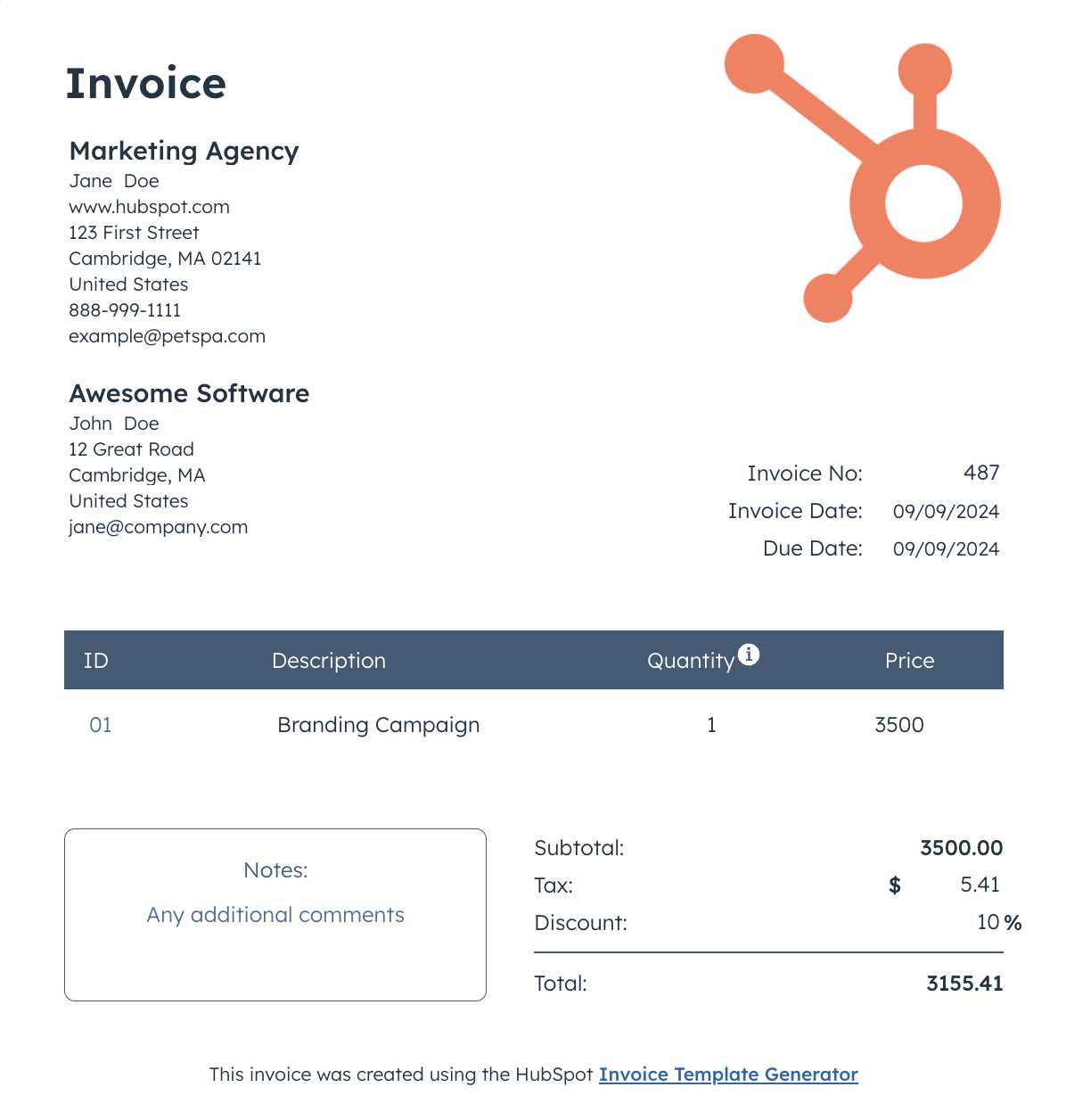

Generate Professional Invoices Quickly with an Invoice Template Generator

Managing billing tasks can be time-consuming and error-prone, especially for small businesses and freelancers. Creating professional invoices manually often involves repetitive steps that can lead to mistakes and inconsistencies. Luckily, there are tools available that simplify this process, allowing you to generate customized billing documents in just a few clicks.

These digital solutions offer a wide range of features that not only automate the creation of professional-looking documents but also help save time and reduce human error. Whether you’re working with clients regularly or just need to send occasional requests for payment, these tools offer customizable layouts, quick editing options, and automated calculations to make billing more efficient.

