How to Use an Export Invoice Template for Efficient International Transactions

When conducting business across borders, it’s crucial to provide clear and accurate financial records that outline the terms of sale. These documents serve not only as proof of transaction but also ensure compliance with international trade regulations. Having a well-structured record can significantly streamline the process and minimize misunderstandings with clients and customs authorities.

For businesses involved in global trade, preparing these forms can be a time-consuming task. However, by using organized structures and including all necessary details, the process becomes far more efficient. A properly designed document helps avoid potential delays and ensures both parties are aligned on payment terms, product details, and delivery arrangements.

Whether you’re new to international sales or have years of experience, adopting a reliable method for creating these essential records is key to maintaining smooth operations and reducing administrative workload. In this guide, we’ll explore how to build a professional document that will meet both your needs and the expectations of global clients.

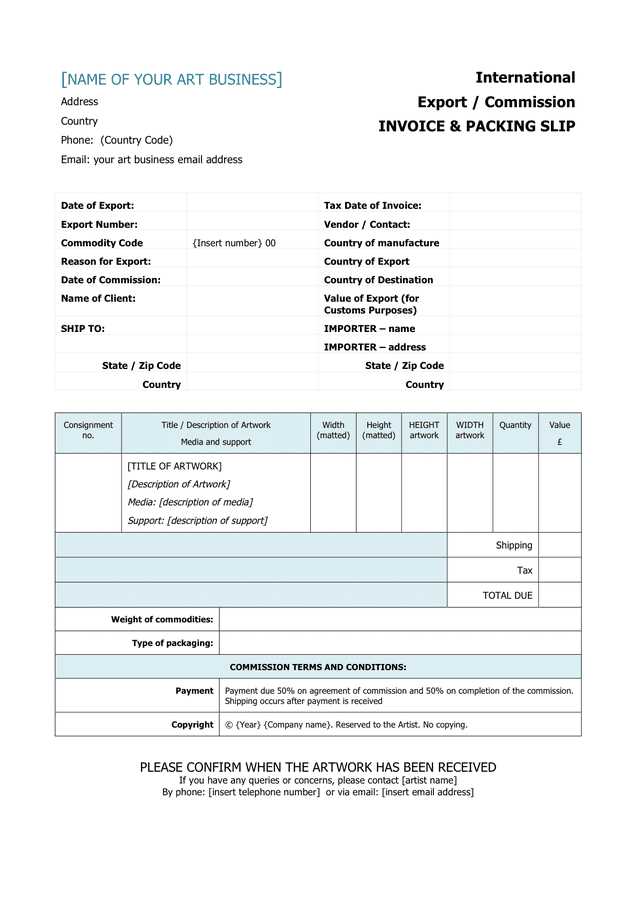

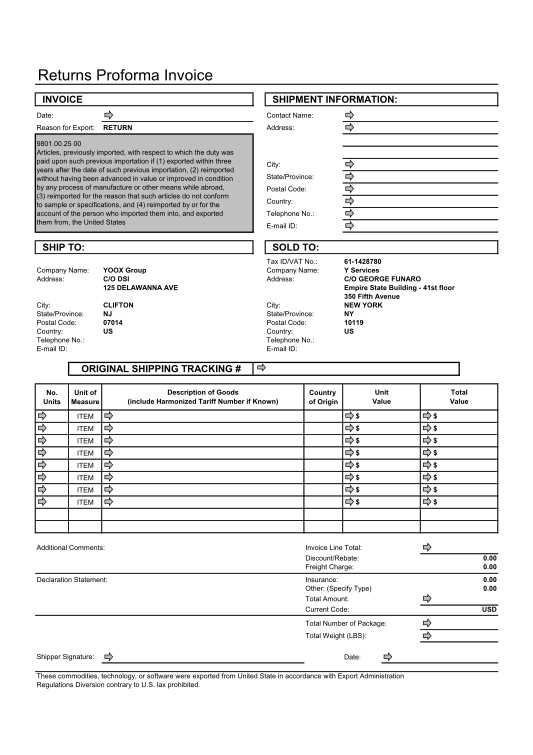

Export Invoice Template Overview

For businesses involved in international trade, creating a clear and structured financial document is essential for smooth transactions. Such a document provides both the seller and buyer with detailed information about the sale, ensuring that terms are understood and legally recognized across borders. A well-organized form is critical for smooth customs clearance and timely payments.

These documents generally include several key sections, each serving a specific purpose. The format may vary depending on the specific needs of the transaction or the preferences of the involved parties. However, certain elements remain consistent to ensure compliance with regulations and clarity for both sides.

- Seller and Buyer Information: Basic contact details of both parties, including names, addresses, and registration numbers.

- Product Description: Clear details of the goods sold, including quantities, unit prices, and total amounts.

- Shipping and Delivery Terms: Information on how and when the goods will be shipped, along with associated costs.

- Payment Terms: Details on when and how payment is expected, including any applicable discounts or late fees.

- Customs and Tax Information: Relevant data on duties, taxes, and any required documentation for customs clearance.

Having a standardized way to create such forms not only ensures consistency but also saves valuable time. Additionally, it helps in minimizing errors and avoids miscommunication that could delay the process. Whether done manually or using software, keeping these essential elements in place will help businesses maintain clear records and smooth international dealings.

Why Export Invoices Are Important

In international business, having well-documented records of every transaction is crucial for ensuring transparency, smooth operations, and regulatory compliance. These documents not only serve as a written confirmation of the deal but also play a vital role in financial management, logistics, and legal matters. Without them, businesses risk facing delays, miscommunication, and even legal disputes.

