Warehouse Invoice Template for Streamlined Billing

Managing billing for goods and services in any storage or logistics facility requires clear and precise documentation. This ensures accurate tracking of products, timely payments, and smooth operations. With the right approach, businesses can enhance their workflow and reduce errors.

Having a structured document that outlines the details of transactions is crucial for both vendors and clients. A well-designed system can prevent confusion and create transparency in business dealings. By implementing a flexible yet effective document format, companies can optimize their invoicing processes and avoid common pitfalls.

Whether you are dealing with small shipments or large-scale distributions, using the correct format is essential for clarity. Such a system offers a seamless way to manage orders, payments, and inventory, all while maintaining a professional image. Properly formatted records ensure that all parties involved are on the same page, making the entire process smoother and more reliable.

Warehouse Invoice Template Overview

In any business that involves storing and shipping products, keeping track of transactions and exchanges is critical. Clear, concise documentation is essential for ensuring that all parties involved understand the terms, quantities, and payment details. This kind of document provides the necessary framework for organizing the flow of goods and money between the business and its clients.

For businesses, using a well-structured document format not only improves accuracy but also enhances efficiency. By incorporating the right fields and data, these forms can easily capture all necessary information, helping businesses maintain proper records and prevent errors. A comprehensive system ensures consistency in transactions and speeds up the billing process, making it easier for both parties to complete their dealings.

Why Structured Forms Matter

Structured forms allow companies to maintain a professional standard while providing transparency to their clients. Every transaction becomes easier to track, reducing the chance of disputes. Whether you are a small operation or a large enterprise, having a standardized approach to documenting exchanges can significantly improve your financial management.

Improving Operational Efficiency

By using well-defined document structures, businesses can automate various aspects of their operations. Automation helps reduce manual errors and saves time in the long run, allowing employees to focus on more strategic tasks. Moreover, these documents are easy to integrate with accounting or management software, providing a seamless connection between documentation and financial tracking.

