QuickBooks Trucking Invoice Template for Streamlined Billing and Accounting

Managing financial records efficiently is a cornerstone of success in the transportation industry. With the right tools, businesses can simplify the process of tracking earnings, expenses, and payments, ensuring timely and accurate billing. A well-designed document structure can significantly reduce manual errors and administrative burden, making it easier to stay organized and focused on growth.

For those in the logistics and freight sector, automating the billing process offers numerous benefits, from improving cash flow management to minimizing human error. By using digital solutions tailored to the unique needs of the industry, companies can create professional documents that are both clear and legally compliant. The ability to customize these documents for specific services, rates, and payment terms further enhances operational efficiency.

Implementing a professional document structure can not only save time but also improve client relations by presenting clear, accurate details in every transaction. Whether you’re an independent contractor or managing a large fleet, adopting a seamless method for handling financial paperwork is essential for smooth business operations. With the right resources, businesses can focus on what truly matters–delivering exceptional service to their clients.

QuickBooks Trucking Invoice Template Overview

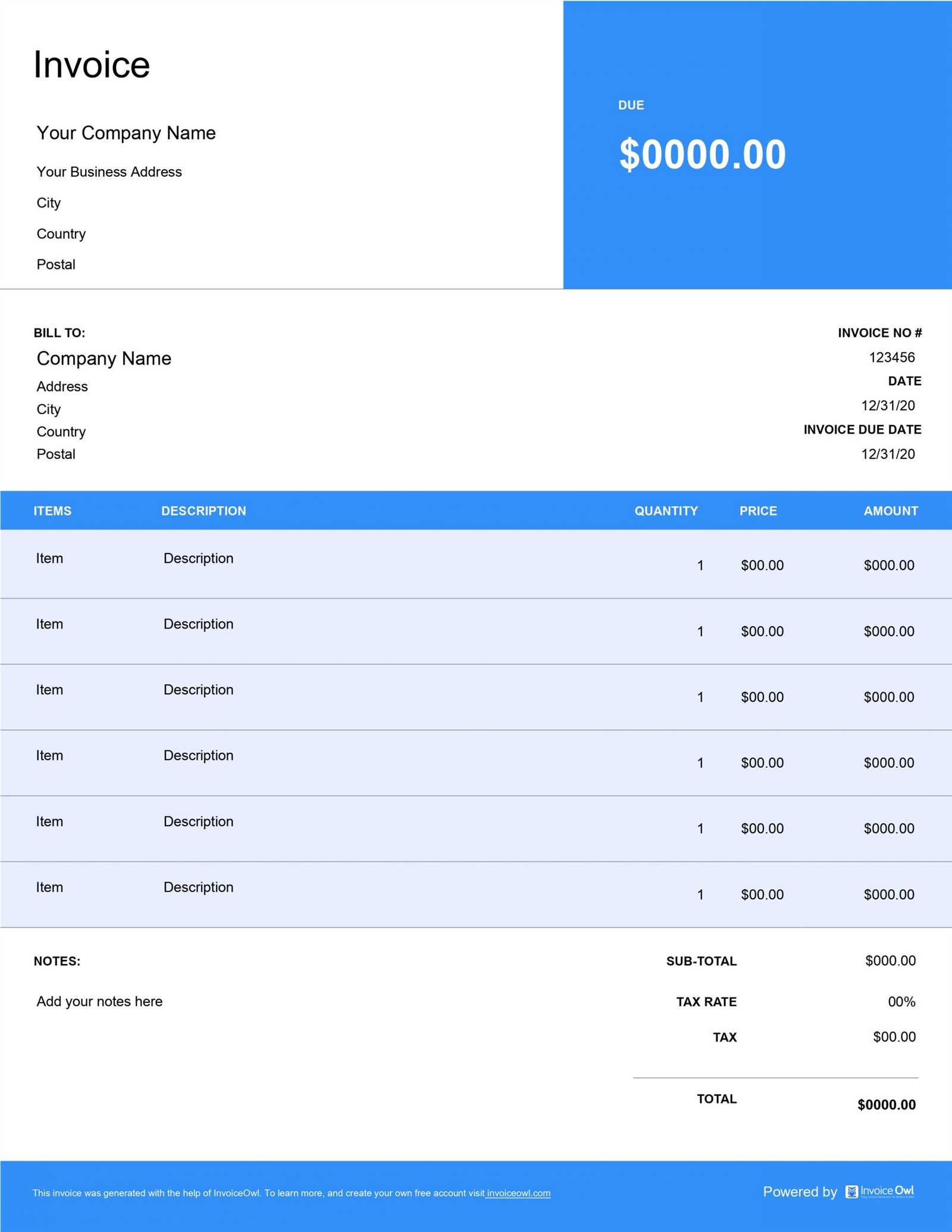

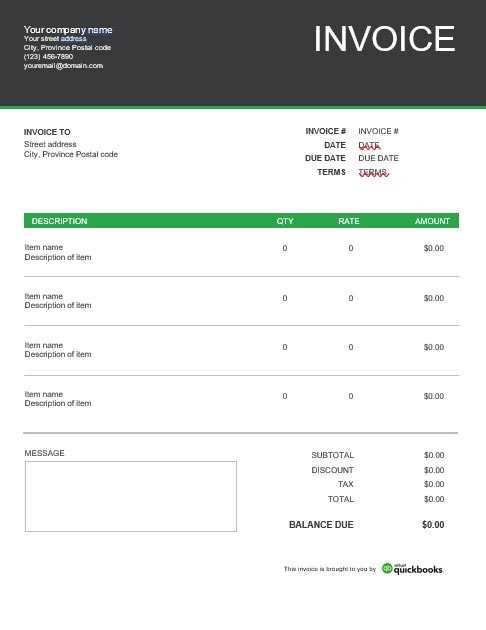

Efficient billing is essential for businesses in the transportation sector, and having the right document structure in place is key to maintaining smooth operations. A customizable, professional billing format allows service providers to clearly communicate charges, payment terms, and other relevant details. This structured approach simplifies the process of creating and managing financial records while ensuring accuracy and consistency across all transactions.

With the right tools, business owners can automate the creation of these documents, saving valuable time and reducing the chances of errors. Such a solution provides flexibility, allowing users to easily modify the format according to their specific needs, whether it’s for different types of services, variable rates, or unique client preferences. Customization is a significant advantage, as it ensures the final document accurately reflects the specifics of each service provided.

