Free Sample of Invoice Template in Excel for Easy and Efficient Billing

Managing financial transactions efficiently is crucial for any business. A well-organized system for documenting payments ensures smooth operations and helps maintain professionalism. Many entrepreneurs and freelancers rely on structured documents to track their sales and services, making it easier to record the necessary details and communicate them to clients.

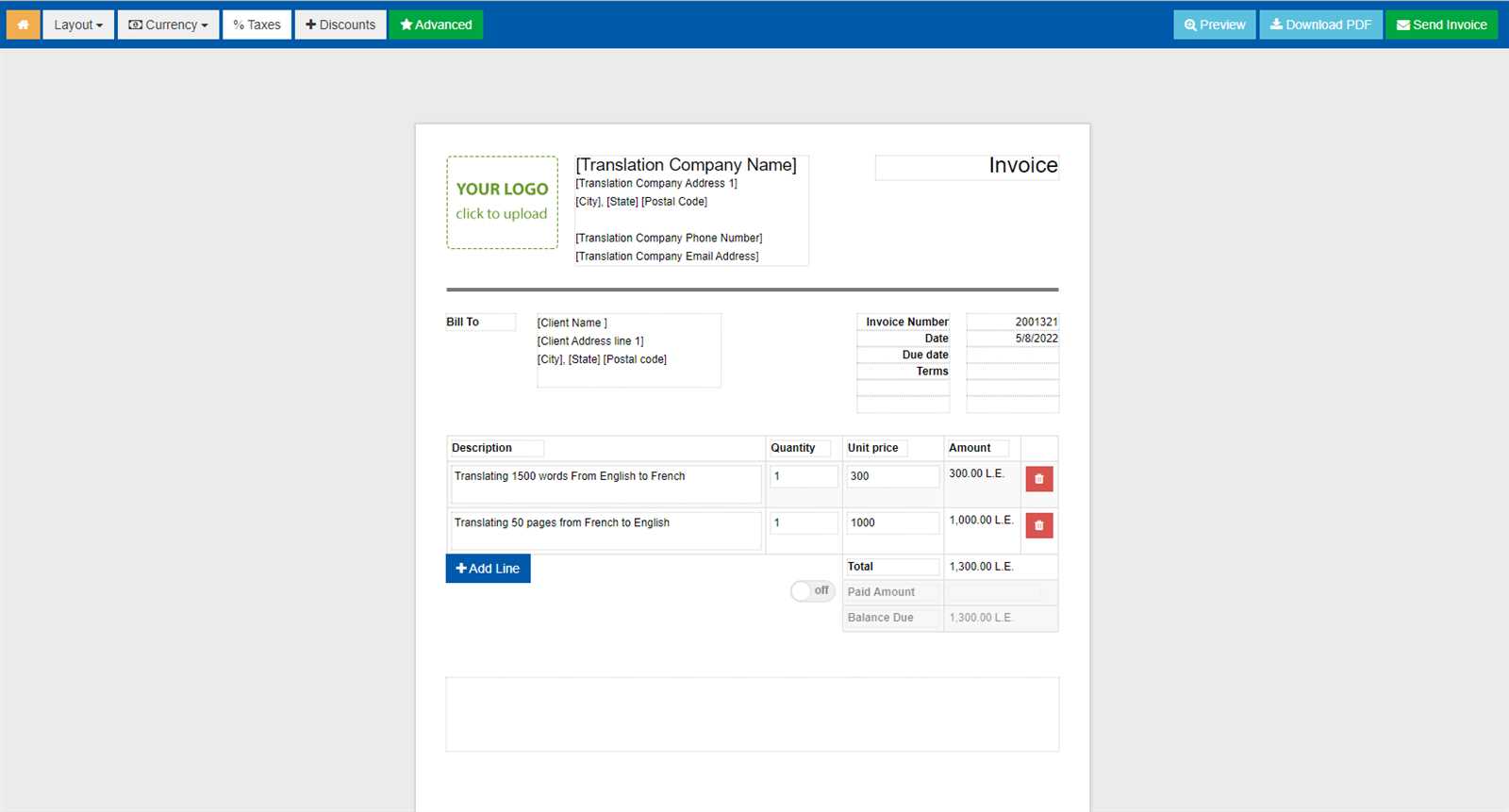

Creating these records doesn’t have to be complicated. With the right tools, you can build a clear, easy-to-understand document that includes all the essential information. By leveraging digital solutions, it becomes possible to automate much of the process, saving both time and effort.

In this guide, we’ll explore practical resources that simplify the process of drafting such documents, making it easier to manage your finances without the hassle of manual calculations or formatting. These tools are designed to fit the needs of both individuals and businesses, helping you stay organized and professional in every transaction.

