How to Create a Nanny Invoice Template for Easy Payment Management

For anyone providing childcare or personal assistance, managing payments can quickly become overwhelming without the proper tools. Ensuring timely and accurate billing is essential to maintaining a professional relationship with clients and avoiding confusion or missed payments. Having a well-organized system in place can streamline the entire process, making it easier for both caregivers and families.

One of the most efficient ways to manage payment requests is by utilizing a structured format that clearly outlines services rendered, payment amounts, and due dates. This can help to establish transparency and accountability, which are key to fostering trust and ensuring that both parties are satisfied with the financial aspects of the arrangement.

In this guide, we will explore how to design an effective billing document that can be easily tailored to suit individual needs. Whether you’re a professional caregiver, a parent, or a service provider, having access to a clear and customizable billing format can save time, reduce errors, and ensure you receive compensation for your valuable work.

Understanding the Importance of Caregiver Payment Documents

When it comes to managing financial transactions in caregiving services, having a clear and professional record of services rendered is essential. Such records not only ensure that both parties are on the same page but also help avoid misunderstandings regarding payment details. A structured approach to billing serves as both a confirmation of work performed and a formal request for compensation, making it an essential tool in any professional caregiver-client relationship.

These financial records serve several important functions, such as documenting hours worked, specifying the rate of pay, and providing transparency on payment terms. By utilizing a reliable method to issue payment requests, caregivers can ensure they are paid accurately and on time while also giving clients peace of mind that everything is accounted for. Clear documentation can also be a helpful reference in case of disputes or audits, offering a straightforward way to track earnings and confirm payment history.

Key Benefits of Clear Payment Records

| Benefit | Description |

|---|---|

| Clarity | Clear records ensure both parties understand exactly what is being billed and when payment is due. |

| Organization | Well-organized records make it easier to track hours worked and payments received over time. |

| Legal Protection | Proper documentation provides protection in case of disagreements or legal inquiries regarding compensation. |

| Professionalism | A formalized system of billing enhances the professionalism of both the caregiver and the family receiving care. |

Ensuring Transparency and Accountability

Maintaining transparency in the payment process is crucial for building trust between a caregiver and their clients. A structured payment record helps establish clear expectations regarding services and compensation. When both parties are aware of the terms, including hourly rates, services provided, and payment schedules, it reduces the risk of confusion or disputes. This clarity not only supports smooth transactions but also contributes to a long-term, professional relationship.

Why Caregiver Payment Records Are Essential for Both Parties

Establishing clear payment records is crucial for ensuring that both caregivers and families have a mutual understanding of the terms of their financial arrangement. These documents serve as a formal agreement, outlining the specifics of the work provided, the rates of pay, and when payments are due. Without a reliable system for tracking transactions, both parties may face confusion, missed payments, or misunderstandings that can affect the overall working relationship.

For caregivers, having a well-organized document helps ensure they are compensated fairly and on time. It provides a transparent record of hours worked and services provided, which is essential when managing multiple clients or families. For families, these records offer assurance that the caregiver’s work is being compensated according to the agreed terms, while also making it easier to track payments for budget or tax purposes.

Key Benefits for Caregivers

- Timely Payments: A structured payment record helps ensure that payments are made on time, reducing the risk of missed or delayed payments.

- Accurate Tracking: Caregivers can easily track the hours worked and services provided, ensuring that they are paid correctly for their time and effort.

- Professionalism: Providing clear, formal documentation demonstrates professionalism and enhances the caregiver’s reputation.

- Tax Compliance: Detailed payment records are crucial for tax reporting and personal financial management.

Key Benefits for Families

- Clarity on Services: Clear payment records help families understand exactly what they are being charged for and when payments are due.

- Financial Planning: Families can track and manage expenses more effectively by keeping a record of regular payments.

- Dispute Prevention: A well-documented record can help resolve any disputes regarding hours worked or amounts owed.

- Legal Protection: Both parties are protected legally in case of disagreements or if the arrangement is ever questioned.

In summary, clear and professional payment documentation not only helps establish trust but also ensures smooth and efficient financial transactions. It benefits both caregivers and families by providing transparency, protecting both sides, and fostering a professional and organized environment for everyone involved.

