Download Invoice and Statement Template Excel for Easy Billing

Managing financial transactions efficiently is crucial for any business. Having the right tools at hand can save you time and reduce errors, especially when it comes to tracking payments, generating reports, and keeping everything organized. The use of organized sheets for creating professional documents can make a significant difference in how quickly you get paid and how well you manage your finances.

With customizable spreadsheets, you can easily create professional-looking records for every transaction. These ready-to-use files offer flexibility and can be tailored to suit the needs of your specific business, whether you’re working with individual clients or handling multiple accounts. Automation features like calculations and totals further streamline the entire billing process.

Whether you’re a freelancer, small business owner, or managing a larger company, these documents offer a simple, efficient solution to keep track of your financial dealings. By utilizing these ready-to-edit tools, you can focus more on growing your business and less on paperwork.

Invoice and Statement Template Excel Overview

Managing financial records is an essential part of running a business, whether small or large. Proper documentation of payments, charges, and balances ensures smooth transactions and prevents disputes. Ready-to-use files allow for easy creation of professional records, offering both customization and efficiency. These sheets serve as a powerful tool for organizing business finances and ensuring accuracy in client interactions.

Key Features

- Easy Customization: Adjust the layout, fields, and design to match your business requirements.

- Automated Calculations: Built-in formulas help calculate totals, taxes, and balances automatically.

- Multiple Client Management: Handle numerous customers or projects with separate sections for each account.

- Professional Design: Clean, simple formats enhance the appearance of your financial records.

- Time Efficiency: Save time with pre-designed structures that require minimal setup.

Why You Need These Tools

Having ready-to-go solutions helps eliminate manual errors and ensures consistency across all transactions. With the ability to track both incoming and outgoing amounts, you stay organized and avoid missing any important details. Whether for invoicing clients, summarizing balances, or generating financial summaries, these files simplify what could otherwise be time-consuming tasks. Furthermore, they are versatile and can be used by a range of industries, from freelancers to larger enterprises.

Why Use Excel for Invoices

Managing financial records efficiently is key to maintaining smooth business operations. A spreadsheet program offers an accessible, versatile, and cost-effective solution for tracking payments, calculating totals, and organizing financial data. The ability to customize documents to suit your specific needs makes it an ideal tool for managing client transactions and other business-related billing processes.

Advantages of Using a Spreadsheet Program

- Customization: Easily modify layouts, add or remove fields, and adjust styles according to your business needs.

- Built-In Calculations: Automate calculations for totals, taxes, discounts, and balances, reducing manual errors.

- Cost-Effective: No need to invest in expensive accounting software when a simple spreadsheet can accomplish the same tasks.

- Flexibility: Tailor the structure to fit a variety of business models, from freelancers to large companies.

- Data Organization: Keep all transactions in one place, making it easier to search, track, and report on finances.

Efficiency and Time Savings

Using a spreadsheet tool for financial documents not only speeds up the process but also ensures greater accuracy. By setting up templates with predefined fields and calculations, you can quickly generate reports without needing to start from scratch each time. This level of automation saves

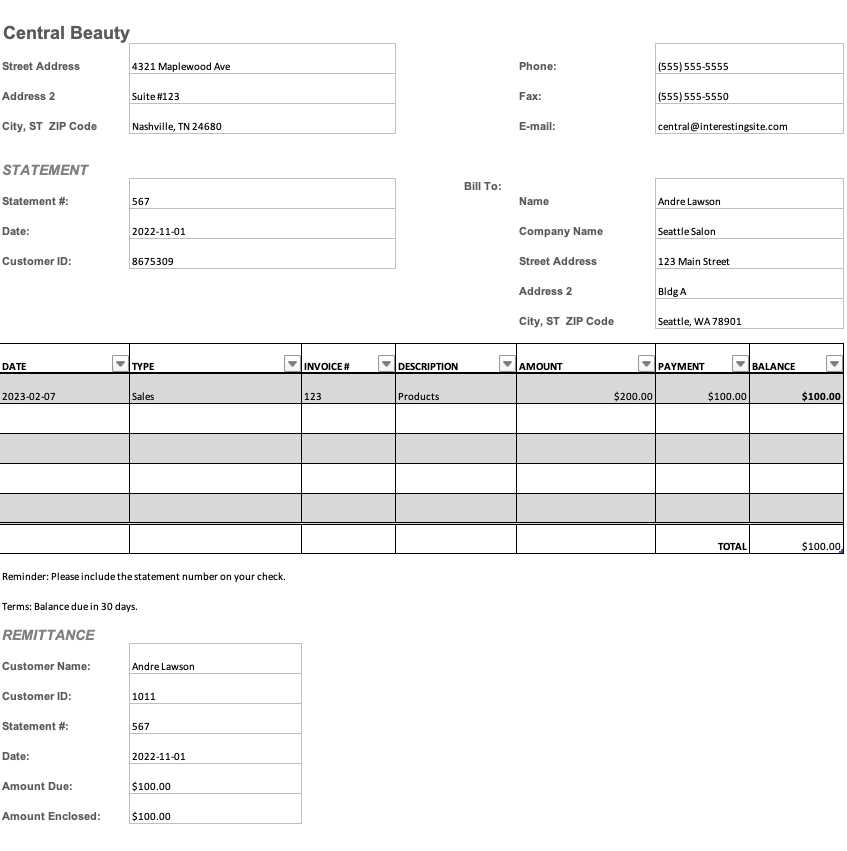

Benefits of Using Statement Templates

Using pre-made files to organize financial records brings significant advantages to businesses. These structured documents allow you to track client balances, payments, and outstanding amounts with ease. Having a clear overview of financial interactions in one place ensures accuracy, reduces errors, and helps you stay on top of your business finances.

Key Advantages

- Improved Organization: Consolidate all financial transactions in a single, easy-to-read document, making it easier to track payment histories.

- Time-Saving: Pre-designed layouts save time, eliminating the need to create new documents from scratch for each client or transaction.

