Invoice Management Template for Efficient Financial Organization

Efficient financial documentation is crucial for businesses of all sizes. A well-organized system not only ensures timely payments but also helps maintain a professional image. By simplifying the way you handle billing and records, you can save valuable time and reduce the chances of errors that could cost you later.

Optimizing your billing workflow with a structured system can greatly enhance productivity. Whether you’re a freelancer, a small business owner, or part of a larger organization, the right approach to financial tracking is essential for smooth operations and cash flow management.

By adopting a streamlined solution for invoicing, you can easily create, store, and track your financial transactions. These tools are designed to simplify the process, making it easier to stay organized, maintain accurate records, and focus on what matters most–growing your business.

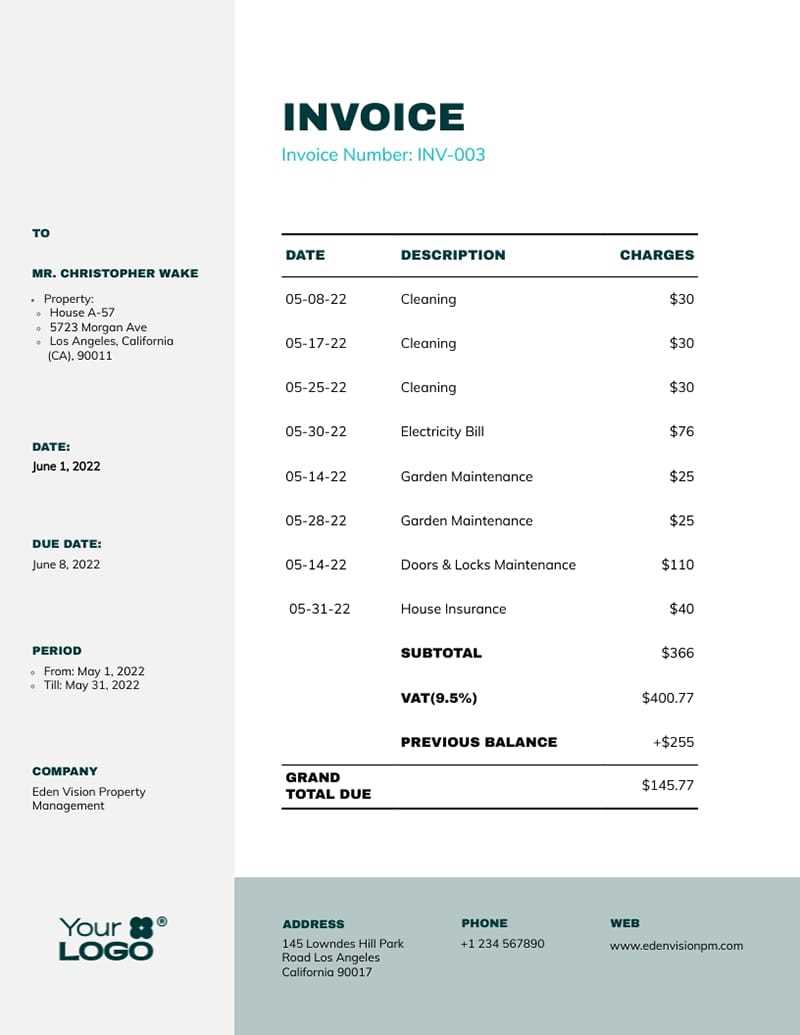

Invoice Management Template Overview

Efficient financial record-keeping is vital for businesses looking to stay organized and ensure smooth operations. The right solution can streamline your processes, automate repetitive tasks, and improve accuracy in tracking payments and receipts. A structured approach to billing and documentation allows you to focus on your core business activities while reducing administrative burdens.

What Is a Financial Record Solution?

A financial record solution is a tool or system that helps businesses create, store, and track billing documents. It simplifies the entire process by providing a standardized format that can be easily customized to suit specific needs. Whether you are working with clients, suppliers, or vendors, having a consistent approach is crucial for maintaining professionalism and ensuring clarity in all transactions.

Key Advantages of Using a Structured Billing System

Automation is one of the main advantages of using an organized billing system. By automating key tasks such as creating records, calculating totals, and managing due dates, you free up valuable time that can be spent on more strategic activities. In addition, it ensures consistency and accuracy throughout your financial documentation.

Overall, these solutions help businesses maintain transparency and reliability in their financial dealings, building trust with clients and reducing the risk of errors or misunderstandings.

Why You Need an Invoice Template

Maintaining a consistent and professional approach to financial documentation is essential for any business. Having a pre-designed structure for recording transactions not only saves time but also helps you avoid common errors that can arise from manual entries. By using a well-organized format, you can ensure accuracy and clarity in your financial dealings, which builds trust with clients and simplifies the process of tracking payments.

Efficiency and Time Savings

When you use a structured system for generating records, much of the work becomes automated. This allows you to quickly fill in the required information without starting from scratch each time. A streamlined system makes it easier to manage multiple records simultaneously, minimizing the chances of overlooking details. This efficiency is especially valuable for small businesses and freelancers who need to handle a high volume of tasks with limited resources.

Professionalism and Consistency

Professional appearance is crucial for your business reputation. A well-designed billing format enhances your credibility by presenting a clear and consistent structure for every transaction. This not only makes your communications more transparent but also ensures that all necessary details are included, reducing the risk of misunderstandings or disputes. Consistency in how you manage financial records shows clients that you take your business seriously.

