Wave Invoice Template for Effortless Billing and Payment Management

Managing payments and billing can be a time-consuming task for any business, but with the right tools, it becomes a seamless and efficient process. Creating professional invoices and tracking payments shouldn’t be a hassle, especially when you have access to user-friendly solutions that simplify these tasks.

Whether you’re a freelancer or a small business owner, automating and customizing your billing system can save you significant time and reduce errors. By utilizing digital resources, you can ensure that your financial documentation is accurate, easy to generate, and consistent across all transactions.

In this guide, we will explore a highly effective solution that enables you to craft customized bills in just a few steps, making it easier than ever to manage payments, keep track of client balances, and maintain a professional image for your business.

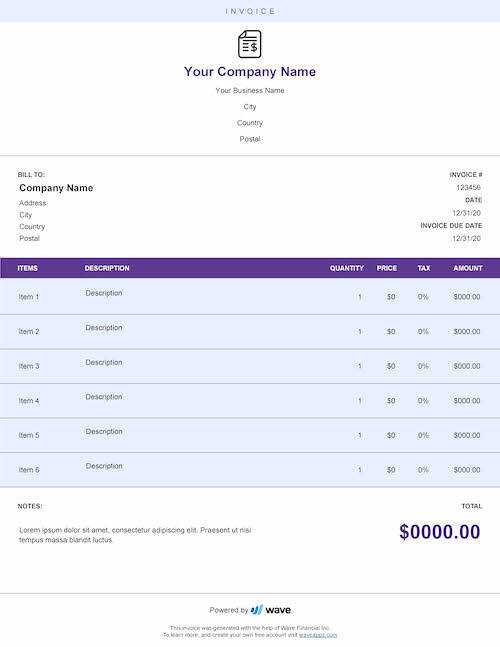

Wave Invoice Template Overview

Creating professional and accurate billing documents is crucial for any business. The right tool can help you generate and manage these documents quickly while ensuring consistency and clarity. This solution offers a straightforward approach to creating customized, detailed financial statements that fit your business needs.

With this system, you can easily create invoices that reflect your branding and include all necessary information, such as itemized charges, payment terms, and due dates. It also offers built-in features to track payments and outstanding balances, making it an essential tool for streamlining your billing process.

Key features include:

- Customizable fields for business details and client information

- Ability to add product or service descriptions with pricing

- Predefined tax and discount options for quick calculation

- Automated payment tracking to monitor outstanding amounts

- Downloadable documents for printing or sharing electronically

By using this platform, businesses can save time on repetitive tasks and ensure that their billing system is as efficient and professional as possible.

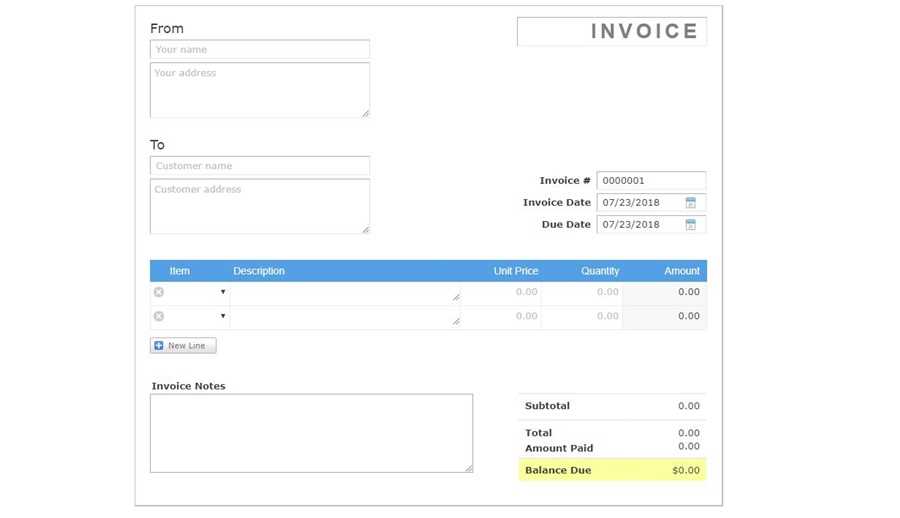

How to Download Wave Invoice Template

Accessing and downloading a ready-made billing document for your business needs is quick and simple. With just a few steps, you can get a customizable form that will help you create professional financial statements in no time.

Follow the steps below to download the necessary file:

| Step | Action |

|---|---|

| 1 | Visit the official website or platform offering the tool. |

| 2 | Sign up for an account or log in if you already have one. |

| 3 | Navigate to the ‘Billing’ or ‘Documents’ section of the platform. |

| 4 | Select the option to download the form in your preferred format. |

| 5 | Save the file to your device or cloud storage for easy access. |

Once downloaded, you can begin personalizing the document by adding your business details, client information, and itemized charges. This simple process allows you to start using it immediately for your billing purposes.

Benefits of Using Wave Invoices

Leveraging a digital system for generating billing documents can significantly enhance the efficiency of your financial operations. By using an automated solution, you not only streamline your workflow but also ensure accuracy, consistency, and a more professional presentation of your services.

Time and Effort Savings

One of the key advantages of this solution is the time it saves. Manually creating and tracking billing statements can be tedious, especially for businesses with numerous clients or frequent transactions. With automated templates, generating a document only takes a few minutes. You can easily update information, calculate totals, and apply taxes or discounts without having to redo the entire process.