Incorporating a solution designed for the logistics industry means that every financial interaction is handled professionally. These systems are built with the needs of transportation providers in mind, offering features such as built-in calculations, automatic updates, and integration with accounting tools. This integration streamlines not only billing but also broader financial management, offering a seamless experience from start to finish.

QuickBooks Trucking Invoice Template Overview

Efficient billing is essential for businesses in the transportation sector, and having the right document structure in place is key to maintaining smooth operations. A customizable, professional billing format allows service providers to clearly communicate charges, payment terms, and other relevant details. This structured approach simplifies the process of creating and managing financial records while ensuring accuracy and consistency across all transactions.

With the right tools, business owners can automate the creation of these documents, saving valuable time and reducing the chances of errors. Such a solution provides flexibility, allowing users to easily modify the format according to their specific needs, whether it’s for different types of services, variable rates, or unique client preferences. Customization is a significant advantage, as it ensures the final document accurately reflects the specifics of each service provided.

Incorporating a solution designed for the logistics industry means that every financial interaction is handled professionally. These systems are built with the needs of transportation providers in mind, offering features such as built-in calculations, automatic updates, and integration with accounting tools. This integration streamlines not only billing but also broader financial management, offering a seamless experience from start to finish.

Key Features of QuickBooks Invoice Templates

Having an efficient and versatile billing document is essential for managing payments and tracking financial transactions. The most effective solutions provide a range of features that help businesses in the logistics sector stay organized and streamline their processes. From simplifying the creation of financial documents to enhancing accuracy, these tools are designed to meet the specific needs of service-based industries.

Customizable Design for Every Business Need

One of the key features is the ability to personalize the format, allowing businesses to tailor it to their specific requirements. Whether it’s adjusting service descriptions, payment terms, or rates, flexibility ensures that each document accurately represents the services provided. Customization allows users to align their documents with their brand identity, enhancing professionalism and improving client relationships.

