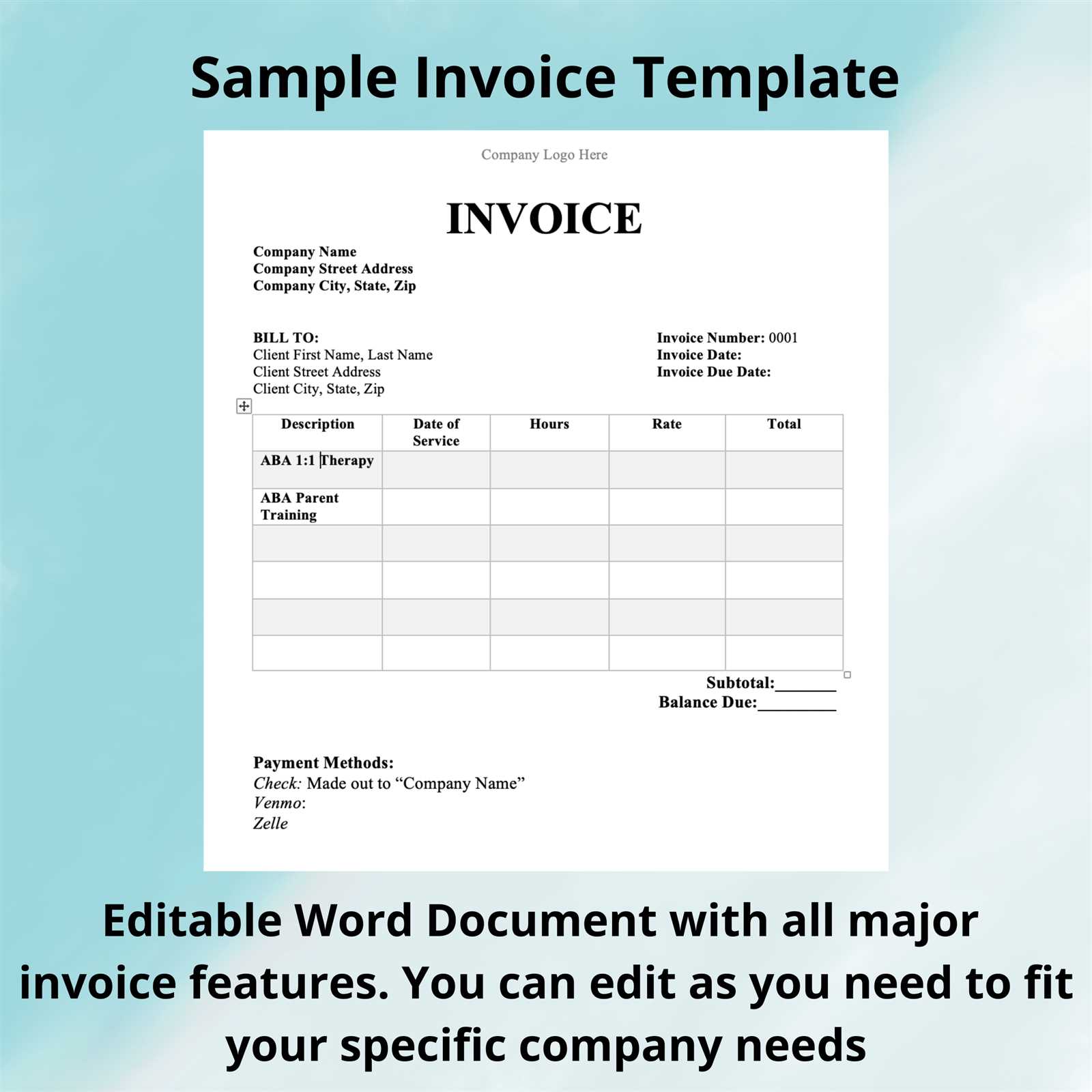

Sample Invoice Template for Quick and Easy Billing

When it comes to managing business transactions, having a well-structured document for requesting payment is crucial. Whether you’re a freelancer, small business owner, or large enterprise, creating clear and professional billing forms ensures smooth financial operations. These documents not only provide essential details about the transaction but also reflect your business’s reliability and professionalism.

Designing a useful and efficient payment request form doesn’t have to be complicated. With the right format, you can easily adapt it to your specific needs, from including detailed service descriptions to setting clear payment deadlines. A carefully crafted document can also help maintain consistency and improve your relationship with clients by making the payment process straightforward and transparent.

In this article, we will explore various options for building the ideal payment request form, focusing on key components that make it effective, customizable, and easy to use. Whether you’re starting from scratch or refining an existing one, these insights will help you streamline your billing process and avoid common mistakes.

Sample Invoice Template for Businesses

For any business, having a structured and professional document for requesting payment is an essential part of maintaining smooth financial operations. The right format ensures clarity and helps prevent any misunderstandings between you and your clients. By organizing the necessary information in an easy-to-read layout, you can make the billing process more efficient and transparent.

