Free Catering Invoice Template Download

When managing events and food services, providing clients with clear, professional documentation of charges is essential for smooth transactions. A well-structured document ensures both clarity and trust between service providers and customers. It serves not only as a record of the transaction but also as a formal agreement on services rendered, pricing, and payment terms.

Creating such documents from scratch can be time-consuming. However, there are many resources available that offer customizable options, helping streamline the process. These resources are designed to suit various service needs, from simple food orders to large-scale event management. With the right tools, businesses can focus more on their core tasks while handling financial matters efficiently.

Understanding the components of an effective billing document can make all the difference. From listing services to specifying deadlines and amounts, every detail matters. With easy-to-use formats, service providers can create customized bills quickly, ensuring both accuracy and professionalism in every transaction.

Free Catering Invoice Template Download

For any business in the food or event services industry, creating accurate and professional billing documents is crucial. Accessing customizable formats can simplify this task, allowing for quick creation of billing records that maintain a high level of professionalism. These resources provide an easy way to produce detailed, clear statements for clients, improving workflow efficiency.

Benefits of Using Customizable Billing Documents

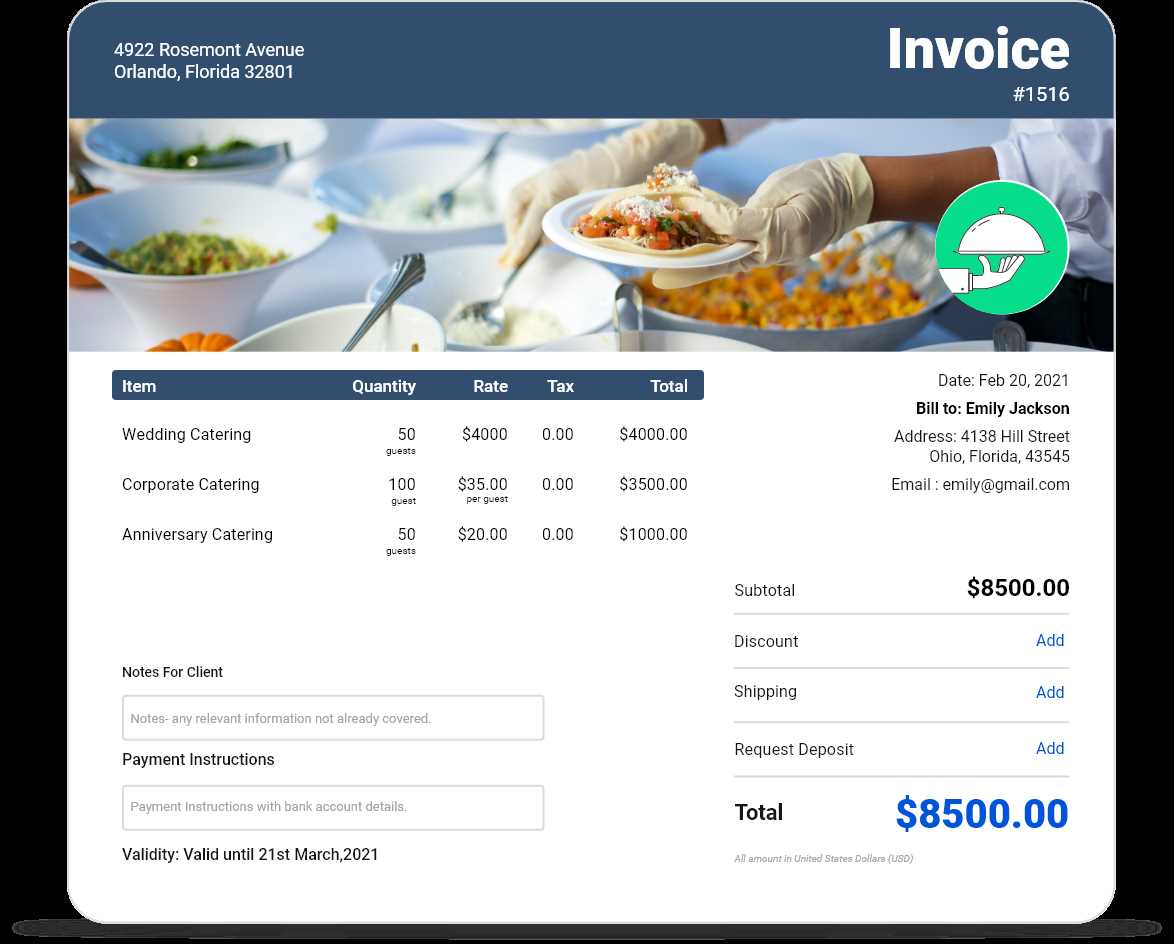

Using customizable formats can help streamline the billing process by ensuring that each document includes the necessary details, such as service descriptions, prices, payment terms, and client information. The ability to adjust these documents according to each specific job or client allows for a more personalized approach, which can enhance client satisfaction and reduce errors.

