U.S. Customs Invoice Template for Smooth Import and Export Transactions

When engaging in cross-border trade, having the right paperwork is crucial for smooth transactions and compliance with international regulations. Proper documentation ensures that goods are processed quickly and efficiently at borders, preventing unnecessary delays or fines. One of the most important documents in this process is the form used to declare the value and description of items being shipped.

Accurate paperwork is key to minimizing issues during customs clearance. Not only does it provide authorities with necessary details, but it also protects both parties in a transaction by clearly outlining the terms and value of the shipped goods. Having a reliable format for these documents can make the entire process easier and more transparent.

In this guide, we will explore how to create and use a well-structured form for international shipments, highlighting the essential elements and offering practical advice on how to tailor it to meet specific needs. Whether you’re a seasoned exporter or just starting, understanding the structure and requirements of this documentation is essential for maintaining smooth operations across borders.

Understanding U.S. Customs Invoice Requirements

When shipping goods internationally, certain documentation is required to ensure compliance with trade regulations and facilitate smooth processing at border control points. This documentation provides key details about the shipment, allowing authorities to assess taxes, duties, and ensure compliance with import/export laws. The structure and content of these documents are strictly defined to prevent delays and minimize risks during the shipping process.

There are specific elements that must be included to meet the legal and procedural requirements for international shipping. These elements ensure that the relevant parties have clear and accurate information about the goods being shipped, helping to avoid potential misunderstandings or issues during customs clearance.

- Detailed Description: The shipment should be clearly described, including the nature of the goods, quantity, and intended use. This helps authorities assess whether the goods comply with local regulations and determine any applicable tariffs.

- Value Declaration: The value of the goods must be declared, as this influences the duties and taxes levied on the shipment. An accurate value is necessary to avoid fines or incorrect duty assessments.

- Origin Information: The origin of the goods must be identified to determine whether preferential trade agreements or restrictions apply. This is especially important for international transactions between different trade regions.

- Harmonized System (HS) Codes: The correct HS codes must be listed for each product, allowing authorities to classify goods correctly and apply the correct tariffs.

- Consignment and Receiver Details: Accurate contact details of both the sender and receiver are necessary for tracking, delivery, and communication in case issues arise.

By following these guidelines and ensuring that all required information is accurately provided, businesses can facilitate faster processing times, avoid unnecessary delays, and maintain good standing with regulatory authorities during international shipments.

Importance of Accurate Customs Invoices

Providing precise and comprehensive documentation is essential for smooth international shipments. Accurate paperwork ensures that goods are processed quickly at border checkpoints, avoiding unnecessary delays and complications. Errors in these documents can lead to severe consequences, including fines, confiscation of goods, or increased processing times, which can be costly for businesses.

Benefits of Accuracy in Shipping Documents

Ensuring that all details are correct in the shipping declaration benefits both the sender and the recipient, as well as the regulatory authorities involved. It helps to prevent misclassifications, which can lead to disputes or additional charges, and facilitates the efficient movement of goods across borders.

| Benefit | Explanation |

|---|---|

| Speed of Clearance | Accurate documentation allows for faster processing at the border, reducing delays and keeping delivery schedules intact. |

| Compliance | Correct forms help meet legal requirements, preventing issues with regulations that could lead to fines or penalties. |

| Cost-Effectiveness | By avoiding mistakes, businesses can reduce the risk of extra charges and the need for resubmission of incorrect paperwork. |

Consequences of Incorrect Shipping Documentation

Incorrect or incomplete shipping declarations can cause significant issues, not only in terms of potential legal ramifications but also in the overall efficiency of the supply chain. Mismatched details may delay the processing time and increase the likelihood of additional inspections, leading to unnecessary costs and disruption of business operations.

In summary, ensuring the accuracy of the required documents when shipping internationally is critical for smooth and cost-effective transactions. Taking the time to complete and verify these forms helps maintain good relationships with both clients and regulatory authorities while minimizing the risk of errors and penalties.

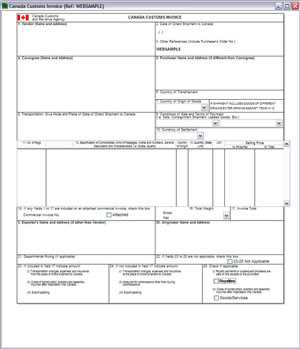

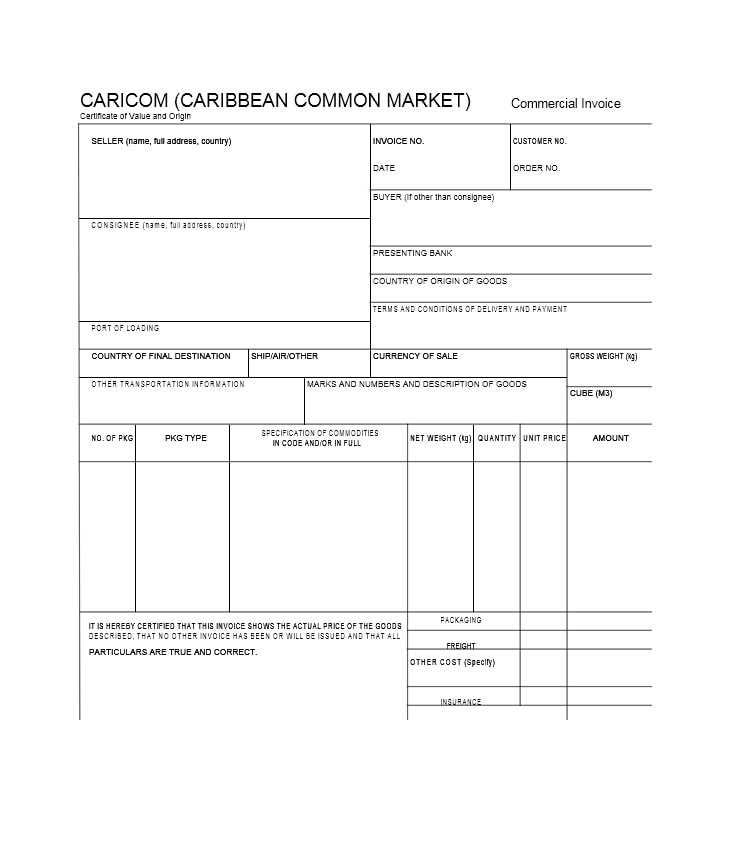

Key Components of a U.S. Customs Invoice

When shipping goods internationally, a well-structured document is essential to ensure smooth processing at the border. This document provides key details about the shipment, allowing authorities to assess the value, classify the goods correctly, and apply the appropriate taxes and duties. Several important elements must be included to meet legal and procedural requirements for international trade.

Essential Information for International Shipments

For any shipment to be processed efficiently, the following elements must be clearly presented in the documentation:

- Sender and Recipient Information: Accurate contact details of both the shipper and the recipient, including names, addresses, and phone numbers, are required for proper tracking and communication.

- Description of Goods: A detailed description of the items being shipped, including their nature, use, and purpose, helps authorities understand the contents of the shipment and classify them correctly.

- Value Declaration: The declared value of the goods is crucial for calculating taxes and duties. It must be accurate to avoid penalties or delays in processing.

- Origin of Goods: The country of origin is important to determine if trade agreements or special tariffs apply. This helps ensure the correct duties are applied.

- HS Codes: Harmonized System codes are used to classify products for international trade. These codes help customs authorities determine the correct tariff rates.

Additional Requirements for Compliance

In addition to the core elements mentioned above, certain additional information may be required depending on the nature of the shipment:

- Currency and Payment Terms: The currency used for the transaction and any payment terms or agreements should be clearly stated to avoid confusion or disputes.

- Freight Charges: If the sender or recipient is responsible for shipping costs, these charges must be outlined to ensure transparency and correct duty calculations.

- Serial Numbers and Product Identification: For high-value or regulated goods, providing serial numbers or other unique identifiers may be necessary for tracking and verification.

Ensuring all these components are accurately included helps streamline the shipping process, prevents delays, and ensures compliance with international trade regulations.