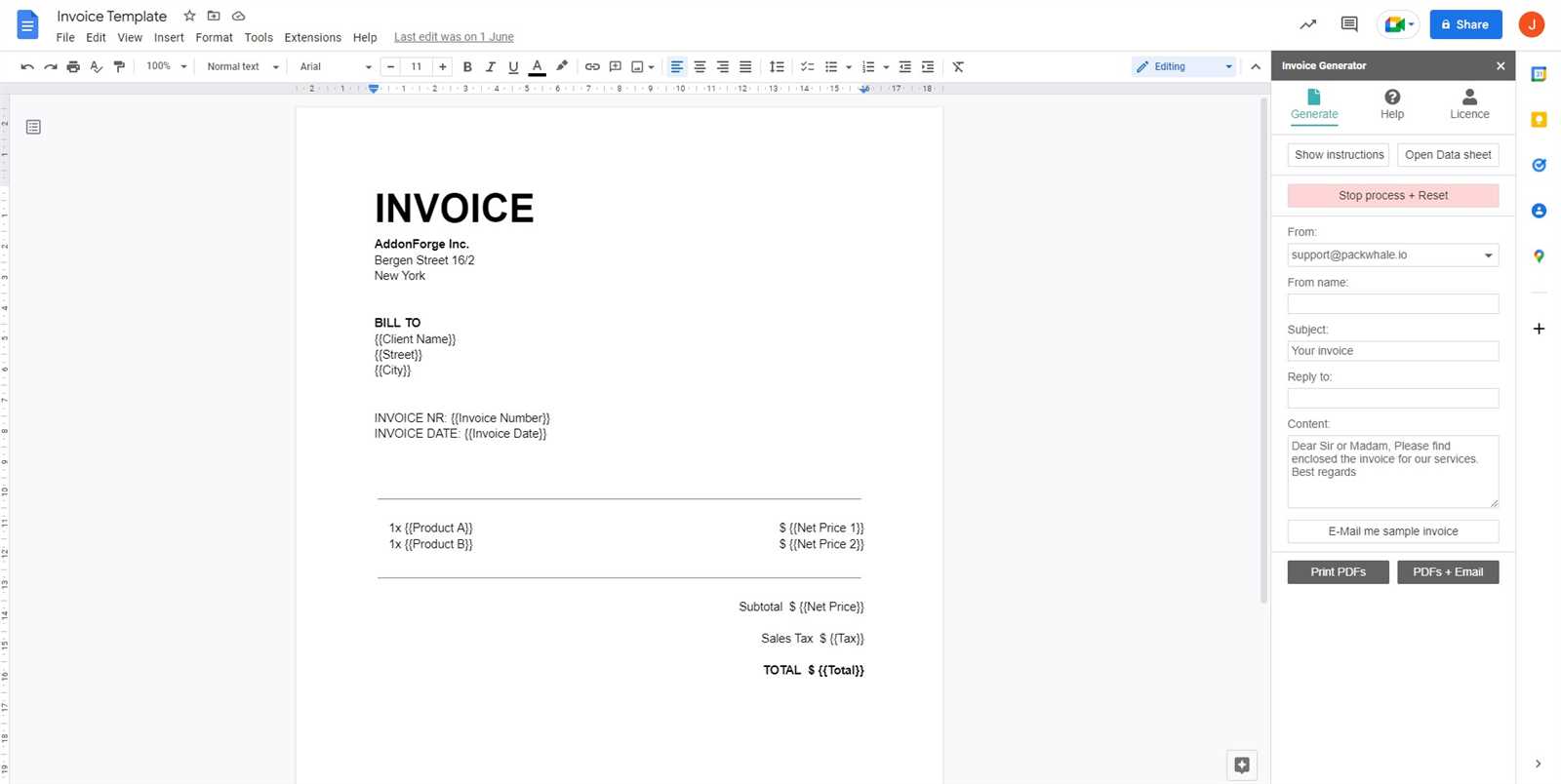

Automated tools can help you focus on growing your business rather than spending hours on administrative tasks. With intuitive interfaces, these platforms make it easy to produce clean, well-organized statements that reflect your brand. The ability to add your logo, adjust the design, and select the proper format ensures your documents always look polished and professional.

