Free Printable Downloadable Blank Invoice Template

For any business or freelancer, having the right tools to generate accurate and professional records is crucial. A well-structured document not only ensures clarity but also promotes trust and credibility with clients. With the right resources, you can easily produce consistent and polished reports tailored to your specific needs.

In today’s digital world, customizable forms are an essential part of streamlining administrative tasks. Whether you’re issuing payments or tracking transactions, having an efficient way to manage such records saves valuable time and effort. With just a few clicks, you can create high-quality forms that meet your professional standards without having to start from scratch each time.

Tailoring your documents for various purposes–be it sales, services, or other agreements–becomes easier with these adaptable options. With the ability to modify text, add logos, and choose the layout that best suits your brand, you can present your information in a clear and formal way, improving both the organization and overall presentation.

Benefits of Using Invoice Templates

Utilizing pre-designed documents for financial transactions offers numerous advantages to businesses and individuals. These resources simplify the process of creating essential records, ensuring accuracy and efficiency while minimizing the potential for errors. By relying on well-organized formats, you can save valuable time and focus on other aspects of your work.

Consistency is one of the key benefits when using these tools. Every document follows a uniform structure, making it easier for clients to understand and for businesses to manage records. This consistency in appearance and layout also enhances your professional image, fostering trust and reliability in your dealings.

Another important aspect is customization. These forms can be tailored to meet your specific needs, whether for small-scale projects or larger contracts. Adjusting the layout, adding logos, and inserting personal details ensures that each document aligns with your brand’s identity, providing a polished and professional presentation every time.

How to Customize Your Invoice Template

Customizing your financial documents allows you to tailor them specifically to your business needs. By making small adjustments to the structure and design, you can ensure that each document not only meets your functional requirements but also reflects your brand’s identity. Here’s how to personalize your forms effectively.

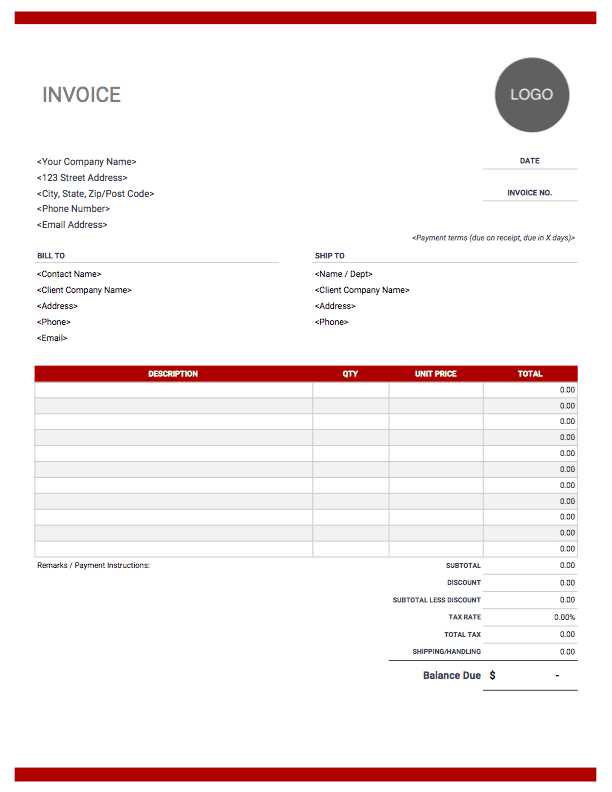

Start by focusing on the key elements that make up your document. These should include:

- Company Information: Add your business name, logo, address, and contact details to make the document look professional and easily identifiable.

- Client Details: Include spaces for the client’s name, address, and contact information to personalize each document for the recipient.

- Itemized List: Ensure there’s room for detailed descriptions of goods or services provided, along with the corresponding prices.

- Payment Terms: Include sections that specify payment due dates, accepted payment methods, and any late fees or discounts.

Once you’ve set the essential fields, think about the design of the document. Use your brand’s colors and fonts to create a cohesive look. Make sure the layout is clean and easy to read by adjusting the spacing, borders, and font sizes.

Finally, save your customized form in a format that allows for easy editing in the future. This will make it simple to update details for new clients or different transactions without having to start from scratch each time.

Types of Printable Invoice Templates

There are various formats available for creating professional documents that record transactions. Each type is designed to meet specific business needs, from simple requests for payment to more detailed breakdowns of services or products provided. Choosing the right format can help streamline your processes and ensure that your records are accurate and easy to understand.

