Free Food Invoice Template Word Download and Customization Guide

Creating well-structured billing documents is essential for businesses that need to keep track of transactions and maintain clear records with clients. With the right tools, this process can be simplified and streamlined. Customizable documents provide flexibility and efficiency, making it easy to create consistent, professional records for every sale or service rendered.

In this guide, we will explore how to design, customize, and manage these records using a widely accessible text processor. Whether you’re a small business owner or a freelancer, learning how to effectively create and modify these files will ensure accuracy and professionalism in your financial communications. You’ll also discover helpful tips and tricks for creating documents that reflect your business identity while remaining easy to understand for your clients.

Food Invoice Template Word: A Complete Guide

Creating a polished and professional billing document is a key part of managing transactions with clients. Whether you’re running a small eatery or catering business, having a customizable, easy-to-use document is essential for clear financial communication. This guide will walk you through the steps of creating a custom record for services rendered, designed to suit your business needs.

Why Customize Your Billing Document?

Customizing your record not only ensures consistency but also helps maintain a professional image. By adjusting key elements such as your business logo, contact details, and itemized descriptions, you can present an organized and cohesive look that strengthens your brand. This personalized approach will also make the billing process more efficient, allowing you to focus on providing great service to your clients.

Steps to Creating Your Document

Start by selecting a platform that allows easy customization and formatting. Many popular text editors offer ready-made formats that can be quickly modified according to your needs. Once you’ve chosen a layout, add all necessary fields like the client’s name, service or product details, and pricing. For additional professionalism, consider adding payment terms and due dates to keep everything clear and transparent.

Tip: Regularly updating and refining your document ensures that it stays relevant to your evolving business needs and maintains its usefulness over time.

Why Use a Food Invoice Template?

Having a predefined structure for your billing documents saves time and ensures consistency across all transactions. By using a customizable format, you can streamline the process of generating professional records, reducing the chances of errors and discrepancies. This method not only simplifies your workflow but also ensures that every detail is captured accurately, making it easier for both you and your clients to stay organized.

Moreover, utilizing a ready-made layout allows you to focus on the core aspects of your business rather than spending excessive time on administrative tasks. With a well-designed document, you can easily add or modify information such as pricing, client details, and services rendered without the need to start from scratch every time.

Efficiency: A well-crafted structure makes the entire billing process faster, which ultimately saves time and resources.

Professionalism: Consistent use of a clear, organized format enhances your business image, making you appear more reliable and trustworthy to clients.

How to Customize Your Billing Document

Customizing your billing document allows you to tailor it to your specific needs and ensure it reflects your business identity. A personalized structure ensures that all necessary information is included, while giving you flexibility to adjust the layout to suit your preferences. This process enhances both the clarity of the document and its professional appearance, creating a seamless experience for you and your clients.

Adjusting Basic Information

The first step in customization is adding your business details, such as your company name, logo, and contact information. This helps clients easily identify the document as official and provides them with a direct way to reach out if they have questions. Additionally, ensure that client-specific information, like names and addresses, are clearly stated and easy to locate.

Personalizing the Layout and Content

Once the basic information is set, focus on the design and structure. Adjust the fonts, colors, and spacing to match your branding. You can also add specific sections to suit your business type, such as a detailed breakdown of items or services, taxes, or discounts. The more detailed and organized your layout, the easier it will be for clients to understand and process the charges.

Tip: Keep your document simple and professional. Avoid cluttering it with unnecessary elements that could confuse or overwhelm the client.

Efficiency: Customizing the structure allows you to quickly generate documents without having to start from scratch each time.

Benefits of Using Word for Invoices

Using a popular text editor for creating billing documents offers numerous advantages for small businesses and freelancers. This software provides a range of customizable features, ensuring that you can design and format your financial records to suit your specific needs. From ease of use to extensive editing options, it’s a powerful tool for managing your business transactions efficiently.

Ease of Customization

One of the main benefits of using a text editor is the flexibility it provides. You can easily modify the layout, fonts, and colors to match your branding and ensure that your documents look professional. Adding or removing sections such as taxes, discounts, or custom notes is simple and can be done quickly without any advanced technical skills.