Key Features to Look for in Billing Documents

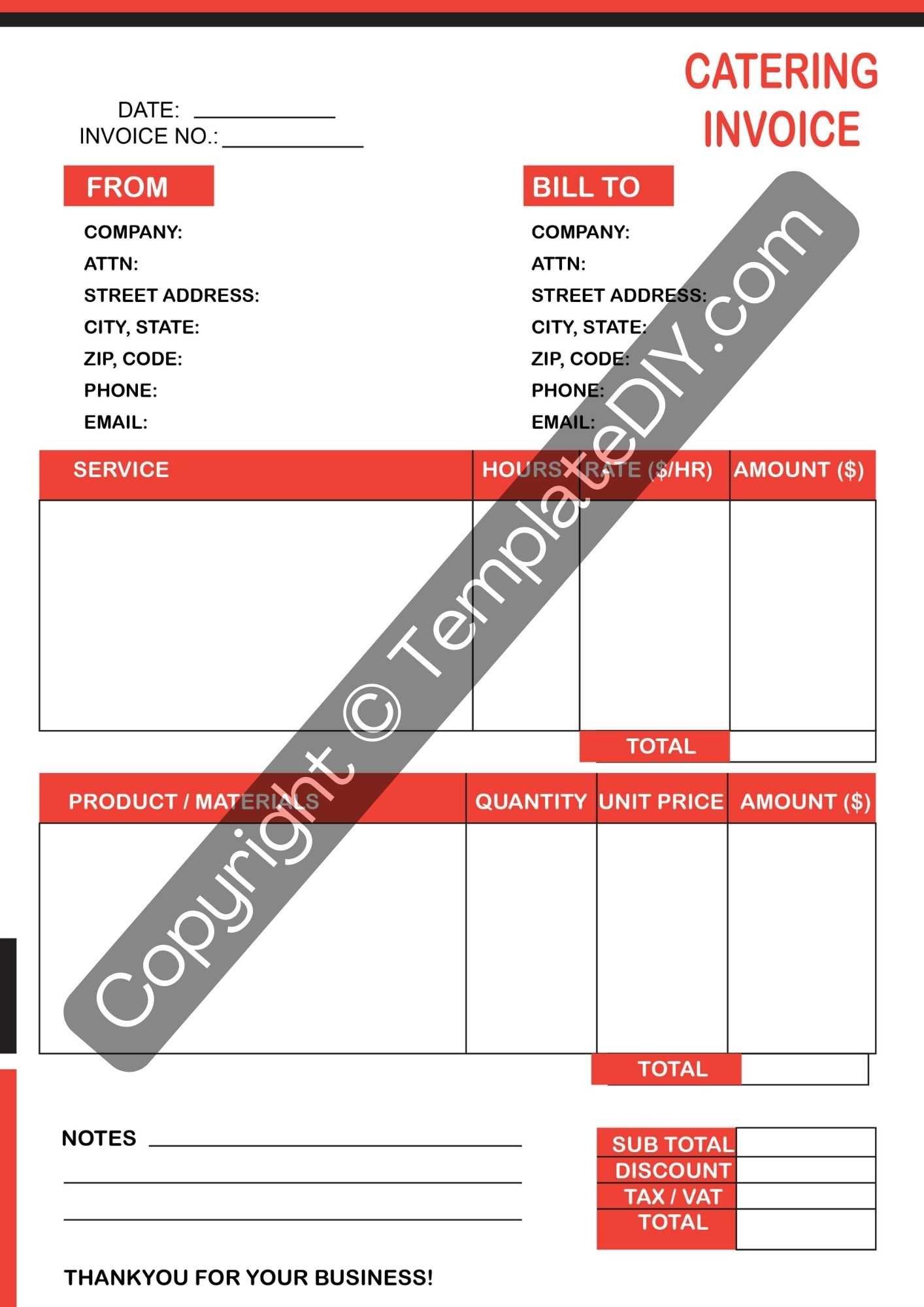

When choosing a resource for creating billing records, it’s important to select one that covers all the essential aspects of a financial document. Look for formats that include sections for itemizing services, indicating amounts, specifying due dates, and adding payment instructions. These features ensure that the document serves its purpose effectively, whether for small events or large-scale gatherings.

| Feature | Description |

|---|---|

| Service Breakdown | Clear listing of services provided with corresponding costs |

| Client Information | Fields for adding client name, address, and contact details |

| Payment Terms | Details of due dates, late fees, and payment methods accepted |

| Itemization | Ability to break down services into individual charges for transparency |

Having access to a comprehensive and easy-to-use document resource can save valuable time, helping businesses maintain a professional appearance while keeping their financial operations organized. With the right tool, creating well-organized billing statements becomes a simple and stress-free task.

Why Use a Billing Document Format

Efficient billing is a key aspect of managing any business in the food and event service industry. Having a ready-made format for creating financial records ensures consistency and professionalism. It allows service providers to quickly generate clear, precise statements for their clients, making the payment process smoother and reducing the risk of errors.

Improving Efficiency and Accuracy

Using a pre-structured format significantly speeds up the creation of financial documents. With predefined sections and fields, there is less chance of missing important details, ensuring that every service is accounted for correctly. This reduces the time spent on administrative tasks and minimizes errors that could lead to confusion or disputes with clients.

Enhancing Professionalism and Transparency

A well-organized and clear document communicates professionalism to clients. When all the necessary information is presented neatly and logically, it builds trust and reflects positively on the business. Additionally, the ability to itemize services and specify prices clearly ensures that clients fully understand the charges, leading to better transparency and customer satisfaction.

Key benefits:

- Time-saving – Quickly generate detailed records with minimal effort.

- Consistency – Maintain a uniform format for all financial documents.

- Clear communication – Ensure clients understand every charge.

- Professional image – Present a polished and reliable business appearance.

How to Customize Your Billing Record

Personalizing your financial documents helps reflect your business’s unique offerings and ensures accuracy in your records. Customization allows you to adjust key details such as service descriptions, pricing, and client information, which can vary with each project or client. By tailoring your document, you can meet both your needs and your client’s expectations more effectively.

