Printable Commercial Invoice Template for Quick and Easy Billing

When running a business, having a reliable system to manage transactions and payments is essential. One of the most important tools for ensuring smooth operations is creating professional documents that detail the services or goods provided, along with the agreed-upon pricing. These documents help maintain clarity between businesses and their clients, and they are vital for record-keeping and tax purposes.

Creating a well-structured payment document can save time, reduce errors, and increase overall professionalism. Many businesses opt for customizable formats that can be easily adjusted to suit specific needs. These formats offer flexibility in terms of design, ensuring they meet the branding requirements and include all necessary information for seamless transactions.

Using the right structure ensures that all crucial details are captured, from the buyer and seller’s information to payment terms and itemized lists. Whether you’re just starting a small business or managing a larger company, understanding how to design and implement these records effectively can enhance your workflow and communication with clients.

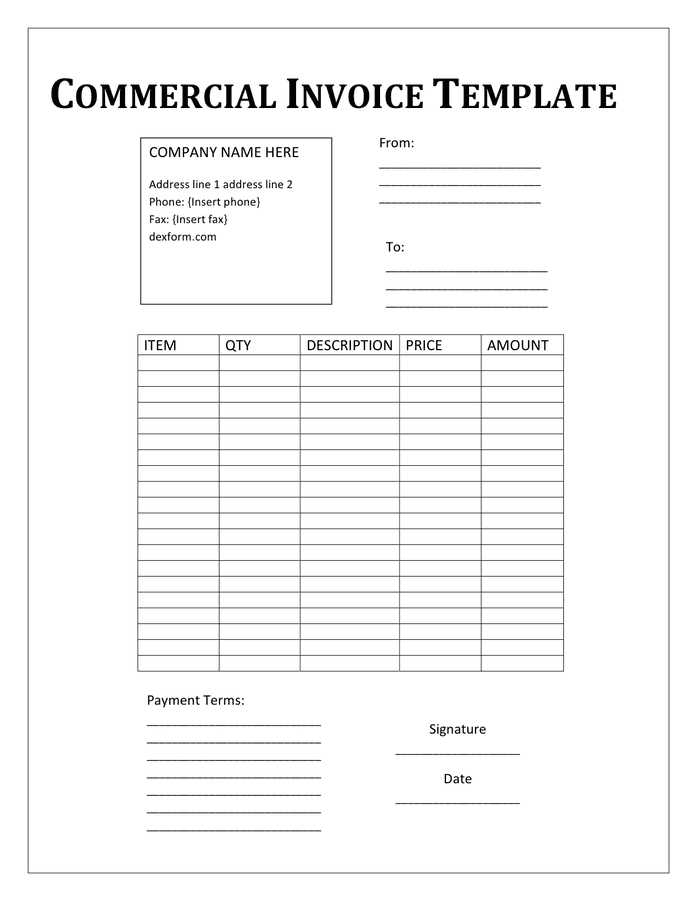

Printable Commercial Invoice Template

Having a clear and structured document for recording transactions is crucial for any business. These documents ensure that both parties, the seller and the buyer, have a mutual understanding of the goods or services provided and the agreed-upon payment terms. A well-organized record helps to keep track of all financial exchanges and provides an essential reference for both parties in case of disputes or audits.

For small businesses or independent professionals, having a pre-designed document that can be quickly customized for each transaction is a time-saver. By using a standardized structure, it becomes easier to manage multiple transactions while maintaining a high level of professionalism.

Key Features of a Well-Designed Document

- Header with Business Information: Include the name, address, and contact details of the business issuing the document.

- Client Information: Ensure the buyer’s name, address, and contact details are clearly stated.

- Itemized List: Provide a detailed breakdown of goods or services provided, including quantities and prices.

- Payment Terms: Clearly state the payment due date, accepted methods of payment, and any additional charges.

- Unique Identifier: Assign a unique reference number to each document for easy tracking.

How to Create a Professional Document

Creating an effective billing document doesn’t require advanced software or design skills. Simple tools, such as word processors or spreadsheet applications, can help create a layout that includes all the necessary sections. Here’s a basic guide for creating an effective record:

- Choose a clean, simple layout to ensure all information is easily readable.

