Free Customizable Invoice Template for Easy Use

Creating clear and professional documents for payments is essential for any business. Having the right tool to generate these documents can save time and ensure accuracy. With the right solution, you can quickly generate tailored bills that reflect your services and payment terms. Whether you’re a freelancer or managing a small business, an adaptable document can meet various needs and make your financial interactions smoother.

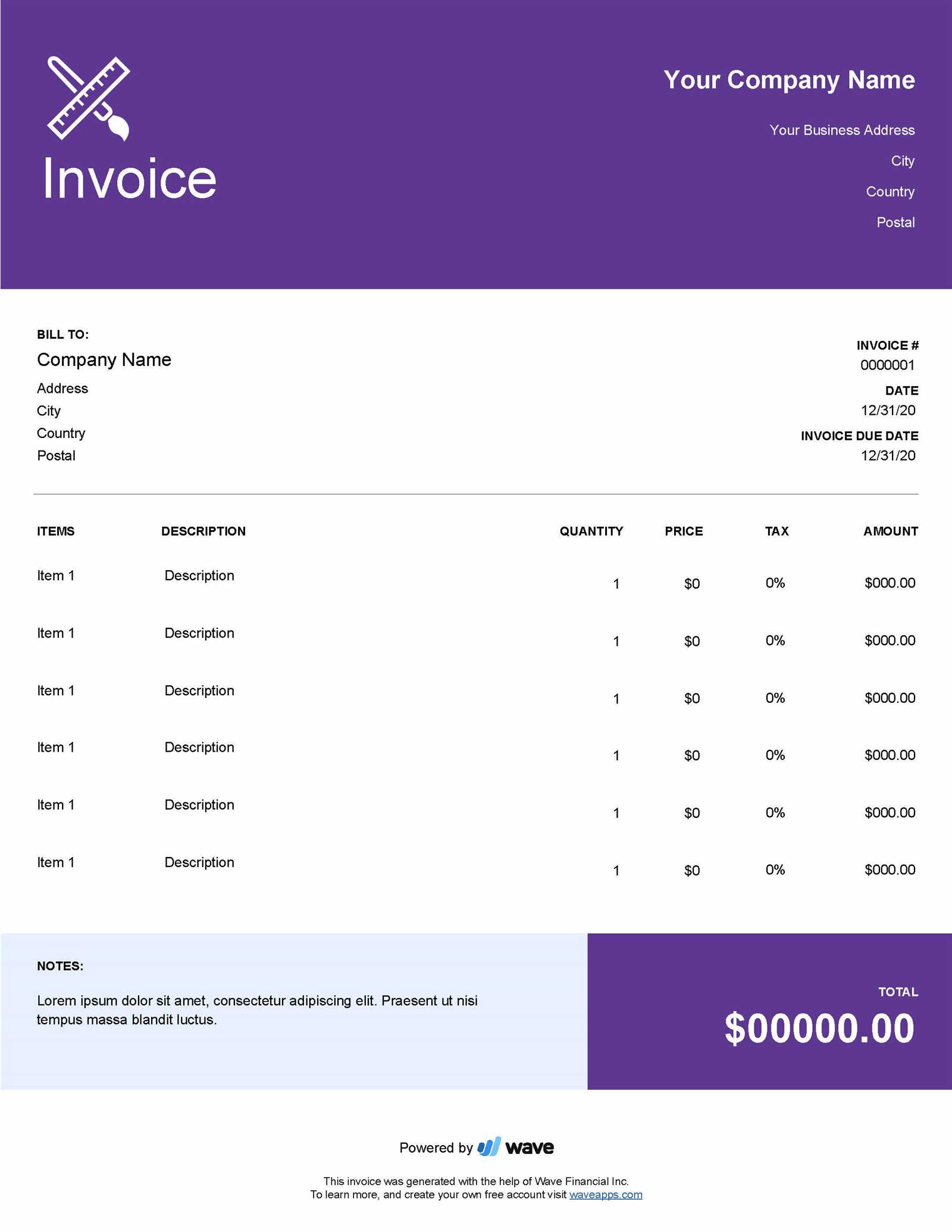

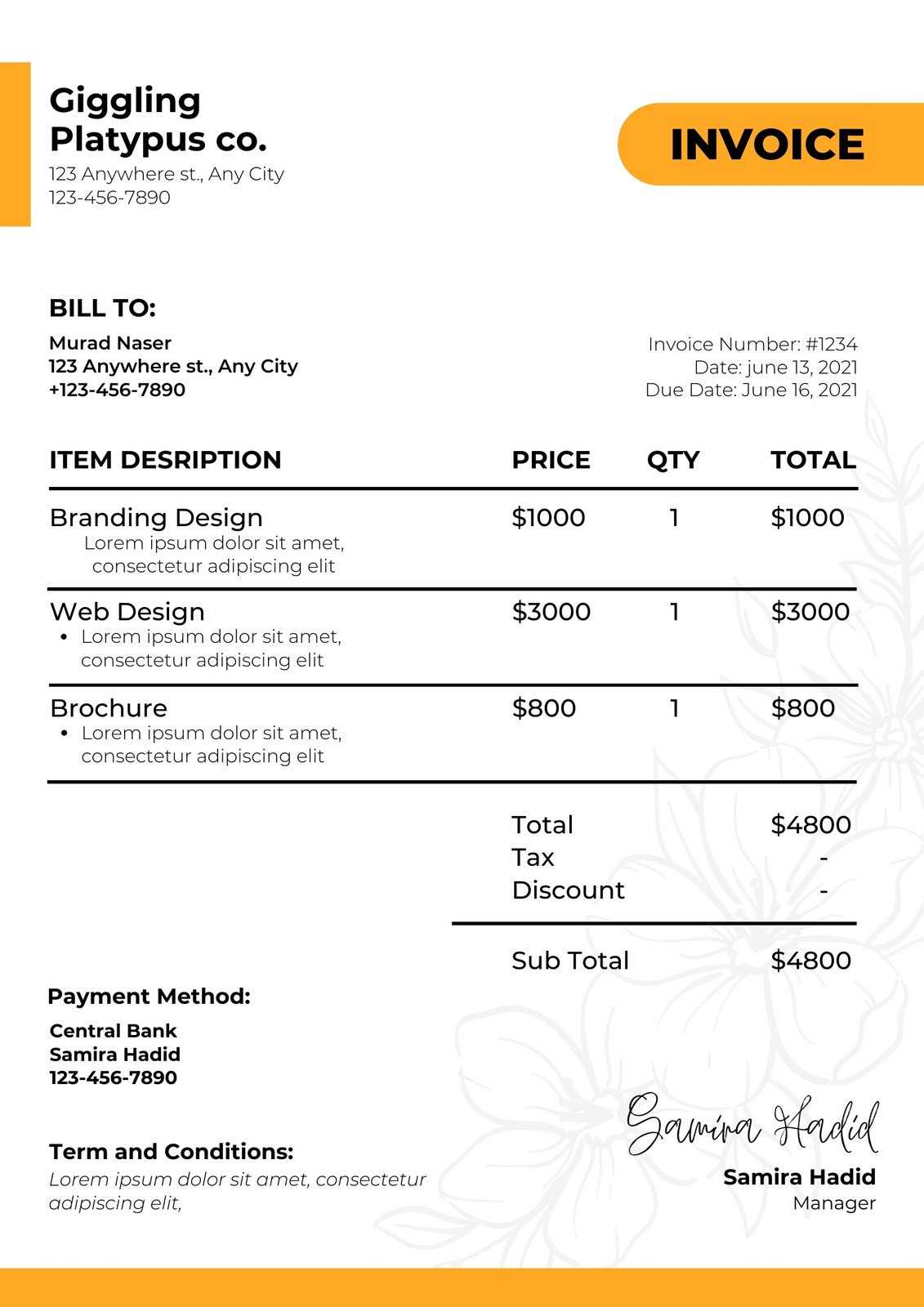

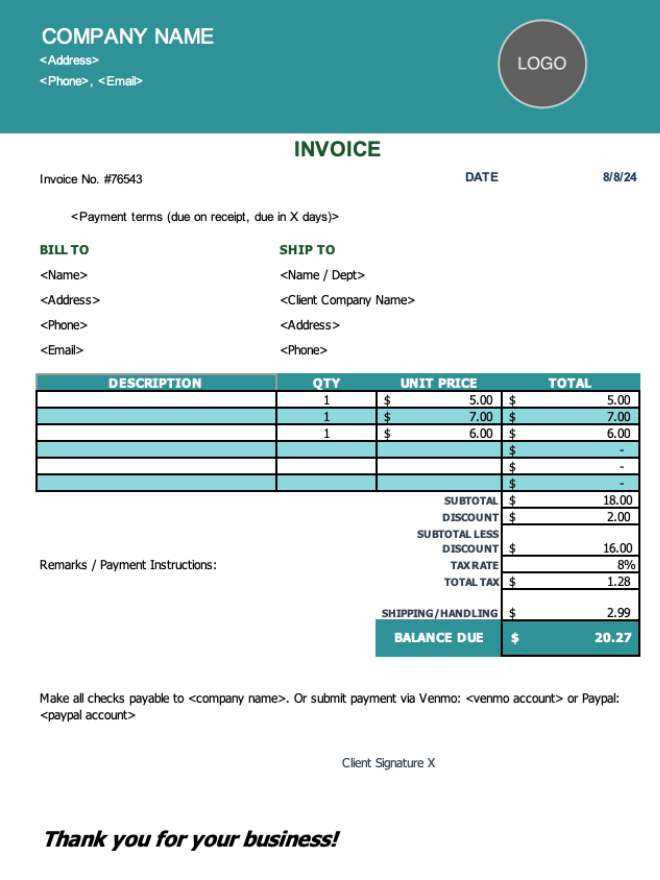

Utilizing ready-made solutions allows you to skip the complexity of starting from scratch. These tools provide structured layouts where you can input specific details, from client information to the total amount owed. By selecting from a variety of formats, you can easily match the look and feel of your business or personal style.

Having access to editable formats means you can quickly adjust the details each time you create a new document. This flexibility reduces errors, speeds up your workflow, and adds a professional touch to every transaction. Whether you need to change the layout, update contact info, or adjust payment instructions, such tools ensure your bills are always up to date and tailored to your needs.

Free Customizable Invoice Template Overview

When managing your finances, having an effective tool to generate payment documents is crucial. Using a flexible structure for billing allows businesses and freelancers to create consistent and professional paperwork that can be tailored for every client. These documents can be easily adjusted to suit different needs, making them an essential tool for managing transactions smoothly.

Key Features of Editable Billing Documents