Key Reasons for Their Importance

- Legal Protection: Accurate records help protect both parties in case of disagreements. They serve as proof of the terms agreed upon, including product details, payment conditions, and shipping arrangements.

- Customs Compliance: These documents are required for customs clearance. They provide necessary information for customs officers to verify that the shipment is legitimate and meets all import/export regulations.

- Financial Accuracy: Clear records help prevent discrepancies in financial reporting, making it easier for businesses to track revenue, costs, and taxes associated with each transaction.

- Efficient Payment Processing: By outlining payment terms in detail, these documents help ensure timely and accurate payments, reducing the risk of delayed or missed payments.

Additional Benefits

- Improved Customer Relations: Transparent documentation helps build trust with international clients by showing professionalism and attention to detail.

- Facilitation of Audit and Tax Filing: Properly structured records simplify the process of preparing for audits and filing taxes, ensuring compliance with local and international tax laws.

In summary, these records are far more than just formalities; they are essential tools that facilitate smooth, secure, and legally compliant international transactions. By ensuring that all terms are properly documented, businesses can avoid unnecessary risks and ensure long-term success in the global marketplace.

Key Elements of an Export Invoice

To ensure that all details of a transaction are clearly outlined and understood by both parties, certain key components must be included in the document. These essential sections provide transparency, establish payment terms, and meet the regulatory requirements for international trade. Each part plays a specific role in making the document both accurate and legally binding.

Essential Components

| Section | Description |

|---|---|

| Seller and Buyer Information | Includes names, addresses, and contact details for both parties involved in the transaction. |

| Product Description | Details of the items being sold, including quantities, unit prices, and product codes if applicable. |

| Shipping Terms | Outlines delivery methods, shipping dates, and any additional charges for transporting the goods. |

| Payment Terms | Specifies when and how payment should be made, including any agreed-upon discounts or penalties. |

| Customs Information | Includes the necessary data for customs clearance, such as harmonized codes and country of origin. |

| Total Amount Due | The total cost of the transaction, including product price, taxes, shipping, and other applicable fees. |

Additional Considerations

While the above elements are essential, it’s also important to include any special instructions or agreements between the buyer and seller. This could include information about insurance, packaging, or specific terms of delivery. A comprehensive and clear document will ensure that all parties are aligned and minimize the chances of errors or disputes later in the process.