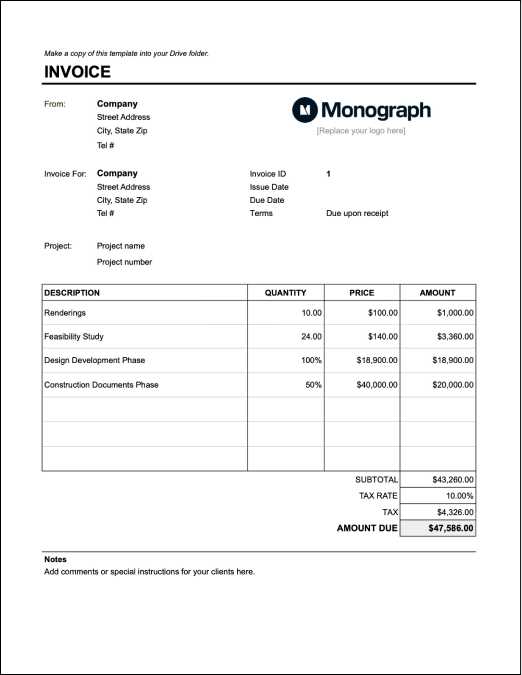

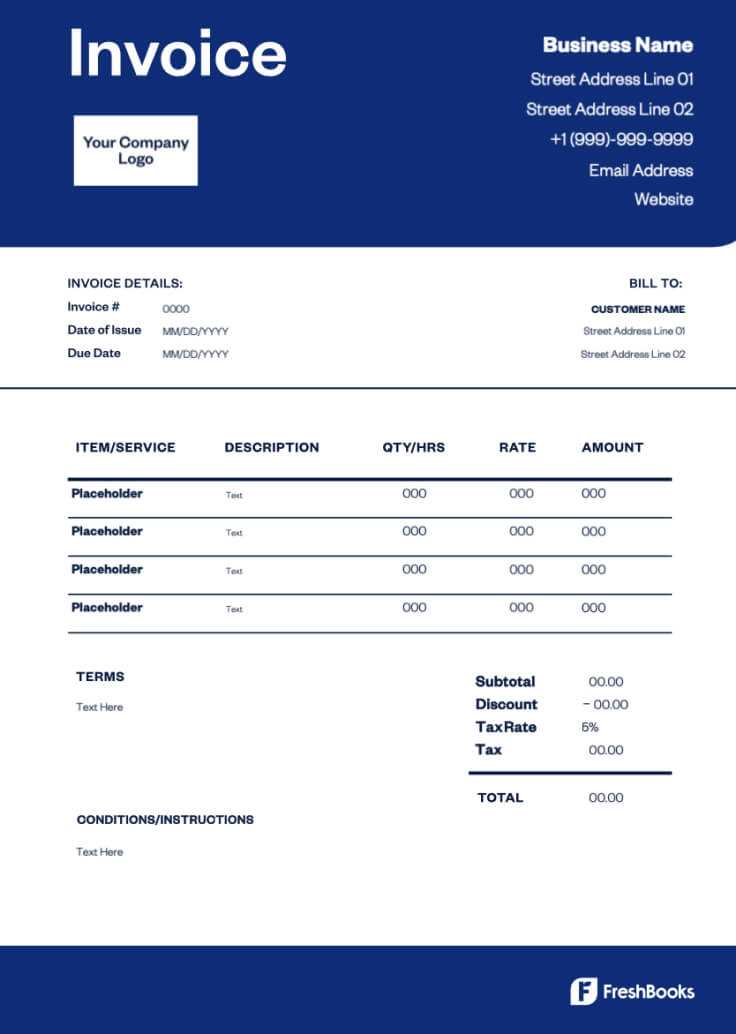

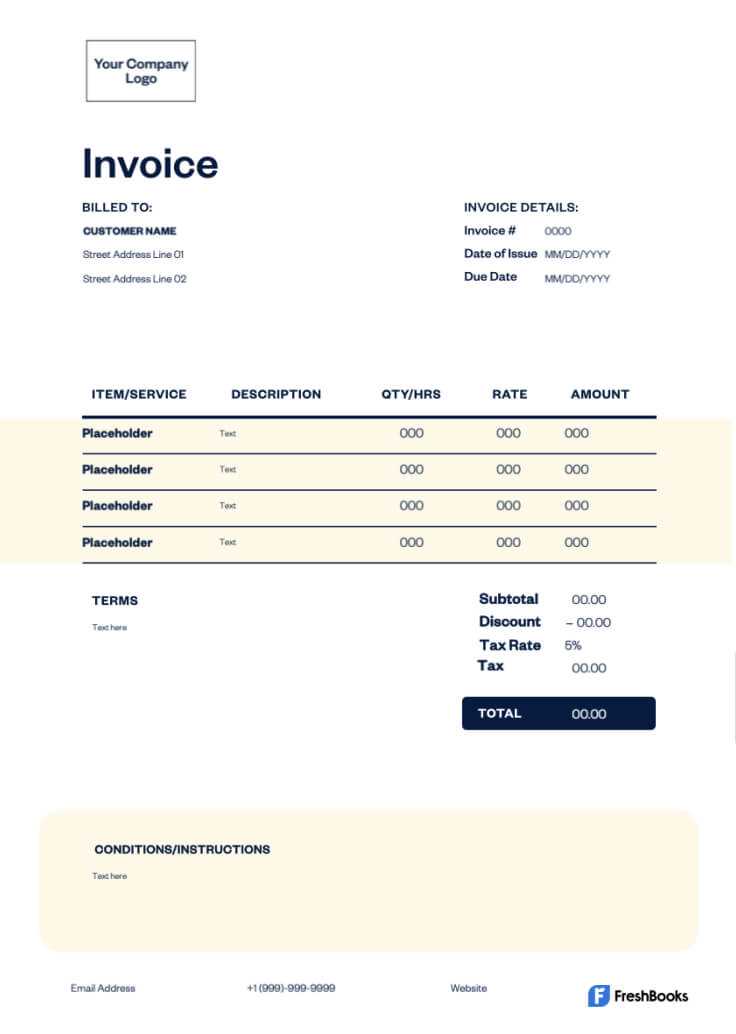

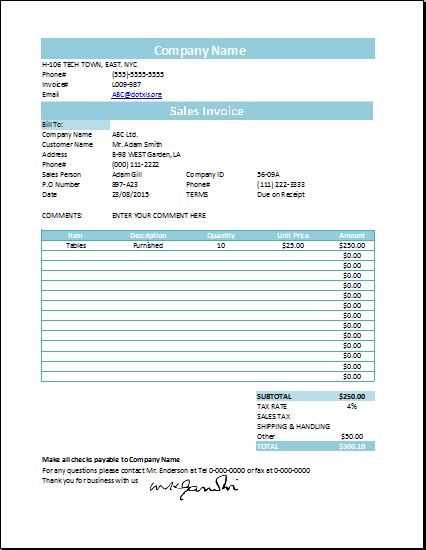

Sample of Invoice Template in Excel

Creating professional billing documents doesn’t have to be a time-consuming task. With the right structure in place, you can quickly generate accurate records for every transaction. A structured layout not only saves you time but also ensures that all relevant details are properly documented, making the process more transparent and efficient.

