Interpreter Invoice Template for Easy and Professional Billing

For those providing language assistance in various forms, managing payment requests efficiently is crucial for maintaining a smooth workflow. A well-structured document can help ensure clarity for both the service provider and the client, making financial transactions more transparent and organized.

Whether you are a freelancer or working with a larger agency, having the right tool to document your services is essential. This document should clearly outline the work completed, the terms of payment, and any additional details relevant to the transaction. A professional approach to creating these documents not only helps you maintain financial organization but also fosters trust with your clients.

By customizing this document to suit specific needs, language experts can focus more on their craft and less on administrative tasks. In this guide, we’ll explore the features that make an effective document for billing purposes, offering practical advice for customization and best practices for getting paid on time.

Interpreter Invoice Template Overview

Creating a clear and concise payment request document is essential for any language professional. This type of document serves as an official record that outlines the services rendered, payment terms, and other relevant details necessary for a seamless transaction. It provides a formal agreement between the service provider and the client, ensuring that both parties are on the same page regarding the scope of work and payment expectations.

A well-organized payment request can help professionals manage their business operations more effectively. It can streamline the billing process, reduce confusion, and improve cash flow. Whether you are billing hourly or per project, having the right structure in place allows you to maintain a professional appearance while safeguarding your financial interests.

| Element | Description |

|---|---|

| Client Information | Details such as name, contact information, and address of the client |

| Service Description | Clear description of the services provided, including dates and hours worked |

| Rate | Hourly or flat rate for the services rendered |

| Payment Terms | Details about when payment is due and any late fees or discounts |

| Total Amount | Final amount due after considering all services and rates |

By including these critical elements, a service provider ensures transparency and helps clients understand the charges associated with the service. This clear format minimizes misunderstandings and ensures prompt and accurate payment, allowing both parties to proceed with confidence.

Why Use an Interpreter Invoice Template

Having a structured and professional billing document can significantly improve the way you handle financial transactions with clients. It serves as both a record and a tool for ensuring accurate and timely payments. With the right layout, you can minimize errors, avoid confusion, and ensure consistency across all billing communications.

Using a standardized document helps professionals in the language service industry streamline their workflow, saving time and effort. A pre-designed structure allows for quick customization without having to create new documents from scratch for every project. Here are a few reasons why it’s beneficial to use such a tool:

- Efficiency: Quickly fill in essential details without wasting time on formatting or design.

- Consistency: Maintain a uniform appearance across all billing documents, reinforcing professionalism.

- Clarity: Clearly outline the work completed, the rate charged, and the total amount due, reducing misunderstandings.

- Accuracy: Ensure all relevant details are included, such as service descriptions, hours worked, and payment terms.

- Time-Saving: Reduce the time spent on administrative tasks by using a ready-to-go structure.

By utilizing such a document, you not only enhance your organization but also build trust with your clients, as they can easily understand the billing process and feel confident in the transaction.

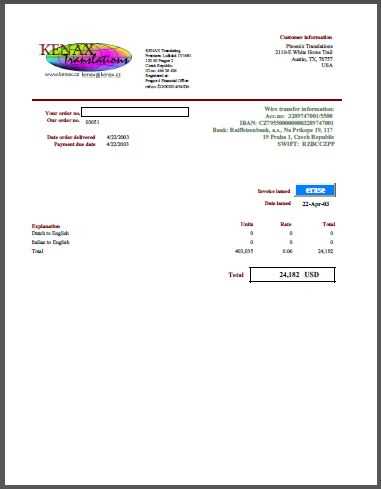

Key Elements of an Interpreter Invoice

To ensure smooth and professional financial transactions, it’s important to include all the necessary details in your billing document. Each element of the document plays a crucial role in providing clarity to both the service provider and the client. A well-structured record ensures that both parties have a mutual understanding of the charges and terms, helping to avoid confusion and delays in payment.

Essential Information to Include

Every billing document should contain some key details that make it easily recognizable and verifiable. These include:

- Client Details: Name, address, and contact information of the client receiving the services.

- Service Provider Details: Your name, contact information, and business details if applicable.

- Service Description: A clear summary of the work performed, including dates, hours worked, and any specific services rendered.

- Payment Terms: Clear instructions on how and when payment is expected, including any late fees or discounts for early payment.

Additional Important Components

In addition to the basic information, there are several other elements that help ensure transparency and facilitate smooth payment processing:

- Rate or Pricing: The agreed-upon rate for the services provided, whether hourly, per project, or a fixed amount.

- Total Amount Due: The final amount the client needs to pay after factoring in all services and rates.

- Payment Instructions: Methods of payment accepted, such as bank transfer, PayPal, or credit card, along with the necessary details for processing payment.

Including these key components in your billing document will not only help you stay organized but also foster a professional relationship with your clients by ensuring clarity and reducing the chances of disputes.

