Free Creative Invoice Template for Professional Billing

When managing your business finances, having a visually appealing and organized document for payments is essential. A well-structured and engaging bill not only conveys professionalism but also helps clients feel confident in your services. Whether you’re an entrepreneur, freelancer, or small business owner, the right design can make a lasting impression.

Customizing your billing layout allows you to reflect your unique style while keeping it functional. With the right tools, you can easily adapt the format to suit your business needs. These documents are more than just a request for payment–they are an extension of your brand and a reflection of your attention to detail.

Using accessible resources makes it easier to find a solution that works for you. With multiple options available online, you can download and modify templates that align with your aesthetic and business values. The goal is to streamline your billing process while maintaining clarity and professionalism.

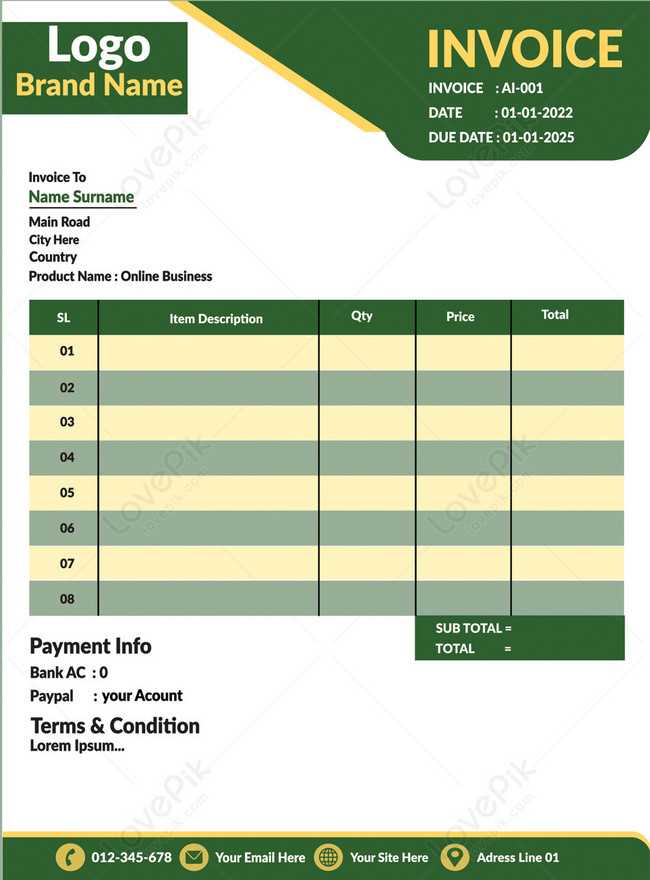

Free Creative Invoice Template Download

Finding the right layout for billing can be time-consuming and expensive, but fortunately, there are many high-quality options available at no cost. These documents are designed to help you manage financial transactions efficiently while presenting a polished, professional appearance. Whether you’re running a business, freelancing, or simply need to send a one-off bill, downloading an editable layout can save you time and effort.

Many websites offer downloadable files that you can easily customize to match your specific requirements. These resources typically include a variety of styles, from simple designs to more elaborate formats, ensuring that you can find one that best suits your brand or personal preference.

- Instant access to numerous designs

- Easy customization for various industries

- Compatible with popular software like Word or Excel

- Helps maintain a professional and consistent appearance

By choosing from a range of editable options, you can avoid starting from scratch, making the process of creating a polished document both faster and more straightforward. The availability of these tools allows you to focus on the core aspects of your business while still presenting a clean, well-organized request for payment.

Why Choose a Creative Invoice Template

Selecting an effective billing layout goes beyond just making a request for payment; it’s about creating an experience that reflects your professionalism. A well-crafted document can strengthen your brand identity, improve communication, and foster trust between you and your clients. The right design not only helps to keep transactions clear but also enhances your business image.

Using a well-designed document shows that you pay attention to detail, helping to build credibility and trust. When your billing materials are visually appealing and easy to understand, clients are more likely to view you as reliable and organized. This can result in faster payments and a stronger relationship with your customers.

Additionally, with the flexibility of modern layouts, you can incorporate elements that make your documents stand out, such as customized logos, colors, and fonts. These small touches can convey your business values and set you apart from others in your field. By choosing a professional, polished format, you demonstrate that your business is committed to quality in every aspect, not just in the services you provide.

