How to Use an Amazon Invoice Template for Efficient Billing

In the world of online commerce, maintaining an organized and professional billing system is crucial for both sellers and customers. Whether you’re running a small business or managing a larger operation, having a structured document to record each transaction is essential for clarity and efficiency. A well-designed record not only helps you keep track of payments but also ensures transparency and reduces the chances of errors.

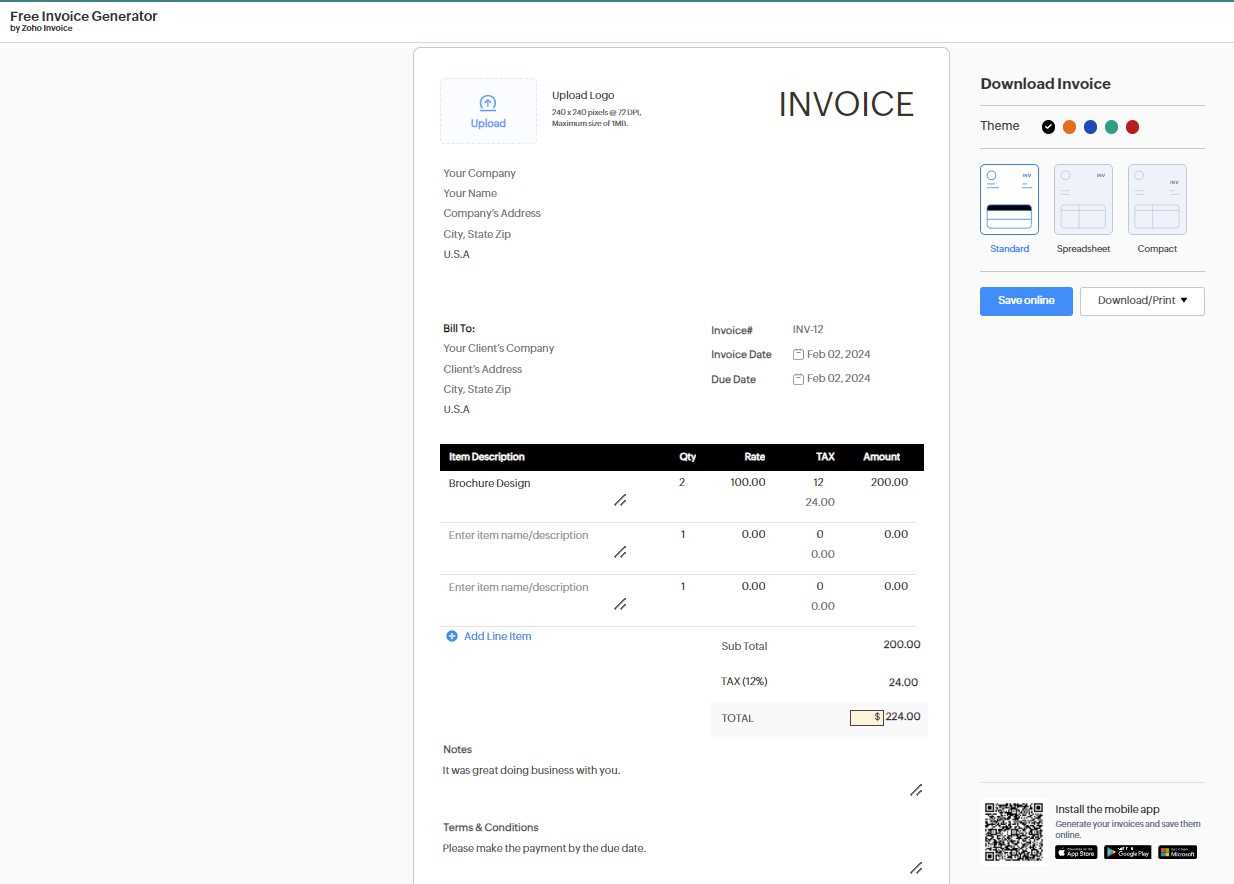

There are several tools available that make it easy to create customized documents for every sale. These customizable documents are designed to capture all the necessary information, from product details to payment summaries, in a clear and readable format. By using a pre-built system, you can save time and focus on other important aspects of your business, such as growth and customer service.

In this guide, we will walk you through the process of creating, managing, and customizing these records. We’ll also explore how they can be optimized for your specific needs, offering practical tips and solutions for any challenges you may face. Whether you’re looking to create a one-off document or automate the process for ongoing transactions, this resource will help you stay on top of your financial management.

Amazon Invoice Template Overview

When managing sales and transactions online, having a well-structured document to record each purchase is essential for ensuring smooth business operations. These documents are key to providing clear and accurate details for both sellers and buyers. By using a ready-made system, businesses can save time while maintaining professionalism and accuracy in their record-keeping.

Such systems allow for easy customization, enabling sellers to tailor each document to fit the unique requirements of their business. Whether for a single sale or bulk orders, these documents help keep track of the necessary details such as product descriptions, prices, taxes, and shipping information. They ensure both parties involved in the transaction have a clear understanding of the sale, which is critical for customer satisfaction and legal compliance.

