Top Construction Invoice Templates for Efficient Billing

Managing financial transactions in any project can be a complex task, but having the right tools can significantly simplify the process. For professionals working on various tasks, having a reliable way to document work done, costs incurred, and payments due is essential to maintain smooth operations and avoid misunderstandings.

In this guide, we’ll explore practical resources that allow you to efficiently record your services, track expenses, and request payments. By using pre-designed documents, you can save time and ensure all important details are included for accurate financial tracking. These documents help avoid errors and streamline the billing process for both you and your clients.

Whether you’re managing small or large projects, well-organized paperwork ensures transparency and reduces administrative workload. You’ll find customizable solutions that suit various types of work, from general labor to specialized tasks, making it easier to manage billing requirements for any project.

Essential Billing Documents for Builders

For builders, having an efficient system to document services rendered and payments due is crucial for maintaining clear financial records. A well-structured document ensures that both parties have a mutual understanding of the work completed and the agreed-upon costs. Whether for small tasks or large-scale projects, these documents help streamline the payment process and eliminate potential confusion.

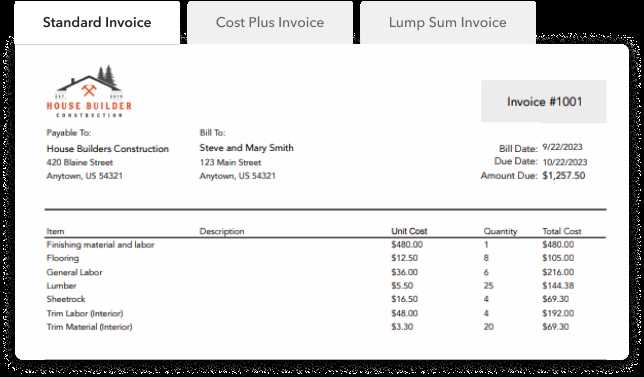

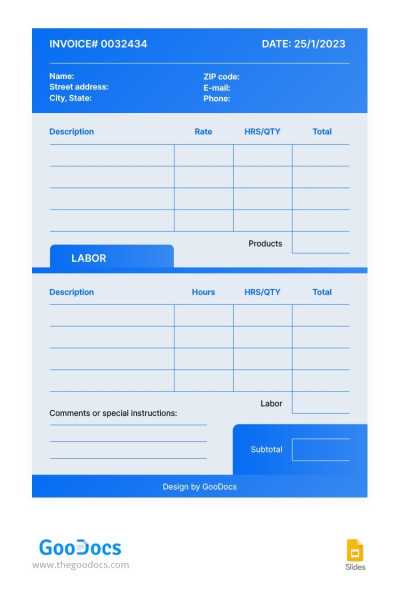

The right form allows professionals to outline key details such as labor hours, materials used, and additional expenses. Customizable options give flexibility to tailor each document to suit the specific requirements of the job, from basic tasks to more intricate construction projects. Using a consistent format not only improves professionalism but also accelerates the payment process.

Having access to these essential resources means builders can focus more on the physical aspects of their work, knowing their financial management is in good hands. Accurate and reliable billing paperwork enhances credibility, boosts client trust, and helps avoid delays in receiving compensation for the work done.

How to Create a Professional Billing Document

Creating a clear and concise billing document is essential for ensuring accurate communication between service providers and clients. By outlining the details of the work performed, associated costs, and payment terms, a well-organized statement simplifies financial transactions and fosters transparency. Knowing what to include in each section helps make this process efficient and ensures that no crucial information is overlooked.

Key Elements to Include

A successful billing document should contain a few core components to ensure clarity. Start by providing basic information such as the date of the statement, contact details for both parties, and a unique reference number for easy tracking. This setup makes it simple to identify and organize multiple records.

Next, add an itemized list of tasks completed and materials used. Each entry should be detailed enough to specify the exact work done, making it easier for clients to understand the charges. Ensure that all costs are clearly indicated, including labor, materials, and any additional fees, as this transparency builds trust and m

Customizing Your Project Billing Template

Personalizing a billing document can make a big difference in both professionalism and clarity. By adapting each document to suit the unique needs of your business and specific job details, you ensure that all necessary information is presented accurately and clearly. A well-tailored format can improve readability and reduce the chances of errors, enhancing client satisfaction and helping to establish a trustworthy reputation.