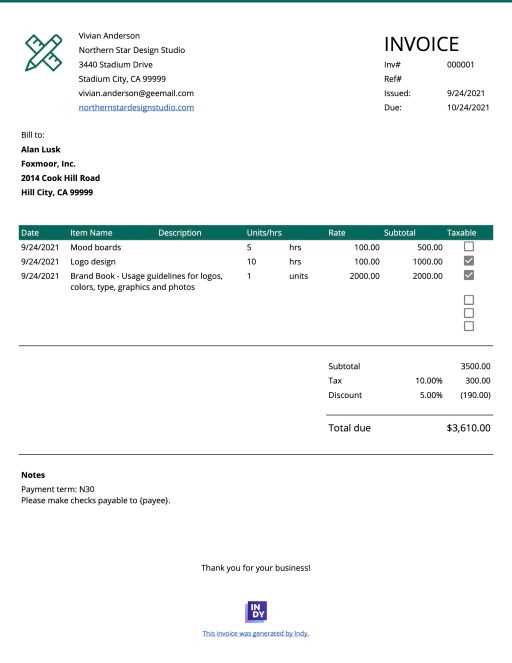

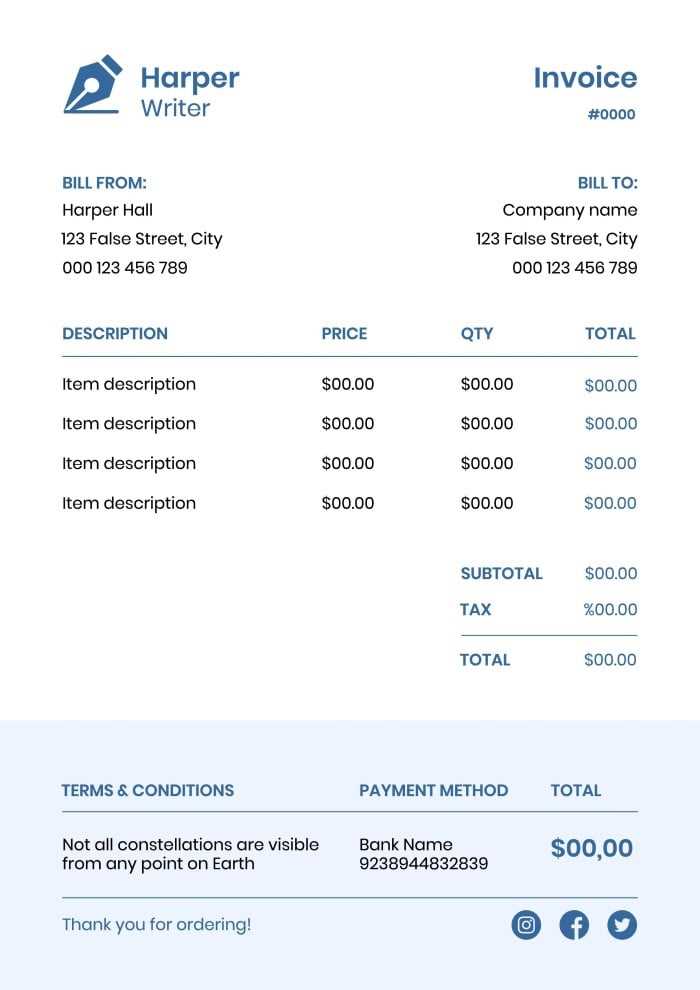

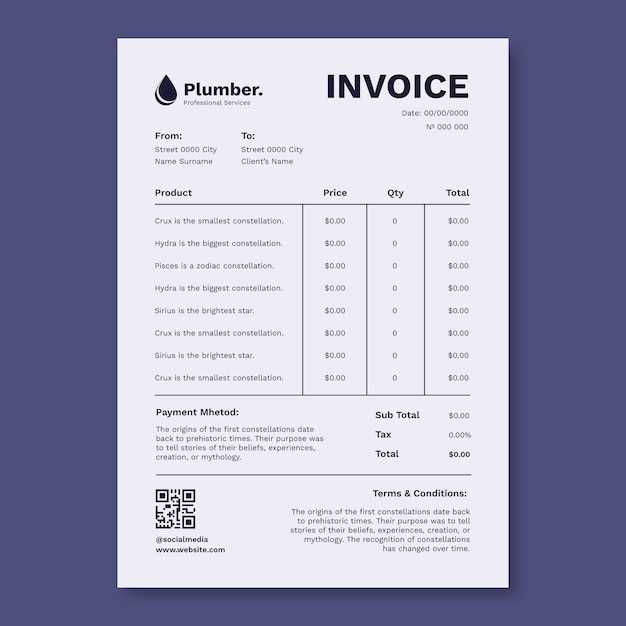

How to Customize Your Invoice Template

Personalizing your billing document is an important step in ensuring it reflects your unique business practices and meets your specific needs. Customization allows you to present a professional, branded look, while also tailoring the structure to better align with your services and client expectations. A well-customized document not only enhances your image but also helps in maintaining consistency across all your financial communications.

Steps for Personalization

To create a document that suits your requirements, follow these key steps:

- Adjust the Layout: Choose a layout that fits the type of work you do. For instance, if you bill hourly, highlight the time spent clearly.

- Include Your Branding: Add your logo, brand colors, and contact information to maintain a professional identity.

