Free Contractor Invoice Template PDF for Quick and Easy Billing

Managing finances and ensuring timely payments is a crucial part of any business, especially for self-employed individuals and those working on short-term projects. Having a structured approach to requesting compensation can save time, reduce errors, and create a more professional relationship with clients. A well-organized document to request payment can streamline this process and make it easier to track what is owed and when it is due.

Utilizing a standardized format for documenting services rendered not only ensures accuracy but also helps maintain consistency in business operations. By using the right kind of document, freelancers can focus on their work while confidently managing their financial transactions. This is an invaluable tool for anyone looking to improve the efficiency of their billing system and keep everything organized in one place.

In this guide, we will explore how you can access and use a structured billing document to simplify the payment process. Whether you’re just starting out or looking to refine your current system, adopting a professional approach to financial documentation can significantly improve your workflow and speed up payments.

Free Contractor Invoice Template PDF

Having a reliable document to request payment for completed work is essential for any independent professional. It ensures both clarity and transparency between you and your clients, helping to avoid misunderstandings. This document serves as an official record of the services provided and the amount due, making it easier to keep track of finances and manage cash flow effectively.

Access to a well-designed, pre-formatted payment request can save significant time and effort. It eliminates the need to create such a document from scratch each time a new task is completed. With the right form, you can quickly fill in the necessary details, ensuring your billing process remains consistent and professional without unnecessary delays.

For many, finding a suitable form that fits the nature of their business is key. Whether you’re offering one-time services or ongoing projects, using a clear and customizable document can streamline your entire payment process. In the next sections, we’ll explore where to find such resources and how to use them to enhance your billing system.

Why Use a Contractor Invoice Template

Having a standardized document for billing purposes is crucial for maintaining professionalism and ensuring accuracy in financial transactions. When working with clients, it’s important to provide a clear record of services completed and the amount due. A consistent approach to this process can help build trust and ensure you get paid on time.

Here are some key reasons to use such a document:

- Saves Time: Instead of creating a new document from scratch each time, a pre-designed structure allows for quick and efficient completion.

- Reduces Errors: A consistent format minimizes the risk of missing important details, such as dates, amounts, or payment terms.

- Professional Appearance: A polished, formal document can help create a more professional image for your business.

- Easy to Customize: Most formats are flexible and allow you to adjust the content as needed for different clients or projects.

- Streamlined Tracking: It becomes easier to keep a record of all payments and outstanding balances when using a structured format.

By adopting a structured approach to billing, you can focus more on your work while ensuring timely and accurate payments from your clients. The right tool can make the process smooth and efficient, benefiting both you and your clients.

Benefits of PDF Invoices for Contractors

Choosing the right format for your payment requests is essential for both professionalism and efficiency. Digital documents offer several advantages, making them a preferred choice for many professionals who need to send payment requests. These benefits not only streamline the billing process but also ensure that all parties involved have easy access to accurate and well-organized records.

Key Advantages of Digital Billing Documents

- Universal Compatibility: Digital formats can be easily opened on any device, whether it’s a computer, tablet, or smartphone, ensuring seamless communication with clients.

- Quick Delivery: Sending a payment request electronically ensures it reaches the client instantly, speeding up the billing process and potentially reducing delays.

- Enhanced Security: Unlike paper records, digital files can be password-protected, reducing the risk of unauthorized access or loss.

- Space-Saving: Storing digital files takes up no physical space, making organization and retrieval much easier compared to traditional paperwork.

- Environmental Benefits: Reducing the need for paper helps lower your carbon footprint and supports sustainability efforts.

How Digital Documents Improve Professionalism

- Consistency: A digital format ensures that each payment request follows a uniform structure, giving your business a more organized and professional appearance.

- Customization: Digital documents are easy to modify and personalize for each client, allowing you to tailor details such as logos, payment terms, and service descriptions.

- Easy Archiving: Electronic records are simple to store, search, and back up, making it easy to maintain a comprehensive financial history for your business.

Using digital formats for your payment requests not only makes the process more efficient but also supports a professional image and smooth client interactions. The convenience and flexibility provided by these documents can ultimately help you focus more on your work and less on administrative tasks.

