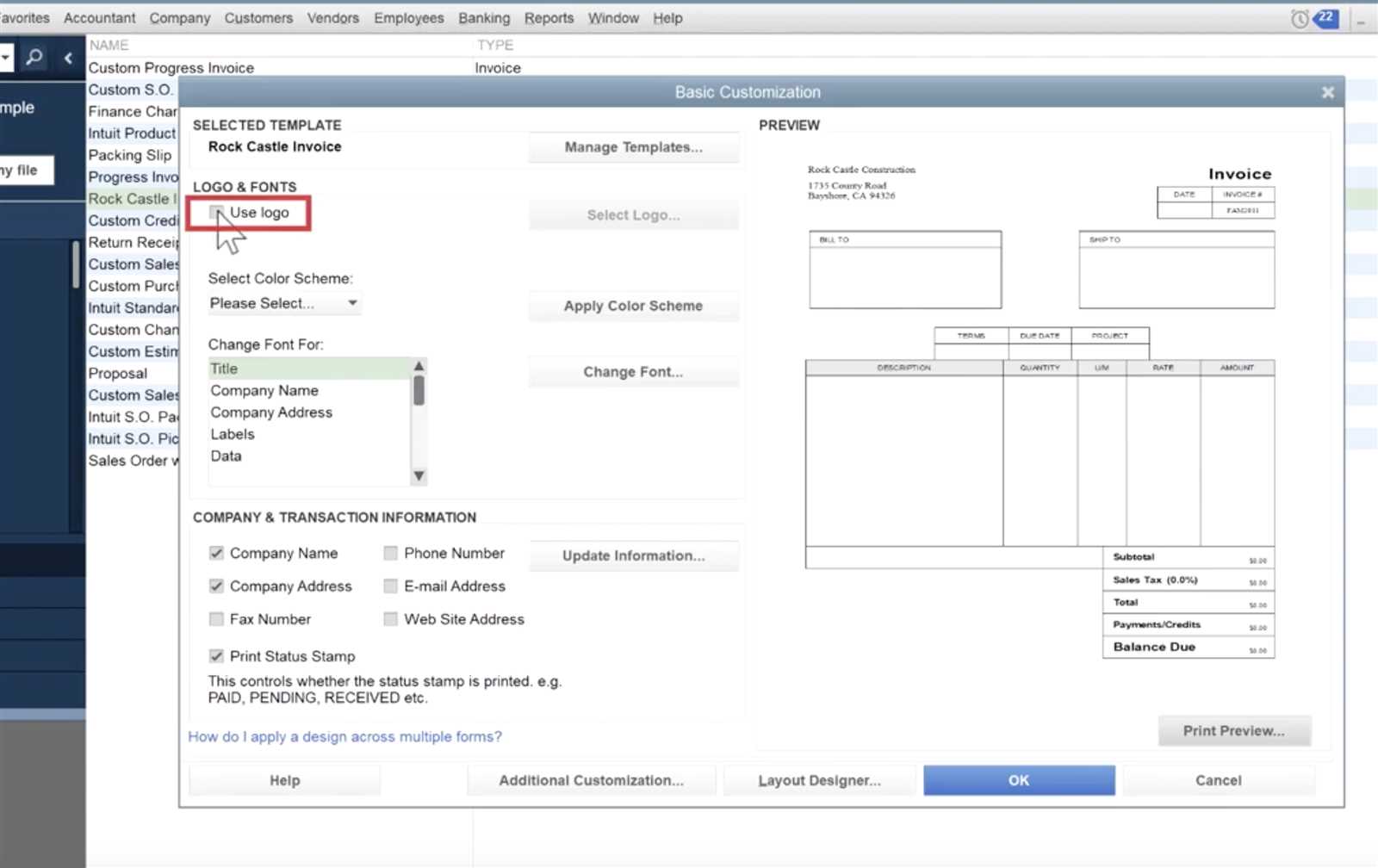

How to Add Your Logo to Documents

Incorporating your company’s logo into your financial documents not only enhances branding but also makes your paperwork look more professional and personalized. A logo serves as an important identifier, helping clients immediately recognize your business. Adding it to your records can reinforce your brand’s presence while maintaining a polished appearance.