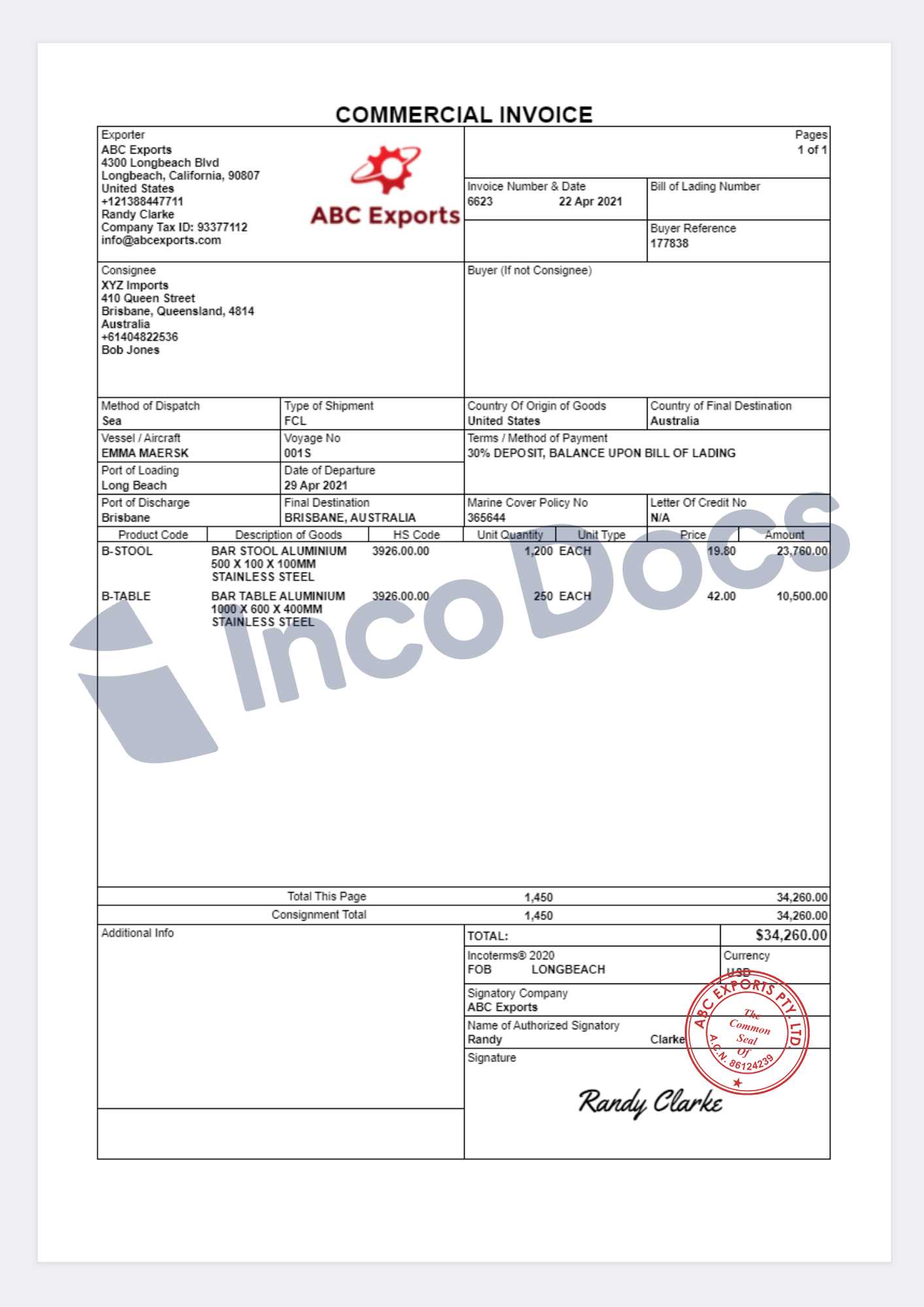

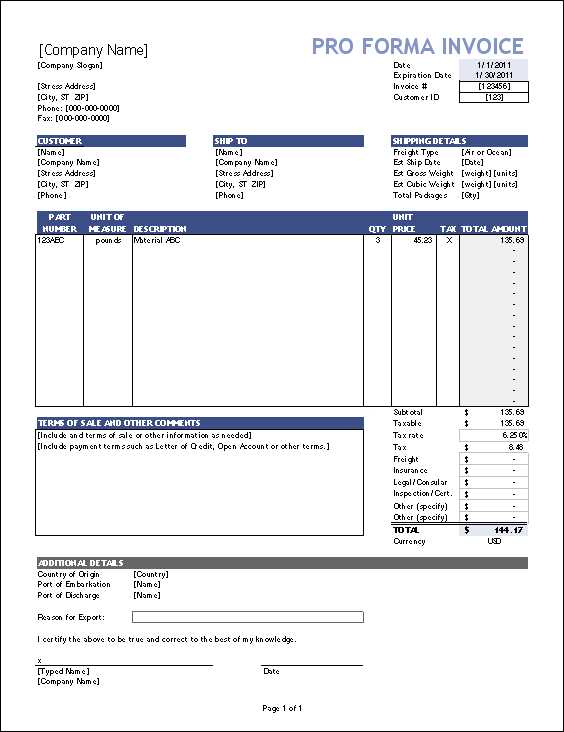

How to Create an Export Invoice

Creating a comprehensive document for international transactions involves more than just filling in basic details. A well-structured record ensures clarity for both the buyer and seller, streamlines the shipping process, and ensures compliance with legal and financial requirements. By following a clear process, businesses can avoid errors and guarantee timely payments and smooth customs clearance.

Steps to Follow When Creating the Document

- Start with Basic Information: Include the full names, addresses, and contact details of both the seller and the buyer. This establishes the parties involved in the transaction.

- Provide a Clear Description of Goods: List the items being sold, including quantities, unit prices, product codes (if applicable), and total value for each item.

- Include Shipping Information: Specify the mode of transport, expected delivery date, and any additional charges related to shipping. This will avoid any confusion about costs or delays.

- State Payment Terms: Clearly outline how and when payment should be made, including any agreed-upon discounts or penalties for late payment.

- Account for Customs and Taxes: Ensure that all relevant tax information and customs requirements are listed, including duties, taxes, and necessary documentation for import/export procedures.

- Calculate Total Amount: Sum up the costs for each item, including shipping and taxes, to give the buyer the full amount due.

Additional Tips for Accuracy

- Double-check all figures: Ensure that unit prices, quantities, and totals are correct to avoid disputes or delays.

- Use clear and consistent formatting: This will make the document easier to understand and reduce the risk of misinterpretation.

- Provide supporting documents: Attach any relevant paperwork, such as certificates of origin or licenses, to assist in customs clearance.

By following these steps, businesses can efficiently create documents that not only facilitate smoother transactions but also ensure both legal and financial compliance throughout the trade process.

Common Mistakes in Export Invoices

When creating financial documents for international transactions, it’s easy to make errors that can lead to delays, disputes, or even legal issues. Common mistakes often arise from incorrect information, missed details, or misunderstanding of specific requirements. These mistakes can complicate the shipping process, impact payments, or cause unnecessary back-and-forth with customs authorities.

Common Errors to Avoid

| Error | Explanation |

|---|---|

| Incorrect or Missing Contact Information | Failing to include full and accurate contact details of both the seller and buyer can delay communication and cause confusion during the transaction. |

| Incomplete Product Descriptions | Not providing enough details, such as quantity, unit price, or product codes, can result in misunderstandings or delays in customs clearance. |

| Wrong Shipping Details | Misstating shipping methods, delivery dates, or costs can lead to disputes with the buyer or shipping delays. |

| Omitting Tax or Duty Information | Not listing applicable duties or taxes can cause customs to hold goods, or the buyer may be surprised by additional charges later. |

| Inaccurate Total Amount | Errors in summing up the costs of goods, shipping, or taxes can lead to disputes or delayed payments. |

| Unclear Payment Terms | Vague or inconsistent payment terms can result in delayed payments, affecting cash flow and business relationships. |

Preventing Mistakes

To avoid these errors, it’s important to carefully review all details before finalizing the document. Double-check all product descriptions, payment terms, and tax information. Using a standardized format can also help ensure consistency and accuracy. In addition, having someone else review the document can provide a fresh perspective and catch mistakes that might have been overlooked.

By being diligent in your preparation and thorough in reviewing, you can minimize errors and ensure that all parties involved have the information they need to proceed with the transaction smoothly.

