Yearly Invoice Template for Simplified Billing

Managing financial records for your business can be a daunting task without the right tools. Keeping track of payments, due dates, and customer details requires a system that helps simplify and organize your workflow. An efficient way to do this is by using a structured document designed for recurring annual transactions.

By adopting a pre-made format that suits your business needs, you can save time and reduce errors. These organized forms ensure that every detail is captured accurately and consistently, leading to smoother operations and better financial management. Whether you are a freelancer or running a large enterprise, having a reliable structure to handle client transactions is key to success.

With the right approach, you can create a professional-looking statement that reflects the nature of your work, improves your cash flow, and reduces administrative workload. This guide will explore the benefits and options available to help you make the most of your billing system.

Yearly Invoice Template Overview

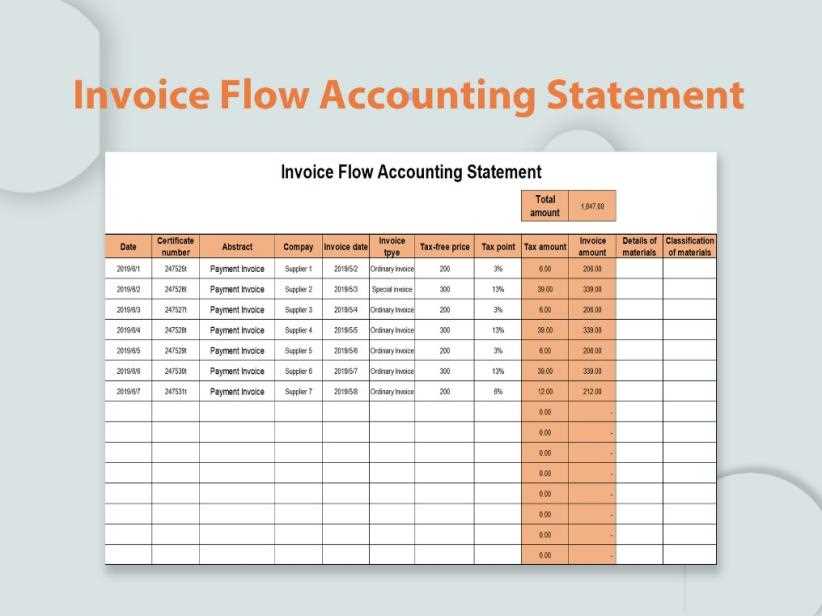

When managing financial records for a business, consistency and accuracy are crucial. A well-structured document that captures essential details about transactions over a given period can help streamline the accounting process. It ensures that all necessary information is in one place, making it easier to track payments, monitor due dates, and stay on top of financial obligations.

Such a document typically includes a series of standardized fields that reflect the nature of the transaction. Whether you are billing a client annually or managing multiple accounts, having a unified format helps maintain organization and clarity. It reduces the likelihood of errors and simplifies the process of sending, receiving, and tracking payments.

The key features of an efficient financial document format include:

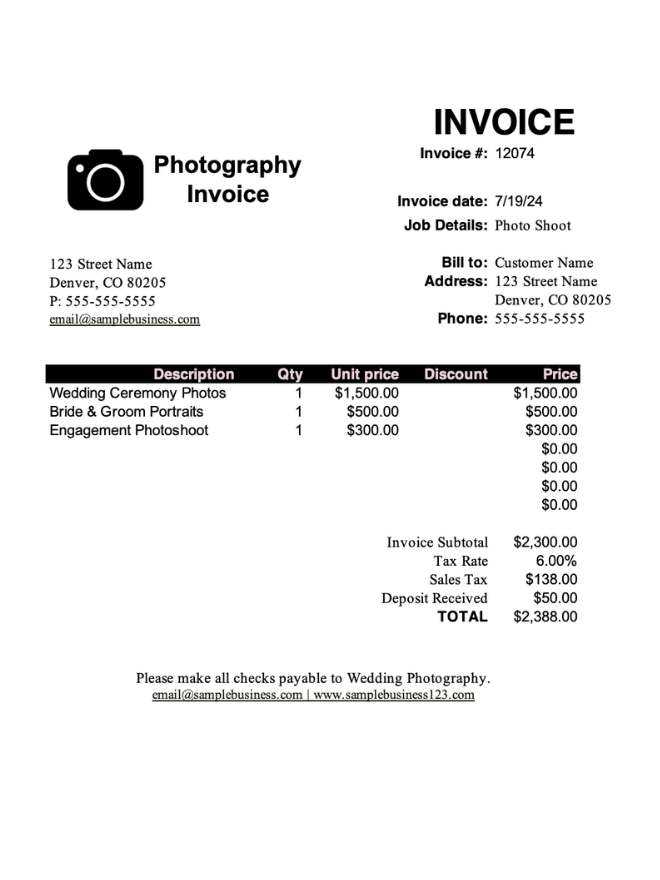

- Client Details: Name, contact information, and billing address

- Transaction Description: Clear breakdown of the products or services provided

- Dates: Payment and service dates to ensure timely processing

- Payment Terms: Clear instructions regarding payment due dates, methods, and penalties for late payments

- Total Amount: Accurate calculation of the full sum owed

By using a structured approach, businesses can enhance their financial management practices, ensuring that all transactions are clearly documented and easy to reference. This not only benefits internal operations but also improves communication with clients, providing them with transparent and organized billing information.

What is a Yearly Invoice Template

A document designed to track and manage financial transactions over a specific period is essential for maintaining smooth business operations. This type of structured form helps businesses capture all necessary details in one place, making it easier to manage recurring charges, payments, and client information.

Such a form typically includes a variety of fields and sections that streamline the process of recording payments and ensuring consistency throughout the year. These are essential for businesses with clients or customers who require regular billing over an extended period. By using this approach, companies can stay organized and ensure timely transactions.

The primary components of this type of document include:

- Client Information: Contact details such as name, address, and email

- Product or Service Description: Clear outline of the goods or services being charged

- Payment Terms: Specific dates and payment methods to be followed

- Amount Due: Total cost of services or products, including any applicable taxes or fees

- Additional Notes: Any relevant information, such as discounts or special instructions

By incorporating a standardized structure, businesses can simplify their billing procedures, reduce errors, and provide clients with easy-to-understand documents that improve financial transparency and communication.

Benefits of Using a Yearly Template

Adopting a structured format for documenting financial transactions can significantly improve efficiency and accuracy in business operations. By using a consistent approach, businesses can streamline their billing process, ensuring all details are clearly presented and easy to track. This organization leads to better time management and fewer errors in client communication.

Time and Effort Savings

One of the key advantages of using a standardized structure is the time saved in creating and managing documents. Instead of starting from scratch every time, a pre-made structure allows businesses to quickly fill in specific details for each transaction. This reduces the need for manual data entry and speeds up the entire process.

Improved Accuracy and Consistency

By following a consistent format, businesses are less likely to overlook important details, such as payment terms or transaction descriptions. This reduces errors that could lead to misunderstandings or payment delays. Furthermore, consistent documentation fosters a professional image and builds trust with clients.

With a reliable system in place, businesses can ensure that every transaction is clearly documented and easy to reference when needed. This can also help in keeping financial records organized, making it easier to assess cash flow, reconcile accounts, and meet regulatory requirements.