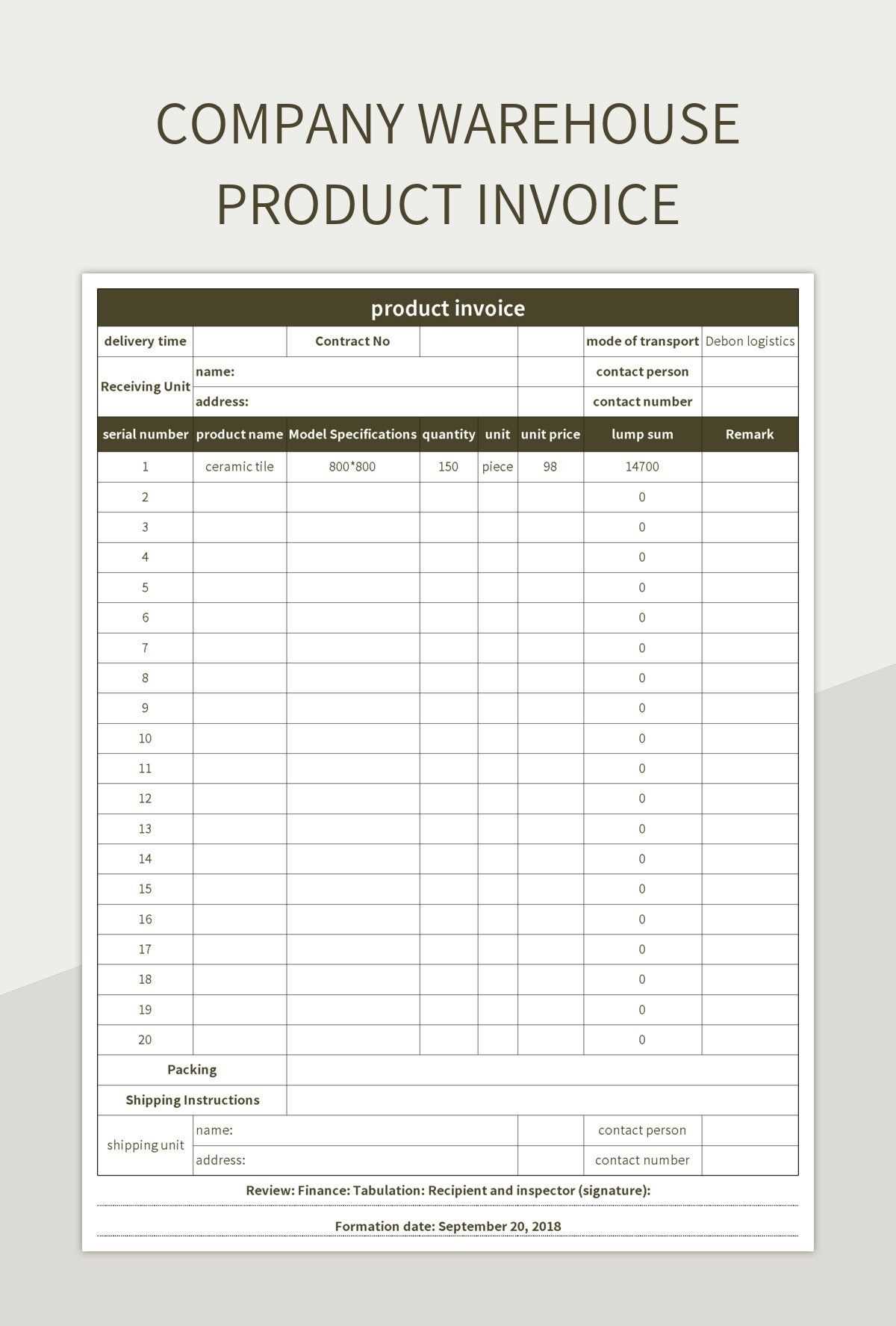

What is a Warehouse Invoice

A document used to record the details of transactions involving the movement of goods within a storage facility is crucial for keeping track of sales, shipments, and payments. This type of document serves as both a receipt and a request for payment, clearly outlining what products have been sent, their quantities, and the total amount due. It helps ensure both the buyer and seller have the same understanding of the goods exchanged and the financial obligations involved.

Typically issued by the business that stores the goods, such a document includes essential information such as item descriptions, delivery dates, payment terms, and sometimes even tax calculations. It functions as a formal record for both the company and its clients, making it easier to resolve any potential discrepancies and keep the transaction process smooth and transparent.

Key Components of the Document

The document typically includes important details such as the names of the buyer and seller, product descriptions, quantities, and the agreed-upon price. Additionally, any special terms regarding shipping or payment deadlines are also included to ensure there are no misunderstandings. These details help establish a clear, unambiguous record of the transaction.

Ensuring Accuracy in Business Transactions

Having a structured and accurate document helps prevent mistakes in accounting and order fulfillment. By providing a detailed breakdown of each transaction, it ensures that both the business and the customer can easily verify the terms and details of their dealings. This transparency fosters trust and minimizes the likelihood of disputes, making it easier for both parties to maintain a professional relationship.