Editable billing solutions offer a variety of features that can simplify the billing process. These tools allow users to input personalized information quickly, such as business details, payment terms, and client information. By customizing the structure, you ensure that each document reflects your specific requirements without starting from scratch every time.

| Feature | Description |

|---|---|

| Flexibility | Easily modify the content to fit specific needs, such as changing terms or adding discounts. |

| Professional Layouts | Pre-designed formats that ensure a polished and organized appearance for every document. |

| Time-Saving | Reduce the time spent on creating documents from scratch by using ready-to-go structures. |

| Customization | Adjust font styles, colors, and logos to match your business identity. |

Why Choose an Editable Billing Solution?

Opting for an adaptable document generator simplifies the billing process by providing a ready-made framework that can be tailored. This allows businesses to maintain consistency while saving time on repetitive tasks. Additionally, the ability to personalize documents ensures they align with your specific branding and client expectations.

Why Use a Custom Invoice Template

Using a pre-designed solution for creating payment documents helps streamline the billing process and ensures that important details are not overlooked. By adopting a flexible document format, businesses and freelancers can save time, maintain professionalism, and make their financial transactions more efficient. These tools allow for easy modifications, ensuring each document is tailored to the unique needs of the situation.

Efficiency and Time Savings

Creating payment paperwork from scratch can be time-consuming and prone to errors. With a pre-made framework, you eliminate the need to start every document from zero, thus significantly speeding up the process. Simply fill in the relevant details, and the structure will handle the rest. This saves time that can be better spent on other tasks.