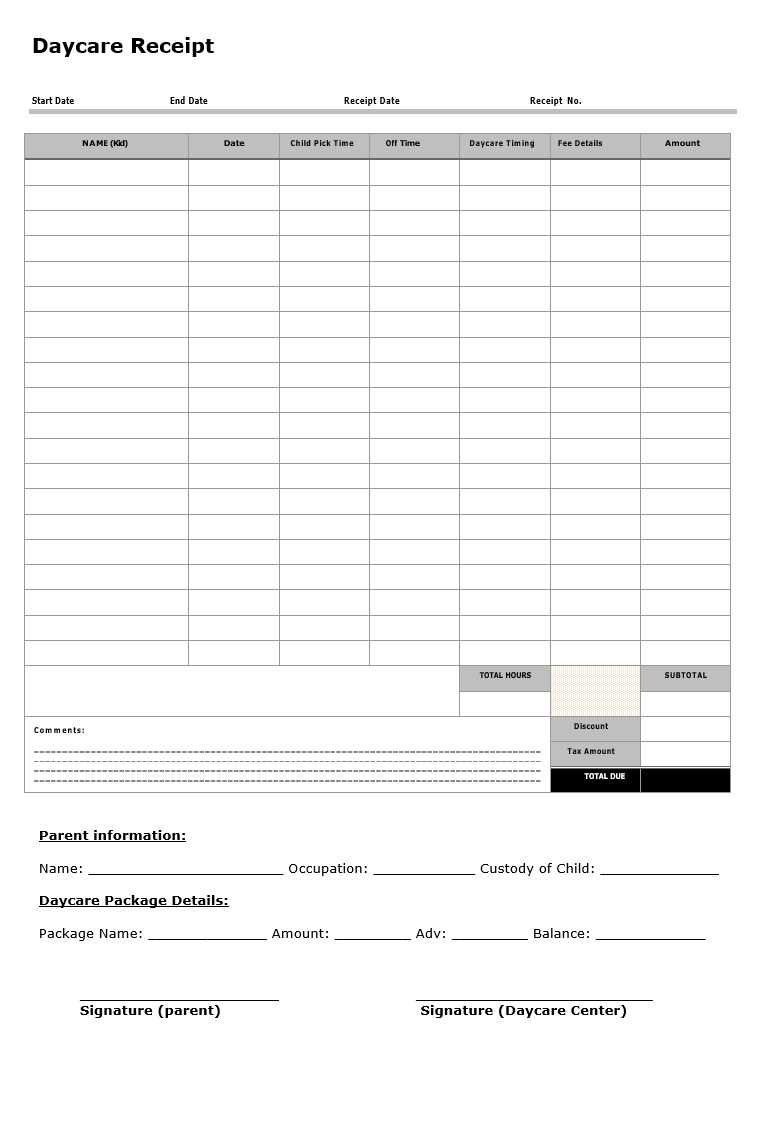

What to Include in a Caregiver Billing Document

Creating an accurate and clear billing document is essential for both the caregiver and the family receiving care. A well-structured record should contain all relevant details about the services provided, the hours worked, and the agreed-upon payment terms. This ensures that both parties understand the financial arrangement and reduces the likelihood of confusion or disputes over payment. Below are the key elements that should always be included in any payment request for caregiving services.

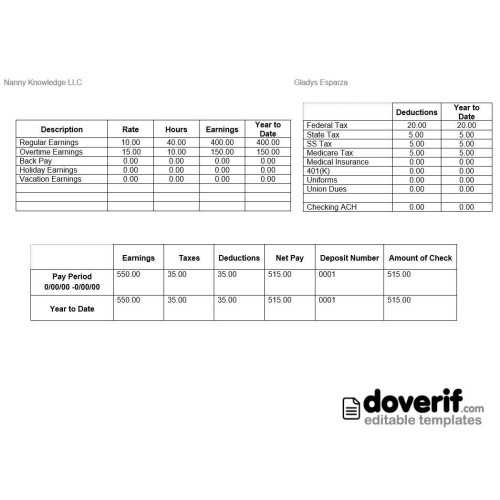

First, the document should clearly identify both the caregiver and the family receiving care. This includes names, contact information, and any relevant account or reference numbers. Additionally, the document should specify the time period for which the services were provided, whether it’s a weekly, bi-weekly, or monthly summary, so that both parties know exactly when the services occurred.

