International Invoice Template for Global Business Transactions

Managing payments across borders can be challenging, especially when dealing with clients from different regions. A well-structured billing document is essential for ensuring clear communication, reducing errors, and maintaining professionalism in financial dealings. Having a reliable tool to outline the terms of payment, itemize goods or services, and specify amounts is crucial for any business involved in cross-country transactions.

In this guide, we will explore how to design a billing document that suits international business needs. From proper formatting to including key details, you’ll learn how to create an accurate and legally compliant record for every sale or service provided. By understanding the essential elements of such a document, you can improve the efficiency of your global operations and minimize payment-related disputes.

Whether you’re a freelancer working with clients worldwide or a company expanding into new markets, this document serves as a formal agreement that clarifies expectations for both parties. With the right approach, you can ensure that payments are processed smoothly, and that your business remains organized and professional in all financial exchanges.

What is a Billing Document for Global Transactions

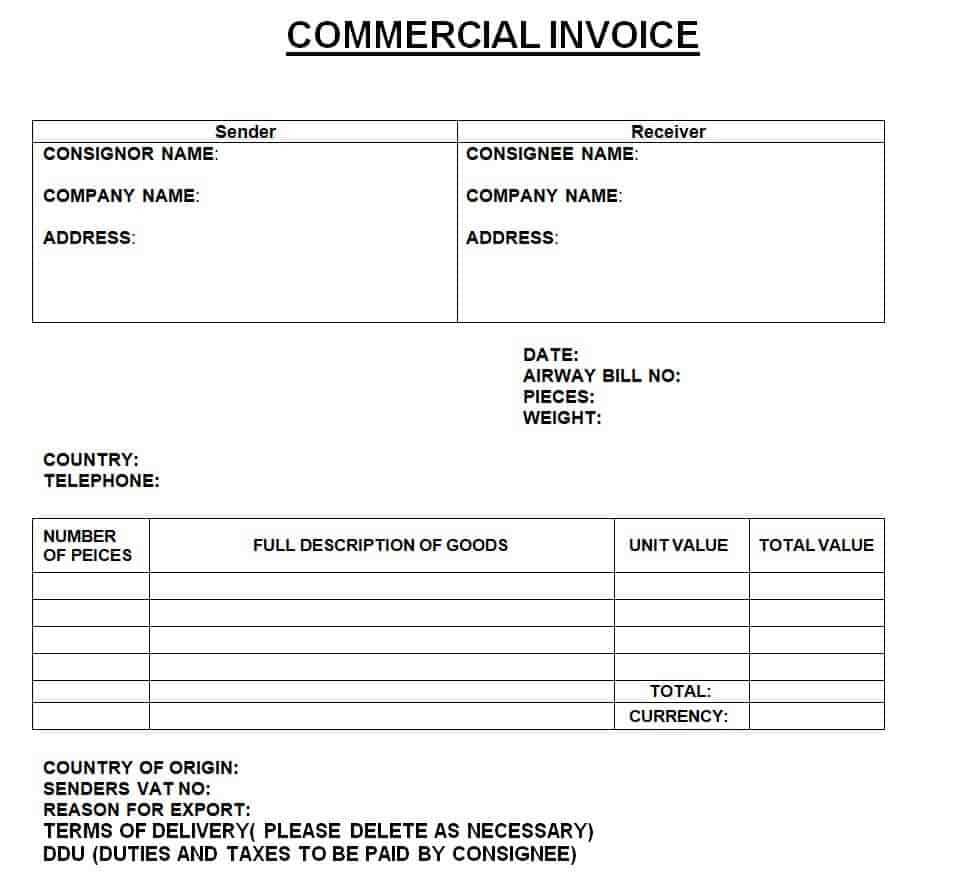

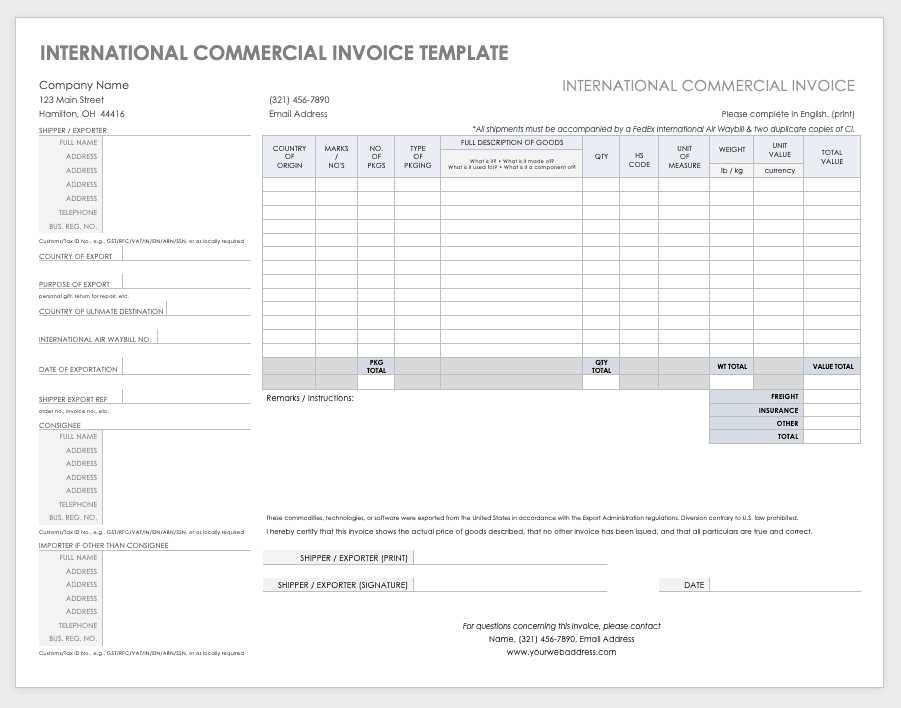

A billing document used for global transactions is a formal record that outlines the details of a sale or service agreement between a seller and a buyer from different countries. It serves as a request for payment, clearly detailing the goods or services provided, the terms of payment, and the total amount due. This document ensures transparency and helps both parties keep track of financial exchanges, preventing misunderstandings or disputes.

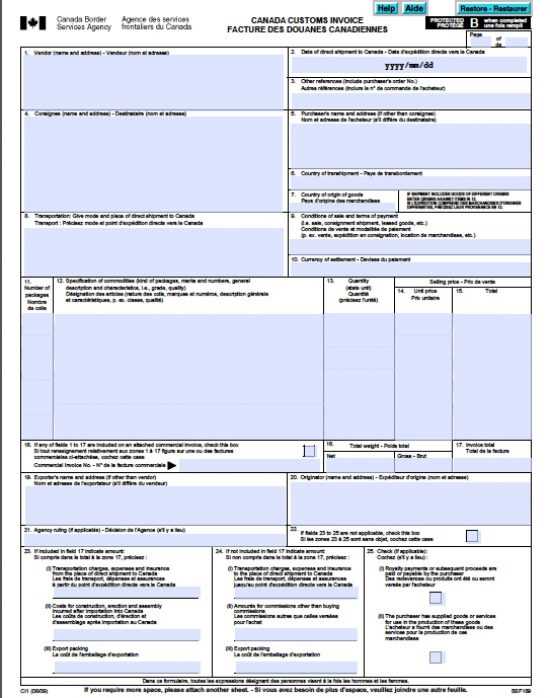

These documents typically include essential information such as the seller’s and buyer’s contact details, the transaction date, payment terms, and the currency in which the payment is to be made. They may also need to account for various international regulations, taxes, and duties, depending on the countries involved. A well-structured document can streamline the process of cross-border transactions, ensuring smooth communication and efficient payment processing.