Accessibility and Compatibility

This software is widely accessible, and the files you create can be shared across various platforms without compatibility issues. Whether you are sending your records via email, printing them for in-person meetings, or storing them digitally, using a common format ensures that your clients will be able to view and use them without hassle.

Efficiency: Templates and customizable layouts make the document creation process much quicker, saving time for other important tasks.

Cost-Effective: Many text editors are included with office software packages or are available for free, making them a budget-friendly option for businesses of any size.

Where to Find Free Templates

Finding free resources for creating professional billing documents is easier than ever. Numerous websites and platforms offer ready-to-use formats that can be downloaded, customized, and tailored to fit your business needs. These free resources are a great starting point for businesses looking to save time and money on administrative tasks while maintaining a polished image.

- Microsoft Office Online: The official website offers a variety of free layouts that you can directly download and modify within their text editor.

- Google Docs: Google’s cloud-based platform provides free templates that can be accessed and customized online, with the added benefit of automatic saving and easy sharing.

- Template Websites: Many third-party websites, such as Template.net and Vertex42, offer free customizable formats that can be downloaded and adjusted to your specifications.

- Freelance Marketplaces: Websites like Etsy and Fiverr may offer free or low-cost resources created by independent designers, giving you access to unique, specialized designs.

These resources provide an excellent way to get started without the need for expensive software or custom designs. With a few clicks, you can find an option that fits your business style and workflow.