How to Customize Your Invoice

Tailoring a financial document to your specific needs ensures it accurately reflects your business style and improves client communication. Customizing your billing structure allows you to include essential details while maintaining professionalism. The more relevant information you add, the easier it becomes for clients to understand their obligations and for you to track payments.

Essential Customization Options

There are several key aspects to customize when creating a financial statement. Adjusting these elements to suit your business ensures that the document is both informative and clear:

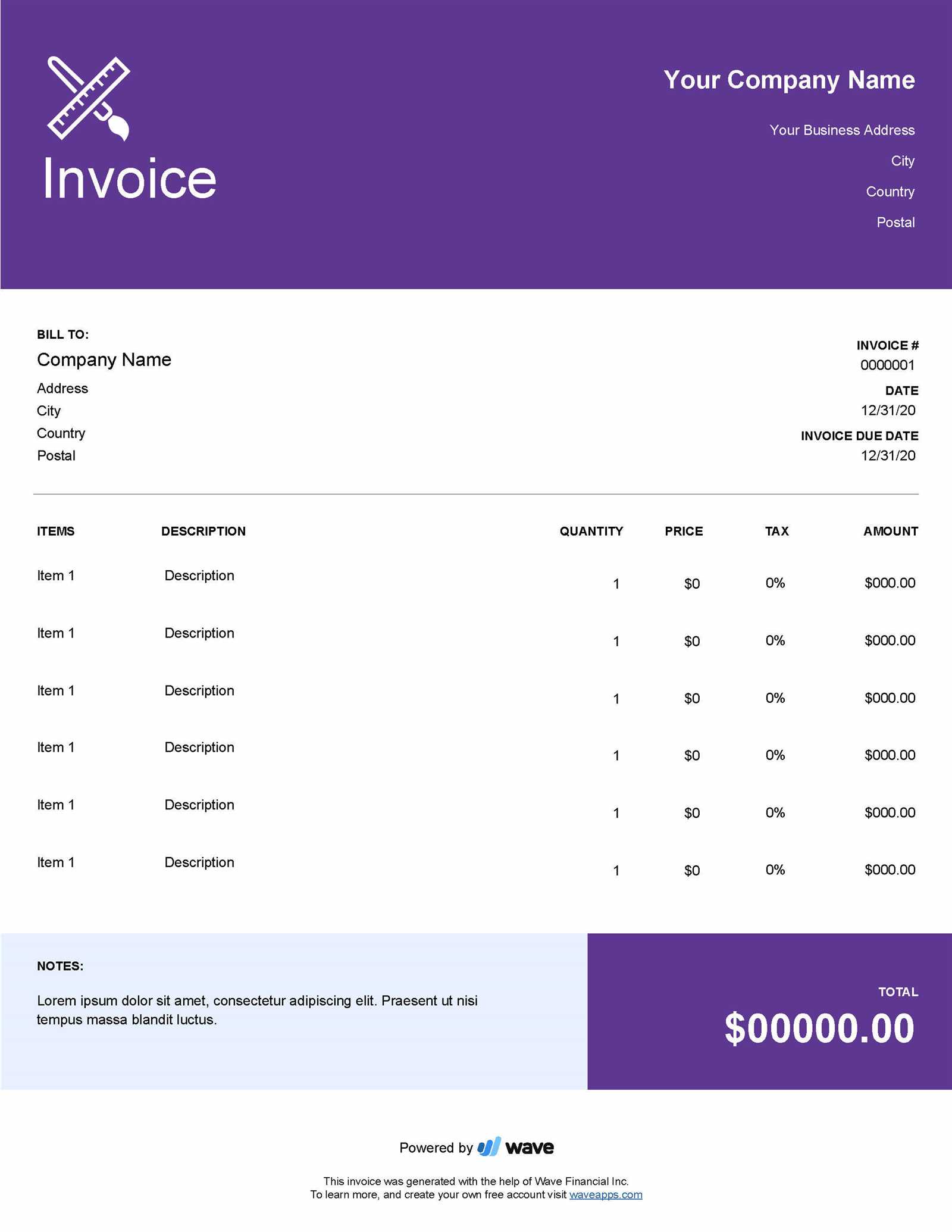

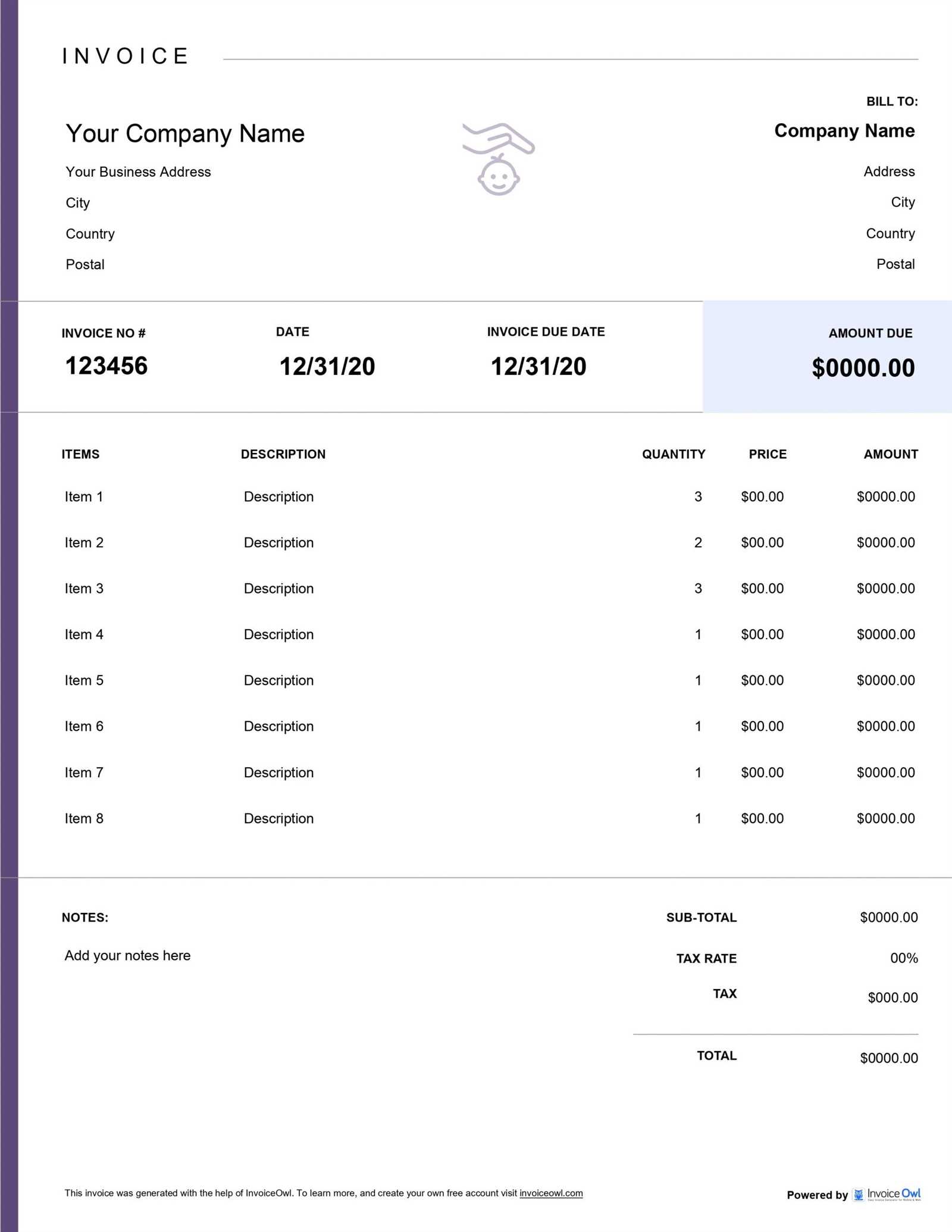

- Header Section: Include your company logo, business name, and contact details for a professional appearance.