Here’s a breakdown of the key components usually included in such a document:

| Section | Description |

|---|---|

| Seller and Buyer Information | Details of the business or individual issuing the bill and the recipient, including names, addresses, and contact info. |

| Transaction Date | The date when the sale or service was completed, which is important for tracking payment timelines. |

| Description of Goods/Services | A detailed list of the products or services being billed for, including quantities, prices, and relevant terms. |

| Payment Terms | Specifies when and how payment is expected, including any applicable interest or penalties for late payments. |

| Total Amount Due | The final amount owed, often displayed with applicable taxes, shipping costs, and any other fees. |

| Currency | The currency in which the payment should be made, considering the countries involved in the transaction. |

By including all necessary details and following the appropriate format, such a document helps avoid confusion and ensures both parties understand the payment expectations clearly.

Why You Need a Billing Document for Cross-Border Transactions

When engaging in business across different countries, it’s essential to have a clear and standardized method for requesting payment. A well-constructed billing record provides both the seller and the buyer with a formal document that outlines the terms of the transaction, ensuring that all parties are on the same page regarding what is owed and when it should be paid. Without such a record, misunderstandings can arise, leading to payment delays, disputes, or even lost revenue.

Having a detailed and professional document not only fosters trust between businesses in different regions but also ensures compliance with local laws and regulations. This is especially important when dealing with various tax rules, currency exchanges, and payment practices that differ from one country to another. By using a consistent format, businesses can streamline their financial processes, making it easier to manage payments and maintain accurate records.

