Free Invoice Template for Consulting Services

Managing finances effectively is a crucial aspect of any business. One key component of this process is ensuring that clients receive clear, well-structured documents outlining the amounts owed. Whether you’re an independent advisor or a small business owner, it’s essential to have a reliable and professional method for presenting payment details.

There are numerous ways to create such documents, but opting for a structured format can save time and avoid errors. With the right tools, you can generate accurate, customizable bills that maintain a high level of professionalism. These documents not only ensure clarity but also contribute to the smooth flow of transactions between you and your clients.

Streamlining this process allows you to focus more on the work itself and less on administrative tasks. By adopting simple yet effective solutions, you enhance your overall business efficiency. Explore various options available to streamline your billing, all without sacrificing quality or compliance.

Free Invoice Template for Consultants

As a professional, it’s essential to have a streamlined way to present payment requests to clients. A well-structured document can save you time and enhance your professionalism. Many professionals, especially those who are just starting out, may not have the resources to hire an accountant or use expensive software, but fortunately, there are simple solutions available to meet these needs.

Why Choose a Pre-made Solution

Using a pre-designed document ensures that you don’t miss important information, and it helps maintain consistency across your transactions. The primary advantage of these pre-made forms is that they are easy to use and can be customized to fit your specific needs, whether you’re dealing with hourly rates or project-based fees.

