How to Create a QuickBooks Recurring Invoice Template

Managing regular payments for your business can quickly become a repetitive and time-consuming task. Setting up an efficient system that automatically handles recurring charges ensures that you can focus more on growing your business rather than constantly tracking invoices. Automation of billing procedures not only saves valuable time but also helps prevent errors, ensuring a smoother workflow.

By customizing your billing structure to fit the needs of your clients, you can simplify how you manage subscriptions, contracts, or any service that requires ongoing payments. Creating a streamlined system allows you to maintain consistency and professionalism while reducing the effort needed to generate new bills manually. With a few simple steps, you can set up a framework that runs smoothly every time a new payment cycle begins.

In this article, we will explore how to set up automated billing methods, the advantages they bring to your business, and how to tailor them for maximum efficiency. Whether you are new to automation or looking to refine your existing process, the right tools and settings can significantly improve your billing routine.

QuickBooks Recurring Invoices Explained

Managing ongoing payments is a crucial part of maintaining a steady cash flow for businesses that offer subscription-based services or long-term contracts. Automating this process can significantly reduce the time spent on manual tasks and ensure that payments are generated on schedule without any delay. The concept behind automated billing is simple: set up a system where charges are created and sent out automatically according to a pre-established timeline.

By setting up automated billing for your clients, you eliminate the need for frequent manual input, which can lead to errors or missed payments. Once the payment schedule is configured, the system takes over, producing and sending the necessary documentation to clients without requiring constant attention. This way, you can manage multiple clients or subscriptions without overwhelming your team or yourself.

How It Works

After configuring the parameters–such as payment amounts, due dates, and client information–the system generates and sends out the necessary payment reminders and billing records automatically. This reduces the chances of late payments and improves cash flow by maintaining regular intervals between charges.

Benefits of Automated Billing Systems

Automating billing processes offers several advantages. Not only does it save time and reduce administrative overhead, but it also ensures consistency in how payments are handled. Additionally, automation helps maintain a professional appearance by ensuring that clients receive their billing documents on time, every time, without you having to manually create each one.

Benefits of Using Recurring Invoice Templates

Automating the process of billing for ongoing services or subscriptions offers several key advantages to businesses. By setting up a standardized method for creating and sending payment requests, you can save time, reduce errors, and ensure that your clients are billed consistently without the need for manual intervention each time. This streamlined approach not only enhances operational efficiency but also improves customer satisfaction by ensuring that charges are always processed promptly and accurately.

One of the main benefits of using automated billing systems is the reduction in administrative workload. By creating a setup that generates bills on a predetermined schedule, businesses can eliminate the need for manual entry, freeing up resources for more strategic tasks. Additionally, automation minimizes the chances of forgetting to send an important bill or making clerical errors, which can often lead to payment delays or client dissatisfaction.

Another significant advantage is the ability to maintain a professional and consistent billing experience for clients. With every payment cycle, customers receive their documents promptly, helping to establish trust and improve the overall relationship. This consistency can be particularly valuable for businesses with long-term contracts or recurring services where a high level of reliability is expected.