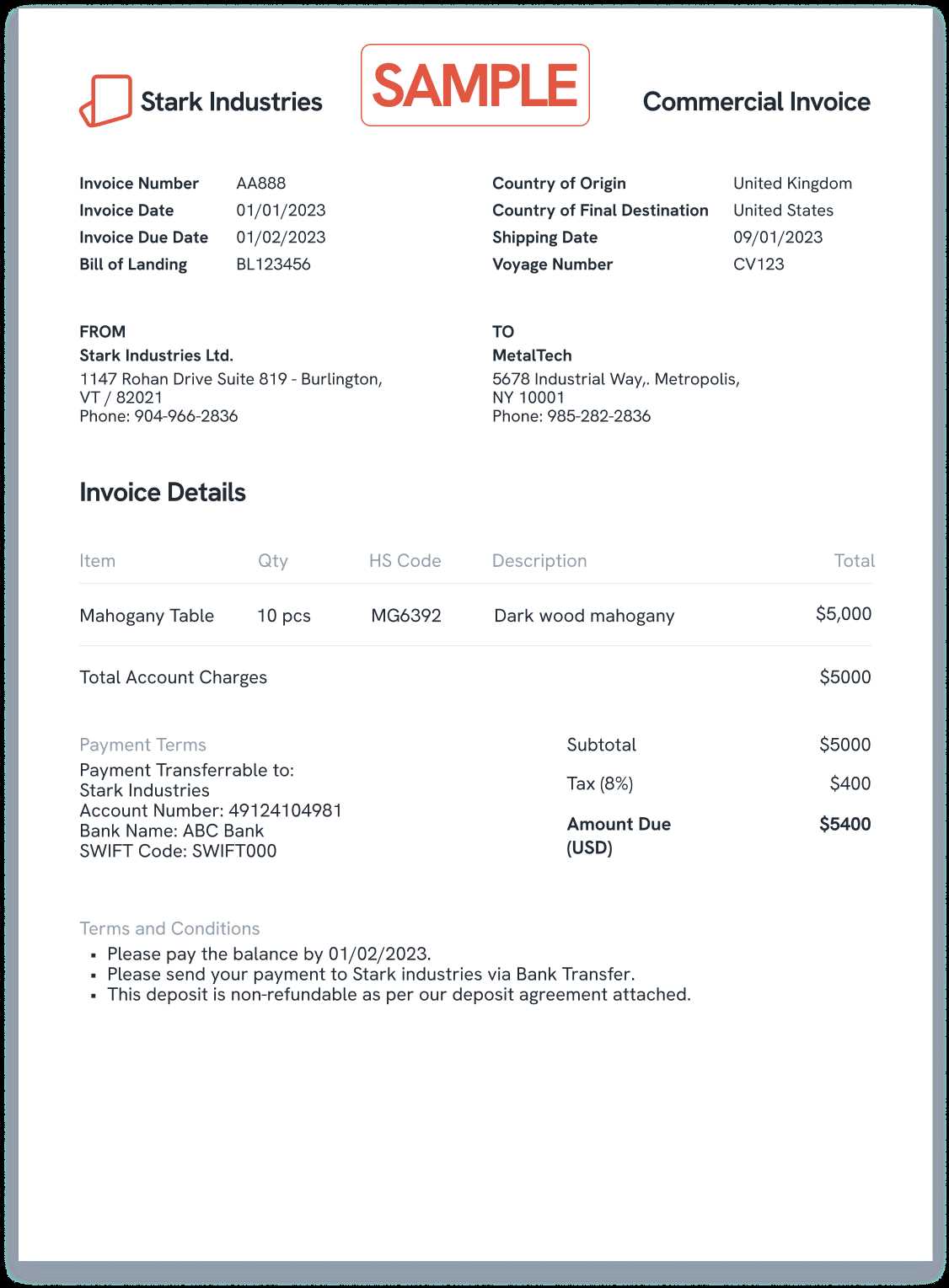

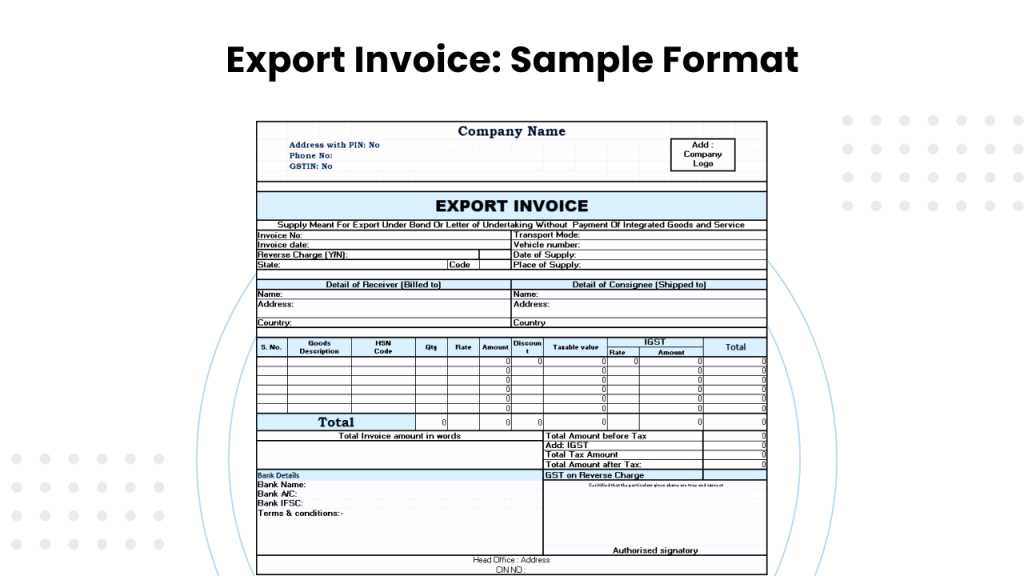

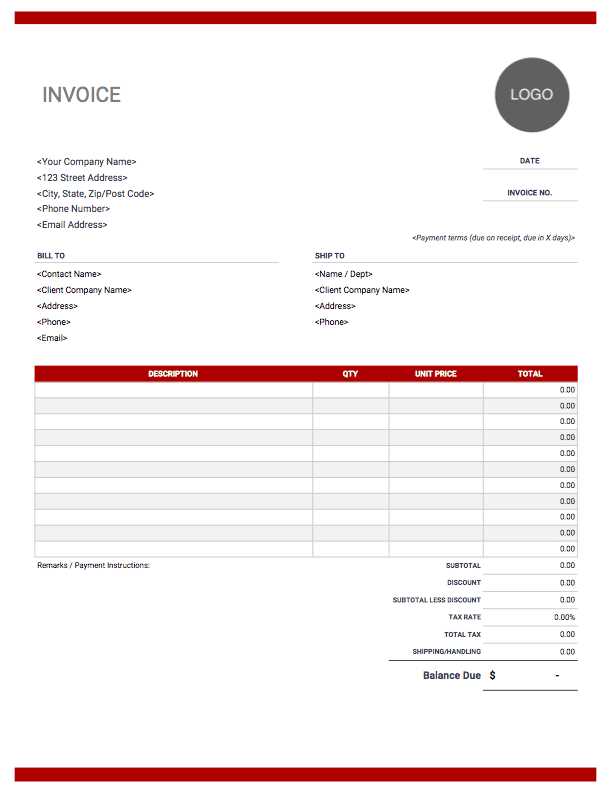

Free Export Invoice Templates Online

For businesses involved in international transactions, finding a reliable and easy-to-use format for documenting sales is essential. Fortunately, there are many free resources available online that offer pre-designed documents, making it easier to create professional and accurate records without the need for specialized software or a design team. These free resources help ensure that the key elements of a transaction are included, reducing the risk of errors or omissions.

These templates are typically customizable and can be adapted to suit the specific needs of different types of sales. Many are available in various formats, such as Word, Excel, and PDF, allowing for flexibility depending on your preferences or system requirements. The ease of use and accessibility of these resources make them ideal for businesses of any size, whether you’re just starting out or looking to streamline your existing process.

Advantages of Using Free Online Templates:

- Cost-effective: No need to invest in expensive software or hire designers. Many high-quality options are available for free.

- Ease of Use: Templates are designed to be user-friendly, requiring little to no experience in document creation.

- Time-saving: Pre-designed formats allow you to quickly generate the necessary records without starting from scratch.

- Customization: Templates can be modified to include your company branding, product details, and specific terms of sale.

Many websites offer free downloads of these resources, and some even provide additional tools to further simplify the creation process. These can include automated calculations for totals, tax rates, and shipping costs. With the right template, businesses can produce professional, accurate, and legally compliant documents that support smooth and efficient international trade.

Customizing Your Export Invoice Template

Customizing the document used for international transactions allows businesses to ensure that all relevant details are accurately reflected while maintaining a professional appearance. By adapting the design and content to fit your specific needs, you can create a document that is both functional and aligned with your company’s branding and operational processes. A personalized layout not only enhances the document’s clarity but also ensures it meets the legal and financial requirements of both parties involved.

Key Areas for Customization

- Company Branding: Include your company logo, name, and contact information at the top of the document. This helps establish your brand identity and adds a professional touch.

- Payment Terms: Customize the payment section to reflect your specific payment methods and due dates. This ensures that the buyer understands when and how to make the payment.