- Automated Calculations: With built-in formulas, you can automatically calculate outstanding balances, totals, and taxes, reducing manual work.

- Professional Appearance: These ready-made designs provide a polished, professional look that can impress clients and business partners.

- Customization: Tailor the document’s design and structure to suit your business’s specific needs and preferences.

Why It Matters for Your Business

For businesses of all sizes, having the ability to generate clear, accurate financial records is crucial for maintaining smooth operations. Whether it’s summarizing the history of transactions with a single client or generating a complete financial overview, these files streamline the process, helping you avoid confusion and ensure timely payments. They provide a simple yet effective way to stay on top of cash flow without needing complex accounting systems.

Customizing Invoice Templates in Excel

Personalizing financial documents to suit your specific business needs is essential for creating a professional and consistent look. Customization allows you to add or remove certain fields, adjust the layout, and incorporate your brand identity into every document. Tailoring these files ensures they reflect your business processes and improve the clarity of your communication with clients.

Steps to Personalize Your Document

- Modify Fields: Adjust text boxes and input areas to include details like business name, client information, and payment terms.

- Add Branding: Incorporate your company logo, colors, and fonts to make the document match your brand’s visual style.

- Adjust Layout: Change the column sizes, row heights, and positioning to ensure that all information is clearly presented and easy to understand.

- Automate Calculations: Set up formulas to calculate totals, taxes, and discounts automatically based on input values.

- Include Additional Sections: If necessary, add sections for special instructions, payment methods, or late fees.

Sample Customization Table

| Field | Customization Option |

|---|---|

| Client Name | Change font size or add color for emphasis |

| Amount | Use bold or italics to highlight totals |

| Payment Due Date | Change cell format to date or highlight in different color |

| Tax Rate | Adjust percentage in formula or add a fixed rate |

| Additional Notes | Add a comment box or extra row for customized instructions |

By following these simple steps, you can create a highly functional, professional document that fits your business perfectly. Customization gives you full control over the appearance and functionality of each record