Improved Accuracy and Professionalism

Automating your billing process minimizes the chances of errors, such as incorrect calculations or missing details. This leads to more accurate financial records, making it easier to keep track of payments and outstanding balances. Furthermore, the ability to customize the document’s design ensures that each statement aligns with your business’s branding, creating a more polished and professional image for your clients.

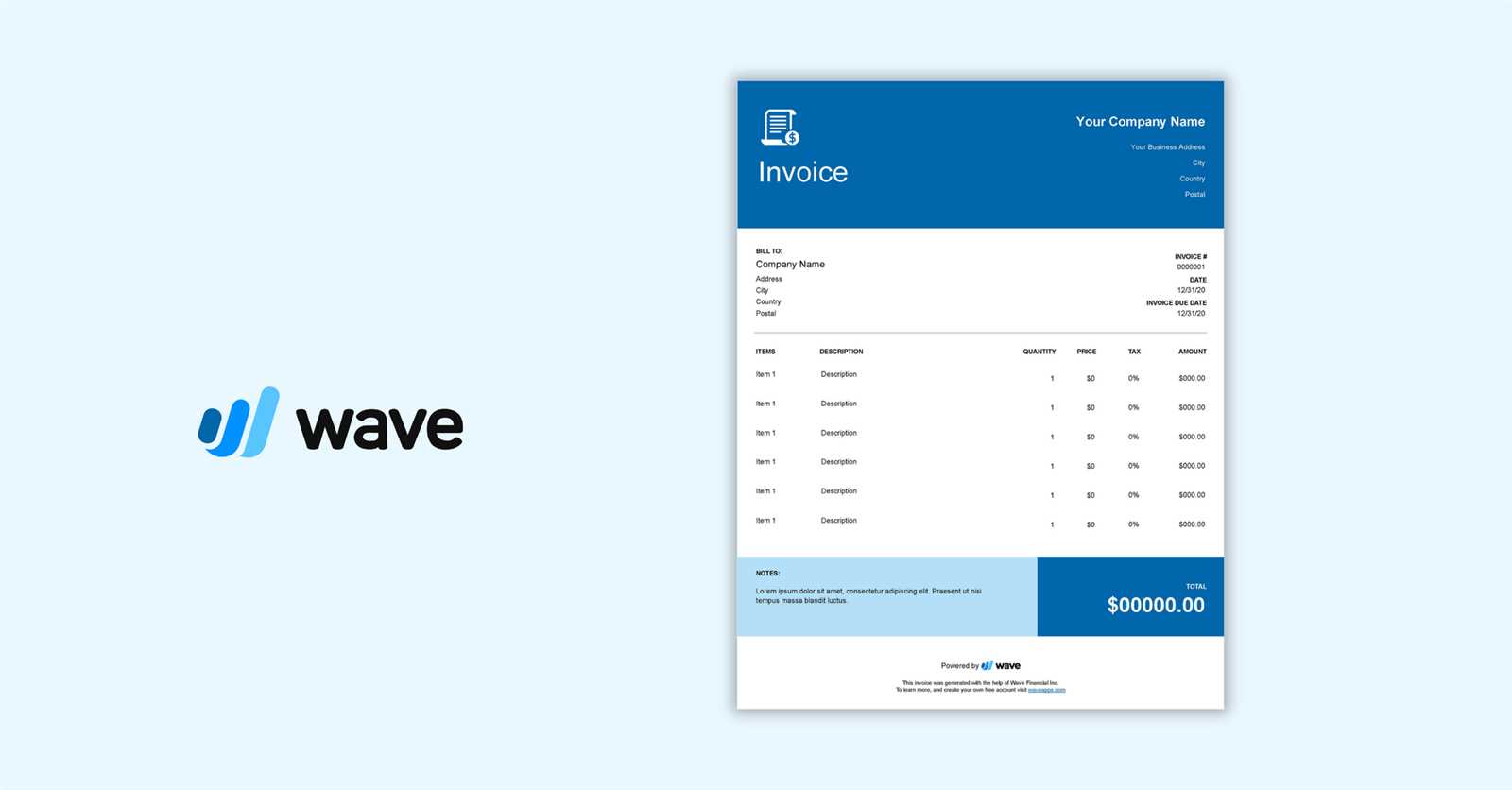

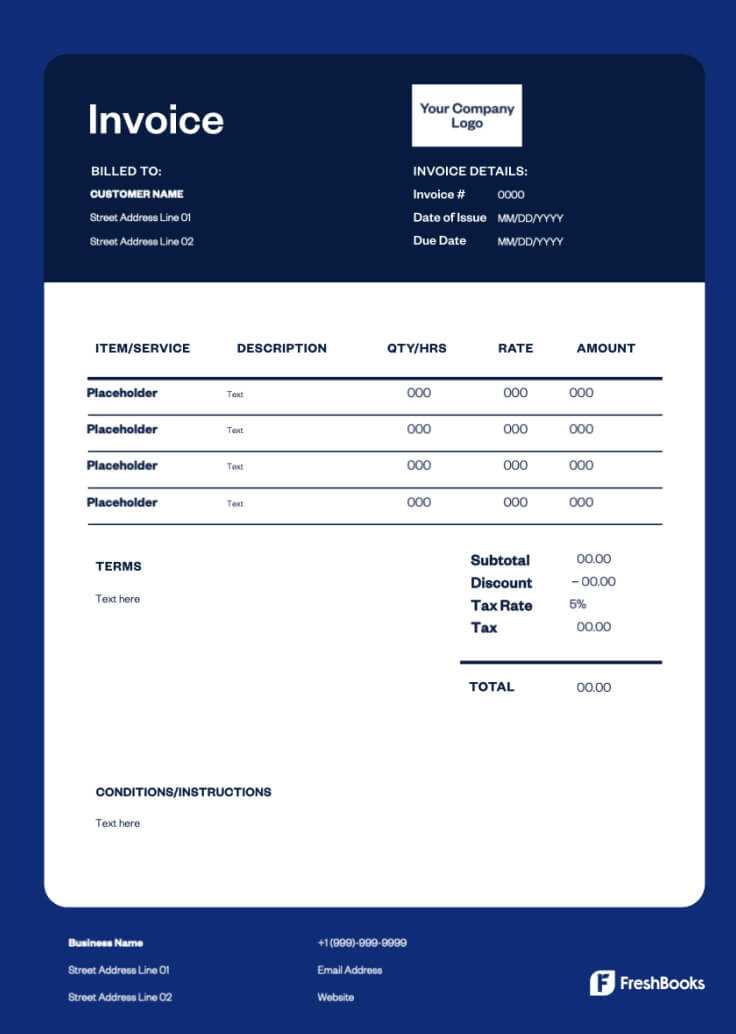

Customizing Your Wave Invoice Template

Personalizing your billing documents is an essential step in ensuring that they reflect your business’s unique identity. Customization not only helps make your documents look more professional but also ensures that they meet your specific operational needs. With the right customization options, you can create an ideal financial statement that aligns perfectly with your brand.

Basic Customization Options

When creating a billing document, there are several key areas you can adjust to make it truly yours:

- Business Information: Add your company’s name, address, and contact details so that clients can easily reach you.

- Logo and Branding: Upload your logo and choose colors that match your brand’s identity, creating a cohesive and professional look.

- Payment Terms: Set your preferred payment conditions, including due dates and late fees, to ensure clarity and manage expectations.

Advanced Features for Enhanced Customization

Beyond the basics, there are additional customization features that allow you to fine-tune the document:

- Itemized List: Include detailed descriptions of products or services, along with individual prices, taxes, and discounts.

- Multiple Currency Options: Adjust the currency settings if you work with international clients, ensuring your documents are universally understandable.

- Payment Methods: Include options for clients to choose how they would like to pay, whether it be through bank transfer, credit card, or other methods.

By utilizing these customization options, you can ensure that your billing statements are not only functional but also aligned with your company’s image and operational processes.