Key Features of a Structured Billing Document

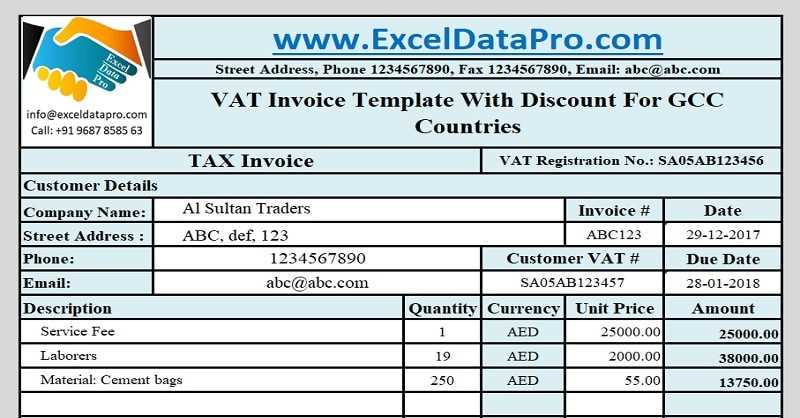

A well-designed document typically includes fields for essential information such as client name, service description, payment terms, and total amount due. These documents can also incorporate automated features, such as formulas to calculate totals and taxes, which help avoid errors and speed up the process. Using a digital format ensures you can make quick edits and reuse the structure for future transactions.

How to Customize the Layout for Your Needs

One of the main advantages of using a digital format is the ability to customize the structure. Depending on your business type, you can add or remove fields, adjust the design, or include additional information such as logos or payment instructions. These modifications make the document uniquely suited to your needs while maintaining a professional appearance.

Why Use an Invoice Template

Having a pre-designed structure for billing makes managing financial records more efficient and less prone to mistakes. Using a ready-made framework ensures consistency across all transactions, which is essential for maintaining professionalism in business communications. It saves valuable time that would otherwise be spent creating documents from scratch for each new client or project.

With a standardized format, you can easily incorporate key information such as client details, product or service descriptions, and payment terms. This approach helps eliminate common errors, ensuring that no important details are missed and that the final document is clear and accurate. The simplicity of such a structure also makes it easy for clients to understand, leading to smoother interactions and faster payments.

Furthermore, digital solutions allow for automatic calculations of totals, taxes, and discounts. This not only saves time but also reduces human error, providing a reliable and professional document every time. Additionally, the ability to customize these documents as needed ensures they align with your branding and specific business requirements.

Benefits of Excel for Invoices

Using a spreadsheet software for creating billing documents offers a wide range of advantages, especially when it comes to ease of use and automation. Its versatile features allow you to structure, calculate, and organize data in a way that is both accurate and efficient. With the ability to quickly modify the layout and content, you can create personalized records without needing advanced technical skills.

Automation and Error Reduction

One of the key advantages of using a digital spreadsheet for billing is its built-in automation. By incorporating formulas, you can automatically calculate totals, taxes, and discounts. This not only saves time but also minimizes human error, ensuring that each document is accurate and professional. With this automation, you can focus on providing services, rather than worrying about manual calculations.

Customization and Flexibility

Another significant benefit is the level of customization available. You can tailor the document to meet your specific needs, whether it’s adjusting the layout, adding branding elements like logos, or including additional information that is relevant to your business. The flexibility to modify the structure makes it suitable for a wide variety of industries, from freelancers to larger enterprises.

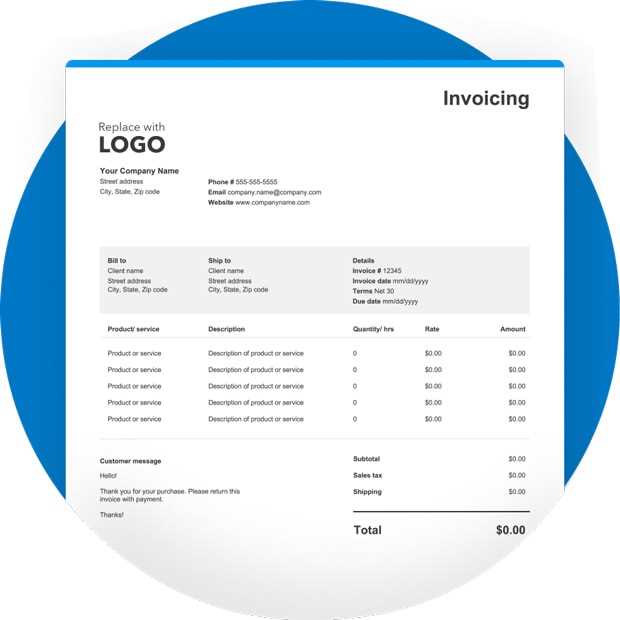

How to Customize Your Template

Personalizing your billing document allows you to create a record that fits your specific business needs and style. By adjusting key elements such as layout, fonts, and data fields, you can ensure that the document is not only functional but also aligned with your brand. Customizing the structure helps make your transactions look more professional and tailored to your services.

Adjusting the Layout and Design

To begin, you can modify the overall design of your document. This includes adjusting the column widths, adding colors, or inserting logos to align with your branding. The goal is to make the document visually appealing and easy to navigate, ensuring that all the necessary information stands out clearly to clients.

Including Specific Business Information

Another way to customize your document is by adding or removing fields that are relevant to your particular industry. You can include additional sections such as payment instructions, discounts, or terms and conditions that reflect your business practices. This flexibility ensures that the document remains informative and comprehensive, covering all necessary details for each transaction.