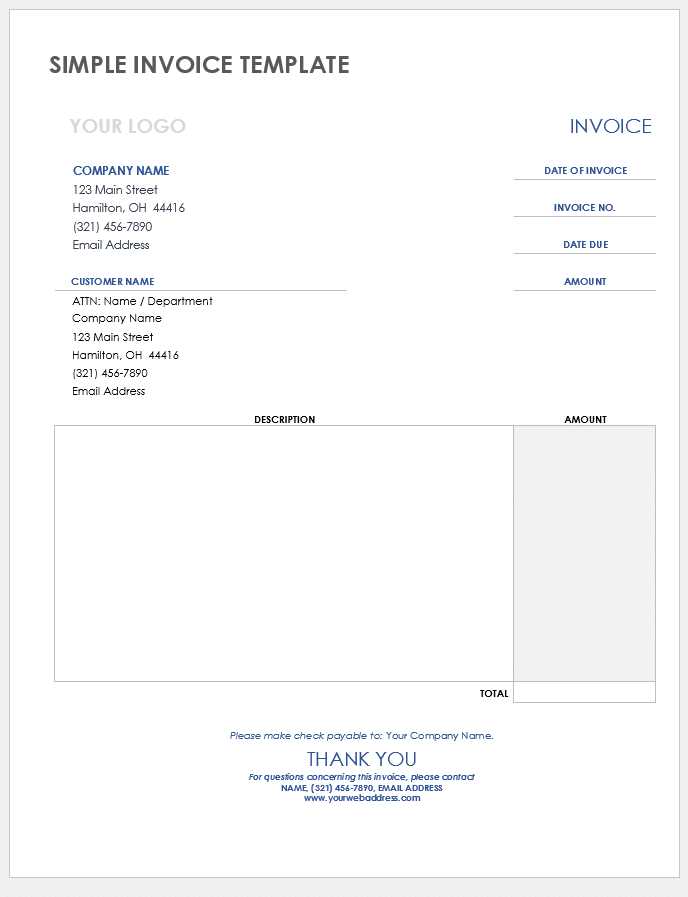

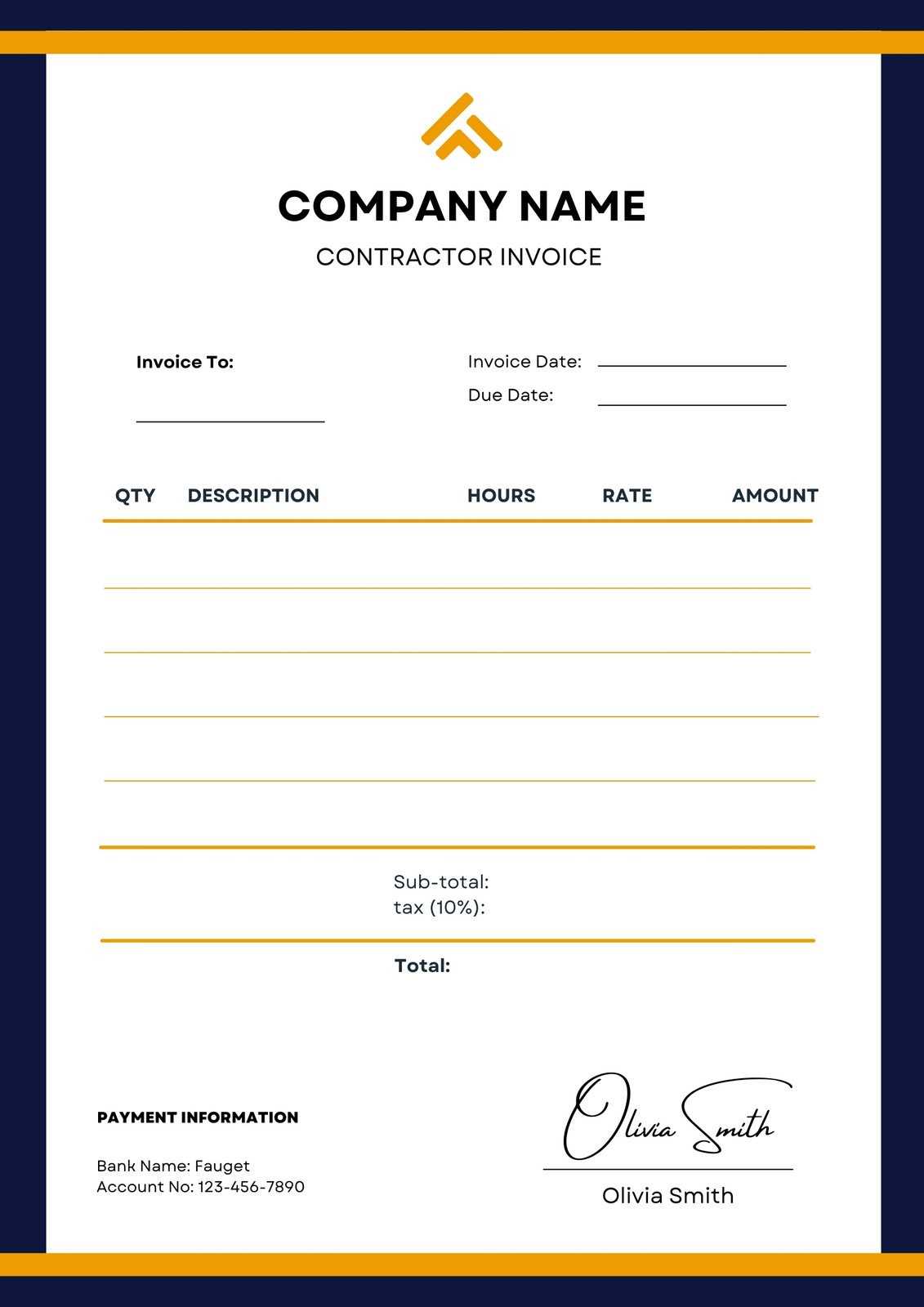

How to Customize Your Invoice Template

Customizing your billing document is an important step in creating a professional and personalized experience for your clients. A well-tailored document can reflect your brand, ensure clarity, and highlight key payment details. By adjusting certain elements of the document, you can make it more suited to your business needs and the nature of each project.

Here are the main areas you can modify to create a customized payment request:

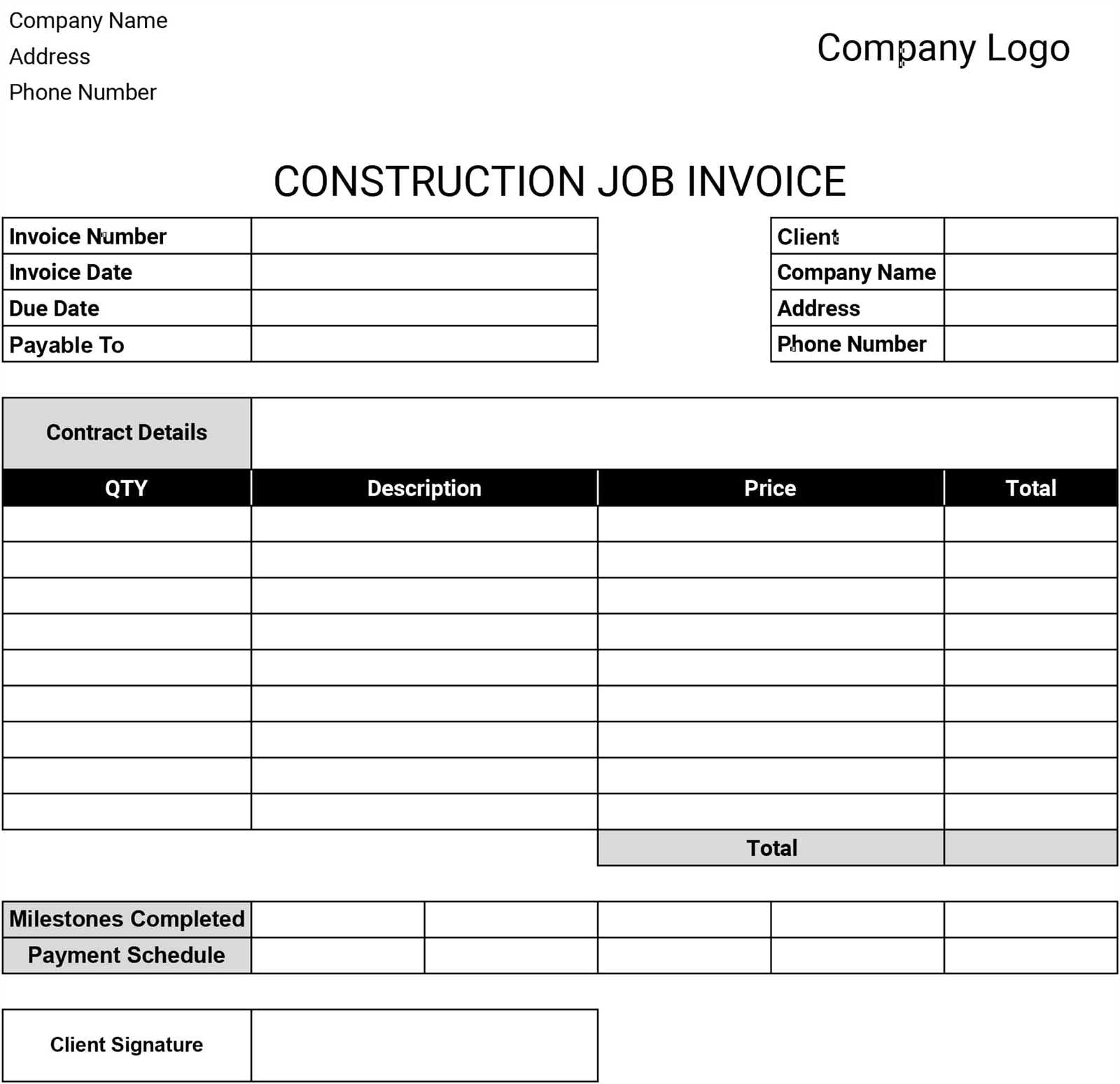

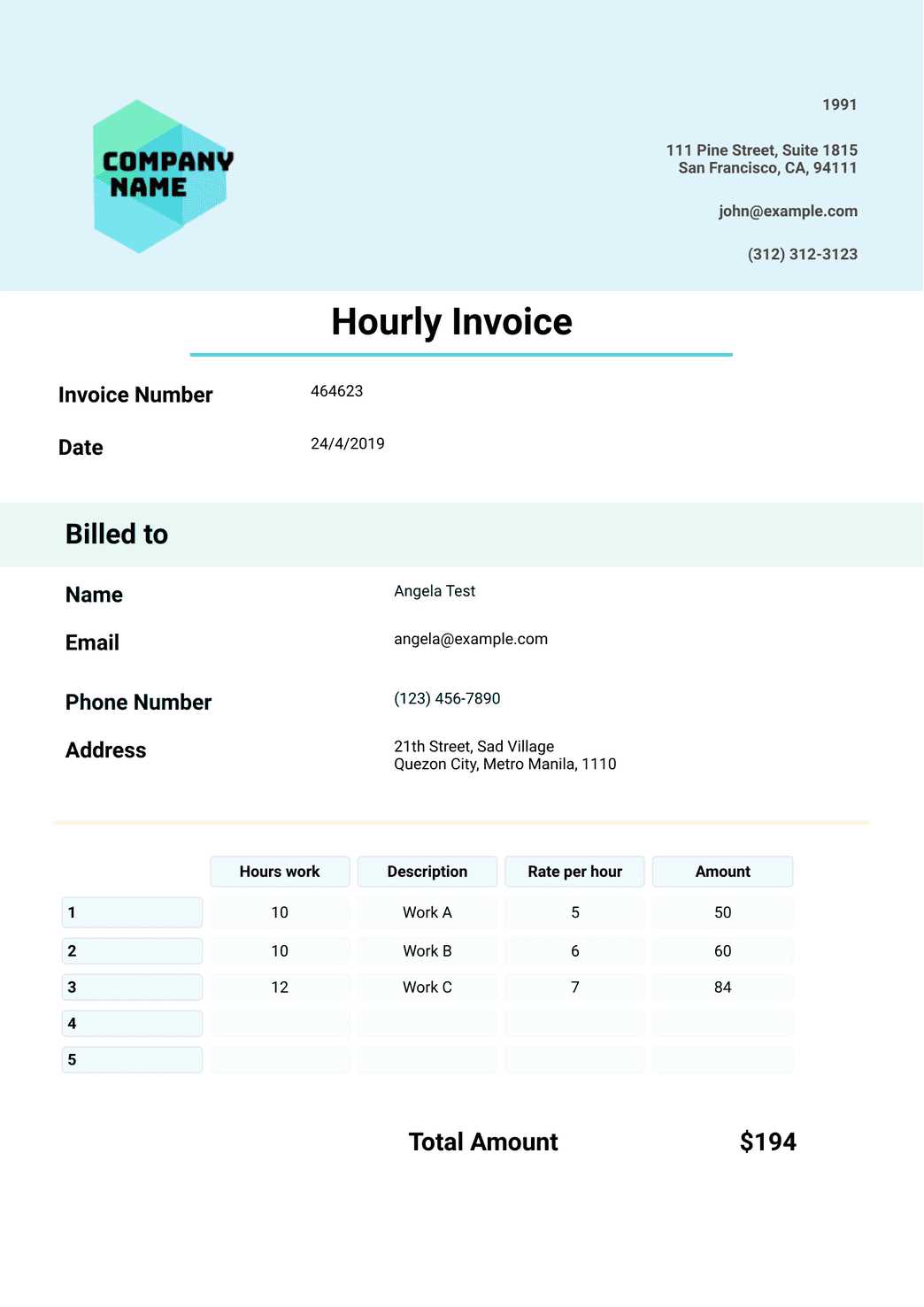

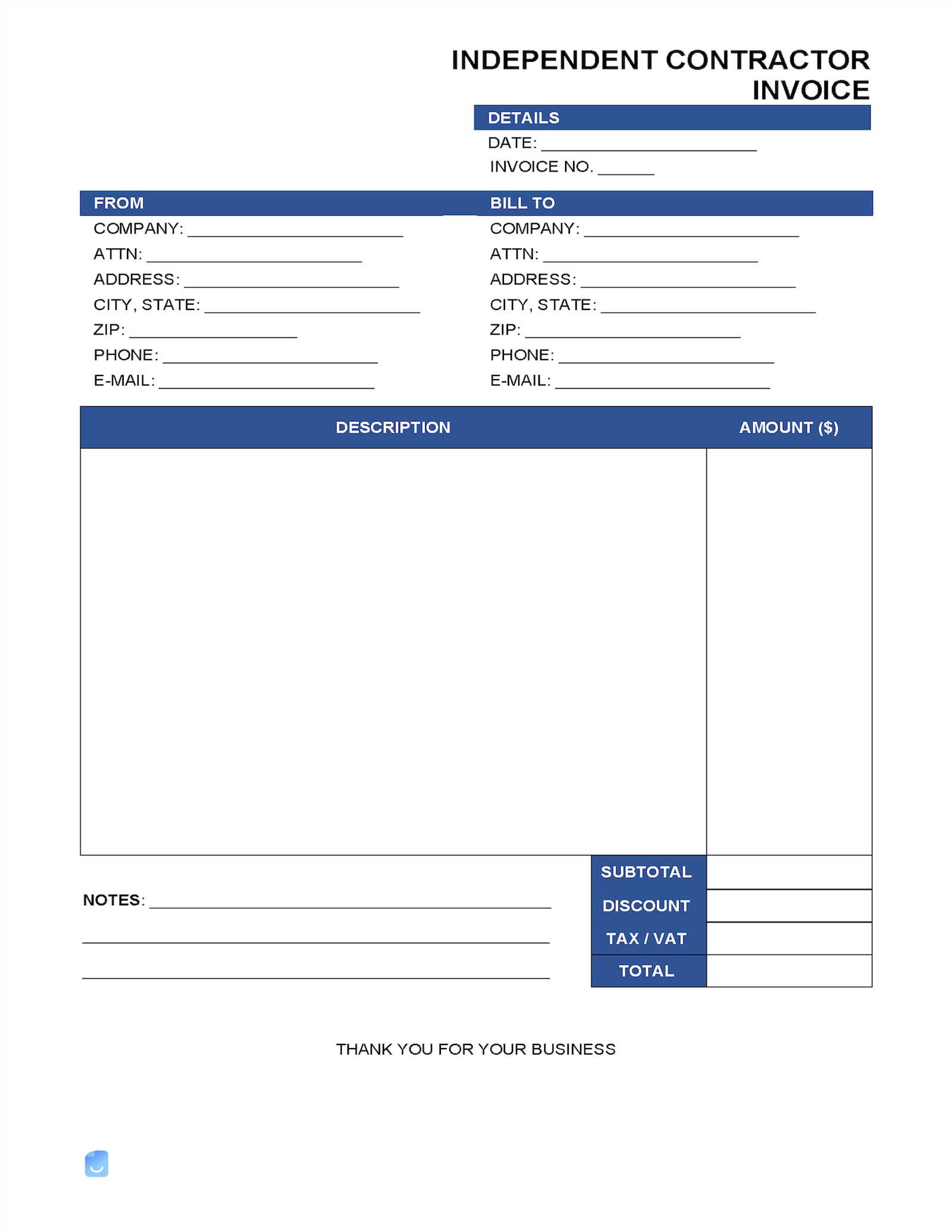

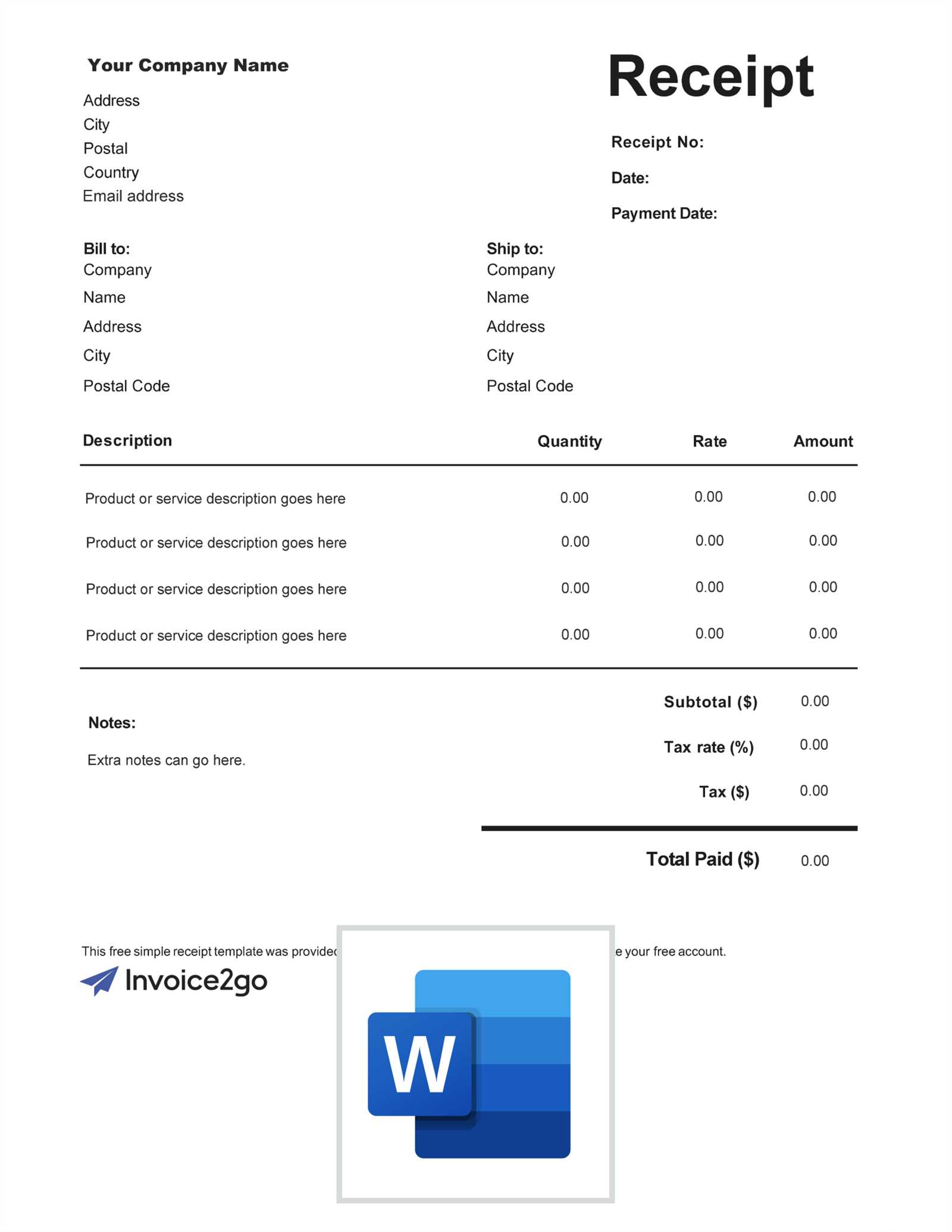

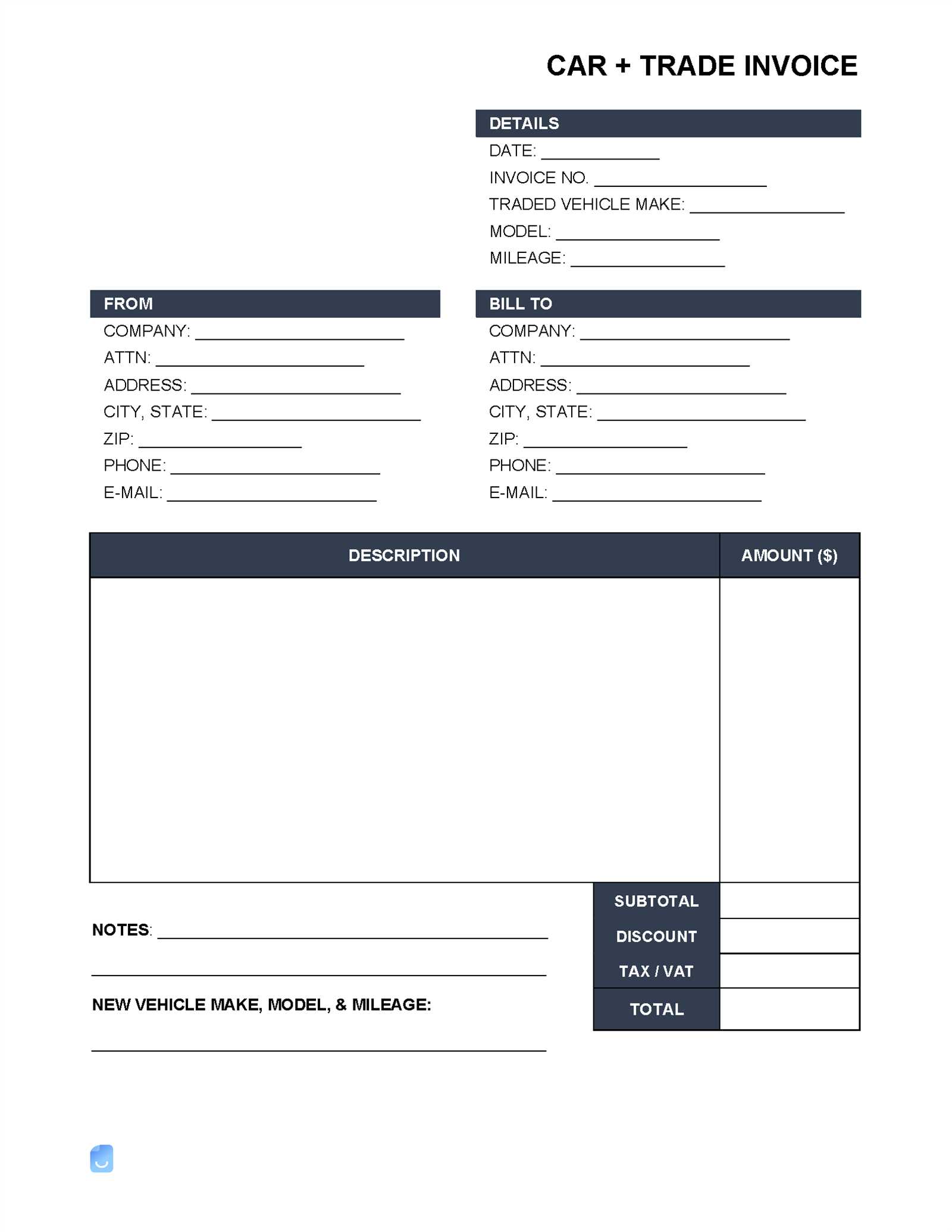

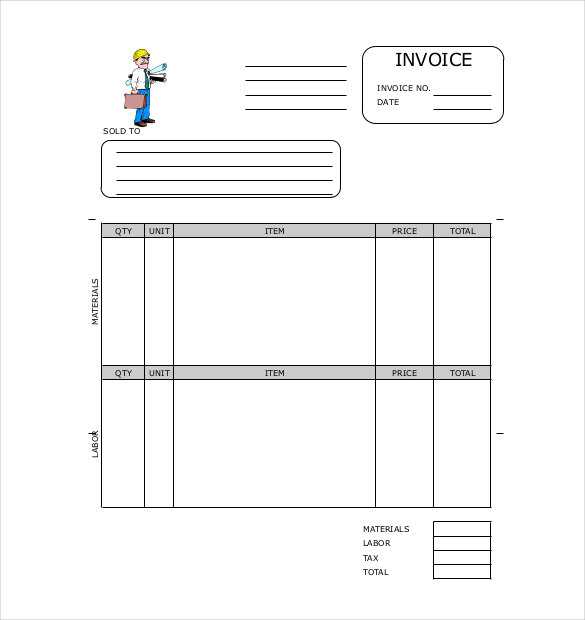

| Section | Customization Options |

|---|---|

| Header | Include your company name, logo, and contact information to establish your brand’s identity. |

| Client Information | Add your client’s name, company details, and contact information to ensure accurate records. |

| Itemized List | Detail the services or products provided, including descriptions, quantities, and individual costs for clarity. |

| Payment Terms | Specify the due date, late fees, or payment methods to establish clear expectations for payment. |

| Notes | Include any additional remarks, special instructions, or thank you messages to personalize the communication. |