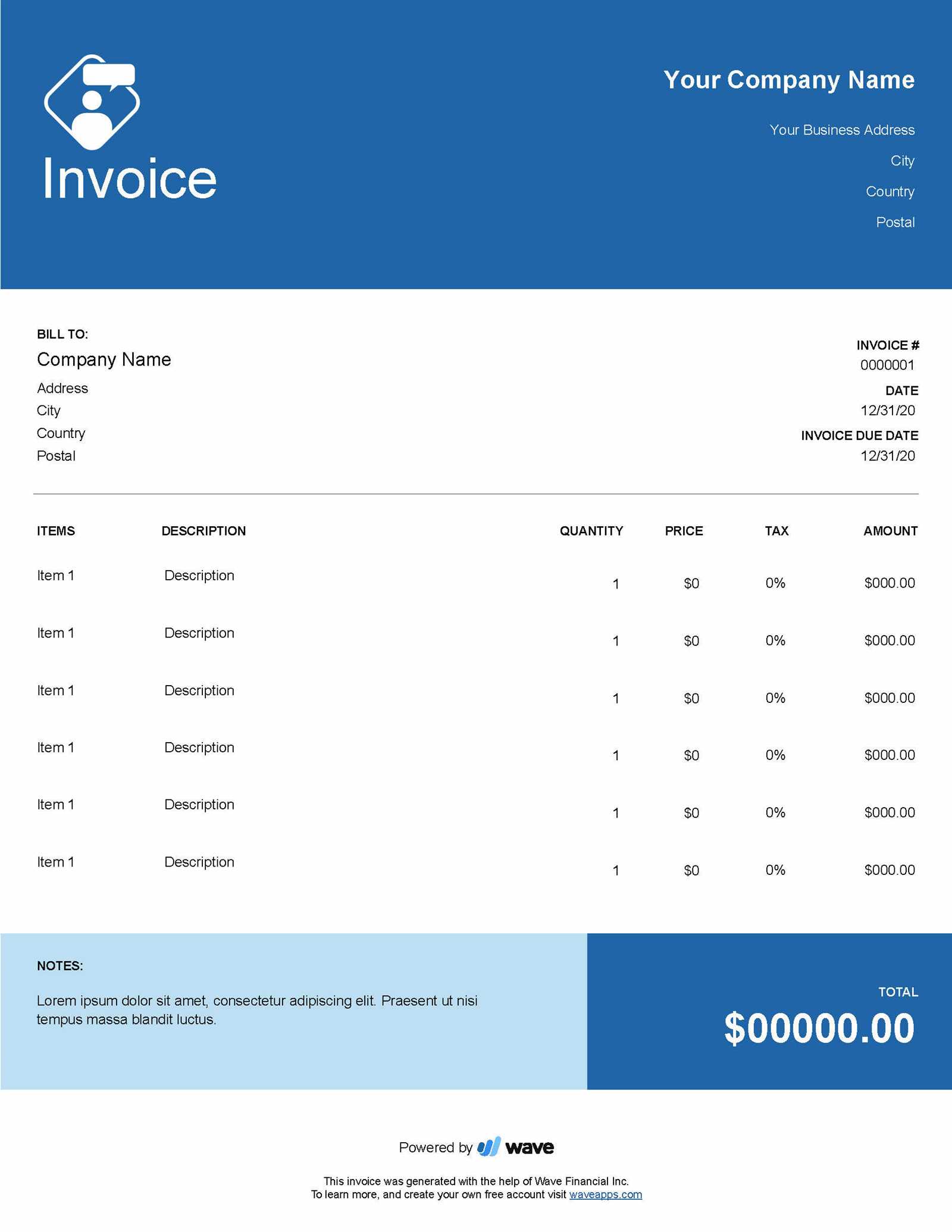

Wave Invoice Template for Small Businesses

For small businesses, managing finances efficiently is crucial to long-term success. A reliable system for creating and sending billing statements can save valuable time and reduce errors. Using a customizable digital solution for generating professional documents ensures that your financial operations run smoothly while presenting your business in a polished light.

With a digital billing document, small businesses can enjoy a variety of benefits:

- Time-saving automation: Automatically calculate totals, taxes, and discounts, eliminating manual entry and the risk of mistakes.

- Professional appearance: A well-designed financial statement helps build trust with clients, reflecting your business’s attention to detail.

- Client tracking: Easily monitor outstanding payments and send reminders, keeping cash flow consistent and organized.

By using such a system, small businesses can streamline their billing process, improve efficiency, and maintain a high level of professionalism in their financial transactions. It also allows you to focus more on growing your business and less on administrative tasks.