- Set Clear Payment Terms: Customize payment due dates, penalties for late payments, or discounts for early settlement based on your business model.

- Define Service Categories: Include specific categories for each type of service you provide, making it easier for clients to understand the breakdown of charges.

Additional Customization Tips

Further enhance your document by considering these options:

- Incorporate a Personal Touch: Add a message or thank-you note to express appreciation for the client’s business.

- Flexible Payment Methods: Tailor the payment section by listing multiple payment options like online platforms, credit cards, or bank transfers to suit client preferences.

- Include Discounts or Promotions: Offer special deals or rates for repeat clients or bulk services.

By making these changes, you can create a document that not only facilitates smooth transactions but also reflects your professionalism and commitment to service.

Best Formats for Interpreter Invoices

When creating a billing document, choosing the right format is crucial for clarity and professionalism. A well-organized format ensures that all necessary information is easily accessible, making it simple for clients to understand the charges and payment terms. Selecting a suitable format also enhances the chances of prompt payment and helps avoid any confusion or misunderstandings.

Popular Document Formats

There are several formats commonly used for creating billing records, each with its own advantages. The right format will depend on your needs and client preferences.

- Word Documents: A versatile option, Word files are easy to edit and can be customized with logos, text, and various styles. They are suitable for clients who prefer to receive editable files.

- PDF Files: This is one of the most professional and widely accepted formats. PDFs are not easily editable, ensuring that the document remains unchanged once sent, making it ideal for formal transactions.

- Excel Spreadsheets: Ideal for those who charge based on hourly rates or need to calculate totals automatically. Excel allows for easy data manipulation and can handle complex billing structures.

- Online Invoicing Platforms: Many professionals now use online platforms that automatically generate billing documents. These services often offer additional features, such as automated reminders and online payment options.

Choosing the Right Format for Your Business

When selecting a format for your billing records, consider the following:

- Client Preferences: Some clients may prefer a specific format, such as PDF for its professionalism or Word for ease of editing.

- Security and Stability: If you need a secure, tamper-proof document, PDF is often the best choice.

- Ease of Use: If you prefer something simple, Word documents or online platforms can be user-friendly, especially for those with minimal technical knowledge.

By selecting the appropriate format for your billing needs, you can enhance the professionalism and efficiency of your transactions.