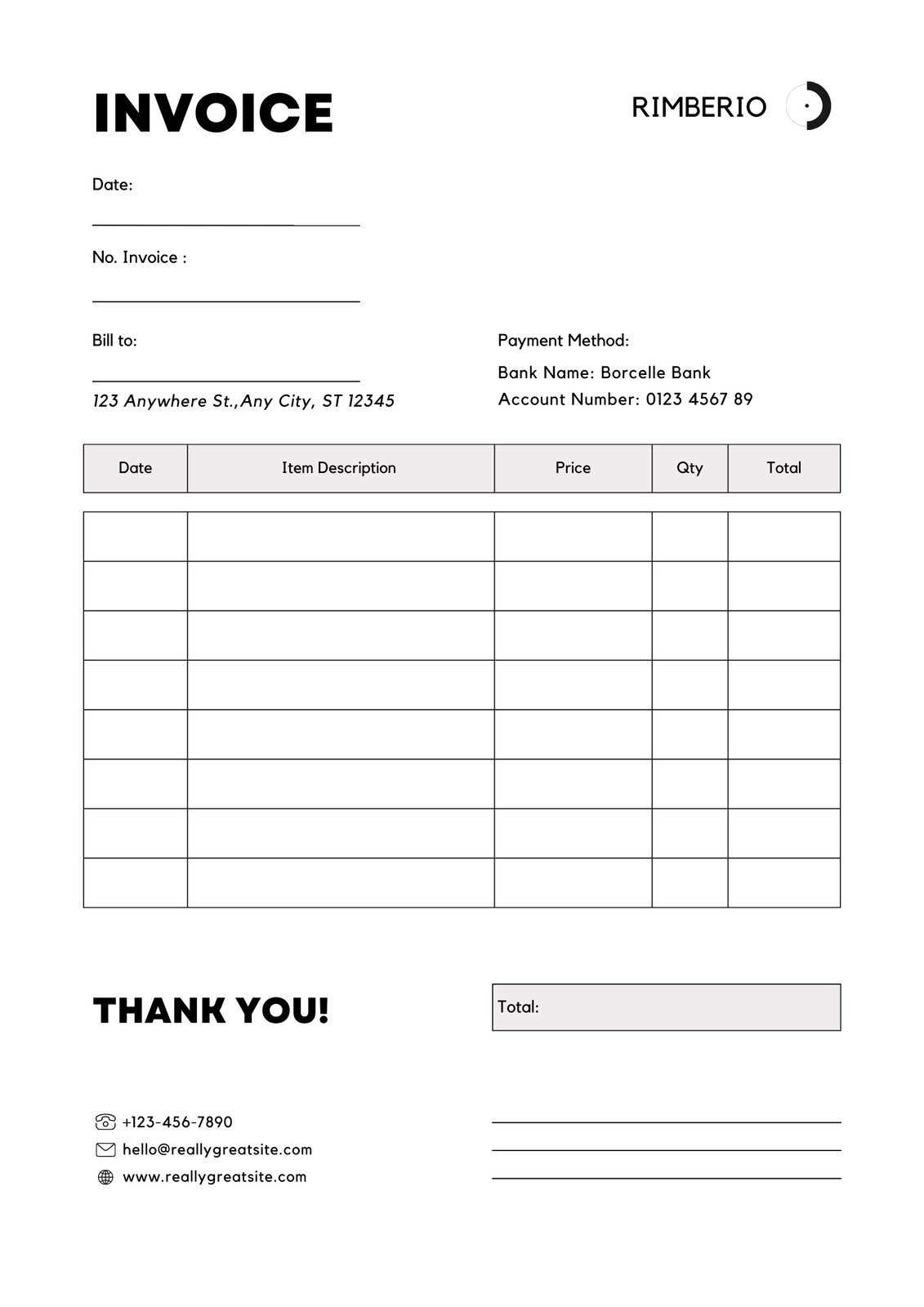

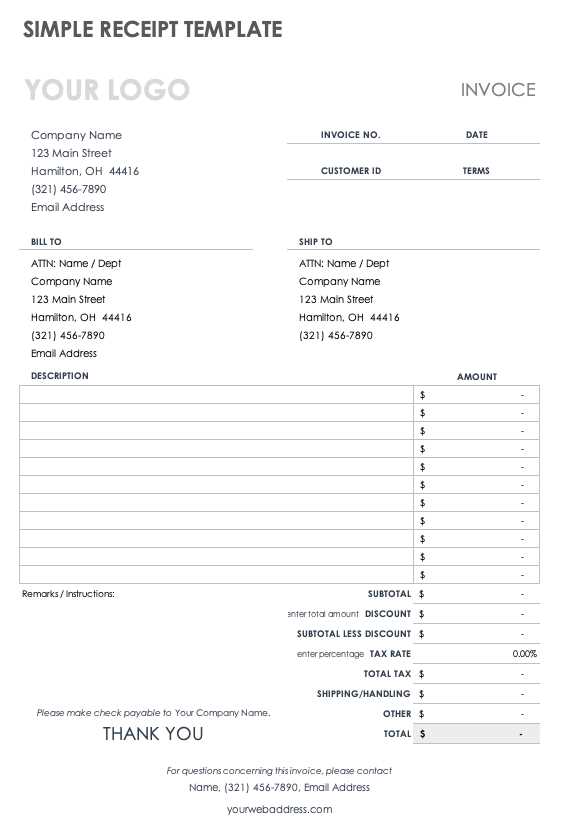

Key Elements of an Invoice Template

A well-constructed document for tracking the exchange of goods and services includes several critical components. These elements ensure that all the necessary information is conveyed clearly, reducing the potential for confusion and disputes. By including key details such as item descriptions, payment terms, and pricing, the document serves as a comprehensive record of the transaction.

Essential Information to Include

For the document to be effective, it should contain several key components. These details help create a transparent and professional transaction record. Common elements include:

- Contact Information: Names, addresses, and contact details of both parties involved in the transaction.

- Product or Service Descriptions: Clear details of what is being exchanged, including quantities and specifications.

- Dates: The date of the transaction, as well as the expected or actual delivery date.

- Pricing: A breakdown of unit prices and total cost, including any discounts or additional charges.

- Payment Terms: Information on payment deadlines, methods, and any late fees if applicable.

- Unique Identifier: A reference number for easy tracking of the document and future correspondence.

Why These Elements Matter

Each element plays a crucial role in ensuring the clarity and efficiency of the transaction process. Clear descriptions and accurate pricing help avoid misunderstandings, while payment terms ensure both parties know when and how payment is due. By organizing all the necessary information into a single document, businesses can streamline operations, improve record-keeping, and establish trust with clients.

Benefits of Using an Invoice Template

Utilizing a well-designed form for recording transactions brings numerous advantages to businesses, particularly in terms of efficiency, accuracy, and professionalism. These structured documents help ensure that all essential details are captured clearly and consistently, simplifying the entire billing process and fostering smoother operations.