- Use consistent fonts and alignments to create a professional appearance.

- Ensure all required fields are included and leave space for customizations based on each transaction.

- Save your layout for future use, reducing the time spent creating new records.

Benefits of Using a Printable Invoice

Utilizing a structured and customizable payment document provides several advantages for businesses of all sizes. These documents help ensure accurate record-keeping, minimize errors, and create a professional impression with clients. Whether it’s for a one-time transaction or an ongoing business relationship, having a reliable format allows for efficiency and consistency in your financial dealings.

Advantages of Using a Structured Payment Record

- Time-saving: Pre-designed formats allow for quick customizations, saving time for each transaction.

- Accuracy: A consistent layout helps reduce the chances of missing key information or making mistakes in calculations.

- Professionalism: A well-organized document enhances the credibility of your business, showing clients you are detail-oriented and serious.

- Legal Compliance: Properly structured documents ensure that all necessary information is captured, which is essential for taxes and audits.

- Tracking and Reference: The ability to assign unique reference numbers or identifiers allows you to track payments easily and keep accurate records for future reference.

How These Documents Improve Business Operations

By using a standardized document, businesses can streamline their payment processes. These documents not only improve communication between the business and clients but also provide clarity on payment expectations. With a clear and uniform structure, the business can maintain organized financial records, making it easier to handle disputes or inquiries.

- Reduces confusion and miscommunication between buyer and seller.

- Improves cash flow management with clear payment terms.

- Facilitates easier bookkeeping and accounting processes.

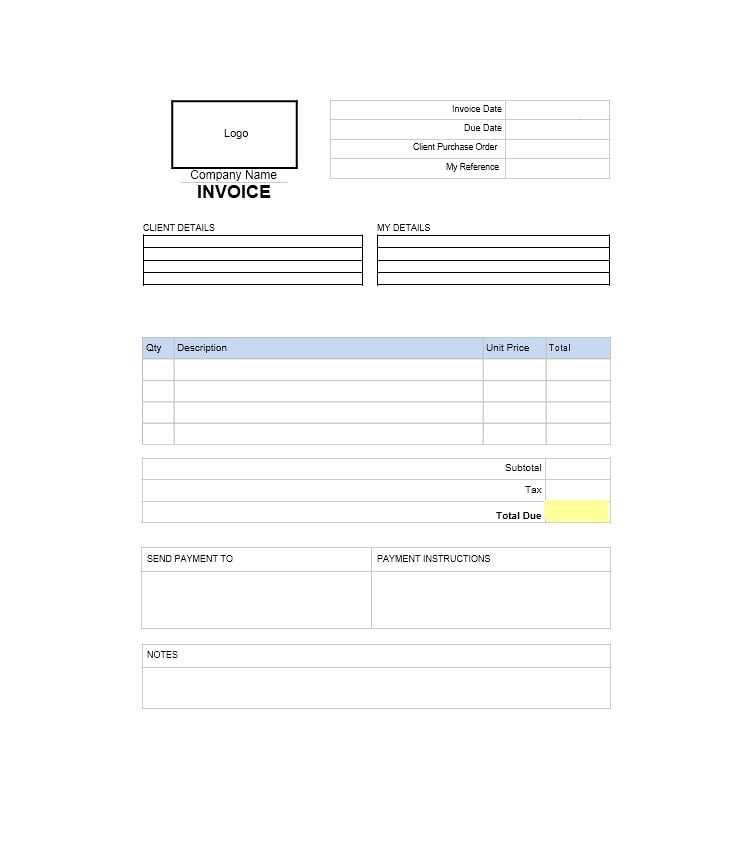

How to Customize Your Invoice Template

Personalizing your billing document allows you to align it with your business needs and brand identity. Customization not only makes your records more professional but also ensures they contain all the necessary details for each transaction. Whether you are adjusting the design or adding specific sections, tailoring your document to suit your unique requirements can improve efficiency and client communication.