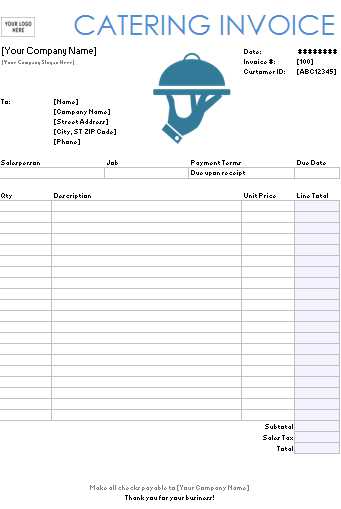

Steps to Personalize Your Document

Customizing a billing document is a straightforward process. Begin by updating the sections with your business name, contact details, and specific services provided. Next, adjust the pricing structure to match the services rendered and include any special terms or discounts as necessary.

- Update your company details – Name, address, phone number, and website.

- Include the client’s information – Name, address, and contact information.

- List the services provided with clear descriptions and prices.

- Specify payment terms – Include deadlines and any late fees if applicable.

- Insert tax rates if required, along with itemized amounts.

Additional Customization Tips

To further personalize your documents, consider adding a logo or adjusting the overall layout. Depending on your business style, you may prefer a simple or more elaborate design. Always ensure the document is easy to read and all details are clearly visible.

- Customize your document design – Add logos, change fonts, and colors.

- Ensure clear service breakdowns – Use bullet points for each item to enhance readability.

- Set payment reminders – Include a section for overdue payment notices or terms.

By tailoring these sections, you can create a professional, clear, and effective billing document that is fully suited to your business needs. This ensures better communication and helps streamline your financial processes.

Key Elements of a Billing Document

When creating a financial record for services rendered, several key components must be included to ensure clarity and accuracy. These elements help both the service provider and the client understand the terms of the transaction. A well-structured document will include not only a list of services and charges but also important details like payment instructions and deadlines.

Essential Components of a Billing Record

Each financial document should include specific sections to ensure that all necessary information is covered. Here are the core elements to include:

- Service Description – Clearly list the services provided, including any special requests or additional details related to the job.

- Pricing Breakdown – Specify the cost for each service or item, and include any discounts, taxes, or surcharges.

- Client Information – Include the client’s name, address, and contact information to ensure the document is properly addressed.

- Service Provider Details – Provide your business name, contact details, and payment methods accepted.

- Payment Terms – Outline the payment due date, accepted payment methods, and any applicable late fees or discounts for early payment.

Additional Information to Include

Depending on the nature of the services provided, there are other details that may be relevant to include in your document:

- Job/Order Number – A reference number can help both parties track the job and match payments to specific projects.

- Tax Details – If applicable, include the tax rate and the total amount of tax charged on the services.

- Notes or Special Instructions – Space for any additional comments or terms, such as cancellation policies or special conditions related to the work.

By ensuring all these key elements are included, you create a comprehensive and professional document that will help maintain clear communication and streamline the payment process for both you and your client.

Benefits of Using Pre-designed Formats

Utilizing pre-designed documents for financial records offers several advantages for businesses. These resources save time, reduce the risk of errors, and ensure consistency in every transaction. By opting for a ready-made format, businesses can focus more on their core operations rather than spending time designing and structuring records from scratch.

Time and Cost Efficiency

Pre-designed formats eliminate the need to create billing documents from the ground up. Instead of starting with a blank page, you can quickly enter the necessary details, speeding up the process. This not only saves time but also reduces the need for hiring specialized personnel or purchasing expensive software.

- Quicker Document Creation – Save time by filling in predefined sections.

- Cost-effective – Avoid additional expenses related to custom software or design services.

- Standardized Format – Maintain a consistent appearance across all documents.

Improved Accuracy and Consistency

Using a predefined structure ensures that no critical information is overlooked. Each section is laid out in a way that encourages comprehensive documentation, minimizing the chances of missing key details. Additionally, this consistency helps in maintaining a professional image and provides a reliable way of tracking transactions.

- Comprehensive Structure – Ensure all necessary details are included in each document.

- Professional Presentation – Present a polished and uniform format to clients.

- Reduced Errors – Predefined fields minimize the risk of missing important data.

Overall, using these resources simplifies administrative tasks and improves the quality of financial documentation, allowing businesses to operate more efficiently and present a more professional image to clients.

Choosing the Right Billing Format

Selecting the appropriate format for your financial documents is essential to ensure clarity and professionalism. The right structure helps both the service provider and the client understand the terms of the transaction, from the services rendered to the payment schedule. A well-chosen format can also improve the overall efficiency of your business by streamlining the creation of records and maintaining consistency across documents.

When deciding on the best document format, consider the nature of the services you offer, the complexity of your pricing, and the specific needs of your clients. Choose a format that is easy to customize and adjust as required, while also being flexible enough to handle different types of transactions and services.

Look for a format that includes all essential sections such as service descriptions, payment terms, and contact details. Additionally, consider design features like space for your business logo, a clean layout for readability, and options to include taxes or additional fees as necessary. These elements will help ensure your document looks professional and meets both legal and client expectations.