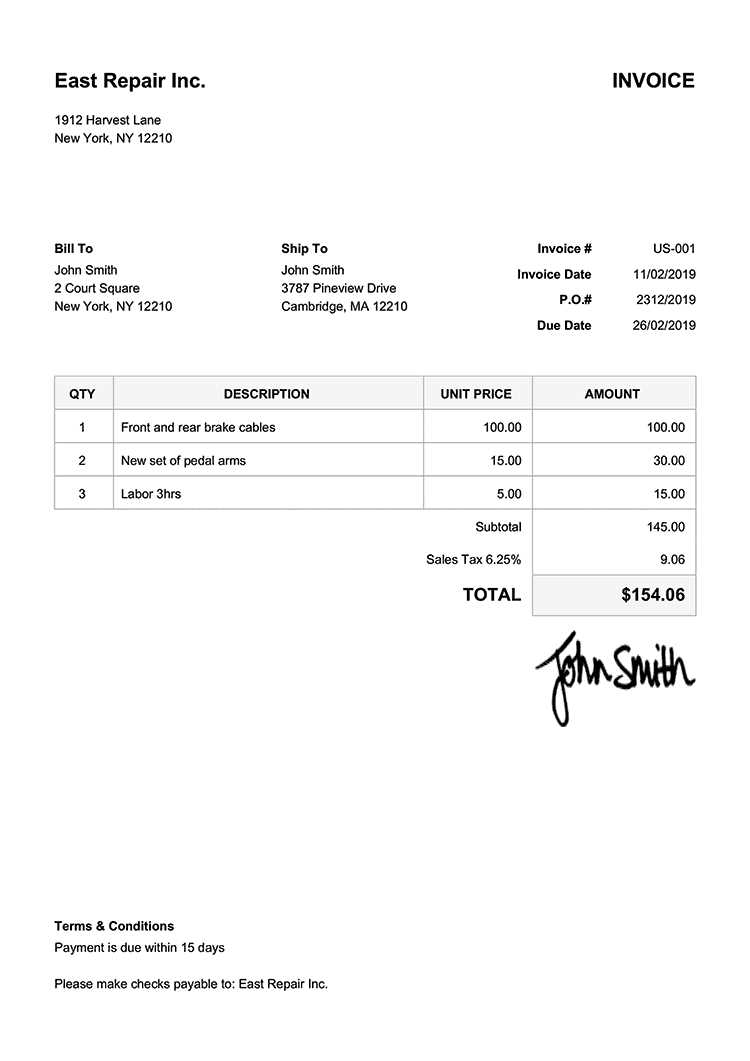

Professional Appearance

Consistency is key to presenting your business in a professional light. A well-organized format creates a polished image, ensuring your paperwork is clear and easy to understand. Whether you’re a small business owner or an independent contractor, using an organized document helps build trust and credibility with clients.

Additionally, these tools often allow you to include your company branding, such as logos and color schemes, which further enhances the professional feel of your documents. Professionalism plays an important role in establishing lasting business relationships.

Benefits of Free Invoice Templates

Utilizing a pre-made solution for creating payment documents offers several advantages, especially when managing expenses or income. These tools help eliminate the complexities of formatting and ensure that you can quickly produce accurate, professional records without any hassle. Whether you’re starting a new business or managing freelance work, having access to these resources can make your financial operations smoother and more organized.

Cost-Effective Solution

One of the primary advantages of using no-cost document generation tools is their affordability. Businesses and freelancers, especially those just starting out, can save money by avoiding the need to invest in expensive software or hire professionals for document creation. Instead, you can rely on simple, accessible tools to create effective paperwork, which helps to reduce overall expenses.

Time-Saving and Efficiency

Time is a valuable resource, and these tools save you a considerable amount by providing ready-to-use formats. Instead of manually creating each document, you can quickly fill in the necessary details and generate a professional-looking record in just a few clicks. This streamlined process allows you to focus on growing your business rather than spending unnecessary time on paperwork.

Additionally, the ease of use and simplicity of these solutions mean you can create multiple documents in a short time, improving your overall efficiency. Whether it’s for a one-off transaction or ongoing billing, using such resources can significantly boost your productivity.

How to Choose the Right Template

Selecting the appropriate structure for creating payment records is crucial for maintaining professionalism and accuracy in your financial documentation. With various options available, it’s important to pick one that aligns with your business needs, industry standards, and personal preferences. Choosing the right framework ensures that you can generate documents efficiently while also meeting your clients’ expectations.

Consider Your Business Needs

The first step in choosing the right solution is understanding the specific requirements of your business. Do you need a simple layout with basic details, or a more detailed document with multiple fields for taxes, discounts, and itemized services? Consider your typical transactions and how complex your records usually are. If your billing is straightforward, a minimalist design might suffice. For businesses with more detailed billing needs, a comprehensive format would be more suitable.

Look for Flexibility and Ease of Use

Usability is another key factor to consider. The ideal solution should be easy to navigate and allow for quick adjustments as needed. Look for a format that offers enough flexibility to make changes, such as adding logos, adjusting text fields, or altering the layout without too much hassle. Time-saving features, like auto-calculation of totals or pre-filled fields, can also enhance your experience and reduce the risk of human error.