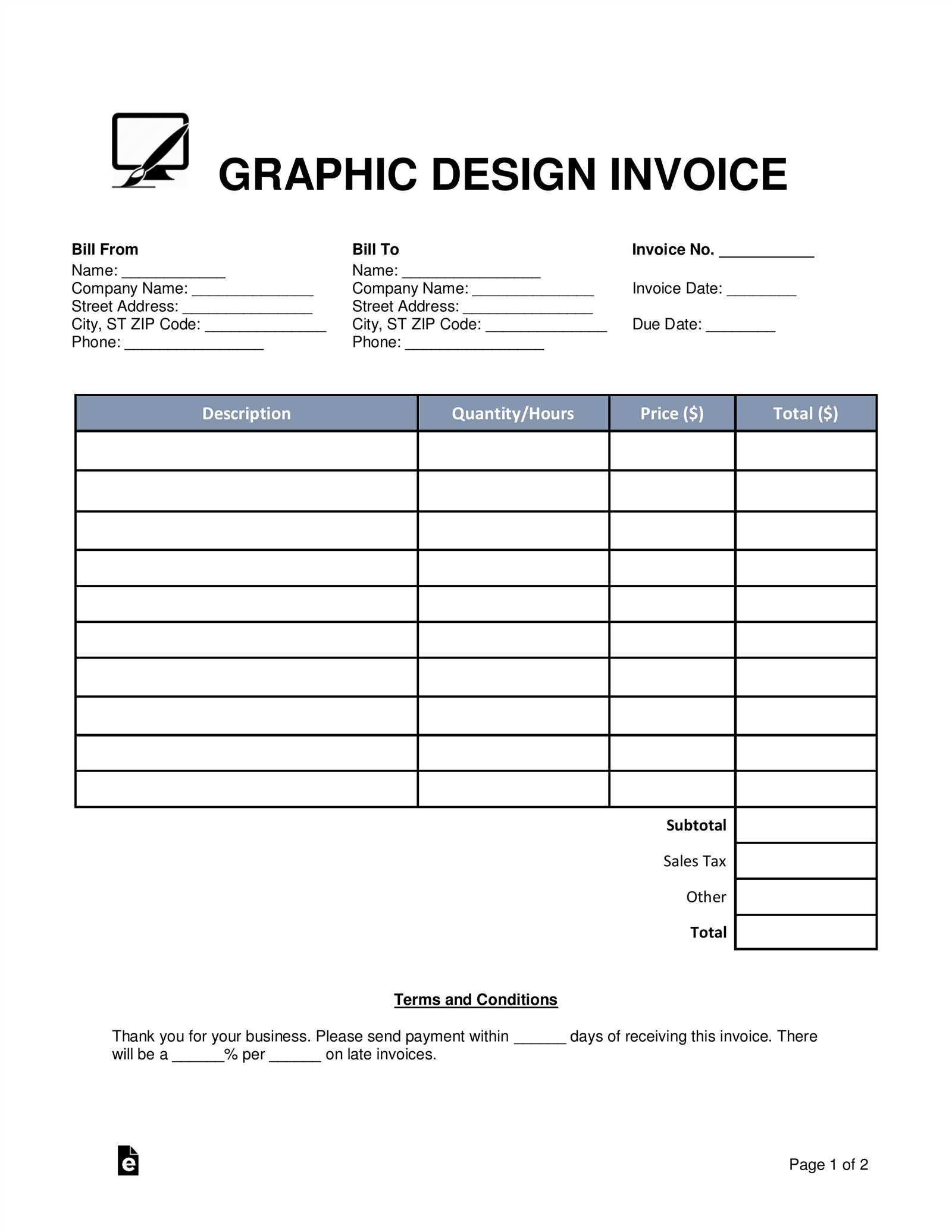

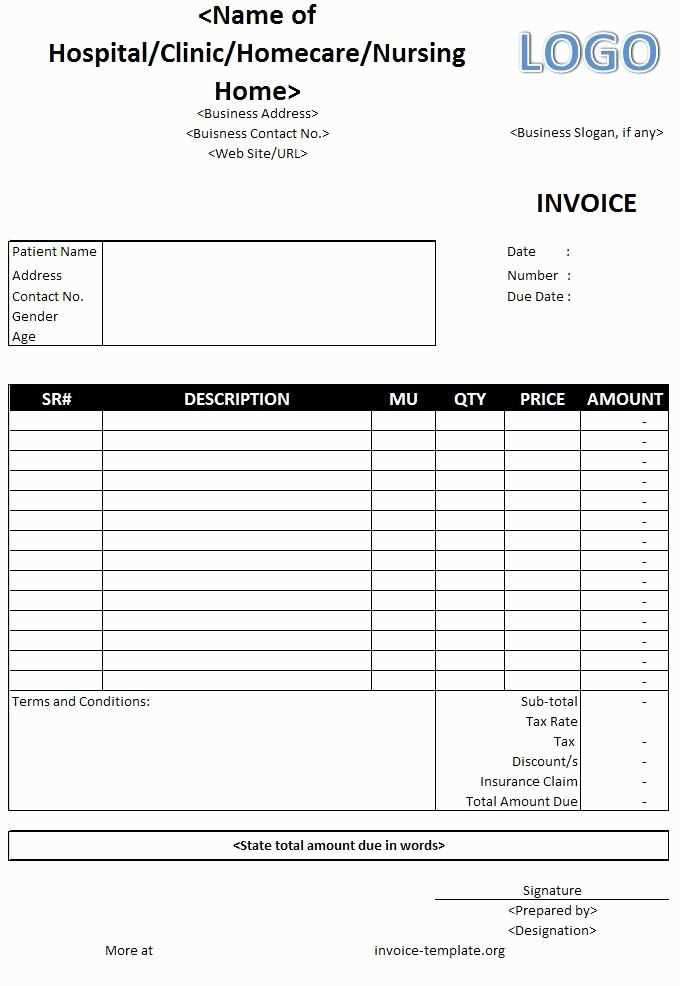

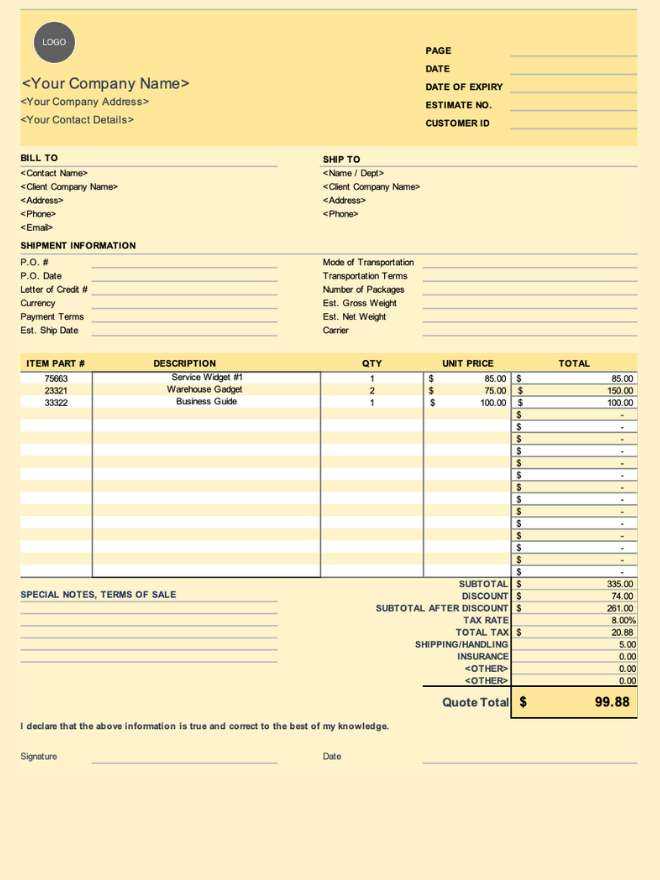

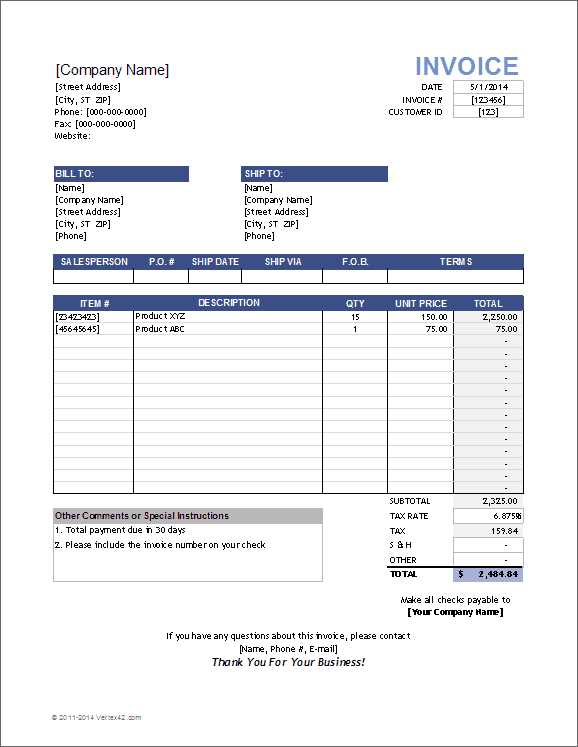

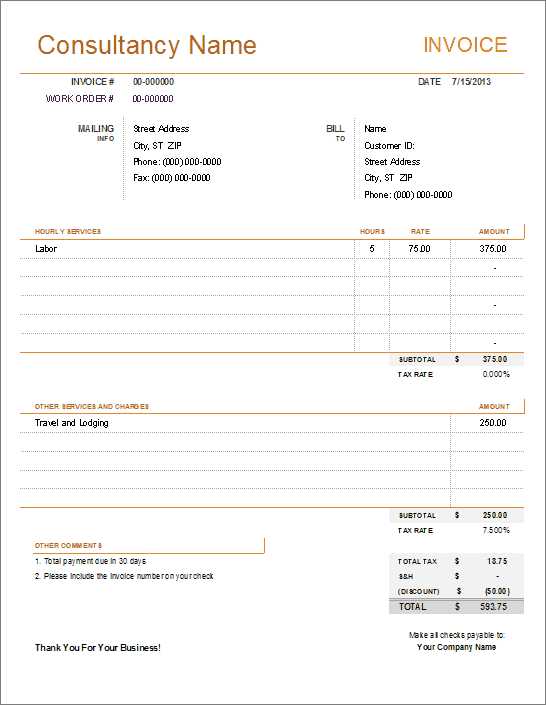

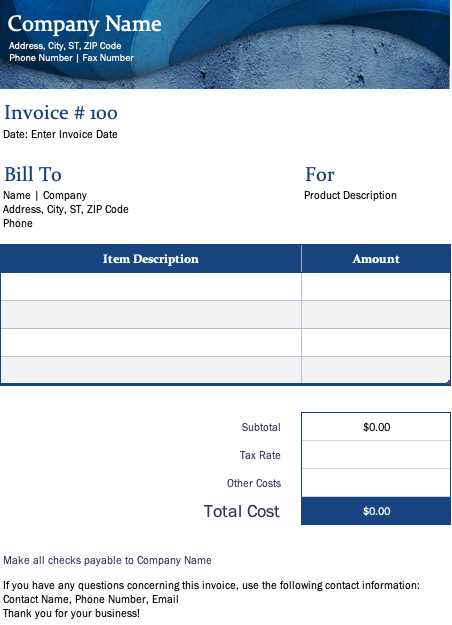

How to Create Your Own Invoice

Designing your own financial document to request payments is easier than it seems. With just a few simple steps, you can set up a professional-looking record that tracks the services provided, the amounts due, and any relevant payment terms. Customizing this document to suit your business ensures that it meets your specific needs and presents a clear, concise breakdown for your clients.

The first step is to decide on the key information that should appear on the document. Typically, this includes the client’s name, a unique reference number, the date of issue, and a list of items or services with their associated costs. The total amount due, payment instructions, and any applicable terms or deadlines should also be clearly outlined.

Essential Sections to Include

- Header Information: Include your business name, contact details, and logo to make the document easily recognizable.

- Client Details: Add the recipient’s name, company name (if applicable), and contact information for clarity.

- Description of Services: List the services or products provided, including quantities and unit prices.

- Payment Details: Specify the total amount due, any taxes, discounts, and the final balance.

- Terms and Conditions: Include payment terms such as the due date, late fees, or acceptable payment methods.

Additional Tips for Personalization

- Formatting: Use clear fonts, bold headers, and appropriate spacing to ensure that the document is easy to read.

- Branding: Add your company’s logo, color scheme, and other branding elements to make the document visually appealing.

- Automation: If you’re using a spreadsheet, set up formulas to automatically calculate totals and taxes based on the services provided.