Key Components to Include

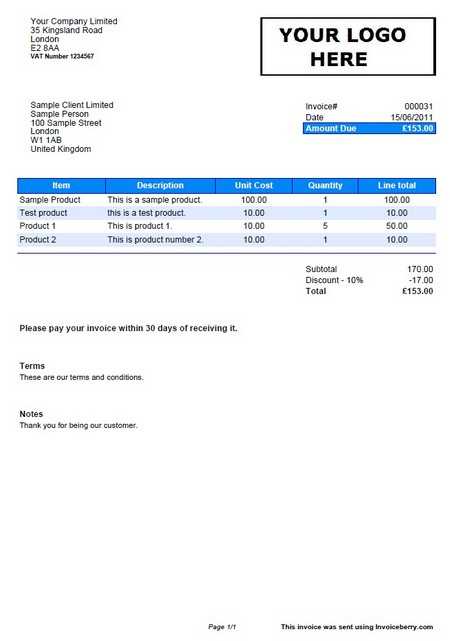

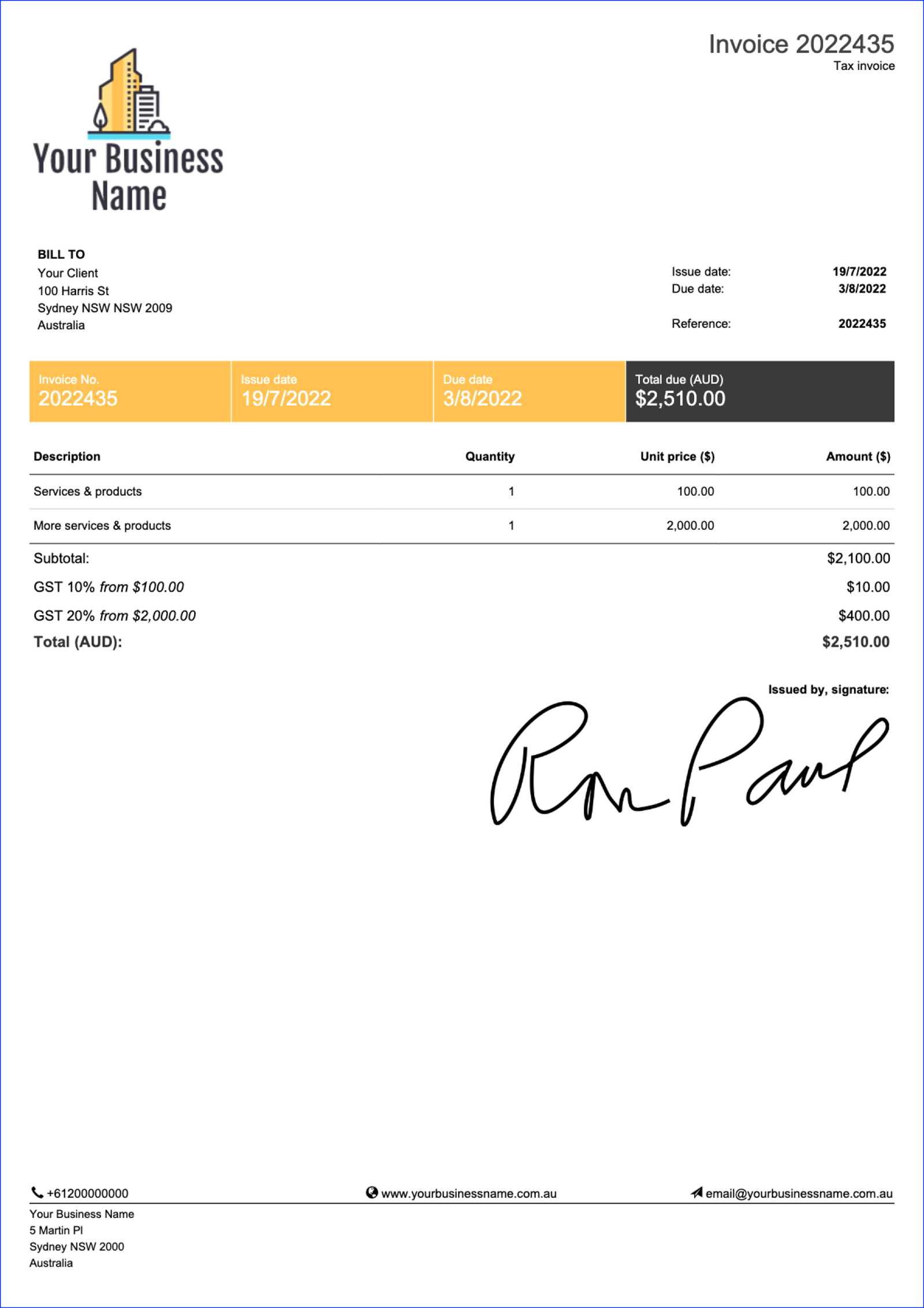

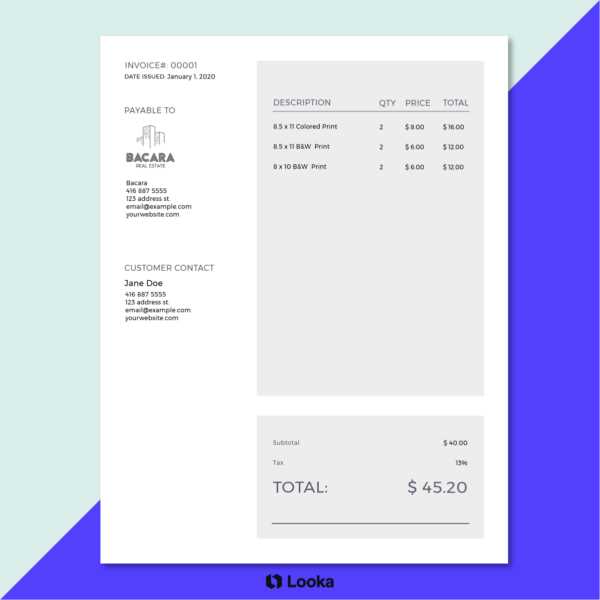

A well-crafted document should cover several key components, each serving a specific purpose. These include details such as the company name and contact information, a unique reference number for tracking purposes, and a clear breakdown of products or services provided. The goal is to make the document both informative and easy for your client to review and understand.

Customization for Different Business Needs

One of the advantages of using a customizable format is that you can adapt it to your specific industry or client requirements. For example, if you’re a service provider, you might need to add hourly rates or the time spent on a particular task. On the other hand, for product-based businesses, including details like quantity and unit price may be necessary. Regardless of your business type, a flexible structure allows you to create a professional billing form that suits your needs while maintaining a consistent image for your company.