Top Features of a Creative Invoice

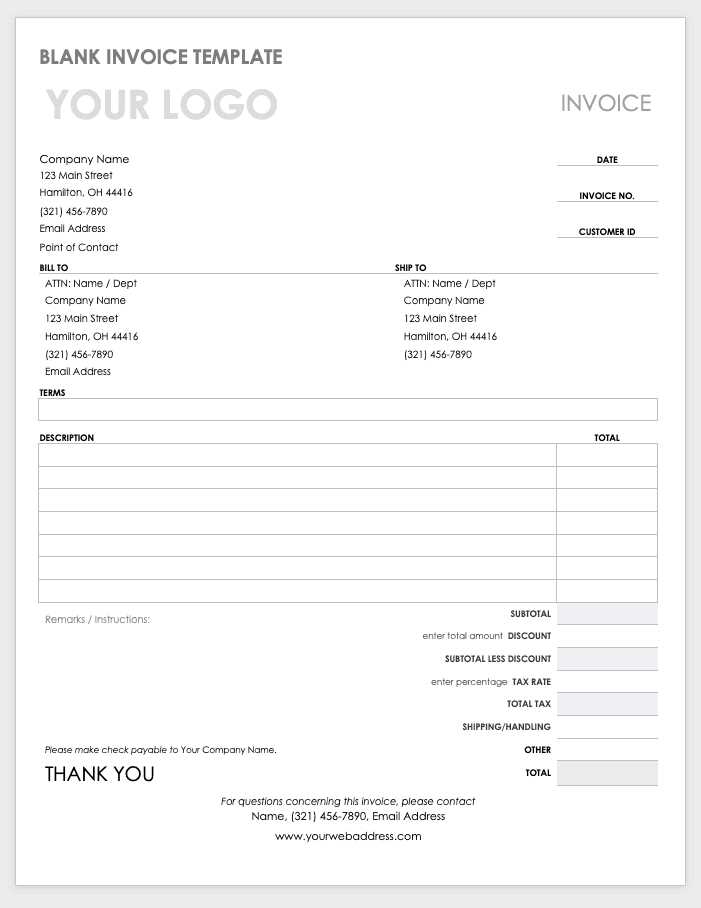

When selecting the perfect billing layout for your business, certain features can make a significant difference in both functionality and appearance. The ideal document should not only fulfill its practical purpose but also reflect your business’s professionalism. Here are the key elements that make up an outstanding design for financial transactions:

- Clear and Organized Structure: A well-organized layout ensures that all necessary information is easy to read and locate. Clients should quickly find the payment details, services provided, and any additional notes.

- Customizable Sections: The ability to tailor each section according to your business needs–such as adding a logo, changing fonts, or adjusting the color scheme–helps maintain consistency with your brand.

