QuickBooks Invoice Templates for Easy and Efficient Billing

Managing financial transactions and client billing can be time-consuming and prone to error if not handled effectively. Streamlining the process not only saves time but also enhances professionalism and accuracy in all your dealings. Using digital tools to automate and customize these tasks ensures smooth operations, allowing you to focus on other essential aspects of your business.

With a range of customizable options, modern accounting platforms offer powerful solutions to simplify the way you create and manage client statements. These solutions are designed to meet the specific needs of different industries, whether you’re a freelancer, small business owner, or part of a larger enterprise. The flexibility to adjust layouts, add company logos, and include payment instructions enhances both clarity and professionalism.

In this guide, we’ll explore how these efficient systems can be used to optimize your billing procedures, making them quicker, more accurate, and easier to track. Embracing automation and customization can transform your accounting workflow into a seamless process that benefits both you and your clients.

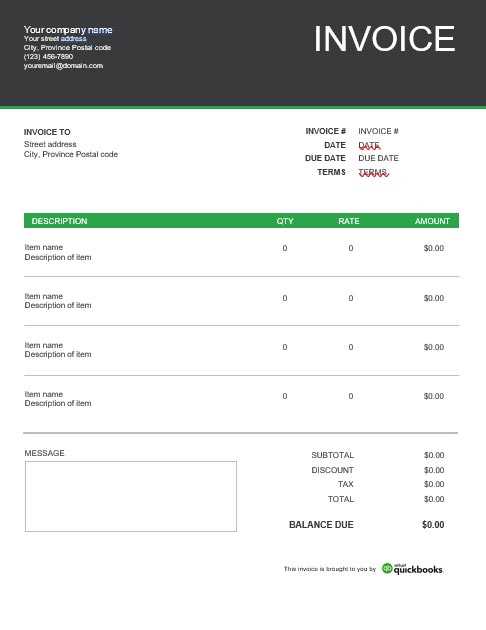

QuickBooks Invoice Templates Overview

Effective billing is crucial for any business, ensuring that transactions are accurately recorded and payments are collected promptly. Digital solutions offer a wide range of customizable options to create professional and efficient billing statements. These tools allow businesses to adjust layouts, add logos, and tailor payment instructions to meet specific needs, making the entire process smoother and more efficient.

These solutions provide a variety of pre-designed formats that can be customized according to your branding and business requirements. Whether you’re dealing with one-time payments or recurring charges, these systems make it easy to manage all your client transactions from start to finish. With built-in automation, creating and sending statements becomes quick and straightforward, reducing manual errors and saving valuable time.

Features of Customizable Billing Documents

The ability to personalize each billing document makes it easier to maintain a professional image while also addressing the unique needs of your business. Below are some key features commonly found in these billing tools:

| Feature | Description |

|---|---|

| Personalized Branding | Incorporate your company logo, colors, and business information to maintain consistency across all documents. |

| Custom Fields | Add fields for special requirements such as project codes, discount information, or terms of service. |

| Automated Reminders | Set automatic reminders for overdue payments to help ensure timely settlements. |

| Multiple Payment Options | Include options for online payment or bank transfer, making it easier for clients to settle their bills. |

Benefits of Using Digital Billing Solutions

Switching to an automated billing system provides numerous advantages, such as improved accuracy, faster processing times, and better organization. With fewer manual steps involved, the likelihood of mistakes is significantly reduced. Furthermore, the ability to quickly generate and send billing statements ensures timely payments, which is essential for maintaining healthy cash flow.

Why Use QuickBooks Templates for Invoices

Creating billing documents manually can be time-consuming and prone to error. Using digital tools designed for this task allows you to streamline the process, reduce mistakes, and maintain a professional appearance. With the ability to customize and automate key aspects of the billing process, you can ensure that all documents meet your business’s specific needs while improving overall efficiency.

These solutions are ideal for both small businesses and freelancers, offering flexibility in layout and content. The ease of customization allows you to include essential information, such as payment terms, due dates, and company details, all in a professional format. Furthermore, automating repetitive tasks like reminders or follow-ups ensures that nothing is overlooked, ultimately boosting productivity and cash flow.

Key Advantages of Using Digital Billing Systems

Below are some reasons why utilizing these digital solutions can enhance your billing process:

| Advantage | Description |

|---|---|

| Time Savings | Automate repetitive tasks and quickly generate billing documents without the need for manual input. |

| Professional Appearance | Create consistent, branded documents that look polished and enhance your company’s image. |

| Customization Options | Tailor each document to fit your unique business needs, whether it’s for one-time projects or recurring services. |

| Accuracy | Minimize human error with automated calculations and pre-set fields that ensure all information is correct. |

| Improved Cash Flow | Set reminders and include multiple payment options to help clients pay on time, ensuring steady cash flow. |

How Automation Can Streamline Billing

By automating various aspects of the billing process, you can focus on growing your business rather than managing paperwork. These systems can automatically send reminders for overdue payments, update records, and even integrate with other accounting tools. This level of automation ensures that your financial transactions are always up to date, reducing manual effort and eliminating common mistakes.

Choosing the Right Template for Your Business

Selecting the right format for creating billing documents is essential for maintaining a professional image while ensuring accuracy in financial transactions. The ideal format should not only reflect your brand but also cater to the specific needs of your business, whether you’re providing one-time services or recurring offerings. Understanding the features that best suit your industry can greatly enhance efficiency and clarity in client communications.