What is an Invoice Template Generator

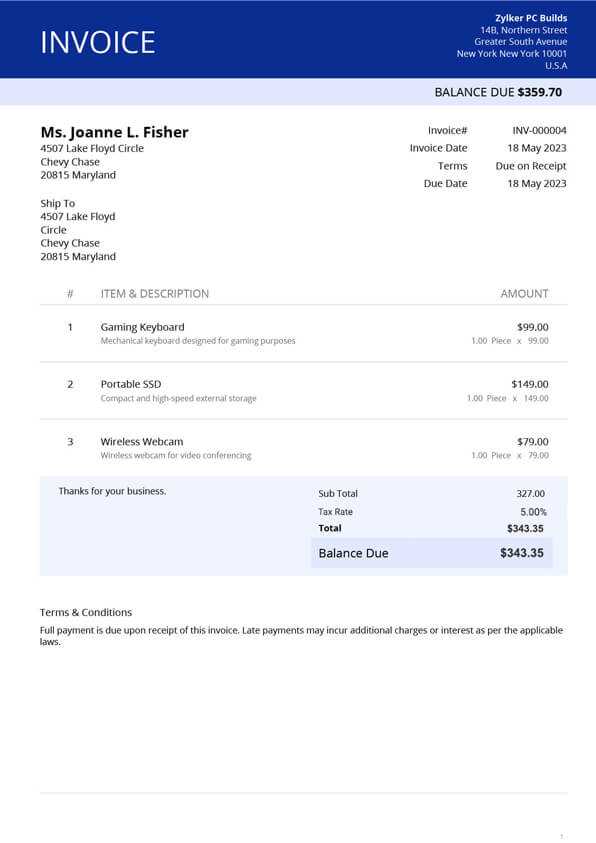

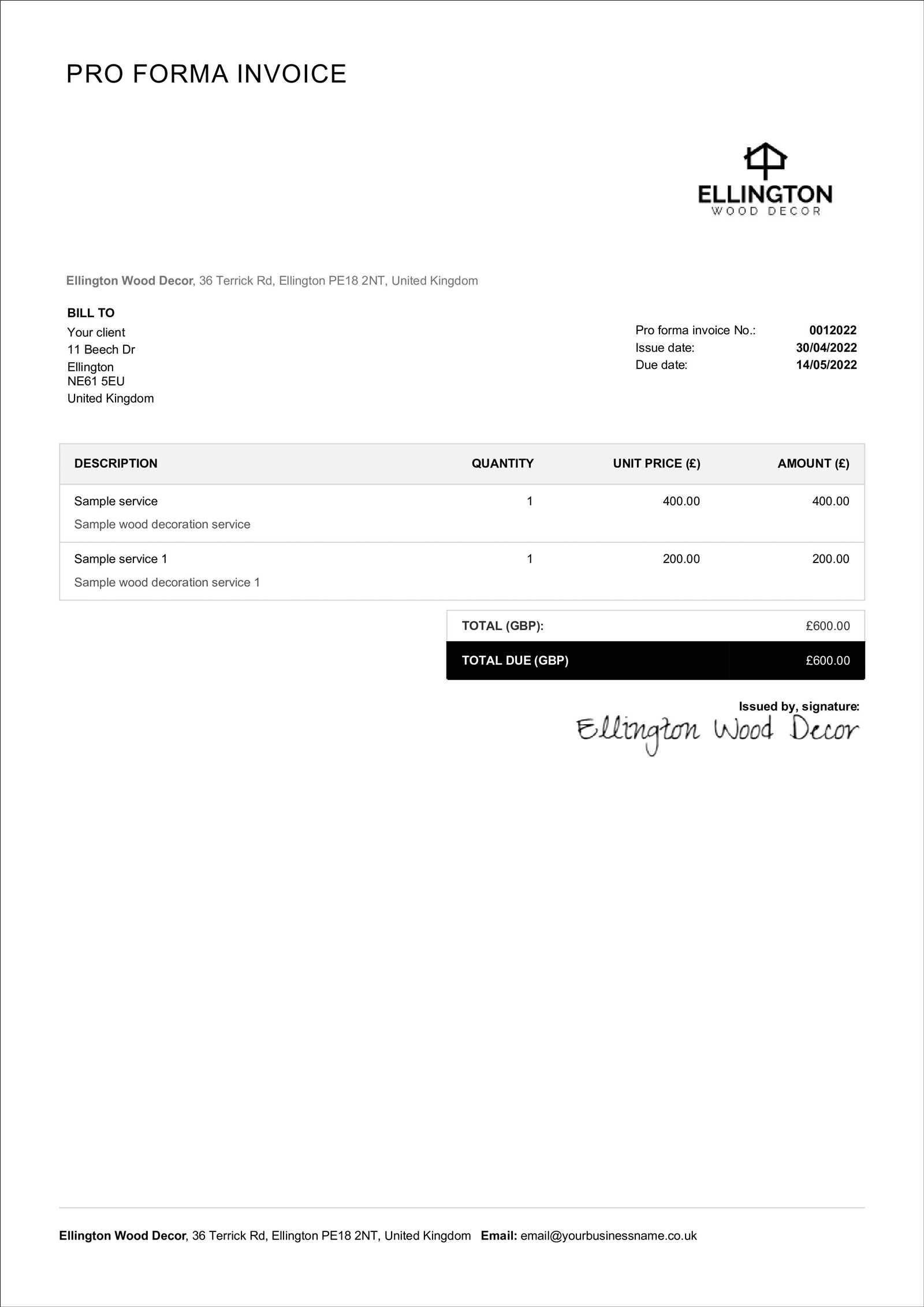

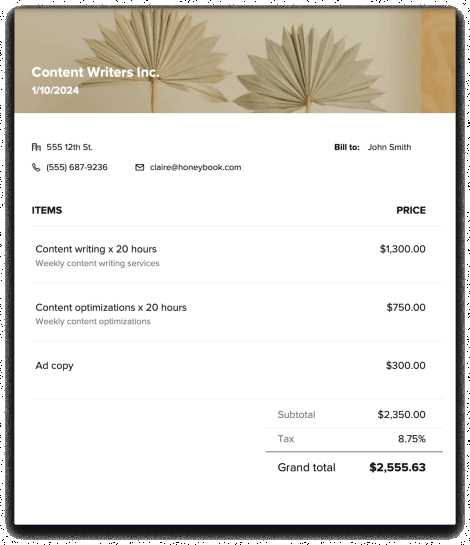

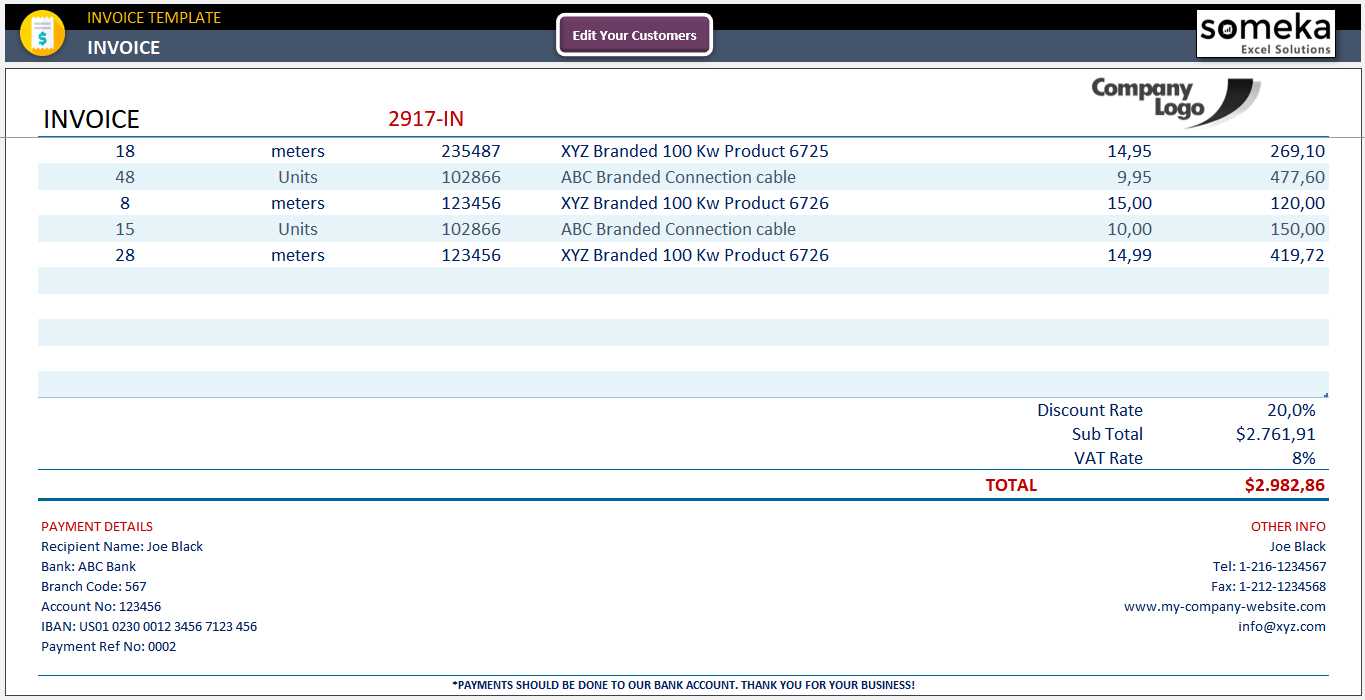

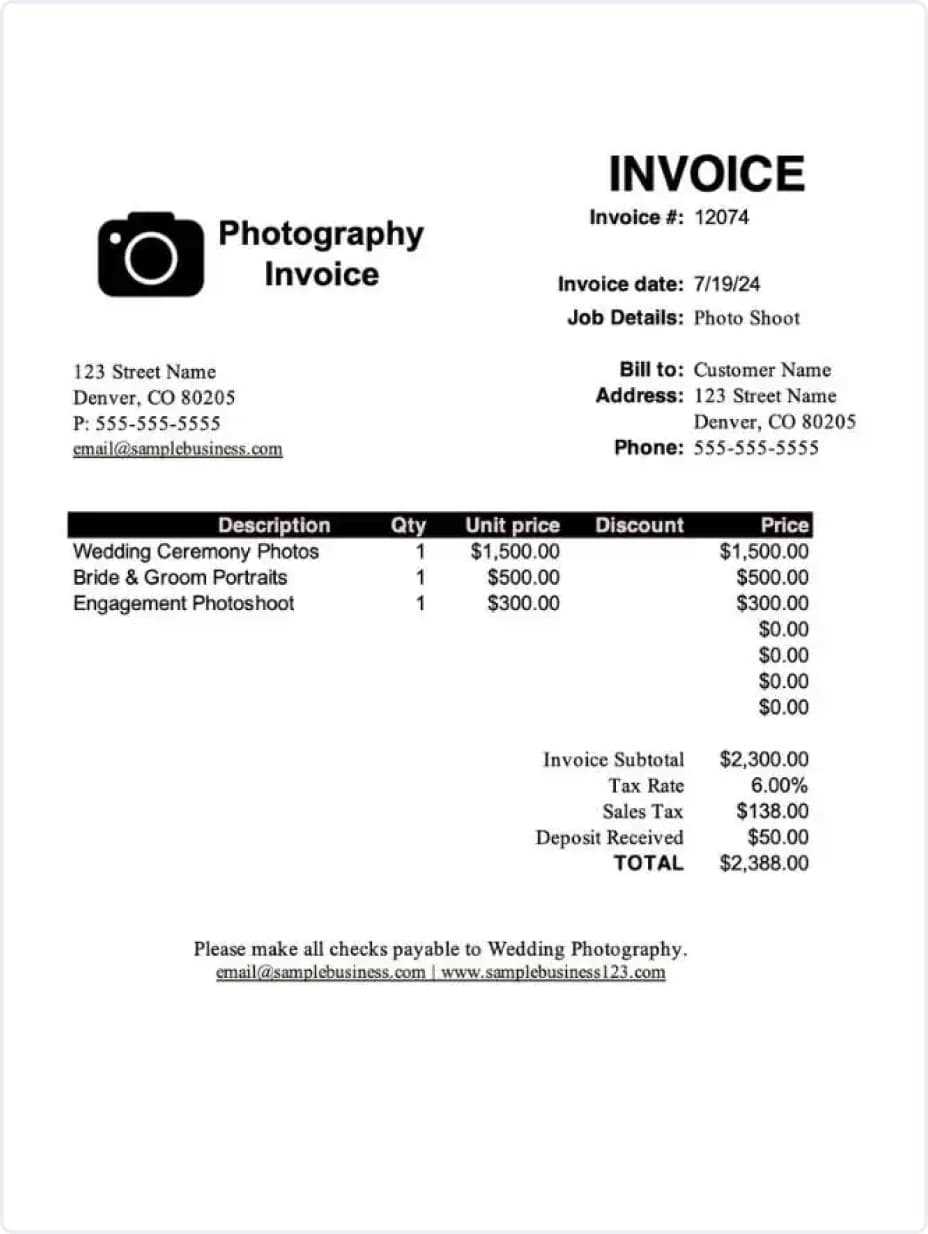

At its core, this tool is designed to help businesses quickly create professional billing documents. By offering pre-designed layouts and customizable fields, it allows users to streamline the process of crafting payment requests without the need for manual formatting. With just a few inputs, users can produce clear, accurate, and well-organized documents that are ready for sharing with clients.

Instead of spending valuable time building each document from scratch, you can leverage these tools to automate key aspects such as calculation, client information insertion, and branding customization. The end result is a polished, professional-looking document that can be easily modified to suit various needs or situations.

Key Features

| Feature | Description |

|---|---|

| Customization | Adjust the layout, fonts, and colors to match your brand. |

| Automatic Calculations | Input amounts and the tool will handle calculations for totals and taxes. |