Another critical component is a breakdown of the hours worked, detailing the start and end times for each session, along with any special tasks or services provided during that time. It’s also important to list the rate of pay and calculate the total amount owed for the period, including any additional charges, such as overtime or holiday rates.

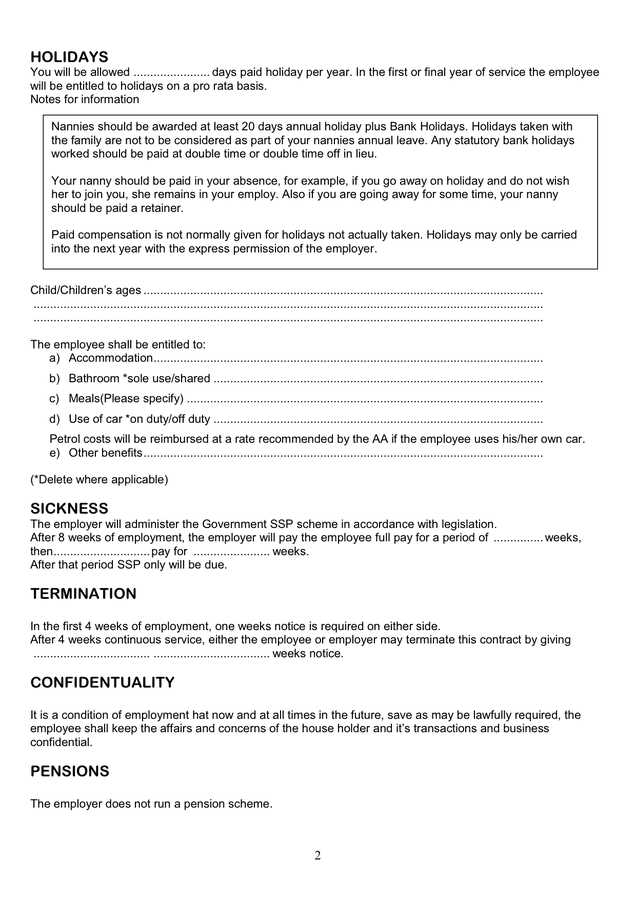

Finally, the payment terms and due dates must be clearly outlined. This includes specifying the acceptable payment methods (e.g., check, bank transfer) and any late fees or penalties for overdue payments. Having these details ensures transparency and prevents misunderstandings about when and how payment should be made.

Key Details Every Caregiver Payment Record Should Have

To ensure that a payment request is clear, accurate, and professional, there are several key details that must be included. These essential elements provide transparency and help both the caregiver and the family receiving care avoid confusion about the services rendered, the payment amount, and the terms of the arrangement. By including all of the necessary information, the document becomes an effective tool for ensuring that both parties are on the same page regarding compensation.

Basic Contact Information

First and foremost, the document should include the full name and contact details of both the caregiver and the family receiving care. This information is crucial for identification and helps ensure the document is correctly attributed to the appropriate parties. In addition to names and phone numbers, consider adding email addresses or any other relevant communication methods.

Details of Services Rendered

Next, a clear breakdown of the work completed is essential. This should include:

- Hours worked: List the exact start and end times for each service session.

- Type of care provided: Specify the services rendered, such as child supervision, meal preparation, or light housework.

- Any additional duties: If there were extra tasks outside the usual scope, such as errands or special requests, these should also be noted.

Payment Information

Equally important is providing details about the agreed-upon rate of pay and the total amount owed. This should include:

- Hourly or flat rate: Clearly state the agreed rate for services, whether it’s based on time worked or a fixed fee for specific tasks.

- Subtotal: Provide the total amount for the services rendered during the specified period.

- Additional charges: If applicable, list any extra fees, such as overtime or holiday rates, and explain how they are calculated.