Once you’ve set up the structure, you can save your file and reuse it for future clients. This way, you don’t have to start from scratch every time, and you can ensure that each record looks consistent and professional. By creating your own payment request document, you take full control over the design, layout, and content, ensuring it suits your business style and processes.

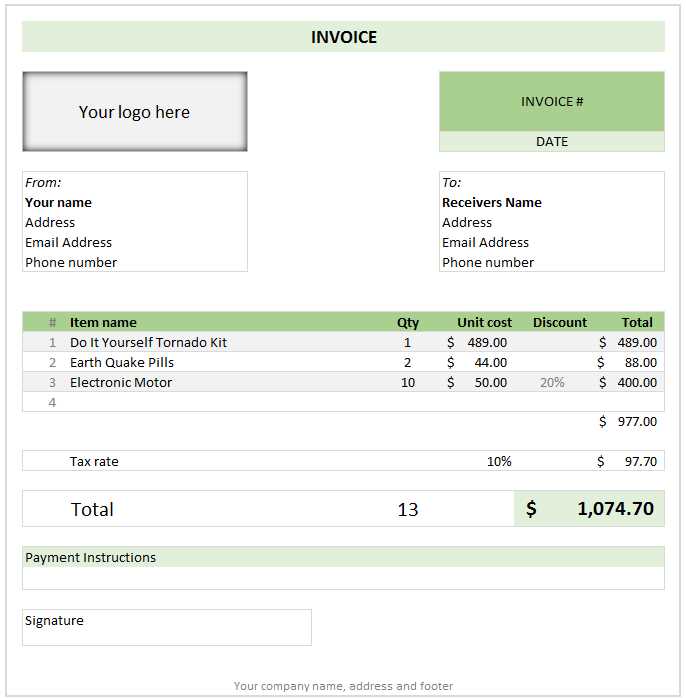

Features of Excel Invoice Templates

Pre-designed documents for tracking payments come with a variety of built-in features that make them powerful tools for businesses. These ready-to-use files simplify the process of creating professional records, automating many of the repetitive tasks involved in financial management. By offering flexibility and functionality, they help you stay organized and ensure accuracy in all your transactions.

Key Features

- Customizable Layout: You can easily modify the structure, change the font, and adjust columns to fit your specific business needs.

- Automatic Calculations: Built-in formulas automatically compute totals, taxes, and discounts, reducing manual errors and saving time.

- Pre-set Sections: These documents include dedicated sections for payment details, service descriptions, client information, and due dates, which can be quickly filled out for each transaction.

- Clear Design: Clean, professional layouts with appropriate spacing and easy-to-read fonts ensure that every document looks polished and is easy for clients to understand.

- Multi-Client Support: You can manage multiple clients or projects in a single file, keeping each record organized and easily accessible.

Additional Functionalities

- Recurring Billing: Set up templates to handle regular payments, such as subscriptions or service agreements, with recurring amounts and due dates.

- Customizable Tax Rates: Adjust tax percentages and include them in your calculations to ensure compliance with local regulations.