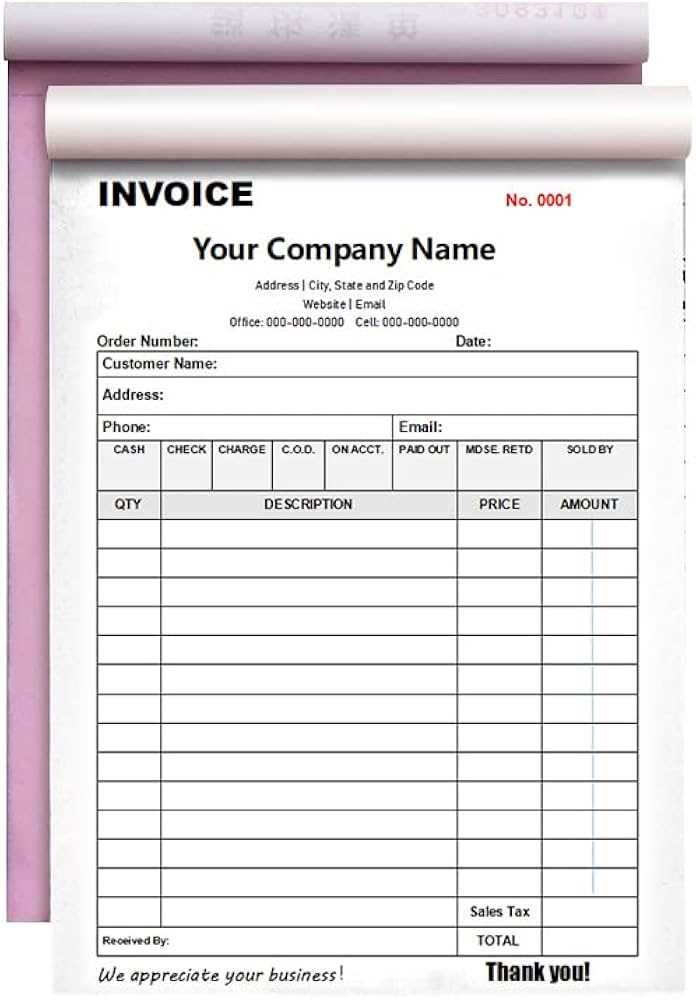

Key Features of a Standard Sales Document

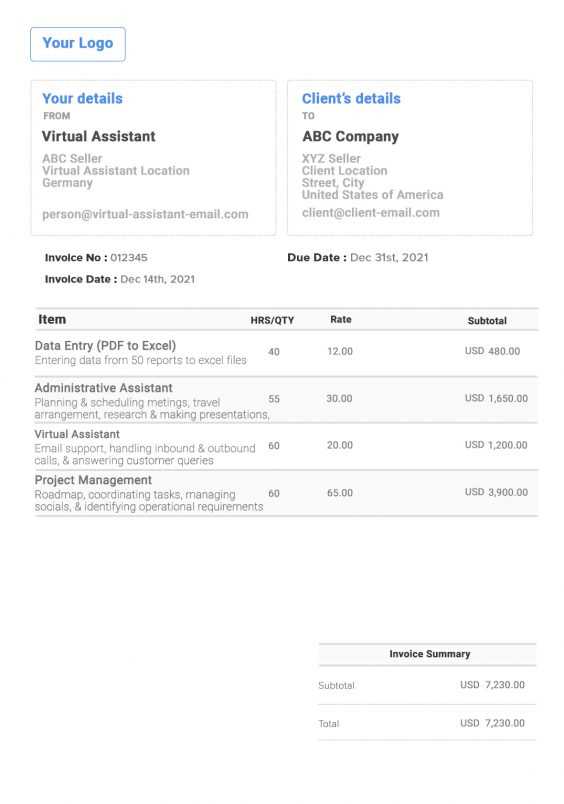

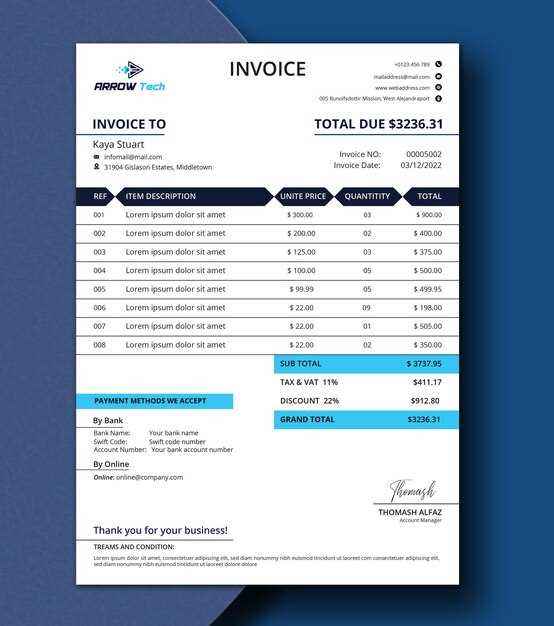

A good sales document includes several important features that make it both functional and professional. At the core, it should include the buyer’s and seller’s contact details, itemized list of products or services, applicable taxes, total amounts, and payment methods. Additionally, a reference number or order ID should be included for easy identification and future tracking.

Why Use a Pre-made Solution

Using a pre-designed solution offers numerous benefits. It saves time, as all the necessary fields are already included. Customization options allow businesses to adjust the look and feel according to their brand or operational needs. Moreover, automation can be integrated to streamline the process, ensuring quick generation of documents for every transaction.

What is an Amazon Invoice Template

In the world of e-commerce, keeping accurate records for each transaction is crucial. A well-organized document used to summarize and confirm the details of a sale is a vital tool for both business owners and customers. This type of document ensures that all relevant information is presented clearly, including item descriptions, quantities, prices, and payment terms. It also serves as proof of the transaction for both parties.