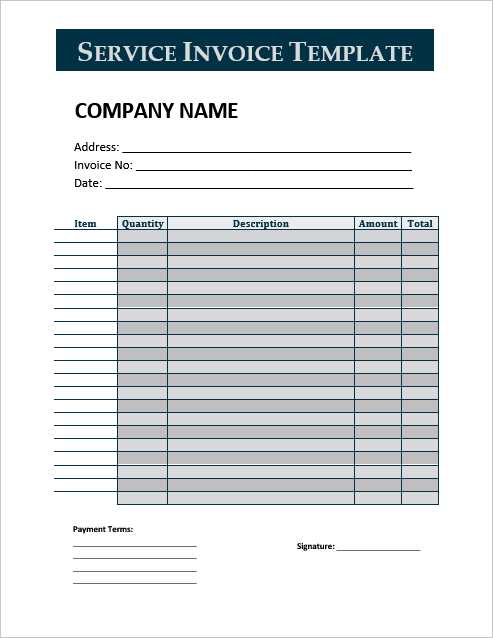

Basic Format

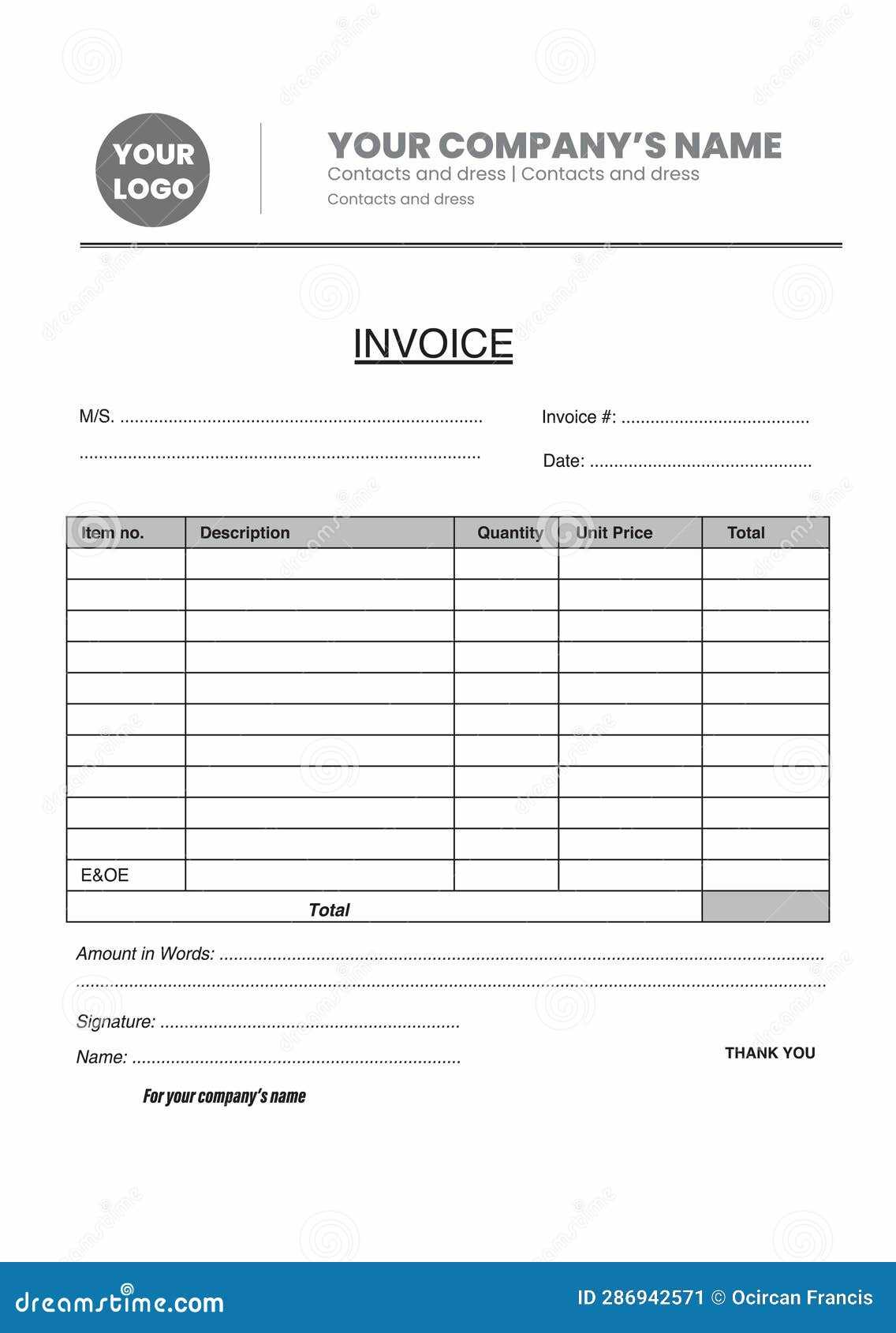

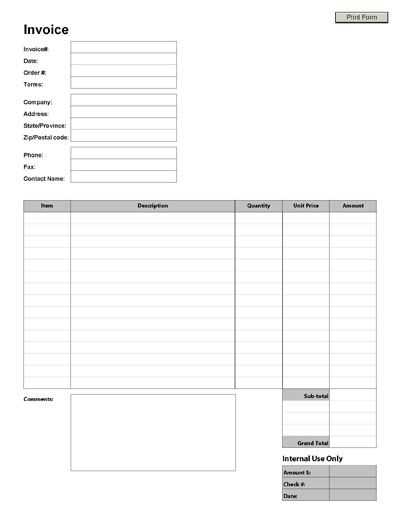

The most straightforward option is a basic layout that includes essential fields such as the client’s name, the date, and an itemized list of products or services. This type is ideal for small businesses or freelancers who need a simple way to track their transactions without additional features.