How to Create Your Own Template

Creating a custom structure for your financial documents allows you to tailor the process to your specific business needs. By setting up a consistent format, you can simplify record-keeping, ensure all relevant details are included, and reduce the time spent on generating new entries. Whether you’re starting from scratch or modifying an existing format, designing your own solution is an effective way to maintain accuracy and efficiency in your operations.

To create a personalized system, begin by outlining the key information you need to capture, such as transaction dates, amounts, recipient details, and payment terms. Then, choose a format that best suits your workflow, whether it’s a digital spreadsheet, a word processing document, or a specialized tool. Be sure to include areas for customization, such as a section for adding notes or discounts. By doing so, you ensure flexibility while maintaining a professional and standardized approach to your financial records.

Key Features of an Ideal Template

An effective financial document structure should include specific elements that streamline the process and ensure accuracy. Whether you’re creating records for services rendered or goods sold, the right features make it easier to track transactions, manage payments, and stay organized. Below are the key aspects that define an ideal solution for business billing and record-keeping:

- Clear and Concise Layout: A well-organized format ensures that all necessary details are easy to read and understand.

- Customizable Fields: The ability to adjust the structure for different types of transactions or clients adds flexibility and allows for tailored documentation.

- Automated Calculations: Built-in functions that automatically compute totals, taxes, and discounts save time and reduce human error.

- Payment Tracking: A section to record payment status and outstanding balances helps you stay on top of your finances.

- Branding Elements: The option to include your logo, business details, and color scheme maintains consistency with your company’s professional image.

- Legal Compliance: Pre-set fields for necessary legal information, such as payment terms and tax rates, help ensure that your documents meet regulatory standards.

- Export and Sharing Capabilities: The ability to export records to various file formats (PDF, Excel, etc.) allows for easy sharing and storage.

These features work together to create an efficient system that reduces manual work, enhances accuracy, and promotes a professional approach to financial documentation.

Benefits of Using Invoice Templates

Adopting a standardized structure for your billing and financial records offers numerous advantages, both in terms of efficiency and accuracy. By eliminating the need to create new documents from scratch each time, you can significantly reduce administrative workload while maintaining a professional and consistent approach. Below are some of the primary benefits of using a pre-designed system for managing financial transactions.

Time Savings and Efficiency

One of the most significant advantages of using a structured format is the time saved in document creation. Instead of manually inputting information into a blank document, you simply fill in the necessary details, ensuring a faster turnaround for clients or customers. This efficiency is especially valuable for small businesses and freelancers who handle multiple transactions daily.

Consistency and Professionalism

With a standardized system in place, you maintain uniformity across all of your financial records. This consistency not only helps to prevent errors but also conveys a more professional image to clients and vendors. Whether you’re working with a single client or managing large volumes of transactions, having a reliable and professional-looking document reinforces trust and credibility.

Overall, using a streamlined solution for your business documentation helps maintain accuracy, enhances productivity, and allows you to focus on what matters most–growing your business.

Choosing the Right Invoice Template for Your Business

Selecting the appropriate structure for your financial documents is essential to streamline your billing process and ensure consistency across all transactions. The right system should match the specific needs of your business, whether you’re a freelancer, a small business owner, or part of a larger enterprise. It should simplify the creation of records, reduce errors, and maintain a professional appearance for clients and vendors alike.

Factors to Consider When Choosing a Billing Format

When selecting the right system for your business, consider the following factors:

- Industry Requirements: Different industries may have specific standards or regulations for financial documentation. Ensure that the structure you choose complies with these requirements.

- Customization Options: Choose a format that allows for easy customization, whether it’s for adding company branding, modifying the layout, or including specific fields tailored to your business.

- Ease of Use: Opt for a solution that is user-friendly and doesn’t require extensive training or technical knowledge. A simple design can save time and reduce errors.

- Automation Features: Look for a system that automates key tasks, such as calculating totals or tracking payment statuses. This will save time and improve accuracy.

- Compatibility with Other Tools: Consider whether the system integrates with your accounting software, CRM, or other tools to streamline workflows.

Choosing Between Digital and Physical Formats

Deciding between digital or physical formats depends on your preferences and business model. Digital formats are more efficient for tracking and storing records, and they offer better automation features. However, some clients may prefer physical records for their simplicity and familiarity. Weigh the pros and cons of both options to determine which best fits your needs.

By taking these factors into account, you can select the most suitable financial document structure that meets your operational needs and enhances the efficiency of your billing process.

Common Mistakes in Invoice Management

When handling financial records, it’s easy to overlook small details that can lead to significant problems down the line. Whether you’re a small business owner or managing a larger organization, avoiding common mistakes in your record-keeping processes is essential for smooth operations and maintaining trust with clients and vendors. Below are some of the most frequent errors that can occur when creating or tracking financial documents.

Missing or Incorrect Information

One of the most common errors is forgetting to include or incorrectly entering crucial details. This can include missing payment terms, incorrect client information, or inaccurate amounts. These mistakes can lead to confusion, delayed payments, and damage to professional relationships. Always double-check the details before sending any document, and make sure that all fields are complete and correct.

Failure to Follow Up on Unpaid Balances

Another frequent issue is neglecting to follow up on outstanding payments. Even when a financial record is sent on time, clients may forget to pay or fail to notice payment deadlines. Without a system to track due amounts and follow up, you could experience delayed cash flow, which impacts your business operations. Ensure you have a clear method for monitoring payments and contacting clients if payment is overdue.