By making these adjustments, you can create a more professional and efficient billing experience. Tailoring your payment request to fit each client’s needs helps improve the clarity of the transaction and ensures all necessary details are included, leading to smoother business operations.

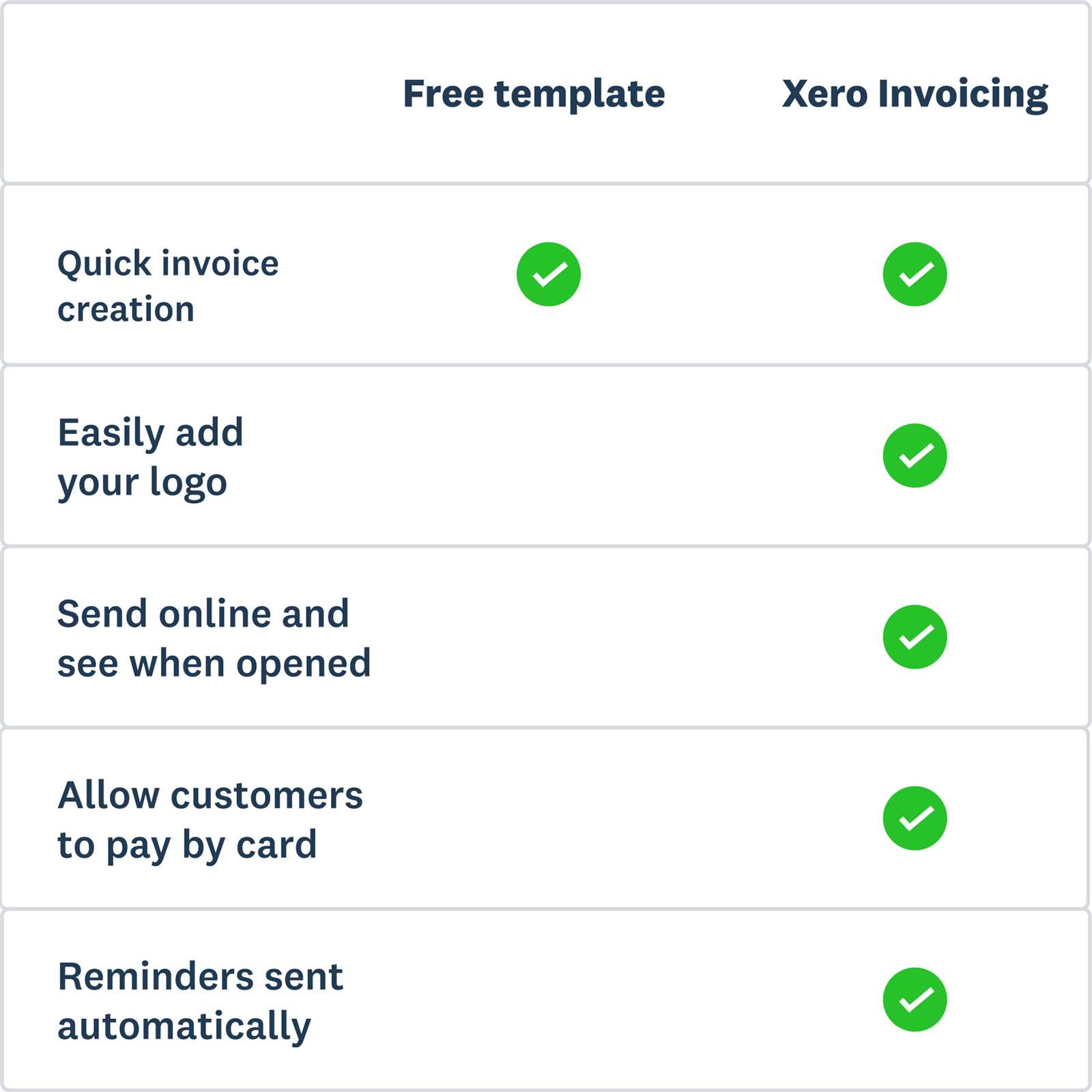

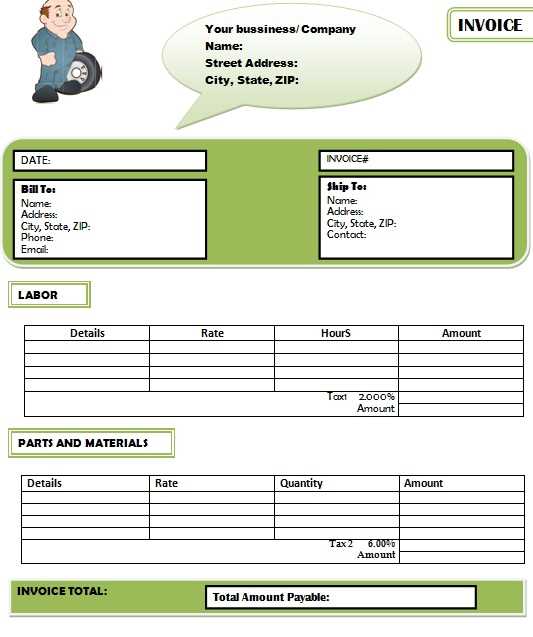

Top Features to Look for in Templates

When choosing a format for creating payment requests, it’s important to consider specific features that will make the process easier, faster, and more professional. The right design should help you effectively communicate payment details while maintaining consistency and clarity. Here are the essential elements to look for when selecting a structure for your billing documents:

- Clear Layout: A well-organized design with distinct sections for essential information, such as service descriptions, totals, and payment terms, will help both you and your clients quickly understand the details.