What Should Be Included

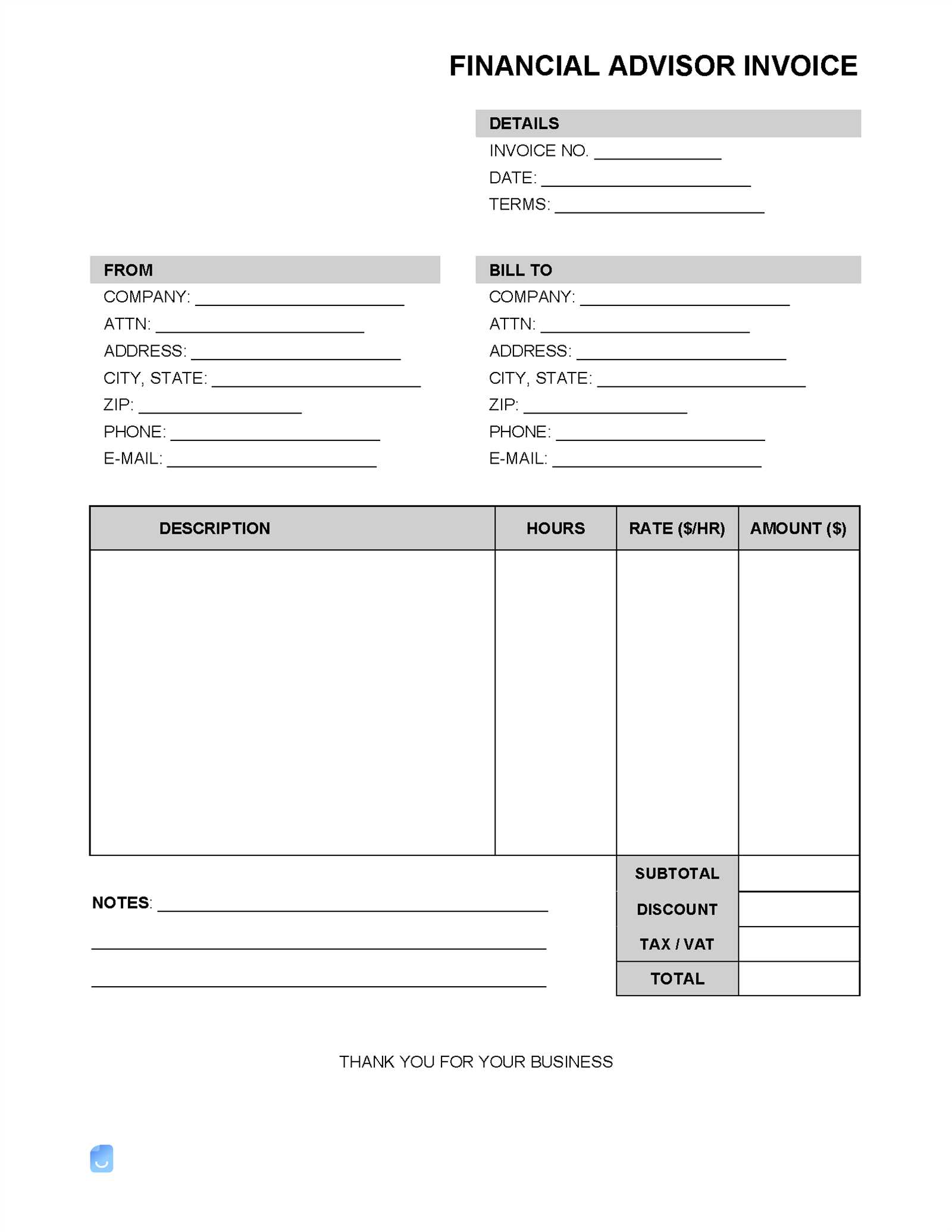

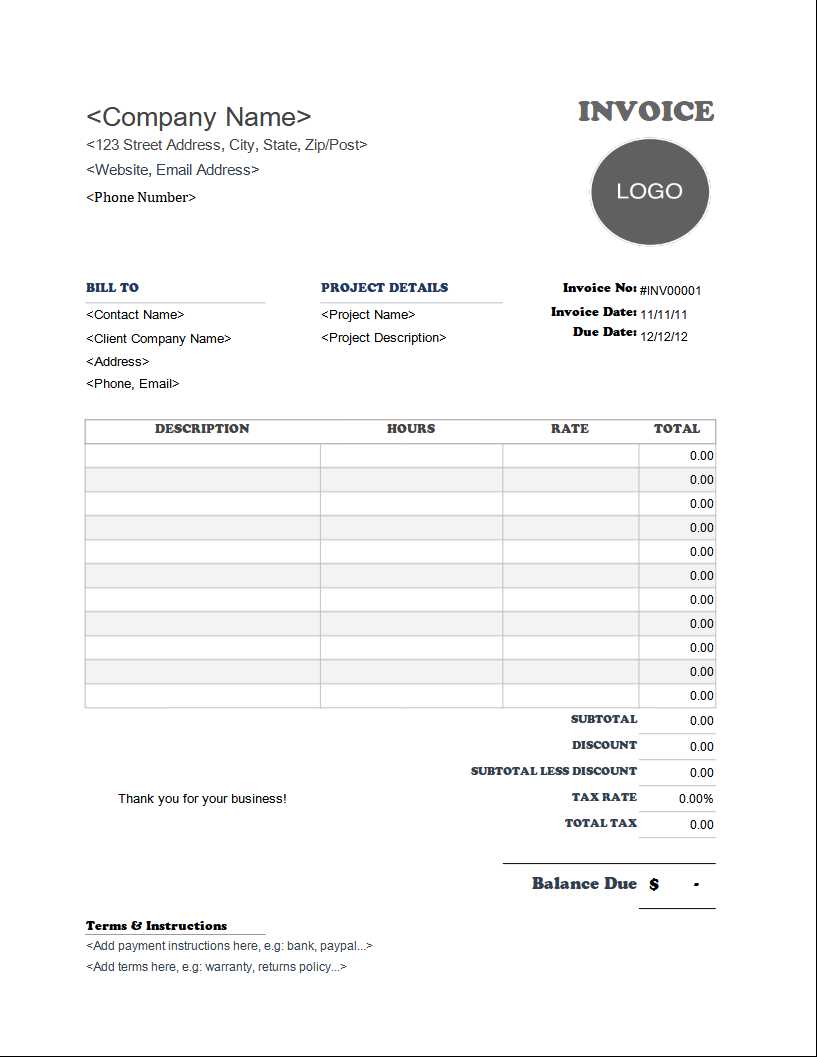

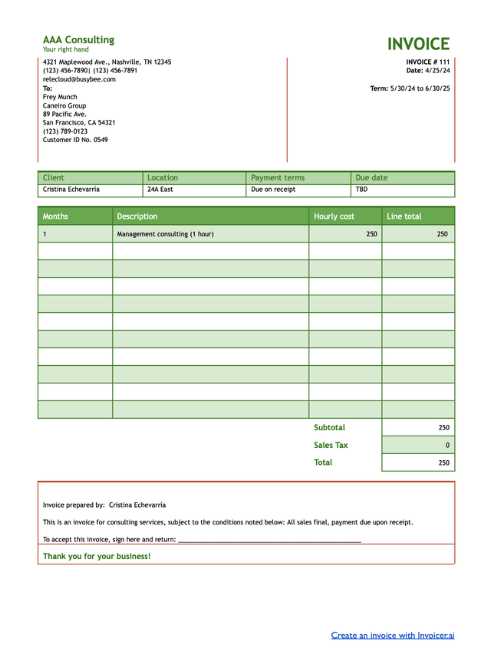

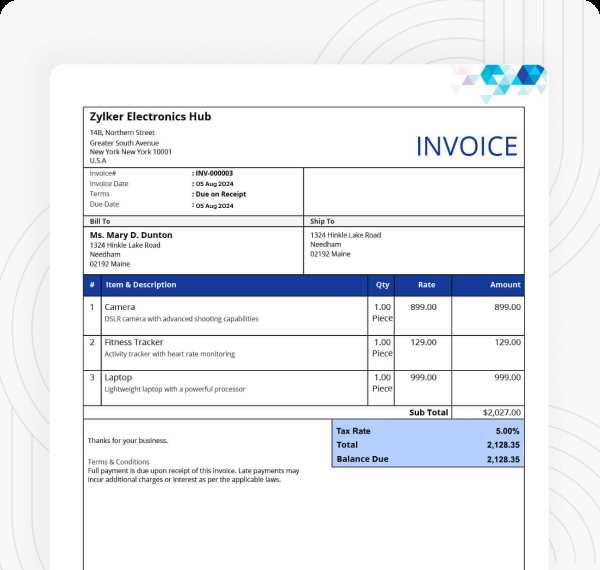

When customizing such a document, ensure it includes all necessary fields to avoid confusion and potential disputes. Common elements to consider are:

- Your name or business name and contact details

- Client’s name and contact information

- List of services provided or work completed

- Amount due, including any taxes or additional fees

- Payment terms, including due date and method of payment

- Invoice number for tracking purposes

With these details clearly outlined, you create transparency and help ensure prompt payments from clients. A well-organized document can also reflect positively on your reputation and build trust with clients, showing that you pay attention to the details of your business interactions.