- Professional Look: Pre-designed themes and color schemes give a polished and cohesive appearance that reflects your brand’s identity.

- Data Tracking: Keep records of payments made and outstanding amounts, enabling better cash flow management and reducing the risk of missed payments.

These features make pre-designed financial documents incredibly versatile and efficient, allowing you to focus more on growing your business while maintaining full control over your billing process.

Managing Multiple Clients with Excel

Handling multiple clients can quickly become overwhelming, especially when it comes to organizing transactions, tracking payments, and maintaining accurate records for each account. Using a spreadsheet program to manage these tasks provides an efficient way to stay organized. You can easily set up a system that allows you to track every client’s details, payment history, and outstanding balances in one place, saving time and ensuring that nothing is overlooked.

Organizing Client Information

When working with various clients, it’s important to structure your document in a way that keeps their information separate yet easily accessible. Creating individual sections for each client within a single file allows you to manage multiple accounts without confusion. You can organize the data by using separate sheets or tabs for each client or by allocating specific columns and rows within one sheet.

- Separate Sections: Assign individual rows or columns to each client, keeping all relevant data such as contact details, payment amounts, and due dates organized.

- Customizable Fields: Include specific information for each client, such as unique identification numbers, billing addresses, or special payment terms.

- Payment History: Keep a running total of all previous payments, highlighting outstanding amounts and showing a clear financial history for each client.

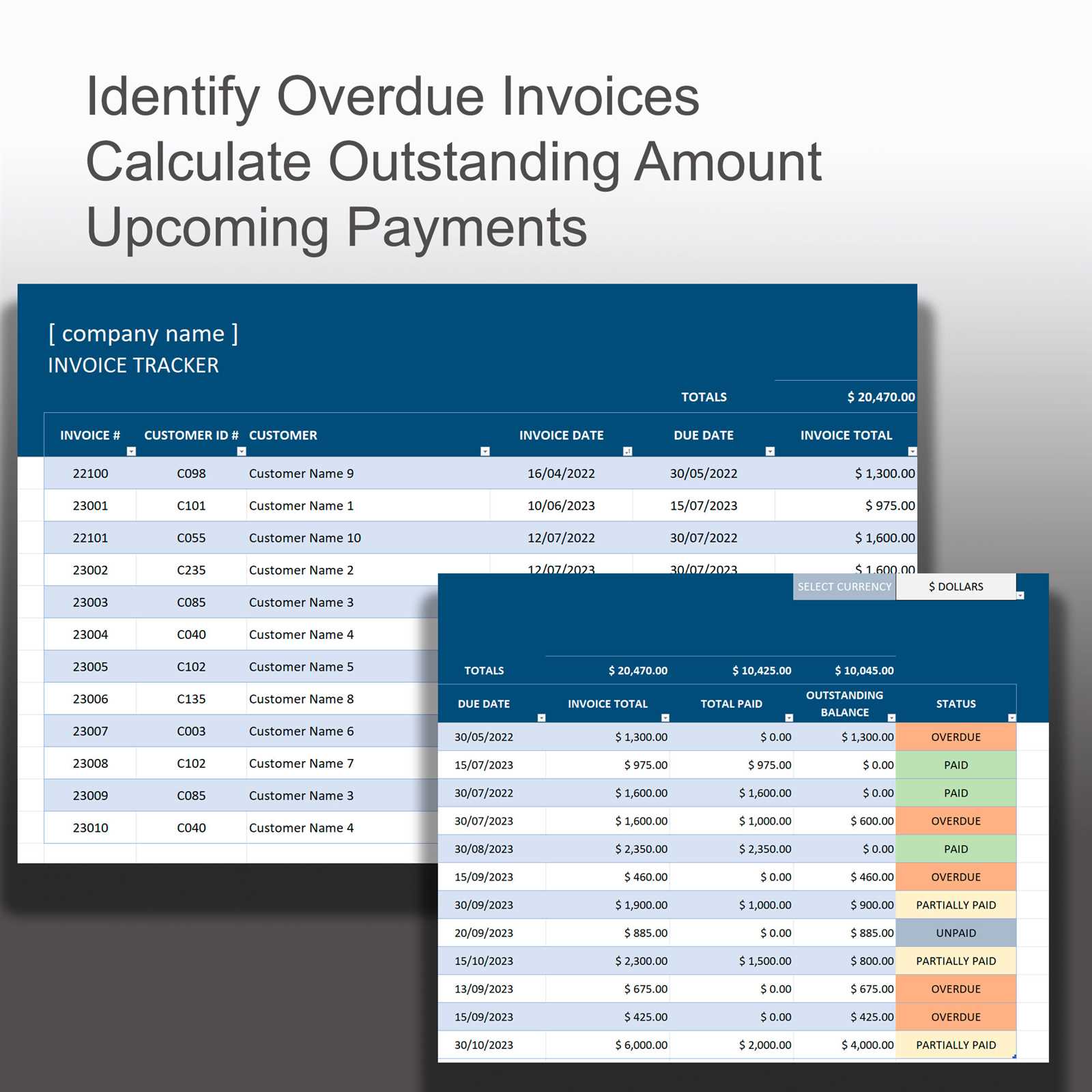

Tracking Payments and Balances

Maintaining accurate records of payments is essential for managing multiple accounts. By using built-in formulas and automated calculations, you can easily track which clients have paid, how much is outstanding, and when payment is due. Setting up a tracking system in your spreadsheet ensures that all clients are billed appropriately and that you never miss a payment.

- Payment Status: Set up visual cues, such as color coding or icons, to indicate whether a payment is pending, overdue, or completed.

- Automated Reminders: Use conditional formatting or alerts to automatically highlight overdue payments, making it easier to follow up with clients in a timely manner.

- Clear Balance Overview: Use formulas to automatically calculate each client’s remaining balance, including any additional charges, taxes, or discounts.

With the right system in place, managing multiple clients becomes much easier. By streamlining the process of tracking payments and organizing data, you free up time to focus on growing your business and maintaining strong client relationships.