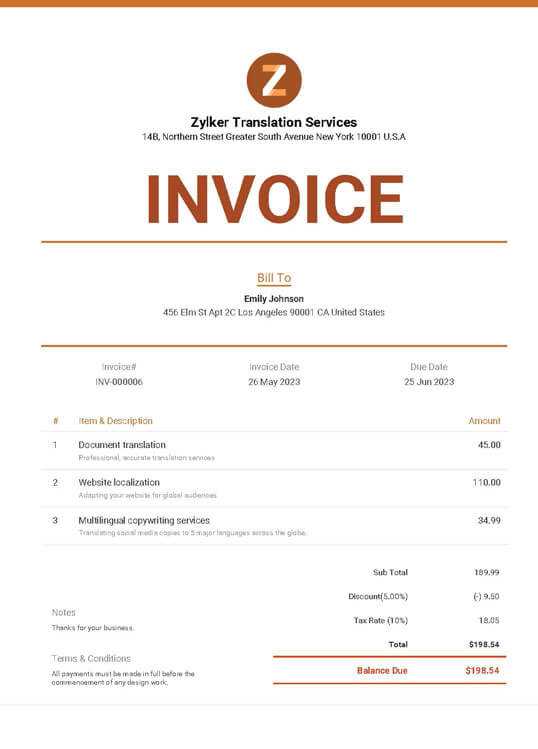

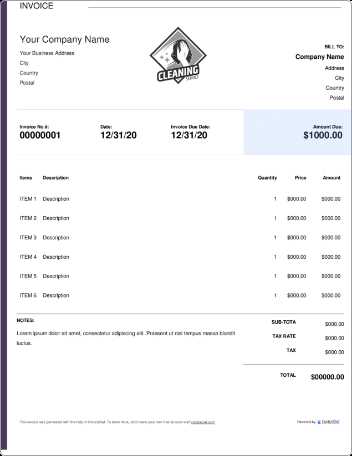

Essential Features in Invoice Templates

When creating billing documents, certain features are necessary to ensure clarity, professionalism, and efficiency. These essential elements help make sure that the document is not only informative but also easy to understand for both you and your client. A well-structured record should include the right balance of detail and simplicity to avoid confusion and provide all the required information in an organized manner.

Key Components to Include

- Business Information: Include your company name, address, contact details, and logo to help establish credibility and make it easier for clients to reach you.

- Client Details: Clearly list the client’s name, address, and contact information to ensure there is no confusion regarding the recipient.

- Transaction Date: Always specify the date when the services were rendered or the product was delivered, along with the due date for payment.

- Itemized List: A detailed breakdown of services or goods provided, including quantities, rates, and totals, helps prevent disputes and ensures transparency.

- Total Amount Due: Make sure the total amount is clearly stated, with taxes and any applicable discounts or additional charges outlined separately.

- Payment Terms: Include the agreed-upon payment terms, such as the method of payment and the due date, to avoid confusion.

Additional Useful Features

- Unique Reference Number: Assign a unique identifier to each document to make it easier to track payments and keep records organized.

- Notes or Special Instructions: Adding space for any additional comments or special instructions can help clarify terms or remind clients of discounts or promotional offers.

- Payment Options: Including multiple methods of payment can help clients pay in the most convenient way for them, speeding up the transaction process.

Top Sources for Free Invoice Templates

When looking for a reliable resource to create billing documents, there are many platforms available that offer ready-made solutions. These sources allow you to access high-quality designs that can be easily adapted to suit your specific needs. Whether you are a small business owner or an independent contractor, using these resources can save you both time and money while ensuring that your records are professional and accurate.

Online Platforms with Ready-Made Designs

There are numerous websites that provide a range of pre-built formats, designed for various industries and purposes. Many of these platforms offer a variety of layouts and styles, so you can easily find one that fits your business requirements. Here are some of the most popular sources:

- Canva: Known for its easy-to-use design tools, Canva offers a wide range of pre-made formats that are fully editable. You can adjust everything from fonts to colors to make the documents match your branding.

- Microsoft Office Templates: Microsoft provides a collection of pre-designed documents for Excel, Word, and other Office applications. These are simple to use and highly functional for basic billing purposes.

- Zoho Invoice: Zoho offers a user-friendly platform where you can generate tailored documents online, and they provide many templates suited for different industries.

- FreshBooks: FreshBooks is an online invoicing solution that also offers free access to several templates. It’s especially popular with freelancers and small businesses.

- Google Docs: Google Docs offers several document formats that can be adapted for billing purposes. These templates are convenient, as they are stored in the cloud and easily shareable with clients.

Benefits of Using Online Resources

These platforms provide significant time savings and convenience, as most of the documents are ready to use with just a few modifications. You don’t need to worry about formatting or layout – everything is designed for you. Additionally, many of these sources are completely accessible without any hidden costs, making them ideal for entrepreneurs or individuals just starting out.