- Total amount due: Clearly indicate the final amount owed, including any taxes or extra charges.

By including these core details, the payment request becomes an effective, organized, and transparent document that ensures both the caregiver and the family are clear about the expectations and financial terms of their agreement.

Choosing the Right Caregiver Billing Format

Selecting the most suitable format for your payment requests can significantly improve the efficiency and professionalism of your financial transactions. A well-designed billing document not only ensures that all important information is clearly presented, but also helps you maintain consistency and organization in your record-keeping. The right format should be simple, customizable, and capable of handling the specific needs of the caregiving arrangement.

Factors to Consider When Choosing a Billing Format

When selecting a billing format, it’s important to keep a few key factors in mind:

- Ease of use: Choose a format that is easy to fill out, whether you’re doing so manually or using software. Simplicity is essential to avoid errors or delays.

- Customization: Look for a design that allows you to personalize fields such as names, rates, and service descriptions. The ability to adjust the layout based on specific needs is important.

- Flexibility: Ensure that the format can accommodate different payment schedules (weekly, monthly, etc.) and adjust for overtime or special fees.

Choosing Between Digital and Paper Formats

Another important decision is whether to use a digital or paper version of the document. Digital formats, such as those created in Word or Excel, offer advantages like easy editing, email delivery, and the ability to store records electronically. On the other hand, paper formats may be preferred in more traditional settings, or for those who want to provide a physical copy for their clients. Both options can work well, but digital formats often provide greater convenience and organization over time.

Ultimately, the right choice will depend on the specific needs of both the caregiver and the family, but ensuring that the format is clear, professional, and tailored to the arrangement is crucial for smooth financial transactions.

Free vs Paid Caregiver Billing Formats

When choosing a format for payment requests, caregivers often face the decision between using a free or a paid solution. Both options have their benefits and limitations, and the right choice depends on the specific needs of the caregiver and the level of customization or features required. While free formats are accessible and easy to use, paid options typically offer more advanced features, greater flexibility, and enhanced professionalism. Understanding the differences between these options can help caregivers make an informed decision that aligns with their business needs.

Advantages of Free Billing Formats

Free billing formats are widely available and provide a quick solution for caregivers who need a simple and no-cost method for tracking payments. Some of the key benefits include:

- Cost-effective: As the name suggests, these formats come with no upfront costs, making them ideal for caregivers just starting out or those with a limited budget.

- Easy to access: Free formats can often be downloaded instantly from various online platforms without the need for registration or payment.

- Basic functionality: They typically offer all the basic features needed for simple billing, such as fields for work hours, rate, and total amount due.

Benefits of Paid Billing Formats

Paid billing formats, while requiring an investment, offer numerous features that can be beneficial for caregivers seeking more professional and advanced options. These formats often come with additional capabilities, including:

- Customization options: Paid formats often allow for more detailed customization, such as adding your logo, changing the layout, or including specific payment terms that suit your business.

- Increased professionalism: With a polished, professional design, paid formats can make your billing documents appear more official, which can help build trust with clients.

- Additional features: Many paid options come with extra tools such as automatic tax calculations, recurring billing, or integration with accounting software, which can save time and reduce errors.

Ultimately, the choice between free and paid options depends on your specific needs and preferences. For caregivers with simple billing requirements, free formats may be sufficient. However, for those seeking a more tailored experience or additional features, a paid solution could be a worthwhile investment that enhances both the billing process and the overall professionalism of their services.

How to Customize Your Caregiver Billing Document

Customizing your billing document is an essential step in ensuring that it meets your unique needs and reflects your professional style. A well-designed, personalized record not only provides all the necessary details but also enhances your brand identity, making it more memorable to clients. Whether you want to add specific terms, include your business logo, or adjust the layout to fit your preferences, customization options allow you to create a document that works best for you and your clients.

Key Areas for Customization

There are several areas in your payment document where customization can make a significant impact:

- Header and Branding: Add your business name, logo, and contact information at the top of the document. This not only personalizes the document but also makes it look more professional.

- Service Description: Customize the sections that describe the type of care or services provided. You can break down tasks in more detail to ensure clarity, especially if you offer a variety of services.