- Product Descriptions: Adjust the product listing to include item codes, descriptions, and any other specific details relevant to your business. This makes it easier for the buyer to identify the items purchased.

- Shipping Information: Personalize the shipping section to include preferred carriers, delivery terms, and any tracking information, helping the buyer track their order easily.

- Tax and Duty Information: Ensure that any taxes, duties, or additional charges are clearly listed. This can be customized based on the destination country and local regulations.

Tools for Easy Customization

- Excel/Spreadsheet Software: Many people use Excel or Google Sheets to customize the document, taking advantage of built-in functions for calculating totals, taxes, and shipping fees.

- Online Customization Tools: Websites offering free document creation tools may also provide customization options, allowing you to edit the design, layout, and fields according to your preferences.

- Word Processors: Software like Microsoft Word or Google Docs offers a simple way to customize and format the document, enabling easy text modifications and adjustments to layout.

Customizing your documents ensures that they not only reflect your business needs but also comply with international trade requirements, making the transaction process smoother and more efficient for both parties involved.

Export Invoice Format Best Practices

Creating a well-organized document for international transactions requires careful attention to detail. The format of this record should be structured to ensure clarity, accuracy, and ease of understanding for all parties involved. Following best practices when designing these documents not only helps reduce the risk of errors but also ensures compliance with legal and financial requirements across different countries.

Key Considerations for an Effective Format

- Clear and Logical Layout: Use a simple and easy-to-follow structure, dividing the document into distinct sections such as buyer and seller information, product details, and payment terms. This makes it easier for all parties to find relevant information quickly.

- Consistent Design: Choose a clean and professional design that reflects your brand. Consistent fonts, colors, and spacing make the document look polished and credible.

- Accurate Currency and Tax Details: Clearly indicate the currency used in the transaction and make sure that all taxes, duties, and additional charges are specified. This helps avoid confusion regarding the total amount due.

- Correct Use of Dates: Include the date of issue, shipping date, and payment due date. Ensuring accuracy in these fields is essential for tracking the progress of the transaction and avoiding misunderstandings.

- Detailed Product Information: Provide detailed descriptions of the products or services being sold, including quantities, unit prices, and product codes. This information is essential for both the buyer and customs authorities.