Steps to Customize Your Billing Document

- Choose the Right Layout: Select a clean and simple structure that is easy to read and includes all essential fields like item descriptions, quantities, and total prices.

- Add Your Branding: Include your company logo, colors, and contact information to make the document visually aligned with your business’s identity.

- Include Specific Terms: Tailor the payment terms, delivery instructions, and any discounts or taxes to meet your particular business practices.

- Personalize Customer Information: Ensure each document includes accurate details such as the customer’s name, address, and contact information to avoid confusion.

- Adjust Payment Instructions: Include payment options, due dates, and any other details related to how the customer can settle the bill.

Tools for Customizing Your Document

There are several tools available, both online and offline, to help you easily create customized billing records. From word processors to specialized accounting software, each offers flexibility in adding personalized touches to your documents. Most tools allow you to save your customized layout for future use, ensuring consistency across all transactions.

Essential Information on a Billing Document

For any business transaction, a properly formatted record is essential to ensure clarity and avoid disputes. This document should contain all the necessary details that outline the goods or services provided, along with payment terms and other important conditions. Properly including key information ensures that both the seller and buyer are on the same page regarding the transaction.

Key Components of a Payment Record

Here are the critical sections to include in your billing document:

| Information | Description |

|---|---|

| Business Details | Name, address, and contact information of the business issuing the record. |

| Customer Information | Details about the buyer, including name, address, and contact details. |

| Transaction Date | Date when the goods or services were provided or when payment is due. |

| Itemized List | A breakdown of products or services provided, including quantity, price per unit, and total price. |

| Payment Terms | Details on payment due date, accepted methods, and any additional charges such as taxes or shipping fees. |

| Reference Number | A unique number to identify the document for future tracking and reference. |

Additional Considerations

In addition to the key elements listed above, some businesses may include additional sections, such as discounts, delivery details, or terms and conditions. Customizing your record to include these can help make the transaction process clearer and more efficient for both parties involved.

Choosing the Right Invoice Format

When selecting a format for your business records, it’s important to choose one that aligns with your specific needs and ensures ease of use. The right structure can help streamline your billing process, maintain professionalism, and ensure clarity between you and your clients. Whether you need a simple layout or something more detailed, the format you choose should be easy to customize and adapt for different transactions.

Factors to Consider When Choosing a Format

Several key factors should influence your decision when selecting a layout for your transaction records:

| Factor | Consideration |

|---|---|

| Simplicity | A clean and straightforward format is often the best choice, reducing confusion and ensuring all essential information is clearly visible. |

| Customization | Choose a format that allows easy customization, so you can adjust it for each client or transaction. |

| Branding | The layout should allow for inclusion of your company logo, colors, and other branding elements to maintain a professional look. |

| Legal Requirements | Ensure the structure meets any legal or industry-specific requirements for documenting transactions. |

| Ease of Use | The format should be simple enough for anyone to use, whether you are handling it manually or through software. |

Popular Formats for Different Needs

There are several types of layouts available, each catering to different business models. Some formats are ideal for one-off transactions, while others are better suited for ongoing billing with detailed itemizations. Choose the one that best fits the volume and complexity of your transactions:

- Basic Layout: Ideal for small businesses with simple transactions.

- Detailed Format: Suitable for businesses offering multiple products or services with itemized pricing.

- Recurring Billing Layout: Best for businesses that provide ongoing services with regular payment intervals.

Free Printable Invoice Templates Available Online

There are numerous online resources offering free, customizable documents for businesses that need to create clear and professional records for their transactions. These documents are designed to be easy to use, helping you maintain consistency and save time. Whether you’re a freelancer, a small business owner, or part of a larger enterprise, these tools can help you streamline your billing process without any cost.

Benefits of Using Free Online Templates

- Cost-Effective: Accessing free layouts eliminates the need to invest in expensive software or hire designers.

- Easy Customization: Many free resources allow you to adjust the format to suit your specific needs, from adding your company logo to modifying the fields for services or goods provided.

- Time-Saving: Pre-designed formats can be quickly filled out, reducing the time spent creating documents from scratch.

- Variety of Designs: You can choose from a range of styles and layouts, ensuring you find the best match for your business’s identity and the complexity of your transactions.

