Truck Driver Invoice Template for Easy Billing and Payment Tracking

For individuals in the transportation industry, managing payments is a crucial part of maintaining a steady cash flow and ensuring proper compensation for services rendered. Crafting accurate and professional documentation for each service completed helps both the service provider and client keep track of financial transactions effectively.

One of the most important tools for streamlining this process is a well-structured document that clearly outlines the terms of payment, services provided, and any additional charges. These documents not only help in securing timely payments but also establish trust and professionalism in business dealings.

By using customizable and easy-to-use forms, transportation professionals can reduce administrative burdens and focus more on their core operations. With the right approach, invoicing becomes a seamless part of the workflow, helping to keep businesses organized and clients satisfied.

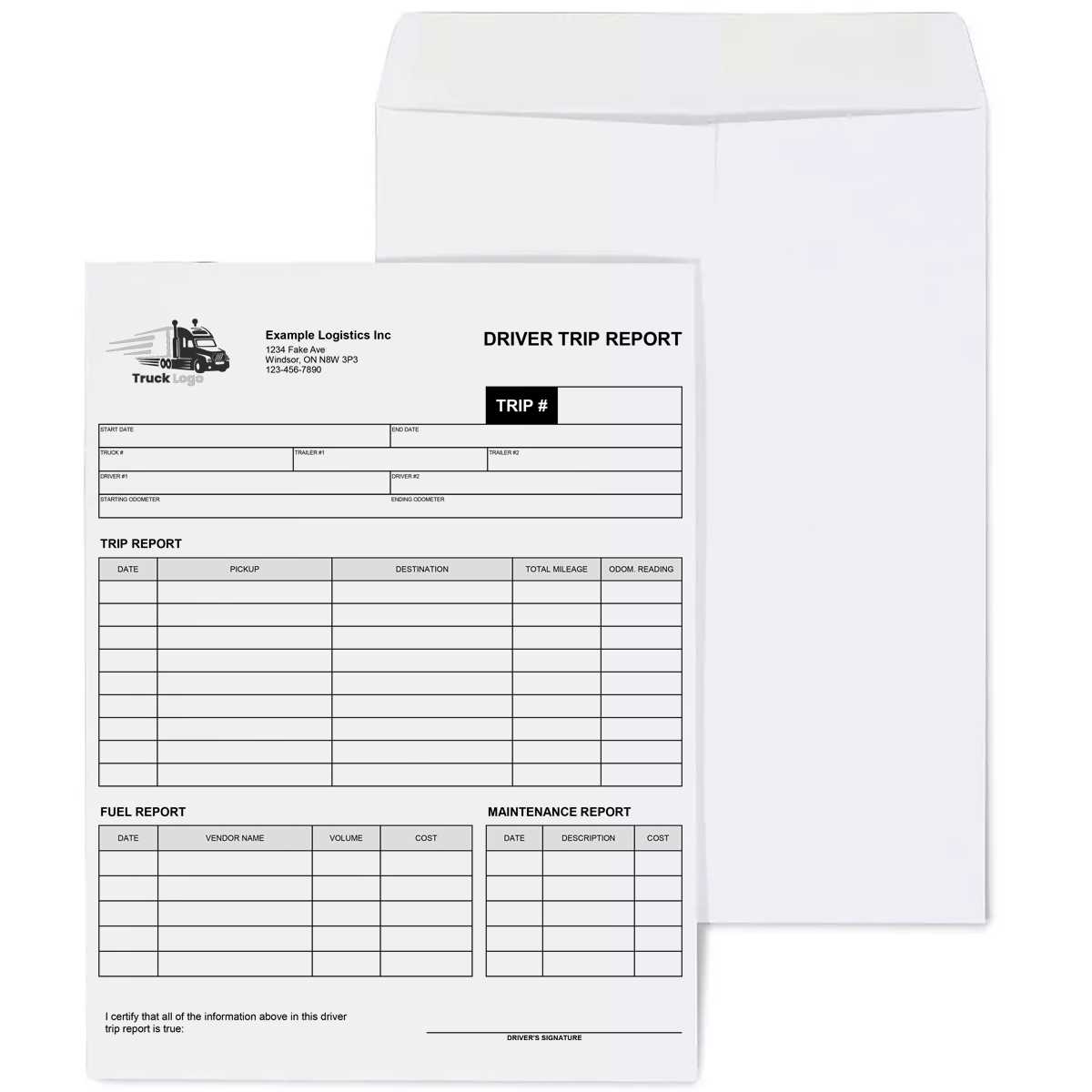

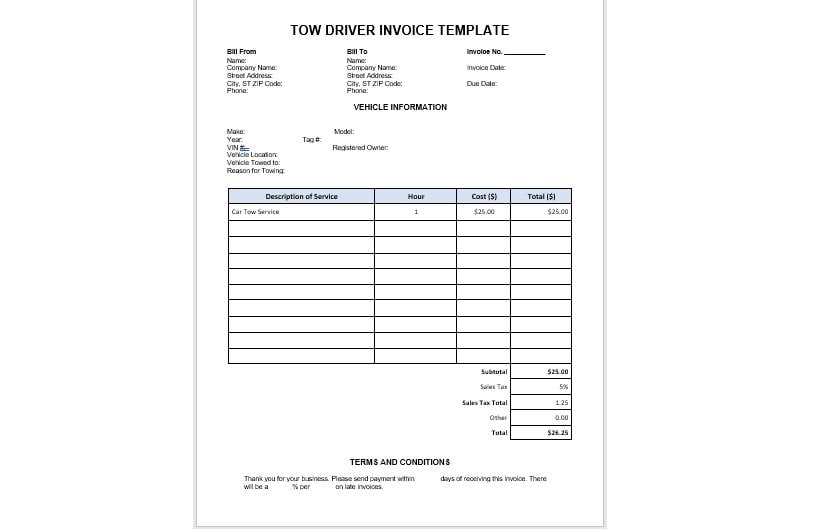

Truck Driver Invoice Template Overview

When it comes to managing payments in the transportation industry, using a standardized document to outline the terms and services provided is essential. Such documents help ensure clarity, reduce errors, and streamline the billing process, making it easier for both service providers and clients to stay on the same page.

A well-structured billing document typically includes key details such as service descriptions, payment terms, and additional charges. By utilizing a predefined format, professionals can easily generate accurate records for every job, which contributes to better financial management and timely payments.

The following table outlines the key components typically included in such a document:

| Section | Description |

|---|---|

| Contact Information | Names, addresses, and contact details of both parties involved. |

| Service Description | Details of the work performed, including dates, locations, and any special instructions. |

| Payment Terms | Agreed-upon payment schedules, methods, and deadlines for settlement. |

| Additional Charges | Any extra costs such as fuel surcharges, tolls, or emergency fees. |

| Total Amount | The final cost to be paid, including all services and additional fees. |

Using a structured approach like this helps ensure all essential information is included, preventing confusion or delays in payment processing. Whether created manually or through digital tools, this format helps professionals keep their billing practices consistent and transparent.