Tools and Tips for Format Optimization

- Spreadsheet Software: Using Excel or Google Sheets helps you easily organize data, perform calculations for totals, taxes, and shipping fees, and apply consistent formattin

How to Include International Shipping Costs

When documenting transactions that involve international delivery, it’s essential to clearly outline the costs associated with shipping. This ensures both the buyer and seller are aware of all charges and helps avoid misunderstandings. Including accurate shipping details in the financial record not only ensures transparency but also supports smooth customs processing and payment collection.

Shipping costs can vary significantly depending on factors such as the destination country, weight, size of the shipment, and the chosen delivery method. These costs should be carefully calculated and clearly stated in the document. Below are key points to consider when adding international shipping fees:

- Specify the Shipping Method: Indicate the type of delivery service being used (e.g., air freight, sea freight, express courier) and any associated costs. This helps the buyer understand the expected delivery time and service level.

- Include Shipping Charges: Clearly list the total cost of shipping, broken down by any relevant factors (e.g., weight, distance, or urgency). This ensures the buyer knows exactly what they are paying for.

- Outline Additional Fees: If there are any additional costs, such as insurance, packaging, or handling, these should be listed separately to avoid confusion.

- Specify Delivery Terms: Include details such as the Incoterms (e.g., FOB, CIF) to clarify who is responsible for covering the shipping costs and handling risk at each stage of the process.

- Customs Duties and Taxes: While not technically part of the shipping costs, any customs duties or taxes should be mentioned, as they may be the buyer’s responsibility and need to be accounted for in the final amount.

By carefully outlining shipping costs and related terms, businesses can avoid confusion and ensure a smoother transaction for both parties involved in international trade.

Export Invoice and Customs Documentation

When conducting international trade, proper documentation is crucial not only for financial transparency but also for ensuring compliance with customs regulations. These documents are essential for the smooth clearance of goods through customs, helping both parties avoid delays and ensuring that all necessary duties and taxes are paid. A detailed and accurate record will provide customs authorities with the information needed to assess and approve the shipment.

The correct documentation should accompany every international shipment, detailing the terms of sale, product information, and compliance with international trade laws. Below are key aspects to consider when preparing documents for customs:

Key Documentation Required for Customs

- Commercial Documents: These include the sales agreement, order confirmation, or any other document that specifies the terms and conditions of the transaction.

- Product Descriptions and Harmonized Codes: A detailed description of the goods being shipped, along with the appropriate harmonized tariff codes, is essential for customs to classify and value the goods.

- Customs Declaration Forms: Depending on the destination, you may need to submit specific forms declaring the nature of the goods, their value, and their origin. This ensures the proper duty rates are applied.

- Certificates of Origin: These documents confirm the country where the goods were manufactured and are required for certain goods to qualify for preferential tariffs or to meet specific trade agreements.

- Import/Export Licenses: Some products may require licenses before they can be shipped internationally. Make sure to include any necessary permits to avoid delays at customs.

- Shipping and Transport Documents: Bills of lading, air waybills, or other transport documents provide proof of shipment and outline the terms of delivery, which is important for clearing goods through customs.

Best Practices for Smooth Customs Clearance

- Accurate and Complete Information: Ensure all fields are filled out correctly and that descriptions are clear and precise to avoid confusion during the customs review process.

- Ensure Proper Valuation: Declare the correct value of the goods to ensure that customs duties and taxes are calculated accurately.

- Check Destination Requirements: Different countries have varying customs requirements, so it’s important to be familiar with the specific documentation needed for each destination.

- Provide Clear Instructions: Include any additional instructions for customs or shipping companies, such as specific handling requirements or preferred delivery methods.

By ensuring that the correct documents are provided and all details are accurate, businesses can facilitate smoother customs clearance, avoid unnecessary delays, and ensur

How to Calculate Export Duties and Taxes

When shipping goods internationally, understanding and calculating duties and taxes is a crucial step in ensuring compliance with customs regulations. These fees are imposed by the destination country and vary based on the nature of the goods, their value, and the country of origin. Accurate calculation of these costs helps prevent delays, avoids unexpected charges, and ensures that the buyer is fully informed about the total cost of the transaction.

To calculate duties and taxes, it’s important to first gather the necessary information about the goods being shipped, such as their classification, value, and shipping method. Each country has its own tariff schedule, which determines the applicable duties based on product categories and other factors. Below are the key steps involved in calculating these fees:

Steps for Calculating Duties and Taxes

- Determine the Harmonized System (HS) Code: Every product is assigned a specific HS code that corresponds to its classification for customs purposes. This code helps determine the tariff rate applicable to the goods.

- Assess the Value of the Goods: Customs duties are often calculated based on the value of the goods being shipped. This includes the cost of the items, plus any additional costs such as shipping or insurance.

- Consult the Destination Country’s Tariff Schedule: Each country maintains a tariff schedule that lists the duty rates for various products. Using the HS code and the product’s value, you can find the appropriate duty rate in the schedule.

- Calculate the Duty Amount: Multiply the value of the goods by the applicable duty rate to determine the amount of duty payable. This amount may vary depending on the country’s trade agreements, such as preferential tariffs.

- Account for Other Taxes: Some countries impose additional taxes, such as Value Added Tax (VAT), Goods and Services Tax (GST), or other local taxes. These taxes are typically calculated as a percentage of the total value of the goods, including shipping and duties.

Additional Considerations

- Customs Declarations: Ensure that you accurately declare the value, nature, and classification of the goods on the necessary customs forms to avoid penalties or delays.

- Exemptions and Allowances: Some products may qualify for reduced duties or tax exemptions under specific trade agreements or due to the nature of the goods (e.g., personal items or donations).

- Professional Assistance: If the calculations are complex, or if you’re shipping large volumes of goods regularly, consider consulting with a customs broker or logistics expert to ensure compliance and accuracy.

