Free Consultant Invoice Template DOC

Creating accurate and professional financial documents is essential for anyone offering specialized services. Whether you’re an independent contractor or part of a small business, ensuring clear and concise billing is crucial for maintaining healthy client relationships. Streamlining this process can save you time and reduce the risk of errors.

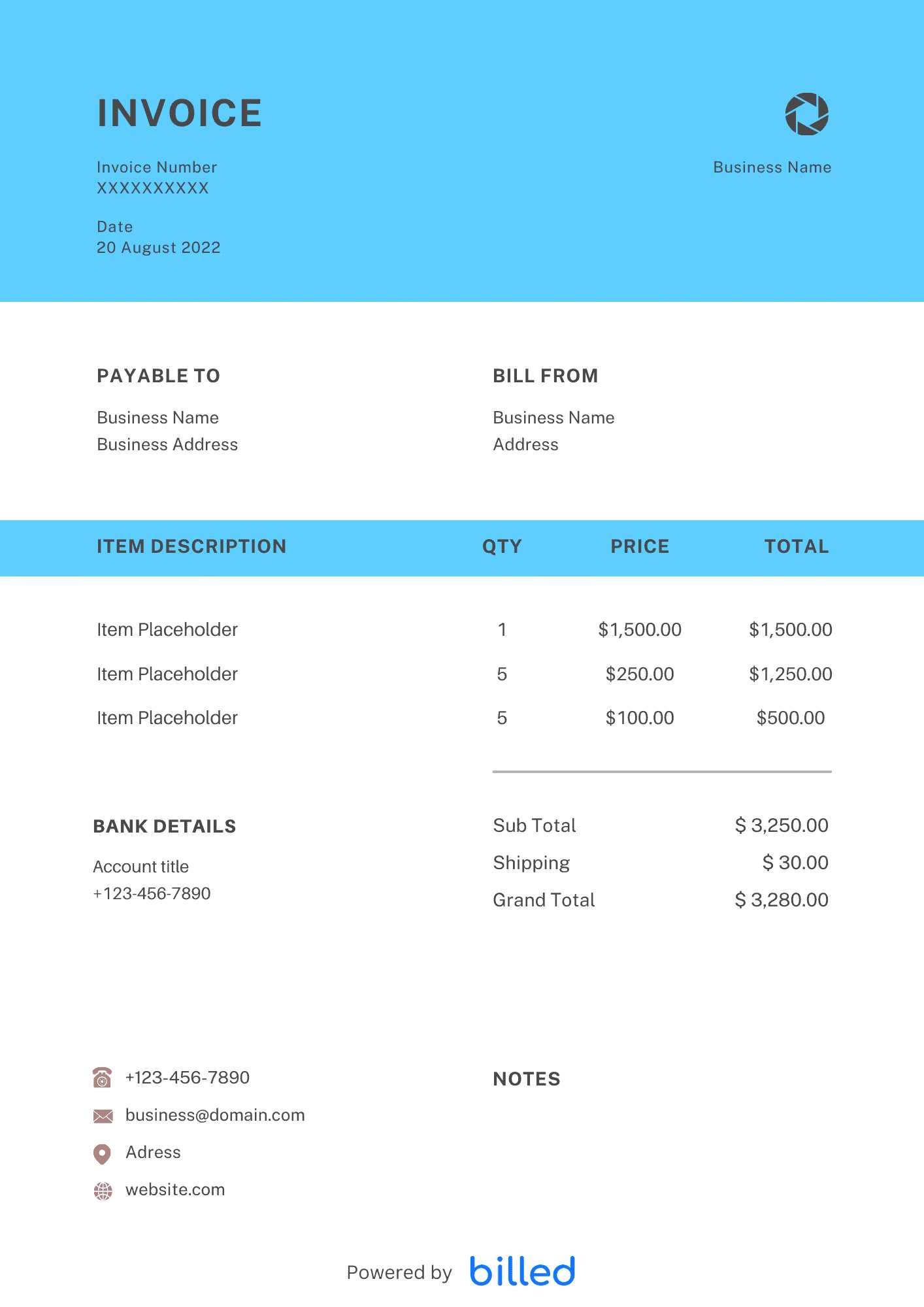

Customizable templates provide a simple way to generate consistent and detailed statements, helping to organize the billing process. These tools are designed to be user-friendly, making it easy to personalize each document according to your business needs and preferences.

Managing finances effectively involves more than just tracking payments; it also requires ensuring that your clients receive accurate and timely records. By using the right tools, you can keep your documentation professional and avoid unnecessary delays in payment processing.