Each business has unique requirements, so it’s important to evaluate what will work best for your operations. Consider factors like the type of products or services you offer, the frequency of transactions, and the level of detail required on each document. A well-chosen format will streamline your accounting process and provide your clients with a clear, easy-to-read summary of the charges.

Key Factors to Consider When Choosing a Format

When deciding on the most suitable format, keep the following points in mind:

| Factor | Description |

|---|---|

| Business Type | Choose a design that aligns with your business model, whether you’re a freelancer, retailer, or service provider. |

| Transaction Frequency | If your billing is frequent, look for formats that allow easy repetition and automated entries. |

| Client Expectations | Ensure the layout is easy to understand, with clear terms and payment instructions for your customers. |

| Customization Needs | Opt for a format that lets you personalize key fields like discount rates, tax details, or due dates. |

Benefits of a Tailored Format

Choosing a design that aligns with your business’s needs not only improves operational efficiency but also helps foster trust and professionalism with your clients. A format that suits your unique requirements can provide clarity and reduce the likelihood of misunderstandings, ensuring that both you and your clients are on the same page regarding payment terms and details.

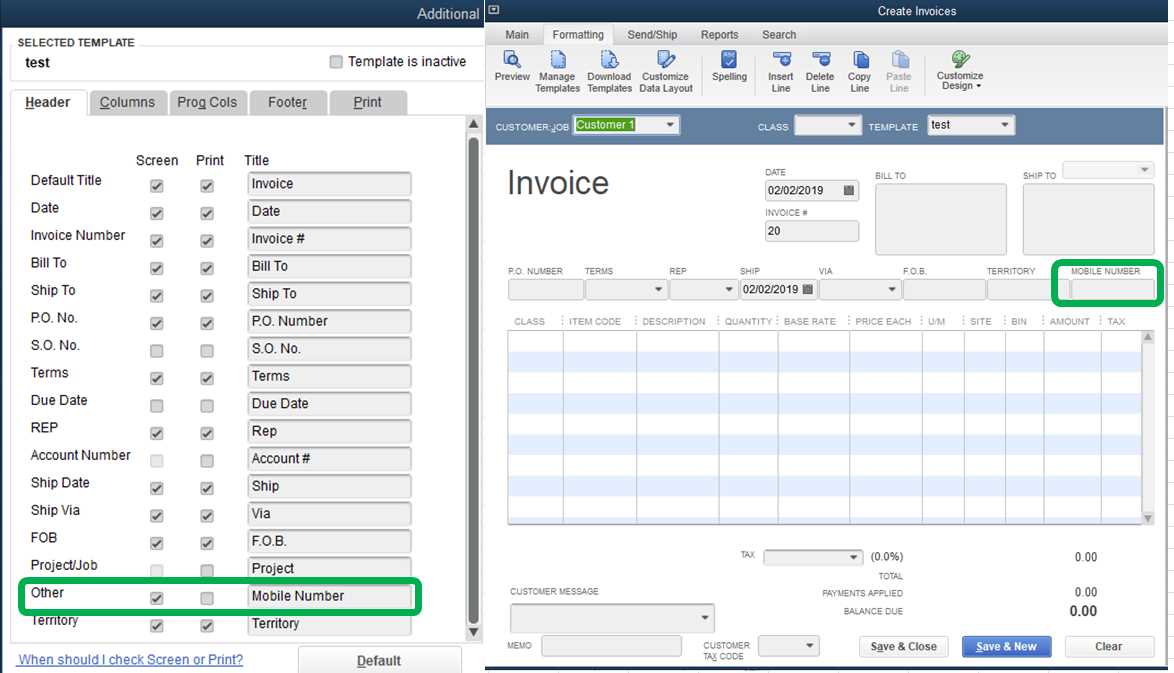

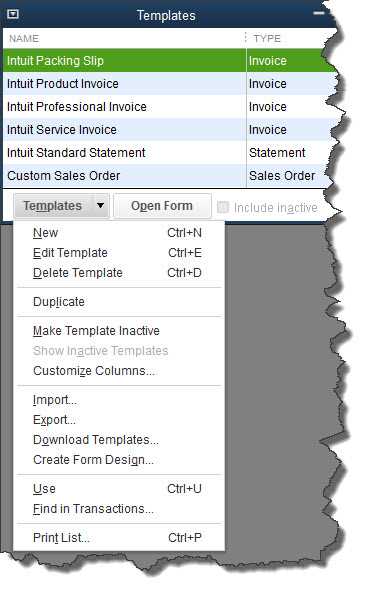

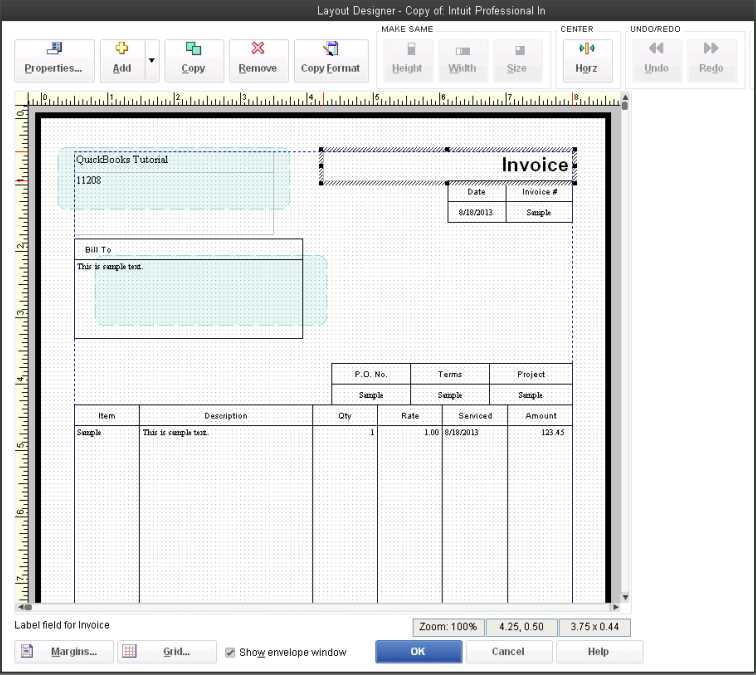

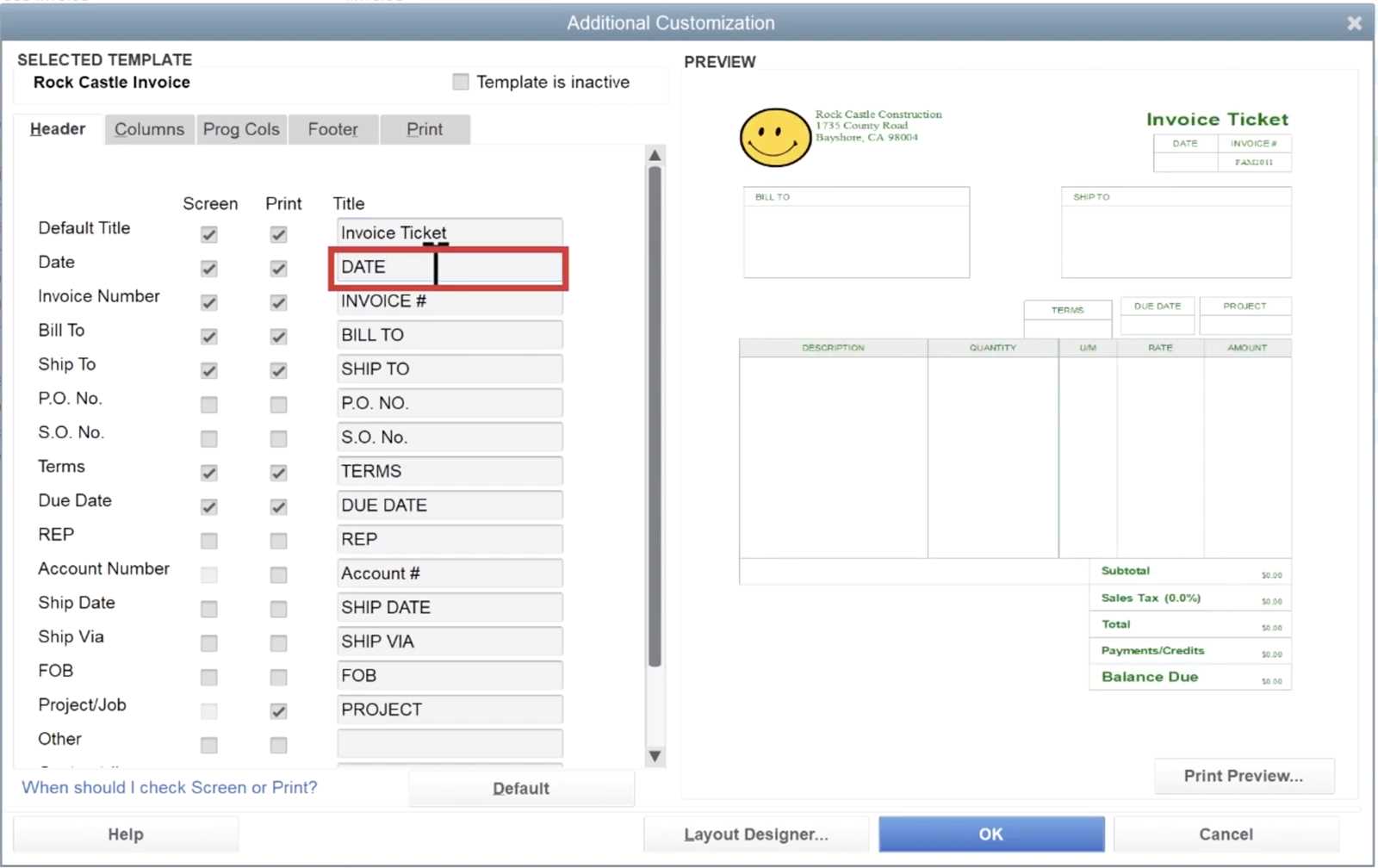

Customizing QuickBooks Invoice Templates

Tailoring your billing documents to suit your business needs can significantly improve the professionalism and clarity of your financial communications. Customization allows you to include specific details such as your company logo, payment terms, and custom fields that reflect your unique services. By adjusting the layout and content of each document, you ensure that it not only meets your functional needs but also aligns with your brand identity.

Customizing these documents ensures that every communication is clear and consistent, helping to establish trust with your clients. Whether it’s adding unique design elements or adjusting fields to reflect different billing practices, personalization is key to creating a smooth experience for both your business and your customers.