By following these steps and being diligent about the information y

Legal Requirements for Export Invoices

When conducting international trade, ensuring that all documentation meets legal standards is essential for both parties involved. These documents are not only critical for facilitating smooth transactions but also for complying with various regulations imposed by customs authorities and tax agencies. Legal requirements often vary from one country to another, making it necessary to understand the specific obligations for each destination to avoid penalties or shipment delays.

The legal aspects of creating these documents go beyond simply listing product details and prices. Certain information must be included to meet both international trade agreements and local laws. Below are the key legal requirements businesses must keep in mind when preparing documentation for cross-border transactions:

- Complete and Accurate Product Information: The document must clearly describe the goods being sold, including quantities, unit prices, and product codes. This helps customs authorities assess the proper duties and ensures that the goods can be easily identified upon arrival in the destination country.

- Correct Valuation: The total value of the goods should be accurately declared, including the cost of items, shipping charges, and any additional fees. Over- or under-reporting the value can result in fines, delays, or even legal issues.

- Inclusion of Exporter and Importer Information: Proper identification of both the seller (exporter) and buyer (importer) is essential. This includes full names, addresses, contact details, and any relevant business registration numbers. In some countries, the seller may also need to provide their export license number.

- Compliance with Trade Agreements: Some products may be subject to specific trade agreements or tariffs. Documents must reflect any exemptions or preferential tariffs that apply based on these agreements, such as free trade agreements (FTAs) between countries.

- Accurate Shipping Terms: Terms of sale (e.g., Incoterms) must be clearly stated to define the responsibilities of both the seller and buyer concerning shipping, risk, and payment. This helps avoid misunderstandings or disputes during the transaction.

- Currency and Payment Terms: The currency used for the transaction must be specified, and payment terms should be outlined clearly, including any due dates or methods of payment.

- Certificates and Licensing: Depending on the product type and destination country, businesses may need to provide additional certificates or licenses, such as certificates of origin, health certificates, or export permits, which ensure compliance with specific import regulations.

Failure to meet these legal requirements can lead to customs rejection, fines, or delays in processing. Therefore, it’s important to stay informed about the documentation requirements of both your country and the destination country before finalizing the transaction.

Tips for Fast Invoice Processing

Efficient processing of financial documents is critical for maintaining a smooth cash flow and ensuring timely payments. The faster a business can process these records, the quicker it can receive payments and keep operations running smoothly. By streamlining the process, you can reduce the likelihood of delays or errors and improve overall business efficiency.

Essential Steps to Speed Up the Process

- Use Automated Systems: Implementing software that automatically generates and sends financial documents can significantly reduce manual work and minimize the risk of errors. Automation ensures that every document is formatted consistently and sent on time.

- Ensure Accuracy from the Start: Double-check all details before sending, such as the buyer’s information, product descriptions, and pricing. A document free from errors means fewer back-and-forth communications and faster approvals.

- Send Immediately After Confirmation: Once the transaction is confirmed, send the document as soon as possible to start the payment process. Delays in sending can result in delays in receiving payments.

- Offer Multiple Payment Methods: Providing customers with several payment options can speed up the process, as it makes it easier for them to settle the balance quickly. Consider including options like bank transfers, credit card payments, and online payment gateways.

- Clearly Define Payment Terms: Clearly state the payment due date and any late fees to avoid confusion. Setting firm payment terms helps customers prioritize their payments and prevents unnecessary delays.

Additional Best Practices

- Follow Up on Pending Payments: Keep track of outstanding payments and send reminders as the due date approaches. Proactive follow-up can help you avoid delays and ensure that customers know when their payment is due.

- Digital Record Keeping: Store all financial documents electronically for easy access and quick retrieval. This makes it easier to track and reference past transactions, speeding up the process for future dealings.

By implementing these strategies, businesses can reduce bottlenecks in processing and improve their overall efficiency in managing financial transactions.

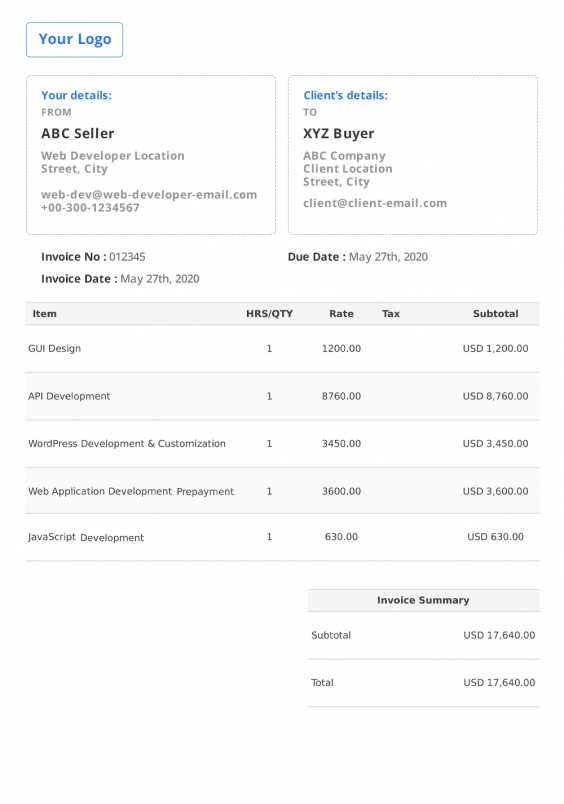

Export Invoice Software vs Manual Templates

When managing transactions and financial records for international business, companies have two primary options for generating documents: using specialized software or relying on manual methods. Both approaches have their pros and cons, and the choice largely depends on the size of the business, the volume of transactions, and the complexity of the required documentation. Understanding the differences between software solutions and manual systems can help businesses make an informed decision on which method best suits their needs.