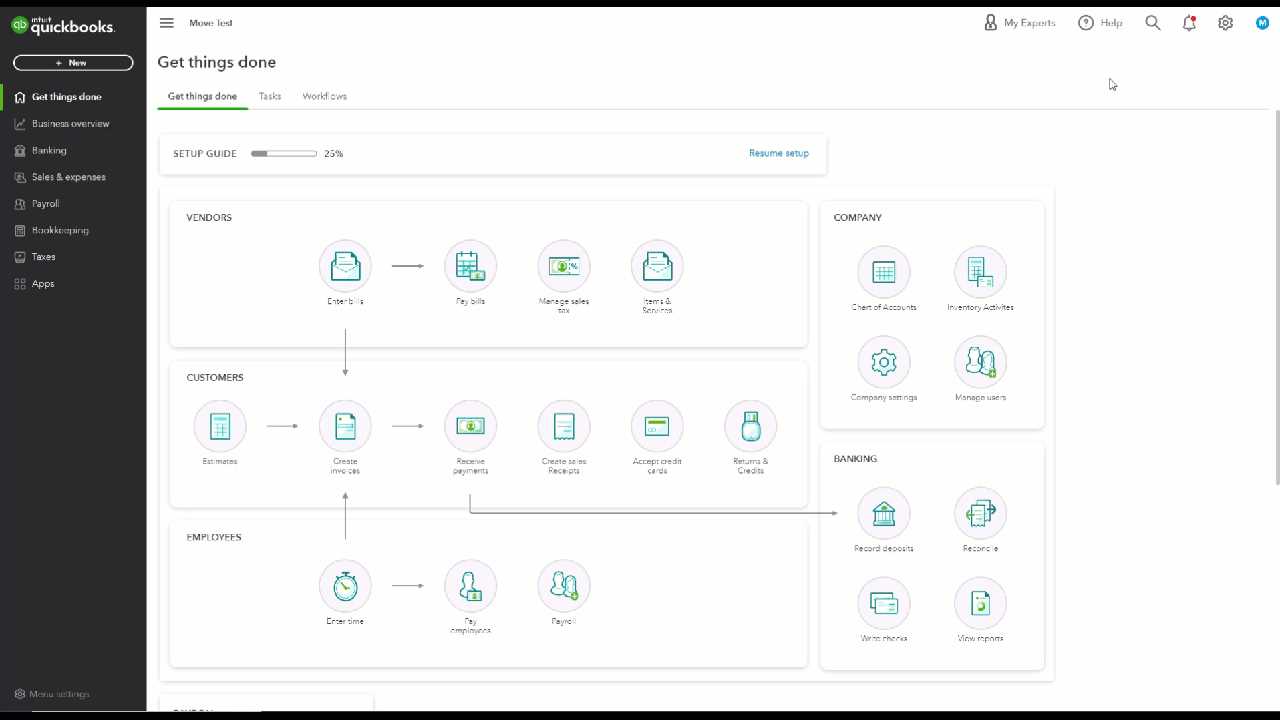

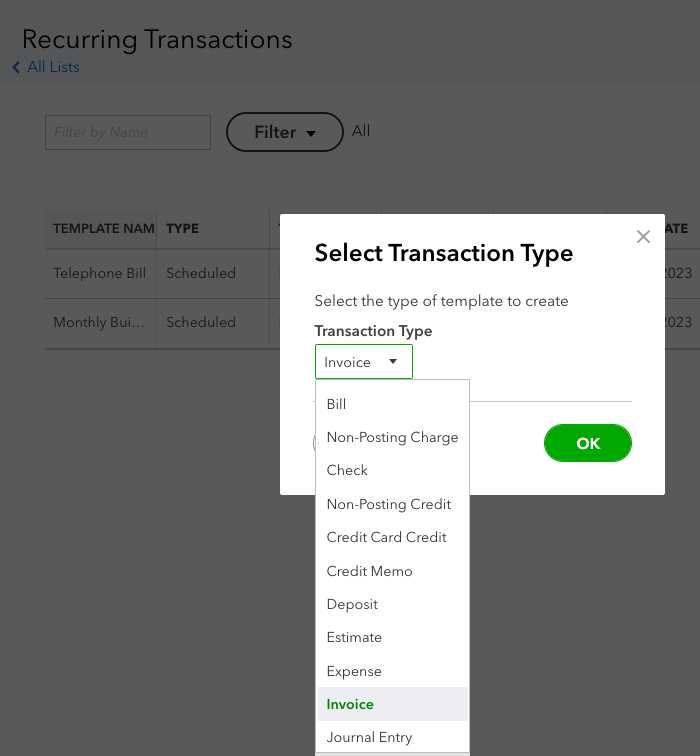

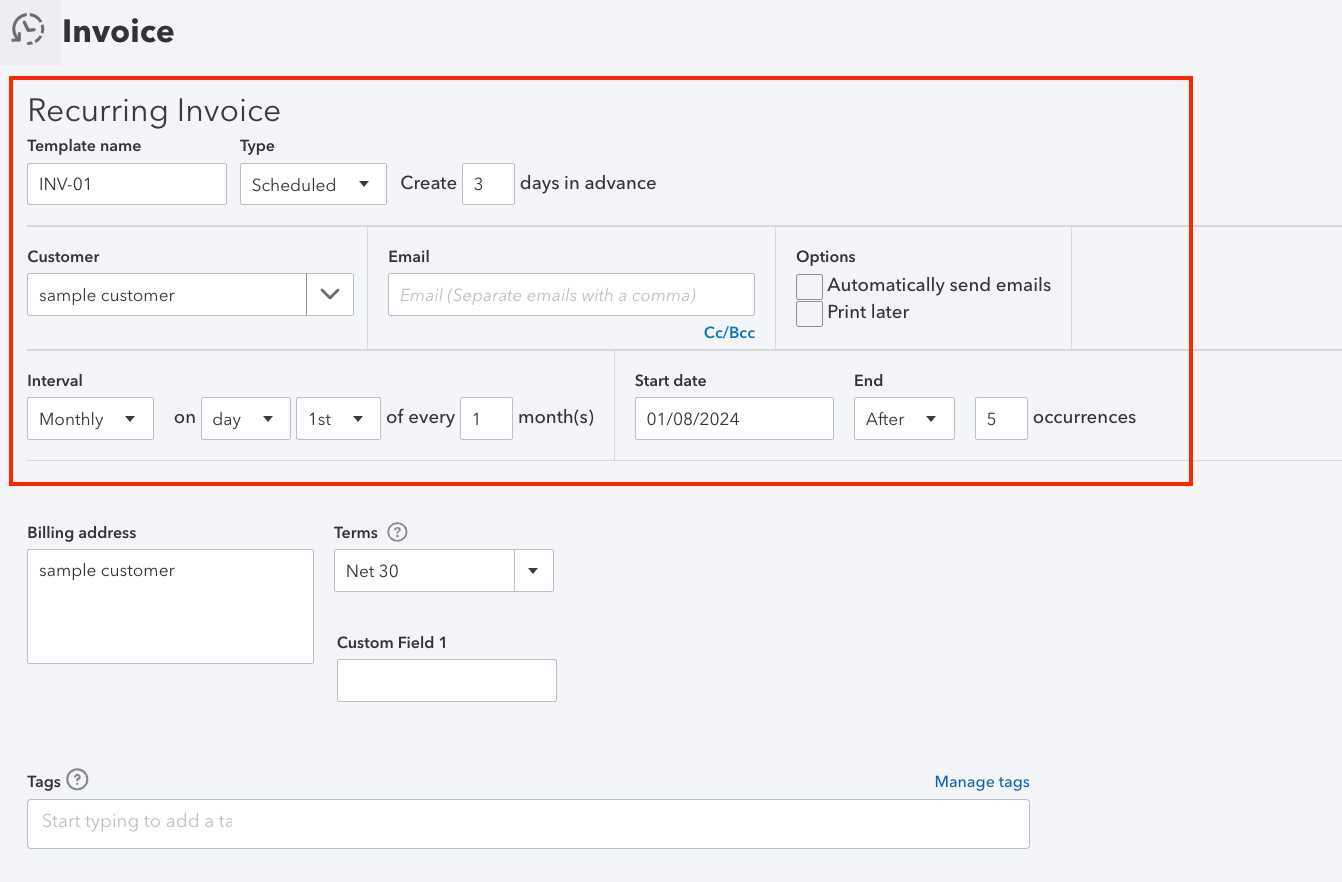

How to Set Up Recurring Invoices

Setting up an automated billing system for ongoing charges is a simple and efficient way to ensure that your business runs smoothly without missing any important payments. By establishing a pre-set structure for payment cycles, you can save valuable time while maintaining consistency. This process involves creating a system that will generate and send the necessary billing documents to clients automatically on a regular basis, based on the criteria you define.