Benefits of Using a Formal Payment Record

Utilizing a structured payment document provides several key advantages for businesses involved in global transactions:

| Benefit | Description |

|---|---|

| Clarity | Clearly outlines the terms of payment, including the amount due, payment methods, and deadlines, reducing the risk of confusion. |

| Legal Compliance | Helps ensure that both parties adhere to relevant tax laws, customs duties, and other regulations required by different countries. |

| Efficient Record Keeping | Facilitates easier tracking of payments, helping businesses stay organized and maintain accurate financial records for future reference. |

| Professionalism | Enhances the company’s credibility and fosters better relationships with clients and partners by maintaining a clear, formal approach to transactions. |

Improved Cash Flow Management

By providing clients with a proper payment request, businesses can better manage cash flow. A structured document helps set expectations for when payment is due, reducing delays and enabling more accurate forecasting. It also helps businesses quickly follow up on overdue payments, ensuring that funds are received on time to maintain operations.

Key Elements of a Global Billing Document

When creating a billing document for cross-border transactions, it’s crucial to include specific elements that ensure clarity and prevent confusion between the seller and the buyer. These elements help outline the nature of the transaction, the agreed-upon terms, and the total amount due. Including all necessary details not only streamlines the payment process but also ensures compliance with international financial standards.

To create an effective document, certain key components must be carefully detailed. These components provide structure, making it easier for both parties to understand their obligations and rights. Below are the essential elements that should be included in any billing record for global transactions.

| Element | Description |

|---|---|

| Seller and Buyer Information | The contact details of both the seller and the buyer, including names, addresses, and phone numbers. This helps identify the parties involved and ensures communication is clear. |

| Transaction Date | The exact date when the goods or services were delivered or completed, marking the start of the payment period. |

| Description of Products/Services | A clear breakdown of the goods or services provided, including quantities, unit prices, and any other relevant details such as model numbers or specifications. |

| Payment Terms | Details on how and when payment is expected, including any early payment discounts, late payment penalties, or installment plans. |

| Total Amount Due | The full amount to be paid, including taxes, shipping costs, or any additional charges. This ensures both parties are aware of the total financial obligation. |

| Currency | The currency in which the payment should be made, ensuring both parties are aligned on the financial terms regardless of their location. |

| Tax Information | Details regarding any applicable sales tax, VAT, or other local taxes that need to be included as part of the payment calculation. |

| Banking Details | Information on how the payment should be made, including bank account details or online payment instructions. |

By including these essential elements in the document, businesses can ensure that all important details are clearly communicated, reducing the risk of delays or disputes in the payment process.