Why Use a Truck Driver Invoice

Utilizing a standardized document for billing purposes is crucial for anyone in the transport industry. It not only helps ensure clear communication between the service provider and client but also aids in maintaining an organized record of all completed jobs. Without such documents, tracking payments, managing financial records, and preventing disputes becomes much more challenging.

A well-structured payment document serves several key purposes. It sets clear expectations regarding payment terms, ensures transparency in financial dealings, and provides a formal record of services rendered. This documentation also serves as evidence in case of disagreements or delays, offering protection to both parties involved.

Efficiency is another reason to use these forms. By having a ready-made structure, the process of preparing bills becomes quick and straightforward. This frees up time for other critical business tasks and reduces the likelihood of errors that can occur when creating custom documents each time.

Additionally, using a predefined format helps maintain a professional image. Clients are more likely to trust a business that provides clear, formal paperwork for services rendered, leading to stronger relationships and repeat business. Having a clear record of transactions also makes it easier to manage taxes and accounting at the end of the year.

Key Elements of an Invoice

When preparing a document to request payment for services rendered, it is important to include specific details that ensure the transaction is clear and easy to understand. A well-structured document provides essential information that prevents confusion and ensures both parties are aligned on the terms of the agreement.

Essential Details to Include

To create a comprehensive billing document, certain key components must be included. These elements help establish the validity of the transaction, ensure proper recordkeeping, and make it easier for both the provider and client to track financials.

| Component | Description |

|---|---|

| Contact Information | Details for both the service provider and the client, including names, addresses, and phone numbers. |

| Service Description | A clear explanation of the work completed, including dates, locations, and specific services provided. |

| Payment Terms | The agreed-upon method, due date, and conditions for payment, including any late fees or discounts. |

| Itemized Charges | Breakdown of the cost for each service or item, including labor, materials, and any additional fees. |

| Total Amount Due | The total sum that needs to be paid, incorporating all charges and taxes. |

Why These Elements Matter

Each element plays a crucial role in ensuring both parties are on the same page regarding the transaction. Clear descriptions and itemized lists prevent misunderstandings and disputes, while accurate payment terms ensure that funds are transferred promptly. By including these essential components, service providers can maintain transparency and professionalism, which ultimately leads to smoother business operations.

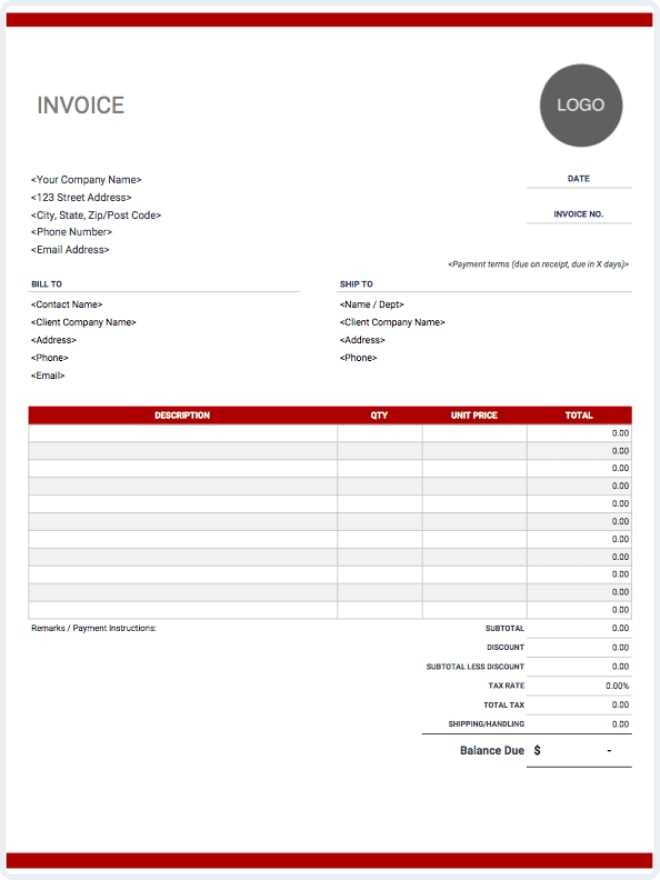

How to Create a Custom Invoice

Creating a personalized billing document involves customizing a standard structure to meet specific needs. This process allows service providers to ensure that all relevant details are captured accurately and presented in a professional format. By tailoring the document, it can reflect the nature of the services, the preferences of both parties, and the unique terms of the transaction.

The first step is to decide on the layout and overall design. A simple, clean format is often preferred to ensure that all information is easy to read and understand. Most importantly, the layout should include sections for contact details, a description of the work completed, and payment terms. Customization comes into play when adjusting the content to suit the specific job, client, or service provided.

Step-by-step process:

- Choose a Layout: Start with a basic template or design that includes all the necessary sections like service description, costs, and payment details.

- Fill in Contact Information: Ensure both your details and the client’s are listed accurately, including names, addresses, and phone numbers.

- Describe the Work: Provide a clear, detailed account of what was done, including dates, locations, and any special services performed.

- List Charges: Break down the costs by item or service, including labor, materials, or any additional fees that apply.

- Include Payment Terms: Clearly outline the due date, accepted payment methods, and any late fees or discounts that apply.

- Summarize Total Amount: Calculate the total amount due, ensuring it includes all services, taxes, and fees.

Customization allows for flexibility in how you present your billing details. Whether you’re working with a new client or repeating a service, adjusting the document for each situation helps create a personalized experience. By maintaining consistency and clarity, you ensure that clients understand the charges and payment expectations, which minimizes confusion and speeds up the payment process.

Essential Information to Include

To ensure that your billing document is both effective and professional, it is crucial to include all necessary details that clarify the transaction. The information presented must cover all aspects of the service provided, payment terms, and any additional charges. Omitting important data can lead to confusion, delays, or disputes, so it is essential to include the following key elements:

- Contact Information: Include full names, addresses, and phone numbers for both the service provider and the client. This ensures that both parties can easily communicate if needed.

- Service Description: Clearly explain the work completed, including dates, locations, and any special instructions or requests. This helps avoid misunderstandings about the services provided.

- Itemized Charges: Break down the costs for each service, product, or extra fee. Itemizing charges provides transparency and allows both parties to see exactly what they are paying for.

- Payment Terms: Specify the payment due date, acceptable methods of payment, and any terms for late fees, discounts, or installments. This ensures both sides are clear on when and how payment is expected.

- Total Amount Due: Always summarize the total amount owed, including any taxes, surcharges, or adjustments. This prevents confusion and helps the client know exactly what they need to pay.

