How to Use Microsoft Invoice Template for Your Business

When it comes to managing finances, having a clear and organized system for documenting transactions is essential. Whether you’re a freelancer, small business owner, or large company, a well-structured payment record can save time and prevent confusion. Designing a formal document that captures all the necessary details ensures smooth communication with clients and customers, making payment processes straightforward and hassle-free.

Customizing your billing format allows you to tailor the information to your specific needs while maintaining a professional appearance. By using editable formats, you can easily update the details each time you issue a new document, ensuring accuracy and consistency. These solutions are designed to make financial communication more efficient, with space for crucial data such as amounts due, due dates, and client information.

With the right tools, creating and managing these documents becomes a seamless part of your workflow. Leveraging simple, user-friendly platforms offers a practical approach to handling all your financial records, whether for one-time projects or recurring payments. The ability to generate and modify these documents quickly means less time spent on administrative tasks and more focus on what matters most–growing your business.

Understanding Billing Document Formats

Creating a professional payment record requires a standardized approach to ensure all essential details are included. These documents serve as formal requests for payment and help establish clear expectations between businesses and their clients. Using the right structure not only guarantees that all necessary information is presented but also reinforces your brand’s credibility and professionalism.

Pre-designed solutions for these documents simplify the creation process. By using a ready-made layout, you can easily modify the content to suit each specific transaction, saving time while maintaining consistency. These customizable formats provide placeholders for critical details like the client’s name, the services provided, payment amounts, and due dates, ensuring that all necessary fields are addressed.

Flexibility is a key advantage of these formats. Whether you need a basic design or a more complex one with additional features like tax calculations or payment terms, these tools can be adjusted to fit your requirements. Understanding how to leverage these resources allows you to streamline your billing process, reduce errors, and enhance the overall client experience.

Benefits of Using Billing Document Formats

Utilizing pre-designed billing structures offers several advantages, especially for those looking to streamline their financial operations. These ready-made solutions help reduce the time spent on creating payment requests from scratch, ensuring efficiency and consistency across all transactions. By relying on an established format, businesses can focus more on their core activities and less on administrative tasks.

Time Efficiency and Consistency

Speed is one of the primary benefits when using pre-constructed formats. Rather than starting with a blank page, these designs provide a framework that only requires filling in specific details, such as payment amounts or client names. This approach ensures that every document follows a uniform structure, enhancing professional presentation and minimizing the risk of missing essential information.

Customization and Flexibility

Customizability allows users to tailor the format to their unique business needs. Whether adding custom fields or adjusting the design to match branding, these tools provide the flexibility to adapt the document to different client types or transaction scenarios. This flexibility also helps businesses stay agile, adjusting the layout as their needs evolve over time.

How to Create a Billing Document in Word

Creating a formal payment request using a word processing program is a straightforward process that allows you to easily customize the layout and content. Whether you need to send a one-time request or establish a recurring system, the right document structure can ensure all necessary details are clearly presented. By using a word processor, you can create professional-looking records without the need for complex software or design tools.