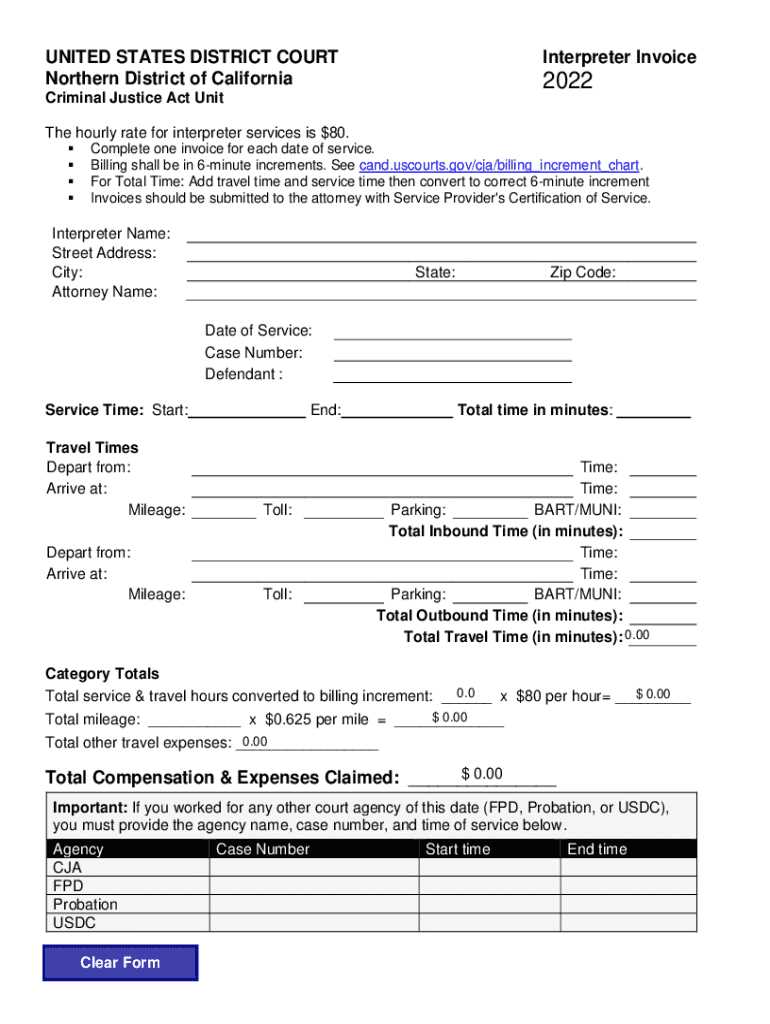

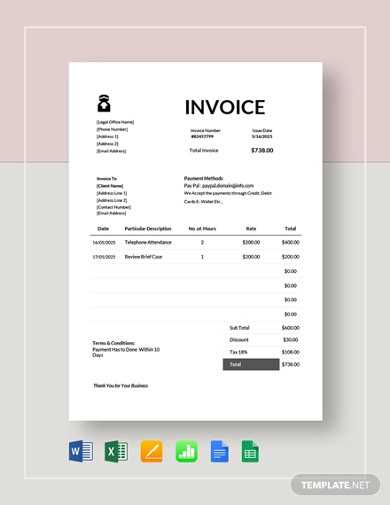

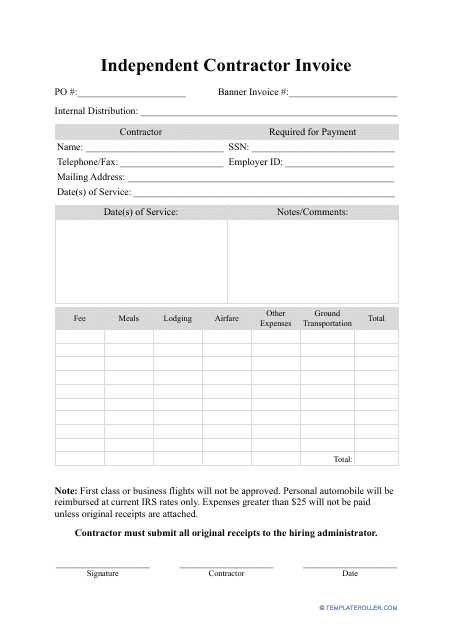

Free Interpreter Invoice Templates Online

Finding a ready-made document that fits your billing needs can save you time and effort, allowing you to focus more on your services rather than administrative tasks. Many websites offer free resources that can be easily customized to suit your specific requirements. These documents often come in various formats, including Word, PDF, and Excel, giving you flexibility based on your preferences.

Using an online resource for your billing records offers several advantages. Not only do these platforms provide professionally designed structures, but they also allow for quick customization, helping you get paid faster while maintaining a polished image. Here are some benefits of using free resources available online:

- Easy Customization: Modify fields such as client details, service descriptions, and pricing to match your specific needs.

- Instant Access: Download and use the documents immediately after entering your details, without the need for software or complex setups.

- Variety of Formats: Choose from different file types to suit your preferences, whether you need something editable or a fixed, secure format.

- Free of Charge: Many websites offer these resources at no cost, making them an ideal choice for freelancers or small businesses.

Here are a few popular platforms where you can find these free resources:

- Invoice Generator: Simple and easy-to-use tool for creating professional billing documents, with customizable fields and a wide variety of formats.

- Canva: A design platform offering free, customizable billing documents with aesthetic and functional options for various services.

- Zoho Invoice: An online service that provides free templates along with integrated billing and payment management features.

- Template.net: A comprehensive site offering a range of free billing document designs for different industries and use cases.

By using these online resources, you can quickly generate and send polished, professional documents that help you manage your transactions more effectively.

Common Mistakes in Interpreter Invoices

When creating a billing document, small errors can lead to confusion, delayed payments, or misunderstandings between you and your client. It’s essential to pay attention to the details, as mistakes in this document can reflect poorly on your professionalism. Even minor inaccuracies can cause unnecessary back-and-forth and complicate the payment process.

Frequent Errors to Avoid

Here are some of the most common mistakes that can occur when preparing a payment request:

- Missing Client Information: Failing to include the full name, address, or contact details of the client can lead to confusion and delays.

- Incorrect Service Descriptions: Not clearly outlining the services provided, including dates and times, can result in disputes or the client questioning the charges.

- Inconsistent Pricing: Using unclear or inconsistent pricing structures, such as not specifying whether rates are hourly or flat, can lead to misunderstandings.

- Omitting Payment Terms: Not stating payment deadlines or late fees can lead to delayed payments or clients ignoring terms.

- Overlooking Taxes: Not including applicable taxes or failing to break down the tax calculation can create issues, especially for clients who need this information for their own accounting purposes.

How to Avoid These Mistakes

To prevent these errors, consider the following tips when preparing your document:

- Double-check all details: Always verify the accuracy of client information, the description of services, and pricing before finalizing the document.

- Use clear and simple language: Make sure your descriptions are easy to understand and leave no room for ambiguity.

- Be consistent with rates and charges: Clearly state whether you charge hourly, by the project, or in another manner, and stick to the same structure throughout.

- Include all relevant taxes and fees: Make sure to add any necessary tax calculations and clearly itemize them to avoid confusion.

By being mindful of these common mistakes and taking the time to review your documents, you can improve the efficiency of your billing process and reduce the likelihood of disputes or delays in payments.

