How to Use the Vertex Invoice Template for Professional Billing

Managing financial transactions efficiently is essential for any business, whether it’s a small startup or an established enterprise. Accurate and professional documentation of payments and receipts ensures smooth operations and fosters trust with clients. A well-structured billing document can make all the difference in how your business is perceived and how quickly payments are processed.

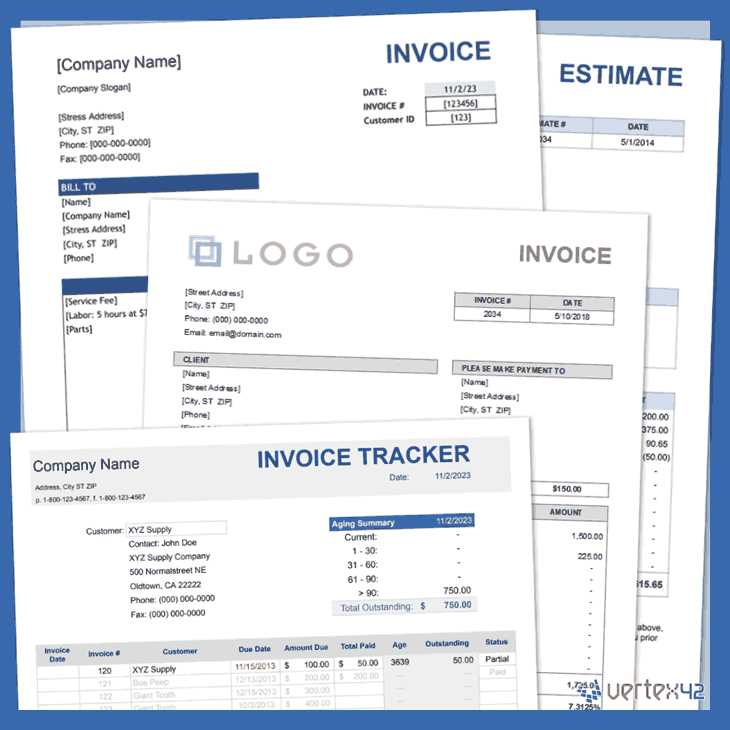

In this article, we will explore a powerful tool that simplifies the creation of such documents. Designed to be both user-friendly and versatile, this solution helps streamline your financial record-keeping. With customizable options, it allows you to tailor each document to meet your unique business needs, ensuring both consistency and professionalism in every transaction.

By adopting this solution, businesses can save valuable time and reduce the risk of errors, ultimately improving cash flow and client relationships. Whether you’re a freelancer, small business owner, or part of a larger organization, this tool offers significant advantages that contribute to overall efficiency and success.

Understanding the Billing Document Solution

Creating clear and accurate financial documents is crucial for maintaining smooth business operations. An efficient billing tool provides a structured framework for presenting essential transaction details in a professional format. This tool simplifies the process of organizing and tracking payments, making it easier to manage accounts and maintain positive client relationships.

The main purpose of this solution is to automate and standardize the creation of billing records, which can be customized to reflect the specific needs of different businesses. With various options for personalizing content, businesses can ensure that all essential information is included, such as service descriptions, payment terms, and client details.

Here are some key features that make this solution effective:

- Customizable Fields: Tailor each document to suit your business, whether you are a freelancer or part of a larger organization.

- Automated Calculations: Save time and reduce errors with built-in tools that automatically calculate totals, taxes, and discounts.

- Professional Design: Create clean, well-organized documents that convey professionalism and make a strong impression on clients.

- Easy Integration: The solution can be seamlessly integrated with accounting software to streamline financial tracking.

By using this billing solution, businesses can enhance their workflow, ensure greater accuracy in their financial records, and present a polished image to clients. It’s an indispensable tool for companies seeking a reliable method for handling transactions and ensuring timely payments.

Key Features of the Billing Document Solution

The right tool for generating financial documents offers a range of features that help businesses maintain accuracy and efficiency in their billing process. With a focus on customization, automation, and professionalism, these features can save time, reduce errors, and improve overall workflow. Below are the key elements that make this solution an essential tool for any business looking to streamline its financial documentation.