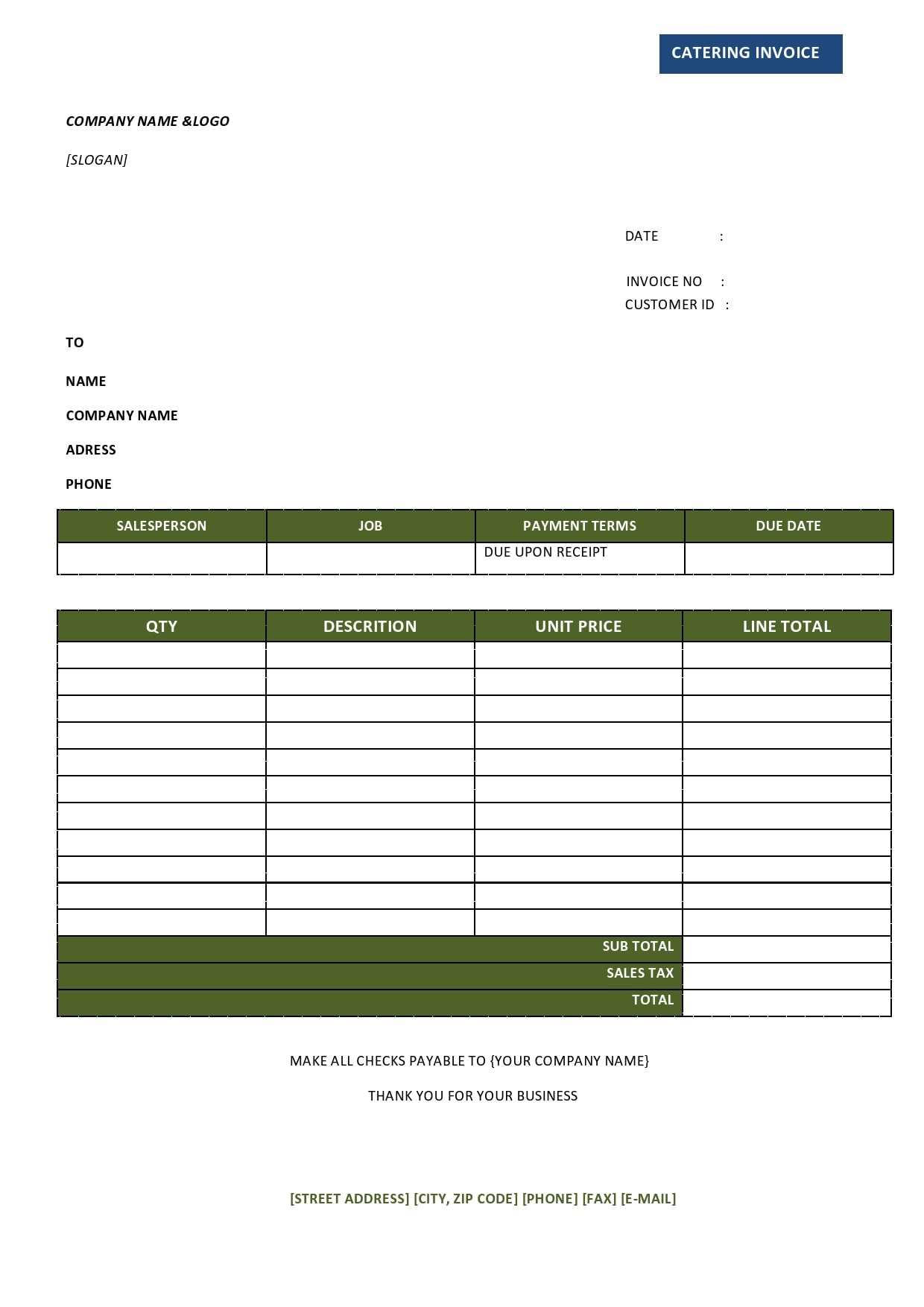

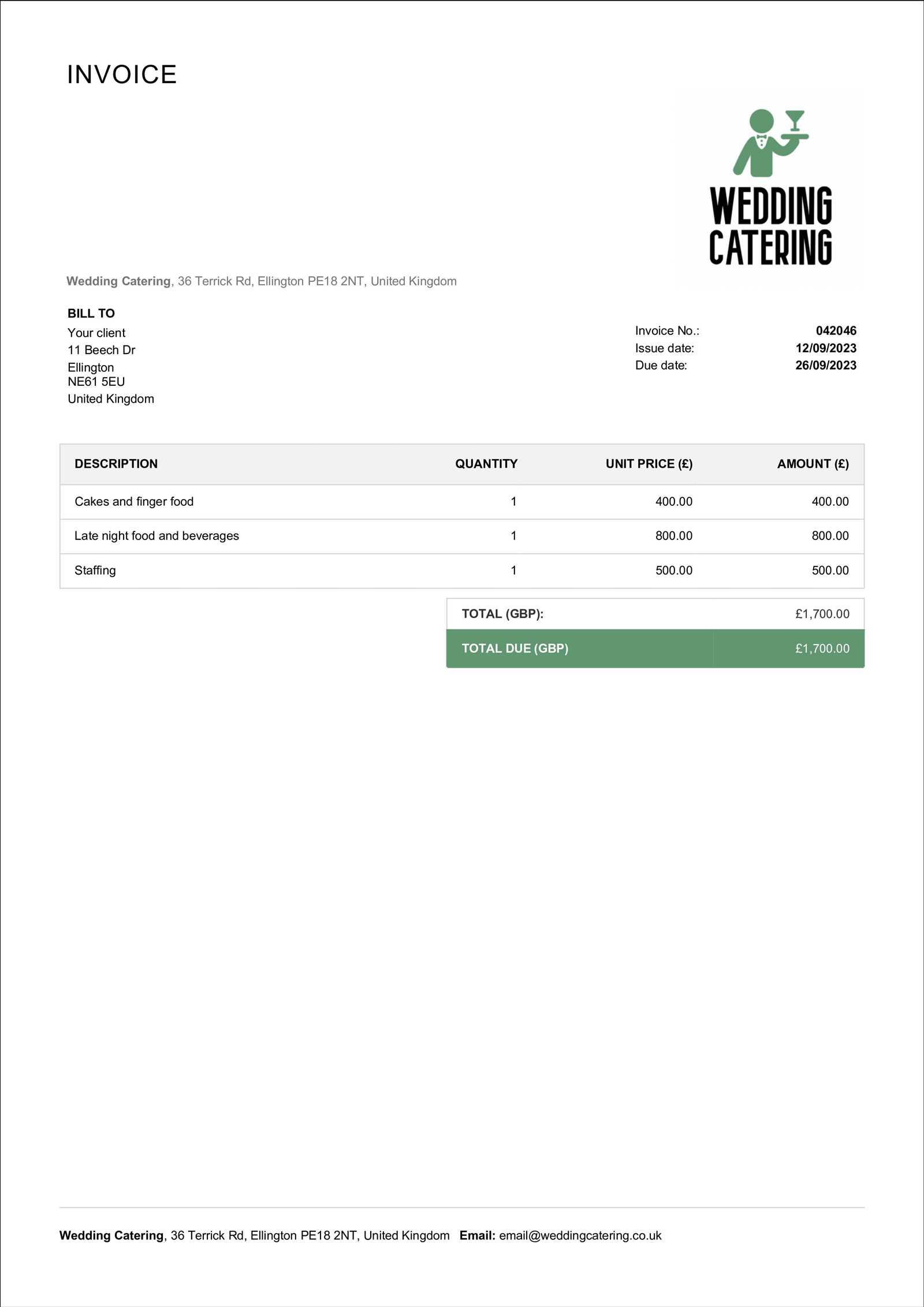

Key Features of a Billing Document

When creating a professional record of transactions, it’s essential to include certain key elements that ensure clarity, accuracy, and transparency. A well-designed document not only makes it easier to track payments but also helps foster trust between you and your clients. These features are fundamental for maintaining consistency and professionalism in your business dealings.

Essential Information

At the core of any billing document is the inclusion of basic but critical details. This includes your business name, address, and contact information, as well as the client’s information. It’s important that both parties can easily identify the document and understand the terms of the transaction. The document should also clearly state the unique reference number and date, which helps with tracking and record-keeping.

Itemized List and Pricing

A clear breakdown of services or products provided is a crucial feature. This section should list each item or service with its corresponding price, quantity, and total amount. This transparency helps avoid misunderstandings and ensures that both parties are on the same page regarding what is being charged. Additional details like taxes, discounts, and shipping fees should also be included when applicable.

Tip: Ensure that your terms of payment, such as due date and accepted payment methods, are prominently displayed to avoid confusion and promote timely settlements.

Efficiency: Including all necessary details in a clear and organized manner saves time and minimizes the risk of errors in future transactions.

Step-by-Step Process for Creating Billing Documents

Creating a detailed and professional document for tracking transactions is straightforward when you follow a structured process. By breaking down the steps, you can ensure accuracy and consistency with every document you produce. Here’s a step-by-step guide to help you create effective records for your business.

Follow these simple steps to create a clear and organized transaction record:

| Step | Description |

|---|---|

| Step 1: Include Business Details | Start by adding your company name, logo, address, and contact information. This makes it clear to your client who is issuing the document and provides necessary contact details. |

| Step 2: Add Client Information | Include the client’s name, address, and any relevant contact information. This ensures that the document is correctly linked to the right party. |

| Step 3: List Products or Services | Provide a detailed list of items or services provided. Include the quantity, unit price, and a brief description of each entry. |

| Step 4: Add Payment Terms | Specify the payment terms, including due dates, accepted payment methods, and any late fees or discounts offered. |

| Step 5: Calculate Total | Sum up the total cost, including taxes and any additional charges, to present a final amount due. |

| Step 6: Final Review | Double-check all the details, ensuring accuracy before sending the document to the client. |

By following these steps, you can create a well-organized and professional record that helps maintain clear communication with your clients while ensuring a smooth transaction process.

Tips for Professional Billing in Word

Creating polished and professional billing documents is crucial for maintaining clear and effective communication with your clients. Whether you’re sending a statement for a service or a product sale, using the right format and paying attention to detail helps build trust and ensures timely payments. Here are some essential tips for enhancing your billing documents using a text editor.

Formatting for Clarity and Consistency

Proper formatting is key to creating a document that’s easy to read and professional-looking. Here are a few tips for achieving a clean and organized appearance:

- Use a clear, legible font: Stick to standard fonts like Arial or Times New Roman, which are easy to read and look professional.

- Keep a consistent layout: Align all elements (text, tables, etc.) neatly to maintain uniformity across your document.