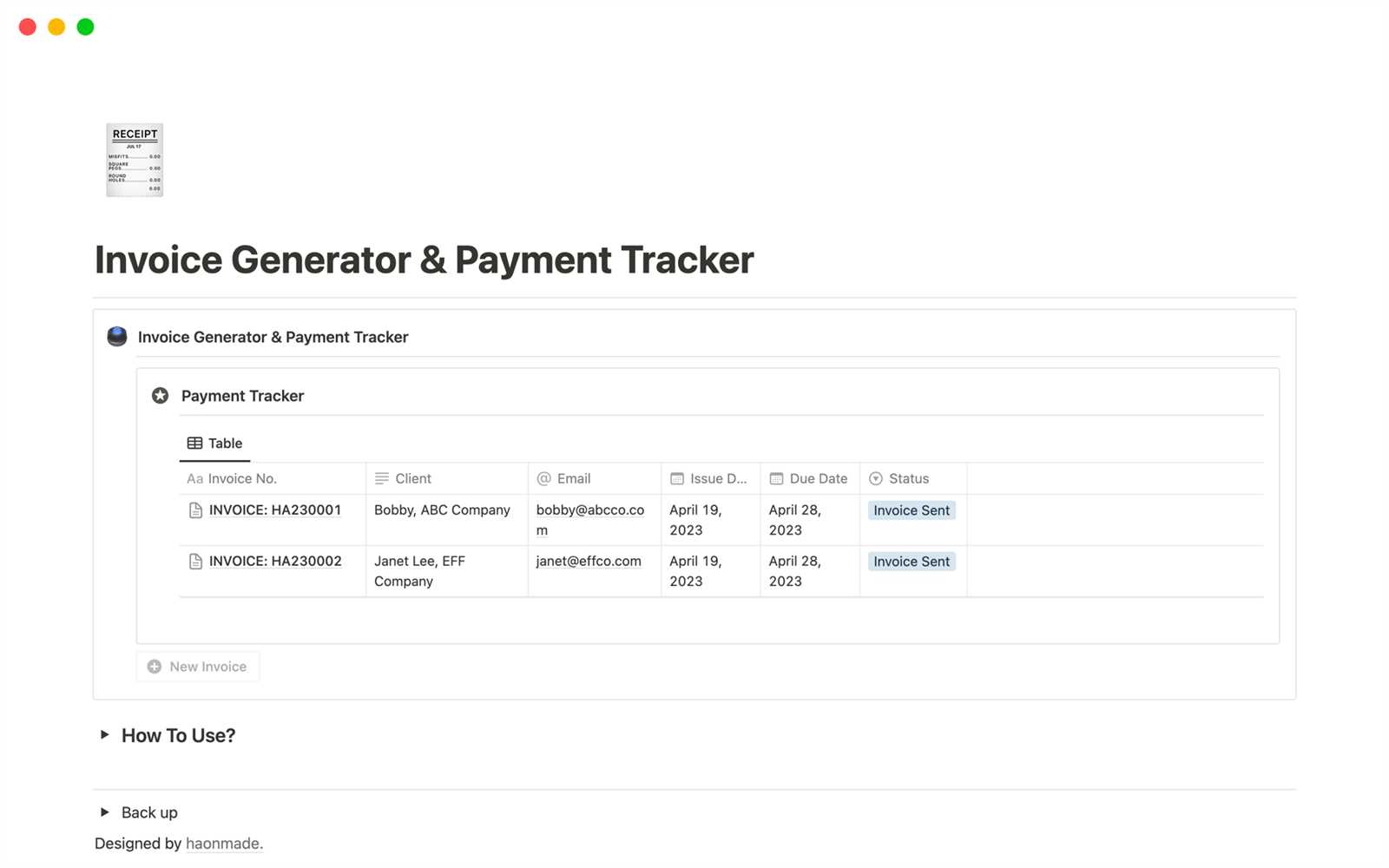

| Client Management | Store and quickly insert customer details into your documents. |

| Download and Share | Download the final document in various formats for easy sharing and printing. |

Why Use Such a Tool?

Using this type of platform can save a significant amount of time while ensuring consistency across all documents. Whether you’re a freelancer handling a few clients or a business owner managing multiple transactions, having a simp

Benefits of Using Invoice Templates

Automating the creation of billing documents brings several key advantages to businesses, especially for small owners and freelancers. By relying on pre-designed, customizable formats, you can reduce manual effort, increase consistency, and ensure accuracy in all your transactions. These tools not only simplify the process but also help maintain professionalism in communications with clients.

Time-Saving

One of the primary advantages of using automated document creation tools is the significant amount of time they save. Instead of manually entering client details, calculating totals, or formatting the layout, these platforms handle all of that for you. You can generate a polished, accurate document in minutes.

- Quick document creation with minimal effort.

- Automatic data insertion, including client details and services rendered.

- Instant calculations for tax and total amounts.

Consistency and Professionalism

Maintaining a consistent look across all your financial documents helps convey a professional image to your clients. Automated tools ensure uniformity in design, language, and formatting, making it easy to maintain high standards in your billing practices.

- Pre-designed styles ensure all documents look the same.

- Ability to add branding elements like logos and custom colors.

- Clear and easy-to-read formats for clients to understand.

Accuracy and Error Reduction

Manual entry of numbers and details increases the risk of human error, which can lead to costly mistakes. Automated systems reduce this risk by performing automatic calculations and ensuring all fields are filled correctly before generating the final document.

- Automatic tax and discount calculations.

- Built-in error checking for common mistakes.

- Prevention of skipped or incorrectly entered information.

How to Create Custom Invoices Online

Creating personalized billing documents online is a straightforward process that allows businesses to tailor each document to meet specific needs. These platforms offer user-friendly interfaces that guide you through the creation process, providing all the necessary tools to customize everything from the layout to the content. Here’s a step-by-step guide to getting started with online document creation.

Step 1: Choose a Platform

The first step is to select an online tool that offers customizable billing formats. There are several options available, ranging from free tools to premium services with additional features. When choosing, consider the ease of use, available design options, and whether the platform integrates with your other business tools.

- Look for platforms with drag-and-drop functionality.

- Ensure it allows for easy logo and brand color integration.

- Check for compatibility with accounting software.

Step 2: Customize the Layout

Once you’ve selected a platform, you can start personalizing the document’s layout. Most tools offer a variety of designs that can be adjusted to fit your brand. You can choose the sections you need, such as service descriptions, payment terms, or client contact details, and rearrange them to suit your preferences.

- Choose a clean, professional layout.

- Include essential details like payment methods and due dates.

- Position branding elements like your logo for maximum visibility.

Step 3: Input Client Information

After customizing the

Choosing the Right Invoice Format

Selecting the proper layout for your billing documents is crucial for maintaining professionalism and clarity. The right format not only ensures that all necessary details are included but also makes it easier for your clients to understand and process the information quickly. Depending on the type of business you run, your client’s preferences, and the nature of the transaction, there are various formats to choose from. Here’s how to determine the best fit for your needs.

Factors to Consider

When choosing a format, it’s important to take several key factors into account. The format should reflect both your brand and the specifics of your business model. Consider the following elements:

- Clarity: Choose a design that highlights important details like amounts, payment terms, and due dates.

- Branding: Ensure that the design supports your branding, with room for your logo and business colors.

- Client Preferences: Some clients may prefer a more formal document, while others might appreciate a simpler layout.

- Transaction Type: If you’re providing ongoing services, consider a format that tracks past payments or includes recurring billing features.

Common Layout Options

There are several common formats to choose from, each suited to different needs. Here are some of the most popular options:

- Basic Layout: A simple, no-frills format that includes essential information like items or services, prices, and payment terms. This is ideal for freelancers or small businesses with straightforward transactions.