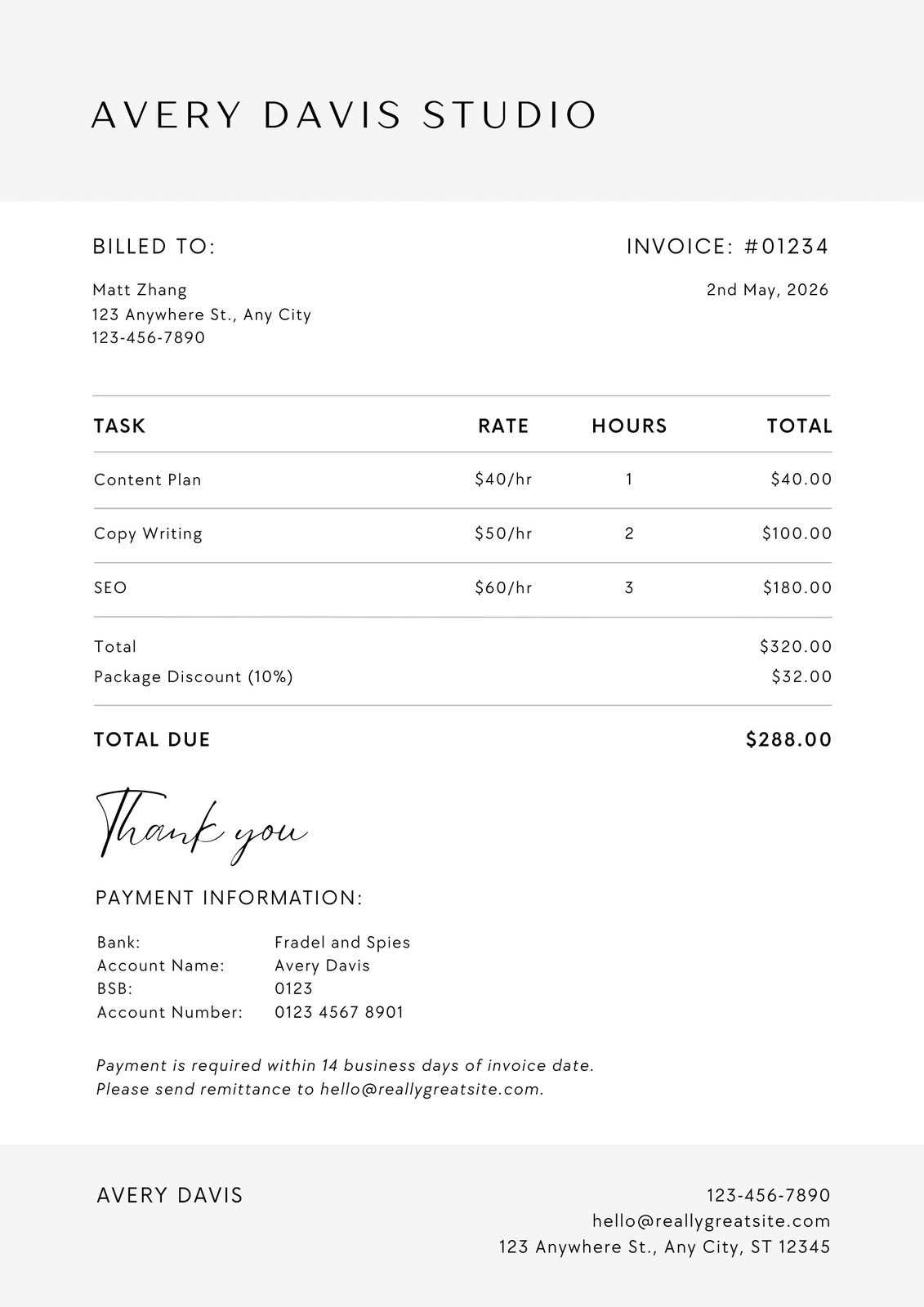

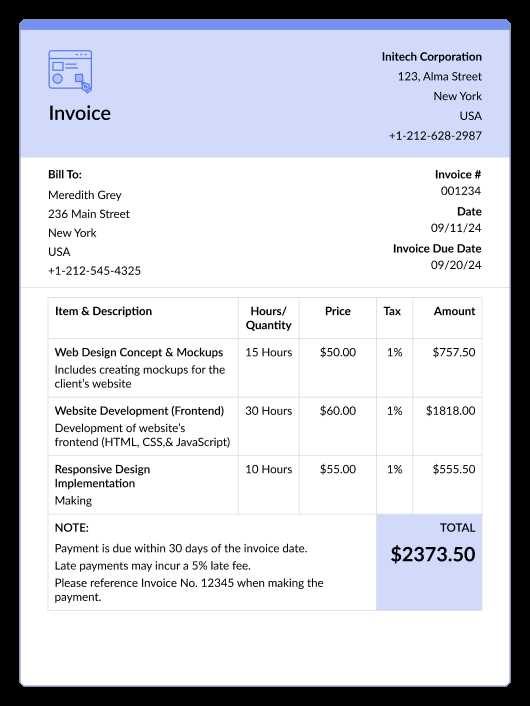

- Detailed Service Breakdown: Clearly outlining the products or services provided, including quantities, unit prices, and totals, is essential for transparency and preventing confusion.

- Professional Design Elements: A polished look, with balanced use of color and spacing, can enhance the document’s overall appeal. Design elements like lines, borders, and sections give a cohesive feel.

- Payment Terms and Information: It’s crucial to include payment methods, due dates, and late fee policies to avoid misunderstandings and ensure smooth transactions.

- Easy-to-Understand Language: The language used should be clear and concise, ensuring that clients can easily comprehend the information without any confusion.

- Option for Additional Notes: Including a section for personalized comments or notes allows you to convey extra information, such as thanking your client or offering future discounts.

These features work together to create a functional and attractive document that supports your business’s needs while ensuring a seamless experience for your clients. By integrating these elements, you can enhance both the efficiency and professionalism of your billing process.

How to Customize Your Invoice Template

Customizing your billing document allows you to add a personal touch and ensure it aligns with your business’s branding. By tailoring the layout to fit your needs, you can create a professional, clear, and aesthetically pleasing document that reflects your company’s identity. The process is simple and can be done using various software tools, providing flexibility and control over the final look.

Steps to Personalize Your Billing Document

- Choose a Layout: Start by selecting a basic structure that suits your needs. Whether it’s a simple design or a more detailed format, ensure that it includes sections for the necessary information.

- Brand Your Document: Add your company logo, choose your brand colors, and select fonts that reflect your brand’s style. This will give the document a consistent and professional appearance.