Where to Find Free Templates

Various platforms and websites offer free resources for businesses looking to simplify their billing processes. Here are some popular sources:

- Template Websites: Many dedicated sites provide a wide variety of customizable documents for different business needs.

- Microsoft Office or Google Docs: Both platforms offer free, easy-to-use layouts that can be downloaded and customized in no time.

- Accounting Software Platforms: Some online accounting tools provide free document formats for users, especially if you’re already using their services for other accounting tasks.

- Freelance Marketplaces: Freelancers and small businesses can often find free resources on platforms such as Fiverr or Upwork that specialize in document design.

Designing a Professional Billing Record

Creating a polished and professional billing document not only ensures clarity in your financial transactions but also helps build trust with your clients. A well-designed record reflects the quality of your business and makes it easier for clients to process payments. It’s important to pay attention to both the layout and the content, ensuring that all necessary information is easy to find and that the document looks organized and professional.

Key Design Elements to Include

To create a professional document, certain design elements are essential to make the record visually appealing and functional. Below are the key aspects you should focus on:

| Design Element | Purpose |

|---|---|

| Branding | Including your company logo, colors, and fonts helps reinforce your business identity and makes the document more recognizable. |

| Clarity | A clean, simple layout ensures that all information is easy to read and understand, minimizing confusion. |

| Structured Layout | Organize information into clearly defined sections, such as contact details, transaction items, payment terms, and totals. |

| Consistent Fonts | Using professional and easy-to-read fonts will give your document a more polished look and improve its legibility. |

| Space Management | Ensure there’s enough white space to prevent the document from feeling crowded, allowing each section to breathe. |

Tips for a Polished Final Look

- Keep It Simple: Avoid using excessive colors or fonts that could distract from the information.

- Use High-Quality Paper: If you’re printing the document, using high-quality paper can elevate the overall impression.

- Ensure Accuracy: Always double-check the details, such as contact information, amounts, and due dates, to maintain professionalism.

- Save and Reuse: Save your document layout as a template so you can reuse it for future transactions, ensuring consistency across all your bil

Common Mistakes to Avoid on Billing Documents

Creating an accurate and professional billing document is crucial for maintaining smooth financial transactions. However, there are several common errors that can cause confusion, delays in payment, or even disputes. Avoiding these mistakes ensures that your records are clear, concise, and helpful to both you and your clients. By being mindful of these issues, you can prevent unnecessary complications and foster trust with your customers.

Frequent Errors to Watch For

- Incorrect Contact Information: Double-check that both your business and the client’s details are correct, including names, addresses, and phone numbers.

- Missing Dates: Ensure that the date of issue and the due date are clearly listed to avoid misunderstandings about payment deadlines.

- Itemization Mistakes: Always provide a clear, detailed breakdown of services or products provided. Avoid vague descriptions and be precise about quantities, prices, and totals.

- Omitting Payment Terms: Specify the payment due date, accepted methods of payment, and any additional fees such as taxes or shipping costs.

- Calculating Errors: Ensure that all calculations, including taxes and discounts, are correct. Double-check the totals before finalizing the document.

- Failure to Include Reference Numbers: Always include a unique identifier for the transaction, which can be used for tracking and future reference.

Tips for Error-Free Documents

- Proofread: Before sending the document, review all details to ensure there are no errors or omissions.

- Use Automation: Consider using software or tools that can automatically fill in information and perform calculations to reduce human error.

- Seek Feedback: If you’re new to creating these documents, ask a colleague or professional to review them before sending.

- Maintain Consistency: Ensure that all your records follow the same structure and format, making it easier for both you and your clients to track and manage transactions.

Why Invoicing Accuracy Matters for Businesses

Accurate billing is a cornerstone of any successful business. When transactions are documented properly, it not only ensures that payments are collected on time but also helps maintain positive relationships with clients. Small errors in financial documents can lead to confusion, delayed payments, and even damage your company’s reputation. This section explores the importance of precise record-keeping and the long-term benefits it brings to business operations.