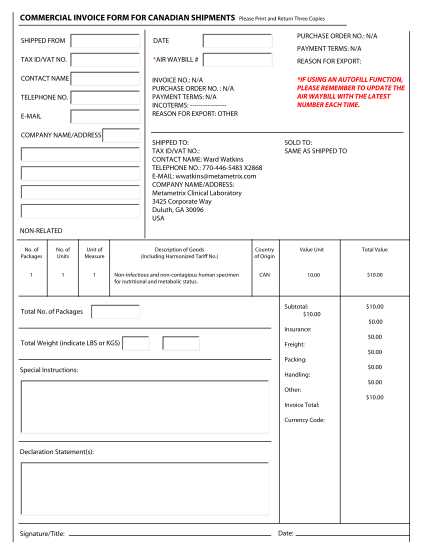

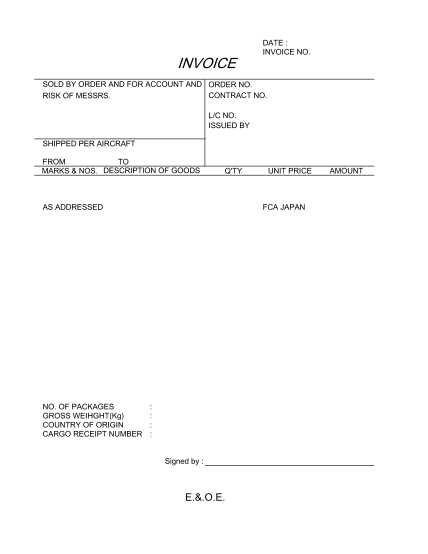

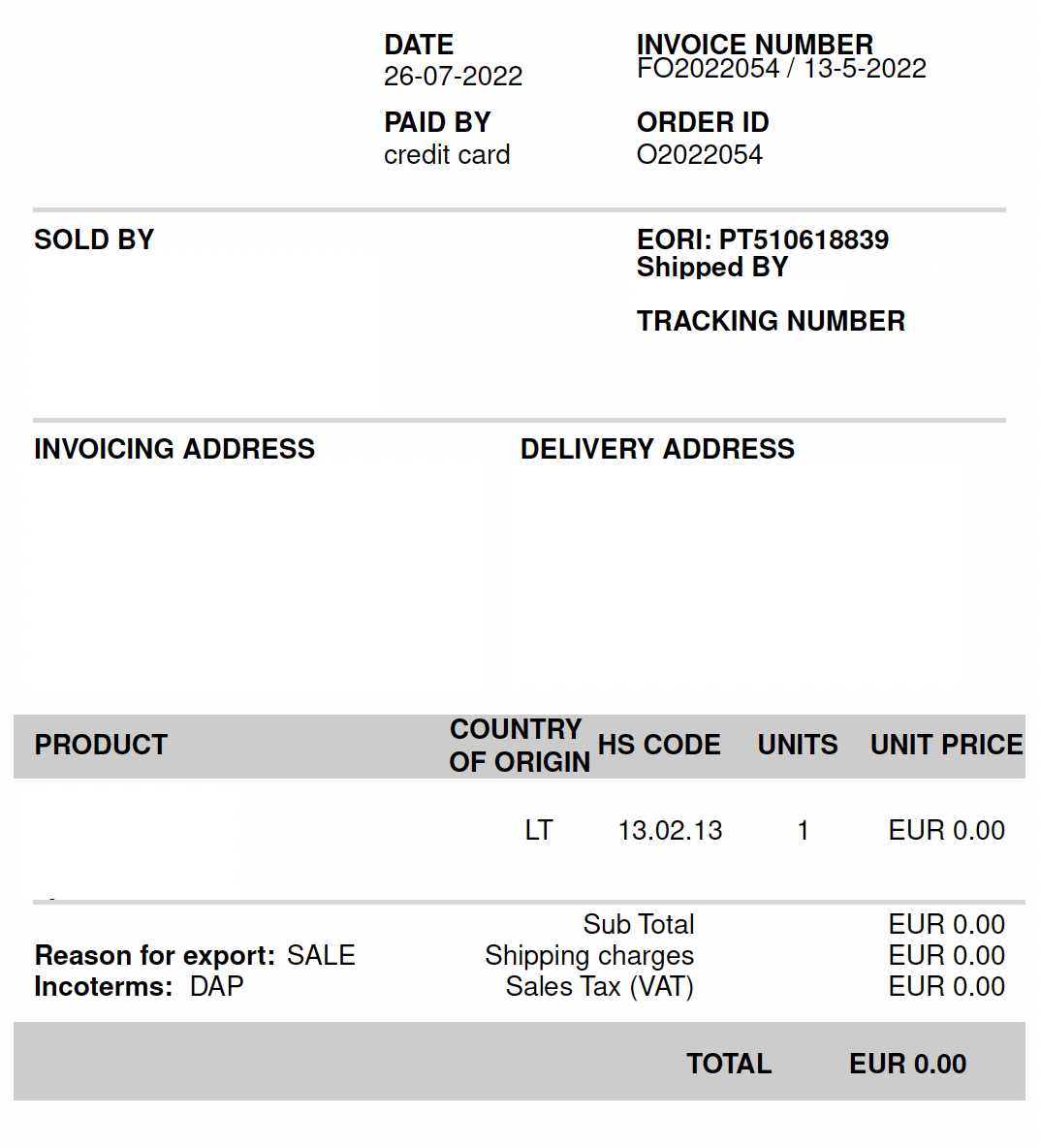

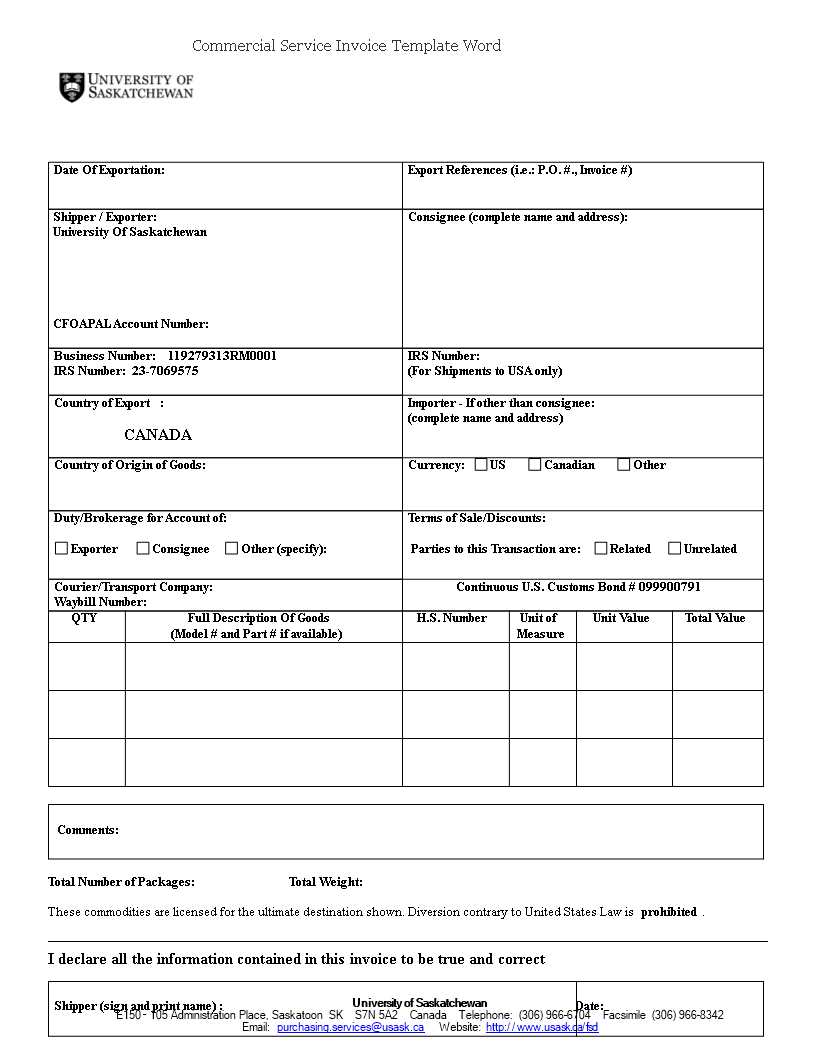

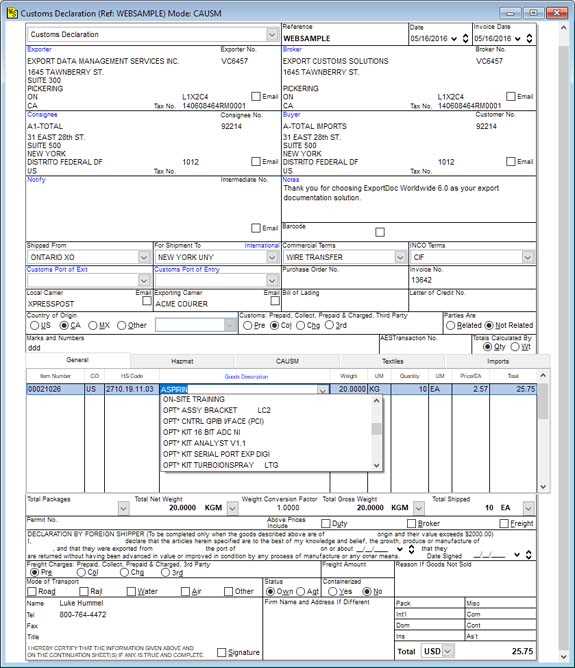

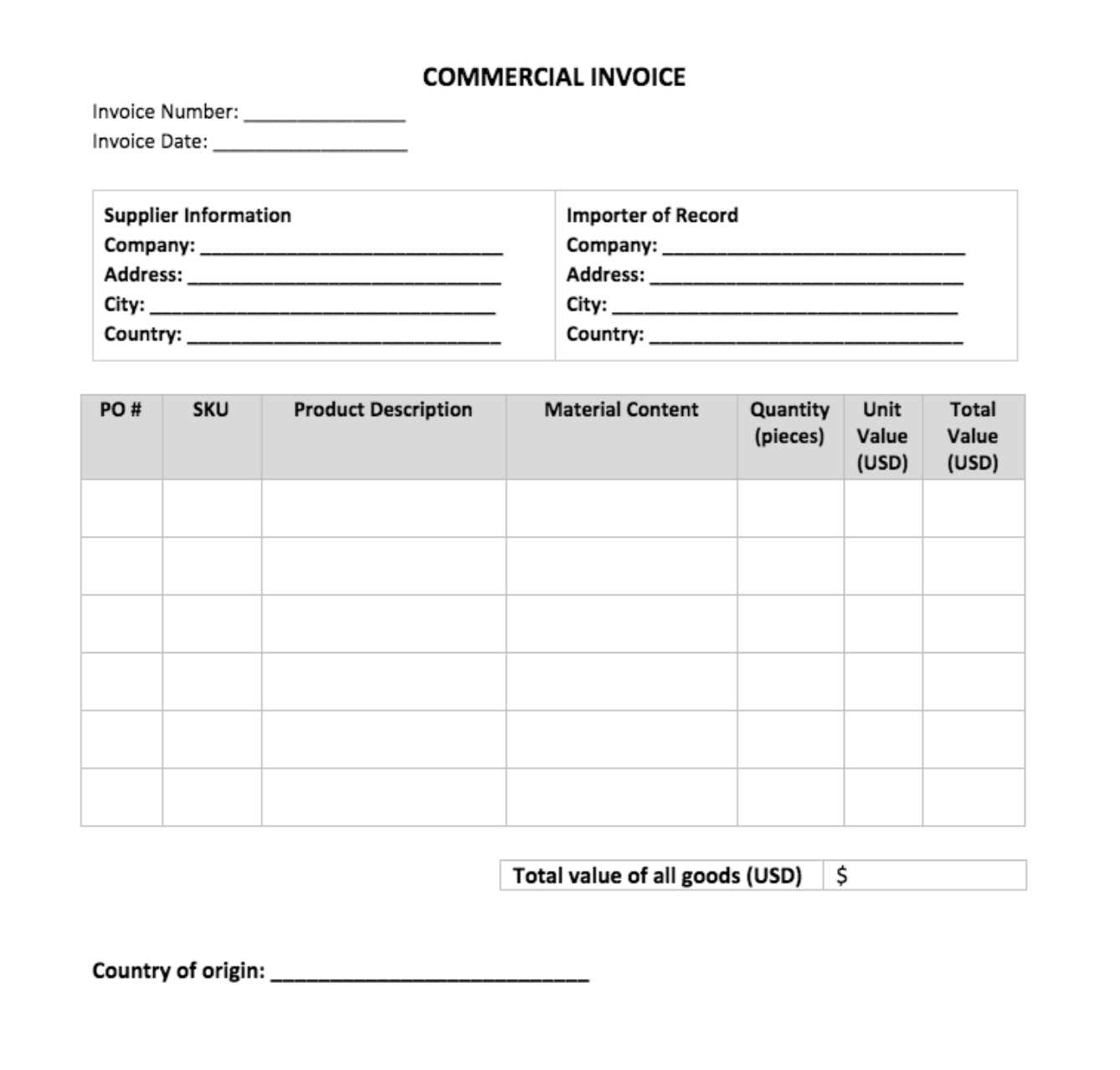

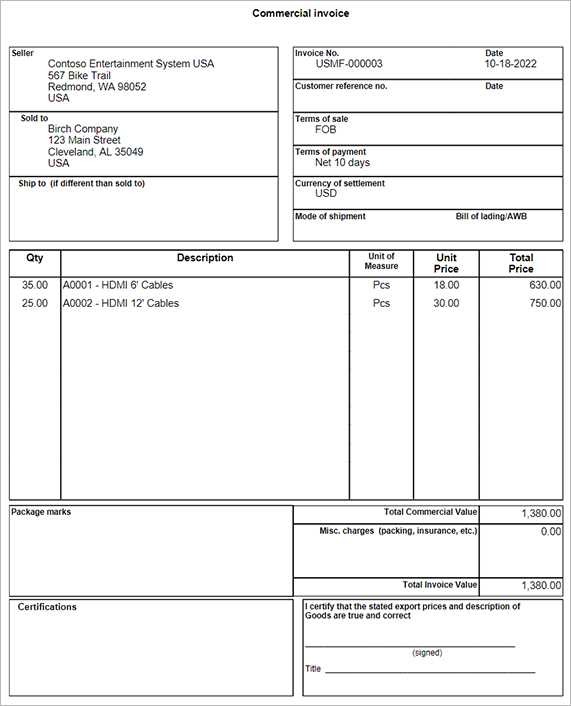

How to Create a Shipping Documentation Form

Creating a comprehensive and accurate document for international shipments is essential for smooth processing and compliance with trade regulations. A well-designed form can help both the sender and recipient ensure that all necessary information is included, reducing the risk of delays and fines. Below are key steps to guide you in crafting a reliable document for cross-border transactions.

Step-by-Step Guide to Structuring the Document

To create an effective shipping declaration, follow these key steps:

- Gather Required Information: Before starting, collect all relevant details about the goods being shipped, including descriptions, values, and the addresses of both sender and recipient.

- Design the Layout: Choose a clean and organized layout that allows easy input of all the required fields. A good layout helps to avoid confusion and ensures nothing is overlooked.

- Include Basic Information: Include essential fields like sender and recipient details, description of goods, and declared value. These are the core components that must always be included.

- Leave Space for Additional Information: Create sections for extra details, such as HS codes, country of origin, and shipping terms, that may vary depending on the type of goods or shipment.

- Ensure Clarity and Accuracy: The language used should be simple and precise. Any vague descriptions can lead to errors and delays during processing.

Additional Tips for a Comprehensive Form

Once you’ve structured the basic layout, consider these tips to enhance the functionality and accuracy of the form:

- Use Predefined Fields: To reduce mistakes, create predefined fields for the most common data points (such as product categories, shipping methods, or taxes) to make filling out the document faster and more consistent.