Increased Efficiency and Time Savings

One of the primary benefits of using a pre-designed structure is the significant time saved. With an established format, there is no need to manually create each document from scratch. This allows businesses to focus on other important tasks, such as customer service or inventory management, while automating the creation of transactional records.

Improved Accuracy and Consistency

Using a predefined layout ensures that no critical information is overlooked, reducing the risk of errors. Whether it’s product details, pricing, or payment terms, having a consistent approach guarantees that the same data fields are filled out correctly each time. This consistency not only improves operational accuracy but also helps avoid misunderstandings and disputes with clients.

By ensuring that the right details are captured and organized properly, businesses can streamline their financial processes, reduce administrative workload, and present a more professional image to clients and partners.

Customizing Your Warehouse Invoice

Adapting your billing document to suit your business needs can significantly enhance its effectiveness. Customization allows you to tailor the structure and layout to reflect your company’s branding and to include specific details relevant to your industry. Whether you’re dealing with large volumes of products or specialized services, having a personalized format can improve both the clarity and professionalism of your transactions.

Custom features might include adding your company logo, changing the layout to highlight important details, or adjusting the sections to match the specific goods or services you offer. It can also involve incorporating additional information like payment instructions or return policies, ensuring the document meets all legal and operational requirements.

By making these adjustments, businesses can ensure that their documents are not only functional but also aligned with their corporate identity. This customization enhances customer satisfaction by providing a clear, well-organized record of each transaction while reinforcing brand recognition.

How to Create a Warehouse Invoice

Creating an effective document for tracking transactions between your business and clients doesn’t need to be complicated. The process begins with gathering all the necessary information and organizing it in a clear and consistent format. Whether you are using software or a simple spreadsheet, the goal is to ensure that each record accurately reflects the details of the goods or services exchanged.

Start by including the essential details, such as the names and contact information of both parties, along with a unique reference number for easy tracking. Next, add descriptions of the products or services provided, including quantities and prices. Be sure to clearly specify payment terms, such as the due date and accepted methods of payment, along with any taxes or additional charges that apply. Finally, double-check the document for accuracy before sending it to the customer.

Once the basic structure is in place, you can further customize the document by adding elements like your company logo or specific payment instructions. This will make your records both professional and tailored to your business’s needs. The key is to ensure clarity and transparency at every step of the process, which will help streamline operations and foster positive relationships with your clients.

Choosing the Right Template for Your Business

Selecting the right format for documenting your transactions is essential for streamlining your financial processes. The correct structure ensures that all necessary information is included, making the billing and tracking process more efficient. The right choice can depend on factors like the size of your business, the nature of your products, and the complexity of your transactions.

When choosing a structure, consider the following factors:

| Factor | Consideration |

|---|---|

| Business Size | Small businesses may benefit from simpler forms, while larger enterprises might require more complex documents to handle multiple items or services. |

| Product Type | Depending on whether you’re dealing with physical goods or services, you might need different sections or itemizations on your document. |

| Customization Needs | If branding is important, choose a format that allows easy customization with logos, colors, and other company-specific details. |

| Software Integration | Consider whether the document can integrate with your existing accounting or inventory management software. |

By carefully evaluating these factors, you can select a format that will not only simplify your workflow but also reflect your business needs, ensuring smoother interactions with clients and more accurate records of all transactions.

Common Mistakes in Warehouse Invoices

Despite the importance of creating accurate records for business transactions, mistakes can still occur when documenting exchanges. These errors can lead to confusion, delays in payment, or disputes between parties. Understanding the common mistakes that can arise when preparing these forms can help businesses ensure their documents are both accurate and professional.

Common Errors to Avoid

Several typical mistakes can compromise the effectiveness of your business transaction records. The following are the most frequent issues encountered:

- Incorrect Pricing or Quantities: Failing to accurately list the prices or quantities of items exchanged can cause confusion and may lead to overpayment or underpayment.

- Missing or Incorrect Contact Information: Omitting contact details for either party can result in communication issues, which may delay payments or lead to misunderstandings.

- Unclear Payment Terms: Vague or missing payment instructions can lead to delayed payments. It’s important to clearly outline deadlines, accepted payment methods, and any applicable late fees.

- Failure to Include a Unique Reference Number: Without a reference number, it can be difficult to track and verify transactions, particularly in case of disputes.

- Omitting Taxes or Additional Charges: Forgetting to account for taxes, shipping, or other fees can create confusion for the recipient and result in incorrect payment amounts.