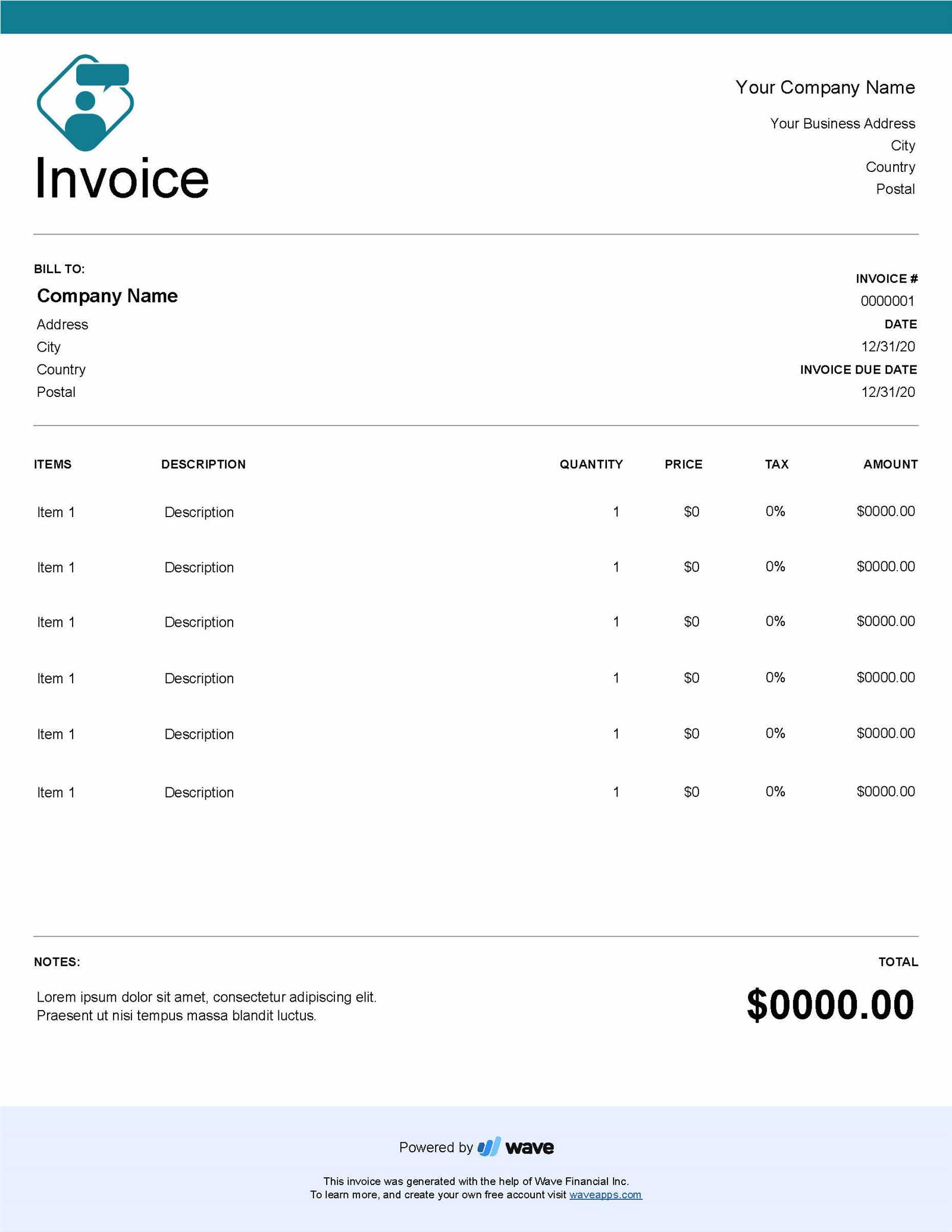

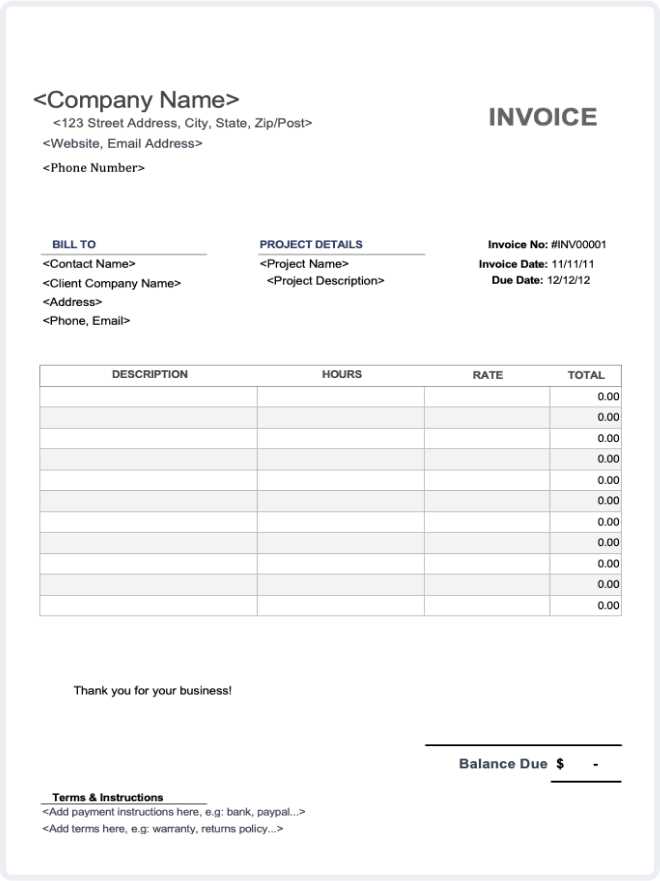

How to Customize Your Invoice Template

Personalizing your payment document is essential for ensuring it accurately reflects your business and brand. Whether you’re adding your logo, adjusting the layout, or modifying payment terms, these small adjustments can make your documents look professional and tailored to each client. Customization also allows you to match your company’s specific needs and the way you do business.

Key Areas to Customize

When modifying a pre-made document, there are several sections you should focus on to ensure that your billing records are clear and professional:

| Section | Customization Tips |

|---|---|

| Header | Include your company logo, name, address, and contact information. This makes the document look official and allows clients to easily contact you. |

| Client Details | Ensure the client’s name, address, and contact info are correctly filled in. This ensures accurate communication and record-keeping. |

| Service or Product List | Detail each product or service provided, including quantities, unit prices, and a brief description. This adds clarity to your billing and prevents confusion. |

| Payment Terms | Modify the terms based on the agreement, including the payment due date, method of payment, and any late fees if applicable. |

| Design | Adjust fonts, colors, and layouts to match your brand identity. Customizing the appearance makes your documents more cohesive with your overall marketing materials. |

Tools for Customization

There are several tools available that make it easy to adjust these documents according to your needs. Online platforms like Canva or Google Docs allow you to drag and drop elements, while software like Microsoft Word and Excel offer built-in customization features. These tools provide flexibility, making it simple to tweak documents without advanced design skills.

How to Add Your Business Logo

Incorporating your company logo into financial documents not only enhances brand visibility but also gives your paperwork a professional and cohesive look. Whether you’re using a simple structure or a more detailed layout, placing your logo prominently can help reinforce your business identity and build trust with clients. The process of adding a logo is simple and can be done in just a few steps using a variety of tools.

Step-by-Step Guide

Follow these basic steps to insert your logo into any document:

- Prepare Your Logo File: Ensure that your logo is saved in a suitable format, such as PNG, JPEG, or SVG. Choose a high-resolution version to ensure it appears clear and sharp on the document.

- Choose the Right Placement: The logo is typically placed at the top of the page, either centered or aligned to the left. Consider where it will be most visible without overwhelming the rest of the content.

- Adjust the Size: Ensure your logo is sized appropriately. It should be large enough to be recognizable but not so large that it distracts from the important details of the document. Most tools allow you to resize the image by dragging its corners.

- Upload or Insert the Logo: Use the document editor’s “Insert Image” or “Upload” option to add the logo file to the document. This can be done in programs like Microsoft Word, Google Docs, or design tools like Canva.

Choosing the Right Tools for the Job

Many online platforms and software programs offer simple ways to add logos. Popular tools such as Canva or Microsoft Word allow you to drag and drop your logo into place, while Google Docs and Excel offer straightforward insertion options through the “Insert” menu. The key is to choose a tool that allows for flexibility and easy adjustments.