Such documents can be customized to fit specific business needs, with pre-made formats designed to simplify the process. They are particularly helpful for sellers who deal with numerous transactions, as they automate the creation of records and ensure consistency across all orders. Whether used for invoicing, accounting, or customer communication, these solutions offer a streamlined approach to financial documentation.

Key Components of the Document

Typical records of this kind include essential information such as the seller’s and buyer’s details, a unique reference number, descriptions of the goods or services sold, pricing, taxes, shipping costs, and total amounts due. These fields provide a comprehensive overview of the transaction and help prevent misunderstandings between the two parties.

Why Use a Pre-designed Solution

Using a pre-made solution offers several advantages, especially for businesses handling a high volume of transactions. Not only does it save time by eliminating the need to create documents from scratch, but it also ensures accuracy and professionalism in each sale record. These tools often allow for easy customization, enabling businesses to match the look and feel of their brand.

Benefits of Using an Invoice Template

Utilizing a pre-designed document format to record sales transactions offers numerous advantages for businesses. Not only does it improve efficiency, but it also helps maintain consistency and professionalism in all financial interactions. By automating the process, sellers can focus on other critical tasks while ensuring that each transaction is documented clearly and accurately.

One of the key benefits of using a ready-made solution is time savings. Instead of manually creating records from scratch, businesses can quickly fill in the relevant information, allowing them to process sales more swiftly. Additionally, these documents help reduce the likelihood of errors, ensuring that all necessary details are captured correctly, such as prices, taxes, and shipping information.

Key Advantages

| Benefit | Description |

|---|---|

| Efficiency | Quickly create and manage sales records without starting from scratch. |

| Consistency | Ensure uniformity across all transaction records for a professional appearance. |

| Accuracy | Minimize errors by using pre-designed fields that capture all necessary details. |

| Customization | Easily adjust the format to fit your specific business requirements and branding. |

Additional Benefits

Another significant advantage is the ability to automate recurring tasks. For businesse

How to Download Amazon Invoice Templates

For businesses looking to simplify their record-keeping process, downloading a pre-designed document format is the first step. These ready-made solutions are widely available online and can be customized to fit your specific needs. Once you have access to the right resources, you can quickly generate professional records for each sale.

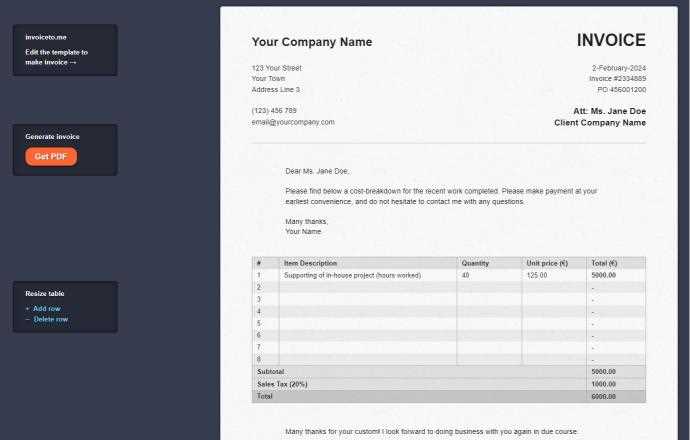

To download these formats, start by searching for reputable websites that offer reliable and easy-to-use documents. Many platforms provide free downloads, while others may require a subscription or one-time payment. It’s important to choose the right format based on your business requirements, such as the number of transactions or specific details needed for each record.

After selecting your preferred design, most sites will offer a direct download link, allowing you to quickly save the file to your computer. From there, you can easily open and edit the document using programs like Microsoft Excel or Google Sheets. With the right tools in place, you’ll be able to customize the document fields, adjust the layout, and tailor it to match your branding.

Pro Tip: Always check if the downloaded files are compatible with the software you plan to use, and ensure they are free from malware by downloading only from trusted sources.

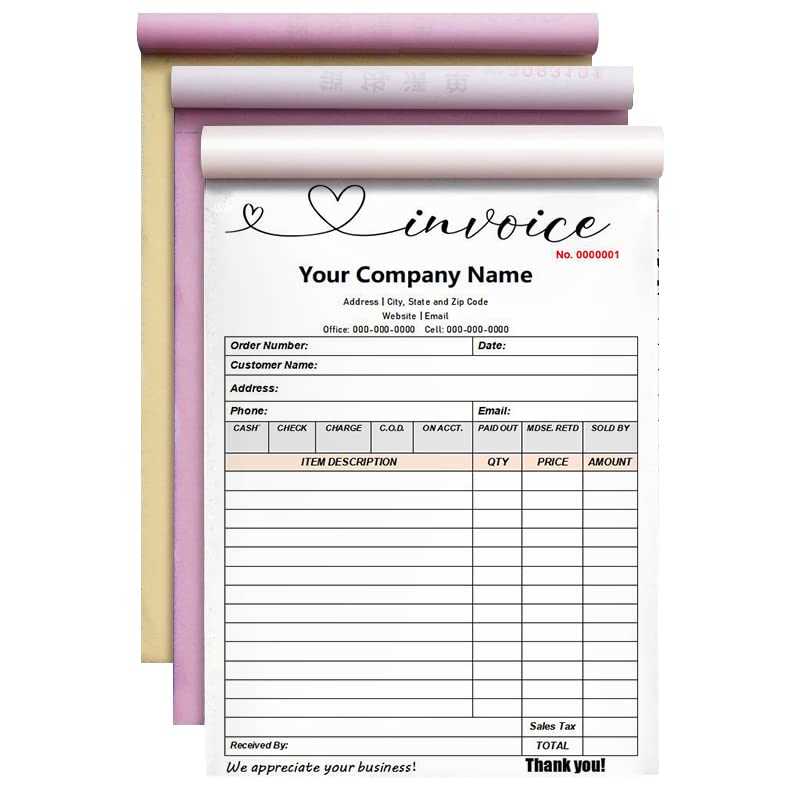

Customizing Your Amazon Invoice Template

When running an online business, it’s essential to ensure that your transaction documents are tailored to meet your brand’s standards. Personalizing these documents not only enhances professionalism but also provides your customers with a clear and consistent experience. Whether it’s adjusting design elements or including additional information, customizing your documents can be a straightforward process with the right tools.