Why You Need a Consulting Invoice

Having a clear, formal document to request payment is a crucial part of maintaining professionalism in your business. Without it, you risk confusion, delays, and potential misunderstandings with your clients. This kind of paperwork serves as an official record of the work completed, the agreed-upon fees, and the terms of payment.

Such a document not only provides clarity to your clients, but it also helps you maintain a structured system for tracking income and expenses. It can act as a safeguard in case of disputes, as both parties have a written reference to refer to when discussing payment. Moreover, using a consistent format enhances your credibility and shows clients that you are organized and reliable.

For those who work independently or run small businesses, this step is particularly important. It ensures that you get paid on time and helps establish your financial processes, ultimately making it easier to manage your cash flow and focus on growing your business.

How to Create a Professional Invoice

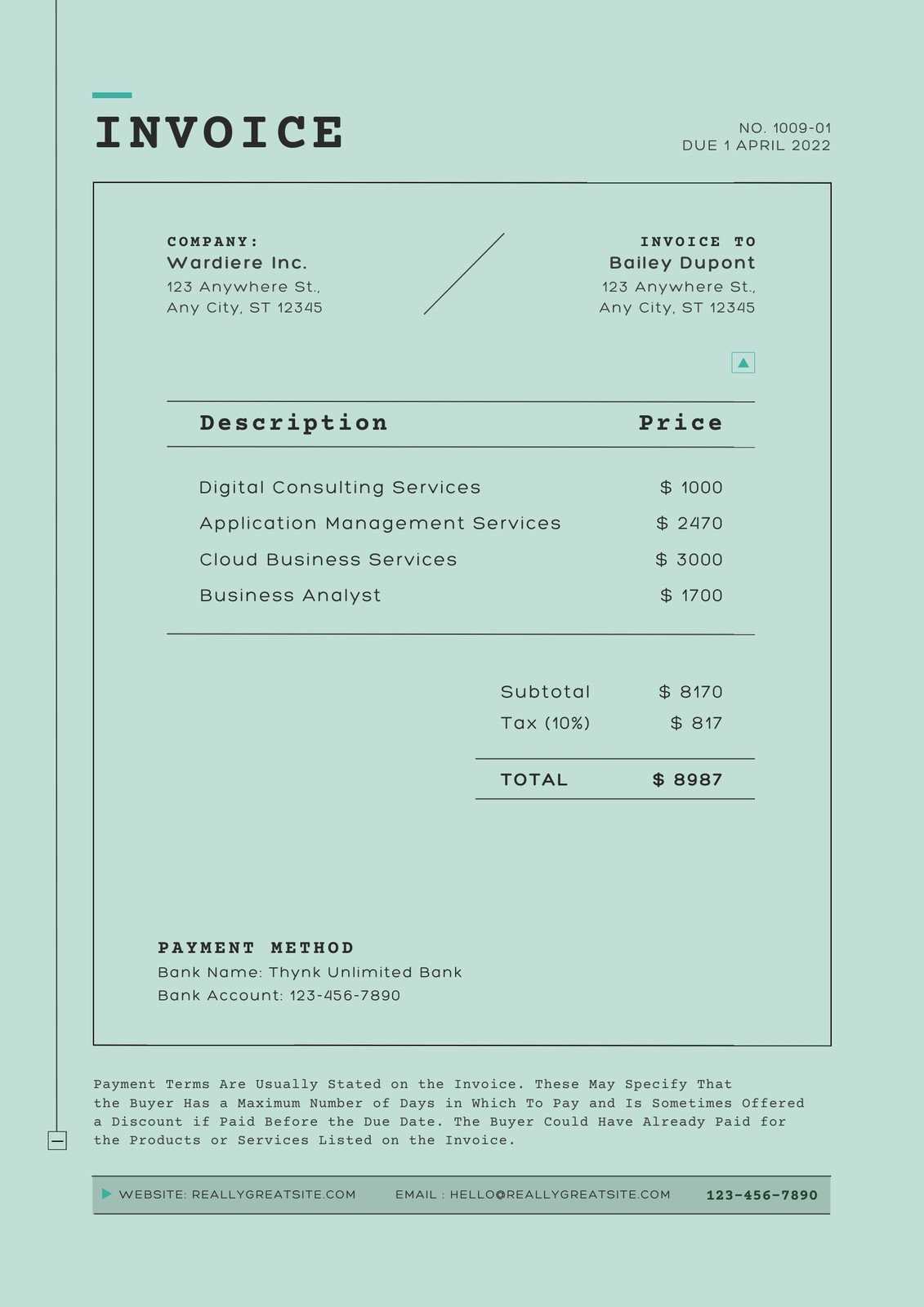

Creating a professional document to request payment involves more than just listing amounts owed. The goal is to present the details clearly and in a way that reflects your professionalism. An organized and visually appealing document not only helps avoid confusion but also enhances your reputation with clients.