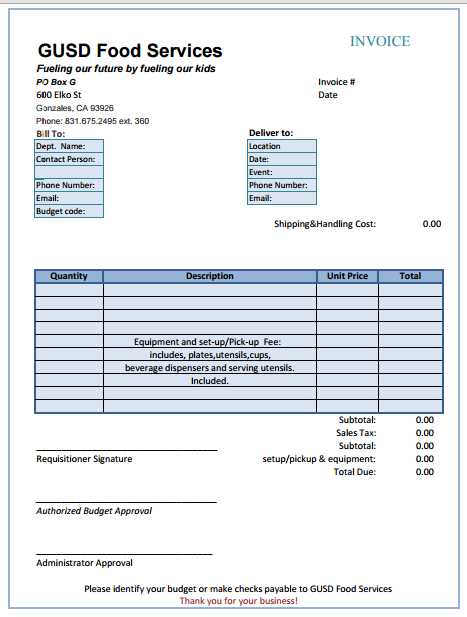

How to Add Event Service Details

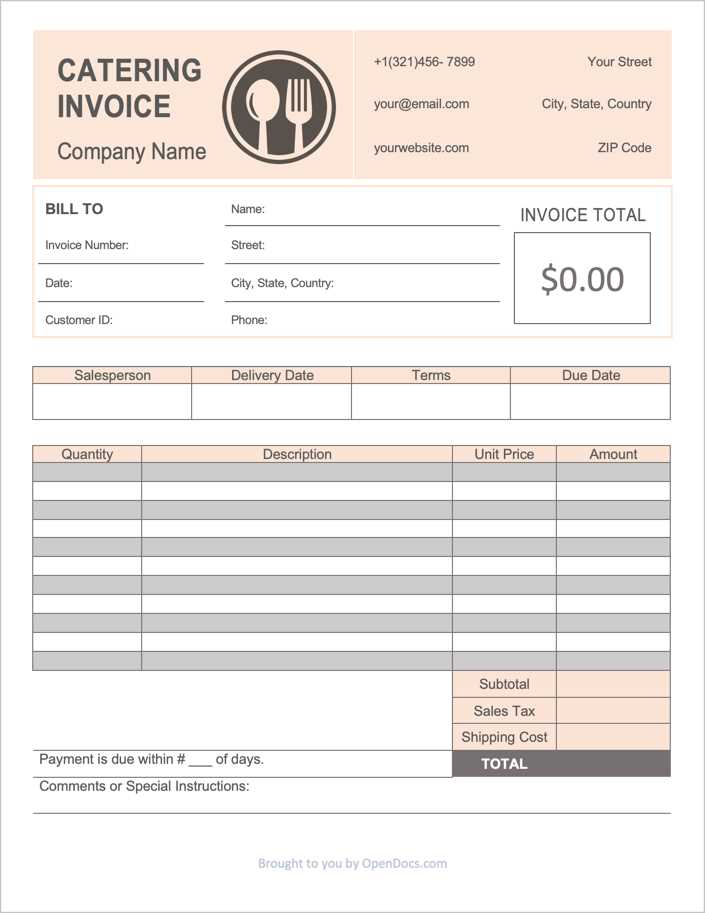

Including specific service information in your financial records ensures transparency and clarity for both parties involved. Clearly outlining the services provided helps clients understand the charges and ensures that all aspects of the agreement are covered. To make your documents comprehensive, it’s important to accurately describe each service, its pricing, and any additional factors that might affect the total cost.

Start by providing a clear description of each service offered, such as meal options, event setup, or additional support. Break down the pricing for each item or service, making it easy for the client to see what they’re being charged for. Don’t forget to include any optional extras, such as equipment rentals or special requests, and list those separately to avoid confusion.

Steps to include service details:

- Describe each service clearly – Mention the specific services provided, such as food, drinks, staffing, or decoration.

- Provide individual pricing – List the cost of each item or service to show how the total amount was calculated.

- Include any extra charges – If applicable, add additional costs like delivery fees, overtime, or special requests.

- Use a clear format – Organize the information in an easy-to-read manner to avoid confusion.

By breaking down each service, you ensure that your financial records are transparent and that clients fully understand what they are being billed for, fostering trust and clarity in every transaction.

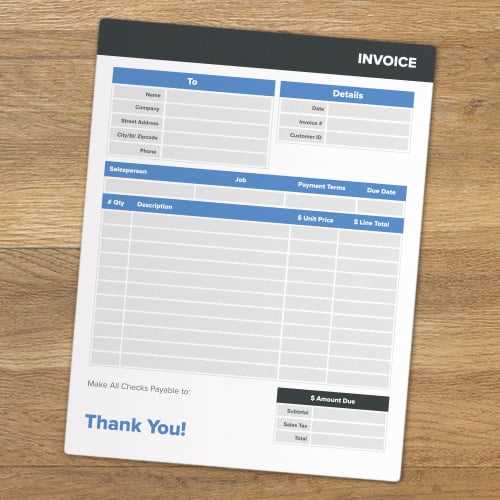

Formatting Your Billing Document Professionally

Presenting your financial records in a clean, well-organized format is essential for making a good impression on clients. A professional layout not only enhances the readability of your document but also reflects your business’s attention to detail. Proper formatting helps clients easily understand the services provided, payment terms, and other key information, which can lead to smoother transactions and improved trust.

Key Elements of Professional Formatting

A professional document should be structured in a way that is both visually appealing and easy to follow. Here are a few important formatting considerations to keep in mind:

- Use clear headings and sections – Break down the document into logical sections, such as contact information, service details, and payment terms, with distinct headings for each.

- Choose a readable font – Select a clean, easy-to-read font like Arial or Times New Roman. Avoid decorative fonts that might make the text difficult to follow.

- Ensure proper alignment – Align the text consistently. For example, align the prices and quantities in columns for a neat, organized appearance.

- Incorporate white space – Use margins and spacing between sections to prevent the document from feeling cramped. This enhances readability and gives it a more professional look.