Key Areas for Customization

- Logo and Branding: Incorporating your company logo, color scheme, and fonts helps maintain a cohesive look across all business communications.

- Contact Information: Make sure your business’s contact details are accurate and easily visible. This includes your phone number, email address, and business address.

- Payment and Shipping Details: Including specific payment methods, tracking numbers, and shipping dates can provide customers with a seamless post-purchase experience.

Steps to Customize Your Document

- Select a suitable document format that aligns with your business needs.

- Use a software tool or platform that offers customization options.

- Adjust fields and sections to include your branding elements, such as logos and business details.

- Ensure that all required legal and financial details are correctly displayed.

- Preview and test the document to ensure it looks professional and functions well across different platforms.

By taking the time to personalize your transaction documents, you not only improve your brand’s image but also create a more organized and customer-friendly experience.

Essential Elements of an Amazon Invoice

When creating a document to confirm a transaction, it is important to include specific information that both businesses and customers expect. This ensures clarity, avoids misunderstandings, and provides all necessary details for accounting and record-keeping. Certain elements are considered crucial for the document to be both legally compliant and professionally presented.

| Element | Description |

|---|---|

| Transaction Number | A unique reference number for easy identification and tracking of the order. |

| Seller Details | Includes the seller’s name, address, and contact information to establish the source of the sale. |

| Buyer Information | The buyer’s name, billing address, and contact details to ensure correct delivery and communication. |

| Product Details | A list of items purchased, including their quantity, description, price, and any applicable discounts. |

| Payment Terms | Details on the payment method, amount due, and any relevant payment instructions or deadlines. |

| Tax Information | Clearly specified tax amounts, rates, and whether the sale is taxable or exempt based on location. |

| Shipping Information | Shipping method, delivery date, and any tracking numbers for the order. |

| Return Policy | Outline of the return or exchange policy, including time frames and conditions for returns. |

By including these essential elements, the document not only meets legal and customer expectations but also ensures a smooth and transparent transaction process. This helps both buyers and sellers manage their records more effectively and build trust.

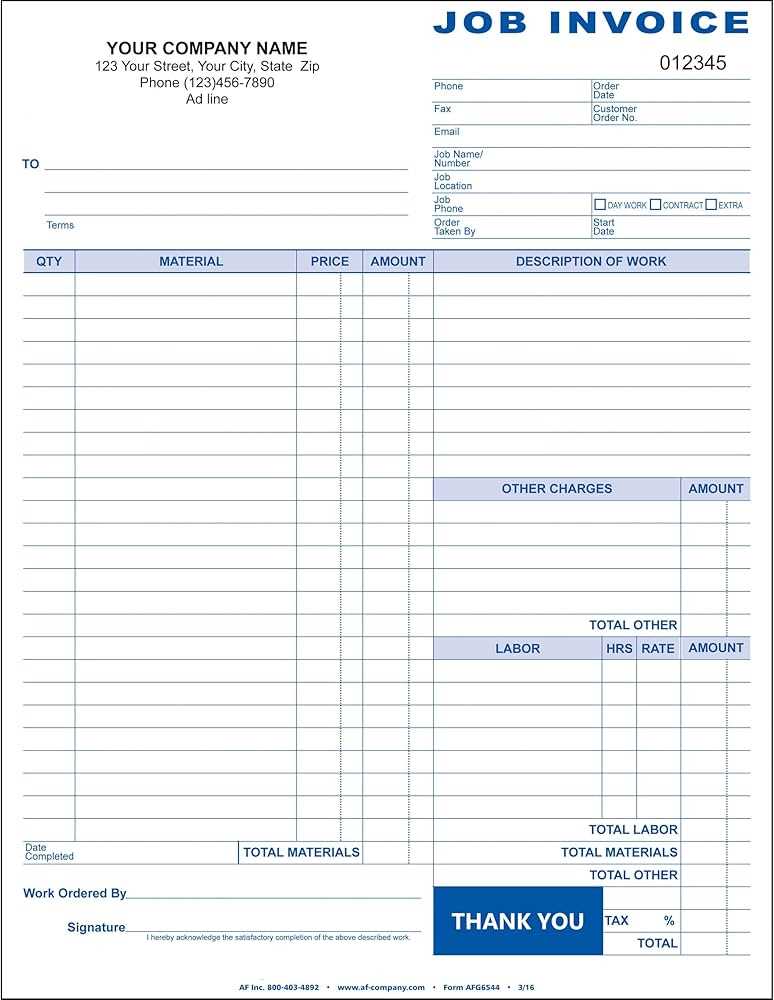

How to Add Product Details to Your Invoice

When documenting a transaction, it’s essential to provide clear and detailed information about the items sold. Including comprehensive product details not only helps avoid confusion but also ensures that both the buyer and seller have accurate records for future reference. A well-organized list of products with their respective details makes the document professional and transparent.

