Instagram Influencer Invoice Template for Seamless Payment Tracking

As a content creator, managing payments and financial transactions efficiently is crucial to maintaining a professional reputation and ensuring timely compensation. One of the best ways to handle this aspect of your business is by utilizing a well-structured document that clearly outlines the services provided and the corresponding payment details.

By using a clear and organized approach to billing, you not only present yourself in a professional light but also minimize the risk of confusion or disputes with clients. These documents act as official records of the work completed and the agreed-upon terms, streamlining the process of getting paid and keeping your finances in order.

Whether you’re collaborating with brands, managing partnerships, or offering paid services, having a reliable way to issue payment requests is essential. Crafting an easy-to-understand and customizable document can make the payment process smoother for both you and your clients, ensuring a more seamless experience for everyone involved.

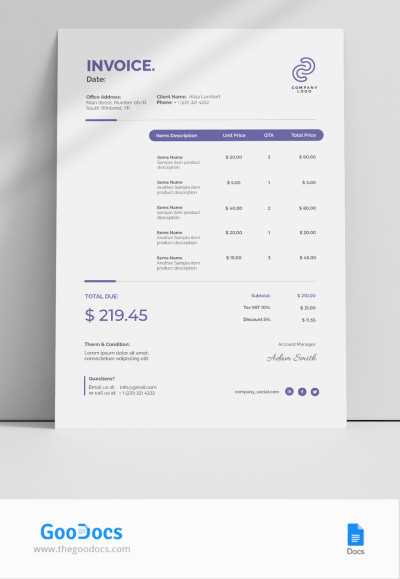

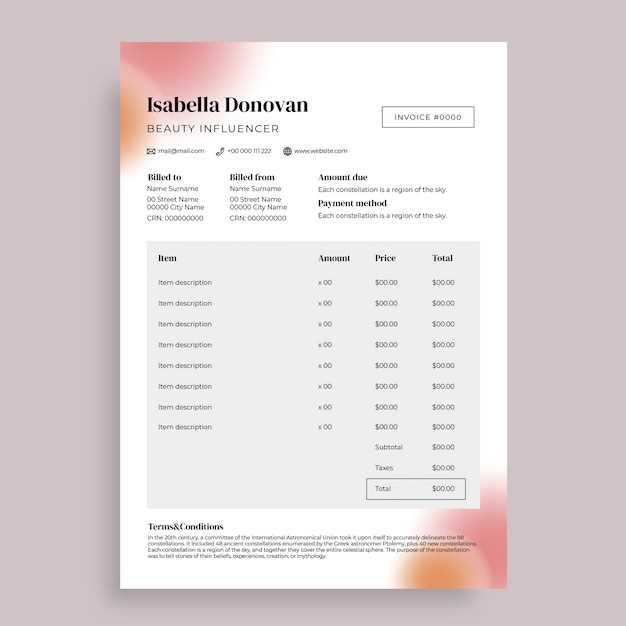

Instagram Influencer Invoice Template Overview

Managing the financial aspects of your creative work is essential for maintaining a professional image and ensuring you receive prompt payment for your efforts. A well-structured document is key to organizing these transactions, as it ensures clarity and consistency in all your dealings with clients. This document helps both parties understand the agreed-upon terms and facilitates smooth communication about compensation.

For creators, this type of document serves as an official record of work completed, outlining the services provided, payment details, and deadlines. It streamlines the payment process and avoids misunderstandings, making it easier to track and manage all your financial interactions.

Below is an example of the key sections typically included in such a document:

| Section | Description |

|---|---|

| Contact Information | Details of both the creator and the client, including names, addresses, and communication channels. |

| Service Description | A clear outline of the services provided, including project details or content created. |

| Payment Terms | Specifies the amount due, payment methods, and any deadlines for payment. |

| Due Date | The agreed-upon date by which payment should be received. |

| Additional Notes | Any other relevant information, such as late fees, revisions, or project-specific agreements. |

By including these key elements, the document not only protects both parties but also helps ensure that payments are processed smoothly and without delay.

Why Use an Influencer Invoice Template

For creative professionals, managing financial transactions efficiently is a critical aspect of running a successful business. A well-designed document that outlines the work completed and payment terms ensures clarity and professionalism in your dealings with clients. By using a structured format, you can reduce the risk of misunderstandings and delays, making the payment process smoother for both parties.

Professionalism and Organization

Using a structured document shows that you approach your work with a high level of professionalism. It provides clients with clear and easy-to-understand details about your services, payment expectations, and deadlines. This not only helps build trust with clients but also demonstrates your commitment to maintaining a well-organized business.

Time and Effort Savings

Instead of starting from scratch every time you need to send a payment request, having a ready-to-use format saves valuable time. You can easily customize the document for each client, reducing the effort required to create a new one each time. This efficiency allows you to focus more on your creative work, while still ensuring that your financial processes are properly managed.

In summary, using a clear, structured document is an essential tool for ensuring smooth financial transactions and maintaining a professional relationship with clients. It saves time, reduces errors, and helps ensure timely payments for the work you do.

Benefits of Professional Invoice Design

A well-designed payment document goes beyond just listing charges. It conveys professionalism and helps set the right tone in your client relationships. When crafted thoughtfully, it can ensure smoother transactions, increase trust, and enhance your overall brand image.

Improved Client Trust

Clients are more likely to trust a creator or business that presents clear, polished, and professional payment documents. A well-organized format reflects reliability and attention to detail, making clients feel confident about working with you.

- Establishes credibility

- Helps in maintaining professional relationships

- Demonstrates organization and efficiency

Clear Communication of Payment Terms

One of the key advantages of using a professional layout is that it clearly communicates payment expectations. By presenting all relevant details in an easy-to-understand format, you minimize confusion and ensure that clients know exactly what they owe and when payment is due.

- Clearly outlines work completed and payment amounts

- Highlights deadlines and payment methods

- Reduces disputes over billing terms

In short, investing in a well-structured document not only simplifies the billing process but also reinforces your professionalism, making it easier to establish long-lasting business relationships.

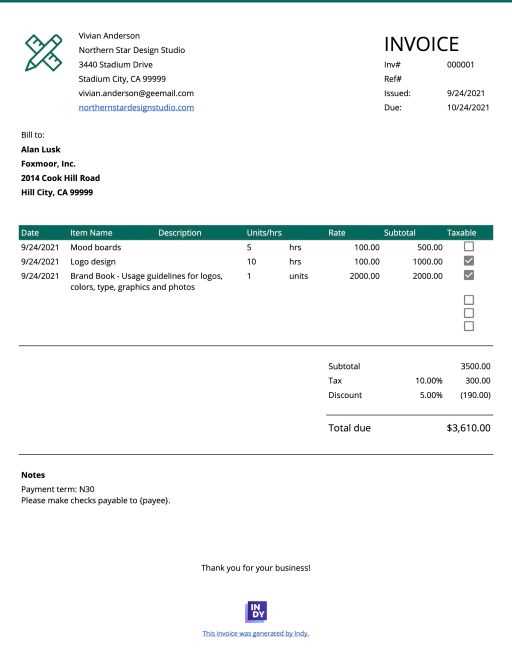

Key Elements of an Influencer Invoice

A well-structured document should include specific components to ensure clarity and completeness. These key elements help both the service provider and client understand the terms of payment, preventing any potential misunderstandings. Below are the essential components that make up a well-organized payment request.

Client and Service Provider Information

At the top of the document, it is important to include both parties’ contact details. This includes the name, address, phone number, and email address for both the creator and the client. Including this information ensures that the document is personalized and identifies the parties involved in the transaction.

Detailed Service Breakdown

One of the most critical sections is a clear breakdown of the services rendered. This section should specify what was done, including the scope of work, time spent, and any other relevant details. Being transparent in this section helps avoid confusion and ensures both parties are on the same page regarding the terms of the agreement.

- Service description (e.g., content creation, brand collaboration)

- Quantity of work (e.g., number of posts, videos, etc.)

- Rate and total charge

Payment Terms

Clearly outline the payment due, including the amount, payment method (bank transfer, PayPal, etc.), and any applicable deadlines. This section ensures that the client knows exactly when and how to settle the bill. It’s also helpful to include details about any additional charges, such as late fees, for overdue payments.

By including these key elements in a payment request, you provide both yourself and your clients with a clear understanding of the terms, helping to ensure smooth financial transactions.

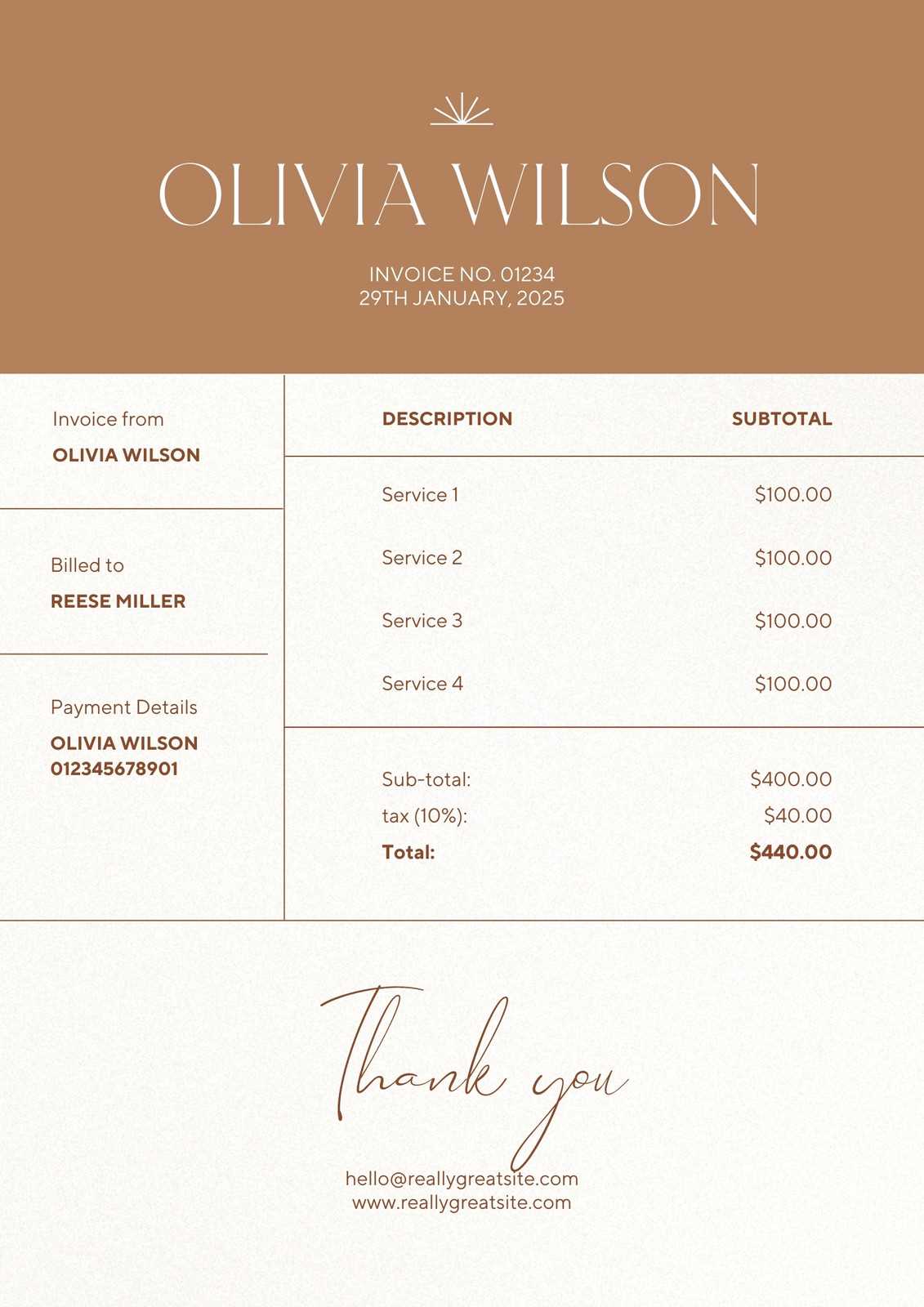

How to Customize Your Invoice Template

Customizing your payment request document is essential to reflect your unique style and business needs. A personalized format not only makes the document look more professional but also ensures that it aligns with your brand identity. Customization allows you to adjust the layout, content, and design to suit different clients and projects.

Start by including your business logo and branding elements at the top of the document. This creates a professional appearance and reinforces your brand. Additionally, you can adjust the color scheme and fonts to match your personal or business aesthetic, making your payment request stand out.

Adjusting Key Sections

While the basic structure remains the same, you can modify certain sections based on the nature of the work. For example, you may want to change the service description to include specific project details, or add a section for extra charges like travel expenses or additional revisions. Tailoring these details to each client or project ensures accuracy and relevance.

Personalizing Payment Details

Customizing the payment section is another important step. You can specify different payment methods, such as online transfer options or cryptocurrency, depending on your preferences or client needs. You may also want to include terms like early payment discounts or late fees to make your expectations clear.

By taking the time to personalize the document, you not only enhance its professionalism but also create a more tailored experience for your clients, making financial transactions more efficient and organized.

Choosing the Right Payment Terms

Selecting the appropriate payment terms is crucial for maintaining healthy cash flow and ensuring that both parties are clear on when and how payments are due. The terms you set will influence the speed and consistency with which you receive compensation, as well as the overall professionalism of your business transactions.

There are several aspects to consider when defining payment terms, such as due dates, payment methods, and any early or late payment penalties. Each of these factors helps ensure that both you and your clients understand the expectations, which can prevent delays and misunderstandings.

Setting Clear Due Dates

One of the most important elements of payment terms is the due date. Setting a clear, reasonable deadline for payment helps clients plan accordingly and ensures that you are compensated in a timely manner. Commonly used options are 30, 45, or 60-day terms, but you may choose shorter or longer periods based on your business needs.

Offering Flexible Payment Methods

Offering a variety of payment options can make it easier for clients to pay on time. This could include bank transfers, online payment services, or even credit card options. The more flexible your payment methods, the more likely clients will adhere to your terms.

By choosing the right payment terms, you can create a system that works for both you and your clients, improving the efficiency of financial transactions while maintaining a professional relationship.

Tracking Payments Effectively with Templates

Efficiently monitoring payments is essential to ensure that you are compensated for the work you complete. A structured document can help you track the status of each payment, identify overdue amounts, and manage your finances more effectively. By including specific sections to track payment dates and amounts, you can easily stay on top of your cash flow.

Creating a Payment Tracking System

Incorporating a tracking section within your payment document allows you to record each transaction’s status. This might include columns for payment amounts, due dates, payment received dates, and the remaining balance. With these details readily available, you can quickly identify which payments are outstanding and follow up accordingly.

Using Digital Tools for Monitoring

While traditional paper-based tracking is possible, using digital tools can significantly enhance your ability to track payments. Software programs or online platforms that allow you to create, store, and update your payment documents can provide automated reminders and alerts for overdue payments. This reduces the chances of missing payments and helps maintain a steady cash flow.

By adopting a clear system for tracking payments, you ensure timely compensation and maintain financial organization, which is crucial for the success of your business.

Common Mistakes to Avoid on Invoices

When creating a payment request document, it is essential to avoid common errors that could lead to confusion, delays, or even disputes with clients. A well-structured and error-free document not only facilitates smooth financial transactions but also helps in maintaining professionalism. Below are some common mistakes to avoid.

Missing or Incorrect Information

One of the most critical mistakes is leaving out essential details or providing inaccurate information. This can cause unnecessary delays in payments and confusion. Make sure to double-check the following:

- Correct client and service provider contact information

- Accurate payment amounts and service descriptions

- Clear payment due dates

Unclear Payment Terms

Vague or unclear payment terms can create misunderstandings. It is vital to specify the due date, payment methods, and any penalties for late payments. Lack of clarity in this section may lead to delayed payments and even disputes. Be specific and transparent about your expectations.

Failure to Include a Breakdown of Charges

Without a detailed breakdown of services provided and the corresponding costs, clients may question the amount they are being asked to pay. Ensure that your document includes:

- A clear description of each service

- The number of hours or quantity of work completed

- The agreed-upon rate for each service

Not Providing a Unique Reference Number

Each document should have a unique reference number to help track and organize payments easily. Without this identifier, it may become difficult to match the payment to the correct document, especially when dealing with multiple clients or projects. Always assign a reference number to each document.

By avoiding these common mistakes, you can ensure that your payment requests are clear, professional, and efficient, leading to timely and accurate payments from your clients.

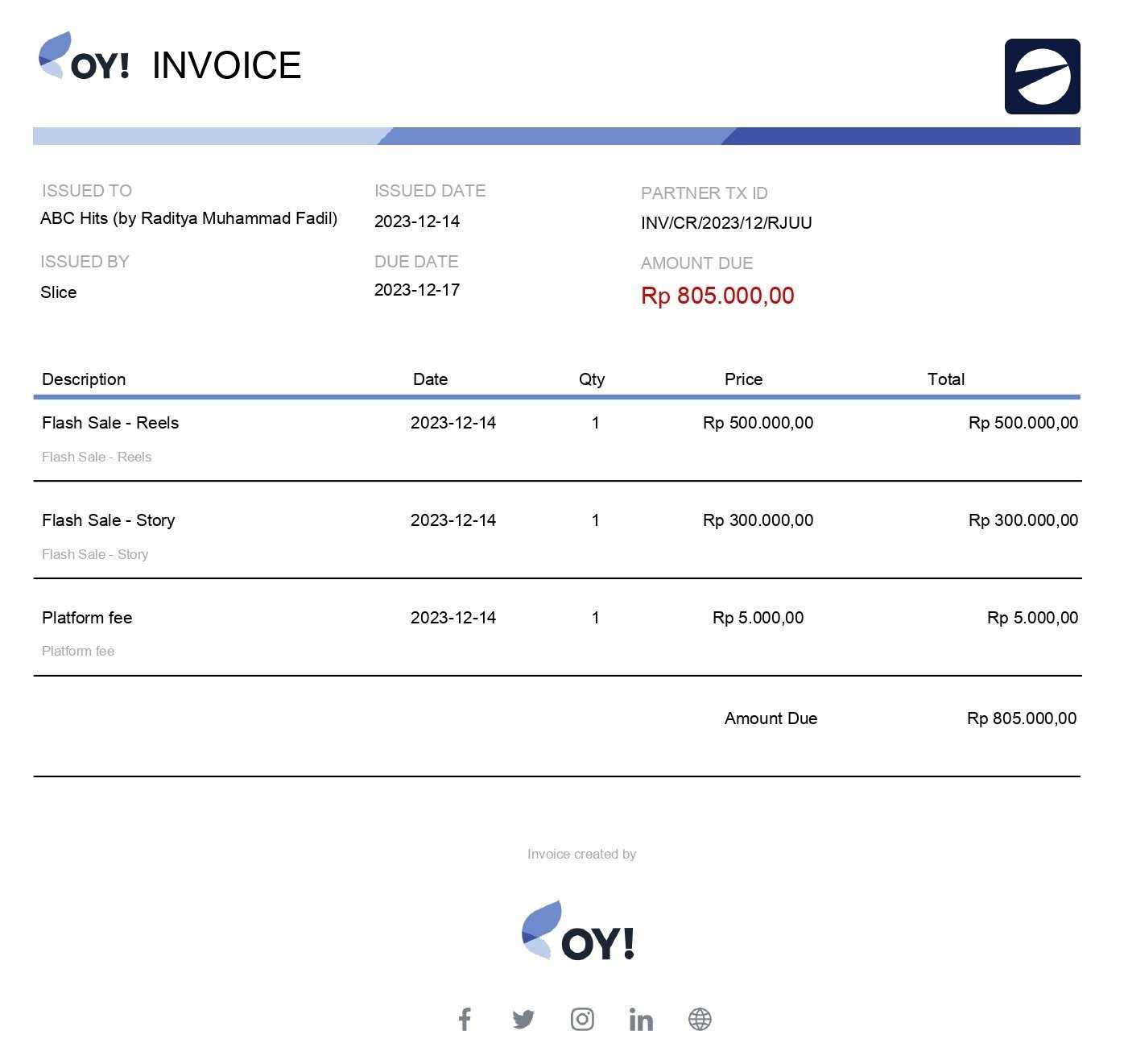

How to Include Taxes in Invoices

Including taxes in your payment request documents is essential for legal compliance and ensuring that your clients understand the total cost of the services provided. Properly calculating and clearly showing taxes helps prevent confusion and ensures that both you and your client are aligned on the financial aspects of the transaction.

Calculating the Correct Tax Amount

The first step in including taxes is determining the appropriate tax rate for your location and industry. Tax rates vary by country, state, or even city, and different services or products may be subject to different rates. It’s crucial to research and apply the correct tax rate based on your business’s legal requirements. Once you know the rate, calculate the tax amount based on the total price of the services provided.

Clearly Displaying Taxes on the Document

When listing the total amount due, it’s important to separate the cost of services from the tax amount. This helps clients see exactly how much of the total is going towards taxes and ensures transparency. You can include a line item labeled “Tax” or “Sales Tax” with the exact percentage applied and the total tax amount. Additionally, make sure to show the final total after taxes have been added.

- Service Amount

- Applicable Tax Rate

- Total Tax Amount

- Final Total (including tax)

By including taxes correctly and ensuring that all amounts are clearly outlined, you can avoid confusion and potential issues down the line, fostering trust and professionalism with your clients.

Adding Discounts and Promotions to Invoices

Incorporating discounts and special offers into your payment request documents can be an excellent way to reward clients, encourage prompt payments, or promote specific services. Whether you’re offering seasonal discounts or a one-time promotion, it’s essential to display these adjustments clearly so that clients can easily understand the changes to the total amount due.

Clearly Specify Discount Details

When offering a discount, it’s important to list the discount amount or percentage clearly on the document. This helps avoid confusion and ensures that clients see the value they are receiving. Be sure to include the following details:

- The type of discount (e.g., percentage off or fixed amount)

- The reason for the discount (optional, but useful for transparency)

- The date or time frame when the discount is applicable

Including Promotional Offers

If you’re running a special promotion, make sure to outline the terms and conditions in the payment document. Whether it’s a limited-time offer or a loyalty reward, it’s crucial to include the following:

- Details of the promotion (e.g., “Buy one, get one free” or “10% off your first purchase”)

- The period during which the promotion is valid

- Any restrictions or conditions that apply (e.g., minimum purchase required)

By adding discounts and promotions clearly, you create transparency and ensure that clients fully understand the value they are receiving. This fosters positive relationships and encourages repeat business.

Invoice Numbering and Record Keeping Tips

Maintaining a clear and organized system for tracking payment requests is essential for both financial transparency and efficient business operations. Proper numbering and record-keeping practices help you stay on top of transactions, facilitate easier audits, and ensure that no payments are overlooked. Adopting a systematic approach to these aspects can also improve your professional image and client trust.

Importance of Sequential Numbering

Assigning a unique, sequential number to each payment request is crucial for maintaining an organized system. This numbering allows you to easily track the documents and prevents confusion when handling multiple clients or projects. Using a consistent format, such as “001,” “002,” or including the year, can help you quickly identify and locate specific records. Avoid skipping numbers or repeating them to ensure a clean and accurate record-keeping system.

Tips for Effective Record Keeping

In addition to numbering, it is important to keep detailed and accurate records for all transactions. Here are some tips to enhance your record-keeping process:

- Maintain a digital or physical folder for each client to store all related payment documents.

- Keep a spreadsheet to track the status of each document, including the amount billed, payment date, and any outstanding balances.

- Set reminders for follow-ups on overdue payments to avoid missed opportunities.

By properly numbering documents and keeping thorough records, you ensure better financial management and improve your ability to handle future transactions smoothly.

Including Client Information Correctly

Accurate client information is essential for ensuring that payment documents are processed smoothly and without errors. By properly including all relevant details, you can avoid confusion, ensure compliance, and foster a professional relationship with your clients. Accurate records also help in case of disputes or future reference.

The key to correctly listing client details is ensuring that all the necessary fields are filled out clearly and accurately. Missing or incorrect information can delay payments or cause misunderstandings. Make sure to include the client’s full name or business name, address, email, and contact phone number. In some cases, you may also need to add a client identification number or account number if relevant for tracking purposes.

Key Client Information to Include:

- Full name or company name

- Complete billing address

- Email address for communication

- Contact phone number

- Client account or ID number (if applicable)

By ensuring all client details are accurate and up-to-date, you maintain professionalism and reduce the chances of errors that could impact the payment process.

Payment Due Dates and Deadlines

Setting clear due dates and deadlines for payments is crucial to ensure timely financial transactions and maintain a smooth cash flow. Establishing these timelines helps both parties know when to expect payments and reduces the risk of delayed or missed transactions. Without a defined payment deadline, clients may delay payments, which can negatively affect your business operations.

How to Set Effective Payment Deadlines

When determining payment deadlines, consider factors such as the nature of the project, the client’s payment history, and any industry standards. Generally, payment terms such as “Net 30” (30 days from the billing date) or “Due Upon Receipt” are common. Be clear about the time frame and ensure that the client understands the terms before agreeing to the contract.

- For short-term projects, a 15- or 30-day deadline is often appropriate.

- For long-term contracts, you might consider setting up milestone-based payments.

- Always include the due date in a prominent location on the payment document to avoid confusion.

Importance of Enforcing Deadlines

It’s essential to communicate the consequences of missed deadlines. This can include late fees or interest charges to incentivize timely payments. Clearly stating these terms upfront can help clients understand the importance of adhering to the established due dates, leading to better financial management and stronger client relationships.

How to Format Your Payment Request for Clarity

Clear formatting is essential to ensure that all details in a payment request are easily understandable by the client. A well-structured document reduces the risk of errors and misunderstandings, helping both you and your client stay on the same page regarding the terms of the transaction. A clean, organized layout can also enhance your professional image and make it easier for clients to process payments promptly.

When preparing your payment request, focus on simplicity and clarity. Avoid cluttering the document with unnecessary details, and instead, ensure that all essential information stands out. Organize the sections logically, and use headings or bold text to highlight key areas, such as the total amount due, the services provided, and the payment due date.

Key Formatting Tips:

- Use a clear, readable font size (e.g., 12-14 pt) to ensure legibility.

- Separate different sections with headings, such as “Services Rendered” and “Payment Details.”

- Ensure the total amount due is prominent and clearly labeled.

- Double-check for consistency in the layout and alignment.

By following these formatting guidelines, you ensure that the document is easy to read, minimizes confusion, and fosters a smooth payment process.

Digital vs Paper Payment Requests: Which to Choose

When deciding between digital or paper methods for sending payment requests, it’s important to weigh the benefits and challenges of each approach. Both have their pros and cons, depending on the preferences of your business and clients, as well as the specific needs of your industry. The choice between digital and paper largely comes down to factors like speed, convenience, and environmental impact.

Advantages of Digital Payment Requests

Digital payment requests have become increasingly popular due to their convenience and speed. Sending a request electronically ensures instant delivery, and clients can process payments faster. Additionally, digital formats often come with built-in features that simplify the tracking and management of transactions.

- Faster Delivery: Digital requests are delivered immediately, reducing the time between sending and receiving payment.

- Easy Record-Keeping: Electronic documents can be stored and organized in a way that makes tracking payments more efficient.

- Environmentally Friendly: Reducing paper use contributes to environmental sustainability.

- Automated Reminders: Some digital platforms offer automated payment reminders to help clients stay on track with their payments.

Benefits of Paper Payment Requests

Although digital options are widely used, paper payment requests still have some distinct advantages, particularly for businesses that work with clients who prefer traditional methods or do not have access to electronic platforms.

- Physical Proof: Some clients may prefer a tangible document for their records, offering a sense of security and reliability.

- Client Preference: Certain industries or clients may still prefer receiving physical documents, especially in more formal or established business settings.

- Customizable Design: Paper requests allow for more personalized designs, potentially adding a touch of professionalism or uniqueness.

In the end, the choice between digital and paper comes down to your client base and how you prefer to manage your transactions. Many businesses are moving toward digital methods due to their efficiency, but paper may still have its place depending on specific circumstances.

Tools for Creating Payment Requests

When it comes to creating payment requests, having the right tools can significantly improve efficiency and accuracy. There are various platforms and software available that help streamline the process, whether you’re handling one-time transactions or recurring billing. These tools not only simplify the creation of professional documents but also ensure that all necessary details are included and organized properly.

Online Platforms for Payment Requests

Several online platforms are designed specifically to assist in creating and sending payment requests. These tools often come with pre-built templates, automated features, and customizable options to suit different needs.

- PayPal: Widely recognized, PayPal offers an easy way to generate professional payment documents directly through their system. It’s simple to customize and track payments in real-time.

- QuickBooks: Ideal for businesses looking for more comprehensive financial management, QuickBooks offers powerful tools to create and manage payment requests alongside bookkeeping and tax preparation.

- Wave: This free accounting software allows users to generate and send payment documents, track payments, and manage business finances in one place.

- FreshBooks: Known for its user-friendly interface, FreshBooks makes it easy to create detailed and clear payment requests, track time, and manage client information.

Customizable Software for Advanced Needs

For those who require greater customization or have specific requirements for payment documentation, there are specialized tools that allow for advanced personalization and in-depth financial tracking.

- Zoho Invoice: Zoho Invoice is a customizable platform that provides professional templates and options to tailor invoices, track payments, and set up automated reminders.

- Invoicely: Invoicely offers a wide variety of templates and billing features, including the ability to handle multiple currencies and generate recurring payment requests.

- AND.CO: Designed for freelancers and small businesses, AND.CO allows users to create visually appealing payment requests, automate reminders, and manage expenses.

Choosing the right tool for creating payment documents depends on your business needs, volume, and the level of detail required in each request. Many of these platforms offer free trials, so it’s worth experimenting with different tools to find the best fit for your needs.

When to Send Your Payment Request

Timing is crucial when it comes to sending a payment request. Whether you are offering a service or selling a product, knowing the right moment to issue your request can help ensure a smooth transaction and timely payment. It is important to consider the nature of the work, the agreement with the client, and their payment practices.

Sending Requests After Completion of Work

One of the most common times to send a payment request is after you have completed the agreed-upon work. This helps establish clear expectations and ensures that you are compensated promptly for your efforts. Depending on your agreement, you may issue the request immediately after delivery or set a specific period after the project ends.

- Project-Based Work: For one-time projects, it’s common to send the request once the project is completed and all deliverables have been submitted.

- Ongoing Services: For recurring work, a request is often sent at the end of the billing cycle, such as weekly, monthly, or quarterly.

When to Send After Agreement

In some cases, you may agree on a specific payment schedule before beginning any work. This agreement could specify when to send the request, whether it’s upon a specific milestone or on a predetermined date.

- Advance Payments: Some arrangements require you to send a request in advance for a deposit before starting work. This ensures that both parties are committed to the project.

- Milestone Payments: If the work is broken into phases, you may need to issue a request after completing each milestone or phase.

By understanding the best times to send your request, you ensure both parties are aligned on payment expectations and that your work is properly compensated on time.