- Detailed

Free vs Paid Invoice Generator Tools

When managing business finances, having the right tools to create and organize payment requests can significantly streamline the process. Whether you’re a freelancer, small business owner, or part of a larger enterprise, choosing the appropriate software to help with billing can be a challenging decision. There are two main options available: free and paid tools. Both come with distinct advantages and limitations that cater to different needs. Understanding these differences is crucial in making an informed choice.

Free tools are often appealing due to their no-cost nature, but they tend to offer limited features. These options may suit individuals or small businesses with minimal needs but may lack the advanced capabilities required for more complex financial tasks. On the other hand, paid options typically provide a more comprehensive set of features, offering greater flexibility and professional-grade capabilities. However, the upfront cost is a key consideration.

- Free Tools:

- Basic functionalities to create simple bills or payment requests.

- May include limited templates or customization options.

- Often supported by ads, and can have fewer updates or support.

- Best for personal use, startups, or businesses with minimal invoicing needs.

- Paid Tools:

- Advanced features like recurring billing, integration with accounting software, and detailed reporting.

- Better customization options, allowing for branding and personalized formats.

- Dedicated customer support and frequent updates.

- Ideal for businesses with complex billing needs or high transaction volumes.

Ultimately, the choice between free and paid software depends on the complexity of your financial processes, the size of your business, and the level of professionalism you aim to project to your clients. If you’re just getting started or only need basic functionality, free options might be sufficient. However, if you’re looking for scalability and enhanced features, a paid solution will likely be the better investment in the long run.

Key Features of Invoice Template Generators

When it comes to creating professional billing documents, certain features are essential for ensuring both efficiency and accuracy. These tools are designed to help businesses streamline the process of drafting financial requests, making them easier to generate, manage, and customize. By offering a range of functionalities, these platforms allow users to handle their billing needs effectively, whether for one-time projects or recurring services.

Customization Options

The ability to customize the layout and design of documents is one of the most important aspects of these tools. Customization allows businesses to maintain a consistent brand identity, which can help in building trust and professionalism with clients. Features to look for include the ability to modify fonts, colors, logos, and other visual elements. This level of personalization ensures that each document aligns with a company’s unique image.

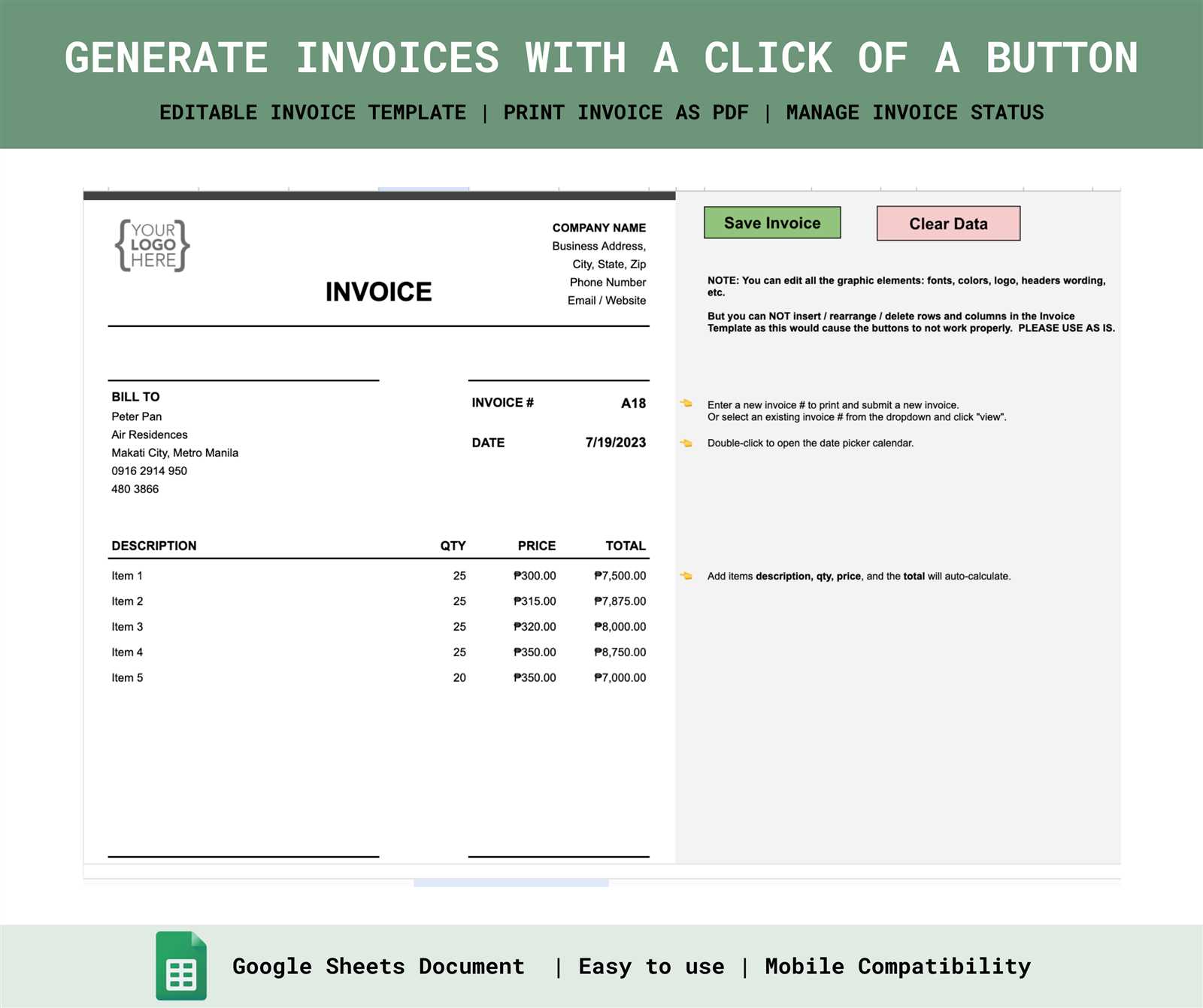

Automation and Recurring Features

Another key feature is the ability to automate certain tasks, such as recurring billing and automatic calculations. For businesses that offer subscription-based services or regular contracts, these tools can significantly reduce administrative overhead. With automation, users can set up recurring cycles and have the system send out billing documents at predefined intervals, saving time and reducing human error.