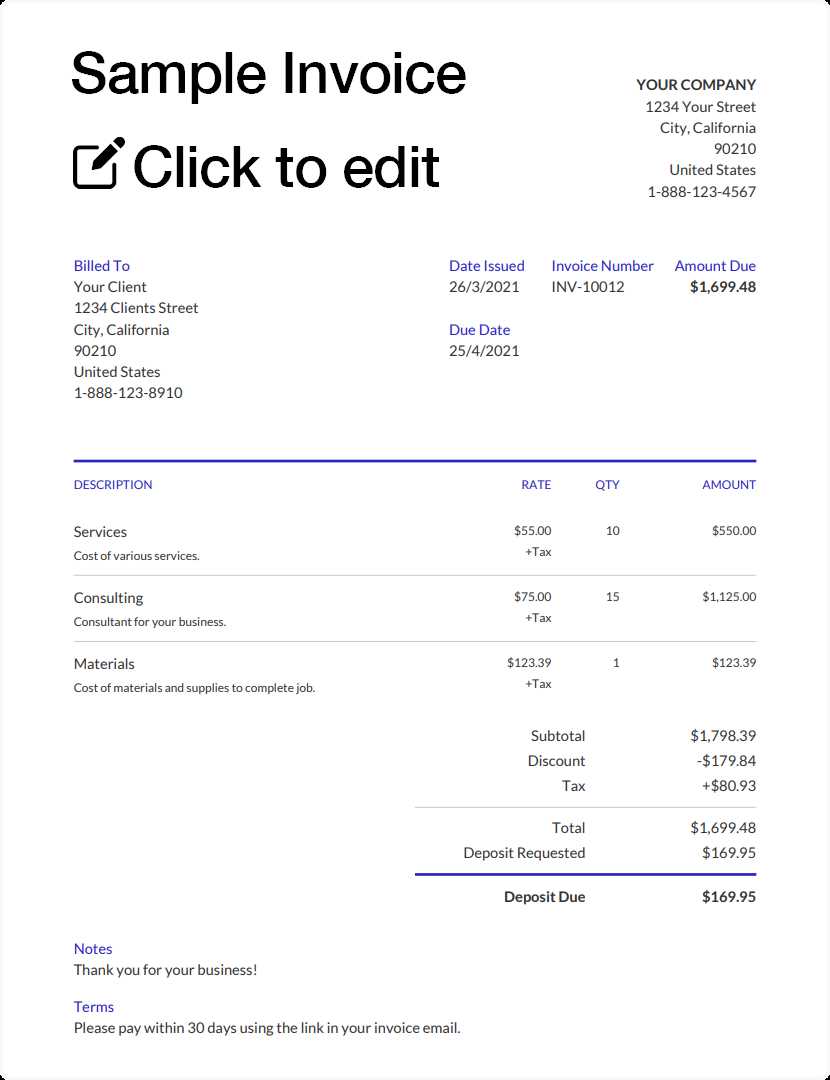

How to Create a Simple Invoice

Creating a straightforward billing document doesn’t have to be a complex task. The key is to organize important details in a clear, structured way so that both you and your clients can quickly understand the information. Whether you’re managing a freelance project or running a small business, a basic yet professional request for payment can help streamline your operations and ensure timely payments.

Steps to Follow

To begin, include your business name and contact details at the top of the form. This ensures that your client can easily reach you if they have questions or need clarification. Next, add the client’s information, including their name or company name, address, and contact number. This helps avoid any confusion if you have multiple clients or customers.

Breakdown of Charges

After the client details, list the goods or services provided along with the corresponding costs. For each item, include a brief description, the quantity or hours worked, the unit price, and the total amount. This transparency allows your client to review the charges and ensures there are no discrepancies. Finally, don’t forget to include the payment terms–this could include the due date and accepted methods of payment.

Key Elements of an Invoice Template

When creating a billing document, it is essential to include certain core components that ensure clarity and accuracy. These elements help both the business owner and the client understand the details of the transaction, avoid confusion, and facilitate a smooth payment process. A well-structured request for payment should not only look professional but also include all the necessary information.

At the top of the form, clearly state your business name, contact information, and logo if applicable. This establishes your identity and makes it easier for the client to reach out with any questions. Similarly, the client’s details, such as their name, address, and contact information, should follow to ensure proper record-keeping.

The next crucial part is the unique reference number–this helps track each transaction and simplifies bookkeeping. Also, be sure to include a detailed description of goods or services, their respective quantities, and unit prices. The total cost should be clearly visible, and any applicable taxes or discounts must be itemized separately.

Finally, include payment terms, including the due date, acceptable payment methods, and any late fees if applicable. A clear payment schedule not only sets expectations but also helps maintain a professional relationship with your clients.

Why Use Invoice Templates for Billing

Utilizing pre-designed structures for creating payment requests offers numerous advantages for businesses of all sizes. These ready-made documents save time, reduce errors, and help maintain a consistent and professional image across all financial communications. By relying on a standardized format, you ensure that each transaction is documented clearly and accurately, enhancing both efficiency and reliability.

Time Efficiency and Consistency

One of the biggest benefits of using structured formats is the time it saves. Instead of starting from scratch every time you need to request payment, you can easily fill in the necessary details. This not only speeds up the billing process but also ensures that each form follows the same consistent layout, making it easier for clients to understand and process.

- Reduces repetitive tasks: Pre-designed forms can be reused for every transaction.

- Improves organization: A consistent format makes it easier to track payments and follow up on overdue amounts.

- Enhances professionalism: Customizing a standard structure allows you to maintain a polished, cohesive brand image.

Minimizing Errors and Improving Accuracy

Another key advantage is the reduction of errors. With a clear, predefined structure, there’s less room for forgetting important details or miscalculating totals. The right format ensures that all critical information, such as the amount due, due date, and payment terms, is included and correctly displayed every time.

- Prevents omissions: All essential fields are included in the layout, reducing the chance of missing key details.

- Ensures correct calculations: Many billing forms come with built-in formulas for automatic calculation of totals and taxes.

- Promotes clarity: A well-structured form helps clients easily review and understand the charges, minimizing disputes.