To add product details effectively, consider including the following key information:

- Product Name: A brief but clear description of the item being sold, making it easy for the buyer to identify the product.

- Quantity: The number of units purchased, which should match the order confirmation.

- Unit Price: The price per unit, ensuring the buyer knows how much they are paying for each item.

- Total Price: The total cost for each product, which is calculated by multiplying the unit price by the quantity.

- Product Code or SKU: A unique identifier for the product, helping with inventory management and returns.

- Product Description: A short description or key attributes of the product, especially if the buyer needs more clarity about what they purchased.

By including these elements in the transaction documentation, you provide a detailed breakdown that benefits both parties. A comprehensive listing of products promotes transparency and minimizes any potential disputes over the sale. Additionally, ensuring accuracy in these details can support easy returns, exchanges, or warranty claims in the future.

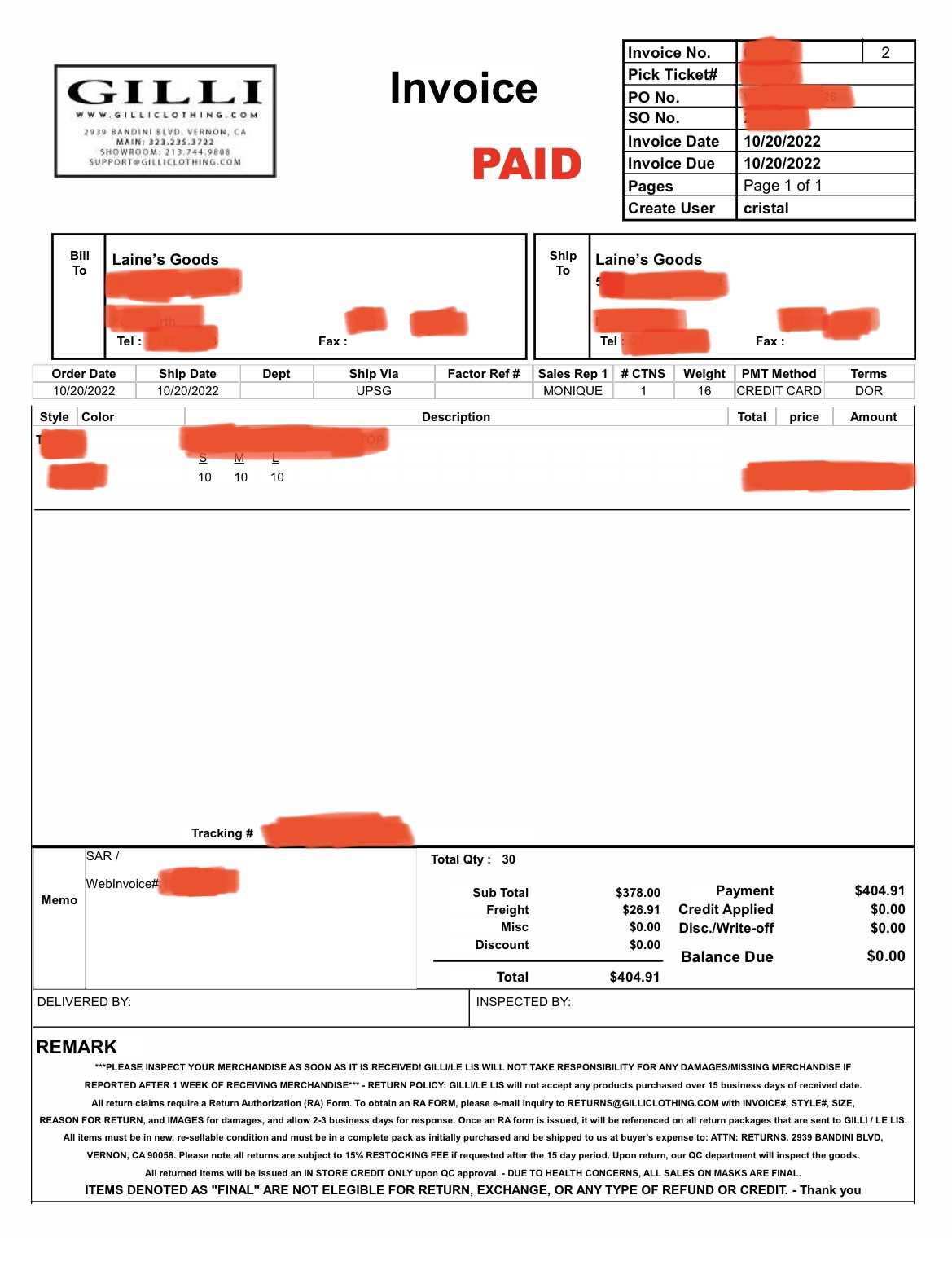

Including Taxes in Your Amazon Invoice

When finalizing a transaction, it’s crucial to ensure that any applicable taxes are properly calculated and clearly displayed. This not only helps maintain transparency with your customers but also ensures compliance with local regulations. Proper tax inclusion on transaction documents is essential for both accounting purposes and customer trust.

| Tax Component | Description |

|---|---|

| Tax Rate | The percentage of the purchase price that is applied as tax, which may vary based on the buyer’s location. |

| Taxable Amount | The total cost of the goods or services before tax, which forms the basis for the tax calculation. |

| Tax Total | The calculated amount of tax, based on the applicable tax rate and taxable amount. |

| Tax ID | A unique identifier assigned to your business for tax purposes, often required for compliance in many regions. |

It is important to clearly itemize the tax details on your document to avoid confusion. The tax rate should be displayed alongside the taxable amount and the total tax due. This provides a full breakdown for the customer, making it clear how the final total was calculated. Always verify the local tax rules and rates that apply to your transactions to ensure accurate tax reporting.