How to Prevent These Mistakes

To avoid these issues, businesses should implement a checklist to ensure all necessary details are included and accurate. Double-checking prices, contact information, and payment terms can prevent misunderstandings. Additionally, ensuring that each transaction has a unique reference number and that all additional charges are accounted for will help keep records clear and accurate.

By being mindful of these common mistakes, businesses can create clearer, more professional transaction records and maintain smoother relationships with their clients.

Legal Requirements for Warehouse Invoices

When creating formal records of transactions between businesses and customers, it’s essential to adhere to certain legal standards. These documents are not only used for internal record-keeping but also play a vital role in taxation, dispute resolution, and regulatory compliance. Understanding the legal requirements ensures that your records are valid and protect both parties in the event of audits or disputes.

The following are key legal requirements to consider when preparing these official documents:

- Accurate and Clear Information: All relevant details, such as the names and addresses of both parties, must be included to avoid ambiguity. This helps to verify the legitimacy of the transaction and ensures transparency.

- Unique Transaction Reference Number: Each record should have a distinct identification number to facilitate tracking, auditing, and referencing during future communications.

- Proper Date and Timing: The transaction date, as well as the delivery date (if applicable), must be clearly listed to ensure accurate timeframes for payment and other legal obligations.

- Tax Information: Including applicable taxes, VAT (Value Added Tax), or other regulatory fees is essential for both parties to comply with tax laws and avoid penalties.

- Payment Terms and Conditions: Clearly stated payment terms are crucial, including the due date, interest charges for late payments, and accepted payment methods. This helps prevent disputes over payment expectations.

- Item Descriptions and Pricing: A detailed breakdown of the items or services provided, including unit prices, quantities, and total amounts, is important for legal transparency and resolving any potential disputes.

By ensuring these elements are included, businesses not only protect themselves legally but also foster trust and professionalism in their relationships with clients and partners. Adhering to these standards is key to maintaining compliance and ensuring smooth transactions.