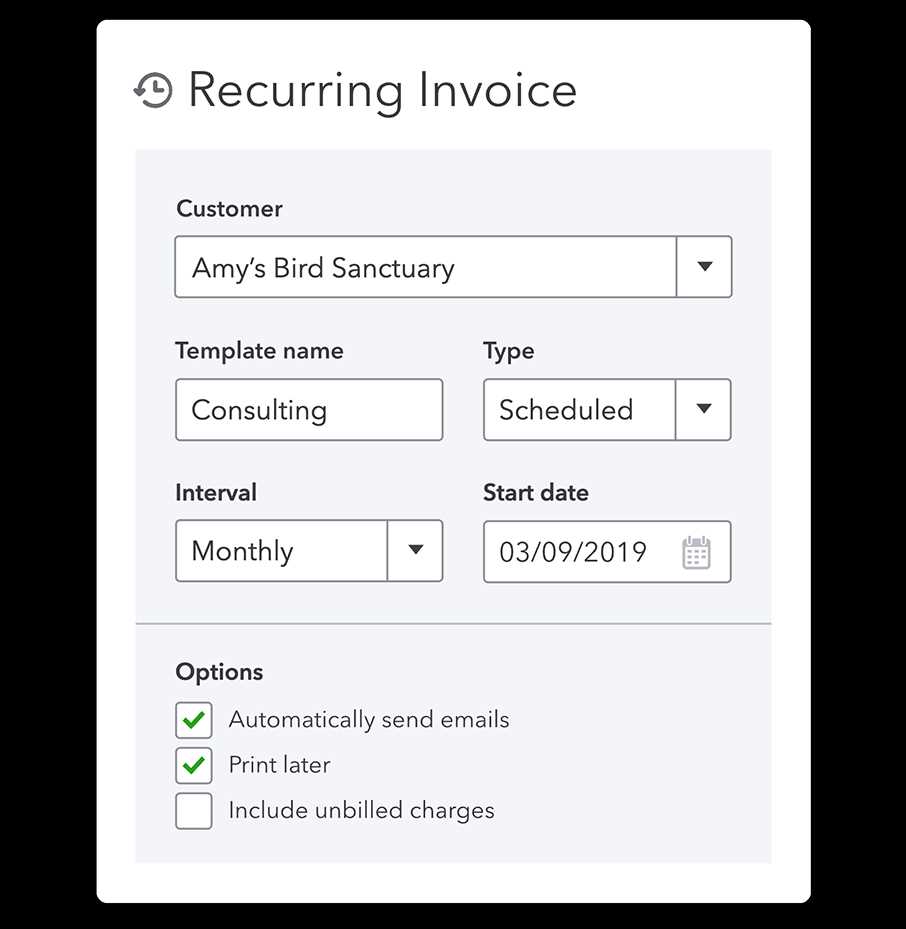

The first step in setting up automated billing is to define the key parameters for each charge. This includes specifying the amount, due dates, frequency of payments, and the clients who will be receiving these charges. Once these details are set, you can move on to configuring the system to handle the generation of these documents without further input. Make sure to include any relevant terms, such as discounts, taxes, and payment instructions, to ensure clarity for your clients.

Once the initial setup is complete, monitoring the system is important to ensure that everything runs according to plan. You should regularly check that charges are being processed correctly and that clients are receiving their bills as expected. Adjustments can be made at any time to reflect changes in the service, payment terms, or customer preferences. With this system in place, billing becomes a hassle-free task, improving both efficiency and customer satisfaction.

Customizing Your QuickBooks Invoice Template

Tailoring your billing documents to reflect your brand and specific business needs can enhance your professional image and make communication clearer for your clients. Customization allows you to modify the appearance, content, and structure of the payment requests you send out. By making these adjustments, you can create a personalized experience that aligns with your company’s standards and ensures your clients have all the necessary information to process their payments smoothly.

Key Elements to Customize

There are several key elements of your payment documents that can be customized to improve clarity and reinforce your brand identity. These include:

- Logo and Branding: Incorporating your company’s logo and brand colors helps maintain a consistent visual identity.

- Contact Information: Clearly displaying your contact details makes it easy for clients to reach out with questions or concerns.

- Payment Terms: Customize payment terms, such as due dates, late fees, and early-bird discounts, to suit your business practices.

- Service Descriptions: Tailor the language and details of the services you offer, ensuring they align with the client’s expectations.

Steps to Customize Your Billing Documents

Follow these simple steps to personalize your payment requests:

- Select the format or layout you want for your document.

- Add your logo and adjust the color scheme to match your branding.

- Enter the relevant client and service details, making sure to include any specific terms or discounts.

- Review the final document to ensure all fields are accurate and easy to read.

- Save your custom layout as a default for future use, so you don’t have to redo the process each time.

By investing time in customizing your payment requests, you ensure that each client receives a professional, easy-to-understand document tailored to their needs. This not only improves efficiency but also enhances client relationships through clear, personalized communication.

Managing Client Subscriptions with QuickBooks

Effectively managing client subscriptions is a key aspect of maintaining long-term business relationships, especially when services are provided on an ongoing basis. Organizing and tracking each client’s subscription ensures that payments are processed on time and the correct services are rendered without confusion. With the right system in place, businesses can automate the management of various subscription plans and monitor their clients’ status without the need for constant manual updates.

In this section, we’ll explore how to manage client subscriptions efficiently, tracking key details such as payment cycles, service adjustments, and renewal periods. Properly setting up a subscription management system not only helps avoid missed payments but also enhances client satisfaction by providing clear, consistent service.