Lack of Consistency

Inconsistent formats and structures across your financial documents can lead to confusion, especially if you handle multiple clients or transactions. If you use a variety of designs or record-keeping systems, it becomes harder to track details, and errors are more likely to occur. Having a standardized, easy-to-use structure ensures accuracy and makes it easier to manage your records.

Not Staying Compliant with Legal Requirements

Ignoring legal regulations is another mistake that can have serious consequences. Depending on your region and industry, certain information may be required on all financial documents, such as tax numbers or specific payment terms. Failing to comply with these regulations can result in fines or legal disputes. Always ensure that your financial records are up-to-date with current laws and industry standards.

By recognizing and addressing these common mista

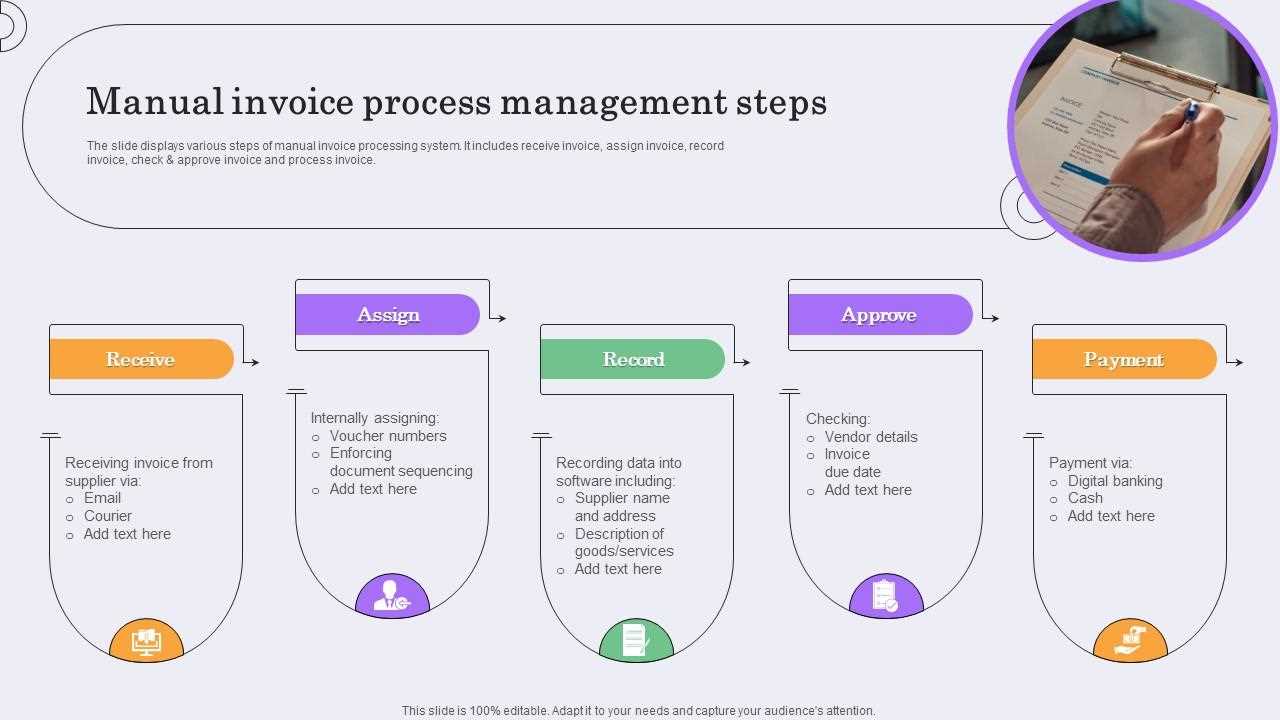

Automating Invoice Generation with Templates

Automating your financial document creation process can save significant time and reduce the risk of errors. By utilizing a system that generates records automatically, you can streamline your workflow, ensure consistency, and eliminate the need for manual data entry. This approach not only improves efficiency but also allows for faster invoicing and smoother business operations.

Automation typically works by pulling data from existing sources, such as a customer database or accounting software, and filling in the necessary fields within your document format. This reduces the manual effort involved in generating each record, making the process faster and more reliable.

Key Benefits of Automation

- Increased Efficiency: Automatically populating fields like customer details, amounts, and dates saves valuable time.

- Reduced Errors: Automated systems minimize human input, reducing the chances of data entry mistakes.

- Faster Turnaround: With automation, you can generate multiple records in a fraction of the time it would take to create them manually.

- Consistent Formats: Ensures all your financial documents are in the same format, improving professionalism and reducing confusion.