- Include enough white space: Avoid clutter by leaving space between sections and using margins to create a clean structure.

- Highlight important information: Bold or italicize essential elements like totals, payment due dates, and client names.

Customizing Your Document

To make your billing documents stand out, customization is important. Tailor your records to reflect your business identity while ensuring they remain functional:

- Incorporate your branding: Include your company logo and use your brand colors for a personalized touch.

- Add contact details: Make sure to display your phone number, email, and website to make it easy for clients to get in touch with you.

- Include payment terms: Clearly state payment deadlines, accepted methods, and any late fee policies to avoid misunderstandings.

By following these tips, you’ll create billing documents that not only look professional but also help ensure timely and accurate payments from your clients.

Billing Document for Small Businesses

For small businesses, keeping track of financial transactions in an organized and professional manner is essential. Having a customizable billing document allows you to streamline the process, ensure consistency, and maintain a high level of professionalism when communicating with clients. This section will guide you through the advantages of using a structured format designed specifically for smaller enterprises.

Why Small Businesses Need a Structured Billing Document

Small business owners often juggle multiple tasks at once, making it crucial to have an efficient system for handling financial documentation. A well-designed record ensures that you capture all relevant transaction details in one place, reducing errors and confusion. It also helps you track payments, issue receipts, and follow up with clients who may have missed deadlines.

Key Elements for Small Business Records

When creating a billing document for a small business, there are a few essential components to include:

- Business Details: Your company name, contact information, and logo help establish your brand and make the document more professional.

- Client Information: Make sure to list your client’s name, address, and other relevant contact details to avoid mistakes.

- Services or Products Provided: List each service or item with its description, quantity, and price to give the client a clear understanding of the charges.

- Payment Terms: Clearly state due dates, payment methods, and any penalties for late payments.

By using this structured approach, small business owners can manage transactions more effectively, reduce administrative stress, and ensure better cash flow management.

How to Add Logo and Branding

Incorporating your brand’s logo and identity into your billing documents adds a professional touch and strengthens brand recognition. Customizing your records with consistent visual elements helps create a cohesive experience for your clients and reinforces your business’s image. Here’s a step-by-step guide to adding logos and branding to your documents.

Step-by-Step Guide to Adding Branding

Follow these simple steps to include your logo and branding in your documents:

- Choose Your Logo: Select a high-quality image file of your logo. Ideally, it should be in PNG or JPEG format with a transparent background for better integration.

- Position Your Logo: Place your logo in the header section of the document, where it is easily visible. Usually, the top left corner is a common placement, but you can adjust it according to your preference.

- Match Brand Colors: Use your brand’s color scheme for text and background accents. For example, adjust the font color for headings or table borders to align with your brand’s identity.

- Choose a Professional Font: Select a font that complements your branding. Stick to easy-to-read fonts that reflect your business’s style, whether modern, classic, or playful.

Other Branding Elements

- Business Contact Information: Ensure that your phone number, email, and website are clearly visible and match your brand’s visual style.

- Consistent Formatting: Use consistent font sizes, styles, and spacing throughout your document to maintain a uniform look that reflects your business’s professionalism.

By adding your logo and utilizing your branding elements, you create a more personalized and professional document that strengthens your business identity and improves client recognition.

Common Mistakes to Avoid in Billing Documents

When creating financial documents for your business, accuracy is essential. Even small mistakes can lead to confusion, delayed payments, or loss of trust with clients. By being mindful of common errors, you can ensure that your records are clear, professional, and effective. Here are some common mistakes to avoid when creating billing documents.

Common Errors in Billing Documents

- Missing Contact Information: Always ensure your business details, including your name, address, phone number, and email, are included. This makes it easy for clients to reach out if they have questions or concerns.

- Incorrect Client Information: Double-check the accuracy of your client’s details, including their name, address, and contact information. Incorrect information can lead to confusion and delayed payments.

- Unclear Payment Terms: Avoid ambiguity when stating payment due dates, late fees, or accepted payment methods. Make sure your client understands when payment is expected and how to make it.