- Additional Notes: If relevant, include any terms that are specific to the transaction, such as return policies, warranty information, or ongoing agreements. This provides clarity and can prevent future disputes.

Including all of these key details not only helps ensure that the billing process goes smoothly but also maintains a professional image and builds trust with clients. A well-organized and comprehensive document reflects attention to detail, which is crucial for maintaining good business relationships.

Understanding Payment Terms for Drivers

For professionals in the transportation industry, it is essential to establish clear payment terms in every billing document. These terms set the foundation for financial transactions and help avoid misunderstandings or delays in payment. Understanding and outlining these terms is not only important for securing timely compensation but also for maintaining healthy business relationships with clients.

Payment terms typically cover various aspects such as the due date, acceptable payment methods, and any penalties or incentives related to the payment schedule. They should also clarify whether the payment is due immediately upon receipt or within a set period, such as 30 days. These details help both the service provider and the client stay organized and on track.

- Due Date: Specify when payment is expected, whether immediately or within a set number of days (e.g., 15, 30, or 45 days).

- Accepted Payment Methods: Clearly state which payment methods are acceptable, such as bank transfer, check, or online payment platforms.

- Late Fees: Indicate any additional fees for overdue payments. Late fees should be reasonable and clearly defined to ensure compliance.

- Discounts for Early Payment: If applicable, offer a discount to clients who settle the payment early. This can encourage prompt payment.

- Partial Payments or Installments: If the total amount is large, consider allowing partial payments over time. Specify the amounts, due dates, and any interest or fees associated with installments.

Clearly outlining these terms benefits both parties by ensuring expectations are aligned. A well-defined payment schedule reduces the risk of late payments and promotes a smooth and transparent transaction process. Moreover, it enhances the professional image of the service provider and builds trust with clients.

Common Mistakes in Billing Documents

When creating payment requests for services rendered, even small errors can lead to confusion, delayed payments, or disputes. Ensuring accuracy and clarity is essential to maintaining good client relationships and ensuring timely compensation. Below are some of the most common mistakes that can occur when drafting such documents and how to avoid them.

Errors in Document Details

- Missing Contact Information: Failing to include complete contact details for both parties can cause delays in communication. Always ensure both the service provider’s and client’s names, addresses, and phone numbers are included.

- Incorrect Dates: The date of service or the date the payment is due must be accurate. A mistake here can lead to misunderstandings about when payment is expected or what services were provided.

- Ambiguous Service Descriptions: Vague or unclear descriptions of the work done can confuse the client. Be specific about the services provided, including locations, dates, and any special instructions or requirements.

Financial Errors

- Incorrect Calculations: Always double-check the math! Miscalculations can lead to overcharging or undercharging. Make sure all figures add up correctly, including tax, discounts, and any additional charges.

- Omitting Payment Terms: Without clear payment terms, clients may not understand when or how to make a payment. Specify the payment due date, accepted methods, and any penalties for late payment.

- Failure to Itemize Charges: Not breaking down the charges into individual components can lead to confusion. Ensure that all costs–whether for labor, materials, or extra services–are clearly listed.

By addressing these common mistakes, you can avoid confusion and ensure that payment is processed quickly and smoothly. A well-prepared and accurate document reflects professionalism and helps maintain strong client relationships.