Key Subscription Management Details

| Subscription Plan | Start Date | Renewal Date | Status | Payment Amount |

|---|---|---|---|---|

| Basic Service | January 1, 2024 | January 1, 2025 | Active | $100/month |

| Premium Service | March 1, 2024 | March 1, 2025 | Active | $200/month |

| Standard Service | April 15, 2024 | April 15, 2025 | Paused | $150/month |

By organizing client subscription data in this way, businesses can quickly view important details like subscription types, payment amounts, and renewal dates, helping to ensure that every client is properly serviced and billed. This also simplifies communication with clients when any changes to their subscriptions are necessary, such as upgrades, downgrades, or suspensions.

Automating Invoice Creation in QuickBooks

Automating the creation of payment requests can significantly streamline your business processes and reduce administrative workload. By setting up an automated system for generating billing documents, you can ensure that clients receive their payment reminders on time without any manual intervention. This helps maintain a consistent cash flow while also eliminating the risk of human error in document preparation.

Once the system is set up, it will automatically create the necessary payment documents based on pre-configured parameters such as due dates, amounts, and billing cycles. This process not only saves time but also reduces the chances of missing deadlines or overlooking important details. Let’s explore how this automation works and the key elements you need to manage.

Key Features of Automated Payment Creation

| Feature | Description |

|---|---|

| Customizable Schedules | Set up specific dates and frequencies for generating payment requests, ensuring timely billing for each client. |

| Automatic Client Details | Client data such as name, address, and service details are automatically pulled into each document, saving time and ensuring accuracy. |

| Flexible Payment Terms | Adjust terms like due dates, payment methods, and discounts automatically, tailored to the individual client’s needs. |

How to Set Up Automated Billing

Setting up an automated billing process involves configuring your system to generate documents based on the following steps:

- Enter client details and define the services provided.

- Set up billing frequency and the amount to be charged.

- Choose how and when the document will be sent to the client (email, print, or online portal).

- Review and save the configuration to ensure that the process runs smoothly moving forward.

Once these steps are completed, the system will handle the creation and distribution of billing documents on its own, allowing your team to focus on other critical tasks. The automation ensures that you are always on track with your billing cycle, improving both client satisfaction and cash flow.

Common Mistakes with Recurring Invoices

While automating billing processes can save time and reduce errors, there are common pitfalls that businesses may encounter if the system is not set up correctly. These mistakes can lead to missed payments, confusion with clients, and inefficiencies that undermine the benefits of automation. It’s important to be aware of these issues and take proactive steps to avoid them, ensuring smooth operations and a positive customer experience.

One of the most frequent mistakes is failing to update client information or payment terms. If details like addresses, payment amounts, or billing cycles aren’t regularly reviewed and updated, it can result in inaccurate charges or delayed payments. Another issue arises when businesses neglect to double-check the automated settings, leading to errors in the generation and distribution of payment requests. These small oversights can cause bigger problems down the line, such as a backlog of unpaid bills or unhappy clients.

Additionally, not clearly communicating the billing structure to clients is another common mistake. If customers are unaware of when or how they will be charged, it can lead to confusion, disputes, or even cancellations. To avoid these issues, businesses should ensure transparency in their billing practices, providing clear documentation and reminders about payment schedules and terms.

Why QuickBooks Recurring Invoices Save Time

Automating the generation and delivery of payment documents can save a significant amount of time for businesses. By eliminating manual entry and repetitive tasks, an automated system ensures that clients are billed consistently and on schedule without the need for constant attention. This allows employees to focus on more strategic tasks, improving overall efficiency and reducing the risk of human error.

With an automated system, you no longer have to recreate payment documents each time a client is charged. Once set up, the system generates and sends the required documents according to the pre-configured payment schedule. This consistency in the process not only saves time but also ensures that clients always receive their payments on time, leading to better cash flow management.

Key Time-Saving Benefits

| Benefit | Description |

|---|---|

| Eliminates Manual Work | Once the system is set up, payment documents are generated automatically, removing the need for repetitive data entry. |

| Reduces Errors | Automation ensures that the same format and details are used consistently, minimizing the risk of human error and oversight. |

| Improves Cash Flow | Automated billing ensures payments are sent on time, reducing delays and improving cash flow management. |

| Streamlines Client Management | Client details and payment schedules are stored and automatically updated, reducing the need for manual tracking. |

By automating the billing process, businesses can streamline their operations, reduce overhead costs, and ensure that clients are always billed on time. This level of automation frees up valuable resources that can be used for other important aspects of business growth and customer service.