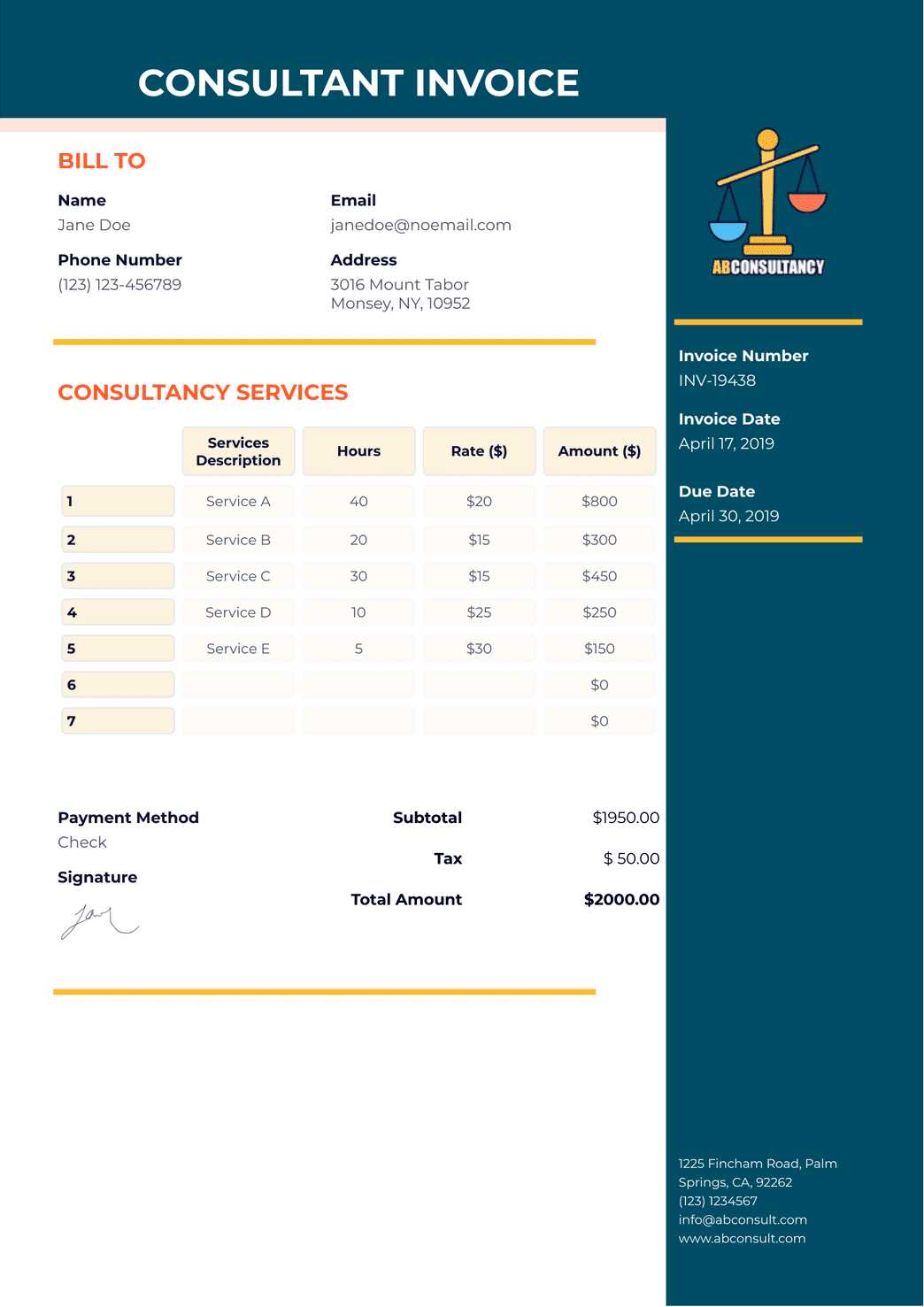

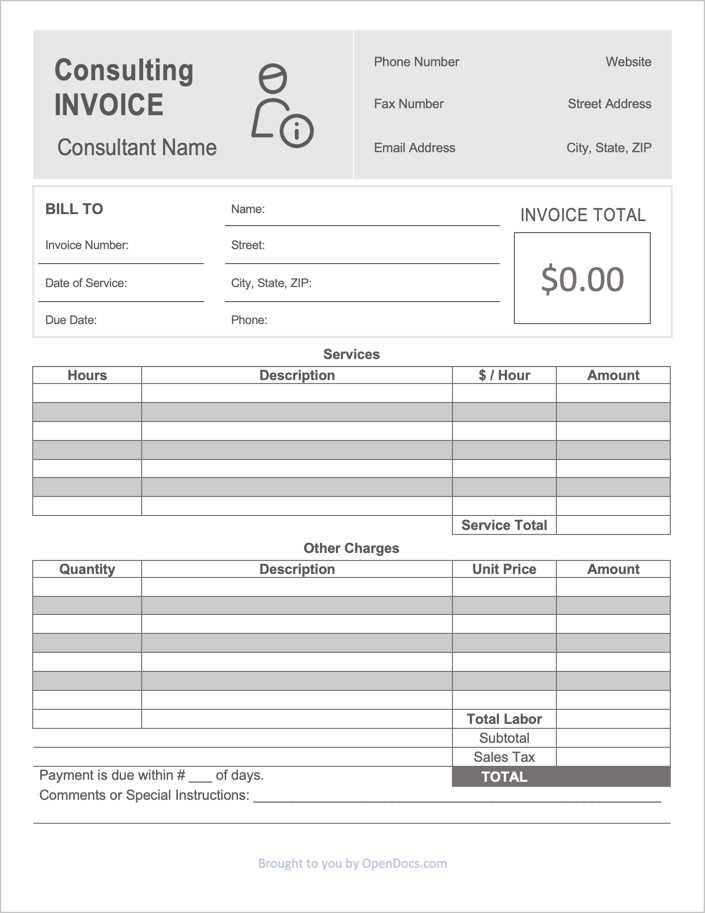

Consultant Invoice Template DOC Overview

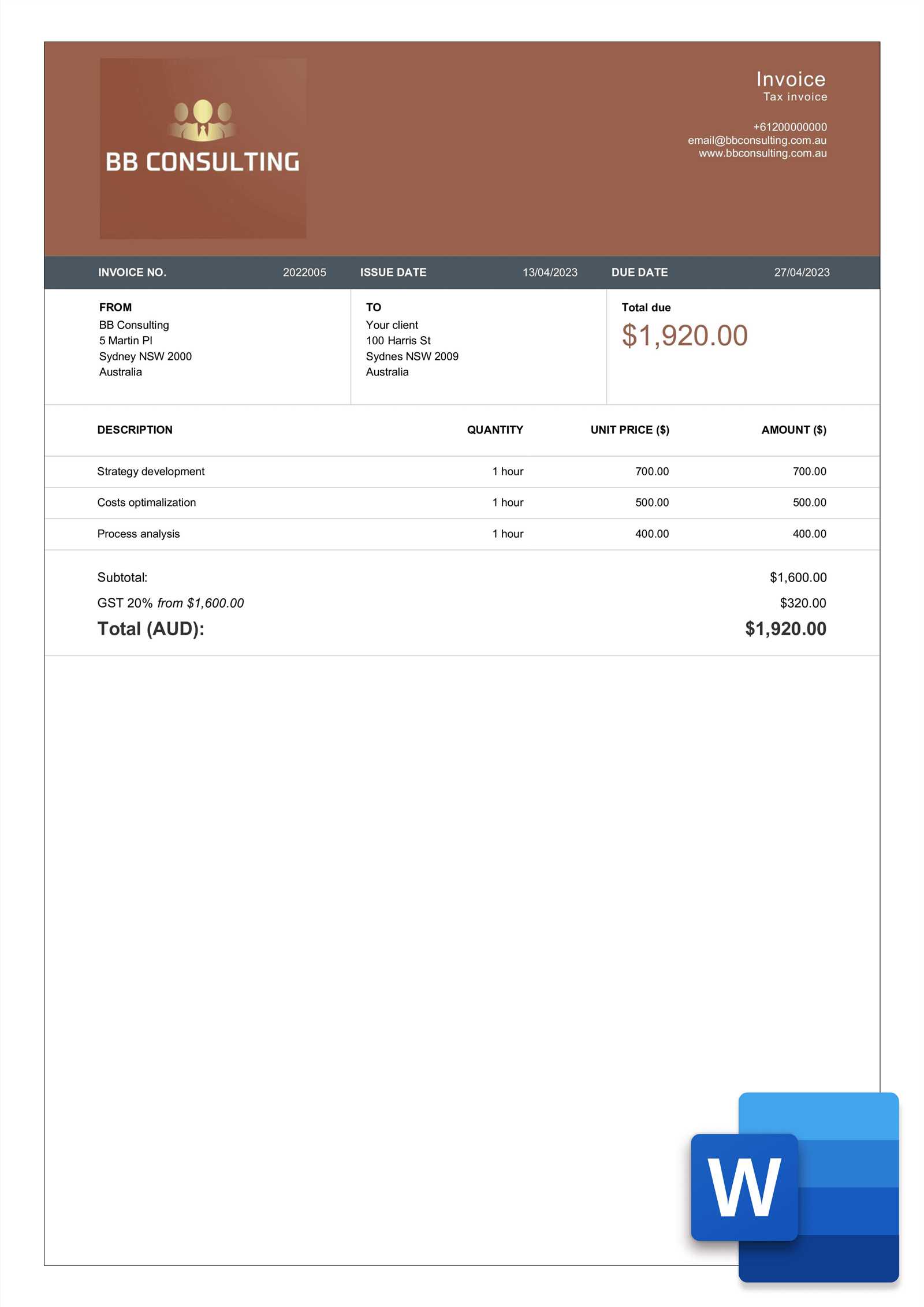

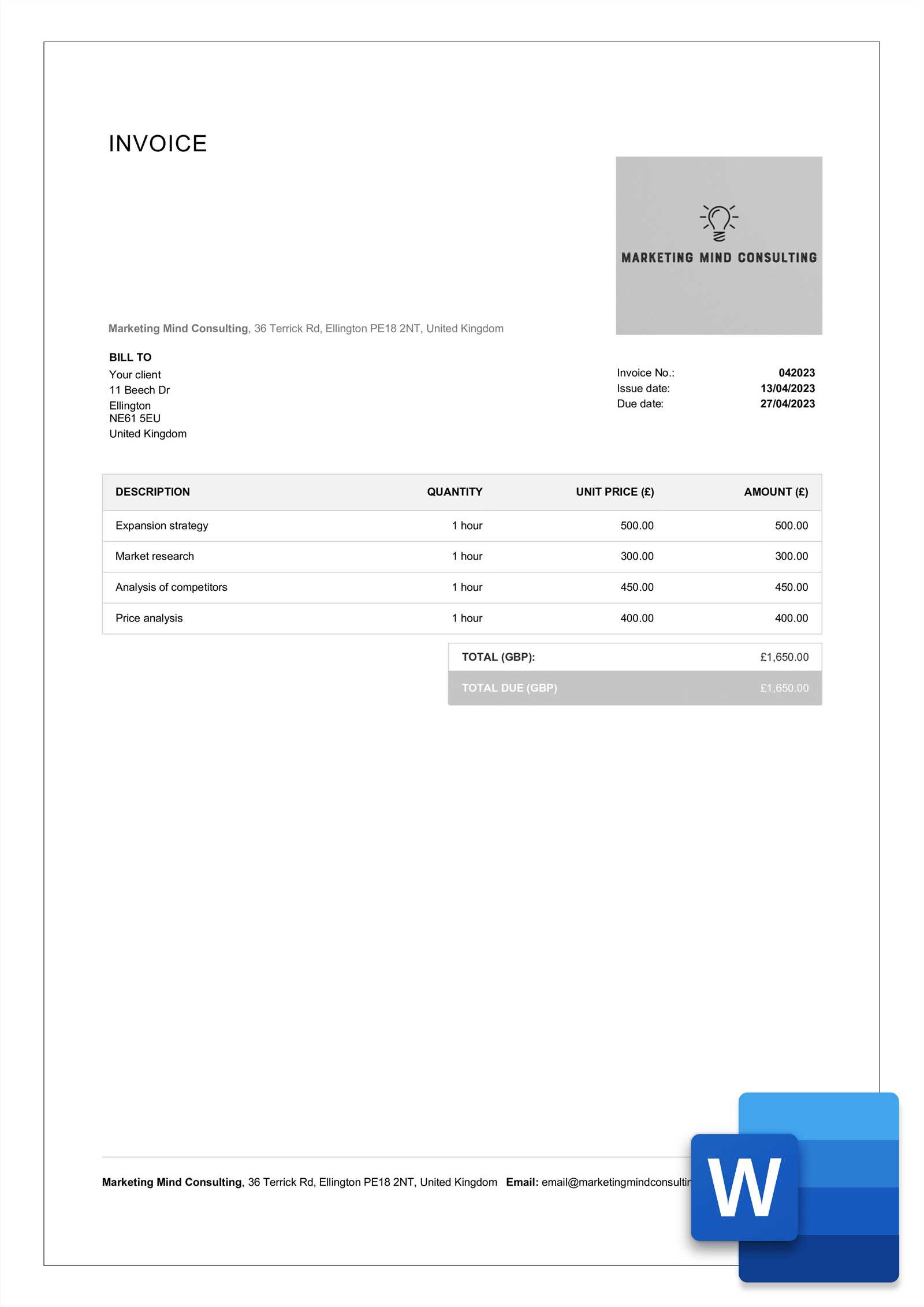

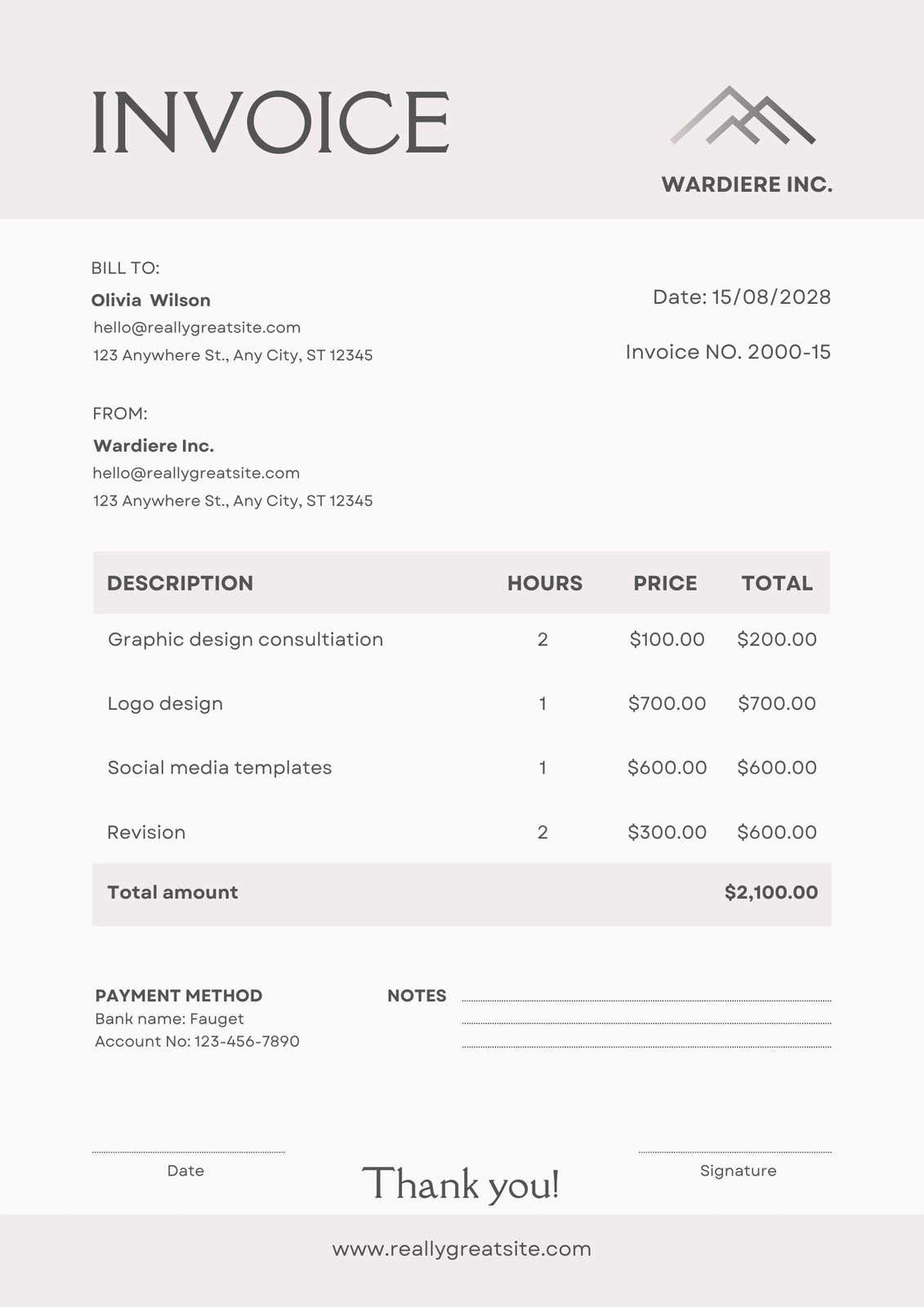

Professional billing documents are essential tools for service providers who need to request payments from clients. These documents help ensure clarity in financial transactions, providing clients with the necessary details regarding the work completed, payment terms, and total amounts due. A well-structured billing document can make the payment process smoother and more efficient for both parties.