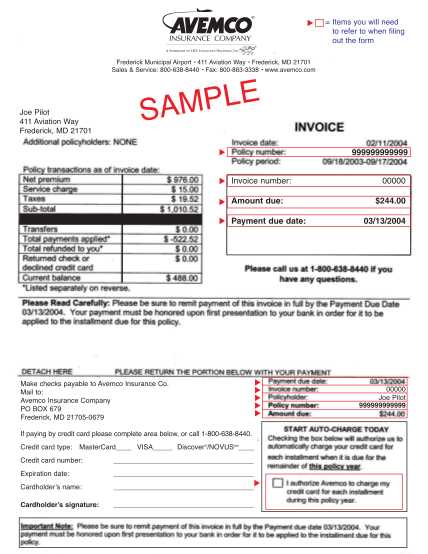

How to Add Payment Terms to Invoices

Clear and concise payment terms are essential for ensuring that both you and your client have a mutual understanding of the expectations surrounding financial transactions. Including these terms in your billing document helps avoid confusion and delays, ensuring that you are paid on time and that both parties know their obligations. Payment terms provide the foundation for how, when, and under what conditions the payment will be made.

Here are some key steps to follow when adding payment terms to your billing documents:

- Specify the Payment Due Date: Clearly state the date by which the payment should be made. You can use phrases like “Due within 30 days” or “Payment due by [specific date].”

- Include Late Payment Fees: If you charge late fees for overdue payments, make sure to specify the amount or percentage that will be added after the due date has passed.

- Offer Early Payment Discounts: If you provide a discount for early payments, include details like “2% discount if paid within 10 days” to incentivize clients to settle sooner.

- State Accepted Payment Methods: List the methods of payment you accept, such as bank transfers, credit cards, checks, or online payment platforms like PayPal.

- Define Payment Schedules: If you have recurring services, mention the frequency and the specific dates for payment (e.g., weekly, monthly, upon completion of each service).

By setting clear payment terms, you not only ensure that your clients understand when and how to pay, but also protect yourself from delays and payment issues. These terms set a professional tone and demonstrate that you value timely compensation for your work.

Tracking Payments with Your Invoice

Efficiently tracking payments is essential for maintaining cash flow and ensuring that clients honor the agreed-upon payment terms. By properly documenting payments, you can easily monitor outstanding balances, keep track of received funds, and avoid any confusion regarding past due amounts. Including a payment tracking section in your billing document helps both you and your client stay on the same page, streamlining financial management.

How to Track Payments

One of the most effective ways to track payments is by including a dedicated section on your billing document where both you and the client can note important details such as payment dates, amounts paid, and outstanding balances. Below is an example of how to structure this information:

| Payment Date | Amount Paid | Payment Method | Outstanding Balance |

|---|---|---|---|

| MM/DD/YYYY | $XXX.XX | Bank Transfer | $YYY.YY |

| MM/DD/YYYY | $XXX.XX | PayPal | $ZZZ.ZZ |

Additional Tips for Payment Tracking

Incorporating the following practices into your billing system can further improve payment tracking:

- Mark Paid Amounts: Clearly highlight or mark paid amounts in your documents to avoid any confusion about what has already been settled.

- Maintain a Payment Log: Keep a separate log of all payments received, including dates and reference numbers for easier record-keeping.

- Follow Up on Unpaid Amounts: If the payment terms are not met, set reminders to follow up promptly with the client regarding outstanding balances.

By organizing and tracking payments properly, you ensure better financial management and minimize the chances of missed payments or disputes.

Benefits of Digital Interpreter Invoices

Switching to a digital format for your billing records offers numerous advantages over traditional paper-based methods. Not only does it improve efficiency, but it also streamlines the entire process, making it easier to create, send, and track payments. By leveraging digital tools, you can ensure faster transactions, reduce administrative overhead, and enhance the overall experience for both you and your clients.

Key Advantages of Using Digital Formats

Here are some of the main reasons why using a digital document for billing is highly beneficial:

- Speed and Convenience: Sending digital records via email or online platforms is much quicker than printing and mailing physical documents, leading to faster processing and payment.

- Easy Customization: Digital documents are highly customizable. You can quickly adjust the content, layout, and structure to fit your specific needs, without the hassle of retyping information each time.

- Reduced Errors: Digital platforms often offer automated calculations, reducing the chances of human error in total amounts, taxes, or discounts.

- Environmental Impact: By eliminating the need for paper, digital billing reduces your environmental footprint, making your business more sustainable.

Efficiency in Tracking and Record-Keeping

In addition to speeding up transactions, digital formats offer enhanced tracking and organization capabilities:

- Automatic Payment Tracking: Many online tools integrate with payment systems, allowing you to track when payments are made and automatically update your records.

- Easy Access and Storage: Digital documents can be stored securely on cloud platforms or computers, allowing for easy access and retrieval at any time.

- Increased Professionalism: Sending a neat, well-formatted digital document adds a professional touch to your business communications, making a positive impression on clients.

By switching to digital formats, you not only simplify the administrative side of your work but also increase the overall efficiency of your business operations. It’s a smart, modern approach to managing financial transactions.