Steps to Add Your Logo

To include your logo in your documents, follow these simple steps:

- Log in to your accounting software and navigate to the document customization section.

- Locate the option for adjusting the layout or design of your financial records.

- Find the area where you can add images or logos.

- Upload your logo file (ensure it is in a supported format such as PNG or JPG).

- Position the logo in the preferred location on the document, typically at the top left or center.

- Save the changes to apply the new design.

Tips for Logo Placement

When placing your logo, consider the following tips to ensure it looks professional:

- Size: Make sure your logo is not too large or too small. It should be clearly visible but not overpower the other content.

- Position: The top-left corner or center are common places to position a logo, ensuring it’s the first thing clients see without disrupting the document’s readability.

- Quality: Use a high-resolution image to ensure your logo appears crisp and clear, not pixelated.

By following these steps and tips, you can easily add your logo to your business documents and create a stronger visual identity for your company.

Changing Colors and Fonts in Your Billing Documents

Customizing the colors and fonts of your business paperwork allows you to reinforce your brand’s identity and make your documents more visually appealing. By selecting specific colors and fonts, you can create a cohesive and professional look that aligns with your company’s style. This adjustment not only enhances the aesthetic but also ensures clarity and easy readability for your clients.

Steps to Modify Colors and Fonts

Here’s a simple guide to changing the colors and fonts of your financial records:

- Access the document customization area in your accounting platform.

- Look for the options to adjust the layout or design.

- Select the section where you can modify fonts and color schemes.

- Choose the desired font style, size, and color for various text sections like headings, body text, and totals.

- Pick your brand’s color palette or select custom colors for text, borders, and background elements.

- Save the changes to apply the new settings.

Choosing the Right Fonts and Colors

When selecting fonts and colors for your documents, consider the following recommendations to ensure both functionality and aesthetic appeal:

| Font Style | Recommended Usage |

|---|---|

| Serif | For formal, professional documents (e.g., contracts, business correspondence). |

| Sans-serif | For modern, clean, and easy-to-read documents (e.g., statements, reports). |

| Bold | To emphasize important sections like totals, due dates, or headings. |

For colors, stick to your brand’s primary colors to maintain consistency. Ensure the text contrasts well with the background for optimal readability. Avoid using too many bright or clashing colors, as this can make the document look unprofessional and harder to read.

By carefully selecting colors and fonts that align with your brand and business goals, you can make your documents more effective and visually appealing to your clients.

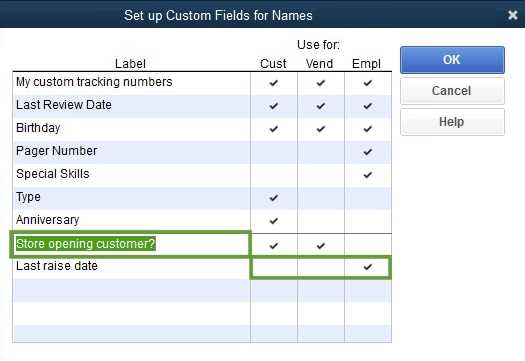

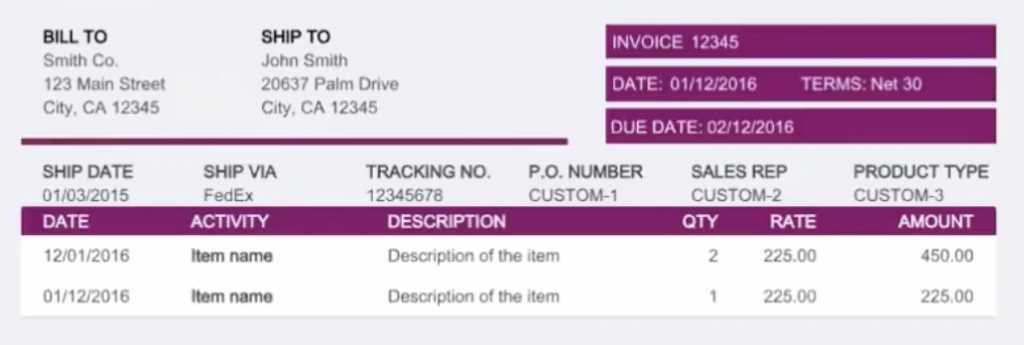

Adding Custom Fields to Your Billing Documents

Custom fields allow you to capture additional information that is important to your business and clients. Whether it’s a project number, special instructions, or a custom reference code, adding personalized fields gives you the flexibility to tailor your paperwork to specific needs. This feature helps to keep track of unique details without cluttering the main content, providing both clarity and structure.