Additional Formatting Tips

To further enhance the presentation of your financial document, consider the following tips:

- Add your logo and branding – Incorporating your company’s logo and using brand colors can make the document more personalized and professional.

- Use bullet points for item lists – Presenting service details in a bulleted list can make it easier for clients to understand what they are being charged for.

- Include footer information – A footer with payment instructions, your contact information, or any legal disclaimers can add to the professional appearance of your document.

By following these formatting guidelines, you ensure that your document is not only visually appealing but also clear and easy for clients to read. This professional presentation will contribute to positive business relationships and help streamline your financial processes.

Including Payment Terms in Billing Documents

Clearly defining payment terms is a vital part of any financial document. By outlining when and how payments are expected, you help avoid misunderstandings and ensure a smooth transaction. Payment terms establish expectations for both parties, making it clear when the payment is due, what forms of payment are accepted, and any penalties for late payments. This can significantly enhance the efficiency of financial exchanges.

Key Components of Payment Terms

To create a comprehensive and clear payment section, include the following elements in your document:

- Due Date – Clearly specify the date by which the payment should be completed. This helps the client know when the payment is expected.

- Accepted Payment Methods – List all the payment options available, such as bank transfers, credit cards, or online payment systems.

- Late Payment Fees – If applicable, mention any late fees or interest charges that will be applied if the payment is not made on time.

- Discounts for Early Payment – You may offer discounts for early payments as an incentive to encourage prompt settlement of balances.

Why Clear Payment Terms Matter

Having well-defined payment terms in your financial documents helps protect your business interests and minimizes the risk of late or missed payments. It also sets clear expectations with your clients, preventing unnecessary confusion. The more transparent your payment terms are, the easier it is for your clients to comply, which can improve cash flow and ensure the timely completion of transactions.

- Prevents Delays – By specifying deadlines, clients are less likely to delay payments.

- Improves Cash Flow – Clear terms encourage quicker payments, helping maintain a steady cash flow.

- Strengthens Professionalism – Well-outlined payment terms reflect a professional approach to business and financial management.

By incorporating these details into your billing documents, you foster clear communication and ensure a smoother payment process for both you and your clients.

Tax Considerations for Billing Documents

When creating financial records, it’s important to understand the tax implications of your transactions. Including the correct tax information in your documents ensures compliance with local laws and helps avoid penalties. Whether it’s sales tax, value-added tax (VAT), or other applicable taxes, accurate reporting is crucial for both your business and your clients.

Types of Taxes to Include

Depending on your location and the nature of the services provided, there may be several taxes to consider. Here are the most common ones:

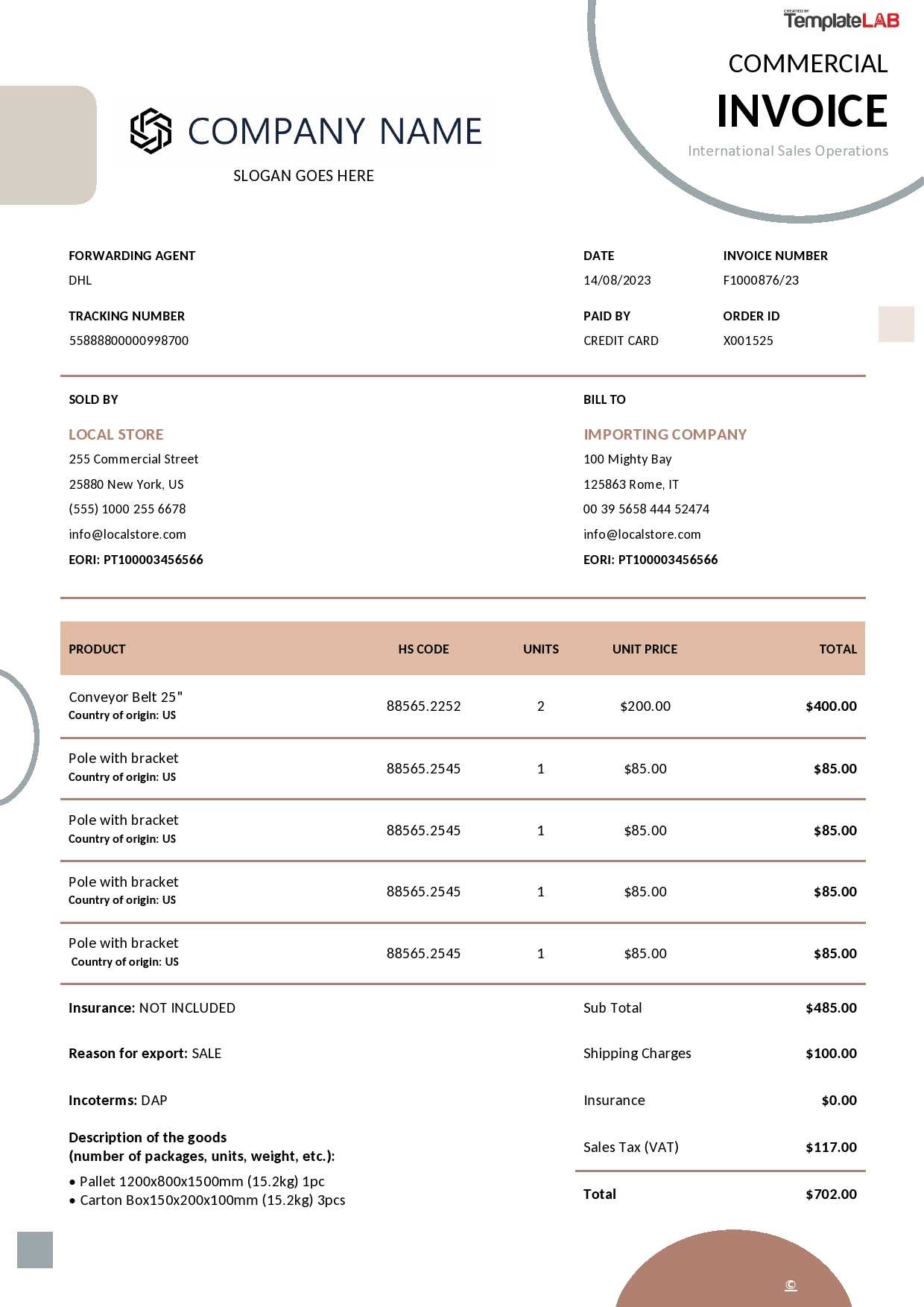

- Sales Tax – A tax levied on the sale of goods and services. It’s essential to include this if your business is in a jurisdiction where sales tax applies.

- VAT (Value-Added Tax) – A consumption tax applied to goods and services. This is common in many countries outside the United States and needs to be calculated and shown separately.

- Service Tax – If your service is subject to a service tax, you’ll need to account for it in your document and clearly list the amount charged.

- Local Taxes – In some regions, additional local taxes may apply, and these should be considered when creating the document.

How to Add Tax Information

Ensure that tax information is clearly presented to avoid confusion. Here’s how to structure it:

- Show Tax Rates – Clearly indicate the applicable tax rate for each service or product.

- Separate Tax Amounts – Itemize the tax amount for each service separately, rather than including it in the overall price, so clients can see the breakdown.

- Include Tax Identification Number – For businesses that are required to charge tax, displaying your tax ID number can ensure transparency and compliance.

- Provide Total Tax – Ensure the final amount includes a section for the total tax, clearly labeled, so the total due is accurate.

By following these tax considerations, you help ensure your financial records are legally compliant, transparent, and clear for your clients. Proper tax handling not only avoids legal issues but also strengthens the professional image of your business.

How to Include Discounts on Billing Statements

Offering discounts is a great way to incentivize customers and encourage repeat business. When including discounts in your financial documents, it is important to be clear and transparent about how they are applied. Properly documenting discounts ensures that both you and your clients understand the terms and conditions of the offer, avoiding any confusion or disputes later on.

Types of Discounts to Include

There are various types of discounts that may be applicable in your transactions. Below are some common types to consider:

- Percentage Discounts – This type of discount is based on a percentage of the total amount, such as a 10% reduction on the overall price.

- Fixed Amount Discounts – A fixed monetary amount is subtracted from the total, for example, $50 off the final bill.

- Bulk Discounts – Offered for large orders or purchases, such as a discount for buying multiple items or booking in bulk.

- Early Payment Discounts – Discounts provided to clients who settle their balance before a certain date.

How to Present Discounts Clearly

Here’s how to effectively communicate discounts within your billing statements:

- List the Discount Separately – Clearly highlight the discount as a separate line item in the document, showing the amount being subtracted.

- State the Discount Terms – Include any conditions for the discount, such as time frames or minimum order requirements.

- Show the Original Price – It’s useful to display the original price before the discount is applied, to clearly demonstrate the value of the discount.

- Clearly Show the New Total – After applying the discount, make sure the new total is clearly indicated, so the client knows exactly what they owe after the discount has been factored in.

By following these steps, you can ensure that your discounts are transparent and straightforward, providing both you and your clients with a clear understanding of the financial terms of the transaction. This not only builds trust but also helps maintain professionalism in your business operations.

Tracking Payments with Your Document

Properly managing payments is an essential part of maintaining smooth business operations. Ensuring that payments are tracked accurately can help you avoid overdue balances and improve cash flow. Incorporating a system for recording payment statuses directly within your document is an effective way to monitor what has been paid and what remains outstanding.

How to Track Payments Effectively

Here are some key elements to include for effective payment tracking:

- Payment Due Date – Always specify the due date for payments. This helps both you and the client keep track of when payments are expected.

- Partial Payments – If a client has made a partial payment, clearly note the amount received and the remaining balance due.

- Payment Method – Indicate how the payment was made (e.g., bank transfer, check, cash, online payment) to ensure there is no confusion about how the payment was processed.

- Payment Date – Always record the date when payment is received. This is crucial for keeping accurate financial records and tracking when transactions occurred.

Adding Payment Status Information

It’s important to indicate the status of each payment to keep everything organized. Here are a few examples of payment statuses you might want to track:

- Paid – The full amount has been received.

- Pending – The payment is due but has not yet been made.

- Overdue – The payment has not been made by the due date.

- Partially Paid – A portion of the amount has been paid, and the remaining balance is due.

By including these details, you can easily monitor the status of payments for each transaction. This will not only help streamline your accounting but also ensure that you are staying on top of all outstanding balances.

Saving and Sharing Your Billing Document

Once your financial document is ready, it’s important to ensure that it is stored securely and can be easily shared with clients. A well-organized system for saving and sharing ensures that both you and your clients can access it anytime, reducing the chance of errors or disputes. Using the right file formats and methods will also improve the professionalism of your communications.

Saving Your Billing Document

When saving your document, consider the following tips to ensure that it remains organized and accessible:

- File Format – Save your document in a widely accepted format, such as PDF, to ensure that clients can open and view it without issues.

- File Naming – Use clear, consistent naming conventions that help identify the document easily, such as including the client name and the date (e.g., “ClientName_Invoice_2024_05_01.pdf”).