- Client Information: Ensure that the recipient’s name, address, and contact details are correct to avoid confusion.

- Payment Terms: Specify due dates, accepted payment methods, and any penalties for late payments.

- Service or Product Description: Provide a detailed list of the products or services delivered, including quantity, unit price, and total cost.

- Discounts and Offers: Add any applicable discounts or special offers to make the document more appealing.

Advanced Customization Features

For businesses with more complex needs, there are additional options to further personalize the document:

- Invoice Numbering: Implement a unique numbering system to help track multiple records easily.

- Currency and Tax Information: Specify the currency being used and include tax rates where applicable to ensure transparency.

- Additional Notes: Add custom instructions, project details, or other relevant information in the notes section.

By adjusting these elements, you can create a document that meets your specific needs and presents your business in a polished and professional manner.

Key Elements of an Invoice

A well-organized billing document includes several critical components that ensure clarity and accuracy. These elements provide all the necessary information for both the sender and the recipient to understand the terms, services, and amounts involved. Including the right details minimizes confusion and ensures smooth transactions.

Essential Information to Include

The following components are essential for a complete and effective financial document:

- Business Details: Your company name, address, and contact information should be clearly visible at the top of the document.

- Client Information: Include the client’s name, company, and contact details to ensure the document is directed to the correct person.

- Unique Identification Number: Each document should have a unique reference number for tracking and record-keeping.

- Date of Issue: The date when the document is issued should be clearly noted to avoid any confusion regarding payment deadlines.

- Service or Product Description: Detailed descriptions of the items or services provided, along with quantities and individual prices.

Additional Key Details

For a complete and professional document, consider adding these extra features:

- Payment Terms: Specify payment due dates, accepted methods of payment, and any penalties for late payments.

- Tax Information: If applicable, include tax rates and amounts to ensure full transparency in the billing process.

- Total Amount Due: Clearly display the total amount owed, including any applicable discounts or additional fees.

- Notes or Special Instructions: Use this section to provide any extra information, such as delivery details, warranty information, or terms of service.

By incorporating these key elements, you ensure that every transaction is properly documented and easy to understand for both parties involved, leading to better financial management and stronger client relationships.

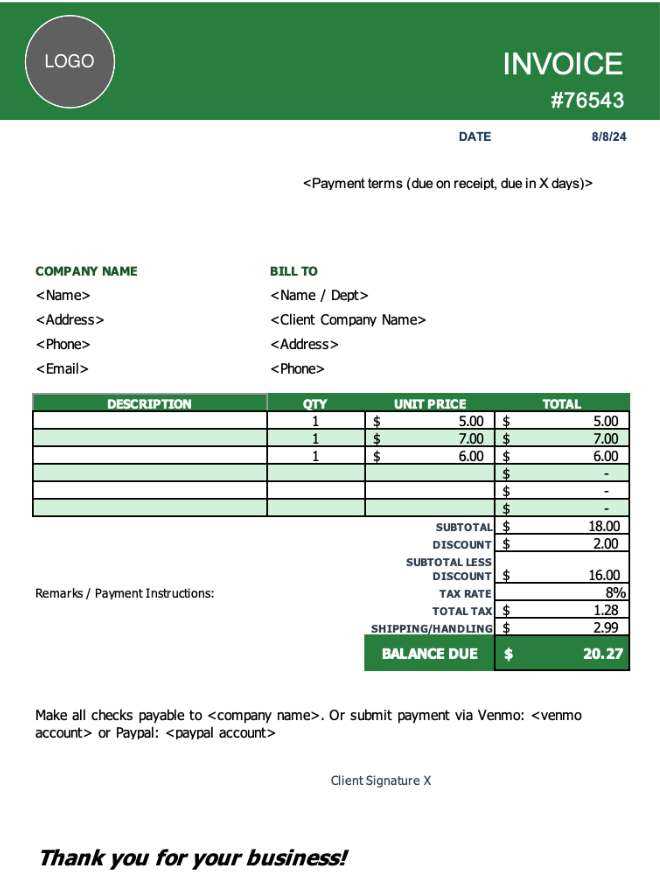

Choosing the Right Format for You

Selecting the appropriate structure for your financial records is essential to ensure that it suits your business needs and workflows. A well-designed document can make a significant difference in how efficiently you manage transactions, track payments, and communicate with clients. Different formats offer various advantages, so understanding your preferences and requirements will help you make the right choice.

Factors to Consider

When deciding on the best structure for your business, consider the following key factors:

- Business Size: Larger businesses with multiple clients or more complex transactions may benefit from automated systems or advanced formats, while smaller businesses might prefer simpler, manual methods.

- Frequency of Use: If you need to generate these documents regularly, look for a format that allows for easy customization and quick updates.

- Legal and Tax Requirements: Make sure the format you choose meets any local legal or tax standards, including proper breakdowns for taxes and compliance details.

- Client Preferences: Some clients may require specific details or prefer particular formats. Be sure to understand their needs to maintain a professional relationship.

Format Options to Explore

There are a few common formats to consider, each offering unique features and advantages:

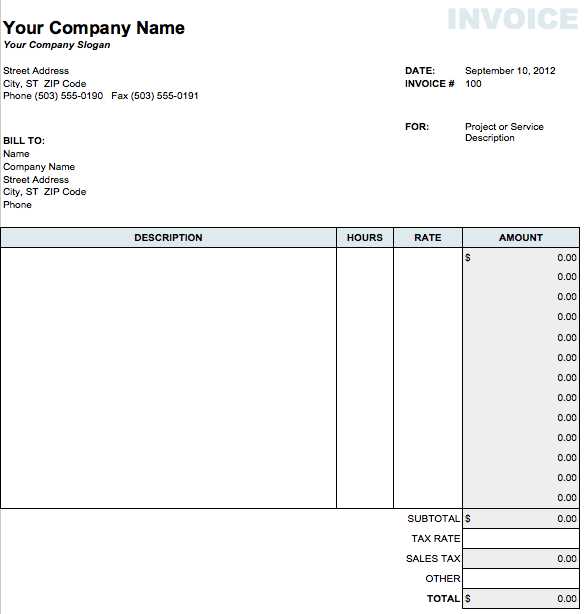

- Manual Documents: These are custom-designed records that you can create and adjust as needed, offering flexibility but requiring more effort and time.

- Spreadsheet-Based: Programs like Excel or Google Sheets allow for simple calculations and easy updates while also offering pre-made templates that are easy to modify.

- Automated Systems: Online billing platforms and software solutions can generate documents automatically, saving time and reducing the likelihood of errors. They may also include features for recurring payments, client management, and reporting.

- Printable Forms: For businesses that require paper-based transactions, printable forms can provide a professional, physical copy that can be handed over or mailed to clients.

By considering these factors, you can choose the right format that enhances efficiency, meets your needs, and improves the accuracy and professionalism of your financial documents.