- Customizable Fields: Flexibility to edit and adjust content for each client or project ensures that the document remains relevant to your specific needs. Look for options that allow easy modification of text, dates, and amounts.

- Professional Design: A polished, clean look helps establish a professional image. Avoid overly complicated designs; simplicity and elegance often leave a better impression.

- Legal Compliance: Ensure that the document includes all the necessary information required by law, such as tax details, business registration numbers, and terms of service. This helps avoid potential legal issues and misunderstandings.

- Automated Calculations: Built-in formulas that automatically calculate totals, taxes, and discounts can save time and reduce the chance of human error.

- Branding Options: The ability to add your logo, business name, and brand colors can make the payment request align with your company’s identity, strengthening your professional image.

- Compatibility with Multiple Formats: The option to save or share the document in various file formats ensures you can easily send it in a way that works best for both you and your clients.

By choosing a well-designed structure with these key features, you can enhance the billing process, improve communication with clients, and present yourself as a professional in your field.

Where to Find Free Contractor Invoice Templates

There are several reliable sources online where you can find pre-designed documents to help streamline your billing process. These resources offer various formats that cater to different industries and business needs. Whether you need a simple layout or a more detailed, customizable design, the internet provides a wealth of options to choose from.

Online Platforms Offering Free Billing Documents

Numerous websites specialize in providing free and easily accessible formats for creating payment requests. These platforms often offer downloadable documents that you can edit directly on your computer or fill out online. Some of the most popular sites include:

- Online Document Creators: Platforms like Google Docs and Microsoft Word allow you to access free billing formats that are easy to customize and save in various formats.

- Business Websites: Websites dedicated to small business tools often provide downloadable formats as part of their resource sections. These are typically tailored to meet legal and professional standards.

- Accounting Software Websites: Some accounting software companies offer downloadable options as part of their free tools, even if you don’t use their software.

Open-Source and Community-Driven Resources

If you’re looking for more specialized or unique designs, you can also explore open-source communities. These resources often feature contributions from professionals who share their custom formats for public use. Some websites also allow you to modify and share your own documents with others, fostering a community-driven approach to template creation.

By exploring these platforms, you can find the right format that suits your business needs, ensuring that your payment requests are both professional and easy to use.

How to Download a Free PDF Invoice

Downloading a ready-to-use document for requesting payment is a simple and effective way to speed up your billing process. Many websites and platforms provide these documents in a downloadable format that you can quickly access and use. By following a few straightforward steps, you can easily get a professional billing document without the hassle of creating one from scratch.

Steps to Download Your Payment Request Form

To get started, here are the general steps you need to follow to download a ready-made form:

| Step | Description |

|---|---|

| Step 1: | Visit a trusted website that offers downloadable documents. Look for a section with billing or payment request resources. |

| Step 2: | Choose the appropriate document based on your business type and needs. You may find options for one-time services, recurring projects, or various industries. |

| Step 3: | Click the download link or button. The file will typically be available in a universal format that you can open with common software, such as Microsoft Word, Excel, or directly as a digital document. |

| Step 4: | Save the file to your device. Be sure to name it appropriately for easy reference and future use. |

| Step 5: | Open the document on your device and start filling in the necessary details like client information, services rendered, and payment terms. |

Where to Find Downloadable Files

Many websites offer documents with simple steps for downloading. Some platforms may require you to create an account or sign up for newsletters to access their free resources, while others provide instant downloads without any restrictions. Be sure to check the terms of use to ensure you’re downloading from a reputable source.

Once downloaded, you can modify the document as needed, ensuring it matches your business requirements, and send it to your clients for prompt payment processing.