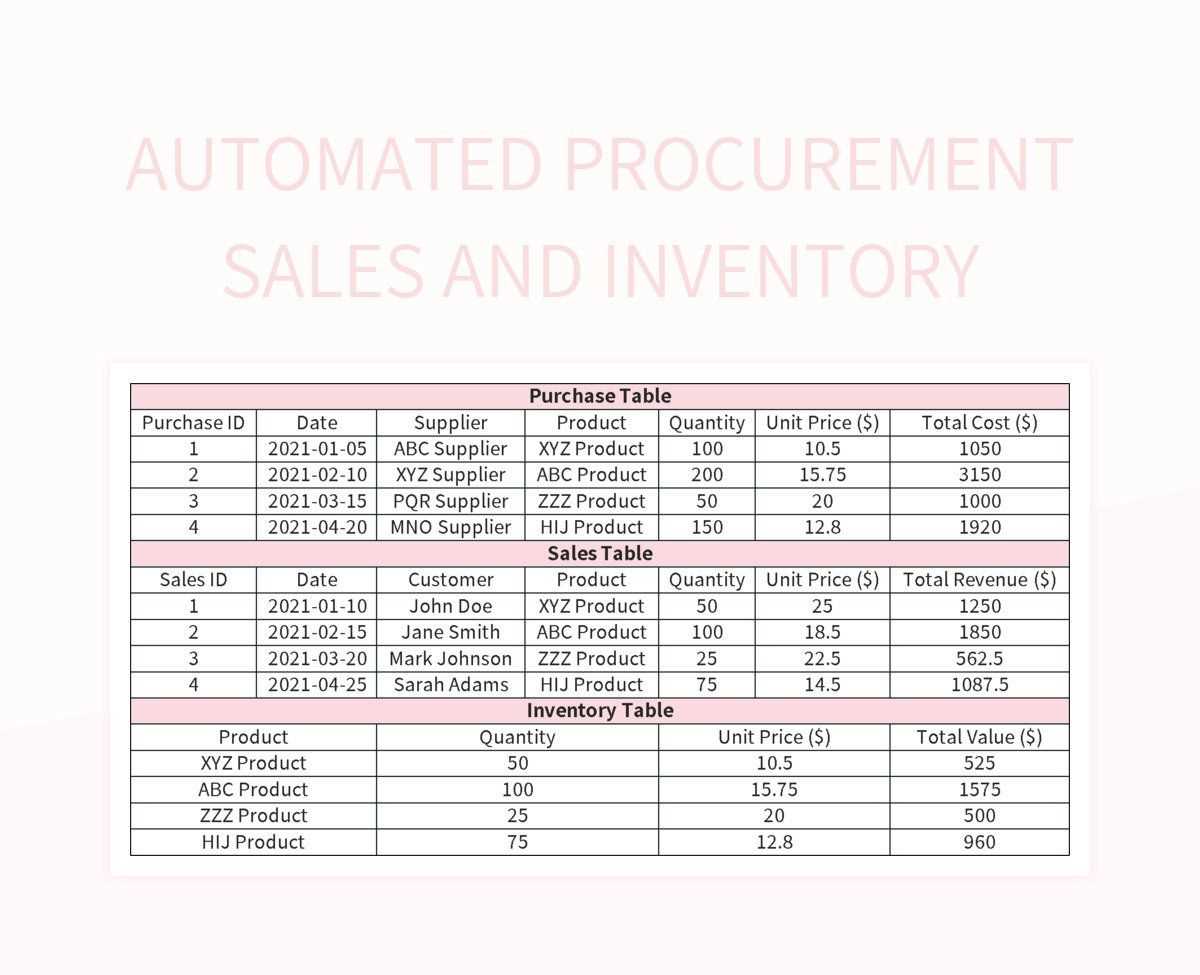

Integrating Invoices with Warehouse Software

Efficiently managing transaction records alongside inventory systems is key to streamlining business operations. By integrating billing documents with your inventory management software, you can automate the process of updating stock levels, generating financial records, and improving overall workflow. This integration not only reduces the chance for human error but also saves time and resources, allowing your business to run more smoothly and effectively.

Benefits of Integration

When your billing system is linked with inventory management software, several advantages arise:

- Real-Time Stock Updates: Automatically update your inventory as sales are processed, ensuring accurate stock counts and preventing over-selling or understocking.

- Seamless Financial Tracking: Automatically generate accurate financial records for each transaction, reducing the need for manual entry and minimizing errors.

- Faster Processing: Automation speeds up the entire process, from generating records to confirming payment and updating stock, which improves efficiency.

- Better Reporting: Integrating both systems allows for more detailed and accurate reporting, helping businesses make informed decisions and manage resources more effectively.

How to Integrate the Systems

Integrating these systems typically involves selecting software that supports API connections, allowing your billing and inventory tools to communicate with each other. Many modern platforms offer plug-and-play integrations, making it easier for businesses to connect these systems without needing advanced technical expertise. Once the integration is set up, ensure that both systems are properly synced, and run test transactions to confirm the data flows correctly between them.

By linking your transaction records with inventory management tools, you can significantly improve operational efficiency and reduce the risk of errors in both financial and stock data.

Automating Invoice Generation for Efficiency

Automating the creation of transaction documents is a powerful way to enhance operational efficiency. By leveraging software to automatically generate these records, businesses can reduce manual effort, minimize errors, and ensure that all necessary information is included without fail. This not only speeds up the process but also ensures that every document is consistent and compliant with regulatory standards.

Benefits of Automation

Automating document creation provides several key advantages that can significantly improve business operations:

- Reduced Manual Labor: Automation eliminates the need for employees to manually fill out forms, saving valuable time and reducing the risk of human error.

- Faster Processing: By automating the process, documents are created in a fraction of the time, speeding up the entire workflow from order to payment.

- Consistency and Accuracy: Automation ensures that the same format, structure, and required details are included in every record, leading to more accurate and consistent documentation.

- Cost Savings: By minimizing the time spent on manual tasks and reducing the likelihood of mistakes, businesses can cut operational costs significantly.

Key Features to Look for in Automation Software

To ensure maximum efficiency, it’s important to choose automation software that offers the following capabilities:

| Feature | Description |

|---|---|

| Customization Options | Ability to adjust templates to fit your specific needs, including the inclusion of your company logo, payment terms, and other details. |

| Integration with Other Systems | Ensure the software can integrate seamlessly with your other systems, such as inventory or accounting software, to streamline data flow. |

| Automatic Reminders | Set up automatic reminders for overdue payments or recurring charges to ensure timely action. |

| Real-Time Updates | Software should update information in real-time, reflecting changes in stock, pricing, or customer details. |

By automating the generation of transaction records, businesses can streamline their operations, save time, and reduce the chances of human error, leading to a mor

Invoice Templates for Different Industries

Each business sector has unique needs when it comes to creating formal transaction records. These documents must capture industry-specific details, from product descriptions to payment terms, to ensure clarity and compliance. Tailoring these records to meet the requirements of your industry not only streamlines processes but also promotes professionalism and reduces the likelihood of misunderstandings or disputes.