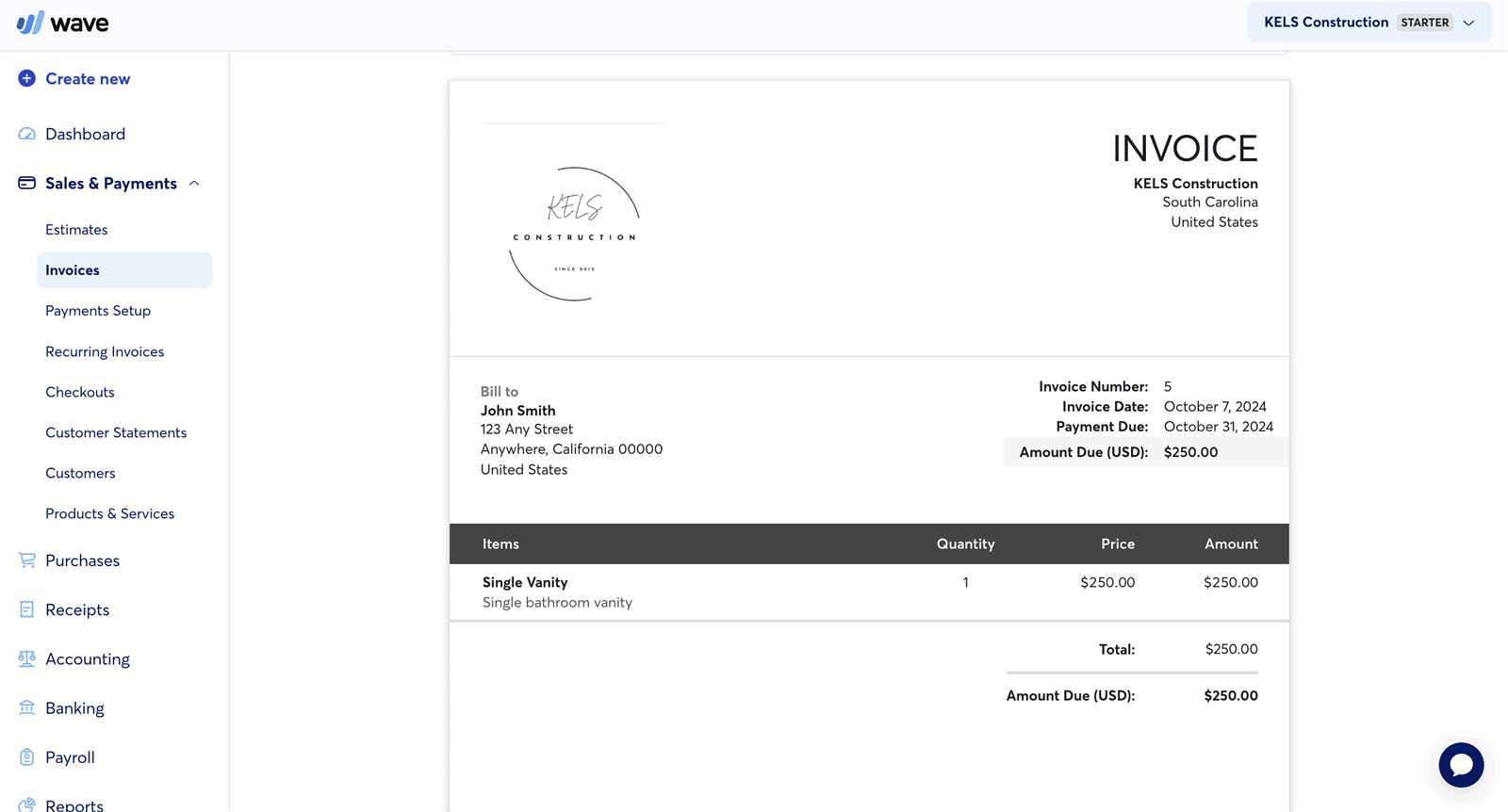

Step-by-Step Guide to Create an Invoice

Creating a professional billing document is a simple process that ensures clarity between you and your clients. Whether you are a freelancer or a small business owner, following a straightforward approach to generating your financial statements helps maintain accuracy and efficiency. Below is a detailed guide to creating a customized billing document from start to finish.

1. Add Your Business Information

Start by entering your business name, address, and contact details. This ensures that the client can reach you easily if there are any questions about the charges or payment terms. You can also include a logo to make the document more personalized and professional.

2. Include Client Details

Next, add your client’s information. This includes their name, company (if applicable), address, and contact information. This step ensures that both parties are clearly identified on the document and helps avoid confusion.

Tip: Always double-check the client’s contact details to ensure accurate communication.

3. List the Products or Services

Now, you can add a detailed list of the products or services provided. Be sure to include:

- Description: A clear, concise description of each item or service.

- Quantity: How many units or hours of service were provided.

- Price: The unit price for each item or service.

- Total: The total cost for each item or service, including any taxes or discounts.

4. Set Payment Terms and Due Date

Specify the payment terms, such as the due date for payment, any late fees for overdue payments, and acceptable payment methods (e.g., credit card, bank transfer). This ensures both you and your client are on the same page regarding when payment is expected and how it should be made.

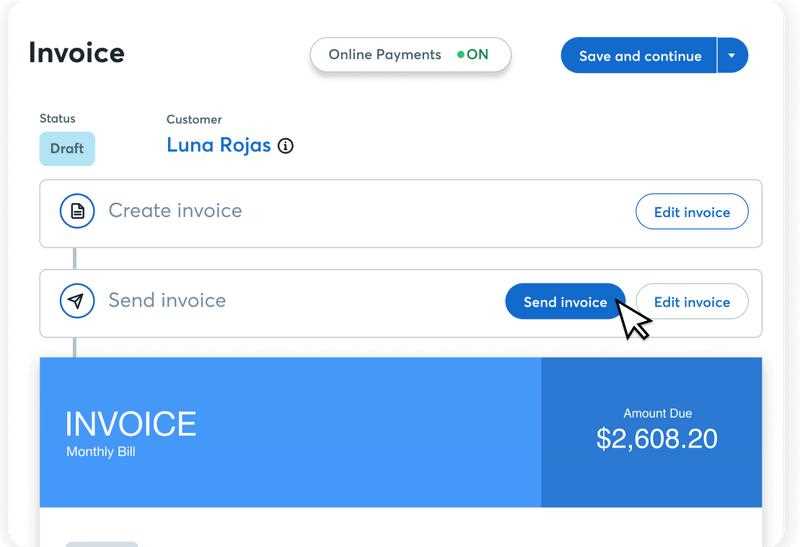

5. Final Review and Sending

Before sending the document, double-check all the details for accuracy. Make sure all charges are correct, taxes are applied properly, and the due date is clearly stated. Once everything is accurate, save the document and send it to your client via email or your preferred communication method.

Final Tip: Save a copy for your records to track payments and maintain an organized financial history.