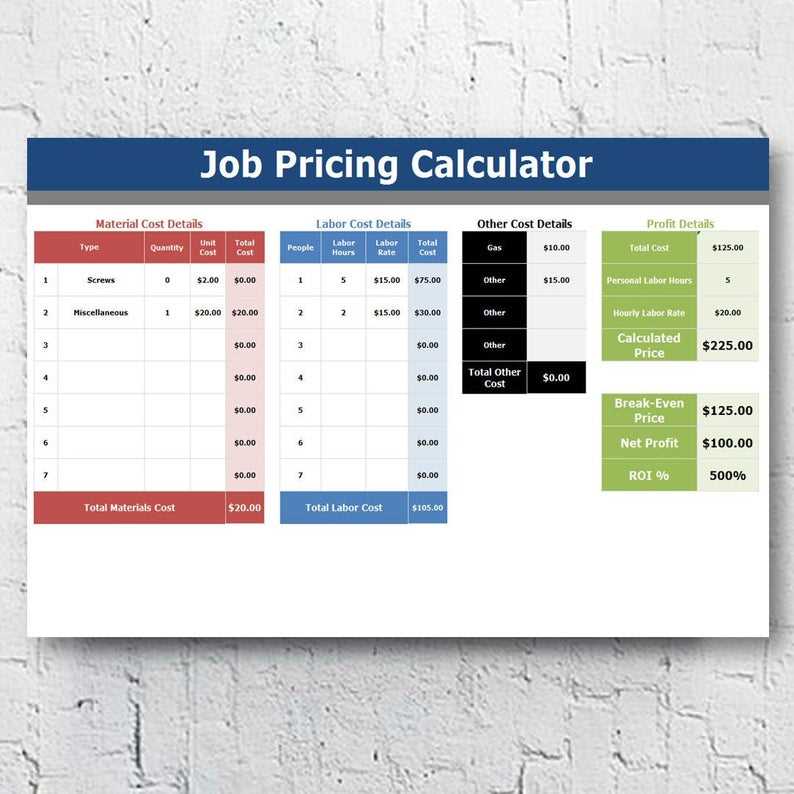

How Automation Works

Automation tools integrate with your business systems, such as accounting software or customer management platforms, to generate financial records. Here’s an example of how the process might look:

| Field | Manual Entry | Automated Process |

|---|---|---|

| Customer Name | John Doe | Automatically pulled from the customer database |

| Amount Due | $500 | Automatically calculated based on previous transactions |

| Due Date | April 15, 2024 | Automatically set based on payment terms |

| Itemized List | Item 1, Item 2, Item 3 | Pulls from previous records or inventory system |

By integrating automated systems, you not only speed up your processes but also improve the accuracy and consistency of your financial records, ensuring that every document generated meets your business needs and complies w

Customizing Your Invoice Template for Branding

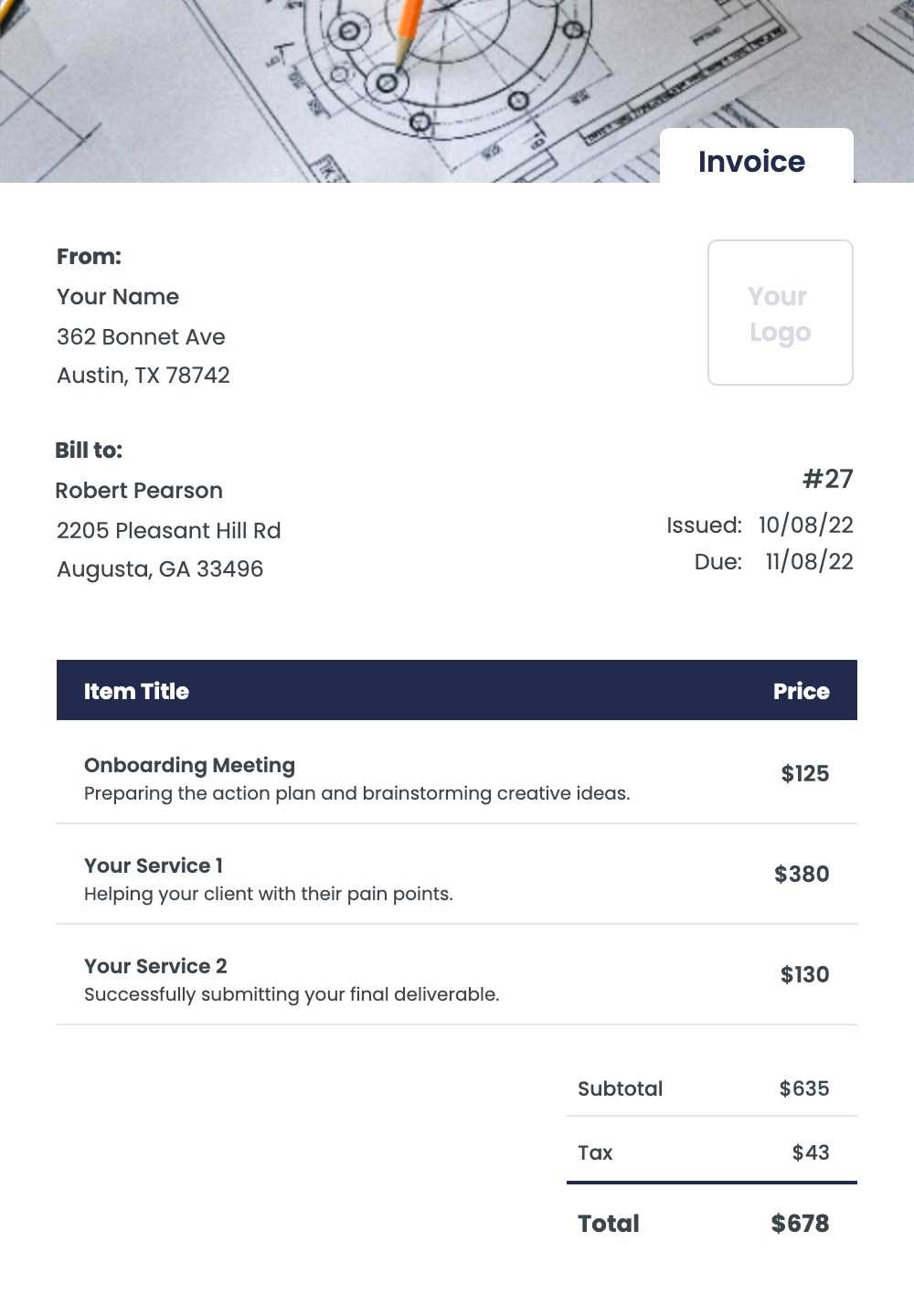

Customizing your financial documents to reflect your brand identity can help you stand out and leave a lasting impression on your clients. By incorporating design elements such as your logo, company colors, and font styles, you create a professional and cohesive image that strengthens your business’s reputation. A well-branded document not only makes your communication more polished but also reinforces your brand’s presence with every transaction.