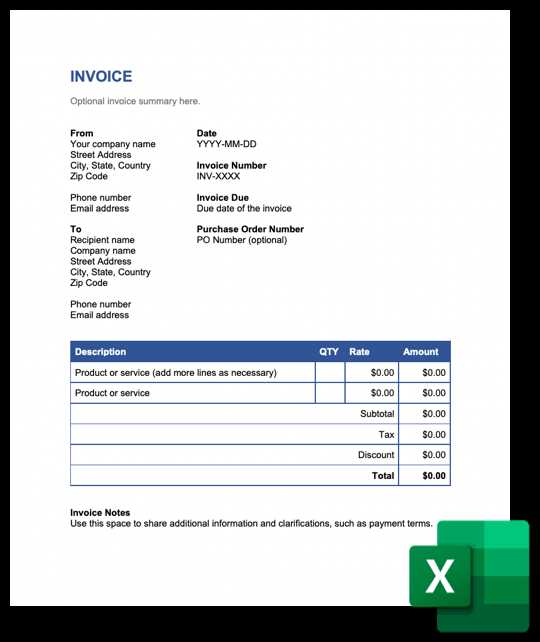

Free vs Premium Invoice Templates

When selecting a structure for your billing documents, businesses often face the choice between using free resources or opting for paid solutions. Both options come with their own set of advantages and limitations, so it’s essential to weigh the pros and cons based on your business needs and budget. Whether you are just starting out or looking to streamline your financial operations, understanding these options can help you make an informed decision.

Advantages of Free Options

Free resources provide a low-cost way to create and manage your financial documents. While these solutions may lack advanced features, they are suitable for businesses with simpler needs. Here are some benefits of using free solutions:

- No Cost: Free options are accessible to anyone without the need for a subscription or one-time payment.

- Basic Functionality: For small businesses or those with infrequent transactions, free templates often provide all the basic features required to complete billing tasks.

- Easy to Use: Many free options are straightforward, requiring minimal learning curve and allowing for quick setup and use.

Advantages of Premium Options

Premium solutions, while coming with a price tag, often offer enhanced features and greater customization. For businesses that need more advanced functionality or higher levels of professionalism, paid options might be the better choice:

- Advanced Features: Premium solutions often come with built-in tools for automatic calculations, recurring billing, and advanced reporting.

- Customization Options: Paid templates typically allow for greater customization, including branding options, more complex layouts, and personalized fields.

- Support and Updates: Premium options often come with customer support and regular updates, ensuring you have access to the latest features and fixes.

- Professional Appearance: Premium documents tend to look more polished and professional, which can enhance your business’s image with clients.

While free solutions can be ideal for small businesses or startups, premium options offer more sophisticated tools and flexibility for those looking to scale or streamline their processes. The right choice depends on your business’s specific needs, volume of transactions, and available budget.

Best Software for Invoice Creation

Choosing the right software for creating financial records is crucial for managing your business’s billing process efficiently. The right tool can automate many aspects of the creation and tracking process, saving you time and reducing errors. There are various options available, from simple applications to comprehensive platforms that offer additional features like payment tracking, reporting, and client management.

Top Software Solutions for Billing

Here are some of the best software options for generating professional and accurate billing documents:

- QuickBooks: Known for its comprehensive accounting features, QuickBooks provides invoicing, tax tracking, and detailed reports. It is ideal for small to medium-sized businesses looking for a complete solution.

- FreshBooks: A user-friendly option that excels in providing simple and customizable billing options. It includes features for time tracking, project management, and payment reminders.

- Zoho Invoice: A cost-effective solution with customizable designs, recurring billing, and multi-currency support, perfect for freelancers and small businesses.

- Wave: A free software offering essential billing and accounting features. It’s ideal for startups or small businesses on a budget, with basic invoice generation and expense tracking.

- Invoice Ninja: A flexible platform that allows you to create professional billing documents, track payments, and manage clients. It is free with options for premium features.

Key Features to Look For

When choosing software, consider these features to ensure it meets your needs:

- Customization Options: Look for software that allows you to personalize your documents with your company branding and tailored fields.

- Automation: Automated reminders for overdue payments and recurring billing can save a lot of time and reduce administrative work.

- Integration with Payment Systems: Choose software that integrates with popular payment processors, making it easier to track payments and manage transactions.

- Cloud Access: Cloud-based software allows you to access your documents from anywhere, streamlining your workflow and improving accessibility.

Selecting the right software for your business depends on your specific needs, such as the volume of transactions, the level of customization required, and your budget. Whether you need a simple tool or a comprehensive platform, these solutions can help you manage your billing process more effectively.

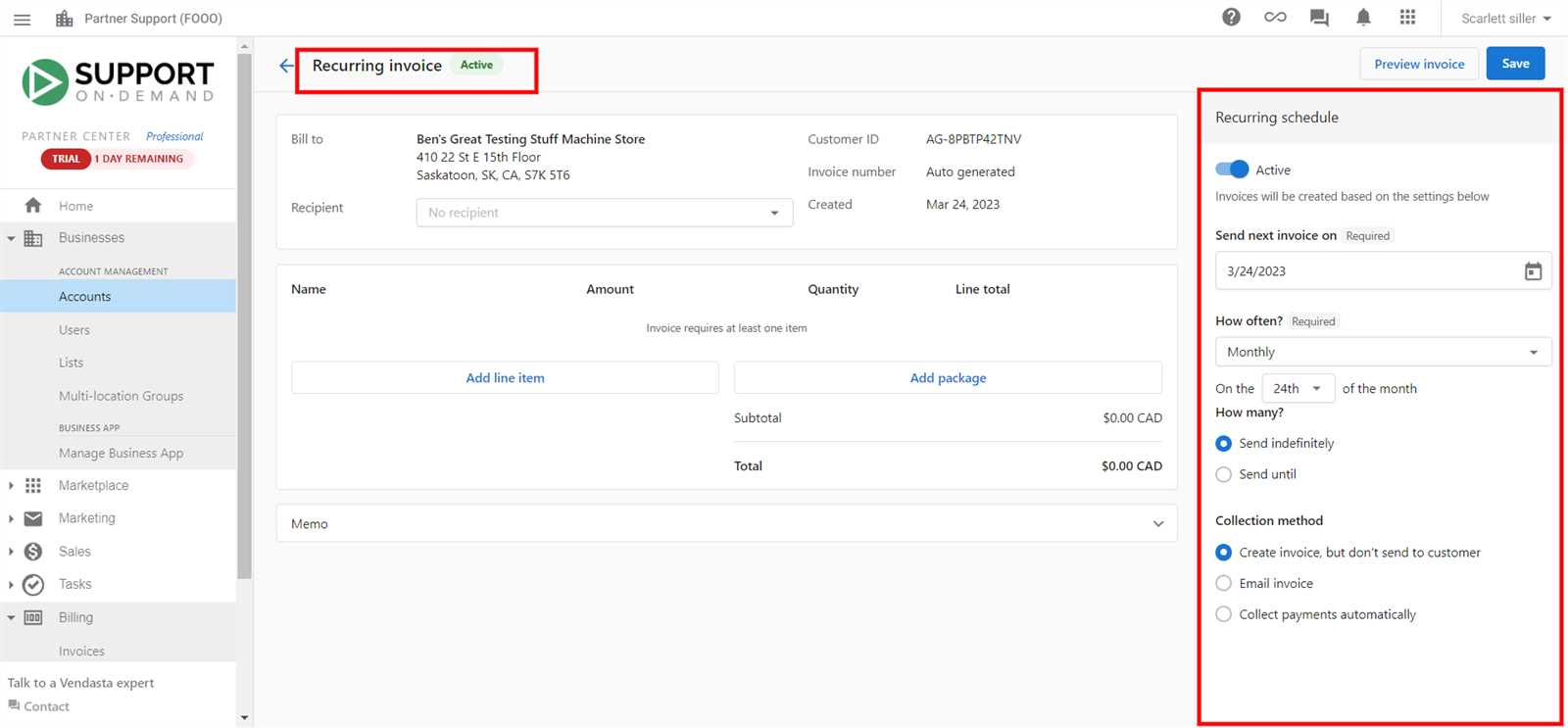

How to Automate Invoice Generation

Automating the process of creating and sending billing documents can save your business significant time and effort. By integrating automation into your workflow, you can ensure accuracy, reduce manual errors, and streamline the process of tracking payments. Automation can help create recurring documents, send reminders, and even update your accounting system with little to no manual input.