Tip: Always preview your document before sending it out to ensure that your logo is correctly placed and that the overall layout looks balanced.

Creating a Professional Look with Templates

Designing polished and effective payment documents is crucial for making a strong impression with clients and business partners. A well-designed document not only communicates important financial details but also reinforces your brand identity and professionalism. By utilizing structured layouts, you can ensure that your records are both visually appealing and easy to understand, which can help build trust with clients and improve the overall experience.

Key Design Elements to Focus On

When working with pre-designed formats, it’s important to focus on several key design elements that contribute to a clean, professional appearance:

- Layout: Keep the structure simple and organized. A clean layout with clear sections and logical flow helps readers easily navigate through the document.

- Typography: Use professional fonts that are easy to read. Avoid using too many font styles–stick to one or two at most to maintain consistency.

- Branding: Incorporate your company’s colors, logo, and fonts to ensure that the document aligns with your overall brand identity. This adds a personal touch and reinforces recognition.

- Spacing: Proper use of white space can make the document feel less cluttered and more approachable, improving readability and user experience.

How to Ensure Consistency Across Documents

For businesses that create multiple documents regularly, maintaining consistency in design is key. Ensure that the same structure, fonts, and branding elements are used across all your records. This creates a cohesive experience for your clients and reinforces a professional image every time you communicate with them.

Tip: If you’re using a digital platform like Google Docs or Canva, save your customized layout as a reusable file to maintain consistency without having to recreate the design each time.

Invoice Template for Small Businesses

For small businesses, having a streamlined and professional method for creating billing records is crucial for maintaining cash flow and building trust with clients. Using a well-structured document not only ensures that payments are tracked accurately but also helps maintain consistency in your financial operations. With the right format, you can quickly create clear and professional documents that are tailored to your business needs, saving time and reducing errors.

Essential Features for Small Business Billing Documents

When choosing or creating a billing record for a small business, it’s important to include several key elements to ensure that your documents are both effective and professional:

- Company Information: Include your business name, logo, contact details, and tax identification number. This adds professionalism and makes it easy for clients to reach you.

- Client Information: Clearly list the name, address, and contact details of your clients, so there is no confusion when processing payments.

- Itemized List: Break down the products or services provided, including quantities, individual prices, and a brief description. This helps avoid disputes and makes the charges easy to understand.

- Total Amount Due: Clearly highlight the total amount to be paid, ensuring that all taxes, discounts, and fees are included in the final amount.

- Payment Terms: Specify the due date, acceptable payment methods, and any late fees to ensure clarity and avoid misunderstandings.

Why Small Businesses Should Use Pre-Built Solutions

For small businesses with limited time and resources, using a pre-designed solution offers several advantages. These solutions save time by eliminating the need to design billing records from scratch, enabling business owners to focus on other important tasks. Additionally, pre-built formats often come with built-in calculations, making the process of adding totals, taxes, and discounts much easier. Many platforms also allow for easy edits, so you can adjust the design to better reflect your branding or specific billing needs.

Tip: Always ensure that your documents align with your business branding to create a cohesive and professional experience for your clients.

Customizing Payment Terms on Invoices

Adjusting the payment terms on your financial documents is crucial for setting clear expectations with clients and ensuring timely payments. These terms outline when payment is due, how it should be made, and any penalties for late payments. By customizing these details, you can accommodate different client needs and protect your business interests while maintaining positive relationships with your customers.

Important Elements to Consider

When customizing the payment conditions, several key elements should be clearly defined to avoid confusion and ensure smooth transactions:

- Due Date: Specify the exact date by which payment is expected. This is one of the most important components for timely payments. Common terms include “Net 30” (payment due within 30 days) or “Due on Receipt” (payment is due immediately upon receiving the document).

- Accepted Payment Methods: Clearly list the payment options available, such as bank transfers, credit cards, PayPal, or checks. Offering multiple payment methods can encourage faster payments.

- Late Fees: Include any applicable late fees or interest charges for overdue payments. This helps incentivize clients to pay on time and protects your business from cash flow disruptions.

- Discounts for Early Payment: Some businesses offer a discount (e.g., 2% off for payment within 10 days) to encourage prompt payments. If you offer such a discount, be sure to specify the percentage and the timeframe for the discount to apply.

- Installment Payments: If your services or products are more expensive, you might offer payment installments. Clearly outline the payment schedule and amounts due for each installment to avoid misunderstandings.

Tips for Effective Payment Terms

- Be Clear and Specific: Vague payment terms can lead to delays and confusion. Use clear, concise language to specify exactly when and how payments should be made.

- Consider Client Needs: Offering flexible terms can help build stronger relationships with clients. For example, some clients may need longer payment windows or installment plans, especially for large projects.

- Review Regularly: Payment terms may need to be adjusted based on your business needs, market conditions, or client preferences. Regularly reviewing and updating your terms can help maintain financial stability and reduce payment issues.

How to Include Taxes and Discounts

Including taxes and discounts in your billing records is essential for ensuring accuracy and transparency in financial transactions. Both taxes and discounts can significantly affect the final amount due, so it is important to outline them clearly to avoid confusion and potential disputes. Properly adding these elements not only ensures compliance with tax regulations but also demonstrates professionalism and attention to detail.

Steps for Including Taxes

When adding taxes, it’s important to follow the appropriate tax rate for your location or industry. Here’s how to properly include taxes in your billing records:

- Identify Applicable Taxes: Determine the taxes that apply to your goods or services, such as sales tax, VAT (Value Added Tax), or service tax, based on your location and business type.

- Specify Tax Rates: Clearly state the tax rate that is being applied to the subtotal. For example, you can write “Sales Tax (10%)” or “VAT (15%)” depending on your region’s tax laws.

- Calculate Tax Amount: Multiply the subtotal by the tax rate to calculate the amount due in taxes. For example, if your subtotal is $100 and the tax rate is 10%, the tax amount would be $10.

- Show Tax Separately: To maintain clarity, list the tax amount as a separate line item under the subtotal. This makes it easy for the client to see how much tax they are being charged.