Customization and Flexibility

One of the standout features of this solution is its high level of customization. Users can easily adjust fields, fonts, and layout to fit their unique needs. Whether it’s adding a company logo, altering the payment terms, or adjusting the item list, the tool allows businesses to create documents that reflect their brand identity and operational preferences. This level of personalization ensures that every document appears professional and tailored to the client’s specific needs.

Automation and Error Reduction

Automating key elements of the document creation process is another powerful feature. Built-in calculations for totals, taxes, and discounts reduce the risk of human error. Once the data is entered, the system automatically updates totals and generates accurate documents with minimal effort from the user. This automation not only saves time but also ensures that all calculations are accurate, preventing costly mistakes and delays in the billing cycle.

By combining customization with automation, this solution helps businesses maintain consistency and efficiency while reducing administrative burdens. These features make the process of managing financial records seamless, ensuring timely and accurate transactions with clients.

How to Customize the Billing Document Solution

Customizing your financial documents allows you to create personalized and professional-looking records that align with your business needs. Whether you’re working with clients, customers, or partners, tailoring each document ensures it reflects your brand, highlights important details, and meets specific requirements. This section will guide you through the customization options available to make your documents stand out.

Adjusting Layout and Design

One of the most important aspects of customization is the design and layout of the document. The visual appeal can significantly influence how your business is perceived. Here are the key elements you can modify:

- Logo Placement: Add your company logo to the header for a branded, professional look.

- Font and Colors: Adjust fonts and colors to match your corporate identity, ensuring consistency with your overall brand design.

- Text Alignment: Customize the alignment of text and fields to ensure clarity and ease of reading for your clients.

Modifying Content and Fields

Another important feature of customization is the ability to adjust the content and structure of the document. You can easily add, remove, or rearrange sections to meet your specific needs. This allows you to present essential details clearly and concisely:

- Client Information: Include or edit client names, addresses, and contact details to ensure accurate communication.

- Service Descriptions: List the products or services provided, adding specific details about each item as needed.

- Payment Terms: Modify payment instructions, deadlines, and methods to suit each client’s preferences.

By leveraging these customization features, businesses can ensure that every document not only looks professional but also functions effectively in communicating essential financial information. This flexibility enhances the overall efficiency of your billing process and helps maintain strong relationships with clients and customers.

Benefits of Using the Billing Document Solution

Utilizing an efficient tool for generating financial records brings several key advantages to businesses of all sizes. From streamlining workflows to improving accuracy, this solution helps eliminate manual errors and ensures that all essential information is captured correctly. Below, we explore the main benefits of adopting such a tool in your business operations.

Time Savings and Efficiency

One of the most significant benefits of using this solution is the amount of time saved in creating detailed and accurate documents. With automated calculations, predefined fields, and customizable templates, businesses can generate professional records in minutes instead of hours. This efficiency frees up valuable time that can be spent on other important tasks, such as client communication or business development.

Improved Accuracy and Reduced Errors

Manual data entry often leads to mistakes, which can result in delayed payments and misunderstandings with clients. This solution minimizes such risks by automating key aspects of the document creation process. With built-in calculations for totals, taxes, and discounts, businesses can ensure accuracy in every document. Consistency and precision are maintained across all financial records, leading to fewer discrepancies and smoother transactions.

By leveraging this solution, businesses can also present a more professional image to clients. The clean, organized structure of the documents conveys a sense of reliability, while customizable features allow companies to align the appearance with their branding. This level of professionalism enhances trust and encourages positive relationships with clients.

In summary, using this tool helps improve both the efficiency and accuracy of your financial documentation, allowing businesses to focus on what truly matters: growing and maintaining strong relationships with clients and partners.

Steps to Create a Billing Document with the Solution

Creating a financial record for a client or business transaction is a straightforward process when using the right tool. With the right features and a user-friendly interface, you can generate professional documents in just a few simple steps. Here is a guide to help you create an accurate and well-organized billing record quickly.

Follow these steps to create your document:

- Choose a Format: Begin by selecting the preferred format for your document. Most solutions offer multiple layout options, so choose one that aligns with your business needs and branding.