Key Elements to Personalize

When adjusting your financial record structure to match your brand, consider the following aspects:

- Logo: Including your company logo at the top of the document instantly communicates your brand’s identity.

- Color Scheme: Use your brand’s colors in the design of your records to create a visually cohesive and recognizable look.

- Typography: Choose fonts that align with your brand’s style guide, ensuring readability while maintaining a professional aesthetic.

- Contact Information: Clearly display your business’s contact details in a consistent, easily accessible format.

- Tagline or Message: Consider adding a short, memorable tagline or a thank you note to personalize the experience for your clients.

Benefits of Customization

Personalizing your financial documents has several key advantages, including:

- Increased Professionalism: A branded document conveys professionalism, which can enhance trust with clients and vendors.

- Stronger Brand Recognition: Every time a client receives a document, they are reminded of your company, helping to build brand recall.

- Consistent Customer Experience: Consistency across all touchpoints, including your records, creates a unified customer experience that reflects well on your business.

Incorporating your branding elements into your financial documents helps reinforce your identity, creates a polished look, and ensures that each client interaction aligns with your overall business strategy.

How Invoice Templates Save Time

Automating and streamlining the creation of your financial documents can significantly reduce the amount of time spent on administrative tasks. By using a predefined structure, you eliminate the need to start from scratch each time you need to generate a record. This not only speeds up the process but also allows for faster billing cycles, helping your business stay organized and efficient.

Efficiency in Document Creation

One of the biggest time-saving benefits of using a structured solution is the ability to quickly generate records without re-entering common information. This includes customer details, transaction amounts, and payment terms. Instead of typing out the same data repeatedly, you can simply fill in the necessary fields, cutting down the time spent on each task.

How Time is Saved

Here’s a comparison of how much faster the process can be with a predefined system:

| Step | Manual Process | Using a Predefined System |

|---|---|---|

| Enter Customer Information | Typing out name, address, and contact details for each transaction. | Automatically populated from existing client database. |

| Calculate Amount Due | Manually adding up amounts, applying discounts, and calculating tax. | Automatically calculated with built-in formulas. |

| Formatting and Design | Creating a new layout or adjusting the appearance of each record. | Consistent, pre-designed format that only requires minor adjustments. |

| Saving and Sending | Saving as a new document and manually sending via email. | Quick export and instant sharing options, reducing wait time. |

By removing the need for repetitive tasks and automating key steps, a predefined structure allows your team to complete tasks much faster, improving overall efficiency and freeing up time for other essential activities.