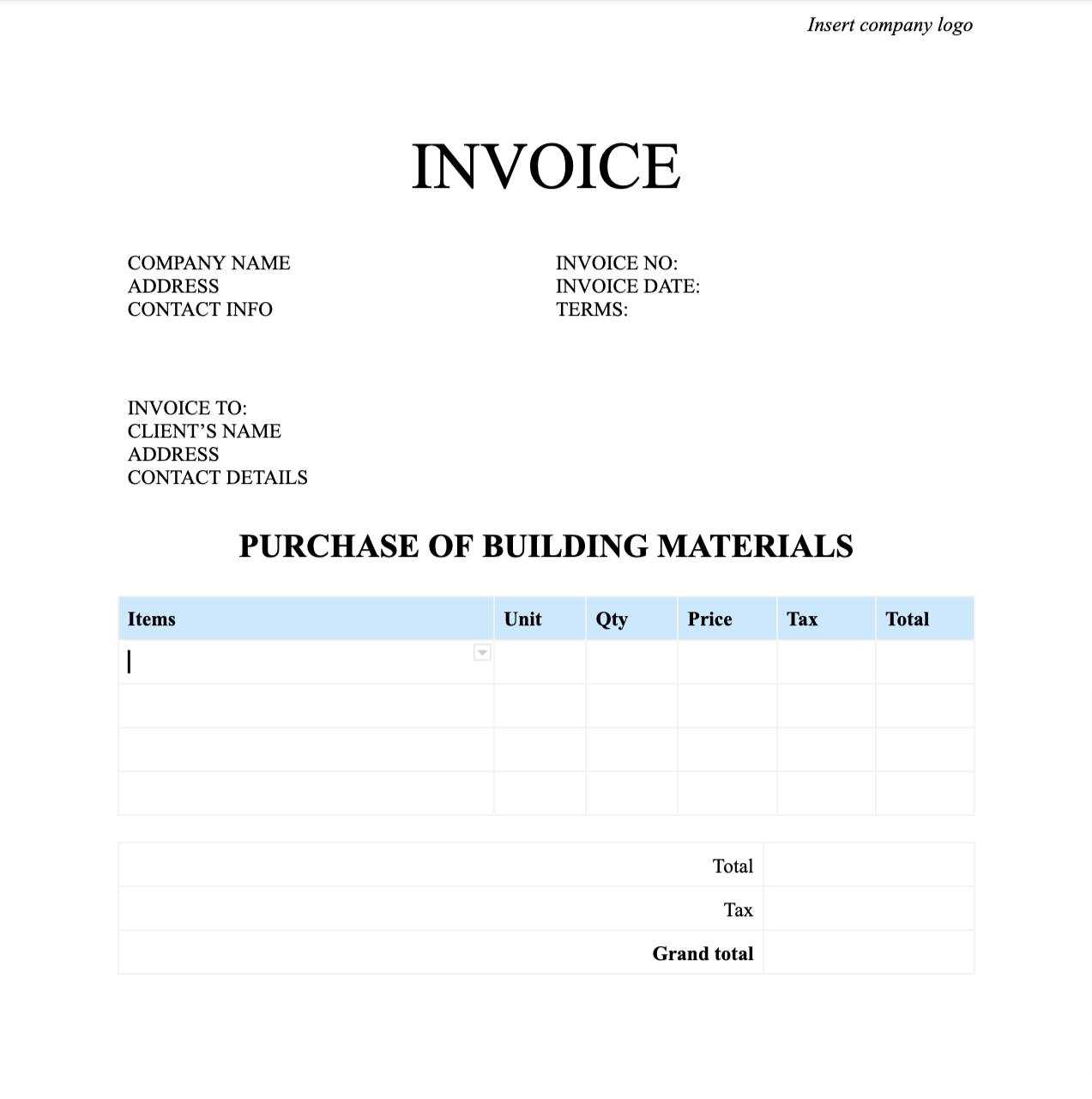

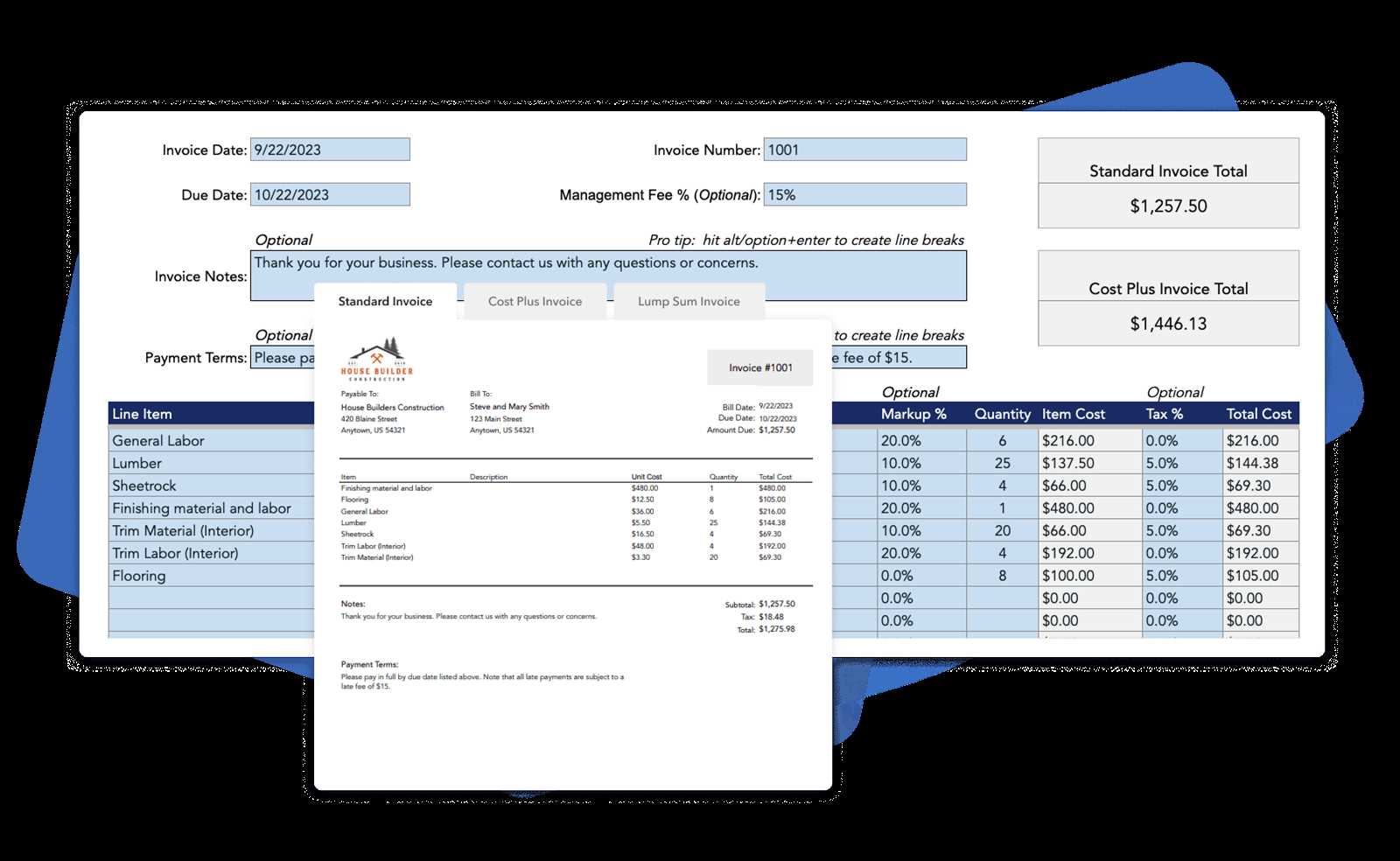

One way to approach customization is by adding sections that reflect the specific aspects of your work, such as specialized services, unique materials, or varying hourly rates. The following table offers a simple structure to organize essential sections while leaving room for additional details that might apply to different projects:

| Section | Description | ||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Header | Includes business logo, contact information, and date of issue. | ||||||||||||||||||||||||||||||