- Enter Client Information: Add the client’s name, address, and contact details. Ensure all information is accurate to avoid any confusion or delays.

- List Products or Services: Clearly outline the products or services provided, including quantities, descriptions, and unit prices. Be as specific as possible to avoid misunderstandings.

- Include Payment Terms: Specify the payment terms, such as due date, acceptable payment methods, and any late fees if applicable. Clear payment instructions help ensure timely transactions.

- Double-Check Totals and Calculations: Review all totals, taxes, and discounts to ensure everything adds up correctly. The system may automatically calculate these, but it’s always good practice to double-check.

- Finalize and Send: Once all information is correct, finalize the document and send it to the client. Most systems allow for easy export or direct email options to simplify this step.

By following these simple steps, you can efficiently create a professional document that clearly communicates the details of the transaction. Whether you’re invoicing for services, products, or other business activities, this process ensures that all the necessary information is included and presented in a polished format.

How the Billing Solution Saves Time

Efficiency is key when managing business transactions, and using the right tool can significantly reduce the time spent on creating and processing financial records. With its streamlined features and automated processes, this solution helps businesses cut down on manual work, ensuring quick turnaround times and minimal effort. Below, we explore how the solution can save time in your daily operations.

By automating key steps in the document creation process, businesses can avoid repetitive tasks and focus on more important activities. Here’s how it helps:

| Step | Time Saved | How It’s Achieved |

|---|---|---|

| Pre-built Structure | Significant | The solution comes with ready-to-use formats, eliminating the need to design each document from scratch. |

| Automated Calculations | Moderate | Built-in tools automatically calculate totals, taxes, and discounts, reducing time spent on manual math. |

| Data Entry Fields | Moderate | Predefined fields for client details, services, and payment terms speed up data entry by minimizing the need to manually format documents. |

| Easy Export Options | Minor | Documents can be easily exported or emailed directly, cutting down the time needed for distribution and follow-up. |

By leveraging these features, businesses can streamline their entire billing process. This not only saves time but also ensures consistency and accuracy across all financial records. Whether you’re a freelancer or managing a larger company, these time-saving tools allow for faster document generation, ensuring prompt invoicing and quicker payments.

Common Mistakes to Avoid in the Billing Document Solution

When creating financial records, accuracy and attention to detail are essential. While the right tool can help streamline the process, mistakes are still common if proper care isn’t taken. Even small errors in your documents can cause confusion, delay payments, or damage your business reputation. Below, we’ll cover some common pitfalls to avoid when using this tool.

Here are the most frequent mistakes and how to avoid them:

| Mistake | Why It Matters | How to Avoid It |

|---|---|---|

| Incomplete Client Information | Missing or incorrect client details can lead to misunderstandings or delayed payments. | Always double-check client names, addresses, and contact information before finalizing the document. |

| Incorrect Payment Terms | Unclear or inaccurate payment instructions can cause confusion and delays in receiving funds. | Ensure payment terms (e.g., due date, accepted methods) are explicitly stated and aligned with your agreement with the client. |

| Omitting Taxes and Discounts | Forgetting to include taxes or discounts can lead to incorrect totals and cause discrepancies with clients. | Double-check all calculations and ensure taxes, discounts, and fees are correctly applied. |

| Using Inconsistent Formatting | Inconsistent fonts, styles, or layouts can make the document appear unprofessional and difficult to read. | Stick to a consistent design and layout, and use the tool’s built-in options for a cohesive look. |

| Sending Documents with Errors | Sending a document with errors can damage your business’s credibility and delay the payment process. | Always proofread the document before sending it to ensure all details are correct and clear. |

By avoiding these common mistakes, you can ensure that your financial records are accurate, professional, and prompt, helping to maintain positive relationships with clients and improving your overall workflow.

How to Export Billing Documents Efficiently

Once your financial records are created, the next important step is exporting and sharing them with clients or relevant parties. Efficient export options ensure that your documents are delivered promptly and without issues. Whether you’re sending a single document or managing a bulk export, following the right process can save time and reduce errors.