Automated Calculations and Payment Tracking

Automated functions simplify billing by performing calculations for total amounts, taxes, and discounts, reducing the risk of human error. This feature also allows businesses to easily track outstanding payments and overdue invoices. With automatic reminders and updates, businesses can maintain better control over their cash flow, ensuring timely payments and improved financial management.

Key Features of QuickBooks Invoice Templates

Having an efficient and versatile billing document is essential for managing payments and tracking financial transactions. The most effective solutions provide a range of features that help businesses in the logistics sector stay organized and streamline their processes. From simplifying the creation of financial documents to enhancing accuracy, these tools are designed to meet the specific needs of service-based industries.

Customizable Design for Every Business Need

One of the key features is the ability to personalize the format, allowing businesses to tailor it to their specific requirements. Whether it’s adjusting service descriptions, payment terms, or rates, flexibility ensures that each document accurately represents the services provided. Customization allows users to align their documents with their brand identity, enhancing professionalism and improving client relationships.

Automated Calculations and Payment Tracking

Automated functions simplify billing by performing calculations for total amounts, taxes, and discounts, reducing the risk of human error. This feature also allows businesses to easily track outstanding payments and overdue invoices. With automatic reminders and updates, businesses can maintain better control over their cash flow, ensuring timely payments and improved financial management.

Key Features of QuickBooks Invoice Templates

Having an efficient and versatile billing document is essential for managing payments and tracking financial transactions. The most effective solutions provide a range of features that help businesses in the logistics sector stay organized and streamline their processes. From simplifying the creation of financial documents to enhancing accuracy, these tools are designed to meet the specific needs of service-based industries.

Customizable Design for Every Business Need

One of the key features is the ability to personalize the format, allowing businesses to tailor it to their specific requirements. Whether it’s adjusting service descriptions, payment terms, or rates, flexibility ensures that each document accurately represents the services provided. Customization allows users to align their documents with their brand identity, enhancing professionalism and improving client relationships.

Automated Calculations and Payment Tracking

Automated functions simplify billing by performing calculations for total amounts, taxes, and discounts, reducing the risk of human error. This feature also allows businesses to easily track outstanding payments and overdue invoices. With automatic reminders and updates, businesses can maintain better control over their cash flow, ensuring timely payments and improved financial management.

Key Features of QuickBooks Invoice Templates

Having an efficient and versatile billing document is essential for managing payments and tracking financial transactions. The most effective solutions provide a range of features that help businesses in the logistics sector stay organized and streamline their processes. From simplifying the creation of financial documents to enhancing accuracy, these tools are designed to meet the specific needs of service-based industries.

Customizable Design for Every Business Need

One of the key features is the ability to personalize the format, allowing businesses to tailor it to their specific requirements. Whether it’s adjusting service descriptions, payment terms, or rates, flexibility ensures that each document accurately represents the services provided. Customization allows users to align their documents with their brand identity, enhancing professionalism and improving client relationships.

Automated Calculations and Payment Tracking

Automated functions simplify billing by performing calculations for total amounts, taxes, and discounts, reducing the risk of human error. This feature also allows businesses to easily track outstanding payments and overdue invoices. With automatic reminders and updates, businesses can maintain better control over their cash flow, ensuring timely payments and improved financial management.

Key Features of QuickBooks Invoice Templates

Having an efficient and versatile billing document is essential for managing payments and tracking financial transactions. The most effective solutions provide a range of features that help businesses in the logistics sector stay organized and streamline their processes. From simplifying the creation of financial documents to enhancing accuracy, these tools are designed to meet the specific needs of service-based industries.

Customizable Design for Every Business Need

One of the key features is the ability to personalize the format, allowing businesses to tailor it to their specific requirements. Whether it’s adjusting service descriptions, payment terms, or rates, flexibility ensures that each document accurately represents the services provided. Customization allows users to align their documents with their brand identity, enhancing professionalism and improving client relationships.

Automated Calculations and Payment Tracking

Automated functions simplify billing by performing calculations for total amounts, taxes, and discounts, reducing the risk of human error. This feature also allows businesses to easily track outstanding payments and overdue invoices. With automatic reminders and updates, businesses can maintain better control over their cash flow, ensuring timely payments and improved financial management.