Key Customization Options to Consider

When modifying your billing documents, consider the following key features to enhance their clarity and functionality:

| Customization Option | Description |

|---|---|

| Branding | Incorporate your logo, business colors, and contact details to make the document reflect your brand identity. |

| Payment Terms | Include fields for payment due dates, late fees, or discounts for early payments to set clear expectations. |

| Custom Fields | Allow space for specific project details, purchase order numbers, or service descriptions unique to each client. |

| Multiple Currency and Tax Rates | Adapt your documents to support different currencies or regional tax laws depending on your location and client base. |

Benefits of Personalizing Billing Documents

Personalized documents not only look more professional but also help prevent confusion regarding payment details. By ensuring that all essential information is clearly presented, you reduce the likelihood of disputes and improve client satisfaction. Moreover, a consistent, branded format helps reinforce your business identity and makes your documents instantly recognizable to clients, further strengthening your professional relationship.

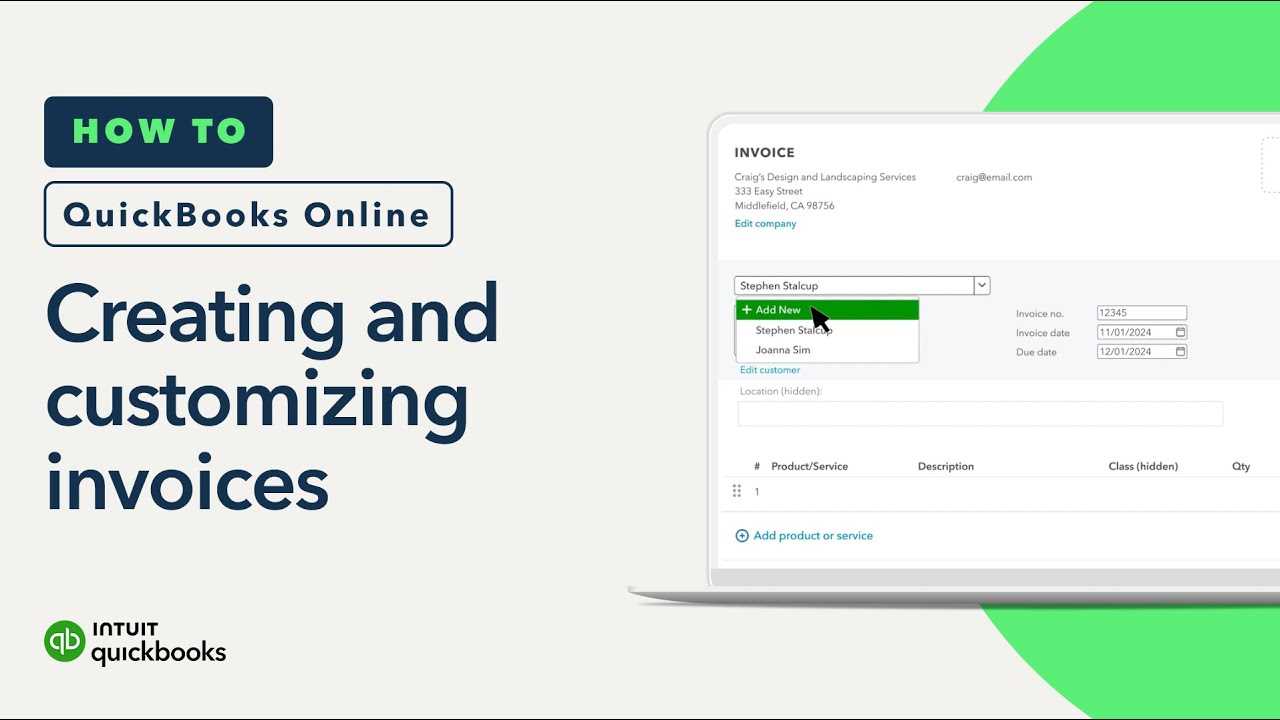

How to Create Invoices in QuickBooks

Generating billing statements manually can be a time-consuming process, but modern accounting software allows you to create and manage documents with ease. These platforms offer intuitive tools that guide you through the process, enabling you to generate accurate, professional documents in just a few simple steps. By automating key elements such as calculations and client details, you can streamline the entire process and ensure that all necessary information is included.

Creating a billing statement in these systems is straightforward. After entering basic details such as the client’s name, service descriptions, and payment terms, the system automatically fills in the rest of the document, including taxes and totals. This automation not only saves time but also reduces the likelihood of errors that could affect your business operations.

Steps to Create a Billing Document

Follow these basic steps to quickly generate a professional billing statement:

| Step | Description |

|---|---|

| Step 1: Client Information | Input the client’s name, contact details, and any specific billing preferences to ensure the document is personalized. |

| Step 2: Add Services or Products | List the products or services provided, including quantities, unit prices, and any relevant descriptions. |

| Step 3: Apply Taxes or Discounts | Specify any applicable tax rates or discounts, ensuring accurate calculations for both parties. |

| Step 4: Payment Terms | Set clear payment due dates, late fees, or installment options based on your business’s policies. |

| Step 5: Review & Send | Review the document for accuracy and send it directly to your client via email or other available methods. |

Additional Tips for Effective Billing

For a more seamless experience, consider saving common service offerings as reusable templates. This allows you to quickly generate new documents without having to enter the same details repeatedly. Additionally, ensure that your billing statements are easy to understand, with clear descriptions and payment instructions to minimize confusion and speed up the payment process.

Automating Invoice Generation with QuickBooks

Automating the process of creating billing documents can save your business valuable time and reduce the chances of errors. With the right tools, you can set up a system that automatically generates financial statements based on predefined criteria, such as due dates, service types, or client preferences. This process ensures consistency and frees up your time, allowing you to focus on other important tasks.

