Unpaid Invoice Template for Efficient Payment Tracking

Tracking and collecting payments is a crucial part of any business operation. When clients delay settling their dues, it can disrupt your cash flow and add unnecessary stress to your financial management. Having an effective way to remind customers of outstanding balances is essential for maintaining a healthy financial situation.

Organizing reminders and providing clients with clear, professional documents can simplify the process. A well-structured form can help communicate the issue, making it easier for customers to understand their obligations. By setting up a systematic approach for overdue accounts, you can reduce confusion and encourage timely payments.

With the right tools, businesses can automate much of the follow-up process, freeing up time for other tasks. Clear and concise documents not only help with collecting payments but also foster trust and transparency between you and your clients. This practice is key to keeping financial operations smooth and efficient.

Unpaid Invoice Template Overview

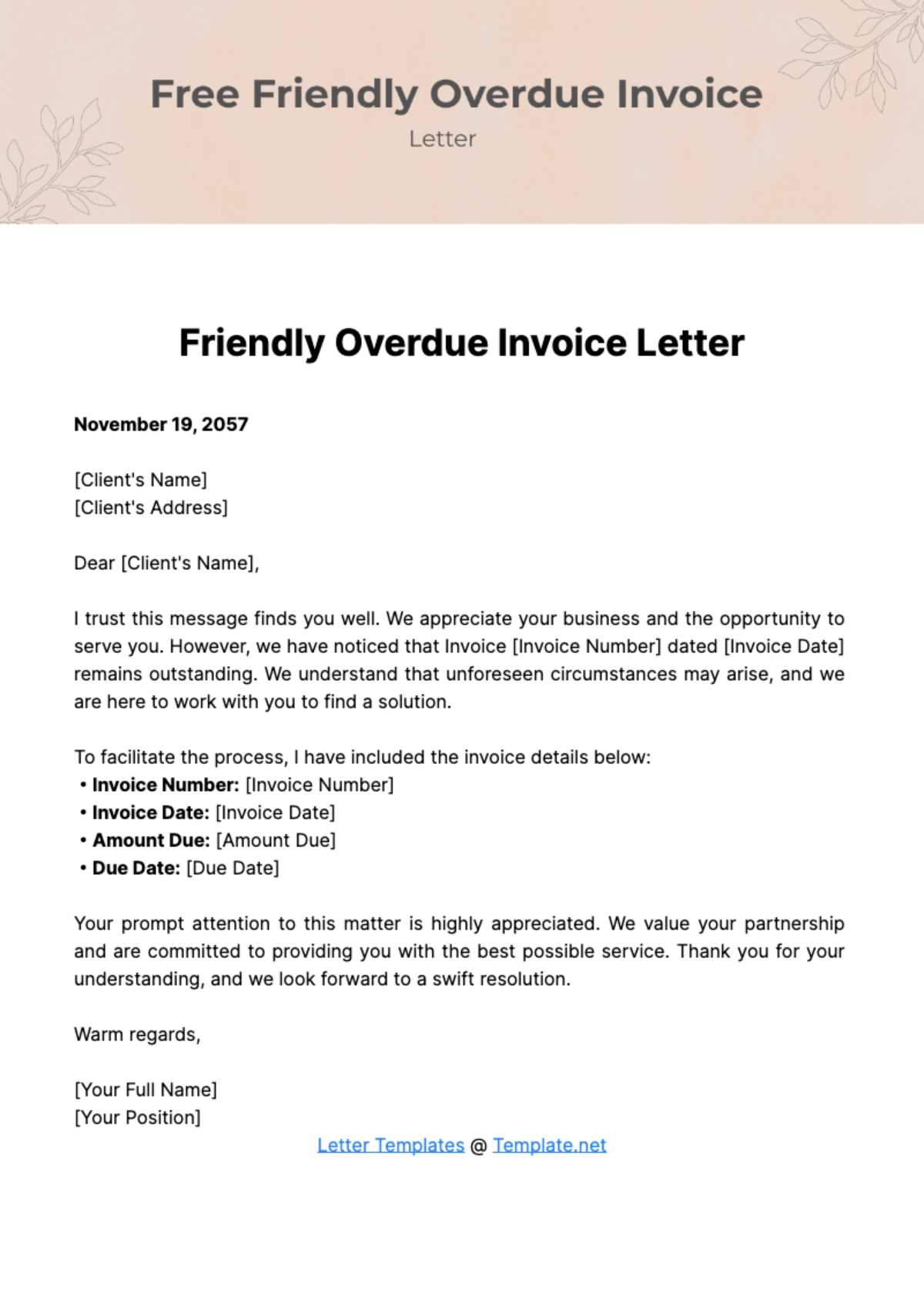

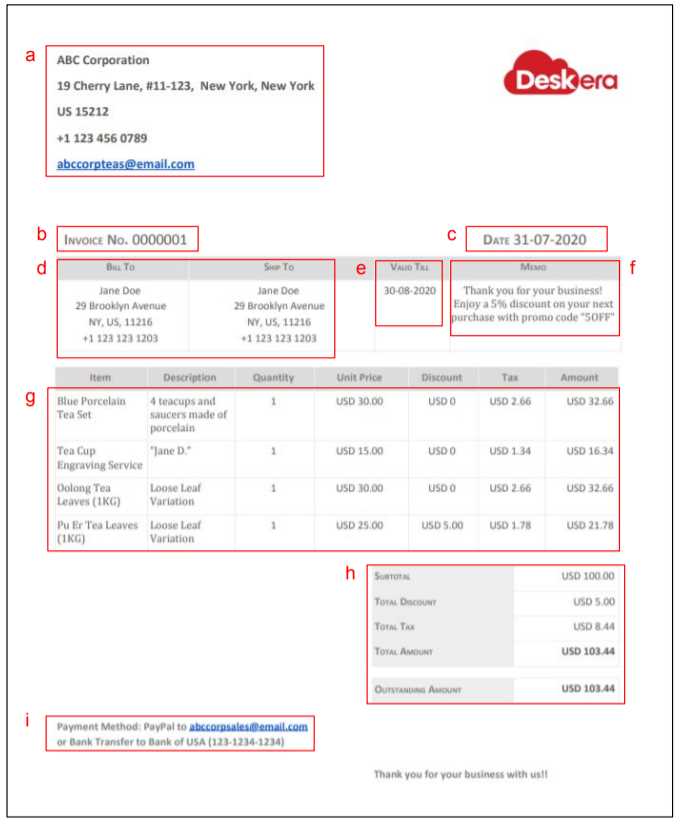

When payments are overdue, businesses need a reliable method to follow up with clients. A professional document designed specifically for this purpose helps to streamline the process, making it clear what amounts are owed and when they need to be paid. These tools not only remind clients but also serve as formal records of outstanding debts.

Customizable forms offer flexibility, allowing businesses to tailor the content to their specific needs. By including all necessary details, such as payment terms, due dates, and contact information, these documents ensure that both parties understand their obligations. This clarity can reduce confusion and improve communication between the business and the client.

Using such a document can also assist in maintaining a professional image. Clients are more likely to respond positively to a well-organized and clearly presented request for payment. With the right format, businesses can enhance their collection process, ensuring that they receive the funds owed to them in a timely manner.