- Forgetting to Include Taxes or Fees: If your products or services are subject to taxes or additional fees, make sure these are clearly stated. Not including them can result in discrepancies and delayed payments.

Formatting Mistakes to Avoid

- Unorganized Layout: A cluttered or poorly structured document can make it difficult for clients to understand the charges. Use headings, bullet points, and consistent spacing to keep the information clear and easy to follow.

- Inconsistent Currency or Units: Ensure that the currency symbol is used consistently, and quantities and unit prices are clearly listed. Mixing different units or symbols can cause confusion.

- Failure to Include a Unique Reference Number: Each document should have a unique reference number for easy tracking. This helps both you and your clients stay organized and avoid potential confusion.

By avoiding these common mistakes, you can ensure that your financial records are clear, professional, and accurate, leading to smoother transactions and stronger relationships with your clients.

How to Track Payments with Billing Documents

Efficiently tracking payments is crucial for managing cash flow and maintaining healthy client relationships. A well-organized financial document allows you to clearly note which payments have been made, what remains outstanding, and any issues that need to be addressed. Here are some practical methods for tracking payments through your billing documents.

Tracking Payments Step-by-Step

Using a structured format makes it easier to follow up on payments and ensure everything is up to date. Below is a simple process for tracking payment status effectively:

| Step | Description |

|---|---|

| Step 1: Record Payment Due Dates | Clearly state when payments are due. This will help both you and your clients stay on track with deadlines. |

| Step 2: Include a Payment Status Column | In your document, include a column where you can manually update the payment status (e.g., Pending, Paid, Overdue) for each transaction. |

| Step 3: Add Payment Methods | Clearly list the accepted payment methods and note the one used by the client (e.g., credit card, bank transfer, cash). |

| Step 4: Update After Payment | After a payment is made, update the status and include the payment date, amount paid, and any remaining balance. |

Tracking Tools and Tips

In addition to maintaining payment status on each document, here are a few tips for more efficient tracking:

- Use Software Tools: Consider using accounting software that integrates with your billing system. These tools can automatically update payment statuses and provide reports on overdue payments.

- Set Payment Reminders: Set up automated reminders to follow up with clients who haven’t paid by the due date. This ensures that you stay proactive and don’t miss any follow-ups.

- Keep Backup Records: Maintain detailed records of all transactions, including receipts or bank statements, in case of disputes or errors.

By following these steps and tips, you can keep a clear record of payments and ensure that your business’s financial tracking remains efficien

Billing Document Formatting Tips

Proper formatting of your financial documents ensures clarity, professionalism, and ease of understanding. A well-organized layout not only makes it easier for your clients to review the charges but also helps maintain a streamlined and consistent process for your business. Here are some essential formatting tips to help you create clean, professional records every time.

Key Formatting Considerations

To create a document that is both aesthetically pleasing and functional, follow these guidelines:

- Use Clear Headings: Make sure each section of your document is clearly labeled. Headings like “Client Information,” “Items/Services Provided,” and “Payment Terms” help the reader navigate easily.

- Consistent Font Choices: Choose legible fonts such as Arial, Times New Roman, or Calibri. Use a uniform font size for the body text and slightly larger sizes for headings.

- Proper Alignment: Ensure that text and numbers are aligned properly. For example, item descriptions should be aligned to the left, while prices and totals should be aligned to the right for easier reading.

- Use Tables for Clarity: When listing services, items, or quantities, tables help organize the data clearly. Ensure the table is simple, with proper borders and space for each entry.

- Leave Adequate White Space: Don’t overcrowd the document. Leave enough space between sections and use margins to give your document a clean, professional appearance.

Additional Tips for Enhancing Readability

- Bold Important Information: Highlight key details like total amounts due, payment due dates, and client names by making them bold. This ensures the most important data stands out.

- Use Color Sparingly: If you want to add a personal touch, use your brand colors for headings or borders, but avoid overuse. Too much color can make the document appear cluttered and unprofessional.

- Incorporate Your Logo: Including your company logo at the top of the document helps reinforce your brand identity and adds a professional touch.

By following these formatting tips, you’ll be able to create billing documents that not only look professional but also communicate the necessary information effectively to your clients.