Step-by-Step Guide to Building Your Document

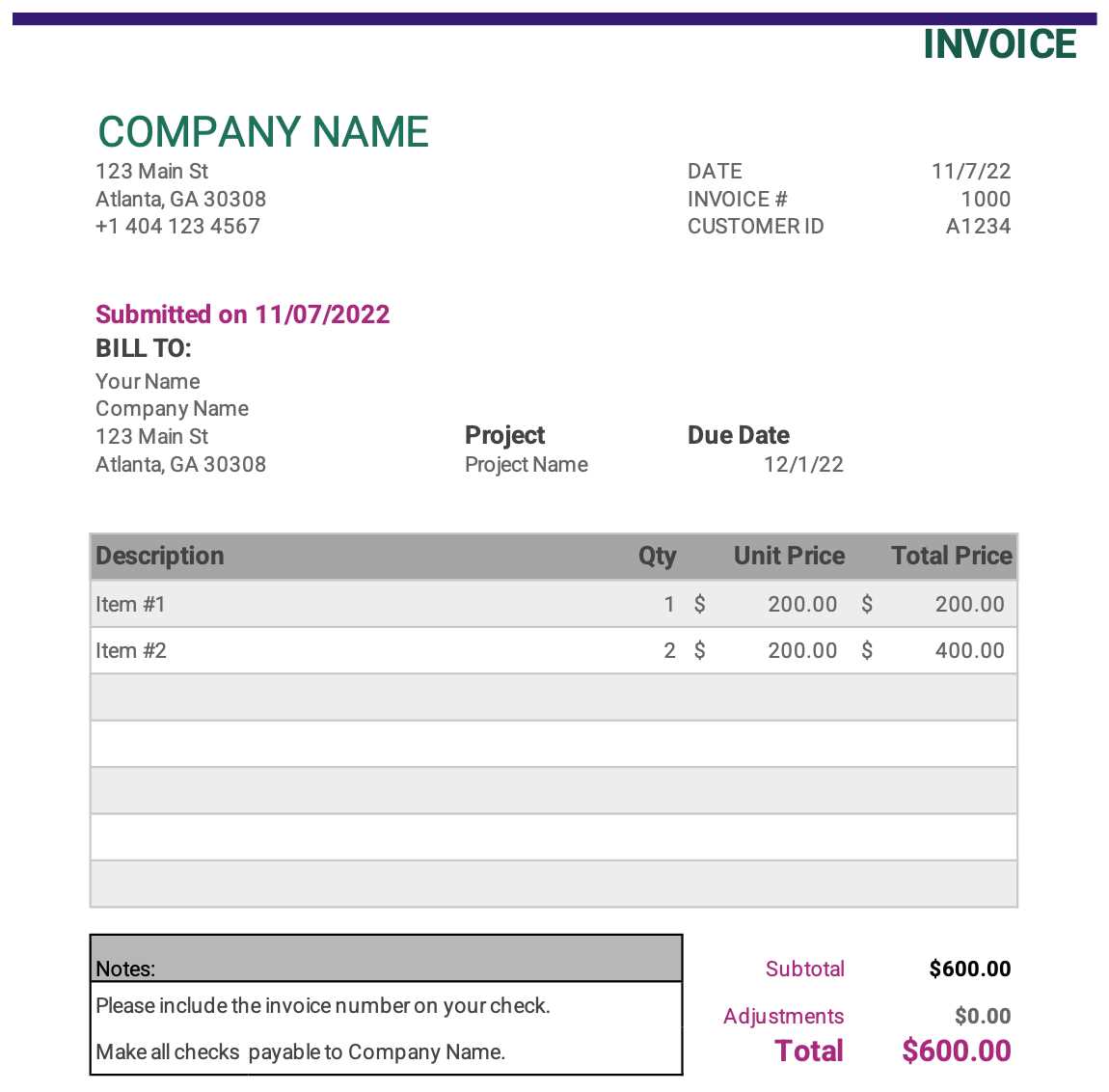

Start by opening a new blank document in your word processor. Then, create a header that includes your business name, address, and contact information, followed by the client’s details. It is also essential to include a unique reference number for each record to ensure proper tracking. After adding the basic information, you can insert the list of services or products provided, along with the corresponding amounts. Finish by specifying payment terms, due dates, and any other necessary instructions.

Enhancing the Document’s Appearance

Formatting is key to making the document look polished and professional. Use bold text to highlight important sections like total amounts due and due dates. Adding lines or tables can help organize the content for easier readability. Adjusting the font style and size can also contribute to a cleaner, more consistent look. Once you are satisfied with the layout, save the document and share it with your client via email or print.

Customizing Your Billing Document Format

Personalizing your payment request format allows you to adapt it to your specific business needs, ensuring it reflects your branding and contains all relevant details. Customization not only helps make the document look more professional but also makes it easier to manage various types of transactions. Adjusting elements like fonts, colors, and fields ensures that your document meets both aesthetic and functional requirements.