By utilizing automation, you eliminate the need to manually enter data for each transaction. Instead, the system takes care of calculations, adds necessary details, and even sends out documents when payment is due. This level of efficiency improves cash flow and ensures that clients receive accurate statements without delay.

Setting Up Automated Billing

Here are some key steps to set up automated billing in your accounting system:

| Step | Description |

|---|---|

| Step 1: Client Information | Ensure that all client details are up to date, including billing preferences, contact details, and payment methods. |

| Step 2: Define Recurring Charges | Set up recurring charges for clients who require regular services or subscriptions, such as monthly payments or memberships. |

| Step 3: Set Payment Terms | Define terms such as due dates, discounts for early payment, or penalties for late payments to be automatically applied. |

| Step 4: Schedule Document Delivery | Choose how frequently the system should generate and send documents–whether it’s weekly, monthly, or based on specific client agreements. |

| Step 5: Monitor & Adjust | Regularly check the system’s performance and make adjustments as necessary to ensure it continues to meet your needs. |

Benefits of Automating Billing

Automating the billing process offers several key advantages, such as:

- Consistency: Every client receives the same level of detail and accuracy in their documents.

- Time Efficiency: Save hours spent on manual document creation and management.

- Reduced Errors: Automation minimizes the chance of human error in calculations and data entry.

- Improved Cash Flow: Timely and accurate billing ensures faster payments, helping to maintain a healthy cash flow.

By implementing automated billing, you can enhance both the speed and accuracy of your business’s financial operations while ensuring that your clients are consistently and professionally served.

QuickBooks Templates for Small Businesses

Small businesses often face unique challenges when it comes to managing their financial documents. Streamlining billing processes while maintaining professionalism is crucial for efficient operations. Using digital solutions that allow you to quickly create and customize statements can help businesses stay organized and reduce the amount of time spent on administrative tasks. These solutions enable entrepreneurs to focus more on growing their businesses while keeping their finances in order.

For small businesses, the right tool can simplify complex tasks, such as calculating totals, applying taxes, and tracking payment status. Additionally, these tools offer various customizable options that align with specific business needs, whether you’re a consultant, a service provider, or a retailer. By choosing the right system, you can ensure that each document looks professional and contains all necessary information, making transactions smoother and more transparent for your clients.

Why Small Businesses Benefit from Digital Billing Solutions

Here are several reasons why digital solutions are a game-changer for small businesses:

| Benefit | Description |

|---|---|

| Cost-Effective | Affordable pricing for small businesses with scalable options as your business grows. |

| Efficiency | Automate repetitive tasks, reducing the time spent on manual calculations and document creation. |

| Professional Appearance | Create consistent, branded documents that enhance your company’s credibility and impress clients. |

| Customizability | Adjust the layout and content to reflect your business’s specific requirements and customer expectations. |

How Digital Solutions Simplify Billing for Small Business Owners

When managing a small business, every minute counts. Automated solutions reduce the burden of administrative work, such as tracking payments, sending reminders, or adjusting rates based on client agreements. By choosing the right tools, small business owners can maintain organized financial records and ensure timely payments–key factors in sustaining steady cash flow and long-term growth.

Best Practices for Professional Invoices

Creating clear and professional billing documents is essential for maintaining positive client relationships and ensuring timely payments. A well-designed statement not only helps clients understand the charges but also reflects the professionalism of your business. Implementing best practices in your billing process ensures accuracy, reduces misunderstandings, and enhances your reputation as a reliable service provider or seller.

To create an effective billing document, it’s important to include all necessary details in an organized, easy-to-read format. This includes accurate item descriptions, clear payment terms, and relevant contact information. Consistent use of these best practices can streamline your accounting process and foster trust with your clients.

Key Elements of a Professional Billing Document

Below are some key components that should be included in every billing document to ensure clarity and professionalism:

| Element | Description |

|---|---|

| Clear Contact Information | Include your business name, address, phone number, and email address to make it easy for clients to reach you. |

| Itemized List of Services | Provide a detailed breakdown of the products or services rendered, with quantities, rates, and descriptions. |

| Accurate Payment Terms | Clearly state the due date, accepted payment methods, and any penalties for late payments to avoid confusion. |

| Unique Invoice Number | Assign each document a unique identifier to keep your records organized and facilitate easy reference. |

| Tax Information | If applicable, include the appropriate tax rates and amounts to ensure transparency in the transaction. |

Why Consistency Matters

Consistency in your billing documents is key to building trust with clients. By using the same layout and format for every document, you make it easier for clients to understand the charges and recognize your brand. A familiar, professional appearance also signals reliability and reinforces the credibility of your business.

Enhancing Invoices with Your Branding

Integrating your business’s branding elements into financial documents is an excellent way to create a cohesive, professional image. Customizing your billing documents to reflect your logo, colors, and overall design style reinforces your brand identity and makes your business instantly recognizable. This added personal touch not only improves the visual appeal but also contributes to a more professional relationship with your clients.

Including your brand on every billing statement helps reinforce your business’s presence in the marketplace. Whether you’re a small business or a large corporation, having a consistent brand image across all communications, including financial documents, fosters trust and credibility. A well-designed document shows attention to detail, signaling that you value both the quality of your work and the experience of your clients.