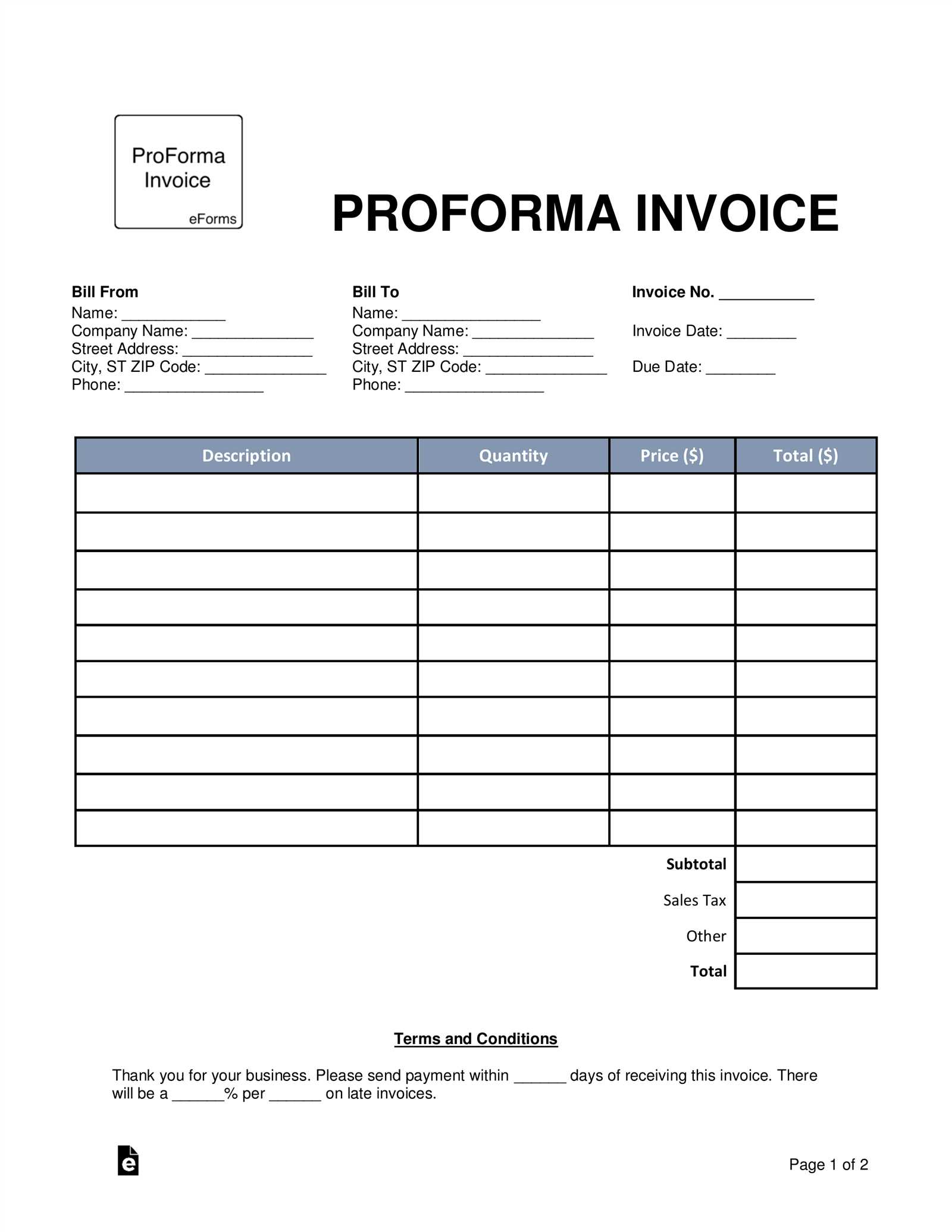

Detailed Format

A more advanced structure includes additional sections for taxes, discounts, and payment terms. This format is suited for larger projects or businesses that require a more comprehensive record of the transaction. It allows for a more detailed breakdown, ensuring both the business and the client have a clear understanding of the financial exchange.

By choosing the right design for your needs, you can ensure that your forms are both functional and professional. Whether you need something simple or more detailed, there is a format that will suit your business requirements.

Why Choose a Blank Invoice Template

Opting for an unfilled document to record financial transactions offers flexibility and customization. By starting with a structure that contains only the necessary fields, you have the freedom to tailor each record according to the specifics of the transaction. This approach provides a clean slate, allowing you to add, remove, or modify sections as needed for various situations.

One major advantage of this method is personalization. With a customizable format, you can adjust the design to reflect your brand’s identity, ensuring consistency in your business communications. Additionally, this style provides a level of control over how your records are presented, allowing for adjustments to suit different types of clients or transactions.

Moreover, starting with a flexible structure saves time in the long run. You don’t need to recreate the layout every time you need a document. Instead, you can quickly update the relevant information, maintaining both accuracy and professionalism in every record.