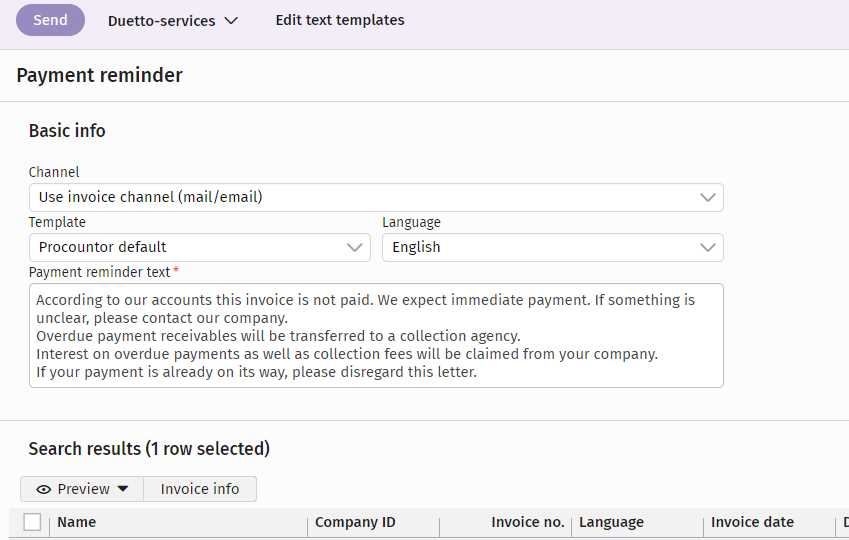

How to Use an Unpaid Invoice Template

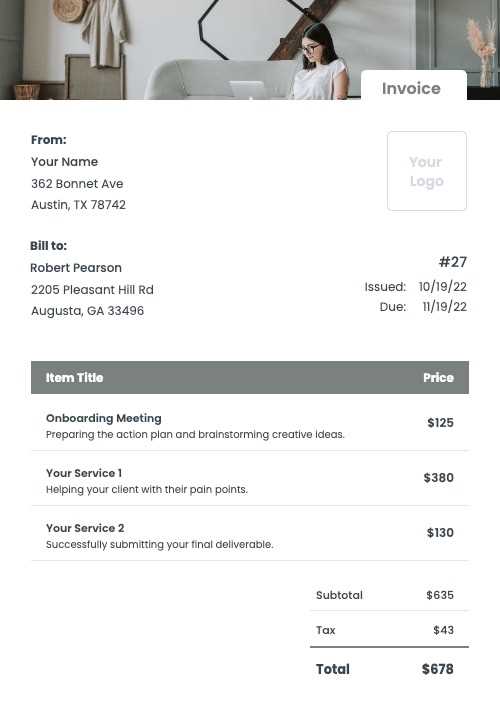

Using a well-structured document to remind clients of outstanding payments is an essential step in maintaining smooth financial operations. The key is to ensure that all necessary information is clearly presented, making it easier for clients to understand what is owed and when payment is due. Here’s how to make the most out of this useful tool.

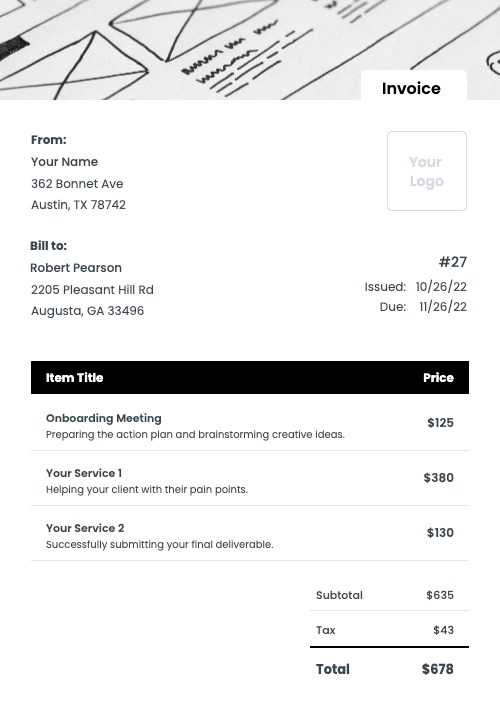

Step 1: Enter Payment Details

Start by entering the essential details such as the client’s name, the amount due, the due date, and any relevant terms and conditions. This step is crucial to ensure there is no ambiguity regarding the payment expectations. Customization options will allow you to add specific notes, such as late fees or payment instructions, if necessary.