Key Branding Elements to Include

Here are some important branding elements that can be incorporated into your financial statements:

| Branding Element | Description |

|---|---|

| Logo | Place your business logo at the top of the document to make it instantly recognizable and enhance brand visibility. |

| Color Scheme | Use your brand’s colors in headings, borders, and background accents to create a consistent and cohesive look. |

| Font Style | Choose fonts that align with your brand’s aesthetic and are easy to read, contributing to a professional appearance. |

| Contact Details | Include your business’s phone number, email, and website in a clear, prominent location, reinforcing your brand’s accessibility. |

| Tagline or Slogan | Incorporating a brand slogan or tagline can add a personal touch and further communicate your business values. |

Why Branding Matters in Billing Documents

Branding your billing documents is more than just an aesthetic choice; it’s a strategic move that reinforces your professionalism. Clients are more likely to remember and trust a business that presents itself consistently across all touchpoints. A branded document helps set you apart from competitors, demonstrates attention to detail, and promotes a positive business image that can foster long-term client relationships.

How QuickBooks Templates Save Time

Time is one of the most valuable resources for any business, and optimizing daily tasks is essential for growth and efficiency. Using pre-designed documents can save a significant amount of time by reducing the need to manually create and format every new billing statement from scratch. These ready-made solutions automate much of the work, allowing business owners to focus on other critical areas of their operations.

With automatic calculations, consistent layouts, and pre-set fields, these digital solutions streamline the process of generating billing documents. Whether you need to send out regular charges or one-time transactions, automated systems eliminate repetitive tasks and ensure that your documents are always accurate and professional-looking.

Time-Saving Benefits of Automated Billing

Here are several key ways automated solutions can save time in your business:

- Pre-set Information: Automatically fill in client details and pricing based on your established records, reducing manual entry.

- Instant Calculations: Automatic calculations for taxes, discounts, and totals ensure accuracy and save you time on manual math.

- Consistent Layouts: Use a consistent format for every document, which eliminates the need for reformatting each time you create a new one.

- Batch Processing: Generate multiple documents at once for recurring clients or services, saving time on repetitive tasks.

Improving Efficiency with Automation

By reducing the time spent on creating and formatting billing statements, automated solutions free up resources for more important business activities. With the ability to quickly generate accurate, branded documents, business owners can ensure timely payments, avoid delays, and improve overall cash flow management. Automating routine tasks leads to more efficient operations and helps you focus on growing your business instead of being bogged down by administrative work.

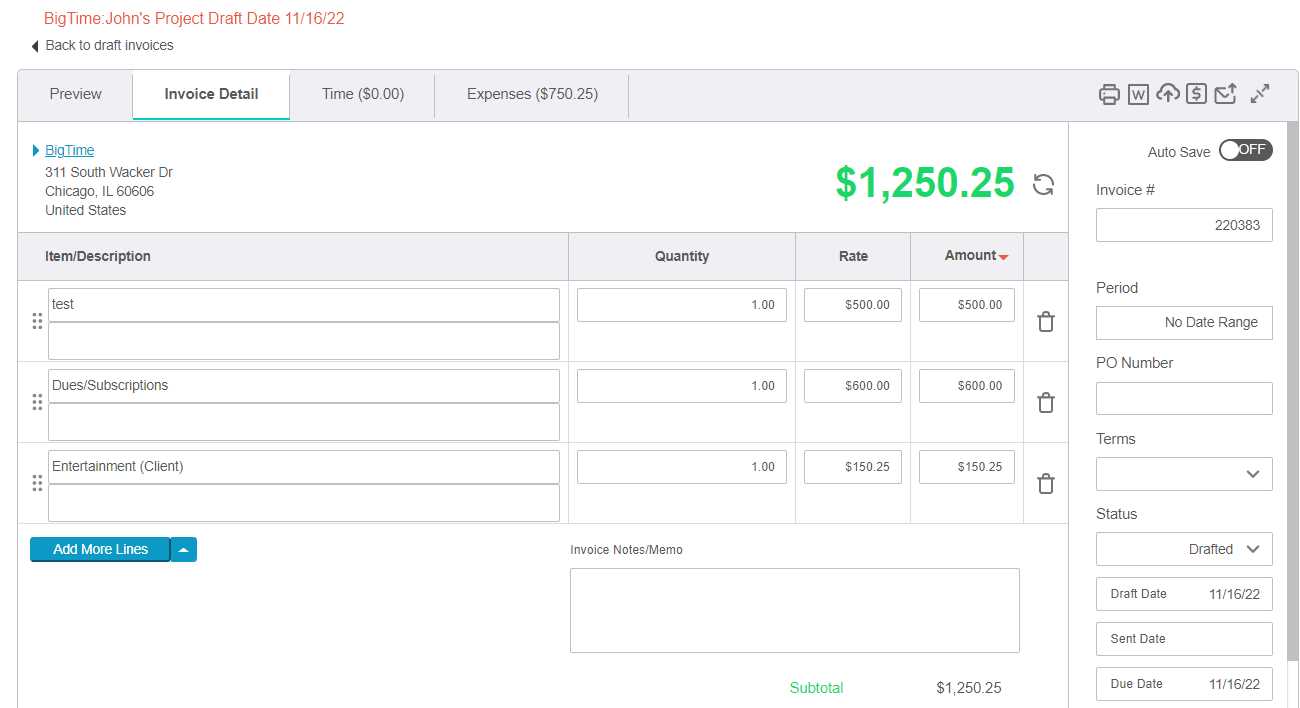

Managing Multiple Invoices in QuickBooks

Handling a large number of billing statements at once can be a daunting task for any business. Keeping track of each transaction, ensuring accuracy, and making sure all payments are processed efficiently requires an organized system. By utilizing digital solutions, businesses can streamline the management of multiple financial documents, allowing for better organization, quicker follow-ups, and more effective tracking of payments.