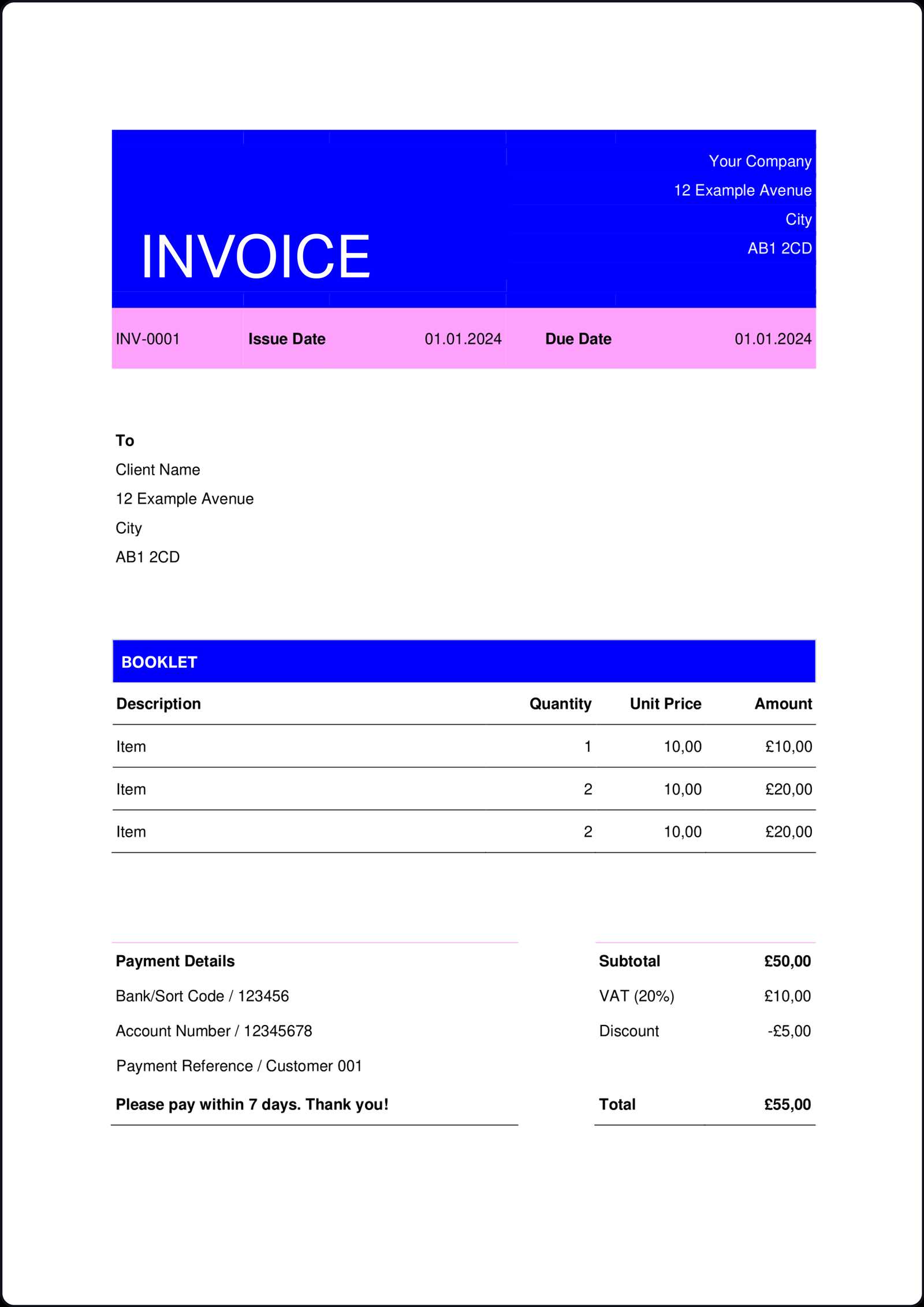

Customizing Your Invoice Template Effectively

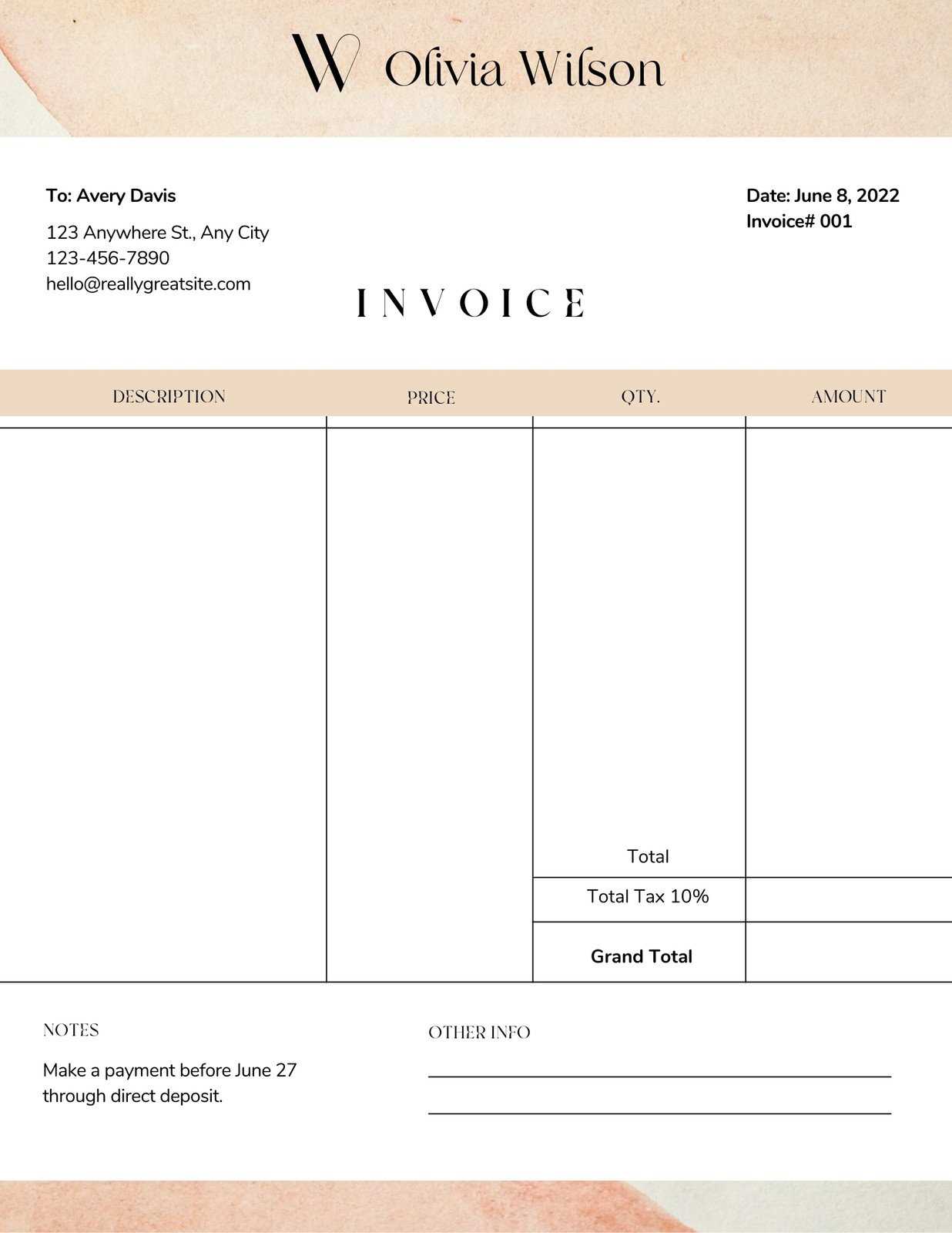

Tailoring your billing document to match your business needs is essential for creating a professional and efficient payment process. Customization not only enhances the document’s visual appeal but also ensures that all the necessary details are included in a clear and organized manner. A personalized billing form can reflect your brand identity and make the transaction process smoother for both you and your clients.

When customizing a billing form, focus on ensuring that the layout suits your specific industry requirements while maintaining clarity. It’s important to strike a balance between adding relevant details and keeping the document easy to read. The key is to include the right fields while avoiding unnecessary clutter.

| Field | Description |

|---|---|

| Business Details | Ensure your business name, address, and contact information are clearly visible at the top. |

| Client Information | Include the client’s name, address, and contact details to avoid confusion. |

| Service/Product Details | Provide a clear description of services rendered or goods delivered, with corresponding costs. |

| Payment Terms | Clearly state the due date, payment methods, and any late fees or discounts offered. |

Customizing these sections allows you to adjust the form to fit the specific needs of your clients while keeping the overall structure intact. By focusing on these key areas, you can create a personalized document that looks professional and is easy to understand, fostering trust and clear communication between you and your clients.

Choosing the Right Invoice Format

Selecting the appropriate structure for your billing document is crucial to ensure smooth transactions and clear communication with your clients. The format you choose can impact how easily your client processes the payment, and it should reflect both your business style and the nature of the transaction. A well-organized and clear design fosters professionalism and encourages timely payments.

When choosing the right layout, consider factors such as the complexity of the services or products offered, the volume of transactions, and the client’s preferences. A simple, clean design might work well for small projects, while more detailed formats may be required for complex or long-term engagements. It’s essential that the format you choose supports easy customization and can scale as your business grows.

| Format Type | Best For |

|---|---|

| Basic Layout | Small businesses or freelancers offering simple services with minimal details. |

| Detailed Format | Businesses with multiple products/services, requiring itemized lists or complex billing structures. |

| Graphic Design Focus | Creative professionals or businesses wanting to incorporate brand elements like logos, colors, or custom fonts. |

| Automated Layout | Large companies or businesses with frequent transactions who need a standardized format for efficient processing. |

Consider these factors when selecting your structure. The right format will help reduce confusion, ensure that you don’t miss important details, and make your business appear organized and reliable to your clients.