Essential Elements of an Invoice

To create a clear and effective billing document, it’s important to include several key components that ensure both parties understand the terms of the transaction. These elements not only provide clarity but also help avoid disputes by ensuring all necessary details are covered. Below are the crucial components every billing record should contain:

| Element | Description |

|---|---|

| Contact Information | Include the names, addresses, and contact details of both the business and the client. This helps identify who is involved in the transaction. |

| Document Number | A unique reference number for each record. This allows for easy tracking and retrieval of past transactions. |

| Transaction Date | The date when the goods or services were provided or when the transaction occurred. |

| Service or Product Description | Clear details about the services or products provided, including quantities and unit prices. |

| Payment Terms | State the due date for payment and any applicable penalties for late payments. |

| Total Amount | The full amount due for the goods or services provided, including any applicable taxes or discounts. |

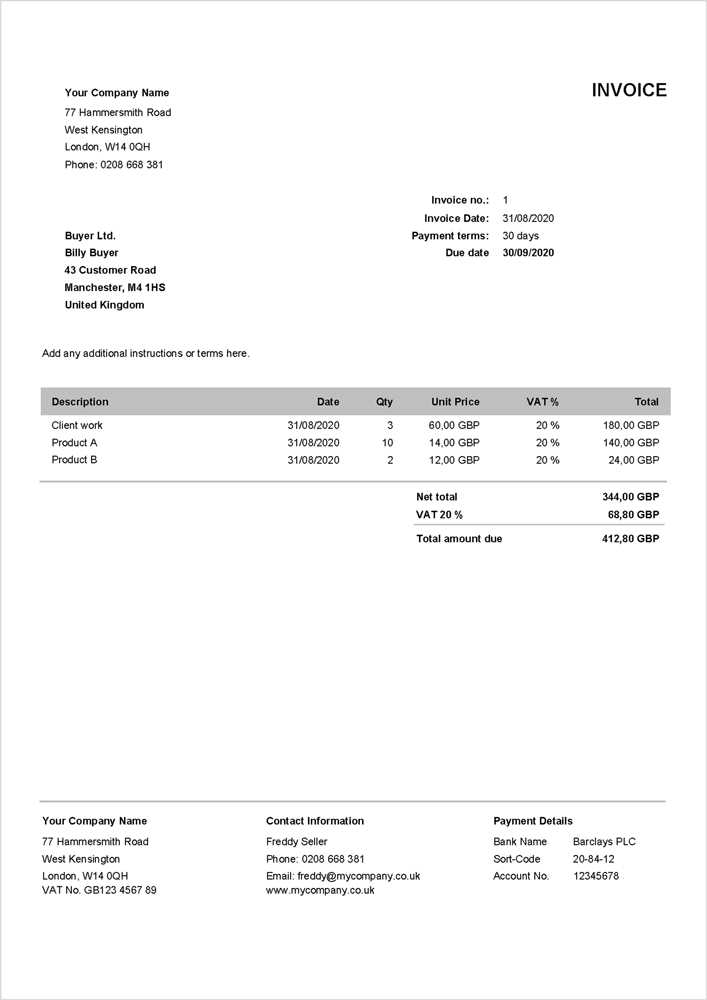

These essential components ensure the document is both comprehensive and professional, making it easier for clients to understand their obligations and for businesses to track payments effectively.