Start by including essential information such as your name, business name, and contact details. It’s important to also specify the client’s name and their contact information. A well-structured breakdown of the work completed, along with pricing and payment terms, ensures transparency. Be sure to number each request for easy tracking, and specify a due date for payment.

Formatting matters too. Use a clean, easy-to-read design with enough space between sections to prevent the information from looking cluttered. Consider adding your logo or a consistent color scheme to reinforce your brand identity. This approach will not only make your document professional but also make it stand out in the client’s mind.

Essential Information to Include in an Invoice

When creating a payment request, it’s important to provide all the necessary details to avoid confusion and ensure that both you and your client are on the same page. A well-organized document should include key information that clearly outlines the amount owed, the work completed, and the payment terms.

Basic details such as your name or business name and the client’s contact information are essential. Additionally, you should include a unique reference number to help both you and the client track the request easily. This is particularly useful for record-keeping and future reference.

Breakdown of charges is another critical aspect. Clearly list the work performed, specifying the quantity, rate, and total cost for each task or project. If applicable, mention any taxes, additional fees, or discounts, as this helps avoid misunderstandings regarding the final amount.

Lastly, include payment terms, such as the due date, accepted payment methods, and any late fees if applicable. This ensures both parties understand the timeline and expectations for completing the transaction.

Benefits of Using a Template

Using a pre-designed document offers several advantages, especially when it comes to saving time and ensuring consistency. A ready-made structure helps you quickly generate the necessary paperwork without worrying about formatting or missing essential details. By relying on a template, you eliminate the need to create documents from scratch every time, allowing you to focus on other aspects of your business.

Time Efficiency

Speed is one of the key benefits of utilizing a pre-made document. Templates are designed to streamline the process, allowing you to fill in specific information and generate a professional-looking request in minutes. This reduces the time spent on formatting and ensures that all required fields are included.

Consistency and Professionalism

Using a standardized document not only saves time but also helps maintain uniformity across all your transactions. A consistent format reinforces your brand image and communicates professionalism to your clients. Whether you are working with new or returning clients, presenting the same high-quality format each time builds trust and reliability.

In the long run, adopting a structured approach to creating your requests also ensures you never overlook important details. This reduces the risk of errors and simplifies your administrative work, which is crucial for keeping operations running smoothly.

Customizing Your Consulting Invoice

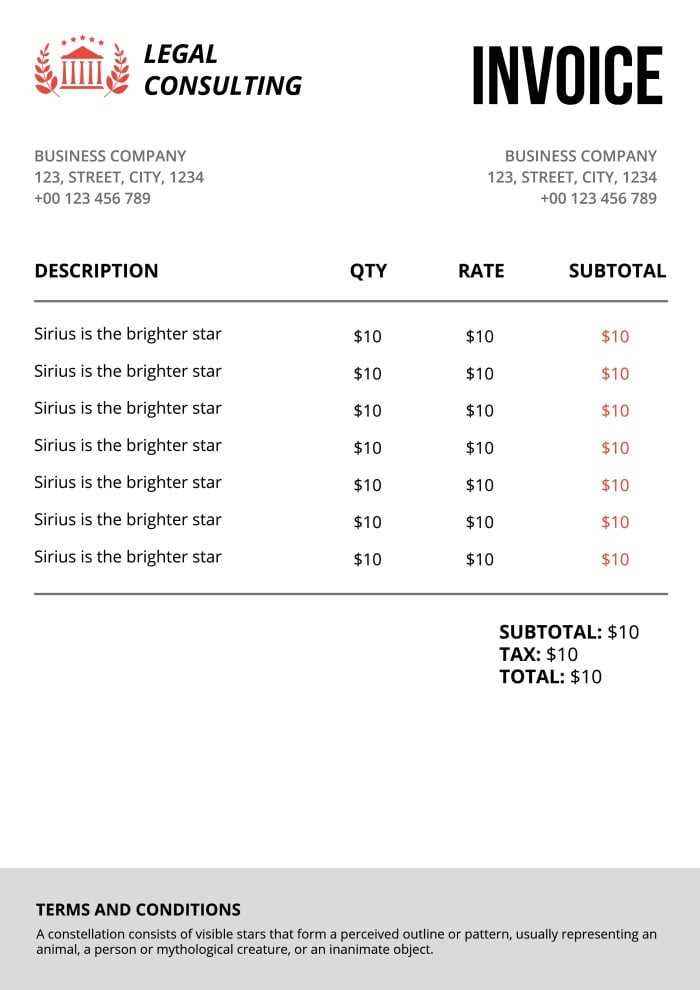

Adapting a payment request document to reflect your specific needs is crucial for creating a professional appearance and ensuring that all relevant details are captured accurately. Customization allows you to tailor the layout, content, and design to suit your business and make the request more personal and aligned with your brand. Whether you work on hourly rates or project-based fees, personalizing your document ensures clarity and enhances the overall client experience.