Steps to Add Custom Fields

Follow these steps to add custom fields to your financial records:

- Log into your accounting platform and access the customization section for business documents.

- Locate the option to modify or manage document fields.

- Select “Add Custom Field” or a similar option to create a new field.

- Choose the type of field you need (e.g., text, number, date, or dropdown).

- Label the field with a clear, descriptive name that will make it easy to identify.

- Position the field in the appropriate place on your document where it will be visible but not disruptive.

- Save your changes to apply the custom field to future documents.

Types of Custom Fields You Can Add

Custom fields can be used to capture a wide range of information. Here are some examples:

| Field Type | Recommended Use |

|---|---|

| Text Field | For entering special instructions, client reference numbers, or custom descriptions. |

| Date Field | To track important dates such as contract start dates, project deadlines, or delivery dates. |

| Dropdown | For selecting predefined options, such as payment methods or service types. |

| Number Field | To record quantities, order numbers, or project costs that need precise calculations. |

Adding these custom fields helps ensure that every document includes all necessary information, tailored to each transaction, making it easier to manage your business relationships.

Incorporating Tax Information on Billing Documents

Including accurate tax information on your business documents is essential for both compliance and transparency. Whether you’re dealing with sales tax, VAT, or other applicable taxes, providing this information clearly ensures that your clients understand the total amount due and helps prevent misunderstandings. Correctly displaying tax breakdowns also supports efficient record-keeping and simplifies the payment process.

Steps to Add Tax Details

Follow these steps to incorporate tax information into your financial records:

- Log in to your accounting platform and access the document settings section.

- Locate the tax settings or tax-related options within the customization area.

- Enable or select the tax categories that apply to your business.

- Specify the tax rates for each item or service, if applicable.

- Ensure that the tax breakdown is included clearly on the document (usually in a separate section for clarity).

- Save and apply the changes to ensure tax details are included in all future records.

Types of Tax Information to Include

Depending on your region and the services you provide, you may need to include different types of tax information. Here are some common tax-related details to consider:

- Sales Tax: Include the percentage rate and total sales tax applied to the items or services provided.

- VAT (Value-Added Tax): If applicable, list the VAT percentage and the corresponding amount for each taxable item.

- Tax Exemptions: If any products or services are tax-exempt, clearly indicate these exceptions to avoid confusion.

- Tax Identification Number: Display your business’s tax ID number if required by local regulations.

By accurately incorporating tax information into your documents, you ensure that your clients are fully informed about the charges and comply with tax reporting requirements.

Using Accounting Software for Recurring Billing Templates

Automating repetitive billing tasks can save significant time and effort for your business. By setting up recurring billing structures, you can ensure that your clients receive consistent, timely requests without the need for manual entry each time. This feature allows you to set up payment schedules for subscription services, retainer agreements, or any other service that requires regular invoicing.

Here’s how using automation for recurring billing can benefit your business:

- Consistency: Clients will receive their payment requests on time, every time, without needing manual intervention.

- Efficiency: Save time by automating the process, allowing you to focus on other important tasks.

- Improved Cash Flow: Regular, predictable billing helps you maintain steady cash flow by reducing delays or missed payments.

Setting Up Recurring Billing in Your Accounting Platform

To set up a recurring billing structure, follow these simple steps:

- Log in to your accounting system and navigate to the section for managing billing or transactions.

- Select the option to create a new recurring record.

- Fill in the details of the recurring payment, including the client’s information, frequency, amount, and any applicable terms.

- Choose the start and end dates for the recurring schedule, or set it to continue indefinitely.

- Save the configuration to start the automatic generation of documents.

By automating regular billing tasks, you can ensure accuracy and save valuable time, all while maintaining strong relationships with your clients. This system allows for better financial planning, reducing the chances of errors or missed payments.