Key Features of QuickBooks Invoice Templates

Having an efficient and versatile billing document is essential for managing payments and tracking financial transactions. The most effective solutions provide a range of features that help businesses in the logistics sector stay organized and streamline their processes. From simplifying the creation of financial documents to enhancing accuracy, these tools are designed to meet the specific needs of service-based industries.

Customizable Design for Every Business Need

One of the key features is the ability to personalize the format, allowing businesses to tailor it to their specific requirements. Whether it’s adjusting service descriptions, payment terms, or rates, flexibility ensures that each document accurately represents the services provided. Customization allows users to align their documents with their brand identity, enhancing professionalism and improving client relationships.

Automated Calculations and Payment Tracking

Automated functions simplify billing by performing calculations for total amounts, taxes, and discounts, reducing the risk of human error. This feature also allows businesses to easily track outstanding payments and overdue invoices. With automatic reminders and updates, businesses can maintain better control over their cash flow, ensuring timely payments and improved financial management.

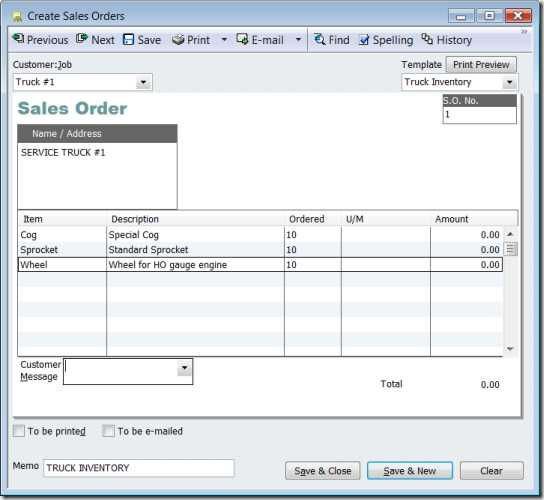

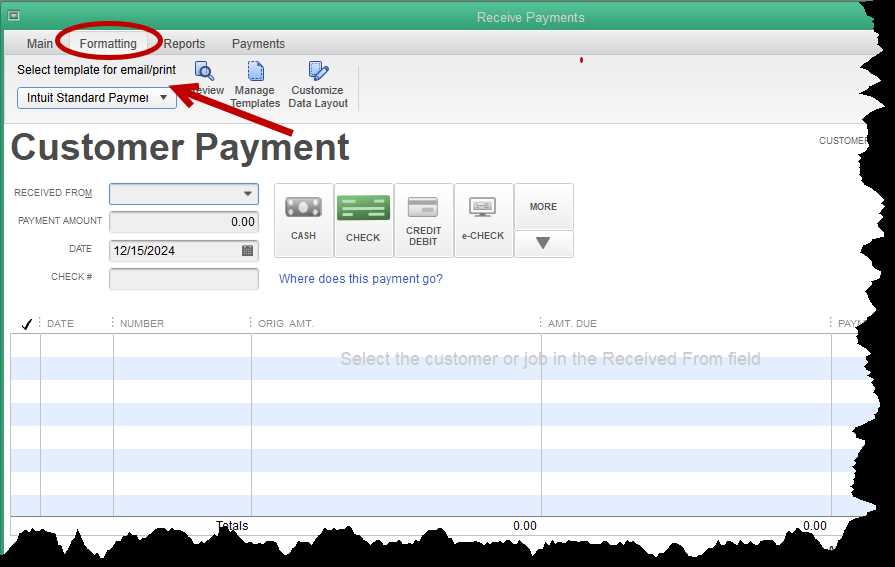

Tracking Payments and Expenses in QuickBooks

Effective financial management requires careful monitoring of both incoming payments and outgoing costs. Keeping track of transactions helps businesses stay on top of their cash flow, avoid overdue bills, and identify any discrepancies early on. The right tools can automate much of this process, making it easier to maintain accurate records without manual input.