- Adjust Sections and Fields: Modify the fields to suit your business requirements. Include sections such as service descriptions, quantities, rates, and payment terms. Make sure to leave enough space for all details without overcrowding the document.

- Include Payment Information: Clearly indicate your payment terms, due date, and available methods. This ensures your clients know exactly how to settle their bills.

Additional Tips for Customization

- Tailor the Tone: If you’re running a creative business, a more casual tone and playful design might be appropriate, while a corporate setting might call for a more formal approach.

- Add Personal Notes: Include a section for any personalized messages, such as thank you notes or follow-up information, to build a positive relationship with your clients.

- Test Your Design: Before using your customized document regularly, review it to ensure that all information is displayed clearly and that there are no errors in calculations or formatting.

By following these steps, you can create a personalized and professional document that enhances your business’s image and simplifies the billing process for both you and your clients.

Free Invoice Templates for Small Businesses

Small business owners often need to manage various tasks, and handling financial transactions is one of the most important. Using a well-structured document for billing can simplify this process, reduce mistakes, and ensure that clients receive clear, professional requests for payment. Fortunately, there are numerous resources online where you can download ready-to-use layouts without any cost, which can be customized to fit your needs.

For small businesses, having a customizable, easy-to-use billing document is essential for maintaining a smooth cash flow and building strong client relationships. With the right tool, you can create documents that look polished and reflect the quality of your products or services. These resources typically include various designs, making it easier to choose one that suits your company’s style.

Many options are available that cater specifically to small businesses, offering:

- Simple and Organized Layouts: Easy-to-fill sections for service descriptions, payment terms, and total amounts.

- Customizable Fields: Allowing you to add your company’s branding, adjust item categories, and personalize text.

- Compatibility with Common Software: Formats that work with popular tools like Word, Excel, or Google Docs.

- Clear Payment Instructions: Providing clients with necessary information, such as payment methods and due dates.

By using these downloadable resources, small business owners can ensure that they are sending consistent and professional billing documents, which are essential for maintaining good business practices and promoting timely payments.

Benefits of Using Creative Invoices

Utilizing well-designed billing documents offers several advantages that extend beyond simply requesting payment. A polished and organized layout not only helps streamline the payment process but also enhances your business’s image, ensuring that clients take your transactions seriously. When done right, these documents reflect professionalism and attention to detail, which can have a positive impact on your overall business operations.

Below are some key benefits of using visually appealing and well-structured billing documents:

| Benefit | Description |

|---|---|

| Improved Client Perception | A polished document shows that your business is organized and trustworthy, making clients more likely to pay on time and recommend your services. |

| Brand Consistency | Customizing your document with your brand’s logo, colors, and fonts ensures that your business is easily recognizable and presents a cohesive identity across all communication channels. |

| Faster Payments | Clear and easy-to-read details make it simpler for clients to understand amounts due, reducing confusion and encouraging quicker payments. |

| Reduced Errors | A well-organized structure minimizes the risk of mistakes, ensuring that all relevant information is clearly presented and easy to follow. |

| Enhanced Professionalism | Using a thoughtful and appealing layout creates a strong impression of professionalism, helping you stand out from competitors who may use generic, less engaging formats. |

By using effective designs for your payment requests, you are not only improving efficiency but also investing in your brand’s credibility and long-term success. These documents serve as an important part of client interactions, making it easier for you to get paid while reinforcing your commitment to quality and attention to detail.

Design Tips for Professional Invoices

Creating a polished and effective billing document requires attention to both functionality and aesthetics. A well-designed payment request not only ensures clarity but also reflects your business’s professionalism and attention to detail. Simple design elements can go a long way in making your document more readable and visually appealing, ensuring that clients can easily understand the details and respond promptly.

Key Design Principles to Follow

Here are some essential tips to keep in mind when designing your billing document:

| Design Element | Tip |

|---|---|

| Clear Structure | Ensure that the layout is easy to follow, with distinct sections for services rendered, payment terms, and totals. This allows clients to quickly locate all relevant details. |

| Consistent Branding | Incorporate your company’s logo, colors, and fonts to make your document immediately recognizable and consistent with your other business materials. |

| Simple, Readable Fonts | Choose clear, professional fonts such as Arial or Times New Roman. Avoid overly decorative fonts that can make the document difficult to read. |

| Space and Alignment | Use adequate spacing and ensure that information is aligned properly. This improves readability and prevents the document from feeling cluttered. |

| Use of Color | Stick to a simple color palette–preferably using your brand’s primary colors. Avoid using too many bright or contrasting colors, which can make the document feel chaotic. |

Additional Design Considerations

- Incorporate Payment Details: Make sure payment instructions are clearly visible and include all necessary information, such as payment methods and due dates.