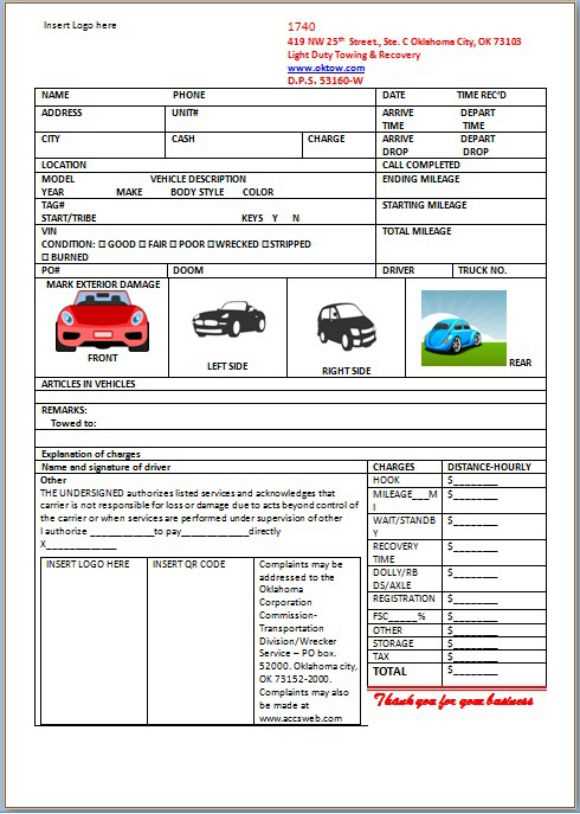

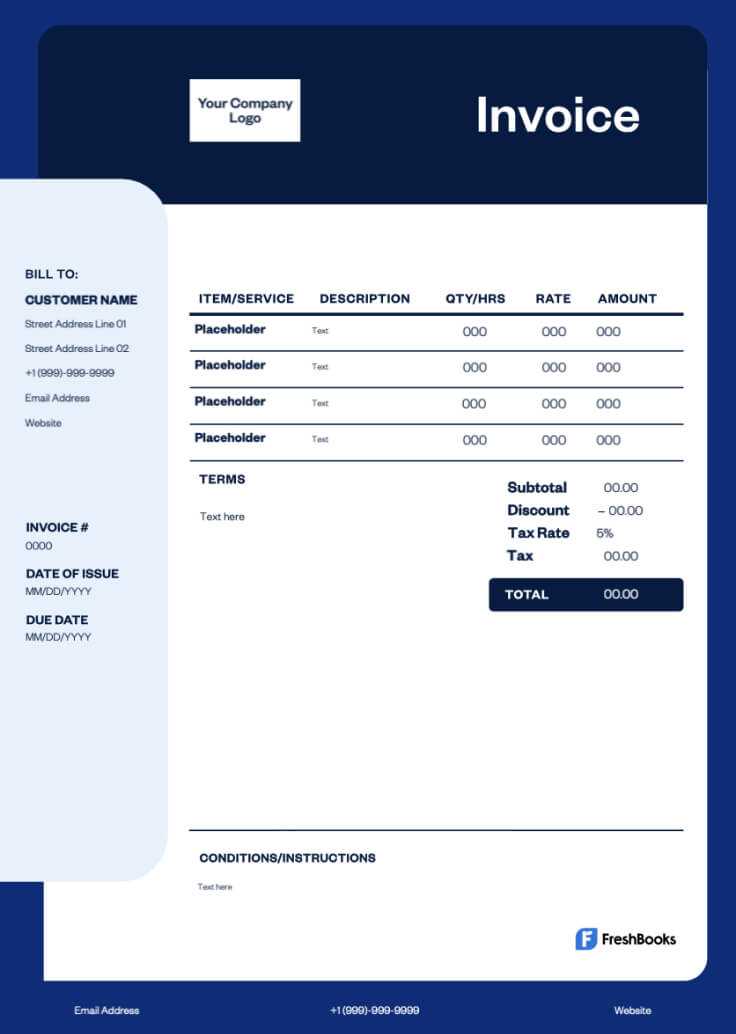

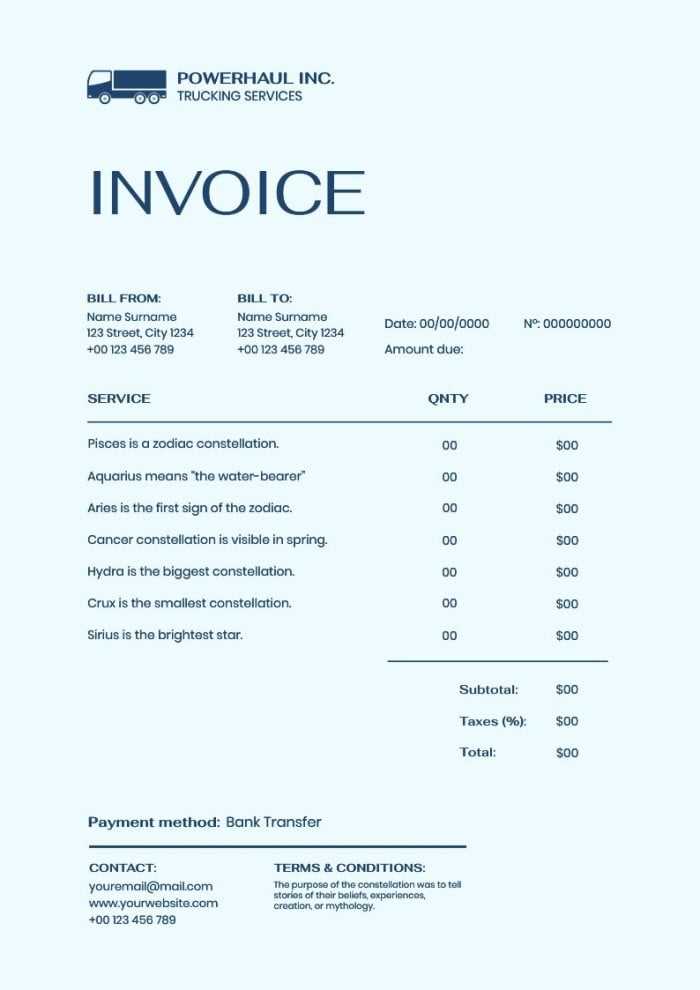

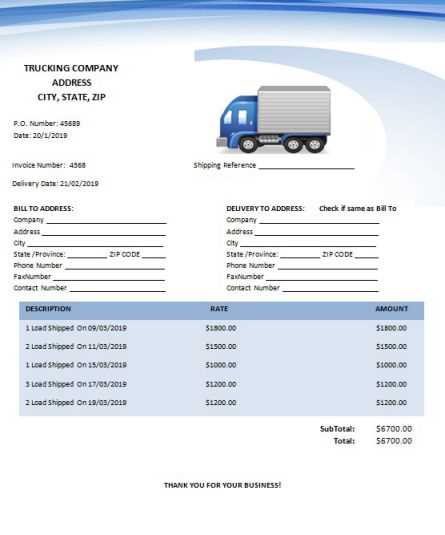

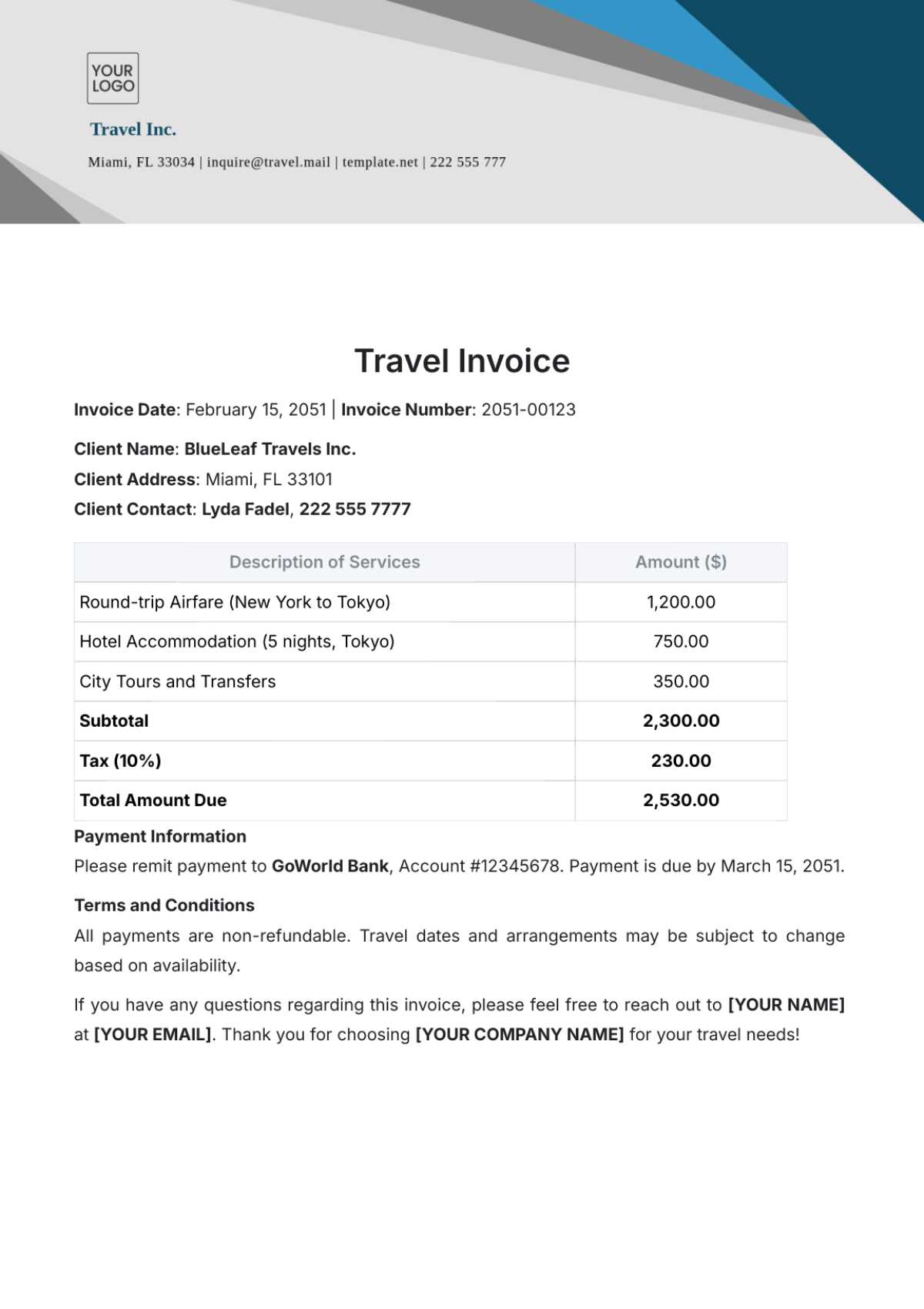

Free Billing Document Templates

For professionals in the transport industry, using a ready-made billing document can significantly simplify the invoicing process. These free resources provide a straightforward and efficient way to create accurate and professional-looking bills without needing to design one from scratch. By utilizing these pre-designed formats, service providers can save time and reduce errors in their billing practices.