These systems offer tools that allow you to easily manage numerous documents, track their status, and send reminders as necessary. Whether you’re dealing with recurring billing or one-off transactions, using the right tools to organize your workflow can save time and reduce errors, ensuring that nothing slips through the cracks.

Key Features for Managing Multiple Transactions

Here are some important features that help businesses manage numerous financial documents effectively:

| Feature | Description |

|---|---|

| Batch Creation | Create and send multiple documents at once for recurring clients or services, saving time on repetitive tasks. |

| Status Tracking | Keep track of whether a document is paid, pending, or overdue to ensure timely follow-ups and reduce unpaid balances. |

| Automatic Reminders | Set up automatic reminders to notify clients of upcoming payments or overdue balances, reducing the need for manual follow-ups. |

| Customizable Lists | Organize your documents by client, date, or status to quickly find and manage specific transactions. |

Improving Workflow Efficiency

Managing multiple transactions doesn’t have to be a complex or time-consuming process. With the right tools, businesses can automate and organize every aspect of the billing process, ensuring a smooth workflow from start to finish. By automating follow-ups, tracking payment statuses, and using batch processes, businesses can enhance operational efficiency and improve cash flow management, ultimately leading to a more organized and effective operation.

Integrating Payment Options into Invoices

Offering multiple payment methods in your billing documents can simplify the process for clients and improve cash flow for your business. By including various payment options directly on your financial statements, you make it easier for clients to settle their accounts in a way that’s most convenient for them. This flexibility not only enhances customer satisfaction but also helps ensure faster payments.

Integrating payment options means providing clear instructions for clients on how they can pay, whether through credit cards, bank transfers, or online payment systems. This approach eliminates barriers and helps you avoid delays associated with payment processing. Additionally, clear and accessible payment instructions reduce the need for follow-up communication, which can save time and streamline the process.

Common Payment Methods to Include

Here are several payment methods that can be integrated into your financial documents:

- Credit and Debit Cards: Include a link or instructions on how to pay via credit or debit cards, ensuring quick transactions.

- Bank Transfers: Provide clients with your bank account details for direct transfers, allowing for secure and traceable payments.

- Online Payment Systems: Integrate popular payment platforms like PayPal, Stripe, or other digital wallets, which offer convenience and global reach.

- Checks: Include instructions for clients who prefer to pay by check, especially for larger transactions or those who do not use digital payment methods.

Benefits of Offering Multiple Payment Options

Offering a range of payment methods brings several advantages to your business:

- Faster Payments: More payment options mean quicker processing, helping your business maintain a healthy cash flow.

- Increased Customer Satisfaction: Clients appreciate flexibility and convenience, leading to higher satisfaction and repeat business.

- Reduced Late Payments: By providing convenient payment methods, clients are more likely to pay on time.

- Global Reach: Online payment systems allow you to accept payments from clients around the world, expanding your market.

By integrating these payment options directly into your financial documents, you streamline the transaction process and create a more efficient and customer-friendly billing system. This not only benefits your clients but also improves your business’s operational efficiency and financial management.

Tracking Invoice Payments with QuickBooks

Managing payments and keeping track of which transactions have been settled can be a time-consuming task for any business. However, with the right tools, you can streamline this process and keep accurate records of all payments received. By using digital systems to track the status of each document, you ensure that nothing is missed, which helps improve cash flow and prevents payment disputes.

These systems allow you to monitor when payments are made, whether partial or full, and track overdue balances. With clear records and automated reminders, you can stay on top of outstanding amounts, making the collection process much more efficient. This reduces the need for manual follow-ups and ensures you always know where your finances stand.

How to Track Payment Status

Tracking payment status is essential for managing your cash flow. Here are several ways these digital solutions can help you stay organized:

| Method | Description |

|---|---|

| Automatic Updates | Automatically update the status of each document once a payment is received or marked as pending. |

| Payment Reminders | Set automatic reminders to notify clients of upcoming or overdue payments, reducing the need for manual follow-ups. |

| Partial Payment Tracking | Easily track partial payments and see how much is left to be paid, allowing for better financial forecasting. |

| Transaction History | Maintain a complete history of all transactions, making it easy to reference past payments and identify any discrepancies. |

Benefits of Payment Tracking

Tracking payments through an organized system offers several advantages to your business:

- Better Cash Flow Management: Know exactly when payments are made and track overdue balances to keep your business on solid financial ground.

- Reduced Errors: Automated updates reduce the chances of human error in recording payments or misplacing financial data.

- Improved Customer Relations: Quickly identify unpaid balances and send timely reminders, ensuring smoother communication with clients.

- Time-Saving: Eliminate the need for manual tracking, allowing you to focus on more important tasks.

By utilizing these tracking features, you can maintain a clearer picture of your finances and ensure that payments are received on time, minimizing the

QuickBooks Invoices for Freelancers and Contractors

Freelancers and contractors often face unique challenges when it comes to billing their clients. Without a streamlined process, tracking payments, managing multiple projects, and ensuring timely compensation can become overwhelming. However, by using specialized systems to create and send professional documents, freelancers can simplify their workflow and ensure they get paid accurately and on time.