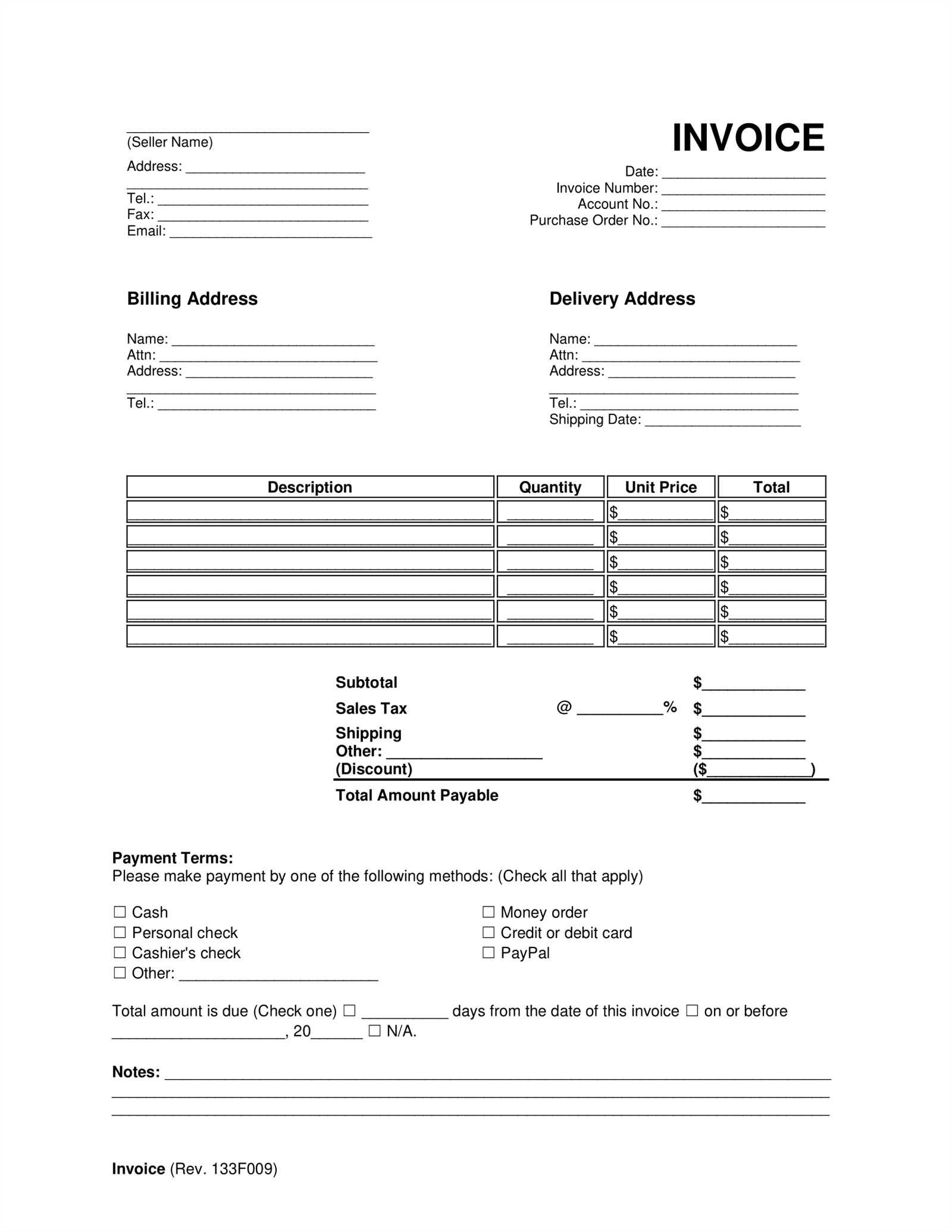

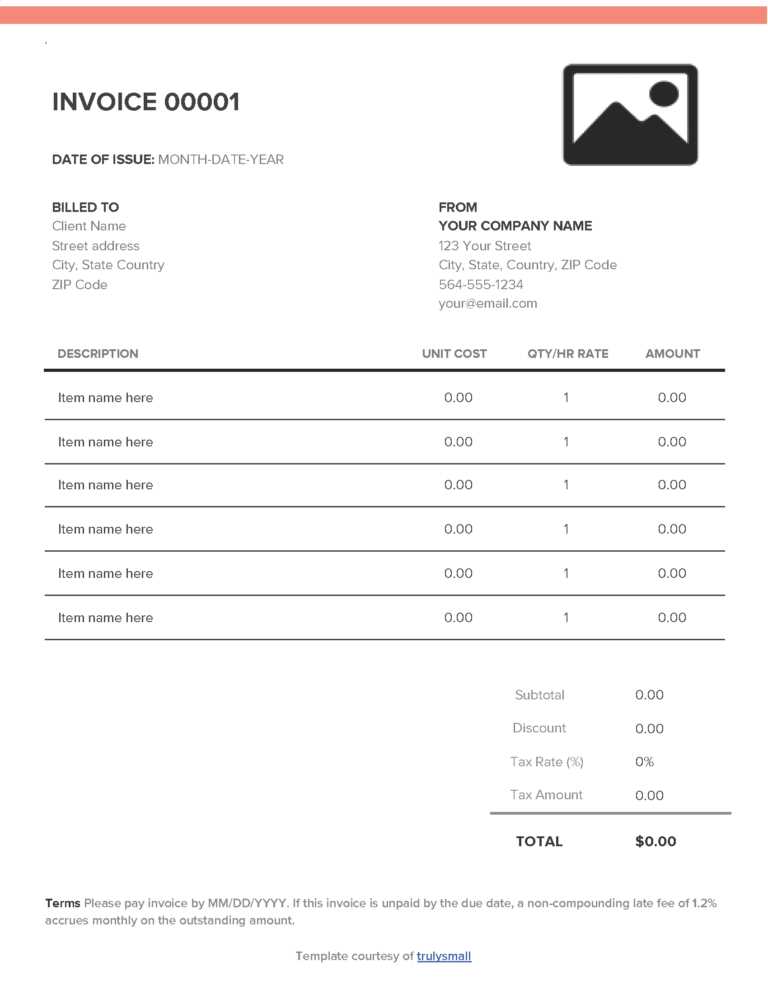

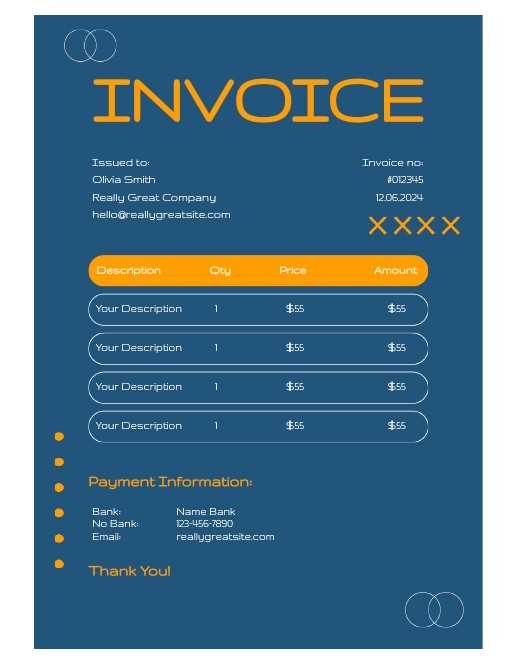

One of the most popular options for creating such records is by using a pre-designed format that can be customized to fit individual needs. These formats offer flexibility, allowing users to input specific service details, adjust pricing, and personalize the layout to reflect their business style. By utilizing this type of tool, freelancers and business owners can maintain professionalism in every financial exchange.