Free billing resources come in various formats, from downloadable word documents to customizable online templates. These tools are designed to be easy to use and can be adapted to suit the specific needs of any job, ensuring that all the necessary information is included. Whether you are a small business owner or an independent contractor, these free resources help streamline the administrative side of your business.

Benefits of Using Free Templates:

- Time-Saving: Ready-made formats eliminate the need to create a new document for each job, allowing for faster billing.

- Professional Appearance: These templates are designed to look polished and organized, which enhances your business’s credibility.

- Customizable: Most free resources can be easily modified to reflect specific job details, rates, and terms.

- Cost-Effective: Using free templates means no extra costs for designing or purchasing specialized software.

By making use of these free resources, service providers can focus on delivering quality work while ensuring that their billing process remains efficient and professional. Whether you are handling a single task or managing multiple clients, these templates simplify your financial record-keeping and enhance your business operations.

Benefits of Using Invoice Templates

Using a pre-designed billing format offers numerous advantages for professionals in various industries. These ready-made documents not only save time but also enhance accuracy and consistency in financial transactions. By adopting a standardized approach, businesses can ensure that their billing process is both efficient and professional, leading to better client relationships and faster payments.

Time Efficiency

One of the most significant benefits of using ready-made formats is the time saved in creating each billing document. With a predefined structure, service providers can quickly fill in the details of each job and generate a polished, professional document in minutes. This reduces the time spent on administrative tasks and allows more focus on core business activities.

Improved Accuracy and Consistency

By using a fixed layout, the risk of errors in essential details such as charges, payment terms, and contact information is greatly reduced. Consistent use of the same format for each billing cycle ensures that no crucial information is overlooked, and it helps maintain uniformity across all financial documents. This not only improves the professional image of the business but also minimizes misunderstandings or disputes with clients.

Overall, utilizing a structured approach to billing simplifies the process, enhances the accuracy of transactions, and streamlines the financial aspects of running a business. This efficiency leads to more timely payments, better cash flow, and a smoother operation overall.

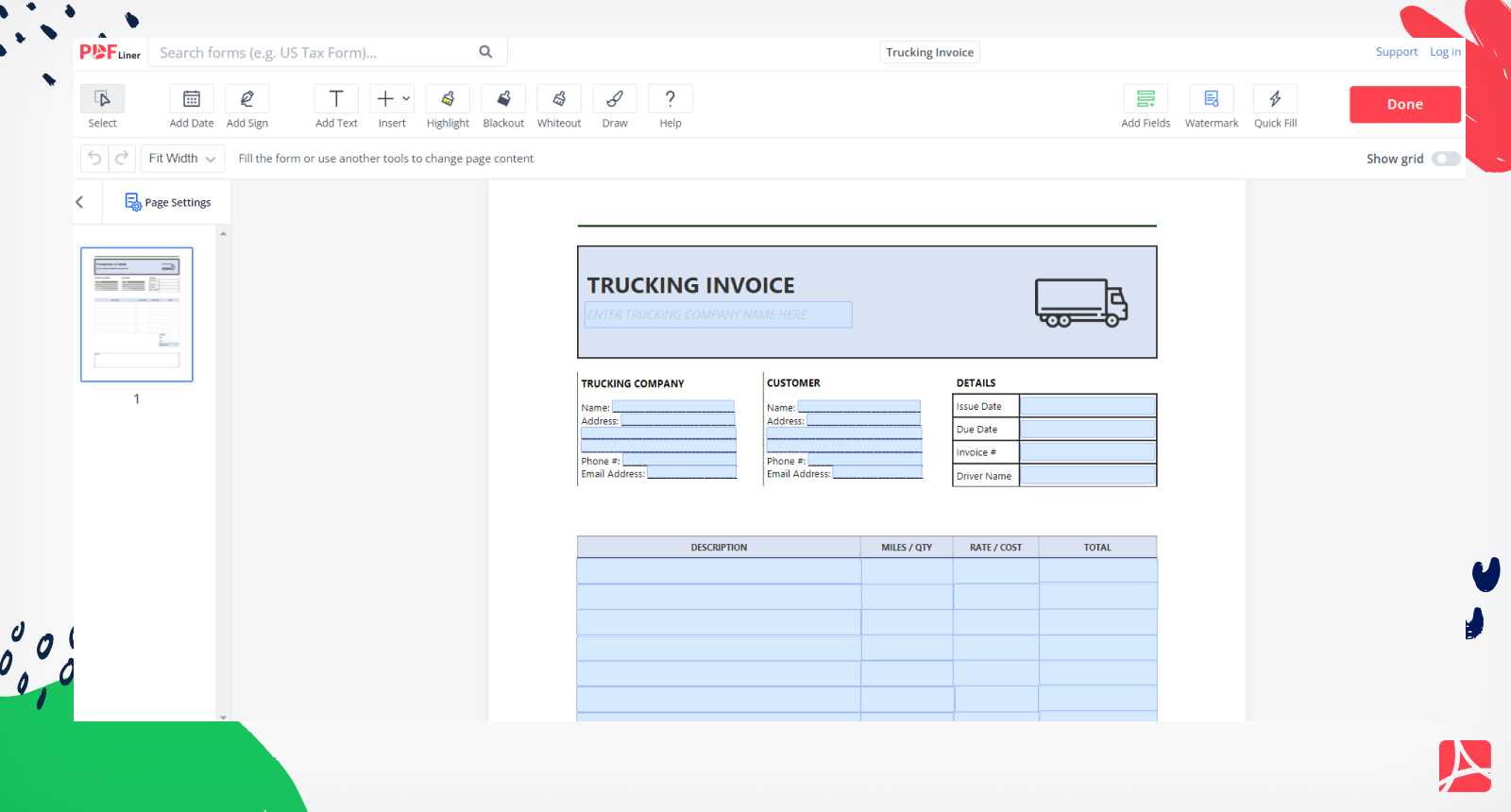

How to Automate Invoice Creation

Automating the process of generating payment requests can significantly improve efficiency, reduce errors, and save time. By leveraging digital tools and software, professionals can create accurate, consistent documents in a fraction of the time it would take manually. Automating this task allows for more focus on delivering services rather than managing paperwork.