Software solutions offer automation and efficiency, streamlining the process by eliminating much of the manual input. On the other hand, manual methods may be favored by small businesses or those with less frequent cross-border transactions, where simplicity and cost-effectiveness are key considerations. Here’s a breakdown of the two options:

Benefits of Software Solutions

- Automation: With software, the creation of documents is largely automated, reducing the chance of human error and saving time on repetitive tasks.

- Customization: Most software solutions allow for easy customization, enabling businesses to tailor documents to their specific needs, whether it’s adjusting layout, adding branding, or modifying sections based on the type of transaction.

- Integrated Features: Many software tools offer integrated payment processing, tax calculations, and even real-time tracking of outstanding balances, making the entire process more seamless.

- Scalability: As businesses grow and handle more transactions, software solutions can scale to accommodate increasing volumes without compromising on efficiency.

Benefits of Manual Methods

- Cost-Effective: Using manual templates is typically more affordable, especially for smaller businesses that don’t want to invest in paid software or deal with ongoing subscription fees.

- Simplicity: Manual systems are often straightforward and require minimal setup, making them ideal for businesses that have fewer transactions or don’t need advanced features.

- Flexibility: With manual templates, businesses have the flexibility to make changes on the fly, adjusting formats or details based on the immediate requirements without being confined to software limitations.

- No Learning Curve: Unlike software tools that may require some learning, manual methods are easy to use for those already familiar with creating financial documents, and they don’t require technical knowledge.

While software solutions offer efficiency and scalability, manual methods provide flexibility and simplicity. Businesses should evaluate their needs based on transaction volume, complexity, and available resources to decide which option will best support their operations.

How to Avoid Invoice Delays in Exports

Delays in processing financial documents for international transactions can create significant disruptions in cash flow and cause unnecessary complications for both businesses and customers. Inaccurate or incomplete documentation, late submissions, and failure to meet legal requirements can all contribute to delays that affect payment schedules and shipment timelines. To ensure smooth and timely processing, it is important to follow best practices that help prevent such delays and keep the transaction process on track.

The key to avoiding delays is ensuring that every document is accurate, complete, and submitted in a timely manner. Below are some effective strategies to prevent hold-ups in processing:

Strategies for Preventing Delays

- Double-Check All Information: Accuracy is crucial. Ensure that all fields are filled correctly and that the product descriptions, quantities, and values are consistent with the sales agreement. Inaccurate details can cause delays when the documents are reviewed by customs or financial institutions.

- Use Standardized Formats: Using a standardized format for documentation ensures consistency and minimizes the chances of missing critical details. Whether using automated software or manual templates, ensure the document contains all necessary sections, such as buyer/seller details, payment terms, and shipping information.

- Ensure Proper Classification of Goods: Correctly classifying goods according to the applicable codes is essential for smooth processing. Make sure that the product codes, descriptions, and harmonized system (HS) codes are accurate to avoid customs delays.

- Set Clear Payment Terms: Clearly state the payment due dates and any late payment penalties. Establishing clear expectations up front can encourage timely payments and prevent misunderstandings.

- Send Documents Early: The earlier you send the necessary documentation, the sooner it can be processed. Avoid waiting until the last minute to submit documents, especially when dealing with international transactions that require additional review.

Common Mistakes to Avoid

Common Mistakes Impact on Processing Incomplete or incorrect details Delays in customs clearance, potential fines Missing required documents (e.g., certificates of origin) Shipment hold-ups and increased clearance times Failure to comply with destination country regulations Rejection of documents or shipments, additional processing time Late submission of financial records Delayed payment processing, interrupted cash flow By following these best practices and avoiding common mistake

Importance of Accurate Export Invoices

Accurate documentation is essential for smooth international transactions. In the context of cross-border business, the correctness of financial records plays a pivotal role in ensuring compliance with legal requirements, minimizing disputes, and enabling efficient processing by customs and financial institutions. Errors in these documents can lead to costly delays, rejected shipments, or even legal penalties, which can significantly impact business operations.

Ensuring the precision of every detail in the document is crucial, not only for legal reasons but also to maintain good relationships with clients and business partners. Incorrect or incomplete data can create confusion, disrupt payment schedules, and result in costly adjustments down the line. Below are some of the primary reasons why accuracy is vital in preparing these critical records:

Key Reasons for Accuracy

- Compliance with Regulations: Most countries have strict regulations on documentation for international transactions. Ensuring that all required information is correct and up-to-date helps avoid penalties and delays caused by customs clearance or regulatory checks.

- Timely Payments: Accurate details, including pricing, taxes, and payment terms, ensure that transactions are processed smoothly, allowing businesses to receive payments on time and maintain consistent cash flow.

- Avoiding Financial Penalties: Incorrectly declaring the value of goods or failing to include necessary charges can lead to fines, additional duties, or even legal action. Accuracy helps to prevent unnecessary costs and legal issues.

- Building Trust with Clients: Consistent accuracy in documents helps to establish a reputation of reliability with clients. Miscommunication due to incorrect data can damage business relationships and reduce client confidence.

Potential Consequences of Errors

Error Type Potential Consequence Incorrect product description or classification Delays in customs clearance, additional duties or fines Missing payment terms or incorrect pricing Delayed payments, disputes with clients, cash flow disruptions Failure to include required documentation (e.g., certificates) Shipment rejections, increased customs processing time Incorrect quantities or product values Legal issues, potential for fines, lost revenue In conclusion, accuracy in preparing financial documentation for international transactions is not just a matter of ensuring smooth operations–it is a legal requirement and a key factor in fostering strong business relationships. Taking the time to double-check every detail will not only avoid complications but will also