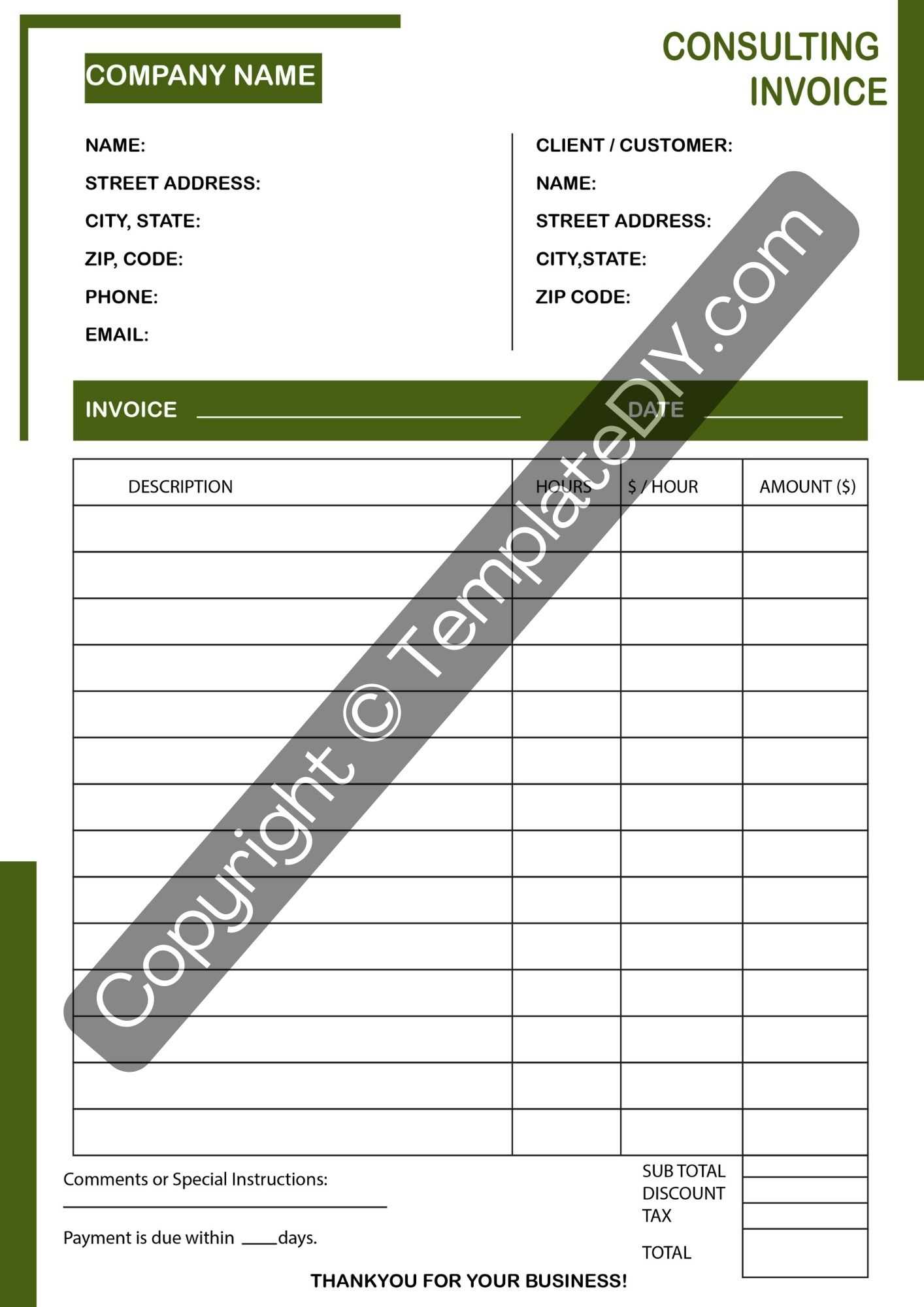

Key elements typically included in these documents are the service description, billing rates, payment terms, and client information. With a clear and organized structure, these documents help avoid misunderstandings and ensure that clients know exactly what they’re being charged for, fostering a sense of transparency and trust in the business relationship.

Why Use a Consultant Invoice Template

Having a structured document for requesting payments is essential for maintaining a professional image and ensuring clarity in business transactions. When working on projects for clients, providing them with a well-organized record that outlines services rendered and the corresponding costs not only streamlines communication but also speeds up the payment process.

Benefits of Using a Pre-Formatted Payment Record

- Saves time: With a ready-made structure, you can quickly input the necessary details without having to start from scratch each time.

- Consistency: Using a standardized format ensures that all your financial documents look professional and are consistent across various clients and projects.

- Accuracy: The layout helps minimize the risk of missing important details, ensuring that clients have all the information needed to process payments correctly.

- Customization: These documents can be easily modified to reflect specific services, rates, and terms that are relevant to each project.

How It Helps With Client Relationships

- Transparency: A clear structure ensures that your clients understand exactly what they are being billed for, which builds trust and reduces misunderstandings.

- Professionalism: Providing an organized, well-crafted payment request enhances your reputation and shows clients that you take your business seriously.

Key Features of Consultant Invoices

Effective billing documents serve as a clear record of the work completed, ensuring that all necessary details are included for payment processing. These records should include not only the financial aspects but also the specific terms that govern the transaction, making it easier for both the service provider and the client to understand the agreement. The following are some essential components that every billing document should contain to ensure accuracy and clarity.

Essential Elements for Accurate Records

- Detailed Description of Services: A comprehensive breakdown of the work completed is vital. This ensures that clients can see exactly what they are paying for and how the charges are structured.

- Clear Payment Terms: Stating the due date, payment methods, and any penalties for late payments helps set expectations and avoid confusion.

- Client and Business Information: Including the name, contact details, and tax identification numbers of both parties ensures transparency and helps with record-keeping for tax purposes.

- Pricing and Total Amount: A clear outline of the pricing structure, including hourly rates, flat fees, or project-based rates, alongside the total amount due, helps avoid discrepancies.

Additional Features That Enhance Professionalism

- Personalized Branding: Including your business logo and contact information gives your document a professional look and reinforces your brand identity.

- Reference Numbers: Adding unique reference numbers to each document helps with organization and tracking of multiple transactions.

- Tax Details: Including applicable taxes or VAT ensures that both parties are clear on any extra charges and are compliant with local laws.

Benefits of DOC Format for Invoices

Choosing the right file format for creating and sending payment requests can significantly impact how easily and efficiently your documents are managed. The DOC format is widely used due to its versatility and compatibility with most word processing software. This format allows for easy customization, editing, and sharing, making it a popular choice for service providers and businesses alike.

Easy Customization and Editing

- Flexibility: A DOC file can be easily modified to fit different client needs or project specifics. You can adjust pricing, add extra details, or change the layout with minimal effort.

- Text Formatting: The format allows for various text styles, such as bold, italics, and underlining, making it simple to highlight important sections like payment terms or service descriptions.

- Images and Logos: You can easily insert logos, images, and other branding elements, enhancing the professional appearance of your document.

Wide Compatibility and Accessibility

- Universal Support: DOC files can be opened and edited using a range of software programs, including Microsoft Word and free alternatives like Google Docs, ensuring that recipients can access the document easily regardless of their platform.

- Simple Sharing: This format is easy to share via email or cloud storage platforms, making it convenient for both the sender and the recipient to access and store the document securely.

- Easy Printing: DOC files are printer-friendly, allowing for quick physical copies to be made if necessary, ensuring flexibility in handling both digital and printed records.

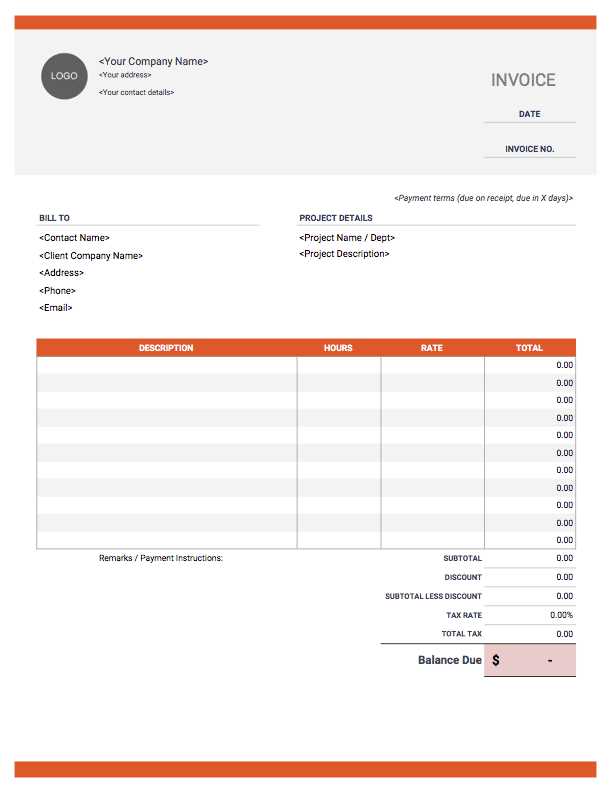

How to Customize Your Invoice Template

Customizing your billing document allows you to create a personalized and professional record that suits your business needs. By adjusting various sections, you can ensure that your document reflects the unique terms of each project and client, while maintaining a consistent style across all your transactions. Customization makes it easier to communicate important details, such as payment terms and services rendered, clearly and effectively.