There are several methods to automate the creation of payment requests. Below are some key steps to implement this process effectively:

- Choose the Right Software: Use accounting or invoicing software that offers automation features. Many platforms allow you to create, send, and track payment documents without the need for manual input.

- Integrate with Other Tools: Integrate the software with other business systems, such as customer management or project tracking tools. This integration can automatically pull in relevant data like client details and job descriptions.

- Set Up Recurring Billing: For ongoing services, set up automated billing cycles. The system will automatically generate and send payment requests at regular intervals without any additional effort from you.

- Use Predefined Fields: Customize your system with predefined fields for contact information, payment terms, and service details. This reduces the need to re-enter the same information each time you generate a new document.

- Enable Payment Reminders: Set up automatic payment reminders that notify clients when payment is due, helping to ensure timely transactions.

By automating these processes, businesses can eliminate the repetitive and time-consuming aspects of billing. This not only improves operational efficiency but also helps maintain accuracy and consistency across all payment requests.

Tips for Professional Invoicing

Creating professional billing documents is essential for maintaining a good business reputation and ensuring timely payments. A well-crafted document reflects your attention to detail and builds trust with clients. Below are some useful tips to help you present a polished, clear, and effective request for payment.

- Use a Clear and Concise Format: Keep your document simple and easy to read. Avoid clutter by using a clean layout with well-defined sections for the necessary information like services rendered, charges, and payment terms.

- Include All Relevant Details: Make sure to provide essential information, such as your contact details, the client’s contact information, a description of the services, dates of service, and itemized costs. The more transparent the document, the fewer chances there will be for confusion.

- List Payment Terms Clearly: Specify payment due dates, accepted methods of payment, and any penalties for late payments. This ensures that your client understands when and how to settle the balance, helping avoid misunderstandings later on.

- Number Your Documents: Use a unique reference number for each billing document. This helps you and your clients keep track of past transactions and provides an organized system for managing payments.

- Double-Check for Accuracy: Always review the document for errors before sending it. Check the pricing, contact details, and dates to ensure everything is accurate. Small mistakes can create confusion and delay payment.

- Set a Professional Tone: Use a courteous and professional tone in your communication. While your document should be formal, keep it polite and respectful to foster positive relationships with your clients.

- Include Payment Instructions: Clearly outline the steps for making payment, whether it’s through bank transfer, credit card, or other methods. This eliminates any uncertainty and encourages timely action from the client.

By following these tips, you can ensure that your billing documents are not only professional but also effective in securing timely payments and building strong, trust-based relationships with your clients.