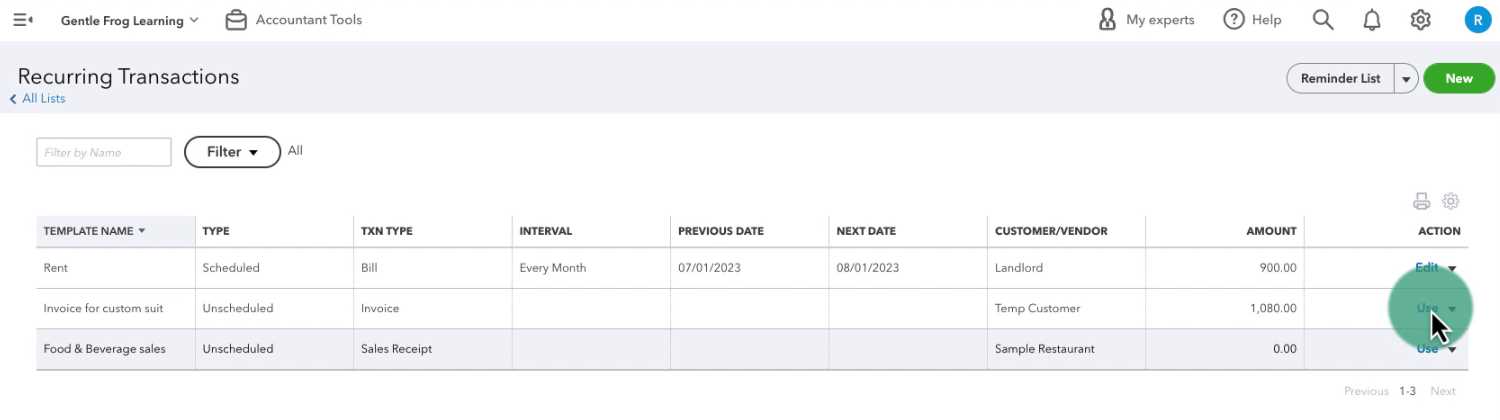

Tracking Payments with Recurring Templates

Efficiently tracking payments is a vital part of maintaining healthy cash flow and ensuring that all transactions are accounted for. With an automated system, payment monitoring becomes easier and more accurate, allowing businesses to quickly identify which clients have paid and which have not. By using a structured approach, you can stay on top of all transactions without the need for constant manual tracking or intervention.

When payment documents are automatically generated and sent to clients based on predefined schedules, the system can also track the status of each payment. This allows you to easily monitor which payments are due, overdue, or completed, streamlining your financial management. By consolidating all payment data in one place, businesses can reduce administrative work and improve financial reporting accuracy.

Moreover, integrating payment tracking with automated billing systems enables businesses to send reminders or follow-up messages to clients who have not yet paid. This not only ensures timely payments but also helps maintain positive client relationships by providing clear communication without the need for manual involvement.

Editing and Updating Recurring Invoices

As your business grows and evolves, so do your client needs and billing requirements. Being able to edit and update your payment documents quickly and accurately is essential for maintaining smooth operations. Whether it’s adjusting the billing amount, changing payment terms, or modifying the service details, having the ability to make these changes effortlessly ensures that your system remains aligned with your business goals and client expectations.

Most automated billing systems allow you to modify existing settings or details at any time without disrupting the entire process. This flexibility helps accommodate changes in contracts, pricing adjustments, or any other updates that may arise. By staying on top of these updates, you can continue offering a personalized experience for each client while maintaining accurate records.

How to Edit Payment Documents

Editing a payment document is a straightforward process, typically involving these steps:

- Access the existing billing setup and select the client or payment cycle you want to adjust.

- Modify the necessary fields, such as payment amount, due dates, or service details.

- Review the changes to ensure they align with the updated agreement or service terms.

- Save the new configuration and let the system automatically update future billing cycles.

Updating Client Information

Client details may also need to be updated from time to time, whether it’s a change in contact information or an adjustment to the services provided. To keep your records current, regularly review client data and make necessary modifications. This can include updating:

- Billing Address: Ensures that payment documents are sent to the correct location.

- Payment Method: Updates to reflect any changes in how the client prefers to settle their bills.