Adding Branding Elements

Branding is an important factor when customizing a document. Including your company logo, business colors, and font style can make the request more recognizable and professional. This not only makes the document look polished but also reinforces your business identity every time you send a request to a client.

Adjusting Layout and Content

In addition to visual elements, you can customize the layout and sections to reflect the unique aspects of your work. For example, if you offer discounts, include a space to highlight them. If your work involves multiple phases or milestones, consider adding a section to break down charges by each phase. Flexibility in design ensures that the document captures all relevant information in a way that is easy for your clients to understand.

Ultimately, customization gives you the freedom to present a document that fits your business model while maintaining clarity and professionalism. It creates a streamlined process that is both effective and aligned with your specific needs.

Common Invoice Mistakes to Avoid

Even a small error in a payment request can lead to confusion, delayed payments, and damaged client relationships. It’s essential to be aware of common pitfalls and take the necessary steps to avoid them. Attention to detail ensures that your document is both accurate and professional, ultimately fostering trust with your clients.

Missing Key Information

Omitting essential details is one of the most frequent mistakes when creating payment requests. Missing elements like your contact information, the client’s details, or the payment terms can cause confusion and delay the payment process. Always double-check that all required fields, such as the unique reference number and due date, are included before sending the request.

Inaccurate Calculations

Errors in math can lead to significant issues and misunderstandings. Double-check the amounts charged for each item, any taxes applied, and the total sum. Even a small mistake in totaling can give the wrong impression and cause unnecessary back-and-forth with the client.

Being thorough with your calculations and ensuring that all amounts are clearly explained can help prevent disputes and strengthen the professionalism of your transactions.

Invoice Format and Layout Tips

The structure and design of your payment request play a significant role in ensuring clarity and professionalism. A well-organized format helps both you and your clients understand the details at a glance, minimizing confusion and improving the overall experience. By following a few layout guidelines, you can create documents that are both functional and visually appealing.

Keep It Clean and Simple

Simplicity is key when it comes to layout. Avoid overcrowding the document with excessive details or graphics. A clean design with clear sections makes it easier for your client to quickly find the information they need. Leave adequate space between sections to prevent the content from appearing cluttered. A simple and organized layout helps maintain professionalism and improves readability.

Logical Section Order

Ensure that the sections are ordered in a logical way, starting with your business details at the top, followed by the client’s information, the breakdown of charges, and payment terms. Using headings and bold text to separate these sections can further enhance clarity. This allows the recipient to easily navigate the document without confusion.

Ultimately, a well-thought-out format can make your payment request appear more professional and facilitate smoother communication with your clients. Prioritizing readability and logical organization goes a long way in presenting your business in the best light.

How to Send Your Consulting Invoice

Once you’ve prepared your payment request document, the next step is to deliver it to your client in a way that is both professional and efficient. The method you choose can impact the speed of payment and the client’s overall experience. There are various options available, each with its own benefits depending on your needs and preferences.

Delivery Methods

There are several ways to send a payment request, each offering different levels of convenience and formality. Below are some common options:

| Method | Advantages | Disadvantages |

|---|---|---|

| Fast, convenient, allows for attachments, easy tracking | Can be overlooked, less formal | |

| More formal, tangible copy, good for high-value transactions | Slower delivery, higher cost | |

| Online Payment Platforms | Secure, integrated payment processing, real-time tracking | Platform fees, requires client to have an account |

Choose the right method based on your relationship with the client, the urgency of the payment, and the formality of the transaction. For most cases, email is a quick and effective option, but for more significant transactions, a mailed copy or using a secure online platform might be preferable.

Once sent, always confirm receipt by following up with your client, ensuring they have received the document and are clear on the payment terms. This step can prevent delays and ensure that there are no misunderstandings down the road.

Digital vs. Printed Invoices

When it comes to delivering payment requests, the choice between digital and physical formats is an important decision. Each method offers its own set of advantages and disadvantages, depending on factors such as client preferences, speed of delivery, and the nature of the transaction. Understanding the pros and cons of both can help you determine the best approach for your business.

Advantages of Digital Documents

- Speed – Digital formats can be sent instantly, allowing clients to receive them immediately.

- Cost-effective – No printing or postage costs are involved, making it a more affordable option.

- Convenient – Digital documents can be stored, tracked, and easily retrieved at any time.

- Environmentally friendly – Reduces paper waste and the environmental impact of physical mail.

Advantages of Printed Documents

- Formality – Physical documents can feel more official and professional, especially for large transactions.

- Client preference – Some clients may prefer a physical copy for their records or accounting purposes.

- Physical presence – A mailed document can sometimes have more of an impact, especially for clients who value tangible communication.

Ultimately, the decision depends on the needs of both you and your clients. For most day-to-day transactions, digital documents offer speed and efficiency, while printed formats might be more suitable for high-value deals or when a more personal touch is needed.