- Include Legal Clauses: Depending on the jurisdiction, you may need to include specific legal language or disclaimers about the contents of the shipment. This ensures that all parties are aware of their obligations.

- Digital Tools: Use digital tools or software that allow for automatic calculations (e.g., taxes or duties), which can reduce the chances of human error and save time during the process.

By following these steps and tips, you can create a reliable document that ensures smooth international shipping and compliance with all necessary regulations. Having a properly designed form reduces the likelihood of delays and makes the process more efficient for everyone involved.

Common Mistakes in Shipping Documentation

When preparing documentation for international shipments, errors in the paperwork can cause significant delays and additional costs. Even minor inaccuracies or missing details can lead to confusion at border controls, customs inspections, or financial penalties. Understanding the most common mistakes can help ensure that the forms are completed correctly and processed smoothly.

Typical Errors to Avoid

Here are some of the most frequent issues found in shipping declarations:

- Incorrect Description of Goods: A vague or incorrect description can result in the goods being misclassified, leading to delays or incorrect duties being applied. It’s important to be specific and accurate about the items being shipped.

- Missing or Inaccurate Value Declaration: Failing to declare the correct value of the goods or underreporting it to avoid higher duties can result in legal consequences and delays. Always ensure the declared value matches the invoice or receipt.

- Omitting Necessary Details: Some forms may require additional information like the country of origin, HS codes, or serial numbers for certain goods. Missing these details can cause a shipment to be flagged for further inspection.

- Inconsistent Unit Measurements: Using the wrong units for weight, volume, or quantity can cause discrepancies in calculating tariffs or lead to misunderstandings regarding the goods being shipped.

- Errors in Consignee and Sender Information: Any mistakes in the contact details of the sender or recipient can cause significant delays in the shipment process. It’s essential to verify that all names, addresses, and contact numbers are accurate and up to date.

How to Prevent These Mistakes

By taking a few simple precautions, you can reduce the risk of errors and ensure that the process goes smoothly:

- Double-check all information: Review all sections of the documentation thoroughly before submission. This includes verifying the descriptions, values, and contact details.

- Use Automated Tools: Utilize digital tools or software designed for international shipments that can help fill in mandatory fields, perform calculations, and reduce the risk of human error.

- Stay Updated with Regulations: Trade laws and regulations change frequently. Be sure to stay informed about the latest requirements for shipping and customs declarations in the destination country.

Avoiding these common mistakes can help ensure that your shipments pass through customs quickly and without unnecessary complications, saving both time and money.

Why You Need a Shipping Declaration Form

Having a structured and organized document for international shipments is essential for ensuring smooth processing at border checkpoints. A reliable form helps both parties involved–sender and recipient–ensure that all the necessary details are provided, reducing the risk of errors, delays, and additional costs. Without such a document, it can be difficult to maintain consistency and compliance with regulations, leading to complications with customs authorities.

Key Reasons to Use a Standardized Shipping Document

Here are several reasons why having a ready-made form for international shipments is important:

- Consistency in Documentation: A standardized form ensures that all relevant information is included every time. This reduces the risk of leaving out critical details that might delay the shipment or cause confusion during the approval process.

- Faster Processing: A well-organized form speeds up the clearance process at borders, as it enables customs authorities to quickly assess and process shipments. This can significantly reduce the time goods spend in transit.

- Compliance with Regulations: International trade regulations often change, and a proper document template helps ensure that you meet all the latest requirements. This minimizes the risk of fines or shipment rejections due to missing or incorrect information.

- Ease of Use: A pre-designed form makes it easier for both businesses and customers to fill in the necessary details correctly, without the need for complex documentation knowledge or training.

- Cost-Effectiveness: By ensuring that all required information is included and correctly formatted, you avoid costly delays and administrative expenses that can arise from incomplete or incorrect paperwork.

How a Proper Form Helps in International Trade

Utilizing a well-structured shipping document form simplifies the entire export and import process. It ensures that the details of each shipment are consistent and compliant with international trade standards, which not only saves time but also prevents unnecessary complications. A properly completed form can also improve communication between the seller, buyer, and customs authorities, ensuring that the shipment reaches its destination without issues.

In conclusion, using a standardized shipping document is a crucial step in facilitating smooth and efficient international transactions. It helps businesses stay compliant, reduce costs, and ensure timely delivery of goods across borders.

Best Practices for Shipping Documentation

When preparing documentation for international shipments, following best practices is crucial for ensuring accuracy, compliance, and efficiency. Properly completed forms not only prevent delays but also help avoid costly mistakes, fines, or legal complications. Whether you’re a first-time exporter or a seasoned business owner, adhering to best practices in document preparation is essential for smooth cross-border transactions.

Key Guidelines to Follow

To ensure that your shipping documentation is complete and error-free, consider the following guidelines:

- Be Detailed and Specific: Always provide clear and precise descriptions of the goods being shipped. Avoid vague terms like “miscellaneous” or “various items,” as these can lead to misclassification and delays in processing.

- Double-Check Value Declarations: Make sure the value of the goods matches the actual transaction value. Incorrectly declared values can result in penalties or delays in clearing goods through customs.

- Use the Correct Classification Codes: Ensure that each product is accurately classified according to the Harmonized System (HS) codes. Misclassified items can incur unnecessary tariffs or fines, and they may be subject to extra inspections.

- Verify Sender and Recipient Details: Incorrect names, addresses, or contact information can lead to delays in delivery or the return of goods. Always confirm that these details are up to date and accurate.

- Stay Informed About Regulations: International trade laws can change frequently. Make sure you’re up to date on the latest import/export regulations for the countries you’re dealing with to avoid errors and fines.

How to Streamline the Documentation Process

Adopting a systematic approach to creating and submitting shipping documents can greatly reduce the risk of mistakes. Here are some strategies to help streamline the process:

- Implement Digital Solutions: Use software or online tools that help automate the generation of shipping forms, reducing the risk of human error and speeding up the process.

- Prepare in Advance: Gather all necessary details, such as the value, description, and origin of