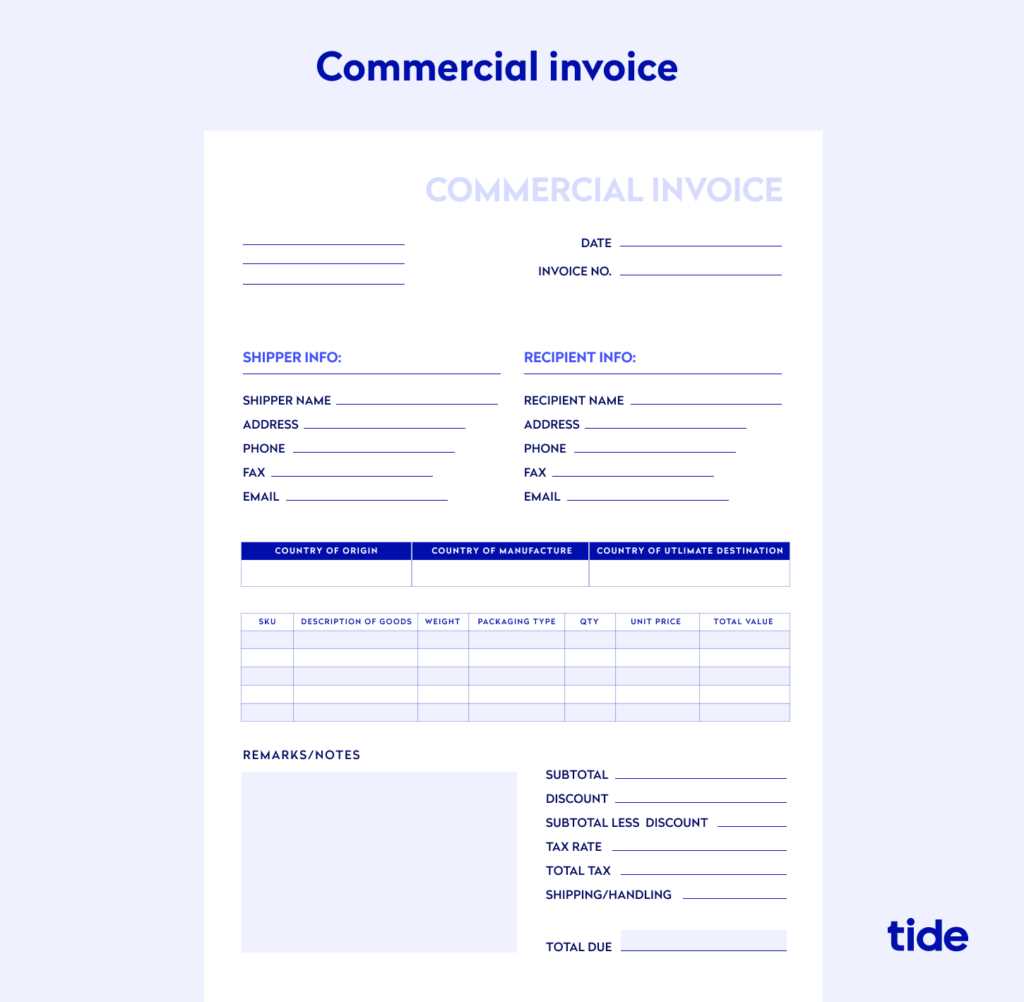

How to Customize Your Billing Document

Personalizing your billing document is an essential step in ensuring that it reflects your brand, meets your business needs, and complies with the necessary legal requirements. A customized billing record can help establish professionalism and make the payment process more efficient by aligning with the specific requirements of both your business and your clients. By tailoring the document’s design, layout, and content, you ensure clarity and consistency in every transaction.

Customizing a billing record involves more than just changing the logo or company name. There are several aspects you can adjust to make the document more effective for your business. Below are key areas you can modify:

- Branding Elements – Incorporating your company’s logo, color scheme, and fonts helps create a cohesive and professional look that aligns with your brand identity.

- Payment Terms – Adjust the payment instructions, deadlines, and conditions to match your preferred methods, such as offering early payment discounts or specifying installment plans.

- Currency and Taxes – Ensure the correct currency is selected and that any local taxes, duties, or fees are included, especially when working across borders.

- Itemized Details – Clearly define the goods or services being provided, including quantities, descriptions, unit prices, and any applicable discounts or add-ons.

- Contact Information – Double-check that the contact details for both your business and the client are accurate, including email addresses, phone numbers, and payment details.

- Legal Compliance – Adapt the document to meet the legal and tax regulations of the regions you’re working in, including VAT numbers or other required identification codes.

Once you’ve decided which areas need customization, it’s important to choose the right tools for creating or editing the document. You can use online generators, accounting software, or even design software to create a template that suits your business style and needs. Most platforms offer easy-to-use features that allow you to input your custom elements without needing advanced design skills.

Additionally, ensure that the layout is simple, easy to navigate, and professional. Clients should be able to find the necessary information at a glance, and the overall document should be clear and free from clutter.

In conclusion, customizing your billing document ensures it is tailored to your specific needs and reflects the unique aspects of your business. Whether you’re a freelancer or a multinational corporation, having a document that is clear, personalized, and professional will help streamline your payment process and maintain positive business relationships.