- Service Terms: Adjustments based on contract renewals or new service offerings.

By staying proactive with edits and updates, you ensure that each client’s billing process remains smooth and error-free, keeping your business operations efficient and client relationships strong.

How to Delete a Recurring Invoice

Sometimes, there may be situations where you need to remove a scheduled billing document or cancel an ongoing billing cycle. Whether it’s due to a change in the service agreement, a client’s request, or an error in the setup, it’s important to know how to delete a payment request properly to avoid confusion or issues in your financial records. Fortunately, removing an automated payment document is a simple process that can be done in just a few steps.

Before deleting, it’s essential to ensure that the document or payment cycle is no longer required. If it’s still active or due to be sent in the future, consider adjusting the details or pausing the cycle instead of removing it completely. Deleting should only be done when it’s absolutely necessary to avoid losing important billing data.

Steps to Delete a Billing Cycle

To delete an active or scheduled payment document, follow these straightforward steps:

- Navigate to the section where your active billing cycles are managed.

- Find the payment schedule or client entry you want to remove.

- Click on the document or schedule to view more details.

- Select the option to delete or remove the document from the system.

- Confirm the deletion when prompted to ensure the correct document is being removed.

When to Delete vs. Pause a Cycle

It’s important to know the difference between deleting and pausing a payment cycle:

- Delete: Use this option if the billing cycle is no longer needed, and there’s no need to keep the data for future reference.

- Pause: If you need to temporarily halt the cycle, such as during a service interruption or client request, consider pausing the cycle instead of deleting it. This allows you to resume it at a later time.

By following these steps, you can manage your billing processes efficiently and ensure that no unnecessary payment cycles are continued. Always double-check before deleting to make sure that the action is correct and won’t cause disruptions in your workflow.

Understanding Invoice Settings

When managing payment documents for your clients, it’s crucial to understand the various settings that can be configured to ensure your billing process runs smoothly. These settings control how payment requests are generated, delivered, and tracked. Adjusting these parameters helps to align the system with your business needs, ensuring accuracy and consistency across all transactions.

Each payment document setup allows you to customize important details such as payment frequency, due dates, and client-specific terms. By understanding these settings, you can automate much of your billing process while maintaining flexibility and control. Let’s explore the key components of these settings and how they can be tailored to suit different business models.

Key Configuration Options

When setting up your payment cycles, there are several crucial options to consider:

- Billing Frequency: Set the frequency at which payments are due (e.g., monthly, quarterly, annually). This helps automate how often the system generates new payment requests.

- Payment Terms: Specify the terms of payment, such as the due date, early payment discounts, or late fees. These terms are critical for setting client expectations and ensuring timely payments.

- Service Descriptions: Customize descriptions of the services provided, ensuring that each client receives a clear breakdown of charges for the services they are being billed for.

- Payment Methods: Configure preferred methods of payment, such as credit card, bank transfer, or online payment gateways, making it easier for clients to settle their bills.

Adjusting and Reviewing Settings

To maintain accuracy in your billing, regularly review and adjust the settings as needed. This might include:

- Ensuring that the payment frequency matches the client’s subscription or agreement terms.

- Reviewing payment terms and updating them based on any contractual changes or client feedback.

- Verifying that the client information, including the correct payment method, is up to date.

- Checking that service descriptions are clear and reflect the correct services provided at the agreed-upon rates.

By taking the time to carefully configure and regularly review these settings, you can streamline your billing process, reduce errors, and ensure a smooth experience for both you and your clients.

Recurring Invoices vs Manual Billing

When it comes to billing, businesses typically have two options: automated, recurring billing or traditional manual billing. Both methods have their advantages and limitations, but choosing the right approach for your business depends on the volume of transactions, the nature of the services or products offered, and the level of customization needed. Understanding the key differences between these two methods can help you determine which is more efficient and effective for your specific needs.

Automated billing systems are designed to handle regular, repeated transactions with minimal effort. Once set up, the system automatically generates and sends payment requests to clients at predefined intervals, ensuring that payments are consistently made on time. On the other hand, manual billing requires businesses to create and send payment requests for each transaction individually, often leading to more time-consuming processes and higher risk of errors.

Benefits of Automated Billing

Automating your billing process offers several benefits that manual methods struggle to match:

- Time Savings: Once configured, automated systems handle all aspects of payment generation and delivery, eliminating the need for constant attention.