- Payment Terms: Tailor payment terms to match your agreement with the client. You may want to include your payment schedule, late fees, or preferred methods of payment.

Creating a Customizable Billing Document

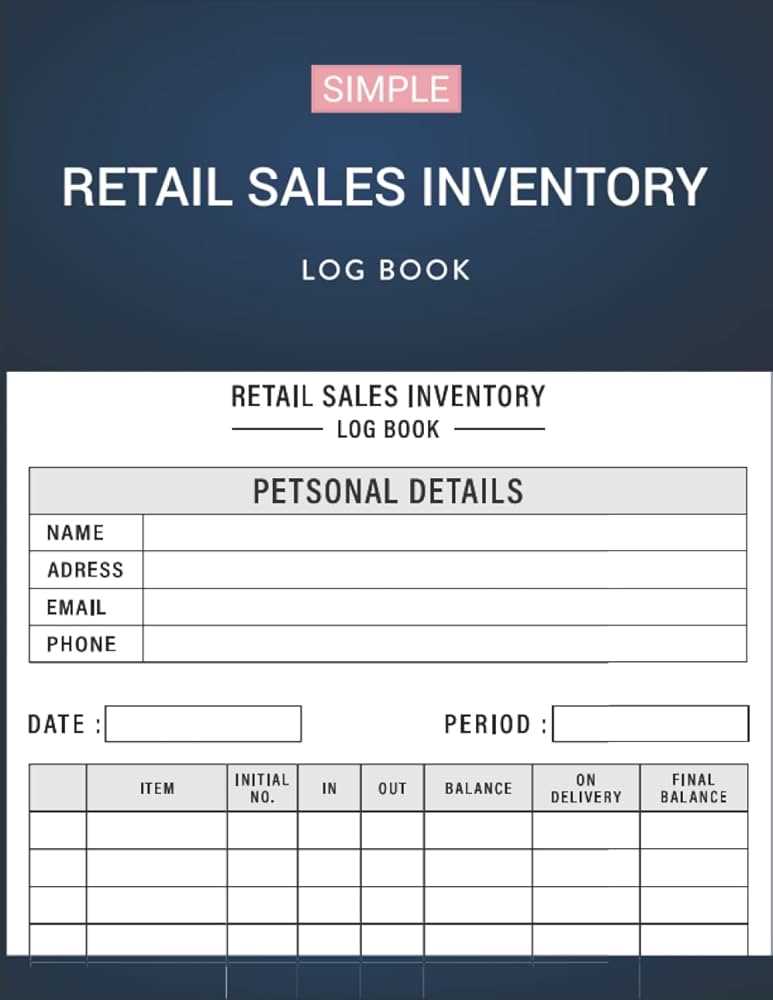

Many billing formats, whether digital or paper, offer customizable fields. These fields can be easily adjusted to suit your style, and many software options allow you to save multiple versions for different clients or situations. Here’s an example of a basic structure that can be customized for different caregiving situations:

| Field | Customization Option | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Caregiver Information | Add your full name, business title, logo, and contact details to make the document uniquely yours. | |||||||||||||||

| Client Information | Customize the client’s name, address, and any relevant reference or account numbers. | |||||||||||||||

| Service Description | List the specific services you provided, with the option to add extra details about special tasks or requests. | |||||||||||||||

| Hourly Rate and Payment | Adjust the hourly rate or flat fee, and include custom payment terms based on the client agreement. | |||||||||||||||

| Additional Charges | Include any extra charges for overtime, holidays, or special requests t