Modifying Key Sections

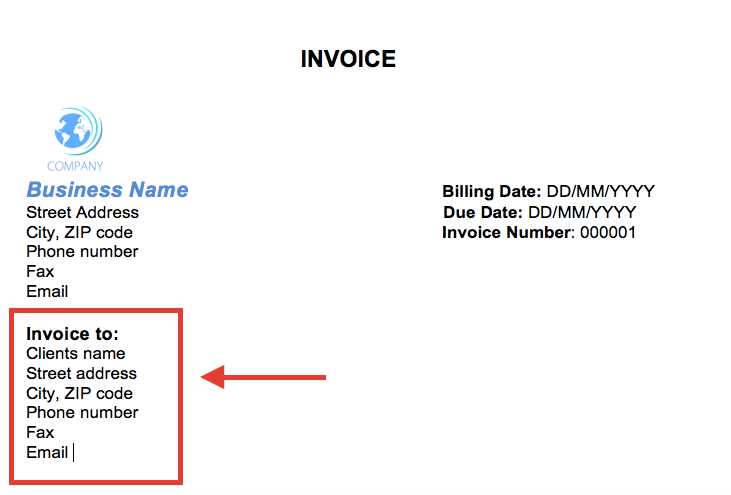

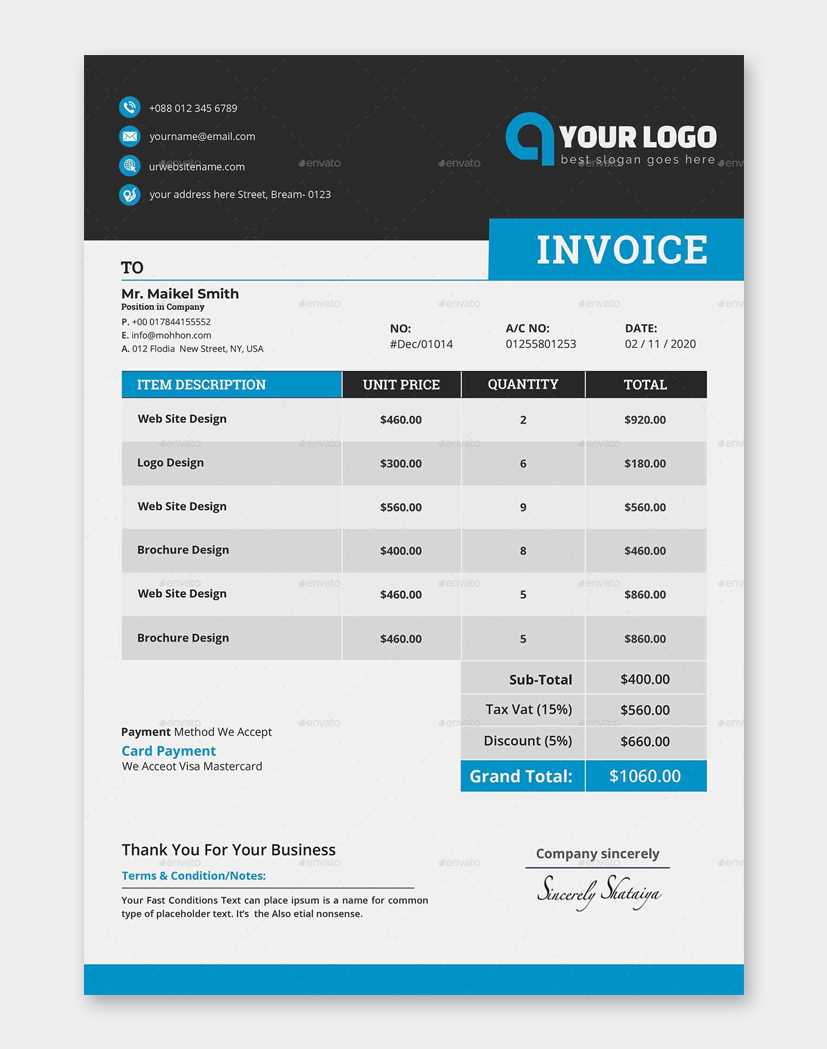

To begin customizing your format, start by adjusting the header to match your company’s branding. This includes adding your business logo, updating the business name and contact details, and choosing a color scheme that aligns with your brand. Then, review the sections related to the client’s details, payment amounts, and due dates to ensure they are easy to navigate. These sections can be personalized with custom fields or labels that reflect the specific services or products you offer.