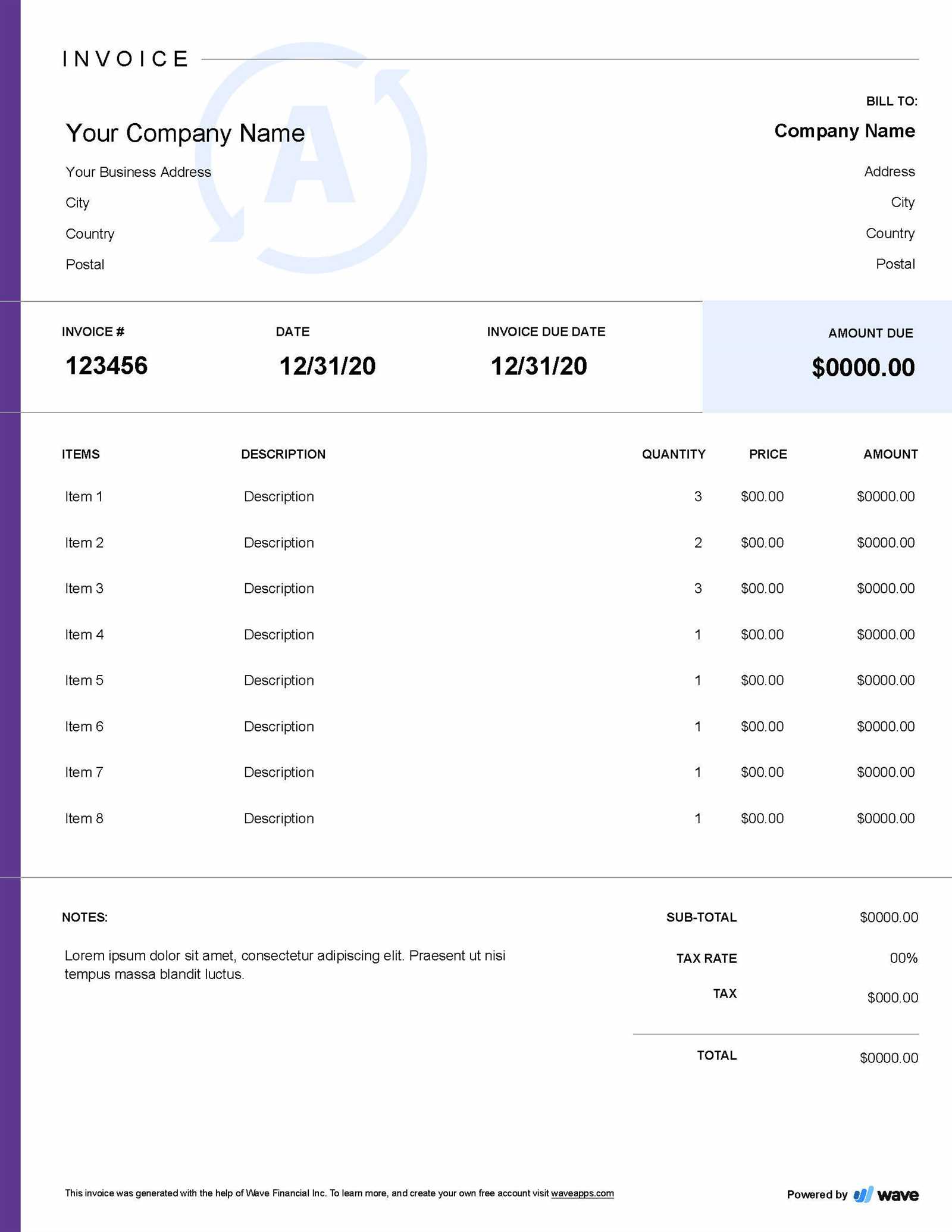

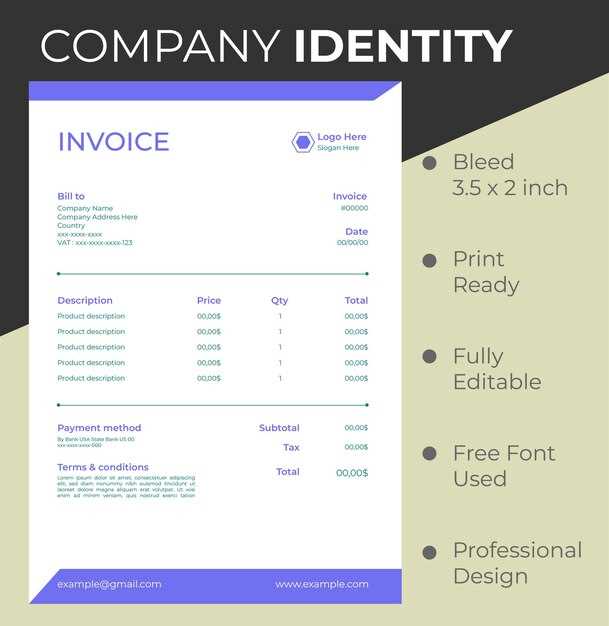

Creating a Professional Invoice for Clients

Creating a polished and well-structured document is key to maintaining professionalism and ensuring that both you and your client are on the same page regarding payment. A well-designed document not only ensures that the client understands the charges but also reflects positively on your business. Crafting a professional document requires attention to detail, clarity, and consistency, ensuring that all necessary information is included without any ambiguity.