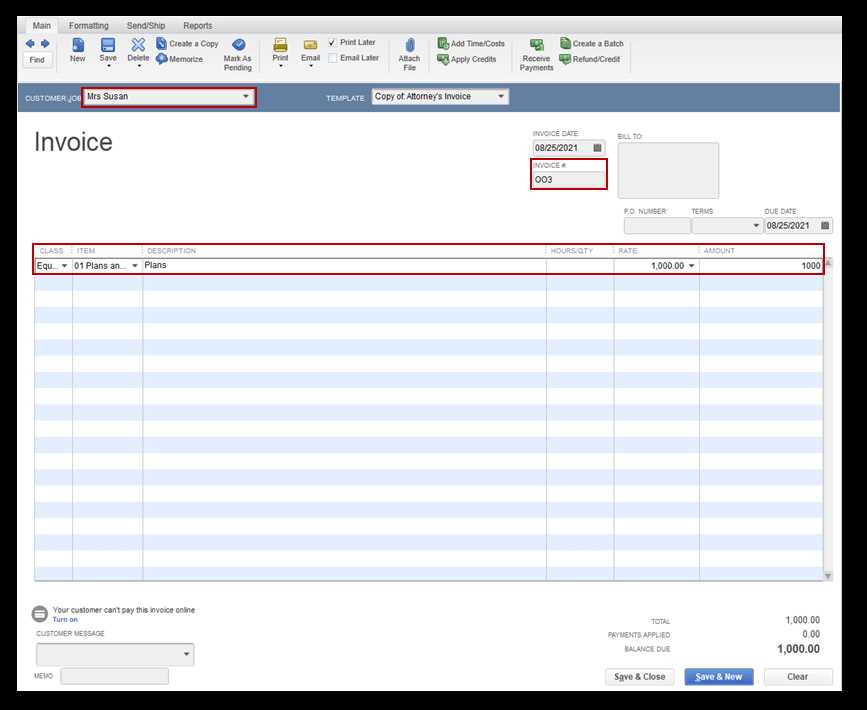

Editing Payment Terms on Your Billing Documents

Establishing clear payment terms is essential for managing client relationships and ensuring timely payments. By adjusting the payment conditions on your business documents, you can specify due dates, late fees, discounts, or other terms that align with your business policies. This flexibility helps set expectations and promotes smooth financial transactions between you and your clients.

Steps to Modify Payment Terms

Here’s a simple guide to adjusting the payment terms on your documents:

- Log into your accounting software and access the section where document settings are managed.

- Locate the option to customize payment conditions or terms.

- Select the field where payment due dates, discounts, or other terms are specified.

- Adjust the due date, payment window (e.g., 30 days, 60 days), and any other conditions, such as early payment discounts or late fees.

- Save the changes to apply them to future transactions.

What to Include in Payment Terms

Clear and concise payment terms are crucial for avoiding confusion. Here are some common details to include:

- Due Date: Specify the exact date by which the payment should be made.

- Payment Methods: List the acceptable methods of payment (e.g., credit card, bank transfer, check).

- Late Fees: Outline any penalties for late payments, including interest rates or fixed fees.

- Discounts: Offer early payment discounts, specifying the amount or percentage off for payments made ahead of schedule.

By setting clear payment terms and adjusting them when necessary, you ensure smoother transactions and maintain better control over your business’s cash flow.