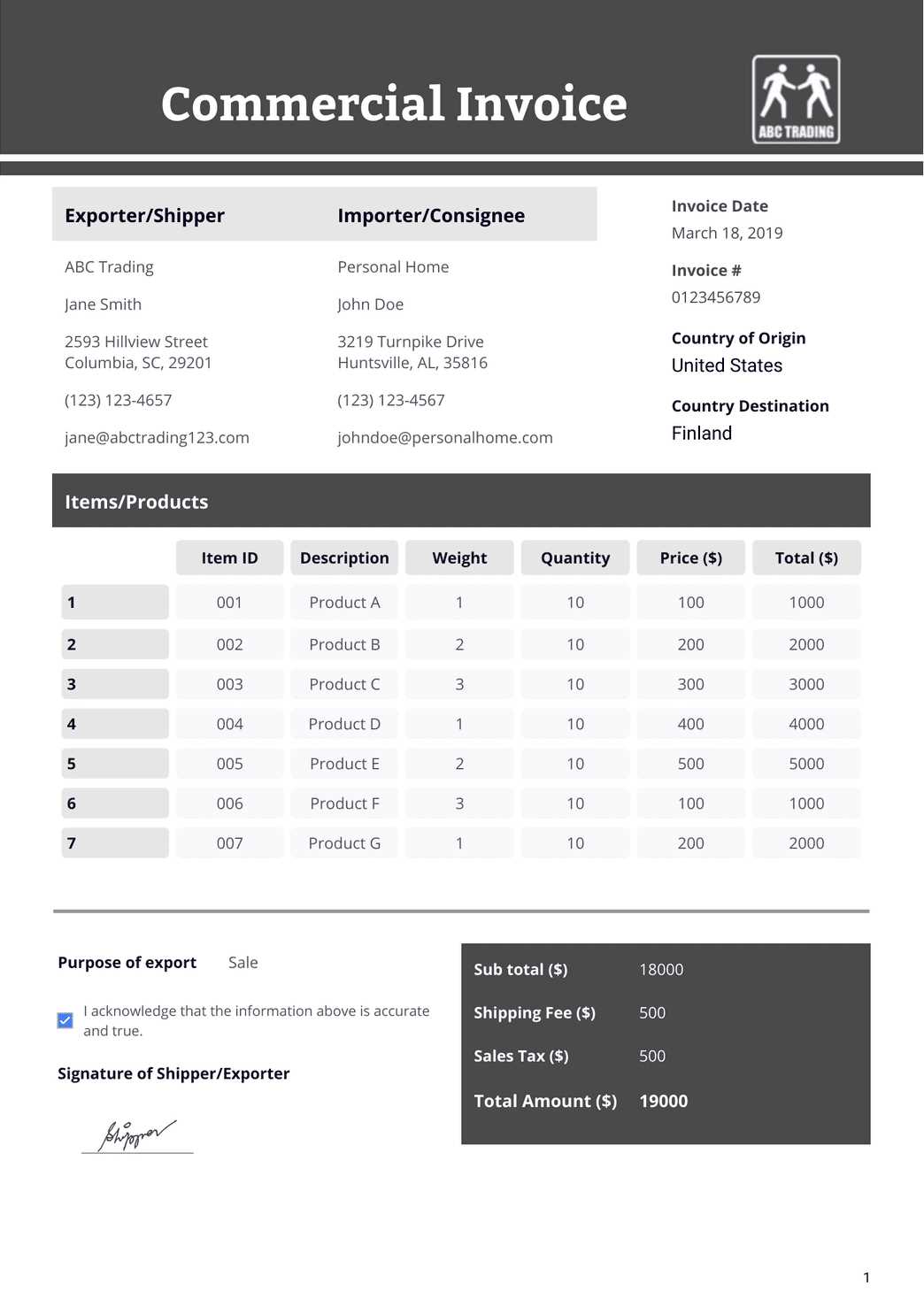

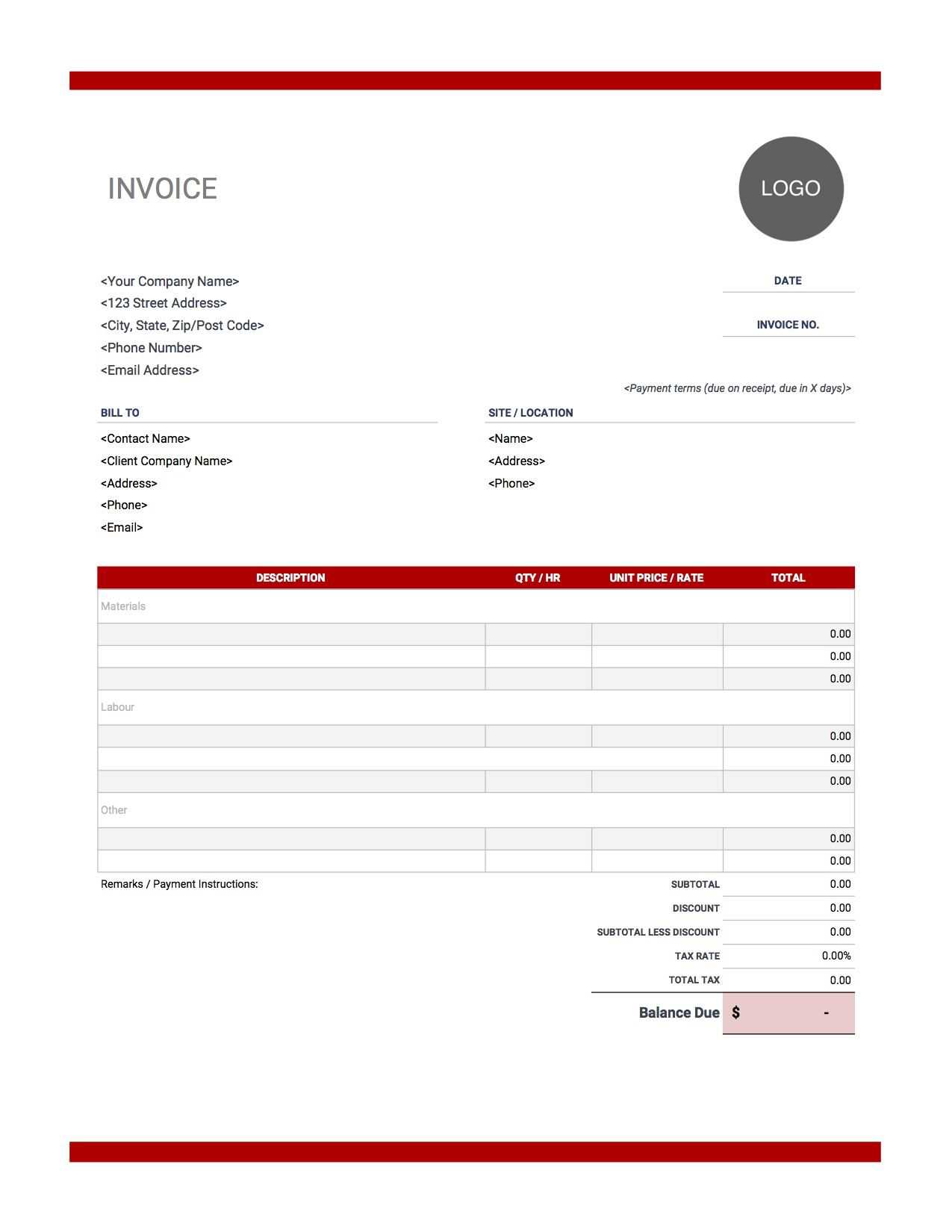

Essential Information for Contractor Invoices

When requesting payment for services rendered, it’s crucial to include all necessary details to ensure both clarity and legal compliance. A well-structured document should provide the client with all the information they need to process the payment correctly. Missing or unclear details could result in delays or disputes, so accuracy is key.

Key Elements to Include in Payment Requests

- Business Information: Include your full name or business name, address, and contact details. This ensures the client knows who is issuing the payment request.

- Client Details: List the client’s name, company, and address to prevent any confusion about who is receiving the request.

- Unique Document Number: Each document should have a unique number for tracking purposes, making it easier to reference in future communications.

- Date of Issuance: The date when the document is created should be clearly stated. This helps establish the timeline for payment expectations.

- Description of Services: Provide a detailed list of services or products delivered. This can include quantities, unit prices, and any other relevant information to justify the amount due.

- Total Amount Due: Clearly state the total amount owed, breaking down costs if necessary. Include any applicable taxes, discounts, or additional charges.

- Payment Terms: Specify payment due dates, acceptable payment methods, and any penalties for late payments to avoid misunderstandings.

- Legal and Tax Information: Depending on your location and business type, you may need to include your tax ID number, business registration details, or other legal information required by law.

Additional Considerations

- Notes or Special Instructions: Include any additional comments, such as thank-you messages or instructions on how to make the payment.

- Attachments or Supporting Documents: If relevant, attach any supporting documents like receipts, contracts, or agreements that substantiate the payment request.

By ensuring these critical elements are included, you’ll create a document that is professional, clear, and ready for processing, reducing the likelihood of payment delays or confusion.

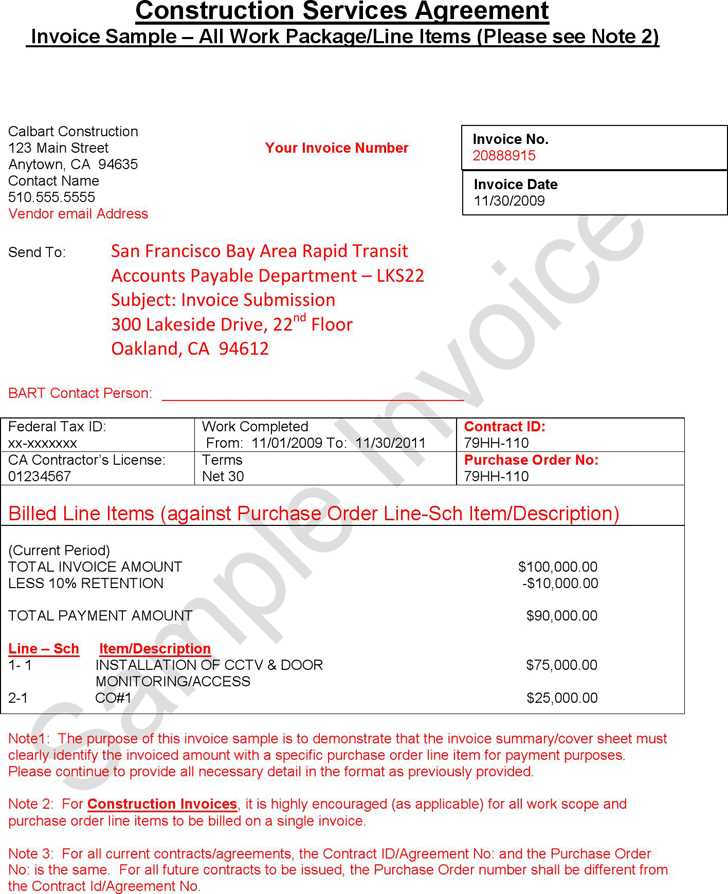

Legal Requirements for Contractor Invoices

When creating a payment request document, it’s essential to ensure that it meets all the legal requirements set forth by your local laws and regulations. These documents are not just a means of tracking payments but also serve as official records for tax purposes and legal disputes. Failing to include necessary information could result in complications down the line, such as delayed payments or issues with tax reporting.

Essential Legal Information to Include

- Business Identification: Include your legal business name, address, and contact information. If applicable, your business registration number or tax identification number (TIN) should also be included to verify your legal status.

- Client’s Information: The name and address of the client receiving the payment request should be listed clearly to avoid confusion or errors.

- Document Number: A unique identification number for each document is crucial for record-keeping and legal tracking. This allows both you and your client to refer to specific documents when needed.

- Date of Issuance: The date when the document is created or issued helps establish the timeline for payment and is important for both parties’ records.

- Payment Terms: Clearly state the due date for payment and any terms regarding late fees, early payment discounts, or installment options. This ensures both parties understand the expectations surrounding payment timing.

- Tax Information: Depending on your location, you may be required to include VAT or sales tax on the total amount. Ensure that all tax rates and amounts are specified and calculated correctly, especially if your business is registered for tax purposes.

Additional Legal Considerations

- Currency and Amount: The total amount due must be clearly outlined, along with the currency in which payment is expected. This helps avoid any confusion, especially with international clients.

- Contractual Terms: If there was a formal agreement in place regarding payment terms, it’s important to reference those terms in the document to avoid legal disputes later on.

- Payment Method: Indicate the accepted methods of payment (e.g., bank transfer, credit card, check) and any relevant details needed to complete the transaction.

By ensuring these elements are included, you will comply with legal requirements and create a document that is both professional and secure. Proper documentation not only helps protect your business but also fosters trust with clients and ensures that both parties are on the same page regarding paymen

Best Practices for Sending Invoices

Sending payment requests professionally and efficiently is crucial to ensuring timely payments and maintaining strong client relationships. While the document itself plays an important role, how and when you send it can have a significant impact on your business operations. Following best practices not only enhances professionalism but also helps avoid misunderstandings and delays.