First and foremost, ensuring accuracy in financial documentation allows businesses to avoid disputes. Clear and correct records leave little room for misunderstandings about payment amounts or services rendered. Clients are more likely to trust and continue working with a business that consistently provides precise, professional records.

Secondly, accuracy helps maintain efficient cash flow. Timely and correct billing means businesses are paid promptly, which is essential for covering operational costs and ensuring smooth financial operations. Missing or incorrect information can lead to payment delays, which may affect your cash flow and overall financial health.

Finally, reliable billing practices can help you avoid costly legal issues. Incorrect or misleading records may raise questions during audits or lead to tax issues. By keeping accurate, transparent documents, businesses can safeguard themselves against potential legal risks and avoid unnecessary penalties.

Integrating Your Billing Document with Software

Integrating your billing system with software tools can significantly improve the efficiency of your business operations. By using digital tools to manage your financial records, you can automate repetitive tasks, reduce human error, and streamline your workflow. This integration allows for seamless document generation, accurate calculations, and faster processing, ensuring your business runs smoothly and efficiently.

One of the primary benefits of integrating your documents with software is the ability to automate the creation of financial records. With software solutions, you can customize fields, set up recurring payments, and instantly generate professional documents with all the necessary information pre-filled. This eliminates the need for manual entry, saving time and minimizing mistakes.

Additionally, linking your financial records to software helps with tracking and organizing your business’s financial data. The software can automatically update records with payment statuses, calculate taxes, apply discounts, and track due dates. This real-time information is crucial for maintaining accurate accounts and ensuring prompt payment collection.

Key Advantages of Software Integration

- Efficiency: Automation of recurring tasks such as generating, sending, and tracking documents.

- Accuracy: Reduces errors by automating calculations and minimizing manual data entry.

- Tracking: Software integration provides real-time updates on payment statuses and due dates.

- Customization: Easily adjust document layouts and fields to suit specific business needs.

Whether you’re using accounting software, customer relationship management (CRM) tools, or cloud-based services, integrating your documents with these systems can streamline the way you manage your finances and improve overall business productivity.

Steps to Create a Billing Document from a Pre-made Layout

Creating a professional billing document from a pre-designed layout can save time and effort while ensuring consistency across all transactions. By following a few simple steps, you can easily generate accurate records that meet your business needs. Whether you’re handling a one-time transaction or managing recurring payments, utilizing an established layout makes the process more efficient and reliable.

Essential Steps for Creating Your Billing Document

- Choose a Suitable Layout: Select a pre-made design that fits your business’s needs. Make sure it includes all the necessary sections such as item descriptions, payment terms, and your business’s contact information.

- Enter Business and Client Information: Input your company’s name, address, and contact details. Be sure to include the client’s full information, including name, address, and payment instructions.

- List Items and Services: Provide a clear and detailed description of the goods or services provided. Include unit prices, quantities, and any applicable taxes or discounts.

- Specify Payment Terms: Clearly indicate the payment due date, accepted methods, and any other terms related to payment, such as late fees or early payment discounts.

- Calculate Totals: Double-check that the amounts, taxes, and total payment due are correct. Be sure to apply any adjustments and verify all calculations before finalizing.

Finalizing Your Document

- Review for Accuracy: Before sending the document, review all the details to ensure there are no mistakes or missing information.

- Save and Export: Once everything is correct, save the document in a suitable format (e.g., PDF, Word) and export it for easy sharing or printing.

- Send to Client: Deliver the completed document to your client via email or your preferred communication method. Be sure to keep a copy for your records.

By following these steps, you can quickly generate professional documents that enhance the clarity and efficiency of your business transactions, improving both your workflow and client relations.

How to Add Discounts or Taxes on Billing Documents

When creating a billing document, it’s often necessary to apply certain adjustments, such as discounts or taxes, to the final amount. Adding these elements ensures that your document accurately reflects the pricing structure agreed upon with your client and complies with any tax regulations. This section explains how to easily incorporate discounts and taxes into your billing documents to maintain transparency and accuracy.