Steps to Automate the Billing Process

Follow these steps to begin automating your document creation process:

- Select the Right Software: Choose a platform that supports automated billing. Many tools allow you to set up recurring billing, automatic generation, and delivery of documents.

- Set Up Recurring Transactions: For clients with regular payments, set up automated billing schedules. This ensures that documents are generated and sent on time without manual input.

- Integrate Payment Systems: Connect your automated billing system to your payment processor to track payments and generate receipts seamlessly.

- Customize Templates: Customize your document layout so that it aligns with your branding, making it professional and tailored to your business needs.

- Enable Notifications: Set up automated reminders and overdue notices, ensuring clients are always informed about upcoming payments or overdue balances.

Examples of Automated Tools

Here are some popular tools that can automate your billing processes:

| Software | Features | Best For |

|---|---|---|

| QuickBooks | Recurring billing, automated reminders, custom templates | Small to medium-sized businesses |

| FreshBooks | Time tracking, auto-billing, payment reminders | Freelancers and service-based businesses |

| Zoho Invoice | Recurring billing, multi-currency support, automated notifications | Freelancers and small businesses |

| Wave | Free recurring billing, automated reports | Startups and budget-conscious businesses |

By leveraging automation, you can simplify your accounting workflow, improve your efficiency, and focus more on growing your business rather than spending time on repetitive administrative tasks.

Common Mistakes to Avoid

When creating billing documents or managing financial records, small errors can lead to big problems. From incorrect calculations to missed details, these mistakes can affect your cash flow and damage your professional reputation. Avoiding common pitfalls is key to ensuring that your records are accurate, timely, and professional.

Frequent Errors to Watch Out For

Here are some of the most common mistakes businesses make when preparing their financial documents:

- Incorrect Details: Double-check all client and business information. Missing or incorrect contact details, such as names, addresses, or payment terms, can delay processing and cause confusion.

- Failure to Include Payment Terms: Always specify payment due dates, late fees, and accepted payment methods. This helps avoid misunderstandings and ensures that your clients are clear on their obligations.

- Missing Itemized Lists: Provide a detailed breakdown of products or services provided. This transparency helps clients understand exactly what they are paying for and can prevent disputes.

- Not Using a Professional Layout: A messy or hard-to-read document can give a bad impression. Use clean, consistent formatting to ensure that your document looks professional and is easy to understand.

How to Prevent These Errors

Here are some tips to avoid these common mistakes and keep your documents in top shape:

- Use Automated Tools: Many software options help automate calculations, reduce human error, and ensure that your details are accurate every time.

- Set Up Reminders: Ensure timely payments by setting up reminders for both yourself and your clients about due dates and outstanding balances.

- Review Before Sending: Always proofread your documents before sending them to clients. Check for spelling errors, incorrect amounts, or missing fields to avoid unnecessary corrections.

By paying attention to these common mistakes and implementing simple strategies to avoid them, you can maintain smooth financial operations and build trust with your clients.

Tips for Organizing Your Finances

Proper financial organization is essential for maintaining a healthy cash flow, tracking your business’s profitability, and avoiding financial stress. A well-structured system enables you to keep track of income, expenses, and obligations while simplifying tax preparation and financial planning. Effective organization can also improve decision-making and streamline operations.

Key Strategies for Financial Organization

To effectively manage your finances, consider the following strategies:

- Maintain Detailed Records: Keep thorough records of all transactions, including receipts, invoices, and financial statements. Organizing these records by date, category, and client can make it easier to track and review your financial performance.

- Use Accounting Software: Leverage accounting software to automate record-keeping, manage cash flow, and generate reports. Tools like QuickBooks, Xero, and FreshBooks allow you to streamline financial tasks and reduce the risk of errors.

- Create a Budget: Develop a monthly or yearly budget to track income and expenses. Set aside funds for taxes, savings, and future investments. A well-maintained budget helps ensure that your finances remain in control and helps you avoid overspending.

- Separate Personal and Business Finances: Maintain separate accounts for business and personal expenses. This makes bookkeeping easier and avoids complications during tax season.

Staying Consistent with Your Financial Organization

Consistency is key when organizing your finances. Regularly review your records, update your budget, and reconcile your accounts. Set aside time each week or month to monitor your financial health and make adjustments as necessary. This proactive approach will help you stay on top of your business’s financial needs and avoid unnecessary surprises.

By following these tips, you’ll be better equipped to manage your finances efficiently, make informed decisions, and ensure long-term financial stability for your business.

How to Save Time with Templates

Efficient document creation can significantly reduce the time spent on repetitive tasks. By using pre-designed structures, you can automate and simplify the process of generating regular documents, allowing you to focus on more critical tasks. The time-saving benefits of such tools are particularly noticeable for businesses that need to create similar documents frequently.

One of the key advantages of using pre-built documents is the ability to streamline your workflow. Instead of creating a new file from scratch each time, you can modify an existing one with just a few simple updates. This helps ensure consistency across all your business communications while saving valuable time.

Key Benefits of Using Pre-designed Structures

- Quick Customization: Pre-designed documents allow you to quickly change key details, such as dates, amounts, and client information, without needing to format the entire document each time.

- Consistency: By reusing the same format, you ensure that every document is consistent in style and structure, reinforcing professionalism in your communications.

- Reduced Errors: With a set structure in place, the chances of making errors or forgetting important information are minimized, as most of the work is already laid out for you.

How to Implement Templates for Time Savings

To make the most of pre-designed documents, consider the following strategies:

| Action | Benefit |

|---|---|

| Save and Organize Common Formats | Having a library of your most frequently used document types helps you access them quickly whenever needed. |

| Set Up Auto-fill Fields | Automating client details, dates, and other frequently updated information reduces manual input and speeds up document creation. |

| Use Cloud Storage | Storing templates in the cloud ensures they are accessible from any device, making document generation faster and more flexible. |

By incorporating pre-designed documents into your workflow, you can save time, reduce errors, and maintain consistency, all while improving overall productivity.