Invoice Payment Terms Explained

Clearly defining payment expectations is a crucial part of any financial agreement. By setting explicit terms, you help ensure that both parties are aware of when and how payments should be made. These terms outline the time frame for payment, accepted methods, and any penalties for late payments. Understanding these conditions can prevent confusion and improve the overall payment process.

Common Payment Terms

Due date – This is the agreed-upon date by which the payment should be made. It is often set based on the completion of the work or a specific calendar period (e.g., 30 days after receipt).

Late fees – If a client misses the payment due date, a late fee may apply. This is typically a fixed amount or a percentage of the total amount owed, designed to encourage timely payments.

Payment Methods and Methods of Collection

- Bank transfer – A common and secure method for transferring funds directly from one account to another.

- Credit/debit card – Many businesses now accept card payments, offering convenience for both parties.

- Online platforms – Using tools like PayPal, Stripe, or similar services allows for quick and secure payments, often with lower transaction fees.

By specifying payment terms clearly and upfront, you help ensure a smooth and timely transaction process. Being transparent with your clients about these expectations reduces the likelihood of misunderstandings and makes it easier to manage cash flow.

How to Track Invoice Payments

Keeping track of payments is essential for managing cash flow and ensuring that you receive timely compensation for your work. Implementing an organized system for monitoring outstanding payments helps you stay on top of your finances, avoid confusion, and take prompt action if a payment is delayed. There are several ways to track payments effectively, from manual methods to automated tools.

Manual Tracking Methods

While digital solutions are popular, some small businesses or freelancers may prefer a more hands-on approach. Here are a few common methods:

- Spreadsheets – Using tools like Excel or Google Sheets allows you to manually track payments. You can create columns for invoice numbers, amounts due, due dates, and payment statuses.

- Physical logbooks – For those who prefer offline methods, keeping a physical record of payments can be effective, especially when dealing with smaller volumes of transactions.

Automated Tracking Tools

If you deal with numerous clients or have a high volume of transactions, automation might be the best option. Many online tools and platforms allow you to:

- Track status in real-time – View the payment status of all requests in one place, including amounts paid, outstanding balances, and due dates.

- Send reminders – Set up automatic reminders for upcoming due dates or overdue payments to encourage timely action from clients.

- Generate reports – Automated systems can provide you with detailed reports on your finances, helping you analyze trends and make informed business decisions.

By maintaining accurate records, whether manually or through automated systems, you ensure that payments are properly tracked and that any issues are identified and addressed in a timely manner.

Invoice Templates for Different Needs

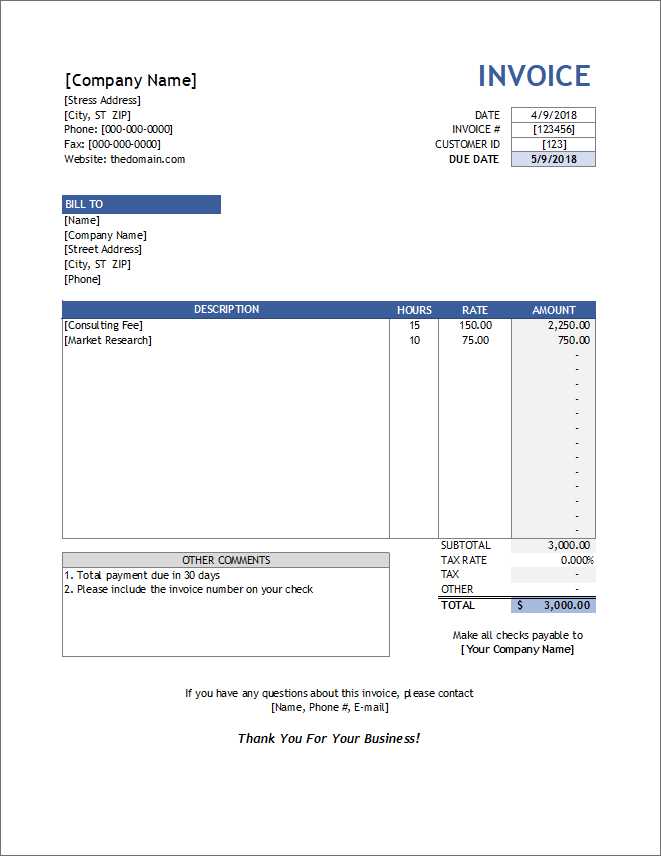

Depending on the type of work you do and your client requirements, a standardized payment request document may not always meet your needs. Customizing your document based on the project type, payment structure, and client expectations can help ensure accuracy and professionalism. Understanding the different formats and how they apply to various business scenarios will allow you to create documents that best fit your needs.

Different Payment Scenarios

Different business models often require different approaches to structuring the payment request. Here are a few scenarios:

| Scenario | Features | Best For |

|---|---|---|

| Hourly-Based Work | Tracks time spent, hourly rate, and total amount | Freelancers, contractors, and agencies with time-based work |

| Project-Based Work | Details the specific milestones, deliverables, and fees | Project managers and businesses handling large-scale tasks |

| Recurring Payments | Lists fixed amounts with recurring dates for subscription or ongoing work | Retainers, memberships, and long-term contracts |

Customizing for Clients

Not all clients will have the same expectations when it comes to payment documentation. For some, a basic request might be sufficient, while others may require more detailed breakdowns. Customizing your document to include or exclude specific fields based on the client’s preferences can help streamline the process and reduce any misunderstandings. Consider offering variations of your document to cater to different client needs:

- Basic Details – A simple, clean document with essential information for small or one-time projects.