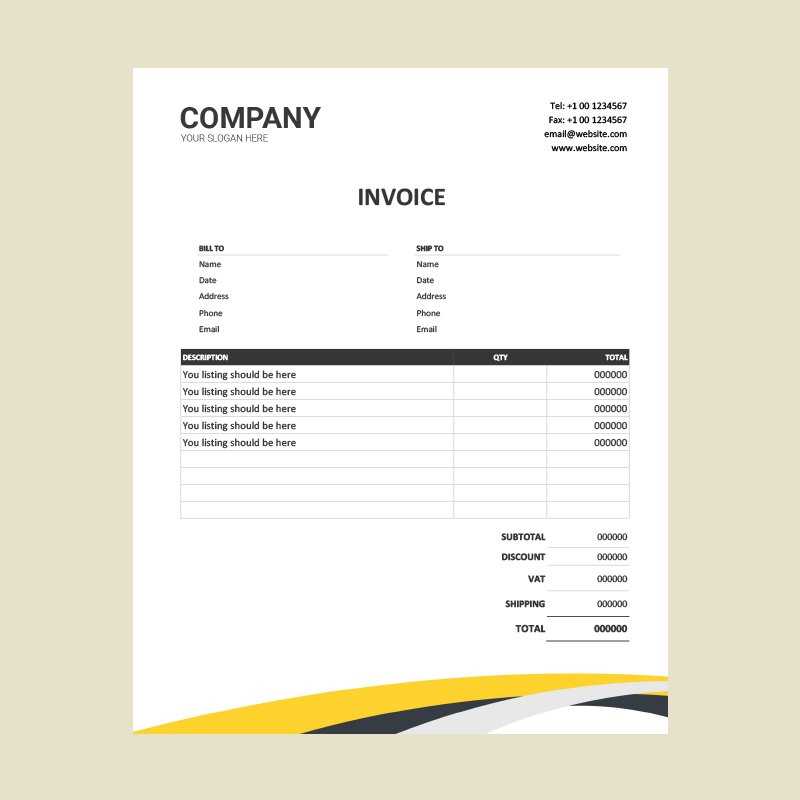

Best Practices for Invoice Design

Creating a well-organized and professional document for financial transactions is essential to ensure clear communication between the parties involved. A thoughtful approach to layout, content, and visual elements can greatly enhance the recipient’s understanding and improve the likelihood of prompt payment. A carefully crafted document not only reflects the professionalism of the sender but also helps to minimize confusion or errors that might delay the payment process.

Clarity and Simplicity

One of the most important aspects of any business document is clarity. Use a clean, straightforward layout that emphasizes key information such as amounts, due dates, and payment terms. Avoid clutter by eliminating unnecessary graphics or complicated fonts. A minimalist design allows the recipient to quickly scan the document and find the critical details without being distracted by superfluous elements.

Consistent Branding and Contact Information

Maintaining a consistent visual identity throughout your documents strengthens your brand recognition and establishes trust. Ensure your company’s logo, colors, and fonts are properly integrated. Additionally, clearly display your contact details, including physical address, email, and phone number. This not only helps with professional image but also makes it easier for the recipient to reach out in case of any questions or discrepancies.