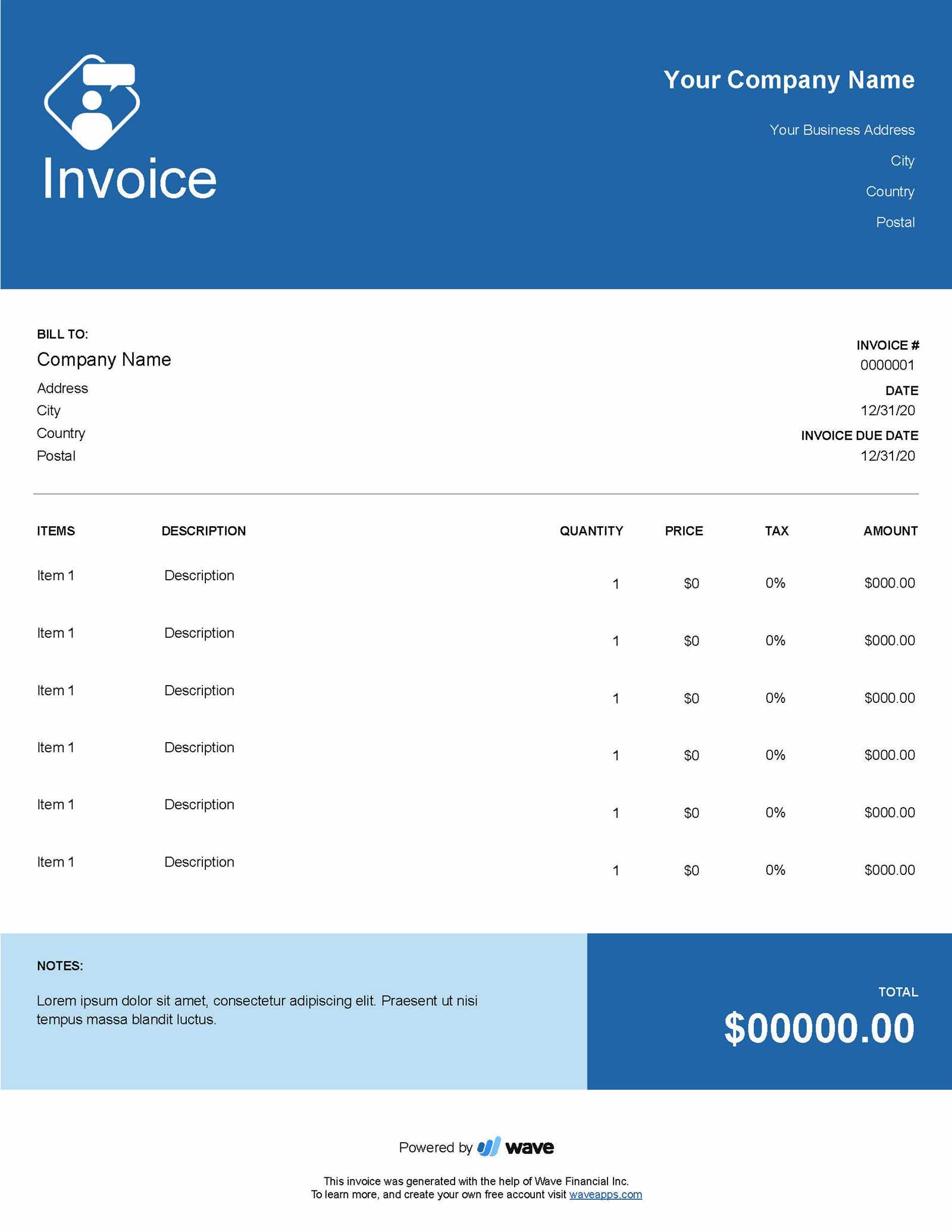

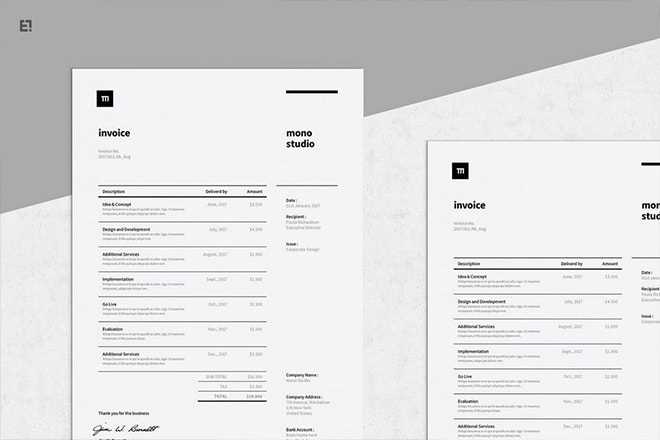

Designing a Professional Invoice

Creating a professional document for billing is crucial for maintaining clear communication with clients and ensuring timely payments. A well-designed document reflects your business’s credibility and can make the payment process smoother. The design should be clean, organized, and easy to understand, while also including all necessary information to avoid confusion.

When designing such a document, it’s important to consider both form and function. A clear layout not only helps clients quickly find the details they need but also demonstrates your professionalism. The structure should be intuitive, and the document should be visually appealing without being overly complex.

Essential Elements of a Professional Document

- Business Branding: Include your logo, business name, and contact information at the top of the document. This establishes your brand identity and ensures clients know exactly who the document is from.

- Client Information: Clearly display the client’s name, address, and contact details. This helps ensure that there are no errors regarding who the bill is addressed to.

- Itemized List: Break down the charges into clear, separate items with descriptions, quantities, and prices. This transparency reduces the likelihood of disputes and confusion.

- Payment Terms: Include details about when the payment is due, any late fees that may apply, and acceptable methods of payment. This ensures clarity about the expectations for payment.

- Total Amount: Highlight the total amount due at the bottom of the document to make it easily visible. This helps clients quickly determine what they owe.

Design Tips for a Professional Look

- Simplicity: Keep the layout simple with plenty of white space. Avoid clutter to make the document easy to read and understand.

- Consistent Fonts: Use professional, easy-to-read fonts like Arial or Times New Roman. Keep the font size consistent for better readability.

- Clear Section Headers: Organize the document into sections with clear headers to guide the reader through the information efficiently.

- Use of Colors: While it’s important to maintain a professional appearance, using a subtle color scheme for headings and accents can help enhance the overall aesthetic without detracting from the content.

By following these guidelines, you can create a billing document that not only looks professional but also functions effectively to ensure a smooth transaction process for both you and your clients.

Tracking Payments and Due Dates

Effectively monitoring payments and due dates is essential for maintaining cash flow and ensuring that all financial transactions are completed on time. It helps prevent misunderstandings with clients and keeps your business running smoothly. By establishing a clear system for tracking, you can quickly identify overdue payments and take appropriate actions to resolve any issues.

Having a method to track payments ensures that you don’t miss any critical deadlines. It’s also important for managing your financial records and planning for future expenses. Whether you use manual methods or automated software, keeping accurate records will save you time and help you stay organized.

Steps to Track Payments and Due Dates

- Record Payment Information: Each time a payment is received, document the amount, date, and the method of payment. This will help you keep track of which clients have paid and which are still pending.

- Set Clear Due Dates: Always include a clear due date on each document. Make sure that your clients are aware of the expected payment timeframes to prevent delays.

- Monitor Overdue Payments: Regularly check your records to identify overdue payments. Following up with clients promptly will help reduce the chances of prolonged delays.

Tools for Tracking Payments

| Tool | Features | Pros | Cons |

|---|---|---|---|

| Spreadsheet | Manual entry, custom columns for dates and amounts | Cost-effective, customizable | Time-consuming, manual tracking errors |

| Accounting Software | Automatic updates, payment reminders, integration with bank accounts | Efficient, time-saving, easy to use | Subscription fees, learning curve for new users |

| Cloud-Based Tools | Access from anywhere, real-time updates | Convenient, scalable | Requires internet connection, monthly fees |

By following these practices and using the right tools, you can stay on top of your payments and due dates. This ensures smoother operations and minimizes the risk of financial disruptions in your business.