Adding Discounts to Your Document

Discounts can be applied in different ways depending on the nature of the agreement and the pricing structure. Here are the most common approaches:

- Percentage Discount: You can apply a percentage-based discount to the total amount or to individual items. For example, a 10% discount on the subtotal will reduce the final amount by that percentage.

- Fixed Amount Discount: A fixed discount reduces the total by a set amount. For instance, a $20 discount on the overall bill reduces the amount due by that exact value.

- Conditional Discounts: Sometimes discounts are applied based on specific conditions, such as early payment or bulk purchases. In such cases, clearly specify the terms for eligibility.

Incorporating Taxes into Your Billing Document

Taxes are essential to ensure compliance with local regulations and to accurately charge clients based on applicable rates. Here’s how to include taxes on your document:

- Sales Tax: Most businesses will need to apply sales tax based on the tax rate for the specific region. Ensure you include the tax rate and clearly indicate how much is being added to the total amount.

- Itemized Taxes: For more detailed billing, you can list the tax for each individual item or service. This helps clients understand how their charges are calculated.

- Tax Exemption: If certain items or services are exempt from taxes, clearly mark these exceptions to avoid confusion.

By correctly applying discounts and taxes, you help ensure that your billing documents are clear, accurate, and in line with both business practices and legal requirements. These adjustments can improve client satisfaction and reduce the risk of disputes or payment delays.

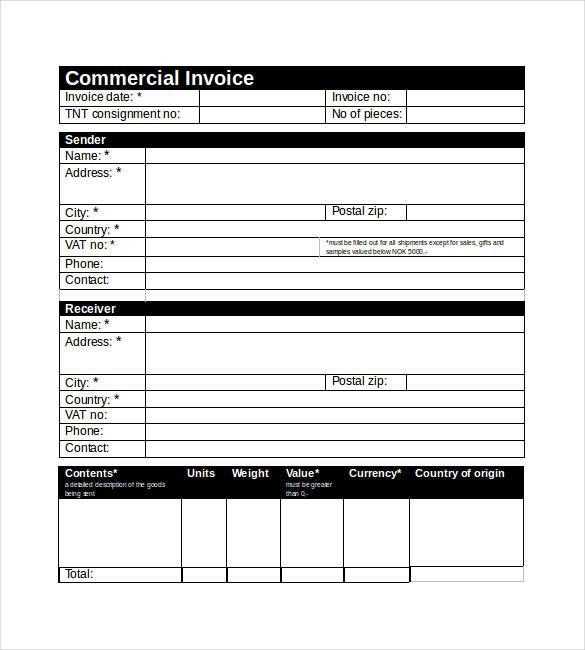

Legal Requirements for Billing Documents

When preparing billing documents for your business, it’s important to ensure that they meet all the necessary legal requirements. These documents are not only essential for tracking payments and transactions but also serve as official records for both your company and your clients. Failing to include the required information or not complying with relevant regulations can lead to complications, including delays in payments or legal issues. This section explores the key legal elements that should be present in every billing document.

Essential Legal Information to Include

- Business Details: Your company’s name, address, and contact information should always be included. This helps identify the source of the transaction and serves as an official record.

- Client Information: Similarly, the client’s name, billing address, and contact information must be specified to ensure clarity about who the transaction is between.

- Transaction Date: A clear date when the transaction occurred should be provided. This is essential for legal and financial record-keeping purposes.

- Unique Reference Number: A unique identifier, such as a reference or order number, ensures that each document can be easily tracked and cross-referenced in case of disputes.

- Details of Goods or Services: Clearly list the products or services provided, including quantities, descriptions, and the agreed-upon price. This transparency helps avoid confusion or discrepancies later on.

Tax Information and Compliance

- Tax Identification Number: Depending on local laws, businesses may need to include their tax identification number (TIN) or VAT number on all official billing documents.

- Applicable Taxes: If taxes are applicable, the correct tax rate should be specified. Ensure that the total tax amount is calculated accurately and reflected on the document.

- Currency and Payment Terms: Clearly state the currency used for the transaction and any terms regarding payment, including deadlines and late fees, if applicable.