Important Elements of a Professional Document

When preparing a billing statement for your clients, make sure to include the following critical components:

- Client and Service Provider Details: Include your name, address, contact information, as well as the client’s full name and contact details to ensure that there is no confusion about the parties involved.

- Clear Service Descriptions: Provide a concise but detailed breakdown of the services rendered, including dates, hours worked, and any specific deliverables.

- Pricing and Payment Terms: Clearly list the agreed-upon charges for each service, along with the total amount due. Be explicit about payment deadlines and accepted methods.

- Unique Reference Number: Assign a unique number to each document for easy tracking and record-keeping.

Example of a Professional Document Structure

Here is an example of how to structure your billing document for maximum clarity:

| Description of Service | Hours Worked | Rate | Total |

|---|---|---|---|

| Translation of legal documents | 5 hours | $50/hour | $250 |

| Meeting with client for consultation | 2 hours | $50/hour | $100 |

| Total Amount Due | $350 |

By keeping your document simple, clear, and well-organized, you make it easier for your client to understand the charges and make payments without any confusion. A professional document also boosts your credibility and promotes a positive business relationship with clients.

Including Tax Information on Invoices

Including tax details in your billing records is crucial for ensuring transparency and compliance with local regulations. It helps both you and your client understand the breakdown of charges and ensures that the proper taxes are applied. Properly documenting tax information also simplifies record-keeping and makes it easier to handle any future audits or financial reviews.

Key Tax Information to Include

When adding tax details to your billing documents, make sure to include the following important elements:

- Tax Rate: Clearly state the percentage of tax applied to the total charges. For example, “Sales tax: 5%” or “VAT: 20%.”

- Tax Amount: Specify the exact amount of tax charged for each service or product, based on the applicable rate.

- Total Amount with Tax: Include the final total, which should account for both the service charges and the tax, ensuring there are no discrepancies.

- Tax Identification Number (TIN): If applicable, include your tax identification number to make the document more formal and compliant with tax laws.

Example of Tax Breakdown

Here’s an example of how to include tax information clearly in your document:

| Description of Service | Amount | Tax Rate | Tax Amount |

|---|---|---|---|

| Consulting services | $500 | 10% | $50 |

| Total | $500 | $50 | |

| Grand Total | $550 |

By including tax information clearly and accurately, you can avoid confusion and ensure that your clients are aware of all financial obligations. Proper tax documentation also supports a smooth transaction process and helps you remain in compliance with tax authorities.

How to Invoice for Different Services

When billing for a variety of services, it’s essential to clearly communicate the specifics of each service provided, ensuring both you and your client are on the same page regarding charges. Different services may require different pricing structures, terms, and breakdowns, so it’s important to tailor your billing documents accordingly. Whether you are charging by the hour, per project, or using a flat rate, clarity and accuracy are key to a smooth transaction.

Here are some tips for billing clients for various types of services:

- Hourly Charges: For services billed by the hour, include the number of hours worked, the hourly rate, and a clear total. It’s also helpful to specify the exact hours and dates worked to avoid confusion.

- Flat Rate Fees: For services that are provided for a set fee (e.g., a completed project or a fixed amount for a specific task), make sure to outline what is included in the fixed cost. Clearly list any conditions or limitations for that fee.

- Retainer-Based Charges: If your services are billed on a retainer basis, make sure to specify the amount paid upfront, the services covered, and the duration of the agreement. This is especially important for ongoing work over a longer period of time.

- Milestone Payments: For larger projects, consider breaking the payment down into stages or milestones. Specify the amount due at each milestone and clearly outline what work will be completed at each stage.

Each service type requires a slightly different approach to ensure transparency and fairness for both parties. Customizing your billing document for each type of service helps prevent misunderstandings and ensures you are compensated appropriately for your work.

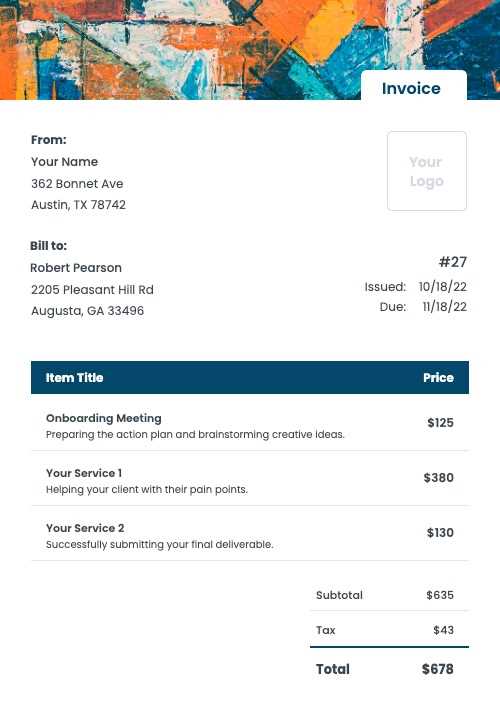

Billing Document for Freelancers

For freelancers, creating a detailed and professional billing document is essential to ensure timely payments and maintain clear communication with clients. This document not only reflects the services rendered but also sets the terms for payment, making it a crucial part of managing your freelance business. A well-structured billing record helps protect both parties by outlining the specifics of the transaction, from hours worked to the agreed-upon rate, and ensures that both parties are on the same page regarding payment expectations.