Legal Requirements for Invoices

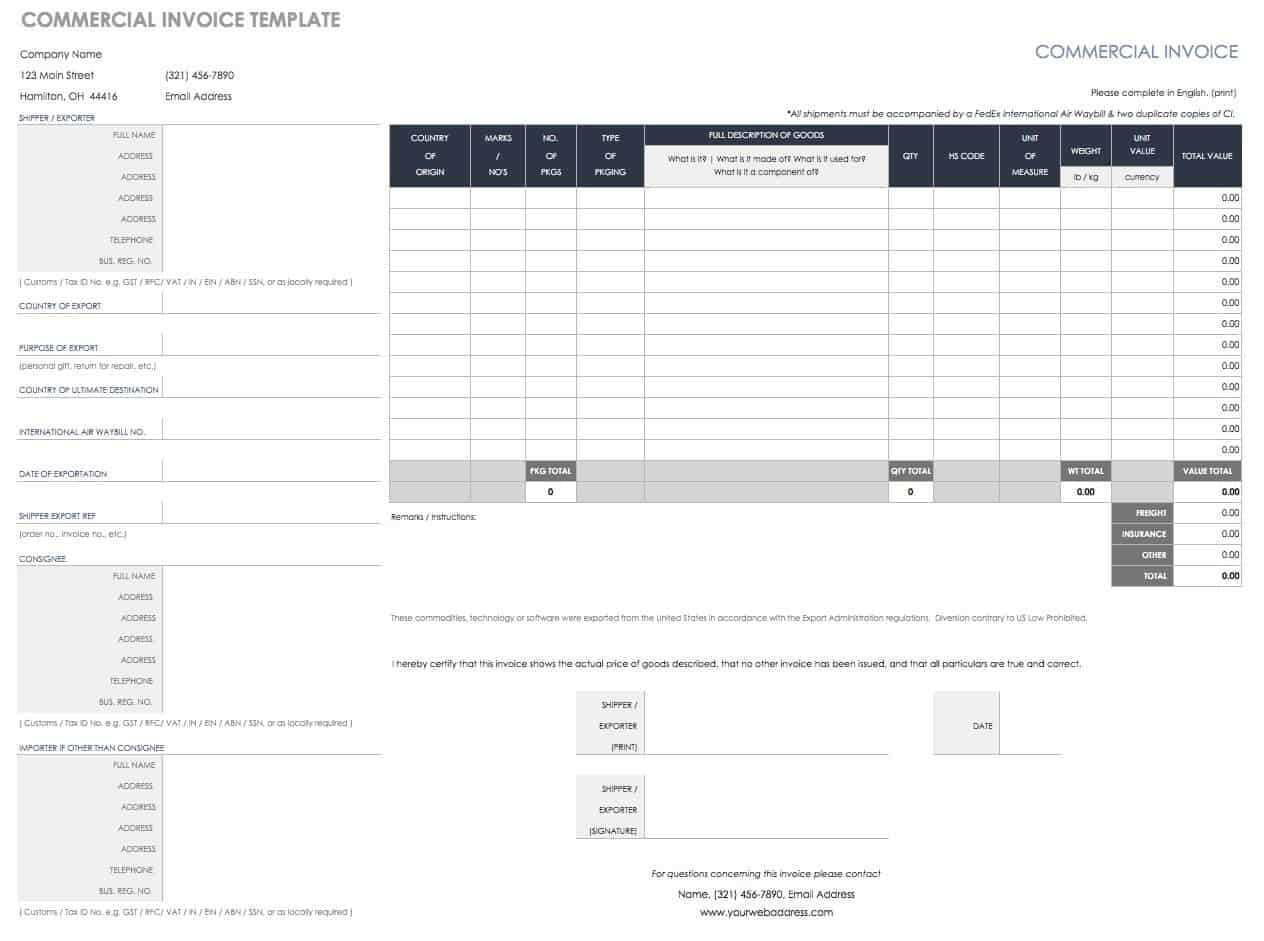

When creating any form of billing document, it’s essential to comply with local and international laws. Proper documentation not only protects your business interests but also ensures that you meet tax regulations and avoid potential legal issues. Various regions have specific guidelines regarding what information should be included and how these records must be maintained.

Understanding the legal requirements is crucial for businesses of all sizes. Whether you are working with clients domestically or internationally, ensuring your documents meet regulatory standards can save you time, money, and protect your reputation.

Key Legal Requirements

- Identification Details: Always include the name, address, and tax identification numbers of both the seller and the buyer.

- Transaction Date: Clearly state the date of the transaction or service provided to ensure proper record-keeping.

- Description of Goods/Services: Provide a detailed list of the goods or services provided, including quantities and pricing.

- Tax Information: If applicable, include tax amounts or VAT information in accordance with local tax laws.

- Unique Reference Number: Assign a unique number to each document for tracking and legal purposes.

Common Legal Requirements Across Regions

| Region | Required Information | Notes |

|---|---|---|

| European Union | Tax ID, VAT number, date, full description, total amount, tax rate | Each country may have additional regulations, but these are standard across the EU. |

| United States | Invoice date, payment terms, product/service description, total amount | Specific states may have unique tax requirements; check local laws for further details. |

| Canada | Tax registration number, GST/HST rates, product/service description | Ensure compliance with provincial and federal tax laws when billing across regions. |

Adhering to legal standards ensures not only the smooth running of your business but also helps build trust with clients and partners. Make sure to regularly review local regulations to stay up-to-date with any changes in the law.

How to Send Invoices Effectively

Sending billing documents in a timely and professional manner is key to maintaining healthy business relationships and ensuring that payments are received on time. It is not only about the content of the document but also about how and when it is sent. Understanding the best practices for delivering these documents can improve cash flow and client satisfaction.

One important aspect to consider is the method of delivery. Depending on your client’s preferences and the nature of your business, sending documents through email, postal mail, or through a digital platform can be effective. Each option has its advantages, and choosing the right one depends on the nature of your transactions and the client’s expectations.

Another key point is the timing. Ensure that your documents are sent promptly, with clear payment terms, and well before the due date. The clarity of your instructions and the professionalism of the document will help avoid confusion and delays in payment.

To streamline the process, consider using automated tools or software that can generate and send documents to clients directly. These tools can also help keep track of sent records and due dates, reducing administrative work and minimizing errors.

When to Update Your Invoice Template

Keeping your billing documents current is crucial for ensuring accuracy and compliance with changing business practices and regulations. Over time, certain elements may need to be updated to reflect changes in your business, tax laws, or client preferences. Understanding when and why to make these updates can help maintain professionalism and efficiency in your financial processes.

Here are some key instances when updating your billing documents may be necessary:

Changes in Tax Rates

If there are adjustments to local or national tax rates, you will need to update your documents to reflect the new rates. This ensures that your clients are charged correctly and helps you remain compliant with financial regulations.

Business Rebranding or Name Changes

Any updates to your business’s branding, such as a new logo, address, or company name, should be reflected in your billing documents. This not only ensures consistency across your communications but also helps to maintain a professional appearance.

Regular Review of your documents every few months can also ensure that outdated information is removed, and any new fields or features are added to keep things organized and up to date.