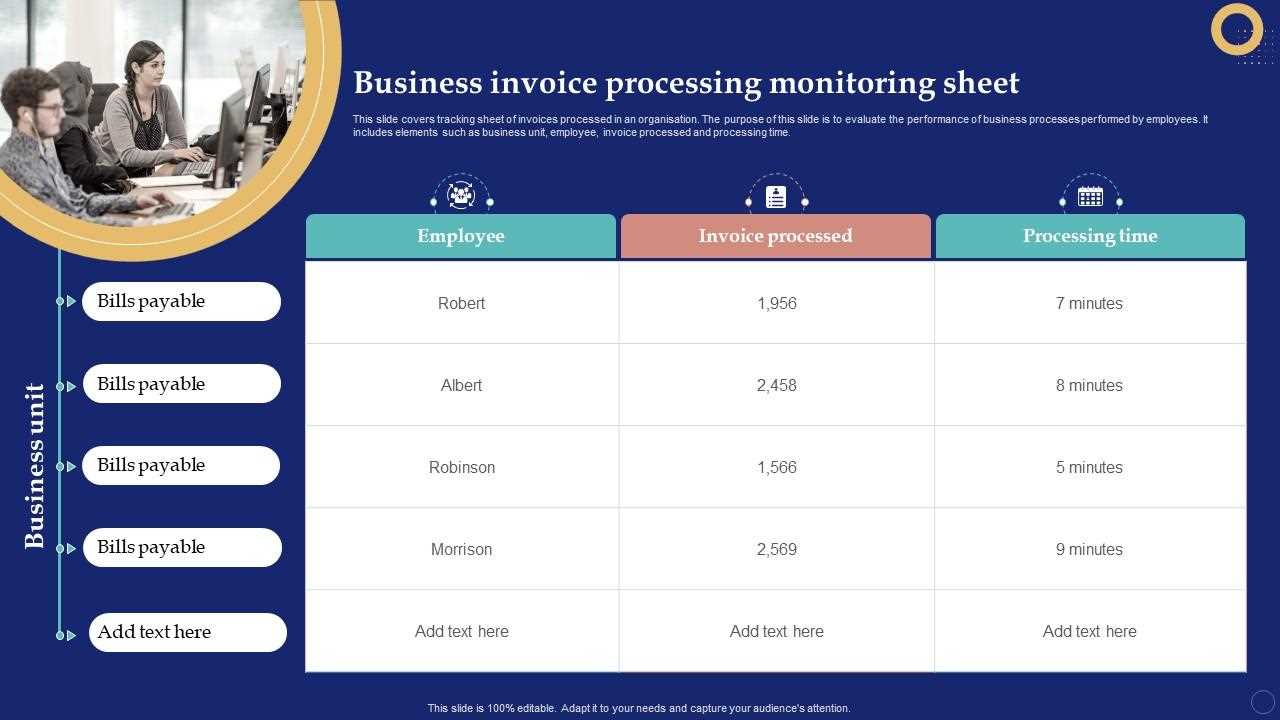

Tracking Payments with Invoice Templates

One of the critical aspects of financial record-keeping is accurately tracking payments and outstanding balances. By using a structured system for your billing documents, you can easily monitor payment statuses and ensure timely follow-ups on overdue amounts. A well-designed format enables you to record the status of each transaction, helping you keep track of which invoices have been paid and which are still pending.

How a Structured System Helps Track Payments

With a predefined structure, it’s easy to include dedicated sections that allow you to mark the payment status of each record. Whether it’s “Paid,” “Partial Payment,” or “Unpaid,” having this information readily available helps you stay organized and avoid confusion. This also provides a quick reference for future follow-ups or reconciliation efforts.

Features to Include for Effective Payment Tracking

To make payment tracking more efficient, ensure your financial document format includes the following features:

- Payment Status Field: A clear section to indicate whether a payment has been made, partially paid, or is still pending.

- Due Date Tracking: A field showing the due date, allowing you to easily identify overdue payments.

- Outstanding Balance: An automatic calculation of remaining amounts due, helping you keep track of what clients still owe.

- Payment History: A place to note past payment dates, amounts, and methods, making it easier to track the payment timeline.

By integrating these features into your system, you can streamline the tracking process, reducing the chances of missed payments or miscommunication with clients. This makes your financial operations more transparent and efficient, improving cash flow management and overall business performance.

Integrating Invoice Templates with Accounting Software

Connecting your financial record formats with accounting software can significantly streamline your business operations. By integrating your billing system with accounting tools, you can automate data transfer, minimize manual data entry, and ensure consistency across your financial documents. This integration simplifies bookkeeping tasks, improves accuracy, and saves valuable time by reducing redundant work.

When these systems are connected, information such as client details, payment statuses, and amounts due are automatically populated, reducing the risk of human error. Additionally, the integration allows for seamless tracking of payments, expenses, and taxes, making it easier to generate reports and stay on top of financial performance.

For businesses that handle a large volume of transactions, this kind of integration is especially beneficial, as it reduces administrative overhead, helps avoid duplication of efforts, and ensures that all records are up-to-date and compliant with accounting standards.

Ensuring Legal Compliance in Invoices

Ensuring that your financial documents meet legal and regulatory standards is crucial for avoiding legal issues and ensuring smooth business operations. Many regions and industries have specific requirements regarding the information that must be included in records related to transactions. By adhering to these legal standards, you not only protect your business from potential fines but also foster trust with your clients and partners.

Different laws may require certain details, such as tax identification numbers, specific language around payment terms, or the inclusion of applicable taxes. It’s essential to stay informed about the legal requirements in your area and ensure that every financial document you create is compliant with these laws.

Key Elements for Legal Compliance

Here are some of the essential elements that should be included to ensure your records are legally compliant:

| Required Information | Description |

|---|---|

| Tax Identification Number | Your business’s or client’s tax ID may need to be included for tax reporting purposes. |

| Payment Terms | Clearly state payment terms, including due dates, late fees, and discounts for early payment. |

| Itemized List of Goods/Services | A breakdown of each product or service provided, including unit prices and quantities. |

| Applicable Taxes | Ensure the correct tax rates are applied based on jurisdiction and business type. |

| Legal Disclaimers | In some regions, specific disclaimers or terms of service are legally required on all documents. |

By ensuring that all of these elements are present, you can be confident that your records meet legal standards and protect your business from potential complications. Stay updated on changing regulations and adapt your process as needed to maintain compliance.

Best Practices for Organizing Invoices

Keeping your financial records organized is essential for maintaining an efficient business operation. A well-structured system not only makes it easier to track payments and outstanding balances, but it also helps you stay on top of deadlines and ensures compliance with accounting standards. By implementing the right practices, you can streamline your document organization process and improve both accuracy and workflow.

Effective Strategies for Organization

Here are some of the best practices for organizing your financial documents:

- Use a Consistent Naming Convention: Establish a standard naming system that includes relevant information such as the client’s name, date, or unique document number. This makes it easier to locate and track specific records over time.

- Digitize Records: Storing documents digitally, either on a cloud storage platform or within an accounting software system, makes them more accessible, secure, and easier to back up in case of emergencies.

- Group by Status: Organize your records into categories such as “Paid,” “Pending,” or “Overdue.” This allows you to quickly see which transactions need your attention and follow up accordingly.

- Maintain a Clear Filing System: Whether physical or digital, set up folders or databases that are clearly labeled and easy to navigate. This will reduce time spent searching for specific documents.

- Set Reminders for Follow-ups: Use a reminder system to prompt you when payments are due or when follow-ups are needed for overdue transactions. Automated reminders can help you stay organized and ensure nothing falls through the cracks.

Tools to Help with Organization

There are several tools that can help you stay organized and keep your financial records in order:

- Accounting Software: Programs like QuickBooks, Xero, or FreshBooks offer built-in organization features, such as automatic categorization, customizable reports, and real-time tracking of payments.