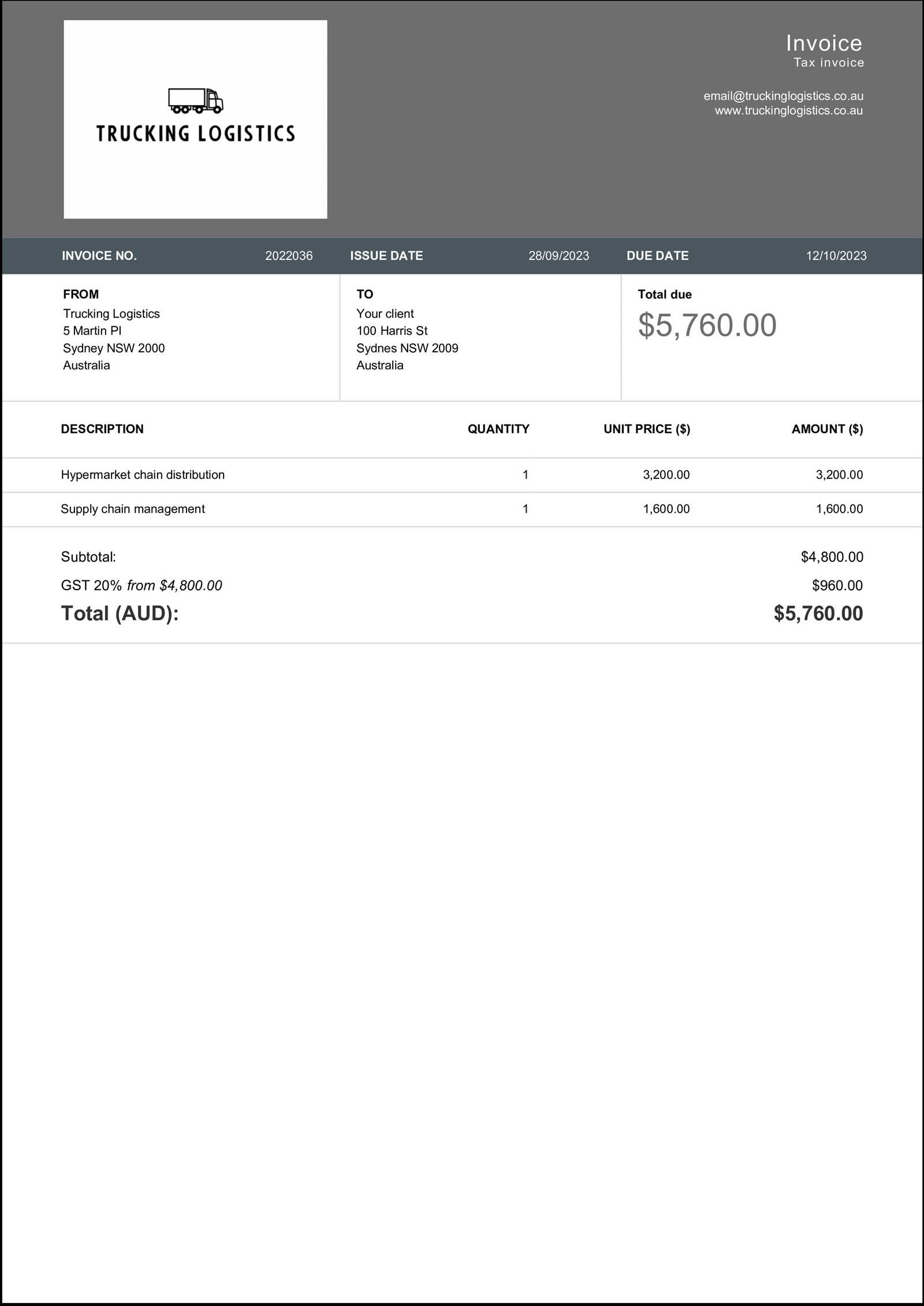

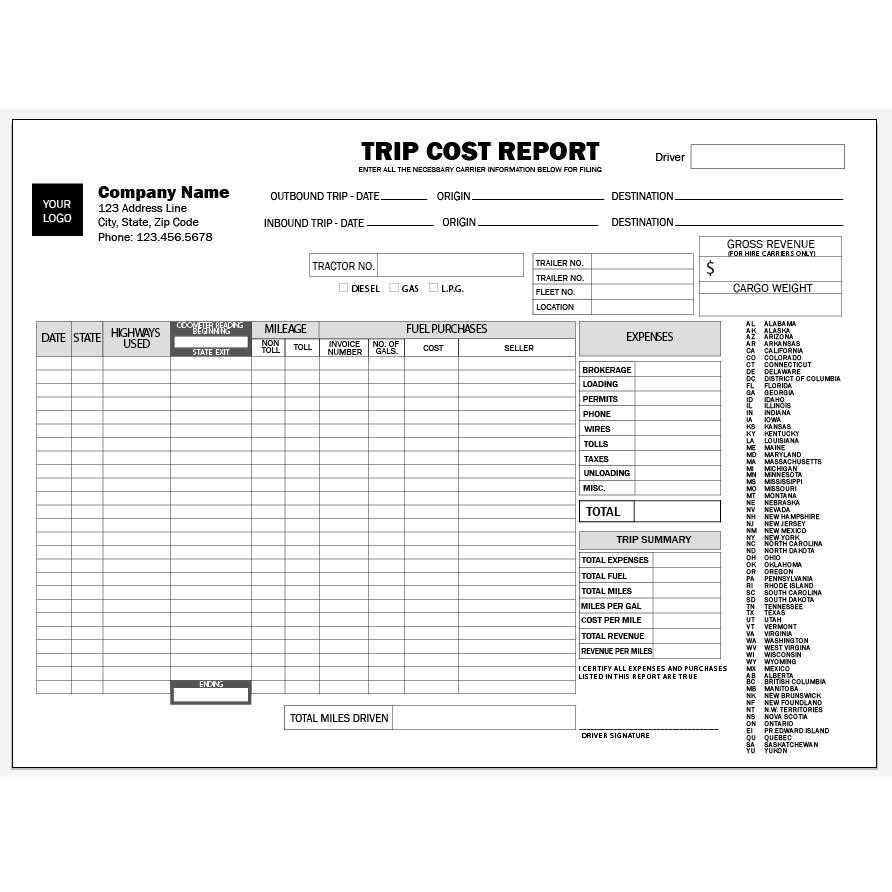

Incorporating Taxes and Fees

When creating billing documents, it’s crucial to account for any applicable taxes and additional fees to ensure transparency and compliance with regulations. Accurately including these charges helps avoid misunderstandings with clients and ensures that the total amount due reflects the full cost of services rendered. Properly calculating and listing taxes and fees also prevents delays in payment and fosters trust between you and your clients.

Types of Taxes and Fees to Consider

- Sales Tax: Depending on your location and the type of services provided, sales tax may need to be applied. Make sure you know the local tax rate and apply it correctly to the total cost of the service.

- Service Fees: Additional charges, such as processing or handling fees, should be clearly listed. These are often necessary to cover operational costs or specialized services.

- Fuel Surcharges: If relevant, include any surcharges related to fuel, especially if the cost fluctuates based on distance traveled or fuel price variations.

- Late Payment Fees: If you charge penalties for overdue payments, these fees should be clearly defined and included in the document. Indicate when late fees will be applied and how they are calculated.

- Discounts: If you’re offering a discount, whether for early payment or promotional purposes, it should be listed as a separate item, showing both the original and discounted amounts.

How to Include Taxes and Fees in the Document

- Itemized List: Break down each tax and fee separately in your document. This allows clients to see exactly what they are being charged for, enhancing transparency.

- Apply Correct Calculations: Double-check the rates and apply them to the appropriate charges. Incorrect calculations can lead to client dissatisfaction or even legal issues.

- Clearly Label All Charges: Ensure that every tax and fee is clearly labeled with a description, so clients understand what each charge is for.

- Include the Total: After adding taxes and fees, make sure to show the final total due, which includes the base price, taxes, and any additional charges. This helps avoid confusion at the time of payment.

By accurately including taxes and fees in your billing documents, you can maintain professionalism, avoid disputes, and ensure you are compensated correctly for all services provided.

Invoice Software vs Manual Templates

When managing the billing process, businesses often face the choice between using automated software or relying on manual documents. Each option has its advantages and challenges, and the decision largely depends on the volume of transactions, the complexity of the services, and the resources available. Understanding the differences between using software solutions and manual formats can help you choose the right approach for your needs.

Advantages of Using Software

- Efficiency: Automated software allows for quick and easy generation of billing documents, saving time on repetitive tasks. Once client details and service information are entered, the software can generate documents with a few clicks.

- Accuracy: Automation reduces human error. Software typically includes built-in calculations for taxes, discounts, and totals, which minimizes mistakes in financial figures.

- Tracking and Reporting: Many software solutions offer features for tracking payments, sending reminders for overdue amounts, and generating reports. This allows you to keep a detailed record of all transactions.

- Customization: Invoice software often comes with customizable templates that can be adjusted to fit your branding and specific business needs, providing a more professional appearance.

Advantages of Manual Formats

- Low Cost: Manual formats, such as paper or simple digital documents, do not require the purchase of software or subscriptions. This makes them an attractive option for small businesses or independent contractors with limited budgets.

- Personalization: Creating a custom document by hand can add a personal touch that strengthens client relationships. You have full control over the document’s design and structure.

- No Technical Dependence: Manual methods do not rely on technology. This can be beneficial for those who prefer to avoid software and potential technical issues such as system crashes or software malfunctions.

- Simple to Use: For small-scale operations, manually creating a document can be straightforward and does not require specialized knowledge or training. Anyone can create a basic billing document with just a few details.

While manual methods can be cost-effective and simple to use, they tend to be more time-consuming and error-prone, especially as your business grows. On the other hand, using automated software can significantly speed up the process, improve accuracy, and provide valuable tracking features for better business management. Ultimately, the choice depends on the size of your operation, your budget, and your specific needs.

How to Track Outstanding Payments

Tracking unpaid balances is essential for maintaining healthy cash flow and ensuring that you are compensated for the services you provide. Without a clear system in place, it can become difficult to keep track of overdue payments, leading to financial uncertainty. Establishing an effective method for monitoring outstanding payments helps prevent late fees, encourages timely payment, and ensures you stay organized.

There are several strategies and tools available to help you monitor unpaid balances. One approach is to maintain a manual record of all transactions and their due dates, while another is to use digital tools that can automate the tracking process. Regardless of the method, it’s important to have a clear overview of which payments are due, how long they have been outstanding, and what actions are needed to follow up.

Here are some effective ways to track outstanding payments:

- Use Payment Tracking Software: Many accounting and billing platforms allow you to automatically track unpaid amounts, set reminders, and send follow-up emails or notifications to clients. These tools streamline the process and reduce the risk of human error.