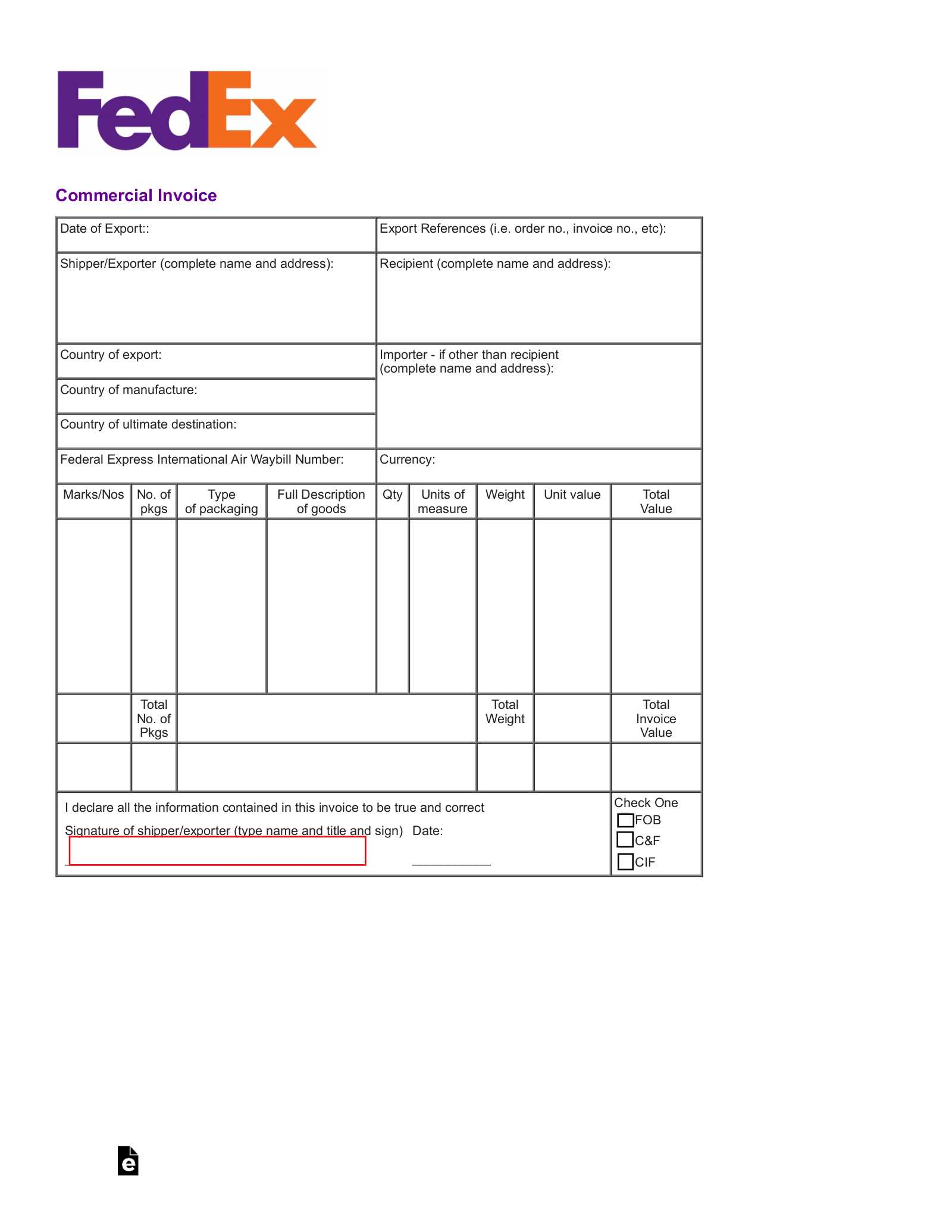

Legal Considerations for International Invoices

When conducting cross-border transactions, there are several legal aspects that must be considered to ensure compliance with both local and international laws. These factors not only protect the interests of both parties but also help to avoid disputes or delays. Understanding the legal requirements specific to each jurisdiction is crucial when drafting a document for payment, as it can affect everything from taxation to payment methods.

- Jurisdiction and Governing Law: It’s essential to specify which country’s laws govern the agreement. This can affect dispute resolution, enforcement, and interpretation of terms.

- Tax Compliance: Different regions have varying tax regulations, including value-added tax (VAT) or sales tax. Clearly state if tax is included or excluded and ensure correct rates are applied.

- Currency and Payment Terms: Clarify which currency will be used for the transaction and outline the payment terms, including any applicable exchange rate considerations and due dates.

- Export/Import Regulations: For certain goods or services, be aware of trade restrictions, customs duties, or other regulatory controls that may apply in either country.

Incorporating Legal Disclaimers

Including legal disclaimers in the document can help mitigate risks and clarify responsibilities. It’s important to note the following:

- Late Payment Penalties: Specify any interest or fees charged for overdue payments to avoid misunderstandings.

- Dispute Resolution Mechanisms: Define the process for resolving disagreements, such as arbitration or mediation, and mention any relevant institutions.

- Confidentiality Clauses: If necessary, include a confidentiality agreement to protect sensitive information exchanged between the parties.

Common Mistakes to Avoid in Invoicing

Inaccurate or poorly structured payment documents can lead to confusion, delays, or even financial losses. Common errors made when creating such documents can have a significant impact on business operations and relationships with clients. Avoiding these pitfalls ensures smoother transactions and strengthens professional credibility.

Key Errors to Watch Out For

- Incorrect or Missing Information: Always double-check for accurate details such as the recipient’s name, address, payment terms, and dates. Missing or incorrect information can delay processing or cause disputes.

- Ambiguous Payment Terms: Be clear about the due date, accepted payment methods, and any late fees. Uncertainty around these terms can result in misunderstandings.

- Not Including a Unique Reference Number: Each document should have a unique identifier to help both parties track and reference the payment easily. This helps prevent errors in bookkeeping or communication.

- Unclear Item Descriptions: Ensure that all goods or services are described in detail, including quantities, unit prices, and any applicable taxes. Lack of clarity here can result in disputes or confusion over charges.

- Failure to Comply with Local Tax Requirements: Each region has specific rules regarding tax rates and documentation. Make sure all relevant taxes are correctly applied and disclosed to avoid legal issues.

Formatting and Layout Mistakes

- Cluttered Design: A crowded document can make it difficult for clients to read or find important details. Keep the layout clean and organized for easy navigation.

- Poor Readability: Use clear fonts and appropriate font sizes. Small or difficult-to-read text can frustrate recipients and result in overlooked details.

- Not Providing a Clear Breakdown of Charges: Always list charges individually, including any discounts or additional fees, so the recipient understands exactly what they are paying for.

How to Add Currency Conversion Information

When working with cross-border transactions, it’s crucial to provide clear currency conversion details to avoid confusion and ensure that both parties understand the total amount due. Displaying the currency exchange rate, conversion date, and final payment amount ensures transparency and helps to mitigate any misunderstandings related to fluctuations in currency values.

Steps to Include Currency Conversion Details

- Specify the Original Currency: Clearly state the currency in which the goods or services were priced, such as USD, EUR, or GBP, before any conversion.

- Provide the Exchange Rate: Include the exchange rate used to convert the amount into the recipient’s local currency. Mention the source of the exchange rate, such as a bank or currency service.

- List the Date of Conversion: State the exact date on which the conversion rate was applied, as exchange rates fluctuate over time.

- Indicate the Final Amount: After applying the conversion, show the final amount due in the recipient’s currency. Ensure this is easy to identify to avoid any confusion.

Additional Considerations

- Currency Conversion Fees: If applicable, mention any fees associated with the currency exchange. This can include service charges from a payment processor or bank.

- Clarify Payment Method: Specify which currency will be accepted for payment, especially if the payment platform supports multiple currencies.