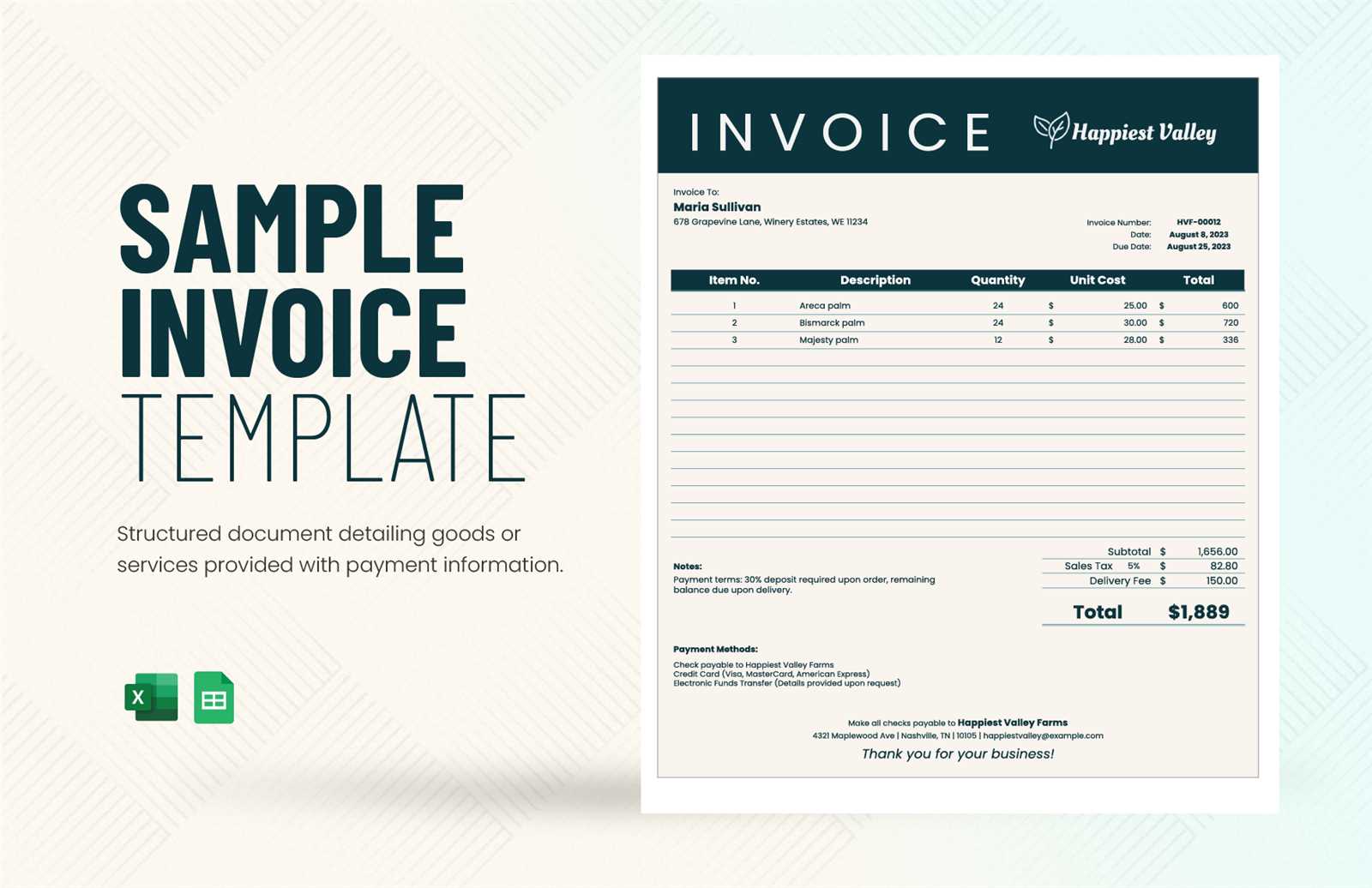

Creating a Professional Invoice Design

Designing a polished and professional billing document is essential for leaving a positive impression on clients and ensuring that all relevant details are presented clearly. A well-structured and visually appealing layout not only enhances readability but also reflects the quality and reliability of your business. By paying attention to key design elements, you can create a document that stands out and fosters trust.

Key Design Principles

A clean, simple design is the cornerstone of any professional billing record. It’s important to balance form and function by focusing on clarity and easy navigation. Key information such as client details, services provided, and payment terms should be easy to locate. The use of a consistent color scheme, appropriate fonts, and organized sections can help ensure that the document looks cohesive and well thought out.

Layout Considerations

To achieve a streamlined and professional look, make sure to align all text and numbers properly, and ensure that there is sufficient white space around sections. This makes the document less cluttered and easier for clients to read. Below is an example of how to structure key areas for maximum clarity:

| Section | Design Tips |

|---|---|

| Header | Include your logo and business name prominently. Make sure your contact information is easy to find. |

| Client Information | Place the client’s details in a clear section, ensuring they are separate from other content. |

| Service Details | Use tables to list items, quantities, prices, and totals. Keep it neat with clear columns and rows. |

| Footer | Include payment instructions, terms, or any additional notes in a small section at the bottom. |

With these design principles in mind, you can create a visually appealing and functional billing document that conveys professionalism and clarity to your clients.

Steps to Fill Out an Invoice in Excel

Filling out a billing document efficiently requires attention to detail and an organized approach. By following a clear set of steps, you can ensure that all relevant information is included correctly, reducing errors and speeding up the process. Below are the key stages involved in completing a billing record using a spreadsheet program:

Step-by-Step Guide to Completing the Document

- Enter Your Business Information

Start by filling in your business name, address, contact details, and logo (if applicable). This information should be located at the top of the document so that your client can easily identify who issued the bill.

- Include Client Information

Next, input the client’s name, address, and any other relevant contact details. This ensures clarity about who is responsible for payment.

- Assign a Unique Reference Number

Every billing document should have a unique number for easy tracking and future reference. This could be a combination of numbers and letters, such as “INV-001” or “2024-01”.

- Specify the Date

Include both the date the services or products were provided and the date the document is being issued. These dates help determine the payment due timeline.

- List Services or Products Provided

In this section, provide detailed descriptions of each product or service. Include quantities, unit prices, and any relevant item codes to ensure the client understands what they are being charged for.

- Calculate Totals

Using formulas, calculate the subtotal, applicable taxes, discounts, and the final amount due. Double-check the calculations to avoid errors.

- Enter Payment Terms

Clearly state the payment due date and any conditions, such as late fees or early payment discounts, to avoid confusion later on.

- Provide Additional Notes

If necessary, include special instructions or terms at the bottom of the document, such as preferred payment methods or details about warranties.

Final Checks and Saving the Document

- Review for Accuracy

Before sending the document, review all the fields to ensure that the details are correct and complete. Verify the calculations one last time to prevent any mistakes.

- Save and Send

Once you’re confident that the document is ready, save it as a PDF or in another suitable format, and send it to your client via email or print it for physical delivery.

By following these steps, you can efficiently complete your billing documents, saving time and ensuring that your client rece

Using Formulas in Excel Invoices

Incorporating formulas into your billing documents can significantly reduce the time spent on calculations and ensure accuracy. With the ability to automate basic mathematical functions, you can quickly compute totals, taxes, and discounts, leaving less room for errors. Formulas also allow for seamless updates to pricing, ensuring that any changes are reflected throughout the entire document.

Common Formulas for Billing Documents

There are several formulas you can use to make your document more efficient and professional. Here are the most common ones:

- Sum Formula

Use this formula to calculate the total cost of items listed in the document. It adds up all the quantities multiplied by their respective unit prices.

- Tax Calculation

To calculate the tax amount, multiply the subtotal by the tax rate. For example, if the subtotal is in cell B10 and the tax rate is 10%, the formula would be

=B10*0.10. - Discount Calculation

If you’re offering a discount, you can use a similar formula to calculate the amount to be deducted from the subtotal. For example, if the discount rate is in cell C15, the formula might look like

=B10*C15. - Final Total

The final amount due is simply the sum of the subtotal, tax, and any applicable discounts. Use a formula like

=B10+B15-B20to add the subtotal and tax, then subtract the discount.

How to Apply and Update Formulas

To apply a formula, click on the cell where you want the result to appear, enter the formula using the appropriate cell references, and press Enter. Afterward, you can copy and paste this formula to other cells to apply the same calculations across multiple rows or columns. One of the most useful features is the ability to update the values dynamically. If you change the price or quantity, the corresponding totals and taxes will update automatically.

Using formulas in your documents makes the entire process more efficient and accurate, saving you time while ensuring that everything is calculated correctly.