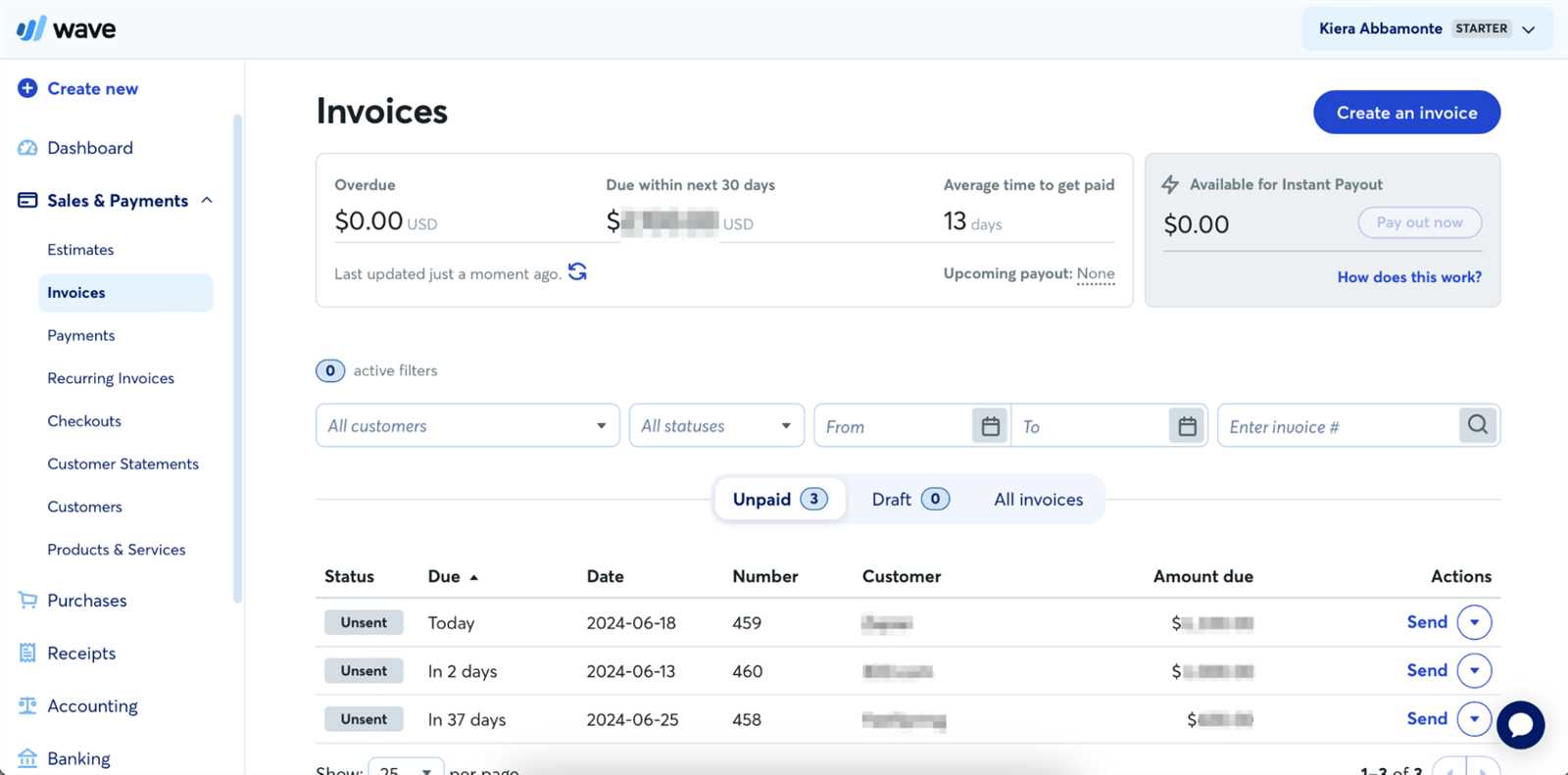

Tracking Payments with Wave Invoice Template

Effectively monitoring payments is essential for maintaining smooth cash flow and ensuring your business runs without interruptions. Using a digital system to track client payments helps you stay organized, identify overdue balances, and manage your financial records with ease. This process allows you to quickly view the status of each transaction and take the necessary actions to follow up on unpaid amounts.

1. Payment Status Updates

Once you send a billing document, you can mark its payment status within the system. Typically, you’ll have the following status options:

- Unpaid: The client has not yet made a payment.

- Paid: The client has completed the payment.

- Partially Paid: The client has made a partial payment but still owes a balance.

- Overdue: The due date has passed, and payment is still pending.

2. Automated Payment Reminders

To streamline the process, you can set up automated reminders that will be sent to clients who have not yet paid by the due date. This ensures you don’t have to manually track and follow up with each client, saving you time and reducing the risk of overlooking overdue payments. Additionally, it helps maintain a professional tone by keeping communication consistent and on schedule.

Tip: Always customize the reminder message to maintain a courteous and professional relationship with your clients, even if payments are late.

Common Mistakes to Avoid with Wave Invoices

Creating financial statements is a crucial task for any business, but errors in your billing process can lead to confusion, delays, and even lost revenue. Whether it’s a simple mistake in calculation or a missing detail, these oversights can negatively impact your cash flow and professional image. Avoiding common mistakes is essential to ensure your documents are accurate, clear, and effective.

1. Missing Client Information

One of the most frequent errors is failing to include complete client details. Missing contact information, such as the client’s address or email, can make it difficult to communicate or follow up on overdue payments. Always double-check that the client’s name, address, and contact information are properly entered to avoid confusion.

2. Incorrect Payment Terms

Clearly stating payment terms is crucial to prevent misunderstandings. If you don’t specify when payments are due or fail to outline late fees, clients may delay payments or ignore the terms altogether. Always make sure that due dates and any penalties for late payments are clearly visible and agreed upon before sending out a document.

3. Inaccurate Pricing and Calculation Errors

Errors in pricing or calculations can lead to clients being overcharged or undercharged. This can damage your reputation and create trust issues with your customers. Double-check each item or service’s price, quantity, and applicable taxes to ensure that totals are accurate before finalizing the document.

4. Failing to Track Payments

Once you send out a billing statement, it’s important to track whether the payment has been made, partially made, or is still pending. Not keeping track of payments can result in missed opportunities to follow up with clients, causing overdue payments to go unnoticed. Regularly update the payment status within your system to stay organized.

Tip: Set up reminders or automatic notifications to help you follow up on outstanding balances in a timely manner.