Best Practices for Invoice Design

A well-designed document for requesting payments is not only about appearance but also about clarity and ease of use. When creating financial documents, the goal should be to present the necessary information in a clear, structured way that is easy for both you and your clients to understand. A clean, professional design can improve communication and ensure that all important details are easy to find, reducing confusion and the risk of errors.

Key Elements of a Good Design

- Clear Layout: Use a simple, structured layout with distinct sections for client details, payment amounts, and terms. Ensure that there is enough white space to make the document easy to read.

- Consistent Branding: Include your company logo, colors, and fonts to make the document easily recognizable and aligned with your brand’s identity.

- Readable Fonts: Choose fonts that are legible both on screen and in print. Stick to simple, professional fonts like Arial, Helvetica, or Times New Roman.

- Logical Flow: Organize the content in a logical sequence. Start with contact information, then proceed to the list of services or products, followed by payment details and any terms or instructions.

Design Tips for Improved Functionality

- Highlight Key Information: Make the total amount due, due date, and payment terms stand out by using bold text, larger font sizes, or contrasting colors.

- Use Tables for Clarity: Organize items and amounts in tables for easy reading. Include columns for descriptions, quantities, unit prices, and totals, making it simple to see the breakdown at a glance.

- Keep It Simple: Avoid clutter by sticking to essential information. Too many design elements or excessive text can make the document overwhelming.

- Incorporate Payment Instructions: Provide clear payment instructions at the bottom, such as methods accepted, bank account details, or links for online payments.

By following these design best practices, you can create professional, easy-to-read documents that help ensure smooth financial transactions. A well-structured format not only improves client satisfaction but also reflects the professionalism of your business.

Tracking Payments with Excel Templates

Monitoring payments and outstanding balances is crucial for maintaining cash flow and ensuring timely follow-ups with clients. Using pre-designed financial sheets allows you to easily track which payments have been made, which are pending, and which are overdue. These sheets automate many tracking tasks, ensuring that you never miss a payment or lose track of a financial transaction.

Setting Up a Payment Tracking System

By organizing your data in a clear, structured way, you can quickly see the status of each payment. Essential details such as client names, amounts due, payment dates, and balance statuses should be included to provide a complete overview of your financial situation. Additionally, using formulas to automatically calculate totals and outstanding amounts makes the process even more efficient.

| Client Name | Amount Due | Amount Paid | Balance | Due Date | Status |

|---|---|---|---|---|---|

| Client A | $500 | $500 | $0 | 2024-11-10 | Paid |

| Client B | $300 | $150 | $150 | 2024-11-15 | Partial Payment |

| Client C | $700 | $0 | $700 | 2024-11-20 | Pending |

This table clearly shows the status of payments for each client, making it easy to spot outstanding balances. You can also use color-coding or visual cues to indicate overdue payments or accounts that require follow-up. Automation features allow for real-time updates, making this method both efficient and error-free.

With these tracking features in place, you can streamline the process of monitoring finances, improving both your workflow and your ability to stay on top of your cash flow.

Saving Time with Automated Calculations

Manually calculating totals, taxes, and discounts can be time-consuming and prone to errors. By using automated calculations in your financial documents, you can significantly reduce the time spent on these tasks and ensure greater accuracy. Automated features such as formulas and functions allow you to quickly update figures based on the information you input, making the entire process more efficient.

Key Benefits of Automation

- Reduced Errors: By automating calculations, you minimize the risk of mistakes that can arise from manual entry or miscalculations.

- Time Efficiency: Automated functions instantly update totals, taxes, and balances, allowing you to focus on other important tasks.

- Consistency: Every document is calculated in the same way, ensuring uniformity and reducing the need for manual oversight.

- Real-Time Updates: As soon as data is entered or modified, all related fields are automatically updated, keeping your calculations accurate without additional effort.

Common Automated Functions

- SUM: Adds up totals for columns or rows, such as total amounts for services or products provided.

- IF Statements: Use conditional logic to apply discounts or special rates based on specific criteria, such as the total amount or client type.

- Tax Calculations: Automatically apply tax rates to sub-total amounts, adjusting based on regional tax rates or custom percentages.

- Balance Calculation: Subtract the payment received from the total due to instantly calculate the remaining balance.

By incorporating automated calculations into your financial documents, you can save significant time while reducing errors, improving both the speed and accuracy of your work. This automation helps streamline your operations, allowing you to focus on growing your business instead of getting bogged down by repetitive tasks.

How to Edit and Update Statements

Occasionally, you may need to make changes or updates to your financial documents, whether it’s correcting an error, adding new charges, or reflecting recent payments. Fortunately, making adjustments is simple and can be done quickly without disrupting the overall structure of the document. With the right tools and knowledge, editing these files becomes a straightforward process that ensures your records remain accurate and up-to-date.

Steps to Edit Your Document

- Open the File: Start by opening the document you want to update. If you’re working with an existing record, locate the file on your system.

- Locate the Section to Edit: Find the specific area where changes need to be made. Whether it’s client information, service descriptions, or payment amounts, focus on the relevant section for modification.

- Make the Necessary Changes: Update the values, add new rows or columns, and make any corrections as needed. You can adjust prices, change dates, or include additional services.

- Review Calculations: After making changes, double-check any automatic calculations to ensure they reflect the most recent data. Update tax rates, totals, or balances as required.

Best Practices for Updating Records

- Maintain a Backup: Before making changes, save a copy of the original document. This way, you can always revert to the previous version if needed.

- Use Clear Versioning: When saving updated versions, use a clear naming convention, such as including the date in the file name (e.g., “ClientName_Updated_2024-11-05”).

- Track Changes: If possible, track changes or add comments to note what has been updated. This is especially useful for large documents or collaborative editing.

- Consistency is Key: Ensure that all changes are reflected consistently throughout the document. Double-check for accuracy in the new totals, taxes, and other calculations.