Maintaining an updated document system will not only improve your billing efficiency but also strengthen the trust and clarity with your clients.

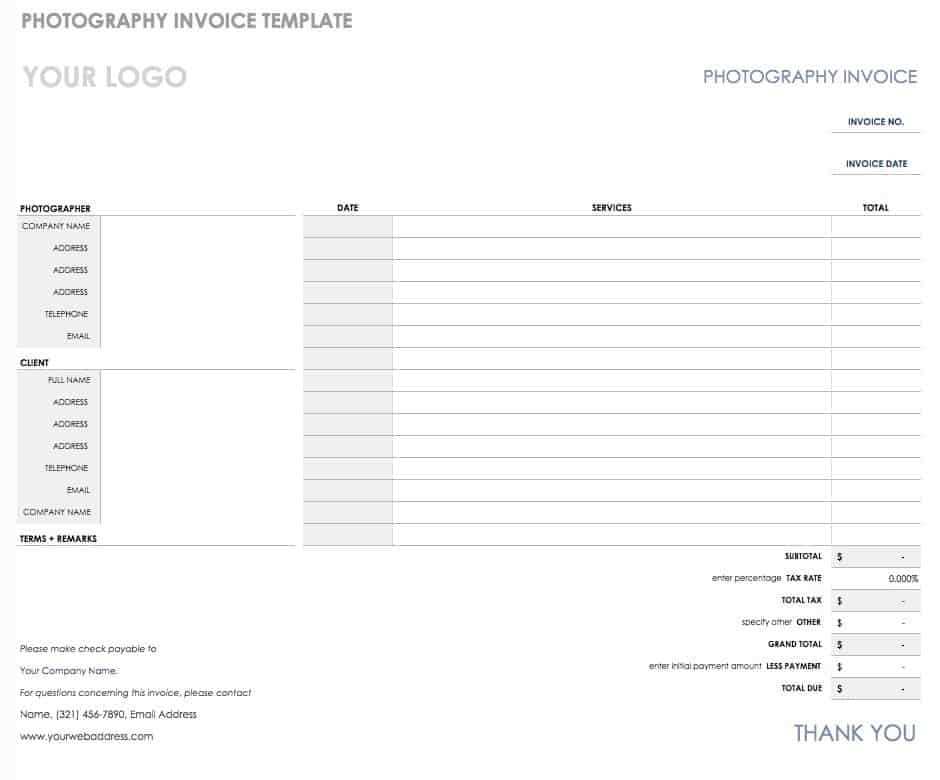

Invoice Template for Different Industries

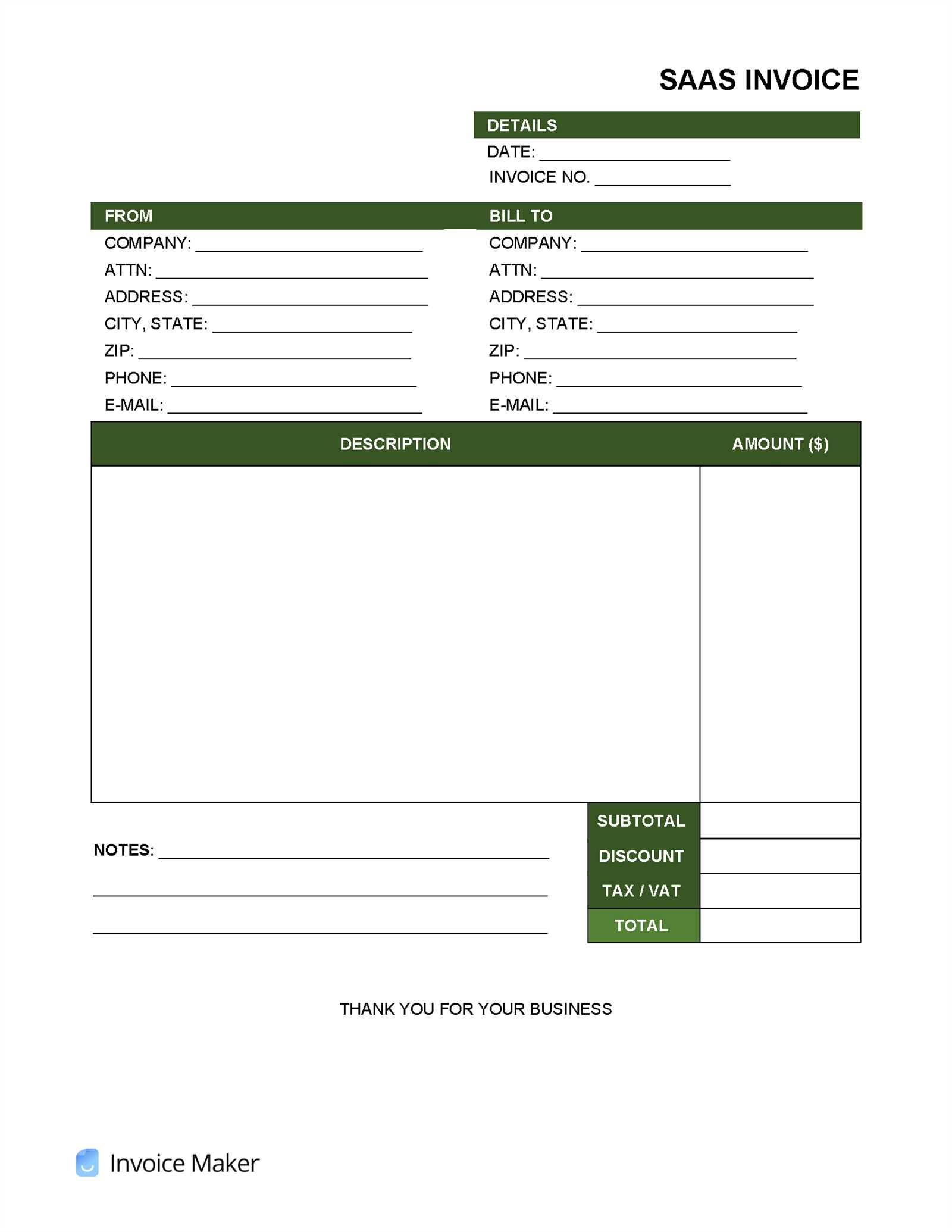

Each industry has its own set of requirements when it comes to documenting financial transactions. Whether you’re in retail, consulting, construction, or any other field, tailoring your billing documents to fit industry standards can improve clarity and ensure compliance. This section explores how to adapt your documents for different sectors.

Retail and E-commerce

In the retail and e-commerce industries, simplicity and speed are crucial. Your billing documents should include essential details such as product descriptions, quantities, and individual prices. It’s also important to include shipping information if applicable, as well as any discounts offered to customers. Clear and concise formatting will make it easy for your customers to understand their purchase breakdown.

Freelancers and Consultants

For freelancers and consultants, invoices often include hourly rates, project-based fees, or retainer agreements. Your document should clearly outline the services rendered, the time spent, and the corresponding fees. Additionally, payment terms, including due dates and late fees, should be prominently displayed. Including a personal touch, like your logo or a customized message, can further enhance professionalism.

Industry-specific details will vary, but tailoring your documents to meet the needs of your business and industry will streamline the process and provide clarity to your clients.

Customizing your financial documents according to your field will not only meet legal and regulatory standards but also help build trust with your clients.