- Round to the Nearest Unit: To simplify calculations, round the final amount to the nearest whole unit or decimal, as per local conventions.

Using Multiple Languages in Invoices

When conducting business with clients from different linguistic backgrounds, it’s essential to create documents that are accessible and easily understood. Including multiple languages in your payment requests not only facilitates smooth communication but also demonstrates professionalism and respect for the recipient’s culture. Properly incorporating multiple languages ensures that both parties are on the same page regarding the terms and details of the transaction.

Benefits of Using Multiple Languages

- Improved Clarity: Presenting key information in the client’s native language reduces the likelihood of misunderstandings and errors.

- Enhanced Professionalism: Including a translation of important sections shows that you care about the client’s experience and are willing to accommodate their needs.

- Wider Market Reach: Expanding your document to include various languages can help you attract clients from different regions, potentially increasing business opportunities.

Best Practices for Multilingual Documents

- Prioritize Key Sections: Focus on translating the most important sections, such as payment terms, amounts, and deadlines. This ensures that critical details are understood.

- Professional Translations: Avoid using machine translations for complex legal or financial terms. A professional translator ensures accuracy and proper terminology.

- Consistent Layout: Maintain a clear and organized format to ensure that each language version is easily distinguishable. Consider using side-by-side columns or clear headings for each language section.

Essential Payment Terms for Global Clients

When dealing with clients across different countries, it’s important to establish clear and concise payment terms that account for various regulations, practices, and expectations. Well-defined terms not only protect your business but also ensure smooth transactions and timely payments. Understanding the key elements of a payment agreement helps to avoid disputes and fosters trust with clients from diverse regions.

- Payment Due Date: Clearly specify when the payment is expected. Standard terms include “30 days from the date of issue” or “Net 60,” but make sure these align with your client’s expectations and business norms.

- Accepted Payment Methods: List the payment methods you accept, such as bank transfers, credit cards, or digital wallets. Consider offering multiple options to accommodate different preferences and international payment systems.

- Currency of Payment: Clearly state the currency in which the payment is to be made, particularly if you and your client are operating in different monetary systems. This helps prevent confusion and ensures the correct conversion rate is applied.

- Late Payment Fees: Include any penalties or interest charges for overdue payments. This sets clear expectations and incentivizes timely payment.

- Early Payment Discounts: Consider offering discounts for early payments as an incentive. For example, “2% discount if paid within 10 days” can encourage quicker transactions.

- Tax Responsibilities: Specify who is responsible for taxes such as VAT or sales tax. This is particularly important when dealing with cross-border transactions where tax obligations can vary.

- Dispute Resolution: Outline the process for resolving payment disputes, including the preferred method (e.g., mediation, arbitration) and the legal jurisdiction that applies.

Tax Implications in International Invoices

When conducting business across borders, understanding the tax implications of cross-border transactions is essential for both compliance and smooth financial operations. Different countries have unique tax structures, including value-added tax (VAT), sales tax, and customs duties, that must be correctly applied depending on the nature of the transaction and the location of the buyer and seller. Properly accounting for these taxes ensures that both parties meet legal obligations and avoid penalties.

| Country | Applicable Tax | Tax Rate | Who Pays |

|---|---|---|---|

| United States | Sales Tax | Varies by state (typically 4% – 10%) | Buyer |

| European Union | Value-Added Tax (VAT) | Varies by country (typically 17% – 27%) | Seller (if established within the EU) |

| Canada | Goods and Services Tax (GST) | 5% (Federal) + Provincial taxes | Seller |

| Australia | Goods and Services Tax (GST) | 10% | Seller |

| China | Value-Added Tax (VAT) | 13% (for most goods and services) | Seller |

Tax obligations may also depend on the specific terms of the sale, such as whether the goods are shipped to the buyer or whether the seller is considered a “taxable person” in the buyer’s country. It’s critical to understand the nuances of tax treaties, exemptions, and the ability to reclaim taxes for exports or cross-border transactions.

Automating Invoice Generation for Efficiency

Automating the creation of payment documents can greatly enhance operational efficiency, reduce errors, and save valuable time. By implementing an automated system, businesses can streamline the process of generating and sending payment requests, ensuring consistency and accuracy with minimal manual effort. Automation also reduces the likelihood of missing deadlines, providing a more professional and reliable service to clients.

Benefits of Automation

- Time Savings: Automated systems generate payment documents instantly, eliminating the need for manual data entry and formatting. This frees up time for more important tasks.

- Accuracy: By reducing human intervention, automation minimizes the chances of errors in calculations, dates, or client details.

- Consistency: Automated tools maintain a consistent format for all documents, ensuring that every communication follows the same professional standard.

- Faster Processing: Automated systems can instantly send documents to clients, speeding up the overall payment process and reducing delays.