By following these simple steps, you can efficiently update your financial documents, keeping all records accurate and current. Regular updates will help you maintain an organized system that meets your business needs and provides your clients with clear, precise information.

Common Mistakes to Avoid in Invoices

When creating financial documents, it’s easy to overlook details that can lead to misunderstandings or delays in payment. Even small errors can cause confusion or force clients to request clarifications, which can slow down the payment process. To ensure smooth transactions and maintain professionalism, it’s important to avoid common mistakes that could compromise the accuracy of your records or harm your relationship with clients.

Key Mistakes to Watch For

- Missing Contact Information: Always include complete details for both your business and the client, such as addresses, phone numbers, and email addresses. Missing contact information can lead to confusion or delays in communication.

- Incorrect Payment Terms: Clearly state the payment terms, including the due date and accepted methods of payment. Failing to specify this can lead to misinterpretation and late payments.

- Unclear Item Descriptions: Each service or product should have a clear, detailed description. Vague or generic terms can lead to misunderstandings about what is being billed.

- Incorrect Calculations: Double-check your figures to avoid errors in totals, taxes, or discounts. Using manual calculations increases the risk of mistakes that can lead to client disputes.

- Not Including a Unique Identifier: Always include a unique reference number for each record. This helps both you and the client easily track payments and resolve any issues that may arise.

Best Practices to Prevent Errors

- Double-Check for Accuracy: Before sending out a document, carefully review all information, including amounts, contact details, and dates. A quick review can help catch mistakes before they become a problem.

- Automate Calculations: Use built-in functions to reduce the chance of errors. Automating totals and tax calculations ensures consistency and accuracy in your documents.

- Stay Consistent: Use the same format and structure for each document. Consistency helps both you and your clients quickly find the information they need and avoids confusion.

- Set Clear Deadlines: Always specify the payment deadline and any late fees that may apply. Clear terms make it easier for clients to understand your expectations.

By paying attention to these common mistakes and following best practices, you can ensure that your financial documents are accurate, professional, and efficient, helping to foster positive relationships with your clients and reducing the likelihood of disputes or delays.

Using Excel for Professional Billing

For businesses that need to manage payments and track financial transactions, a simple, organized system can make all the difference. Utilizing spreadsheet software for generating billing documents offers flexibility, automation, and ease of use, allowing professionals to handle their financial records with efficiency and accuracy. With customizable features, it’s possible to tailor the layout and calculations to meet specific business needs, ensuring that clients receive clear, concise, and timely billing information.

By leveraging the power of spreadsheet software, you can create professional billing documents that automatically calculate totals, taxes, and discounts, reducing the risk of human error. This software also allows you to maintain detailed records, making it easier to track outstanding payments, follow up on overdue balances, and organize your financial data for future reference.

The ability to create and modify billing documents in real time is especially beneficial for freelancers, small businesses, and anyone who regularly deals with clients. Customizing your layout, adding relevant details, and applying automated calculations means less time spent on manual tasks and more time focused on growing your business.

How to Export Excel Templates to PDF

Converting your financial documents from a spreadsheet format to a PDF can provide a more professional, easily shareable version of your records. This process ensures that your layout remains intact, no matter the device or software the recipient uses. By exporting to a PDF, you also preserve the formatting, including fonts, colors, and overall design, making it ideal for sending official documents or keeping a permanent record.

Exporting your document is a straightforward process. Here’s a simple guide to help you convert your work from a spreadsheet to a PDF file, ensuring that all the necessary details are preserved and easily accessible for your clients or your own records.

Steps to Export to PDF

- Open Your Document: Start by opening the file you wish to convert. Make sure all your data is accurate and properly formatted before proceeding.

- Adjust Page Layout: Before exporting, you may want to adjust your layout. Ensure that the document fits neatly on the page, adjusting margins or scaling as needed. This can be done through the “Page Layout” options.

- Go to the ‘File’ Menu: Click the “File” tab in the top left corner of your software.

- Select ‘Save As’ or ‘Export’: Depending on your software version, choose either “Save As” or “Export” to begin the process of saving your file as a PDF.

- Choose PDF as the File Type: In the “Save As” or “Export” window, select PDF as your preferred file format. Choose the destination folder where you’d like to save the document.

- Adjust PDF Settings: If needed, you can customize settings like page size, orientation, and whether to include certain elements like gridlines.

- Click ‘Save’ or ‘Export’: Once all settings are adjusted, click the “Save” or “Export” button to generate the PDF file.

Example of Export Settings

| Setting | Option |

|---|---|

| Page Size | A4, Letter, Custom |

| Orientation | Portrait, Landscape |

| Include Gridlines | Yes, No |

| Scaling | Fit to One Page, Custom Scaling |

By following these simple steps, you can easily convert your documents into a PDF format that is universally accessible, ensuring that your files maintain their structure and professionalism when shared. This is particularly helpful for clients who may not have access to spreadsheet software or for sending documents through email.

Setting Up Payment Terms in Excel

Establishing clear payment terms is a key component of any financial record, helping ensure that both parties understand the expectations regarding timing and methods of payment. By incorporating these terms into your financial documents, you can prevent misunderstandings and avoid late payments. Using spreadsheet software to set up these terms allows for easy customization and automatic calculations, saving time while ensuring consistency across all transactions.

Payment terms can include various details such as due dates, early payment discounts, late fees, and payment methods. Setting these up correctly not only makes your records more professional but also helps streamline the payment process for both you and your clients.

Steps to Set Payment Terms

- Define Payment Due Date: Determine when the payment is expected. This can be a fixed date, such as “30 days from the issue date,” or a specific calendar date.

- Set Early Payment Discounts: If you offer discounts for early payments, clearly state the discount percentage and the time frame in which the payment must be made to qualify for this discount.

- Include Late Fees: Specify any penalties for overdue payments, such as a flat fee or a percentage added to the total amount due after the due date.

- Payment Methods: List the accepted payment methods, such as bank transfer, credit card, or check, ensuring clients are aware of how to pay you.