Choosing the Right Export Format

Most tools allow for exporting your documents in various formats, such as PDF, Word, or Excel. The choice of format depends on your specific needs:

- PDF: A universally accepted format that preserves the layout and design, making it ideal for sharing and printing.

- Excel: Best for cases where you need to manage data in spreadsheets or need further calculations.

- Word: Useful when additional editing is needed before sending the document to the client.

Choosing the correct format ensures that your recipients can easily access and use the document, whether it’s for record-keeping or further processing.

Efficient Exporting Tips

To streamline the export process and avoid mistakes, follow these best practices:

- Batch Export: If you need to send multiple documents, look for batch export options that allow you to export several records at once, reducing the time spent on individual tasks.

- Automated File Naming: Use naming conventions that automatically organize and label files based on client or project details. This will help with file management.

- Email Integration: Many tools allow you to export documents directly via email. Take advantage of this feature to quickly send finalized records to clients without needing to leave the tool.

By following these simple tips and selecting the right export options, businesses can save time and ensure that their financial documents are sent efficiently, helping to maintain a smooth and professional workflow.

Integrating Billing Solution with Accounting Software

Integrating your financial documentation tool with accounting software can significantly streamline your business operations. By automating the flow of data between these two systems, you can eliminate the need for manual entry and ensure that all financial records are accurately tracked. This integration reduces errors, improves efficiency, and provides real-time insights into your cash flow and financial health.

Here’s how the integration works and why it’s beneficial:

- Automatic Data Sync: When your billing tool is linked to accounting software, client details, transaction amounts, and payment terms are automatically transferred. This reduces the time spent entering information and ensures consistency between your records.

- Real-Time Financial Updates: With integration, every new transaction is instantly updated in your accounting software. This provides up-to-date financial information, helping you manage cash flow more effectively and prepare for tax season without last-minute scrambling.

- Reduced Risk of Errors: Manual data entry often leads to mistakes, such as duplicate entries or incorrect figures. By connecting your billing solution with accounting software, you minimize these risks and ensure that all data is accurately recorded.

- Time-Saving Automation: Integration automates several tasks, such as creating reports and tracking expenses, saving you countless hours that would otherwise be spent on manual bookkeeping.

To integrate these two systems, you’ll need to choose an accounting software that is compatible with your billing tool. Many platforms offer seamless integration options, often through APIs or third-party connectors. Once set up, the integration process is typically smooth, and you can begin seeing immediate improvements in your workflow.

Incorporating accounting software into your billing process not only simplifies financial management but also enhances overall business efficiency. It’s a powerful way to keep your financial data organized, accurate, and accessible in real-time.

Improving Billing Accuracy with the Solution

Ensuring the accuracy of financial records is essential for maintaining smooth business operations and fostering trust with clients. Inaccurate details, whether in pricing, client information, or calculations, can lead to confusion, delayed payments, and even strained relationships. Using a reliable billing tool can significantly reduce errors and increase the precision of your documents, making the entire invoicing process more efficient and professional.

Automated Calculations for Error-Free Documents

One of the main ways this solution improves accuracy is by automating calculations. Manual computations for totals, taxes, and discounts often lead to mistakes, especially when dealing with complex billing structures. With built-in automatic calculation features, the tool eliminates the possibility of human error:

- Tax Calculations: Automatically applies the correct tax rates based on the specified location or type of product/service.

- Discounts: Calculates applicable discounts and applies them to the total, ensuring the right amount is reflected in the final amount due.

- Itemized Billing: Ensures that all line items, quantities, and prices are added correctly, giving you a clear and accurate breakdown of the costs.

Consistency and Standardization

Another key feature of the solution is its ability to maintain consistency across all billing records. By using pre-defined fields and structured templates, the tool helps ensure that every document follows the same format. This standardization reduces the risk of missing information, such as client details or service descriptions, and keeps your records clear and organized. It also makes it easier to spot errors quickly when reviewing documents before sending them to clients.

With these built-in features, the likelihood of errors is greatly reduced, and your documents will reflect accurate, well-organized details every time. This not only ensures that your billing process is efficient but also helps in maintaining a positive and professional relationship with clients.