Industry-Specific Considerations

Different industries require specific information on their transaction records, and customizing your approach ensures that all necessary data is included. Below are some common industries and their key requirements:

| Industry | Key Requirements |

|---|---|

| Retail | Clear descriptions of items, including quantity, price per unit, and any applicable taxes or discounts. Quick processing and clear payment terms are crucial. |

| Construction | Detailed breakdown of labor and materials, along with any project milestones, work order references, and billing cycles. Terms of payment for long-term projects are also important. |

| Services | Descriptions of the services provided, including hourly rates, total hours worked, and any additional charges or fees. Payment schedules may vary depending on the service agreement. |

| Manufacturing | Itemized lists of raw materials, production costs, and quantities produced. Often includes additional details such as shipping or handling fees and payment due dates. |

| Freelance/Consulting | Hourly rates, project-based fees, and the scope of work are crucial details. Freelancers may also need to outline tax deductions or business expenses that affect the total amount due. |

Customizing Documents for Your Industry

Adapting the format and content of your transaction records to meet the needs of your industry helps improve operational efficiency and ensures compliance. Most businesses can benefit from using software that offers industry-specific templates, which can automatically adjust the format and fields to suit each sector’s requirements. This customization eliminates the need for manual adjustments and reduces the potential for errors.

By tailoring transaction records to the specific needs of your industry, you not only improve accuracy but also enhance the credibility and professionalism of your business.

Best Practices for Invoice Accuracy

Ensuring the accuracy of transaction documents is crucial for maintaining smooth business operations and fostering trust between companies and clients. Even small errors in these records can lead to misunderstandings, delayed payments, or even legal issues. By following best practices, businesses can reduce the likelihood of mistakes and ensure that all necessary information is clearly and correctly conveyed.

Key Strategies for Accuracy

There are several key strategies that can help businesses improve the precision of their transaction documents:

- Double-Check Information: Always verify the details entered into the document, including product descriptions, quantities, and prices. Any small mistake can lead to significant issues later.

- Use Predefined Fields: When possible, use predefined fields for standard information like payment terms, taxes, and delivery addresses to reduce the chance of errors.

- Automate Calculations: Implementing automated systems for calculating totals, taxes, and discounts can significantly reduce the risk of manual errors and speed up the process.

- Standardize Format: Keeping a consistent format for all documents ensures that employees are familiar with what information is needed and where to find it, helping to avoid confusion and mistakes.

Review and Approvals

To further ensure accuracy, implement a system of reviews and approvals. Having a second set of eyes review the document before it’s finalized can catch any mistakes that might have been missed initially. Regular audits of your document processes can also help identify any recurring issues and prevent them from happening in the future.

By adhering to these best practices, businesses can ensure that their documents are accurate, compliant, and professional, ultimately leading to smoother transactions and better client relationships.

How to Handle Invoice Disputes

Disagreements over transaction documents can arise for a variety of reasons, including incorrect amounts, missing details, or misunderstandings regarding terms. Effectively managing these disputes is crucial to maintaining strong client relationships and ensuring that payments are processed without unnecessary delays. By following a structured approach, businesses can resolve conflicts quickly and fairly.

Steps to Resolve Disputes

When a disagreement occurs, it’s essential to approach the situation calmly and systematically. Here are some steps to follow:

- Review the Document: Begin by carefully reviewing the transaction document to identify any discrepancies. Double-check amounts, terms, and any special conditions that may have caused confusion.

- Communicate Clearly: Reach out to the other party as soon as a dispute is identified. A clear and professional conversation is often the best way to resolve misunderstandings quickly.

- Provide Evidence: If there is a mistake on the document, provide supporting evidence, such as receipts or contracts, to clarify the situation and show why the amount or terms should be corrected.

- Negotiate a Solution: Be prepared to negotiate. Whether it’s agreeing on a revised amount, adjusting the terms, or offering a payment plan, flexibility and willingness to find a fair solution can help resolve the issue.

Preventing Future Disputes

While disputes are sometimes unavoidable, taking proactive measures can minimize the risk of future conflicts. This includes improving document accuracy, ensuring clear communication from the outset, and setting up clear payment terms. Regular audits of your document processes can also help identify common issues before they escalate into disputes.

By approaching disputes with a calm and solution-oriented mindset, businesses can maintain strong, professional relationships with clients while safeguarding their own financial interests.

Tracking and Storing Invoice Records

Maintaining accurate records of financial transactions is crucial for both operational efficiency and regulatory compliance. Proper tracking and storage of these documents ensure that businesses can easily retrieve important information when needed, resolve disputes quickly, and stay organized for tax purposes. This section discusses effective methods for tracking and storing such records securely and efficiently.

Methods for Tracking Transaction Records

There are several ways to keep track of financial documents, ranging from manual systems to automated software solutions. Below are some common methods used by businesses:

- Manual Logs: For small businesses, maintaining a physical logbook or spreadsheet can be an effective way to track important details such as transaction dates, amounts, and client information.