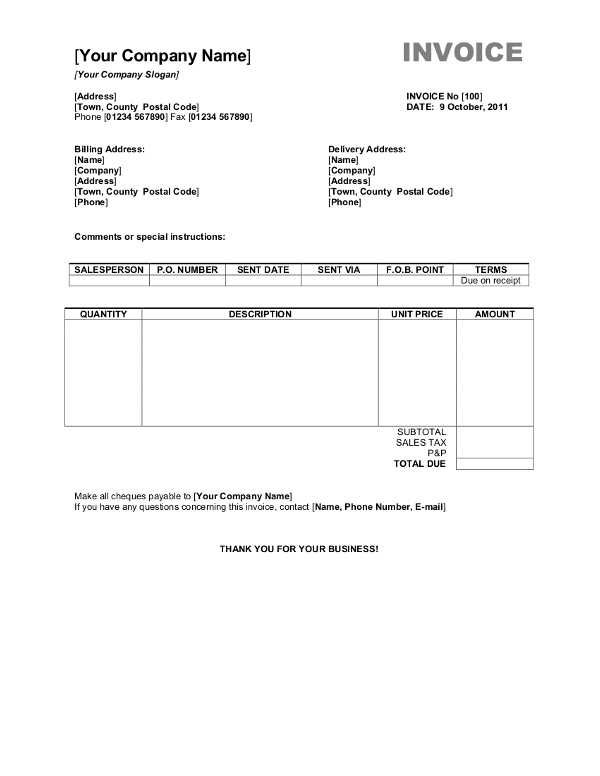

Free Excel Invoice Templates for Download

For those who prefer to streamline the process of creating billing documents, free resources are available that offer pre-designed structures. These files can be easily customized to suit your business needs, and they often come with built-in calculations and formatting. With these ready-to-use solutions, you can save time and ensure accuracy while maintaining a professional appearance for your transactions.

Where to Find Free Resources

There are various websites and platforms offering free downloadable files that can be adapted to your needs. Many of these resources provide a range of designs, from simple layouts to more complex formats with additional features. Below are some popular places where you can access these free files:

- Business Software Websites

Sites like Microsoft Office or Google Docs offer free downloadable structures designed for different types of businesses. These are often customizable and easy to use.

- Freelancer Platforms

Many freelance and small business websites offer free downloadable files designed specifically for independent contractors or service providers.

- Online Document Repositories

Websites dedicated to free document sharing often include billing records among their available resources. These can be downloaded and modified to your specifications.

Advantages of Downloading Pre-Formatted Documents

Choosing to download ready-made files offers several benefits. Not only does it save time, but it also provides you with professionally designed documents that you can use immediately. Here are some reasons to consider downloading these pre-made resources:

- Time Savings

You don’t need to spend time designing your document from scratch. Simply download and make any necessary adjustments.

- Accurate Calculations

Many downloadable files come with built-in formulas for taxes, totals, and discounts, which reduces the chance of human error.

- Professional Design

These pre-made files often feature well-organized, polished designs, helping you present your business in the best light.

With free downloadable files, you can start managing your billing quickly and professionally, ensuring you maintain a consistent and reliabl

How to Automate Invoice Generation

Automating the creation of billing documents can significantly increase efficiency, reduce errors, and save time. By setting up processes that automatically populate fields based on pre-set data, you can eliminate the need for manual data entry and ensure consistency in your records. With the right tools and techniques, you can automate tasks such as calculating totals, applying taxes, and even sending out completed documents to clients.

Steps to Set Up Automation

Automating your billing records involves several steps that allow the document to update and generate itself based on specific data inputs. Below are the basic steps for setting up an automated system:

- Use Pre-built Forms

Start by choosing or creating a structured form where key details such as client information, services provided, and pricing are defined in advance. This template will serve as your base for automation.

- Integrate with Databases

To streamline data entry, connect your billing system with a customer database. This allows the relevant details, such as client names, addresses, and past transactions, to automatically populate the fields in your form.

- Set Up Formulas for Calculations

Implement formulas that will automatically calculate totals, taxes, discounts, and other important fields. This will reduce the likelihood of errors in calculations, and the document will update in real-time as data changes.

- Automate Document Generation

Once all the information is entered and calculations are set up, use automation tools or macros to generate the document at the click of a button. This eliminates the need for you to manually input data into every section of the record.

- Automate Distribution

Once your document is ready, set up a system that can automatically send the document to clients, whether via email or an online portal, with customized messaging included.

Tools to Help Automate Billing

There are a variety of tools available to help automate the generation of financial records. Some of the most popular include:

- Spreadsheet Software

Advanced spreadsheet programs allow you to set up macros and formulas that can automate most of the process for you. They can also integrate with external databases to pull information directly into your forms.

- Accounting Software

Many accounting programs come with built-in automation features that not only help with generating billing documents but also track payments, manage client records, and create reports.

- Custom Scripts

If you have access to technical resources, you can create custom scripts to automate data entry and document generation, allowing for a fully tailored solution.

By implementing automation, businesses can streamline their financial processes, reduce manual labor, and ensure that every transaction is accurately documented and efficiently processed.

How to Track Payments with Excel

Effectively monitoring payments is crucial for maintaining a smooth cash flow and ensuring that all transactions are accounted for. Using a spreadsheet program, you can easily track the status of each payment, monitor overdue amounts, and maintain an up-to-date record of financial transactions. With the right structure, you can automate much of the tracking process, saving you time and reducing errors.

Setting Up Your Payment Tracking System

To create an efficient system for tracking payments, it’s important to design a spreadsheet that captures all relevant information. Below are the essential steps to get started:

- Identify Key Fields

Start by listing key details such as the transaction date, client name, amount due, amount paid, payment due date, and payment status (e.g., “paid,” “pending,” or “overdue”). These fields will allow you to monitor the progress of each transaction.

- Create Columns for Payment Status

Incorporate a column to indicate the payment status. This column can be updated manually or via conditional formatting to automatically change colors based on the payment status (e.g., green for paid, red for overdue).

- Use Formulas for Automatic Calculations

Implement formulas to automatically calculate outstanding balances or totals. For example, you can set a formula that subtracts the amount paid from the total due, displaying the remaining balance.

- Track Due Dates

Set up a column that calculates whether a payment is overdue based on the current date and the due date. You can use a formula like

=IF(TODAY()>due_date, "Overdue", "On Time")to easily see which payments need immediate attention.

Using Conditional Formatting for Better Visibility

One of the best features of a spreadsheet program is the ability to use conditional formatting to visually highlight specific data. By setting rules to change the color of cells based on their values, you can quickly identify overdue payments, partially paid balances, or completed transactions.