Using Tables for Better Organization

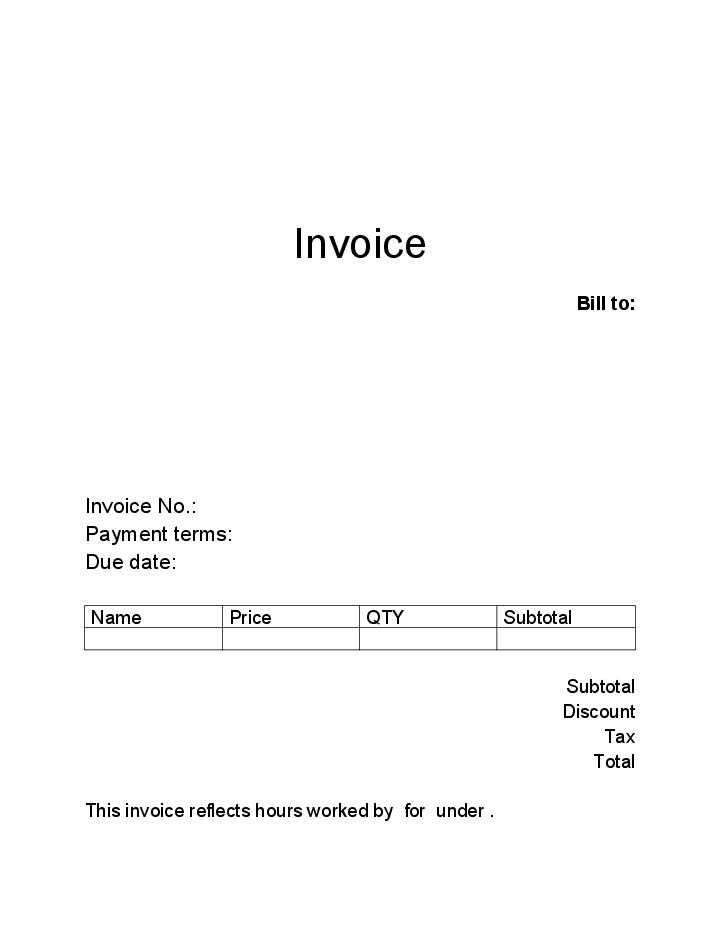

Tables can be very useful for organizing the line items and totals in your document. The table format provides a structured way to present quantities, descriptions, rates, and totals. Here’s an example of how a simple table might look:

| Item | Description | Quantity | Unit Price | Total |

|---|---|---|---|---|

| Service A | Consulting services | 2 | $50 | $100 |

| Service B | Product development | 1 | $200 | $200 |

| Total | $300 | |||

With tables, you can easily track and calculate totals, making the document more clear and professional. Don’t forget to include payment instructions or any additional terms at the bottom for clarity.

Free Microsoft Invoice Template Options

In today’s digital landscape, finding cost-effective solutions for managing billing and payment requests is essential for businesses of all sizes. There are numerous readily available resources that offer pre-designed documents, allowing users to create professional-looking billing statements effortlessly. These options cater to various needs and preferences, ensuring that everyone can find a suitable format for their requirements.

Here are some popular choices for free billing documents:

- Online Generators: Many websites provide user-friendly tools that allow you to create customized billing forms by filling out simple fields. This option is ideal for those who prefer a straightforward approach.

- Office Suites: Several office software packages include a selection of pre-made documents that can be easily modified. These formats often come with professional layouts and allow for personalization to reflect your brand identity.

- Downloadable Formats: You can find numerous downloadable designs in various file formats such as Word, PDF, or Excel. These options allow for offline editing and printing, making them versatile for different scenarios.

- Community Resources: Various online communities and forums share free designs created by users. This option can provide unique and creative solutions tailored to specific industries or preferences.

By exploring these alternatives, you can efficiently manage your billing process while maintaining a professional appearance without incurring any costs. The flexibility of these resources ensures that you can choose the best option that aligns with your operational style.

Essential Fields in an Invoice Template

For any billing document to be effective and clear, it must contain specific details that facilitate smooth transactions and communication between parties. These elements ensure that all necessary information is presented for accurate record-keeping, payment tracking, and client understanding.

Key components to include are:

- Sender’s Information: This section lists the provider’s name, contact details, and address, making it easy for the recipient to identify the source of the request.

- Recipient’s Information: Including the client’s name and contact information helps to specify who is responsible for the payment and ensures proper record alignment.

- Unique Reference Number: Assigning a distinct number to each document aids in tracking and prevents confusion with other transactions.

- Date of Issue: This field records the exact date when the

How to Add Company Branding to Invoices

Enhancing billing documents with brand-specific elements helps businesses create a consistent and professional image. A customized design with unique visual cues not only makes documents more recognizable but also reinforces the brand’s identity with every transaction. Simple adjustments, like adding a logo or choosing consistent colors and fonts, can significantly impact the document’s overall appeal.