Here are some key guidelines to consider when sending payment requests:

- Send Promptly: As soon as the work is completed or the agreed-upon milestones are reached, send the request. Delays in sending the document can lead to delays in payment and disrupt cash flow.

- Choose the Right Format: Email is the most common and efficient way to send payment requests. Ensure the document is attached in a universally accessible format (e.g., Word, Excel, or a digital document) that the client can easily open and review.

- Double-Check the Details: Before sending the payment request, carefully review all the details–client information, services provided, amounts due, and payment terms. Errors in this information can lead to confusion and delays in payment.

- Personalize the Message: When sending the document, include a brief, professional message in the email body. A polite note thanking the client for their business and outlining the payment due date can enhance your relationship and foster a sense of professionalism.

- Set Clear Payment Terms: Make sure the payment due date and any relevant instructions or fees are clearly stated in the document. If late fees or discounts for early payment apply, specify them clearly to avoid any disputes.

- Follow Up: If payment is not received by the due date, don’t hesitate to send a polite reminder. Be professional and courteous, and offer multiple payment options if necessary. A timely follow-up ensures that the payment process stays on track.

- Keep Records: Retain copies of all documents sent, including payment requests and any follow-up communications. This will help you track your financial transactions and resolve any future disputes quickly.

By implementing these best practices, you create a seamless and efficient payment process that benefits both you and your clients. Clear communication, timely follow-ups, and attention to detail can make a significant difference in ensuring your business receives the compensation it deserves on time.

Common Mistakes to Avoid with Invoices

Creating accurate and professional payment requests is essential for smooth business operations. However, even small errors in the details can lead to confusion, delayed payments, or misunderstandings with clients. It’s important to be aware of common mistakes so you can avoid them and ensure a seamless billing process. Below are some of the most frequent errors to watch out for:

| Mistake | How to Avoid It |

|---|---|

| Missing Information | Ensure that all key details–such as your business information, client details, and payment terms–are included. Omitting any of these can cause delays or confusion. |

| Incorrect Amounts | Double-check the figures, including quantities, unit prices, and any discounts or taxes. Mathematical errors can lead to disputes and slow payments. |

| Not Using a Unique Reference Number | Assign a unique reference number to each payment request. This makes it easier for both you and your client to track and refer to specific documents. |

| Unclear Payment Terms | Clearly state the payment due date, accepted payment methods, and any late fees or early payment discounts to avoid misunderstandings. |

| Sending Late Requests | Send the document promptly once services are completed or milestones are achieved. Delayed requests can lead to delayed payments and negatively affect cash flow. |

| Failure to Follow Up | If payment is not received by the due date, follow up with a polite reminder. Ignoring overdue payments can harm your business’s financial health. |

| Not Proofreading | Before sending, review the document carefully to catch any spelling or formatting errors. Mistakes in your payment request can affect your professional image. |

By staying mindful of these common mistakes and taking proactive steps to avoid them, you’ll ensure that your payment requests are clear, accurate, and professional. This will not only help you get paid on time but also build trust with your clients.

How to Track Payments on Invoices

Properly tracking payments is essential for maintaining good financial health and ensuring that all transactions are recorded accurately. Without an effective system for monitoring payments, it can be difficult to know which amounts are outstanding and which have been settled. Implementing a reliable tracking method helps you stay organized, follow up on overdue payments, and avoid potential cash flow issues.

Here are some effective methods for tracking payments on your payment requests:

- Use a Payment Log: Keep a detailed log of all payments received. This can be done manually in a ledger or using a digital system. Record the date of payment, the amount, and any transaction reference numbers for easy tracking.

- Mark Payments on Documents: Once a payment is received, update the document by marking it as “Paid” or noting the payment date. This visual cue ensures you can quickly identify which documents have been settled and which remain unpaid.

- Include Payment Status in Correspondence: When sending reminders or follow-up emails, include the payment status of previous requests. This helps both you and the client stay on the same page and encourages timely payments.

- Use Accounting Software: Many accounting software programs allow you to track and manage payments automatically. These platforms provide real-time updates, generate payment reports, and even send automatic reminders to clients for overdue payments.

- Set Up Payment Reminders: If payments are overdue, send polite reminders to clients. Set up a schedule to send reminders at regular intervals (e.g., 7 days, 14 days) until the payment is received. Include all the necessary details such as the outstanding amount and the due date.

By incorporating these strategies, you’ll be able to efficiently monitor and track your payments, ensuring that your business operations run smoothly. Whether you manage payments manually or use digital tools, staying organized is the key to avoiding missed payments and ensuring timely cash flow.

Using Invoice Templates for Quick Billing

Efficient billing is essential for maintaining smooth cash flow and ensuring timely payments. One of the most effective ways to speed up the billing process is by using pre-designed forms. These ready-made documents allow you to quickly fill in the necessary details, saving time and reducing the chances of errors. By using these streamlined formats, businesses can ensure that payment requests are consistent, professional, and easy to manage.

Here’s how using pre-made forms can help with faster and more efficient billing:

- Time Efficiency: With a ready-to-use structure, there’s no need to start from scratch each time. Simply add in the relevant details like client information, services provided, and amounts due, and you’re ready to send.

- Consistency: Pre-designed forms ensure consistency across all your billing documents. Each request follows the same format, which helps build a professional image and makes it easier for clients to understand the information.

- Fewer Errors: By using a standardized layout, you minimize the risk of forgetting important details or making errors in the formatting. This helps ensure that clients receive all the necessary information to process their payment without confusion.

- Easy Customization: Even though you’re using a pre-designed document, these forms are easy to customize for specific jobs or clients. You can quickly adjust terms, services, or amounts without having to redesign the whole document.

- Professional Appearance: A clean, well-organized document enhances your professional reputation. It shows clients that you are organized and reliable, which can help establish trust and encourage prompt payment.

By utilizing these ready-made forms, businesses can streamline their billing process, save time, and reduce the risk of delays or errors. Whether you’re a freelancer or a larger business, incorporating pre-designed billing documents into your workflow will help you maintain a steady flow of income while keeping everything organized.

How to Save Time with Invoicing Tools

Managing payment requests manually can be time-consuming and prone to errors, especially when dealing with multiple clients and projects. Fortunately, digital tools designed for managing billing can significantly speed up the process. These tools automate many aspects of creating, sending, and tracking payment requests, freeing up valuable time that can be better spent on other aspects of your business.

Here are several ways invoicing tools can help you save time:

- Automated Calculations: Invoicing software automatically calculates totals, taxes, discounts, and other variables. This eliminates the need for manual calculations, reducing the risk of mistakes and ensuring accuracy.

- Customizable Templates: Many tools offer customizable formats that allow you to create professional documents with just a few clicks. Instead of designing each document from scratch, you can use predefined layouts and simply input relevant details like services and amounts.

- Batch Invoicing: Some invoicing tools allow you to send multiple requests at once, saving time when dealing with several clients. You can batch the tasks and issue several documents with the same format at once, ensuring all clients are billed on time.

- Recurring Billing: For ongoing projects or services, invoicing tools can automate recurring payments. You can set up billing cycles for repeat clients, and the system will automatically generate and send payment requests at regular intervals.

- Quick Payment Tracking: Many tools track payments automatically, marking requests as paid or overdue. This feature allows you to quickly see which payments have been made and which ones are still pending, eliminating the need for manual tracking and follow-ups.

- Integrated Payment Options: Many invoicing systems offer direct integration with payment gateways, allowing clients to pay directly through the document. This feature streamlines the payment process, reducing delays and making it easier for clients to settle their balances.

By incorporating invoicing tools into your workflow, you can streamline the billing process, reduce the time spent on administrative tasks, and improve overall efficiency. This not only enhances your business operations but also helps ensure that payments are processed quickly and accurately.

Why PDF is the Best Format for Invoices

Choosing the right format for business documents, especially payment requests, is crucial for ensuring they are professional, secure, and easily accessible by clients. One of the most widely recommended formats for billing documents is the one that preserves the integrity of the original content, regardless of the device or software being used to open it. This format has become a preferred choice for businesses due to its versatility, security features, and universal compatibility.

Here are several reasons why this particular format is ideal for payment documents:

- Universal Compatibility: This format can be opened on nearly all devices and operating systems without any issues. Whether your client uses Windows, macOS, or mobile devices, the document will appear exactly as intended.

- Preserves Formatting: The content of a document saved in this format remains consistent, ensuring that fonts, images, and layout are displayed as originally designed. This ensures that your payment request always looks professional, regardless of where it’s viewed.

- File Size: Files saved in this format are often smaller in size, making them easy to send via email or upload to file-sharing platforms without worrying about exceeding file size limits.

- Security: This format allows for password protection and encryption, adding an extra layer of security for sensitive business information. This ensures that only authorized individuals can access or modify the document.

- Easy Printing: Documents in this format are optimized for printing, ensuring that the layout and formatting remain intact when printed out. This is especially useful for clients who prefer physical copies of payment requests.