- Maintain an Updated Ledger: Keep a manual or digital ledger that includes all outstanding balances, including the client’s name, amount due, and payment due date. Regularly updating this record will help you stay on top of overdue payments.

- Set Clear Payment Terms: Include specific terms regarding payment deadlines and late fees in your contracts or agreements. Clients are more likely to pay on time when they know the consequences of not doing so.

- Send Regular Reminders: Proactively communicate with clients about outstanding balances. Sending polite reminders well before the due date can help avoid delays. Automated systems can help you schedule these reminders at regular intervals.

- Offer Multiple Payment Methods: Simplify the payment process by offering various payment options. The more convenient it is for clients to pay, the quicker you will receive your payments.

By staying organized and proactive in tracking outstanding payments, you can maintain a steady income flow and reduce the likelihood of financial issues. Using a combination of manual and automated methods allows for flexibility and accuracy, ensuring that you’re always on top of your accounts receivable.

Legal Considerations in Billing Documents

When creating payment requests, it is crucial to understand the legal requirements surrounding the document to ensure compliance and avoid potential disputes. These legal considerations protect both the service provider and the client by clearly outlining terms, conditions, and responsibilities. Properly addressing legal factors in your billing documents can help safeguard your business interests and facilitate smoother transactions.

Some key legal aspects to consider when drafting payment requests include:

- Payment Terms: Clearly define the payment deadlines, acceptable payment methods, and any penalties for late payments. This helps ensure that both parties understand their obligations and minimizes the risk of misunderstandings or delayed payments.

- Tax Compliance: Depending on the jurisdiction, certain taxes may be applicable to your services. It is essential to comply with tax regulations by including the correct tax rate and ensuring that taxes are properly calculated and displayed on the payment request.

- Contractual Agreements: If there is a contract in place, ensure that the billing document aligns with the terms of the agreement. This includes payment schedules, service descriptions, and any specific clauses that govern the financial aspects of the arrangement.

- Business Information: Include all required business details, such as your registered business name, address, and contact information. This establishes a formal business relationship and ensures that your client knows who they are dealing with in case of any disputes or questions.

- Dispute Resolution: Specify how disputes will be handled, including whether any mediation, arbitration, or legal proceedings will be required. This can provide a clear process for resolving disagreements in a manner that protects both parties.

- Late Fees and Collection Costs: If your payment terms include late fees, it is important to state the amount or percentage that will be charged for overdue payments. Additionally, outline any costs that may arise from debt collection efforts, should that become necessary.

By addressing these legal factors in your payment documents, you can create a clear, enforceable agreement that benefits both you and your clients. Always consult with a legal professional to ensure that your billing documents comply with local laws and industry regulations.

How to Send Invoices to Clients

Sending payment requests to clients is a crucial part of the business process. Ensuring that the document reaches the right person at the right time is vital for getting paid promptly. There are several methods for sending these documents, each with its advantages and potential drawbacks. The key is to choose the right approach that suits your business needs while also being convenient for your clients.

Methods of Sending Payment Requests

- Email: Sending payment requests via email is one of the fastest and most commonly used methods. You can either attach the document as a PDF file or use invoicing software that automatically generates and sends the document. This method is quick, cost-effective, and allows for easy tracking of sent documents.

- Postal Mail: Although slower and less common in today’s digital age, sending physical copies of payment requests may be necessary for clients who prefer traditional methods or are not comfortable with digital communication. Make sure to use secure mail services and track delivery to ensure it reaches the client.

- Online Invoicing Platforms: There are many online invoicing platforms that allow businesses to create and send payment requests directly through their website or app. These platforms often come with additional features like payment tracking, automatic reminders, and integration with accounting software.

- Hand Delivery: In some cases, especially with local clients, delivering a payment request in person may be appropriate. This method adds a personal touch and can be useful for building stronger relationships with clients. Ensure you keep a copy for your records and get confirmation of receipt.

Best Practices for Sending Payment Requests

- Double-Check for Accuracy: Before sending, ensure that the payment request includes all the necessary details such as the client’s information, services provided, amounts, and due date. Accuracy is key to avoid confusion and delays in payment.

- Set Clear Payment Terms: Be specific about the due date, late fees, and acceptable payment methods. Clearly stating these terms will help prevent misunderstandings and encourage timely payments.

- Follow Up: If the payment request has not been paid by the due date, it’s important to follow up with a polite reminder. Many invoicing software tools allow you to set automatic reminders to notify clients as the due date approaches or after it has passed.

- Track Sent Documents: Keep records of all sent documents, including delivery confirmation, especially when using postal mail or hand delivery. This can protect you in case of a dispute over the payment request.

Choosing the best method for sending your payment requests depends on your clients’ preferences and the size of your operation. Regardless of the method, maintaining clear communication and accurate documentation is essential for ensuring timely payments and maintaining professional relationships.

Best Practices for Invoice Management

Efficiently managing payment requests is essential for maintaining a healthy cash flow and ensuring smooth financial operations. Adopting best practices for organizing, tracking, and following up on payments can prevent overdue accounts and reduce administrative burdens. By implementing a system that prioritizes accuracy, timeliness, and clear communication, businesses can streamline the billing process and improve their overall financial health.

Key Strategies for Effective Management

- Organize and Categorize: Keep a well-structured record of all sent payment requests, including due dates, amounts, and payment status. Using digital tools or software can help you categorize and filter documents based on various criteria, such as client name, due date, or outstanding balance.

- Set Consistent Payment Terms: Establish clear and consistent terms for payments from the beginning. This includes due dates, late fees, and preferred payment methods. Having these terms in place helps clients understand expectations and encourages timely payments.

- Use Automated Reminders: Many invoicing platforms allow you to set up automatic reminders for upcoming or overdue payments. This reduces the chances of forgetting to follow up and ensures that clients are promptly notified of outstanding amounts.

- Keep Detailed Records: Maintain accurate and detailed records for every transaction, including the payment request, any communication with the client, and the payment history. These records will help resolve any potential disputes and serve as a reference for future transactions.

- Regularly Reconcile Payments: Routinely compare your records with incoming payments to ensure all amounts are accounted for. This helps identify any discrepancies early on and ensures that your financial records remain up-to-date.

Tips for Ensuring Timely Payments

- Send Prompt Payment Requests: Send your payment requests as soon as services are rendered or products are delivered. This helps clients recognize the need to pay and gives them enough time to process the payment before the due date.

- Offer Multiple Payment Methods: Providing multiple ways for clients to pay–such as bank transfer, credit card, or online payment platforms–can increase the likelihood of timely payments, making it easier for clients to complete transactions.

- Follow Up Politely: If payment is overdue, send a polite reminder email or make a friendly phone call to inquire about the status of the payment. Maintaining professionalism while following up can help preserve your relationship with the client.

- Incentivize Early Payments: Offer discounts or other incentives to clients who pay early or within a specific time frame. This can encourage quicker paym