By incorporating all necessary legal information, you protect both your business and your clients, making it easier to resolve potential disputes and ensuring compliance with the law. These requirements may vary depending on the country or region, so always verify that your documents meet the local regulations where your business operates.

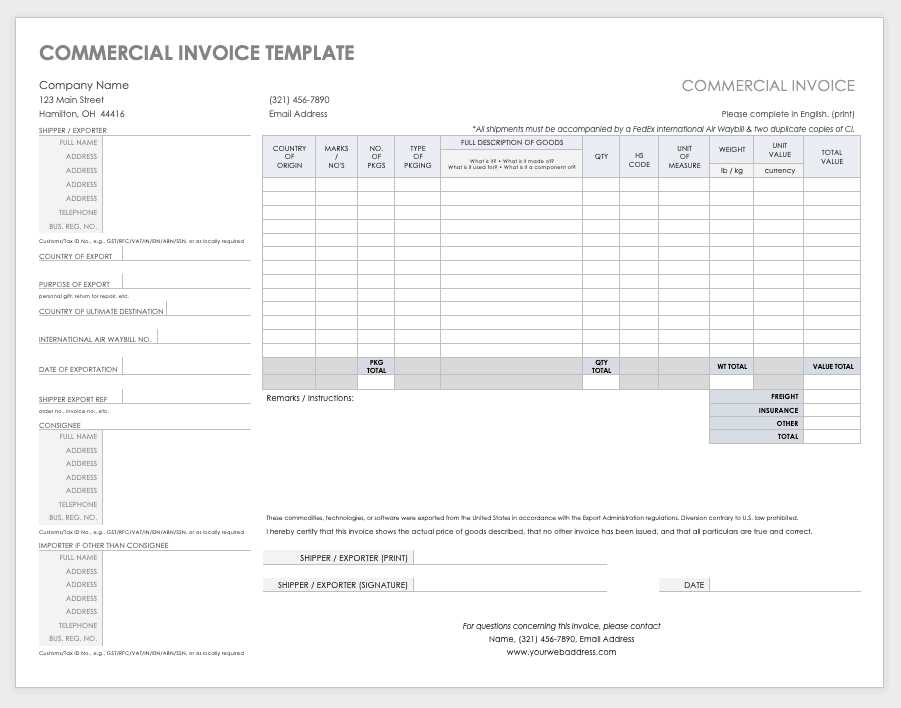

How to Handle International Billing Documents

When dealing with clients or businesses across borders, it is essential to manage billing documents with extra care to ensure compliance with both local and international regulations. International transactions often require additional details to prevent delays and misunderstandings, and understanding the nuances of handling such documents is crucial. In this section, we will explore best practices for managing cross-border financial transactions.

Key Elements for International Billing

- Currency Considerations: Always specify the currency in which the transaction is conducted. Different countries use different currencies, and this helps avoid any confusion or miscalculations.

- Exchange Rate: If payment is made in a foreign currency, make sure to include the exchange rate that applies at the time of the transaction. This ensures transparency for both parties regarding the final amount due.

- Customs and Import Duties: In some cases, additional charges such as customs or import duties may apply. It is essential to clarify whether these costs are covered by the buyer or the seller.

- Payment Terms: Clearly define the terms of payment, including deadlines and acceptable payment methods. International transactions often require bank transfers or international payment platforms.

Legal and Tax Requirements for International Billing

- Tax Identification Number (TIN): Ensure that both the seller and buyer’s tax identification numbers are included, as this is often a requirement in international transactions.

- VAT or Sales Tax: Many countries impose Value Added Tax (VAT) or other sales taxes on cross-border sales. Check whether tax needs to be applied and indicate the percentage and total amount.

- Import/Export Documentation: In some cases, international sales may require specific export or import documentation, such as commercial invoices, certificates of origin, or packing lists.

Handling international transactions requires careful attention to detail, as different countries have varying legal requirements and financial practices. Always consult with legal or financial experts to ensure that all necessary information is provided, and consider using invoicing software designed to handle international transactions for greater ease and accuracy.