Automating Payment Terms in Spreadsheets

- Use Date Functions: Set up formulas that calculate the due date based on the issue date. For example, you can use a simple formula to add 30 days to the issue date, automatically displaying the due date.

- Apply Conditional Formatting: Highlight overdue payments or upcoming due dates with conditional formatting. This will draw attention to payments that need to be followed up on.

- Automate Calculations for Discounts or Late Fees: Set up formulas that automatically apply discounts or calculate late fees based on payment dates, making it easier to track changes in the total amount due.

By effectively setting up payment terms within your financial documents, you ensure a clear understanding between you and your clients regarding expectations. Automated features make managing these terms easier and more efficient, allowing you to focus on other aspects of your business while maintaining smooth cash flow.

Sharing Invoices with Clients Securely

When it comes to sending financial documents to clients, security is crucial. Sensitive information such as payment details, service descriptions, and personal data must be transmitted in a way that protects both you and your client. In today’s digital age, there are several methods to securely share these documents, ensuring privacy and preventing unauthorized access.

It’s essential to use tools and techniques that maintain confidentiality, especially when dealing with large amounts of money or private client information. This includes encrypting documents, using secure file-sharing platforms, and following best practices for digital communication.

Secure Methods for Sharing Documents

- Use Password-Protected Files: One of the easiest ways to secure your financial documents is by password-protecting them. This ensures that only individuals with the correct password can access the document.

- Send Files via Secure Email: Use encrypted email services that provide end-to-end encryption, ensuring that the email and its attachments are only accessible to the intended recipient.

- Utilize File Sharing Platforms: Consider using reputable file-sharing services that offer secure access options, such as password protection, two-factor authentication, or time-limited access links.

- Enable Encryption: If sending sensitive files via email or file-sharing platforms, make sure the documents are encrypted. This adds an extra layer of security in case the file is intercepted during transmission.

Best Practices for Protecting Information

- Use Strong Passwords: Always choose complex, unique passwords for your files and accounts. Avoid using easily guessable information like birthdays or simple words.

- Confirm Recipient’s Identity: Before sending any document, ensure that you are sending it to the correct client. Verify the recipient’s email address or communication method to avoid accidental sharing.

- Limit Access: Share the document only with those who need it, and avoid forwarding it to third parties unless absolutely necessary.

- Monitor Document Access: Use file-sharing tools that allow you to track who has accessed the document. This way, you can ensure that the right people are viewing your records.

By following these best practices, you can ensure that your financial records are transmitted securely, protecting both your business and your clients from potential risks. Secure sharing methods not only safeguard information but also build trust between you and your clients, showing that you prioritize their privacy and security.

Integrating Excel Templates with Accounting Software

Integrating spreadsheet-based financial documents with accounting software can significantly streamline the management of your business finances. By connecting these tools, you can automate data entry, reduce errors, and improve overall efficiency. This integration allows for seamless data flow between the two platforms, enabling faster and more accurate financial reporting and tracking.

When combining spreadsheets with accounting systems, key financial data such as transaction records, tax calculations, and payment details can be automatically transferred and updated. This reduces manual input and ensures that your financial records are consistent across all platforms.

Steps to Integrate with Accounting Software

- Choose Compatible Software: Ensure that the accounting software you are using can integrate with your spreadsheet software. Many modern accounting tools support importing or syncing data directly from spreadsheets.

- Export Data from Spreadsheet: Export your financial data in a format compatible with your accounting software, such as CSV or XLSX. This file can then be uploaded into the accounting tool.

- Set Up Integration Options: Configure the integration settings to define how data should be imported and synchronized between the two platforms. This may include setting up specific fields for income, expenses, taxes, etc.

- Automate Data Syncing: Enable automatic data syncing between your spreadsheet and accounting software. This ensures that updates in one platform are reflected in the other in real time.

Benefits of Integration

- Reduced Data Entry: Automation minimizes the need for manual data input, which can save time and reduce the risk of errors.

- Real-Time Financial Tracking: With integration, your financial records are updated in real time, allowing you to track expenses, income, and other financial data without delay.

- Improved Accuracy: Automated transfers of data between the spreadsheet and accounting software ensure that figures are consistently accurate, reducing the chances of discrepancies.

- Comprehensive Financial Reports: Integration allows for easy generation of detailed financial reports, including profit and loss statements, balance sheets, and tax summaries.

By connecting your financial spreadsheets to accounting software, you can create a more streamlined, accurate, and efficient workflow. This integration ensures your financial data is consistent across all platforms, freeing up time for other important business tasks while keeping your records up to date.

Where to Find Free Invoice Templates

For businesses looking to save time and money, there are numerous sources available to find free financial document formats. These documents can be easily customized to fit your specific needs, whether you’re handling simple transactions or more complex billing. Many platforms offer high-quality, ready-to-use options that you can download and modify to streamline your workflow without having to create them from scratch.

These free resources are often accessible through online websites, software, and even public document libraries. Many offer downloadable formats in various file types, such as PDFs or spreadsheets, making it simple to integrate them into your existing systems.

Top Sources for Free Financial Documents

| Source | Features |

|---|---|

| Microsoft Office Templates | Offers a variety of professional formats for different needs, with easy customization options available in Word and other Office tools. |

| Google Docs | Provides a wide range of simple, customizable formats available for instant use and easy sharing via Google Drive. |

| Template Websites (e.g., Template.net) | Hosts a large collection of free downloadable files, including various styles and layouts that can be tailored to different industries. |

| Free Software (e.g., Wave, Zoho) | Some software offers free, customizable documents directly within their platform, often with additional features like invoicing and payment tracking. |

| Freelancer Communities | Platforms like Fiverr or Upwork provide free or low-cost resources shared by freelancers, which can be a great fit for small businesses or independent contractors. |

These platforms and resources provide the flexibility to select the best formats suited to your business needs, whether you require a basic, no-frills layout or a more detailed, industry-specific design. Best of all, they are free and can save you significant time in document creation, allowing you to focus more on your core business activities.