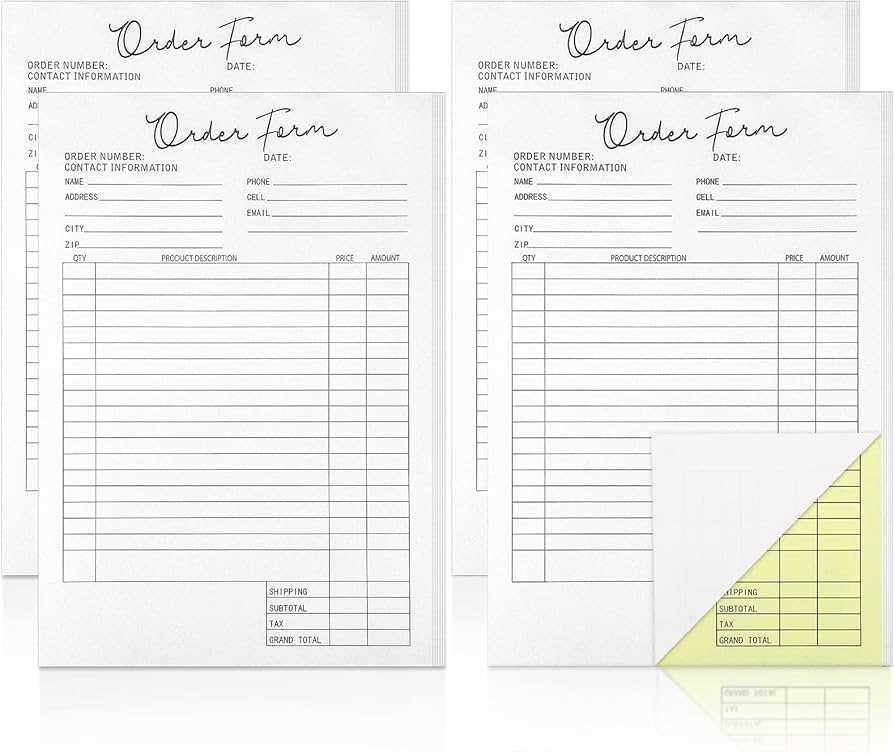

Creating Invoices for Multiple Orders

When processing multiple transactions from the same customer or across several sales, it’s important to consolidate the details of each order into a single document. This approach simplifies record-keeping and provides a clear overview of all items purchased, along with their associated costs. Properly managing multiple orders within one document can improve organization and customer service.

To effectively create a document for multiple orders, consider the following steps:

- Group Orders by Customer: If a customer has made multiple purchases, list all their items together, ensuring that the document reflects a comprehensive view of their entire order history.

- Include Separate Order Numbers: For clarity, assign a unique reference number to each individual purchase within the consolidated document. This helps to track each order separately if needed.

- Summarize Product Details: Include a detailed list of all products from each order, showing item names, quantities, and prices. You may also want to break this down by order to avoid confusion.

- Provide Combined Pricing: Calculate the total cost for each order, then provide a grand total that aggregates all individual purchases. This helps the customer see the complete financial picture.

- Clarify Shipping and Tax Information: Ensure that shipping fees and taxes are clearly indicated for each order. If multiple orders are shipped together, note the combined shipping cost and any applicable taxes for the entire purchase.

- Include Payment Information: Summarize the payment status of each individual order and indicate whether any part of the payment is pending or if discounts were applied to the total amount.

By following these steps, you ensure that each purchase is properly documented,

Formatting and Design Tips for Invoices

The presentation of your transaction documents plays a significant role in enhancing professionalism and ensuring clarity. A well-formatted document is not only easier to read but also ensures that important details are easily accessible. Effective use of design elements helps communicate essential information without overwhelming the recipient.

Key Design Elements

- Consistent Layout: Use a clean, structured layout with clear sections for different types of information, such as customer details, product list, pricing, and payment terms. This helps readers quickly locate the information they need.

- Readable Fonts: Select fonts that are legible and professional. Avoid using too many different font styles or sizes, as this can create visual clutter.

- Logical Flow: Arrange the content in a logical order–start with header information (business and customer details), followed by a list of purchased items, and end with totals and payment information. This provides a natural reading experience.

Formatting Tips

- Use Tables for Clarity: Tables are ideal for organizing product details, quantities, and pricing. This creates a clear breakdown of charges and helps customers easily review their purchase.

- Highlight Key Information: Important items such as total cost, taxes, and payment status should stand out. You can use bold or larger font sizes for these sections, ensuri

How to Save and Export Your Invoice

After creating a detailed transaction document, it’s important to save and export it in a format that is both secure and accessible. This ensures that you have a record for future reference and that your customers can easily access and store the document. Choosing the right format and method for exporting the document can make the process smoother for both you and your clients.

Follow these steps to save and export your transaction document:

- Select the Right File Format: Most commonly, PDF is the preferred format because it preserves the layout and is universally accessible. You can also consider formats like DOCX or Excel for internal use if the data needs to be editable.

- Save Locally or in the Cloud: Once the document is created, save it on your computer or cloud storage platform for easy access. Cloud services also ensure that your files are backed up and accessible from any device.

- Use Descriptive File Names: When saving your document, use clear and descriptive file names that include the transaction number, date, or customer name. This makes it easier to locate the file later.