Free Invoice Templates for Small Businesses

For small businesses, finding a cost-effective solution to manage financial documentation is essential. Pre-designed, customizable forms can save time and effort, helping business owners maintain a professional appearance while ensuring that essential information is consistently included. Fortunately, many free options are available to help small businesses create well-structured and clear billing documents without the need for expensive software or custom designs.

Benefits of Using Free Billing Forms

Using free pre-designed formats offers several key advantages for small businesses:

- Cost-Effective: No need to purchase expensive software or hire professionals for document creation.

- Time-Saving: Ready-made structures mean you can quickly fill in details, streamlining your billing process.

- Customization: Many free options allow for easy editing to match your business style and specific needs.

- Professional Appearance: Well-designed forms improve the overall perception of your business and help you stand out.

Where to Find Free Templates

There are several platforms where you can access free forms suitable for different types of small businesses:

- Online Business Tools: Websites like Canva or Wave offer free customizable layouts that can be adapted to your needs.

- Microsoft Office and Google Docs: Both offer free, simple formats that are easy to download and edit.

- Freelancer Communities: Many freelancer websites provide free resources, including basic billing forms suitable for various industries.

Using these free resources allows small businesses to keep their operations efficient without sacrificing quality. With a few simple adjustments, you can have a professional document ready to use in no time.

How to Include Tax Information on Invoices

Accurately adding tax information to your billing documents is crucial for legal compliance and transparent financial transactions. Whether you’re required to charge sales tax or provide detailed tax breakdowns, including this information properly ensures that your clients understand the full cost of the transaction. A well-organized tax section helps avoid confusion and ensures that your business adheres to local tax regulations.

Key Tax Elements to Include

When adding tax details, there are several critical components that should be included:

- Tax Rate: Clearly state the percentage rate that applies to the goods or services provided. This could vary based on location or type of product.

- Tax Amount: Calculate and display the total amount of tax being charged for the transaction.

- Tax Identification Number: For businesses registered for tax purposes, it’s often necessary to include a unique tax ID number for transparency.

- Exemption Status: If any part of the transaction is exempt from tax, this should be clearly noted, along with the reason for the exemption.

Best Practices for Including Tax Information

Here are some helpful tips for presenting tax information effectively:

- Separate Tax from Total: Display the tax amount separately from the subtotal and total amounts to avoid confusion.

- Itemized Breakdown: If multiple tax rates apply to different items or services, break them down clearly for each line item.