Steps for Including Discounts

Discounts are a great way to incentivize prompt payments or reward loyal clients. Here’s how to effectively incorporate discounts into your billing:

- Define the Discount Type: Specify whether the discount is a percentage (e.g., 10% off) or a fixed amount (e.g., $20 off). Be sure to mention any terms, such as “Discount for Early Payment” or “Volume Discount.”

- Apply the Discount: Calculate the discount based on the agreed terms. For a percentage discount, multiply the subtotal by the discount rate. For a fixed amount discount, simply subtract the discount from the subtotal.

- Show Discount Clearly: List the discount as a separate line item, indicating the discount amount and the reason it is being applied (e.g., “Early Payment Discount” or “Seasonal Offer”).

- Update the Total: Once the discount is applied, update the final amount due. Ensure that the subtotal, taxes, discount, and total are clearly marked for easy understanding.

Tip: Always double-check your calculations for taxes and discounts to ensure they are accurate, and make sure that both the client and your business are in agreement on the terms before finalizing the document.

Using Templates for Freelance Work

For freelancers, maintaining a professional image and staying organized is essential to building lasting client relationships. One of the most effective ways to ensure consistency and efficiency in your billing process is by using pre-designed documents. These ready-to-use structures allow freelancers to quickly generate accurate, well-organized records that highlight services rendered, payments due, and any agreed-upon terms–all while reducing administrative overhead.

Benefits of Using Ready-Made Documents

Freelancers often juggle multiple projects and clients at once, which makes having a streamlined way to manage finances even more important. Pre-built structures for billing can save you time and help avoid errors. Some key advantages include:

- Time-Saving: Pre-made formats allow you to quickly input necessary details such as work performed, client information, and payment amounts without starting from scratch each time.

- Professional Appearance: These ready-to-use structures are designed to look clean and polished, providing a consistent, professional appearance that helps to build trust with clients.

- Clear Breakdown: A well-organized document clearly outlines services, payment terms, and due dates, which reduces the risk of misunderstandings and ensures that both you and your clients are on the same page.

- Customization Options: Many pre-designed formats are flexible enough to be modified to suit your specific needs, allowing you to adjust fields, colors, and even the overall layout while still maintaining the integrity of the structure.

How Templates Benefit Freelance Projects

When handling freelance work, the process of tracking time, rates, and due amounts can become cumbersome without a proper system in place. Using pre-designed documents simplifies this by offering several key features that cater to the needs of freelancers:

- Flexible Billing: Freelancers often work on a variety of contracts, from hourly rates to fixed-price projects. Ready-made formats allow you to easily adjust the layout to match any billing structure.

- Trackable Records: Pre-built solutions help you track previous work and payments with ease, creating a clear history of your transactions with each client.

- Legal Protection: Including terms such as payment deadlines, late fees, and dispute resolution clauses helps protect both you and your client in case of disagreements or delays.

Tip: Keep a consistent format for all your documents to make it easier for clients to recognize and process your billing information quickly. This consistency also contributes to your professional reputation.

Common Mistakes in Invoice Creation

Creating billing documents is a straightforward process, but even small errors can lead to confusion, delays in payments, and potential disputes with clients. Many businesses, especially small ones or freelancers, often overlook certain details when preparing these essential records. Understanding and avoiding common mistakes can help ensure that your documents are clear, accurate, and professionally presented, which ultimately improves your chances of getting paid on time.

Some of the most frequent errors in document creation include miscalculating totals, failing to include necessary payment details, or neglecting to communicate terms clearly. Below are a few common mistakes to watch out for:

- Missing Contact Information: Failing to include your business name, address, or contact details can create confusion for clients and delay payments. Always ensure that both your and your client’s contact information are clearly visible.

- Inaccurate or Missing Dates: Omitting the date of the document or the payment due date can cause unnecessary misunderstandings. It’s important to clearly specify when payment is due and the date the document was issued.

- Not Including a Clear Breakdown of Services: A vague description of the products or services provided can lead to questions or disputes. Always include a detailed list, specifying quantities, unit prices, and total amounts for each service or product rendered.

- Incorrect Calculations: Miscalculating the subtotal, taxes, or discounts is one of the most common errors. Double-check all figures to ensure accuracy, and make sure that taxes and discounts are correctly applied.

- Unclear Payment Terms: Failing to specify when payment is due or what payment methods are acceptable can lead to confusion. Always clearly state your payment terms, including due dates, acceptable methods, and any penalties for late payments.

- Not Using a Professional Format: An unorganized or cluttered document can make it difficult for clients to understand the details. Using a clear, structured layout helps ensure that the document is easy to read and that all necessary information is included.

Tip: Always review your documents before sending them to ensure that all details are correct. This will help build trust with clients and reduce the chances of disputes or delays in payment.

How to Save Time with Invoice Templates

Managing finances efficiently is essential for any business. One of the most effective ways to save time on administrative tasks, especially when dealing with payments and client records, is by using pre-designed billing documents. These documents help streamline the entire process of creating, issuing, and tracking payments, allowing you to focus on more important tasks such as growing your business or serving clients. By having a consistent structure in place, you eliminate the need to start from scratch with each new transaction, speeding up the overall workflow.

Benefits of Using Pre-Made Structures

There are several advantages to using ready-made formats for your financial documents, including:

- Speed and Efficiency: With a pre-structured layout, you only need to fill in the necessary details such as the service description, amount due, and client information. This cuts down the time spent creating each document from scratch.

- Consistency: A consistent format ensures that all of your documents look professional and follow the same structure, which is important for both your branding and clarity.

- Pre-Calculated Fields: Many ready-made structures come with built-in fields for totals, taxes, and discounts, which helps to minimize the chance of errors and speeds up the calculation process.

- Easy Editing: If needed, you can quickly edit or update the document to fit specific project needs without having to design a new format each time.

How Pre-Made Documents Speed Up the Billing Process

By using an efficient layout, businesses can greatly reduce the time spent on invoicing. Here’s how pre-built structures save time in practical ways:

| Process | Time Without a Pre-Made Layout | Time With a Pre-Made Layout |

|---|---|---|

| Creating Document | Start from scratch, including layout, calculations, and formatting | Fill in the blanks with pre-arranged fields and formatting |

| Calculating Totals | Manually add up totals, taxes, and discounts | Auto-calculate with built-in fields for taxes and totals |

| Sending to Client | Write an email and attach a custom document | Save and send via email in just a few clicks |

Tip: Utilize software or online tools that offer ready-made options, as these often include additional time-saving features, such as recurring billing, automatic reminders, and payment tracking.