- Export for Sharing: If you need to send the document to a customer, export it as a PDF or other widely accepted format. Many platforms allow you to export documents directly via email or to a file-sharing service.

- Ensure Security: When saving or sending sensitive transaction data, make sure your document is secure. You can use password protection on files or encrypt them before sharing to protect personal and financial information.

By following these guidelines, you ensure that your transaction documents are saved properly, easily accessible, and secure. Whether you need to refer to them later or share the

Common Mistakes to Avoid with Invoices

When creating transaction documents, even small errors can cause confusion and potentially disrupt business operations. To ensure smooth communication with customers and avoid costly mistakes, it’s important to pay attention to detail. Recognizing and avoiding common pitfalls can help maintain professionalism and ensure that all necessary information is accurately conveyed.

Here are some of the most common mistakes to avoid when creating transaction documents:

- Missing or Incorrect Contact Information: Always double-check that both your business and the customer’s details are accurate. Incorrect names, addresses, or phone numbers can lead to delays or miscommunications.

- Omitting Payment Terms: Be clear about the payment due date and any late fees that may apply. Failing to include this information can lead to confusion or delayed payments.

- Not Including a Clear Breakdown of Charges: Ensure that each product or service is itemized, along with the quantity, unit price, and any applicable discounts. Without this, customers may be unclear about what they are being charged for.

- Incorrect Tax Calculation: Double-check tax rates and ensure that the correct amount is applied to the total cost. Tax errors can lead to compliance issues or customer dissatisfaction.

- Not Including a Unique Reference Number: Every transaction should have a unique reference number to make it easy to track and organize. Without it, future inquiries or accounting tasks may become more difficult.

- Failure to Proofread: Typos, incorrect numbers, or misplaced information can undermine your business’s credibility. Always proofread your documents before finalizing them.

By avoiding these common mistakes, you can ensure that your documents are clear, professional, and effective in preventing misunderstandings. Taking the time to review all details and making sure everything is accurate will help streamline transactions and build trust with your customers.

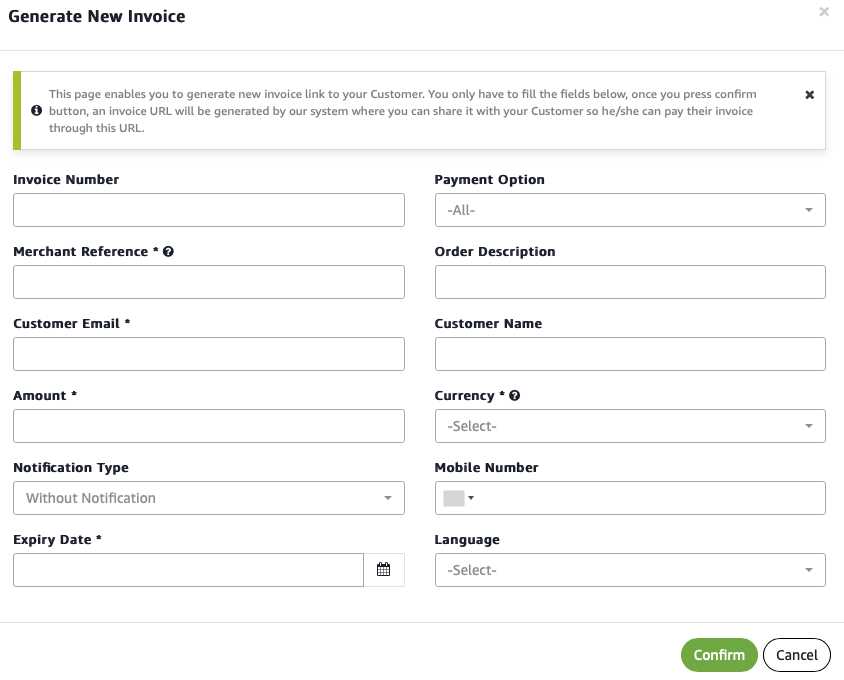

How to Send an Amazon Invoice to Customers

Once you have created a detailed transaction document, the next step is ensuring that it reaches your customer in a timely and professional manner. Properly sending the document not only helps maintain transparency but also improves customer satisfaction. There are several methods you can use to deliver the document, depending on your preference and the customer’s needs.

Here are a few common methods for sending your transaction documents:

- Email: The most efficient way to send a document is through email. You can attach the file in a format such as PDF or DOCX, which can easily be opened and saved by your customer. Make sure the subject line is clear and includes reference to the transaction (e.g., “Your Recent Purchase Receipt”).

- Using a Platform’s Message System: If you are conducting business on a third-party platform, you can often send documents directly through their messaging system. This keeps all communication in one place and provides an easy way for your customer to access the document.

- Direct Download Link: If you have a website or an online store, you can offer a download link for the document. This way, customers can access it directly from their account page at any time.

- Printed Document: For customers who prefer physical copies, consider printing the document and mailing it to their address. While this method may take more time, it may be appreciated by customers who prefer traditional forms of communication.

To ensure a smooth process, keep these tips in mind:

- Confirm the Correct Email or Address: Always verify that you have the correct contact infor

Automating Invoice Creation for Amazon Sales

In the world of online commerce, managing and generating billing records efficiently is crucial for business owners. Automating this process can save time, reduce errors, and streamline operations, allowing sellers to focus on growth and customer satisfaction. By leveraging automated systems, sellers can ensure that all necessary documents are accurately created, stored, and delivered in a timely manner, without manual intervention.