Adjusting the Layout and Design

- Personalize Your Branding: Add your business logo, color scheme, and contact details to create a consistent brand image across all documents.

- Rearrange Sections: Depending on your preference, you can move around sections like service description, total amount, or payment terms to highlight the most important details.

- Font and Style: Modify the font type, size, and text formatting (such as bold or italics) to make key information stand out, like due dates or totals.

Adding Project-Specific Information

- Service Details: Include a clear breakdown of the work completed, making it easy for clients to understand the services they are being charged for.

- Pricing Structure: Adjust the pricing layout to reflect hourly rates, flat fees, or other billing methods specific to each project or client.

- Payment Terms: Personalize payment conditions, such as due dates, late fees, or discounts for early payments, to match the agreement made with your client.

Step-by-Step Guide to Creating Invoices

Creating a professional billing document is essential for ensuring accurate payment processing and maintaining clear communication with your clients. By following a systematic approach, you can easily generate these records and ensure they include all the necessary details. Here’s a step-by-step guide to help you create effective financial documents for your services.

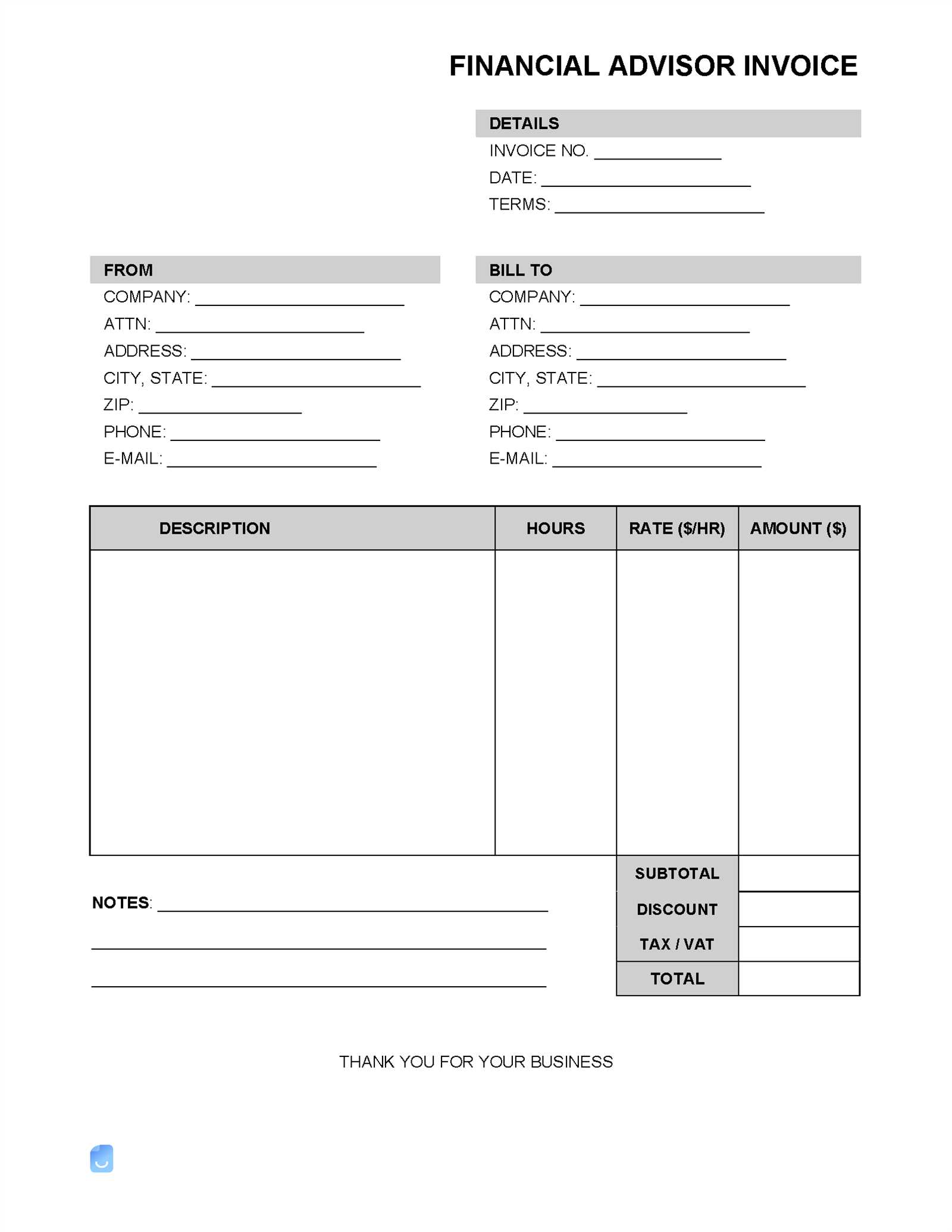

Step 1: Include Your Business Information

The first step is to make sure that your business details are clearly displayed at the top of the document. This should include:

- Your business name and logo (if applicable)

- Your contact information, such as phone number and email

- Your business address or other relevant location details

- Your tax identification number or other legal identifiers if necessary

Step 2: Add Client Information

Next, ensure that your client’s information is correctly listed. This will typically include:

- Client’s name or business name

- Client’s address and contact information

- Any other details that can help identify the client or project

Step 3: Detail the Services Provided

Provide a clear description of the work completed, including:

- A detailed list of the services you provided

- The date the work was completed or the time period it covered

- The agreed-upon pricing for each service, along with any applicable rates or discounts

Step 4: Specify Payment Terms and Total

Conclude the document by including the total amount due, along with clear payment terms. Be sure to mention:

- The total amount due

- The payment due date

- The payment methods you accept

- Any late fees or discounts for early payments, if applicable

Essential Information for Consultant Invoices

When preparing a financial document for services rendered, it’s crucial to include all necessary details to avoid confusion and ensure proper payment. A well-structured record not only helps you maintain professionalism but also provides clarity to your client, making it easier for them to process the payment. Below are the key elements that should be included in every billing document.

Key Elements to Include

| Information Type | Details to Include |

|---|---|

| Business Information | Your business name, logo, contact details, and tax identification number (if applicable) |

| Client Information | Client’s name, business name, address, and contact information |

| Service Description | A detailed list of the services provided, including the work completed and dates |

| Pricing | The rate for each service provided, hourly rates, or project-based pricing |

| Total Amount | The total amount due for payment, including any taxes or additional charges |

| Payment Terms | Due date, payment methods, and any applicable late fees or discounts |

Additional Considerations

In some cases, you may also want to include a unique reference number for easy tracking or to specify any agreed-upon milestones. Keeping these details clear and concise will ensure that both parties are on the same page and facilitate smooth payment processing.

Common Mistakes to Avoid in Invoices

Creating a clear and accurate billing document is essential for maintaining a professional image and ensuring smooth payment processing. However, there are several common errors that can cause confusion and delays. By avoiding these mistakes, you can create more effective and reliable financial records that benefit both you and your clients.

Incorrect or Missing Information

- Incomplete Business or Client Details: Always ensure that both your and your client’s contact information is correct and fully listed. Missing details can lead to delays or misunderstandings.

- Omitting Payment Terms: Be sure to clearly state your payment terms, including the due date, payment methods, and any late fees. Failing to do so can lead to confusion or non-payment.