| Client Information | Details about the client, including name, address, and contact details. | ||||||||||||||||||||||||||||||

| Service Breakdown | An itemized list of tasks

Why Use Organized Billing FormatsUsing pre-designed formats for billing can bring significant benefits to any business that requires efficient and clear documentation of completed tasks and costs. These ready-made layouts simplify the creation process, ensuring all essential details are captured consistently. By adopting a standard format, professionals can streamline their workflow, reduce administrative time, and minimize the chance of errors. Enhanced Efficiency and AccuracyOne of the biggest advantages of standardized forms is the time saved. Instead of starting from scratch each time, professionals can use a structured document that already includes sections for common project details. This consistency not only makes creating each record faster but also helps prevent overlooked details, ensuring every item is accounted for. Improved Client Trust and TransparencyWhen clients receive a professional, well-organized billing statement, it builds trust and reinforces credibility. Clear, itemized sections make it easy for clients to understand the work completed and associated costs, reducing the risk of disputes. Transparent documentation is key to maintaining positive client relationships, as it shows a commitment to openness and detail, essential in professional transactions. Top Features of Project Billing FormatsA well-crafted billing document includes specific features that make it both functional and professional. These elements help ensure all relevant details are recorded, providing clarity for both the provider and the client. By incorporating key sections, each document becomes a comprehensive record of work done, expenses incurred, and payment expectations, facilitating smoother financial management. Key Elements to IncludeTo ensure accuracy and completeness, an effective format typically includes several important components. Below is a table outlining the primary features that make these documents efficient and user-friendly:

Benefits of Using Free Formats

Utilizing these free resources can significantly reduce costs associated with document creation while ensuring a professional presentation. Customizable options allow professionals to adjust details according to their unique business needs, enhancing the overall client experience. Additionally, readily available formats can be easily shared and accessed, making them a convenient choice for busy professionals. Choosing the Right Document for ContractorsSelecting the appropriate billing format is crucial for professionals in the contracting industry, as it ensures that all essential details are effectively communicated. A well-suited document can enhance clarity, promote professionalism, and facilitate smoother transactions with clients. Understanding the unique needs of your business and the expectations of your clients will guide you in choosing the most effective layout. When considering which document to use, take into account the specific services you offer and the typical scope of your projects. Different layouts may emphasize various aspects, such as labor costs, material expenses, or project timelines. Customization is key, allowing you to present your information in a way that resonates with your clientele and reflects your brand identity. Moreover, it’s essential to ensure that the chosen format is easy to use and compatible with your existing workflow. Look for options that allow for quick edits and adjustments, enabling you to adapt to changes in project specifications or client requests. An effective document not only simplifies the billing process but also contributes to maintaining strong client relationships through transparency and professionalism. Understanding Payment Terms on Billing DocumentsGrasping the nuances of payment conditions is essential for ensuring smooth financial transactions in any business arrangement. Clearly defined terms help both parties understand their obligations and expectations, minimizing disputes and promoting timely payments. This section explores key elements that should be considered when specifying payment terms in billing documents. Common Payment Terms to Consider

Benefits of Clear Payment TermsEstablishing clear payment terms offers several advantages, including:

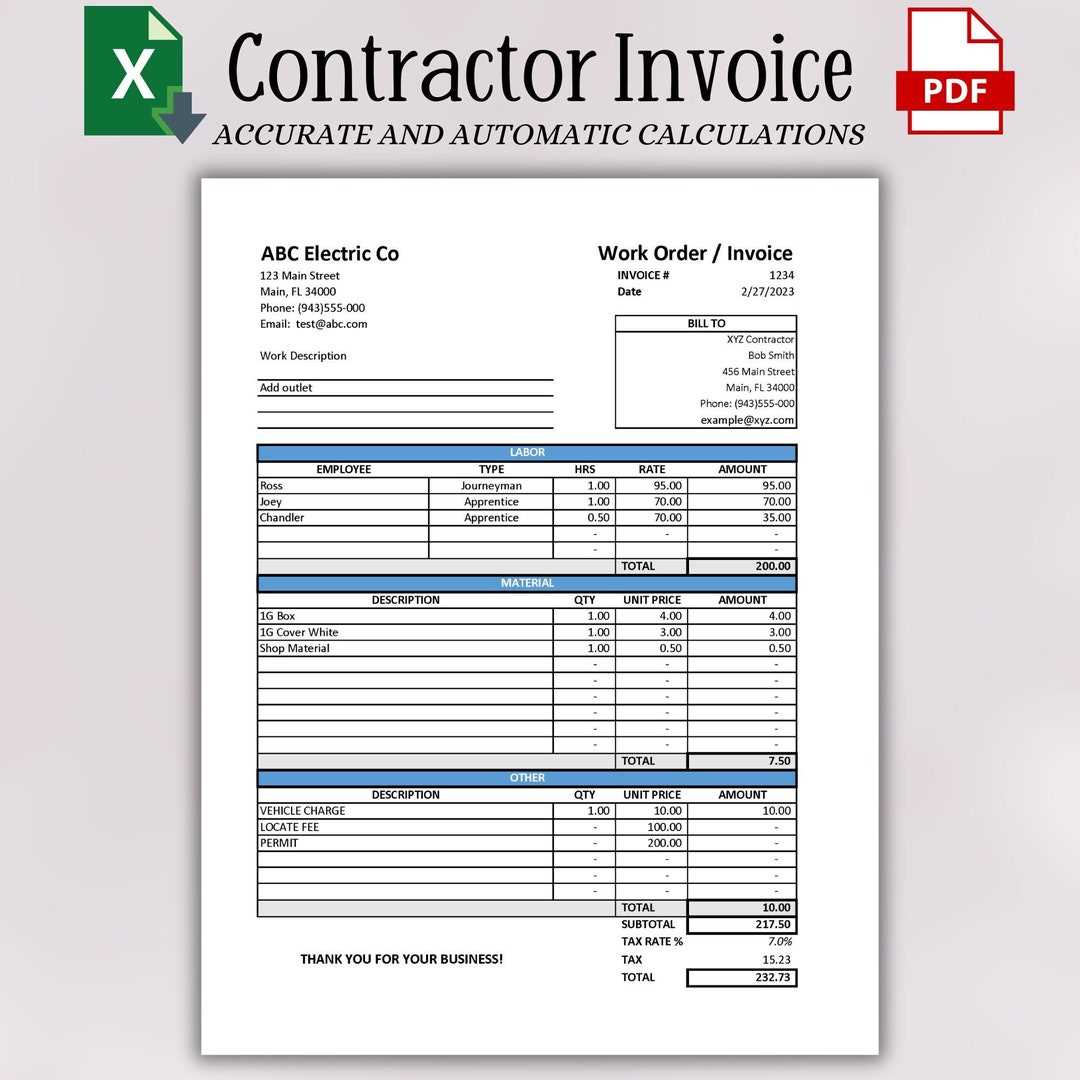

By carefully considering and articulating payment terms, contractors can set the foundation for successful financial interactions, ensuring that all parties are aligned and informed. Document Design Tips for ProfessionalsCreating an effective billing document is essential for communicating professionalism and ensuring clarity in financial transactions. A well-designed format not only captures attention but also conveys important information in an organized manner. By following a few key design principles, professionals can enhance their documents and facilitate smoother interactions with clients. Firstly, prioritizing simplicity is crucial. An uncluttered layout allows essential details to stand out, making it easier for clients to understand the charges. Use clear headings and bullet points to present information succinctly. Consistent font styles and sizes help maintain readability, while appropriate use of white space can create a visually appealing balance. Incorporating branding elements, such as logos and color schemes, reinforces brand identity and adds a personal touch. This not only distinguishes the document but also fosters trust and recognition among clients. Additionally, including essential contact information prominently ensures that clients can reach out easily if they have questions or concerns. Finally, always ensure that the document is easy to edit and update. Flexibility is key, as projects may evolve and require adjustments in pricing or services. By adopting these design strategies, professionals can create impactful billing documents that enhance communication and strengthen client relationships. How to Add Materials and Labor CostsIncorporating expenses for resources and workforce is a critical aspect of creating accurate financial documents. Properly detailing these costs ensures transparency and helps clients understand the basis of the charges. This section will outline effective methods for calculating and presenting these essential elements. Calculating Material CostsAccurate material costs are vital for reflecting the true expenses involved in a project. To effectively add these costs, follow these steps:

Calculating Labor Costs

Labor costs represent another significant component of project expenses. To accurately capture these costs, consider the following:

By meticulously tracking and documenting both resource and workforce costs, you can create a comprehensive financial overview that fosters trust and accountability with your clients. Common Mistakes in Construction InvoicesCreating financial documents can be a complex task, and several common pitfalls can lead to misunderstandings or disputes with clients. Identifying and addressing these frequent errors is essential for maintaining professionalism and ensuring timely payments. This section highlights some typical mistakes to avoid. Incomplete or Missing InformationOne of the most prevalent issues in financial documentation is the absence of critical details. Key elements such as:

Errors in CalculationsMiscalculations can significantly impact the accuracy of financial documents. Common calculation errors include:

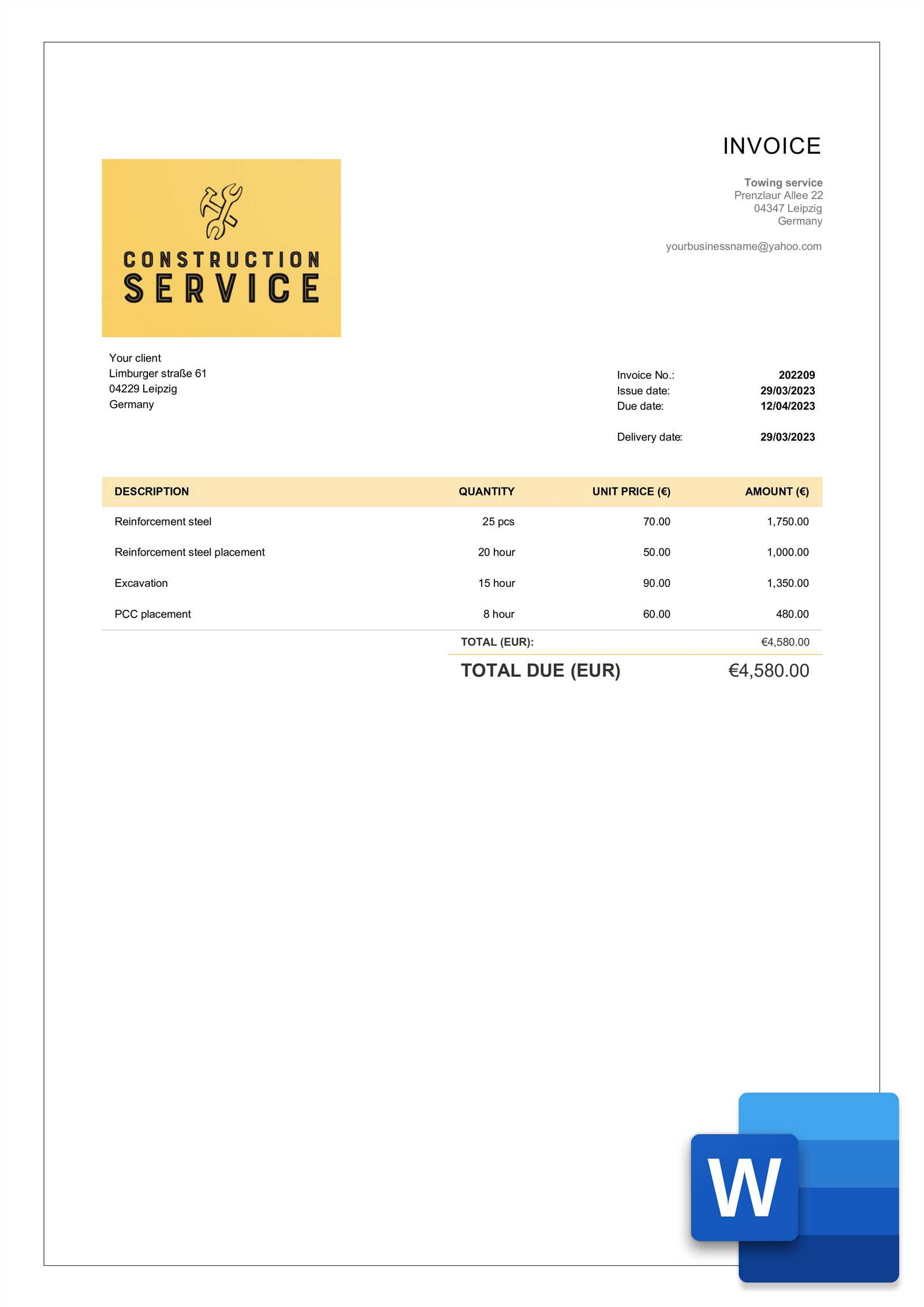

Avoiding these mistakes not only enhances the credibility of the financial documents but also fosters a positive relationship with clients by minimizing disputes and misunderstandings. Creating Invoice Templates for Specific ProjectsWhen working on distinct undertakings, having tailored financial documents can streamline the billing process and enhance clarity for clients. Customizing these documents according to the specifics of each project not only helps in presenting a professional image but also ensures that all relevant details are addressed. This section outlines key considerations for developing documents that meet the unique requirements of various projects. Identifying Project-Specific RequirementsEvery project comes with its own set of parameters, which can influence the structure and content of the financial document. Key elements to consider include:

Sample Structure for a Customized DocumentCreating a structure that allows for flexibility while maintaining essential components is crucial. Below is an example layout for a tailored financial document:

By tailoring financial documents to fit the specific nuances of each project, professionals can enhance transparency, minimize confusion, and foster stronger client relationships. Best Practices for Construction BillingEffective financial management is crucial in the realm of project-based work, as it directly influences cash flow and client relationships. Implementing sound strategies in the billing process not only facilitates timely payments but also enhances professionalism. This section outlines essential practices that can lead to smoother financial transactions and improved project outcomes. Clear and Detailed DocumentationProviding comprehensive documentation is fundamental to ensuring clients understand the costs associated with their projects. Key points to include are:

Regular Communication with ClientsMaintaining open lines of communication fosters trust and prevents misunderstandings. Consider the following approaches:

By adhering to these best practices, professionals can improve their billing processes, leading to enhanced client satisfaction and more efficient financial management. How to Handle Multiple Invoices for ProjectsManaging several financial documents for various projects can be a complex task, but with the right strategies in place, it becomes a streamlined process. Effectively organizing and tracking each financial request is crucial to ensure timely payments and maintain healthy client relationships. This section provides insights into methods for handling multiple requests in a professional manner. Establish a System for Organization

Creating a systematic approach to organizing financial documents is essential. Consider the following steps:

Communicate Effectively with ClientsEffective communication is key when dealing with multiple financial documents. Here are some practices to follow:

By implementing these strategies, professionals can efficiently manage multiple financial requests, ensuring clarity for both themselves and their clients, and ultimately leading to smoother project execution. Ensuring Accurate Billing with TemplatesMaintaining precision in financial requests is essential for the smooth operation of any project. Utilizing well-structured documents can significantly enhance accuracy and reduce the likelihood of errors. This section explores how using organized formats can lead to more reliable billing practices. Key Components of Effective Billing FormatsTo create documents that minimize mistakes, consider incorporating the following elements:

Best Practices for AccuracyIn addition to using well-structured formats, following these best practices can help ensure billing accuracy:

By implementing these strategies and utilizing structured formats, professionals can achieve greater accuracy in their financial requests, leading to improved client relationships and smoother project management. Automating Your Construction Invoice ProcessStreamlining the financial documentation workflow is crucial for improving efficiency and accuracy in project management. Automating the generation and tracking of payment requests can significantly reduce the time spent on administrative tasks, allowing professionals to focus on delivering quality work. This section discusses the benefits of automating these processes and the tools that can facilitate this transition. Benefits of AutomationImplementing automated systems for financial documentation offers several advantages:

Tools for Effective AutomationTo successfully automate financial documentation, consider utilizing the following tools:

By automating the financial documentation process, professionals can enhance their operational efficiency, reduce the risk of errors, and ultimately foster stronger client relationships through timely and accurate billing. |