Simple Tips for Personalizing Billing DocumentsPersonalizing your payment requests not only makes them more professional, but also helps create a lasting impression with your clients. By adding a personal touch, you can make your documents stand out, reinforce your brand, and build stronger relationships with the families you work with. Here are a few simple yet effective tips to help you customize your billing documents and make them feel more tailored to your business. Add a Professional Header – The first thing clients will see is the header, so make it count. Include your name, business logo, and contact details at the top of the document. This not only brands the document but also ensures clients know exactly who the bill is coming from. Customize Service Descriptions – Instead of just listing generic services, describe them in a way that reflects the unique care you provide. For example, instead of simply writing “childcare,” you could specify “educational playtime and meal preparation” to give a clearer picture of what the service entails. Personalize the Tone – The language used in your payment document can also be adjusted to match your relationship with the client. If you have a more casual relationship, use a friendly tone, but if the relationship is more formal, make sure the wording is professional and polite. Phrases like “Thank you for your trust” or “Looking forward to working with you again” add a personal touch. Include Special Notes or Messages – You can add a special note to your clients at the bottom of the document, such as a reminder of your next appointment, a message of thanks for their business, or a seasonal greeting. This shows your clients that you care and can help build rapport. Use a Customizable Design – Many billing tools and platforms allow you to adjust fonts, colors, and layout. Using a design that matches your brand’s color scheme or aesthetic can reinforce your professional image while making your payment requests visually appealing. By following these simple tips, you can create a more personalized and professional billing experience that not only enhances your business image but also strengthens your relationship with clients. How to Calculate Hours and RatesAccurately calculating the number of hours worked and the appropriate rates for your services is essential for maintaining transparency and ensuring fair compensation. Whether you charge by the hour or have a flat fee for specific tasks, it’s important to have a clear method for tracking time and applying the correct rates. This not only ensures that you’re paid correctly but also helps build trust with your clients. Calculating Hours WorkedThe first step in determining the total amount due is accurately calculating the hours worked. Here are some tips to ensure precision:

Setting and Applying RatesOnce you’ve calculated the total hours worked, it’s time to apply the agreed-upon rate. Here are a few steps to help you determine the correct fee:

Calculating the Total Amount DueAfter calculating the hours and applying the correct rates, add any additional charges (like overtime or special services) to get the final amount due. Make sure to double-check all calculations for accuracy before sending the payment request to your client. Accurately Recording Caregiver Work HoursRecording work hours accurately is essential for both caregivers and families to ensure fair compensation and prevent misunderstandings. Whether you work with set hours or have flexible schedules, precise documentation is key to providing transparent and reliable billing. This practice not only helps maintain trust but also ensures that both parties are on the same page regarding the time spent on care services. Methods for Tracking Work HoursThere are several effective methods for tracking work hours. Here are some of the most common approaches:

Best Practices for Accurate RecordingTo ensure the accuracy of your work hour records, follow these best practices:

By using one of these methods and adhering to best practices, you can maintain accurate and reliable records of your working hours. This ensures that you’re compensated fairly for the services you provide while also fosteri Best Formats for Caregiver Billing Documents

Choosing the right format for your payment requests is essential for maintaining a professional appearance and ensuring clarity in your financial transactions. A well-structured document helps both you and your clients keep track of hours worked, services rendered, and amounts owed. There are several options available, from simple spreadsheets to more sophisticated digital formats, each offering different advantages depending on your needs. Popular Formats for Payment RecordsHere are some of the most popular formats for caregiver payment records, along with their benefits and features:

Comparing the OptionsEach format has its pros and cons. To help you choose the best one for your needs, here is a comparison of these common formats:

Choosing the best format depends on your personal preference and the level of detail you need in your billing documents. If you’re looking for flexibility and automation, online billing platforms or spreadsheets might be your best choice. If you value a more polished, professional look, a Word document or PDF template could be ideal. Whatever format you choose, ensure that it is clear, accurate, and fits your specific needs. Choosing Between Word, Excel, or PDFWhen it comes to creating billing documents, selecting the right format can significantly impact both efficiency and professionalism. Each format–whether it’s a Word document, an Excel sheet, or a PDF file–has its unique features, advantages, and potential drawbacks. Understanding the specific needs of your business and how you prefer to work will help you decide which format best suits your needs. Advantages of Word DocumentsWord documents are a popular choice for those who prioritize clean design and customizability. Here are some reasons why you might choose Word:

Advantages of Excel SpreadsheetsIf you need a format that’s more focused on organization and automatic calculations, Excel might be the best option. Here are some key benefits:

Advantages of PDF FilesFor a polished, universally accessible format, PDFs are often the go-to choice. Here are the reasons you might choose PDF:

|