- Accounting Software: Many businesses use specialized software that automatically tracks all incoming and outgoing payments. These systems also provide tools for generating reports and ensuring that records are kept up to date.

- Cloud-Based Solutions: Cloud storage allows businesses to securely store and organize their transaction documents, making them easily accessible from any location and on any device.

Best Practices for Storing Financial Documents

Once records are tracked, it’s essential to store them securely and systematically. Here are a few practices to follow:

- Organize by Category: Grouping documents based on criteria such as date, client, or transaction type can help streamline the process of finding specific records when needed.

- Secure Storage: Whether using digital or physical storage, ensuring that records are protected from unauthorized access is vital. For digital records, this means using encrypted cloud storage or secure servers. For physical records, a locked filing cabinet or secure storage space is necessary.

- Regular Backups: Regularly backing up digital records ensures that important documents are not lost due to hardware failure or other unexpected events.

By implementing these tracking and storage practices, businesses can ensure that they are always prepared for audits, disputes, or any other circumstances requiring easy access to financial documentation.

Managing Payments Through Invoices

Efficient management of payments is critical to maintaining smooth business operations. Properly structured transaction documents serve as a formal record that outlines the amount due, payment terms, and deadlines. These records not only facilitate clear communication between the business and clients but also help ensure that payments are processed promptly and accurately.

When managing payments through transaction documents, it is important to be clear about the key elements, such as due dates, payment methods, and any applicable late fees. This transparency helps prevent misunderstandings and ensures that both parties are on the same page regarding the financial expectations of the transaction.

Ensuring Timely Payment

One of the most important aspects of payment management is ensuring that clients pay on time. Below are strategies to help streamline this process:

- Clear Payment Terms: Always specify payment terms in the document, including due dates, acceptable payment methods, and any early payment discounts or penalties for late payments.

- Payment Reminders: Sending polite reminders before the due date can encourage timely payments. Automated reminders through accounting software can make this process more efficient.

- Multiple Payment Options: Offering various payment methods such as credit cards, bank transfers, or digital wallets can make it easier for clients to pay on time.

Tracking Outstanding Balances

Managing outstanding payments is essential to ensure cash flow remains healthy. Regularly monitoring unpaid balances helps businesses track overdue amounts and follow up promptly. Some common practices include:

- Automated Payment Tracking: Accounting systems can automatically track outstanding payments and send alerts when a payment is overdue.

- Account Statements: Providing clients with periodic account statements summarizing outstanding amounts can help keep them informed and encourage them to settle their balances sooner.

- Escalation Process: If payments are consistently late, businesses should have a clear escalation process in place, which may include charging interest or initiating legal proceedings if necessary.

By managing payments effectively through clear documentation and strategic follow-ups, businesses can maintain financial stability and build stronger relationships with their clients.

Improving Cash Flow with Proper Invoicing

Maintaining a steady cash flow is essential for the smooth operation of any business. One of the most effective ways to ensure consistent cash flow is by streamlining the process of generating and managing financial records that request payment. These documents not only serve as a record of the transaction but also set clear terms for the due amounts, encouraging prompt payments from clients.

By ensuring that each financial record is accurate, detailed, and issued promptly, businesses can reduce delays in payment processing. This practice helps improve cash flow by minimizing the time between service delivery and payment receipt.

Key Elements for Boosting Cash Flow

To ensure financial stability and consistent cash flow, businesses must focus on key elements that help optimize the payment process:

| Element | Impact on Cash Flow |

|---|---|

| Clear Payment Terms | Clearly defining due dates, penalties for late payments, and acceptable payment methods helps reduce payment delays and confusion. |

| Early Payment Incentives | Offering discounts for early payments can encourage quicker transactions, improving cash flow. |

| Accurate and Detailed Records | Providing clients with accurate and transparent financial records reduces disputes and encourages faster processing. |

| Timely Issuance of Records | Issuing financial documents promptly after a transaction ensures that payment deadlines are met on time, minimizing overdue accounts. |

Follow-Up Practices to Enhance Payment Collection

Efficient follow-up strategies can significantly enhance cash flow by ensuring that payments are made on time. Some best practices include:

- Automated Reminders: Set up automated reminders to inform clients when payments are approaching or overdue, reducing the need for manual follow-up.

- Consistent Communication: Maintaining open lines of communication with clients regarding payment status can help prevent delays.

- Incentivizing Timely Payments: Offering incentives, such as discounts or loyalty programs, for prompt payments can motivate clients to settle their bills faster.

By optimizing the invoicing process and focusing on these elements, businesses can improve their cash flow, ensuring greater financial stability and success.