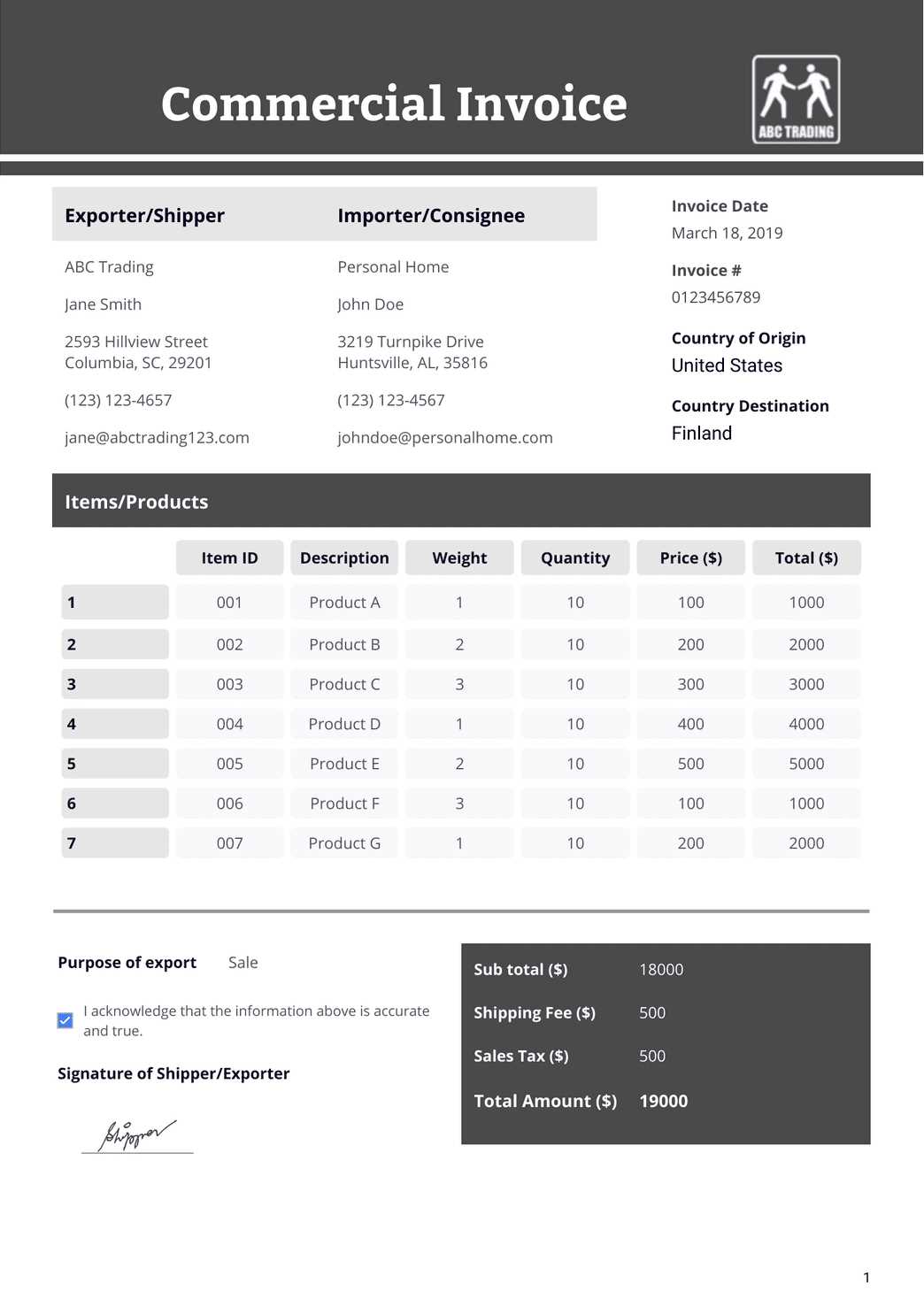

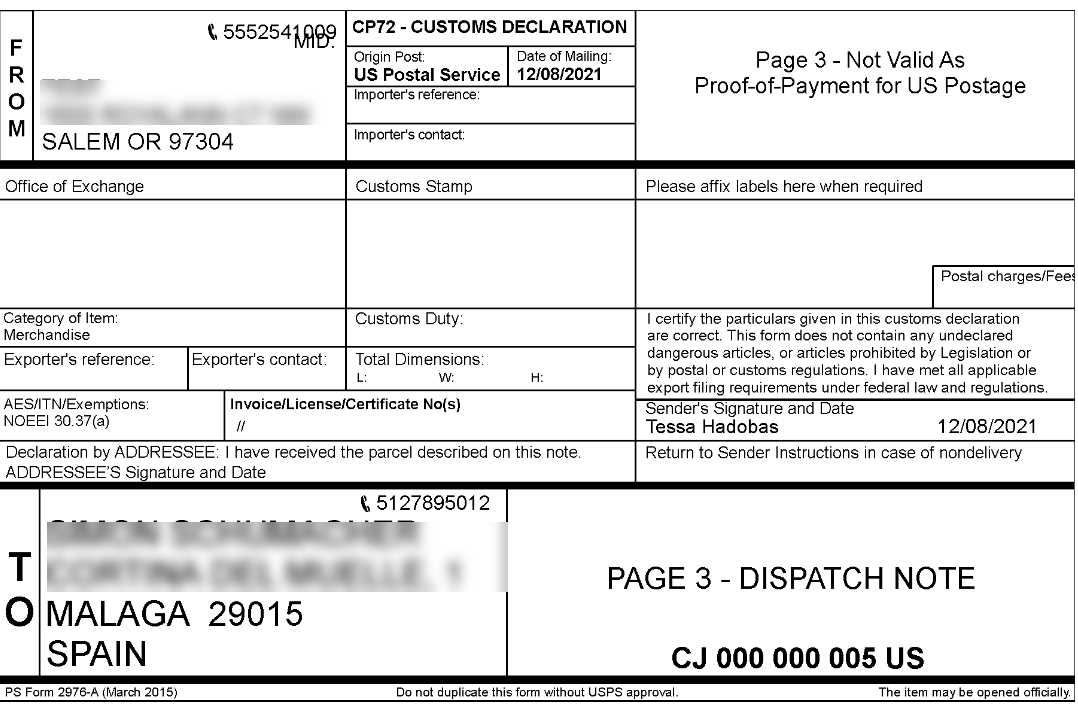

How to Fill Out a Shipping Declaration Form

Completing a shipping declaration form accurately is essential for smooth processing at border control and customs clearance points. This document provides vital details about the shipment, ensuring that authorities can properly assess duties, taxes, and regulations. The process may seem complex, but with the right approach, you can fill out the form with confidence and efficiency.

Step-by-Step Guide to Completing the Document

Follow these steps to correctly fill out the form for international shipments:

- Fill in Sender and Recipient Information: Provide the full name, address, and contact information of both the sender and recipient. Double-check the accuracy of the details to prevent delays in delivery.

- Describe the Goods: Clearly describe each item being shipped, including the quantity, material, and intended use. The more specific you are, the less likely the goods will be flagged for additional inspection.

- Declare the Value of the Goods: Include the exact value of the items, based on the transaction or market value. This helps authorities determine the applicable duties and taxes. Be honest, as misreporting the value can result in fines.

- Provide the Country of Origin: Indicate where the goods were manufactured or assembled. This is important for determining if trade agreements or restrictions apply to the shipment.

- Include Harmonized System (HS) Codes: Assign the appropriate HS code for each product. This code classifies the goods for international trade and helps calculate the correct tariff rates.

Additional Sections to Complete

In addition to the core components, there may be other sections on the form that need attention:

- Shipping Terms and Conditions: Clearly state the agreed-upon terms for the shipment, such as Incoterms (e.g., FOB, CIF) and payment details, to ensure both parties are aware of their responsibilities.

- Special Instructions: If there are any special handling instructions, such as fragile or perishable goods, include them in the designated section to avoid mishandling.

- Sign and Date the Form: After all sections are filled out, ensure that the form is signed and dated by the appropriate party, typically the sender or exporter, to confirm that all information is accurate and complete.

By following these steps carefully, you can complete your shipping declaration form with precision, ensuring that the shipment passes through customs without unnecessary delays. Proper documentation is key to smooth and efficient international transactions.

What Information Should Be Included

When preparing documentation for an international shipment, it’s crucial to include all relevant information to ensure smooth processing and compliance with regulations. Missing or inaccurate details can lead to delays, additional costs, or complications with customs authorities. To avoid such issues, certain key elements should always be included in your shipping documentation.

Essential Information to Include

The following are the fundamental components that must appear in any international shipment document:

- Sender and Recipient Details: Clearly state the full name, address, and contact information of both the sender and recipient. This ensures that the shipment reaches the correct destination and that both parties can be easily contacted if needed.

- Description of Goods: Provide a detailed description of each item being shipped. Be specific about the type, quantity, and purpose of the goods to avoid confusion or misclassification.

- Declared Value of Goods: The value of the items being shipped must be accurately declared. This is used to calculate applicable taxes and duties. Failing to declare the correct value can result in fines or delays.

- HS Codes (Harmonized System): Include the appropriate product classification code for each item. These codes are used by customs authorities to determine the tariff rates and are essential for smooth processing.

- Country of Origin: Indicate the country where the goods were manufactured or produced. This is important for determining if any trade agreements or restrictions apply.

Additional Details to Consider

Depending on the type of shipment, there may be additional information that should be included to ensure compliance and facilitate the customs clearance process:

- Shipping Method and Terms: Specify the shipping method (air, sea, land) and terms (e.g., FOB, CIF) to clarify the responsibilities of both the sender and the recipient regarding the delivery process.

- Freight Charges: Include the details of shipping costs, especially if they are being paid by the sender or recipient. This helps customs authorities understand the full value of the shipment.

- Serial Numbers or Product Identifiers: For high-value or regulated items, include serial numbers or unique identifiers to ensure the goods can be tracked and authenticated if necessary.