Using Table Feature for Billing Documents

Tables are a powerful tool for organizing information in financial records. They allow you to display data in a structured and easy-to-read format, which is essential for clarity and professionalism. By utilizing the table feature, you can create organized sections for listing items, prices, and totals, ensuring all details are clear and accessible to the reader.

Benefits of Using Tables for Billing

Tables provide several advantages when it comes to structuring your financial documents:

- Improved Organization: By breaking down your document into rows and columns, tables help you categorize and organize data systematically. Each item or service is clearly separated with corresponding costs.

- Clear Data Presentation: Tables make it easier for clients to quickly locate specific information, such as quantities, prices, or totals, which helps reduce the likelihood of errors.

- Easy to Update: You can easily modify, add, or remove rows and columns as needed, making the process of creating and maintaining your records more flexible and efficient.

How to Create Tables for Billing

Follow these simple steps to create an effective table for your billing document:

- Insert a Table: In your document editor, select the option to insert a table. Start with the number of rows and columns that fit your needs, and you can always adjust them later.

- Label Each Column: Clearly label each column, such as “Item Description,” “Quantity,” “Unit Price,” and “Total.” This helps break down the components of each charge in an organized way.

- Use Consistent Formatting: Make sure the text within each cell is aligned properly. For example, align numbers to the right, and text (like item descriptions) to the left. This makes the table more readable.

- Highlight Totals: Bold or color the final total to make it stand out, ensuring that clients can easily identify the amount due at a glance.

By utilizing tables, you can turn a complex billing record into a simple, understandable, and professional document that is easy for both you and your clients to follow.

Integrating Taxes into Billing Documents

When creating billing records, it’s essential to account for taxes in a clear and accurate manner. This ensures compliance with local tax regulations and helps avoid misunderstandings with clients. Properly including tax details not only maintains professionalism but also ensures that your financial documents are complete and transparent.

Steps for Including Taxes in Your Billing Record

Here’s how to seamlessly integrate taxes into your financial documents:

- Identify Applicable Tax Rates: Determine the appropriate tax rates based on the services or products provided. These rates may vary by location, industry, or product type, so it’s important to know the specific rules for your area.

- Include a Tax Line: Add a separate line in your document for taxes, clearly indicating the amount being charged. This line should be placed right before the total amount due to ensure transparency.

- Show the Tax Calculation: If applicable, show how the tax was calculated by including the percentage and the corresponding amount for each item or service. This allows clients to verify the charges easily.

- Use the Correct Tax Category: If there are multiple types of taxes (e.g., sales tax, VAT, service tax), break them down into separate categories to avoid confusion.

- Ensure Total Clarity: Clearly state the final amount due, including both the subtotal and the taxes applied. This helps prevent any misunderstandings when clients review their records.

Tax Calculation Example

Here’s an example of how to structure the tax section in your document:

- Item Description: 10 Gourmet Meals

- Subtotal: $100.00

- Tax Rate: 8% Sales Tax

- Tax Amount: $8.00

- Total Due: $108.00

By following these steps and ensuring your tax information is clearly outlined, you provide transparency and professionalism in your billing records, making the process easier for both you and your clients.

Security Tips for Billing Documents

When managing financial records, it’s crucial to safeguard sensitive information from unauthorized access or misuse. Protecting the data in your documents ensures confidentiality and prevents potential fraud or data breaches. By following a few simple security practices, you can ensure that your billing records are kept safe and secure.

Essential Security Practices

- Use Strong Passwords: If you store billing records digitally, always protect them with strong, unique passwords. Avoid using easily guessable passwords like your name or “1234” and opt for a combination of letters, numbers, and symbols.

- Encrypt Sensitive Data: When sharing financial records, ensure they are encrypted to prevent unauthorized access. This is especially important when emailing documents or storing them online.

- Limit Access to Documents: Only allow authorized personnel to access billing records. If you’re working with a team, set permission levels to control who can view or edit documents.

- Store Documents Securely: If you store physical copies of your records, keep them in a locked cabinet or a secure location. For digital copies, use encrypted storage services or secure cloud storage platforms.