Key Branding Elements to Include

Incorporating these elements effectively builds a cohesive look:

Branding Element Purpose Best Practices Logo Represents the business visually, adding authenticity. Place at the top of the document for visibility. Use a high-resolution version. How to Add Company Branding to Invoices

Enhancing billing documents with brand-specific elements helps businesses create a consistent and professional image. A customized design with unique visual cues not only makes documents more recognizable but also reinforces the brand’s identity with every transaction. Simple adjustments, like adding a logo or choosing consistent colors and fonts, can significantly impact the document’s overall appeal.

Key Branding Elements to Include

Incorporating these elements effectively builds a cohesive look:

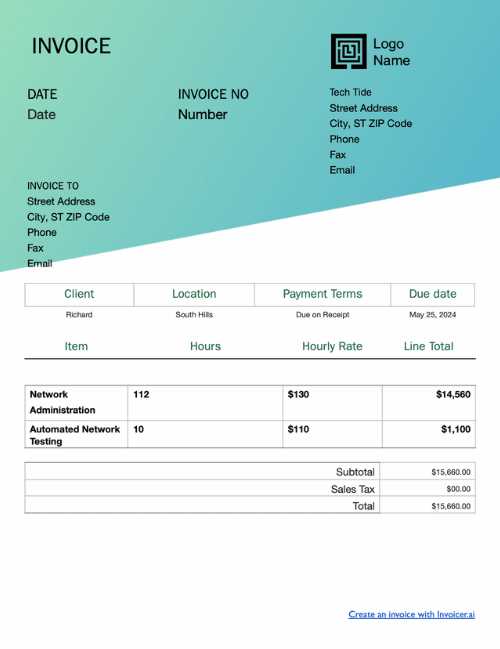

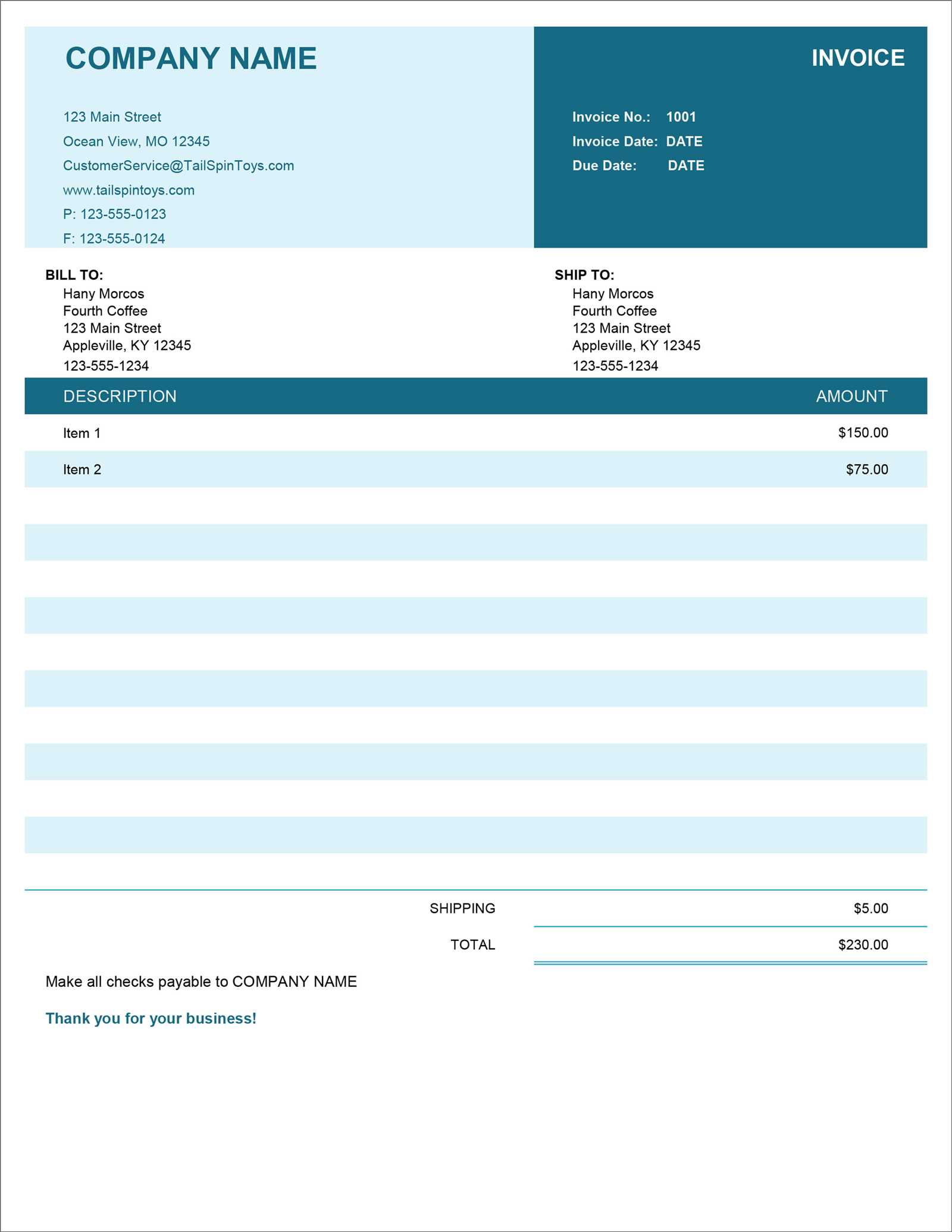

Branding Element Purpose Best Practices Logo Represents the business visually, adding authenticity. Place at the top of the document for visibility. Use a high-resolution version. Color Scheme Establishes a recognizable visual style. Choose colors that align with brand guidelines, typically in headers or borders. Fonts Maintains a consistent, professional appearance. Use the same font family as other company materials for a unified look. Contact Information Provides clients with business details in an organized format. Include business address, phone, and email; use icons if desired for a modern touch. Additional Tips for Effective Customization

- Header and Footer: Use these areas for logos, taglines, or contact details to maximize space and maintain clarity.

- Consistent Layout: Designate specific sections for item descriptions, totals, and terms to ensure uniformity across all documents.

- Customizable Elements: Save the branded design as a reusable format, allowing easy updates and modifications as needed.

By carefully integrating these branding aspects, businesses can elevate the appearance of their billing documents, leaving a lasting impression with each transaction.

Choosing the Right Microsoft Template for Your Business

Selecting a suitable design for billing documents can enhance both professional image and operational efficiency. With various layouts available, it’s essential to choose one that aligns with the business’s needs, industry requirements, and visual identity. By considering specific elements such as customization options, layout style, and the complexity of details required, businesses can streamline the process of generating clear, effective documents for clients.

Factors to Consider When Selecting a Design

Choosing an ideal format involves assessing the following aspects:

- Customization Potential: Opt for a design that allows easy adjustments, such as adding logos, changing color schemes, and editing fields, ensuring the document accurately represents your brand.

- Level of Detail: Depending on your industry, you may need to include detailed line items, taxes, or discount sections. Choose a layout that accommodates all necessary information without overwhelming the reader.

- Layout Simplicity: A clean, organized structure makes it easier for clients to review charges and understand payment terms. Simple, uncluttered designs often work best

How to Automate Invoicing with Templates

Automating billing processes can save time, reduce errors, and create a smoother experience for both businesses and clients. By setting up reusable documents with pre-filled information and integrated formulas, companies can quickly generate accurate billing statements with minimal manual input. This approach helps ensure consistency and enables faster payment cycles.

Steps to Set Up Automated Billing Documents

Implementing automated templates involves the following key steps:

- Create a Standard Layout: Start by designing a base document that includes all essential fields, such as client details, item descriptions, and payment terms. Ensure that the layout is flexible enough for various scenarios.

- Use Formulas for Calculations: Embed formulas to automatically calculate totals, taxes, and discounts. This reduces manual work and improves accuracy, especially for complex or multi-item bills.

- Add Placeholder Text: Use placeholders in fields that require unique input, such as names, dates, or item descriptions. This makes it easy to populate specific information without altering the base design.

- Integrate with Data Sources: For advanced automation, connect the document to a data source, like a client database or accounting software, allo

Tips for Saving and Sharing Invoices

Effective management of billing documents includes both secure storage and efficient sharing methods. Ensuring these records are accessible yet protected helps maintain a clear history of transactions and simplifies communication with clients. Proper saving and sharing practices also contribute to smoother financial operations and timely payments.

Use a Consistent File Naming System: Organize documents with a clear naming structure, such as including the date, client name, and unique reference number. This makes it easier to retrieve records when needed and reduces the risk of confusion.

Save as PDF for Easy Sharing: Converting documents to PDF format preserves formatting and ensures compatibility across devices, allowing clients to view the document exactly as intended. PDFs are also less prone to accidental edits.