- Special Instructions: If there are specific handling requirements (such as fragile items or perishables), include these details to ensure proper treatment of the goods during transit.

By ensuring that all of this information is complete and accurate, you can significantly reduce the chances of delays and complications during the international shipping process. Proper documentation is essential to ensure that goods move smoothly and in full compliance with all applicable laws and regulations.

How to Avoid Shipping Delays

Ensuring that your shipment moves quickly through the approval process is critical to avoiding unnecessary delays. Delays at border checkpoints can disrupt supply chains, increase costs, and create frustration for both the sender and the recipient. By following certain best practices when preparing your shipment, you can minimize the risk of hold-ups and ensure timely delivery.

Key Steps to Prevent Delays

To ensure that your goods move through the processing stages without issues, follow these essential tips:

- Provide Accurate and Complete Documentation: One of the most common reasons for delays is incomplete or inaccurate paperwork. Make sure all required fields are filled out correctly, including descriptions, values, and shipping details.

- Ensure Proper Classification: Incorrect classification of goods can lead to delays and additional inspections. Always verify the correct product codes (HS codes) and ensure they match the shipment’s contents.

- Declare the Correct Value: Underreporting the value of goods can lead to fines and additional inspections. Be honest and precise about the value of your shipment, as this impacts tax and duty calculations.

- Include Full Sender and Recipient Information: Incorrect or incomplete contact details for either party can cause confusion and delays in delivery. Double-check all names, addresses, and phone numbers.

- Review Shipping Terms: Clearly outline the shipping terms, such as Incoterms, to avoid any misunderstandings regarding the responsibilities of both the sender and recipient. Discrepancies in terms can delay customs clearance.

Other Considerations to Keep in Mind

There are several other factors that can affect the speed at which your shipment moves through the approval process:

- Be Aware of Trade Regulations: Different countries have different import regulations. Familiarize yourself with the current regulations in both the country of origin and the destination to avoid unnecessary surprises.

- Pre-Check Special Handling Requirements: If you’re shipping regulated or sensitive goods, such as chemicals, electronics, or food items, ensure that all necessary permits and certifications are included with the shipment. Missing documentation for specialized goods can cause significant delays.

- Choose a Reliable Carrier: Work with trusted and experienced shipping carriers who are familiar with the requirements for smooth international shipments. Their expertise can help navigate the often complex requirements at border controls.

By following these steps and being diligent with your documentation, you can avoid most common delays and ensure your goods are processed efficiently. The goal is to make your shipment as clear and straightforward as possible for customs authorities, reducing the risk of holdups that can disrupt the delivery timeline.

Understanding Harmonized System Codes

The Harmonized System (HS) is an internationally standardized system for classifying traded products. It is crucial for customs authorities, as it helps determine tariffs, taxes, and regulations that apply to specific goods. Properly classifying items using the correct HS code ensures smoother processing of shipments and helps avoid delays, fines, and compliance issues. Understanding how HS codes work is essential for anyone involved in international trade.

Each HS code consists of a six-digit number that identifies a particular product or category of goods. The first two digits represent the broadest category, while the subsequent digits provide more specific information about the product. Some countries may extend the code with additional digits to create more precise classifications for their internal purposes.

Here’s why understanding these codes is important:

- Determining Tariffs and Duties: HS codes are used by authorities to calculate taxes and import/export duties. Correctly classifying products ensures that the appropriate fees are applied to your shipment.

- Customs Compliance: Incorrect or missing HS codes can result in delays or rejections of goods at border checkpoints. It is essential to use the correct codes to avoid complications and ensure compliance with international trade regulations.

- Trade Agreements and Preferences: Many countries have trade agreements that offer reduced duties or preferential treatment on certain products. By using the correct HS code, businesses can take advantage of these agreements to reduce costs.

Overall, a good understanding of HS codes is fundamental to ensuring that shipments are processed quickly and smoothly. By accurately classifying goods, traders can avoid unnecessary complications and ensure compliance with international trade rules.

How to Calculate Import Duties

When goods are shipped internationally, import duties are levied by authorities based on the value and classification of the products. These duties are calculated using a variety of factors, including the nature of the goods, their value, and the country of origin. Accurately calculating import duties is essential for both businesses and consumers to avoid unexpected costs and ensure compliance with trade regulations.

The process of calculating import duties typically involves the following steps:

- Determine the Customs Value: The first step in calculating duties is to establish the customs value of the goods. This is generally the transaction value, which is the price paid or payable for the goods. If additional costs are incurred (such as shipping or insurance), these may also be included in the customs value.

- Identify the Correct Product Classification: Each product must be classified using a code from the Harmonized System (HS). The classification determines the tariff rate that will apply to the product. Different products may fall under different tariff categories, even if they are similar in nature.

- Apply the Relevant Tariff Rate: Once the product classification is established, the appropriate tariff rate is applied to the customs value of the goods. The rate may vary based on the product category and trade agreements between the countries involved.

- Account for Additional Fees: In some cases, additional fees, such as anti-dumping duties or excise taxes, may apply. These are calculated in addition to the standard import duty and can vary by product type and country of origin.

To give an example, let’s say you’re importing a shipment worth $1,000, and the product falls under a category with a 10% tariff rate. The basic import duty would be calculated as $1,000 × 0.10 = $100. If there are any additional fees or taxes, these would be added to this amount, resulting in the total import duty due.

It’s important to note that duty calculations can vary by country, and different countries may have different methods for assessing and applying tariffs. For instance, some regions may have preferential duty rates for certain goods based on trade agreements. Therefore, it’s critical to stay informed about the latest regulations and consult with customs brokers or professionals when necessary.

By understanding how import duties are calculated, businesses can more accurately estimate their costs and avoid unexpected expenses during international shipping. Proper planning ensures a smoother import process and compliance with global trade regulations.