- Backup Copies – Always keep a backup copy of the document in a cloud storage service or external drive to protect against data loss.

Sharing Your Billing Document

Sharing your document effectively is just as important as saving it. Here are some methods for sharing your document:

- Email – The most common and convenient way to send the document. Attach the saved file to an email, and ensure the subject line clearly indicates its content (e.g., “Billing for Services Rendered – May 2024”).

- Online Platforms – If you use accounting software or project management platforms, upload the document directly through those platforms for easy access and tracking.

- Postal Service – For clients who prefer physical copies, print the document and send it via standard or express mail.

Summary Table: Methods of Sharing

| Method | Pros | Cons |

|---|---|---|

| Fast, easy, no cost | Requires internet access, client may not check email promptly | |

| Online Platforms | Efficient for regular clients, secure | Requires setup, both parties must be using the platform |

| Postal Service | Ideal for clients who prefer physical copies | Slower, can incur costs, risk of loss |

By following these tips, you can ensure that your financial documents are securely saved and easily shared with clients, maintaining a smooth workflow for your business operations.

Tips for Faster Invoice Processing

Efficient management of your billing documents is crucial for maintaining a steady cash flow and ensuring that clients make timely payments. By optimizing the process of creating, sending, and tracking these documents, you can reduce delays and increase the speed at which payments are received. Implementing a few simple strategies can save time and minimize errors, helping you stay organized and on top of your financial operations.

Automate and Streamline Your Billing Process

Automation tools can significantly reduce the amount of time spent manually handling billing tasks. Here are some ways to automate and streamline the process:

- Use Accounting Software – Invest in reliable software that automatically generates and sends documents, tracks payment status, and even sends reminders for overdue payments.

- Set Up Recurring Billing – For regular clients, set up recurring payments to avoid generating invoices each time, saving both time and effort.

- Pre-filled Information – Use templates that store client information to reduce the need to manually input details for every document.

Clear Communication and Timely Submission

Submitting your documents promptly and ensuring that they are clearly written can prevent unnecessary delays. Here are a few tips:

- Submit on Time – Send your documents as soon as the service or product is delivered. Delaying submission only lengthens the time it takes for clients to process payments.

- Be Clear and Concise – Avoid unnecessary jargon and ensure that your documents are easy to understand. This will help prevent misunderstandings and speed up the approval process.

- Provide Multiple Payment Methods – Offering several payment options, such as bank transfers, credit cards, or online payment platforms, makes it easier for clients to pay quickly.

Follow Up and Track Payments

Keeping track of your financial documents and following up with clients can significantly speed up the processing time. Here’s how:

- Set Payment Deadlines – Make sure your clients are aware of the expected payment date, and follow up promptly if a payment is missed.

- Track Status Regularly – Use tracking features to monitor the status of your documents. Stay on top of any overdue payments and send reminders when necessary.

By automating tasks, improving communication, and maintaining an organized tracking system, you can ensure that the process of managing your financial documents is faster and more efficient, resulting in quicker payments and smoother operations for your business.

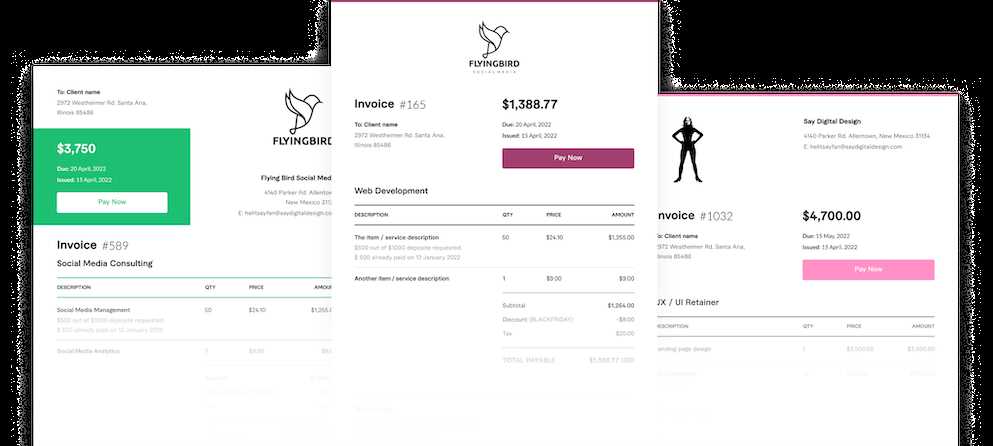

Free Templates vs Paid Options

When it comes to creating professional billing documents, businesses often face the decision between using no-cost options or opting for premium services. Each choice comes with its own set of advantages and disadvantages, depending on the specific needs of the user. Understanding the key differences can help you choose the right option for your business, whether you’re looking to save costs or enhance your document customization and features.

Advantages of No-Cost Options

Free solutions are a popular choice for small businesses and startups who need basic functionality without the upfront costs. Here are some reasons why you might choose a no-cost option:

- No Initial Cost – The biggest advantage is that there is no financial investment required, which can be ideal for businesses on a tight budget.

- Quick Setup – These solutions are often simple to use and don’t require complicated configurations, making them accessible even to those without technical expertise.

- Basic Features – Free options usually include the essential elements needed for creating and sending documents, such as fields for services, prices, and client details.

Benefits of Paid Solutions

While free options might suffice for some businesses, paid solutions offer greater flexibility and additional features that can be worth the investment. Here are a few reasons why you might consider a premium option:

- More Customization – Premium tools often allow you to customize your documents to a higher degree, giving them a more personalized and professional appearance.