- Check Local Regulations: Ensure that you’re using the correct tax rate based on your location and the type of goods or services you’re selling.

By following these steps, you can ensure that your billing documents are complete, accurate, and compliant with tax laws, providing a smooth experience for both you and your clients.

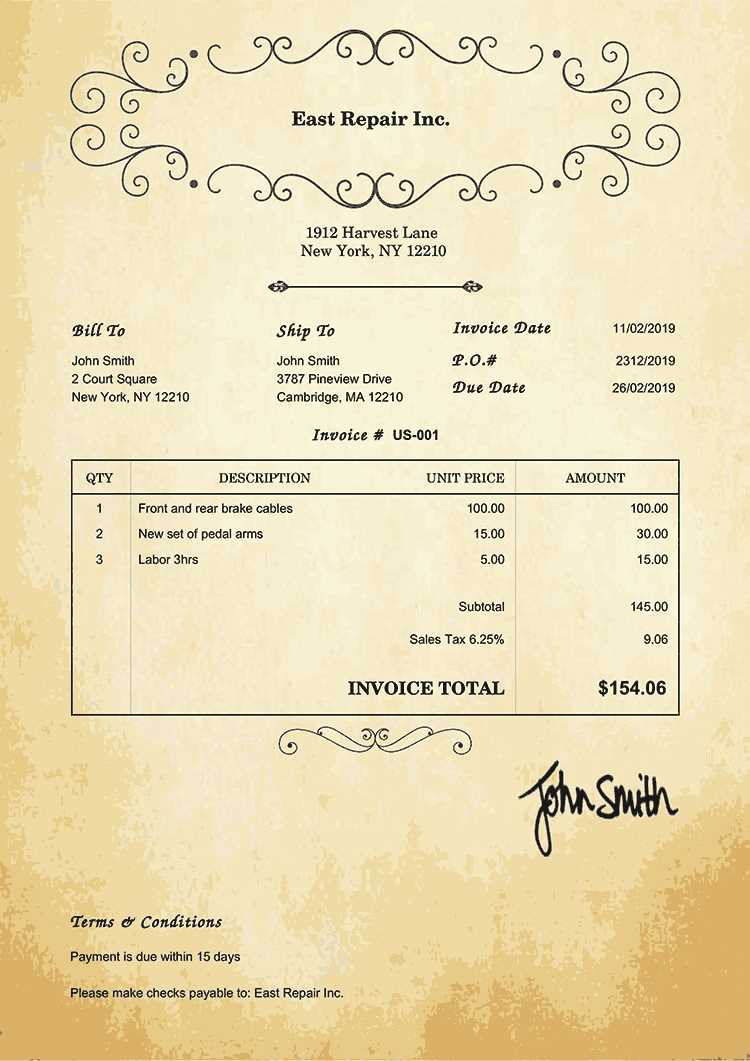

Best Practices for Invoice Layout

Creating a well-organized and easy-to-read billing document is essential for ensuring smooth transactions and clear communication. A clean, logical layout helps clients quickly understand the charges and reduces the likelihood of confusion or disputes. By following a few key principles when designing your form, you can present your information in a professional manner that fosters trust and encourages timely payments.

Key Layout Tips for Clarity and Professionalism

To make your billing form both functional and visually appealing, consider these best practices:

- Use a Clear Structure: Start with the business and client details at the top, followed by a breakdown of the services or products, and then the total amount due. This layout keeps the document organized and easy to follow.

- Ensure Readability: Use a simple, legible font like Arial or Times New Roman. Avoid overly decorative fonts that may distract from the content.

- Maintain Consistent Formatting: Align text and numbers neatly, use bold for headings, and make sure all amounts are clearly separated for easier reading.

- Use Proper Spacing: Adequate space between sections and lines will make the document feel less cluttered and more professional.

- Include a Payment Summary: At the bottom, provide a clear summary of the total due, including tax breakdowns, discounts, and final amounts, so clients can easily understand the total payment required.

Additional Design Elements to Enhance Your Billing Form

Consider these additional features to further enhance your billing document’s layout:

- Branding: Incorporating your business logo, colors, and font style can help reinforce your brand identity and make the document feel more personalized.

- Itemized Charges: If you’re offering multiple services or products, break them down by line item with descriptions, quantities, and individual prices. This makes the charges more transparent.

- Terms and Due Date: Make the payment terms, due date, and accepted payment methods prominent to ensure the client knows exactly w

How to Add Payment Terms to Invoices

Clearly stating payment terms on your billing documents is essential for managing cash flow and setting expectations with your clients. By outlining specific terms such as due dates, payment methods, and any late fees, you ensure both parties are on the same page regarding the financial aspects of the transaction. Properly defined payment terms also help avoid misunderstandings and encourage timely payments.

Key Payment Terms to Include

When specifying the payment terms, there are several crucial details that should be addressed:

- Due Date: Clearly state the date by which payment must be received. This helps prevent delays and provides a clear timeframe for both parties.

- Accepted Payment Methods: List the methods of payment you accept, such as credit cards, bank transfers, checks, or online payment systems like PayPal.

- Late Fees: Specify any penalties for overdue payments. For example, you may charge an additional percentage or a fixed amount for payments made after the due date.

- Early Payment Discounts: If applicable, offer a discount for clients who pay before the due date to incentivize prompt payments.

- Installment Plans: If you allow clients to pay in installments, outline the schedule, amounts, and due dates for each payment.

Best Practices for Displaying Payment Terms

To ensure that your payment terms are clear and easy to understand, follow these guidelines:

- Prominence: Place the payment terms at the bottom or in a designated section that is easy to find, ensuring clients don’t miss them.

- Clarity: Use simple and direct language to avoid any ambiguity about when payment is due and any potential fees.

- Consistency: Ensure that your payment terms are consistent across all billing documents to avoid confusion with clients who may receive multiple forms.

Including clear and precise payment terms helps set the right expectations from the start, ensuring a smoother transaction process and encouraging your clients to adhere to deadlines. By being transparent about your requirements, you also reduce the chances of delayed payments and potential conflicts.