- Itemized Breakdown – For larger or more complex projects, provide detailed descriptions of tasks and fees.

- Discounts and Promotions – Include spaces to apply special rates, discounts, or promotional offers for loyal clients or specific projects.

By tailoring your document to the specific requirements of each project or client, you can ensure clarity, professionalism, and quicker payments.

Where to Find Free Invoice Templates

If you’re looking for a quick and efficient way to create a payment request document without starting from scratch, there are several resources available online. Many platforms offer customizable formats that can be downloaded and used for different types of transactions. These resources can help save time and effort, allowing you to focus on the actual work rather than formatting your payment requests.

Popular Online Sources for Payment Request Documents

Here are some common places where you can find downloadable and customizable formats:

| Source | Features | Best For |

|---|---|---|

| Google Docs | Simple, easy-to-edit options, cloud-based access | Freelancers and small businesses |

| Microsoft Office Templates | Wide variety of formats, highly customizable | Businesses using Microsoft products |

| Online Invoice Generators | Quick, automatic generation with customizable fields | Those needing fast, on-the-go document creation |

Additional Options for Finding Documents

In addition to well-known software platforms, there are also several websites dedicated to offering payment request forms. These platforms often include templates tailored for specific industries, such as creative work, consulting, or retail. Many of these sites allow you to customize the layout and fields to match your business needs. Some may even offer a selection of visually appealing designs to give your payment requests a polished look.

By exploring these resources, you can easily find a suitable format that saves you time and ensures professionalism when requesting payments from clients.

Creating Recurring Invoices for Clients

When working with clients on long-term projects or ongoing agreements, setting up automatic billing can save you time and ensure consistent payments. Recurring billing allows you to set a fixed schedule for payment requests, making it easier to manage finances and reduce administrative work. This process is especially helpful for subscription-based models, retainers, or contracts that involve regular payments.

Setting Up a Recurring Billing System

To create a recurring billing system, you’ll need to determine the frequency, amount, and method of payment. Here’s how to get started:

- Choose a payment cycle – Decide whether payments will be monthly, quarterly, or yearly based on your agreement with the client.

- Specify payment amounts – Define the fixed amount for each billing cycle, whether it’s the same each time or adjusted based on project milestones.

- Select a payment method – Choose how you’ll receive payments, such as through bank transfers, credit cards, or online payment systems.

Benefits of Recurring Payment Requests

By automating the billing process, you can streamline cash flow and reduce the need for manual invoicing each time a payment is due. This not only saves time but also improves client satisfaction, as they will always know when to expect charges. Additionally, it minimizes the risk of missed payments, helping you maintain a steady income stream.

Tracking recurring payments becomes much easier as well, as all payments are linked to a set schedule and can be monitored through accounting software or spreadsheets. This helps ensure that no payments slip through the cracks and that your business stays financially organized.

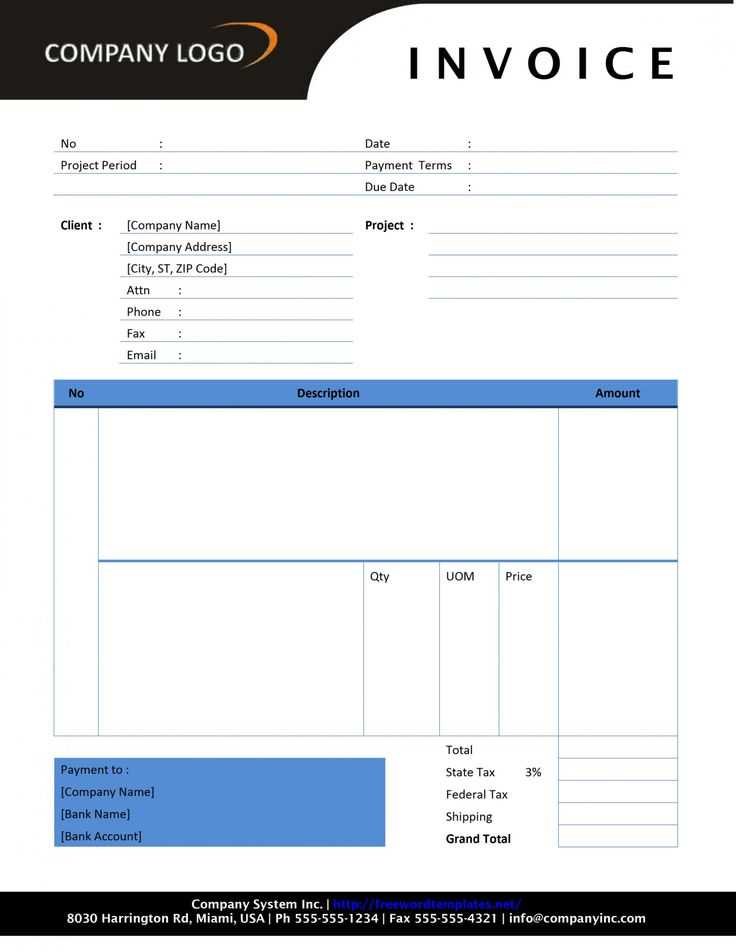

Best Practices for Invoice Numbering

Numbering your payment requests consistently is essential for organization and record-keeping. A well-structured numbering system helps track transactions, ensures accuracy, and simplifies accounting. By implementing a clear and logical numbering system, you can quickly identify specific documents and maintain proper order, making it easier to manage financial records.