- Wrong Pricing or Calculations: Double-check your pricing structure and ensure that the totals match the agreed-upon rates. Mistakes in pricing or math can cause frustration for your client and delay payments.

Formatting and Presentation Issues

- Unprofessional Layout: A disorganized or cluttered document can make it difficult for the client to read and understand the charges. Use a clear and clean layout with well-defined sections.

- Inconsistent Fonts or Styles: Using multiple font types or inconsistent text styles can make your document look unprofessional. Stick to a uniform style for better readability.

- Lack of Proper Organization: Ensure that all necessary sections, such as service descriptions, payment terms, and totals, are clearly marked and logically organized.

By being mindful of these common errors and paying attention to detail, you can avoid unnecessary confusion and improve the overall quality of your billing documents.

How to Track Payments with Invoices

Tracking payments effectively is crucial for managing cash flow and ensuring that your financial records remain accurate. A well-organized payment tracking system allows you to monitor which transactions have been completed, which are pending, and which may require follow-up. By utilizing billing records efficiently, you can stay on top of your payments and maintain clear communication with your clients.

To track payments, make sure to include a unique reference number for each transaction. This helps you identify and match payments to the correct service provided. In addition, it’s essential to regularly update your payment log to reflect any received amounts, partial payments, or overdue balances. Using spreadsheets or specialized software can make this process easier and more streamlined.

Another useful approach is to mark or highlight the payment status on each record. For example, you could label payments as “paid,” “pending,” or “overdue” to keep track of the payment progress. Setting reminders for due dates or following up with clients about overdue payments can also help ensure timely processing and avoid delays in future work.

Best Practices for Professional Invoicing

Maintaining professionalism in your financial documents is key to ensuring prompt payments and fostering strong client relationships. By following a few essential guidelines, you can create billing records that are clear, accurate, and reflect your attention to detail. Adhering to best practices not only enhances your credibility but also helps avoid common errors that can lead to confusion or payment delays.

1. Be Clear and Concise: Always provide a detailed breakdown of the services rendered, including descriptions, dates, and pricing. Avoid vague terms, and make sure your client understands exactly what they are paying for.

2. Include Essential Information: Your business and client’s contact information, along with payment terms, should be easy to find on the document. This ensures that both parties have all the necessary details to complete the transaction smoothly.

3. Set Clear Payment Terms: Clearly state the payment due date, accepted methods, and any applicable late fees or discounts. This helps prevent misunderstandings and establishes a framework for timely payments.

4. Use Consistent Branding: Make sure your billing documents match your business’s branding. Use a professional layout with your logo, business name, and consistent fonts to reinforce your business identity.

5. Send Invoices Promptly: Ensure that you send your billing records as soon as possible after completing work or delivering a product. Timely invoicing encourages quicker payment and demonstrates your professionalism.

By following these best practices, you can create effective, professional billing documents that support smooth transactions and positive client experiences.

How to Send Invoices to Clients

Sending billing records to clients promptly and professionally is crucial for ensuring timely payments. The method you choose to send these documents can impact how quickly your clients respond and how easy it is for them to process the payment. Using the right approach not only helps maintain good business relationships but also minimizes the chances of missed payments or misunderstandings.

1. Choose the Right Method of Delivery: Depending on your client’s preferences and your business practices, you can send your records through email, mail, or even a specialized payment platform. Email is often the fastest and most efficient method, allowing you to send your documents as attachments in formats like PDF or Word. If you choose to send hard copies, ensure they are sent via a reliable postal service to avoid delays.

2. Personalize the Communication: When sending the document, include a brief message or cover letter that introduces the billing record. This adds a personal touch and reminds your client of the services rendered or the agreed-upon terms. It’s also a chance to express gratitude for their business.

3. Follow Up: If you haven’t received payment by the due date, don’t hesitate to follow up with a polite reminder. Whether through email or phone, ensure your communication is courteous and professional. You may also want to include a copy of the billing record for easy reference.

4. Ensure Readability: Before sending, double-check that the document is well-organized, easy to read, and free of errors. Clear formatting ensures that your client can quickly review the details and make the payment without confusion.

By choosing the appropriate method and ensuring clear communication, you make it easier for clients to complete payments and maintain a professional relationship moving forward.

How to Handle Late Payments on Invoices

Dealing with overdue payments is a common challenge for many businesses. When clients fail to pay on time, it can disrupt your cash flow and create unnecessary stress. However, handling late payments professionally and efficiently can help maintain strong relationships while ensuring you get paid for the services you’ve provided.

1. Send a Friendly Reminder

If the payment deadline has passed, the first step is to send a polite reminder. Reach out to the client through email or phone, and gently remind them of the outstanding amount. Include the original billing details and any applicable due dates. In most cases, a simple nudge is enough to prompt the client to make the payment.

2. Implement a Late Fee Policy

Having a clear late fee policy can encourage clients to pay on time. Specify in your terms and conditions that you will apply an additional charge for late payments. This helps establish boundaries and provides an incentive for clients to prioritize their payments.

3. Offer Payment Plans

Sometimes clients may face financial difficulties. In such cases, offering flexible payment plans can be a solution. Breaking down the balance into smaller payments over time can help the client manage their financial obligations while ensuring you receive the full amount.

4. Be Prepared to Escalate

If the client continues to delay payment despite reminders and payment arrangements, it may be time to escalate the situation. Consider involving a collections agency or seeking legal advice, but only after you’ve exhausted other options. Always ensure that your actions are professional and aligned with the terms agreed upon with your client.

Handling late payments effectively requires clear communication, firm policies, and a professional attitude. By managing overdue payments properly, you maintain a positive image and ensure the continued health of your business.

Using Invoice Templates for Tax Purposes

Proper record-keeping is essential for managing taxes, and using well-structured billing documents can significantly simplify the process. When you provide a detailed and organized summary of services and payments, you not only ensure transparency with your clients but also maintain accurate financial records for tax reporting. Having a consistent format for these documents helps you track income, expenses, and tax deductions more efficiently.

These records are crucial for filing taxes accurately and meeting regulatory requirements. By including necessary information such as payment amounts, dates, and client details, these documents help provide clarity during audits or tax preparation. Using a standardized approach also reduces errors and minimizes the time spent organizing financial data at the end of the year.

For tax purposes, it’s important to ensure that all required fields–such as tax identification numbers, transaction dates, and service descriptions–are included in your billing documents. A well-organized format makes it easier to reference specific transactions, calculate taxable income, and apply deductions or credits where applicable.

Incorporating invoicing systems that offer automated tracking of payments and tax-related information can further streamline the process, saving time and reducing the likelihood of mistakes when filing taxes.