Managing Payments

Proper payment tracking allows businesses to stay informed about what is owed and when. With the right system, users can:

- Record payments as they come in

- Send automatic reminders for overdue balances

- Track partial payments and remaining balances

- Generate reports on payment history for clients

Tracking Expenses

Monitoring expenses is equally important for ensuring profitability. Businesses can easily track their costs by:

- Entering and categorizing expenses automatically

- Linking receipts and bills to transactions

- Tracking recurring costs like subscriptions or lease payments

- Generating detailed expense reports for financial analysis

With these tools, businesses can maintain a clear overview of both their income and expenditures, which is essential for making informed financial decisions.

Tracking Payments and Expenses in QuickBooks

Effective financial management requires careful monitoring of both incoming payments and outgoing costs. Keeping track of transactions helps businesses stay on top of their cash flow, avoid overdue bills, and identify any discrepancies early on. The right tools can automate much of this process, making it easier to maintain accurate records without manual input.

Managing Payments

Proper payment tracking allows businesses to stay informed about what is owed and when. With the right system, users can:

- Record payments as they come in

- Send automatic reminders for overdue balances

- Track partial payments and remaining balances

- Generate reports on payment history for clients

Tracking Expenses

Monitoring expenses is equally important for ensuring profitability. Businesses can easily track their costs by:

- Entering and categorizing expenses automatically

- Linking receipts and bills to transactions

- Tracking recurring costs like subscriptions or lease payments

- Generating detailed expense reports for financial analysis

With these tools, businesses can maintain a clear overview of both their income and expenditures, which is essential for making informed financial decisions.

Common Mistakes in Billing Documents

When managing financial records, it’s easy to overlook small details that can lead to significant issues later on. Incorrect or incomplete documentation not only causes confusion but can also delay payments or damage relationships with clients. Recognizing common errors and addressing them early helps maintain smooth business operations and ensures that all transactions are properly documented.

Common Errors in Billing

One of the most frequent mistakes in billing documents involves inaccurate or missing information. Some of the most common issues include:

- Omitting essential contact or service details

- Incorrectly calculating totals or applying the wrong rates

- Forgetting to include taxes or discounts

- Leaving out payment terms or due dates

Administrative Oversights

In addition to errors in the content of the document, administrative oversights can also lead to complications. These include:

- Sending documents to the wrong client or email address

- Failing to update the document for partial payments or previous transactions

- Using outdated billing information or payment methods

- Not following up on overdue balances in a timely manner

By staying vigilant and checking for these common mistakes, businesses can ensure that their financial records are always clear, accurate, and professionally presented.

How to Handle Invoice Disputes in QuickBooks

Managing payment disagreements is an essential aspect of running a business, especially when it comes to discrepancies between the amounts billed and what clients believe they owe. Resolving these issues promptly and professionally helps maintain healthy client relationships and ensures smooth financial operations. Below are the steps you can follow to effectively handle billing disputes within your accounting software.

- Review the Disputed Amount: Begin by closely examining the charges in question. Double-check the figures, including any additional fees, taxes, or adjustments made. Verify the accuracy of each line item to identify any possible clerical errors.

- Communicate with Your Client: Reach out to the customer promptly to discuss the issue. Ensure that your tone remains professional and understanding. Request clarification on why they disagree with the amount and provide them with all necessary documentation to support your claim.

- Resolve and Adjust the Record: Once both parties have come to a mutual understanding, make the necessary changes to the record. This might include issuing a credit, adjusting the amounts, or removing charges that were not valid. It’s crucial to keep all adjustments well-documented for future reference.

- Settle Payments or Agree on a Payment Plan: If an agreement is reached, determine the best way to proceed with the payment. If the customer is unable to pay in full immediately, consider offering a payment plan or an extended due date.

- Document the Resolution: Always ensure that any resolved disputes are thoroughly documented. This includes noting any changes made to the payment history and keeping records of the communications exchanged. This documentation can be valuable for future reference and can help prevent similar issues from arising.

By handling disputes swiftly and professionally, you can maintain trust and transparency with your clients, which is key to sustaining long-term business relationships.