- Consistency: With automated billing, payment requests are sent at the right time, reducing the risk of missed payments or delayed billing.

- Reduced Errors: Since the process is automated, there is less chance for human error in generating or sending payment documents.

- Scalability: Automated billing is ideal for businesses with many clients or subscriptions, as it easily scales to handle an increasing number of transactions.

Benefits of Manual Billing

While automated systems offer convenience, manual billing also has its advantages, especially for certain business models:

- Flexibility: Manual billing allows for complete customization, especially for clients with varying needs or non-standard billing arrangements.

- Control: By manually creating each payment request, businesses have full control over the details of each transaction, which can be useful for complex or one-off services.

- Personal Touch: Manually generated bills can feel more personal, allowing businesses to communicate directly with clients about payment terms or any potential issues.

While both methods can work for different business scenarios, businesses with steady, predictable transactions may benefit more from automation, while those with highly varied or custom billing needs may still prefer manual billing to retain flexibility and control.

Creating Professional Invoices in QuickBooks

Creating polished and professional payment requests is essential for maintaining a positive image with your clients and ensuring prompt payments. A well-crafted payment document not only outlines the details of the services provided but also conveys professionalism and builds trust. With the right tools, you can easily design and generate custom payment requests that reflect your brand and meet the specific needs of your clients.

Using an automated system to generate your payment documents simplifies the process of creating consistent, error-free requests. You can include company logos, tailored descriptions, payment terms, and client information, making each request look professional and clear. The ability to adjust formatting and add personalized details helps businesses present themselves in the best light, ultimately encouraging timely payments and reducing misunderstandings.

Customizing Your Payment Requests

One of the key benefits of using an automated system for creating payment documents is the ability to easily customize them. Consider these features when designing your requests:

- Branding: Add your company logo, colors, and other branding elements to ensure that each payment request reflects your company’s identity.

- Clear Descriptions: Provide detailed descriptions of the products or services offered, including quantities, rates, and any applicable discounts.

- Payment Terms: Clearly specify the due dates, late fees, and any other relevant payment conditions to avoid confusion and set expectations upfront.

Maintaining Professionalism in Every Document

In addition to customization, it’s important to maintain consistency across all payment documents. Here’s how you can do that:

- Standardized Layout: Ensure that your payment documents have a clean, easy-to-read layout with consistent formatting and font usage.

- Timeliness: Send payment documents promptly and on schedule to show your clients that you are organized and reliable.

- Personalization: Personalize each request with the client’s name, the specific services or products they purchased, and any terms unique to their contract.

By investing time into customizing and maintaining a professional appearance for your payment documents, you enhance your company’s reputation and streamline the payment process. A professional approach encourages clients to take your business seriously and ensures that financial transactions are handled smoothly.

How to Preview Recurring Invoices in QuickBooks

Previewing your scheduled payment requests before they are sent out ensures that everything is accurate and aligned with your expectations. This step is essential in preventing errors and ensuring that the correct information is delivered to your clients. By checking your payment documents ahead of time, you can confirm that details such as amounts, due dates, and client information are all properly reflected.

Most systems offer a simple preview option that allows you to view exactly how the final document will appear to the client. This feature helps eliminate mistakes by allowing you to make any necessary adjustments before the request is processed or sent. It is especially useful for businesses with frequent or automated billing cycles, as it ensures consistency and reduces the risk of sending incorrect payment requests.

Steps to Preview Your Payment Requests

To preview a payment document before it is finalized, follow these easy steps:

- Navigate to the section where your active billing cycles are managed.

- Select the specific payment document or cycle you wish to review.

- Look for an option labeled “Preview” or “Preview Payment Request.” This may be located within the settings or options menu for the cycle.

- Click the preview option to view a generated version of the document as it will appear to the client.

- Review all details carefully, such as amounts, payment terms, and client data, to ensure everything is correct.

- If necessary, make adjustments to any of the fields before proceeding with sending or saving the document.

Why Previewing Is Important

Previewing your payment documents offers several important benefits:

- Accuracy: Ensure all details are correct, including amounts, due dates, and client information.

- Consistency: Confirm that each document matches your branding and follows the same format.

- Prevention of Mistakes: Catch errors before they are sent out to clients, saving time and reducing the need for corrections later.

By regularly previewing your payment documents, you can streamline the billing process and enhance the professionalism of your client interactions. It’s a simple but effective way to maintain accuracy and consistency in your business operations.