Digital vs Paper Invoice Templates

Choosing between digital and paper formats for your billing documents depends on several factors, including the size of your business, the volume of transactions, and the preferences of your clients. Both methods offer distinct advantages and drawbacks, and understanding these differences can help you decide which option is best suited for your needs. Whether you opt for a traditional paper-based approach or a modern digital solution, it’s important to ensure that your forms remain professional, clear, and easy to use.

Comparing Digital and Paper Billing Forms

There are several key differences to consider when deciding between a digital or paper format for your payment requests:

Feature Digital Billing Forms Paper Billing Forms Cost Minimal to no cost, only requires digital tools or software. Cost of printing, paper, and postage. Speed Instant delivery via email or online platforms. Slower, requires mailing or physical delivery. Accessibility Can be accessed anywhere with an internet connection. Requires physical access to the document. Storage Easy to store and organize digitally with search functionality. Requires physical storage space, difficult to organize and search. Environmental Impact Environmentally friendly, reducing paper usage. Uses paper, which has a larger environmental footprint. When to Choose Each Option

Deciding which format to use depends on the nature of your business and the preferences of your clients:

- Digital: Best for businesses that deal with high volumes of transactions, have clients who prefer fast, paperless communication, or operate internationally.

- Paper: Suitable for businesses that work with clients who are more comfortable with traditional methods, or when legal or regulatory requirements mandate physical copies.

Ultimately, the choice between digital and paper forms comes down to convenience, cost, and client preferences. By carefully considering your needs and the specific demands of your clients, you can select the method that streamlines your billing process while maintaining professionalism.

Saving Time with Pre-designed Templates

Using ready-made document formats can significantly streamline the billing process, allowing you to focus on other important aspects of your business. Instead of starting from scratch every time you need to create a payment request, pre-designed structures provide a quick and easy solution. These ready-to-use forms can be easily customized to include your business details, client information, and specific charges, saving you time and reducing the potential for errors.

By utilizing pre-made documents, you eliminate the need for complex formatting or repetitive tasks. You simply input the relevant details, and the structure automatically arranges everything in an organized manner. This approach not only saves time but also ensures consistency across all your transactions, making your business look more professional and efficient.

Benefits of Using Pre-designed Billing Forms

- Faster Setup: With a pre-set layout, you can create a billing document in minutes rather than spending time designing it from the ground up.

- Consistency: Every document follows the same structure, ensuring uniformity in the way you present your business information to clients.

- Less Risk of Error: Templates are structured to include all necessary fields, reducing the chances of missing important details like due dates or payment terms.

- Professional Appearance: Pre-designed forms typically feature a clean, professional design, helping you present your business in the best light.

With the time saved, you can focus more on running your business and less on administrative tasks, all while maintaining a professional and efficient billing process.

Understanding Invoice Numbering Systems

Implementing a well-organized numbering system for your billing documents is essential for maintaining order and ensuring proper tracking of transactions. A clear and consistent numbering system not only helps in identifying and referencing past transactions but also plays a critical role in accounting, tax reporting, and audit processes. By using a structured approach to numbering, you can prevent confusion and improve the efficiency of your financial record-keeping.

Invoice numbers typically consist of a unique identifier that distinguishes one billing document from another. The number sequence can follow various patterns, depending on the business’s needs, size, or the volume of transactions. It’s important that the numbering system you choose remains simple yet flexible enough to scale with your business as it grows.

Common Numbering Formats

- Sequential Numbering: The most straightforward system, where each billing document is assigned the next number in a sequence (e.g., 001, 002, 003). This method is easy to implement and track.

- Date-based Numbering: This format uses the date of issuance in the numbering (e.g., 2024-001, 2024-002). It helps identify when the transaction occurred, making it useful for businesses that have fewer but more significant transactions.

- Client-Specific Numbering: Some businesses assign a unique set of numbers for each client, often combined with a sequential identifier (e.g., CLIENT001-001). This system is useful for managing large customer bases with multiple transactions.

- Custom Prefixes or Suffixes: You may use a combination of letters, numbers, or both (e.g., INV001, IN-001) to create a more personalized or descriptive number sequence for specific business needs.

Best Practices for Numbering Systems

- Consistency: Keep the format consistent across all billing documents to maintain clarity and ease of tracking.

- Non-repetitive: Ensure that each number is unique to avoid confusion or overlap in records.

- Flexibility: As your business grows, your numbering system should be scalable to accommodate a larger number of transactions.

- Record-Keeping: Always maintain a ledger or digital system to track assigned numbers, making it easier to reference previous transactions when necessary.

A well-thought-out numbering system not only makes it easier for you to manage financial records but also ensures that clients and accountants can easily locate past transactions. By adopting a method that suits your business needs, you can improve the overall efficiency of your billing and administrative processes.

Common Mistakes in Invoice Creation

Creating a billing document may seem straightforward, but even small errors can lead to confusion, delayed payments, and strained client relationships. Whether you’re new to business or experienced, it’s important to be aware of the common mistakes people make when drafting payment requests. Avoiding these pitfalls can improve the professionalism of your documents and help ensure smooth transactions.

Frequent Errors in Billing Documents

- Missing or Incorrect Contact Information: Failing to include accurate business and client details, such as addresses, phone numbers, or email addresses, can create delays in communication and cause confusion when it’s time to process payments.

- Inaccurate Payment Terms: Ambiguities around due dates, payment methods, or late fees can result in misunderstandings. Make sure that terms are clearly stated to avoid any confusion or disputes over when and how payment should be made.

- Omitting Tax Details: Failing to include applicable taxes or providing inaccurate tax rates can lead to compliance issues, fines, or customer dissatisfaction. Ensure that all tax information is included and calculated correctly.

- Unclear Descriptions of Products or Services: If the details of the goods or services provided are not clear, clients may have difficulty understanding the charges. Always itemize and describe each product or service clearly to avoid confusion.

- Mathematical Errors: Simple mistakes in adding up the total amount or calculating taxes can result in overcharging or undercharging. Double-check all calculations to ensure accuracy.