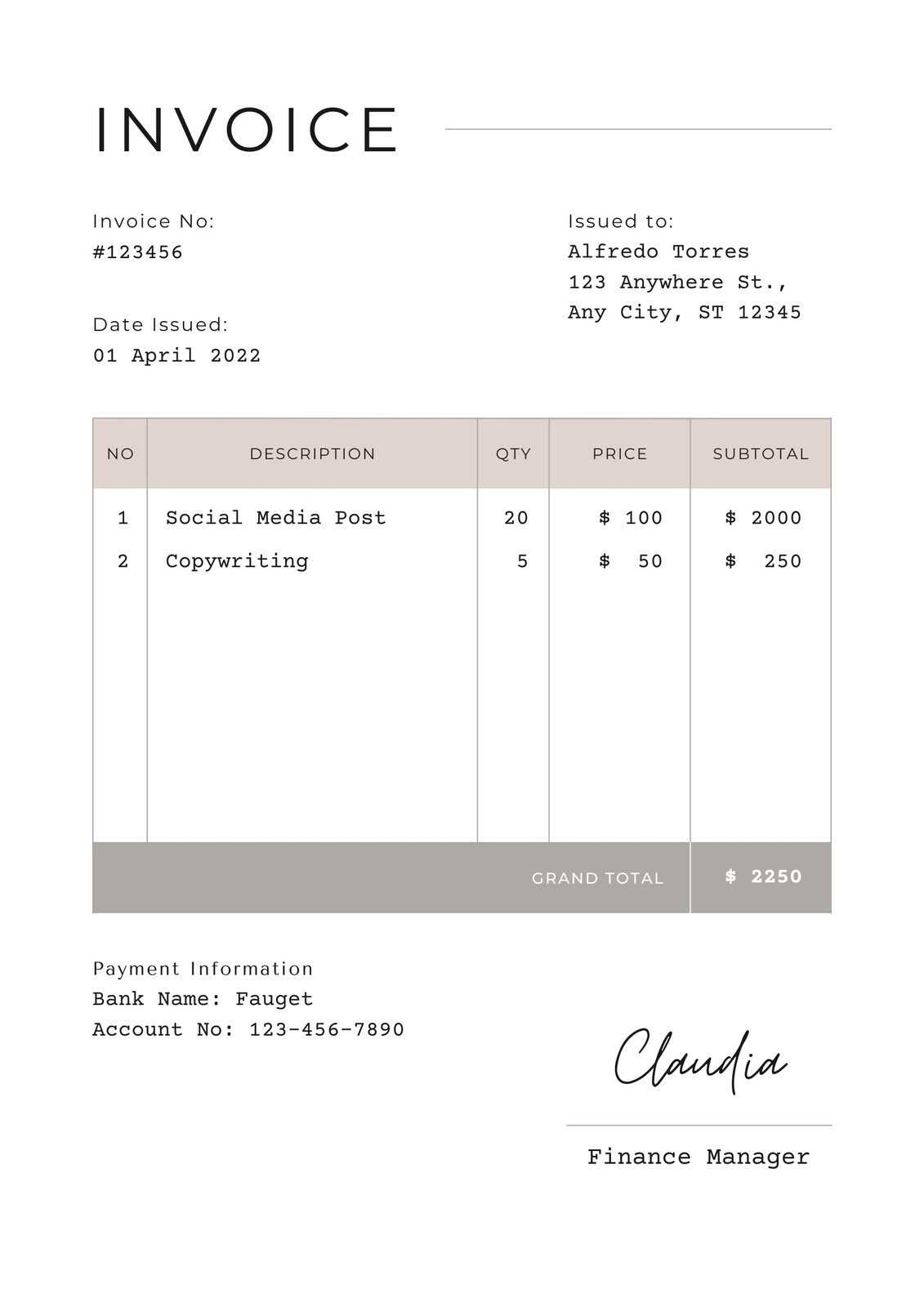

Digital vs. Paper Shipping Documentation

The debate between digital and paper-based shipping documentation has gained importance in recent years, especially as global trade has increasingly moved online. While both formats serve the same purpose–providing detailed information about the goods being shipped–there are key differences in efficiency, accuracy, and convenience. Understanding the advantages and disadvantages of each can help businesses choose the best method for their shipping and regulatory needs.

Advantages of Digital Documentation

Digital shipping documents have become the preferred choice for many businesses due to their convenience and speed. Some key benefits include:

- Speed and Efficiency: Digital documentation can be submitted and processed almost instantaneously, reducing wait times and speeding up the clearance process. This is especially important for businesses that need to move goods quickly.

- Reduced Errors: Automated systems can minimize human errors, such as missing details or incorrect information, which are more likely in paper documents.

- Easy Storage and Access: Digital files are easy to store, organize, and retrieve. This eliminates the need for physical storage space and makes it easier to track and update documentation.

- Environmentally Friendly: Reducing paper use is a key benefit of going digital. It helps decrease waste and contributes to more sustainable business practices.

Advantages of Paper Documentation

Despite the growing use of digital formats, paper documentation still has its place, particularly in certain regions or situations. The benefits of paper documents include:

- Legal Requirements: Some countries or jurisdictions may still require paper-based documentation for official purposes. In these cases, a physical copy may be necessary to meet local regulatory requirements.

- No Technology Reliance: Paper documentation doesn’t require access to the internet or specific software, making it a reliable option in areas with limited digital infrastructure.

- Physical Proof: Paper documents can serve as physical proof of transaction, which may be beneficial in disputes or legal matters.

Overall, while digital documentation is becoming the standard in many parts of the world due to its speed and efficiency, paper documents continue to be used in certain contexts. The choice between digital and paper shipping documentation largely depends on factors such as regulatory requirements, technology access, and the specific needs of the business. However, the trend is moving towards digitalization, offering many advantages in terms of speed, accuracy, and sustainability.

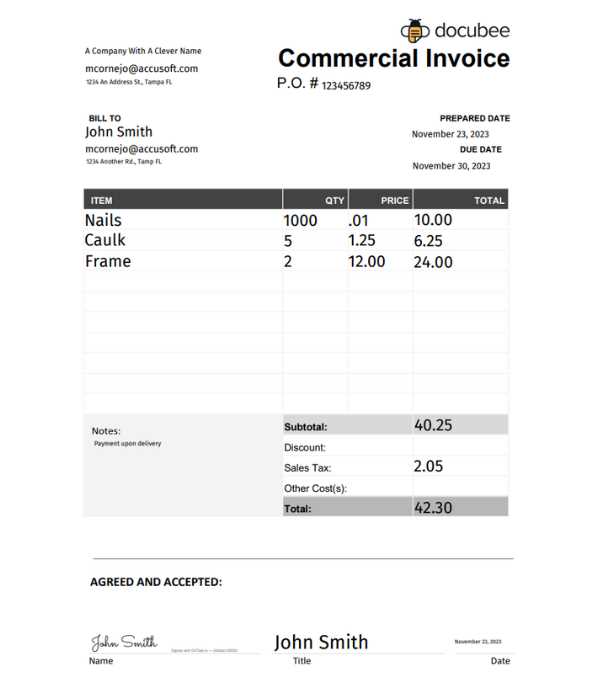

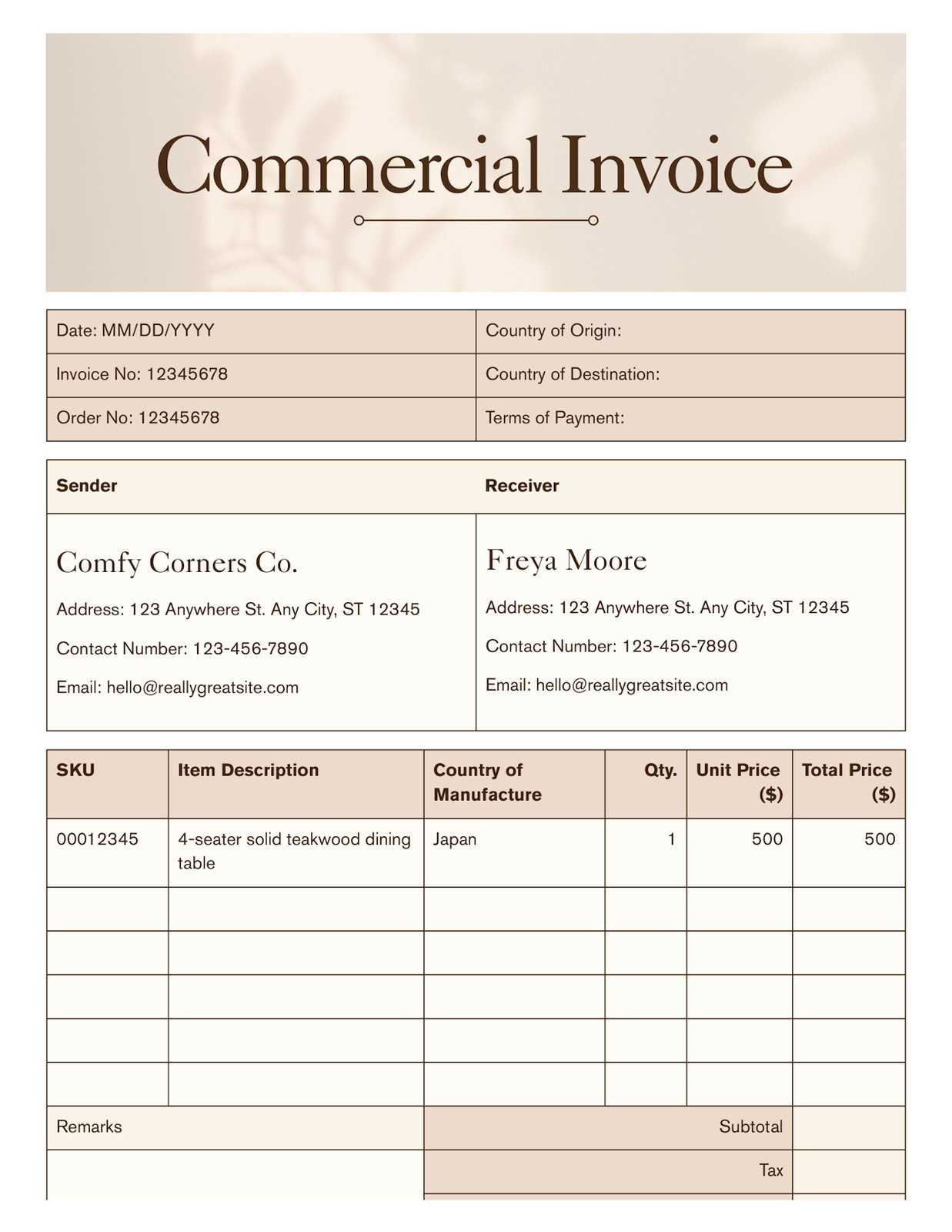

Shipping Documentation Template for International Shipments

When shipping goods across borders, it’s essential to provide a clear and accurate record of the transaction to ensure that the goods are processed efficiently by authorities. A well-organized document that outlines key details about the shipment helps to prevent delays and ensures compliance with regulations. This document typically includes important information about the sender, recipient, and the nature of the goods being shipped.