- Monitor for Suspicious Activity: Regularly review who has access to your financial data and monitor for any unauthorized changes or attempts to access documents.

Additional Tips for Securing Digital Billing Records

- Backup Your Files: Keep backups of your billing documents to ensure that you can recover your data in case of a system failure or security breach. Regularly back up files to an external drive or secure cloud storage.

- Be Cautious with Email: When sending sensitive billing information via email, always double-check the recipient’s address and consider using secure email services or attachments that require a password to open.

- Regularly Update Your Software: Ensure your operating system, antivirus, and any other software you use to manage your financial records are regularly updated to protect against new security threats.

By implementing these security tips, you can protect your financial documents from unauthorized access, keeping both your business and clients’ information secure.

How to Email Your Billing Document

Emailing financial documents is a quick and efficient way to send important information to clients. However, it’s essential to follow best practices to ensure that your document is received, opened, and handled securely. In this section, we’ll explore the steps involved in emailing your billing document while maintaining professionalism and protecting sensitive information.

Steps to Email Your Billing Record

Follow these steps to ensure that your document reaches your client in a secure and professional manner:

- Choose the Right File Format: When sending a document via email, it’s important to use a widely accepted file format such as PDF or Excel. These formats are easy to open and can help preserve the document’s layout.

- Write a Clear Subject Line: Use a subject line that clearly indicates the purpose of the email. For example, “Billing Document for [Client Name] – [Month/Year]” helps your client immediately recognize the content of the message.

- Compose a Professional Email: In your email body, briefly introduce the document, mention any important details (such as the due date or amount due), and provide a polite call to action (e.g., “Please review and process the payment by [due date].”).

- Attach the Document: Always double-check that the correct file is attached before sending the email. If you’re sending multiple documents, ensure they are clearly labeled to avoid confusion.

- Use Encryption or Password Protection: For sensitive financial documents, consider encrypting the attachment or using a password to protect the file. If you use a password, share it through a different communication channel (e.g., via phone or text message).

Best Practices for Sending Documents Securely

- Double-Check the Recipient’s Email Address: Make sure the email is addressed to the correct person to avoid accidental disclosure of confidential information.

- Request a Read Receipt: If your email client supports it, consider requesting a read receipt to confirm that your client has received and opened the document.

- Follow Up: If you haven’t received a response within a reasonable time frame, follow up with a polite reminder to ensure the document was received and is being processed.

By following these steps and maintaining attention to detail, you can email your billing documents efficiently and securely, ensuring that both you and your clients have a smooth transaction process.

Improving Efficiency with Billing Document Templates

Using predefined structures for creating financial records significantly enhances workflow efficiency. By having a ready-to-use format, you can streamline the creation process, reduce human error, and ensure consistency across all your documents. This approach is especially helpful when managing a high volume of transactions or maintaining professionalism across client communications.

Key Benefits of Predefined Billing Documents

- Time-Saving: With a template, you no longer need to start from scratch every time you create a new record. The core structure is already in place, allowing you to quickly input the necessary details.

- Consistency: Using a consistent format for all records helps maintain a professional appearance, which builds trust with clients. It also ensures that all required information is included in each document.

- Reduced Risk of Errors: By standardizing your records, you reduce the chance of omitting important details such as pricing or payment terms, which can lead to misunderstandings or delays.

- Better Record-Keeping: With an efficient system in place, you can easily track your financial documents over time. Having uniform formats allows for easier sorting and searching for specific transactions.

How Templates Enhance Workflow

- Quick Modifications: Templates are flexible and can be customized to suit the specifics of any transaction. You can easily adjust the quantity, price, and other variables without needing to redesign the entire document.

- Automatic Calculations: Many template tools allow for automatic calculations, reducing the need for manual input. This ensures that the numbers add up correctly and saves time on calculations.

- Professional Formatting: Pre-designed templates ensure that your documents are properly formatted, with appropriate sections for item descriptions, totals, and payment details, making them easy to read and understand.

By leveraging predefined billing formats, businesses can enhance operational efficiency, improve accuracy, and maintain professionalism in their financial record-keeping.