Complete Guide to Using an E Invoicing Template for Efficient Billing

In today’s fast-paced business environment, managing financial transactions digitally has become essential for organizations of all sizes. The shift from manual paperwork to automated processes not only saves time but also improves accuracy and compliance. As businesses continue to adopt modern technology, digital invoicing has emerged as a crucial tool for streamlining payment collections and enhancing operational efficiency.

Digital billing systems are designed to simplify the creation, delivery, and tracking of payment requests. By replacing traditional paper invoices with electronic formats, businesses can eliminate errors, reduce costs, and ensure faster processing. These systems can be tailored to meet specific business needs, making them a versatile solution for a wide range of industries.

With the right tools and strategies, businesses can ensure that their financial processes are efficient, secure, and cost-effective. The transition to digital methods is not only about convenience but also about staying competitive in an increasingly paperless world. Whether you are a small business owner or part of a large corporation, adopting digital billing can greatly benefit your bottom line.

What is an E Invoicing Template

In the digital era, businesses are increasingly adopting electronic systems to streamline financial transactions. One of the most useful tools in this process is a structured format for creating and managing billing documents. This system allows businesses to automatically generate, send, and track payment requests without the need for paper. By using a standardized approach, companies can ensure that their billing processes are both efficient and error-free.

Key Features of Digital Billing Formats

A digital billing format typically includes all the necessary fields such as the recipient’s details, the items or services provided, payment terms, and the total amount due. Automation plays a central role in these formats, allowing businesses to quickly fill in and update information without manual input. This reduces the risk of mistakes and ensures consistency across all financial communications.

Advantages of Using Structured Billing Formats

Using a digital document creation system for financial records offers several benefits. It reduces paperwork, speeds up the payment cycle, and enhances transparency for both the business and its customers. Digital records are also easier to store and retrieve, helping companies stay organized and maintain better control over their finances. These benefits, combined with easy integration into accounting software, make electronic billing solutions an essential tool for modern businesses.

Benefits of Using Digital Invoices

Adopting electronic billing systems offers numerous advantages for businesses looking to streamline their financial processes. By moving away from traditional paper-based methods, companies can experience significant improvements in efficiency, accuracy, and cost-effectiveness. Digital solutions not only save time but also provide greater control over the entire billing cycle.

Speed and Efficiency are among the primary benefits. Digital documents can be generated and sent instantly, eliminating the need for printing, mailing, or waiting for physical delivery. This results in faster processing times, enabling businesses to receive payments more quickly and improve cash flow.

Another key benefit is reduced errors. Manual entry of payment details can often lead to mistakes, such as incorrect amounts or missing information. Electronic systems automatically populate fields, reducing human error and ensuring accuracy across all financial records.

Cost savings are another significant advantage. Eliminating the need for paper, postage, and other manual processes helps businesses reduce operational expenses. Furthermore, the time saved by automating the billing process can be reallocated to more strategic tasks, improving overall productivity.

Finally, digital systems offer enhanced security and organization. Electronic records are stored securely, reducing the risk of losing important documents. They are also easier to retrieve, helping businesses maintain a well-organized archive for future reference or auditing purposes.

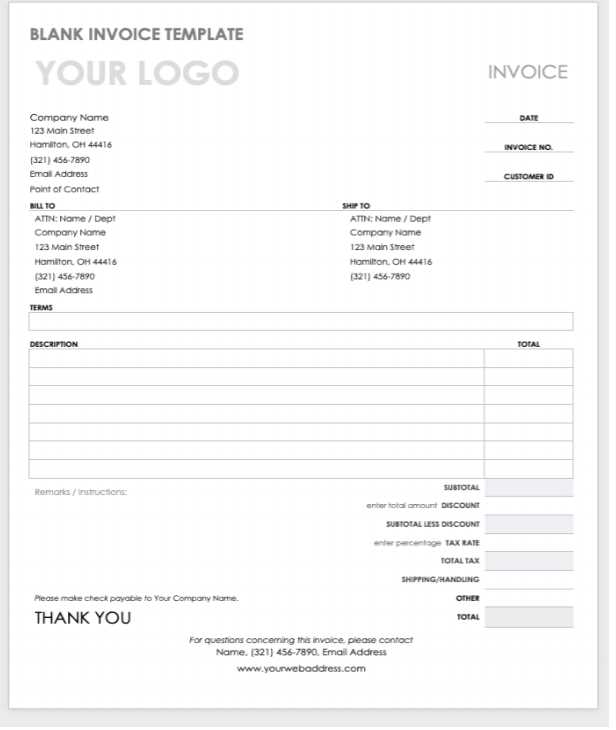

Key Elements of an E Invoicing Template

When creating a digital document for billing purposes, several essential components must be included to ensure clarity, accuracy, and compliance. These elements help businesses create consistent and professional financial communications, making the process easier for both the sender and the recipient.

Essential Information for Financial Documents

- Sender’s Information: This includes the name, address, contact details, and business registration number of the issuing company.

- Recipient’s Information: The details of the customer or client, including their name, address, and contact information, must be clearly stated.

- Invoice Number: A unique identifier for the document, allowing both parties to easily track and reference the transaction.

- Date of Issue: The date when the document is generated, which helps establish payment timelines and due dates.

Transaction Details

- Description of Products or Services: A clear and detailed list of the goods or services provided, along with any relevant quantities, unit prices, and product codes.

- Payment Terms: This section outlines the payment method, due date, and any applicable late fees or discounts for early payments.

- Total Amount Due: The total sum the customer is required to pay, including taxes, shipping costs, and any additional charges.

- Banking Information: If payments are made through bank transfer, the company’s banking details (account number, IBAN, etc.) should be provided.

Including these key elements ensures that the document is complete and transparent, reducing the chance of disputes and making it easier for both businesses and customers to manage their finances effectively.

How E Invoicing Streamlines Business Operations

Digitizing financial documentation has transformed how businesses handle their financial transactions. By replacing manual processes with automated systems, companies can operate more efficiently, reduce human error, and speed up their entire workflow. This shift has a significant impact on productivity, customer satisfaction, and overall cost savings.

- Faster Processing Times: Electronic systems allow for immediate creation, sending, and tracking of billing records. This cuts down on the time spent manually processing paper documents and waiting for physical delivery, resulting in quicker payment cycles.

- Reduced Administrative Work: Automation reduces the need for manual data entry and repetitive tasks. This frees up valuable time for employees to focus on more strategic business activities, enhancing overall efficiency.

- Minimized Errors: By eliminating manual input, digital billing methods drastically reduce the chances of errors such as incorrect amounts, missing data, or miscalculations. Automated systems ensure consistency across all documents.

- Better Cash Flow Management: Electronic payment requests are faster to generate and can be tracked in real time. Businesses can more easily follow up on overdue payments, improving cash flow and reducing the time spent on collections.

Furthermore, by incorporating digital systems into their operations, companies can integrate their financial records with other software, such as accounting tools and enterprise resource planning (ERP) systems. This integration leads to smoother data synchronization, ensuring that financial reports are accurate and up-to-date.

- Improved Transparency: Electronic records are easily accessible and can be tracked throughout the entire billing cycle. Both businesses and clients can monitor the status of payments, reducing misunderstandings and disputes.

- Cost Savings: With fewer physical resources needed–such as paper, postage, and storage–businesses can save on operational costs. These savings can then be reinvested into other areas of the company.

In short, adopting digital processes for financial transactions not only speeds up the administrative side of operations but also improves accuracy, reduces costs, and enhances overall business performance.

Choosing the Right E Invoicing Platform

Selecting the right platform for generating and managing digital payment requests is essential for ensuring smooth financial operations. A well-chosen solution can save time, enhance accuracy, and provide greater control over your financial processes. When considering which platform to adopt, it’s important to evaluate several key factors that align with your business needs and goals.

First, consider the user-friendliness of the platform. The system should be easy to navigate and not require extensive technical knowledge. A simple, intuitive interface allows your team to focus on their tasks without wasting time on training or troubleshooting.

Integration capabilities are another critical factor. Choose a solution that seamlessly integrates with your existing software, such as accounting tools or enterprise management systems. This integration ensures smooth data flow between different departments, reduces manual input, and helps maintain consistency across your financial records.

Security is paramount when dealing with financial information. Ensure that the platform uses robust encryption and complies with industry standards for data protection. This guarantees that sensitive client and payment details are safe from potential breaches.

Additionally, look for a platform that offers customization options. Your business may have unique needs, such as specific fields, branding, or payment terms, that require customization. A flexible platform can accommodate these requirements, providing a more tailored experience for both you and your clients.

Lastly, consider the cost-effectiveness of the solution. While it’s tempting to choose the most advanced or feature-rich option, it’s important to balance functionality with budget. Look for a platform that provides the right features at a reasonable price, and be mindful of hidden costs such as transaction fees or additional charges for premium features.

Choosing the right platform is a decision that can significantly improve your billing processes, providing greater efficiency, security, and cost savings in the long run.

How to Create an E Invoicing Template

Creating a digital document for managing payment requests is a straightforward process, but it requires attention to detail to ensure accuracy and professionalism. A well-designed system can save time, reduce errors, and improve the overall efficiency of your financial workflows. By following a few simple steps, businesses can set up an automated system that meets their specific needs.

Step 1: Select a Platform or Software

The first step is to choose the right platform for creating your electronic payment documents. There are various software options available, from simple online tools to more comprehensive solutions that integrate with accounting systems. Make sure the platform you choose is compatible with your business needs and provides the features necessary to create customized records.

Step 2: Customize the Document Layout

Once you have selected a platform, it’s time to customize the layout of your document. Ensure that it includes all necessary fields, such as the company name, contact information, payment terms, and a detailed list of goods or services. You can also add branding elements, such as your company logo, to maintain a professional appearance. Consistency is key, so make sure the layout remains uniform for all future documents.

Some platforms allow for further customization, such as setting default payment terms, adding taxes or discounts, and defining invoice numbering sequences. These options can save time and ensure that every document generated meets your specific requirements.

Step 3: Test and Implement the System

After creating the document structure, test it to ensure all fields are populated correctly and that the document generates properly. Check for any errors or formatting issues that might disrupt the process. Once the system is fine-tuned, implement it across your business operations. Educate your team on how to use the platform, and set up automation to send payment requests as needed.

By creating a well-organized and automated system for generating payment records, businesses can improve efficiency, reduce errors, and save time on administrative tasks. Whether you’re a small business or a larger enterprise, this approach ensures that your financial processes are streamlined and professional.

Customizing Your E Invoicing Template

Tailoring your digital payment request documents is a crucial step in ensuring they align with your business needs and brand identity. Customization allows you to create a system that reflects your company’s unique requirements while improving the clarity and professionalism of your communications. From adjusting the layout to adding specific fields, these changes can enhance the efficiency and effectiveness of your financial workflows.

First, prioritize the essential information that must appear on each document, such as your business name, contact details, and payment terms. These elements should be clearly displayed and easy to find. Adjusting the layout to emphasize these key pieces of information helps ensure the document is both functional and professional.

Branding is another critical area for customization. Including your company logo, colors, and fonts can make your digital records align with your corporate identity. This small detail improves the overall presentation and ensures that your communications maintain a consistent look and feel, helping reinforce brand recognition with clients.

Adding custom fields allows you to further personalize your documents. For example, if you offer recurring billing, you can include specific fields for subscription terms. If your business offers discounts or special offers, you can add dedicated sections to reflect these changes. Customizable payment terms–such as discounts for early payments or fees for overdue accounts–can also be integrated to ensure all conditions are clear and enforced.

Lastly, make sure that your customized system integrates smoothly with other tools you use, such as accounting or customer relationship management (CRM) platforms. This integration ensures that data is consistently updated across all systems, making the document generation process even more efficient.

By adjusting these aspects of your digital documents, you ensure that each payment request is not only functional but also professional and representative of your brand. This level of customization helps streamline business operations and improves the client experience.

Common Mistakes in E Invoicing

While digital billing systems offer numerous benefits, there are common mistakes that businesses can make when creating or managing payment requests. These errors can lead to delays, confusion, and even financial losses. Being aware of these pitfalls can help companies ensure that their financial processes remain smooth and efficient.

Incorrect or Missing Information

One of the most frequent mistakes is failing to include all the necessary details in the document. Omitting important information such as the recipient’s name, payment terms, or total amount due can cause significant issues. Incomplete records can result in delayed payments and confusion for both parties. It’s crucial to double-check that all fields are filled in correctly before sending any documents.

Failure to Align with Legal Requirements

Different countries and industries have specific legal requirements regarding financial documentation. For example, businesses may need to include certain tax information, such as VAT numbers or detailed breakdowns of taxable items. Not adhering to these standards can lead to compliance issues, fines, or disputes with clients. Always ensure that your documents meet local regulations to avoid legal complications.

Another common mistake is neglecting to track the status of sent documents. Without proper tracking, businesses may miss payments or overlook overdue accounts. Automating the tracking process can significantly reduce this risk and ensure timely follow-ups.

Not Utilizing Automation Features

Many digital platforms offer features to automate repetitive tasks, such as sending payment reminders, calculating taxes, or generating invoice numbers. However, some businesses fail to take advantage of these capabilities. Manual processes can be time-consuming and error-prone, so it’s important to fully integrate automation into your system to maximize efficiency and minimize mistakes.

By avoiding these common mistakes and carefully reviewing your financial systems, you can enhance accuracy, improve cash flow, and ensure that your business operates more smoothly. Taking the time to implement best practices for digital billing will ultimately save both time and money in the long run.

Integrating E Invoices with Accounting Software

Integrating digital payment records with your accounting software is a game-changer for businesses seeking to improve accuracy and streamline financial processes. When these systems work together, businesses can automate data entry, eliminate errors, and generate real-time reports. This integration saves time, reduces manual work, and ensures that financial records are always up to date.

Benefits of Integration

- Seamless Data Flow: By linking your billing system with accounting software, all payment data is automatically transferred, ensuring consistency and accuracy across your records.

- Reduced Human Error: Manual data entry is prone to mistakes. Integrating the two systems eliminates the need for duplicate data entry, significantly reducing errors and improving financial reporting.

- Faster Reconciliation: Integration allows for quicker reconciliation of accounts by providing up-to-date financial information at any given time. This means that businesses can instantly see how payments affect their cash flow and outstanding balances.

- Improved Compliance: When your financial data is synced across both systems, it becomes easier to maintain compliance with tax laws and industry regulations. Integration ensures that all the necessary financial details are accurately recorded and readily available for audits or tax filing.

Steps for Integration

- Choose Compatible Software: Ensure that the digital billing system and accounting software you use can integrate seamlessly. Many platforms offer built-in integrations, while others may require third-party connectors.

- Set Up API Connections: Most modern accounting tools support API (Application Programming Interface) connections, which enable systems to communicate automatically. Set up these connections to enable data sharing between the two platforms.

- Map Data Fields: During integration, map corresponding data fields between the billing and accounting systems (e.g., customer details, amounts, payment status) to ensure the correct information is transferred.

- Test the Integration: Before going live, test the integration by generating sample documents and ensuring that all data flows correctly into the accounting system. This step helps identify any issues before they become major problems.

- Monitor and Maintain: After integration, regularly monitor both systems for any discrepancies and ensure that updates are applied to maintain smooth synchronization.

Integrating your digital billing system with accounting software provides a significant boost to business efficiency, accuracy, and financial management. This seamless connection helps save time, reduce errors, and ensure that your financial records are always in sync with the latest transactions.

How E Invoicing Reduces Errors

In any business, accuracy is critical, especially when it comes to financial transactions. Traditional methods of generating payment records often involve manual data entry, which leaves room for mistakes. However, by moving to a digital system, many of these errors can be minimized or completely eliminated. Automated processes, standardized fields, and built-in checks significantly reduce human error, leading to more accurate financial documentation.

Automated Data Entry

One of the primary ways digital systems reduce errors is by automating data entry. When payment records are created manually, there’s always the risk of typos, missing information, or incorrect calculations. Automation ensures that key details, such as amounts, dates, and client information, are accurately pulled from pre-set fields. This reduces the chances of incorrect or incomplete data.

Built-in Validation Checks

Most digital platforms have built-in validation features that automatically check for common mistakes before the document is sent out. For example, these systems can flag missing fields, mismatched totals, or incorrect tax rates, alerting users to potential issues before they become problems.

| Error Type | Manual Process | Digital System |

|---|---|---|

| Data Entry Errors | Typos, missing details, incorrect amounts | Automatic population of fields, consistent data entry |

| Calculation Errors | Manual addition or multiplication mistakes | Automated calculations for totals, taxes, and discounts |

| Inconsistent Formatting | Varying document styles, inconsistent layouts | Standardized templates with consistent design and structure |

| Missing or Incomplete Information | Omitted customer details or line items | Required fields highlighted, prompts for missing data |

As the table above illustrates, digital systems address the most common sources of errors. By automating calculations, ensuring consistent formatting, and validating information, these platforms help create accurate, professional documents every time.

In summary, moving to a digital system for generating payment documents is an effective way to reduce errors. By automating key processes, validating data, and standardizing document layouts, businesses can significantly improve accuracy, saving time and avoiding costly mistakes.

Saving Time with E Invoicing Automation

Automating the process of generating and sending payment requests can dramatically save time and improve business efficiency. By eliminating the need for manual data entry, repetitive tasks, and paper-based workflows, businesses can streamline their operations and focus on more strategic activities. Automation not only speeds up financial tasks but also ensures greater consistency and reduces the risk of human error.

One of the key benefits of automation is the ability to generate and send records instantly. Instead of spending time manually filling out each document or waiting for physical mail delivery, an automated system can create, review, and dispatch payment requests in seconds. This faster processing accelerates cash flow and allows businesses to handle larger volumes without adding extra labor.

Another time-saving feature is the automatic calculation of totals, taxes, and discounts. Without automation, businesses would need to manually calculate each figure, which can be both time-consuming and error-prone. With an automated system, these calculations are done automatically, reducing the time spent on administrative tasks and increasing accuracy.

Additionally, automation enables businesses to set up recurring payment requests for regular customers or subscriptions. Instead of creating a new document each time a payment is due, the system can automatically generate and send these documents according to a predefined schedule. This recurring automation ensures timely invoicing without additional effort, freeing up valuable time for other important business activities.

By automating time-consuming processes, businesses can allocate resources more effectively, improve productivity, and create more streamlined workflows. Ultimately, automation leads to a more efficient and cost-effective operation, allowing companies to focus on growth and customer satisfaction.

E Invoicing vs Traditional Billing Methods

The way businesses manage payment requests has evolved over the years, with many companies moving from paper-based systems to digital solutions. Traditional billing methods, while familiar, can be slow, error-prone, and labor-intensive. On the other hand, digital billing systems offer faster, more efficient alternatives that streamline financial workflows. Understanding the differences between these two approaches can help businesses make informed decisions about which method best suits their needs.

Key Differences Between Digital and Traditional Billing

- Speed: Traditional methods often involve printing and mailing physical documents, which can take days or even weeks to process. In contrast, digital systems can generate and send payment requests within minutes, speeding up the entire process.

- Accuracy: Manual processes in traditional billing are prone to human error, such as incorrect calculations or missing information. Digital systems, however, automate calculations and data entry, significantly reducing the risk of mistakes.

- Cost: Printing, mailing, and storing physical records can incur significant costs for businesses. Digital systems eliminate these costs by automating most of the process and reducing the need for paper, ink, and postage.

- Environmental Impact: Traditional billing methods require paper, which contributes to deforestation and waste. Digital methods are paperless, making them a more sustainable choice for businesses looking to reduce their environmental footprint.

Benefits of Digital Billing Systems

- Automation: Digital platforms can automate tasks such as data entry, calculation, and sending reminders, saving time and reducing the need for manual input.

- Improved Tracking: Digital systems make it easy to track the status of each payment request, allowing businesses to quickly identify overdue accounts and manage follow-ups efficiently.

- Integration: Many digital solutions integrate with accounting and enterprise resource planning (ERP) systems, allowing for seamless data sharing and reducing the risk of discrepancies between different platforms.

- Security: Digital billing methods often include built-in encryption and security measures to protect sensitive financial data, reducing the risk of fraud or unauthorized access.

While traditional billing methods have served businesses for decades, the advantages of digital payment systems are undeniable. From speed and accuracy to cost savings and sustainability, switching to a digital solution can enhance business operations and improve the customer experience. By embracing modern technologies, companies can stay competitive and optimize their financial processes for the future.

Legal Compliance in E Invoicing

As businesses transition to digital payment documents, ensuring legal compliance is a critical consideration. Different countries and regions have specific regulations regarding the creation, submission, and storage of financial records. Failing to comply with these legal requirements can result in penalties, fines, or even legal disputes. Therefore, understanding the legal framework for digital payment requests is essential for maintaining business integrity and avoiding costly mistakes.

Key Legal Considerations for Digital Billing

- Tax Compliance: Many jurisdictions require specific tax details, such as VAT or sales tax numbers, to be included in digital payment records. Ensuring that these fields are correctly populated is crucial for compliance with local tax laws.

- Data Protection: Legal frameworks like the GDPR in Europe and CCPA in California mandate strict rules for handling customer data. Digital payment systems must ensure that sensitive information is encrypted and stored securely to prevent unauthorized access.

- Document Retention: Various laws require businesses to store payment records for a specified period, often several years. Digital systems must comply with these retention periods, ensuring that records are safely stored and easily retrievable for audits or legal purposes.

- Electronic Signatures: In some regions, digital payment documents require an electronic signature to be legally valid. Ensuring that your system supports compliant e-signature features is important for maintaining the legality of digital transactions.

Ensuring Compliance in Your Digital Billing System

To stay compliant, businesses should select digital solutions that are designed with legal requirements in mind. This includes using platforms that are updated regularly to reflect changing tax regulations and data protection laws. It is also advisable to consult with legal professionals to ensure that the business’s practices align with local laws and industry standards.

By proactively addressing legal compliance, businesses can safely embrace digital payment systems while minimizing the risk of regulatory issues. Properly handling these requirements helps to ensure smooth operations and build trust with clients and regulatory authorities alike.

How to Track E Invoices Effectively

Effectively tracking payment requests is essential for maintaining smooth cash flow and ensuring timely payments. With digital systems, it’s easier to monitor the status of each document, from creation to settlement. However, to make the most of these tools, businesses must set up a solid tracking process. This includes having clear procedures in place to monitor outstanding payments, follow up on overdue accounts, and ensure that no document is lost or forgotten.

Methods to Track Payment Requests

- Automatic Notifications: Many digital systems can send automatic reminders when payment is due or overdue. Setting up these notifications ensures that you never miss a follow-up and helps keep clients informed about their obligations.

- Status Indicators: Use platforms that provide clear status indicators (e.g., sent, viewed, paid) to track where each payment request stands. This enables you to easily see which documents need attention and which ones are already processed.

- Customizable Dashboards: Most digital solutions offer dashboards that allow you to customize the view based on key metrics. By tracking important data, such as the number of outstanding requests or the average time to receive payment, businesses can gain valuable insights into their cash flow performance.

- Integrated Payment Systems: Integrating payment gateways with your system ensures that payments are tracked in real-time. This allows for instant updates on paid and pending accounts, reducing delays in your financial reporting.

Best Practices for Tracking

- Set Clear Payment Terms: Establish clear payment terms with clients from the start. Specify due dates, late fees, and acceptable payment methods to avoid confusion and delays.

- Regular Reconciliation: Periodically reconcile your digital records with bank statements to ensure that all payments are correctly accounted for and no outstanding amounts are overlooked.

- Use a Centralized System: Keep all payment records in a single, easily accessible system to track them efficiently. Avoid scattered files or disconnected platforms to ensure that nothing slips through the cracks.

- Establish a Follow-up Process: Have a structured follow-up process in place for overdue accounts. Automate reminders, and set up escalation procedures for clients who fail to pay after multiple notices.

By implementing these strategies, businesses can gain better visibility into their financial operations, reduce delays, and improve cash flow management. Tracking digital payment records effectively leads to more predictable revenue streams and strengthens client relationships.

Security Considerations for E Invoicing

As businesses increasingly rely on digital systems to generate and manage payment records, ensuring the security of these processes has become more important than ever. Protecting sensitive financial data from breaches, fraud, and unauthorized access is essential for maintaining trust with clients and complying with legal standards. Proper security measures help safeguard both the business and its customers from potential risks associated with digital transactions.

Key Security Risks in Digital Billing

- Data Breaches: Sensitive customer information, such as payment details and tax identification numbers, can be vulnerable to hacking if the right protections are not in place. Ensuring that all data is encrypted and securely stored is vital.

- Fraud: Digital systems can be targeted by cybercriminals who attempt to manipulate or intercept financial records. Regular system updates and anti-fraud measures are necessary to prevent such attacks.

- Unauthorized Access: Without proper authentication, unauthorized individuals might gain access to payment records. Multi-factor authentication (MFA) and strong password policies are essential to secure digital systems from internal and external threats.

- Phishing Attacks: Fraudulent emails or websites designed to mimic legitimate billing systems can trick users into providing sensitive information. Employees should be trained to recognize phishing attempts and use verified platforms to manage financial transactions.

Best Practices for Enhancing Security

- Use Encryption: All payment records and sensitive data should be encrypted both in transit and at rest. This ensures that even if the data is intercepted, it cannot be read or used by unauthorized parties.

- Regular Security Audits: Conduct regular security audits to identify vulnerabilities in your digital payment system. Timely updates and patching are essential for keeping your platform secure from emerging threats.

- Implement Strong Authentication: Use multi-factor authentication (MFA) for all users accessing the system. This adds an extra layer of security by requiring more than just a password to gain access.

- Access Controls: Set strict access controls to ensure that only authorized personnel can view, edit, or send payment requests. Limiting access to sensitive data helps reduce the risk of internal threats.

- Educate Employees: Ensure that all staff members are aware of security best practices, including recognizing phishing scams and using secure networks to access financial platforms.

By addressing these security considerations, businesses can mitigate the risks associated with digital payment processes and safeguard sensitive financial data. Investing in rob

Improving Customer Experience with E Invoices

Enhancing the customer experience is key to building long-lasting relationships and fostering loyalty. One way businesses can achieve this is by streamlining the process of sending and receiving payment requests. Digital systems make it easier for customers to access, review, and pay their bills in a timely and efficient manner, improving their overall interaction with your company. By offering more convenient, transparent, and flexible options, businesses can improve satisfaction and reduce friction in the payment process.

Benefits for Customers

- Faster Access: Digital records can be delivered instantly, allowing customers to access payment information immediately. This eliminates the need for waiting on physical mail or dealing with delays, making it more convenient for customers.

- Clarity and Transparency: Digital documents are easy to read and contain all the necessary details, reducing confusion and minimizing errors. Customers can quickly review charges, taxes, and payment terms without having to decipher handwritten or unclear entries.

- Multiple Payment Options: Digital systems often integrate with various payment gateways, offering customers multiple ways to pay, from credit cards to bank transfers. This flexibility makes the payment process more convenient and customer-friendly.

- Self-Service Features: Many digital platforms allow customers to view their past payments, track their account status, and download payment records at any time, offering greater autonomy and control over their transactions.

Building Trust and Loyalty

By providing a more seamless and user-friendly experience, businesses can foster greater trust with their customers. When clients receive clear, timely, and easy-to-access payment information, they feel more confident in their dealings with the company. This increased transparency can lead to stronger relationships, repeat business, and positive word-of-mouth recommendations.

Ultimately, improving the customer experience with digital systems not only benefits clients but also contributes to greater operational efficiency. By adopting these modern practices, businesses can stay competitive, improve their service, and meet the expectations of today’s digital-savvy consumers.

Future Trends in E Invoicing Templates

The world of digital billing is evolving rapidly, with new technologies and practices reshaping how businesses create, send, and manage payment records. As automation, artificial intelligence (AI), and blockchain become more integrated into financial systems, the future of digital payment documents promises even greater efficiency, security, and accuracy. Businesses that adapt to these emerging trends will be better positioned to meet customer demands and streamline their financial operations.

Key Trends Shaping the Future

- AI-Driven Automation: Artificial intelligence will play a significant role in automating the creation and distribution of payment requests. AI-powered systems will be able to analyze previous transactions, predict invoice needs, and automatically populate fields, reducing human error and speeding up the process.

- Blockchain Technology: Blockchain has the potential to enhance the security and transparency of digital payment records. By using a decentralized ledger, businesses can ensure that all transactions are tamper-proof and auditable, providing an extra layer of trust and reducing the risk of fraud.

- Smart Contracts: The integration of smart contracts will allow businesses to automatically trigger certain actions once specific conditions are met. For example, payment could be automatically processed once an invoice is approved, ensuring quicker settlements and less manual intervention.

- Real-Time Payments: With the rise of instant payment systems, digital billing will shift towards real-time transactions. This trend will enable businesses to receive payments almost immediately, improving cash flow and reducing the wait time for fund transfers.

- Enhanced Data Analytics: Future digital platforms will offer deeper insights into financial data, allowing businesses to track performance, analyze payment trends, and forecast cash flow more accurately. These insights can help optimize billing strategies and improve financial decision-making.

How Businesses Can Prepare

- Invest in Modern Solutions: Businesses should explore advanced digital platforms that integrate emerging technologies like AI and blockchain. Staying ahead of the curve will enable smoother transitions as these innovations become standard in the industry.

- Embrace Automation: Start automating routine processes like invoice generation and payment reminders to improve efficiency and reduce manual work. By incorporating automation early, businesses can free up resources for more strategic tasks.

- Prioritize Security: As the digital payment landscape becomes more sophisticated, businesses must continuously enhance their security measures. Implementing advanced encryption methods and ensuring compliance with data protection regulations will be critical for maintaining customer trust.

- Prepare for Regulatory Changes: Stay informed about evolving legal and regulatory frameworks related to digital transactions. Ensuring that your system is adaptable to new requirements will help avoid costly compliance issues down the road.

By embracing these trends, businesses can create a more streamlined, secure, and future-ready approach to managing financial transactions. Keeping an eye on these developments will allow companies to remain competitive and meet the needs of an increasingly digital marketplace.