Exporting and Printing QuickBooks Invoices

Having the ability to export and print billing documents directly from your financial software can greatly streamline administrative tasks. Whether you need to send physical copies to clients, share them with stakeholders, or simply keep them on hand for your records, the process should be quick and efficient. Below is a guide to help you with exporting and printing your billing statements in a few easy steps.

How to Export Documents

Exporting your financial documents allows you to save them in different formats, such as PDF or Excel, for easy sharing or archiving. Here’s how you can do it:

- Access Your Document: First, locate the specific billing record within your software system. Navigate to the relevant section where the details are stored.

- Select Export Option: Look for an option that allows you to export the document. This is often found under a “File” or “Action” menu, depending on your software interface.

- Choose File Format: Decide whether you want to export the document as a PDF for sharing, or as an Excel file for data analysis. Select the appropriate format from the available choices.

- Save the File: After selecting the format, choose where to save the file on your computer or cloud storage. Make sure the file is easy to find for future reference.

How to Print Documents

If you need to provide physical copies of your billing records, follow these simple steps:

- Preview the Document: Before printing, always preview the document to ensure that it appears as expected. Check for any missing details or formatting issues.

- Select Print Option: Once you are satisfied with the preview, go to the print option. This is typically found in the “File” menu or under a printer icon.

- Choose Printer Settings: Adjust your printer settings such as paper size, orientation, and color options. If you are using a network printer, make sure the correct device is selected.

- Print the Document: Click “Print” and wait for the physical copy to be produced. Make sure that your printer has enough paper and ink to complete the job.

By following these steps, you can quickly expo

Tips for Efficient Invoice Processing

Streamlining the way you handle billing documents can significantly improve cash flow, reduce administrative errors, and save time. Efficient processing involves everything from creating clear and accurate records to ensuring timely payment collection. Below are several tips to help you optimize your workflow and ensure smooth financial operations.

- Automate Repetitive Tasks: Use software features that allow for automatic generation of common charges and recurring bills. Setting up automation for tasks such as sending reminders or creating routine documents can drastically cut down on manual work.

- Standardize Your Billing Format: Consistency in your record format ensures that clients know what to expect. Having a uniform layout for each document makes it easier to check for accuracy, track payment history, and reduce confusion.

- Use Templates for Common Transactions: Create reusable forms for frequent transactions or client interactions. Pre-built templates save time and help ensure that you don’t overlook important details like due dates or payment terms.

- Double-Check Details Before Sending: Mistakes can be costly. Always verify the accuracy of amounts, payment terms, and client information before dispatching any documents. A quick review can prevent delays and minimize the risk of disputes.

- Implement a Clear Payment System: Make sure your payment instructions are easy to follow. Provide multiple options and ensure all clients are aware of deadlines. This transparency helps to speed up the collection process.

- Track Payment Progress in Real-Time: Utilize tracking tools to stay on top of outstanding balances. Knowing when a payment is due or overdue allows you to act quickly and avoid delays in your cash flow.

- Follow Up Promptly: Don’t wait too long before following up on late payments. A timely reminder is often all that’s needed to get clients to settle their accounts. Be professional but assertive in your communications.

By implementing these practices, you can create a more efficient and organized billing process, allowing you to focus on what matters most – growing your business.

How to Set Payment Terms in QuickBooks

Setting clear and consistent payment terms with your clients is crucial for maintaining healthy cash flow and preventing misunderstandings. By defining specific expectations regarding when payments are due, how they should be made, and any applicable late fees, you create a framework that encourages timely payments and reduces administrative challenges. Below are the steps to establish payment terms in your financial management software.

- Navigate to Payment Settings: Start by opening your accounting software and accessing the settings or preferences section. Look for the option labeled “Payment Terms” or something similar under the billing or sales settings.

- Create New Payment Terms: If you are setting up new terms, select the option to create or add a new entry. You will typically be asked to specify the name of the term, such as “Net 30,” “Due on Receipt,” or “2% 10, Net 30,” depending on the discount structure you offer.

- Define the Due Date: Input the number of days after the transaction when payment is expected. For example, “Net 30” means payment is due within 30 days from the date of the document. You can also choose specific due dates or intervals, depending on your agreement with the client.