Steps to Automate Payment Document Generation

- Choose the Right Software: Select an automation tool or software that integrates with your existing accounting or customer management system. This ensures seamless data transfer and accurate document generation.

- Define Custom Templates: Create a custom template that includes all necessary fields such as client details, products or services, payment terms, and tax rates. Ensure the template is flexible enough to accommodate different client needs.

- Set Up Automation Triggers: Automate the process by setting triggers based on events, such as the completion of a project or the delivery of goods. This ensures that payment requests are sent out promptly and on time.

- Integrate Payment Gateways: Link your automated system with online payment gateways to facilitate easy and secure transactions directly from the generated documents.

- Monitor and Adjust: Regularly review the automation process and make adjustments as needed, such as updating templates or adding new payment methods, to ensure that the system remains efficient and up to date.

How to Track Payments on Invoices

Effectively managing and tracking payments is crucial for maintaining cash flow and ensuring the financial health of a business. Properly monitoring outstanding amounts and payment statuses helps prevent errors, reduces the risk of missed payments, and fosters stronger relationships with clients. Having a reliable system in place to track payments also enables businesses to identify overdue amounts and take timely action.

Methods for Tracking Payments

- Use a Payment Log: Maintain a detailed log or record for each transaction. Include information such as the payment date, amount, payment method, and client details. This manual or digital record helps you stay organized and ensures you have a clear overview of incoming payments.

- Leverage Accounting Software: Many accounting platforms offer features to automatically track payments and mark accounts as paid when the funds are received. These systems can sync with bank accounts, saving time and reducing the risk of human error.

- Include a Payment Status on Documents: Clearly indicate the payment status (e.g., “Paid,” “Partially Paid,” or “Unpaid”) on each payment request. This helps both you and the client keep track of the outstanding balance and the payment progress.

- Set Up Automatic Payment Reminders: Implement an automated system that sends reminder emails or notifications when payments are due or overdue. This helps keep clients informed and encourages timely payment.

Best Practices for Efficient Tracking

- Regularly Reconcile Accounts: Periodically compare your payment records with your bank statements to ensure all transactions are accounted for. Regular reconciliation reduces the risk of missed payments or duplicate entries.

- Assign Unique Payment References: Include a unique reference number or payment ID for each transaction. This makes it easier to match payments with specific transactions and reduces confusion.

- Maintain Clear Communication: Communicate payment terms clearly with clients and follow up promptly if a payment is missed. Transparency helps build trust and reduces disputes regarding payment deadlines.

Creating a Professional Invoice Appearance

Presenting a polished, professional document enhances trust and leaves a positive impression on clients. A clean, visually appealing format with organized details is essential to convey clarity and professionalism. Thoughtful design choices can make the document easy to read and show attention to detail.

Utilize clear fonts and layout: Selecting a simple, readable font in an organized structure makes the content easy to follow. Proper spacing and alignment guide the eye and ensure that each section is easy to locate.

Include essential sections: A well-organized document includes distinct areas for important details such as contact information, itemized services, and payment instructions. Each part should be clearly labeled and logically positioned to support easy reference.

Consider brand identity: Integrating subtle brand

Integrating Invoices with Accounting Software

Connecting billing documents with financial management tools streamlines operations, making it easier to track payments, manage client records, and reduce manual work. This integration ensures data consistency and improves the efficiency of record-keeping.

- Automated data entry: Linking your documents with accounting tools helps transfer key details automatically, minimizing errors and saving time on manual entries.

- Real-time updates: Integrated systems allow for instant updates on payment status and client accounts, providing a clear view of current finances.

- Centralized financial tracking: Consolidating billing data and financial records in one platform makes it easier to monitor revenue, outstanding amounts, and cash flow.

- Enhanced compliance and reporting: Integration helps in generating accurate reports and ensures compliance with regulatory requirements by maintaining organized records.

By using software integration, businesses can handle their financial documents more e

Protecting Your Business with Proper Invoicing

Issuing clear and detailed payment requests is essential for maintaining professionalism and safeguarding your business. A well-prepared document not only ensures that your clients understand their obligations but also provides legal protection in case of disputes.

Include essential details: Accurate information, such as itemized services, due dates, and payment methods, helps avoid misunderstandings and sets clear expectations for clients.

Establish terms and conditions: Defining payment terms, late fees, and penalties in your documents reinforces your policies and encourages timely payments, reducing financial risks.

Maintain organized records: Storing all issued documents in an orderly manner aids in tracking payments and provides a reliable paper trail. This can be invaluable if issues arise with clients or during financial audits.

Through detailed and professional documentation, you create a structured approach to client payments, reinforcing both trust and accountability in business relationships.