- Highlight Key Information: Use bold or larger fonts for important sections like the total amount due or due date, making them stand out for easy reference.

- Keep It Simple: Avoid unnecessary graphics or embellishments. A clean, minimalist design will always look more professional than an overly busy layout.

By following these design principles, you can create a polished and professional document that not only looks good but also functions well, ensuring smooth transactions and strengthening your business’s reputation.

How Creative Templates Enhance Brand Identity

Using customized and visually appealing billing documents goes beyond making financial transactions smoother–it helps reinforce your brand identity with every interaction. The design of these documents can serve as a powerful tool in communicating your business’s personality, values, and attention to detail. When crafted thoughtfully, they can turn a simple task like sending a payment request into an opportunity to showcase your company’s unique style.

By incorporating specific design elements, you can create a consistent look that aligns with your branding and makes a lasting impression. From color choices to font selection, every element can contribute to strengthening your overall brand image.

- Incorporating Logo and Brand Colors: Including your logo and company colors on every document ensures that your business remains visually consistent across all communication, making your brand more recognizable to clients.

- Personalized Typography: Using fonts that reflect your brand’s personality, whether formal or casual, can enhance the emotional impact of your documents, allowing them to feel more connected to your business’s identity.

- Custom Layouts: A layout that mirrors your brand’s style–whether minimalistic, bold, or playful–can convey your company’s character and professionalism, setting the right tone for your client relationships.

- Consistent Style Across Platforms: By maintaining design consistency across various documents (e.g., proposals, contracts, and payment requests), you help establish a cohesive brand presence that builds trust with your clients.

Every time you send out a billing document, it acts as a small ambassador for your business. If it reflects your brand accurately, it strengthens the client’s perception of your professionalism and reliability. Over time, these consistent design choices build brand recognition and loyalty, giving your company a competitive edge in the market.

Where to Find Free Invoice Templates

When you’re looking for a professional and easy way to create billing documents without spending money, there are numerous resources available online. Many platforms offer customizable designs that allow you to quickly download and tailor documents to fit your needs. Whether you’re running a small business or working as a freelancer, finding the right layout is essential for streamlining your financial processes.

There are several places to explore:

- Google Docs and Microsoft Word: Both offer free, ready-to-use layouts that you can easily customize within their document editing tools. These options are simple to access and modify without the need for additional software.

- Online Design Platforms: Websites like Canva and Adobe Spark provide a wide range of customizable billing layouts. These platforms often feature drag-and-drop functionality, making it easy to personalize designs quickly and efficiently.

- Dedicated Template Websites: There are numerous websites that specialize in providing downloadable document designs. Sites like Vertex42, Template.net, and Invoice Home offer a variety of choices for different industries, allowing you to pick a layout that suits your style.