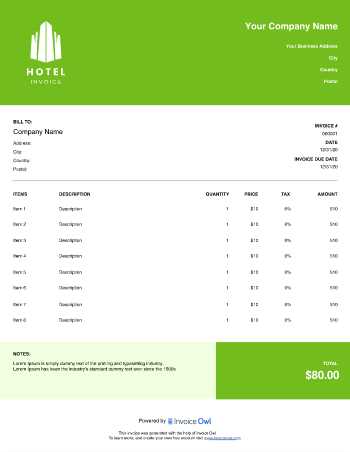

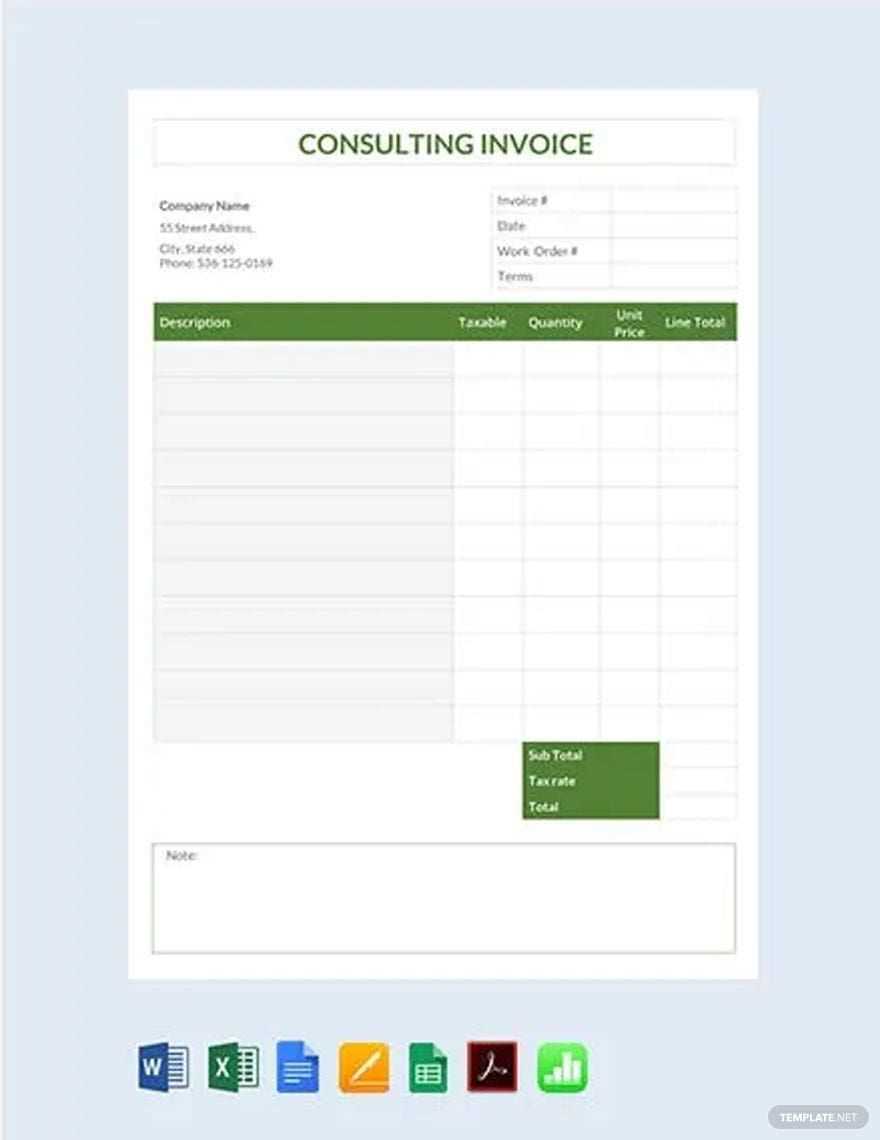

Free Consultant Invoice Templates Online

For businesses and freelancers, having access to free and customizable billing documents is a valuable resource. Online platforms offer a wide variety of ready-made forms that can be downloaded, tailored, and used for financial transactions. These digital tools save time, reduce errors, and ensure consistency in your billing process, especially for small business owners or those just starting their ventures.

Benefits of Using Free Billing Documents

Utilizing free resources for your financial records comes with several key advantages:

- Cost-effective: No need to purchase expensive software or services.

- Easy customization: Personalize documents to match your branding or specific needs.

- Time-saving: Ready-made forms that streamline the process of generating financial records.

- Legal compliance: Many templates are designed to meet basic legal and tax requirements, ensuring you’re on track with regulations.

Popular Platforms Offering Free Billing Forms

There are several reputable websites where you can find free customizable documents, including:

- Template.net: Offers a variety of customizable billing forms with different designs and formats.

- Zoho: Provides free templates with the option to edit and store them digitally for easy access.

- Invoice Generator: Allows users to create professional-looking forms quickly and download them without any cost.

- Microsoft Office: Provides downloadable forms through Word and Excel with customizable fields for various industries.

These online platforms allow for easy generation and modification of documents, making it simple for professionals to create accurate, polished financial records. Whether you’re a freelancer, small business owner, or independent contractor, these free tools ensure that your financial documentation is both efficient and effective.

How to Save Time with Invoicing

Efficient management of financial documents can greatly reduce the time spent on administrative tasks. By streamlining the process of generating and sending payment requests, businesses can focus on core operations and reduce delays in receiving payments. Using automation and organized systems can make a significant difference in speeding up the workflow while ensuring accuracy.

Here are several strategies to save time while handling your financial documents:

| Strategy | Description |

|---|---|

| Automation Tools | Using software to automatically create and send documents, based on preset information, reduces manual work. |

| Recurring Billing | Set up automatic billing for regular clients to avoid generating new forms every time. |

| Cloud Storage | Store documents in the cloud for easy access and quick retrieval when needed. |

| Pre-designed Formats | Use pre-made, customizable formats to reduce the time spent on designing each form. |

| Clear Payment Terms | Define payment terms clearly in the document to avoid back-and-forth clarifications. |

By implementing these strategies, you can streamline your financial processes, reduce time spent on administrative tasks, and improve cash flow by ensuring quicker processing and payment receipt. Investing time in setting up a system that automates or simplifies these tasks pays off in the long run by improving efficiency and reducing potential errors.

Legal Considerations for Consultant Invoices

When creating and managing payment requests, it is essential to ensure that they comply with relevant laws and regulations. Not only do these documents represent a formal agreement between you and your clients, but they also serve as legal records in case of disputes. Properly structuring these documents and including necessary legal elements can help avoid complications and protect both parties’ rights.

Below are some key legal aspects to consider when preparing financial documents:

| Legal Aspect | Description |

|---|---|

| Clear Payment Terms | Specify due dates, payment methods, and any late fees to ensure transparency and prevent future disputes. |

| Accurate Business Information | Always include your correct business name, address, and tax identification number to comply with legal requirements. |

| Tax Compliance | Ensure that your documents reflect the correct sales tax or VAT charges, if applicable, and that they comply with local tax laws. |

| Record Keeping | Maintain records of all transactions for tax filing and potential legal purposes, including the possibility of audits. |

| Contractual References | Include references to any signed agreements or contracts related to the services provided to clarify terms. |

Additional Legal Protections

In addition to ensuring compliance with the above, you should also be aware of any local, state, or federal regulations regarding payment practices, particularly if you are working with international clients. For instance, the use of electronic payment methods may have specific guidelines, and it’s crucial to ensure that your documents adhere to digital transaction laws where applicable.

Dispute Resolution

Including clear terms for resolving disputes in your payment requests can save both time and money. Whether it’s through mediation, arbitration, or court proceedings, having a plan in place for potential conflicts can prevent them from escalating and ensure smoother business operations.

Tips for Streamlining Your Billing Process

Efficiently managing your payment requests can save valuable time and reduce errors, helping your business maintain a steady cash flow. Streamlining the process not only minimizes administrative tasks but also improves client satisfaction. Below are some effective strategies to make your payment management more efficient and hassle-free.

- Automate Billing: Use software to automate the creation and delivery of your payment requests. This eliminates manual data entry, reduces mistakes, and speeds up the process.

- Set Clear Payment Terms: Clearly define payment deadlines, late fees, and accepted payment methods in every transaction to avoid confusion.

- Use Consistent Formatting: Standardize the format of your documents. A consistent style and layout make it easier for both you and your clients to track payments and understand details.

- Send Reminders: Set up automated reminders to notify clients of upcoming or overdue payments. This reduces the chances of missed payments and ensures timely processing.

- Accept Multiple Payment Methods: Offer a variety of payment options to make it easier for clients to pay on time. This may include bank transfers, credit cards, and online payment systems.

- Track Payments Efficiently: Implement a system to track which payments have been received and which are still pending. This will help you manage outstanding balances and avoid late fees.

By adopting these strategies, you can simplify the entire payment process, making it quicker, easier, and more reliable for both you and your clients.