Store in a Secure Location: U

How to Include Tax Information in Invoices

Adding tax details is an essential part of creating clear and legally compliant billing documents. Including accurate tax information not only helps clients understand the full amount due but also simplifies record-keeping for both parties. Whether dealing with single or multiple tax rates, a structured approach ensures transparency and accuracy in every transaction.

Steps for Adding Tax Details

- Identify Applicable Tax Rates: Begin by determining which tax rates apply to your services or products, such as value-added tax (VAT), sales tax, or any regional charges. Each rate should be clearly specified to avoid confusion.

- Add Separate Line for Tax Amount: If possible, include a dedicated line below the itemized list where the tax

How to Include Tax Information in Invoices

Adding tax details is an essential part of creating clear and legally compliant billing documents. Including accurate tax information not only helps clients understand the full amount due but also simplifies record-keeping for both parties. Whether dealing with single or multiple tax rates, a structured approach ensures transparency and accuracy in every transaction.

Steps for Adding Tax Details

- Identify Applicable Tax Rates: Begin by determining which tax rates apply to your services or products, such as value-added tax (VAT), sales tax, or any regional charges. Each rate should be clearly specified to avoid confusion.

- Add Separate Line for Tax Amount: If possible, include a dedicated line below the itemized list where the tax amount is calculated. This way, clients can easily see the subtotal before taxes and the added amount afterward.

- Show Percentage and Calculation: Specify the tax percentage used and the calculation applied. For example, if using a 10% tax rate, clearly state this to ensure clients understand the origin of the total.

- Use Descriptive Labels: Label tax lines with terms that clients will recognize, like “Sales Tax” or “VAT.” Clear labeling avoids misunderstandings and makes it easier for clients to verify amounts.

Example Tax Breakdown

A structured tax breakdown might look as follows:

- Product/Service Total: $500

- Tax (10%): $50

- Total Amount Due: $550

In this format, each element is transparent, and clients can quickly confirm the total charges, including all applicable taxes. By following these steps, you ensure tax data is clearly presented, helping both clients and your business maintain accurate records.

How to Handle Multiple Payment Methods

Offering various ways to complete a transaction can enhance client convenience and improve payment timelines. By incorporating different options for settling accounts, businesses can accommodate a broader range of preferences, ultimately creating a smoother experience for clients and streamlining the collection process.

List Available Payment Options Clearly: At the end of the document, include a section that outlines each available method, such as bank transfers, credit cards, and digital payment platforms. Use clear labels and descriptions so clients understand how to proceed with their preferred method.

Provide Detailed Instructions for Each Method: For complex methods, include specific details to avoid confusion. For instance, if accepting bank transfers, include account numbers and any necessary reference codes. If accepting card payments, provide a secure link or contact information to complete the transaction.

Ensuring Compliance with Invoice Templates

Adhering to industry and regional regulations is essential when preparing billing documents. Including mandatory details and formatting each document according to legal requirements ensures both clarity for clients and legal protection for the business. Proper compliance helps prevent disputes and maintains a professional standard in financial communications.

Include Required Information: Each document should list key elements, such as the business’s legal name, contact details, unique document number, and a detailed summary of provided goods or services. Additionally, always specify the date, as this establishes the timeline for payment and any applicable interest or penalties for late settlements.

Highlight Tax and Legal Details: When taxes apply, include the relevant tax rates, calculation breakdown, and tax registration numbers where necessary. This level of detail ensures transparency and aligns with government requirements for accurate reporting.

Provide Clear Terms and Conditions: Outline payment terms, including the due date and acceptable payment methods. Include any policies regarding late fees or discounts for early settlement, as these conditions help set clear expect

Common Mistakes to Avoid with Invoices

Creating accurate and clear billing documents is essential for maintaining good relationships with clients and ensuring timely payments. However, common errors can lead to confusion, delays, or even disputes. By being aware of these mistakes, businesses can present more professional documents and improve their payment process.

- Missing Key Details: Omitting essential information, such as due dates, payment instructions, or contact details, can make it difficult for clients to complete the payment promptly. Always ensure that each document includes all necessary fields for clarity.

- Incorrect Calculations: Even a small error in adding totals or applying taxes can lead to payment disputes. Double-check each calculation, particularly with tax rates and discounts, to prevent misunderstandings.

- Vague Descriptions: Providing unclear descriptions of products or services can confuse clients. Be specific in describing each item, including quantities, rates, and any