Here’s a list of the essential elements to include in a shipping document for international deliveries:

- Sender and Recipient Information: Include the full names, addresses, and contact details for both the sender and the recipient. This ensures that the goods can be properly identified and delivered.

- Description of Goods: Clearly describe the items being shipped, including the quantity, type, and any distinguishing characteristics. Providing an accurate description is crucial for classification and for determining applicable duties and taxes.

- Value of Goods: Declare the value of the goods being shipped. This is important for determining the applicable duties, taxes, and insurance fees. It’s essential that this value matches the price paid for the goods.

- HS Codes (Harmonized System Codes): Include the correct HS code for each item. This system helps authorities classify goods and apply the right tariff rates. Different goods may fall under different classifications, so accuracy here is key.

- Country of Origin: State the country where the goods were manufactured or produced. This is necessary for determining any applicable trade agreements or restrictions.

- Shipping Method and Terms: Specify the shipping method (e.g., air, sea, land) and the agreed-upon shipping terms (e.g., FOB, CIF). These terms define the responsibilities of both the sender and recipient in the shipping process.

- Freight and Other Charges: Detail any additional shipping or handling fees, including insurance or freight charges, that are part of the shipment. This helps authorities understand the full cost of the transaction.

- Special Instructions: If there are any specific handling instructions or conditions for the goods (e.g., fragile, perishable, or hazardous items), include this information to ensure proper handling during transport.

By including all these details in your shipping documentation, you will help facilitate smooth processing through international borders. This ensures that the goods are correctly classified, that proper duties are applied, and that the shipment reaches its destination without unnecessary delays or issues.

Shipping Documentation Software Tools

Creating and managing shipping documents can be a time-consuming task, especially when dealing with international shipments. To simplify this process, various software tools are available that help businesses generate accurate and compliant documentation. These tools streamline the creation of essential documents, ensuring that all necessary information is included and formatted correctly for customs clearance. Using the right software can save time, reduce errors, and improve the efficiency of international trade.

Here are some key features of software tools designed for creating shipping documents:

- Automated Document Generation: Many software tools allow users to create and generate shipping documents automatically, reducing the need for manual entry. The system often pulls in relevant details from other records or databases, ensuring consistency and accuracy.

- Integration with Shipping Carriers: Many tools integrate directly with major shipping carriers, allowing users to automatically populate shipping forms with tracking numbers, delivery methods, and shipping terms. This integration helps streamline the entire shipping process.

- Pre-Built Templates: Some tools offer pre-built document templates, which can be customized to fit specific business needs. These templates ensure that the correct fields are included and formatted according to international regulations.

- Real-Time Compliance Updates: A good software tool will provide real-time updates on changing regulations, ensuring that your shipping documents are always compliant with the latest rules and standards in the destination country.

- Multi-Language Support: For businesses operating internationally, many tools offer multi-language capabilities, allowing users to create documents in different languages. This feature is especially useful for working with international clients and customs authorities.

- Cost Calculation Tools: Some platforms include built-in cost calculators, helping businesses estimate potential duties, taxes, and other shipping-related costs. This feature helps in managing budgets and providing accurate cost information to customers.

By using shipping documentation software, businesses can streamline the creation of necessary forms, avoid costly mistakes, and ensure compliance with all international trade regulations. Whether you’re a small business or a large enterprise, these tools help make the shipping process more efficient and manageable.

Shipping Document Customization Tips

Customizing shipping documentation is essential for ensuring that it meets the specific needs of your business and complies with regulatory requirements. Tailoring the document allows businesses to include relevant information, streamline the process, and ensure accuracy. Customization can also help improve communication with clients and simplify administrative tasks, making the shipping process more efficient.

Essential Customization Features

When customizing your shipping documentation, here are several key features to focus on:

- Company Branding: Include your company’s logo, name, and contact information at the top of the document to make it look professional and clearly identifiable.

- Field Flexibility: Customize fields to include only the necessary information for your business and specific shipment. For example, you can add extra fields for handling instructions, packaging details, or any additional services.

- Language and Currency Options: If you are dealing with international shipments, consider customizing the document to include multiple language options and adjust currency fields to reflect the appropriate unit of measurement for the region.

- Regulatory Compliance: Ensure that all necessary legal information and fields for regulatory purposes are included. This may involve specific codes, declarations, or certification information depending on the nature of the shipment.

Formatting for Clarity and Efficiency

The design and layout of your shipping document are just as important as the content. A well-structured document will help minimize confusion and ensure smooth processing. Consider these tips for improving the layout:

- Clear Section Divisions: Break the document into clearly defined sections, such as sender and recipient details, product descriptions, and cost breakdowns. This ensures that the information is easy to find and understand.

- Consistent Formatting: Use a consistent font style and size for readability. Make sure headers are bold and sections are clearly separated with lines or spaces for visual clarity.

- Automated Calculations: If the document includes pricing or cost-related information, ensure that it can automatically calculate totals, taxes, and shipping fees. This helps prevent human errors and ensures accurate pricing.

Sample Shipping Document Layout

Here’s a basic layout for a customized shipping document:

Sender Information Name: How to Store Your Shipping Documentation

Proper storage of shipping documentation is essential for ensuring that records are easily accessible and compliant with legal and regulatory requirements. Whether you are managing a few shipments or handling a high volume of international transactions, organizing and securely storing these documents is crucial. A well-structured storage system helps you quickly retrieve important records when needed, such as for audits, compliance checks, or disputes with customers or authorities.

Digital Storage Methods

Many businesses are moving towards digital storage systems to streamline the organization of their shipping records. Some of the key benefits of digital storage include quick access, reduced physical storage space, and easier management. Here are a few tips for storing documents digitally:

- Use Cloud Storage: Cloud platforms like Google Drive, Dropbox, or specialized software provide secure online storage for your shipping records. Cloud services often offer features like automatic backups and file sharing, making it easier to collaborate with team members or external partners.

- Implement Proper File Naming Conventions: Consistently name files using clear, organized naming conventions. For example, you could use the shipment date, recipient’s name, and document type (e.g., “2024-11-05_RecipientName_ShippingDoc”) to make it easy to find and sort documents.

- Organize with Folders and Subfolders: Organize your files into well-structured folders by year, region, or shipment type. This will help you locate records more quickly and reduce the chances of losing important documents.

- Secure Your Files: Ensure that your digital storage is protected with strong passwords and encryption to avoid unauthorized access. Many cloud storage providers offer additional security features like two-factor authentication and file encryption.

Physical Storage Methods

Despite the shift towards digital storage, some businesses still prefer or are required to store paper-based documents. For physical storage, the following best practices can help ensure records are kept safe and accessible:

- Use a Filing Cabinet or Storage Box: Store documents in labeled folders or filing cabinets to keep them organized. You can sort records by year, recipient, or shipment type to make it easier to find specific paperwork when needed.

- Ensure Proper Climate Control: Store documents in a dry, cool place to prevent damage from moisture, heat, or sunlight. This helps to preserve the condition of the documents and ensures their longevity.

- Back Up Critical Documents: Make copies of important shipping documents and store them i