Wave Invoices vs Other Invoice Templates

When it comes to generating billing documents for your business, there are various options available, each offering unique features and capabilities. Some solutions are more comprehensive, while others focus on simplicity and speed. Understanding how one platform compares to others is important in choosing the right tool that fits your specific business needs.

Here’s a comparison of this particular system and other common digital billing solutions:

Key Advantages of Using This System

- Customization: This system allows for easy customization, enabling you to tailor your documents to match your business brand with logos, colors, and specific details.

- Ease of Use: With an intuitive, user-friendly interface, even those with minimal technical skills can quickly generate and send documents without confusion.

- Automated Tracking: Built-in features for automatic payment tracking help businesses stay on top of overdue balances and streamline follow-up processes.

- Free Access: Many of the basic features are available at no cost, which makes it an appealing option for small businesses or freelancers looking to save on administrative costs.

How Other Solutions Compare

- Other Solutions: Some platforms provide more advanced features, such as deeper integrations with accounting software, but may come at a higher cost.

- Traditional Software: Traditional desktop software for billing may offer customization but lacks the ease of cloud-based collaboration, limiting flexibility in accessing documents from multiple devices.

- Spreadsheet Templates: While customizable, spreadsheets require manual updates and do not offer automation for payment tracking or professional design, which can be time-consuming and prone to error.

Ultimately, the best choice depends on your business’s specific needs. If you value simplicity, customization, and cost-effectiveness, this solution might be ideal. However, if you require more advanced features or integrations with other business tools, you may want to explore other options that offer greater flexibility.

Managing Multiple Clients with Wave Invoices

Managing billing for multiple clients can quickly become overwhelming, especially if you handle numerous projects or services at once. Keeping track of each client’s details, payment status, and due dates requires an organized approach to avoid mistakes and ensure timely payments. Using a streamlined system to manage several clients’ billing information makes this process far more efficient and less stressful.

This platform offers a range of features designed to simplify the process of handling multiple clients, ensuring that your business remains organized and that nothing slips through the cracks.

Centralized Client Database

One of the key benefits of this system is its ability to store all client information in one centralized location. This means you can easily access each client’s contact details, payment history, and billing preferences without searching through multiple documents. This feature helps you manage your client base more efficiently and ensures you have all necessary information at your fingertips.

Batch Billing and Automated Reminders

For businesses with many clients, sending out individual billing statements and following up on overdue payments can be time-consuming. However, using a digital solution allows you to send documents in bulk, saving you valuable time. Additionally, automated payment reminders can be scheduled to notify clients about pending payments, reducing the need for manual follow-ups and improving your cash flow.

Tip: Group clients by payment terms or due dates to prioritize follow-ups and avoid confusion.

By using an efficient system, you can manage your client base with ease, keep track of financial interactions, and improve your overall workflow, ultimately boosting client satisfaction and ensuring timely payments.

How to Integrate Wave with Accounting Tools

Integrating your billing system with accounting software is a smart way to streamline your financial management. By syncing these tools, you can automate record-keeping, improve accuracy, and save time. This integration allows you to manage income, expenses, and taxes more efficiently, while ensuring that your financial data is up-to-date across all platforms.

Here’s a step-by-step guide on how to integrate your billing system with popular accounting tools:

| Step | Action |

|---|---|

| 1 | Sign in to your account on the billing platform and navigate to the settings or integration section. |

| 2 | Select the accounting software you wish to integrate with, such as QuickBooks, Xero, or others. |

| 3 | Authorize the connection by providing your login credentials for the accounting tool. |

| 4 | Choose the specific data you wish to sync, such as payment records, client details, or tax information. |

| 5 | Confirm the integration settings and complete the process. Your billing data should now be automatically transferred to your accounting software. |

Once integrated, the tools will sync automatically, keeping your records consistent and saving you from having to manually input financial information into both systems. This integration can also help you run reports and generate financial statements with ease, giving you a clear view of your business’s financial health at any given time.

Free vs Premium Wave Invoice Templates

When choosing a billing solution, businesses often face the decision between using free or premium versions of the available tools. Each option offers distinct benefits, and the right choice depends on the size of your business, your specific needs, and your budget. While free options may meet basic needs, premium solutions often provide advanced features that can enhance the efficiency and professionalism of your financial processes.

Here’s a comparison of the key differences between free and premium solutions for generating billing documents:

Free Options

Free solutions typically offer basic features that can handle essential billing tasks, such as:

- Simple, pre-designed document layouts that you can customize with your business information.

- Basic features like payment tracking and sending documents to clients via email.

- Minimal customization options in terms of design, branding, and document styling.

While free options can be great for startups or small businesses with simple needs, they may lack the flexibility and advanced features that some businesses require as they grow.

Premium Options

Premium solutions typically offer a more robust set of features, such as:

- Advanced customization, allowing you to add logos, adjust colors, and match your branding.

- Automated payment reminders, payment tracking, and integration with accounting tools for a more seamless workflow.

- Support for multiple currencies, tax configurations, and complex pricing structures.

- Priority customer support and access to more detailed analytics or reports.

Premium options are ideal for businesses that need to manage a larger number of clients, require in-depth reporting, or want a fully branded and automated solution. While they come at a cost, the additional features often provide greater efficiency and professionalism, helping businesses scale effectively.

Ultimately, the decision between free and premium options comes down to the complexity of your billing needs and the level of customization and automation required for your business.