- Document Management Systems: Tools like Google Drive, Dropbox, or dedicated document management systems can help store and share files securely while keeping everything in one place.

- Cloud-based Services: Cloud solutions allow easy access from any device, ensuring your financial documents are organized and accessible no matter where you are.

By implementing these best practices and leveraging the right tools, you can significantly improve the organization of your financial records, saving time and ensuring accuracy in your business operations.

Invoice Templates for Freelancers and Small Businesses

For freelancers and small business owners, keeping financial records organized and professional is crucial for maintaining client trust and ensuring timely payments. Customized billing structures that suit the unique needs of independent contractors or small teams can make a significant difference in the efficiency of your operations. With the right approach, you can create clear, accurate, and visually appealing documents that help streamline your business processes.

By using a predefined structure, freelancers and small businesses can save time, avoid errors, and ensure that their documents meet all necessary standards. These billing structures can be easily tailored to reflect your brand, include specific payment terms, and detail all relevant services or products offered. For small businesses, a well-designed record not only ensures professionalism but also helps in keeping track of payments, expenses, and outstanding balances.

Key Features for Freelancers

Freelancers often have specific needs when it comes to billing. Some of the key features that can benefit them include:

- Hourly or Project-Based Rates: Ability to include both hourly rates and flat fees for different types of services.

- Time Tracking: Space for detailed time logs or project milestones to ensure clients understand the work done.

- Personalized Branding: Customizable options to incorporate logos, color schemes, and brand messaging for a more professional look.

- Payment Methods: Clear sections for listing acceptable payment methods such as bank transfers, credit cards, or digital payment systems.

Features for Small Businesses

For small businesses, the billing process may involve more complex invoicing with multiple products or services. Features for small businesses to consider include:

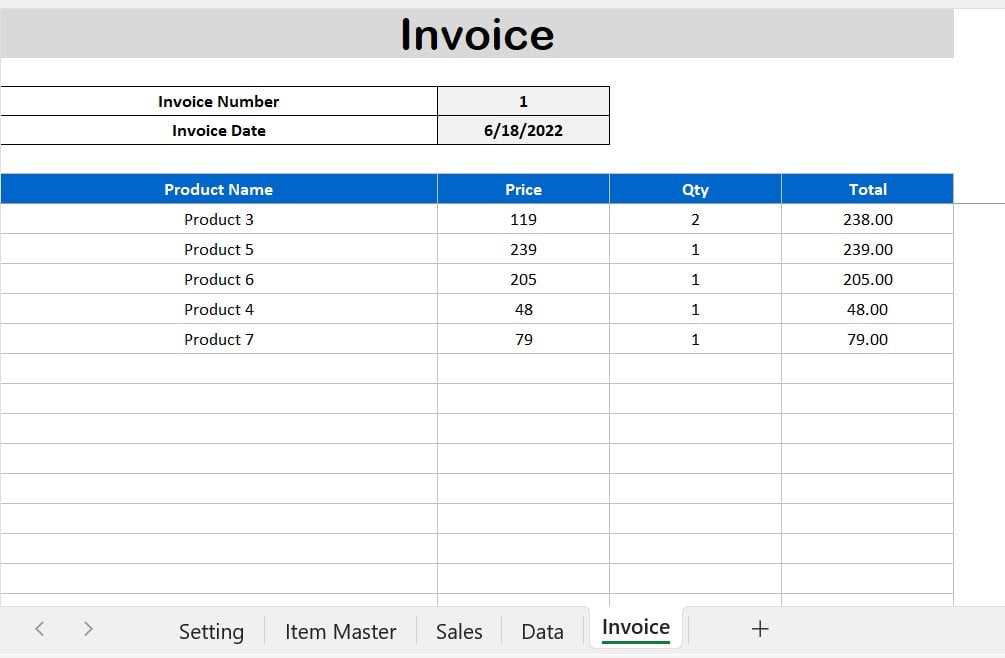

- Itemized Lists: Detailed lists of services or products provided, with quantity, unit price, and total costs.

- Tax Calculation: Automatic tax calculations based on applicable rates to ensure accuracy in billing.

- Discounts and Adjustments: Fields to apply any promotional discounts or adjustments for clients.

- Payment Terms: Clear payment deadlines and late fees to help avoid delays in collections.

Having a ready-to-use structure designed specifically for freelancers and small businesses can reduce administrative burdens and ensure that all necessary details are included in your financial documents. This not only helps you maintain a professional image but also allows you to focus more on growing your business and less on administrative tasks.

How Invoice Templates Improve Cash Flow

Ensuring steady cash flow is a priority for every business, whether large or small. One of the most effective ways to improve cash flow is through the timely and accurate creation of financial documents. By utilizing a well-structured billing system, businesses can speed up the process of requesting payments, minimize errors, and avoid delays that can disrupt cash flow. The faster payments are processed, the better your business can manage its expenses and invest in growth opportunities.

By reducing the time spent on creating records and automating key fields, businesses can significantly shorten the time between completing a service or delivering a product and receiving payment. This not only speeds up collections but also reduces the chances of invoicing errors that could lead to payment delays or disputes. An organized and consistent approach to billing encourages clients to pay on time, helping to maintain a steady flow of income.

Improved Accuracy and Efficiency

One of the main advantages of using a structured system for financial documentation is the reduction of errors that could delay payment. Key fields like customer details, amounts, and payment terms are pre-set and easy to update, reducing the risk of human mistakes. This leads to fewer follow-ups with clients and a faster path to payment. Some additional benefits include:

- Consistent Billing: Using a predefined structure ensures that all necessary information is included in every record, reducing omissions or mistakes.