- Set Discounts or Late Fees: Some businesses offer discounts for early payments or impose fees for late ones. If applicable, specify any terms for discounts, such as “2% off if paid within 10 days,” or outline the penalties for overdue payments, such as a fixed percentage or flat fee.

- Apply Terms to Clients: Once the payment terms are created, apply them to your clients or transactions. This ensures that all future documents sent to the client reflect the agreed-upon terms, reducing confusion and ensuring consistency.

- Review and Adjust Periodically: Payment terms should be reviewed periodically to ensure they are still appropriate for your business and client base. Make adjustments as needed based on your experiences or changes in your business operations.

By setting clear and organized payment terms, you not only promote timely collections but also reduce the risk of disputes and enhance client relationships. Clear terms help ensure both parties are on the same page and contribute to a smoother, more predictable cash flow.

How QuickBooks Enhances Financial Reporting

Effective financial reporting is essential for understanding the health of your business, making informed decisions, and maintaining compliance with tax regulations. Having access to accurate, timely, and comprehensive financial data can greatly improve the decision-making process. With the right tools, you can automate much of this work, allowing for more efficient reporting and deeper insights into your company’s performance.

Real-Time Access to Financial Data

One of the most significant benefits of using financial software is the ability to access up-to-date information at any time. With real-time data, you can track your business’s financial performance as it evolves, giving you the flexibility to make quick decisions based on current trends. This immediacy allows you to avoid surprises, optimize cash flow, and adjust strategies quickly if needed.

- Instant Reports: Generate balance sheets, profit and loss statements, and other key financial reports with just a few clicks. Having these reports available in real time means you can identify potential issues early and address them before they affect your business.

- Customizable Reports: Tailor reports to fit your specific needs. Whether you want to track expenses by category or analyze revenue trends, customization ensures that you’re focusing on the data most relevant to your business.

Automated Financial Insights

Automating the collection and organization of your financial data minimizes errors and ensures consistency. The software automatically updates your records and generates detailed insights based on pre-set parameters. This helps you avoid manual data entry and reduces the risk of human error, making your financial reporting more accurate and reliable.

- Trend Analysis: Automatically track financial trends over time to spot patterns or anomalies. This can help identify profitable areas of your business or flag potential areas for improvement.

- Financial Forecasting: Use historical data to forecast future performance. Predicting cash flow, upcoming expenses, and expected revenue can assist in making smarter business decisions.

By leveraging advanced financial reporting tools, businesses can gain a clearer and more detailed understanding of their financial position. The ability to automate, customize, and analyze financial data enhances the accuracy and timeliness of reports, ultimately contributing to better strategic decisions and smoother business operations.

Alternatives to QuickBooks Trucking Invoice Templates

While many businesses rely on accounting software for creating and managing their billing documents, there are other tools and methods available that can provide flexibility, customization, and ease of use. Whether you’re looking for a more affordable solution, a more specialized tool, or a unique approach that fits your business needs, there are several alternatives to consider. Below is an overview of some of the options available for managing billing records without relying solely on traditional accounting platforms.

| Option | Features | Best For |

|---|---|---|

| Online Billing Tools | Cloud-based platforms that allow users to create, send, and track payments. Often include features like automatic reminders and payment links. | Small businesses or freelancers looking for a cost-effective, straightforward solution. |

| Excel or Google Sheets | Customizable spreadsheets that can be designed to track expenses, calculate totals, and create detailed financial reports manually. | Businesses that need full control over their formats and prefer a more hands-on approach. |

| Third-Party Billing Software | Specialized applications designed for specific industries, providing tools for generating and managing payment records with added features like recurring billing or cost tracking. | Companies with niche needs that require specialized tools for their industry. |

| Accounting Software with Invoice Features | Accounting platforms that include invoicing as one of many integrated features. These often come with robust reporting, tax management, and client communication tools. | Companies that want all-in-one software for managing both finances and billing without relying on a separate template system. |

| Custom-Built Solutions | Tailored software or tools designed specifically for a company’s billing and payment processes, offering the highest level of customization. | Large enterprises or businesses with very specific or complex invoicing needs. |

Each of these alternatives provides unique features and benefits, depending on the size, scope, and needs of your business. Whether you need a simple solution or a more advanced system with customizability, exploring var