One of the primary benefits of automation is the consistency it offers. Automated systems can generate documents with precise information every time a transaction occurs. This consistency eliminates the risk of human error, which could otherwise result in discrepancies or delays that harm customer relationships or complicate financial tracking.

Feature Benefit Accuracy Reduces the chances of errors and ensures precise data in every record Speed Instantly generates documents after each sale, eliminating manual work Efficiency Streamlines the workflow by integrating with sales platforms and accounting software Customization Provides options for adjusting layouts and information to match business needs Implementing automated solutions can significantly reduce administrative burdens. With a seamless flow from order processing to document generation, businesses can maintain accurate records while staying compliant with financial regulations. Automated systems can also support various formats, ensuring that records are compatible with different software used for tax filings or accounting.

Free vs Paid Amazon Invoice Templates

When it comes to generating billing documents for online sales, sellers are faced with the choice between using free resources or opting for paid solutions. Both options have their advantages, but the decision ultimately depends on the specific needs and scale of the business. Free solutions often provide basic functionality, while paid options may offer more customization, additional features, and greater support for complex needs. Understanding the pros and cons of each can help sellers make an informed choice that aligns with their business goals.

Advantages of Free Options

- Cost-Effective: The primary benefit of free resources is that they come at no cost, which is especially appealing to small businesses or startups with limited budgets.

- Quick Setup: Many free tools are easy to set up and use, requiring little to no technical knowledge. This makes them ideal for those who need a simple solution without much complexity.

- Basic Functionality: For businesses with straightforward needs, free options can provide all the necessary features to generate accurate documents for transactions.

Benefits of Paid Solutions

- Customization: Paid resources often come with more flexible design and layout options, allowing businesses to tailor documents to their specific branding and style.

- Advanced Features: These options usually include additional tools such as automa

Legal Considerations for Amazon Invoices

When generating transaction documents for online sales, sellers must ensure they meet legal requirements to avoid compliance issues. These records are not only essential for financial tracking but also for meeting tax obligations and other regulatory standards. Proper documentation helps safeguard businesses against disputes, audits, and penalties. Understanding the legal considerations that influence these documents is crucial for any seller operating in regulated markets.

Essential Information to Include

- Seller Information: The name, address, and contact details of the seller are typically required for legal documentation.

- Buyer Information: Depending on the jurisdiction, details of the buyer (such as name and address) may be necessary for specific legal purposes.

- Transaction Details: A clear record of the purchased items, including product descriptions, quantities, unit prices, and total amount, should be included for accurate reporting.

- Tax Identification Numbers: Sellers and buyers may be required to list their respective tax IDs for proper reporting to authorities.

- Payment Terms: The terms of payment, including any applicable taxes, discounts, and payment due dates, should be clearly stated.

Compliance with Local Regulations

- Tax Regulations: Different countries and regions have varying tax laws, such as VAT or sales tax, that must be accurately reflected on the transaction documents.

- Record Retention: Many jurisdictions require businesses to retain

Integrating Invoice Templates with Accounting Software

Seamlessly connecting billing documents with accounting systems can significantly improve the efficiency of managing financial records. By automating the transfer of data between sales transactions and accounting software, businesses can eliminate manual entry errors, save time, and ensure greater accuracy in financial reporting. This integration allows for smooth workflows, providing real-time updates to accounting ledgers and helping businesses maintain consistent, up-to-date financial information.

Integration can simplify various tasks, such as tracking sales, managing taxes, and preparing reports. Many modern accounting platforms offer built-in support for automatic synchronization with document generation tools. This allows the data from completed transactions to be directly inputted into financial software without the need for duplicating efforts or cross-referencing between multiple systems.

Benefit Description Time Savings Automated data transfer reduces the time spent on manual data entry and bookkeeping. Accuracy Direct integration minimizes the risk of human errors, ensuring that financial records are precise. Real-Time Updates Financial data is automatically updated as transactions occur, providing immediate insights into cash flow and other financial metrics. Easy Tax Compliance Tax-related information, such as VAT or sales tax, is automatically calculated and recorded, streamlining tax reporting and compliance. Integrating billing systems with accounting software can be achieved through various tools and plug-ins, which often come with customization options to suit different business needs. This integration can enhance the financial management process by providing a more cohesive and transparent view of a company’s financial health, which is essential for strategic planning and decision-making.

Tracking and Managing Your Invoices Effectively

Effectively monitoring and organizing financial documents is essential for maintaining smooth business operations. Proper tracking ensures that all transactions are recorded accurately, payments are processed on time, and potential issues are identified early. An organized approach to managing records not only helps businesses stay compliant with tax laws but also enables them to analyze their cash flow and financial performance more effectively.

Key Strategies for Efficient Management

- Centralized Record-Keeping: Store all transaction documents in one secure, easily accessible location. Using a cloud-based system can help ensure that your records are backed up and available anytime, anywhere.

- Use of Unique Identifiers: Assign unique reference numbers to each document. This allows you to quickly locate and track specific transactions, reducing the risk of confusion or loss of records.

- Automated Reminders: Set up automated alerts to remind you of upcoming payment due dates or overdue balances. This can prevent missed payments and improve cash flow management.

- Regular Audits: Conduct periodic reviews of your financial records to ensure that all entries are accurate and up-to-date. Regular audits can also help identify discrepancies or fraudulent activity early.

Tools for Effective Tracking

- Accounting Software: Integrating transaction documentation tools with accounting software enables seamless data entry and reporting. This allows for real-time updates and automated reconciliation of accounts.

- Spreadsheets: For smaller businesses, spreadsheets can provide an affordable and cust