Guidelines for Effective Numbering

When setting up a numbering scheme, it’s important to follow best practices that ensure clarity and consistency. Here are some key points to consider:

| Practice | Explanation | Benefit |

|---|---|---|

| Sequential numbering | Use a simple, continuous number sequence (e.g., 001, 002, 003) to avoid confusion. | Provides clear, chronological tracking of payment requests. |

| Year-based format | Incorporate the year into the numbering system (e.g., 2024-001, 2024-002) for easy sorting and reference. | Helps organize documents by year, particularly for accounting and tax purposes. |

| Client-specific identifiers | Include a client code or reference number (e.g., CLT001-001) to associate payment requests with specific clients. | Helps differentiate documents when managing multiple clients or projects. |

Tips for Maintaining Numbering Consistency

Once you’ve chosen a system, consistency is key. Consider the following tips to maintain organization:

- Use software tools – Many accounting platforms or document management tools offer automated numbering to eliminate human error.

- Avoid reusing numbers – Never use the same number twice to prevent confusion and maintain the integrity of your records.

- Plan for growth – Ensure that your system can accommodate future clients and transactions, especially as your business scales.

By following these best practices, you’ll not only improve your organization but also create a professional and consistent approach to managing financial transactions.

Legal Considerations for Consulting Invoices

When creating payment requests, it’s essential to ensure that they comply with relevant laws and regulations. Understanding the legal requirements that govern such documents not only helps protect your business but also ensures that your clients can trust your professionalism. Legal considerations can vary depending on your location, the nature of your work, and your contractual agreements with clients. Familiarizing yourself with these requirements is a key part of maintaining a smooth and compliant business operation.

Key Legal Requirements for Payment Requests

While specifics can differ depending on jurisdiction, there are several common legal elements that should always be included in your documentation:

| Requirement | Description | Importance |

|---|---|---|

| Clear identification of parties | Include your business name, client’s name, and contact details for both parties. | Ensures both you and the client are correctly identified for legal purposes. |

| Itemized list of work | Provide a clear breakdown of the tasks, fees, and any agreed-upon terms or milestones. | Prevents disputes over the scope of work or agreed-upon charges. |

| Payment terms | Specify due dates, accepted payment methods, and any penalties for late payments. | Protects both parties and sets clear expectations for financial transactions. |

| Tax information | Include applicable tax rates and tax identification numbers (e.g., VAT or sales tax). | Complies with tax laws and ensures that taxes are properly applied and reported. |

Additional Legal Considerations

Aside from the basics, there are some additional elements that may be required based on the nature of your work or location:

- Contracts and Agreements – Always reference any contracts or agreements that outline payment terms, deadlines, and other obligations. This ensures clarity and can help resolve disputes more easily if they arise.

- Late Payment Fees – If you intend to charge late fees, make sure this is clearly stated in your agreement and payment request, as some regions require written consent from the client.

- Jurisdiction – Depending on your location and your client’s, it’s important to clarify the legal jurisdiction that governs the contract in case of any disputes.

By adhering to legal requirements, you not only protect your business but also maintain trust with clients, fostering long-term, professional relationships.

Improving Your Invoicing Process

Streamlining your payment request process is key to maintaining a professional image and ensuring timely payments. By optimizing how you create, send, and track requests, you can reduce errors, save time, and improve cash flow. A well-organized process not only enhances client satisfaction but also simplifies your financial management, allowing you to focus on growing your business.

Automating the Payment Request Process

One of the most effective ways to improve your payment collection process is by automating repetitive tasks. This can be achieved through invoicing software that generates, sends, and tracks requests with minimal input. Automation offers several advantages:

- Consistency – Automation ensures that each request follows the same format, reducing the risk of errors.

- Time-saving – Set up recurring payment cycles for ongoing clients, so you don’t need to generate new documents manually each time.

- Payment tracking – Keep track of all outstanding amounts and payment statuses, ensuring you stay on top of your financials.

Designing a Clear and Professional Layout

A well-structured document not only reflects professionalism but also makes it easier for clients to understand and process payments. Some best practices include:

- Clear headings – Use distinct sections for important details such as client information, due dates, and payment terms.

- Simple, easy-to-read fonts – Choose fonts that are clear and legible, avoiding overly decorative styles that may hinder readability.

- Accurate, itemized breakdown – Always provide a detailed list of charges to avoid confusion or disputes over costs.

By refining these aspects of your process, you’ll ensure smoother interactions with clients and a more efficient way of managing payments.