Best Practices for Professional Billing Documents

Creating professional financial records is essential for businesses that want to maintain a positive image and ensure clear communication with clients. A well-structured document not only reflects the quality of your work but also sets the tone for how clients perceive your professionalism. By following best practices for formatting, content, and design, you can ensure that your financial records are effective, clear, and easy to process.

Clear and Consistent Structure

A professional document should have a clear and consistent structure to make it easy for clients to understand. The layout should be neat, with well-defined sections and headings. Here are some key elements to include:

- Contact Information: Always include both your business details and the client’s contact information at the top of the document. This makes it easy for clients to verify who the document is from and how to contact you.

- Itemized Breakdown: Clearly list the products or services provided, including quantities, descriptions, and unit prices. This breakdown helps prevent misunderstandings and clarifies exactly what the client is being billed for.

- Payment Terms: Clearly outline the payment due date, accepted payment methods, and any additional fees for late payments. This ensures that both parties are on the same page when it comes to deadlines and expectations.

Design and Visual Appeal

While the content is crucial, the design and visual appeal of your documents also play an important role. A well-designed document enhances readability and helps create a lasting impression. Here are some design tips:

- Simple and Professional Fonts: Use clean, easy-to-read fonts such as Arial or Times New Roman. Avoid overly decorative fonts that may make the document look unprofessional.

- Branding: Incorporate your company logo, color scheme, and any other elements that reflect your brand identity. This gives your document a polished, cohesive look.

- Whitespace: Ensure that the document isn’t overcrowded with text. Use plenty of whitespace to separate sections and make the content easier to digest.

By following these best practices, you can ensure that your billing documents not only meet professional standards but also foster clear communication and positive client relationships. A well-crafted document will leave a lasting impression and contribute to the smooth and efficient handling of transactions.

Why Choose This Billing Solution Over Others

When selecting a tool for creating financial records, businesses need a solution that is reliable, efficient, and capable of handling various tasks seamlessly. While there are many options available, choosing the right one can make a significant difference in how smooth and effective the billing process is. This solution stands out for its user-friendly design, powerful features, and overall efficiency, making it a preferred choice for many businesses over other tools available on the market.

Key Advantages of This Solution

Here are some of the reasons why businesses choose this billing tool over others:

| Feature | Benefit | Why It’s Better |

|---|---|---|

| Ease of Use | Simple and intuitive interface | Most solutions are cluttered or require advanced technical skills. This tool makes document creation easy, even for beginners. |

| Customizability | Personalized layout options | Other tools may have limited design flexibility. This solution allows you to fully tailor documents to fit your brand and needs. |

| Automated Features | Automatic calculations, tax inclusion | Many solutions still rely on manual input for calculations. This tool automates key functions to save time and reduce errors. |

| Integration | Seamless connection with other software | Unlike some alternatives, this solution easily integrates with accounting platforms, allowing for more efficient data management. |

| Support and Updates | Regular software updates and dedicated support | Other tools often lack reliable customer support or frequent updates. This tool ensures you always have access to the latest features and assistance when needed. |

Efficiency and Reliability

What really sets this solution apart is its combination of efficiency and reliability. The tool’s ability to automate tasks such as calculations, data entry, and document formatting significantly reduces the time spent on manual processes. In turn, this allows busines

How This Billing Solution Enhances Brand Identity

For businesses looking to strengthen their brand image, every point of interaction with clients is an opportunity to make a lasting impression. When it comes to financial documentation, incorporating your brand elements can enhance your professional image and reinforce your company’s identity. By customizing your billing records, you ensure consistency across all client-facing materials, making your business more recognizable and memorable.

Brand Customization Features

This solution offers several ways to incorporate your brand’s look and feel directly into your financial documents:

- Logo Placement: Adding your company logo to each document helps to establish a consistent visual identity. Clients will immediately associate the record with your brand.

- Custom Colors: Integrating your brand’s color scheme into the document’s design ensures that your brand’s colors are consistently reflected across all communications.

- Font Selection: Choose fonts that align with your brand’s style guide. Whether you prefer a modern sans-serif or a more traditional serif font, having a consistent font choice reinforces professionalism and brand recognition.