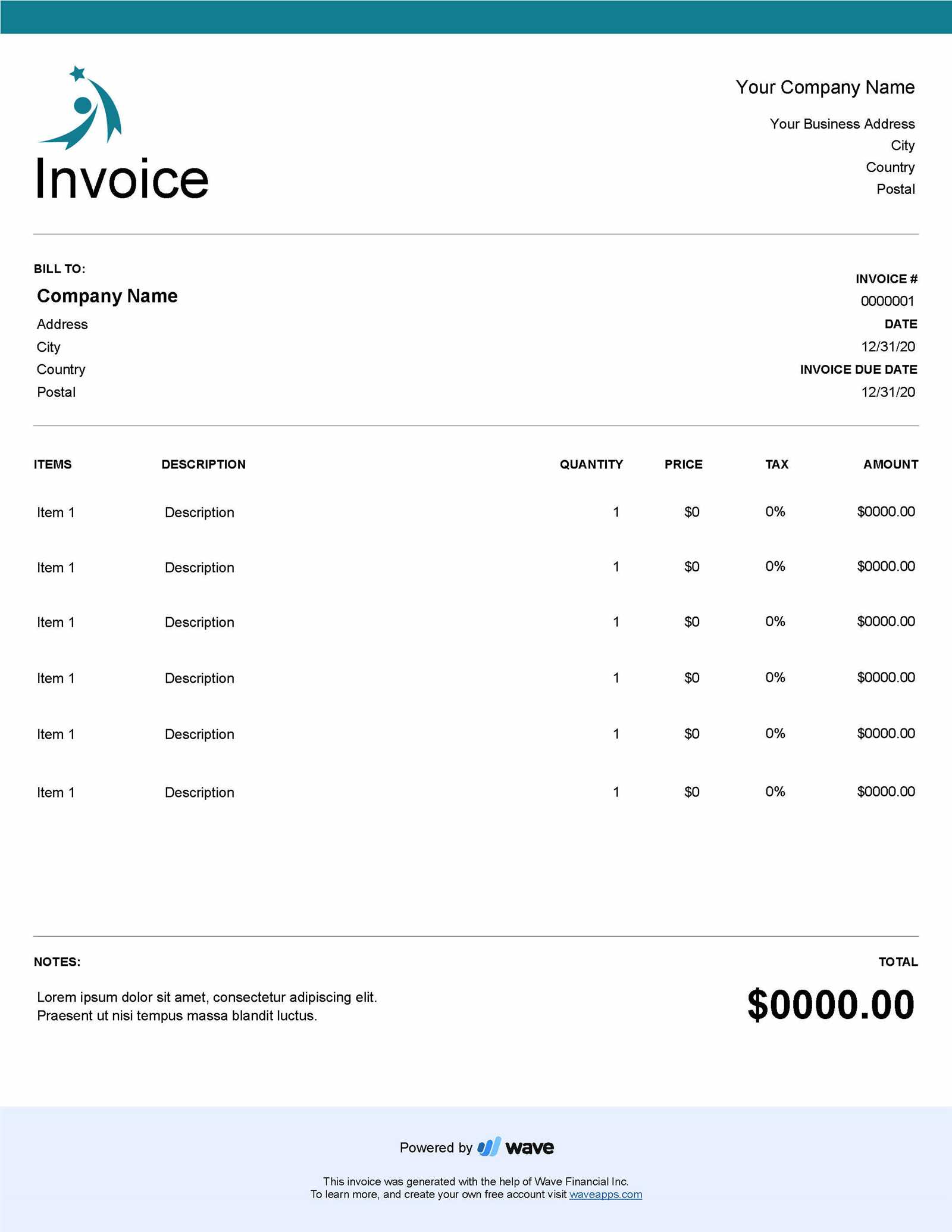

- Accounting Software Tools: Some free accounting software platforms, such as Wave or Zoho Invoice, offer built-in billing document options. These platforms often include features like automatic calculations and integration with payment processing systems.

By exploring these resources, you can easily find a billing layout that suits your business while saving time and effort. These documents can be fully customized to reflect your brand and ensure clarity, allowing you to focus on growing your business while maintaining professional financial practices.

Step-by-Step Guide to Using Invoice Templates

Creating professional billing documents can be a simple and efficient process if you use the right tools. With pre-designed layouts, you can quickly generate clean, organized payment requests tailored to your business needs. This guide will walk you through the steps to effectively customize and use these resources, ensuring you can create polished documents without starting from scratch.

Step 1: Choose the Right Layout

The first step is selecting a layout that matches your business’s style and needs. Consider the following when making your choice:

- Functionality: Ensure the layout includes all the necessary sections, such as item descriptions, total amount, and payment terms.

- Design: Choose a design that complements your brand’s colors, fonts, and overall aesthetic.

- Flexibility: Pick a format that allows for easy customization and can be adapted to your specific business requirements.

Step 2: Customize the Document

Once you’ve chosen your layout, it’s time to personalize it:

- Branding: Add your company logo, adjust the colors to match your brand palette, and choose fonts that reflect your business’s identity.

- Payment Information: Clearly input the due date, total amount due, and accepted payment methods. Include any additional terms like late fees if applicable.

- Service Breakdown: List the services or products provided, including their descriptions, quantities, and prices. This helps ensure clarity for the client.

Step 3: Review and Save

Before sending the document, take a moment to review it:

- Accuracy: Double-check the amounts, dates, and contact information to ensure everything is correct.

- Clarity: Ensure the document is easy to read and all the necessary information is clearly presented.

- Save the Document: Save your customized layout as a PDF or another commonly used file format to ensure it’s easily accessible for both you and your client.

By following these simple steps, you can quickly create professional billing documents that reflect your business’s identity and facilitate smooth financial transactions.

Invoice Templates for Freelancers and Contractors

For freelancers and contractors, having a streamlined and professional way to request payment is essential for maintaining a steady cash flow. Using well-designed documents not only helps ensure clear communication with clients but also reflects professionalism and attention to detail. These resources can be customized to fit the specific nature of your work, providing a clear breakdown of services rendered, payment terms, and other important details.

Freelancers and contractors often work with a variety of clients, which makes it important to have a flexible and customizable billing document. The key features to look for include:

- Detailed Breakdown: Clearly list the services or hours worked, including rates and any additional fees, ensuring that clients understand exactly what they are paying for.

- Payment Terms: Make sure to specify payment deadlines, acceptable methods, and any penalties for late payments. This will help avoid confusion later.