- Highlight Overdue Payments

Set a rule that changes the background color of the “payment status” cell to red if the payment is overdue. This ensures that overdue items are easily visible at a glance.

Incorporating Branding into Invoices

Integrating your brand identity into billing documents is an excellent way to maintain consistency across all your communications. This process not only enhances professionalism but also reinforces brand recognition. When clients receive documents that reflect your business’s unique style, it adds a level of trust and credibility. Customizing billing documents with your logo, color scheme, and fonts can turn a basic transaction into a branded experience that leaves a lasting impression.

Essential Elements of Branding

To successfully incorporate branding, you should focus on key design elements that represent your business. Here are some simple but effective ways to ensure your brand stands out:

- Logo Placement

Position your logo prominently at the top of the document. This creates immediate recognition and ensures that your brand is the first thing the client sees when reviewing the document.

- Brand Colors

Use your company’s color scheme throughout the document to establish consistency. This includes the header, table borders, and even the text highlights. By using colors associated with your brand, you reinforce its visual identity.

- Typography

Select fonts that reflect your business style. Whether it’s modern, elegant, or professional, make sure the fonts align with your overall brand voice and are easy to read. This contributes to a cohesive visual experience for the client.

Customizing the Document Layout

Designing a branded document layout goes beyond just the visual elements. Consider the overall structure and how it aligns with your brand’s message. Here are some tips to consider:

- Header Design

Incorporate your brand’s logo and contact information in a clean, organized header. Make sure the layout is balanced, and the text is aligned with your company’s aesthetic.

- Footer Information

Don’t forget to add a footer that includes your company’s website, social media handles, or any other important links. This can reinforce your online presence while keeping the document looking professional.

- Consistent Formatting

Use consistent formatting for headings, subheadings, and body text. Ensure all sections are clearly defined and easy to navigate, while staying true to your brand’s style.

By thoughtfully integrating your brand elements into your billing documents, you can elevate the overall client experience and ensure that every touchpoint with your business reflects your company’s values and personality.

Invoice Template for Small Businesses

For small businesses, keeping financial records organized and professional is essential. Using structured billing documents ensures clarity, accuracy, and consistency when dealing with clients. Having a ready-made format not only saves time but also helps maintain a professional appearance while facilitating smooth transactions. Whether you’re just starting out or looking to streamline your billing process, a well-designed document can make a significant difference in how clients perceive your business.

Key Features for Small Business Billing Documents

When creating or selecting a structured layout for your small business, it’s important to include all the necessary details while keeping the format simple and easy to understand. Below are key elements to include:

- Business Information

Ensure your business name, address, phone number, and email are clearly visible at the top. This makes it easy for clients to contact you if needed.

- Client Information

Include the client’s name and contact information, so that the document is tailored to the specific customer and can be easily referenced in the future.

- Itemized List of Services or Products

Provide a clear breakdown of the services or products you’ve provided, along with quantities and unit prices. This helps the client understand exactly what they’re being charged for.

- Total Amount Due

Clearly display the total amount due at the bottom, including taxes, discounts, and other adjustments. This prevents confusion and ensures transparency.

- Payment Instructions

Specify the payment methods you accept and include payment terms, such as due date or late fees, if applicable.

Why Small Businesses Need Structured Billing Documents

For small businesses, a structured and consistent billing process not only improves efficiency but also establishes trust with clients. By using a uniform format for all financial documents, you ensure that every transaction is professionally handled. Here’s why adopting a structured system is beneficial:

- Improved Cash Flow

A clear and timely billing process ensures faster payments and reduces the chances of delays.

- Better Financial Tracking

Consistent formats allow you to easily track outstanding payments, ensuring nothing is overlooked.

- Professional Image

Clients appreciate receiving well-organized documents that reflect professionalism, which can lead to more business and referrals.

Managing Multiple Invoices in Excel

When dealing with multiple financial records, staying organized is essential to ensure that all transactions are properly tracked and documented. Whether you’re handling dozens or hundreds of transactions, a structured approach allows you to manage your records efficiently, minimizing errors and simplifying the reconciliation process. With the right organization methods, you can quickly find any document, track outstanding amounts, and keep an eye on your cash flow with ease.

Organizing Your Financial Documents

The first step in managing multiple records is creating a clear structure that allows for easy access and understanding. Below are key tips for organizing your data effectively:

- Use Separate Sheets for Different Clients or Time Periods

Creating different sheets for individual clients or billing cycles (such as monthly or quarterly) can help keep your data segmented and easy to navigate. You can easily switch between sheets to find specific records.

- Use Consistent Naming Conventions

Use clear and consistent naming conventions for your documents, such as including the client name or project number in the filename. This will make it easier to search for specific records when needed.

- Incorporate a Master Tracking Sheet

Create a master sheet that lists all the records and their statuses. This summary page should include columns for client names, amounts due, due dates, payment status, and links to individual documents. This allows you to get a quick overview of your outstanding payments and prioritize follow-ups.

Automating Calculations and Status Updates

To save time and reduce errors when dealing with multiple records, consider setting up automated processes that calculate totals, track payment status, and provide reminders for due dates. Here’s how:

- Use Formulas to Calculate Totals

Implement formulas to automatically sum up amounts, calculate taxes, and display the total balance. This ensures that the calculations are always accurate, and you don’t have to manually update them.

- Track Payment Status

Set up conditional formatting or use formulas to flag overdue payments. For example, you can automatically change the cell color to red when a payment is past due. This allows you to quickly spot outstanding payments and follow up with clients.

- Set Up Reminders

Use a simple formula to highlight or notify you when a payment is due or overdue. You can also integrate a reminder system using conditional formatting to visually display the urgency of a task.

Using Filters and Pivot Tables for Analysis

As you accumulate more data, manually tracking and analyzing it can become overwhelming. To stay on top of your finances, consi

How to Protect Your Excel Invoice Files

When dealing with sensitive financial data, it’s crucial to ensure that your documents remain secure. Protecting your records not only prevents unauthorized access but also ensures the integrity and confidentiality of your business transactions. With the right precautions, you can safeguard your documents from accidental edits, malicious tampering, or unauthorized viewing, giving you peace of mind while handling your finances.