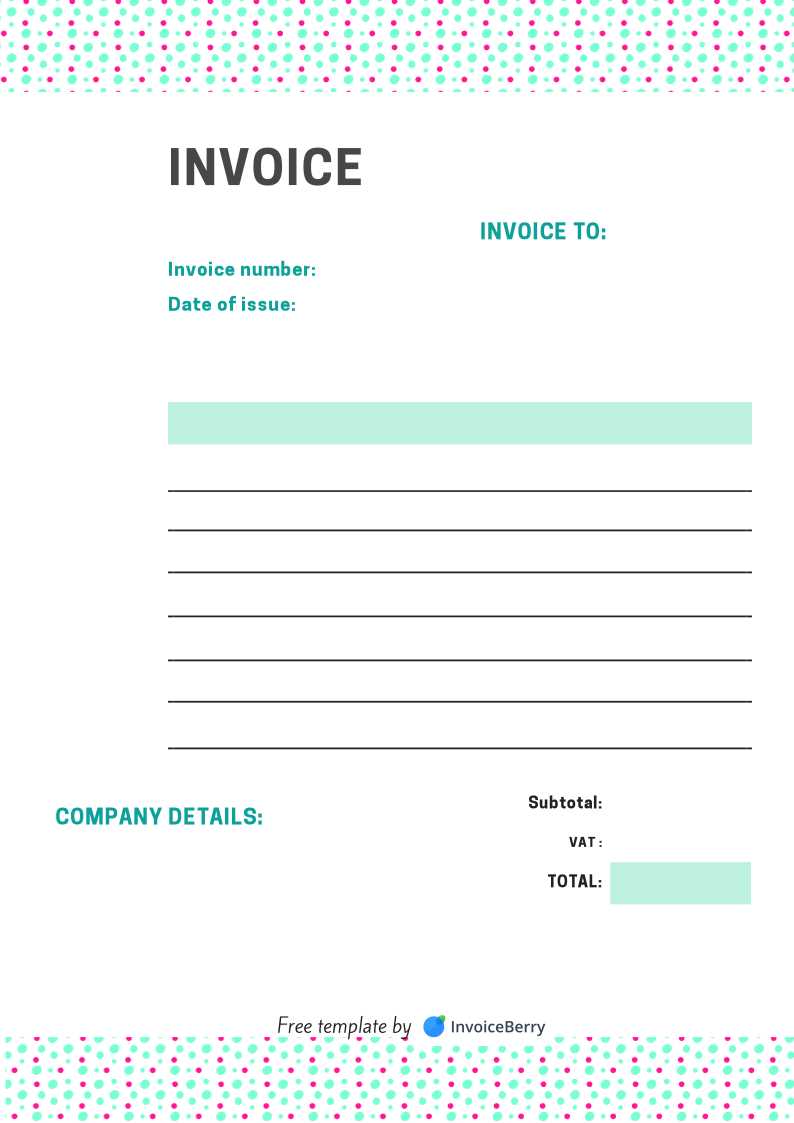

Free Invoice Templates for Small Businesses

For small businesses, managing finances efficiently is crucial for success. One way to streamline this process is by using free forms designed specifically to track and request payments. These resources allow small business owners to quickly generate professional-looking records without investing in expensive software or tools.

Free options often come with a variety of features tailored to the needs of small enterprises, such as:

- Customization: Modify the document to include your company’s logo, contact details, and payment terms.

- Simplicity: Basic structures ensure ease of use, allowing you to create and send documents without unnecessary complexity.

- Cost-Effectiveness: No need for costly software; free options provide all the functionality you need at no cost.

- Quick Setup: You can start generating records almost immediately without a steep learning curve.

These free resources offer an efficient and accessible solution for small business owners looking to manage their billing needs. Whether you’re just starting or have an established operation, having access to simple, customizable forms can save you time and help maintain a professional image with clients.

Steps to Download a Blank Invoice

Getting started with a new financial record is a straightforward process. By downloading an unfilled document, you can create customized forms for each transaction, saving time and ensuring consistency. Below are the simple steps you can follow to access and start using these resources.

Step 1: Find a Reliable Source

The first step is to locate a trustworthy website or service that offers free or paid resources. Look for platforms with positive reviews and a wide variety of options. Many sites provide customizable versions to suit different business types, so it’s important to choose one that meets your needs.

Step 2: Choose the Right Format

Once you’ve found a source, browse the available options and select the one that fits your specific requirements. Some might offer basic structures, while others provide more detailed or industry-specific formats. Pay attention to the layout, design, and any extra features such as automated calculations or itemized sections.

Step 3: Download and Save

After selecting the appropriate format, click on the download button. Be sure to save the file in a location that’s easy to access, so you can edit it whenever needed. Most formats will be compatible with common software such as word processors or spreadsheets, making the process seamless.

Step 4: Start Customizing

Now that you’ve downloaded the document, you can customize it by adding your business information, adjusting payment terms, and listing the products or services provided. This process ensures that each document is tailored to your unique business needs.