Best Practices for Invoice Delivery

Ensuring timely and efficient delivery of billing documents is crucial for maintaining smooth financial operations and fostering positive relationships with clients. Proper delivery not only ensures that the customer receives the necessary information but also helps in tracking and managing payments effectively. In this section, we will outline the most effective practices for delivering billing documents, ensuring accuracy, and minimizing delays.

Choose the Right Delivery Method

Delivery method plays a significant role in how quickly your documents are received and processed. Common delivery methods include:

- Email: The fastest and most widely used method for sending documents. Ensure that the document is sent as a PDF or other commonly accepted formats to preserve formatting.

- Postal Services: For international or high-value transactions, physical delivery via postal or courier services may be necessary. Keep track of tracking numbers for proof of delivery.

- Online Payment Portals: For clients using specific platforms to manage payments, submitting billing documents directly through the portal can streamline the process.

Ensure Proper Documentation and Format

Properly formatted documents help avoid confusion and ensure that clients can easily process them. Include the following key details:

- Clear Identifiers: Make sure the document clearly indicates the purpose of the transaction and includes reference numbers or order IDs for easy tracking.

- Readable Format: Choose a format that preserves your document’s layout, such as PDF. This ensures your client receives a professional and easy-to-read document.

- Accurate Information: Double-check that all information, including amounts, tax details, and payment instructions, is correct before sending. Errors can lead to delays and disputes.

Follow-Up and Track Deliveries

Once the document has been delivered, following up with the recipient can help confirm receipt and resolve any potential issues. Some tips include:

- Send Delivery Confirmations: For digital deliveries, confirm that the document was successfully sent. For physical deliveries, use tracking services to verify receipt.

- Set Payment Reminders: Schedule reminders for payment deadlines. This can be done manually or through automated systems to ensure timely settlements.

- Communication: Be proactive in addressing any queries or concerns from the client regarding the document. Clear communication can help avoid delays in payment.

By following these best practices, businesses can enhance the efficiency of their billing process and ensure that payments are receive

How to Track and Manage Invoices Efficiently

Efficient tracking and management of billing documents are vital to maintaining a smooth workflow and ensuring timely payments. By implementing the right strategies, businesses can reduce errors, prevent overdue payments, and streamline their financial operations. In this section, we will explore methods and tools that can help you track and manage these documents effectively, ensuring both accuracy and efficiency in your business’s financial processes.

Use Digital Tools for Organization

Leveraging digital tools is one of the most efficient ways to manage billing documents. With the right software, you can automate much of the tracking process and ensure that all records are easily accessible. Some tools to consider include:

- Accounting Software: Many businesses use accounting platforms such as QuickBooks or Xero to generate, send, and track documents automatically. These tools help keep records organized and can generate reminders for overdue payments.

- Cloud Storage: Storing documents in the cloud ensures they are accessible from anywhere, at any time. Cloud services like Google Drive or Dropbox offer secure storage and allow for easy file sharing with clients and team members.

- Project Management Tools: Tools like Trello or Asana can be used to track the status of each document and assign tasks to team members, ensuring nothing falls through the cracks.

Maintain a Centralized Record System

Establishing a centralized record system helps ensure that all documents are stored and easily retrievable when needed. Some key components to include are:

- Organized Folders: Create clear, consistent naming conventions for files. For example, organize documents by date, client name, or invoice number for easy access.

- Document Versioning: Keep track of document versions to avoid confusion. If there are multiple versions of a document, ensure the latest version is always marked and easily identifiable.

- Cross-Referencing Systems: Use reference numbers or codes to connect related documents, such as purchase orders and delivery receipts, to the corresponding billing records.

Set Payment Reminders and Alerts

Ensuring that payments are made on time is critical to maintaining a steady cash flow. Set up reminders and alerts to help you stay on top of deadlines:

- Automated Email Reminders: Many digital tools offer the ability to set up automated reminders for clients regarding upcoming or overdue payments.

- Due Date Alerts: Enable due date alerts to notify both you and the client when a payment is due or overdue. This helps reduce late payments and allows for timely follow-up.

- Payment Status Tracking: Keep a record of all paid and outstanding balances, so you can easily track which accounts are overdue and take appropriate action.