- Professionalism: This format is widely recognized as a professional standard for business documents. Using it helps establish credibility and trust, as clients are accustomed to receiving well-organized and secure documents in this format.

In summary, the flexibility, security, and consistency of this format make it the best choice for creating and sharing payment requests. By using it, you ensure that your documents are accessible, professional, and secure, which contributes to smoother transactions and more efficient business practices.

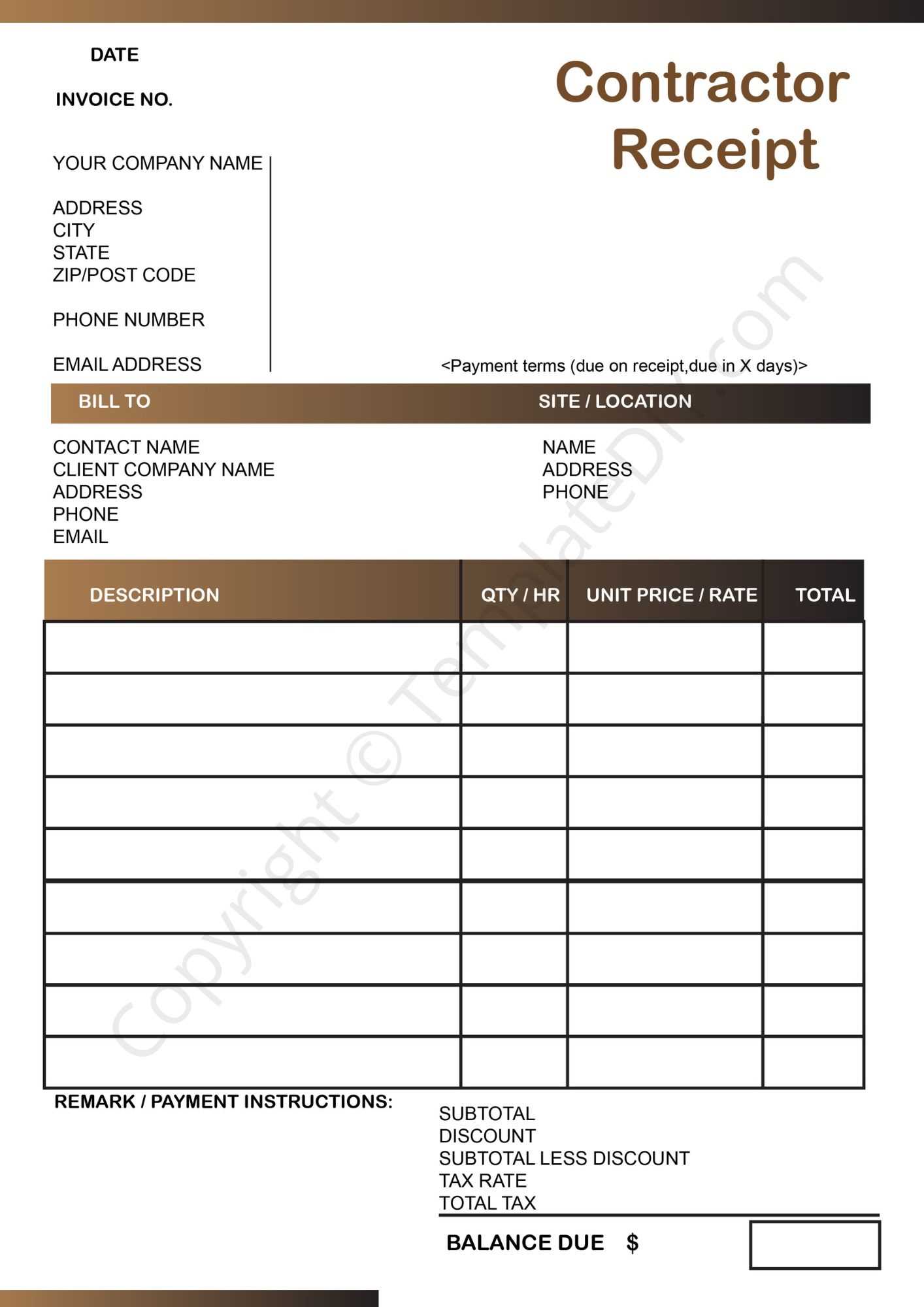

How to Edit Your Contractor Invoice

Making changes to your billing documents is often necessary to ensure accuracy and reflect updates in your services or payment terms. Whether you need to adjust amounts, add or remove items, or update client details, editing your payment requests is a straightforward process with the right tools. In this section, we will cover the steps you need to take to efficiently modify your payment documents.

Follow these simple steps to edit your payment request:

- Open the Document in the Right Program: Start by opening the document in the appropriate software. If you’re working with a digital document, use a program that supports editing (e.g., a word processor for text-based documents or an editing tool for image-based files).

- Update Client and Business Information: Ensure that your client’s details, such as name, address, and contact information, are correct. Also, check that your own business name and contact details are up to date.

- Adjust Services or Products: If the scope of work has changed, update the description of services or products provided. This includes adding new items or removing those that are no longer relevant.

- Modify Amounts: Double-check the prices for each item or service. Make sure to update the totals if there have been any changes in pricing, discounts, or additional charges.

- Revise Payment Terms: Ensure that payment terms are clearly stated. Update any changes in due dates, accepted payment methods, or late fees, if applicable.

- Save and Export the Updated Document: After making the necessary changes, save your document. If you need to share it digitally, export it in a format that can be easily opened and read by your client, such as a format that maintains the layout and structure.

Once you’ve made the necessary edits, review the document to ensure everything is accurate and professionally presented. Clear and precise details will help your clients process the payment more efficiently and avoid any confusion. With the right tools and attention to detail, editing payment documents can be quick and easy.

Free Tools to Create Professional Invoices

Creating polished and well-organized payment requests doesn’t have to be a costly or time-consuming task. There are several free online platforms and software available that help businesses generate professional documents in just a few minutes. These tools often come with built-in features that simplify the entire process, from design to sending the document. Below are some free resources that can help you create polished and efficient billing documents.

Here are some top options to consider for crafting professional documents:

- Invoice Generator by Invoicely: Invoicely offers a free service where you can create and download well-designed documents. The platform allows you to add business and client details, services, pricing, and payment terms, all within a simple and user-friendly interface.

- Wave Accounting: Wave provides a free invoicing tool as part of its accounting software suite. With this platform, you can create, send, and track payment requests. It also allows for customizable templates and easy integration with your bank account for payment tracking.

- Zoho Invoice: Zoho’s free version offers many features, including the ability to generate professional payment documents, track payments, and send reminders. It also provides customizable templates to match your business branding.

- PayPal Invoicing: PayPal offers a free invoicing tool for users who have a PayPal account. It allows for quick creation of payment requests, with options to add your company logo, descriptions, and specific payment instructions. The platform also lets you accept payments directly through PayPal.

- Invoice Simple: Invoice Simple provides a free version that enables users to create and send professional documents quickly. You can add business information, services, and custom notes, and then send the payment request via email or save it as a PDF.

- Google Docs/Sheets: Google offers easy-to-use, free templates within Google Docs and Google Sheets. While it requires a bit more customization, these platforms allow you to create your own documents and store them in the cloud for easy access.

Using these free tools, you can quickly generate polished and professional payment requests without spending money on expensive software. Whether you’re a freelancer or a small business owner, these platforms provide an accessible and efficient way to manage your billing process.

How Invoices Improve Cash Flow Management

Efficient cash flow management is essential for any business, and one of the most effective ways to maintain a healthy financial standing is through well-structured payment requests. These documents not only outline the services or products provided but also specify payment terms, making them crucial for ensuring timely payments. By utilizing payment requests strategically, businesses can better track earnings, predict cash flow, and avoid financial shortfalls.

Clear Payment Terms

One of the primary ways that payment requests contribute to better cash flow management is by clearly defining payment terms. When businesses set expectations around due dates, discounts for early payment, and penalties for late payment, clients are more likely to adhere to the agreed-upon timeline. This clarity helps businesses avoid delays and ensures that payments are received on time, improving cash flow.

Streamlined Tracking and Record-Keeping

Payment requests serve as formal records of transactions, which helps businesses keep track of all incoming payments. By generating and sending these documents consistently, business owners can monitor outstanding balances and identify any overdue amounts. This not only helps with following up on unpaid invoices but also aids in planning for future expenses, ultimately contributing to smoother cash flow management.

In addition, detailed payment requests can help businesses forecast their financial future with more precision. By analyzing past payment patterns, a company can predict upcoming cash inflows and plan accordingly, ensuring that operational expenses are met without delays.

Overall, effective use of payment requests is a powerful tool for improving cash flow management. By establishing clear terms and maintaining accurate records, businesses can reduce the risk of cash flow problems and maintain financial stability.