Key Components for Freelance Billing

When creating a billing document as a freelancer, certain details should always be included to avoid confusion and ensure smooth transactions:

- Client Information: Include the name and contact details of your client to ensure the document is accurately addressed.

- Freelancer Details: Clearly list your name, business name (if applicable), address, and contact details. If you have a tax identification number (TIN), include it as well.

- Detailed Service Description: Provide a breakdown of the services you’ve completed, including dates, hours worked, and specific tasks or projects completed.

- Payment Terms: Clearly state the payment method, due date, and any late fees or discounts that apply. It’s also helpful to mention any deposits paid in advance.

- Subtotal and Total Amount: List the total amount due, including any taxes, fees, or discounts, ensuring transparency in how the final amount is calculated.

Why Freelancers Should Use Professional Billing Documents

Using a professional and clear billing document offers several benefits for freelancers:

- Improved Cash Flow: Clear billing documents help ensure you are paid on time, improving your cash flow and financial stability.

- Legal Protection: A properly structured billing record serves as evidence in case of payment disputes or legal issues.

- Professionalism: A well-organized document enhances your reputation, showing clients that you take your work seriously and are organized.

By taking the time to create a well-structured billing document, freelancers can ensure they are paid accurately and on time, while maintaining a professional relationship with clients.

How to Send Your Billing Document to Clients

Sending a well-prepared billing document to your clients is an essential step in the payment process. Ensuring that it reaches the right person in a timely manner, and through the appropriate channels, will help avoid delays and confusion. In addition to the format of the document, the way you send it can affect how quickly you receive payment and how professional your business appears. It is important to follow best practices to maintain efficiency and transparency with your clients.

Here are a few steps to effectively send your billing document:

- Choose the Right Delivery Method: The method you choose for sending your billing record should depend on your client’s preferences and the nature of your business. Common delivery methods include:

- Email: The most widely used and efficient option for sending digital records. Attach the document in a PDF format to ensure the client can easily open it without formatting issues.

- Postal Mail: If your client prefers paper records, print and mail the document. Always use tracked mail to ensure delivery confirmation.

- Online Payment Platforms: If you are using a platform such as PayPal or other invoicing systems, you can send your billing details directly through their service.

- Personalize the Message: Along with sending the document, include a polite message or email body that reminds the client of the services rendered, the total amount due, and the payment terms. A courteous approach can help reinforce your professionalism.

- Double-Check the Document: Before sending, ensure that all the details in the document are accurate, including the client’s name, services provided, amounts due, and payment terms. A small mistake could lead to confusion or delays in payment.

- Follow Up: If the payment deadline is approaching or has passed, send a polite reminder to your client. Keep your message professional and considerate, while emphasizing the importance of timely payment.

By following these steps, you can streamline the billing process, reduce delays, and ensure that you are paid promptly for your services. Clear and timely communication is key to maintaining strong relationships with clients and keeping your business operations running smoothly.

Tips for Getting Paid Faster as a Freelancer

Receiving timely payments is crucial for any freelancer’s business operations. However, delays can often happen, especially when clients are busy or unclear about payment expectations. To avoid these setbacks, it’s important to establish clear and effective practices for ensuring that you’re paid on time. By taking proactive steps and making payment processes as smooth as possible, you can reduce delays and improve your cash flow.

Establish Clear Payment Terms Upfront

One of the best ways to ensure you are paid on time is by establishing clear payment terms from the start of the project. Discuss the payment expectations with your clients, including the total amount, payment methods, deadlines, and any late fees or discounts. Make sure these terms are clearly outlined in your billing statement. This not only sets proper expectations but also helps avoid confusion or misunderstandings.

Send Professional and Detailed Billing Documents

When it’s time to bill for your services, ensure that the document you send is thorough, clear, and professionally formatted. Include the following essential information:

- Service Breakdown: List each service rendered, the time spent, and the agreed-upon rate.

- Payment Instructions: Make it easy for clients to pay by clearly specifying the methods you accept (bank transfer, PayPal, etc.).

- Due Date: Be specific about when you expect the payment to be made. Clearly state the due date to avoid ambiguity.

- Payment Reminders: Include a polite reminder about your payment terms in your message. This helps reinforce expectations.

Sending well-organized documents that are free of errors will help your clients process the payment quickly and avoid any delays due to confusion or miscommunication.

Offer Incentives or Penalties

To encourage timely payments, consider offering incentives for early payments or penalties for late payments. For example, you could offer a small discount if the client pays within a certain number of days or charge a late fee if the payment is overdue. This can motivate clients to prioritize your payment and prevent delays from happening in the future.

By implementing these strategies, you can significantly reduce payment delays and establish a smooth and professional process for getting paid faster. Clear communication and proper planning are key to ensuring that you maintain steady cash flow and a good relationship with your clients.