- Advanced Features – These may include automatic reminders, tax calculations, advanced reporting, and integration with accounting or CRM systems, which can save time and streamline your processes.

- Better Support – Paid services typically come with customer support, ensuring that any issues you encounter can be resolved promptly.

Which One Is Right for You?

Ultimately, the choice between free and paid solutions depends on your business’s needs. If you’re just starting out and need basic functionality without spending money, a free option may be a great place to start. However, if your business is growing and you need more features, customization, and support, investing in a paid service could help improve efficiency and save time in the long run.

Where to Find Free Catering Templates

If you’re looking to create professional billing documents without spending money, there are many places online that offer no-cost options. These resources can help you get started quickly, providing ready-made formats that can be customized to meet your specific business needs. Knowing where to find these tools will save you time and effort when preparing client statements or service agreements.

Online Platforms with No-Cost Options

There are several well-established websites that offer a range of editable documents at no cost. These platforms allow you to easily find and customize professional documents, making them perfect for individuals and small businesses. Some of the most popular include:

- Template Websites – Many websites specialize in offering a large library of ready-to-use documents. These platforms often provide simple and user-friendly design options for anyone looking to create a professional document.

- Document Sharing Services – Platforms like Google Docs and Microsoft Office Online offer customizable options that can be accessed and edited directly in the browser without needing additional software.

- Business Resource Websites – Websites dedicated to helping small businesses, such as accounting or business advice pages, often offer downloadable files, including essential business documents.

Customizable Tools for Quick Creation

If you’re not interested in using pre-made documents but still need an easy way to generate custom files, consider using software tools with built-in customizable formats. These tools let you tailor your documents to your specific needs and often include additional features like cloud storage for easy access:

- Spreadsheet Software – Programs like Google Sheets or Excel provide a simple way to create your own documents, allowing for full control over formatting and layout.

- Online Design Tools – Websites like Canva or Adobe Spark allow you to build visually appealing documents from scratch using drag-and-drop features, making them ideal for those with no graphic design experience.

By exploring these resources, you can quickly access a variety of no-cost options to create professional, customizable documents tailored to your business. Whether you prefer pre-made formats or customizable software, there are plenty of choices available to suit your needs.

How to Invoice for Event Catering

When it comes to billing for event services, it is essential to ensure that every detail is clearly presented. Properly outlining the costs associated with an event can help clients understand exactly what they are paying for and make the payment process smoother. A well-organized and transparent breakdown of charges is crucial for both the service provider and the client.

Steps to Create a Detailed Bill

To prepare an accurate and professional statement for event services, follow these key steps:

- Client Information – Include the client’s full name or business name, address, and contact information at the top of the document.

- Event Details – Clearly state the date and location of the event, along with a brief description of the services provided. This ensures that both parties are on the same page.

- List of Services – Break down the services rendered. This could include things like food preparation, staff hours, transportation, and any other special requests made by the client.

- Pricing Breakdown – Itemize each service with its corresponding cost. This helps your client see exactly what they are paying for and avoids confusion.

- Payment Terms – Indicate the payment method, due date, and any late fees if applicable. This provides clarity on when and how payment is expected.

Additional Tips for Clear Billing

In addition to the basic information, here are a few extra points to make sure your billing is as effective as possible:

- Be Transparent – Avoid any hidden fees or unclear pricing structures. Your client will appreciate a clear and straightforward document.

- Professional Presentation – Use a clean and easy-to-read format. Well-organized documents will leave a lasting impression on your clients and reflect the professionalism of your business.

- Review Before Sending – Always double-check the document for accuracy. Errors in pricing or event details can lead to misunderstandings and delayed payments.

By following these steps and including all the necessary details, you can create a comprehensive and easy-to-understand document that ensures both you and your clients are on the same page when it comes to payment expectations.

Common Mistakes to Avoid in Invoicing

Properly managing billing for services can be challenging, especially when it comes to ensuring accuracy and professionalism. Small mistakes in the billing process can lead to delayed payments, misunderstandings with clients, or even damage to your business’s reputation. It’s essential to recognize and avoid these common errors to maintain a smooth and efficient payment cycle.

Frequent Mistakes and How to Avoid Them

Here are some of the most common issues people face when preparing financial documents and tips on how to prevent them:

| Common Mistake | How to Avoid It |

|---|---|

| Missing Client Information | Always include full client contact details at the top, such as their name, address, and phone number to ensure clarity. |

| Inaccurate Service Description | Be specific and clear when listing the services rendered, including dates and any special requests from the client. |

| Failure to Itemize Costs | Break down each charge in detail to avoid confusion and provide transparency for the client. |

| Not Including Payment Terms | Ensure payment due dates, methods, and late fees are clearly stated to avoid any misunderstandings later on. |

| Not Reviewing the Document | Double-check all the details before sending it to the client to ensure there are no errors or discrepancies. |

Additional Tips for Accurate Billing

Beyond avoiding common errors, here are some additional tips to help ensure your billing process goes smoothly:

- Maintain Consistency: Always use the same format and layout for all your financial documents. This creates a professional and organized appearance.

- Use Clear Language: Avoid using technical jargon or overly complex terms that could confuse your client. Keep things simple and straightforward.

- Provide a Summary: At the end of the document, include a quick summary of the charges and any applicable taxes to reinforce the total amount due.

By being mindful of these common mistakes and implementing these practices, you can ensure your billing process is efficient, transparent, and professional, leading to quicker payments and stronger client relationships.