How to Avoid These Mistakes

- Double-check Information: Always verify that the details, including client contact information, business data, and payment terms, are correct before sending a bill.

- Use Automation Tools: Consider using invoicing software or online platforms that help minimize human error by automating calculations and keeping track of client details.

- Be Thorough with Descriptions: Always provide detailed descriptions for each item or service, including quantities, rates, and any other relevant information, to ensure full transparency.

- Review Payment Terms: Make sure that your payment terms are clearly stated and include the due date, accepted payment methods, and any applicable penalties for late payments.

By taking the time to avoid these common mistakes, you can create clear, accurate, and professional payment requests that foster good relationships with your clients and ensure timely payments.

How to Adapt an Invoice Template for Different Needs

Not all billing documents are created equal. Depending on your industry, the nature of your products or services, and the preferences of your clients, you may need to make adjustments to the standard structure. Customizing your billing documents can help you better meet the specific needs of your business and improve client satisfaction. The ability to modify key sections allows for greater flexibility while maintaining professionalism and clarity.

Identifying Key Areas for Customization

When adapting your billing document for different scenarios, there are several important elements that you may need to adjust:

- Client-Specific Information: If you’re dealing with different clients who have unique requirements, customize fields such as billing addresses, payment terms, and any references to specific projects or contracts.

- Product or Service Descriptions: For businesses offering a wide range of goods or services, consider adapting the itemized list of products or services to better suit each transaction, ensuring all details are clear and specific.

- Tax and Discount Rates: Depending on the jurisdiction or client agreement, tax rates and discounts can vary. Be sure to adjust these fields accordingly, especially if you deal with multiple regions or offer custom pricing.

- Payment Terms: Adjust payment deadlines, methods, and terms based on the type of client or project. For example, a long-term project might involve installment payments, while a one-time service may require immediate payment.

Best Practices for Tailoring Billing Documents

While customization is important, it’s crucial to maintain consistency and professionalism. Here are some best practices when adapting your billing documents:

- Keep It Simple: Avoid overcomplicating the structure. Focus on the key elements that are relevant to each transaction while ensuring clarity and simplicity.

- Maintain Consistency: Use consistent formatting and terminology across all customized documents to avoid confusion for your clients.

- Ensure Flexibility: Choose a flexible format that can easily accommodate different information without affecting the overall design or readability.

By adapting your documents to suit different situations, you can make sure they serve your business efficiently and effectively. Whether you’re dealing with a new client, a special promotion, or a long-term project, being able to tweak your billing system will help you stay organized and maintain strong client relationships.

Incorporating Your Brand into Invoices

Your billing documents offer more than just a way to request payment–they also serve as a representation of your business. By incorporating your brand elements into these documents, you can enhance your company’s identity and leave a lasting impression on your clients. Customizing your billing format to reflect your brand’s colors, logo, and style will create a consistent and professional experience that reinforces your brand’s image at every touchpoint.

Key Branding Elements to Include

To effectively incorporate your brand into your payment requests, consider including the following elements:

- Logo: Your company’s logo should be prominently displayed at the top of the document. This helps create instant recognition and reinforces your business identity.

- Brand Colors: Use your brand’s color palette to create a cohesive look. Subtle use of these colors can highlight key sections, such as totals or due dates, while maintaining a professional design.

- Typography: Choose fonts that align with your brand’s aesthetic. Whether it’s modern, classic, or playful, using consistent typography strengthens your visual identity.

- Tagline or Slogan: If your business has a tagline or slogan, consider adding it at the bottom of the document or in the footer. This adds a personal touch and reinforces your brand message.

Benefits of Branding Your Billing Documents

- Professionalism: Customizing your forms with branded elements makes your business appear more established and professional.

- Recognition: A branded document helps clients recognize your company instantly, which is especially valuable if they are dealing with multiple vendors.

- Consistency: Having consistent branding across all communication channels–including billing–builds trust and familiarity with your clients.

- Memorability: A well-branded document stands out and can make your business more memorable, increasing the likelihood of repeat business or referrals.

Incorporating your brand into your payment requests doesn’t just help with recognition–it adds a touch of professionalism and personalization that can foster stronger client relationships. By aligning every aspect of your business, including billing, with your brand identity, you create a cohesive and trusted experience for your clients.

Legal Considerations When Creating Invoices

When preparing billing documents, it’s essential to understand the legal aspects involved in the process. A well-drafted document not only facilitates payment but also ensures compliance with tax laws, contractual agreements, and consumer protection regulations. Failing to adhere to these legal requirements can result in disputes, penalties, or even legal action. By incorporating the necessary legal details, businesses can protect themselves and ensure transparent, hassle-free transactions.

Key Legal Elements to Include

There are several legal components that should be included in every billing document to meet regulatory standards:

- Business Identification: Ensure that your business name, address, and registration number (if applicable) are clearly stated. This is vital for identifying the party issuing the document and for tax compliance.

- Client Information: Include the name and address of the customer to whom the payment is owed. This helps prevent confusion in case of disputes or refunds.

- Accurate Payment Terms: Clearly define the payment due date, acceptable payment methods, and any penalties for late payment. This ensures both parties understand the agreed-upon terms.

- Tax Information: If applicable, include the appropriate tax rates, tax identification numbers, and the total tax amount charged. Many jurisdictions require that tax details are included for compliance purposes.

- Legal Disclaimers: Depending on the jurisdiction, it may be necessary to add certain legal disclaimers related to payments, such as late fees, interest, or dispute resolution procedures.

Potential Legal Pitfalls to Avoid

- Failure to Include Correct Tax Information: Many countries and regions require businesses to clearly state applicable taxes on their documents. Failure to do so can result in legal penalties.

- Vague Payment Terms: Avoid using ambiguous language when specifying payment deadlines or methods. Undefined terms can lead to confusion and disputes.

- Not Following Local Regulations: Laws regarding billing documents can vary significantly by country, state, or region. Be sure to research and comply with the regulations relevant to your business location and your client’s location.

- Omitting Important Details: Neglecting to include all necessa