- Space for Additional Notes: Including a section for personal messages or thank you notes helps build rapport with clients, encouraging future business.

- Customization: The ability to add your logo, business information, and personalized branding ensures that your document reflects your business’s identity, further establishing trust and professionalism.

By using these tailored resources, freelancers and contractors can save time, minimize errors, and maintain a polished image when managing their billing tasks, helping to foster strong and lasting relationships with clients.

Common Mistakes When Designing Invoices

Designing payment requests might seem straightforward, but there are several common errors that can create confusion for clients and delay payments. These mistakes can stem from formatting issues, unclear details, or missed opportunities to reflect your brand’s professionalism. Avoiding these missteps ensures that your documents are not only functional but also contribute to smoother business transactions.

1. Lack of Clear Payment Information

One of the most important aspects of any payment request is ensuring the client understands how and when to pay. Common mistakes include:

- Missing Payment Terms: Not specifying when payment is due or the payment methods accepted can cause confusion and delays.

- Ambiguous Amounts: Failing to clearly list itemized services, fees, and the total amount due may lead to misunderstandings.

- Not Including Late Fees: If you have a policy for late payments, ensure it’s clearly stated to avoid any surprises for clients.

2. Poor Design and Layout

The layout and design of a payment request play a major role in its readability and professionalism. Common design mistakes include:

- Cluttered or Overcomplicated Layout: Including too many elements, unnecessary colors, or overly complex fonts can make the document hard to navigate.

- Unclear Section Headings: Each section–such as the list of services, totals, and payment instructions–should be clearly marked to make the document easy to follow.

- Small or Hard-to-Read Fonts: Using fonts that are difficult to read or too small may frustrate clients and delay the payment process.

3. Ignoring Branding

Many businesses overlook the importance of branding in their payment requests. Here are some mistakes to avoid:

- Not Using Your Logo: Failing to include your company logo reduces the document’s professional appearance and makes it less recognizable.

- Inconsistent Brand Colors: Using inconsistent colors or styles that don’t match your business branding can create confusion and reduce credibility.

- Missing Contact Information: Always include clear, up-to-date contact information to make it easy for clients to reach you with questions or concerns.

Avoiding these common mistakes can help ensure that your payment requests are both professional and efficient, contributing to smoother business operations and more timely payments.

Legal Considerations in Invoice Design

When designing payment requests, it’s crucial to ensure that the document not only looks professional but also meets legal requirements. A well-crafted billing document can serve as a legally binding agreement and protect your rights if there’s ever a dispute. Knowing what legal elements to include and ensuring compliance with local regulations can help you avoid costly mistakes and establish a clear record of transactions.

Key Legal Elements to Include

To ensure that your billing document holds up in case of a legal dispute, there are several key elements that should always be present:

- Business Details: Include your full legal business name, address, and tax identification number (TIN) or VAT number, depending on your location.

- Client Information: Clearly list the client’s name, address, and contact information to avoid any confusion about the transaction.

- Unique Invoice Number: Assign a unique number to each payment request. This helps with tracking and creates a clear record for both parties.

- Service Description and Pricing: Provide a detailed breakdown of the services provided, including quantities, rates, and any applicable taxes or fees. Transparency in pricing helps prevent misunderstandings.

- Payment Terms: Clearly state the payment due date, methods accepted, and any penalties for late payments. This protects both you and the client by setting clear expectations.

Compliance with Local Laws

Different countries and regions have specific regulations governing what needs to be included in a payment request. It’s important to be aware of the legal requirements in your jurisdiction:

- Tax Requirements: Make sure to include any necessary tax information, such as sales tax or VAT, based on the local laws.

- Currency: Indicate the currency in which payment is expected, especially if working with international clients. This helps avoid confusion regarding payment amounts.

- Legal Language: Depending on the nature of your business, some jurisdictions may require specific legal language or disclaimers to be included in the document.

By incorporating these legal considerations into your payment documents, you can avoid potential legal issues and create a more secure foundation for your business relationships.

How Creative Invoices Improve Client Relations

Billing documents are not just tools for collecting payments; they are an extension of your business’s relationship with clients. A well-designed payment request can foster a sense of professionalism, build trust, and make clients feel valued. By focusing on the details, such as design, clarity, and personalization, you can improve client satisfaction and strengthen long-term business relationships.

1. Enhancing Professional Image

When clients receive a well-crafted document, it helps project an image of professionalism and attention to detail. This reinforces your credibility and reassures clients that they are working with a trustworthy business. Key benefits include:

- Consistency: A polished, cohesive design that matches your overall branding creates a sense of reliability and trust.