Password Protecting Your Documents

The first and most straightforward method of securing your financial files is by using a password. This is especially important if you share files over email or store them in cloud services. Password protection ensures that only authorized individuals can access or modify the document.

- How to Set a Password:

In most spreadsheet programs, you can set a password by selecting the “Protect Workbook” option under the file menu. Once set, only those with the password can open or edit the document.

- Choosing a Strong Password:

Ensure that the password is complex and unique, containing a combination of letters, numbers, and special characters to prevent unauthorized access.

Restricting Editing and Modifying Content

While password protection limits access, restricting certain areas of the document from being modified provides an added layer of security. By locking specific cells or worksheets, you can prevent unauthorized changes to critical financial data.

- Lock Specific Cells:

You can lock cells that contain sensitive information, such as totals or client names. This ensures that no one can accidentally or intentionally change these details.

- Protect the Entire Document:

Lock entire sheets or the whole document, allowing only certain sections to be edited by authorized users. This feature can be found under the “Review” tab, where you can enable sheet protection.

Backing Up Your Files Regularly

Another important aspect of protecting your documents is backing them up frequently. This ensures that if a file becomes corrupted or is lost, you have access to a recent version.

- Cloud Storage:

Using cloud storage services like Google Drive, Dropbox, or OneDrive allows you to automatically back up your files and access them from multiple devices. These services often come with their own security measures, such as two-factor authentication, for added protection.

- Local Backups:

In addition to cloud storage, it’s a good idea to keep local backups on external drives or USB sticks. This adds an extra layer of redundancy in case of internet connectivity issues or cloud service outages.

Common Mistakes to Avoid in Invoices

Creating accurate and professional financial documents is essential for maintaining clear communication with clients and ensuring timely payments. However, there are several common errors that can lead to confusion, delays, or even disputes. By understanding and avoiding these mistakes, you can ensure that your documents are both effective and reliable.

Here are some of the most frequent errors businesses make when creating financial documents, and tips on how to avoid them:

- Missing or Incorrect Client Information

One of the most basic yet critical errors is failing to include the correct client details. Ensure that the client’s name, address, and contact information are accurate. Incorrect details can lead to confusion or delays in payment processing.

- Omitting Payment Terms

Clearly stating your payment terms is essential. Without a due date or explanation of payment methods, clients might not know when or how to pay, resulting in delayed payments or misunderstandings.

- Errors in Calculations

Double-check all calculations for accuracy. Incorrect totals, taxes, or discounts can cause confusion and may make your business appear unprofessional. Using automated formulas can help prevent such mistakes.

- Not Including an Invoice Number

Each financial document should have a unique identifier to make tracking easier. Without a proper number, it’s difficult to reference specific documents, which could cause organizational issues or delays in payment processing.

- Failure to Include Due Dates

Not specifying a due date can lead to delays in receiving payments. Clients may not realize that payment is expected within a certain timeframe unless it’s explicitly stated in the document.

- Unclear Descriptions of Goods or Services

Vague or incomplete descriptions can lead to confusion about what exactly is being charged. Provide clear and detailed information about the products or services provided, including quantities and unit prices, to avoid misunderstandings.

- Not Proofreading the Document

Simple typos or grammatical errors can make a document look unprofessional and may even lead to confusion. Always proofread your document before sending it to ensure everything is accurate and polished.

- Overcomplicating the Format

While it’s important to include necessary details, it’s also crucial to keep the layout clear and easy to understand. A cluttered or overly complicated design can confuse clients and make the document harder to read.

- Ignoring Follow-Up Procedures

Best Practices for Sending Invoices

Sending clear and professional billing documents is a crucial step in maintaining smooth business operations and ensuring timely payments. How you deliver these documents can have a significant impact on how quickly clients respond and how smoothly the financial process flows. By following a few best practices, you can ensure that your documents are received, processed, and paid without unnecessary delays.

Here are the key practices to keep in mind when sending financial records:

- Send Documents Promptly

Timely submission of your documents is essential for maintaining cash flow. Try to send out billing documents as soon as services are rendered or products are delivered. This shows professionalism and helps prevent delays in payment.

- Use Clear and Professional Formats

The way you present your documents plays a big role in how clients perceive your business. Use a clean, easy-to-read format with clearly labeled sections such as client details, service descriptions, totals, and payment instructions. This will help clients process your documents faster and more efficiently.

- Choose the Right Delivery Method

Consider how your client prefers to receive financial documents. Some clients may prefer emails with attached PDFs, while others may require physical copies or online payment systems. Providing an option that suits their preference can speed up the process.

- Ensure Accurate and Complete Information

Before sending, double-check the accuracy of all details. This includes client information, item descriptions, amounts due, and payment instructions. An error in any of these areas could cause confusion or delays in payment processing.

- Include Payment Terms and Due Dates

Clearly outline when the payment is due and how it should be made. Including payment terms such as “due upon receipt” or “due within 30 days” can help avoid any misunderstandings. Ensure that the due date is prominent to encourage timely payment.

- Use Digital Payment Methods

Make it easy for clients to pay by offering digital payment methods, such as bank transfers, online payment portals, or credit card options. This convenience encourages quicker payment and reduces the likelihood of delays.

- Set Up Automated Reminders

To avoid having to manually chase payments, set up automated reminders for upcoming or overdue payments. This can be done through email or online invoicing systems, and ensures that clients are gently reminded of their obligations without requiring extra effort from your end.

- Follow Up Professionally

If payment is overdue, don’t hesitate to follow up with the client. Be polite and professional in your communication, reminding them of the due date and offering assistance if they are facing payment issues. Regular but courteous follow-ups can help you get paid on time.

By adhering to these best practices, you can improve the efficienc

- Send Documents Promptly

- Missing or Incorrect Client Information

- Use Separate Sheets for Different Clients or Time Periods

- Logo Placement