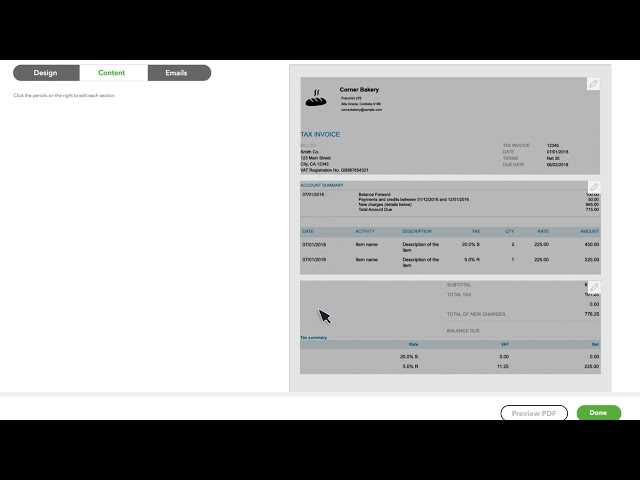

Previewing and Testing Your Billing Document Layout

Once you’ve customized the layout of your business documents, it’s crucial to ensure that everything looks correct before you send them to clients. Previewing and testing your changes allows you to identify any formatting issues, ensure that all information is properly displayed, and confirm that the document aligns with your brand identity. This step helps avoid errors and ensures a professional presentation every time.

Steps to Preview and Test Your Document

Follow these simple steps to review your newly configured layout:

- Access the section where you have customized your document layout.

- Look for the option to preview or view a sample document.

- Select the preview mode to see how the document will appear to your clients.

- Carefully check all sections for proper alignment, readability, and the inclusion of essential information.

- If needed, make adjustments to fonts, colors, or fields to correct any issues.

- Save the changes once you’re satisfied with the layout and appearance.

Key Areas to Test in Your Layout

When previewing your document, be sure to focus on these important elements:

| Element | What to Check |

|---|---|

| Text and Fields | Ensure all required fields are included and the text is legible and properly aligned. |

| Branding | Verify that your logo, color scheme, and fonts are consistent with your brand identity. |

| Tax and Payment Information | Check that tax calculations, due dates, and payment terms are clear and accurate. |

| Spacing and Layout | Ensure there is enough white space and that sections are not cramped or overlapping. |

By thoroughly previewing and testing your document layout, you can ensure that every client receives a professional and polished document that accurately represents your business.

How to Save and Apply Changes in Your Document Layout

After customizing your business documents, it’s essential to save your changes and ensure they are applied correctly to future records. Saving your adjustments ensures that all modifications are preserved and that your documents will reflect the updates automatically. By following the proper steps to apply these changes, you can maintain consistency and professionalism across all your outgoing paperwork.

Here’s how you can save and apply your changes:

- Once you’ve made the desired changes to your document layout, locate the “Save” button or similar option in your system.

- Click “Save” to store the changes. This action will preserve your settings for future use.

- If your system offers the option to preview, use this feature to confirm the changes are applied correctly before saving them permanently.

- After saving, ensure that the changes are set to automatically apply to new documents or transactions going forward.

- Test the changes by generating a sample document to confirm everything looks as expected.

By following these steps, you ensure that your modifications are correctly saved and applied to all future documents, making your processes more efficient and streamlined.

Common Mistakes to Avoid When Customizing Billing Documents

When customizing business documents, it’s easy to overlook small details that can lead to confusion or errors down the line. Even minor mistakes in layout, content, or formatting can affect the clarity of your documents and cause potential issues with clients. By being aware of common pitfalls, you can ensure your documents are professional, clear, and error-free every time.

Here are some common mistakes to watch out for:

- Incorrect Client Information: Always double-check that the recipient’s details, such as name, address, and contact information, are accurate. Incorrect information can lead to miscommunication or delays in payments.

- Missing Payment Terms: Failure to include clear payment terms–such as due dates or late fees–can result in misunderstandings with clients and delayed payments.

- Inconsistent Branding: Ensure that your branding elements, such as logos, colors, and fonts, are consistent across all documents. Inconsistencies can make your business appear unprofessional.

- Overcrowded Layout: A cluttered document can confuse the reader. Make sure your document is well-organized, with clear headings, appropriate white space, and a logical flow of information.

- Neglecting Tax Details: Always verify that tax rates and amounts are correctly applied to each item, especially if your region requires specific tax calculations.

- Forgetting to Preview: Before finalizing any changes, always preview your document to check for errors in the layout, alignment, and content. Testing ensures your changes appear as intended.

By avoiding these common mistakes, you can create accurate, professional documents that foster trust with your clients and make your business processes more efficient.