Feature Description Benefits Custom Design Ability to adjust the layout, fonts, logos, and color schemes of financial documents. Consistency in branding, increased professionalism, and personalized appearance. Automation Set up automated billing cycles and reminders for recurring payments. Time-saving, fewer errors, and easy management of long-term client relationships. Real-Time Calculations Automatic calculations for totals, taxes, and discounts based on input values. Improved accuracy, efficiency, and quicker document generation. Multi-Currency Support Capability to handle different currencies and international clients. Global reach, easier management of international transactions.How Invoice Templates Improve Business Efficiency Efficient financial documentation plays a vital role in any business operation. By utilizing pre-designed structures for creating payment requests, businesses can save significant time and reduce the chance of errors. These ready-made designs streamline the process of recording transactions, making it faster and more consistent. By eliminating the need to start from scratch with each document, organizations can focus on other important aspects of their operations.

Time Savings

One of the main advantages of using pre-structured documents is the considerable time savings. Instead of manually drafting each document from the ground up, a pre-formatted structure allows users to quickly input key information. With fields already set up for customer details, itemized costs, taxes, and totals, creating a financial document becomes a matter of just filling in the blanks.

- Predefined sections for all necessary data reduce time spent on formatting.

- Instant population of key fields like pricing, tax rates, and payment terms ensures accuracy.

- Reusable designs mean less effort is spent on creating new documents for every transaction.

Consistency and Accuracy

Using standardized structures ensures that every document follows a consistent format, which is essential for professional presentation. These structures also automate several calculations, reducing the chances of human error. Ensuring that all essential information is presented in a clear and organized manner not only boosts professionalism but also helps avoid confusion or mistakes that could affect payment collection.

- Consistency in layout enhances brand recognition and trust with clients.

- Automated calculations for totals, taxes, and discounts ensure greater accuracy.

- Less room for error when adding or modifying financial data.

By streamlining the creation process and ensuring consistency, pre-designed structures improve overall operational efficiency. This leads to quicker turnaround times for transactions, reduced administrative workload, and more reliable financial documentation, ultimately contributing to better business management and client relationships.

Design Tips for Professional Invoices

Creating a visually appealing and well-organized financial document is essential for maintaining professionalism and ensuring clear communication with clients. The design plays a key role in how the information is perceived and understood. A clean, structured layout not only makes the document easy to read but also reinforces your brand identity. Following some design best practices can help improve the overall effectiveness of your financial correspondence.

Here are some key design tips that can help you create a polished and professional-looking document:

Design Element Tip Why It Matters Branding Incorporate your logo, brand colors, and fonts to align with your company’s identity. Helps reinforce brand recognition and trust with clients. Clarity Use clear headings and subheadings to separate different sections (e.g., services, totals, taxes). Makes it easier for clients to navigate the document and understand charges. Whitespace Ensure adequate spacing between sections and text to avoid clutter. Improves readability and gives a more polished, professional appearance. Alignment Align text, numbers, and columns consistently for a neat, organized layout. Helps maintain a clean and structured look, improving comprehen Automating Invoice Generation for Small Businesses

For small businesses, time and resources are often limited. Manual processes, such as creating and sending financial documents, can be tedious and prone to error. Automating these tasks not only saves time but also reduces human error, ensuring consistency and accuracy in every transaction. By adopting automation tools, small business owners can streamline their billing processes, allowing them to focus on growth and customer service.

Benefits of Automation for Small Businesses

Automating the creation of financial documents offers several key advantages for small businesses:

- Time Efficiency: Automation allows businesses to quickly generate and send out payment requests without needing to manually input information each time.

- Reduced Errors: Automation minimizes the risk of human mistakes, such as incorrect calculations or missing information.

- Consistency: Automated systems ensure that all documents follow the same format and structure, maintaining a professional appearance across all communications.

- Improved Cash Flow: Automation can help ensure timely delivery and follow-up of billing requests, reducing delays in payments and improving cash flow management.

How Automation Works for Small Businesses

Automation tools typically allow small businesses to set up recurring billing cycles, integrate with accounting systems, and store client data for easy access. Once set up, these systems can generate the necessary documents at regular intervals, calculate totals and taxes automatically, and even send reminders for overdue payments. Many of these tools also provide reporting features, helping businesses track outstanding balances and identify trends in their cash flow.

By integrating automation into their daily operations, small businesses ca

How to Add Branding to Invoices

For any business, consistency in branding is essential for building recognition and trust with clients. Adding your brand’s elements to financial documents not only gives them a professional look but also reinforces your company’s identity. By incorporating logos, colors, and specific fonts, you can create documents that align with your brand’s image, enhancing the overall client experience.

Key Branding Elements to Include

There are several key branding elements that can be included in your financial documents to ensure they reflect your business’s personality and professionalism:

Branding Element How to Implement Benefits Logo Place your company’s logo at the top of the document, preferably near the header. Increases brand recognition and adds a professional touch. Brand Colors Use your brand’s primary colors for headings, borders, and section dividers. Maintains visual consistency across all business communications. Font Style Choose fonts that reflect your brand’s tone (e.g., modern, formal, creative) and use them for headings and body text. Ensures uniformity in all documents and reinforces your brand’s visual identity. Tagline or Slogan Free vs Paid Invoice Generator Tools

When managing business finances, having the right tools to create and organize payment requests can significantly streamline the process. Whether you’re a freelancer, small business owner, or part of a larger enterprise, choosing the appropriate software to help with billing can be a challenging decision. There are two main options available: free and paid tools. Both come with distinct advantages and limitations that cater to different needs. Understanding these differences is crucial in making an informed choice.

Free tools are often appealing due to their no-cost nature, but they tend to offer limited features. These options may suit individuals or small businesses with minimal needs but may lack the advanced capabilities required for more complex financial tasks. On the other hand, paid options typically provide a more comprehensive set of features, offering greater flexibility and professional-grade capabilities. However, the upfront cost is a key consideration.

- Free Tools:

- Basic functionalities to create simple bills or payment requests.

- May include limited templates or customization options.

- Often supported by ads, and can have fewer updates or support.