- Automated Calculations: Many systems automatically calculate totals, taxes, and discounts, minimizing errors in financial records.

- Clear Payment Terms: Including clear payment terms and due dates ensures clients know exactly when payments are expected, encouraging timely settlements.

Faster Payment Processing

A streamlined billing system also makes it easier for clients to make payments promptly. Pre-designed records, with clear breakdowns and payment instructions, allow clients to process payments without confusion or delay. Features such as online payment options or integrated payment systems also make transactions quicker and more convenient for both parties.

By speeding up the entire billing and payment process, a structured approach helps to ensure that your business remains financially stable and can continue to grow without cash flow interruptions.

Top Tools for Creating Invoice Templates

Creating professional and effective financial documents is essential for maintaining a smooth business operation. Fortunately, there are several tools available that make it easier to design customized records that suit your business needs. These tools help streamline the process, save time, and ensure consistency across all your billing documents, allowing you to focus more on your business and less on administrative tasks.

The right software can provide you with a variety of customizable options, such as pre-built layouts, automated calculations, and the ability to add your branding. Many of these tools are user-friendly and require little to no design expertise, making them accessible for both small businesses and freelancers alike. Below are some of the best tools for creating professional billing documents:

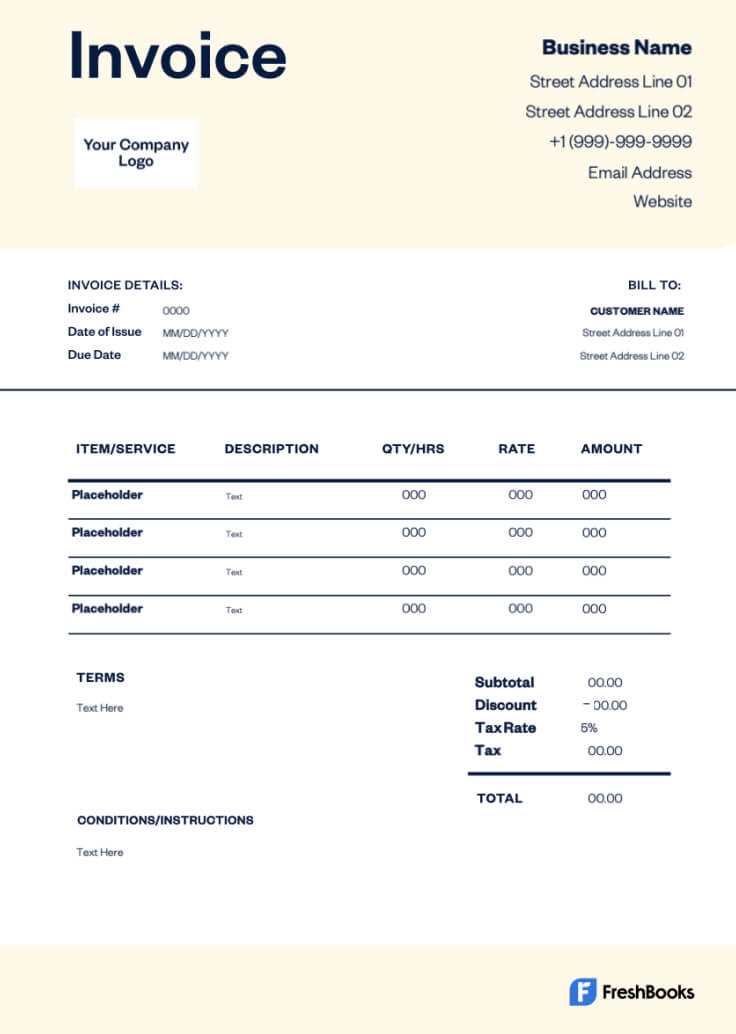

1. FreshBooks

FreshBooks is an accounting and invoicing tool designed specifically for small businesses and freelancers. It offers a range of customizable designs, allowing you to quickly create professional-looking documents. In addition, it integrates with other business tools to help track payments, manage clients, and automate recurring invoices. FreshBooks is especially known for its user-friendly interface and robust support options.

2. QuickBooks

QuickBooks is a popular accounting software that includes a variety of customizable billing formats. It allows you to create documents that are tailored to your business while keeping all financial data in one place. QuickBooks also offers features like automated invoicing, payment reminders, and the ability to generate reports. It’s a great choice for businesses that want an all-in-one solution for managing their finances.

3. Canva

If you want more control over the design of your records, Canva offers an easy-to-use platform with a wide range of pre-designed layouts. It allows you to customize colors, fonts, and logos to match your brand, and it’s perfect for creating visually appealing billing documents. Canva offers a free version with essential features and a paid version with more advanced design tools and templates.

4. Zoho Invoice

Zoho Invoice is a free online tool that offers customizable billing options with a wide selection of templates. You can easily add your company’s branding, set payment terms, and send documents directly to clients via email. Zoho Invoice also provides automation features like recurring invoices, payment reminders, and integrations with other Zoho products, making it a great choice for small businesses.

5. Microsoft Excel or Google Sheets

For those who prefer a more hands-on approach, Excel and Google Sheets offer powerful customization capabilities. With the help of templates and built-in formulas, you can create highly personalized billing documents. While these tools may not offer as many design features as others, they are widely accessible and allow full control over formatting and calculations.

Each of these tools has its own set of features and benefits, so the best one for you will depend on your spec