Setting Up Taxes in Wave Invoice Template

Setting up taxes correctly is an essential part of creating accurate billing documents. Whether you’re required to apply local sales tax, VAT, or any other form of taxation, having the right structure in place ensures your financial documents are compliant and clear for your clients. Proper tax configuration allows for automatic calculations, saving you time and reducing the risk of mistakes.

Configuring Tax Rates

To begin setting up taxes, you’ll first need to define the appropriate tax rates for your business. This process typically involves:

- Identifying the specific tax rates applicable to your location or industry, such as state, federal, or international taxes.

- Adding tax categories for different products or services if they are subject to different rates.

- Ensuring that tax exemptions or special rates are applied correctly for qualifying clients or transactions.

Applying Taxes to Products and Services

Once your tax rates are set up, you can begin applying them to your services or products. This is typically done by:

- Selecting the appropriate tax rate when adding a new item or service to a billing document.

- Ensuring that the tax is calculated automatically based on the item’s price and the relevant tax rate.

- Including the tax breakdown on the final document so clients can clearly see the amount being charged for taxes.

Setting up taxes correctly not only ensures that your documents are accurate but also that your business complies with local tax laws and regulations, helping you avoid potential fines or legal issues. By automating tax calculations, you can streamline your billing process and focus on other aspects of your business operations.

Printing and Exporting Billing Documents

Once your financial documents are created, there may be times when you need to print them for physical records or share them electronically with clients. Having the ability to export and print your documents quickly and efficiently is essential for maintaining smooth business operations. This process allows you to choose the most suitable format for your needs, whether you prefer hard copies or digital copies that can be shared via email or other platforms.

Exporting Documents to Different Formats

Exporting your billing documents to digital formats is an essential step for easy sharing and storage. The most common export options include:

- PDF: A widely-used format that preserves the layout and appearance of your document. PDFs are perfect for sending professional-looking files to clients.

- Excel/CSV: Ideal for clients who need a spreadsheet for accounting purposes. This format allows for easy editing and data manipulation.

- Word: Useful if you need to make further edits to the document before sending it to the client.

Printing Billing Statements

For businesses that require physical copies of their financial documents, the printing option is straightforward. To print your documents, follow these steps:

- Ensure the document is finalized with all the necessary details, including payment terms, dates, and item descriptions.

- Choose the print option in your system, which will generate a printable version of your billing document.

- Select your preferred printer settings (e.g., paper size, number of copies) and print the document.

Tip: Always review the document before printing to avoid wasting paper on incorrect or incomplete copies.

Having these export and printing options at your disposal gives you flexibility in how you manage and distribute billing documents, ensuring that you can meet the needs of clients who prefer different formats or require physical records.

Best Practices for Sending Billing Documents

Sending billing statements to clients requires attention to detail and a professional approach. Whether you’re sending a digital document or a physical copy, making sure everything is accurate and clear is crucial for maintaining trust and ensuring timely payments. There are a few best practices that can help streamline the process, improve communication, and ensure that your financial documents are received and processed efficiently.

Preparing the Document Before Sending

Before you send any billing document, it’s important to verify that all necessary information is included and correct. This includes checking for the following:

| Step | Action |

|---|---|

| 1 | Ensure client details (name, address, contact info) are up-to-date. |

| 2 | Double-check pricing, quantities, and any applicable taxes or discounts. |

| 3 | Verify payment terms, including due dates and late fee details if applicable. |

| 4 | Confirm that any additional notes, such as payment methods or instructions, are clear. |

Sending the Document

Once the document is ready, here are some steps to follow for effective delivery:

- Use Email for Digital Delivery: Sending the document via email is fast and reliable. Attach the document in a commonly used format like PDF to ensure the client can open it easily.

- Use a Professional Email Subject Line: Make your subject line clear and to the point, such as “Billing Statement for [Client Name] – [Invoice Number].”

- Follow Up with Clients: If you don’t receive confirmation or payment within the agreed time frame, send a polite follow-up email to remind them of the outstanding balance.

- Consider a Physical Copy: For clients who prefer paper documents, ensure the document is professionally printed and sent via a reliable postal service.

By following these best practices, you can improve your billing process, reduce errors, and ensure that your clients have all the information they need to process payments on time. Additionally, clear communication helps reinforce your professionalism and builds trust with your clients, ultimately supporting better cash flow for your business.

Security Features in Billing Documents

When handling financial documents, security is a top priority. Protecting sensitive client information, payment details, and transaction records is essential to maintaining trust and complying with regulations. The right system offers robust security features to ensure that both your business and clients are safeguarded from data breaches and fraud.

Data Encryption and Protection

One of the most important security features in digital billing systems is encryption. By encrypting sensitive data such as payment information and client details, the system ensures that even if unauthorized access occurs, the data remains unreadable. This feature is especially critical for businesses dealing with online transactions or storing personal information.

User Authentication and Access Control

Another essential security feature is strong user authentication. Only authorized users should have access to billing records and client data. Features like two-factor authentication (2FA) and role-based access control help restrict access based on user roles, ensuring that sensitive information is only available to those who need it.

These security measures help protect your business and your clients’ data, ensuring confidentiality and reducing the risk of financial fraud. By choosing a system with robust security features, you can focus on growing your business with peace of mind, knowing that your data is protected.