These tools offer features that allow contractors to easily bill for hourly work, project-based pricing, or retainer agreements. They can also track payments and manage different client projects simultaneously, reducing the administrative burden. By incorporating the right systems into their daily operations, freelancers and contractors can maintain focus on their core work without worrying about complex billing processes.

Key Features for Freelancers and Contractors

Here are some essential features that cater specifically to freelancers and contractors:

- Hourly Billing: Easily log the hours worked and generate bills based on hourly rates for accurate compensation.

- Project-Based Billing: Bill clients according to fixed project fees, ensuring transparency and reducing the back-and-forth over charges.

- Recurring Invoices: Automate the generation of recurring bills for ongoing services or retainer contracts, saving time and effort.

- Payment Tracking: Stay on top of payments with clear indicators showing which bills have been paid, which are pending, and which are overdue.

Advantages of Using Billing Systems for Freelancers

Adopting these systems provides several benefits to freelancers and contractors:

- Streamlined Processes: Automate and simplify the billing process, reducing manual errors and time spent on administrative tasks.

- Professional Image: Send polished, consistent documents that improve your professional reputation with clients.

- Faster Payments: With clear payment instructions and automated reminders, you’re more likely to receive timely compensation.

- Financial Clarity: Easily track the status of payments, giving you a clear overview of your income and ensuring better financial planning.

By using these systems, freelancers and contractors can focus on their creative or technical work, while the billing side of their business runs smoothly and efficiently. Simplifying the payment process allows them to deliver quality results and maintain healthy client relationships.

Using QuickBooks to Invoice Recurring Payments

Managing payments for ongoing services can be a challenging task, especially when it comes to ensuring that clients are billed on time and accurately. For businesses offering subscription-based services or long-term contracts, automating the billing process for recurring charges can save time and reduce the risk of errors. By setting up automatic payment cycles, businesses can streamline their billing operations and provide clients with a seamless experience.

Automated billing systems allow businesses to create repeat payments based on predefined schedules. Whether it’s weekly, monthly, or yearly, these systems ensure that clients are invoiced automatically without the need for manual intervention each time a payment is due. This helps maintain consistent cash flow and ensures that businesses don’t miss out on payments.

How Recurring Billing Works

To streamline the process of invoicing for recurring charges, many systems offer features that automate billing based on specific criteria:

- Set Payment Intervals: Choose whether payments will be billed on a weekly, monthly, or yearly basis, ensuring consistency and clarity for clients.

- Custom Amounts: Customize the billing amount for each cycle based on services rendered or any changes in pricing.

- Automatic Payment Processing: Allow clients to set up automatic payment methods, reducing the chances of missed payments and late fees.

- Customizable Reminders: Automatically send notifications to clients before and after a payment is due to keep them informed and avoid misunderstandings.

Benefits of Automating Recurring Payments

Automating recurring payments offers numerous advantages for businesses:

- Time-Saving: Save time by eliminating the need to manually generate and send documents for each billing cycle.

- Consistent Revenue Flow: Regular, automated billing ensures that income remains steady and predictable, which is essential for business planning.

- Improved Client Satisfaction: Clients appreciate the convenience of automatic billing, which eliminates the need for them to remember due dates.

- Accuracy and Efficiency: Reduce the risk of human error in calculating charges or forgetting to send an invoice, improving your business’s reliability.

By utilizing automated billing systems for recurring payments, businesses can ensure that transactions are handled promptly and professionally, leading to better cash flow, fewer administrative tasks, and stronger client relationships.

Common Mistakes to Avoid with QuickBooks Invoices

When managing client billing and payment tracking, even small mistakes can have significant impacts on cash flow and professional relationships. It’s easy to overlook details, especially when dealing with multiple clients and different payment terms. However, by being aware of common pitfalls, businesses can avoid errors that may lead to late payments, confusion, or strained client relations. Understanding what to watch out for can help streamline your billing process and improve your overall efficiency.

Many of the issues that arise in the billing process are simple oversights, but they can lead to bigger problems if not addressed early. From incorrect amounts to missed deadlines, avoiding these common mistakes ensures that clients receive accurate, timely charges, and businesses maintain clear financial records. Below, we’ve highlighted some key errors that you should be cautious of in your billing operations.

Top Billing Mistakes and How to Avoid Them

Here are some of the most frequent mistakes and tips on how to prevent them:

| Mistake | How to Avoid It |

|---|---|

| Incorrect Client Details | Always double-check the client’s contact information, including their address and payment terms, before sending any documents. |

| Missed Deadlines | Set up automatic reminders for upcoming payment due dates to ensure timely submissions and avoid delays. |

| Inaccurate Amounts | Review each billing document carefully before sending it out to ensure that all amounts, including taxes and discounts, are correct. |

| Vague Descriptions of Services | Provide clear and detailed descriptions of services or products rendered, ensuring clients understand exactly what they are being charged for. |

| Failure to Track Payments | Regularly update your payment tracking system to reflect the current status of each transaction and avoid double billing. |

Why These Mistakes Matter

Each of these mistakes can impact your business in various ways:

- Client Confusion: Vague or incorrect billing details can lead to disputes or clients questioning the charges.

- Late Payments: Missed deadlines and unclear payment terms often result in delayed payments, which can affect cash flow.

- Financial Mismanagement: Inaccurate amounts and failure to track payments can result in errors in your financial records, leading to complications when it’s time for tax reporting or audits.

- Damaged Professional Reputation: Continually making errors can damage client trust, potentially causing them to seek services elsewhere.

By taking the time