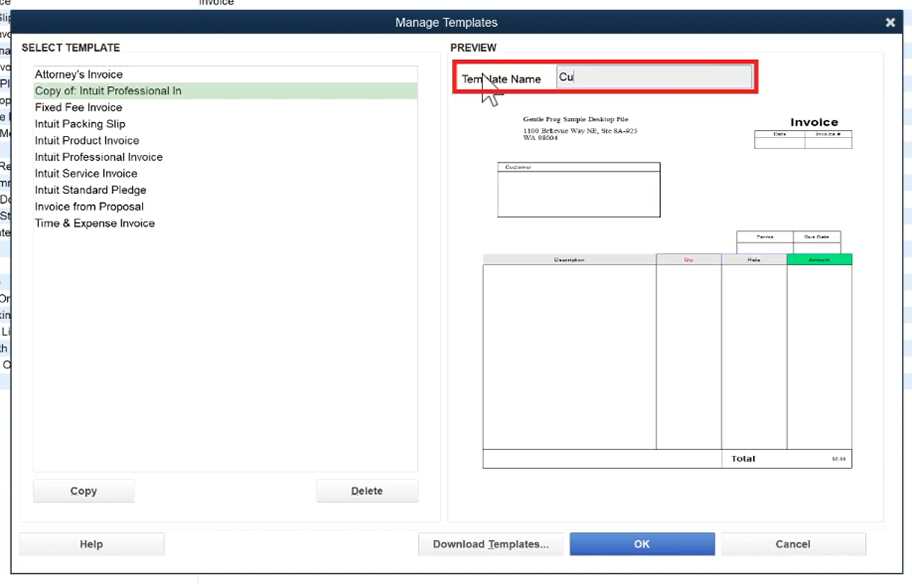

How to Duplicate and Create New Billing Layouts

When managing your business documents, you may find that creating a new layout from scratch isn’t always necessary. Instead, duplicating an existing layout and making adjustments can save time and maintain consistency across your documents. Whether you’re adjusting a design for a specific client or updating a layout for different business needs, duplicating and creating new configurations is a quick and effective way to streamline the process.

Steps to Duplicate an Existing Layout

Follow these simple steps to copy an existing layout and customize it for new use:

- Access the section where your document layouts are stored.

- Select the layout you want to duplicate.

- Look for the option to “Duplicate” or “Copy” the layout. This will create a new version with the same settings.

- Rename the new layout if necessary to differentiate it from the original.

- Make any adjustments to the new layout as needed, such as changing fields, colors, or adding new elements.

- Save the duplicated version to apply the changes and use it for future documents.

Creating a New Layout from Scratch

If you prefer to create a brand new layout, follow these steps:

- Navigate to the document customization section.

- Select the option to create a new layout or design.

- Choose the structure and features you want to include, such as sections for client details, payment terms, or tax information.

- Customize the design with your preferred colors, fonts, and logo to match your brand’s identity.

- Save the new layout for future use and apply it to new transactions as needed.

Duplicating and creating new layouts allows you to maintain flexibility and efficiency in managing your business documents, while ensuring that each document meets your specific requirements.

Best Practices for Customizing Billing Document Layouts

Customizing your business documents is an important step in creating a professional image and ensuring clarity in communication with clients. However, it’s essential to follow best practices to avoid mistakes and ensure that the final product is both functional and aesthetically pleasing. By adhering to these guidelines, you can create layouts that enhance your branding, improve client experience, and make it easier to manage transactions.

Here are some key best practices to consider when adjusting your document design:

| Best Practice | Why It Matters |

|---|---|

| Keep It Simple | A cluttered layout can overwhelm clients. Stick to essential elements and use clean, simple design to improve readability. |

| Use Consistent Branding | Your layout should reflect your brand’s identity. Consistent use of your logo, colors, and fonts reinforces professionalism and trust. |

| Ensure Clear Hierarchy | Use headings, bold text, and spacing to create a visual hierarchy. This makes it easier for clients to find important information quickly. |

| Include All Necessary Information | Ensure that all key details, such as payment terms, client information, and tax calculations, are clearly displayed to avoid confusion. |

| Test Layout Before Finalizing | Preview the document before sending it to clients. Check for alignment issues, readability, and ensure everything is visible as intended. |

By following these best practices, you can create customized layouts that not only look great but also function effectively, helping you maintain strong professional relationships with your clients.