Best Practices for Sending Invoices

Sending clear and accurate billing documents is crucial for ensuring timely payments and maintaining good client relationships. The way you send these records can influence how quickly clients process payments and whether they fully understand the details of the charges. Adopting best practices for sending these documents can help streamline your workflow, reduce errors, and improve your chances of getting paid promptly.

Here are some key practices to follow when sending billing documents to clients:

1. Send Promptly After Service Completion

As soon as the work is completed or a product is delivered, send the billing record without unnecessary delays. Timely billing helps ensure that the payment process begins quickly and reinforces your professionalism. Delaying the process could result in clients forgetting details or becoming confused about the agreed terms.

2. Double-Check for Accuracy

Before sending any billing document, carefully review it for accuracy. Verify that the amounts, services, and payment terms are correct. A small mistake can lead to confusion or even payment disputes, so it’s essential to double-check all the details, including:

- Client Information: Ensure that the client’s name, address, and contact details are correct.

- Service Descriptions: Check that each service or product is described clearly and accurately, with the correct pricing.

- Total Amount: Verify that the final amount is calculated correctly, including taxes and discounts.

3. Use Professional Communication

When sending a billing document, accompany it with a professional email or message. Keep your tone polite and professional, and include a brief explanation of the document, such as the services provided and the payment terms. A courteous message can go a long way in maintaining a good working relationship with your clients. Be sure to:

- Include Clear Payment Instructions: Clearly state how the client can make payment (e.g., bank transfer, online payment platform, etc.).

- Set a Payment Deadline: Remind the client of the due date to avoid delays.

- Attach the Billing Document: Ensure that the document is attached in an easy-to-read format (such as PDF).

4. Use Secure Delivery Methods

When sending billing documents, choose a secure delivery method to protect sensitive financial information. For example, email attachments should be sent with encryption if possible, and cloud-based invoicing software often offers secure methods for sending

How to Organize Your Invoices Efficiently

Proper organization of financial records is essential for any business, ensuring that you can quickly locate documents when needed, avoid errors, and maintain smooth operations. A well-organized system helps you keep track of payments, outstanding balances, and deadlines, while also making it easier to generate reports for tax or accounting purposes. Efficient organization reduces time spent searching for records and minimizes the risk of missing payments or confusing details.

Steps to Organize Your Billing Records

Creating a solid filing system for your financial documents is the first step toward efficient management. Here are some strategies to help you stay organized:

- Create a Folder System: Sort your records by client, project, or due date. For instance, you can create separate folders for each client or group them based on when payment is due. This makes it easier to find specific records quickly.

- Use Descriptive File Names: Give each document a clear and consistent name, such as “ClientName_ServiceDate_AmountDue.” This way, you can identify the document without having to open it.

- Maintain Separate Categories: Separate paid from unpaid records, or use color-coding to quickly identify which documents require action. This helps you stay on top of overdue payments and prevents confusion.

- Set a Routine for Updating: Make it a habit to update your system as soon as a new document is generated. Regularly checking and organizing your records can prevent backlog and ensure timely follow-ups on outstanding payments.

Utilizing Software for Better Organization

In addition to manual organization, using software tools can significantly improve your efficiency. Many invoicing platforms offer advanced features that make the organization process much simpler. These platforms allow you to store records securely, automate reminders, and generate reports with just a few clicks. Here are some key benefits:

- Centralized Storage: Cloud-based systems allow you to store all records in one place, accessible from anywhere, reducing the risk of losing physical documents or disorganized files.

- Search and Filter Options: Software enables you to search by client name, amount, or due date, making it easier to find specific records.

- Automated Reminders: Man

How to Organize Your Invoices Efficiently

Proper organization of financial records is essential for any business, ensuring that you can quickly locate documents when needed, avoid errors, and maintain smooth operations. A well-organized system helps you keep track of payments, outstanding balances, and deadlines, while also making it easier to generate reports for tax or accounting purposes. Efficient organization reduces time spent searching for records and minimizes the risk of missing payments or confusing details.

Steps to Organize Your Billing Records

Creating a solid filing system for your financial documents is the first step toward efficient management. Here are some strategies to help you stay organized:

- Create a Folder System: Sort your records by client, project, or due date. For instance, you can create separate folders for each client or group them based on when payment is due. This makes it easier to find specific records quickly.

- Use Descriptive File Names: Give each document a clear and consistent name, such as “ClientName_ServiceDate_AmountDue.” This way, you can identify the document without having to open it.

- Maintain Separate Categories: Separate paid from unpaid records, or use color-coding to quickly identify which documents require action. This helps you stay on top of overdue payments and prevents confusion.

- Set a Routine for Updating: Make it a habit to update your system as soon as a new document is generated. Regularly checking and organizing your records can prevent backlog and ensure timely follow-ups on outstanding payments.

Utilizing Software for Better Organization

In addition to manual organization, using software tools can significantly improve your efficiency. Many invoicing platforms offer advanced features that make the organization process much simpler. These platforms allow you to store records securely, automate reminders, and generate reports with just a few clicks. Here are some key benefits:

- Centralized Storage: Cloud-based systems allow you to store all records in one place, accessible from anywhere, reducing the risk of losing physical documents or disorganized files.

- Search and Filter Options: Software enables you to search by client name, amount, or due date, making it easier to find specific records.

- Automated Reminders: Many platforms allow you to set up automatic payment reminders, helping you avoid missing payment deadlines.

Tracking Payments and Outstanding Balances

To stay on top of your finances, you need to track which payments have been received and which are still due. Creating a simple tracking system can help. Here’s an example:

Client Name Service Date Amount Due Status Client A 2024-08-15 $500 Paid Client B 2024-08-18 $750 Unpaid Client C 2024-08-20 $320 Paid Tip: Consider using an accounting tool that automatically tracks payments and provides reminders for overdue amounts. This can save time and improve cash flow management.