- Clear Communication: A clean and organized document ensures that clients can easily understand the breakdown of services, fees, and terms, reducing the chances of disputes or confusion.

- Personalization: Customizing the document to include your logo and business colors makes the interaction feel more personal, which can enhance client satisfaction.

2. Strengthening Client Trust and Loyalty

Clients appreciate when a business goes the extra mile to create a professional experience. A well-designed payment request is one way to show that you care about the details, and this can lead to stronger, more trusting relationships. Here’s how it works:

- Transparency: Clear itemization of charges and well-defined payment terms reduce the risk of misunderstandings and build trust.

- Appreciation: Including a personal thank you message or additional notes expressing gratitude for the client’s business can leave a lasting positive impression.

- Consistency in Quality: Clients are more likely to continue doing business with you when they see consistent quality in every interaction, including billing.

By focusing on the quality and design of your payment requests, you can elevate the overall client experience. This attention to detail not only helps improve your client’s perception of your business but also creates a lasting impact that leads to repeat business and referrals.

Using Invoices for Better Financial Tracking

Effective financial tracking is essential for maintaining the health and growth of any business. One of the most efficient ways to keep track of income and expenses is by using well-structured billing documents. These records provide a clear and organized way to monitor payments, manage cash flow, and prepare for tax season. Proper documentation not only ensures that you get paid on time but also helps you gain insights into your business’s financial status.

By using organized and detailed payment records, you can improve your ability to track your financial performance and make informed decisions. Here are some ways billing documents contribute to better financial tracking:

1. Simplified Cash Flow Management

Billing documents help you stay on top of incoming payments and outstanding balances, making it easier to manage your cash flow:

- Clear Payment Terms: Having payment due dates and terms listed on each document allows you to track when payments are expected and plan accordingly.

- Itemized Records: Providing a detailed breakdown of products or services ensures you know exactly where your revenue is coming from, helping you assess which areas of your business are performing well.

- Payment Status Tracking: By noting whether payments are received or pending, you can quickly identify overdue accounts and take timely action to follow up.

2. Improved Financial Reporting

Well-organized billing documents contribute to better financial reporting by providing a clear record of all transactions. This makes it easier to:

- Generate Reports: Use payment records to generate regular reports that track income and expenses, helping you understand your financial health at any given time.

- Prepare for Taxes: Accurate billing records ensure you have all the necessary information for tax preparation, including sales tax and other deductions that can reduce your tax liability.

- Identify Trends: Regularly reviewing your billing documents can help you identify seasonal trends, sales patterns, and areas where you can optimize your pricing strategy.

By incorporating these strategies, you can use billing documents as a powerful tool for improving your financial management. Proper tracking not only helps ensure your business’s success but also gives you the insights needed to make strategic decisions for future growth.

Best Practices for Sending Professional Invoices

Sending a well-organized and timely payment request is crucial for maintaining positive client relationships and ensuring smooth cash flow. A professional approach not only helps expedite payment but also enhances your business’s credibility. By following a few best practices, you can streamline the billing process, reduce the risk of errors, and present a polished image to your clients.

1. Ensure Accuracy and Clarity

Before sending any payment request, it’s essential to double-check the details for accuracy and clarity. Any mistakes or ambiguities could lead to confusion and delays. Here are some key points to consider:

- Correct Client Information: Make sure the client’s name, address, and contact details are up to date and accurately listed.

- Clear Itemization: List the services or products provided with precise descriptions and agreed-upon prices, including taxes, discounts, and any other relevant details.

- Payment Terms: Clearly state the due date, acceptable payment methods, and any late fees to avoid misunderstandings.

2. Timely Delivery

Sending a payment request promptly is crucial for maintaining good financial flow. Clients expect timely reminders, and delays in sending the document can reflect poorly on your professionalism. Follow these guidelines to ensure timely delivery:

- Send Immediately After Service: Send the document soon after completing the work or delivering the product. This helps establish a routine and avoids any payment delays.

- Set Clear Deadlines: Ensure your payment terms specify a clear deadline, such as “Due within 30 days,” and avoid leaving any room for confusion.

- Follow Up on Outstanding Payments: If the payment deadline passes, send a polite follow-up email or message to remind your client of the outstanding amount.

3. Personalize and Brand Your Documents

Personalizing your payment requests helps create a stronger connection with your client and enhances your professional image. Here’s how you can customize your documents:

- Include Your Business Logo: Incorporate your logo at the top of the document to reinforce your brand identity and make the payment request more visually appealing.

- Tailor Your Language: Use professional, yet friendly language, and if appropriate, include a brief note of appreciation for your client’s bus