- Best for personal use, startups, or businesses with minimal invoicing needs.

- Paid Tools:

- Advanced features like recurring billing, integration with accounting software, and detailed reporting.

- Better customization options, allowing for branding and personalized formats.

- Dedicated customer support and frequent updates.

- Ideal for businesses with complex billing needs or high transaction volumes.

Ultimately, the choice between free and paid software depends on the complexity of your financial processes, the size of your business, and the level of professionalism you aim to project to your clients. If you’re just getting started or only need basic functionality, free options might be sufficient. However, if you’re looking for scalability and enhanced features, a paid solution will likely be the better investment in the long run.

Common Mistakes in Invoice Creation

Creating financial documents requires careful attention to detail, as small errors can lead to confusion, delays in payments, or even disputes with clients. Despite the simplicity of the task, many businesses still make common mistakes when drafting these documents. Recognizing and avoiding these errors can improve the efficiency of your billing process, enhance professionalism, and ensure smoother financial transactions.

Common Errors to Avoid

- Missing or Incorrect Contact Information: Failing to include accurate details such as the business name, address, or client’s contact information can cause delays and confusion. Always double-check these details before sending out a request.

- Inaccurate Payment Terms: Not clearly stating payment due dates, late fees, or acceptable methods of payment can lead to misunderstandings. Always specify payment terms upfront to avoid delays.

- Calculation Mistakes: Simple errors in adding up totals or applying tax rates can cause discrepancies. Ensure all calculations are correct and, if possible, use automated tools to minimize human error.

- Missing Description of Services or Goods: Not providing a detailed breakdown of what the client is paying for can lead to confusion or disputes. Be as specific as possible when listing services or products provided.

- Failing to Include a Unique Reference Number: Each financial document should have a unique identifier for tracking purposes. Without it, it becomes difficult to reference

How Invoice Generators Save Money

Efficient financial management is crucial for any business, and using automated tools for creating billing documents is one of the best ways to reduce operational costs. By eliminating manual processes and streamlining document creation, businesses can save both time and money. These tools help prevent errors, reduce administrative workload, and increase productivity, all of which contribute to significant cost savings over time.

Reducing Administrative Costs

Manual creation of financial documents requires time and effort from employees, which can add up to significant costs over time. By automating this process, businesses can free up their staff to focus on other important tasks. This leads to a more efficient allocation of resources and reduces the need for dedicated administrative personnel. In addition, these tools often offer customizable features that allow businesses to quickly create documents without additional training or expertise.

Preventing Costly Mistakes

One of the most common sources of financial losses in businesses comes from human errors, such as miscalculations or missing information. These mistakes can lead to disputes, delayed payments, and even potential legal issues. Automated systems significantly reduce the chances of such errors by performing calculations automatically and providing structured templates. This ensures accuracy in every document, minimizing the risk of costly mistakes.

Overall, automated tools for creating financial documents can save money by increasing efficiency, reducing the need for manual labor, and minimizing errors. By investing in these tools, businesses can enhance their profitability and maintain smoother, more reliable operations.

Why Templates Are Essential for Freelancers

Freelancers often face the challenge of managing multiple projects, each with unique requirements. As their workload increases, the need for efficiency and consistency in administrative tasks becomes even more apparent. Using pre-designed structures can streamline these tasks, ensuring that important details are never overlooked and that every document appears professional and polished.

One of the main advantages of using standardized formats is the time saved. By eliminating the need to manually craft each document from scratch, freelancers can focus more on their core work. This consistency not only saves time but also helps avoid errors that could arise from creating a new structure for each client or project.

Additionally, having a reliable format in place instills a sense of professionalism. Clients are more likely to trust freelancers who present their work in a clear, organized manner. With a consistent approach, freelancers can build stronger relationships with clients, ensuring their reputation grows and they maintain a professional image.

Finally, standardizing key documents allows for easier tracking and archiving. Whether it’s for future reference, tax purposes, or simply keeping records organized, having a pre-set system makes managing paperwork more efficient and reduces the risk of losing important information.

Best Practices for Invoice Customization

Customizing financial documents for each client or project is essential to ensure clarity, accuracy, and professionalism. A well-tailored document reflects not only the specifics of the work but also the freelancer’s attention to detail. By adapting the structure to suit different needs, freelancers can create a more personalized and organized experience for both themselves and their clients.

Here are some best practices to follow when personalizing your financial documents:

Practice Description Clear Branding Ensure your name, logo, and contact details are prominently displayed. This enhances your professional image and makes it easy for clients to reach you. Itemized Breakdown Provide a detailed list of services, hours worked, or products delivered. This helps avoid misunderstandings and ensures clients can see exactly what they are being charged for. Consistent Formatting Stick to a uniform layout for all your financial documents. Consistency improves readability and makes your documents look more organized. Clear Payment Terms Specify payment due dates, accepted payment methods, and any late fees. Clear terms protect both parties and prevent payment delays. Personal Touch Incorporate a brief note of appreciation or a custom message for each client. A personal touch can build stronger client r Security Features in Invoice Template Tools

When handling financial documents, ensuring the safety of sensitive information is crucial. Freelancers and small businesses rely on various tools to create, send, and store important records. Without proper security measures in place, these documents could be vulnerable to theft, unauthorized access, or fraud. Advanced security features are essential to protect both the creator and the recipient from potential risks associated with digital transactions.

Here are some key security features that can enhance the safety of your documents:

- Data Encryption: Encrypting sensitive information, such as client details and payment amounts, ensures that even if documents are intercepted, they remain unreadable to unauthorized parties.

- Access Control: Limiting access to specific users helps prevent unauthorized individuals from viewing or editing the document. This can include password protection or user authentication protocols.

- Two-Factor Authentication: Adding an extra layer of protection by requiring two forms of verification when accessing or sending documents reduces the risk of unauthorized access.

- Audit Trails: Tracking every action taken with a document, such as edits or downloads, helps to ensure accountability and trace any unauthorized modifications.

- Secure Cloud Storage: Storing documents in a secure, encrypted cloud environment ensures that they are safely backed up and can be accessed from any device without compromising security.

By implementing these security measures, freelancers can have pea

- Free Tools: