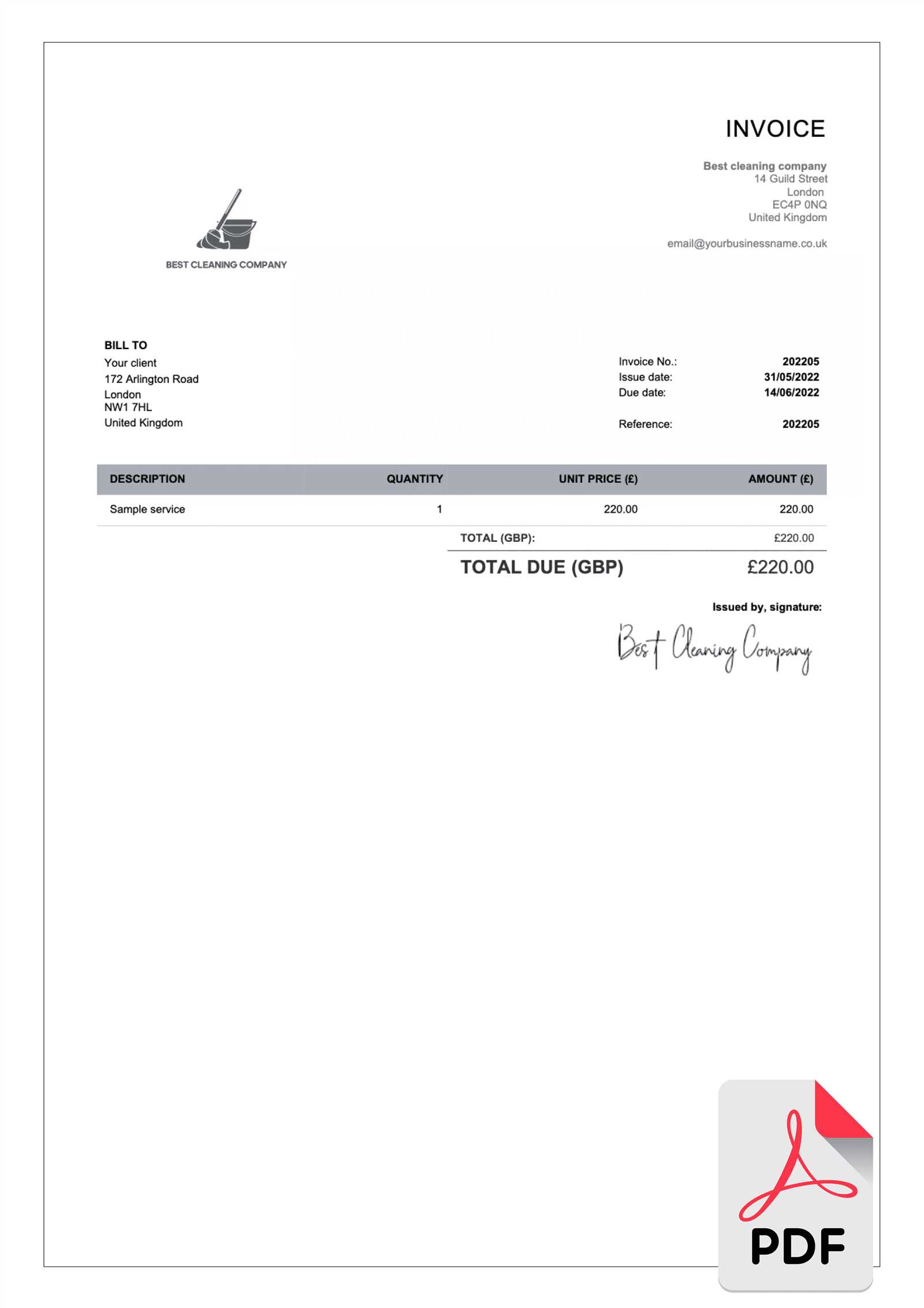

Free Editable Invoice Template Download for Quick Customization

Managing financial transactions efficiently is crucial for maintaining a professional image and ensuring smooth operations. One of the most effective ways to streamline this process is by using ready-made documents that can be easily modified to fit specific needs. By utilizing resources that allow quick personalization, business owners can save time while ensuring accuracy in every financial exchange.

There are many options available online for those who seek simple yet professional solutions for managing their financial records. These resources help create documents that reflect your brand, include essential details, and meet the requirements of both clients and regulatory authorities. Whether you’re a freelancer, contractor, or small business owner, having access to flexible formats is essential for smooth billing.

In this article, we will explore various options that can help you create and manage your financial paperwork. Learn how to modify pre-designed files that suit your business model and save valuable time on administrative tasks.

Free Editable Invoice Templates for Businesses

For businesses of all sizes, having the right documents for financial transactions is essential. Customized documents not only ensure professionalism but also help streamline accounting tasks. Utilizing documents that are simple to personalize can save valuable time and reduce errors, making the billing process more efficient and accurate.

Many platforms offer easily adjustable formats that cater to various business needs. These resources are perfect for anyone looking to create professional-looking documents without the need for expensive software or graphic design skills. Here’s a closer look at how these resources can benefit your business:

Benefits of Using Customizable Billing Documents

- Time-saving: Modify an existing structure to suit your needs without creating a new document from scratch.

- Cost-effective: Avoid spending money on premium software or services by using freely available resources.

- Professionalism: Ensure that your paperwork meets industry standards and aligns with your business branding.

- Flexibility: Easily update details, pricing, and other important information according to each transaction.

Where to Find Customizable Billing Documents

There are several platforms where you can access various types of pre-designed documents that suit different industries. Some of the most popular sources include:

- Online Websites: Numerous websites offer a wide range of formats tailored to different business needs. These sites usually provide user-friendly tools that allow you to customize fields such as date, recipient name, and payment details.

- Cloud-Based Software: Platforms like Google Docs or Microsoft Office Online allow you to use templates stored in the cloud, ensuring that you can access them from anywhere.

- Spreadsheet Tools: Using tools like Excel or Google Sheets, you can find customizable grids and layouts that are easy to adjust for specific financial transactions.

By leveraging these resources, businesses can ensure that they are equipped with all the necessary tools for smooth and accurate billing processes, improving overall workflow efficiency.

Why You Need a Customizable Invoice

In the modern business world, having flexible and adaptable financial documents is crucial for maintaining smooth operations. Standardized forms may work in some cases, but they often lack the ability to meet the unique requirements of different transactions. The ability to tailor documents to fit specific needs ensures that every detail is accurate, professional, and in line with both your branding and legal requirements.

Customized billing documents allow you to make quick adjustments, whether you’re working with a new client, changing service rates, or needing to add additional fields for special charges. This flexibility is essential for businesses aiming to streamline their operations and maintain control over their financial record-keeping.

Advantages of Customizing Your Billing Forms

- Accuracy: Ensure all the necessary details are included for each unique transaction.

- Consistency: Maintain uniformity across all of your business communications and branding elements.

- Professionalism: Present a polished image to clients with tailored documents that align with your business identity.

- Flexibility: Easily adjust for different service types, pricing models, or payment terms.

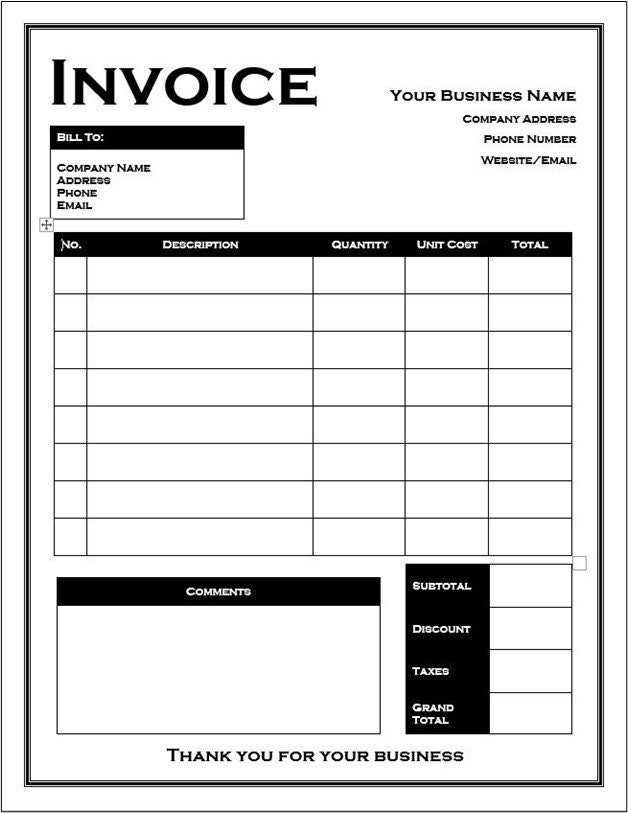

Key Features to Include in Customizable Documents

When creating personalized billing paperwork, several features are essential for a professional and comprehensive layout. Below is a table of the key elements often included in these documents:

| Feature | Description |

|---|---|

| Client Information | Include fields for client name, address, and contact details. |

| Service Description | Clearly define the services or products provided, along with quantity and rate. |

| Payment Terms | Specify payment deadlines, due dates, and any late fees. |

| Branding Elements | Add your company logo, colors, and other branding elements for a cohesive look. |

| Taxes and Discounts | Provide space to list applicable taxes and any discounts offered on the final amount. |

By using customizable documents, businesses can ensure that each financial exchange is handled professionally, accurately, and efficiently, while reflecting the unique needs of each transaction.

How to Download Editable Invoice Templates

Finding the right format for your business’s financial documents is the first step towards streamlining your billing process. Many online platforms offer easy-to-use formats that can be quickly modified to meet your specific needs. These resources provide ready-made structures that allow for quick personalization, ensuring your paperwork is both professional and accurate.

Getting started with these customizable documents is simple. Follow these steps to easily access and personalize your business forms:

Steps to Access Customizable Billing Documents

- Choose a Reliable Source: Look for trusted websites or platforms that offer customizable business documents. Many platforms provide a wide range of choices tailored to various industries.

- Register or Sign Up: Some websites may require you to create an account before accessing their resources. Registration is typically quick and free.

- Browse Available Formats: After signing in, browse the available formats and choose one that suits your business model. These resources usually offer several options, from basic layouts to more detailed designs.

- Select and Customize: Once you’ve selected the document you need, open it in an editable format. Adjust the details such as service descriptions, prices, and client information to match your specific transaction.

- Save and Export: After customizing your document, save it to your computer. Most platforms offer multiple file formats, allowing you to export your document as a PDF, Word file, or Excel sheet for easy sharing and printing.

Where to Find Customizable Resources

Several trusted platforms offer a variety of business forms that can be quickly personalized. Some of the most popular sources include:

- Online Websites: Many websites provide ready-to-use business forms that can be customized directly in your browser.

- Office Suites: Cloud-based tools such as Google Docs or Microsoft Office offer customizable business document formats that can be easily accessed and edited.

- Spreadsheet Programs: Tools like Excel or Google Sheets offer flexible layouts that can be adjusted to create billing documents tailored to your business.

Once you’ve downloaded and customized your business forms, you’ll be able to use them repeatedly, saving time and ensuring consistency in your financial transactions.

Benefits of Using Editable Templates

Customizing business documents to fit your specific needs offers several advantages that streamline processes and enhance professionalism. By utilizing resources that can be easily adjusted, businesses are able to maintain consistency while also catering to unique customer or project requirements. This flexibility allows for more efficient handling of financial records and ensures that documents are always up-to-date with the latest information.

One of the key benefits is the time saved. Instead of creating a document from scratch each time, you can modify an existing structure to meet your current needs. This not only speeds up the process but also reduces the chances of errors, as you are working with a proven layout. Moreover, the ability to adapt details quickly makes managing different types of transactions much easier.

Other important advantages include:

- Consistency: Using a reusable format ensures that all of your documents adhere to the same style, which is essential for maintaining a professional image.

- Cost-effectiveness: Reducing the need for expensive software or design services allows businesses to focus resources elsewhere while still producing high-quality paperwork.

- Accuracy: Customizable structures allow for precise updates, ensuring that all necessary fields are filled correctly for each transaction.

- Branding: Personalizing your documents with company logos, colors, and fonts helps create a cohesive look that strengthens your brand identity.

In short, using customizable business documents can significantly improve efficiency, enhance professionalism, and save time and money, all while maintaining control over the details that matter most.

Top Platforms for Free Invoice Templates

When it comes to creating professional financial documents, many online platforms offer ready-to-use solutions that can be customized to meet various business needs. These platforms provide businesses with the flexibility to modify their forms without the need for advanced software, making it easier to maintain accuracy and consistency across all transactions.

Here are some of the top platforms where you can access customizable formats for your business paperwork:

Popular Websites for Business Documents

- Canva: Known for its design tools, Canva offers a wide range of customizable forms that can be adjusted to reflect your business style. With a user-friendly interface, you can easily personalize every detail.

- Zoho: Zoho provides several formats that are specifically tailored to small businesses. Its tools allow for seamless customization of essential fields such as itemized lists, payment terms, and client details.

- Invoice Generator: This platform offers a simple interface that allows users to create customized documents on the go. It provides basic features that can be edited easily without the need for an account or subscription.

Cloud-Based Platforms for Document Creation

- Google Docs: A popular option for many, Google Docs offers various resources for businesses to create and store customizable documents online. This makes it easy to access your records from any device.

- Microsoft Office Online: Similar to Google Docs, Office Online provides ready-to-use documents that are simple to personalize using Word, Excel, or other cloud-based tools. It’s an excellent choice for businesses already using Microsoft products.

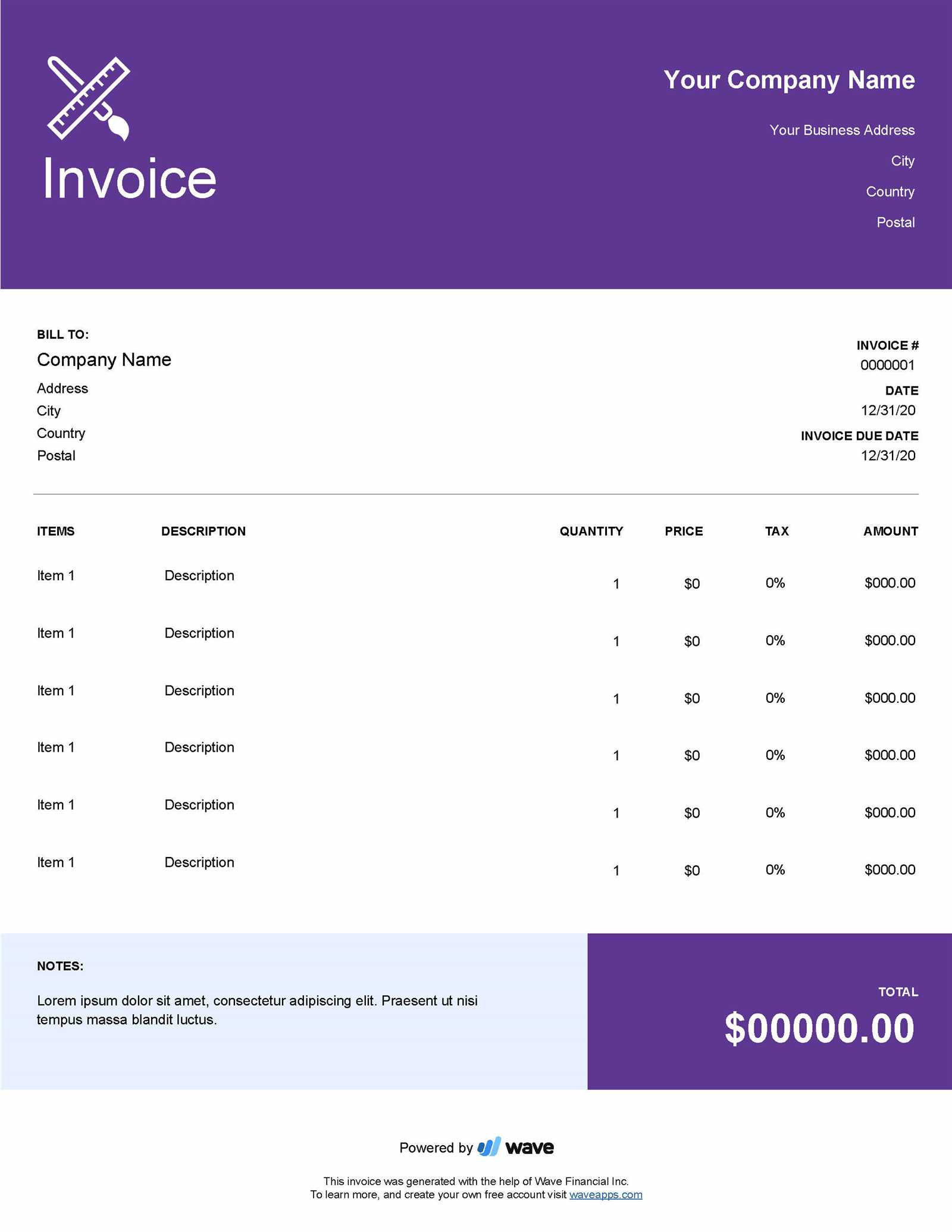

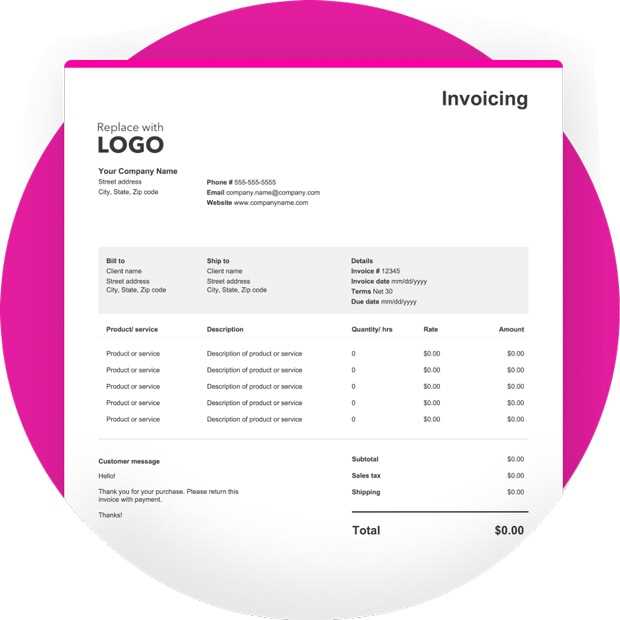

- Wave: Wave is an accounting platform that offers customizable business forms as part of its suite of financial tools. It is particularly useful for small businesses and freelancers looking for simple yet professional solutions.

Each of these platforms offers unique features, allowing businesses to choose the solution that best fits their needs. Whether you are a freelancer or a small business owner, these platforms can help you quickly generate high-quality, professional documents tailored to your specific requirements.

Designing Your Invoice Template Online

Creating customized financial documents online offers convenience and flexibility, allowing businesses to craft the perfect format that aligns with their branding and operational needs. With a variety of online tools and platforms, you can design your documents from scratch or modify existing formats to ensure that every detail is tailored to your requirements. This process helps streamline transactions and ensures consistency across your business records.

When designing your documents, it’s essential to keep both functionality and professionalism in mind. Using online platforms to create your forms ensures that you have access to a range of design features, making it easier to incorporate your company’s branding, update information, and maintain an organized structure. Here are some key steps to help guide you through the design process:

Steps to Design Your Document Online

- Choose a Platform: Start by selecting an online tool that offers customizable document creation options. Popular platforms include Canva, Google Docs, and Microsoft Office Online.

- Pick a Layout: Select a layout that best suits your business style and needs. Many tools offer a variety of pre-made designs that can be personalized according to your specifications.

- Add Necessary Fields: Ensure that the document includes all required sections, such as client information, service descriptions, pricing, payment terms, and taxes. Keep the structure simple and clear to ensure easy comprehension.

- Incorporate Branding: Add your company logo, colors, and fonts to ensure the document matches your business identity and maintains a professional appearance.

- Review and Save: Once you’ve made all necessary customizations, review the document for accuracy. After finalizing the design, save your document in the desired format for easy access and sharing.

Best Tools for Online Design

- Canva: Canva offers an easy-to-use platform with drag-and-drop design tools, allowing you to create personalized financial documents with professional layouts and branding options.

- Google Docs: Google Docs allows for collaborative customization, meaning you can easily share and edit documents in real-time, making it an excellent choice for teams.

- Microsoft Office Online: For those familiar with the Microsoft suite, Office Online provides robust editing features that make designing business documents a breeze.

- Zoho: Zoho provides simple document creation tools that allow for the customization of essential business details and even offer integration with accounting software for seamless management.

Designing your documents online is not only easy but also highly efficient, allowing you to create custom forms that are aligned

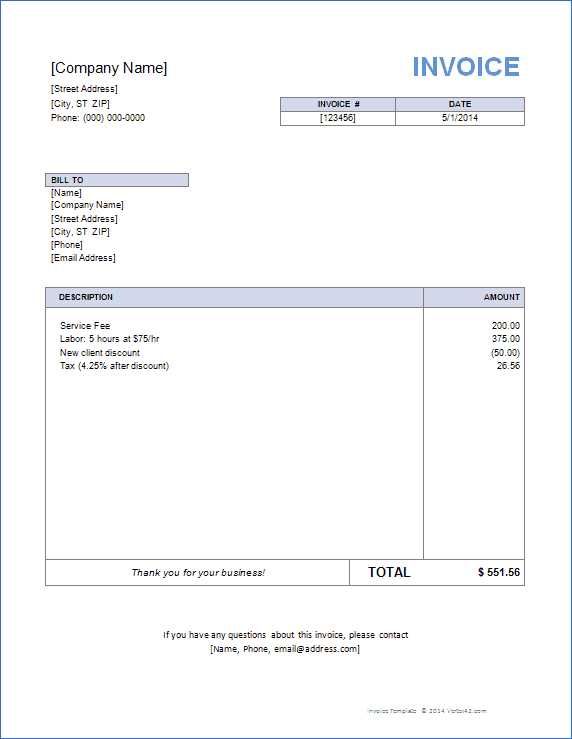

How to Customize Invoice Details

Customizing the details of your financial documents is a crucial step to ensure accuracy and professionalism. Adjusting the elements that make up your business forms allows you to reflect the specific requirements of each transaction, ensuring that all necessary information is presented clearly. From client details to pricing and terms, tailoring each section helps prevent errors and guarantees that all parties involved have the correct information.

Here are some essential areas to focus on when customizing your business documents:

Key Details to Personalize

- Client Information: Ensure that the name, address, and contact details of your client are correct. This is important for maintaining a professional relationship and ensuring that documents reach the correct recipient.

- Business Information: Include your company name, logo, contact information, and tax identification number. This helps your client easily identify your business and adds credibility to the document.

- Service or Product Descriptions: Clearly outline the services or products provided. Be specific about what was delivered, including quantity, type, and any relevant specifications.

- Pricing and Terms: Adjust the pricing details to reflect any agreed-upon rates or special offers. Make sure to include payment terms, such as due dates, late fees, and accepted payment methods.

- Tax and Additional Charges: If applicable, add tax percentages or other extra charges. It’s crucial to ensure the calculations are correct to avoid confusion or disputes later.

How to Adjust Details for Specific Transactions

- Review Client Requirements: Before making any changes, carefully review the client’s needs or the specifics of the project. This will help you determine what needs to be included or excluded.

- Modify Quantities and Prices: Adjust the quantities and prices to reflect the exact products or services provided. Always double-check the numbers to prevent any discrepancies.

- Update Terms and Conditions: Tailor the terms based on the agreement with the client. Ensure payment terms and conditions are clearly stated to avoid misunderstandings.

- Double-check Calculations: Ensure that any taxes or additional charges are calculated accurately. Many platforms automatically calculate totals, but it’s always a good idea to manually verify.

- Save a Template for Future Use: Once you’ve customized the details, save the document as a reusable template for similar transactions. This saves time for future work and ensures consistency.

By customizing each section appropriately, you ensure that every document is tailored to meet the needs of the t

Common Mistakes to Avoid in Invoices

When creating business documents for transactions, small errors can lead to confusion, delayed payments, and a lack of professionalism. It’s essential to ensure that all details are correct and clearly presented. Avoiding common mistakes not only helps maintain trust with clients but also ensures smooth financial operations. Here are some key errors that businesses often make, and how to avoid them:

Common Mistakes in Business Documents

- Incorrect Client Information: One of the most frequent mistakes is entering incorrect or outdated contact details. Always double-check the client’s name, address, and email to ensure accurate communication.

- Missing Payment Terms: Failing to include payment terms can lead to confusion regarding due dates, penalties, or acceptable payment methods. Always clearly state the payment due date and any terms related to late fees or early payment discounts.

- Unclear Descriptions of Products or Services: Vague descriptions of goods or services provided can cause misunderstandings. Be specific about what was delivered, including quantity, type, and other relevant details.

- Inaccurate Pricing: Entering wrong prices, quantities, or applying incorrect discounts can lead to discrepancies and damage trust. Always cross-check pricing to ensure everything aligns with the agreed terms.

- Omitting Tax Information: Failure to include taxes or failing to calculate them correctly can cause issues, especially with clients from different regions. Ensure that taxes are applied and clearly stated in your documents, if applicable.

- Not Including an Invoice Number: An invoice number is a critical part of any business document. Without it, tracking payments and keeping accurate records becomes challenging. Always assign a unique number to each document for easy reference.

- Failure to Include a Company Logo: Not incorporating your company logo may reduce the professionalism of your document. Adding your logo not only enhances brand identity but also helps in establishing credibility with clients.

How to Avoid These Mistakes

- Double-check Details: Before finalizing your document, take the time to review all client and business information. Double-check contact details and pricing.

- Use Clear and Precise Language: When describing goods or services, use specific and understandable language to avoid confusion.

- Verify Calculations: Always verify the math, including the prices, taxes, and discounts. Make use of automated calculation tools to minimize human error.

- Include a Unique Number: Assign a unique number to each document. This helps with organization and ensures that each transaction can be tracked efficiently.

Ensuring Professionalism in Your Invoices

Maintaining a high standard of professionalism in your financial documents is essential for building strong relationships with clients and ensuring that your business is taken seriously. A well-designed document reflects your company’s commitment to accuracy, quality, and customer service. By paying attention to details and adopting best practices, you can present your business in the most professional light possible.

Key Elements for Professional Documents

- Clear and Consistent Layout: A clean, organized design makes your documents easy to read and navigate. Use a consistent structure for all your business communications to create a cohesive brand image.

- Accurate and Complete Information: Ensure all details, including client contact information, payment terms, and a breakdown of services or products, are correct. Missing or incorrect information can lead to misunderstandings and undermine your credibility.

- Professional Branding: Incorporate your company’s logo, colors, and branding elements. This reinforces your business identity and builds trust with your clients.

- Polite and Clear Language: Use courteous and direct language in your communication. Avoid jargon or ambiguous terms and ensure that all instructions are straightforward and easy to follow.

- Timely Submission: Deliver your documents promptly to demonstrate your reliability and professionalism. Timely communication enhances the perception of your business and shows respect for your client’s time.

How to Improve Professionalism in Your Business Documents

- Invest in High-Quality Design: Choose a well-structured layout and make use of design elements that enhance readability. Utilize clear fonts and consistent formatting to avoid clutter.

- Double-Check Information: Before sending any document, verify the accuracy of all data, including addresses, amounts, and dates. This helps prevent mistakes that could damage your reputation.

- Ensure a Consistent Branding Approach: Make sure your company’s branding is consistently applied across all your documents. This includes your logo, font choices, and color scheme.

- Set a Standard for Communication: Develop a tone and style that reflects professionalism in every document. This ensures that all business communications are clear, respectful, and aligned with your company’s values.

- Use Reliable Tools: Employ reliable software or tools to create your documents. Using professional tools ensures that the final result is polished and error-free.

By ensuring your business documents are clear, accurate, and consistent, you create an impression of professionalism that fosters trust and respect from your clients. These small details contribute to your business’s long-term success by enhancing your reputation

How to Add Branding to Your Invoice

Branding your business documents not only enhances your company’s professional appearance but also helps in creating a memorable and cohesive identity across all communications. When clients receive a well-branded document, it fosters trust and reinforces the connection between your business and its services. Adding a personalized touch to your financial documents ensures consistency and strengthens your brand recognition.

Key Branding Elements for Business Documents

- Logo: Your company logo is the most prominent element in establishing your identity. Make sure to place it at the top of the document in a clear and visible location.

- Color Scheme: Incorporating your brand’s colors into the document’s design helps reinforce your business identity. Choose colors that complement your logo and maintain readability.

- Font Choices: Use the same fonts as your website or other marketing materials. This maintains visual consistency and makes your documents appear as part of a unified brand experience.

- Tagline or Slogan: If you have a company slogan or tagline, consider adding it to the footer or header. This adds an extra layer of brand recognition and reinforces your business message.

- Contact Information: Ensure your contact details, such as phone number, email address, and website, are clearly displayed and align with your branding style. This makes it easier for clients to reach out if needed.

Steps to Implement Your Brand in Documents

- Customize the Header: Begin by adding your logo and business name in the header. This is the first thing clients will see, so it should reflect your brand clearly.

- Incorporate Your Business Colors: Choose one or two primary colors that align with your brand and use them in the document’s headings, borders, or background elements.

- Use Consistent Fonts: Apply the same fonts that represent your brand across all sections of the document. Avoid using too many different fonts, as it can make the document look cluttered.

- Personalize the Footer: Add your tagline or contact information in the footer. This makes it easy for your clients to remember your brand and reach out if necessary.

- Use a Professional Layout: A clean and organized design with consistent branding elements ensures that your document is visually appealing and easy to navigate.

By following these simple steps, you can effectively incorporate your business’s branding into your documents, leaving a la

Saving and Sharing Your Custom Invoices

Once you’ve tailored your business documents to fit your needs, the next step is to ensure that they’re stored securely and shared efficiently with your clients. Proper management of these documents is essential to maintain organization and ensure smooth financial transactions. Whether you’re sending documents electronically or keeping them for your records, it’s important to choose the right file formats and methods for sharing.

How to Save Your Custom Documents

When saving your completed business paperwork, it’s crucial to select a file format that preserves both quality and accessibility. Here are some common options:

| File Format | Advantages | Considerations |

|---|---|---|

| Universally accepted, maintains formatting, professional appearance | Requires a PDF reader to open | |

| Word Document | Easy to edit, flexible formatting | Formatting may vary across devices |

| Excel | Great for calculating totals, easy to manipulate | May not appear professional if not formatted correctly |

How to Share Your Custom Documents

After saving your file in the right format, you need to consider how to share it with your clients. Here are several ways to efficiently deliver your documents:

- Email: Attach your document to an email with a clear subject line and a polite message to explain its contents.

- Cloud Storage: Upload the document to a cloud service like Google Drive, Dropbox, or OneDrive, and share the link with your client for easy access.

- Online Payment Platforms: Many online payment services allow you to send documents directly to clients when requesting payment, making the process more seamless.

- Physical Mail: If electronic sharing isn’t an option, consider printing and mailing the documents. While this method is less common, it may be necessary for some clients.

By following these methods, you can ensure that your documents are both safely stored and easily shared with clients, helping streamline your financial processes and maintain professionalism in your business communication.

Managing Multiple Invoice Versions

As a business grows, it becomes essential to maintain different versions of financial documents to cater to varying client needs, services, or projects. These variations can be a result of changes in pricing, service packages, or customized requirements for different customers. Efficiently organizing and tracking these versions can ensure consistency and reduce confusion in your financial records.

Here are a few strategies for managing multiple document versions:

Version Control and Naming Conventions

To keep your documents organized, establish a clear naming convention that reflects the version and the context of each document. For example, you can use the following format:

- ClientName_ServiceType_Date_Version – This makes it easy to identify the version and track updates over time.

- InvoiceNumber_VersionNumber – If you have a unique numbering system, adding a version number helps track revisions.

- ProjectCode_VersionDate – If invoices are related to specific projects, including the project code and date can help organize multiple versions of related documents.

Using Digital Tools for Version Control

Leverage cloud storage services or specialized accounting software to manage different versions of your documents. These tools can automatically track revisions, maintain a history of changes, and help prevent confusion by storing versions in an organized manner. Many platforms also allow you to set permissions, so only authorized personnel can access or make changes to specific documents.

Tracking Changes and Updates

It’s important to keep track of the changes made to each document, especially when working with multiple versions. Documenting updates such as changes in amounts, due dates, or service details can help ensure accuracy. Implementing a revision log can be helpful for this purpose, allowing you to record details of each modification, who made it, and when it was made.

Maintaining Consistency Across Versions

While managing multiple versions of financial documents, consistency is key. Make sure that the format, branding, and essential details remain the same across all versions. This will help maintain a professional appearance and ensure that your clients always receive coherent and reliable documents, regardless of which version they are viewing.

By following these strategies, you can manage multiple versions of your business documents effectively, reducing errors and ensuring smooth operations across all transactions.

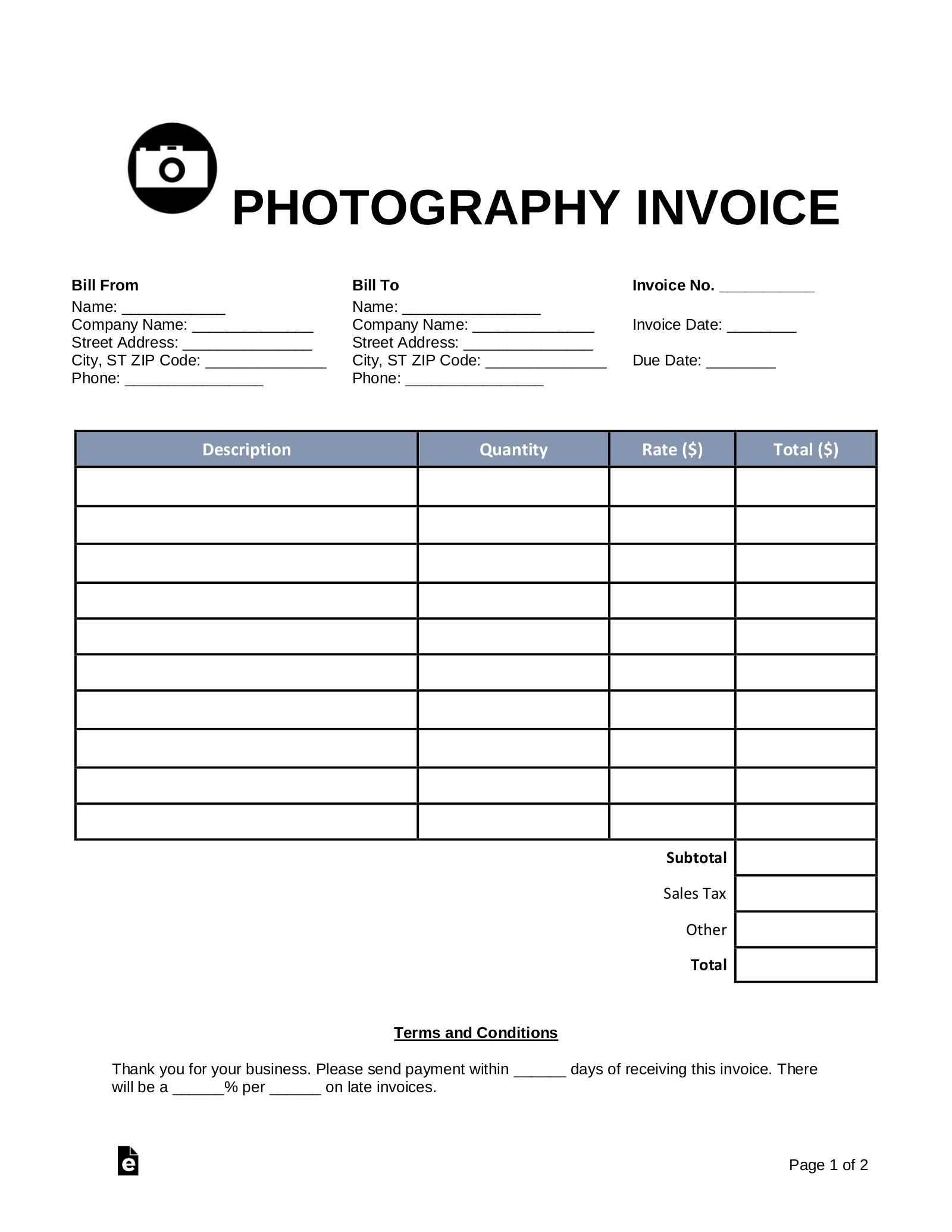

Invoice Templates for Freelancers and Contractors

Freelancers and contractors often work with a variety of clients, each requiring detailed documentation for services rendered. Having a professional, clear, and consistent format for billing can help ensure smooth transactions and maintain good relationships with clients. Tailored documents allow individuals to accurately represent their work, track payments, and avoid any misunderstandings.

For those working independently, using pre-designed formats can save time and reduce the risk of errors. These documents typically include essential information such as services provided, hourly rates, payment terms, and due dates, all organized in an easy-to-understand manner. This type of structure allows freelancers and contractors to present their services in a polished, professional way, helping clients quickly process payments.

By customizing the layout, freelancers can easily reflect their personal or business branding, ensuring that each document is unique and aligned with their image. Whether working on a short-term project or long-term contract, using organized billing documents ensures that payments are tracked and deadlines are met without confusion or delay.

How to Automate Your Invoice Process

Managing payment requests can be time-consuming, especially when dealing with multiple clients or large volumes of work. Automating your billing system can significantly streamline the process, reducing manual effort and minimizing the chances of errors. By using the right tools and strategies, you can create a more efficient workflow and ensure that payments are sent promptly and accurately.

Here are a few steps to help you automate your billing process:

1. Choose the Right Software

To start automating, select a software solution designed for business management that includes features for generating and sending payment requests automatically. Many accounting platforms offer pre-built templates that automatically populate with the necessary information from your client records, saving you time on each transaction. Some options even offer recurring billing, so you can set up recurring projects without needing to manually create each document.

2. Set Up Recurring Payments

If you offer subscription-based or retainer services, setting up recurring payments can further reduce your administrative workload. Many online payment processors and accounting platforms allow you to automate regular charges at fixed intervals, making the process entirely hands-off. This ensures you never miss a billing cycle and that your clients are always invoiced on time.

3. Integrate Payment Systems

For a seamless experience, integrate your billing system with an online payment processor. This enables clients to pay directly from the billing document with just a few clicks. By including payment links, clients can settle their bills quickly, and you can automate payment confirmation notifications. This integration reduces delays and manual follow-ups, allowing you to focus on growing your business.

4. Automate Notifications and Reminders

Automated reminders can help you stay on top of unpaid bills. Many tools allow you to schedule reminders to be sent automatically if a payment is not received by the due date. This proactive approach helps maintain cash flow without needing to follow up manually, reducing stress and administrative effort.

5. Track and Analyze Your Payments

Automation tools often include reporting features that allow you to track the status of all your transactions. By generating real-time reports, you can stay informed about overdue payments, which clients are paying on time, and where your revenue stands. These insights are crucial for planning and improving your overall business strategy.

By integrating these automation techniques, you can simplify your billing workflow, reduce administrative burden, and ensure that payments are always processed efficiently and on time.

Legal Considerations When Using Templates

When creating and utilizing ready-made documents for financial transactions, it’s essential to understand the legal implications involved. While these tools can significantly streamline your business operations, it’s important to ensure they align with applicable laws and regulations. Failing to comply with legal requirements could lead to issues with clients, tax authorities, or even legal disputes.

Here are some key legal considerations to keep in mind when using such tools:

1. Compliance with Tax Regulations

Every region or country has specific tax rules that govern business transactions. When using pre-made documents to request payments, ensure they comply with local tax regulations. For example, your documents may need to include details like tax identification numbers, VAT or sales tax, and specific itemization of charges. Not adhering to these regulations could result in penalties or delays in payments.

2. Intellectual Property Rights

Before using or sharing these documents with clients or other businesses, it’s essential to confirm that you’re not infringing on intellectual property rights. Some templates or layouts may be copyrighted, meaning you can’t alter or distribute them without proper licensing. Always check the terms of use and ensure you’re legally allowed to modify and distribute the files you use.

3. Contractual Terms

Many businesses treat these payment requests as part of a contractual agreement. Therefore, the terms outlined within your documents need to be clear and enforceable. If the templates include pre-written terms and conditions, make sure they accurately reflect the specific arrangements with your clients, and make any necessary adjustments to avoid any future disputes.

4. Data Protection and Privacy

When handling client information, data protection is a major concern. Ensure that any personal details or payment information contained within the document are securely stored and transmitted. Many countries have data privacy laws (such as GDPR in Europe), which mandate how personal data should be handled and protected. Failing to comply with these laws could lead to significant legal consequences.

5. Transparency and Accuracy

Legally, it’s crucial that all the information provided in these financial documents is accurate and transparent. Incorrectly listed amounts, missing details, or confusing terms could lead to misunderstandings or legal challenges. Always double-check that the details align with your records and agreements to avoid any potential issues down the road.

By staying informed about these legal considerations and ensuring compliance, you can confidently use these tools while minimizing risks for your business.

Improving Cash Flow with Efficient Invoicing

Efficient management of payment requests is essential for maintaining a healthy cash flow in any business. By streamlining the process, you can reduce delays, minimize errors, and ensure timely payments. Proper financial documentation not only makes it easier for clients to understand their obligations but also helps businesses receive payments faster, ensuring consistent cash flow.

Here are some strategies to improve your cash flow by optimizing your billing practices:

1. Set Clear Payment Terms

One of the most important aspects of improving cash flow is to establish clear payment terms. This includes specifying:

- Payment due dates

- Accepted payment methods

- Any applicable late fees for overdue payments

- Discounts for early payments, if offered

By providing clear and upfront payment expectations, clients are more likely to pay on time, reducing delays in receiving funds.

2. Automate Payment Reminders

Sending reminders to clients about upcoming payments or overdue balances is crucial for encouraging timely settlements. Automation tools can help streamline this process by sending out notifications automatically, which saves time and prevents missed payments.

3. Provide Multiple Payment Options

Offering various payment methods can make it easier for clients to pay quickly. The more convenient you make it for clients to settle their balances, the faster you’ll receive payments. Consider offering options such as:

- Bank transfers

- Credit and debit card payments

- Online payment platforms (e.g., PayPal, Stripe)

- Checks or cash, if applicable

4. Monitor Outstanding Balances

Regularly reviewing unpaid invoices helps you stay on top of overdue payments. By tracking outstanding balances and following up promptly, you can identify patterns or problematic clients before the situation becomes more complicated.

5. Offer Early Payment Incentives

Encourage clients to pay ahead of schedule by offering discounts or other incentives for early payment. This not only improves your cash flow but also fosters positive relationships with clients.

By implementing these practices, businesses can optimize their billing systems, reduce the time spent chasing payments, and maintain a steady cash flow that supports business growth.