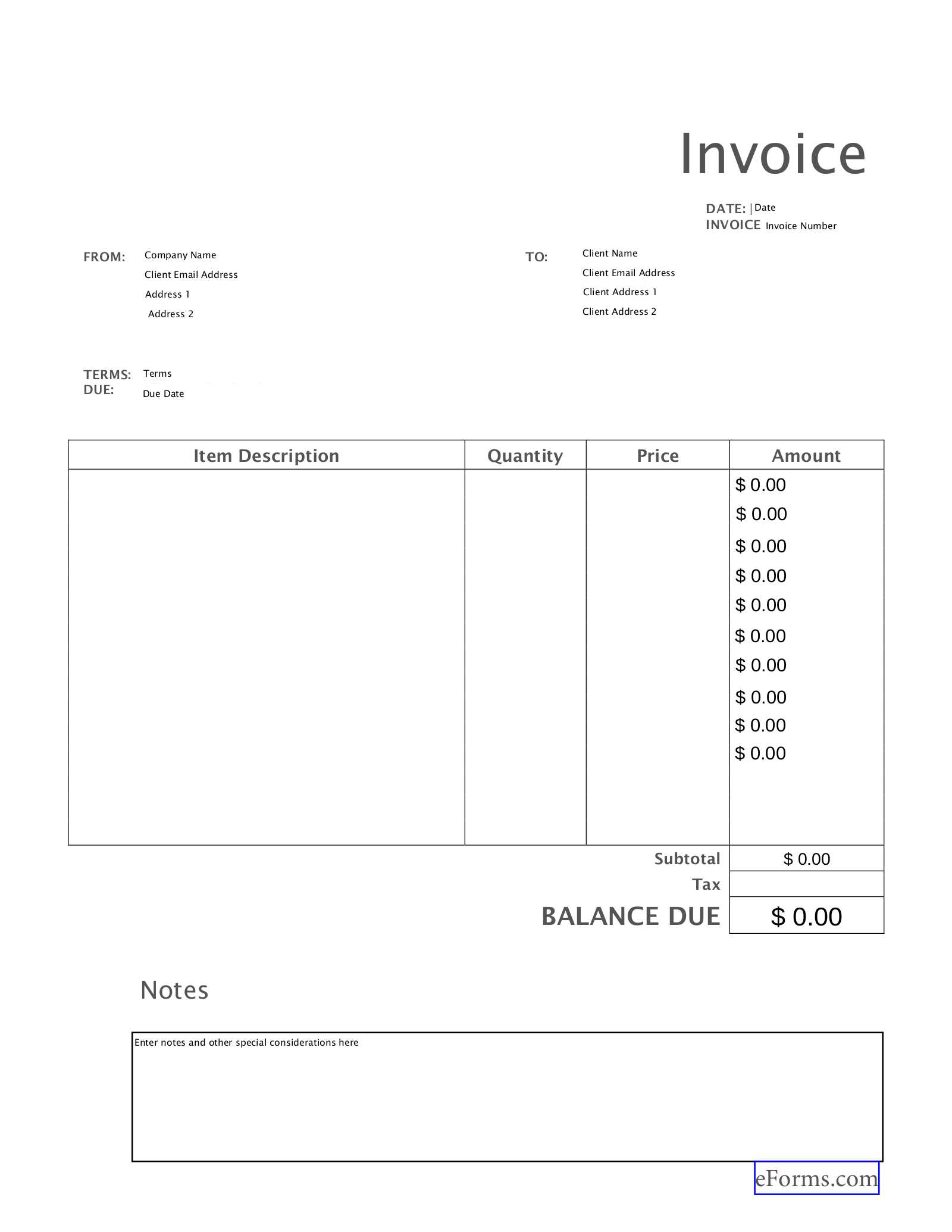

Top Features of a Good Invoice

A well-structured financial document is essential for ensuring clear communication and smooth transactions between businesses and clients. A good record should not only include all necessary details but also be organized in a way that is easy to read and understand. Below are some key features that make an effective and professional document.

Clear Identification Information

One of the most important elements is clear identification. The document should prominently display both your company’s and the client’s contact information, including names, addresses, and relevant identification numbers. This ensures that both parties know exactly who the document pertains to and avoids any confusion in the future.

Detailed Breakdown of Charges

A good document should provide a detailed breakdown of the charges, including descriptions of goods or services provided, quantity, unit prices, and total amounts. This transparency not only builds trust but also ensures that the client understands exactly what they are being charged for. Additionally, including payment terms, such as due dates or late fees, helps manage expectations and ensures timely payments.

Professional Design and Layout

The overall design and layout should be clean and organized. A professional layout makes the document easier to read and demonstrates a level of professionalism that reinforces your business image. Use consistent fonts, clear headings, and proper spacing to ensure the document is visually appealing and easy to navigate.

Accurate Calculations and Totals

Lastly, accuracy is key. Ensure all totals, taxes, discounts, and other charges are calculated correctly. This will help prevent disputes and ensure that payments are processed without delay. Providing automated fields for calculations can also reduce the chances of human error and make the document even more efficient.