- Tailored Messaging: Customizable text fields allow you to add personalized greetings or messages, enhancing the client’s experience and giving the document a more personal touch.

Creating a Cohesive Client Experience

Consistency in branding is key to creating a cohesive client experience. Every interaction–whether it’s through a website, email, or financial document–should communicate the same message about your business. By aligning your billing documents with the visual elements already present in other parts of your business, you build trust and professionalism. Clients will appreciate the attention to detail and will associate your high-quality services with your well-crafted, brand-focused documents.

Ultimately, this solution gives businesses the tools to not only manage financial records effectively but also to present a unified, professional brand image that resonates with clients, building stronger relationships and improving brand recognition over time.

Creating a Payment Schedule with the Billing Solution

Establishing clear and manageable payment terms is essential for maintaining a smooth cash flow and ensuring timely payments. A payment schedule outlines when and how payments are due, helping both businesses and clients stay organized. This solution allows you to easily create detailed payment schedules that can be customized to fit the unique needs of each client, ensuring both clarity and flexibility.

Key Features for Setting Up a Payment Schedule

This solution offers several useful features to help you design a payment schedule that works for both your business and your clients:

- Flexible Payment Terms: Customize the payment intervals (e.g., weekly, monthly, or by milestones) to suit the agreement made with your client.

- Due Dates: Set specific due dates for each payment, making it easy to track and manage when payments should be made.

- Automatic Reminders: Set up automatic reminders for upcoming payments or overdue amounts, ensuring that your clients are consistently informed about their payment obligations.

- Partial Payments: Enable clients to pay in installments. The system allows you to divide the total amount into manageable parts, making it easier for clients to make payments without feeling overwhelmed.

Sample Payment Schedule Breakdown

Here’s an example of how a payment schedule might look when created with this solution:

| Payment No. | Amount | Due Date | Status |

|---|---|---|---|

| 1 | $500 | January 15, 2024 | Paid |

| 2 | $500 | February 15, 2024 | Pending |

| 3 | $500 | March 15, 2024 | Pending |

With this approach, each payment is clearly outlined, and both the business and the client know exactly what is expected. The ability to track payment progress easily ensures that businesses can follow up promptly if needed.

B

Billing Solution for Small Business Owners

For small business owners, managing finances efficiently is crucial for long-term success. A streamlined process for creating financial records not only helps with accurate bookkeeping but also builds credibility with clients. A user-friendly solution for generating professional financial documents allows small business owners to focus on growing their business without getting bogged down in complicated administrative tasks.

Why Small Business Owners Choose This Solution

This solution is designed to meet the specific needs of small businesses by offering an easy-to-use and cost-effective way to handle financial documents. Here’s why it’s a great fit for small business owners:

- Ease of Use: No need for advanced accounting skills. The simple interface makes creating financial records quick and straightforward, even for those with little experience in finance.

- Customization Options: Small business owners can tailor the documents to their brand, including adding logos, custom color schemes, and specific payment terms that align with their business practices.

- Affordable: This solution provides all the essential features without the high cost of complex software. Small business owners can access professional-grade tools at a fraction of the price.

- Time-Saving Features: The automation of key tasks, such as calculations, tax inclusion, and due dates, saves time and reduces the chances of manual errors.

Key Benefits for Small Businesses

Small business owners can benefit from using this solution in many ways, including:

- Professional Appearance: Well-designed, consistent financial documents help small businesses present a polished and trustworthy image to clients.

- Improved Cash Flow: Clear payment terms and schedules help businesses keep track of outstanding amounts, ensuring that payments are received on time.

- Better Record Keeping: Organizing financial records is easier with a streamlined solution, helping small businesses stay on top of their accounting without the hassle of spreadsheets or manual entries.

- Increased Efficiency: By automating repetitive tasks, small business owners can spend more time focusing on business development and less on administrative work.

In conclusion, this solution is a valuable tool for small business owners who need a straightforward, customizable, and efficient way to manage their financial documents. With its user-friendly features, it makes managing client payments and maintaining accurate records simpler than ever, allowing