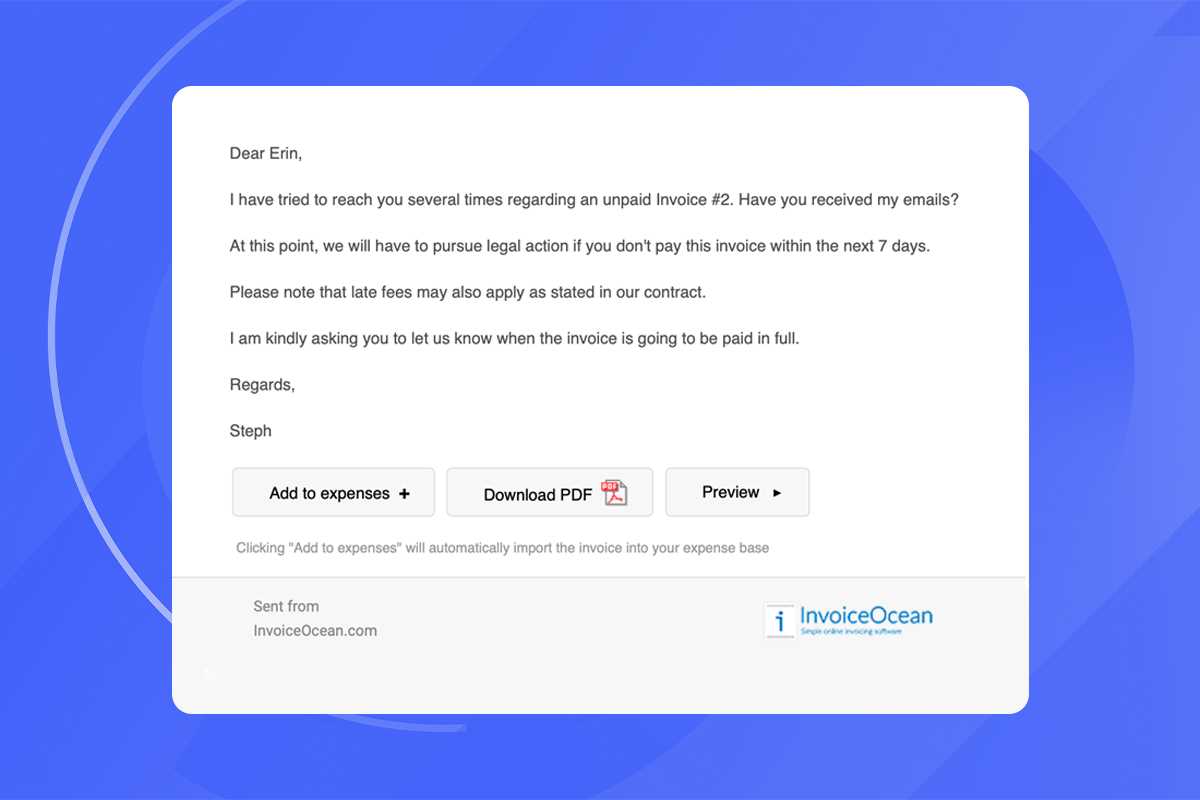

Step 2: Send the Document to the Client

Once the document is filled out, it’s time to send it to your client. Whether through email or traditional mail, ensure that the document is easily accessible and professionally formatted. It’s important to keep a copy for your records in case any disputes arise in the future.

| Field | Description | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Client Name | Enter the full name of the client or company. | |||||||||||||

| Amount Due | Clearly list the amount that is owed by the client. | |||||||||||||

| Due Date | Specify the exact date by which payment should be made. | |||||||||||||

| Late Fees | If applicable, mention any penalties for late payment. | |||||||||||||

Contact Information

Key Features of an Invoice TemplateWhen creating a document to track overdue payments, it’s important to ensure that it contains all the necessary elements to facilitate clear communication and prompt action. A well-designed form can make the process easier for both businesses and clients, ensuring that all essential details are included and properly formatted. Here are the key features that should be present in any document intended to manage overdue payments:

|