Best Practices for Invoice Design

Designing professional financial documents is essential to ensuring clarity and smooth communication between businesses and clients. A well-designed form not only looks professional but also helps the client easily navigate and understand the details. Following a few best practices can significantly improve the quality and effectiveness of your records.

One key aspect of design is keeping it clean and organized. An intuitive layout with clear sections for each piece of information can make a big difference. Below are some design practices that can enhance the readability and professionalism of your forms:

| Best Practice | Description |

|---|---|

| Use Clear Headings | Headings like “Client Information,” “Charges,” and “Payment Terms” should be prominent to guide the reader through the sections. |

| Consistent Font Style | Stick to one or two easy-to-read fonts. This will ensure that the document is clear and professional. |

| Whitespace and Alignment | Use sufficient spacing between sections and align text properly to make the form easy to follow. |

| Branding | Incorporate your company’s logo and colors to maintain brand consistency across all communication. |

| Highlight Key Information | Important elements like due dates, totals, and payment methods should be easy to spot. Consider bolding or enlarging these details. |

By following these best practices, you can create documents that not only look polished but also help maintain professionalism in every transaction.

How to Save Time with Templates

Using pre-designed structures for business documentation is a practical way to streamline your workflow. These ready-made forms allow you to bypass the time-consuming process of creating a new document from scratch for every transaction. With the right approach, you can significantly reduce the time spent on generating and customizing each record.

Here are some ways these pre-structured documents can help you save time:

| Time-Saving Benefit | Explanation |

|---|---|

| Pre-filled Sections | Start with common fields already filled in, such as your business name, logo, and contact information, so you don’t have to input them every time. |

| Faster Customization | Ready-made structures allow for quick adjustments. You just need to update specific details like amounts, services, or dates, reducing the time spent on formatting. |

| Consistency Across Documents | Using the same structure ensures all records are uniform, reducing the need for adjustments every time. Consistency helps minimize mistakes and speed up the process. |

| Automated Calculations | Many forms include built-in fields for automatic calculations, ensuring you don’t have to manually tally totals, taxes, or discounts, saving valuable time. |

| Easy Updates | Once you’ve customized a record format, it’s easy to update it for future use. You only need to make small adjustments for new transactions, eliminating the need to start over each time. |

By using these pre-arranged structures, you can quickly create professional documents, allowing more time to focus on other important aspects of running your business.

Invoice Template Compatibility with Software

When choosing a pre-designed structure for your financial documents, it’s essential to consider how well it integrates with various software platforms. Compatibility with different tools ensures smooth customization, editing, and processing, without the need for manual formatting. Below are key factors to keep in mind when assessing software compatibility.

Popular Software Options for Document Creation

- Word Processors – Tools like Microsoft Word or Google Docs are commonly used for editing and formatting these documents. Many pre-designed forms can be easily opened and customized using these platforms.

- Spreadsheet Programs – Software like Microsoft Excel or Google Sheets provides an ideal environment for creating and managing itemized lists and calculations. Many structures are designed to be compatible with these tools, especially for users needing to track totals and taxes.

- Accounting Software – Programs such as QuickBooks, FreshBooks, or Zoho Books often allow you to import or integrate various formats. Some of these systems may even provide pre-configured forms, making the entire invoicing process faster and more automated.

Key Considerations for Compatibility

- File Format – Ensure the file format matches the software requirements. Common file types include PDF, DOCX, XLS, and CSV. Choose a format that’s supported by your software to avoid compatibility issues.

- Ease of Customization – Check whether the structure is editable in the software you plan to use. Some programs may require additional software or plugins to fully edit the document.

- Automated Features – If you need to automate calculations, ensure that the chosen format can integrate with the software’s formula fields, reducing the time spent on manual input.

By selecting a format that works well with your existing software, you can enhance efficiency and ensure your business processes run smoothly without interruptions caused by technical issues.

Why Digital Invoices Are Important

In today’s fast-paced business environment, transitioning from paper-based records to electronic formats offers significant advantages. Digital records not only streamline the entire billing process but also improve efficiency and reduce the likelihood of errors. By adopting electronic forms, businesses can ensure that their transactions are processed more quickly, securely, and cost-effectively.

Advantages of Using Digital Formats

Businesses that switch to digital forms gain a wide range of benefits. Below are some key reasons why adopting electronic billing is essential:

| Benefit | Description |

|---|---|

| Faster Processing | Digital documents can be created, sent, and received instantly, cutting down on time delays caused by traditional mailing or physical handling. |

| Improved Accuracy | Automation reduces the risk of manual errors, such as miscalculations or incorrect data entry, ensuring more accurate records. |

| Cost Savings | By eliminating paper, printing, and postage costs, businesses can save money and reduce environmental impact. |

| Better Record-Keeping | Electronic files are easier to store, organize, and search, making it more efficient to manage historical records. |

| Enhanced Security | Digital formats offer higher security measures such as password protection, encryption, and audit trails, safeguarding sensitive information. |

Environmental and Organizational Benefits

Adopting digital records also promotes environmental sustainability by reducing paper waste. Additionally, the easy accessibility of digital documents allows for better organization, making it easier for businesses to access past records and respond quickly to inquiries.

By transitioning to digital forms, businesses can stay ahead of the curve and offer an efficient, secure, and environmentally friendly solution to managing transactions.

Creating Professional Invoices Quickly

When it comes to managing business transactions, efficiency is key. Generating well-structured and professional documents doesn’t have to be a time-consuming task. With the right approach, you can create polished records in just a few minutes, ensuring accuracy and professionalism while saving valuable time. Below are some helpful strategies to streamline the process.

Steps to Speed Up Document Creation

By using automated tools and predefined formats, creating professional documents becomes faster and more efficient. Here are a few strategies to consider:

| Step | Description |

|---|---|

| Use Pre-Formatted Structures | Choose a pre-configured layout that suits your needs, allowing for quick customization. This minimizes manual adjustments and reduces errors. |

| Integrate with Accounting Software | Many accounting platforms allow you to generate financial records automatically, pulling in relevant data from your system for an accurate and efficient process. |

| Automate Data Entry | Leverage data import functions to quickly fill in client details, services, or products without typing them out manually each time. |

| Include Reusable Details | For recurring clients or services, store common details (such as contact information, pricing, etc.) to avoid re-entering the same information repeatedly. |

Utilizing Software for Efficiency

With the right software tools, generating polished documents becomes even easier. Many options offer features such as pre-configured fields, client databases, and automated calculations to ensure that your records are not only professional but also accurate and timely.

By incorporating these strategies and leveraging available tools, you can efficiently create professional records, helping you stay organized while focusing on growing your business.

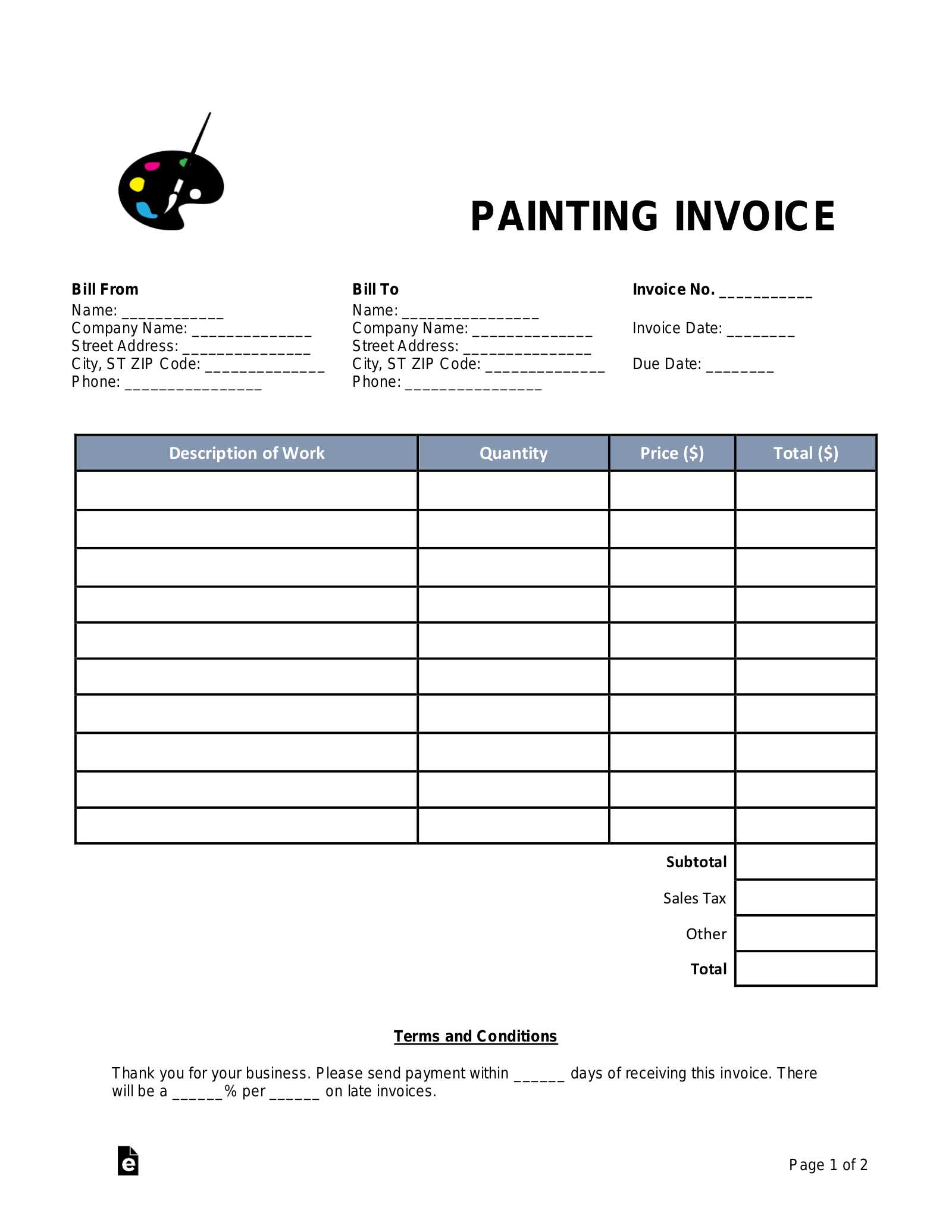

Printable Invoices for Different Industries

Each industry has unique requirements when it comes to documenting financial transactions. From service-based businesses to product retailers, the structure and details included in financial records can vary greatly depending on the nature of the business. Understanding the specific needs of your industry helps in creating efficient and accurate documents that are both clear and professional.

Customizing for Service-Based Businesses

For service-oriented companies, the main focus is typically on hours worked, service descriptions, and rates. A simple yet comprehensive record should include the following elements:

- Client Information: Ensure accurate contact details for easy communication.

- Service Description: Clearly describe the services provided to avoid confusion.

- Time or Quantity: Include details about hours worked or services delivered.

- Payment Terms: Specify due dates, payment methods, and any penalties for late payment.

Tailoring for Product-Based Businesses

For those in product sales, the key details usually involve item descriptions, quantities, and prices. Customizing the financial document for a product-based business includes:

- Product Listing: A detailed list of each item, including names, quantities, and individual prices.

- Total Amount: A clear summary of all items purchased and the total cost, including any taxes or shipping fees.

- Shipping Information: If applicable, include shipping methods and costs, as well as estimated delivery times.

By tailoring these documents to your specific industry, you can ensure accuracy and clarity, making the billing process smoother for both businesses and customers.

Maintaining Consistency in Invoice Design

Consistency in design plays a crucial role in ensuring professionalism and clarity in business transactions. A uniform appearance across all your financial documents not only strengthens brand identity but also makes it easier for clients to understand the details. By adhering to consistent formatting, you create a reliable and organized system that benefits both you and your customers.

The Importance of Consistent Layout

A well-structured design improves readability and helps clients quickly locate the information they need. Maintaining consistent placement of key elements such as:

- Business Information: Always place your business name, address, and contact details at the top for easy identification.

- Itemization: Ensure product or service descriptions, quantities, and prices are consistently formatted, making it easy for clients to verify details.

- Payment Terms: Position the terms in the same area across documents, so clients know where to find the information regarding payment deadlines and methods.

Branding and Design Consistency

Incorporating your logo and color scheme consistently across all business documents reinforces your brand identity. Whether it’s the font style, logo placement, or color palette, keeping these elements the same in every document ensures a cohesive experience for clients. Consistency also adds a touch of professionalism that reflects positively on your business.

By following these principles, you can maintain a streamlined and recognizable design for all your business documentation, enhancing the overall client experience while building trust and reliability.

How to Print Your Invoice Template

Printing your financial documents correctly ensures that they are ready for physical distribution and that all the necessary information is clearly presented. Whether you’re sending invoices by mail or keeping a physical copy for your records, it’s essential to follow a few simple steps to ensure a high-quality printout.

Step 1: Check Document Settings

Before printing, make sure your document is correctly set up for your printer. Here are some important settings to review:

- Page Size: Ensure the page size matches the document’s design (e.g., A4 or Letter).

- Margins: Verify that the margins are set appropriately to prevent cutting off any details.

- Resolution: Check that the resolution is high enough for clear text and sharp lines.

Step 2: Use a High-Quality Printer

For the best results, use a high-quality printer that can produce sharp and crisp text. A laser printer is ideal for text-heavy documents, as it ensures professional-quality printing. If you are printing in color, ensure that your printer is capable of printing your chosen color scheme accurately.

Step 3: Print and Review

Once your settings are configured, it’s time to print. Here’s a simple process to follow:

- Click the print option from your document software.

- Choose your printer and settings (e.g., paper type, color options).

- Print a test page to check for any layout issues or misalignment.

After confirming that everything looks correct, print the necessary number of copies. Be sure to inspect the printed copies for any mistakes before sending them out or filing them for your records.

By following these steps, you’ll ensure that your physical records are clear, professional, and ready for distribution.

Using Invoice Templates for Client Trust

Maintaining a professional image is essential in building lasting relationships with clients. The way you present your financial documents plays a crucial role in this process. By using well-designed, consistent, and clear billing forms, you convey reliability and attention to detail, which fosters trust with your clients.

When clients receive organized and professionally formatted documents, it reassures them that their transactions are being handled with care. An easy-to-read structure with all the required details, such as payment terms, services provided, and totals, helps avoid confusion and shows that you take your business seriously.

Furthermore, consistency in your document design–whether for one-time services or ongoing projects–adds to your credibility. Clients are more likely to return or recommend your services if they feel secure and confident in the clarity and professionalism of your financial exchanges.

By using pre-designed documents that reflect your branding and include all essential components, you make the billing process smoother for both parties. This not only speeds up payments but also strengthens your professional reputation.