Free Excel 2007 Invoice Templates for Easy Invoice Creation

Managing finances efficiently requires tools that simplify the process while maintaining a high level of professionalism. Whether you’re a freelancer, a small business owner, or a larger organization, having a reliable method for generating billing records is essential. With the right tools, you can easily produce polished and accurate documents that reflect the quality of your work.

Using pre-designed forms allows for customization, helping you tailor each document to your specific needs. These ready-made solutions offer a quick start, eliminating the need to design each record from scratch. Instead of spending time creating repetitive documents, you can focus on what matters most–delivering value to your clients.

Incorporating these tools into your routine ensures consistent and professional results. With a few clicks, you can generate documents that are both functional and visually appealing, boosting your credibility and making the process seamless for your clients. Why settle for less when simplicity and efficiency can coexist?

How to Use Free Invoice Templates in Excel 2007

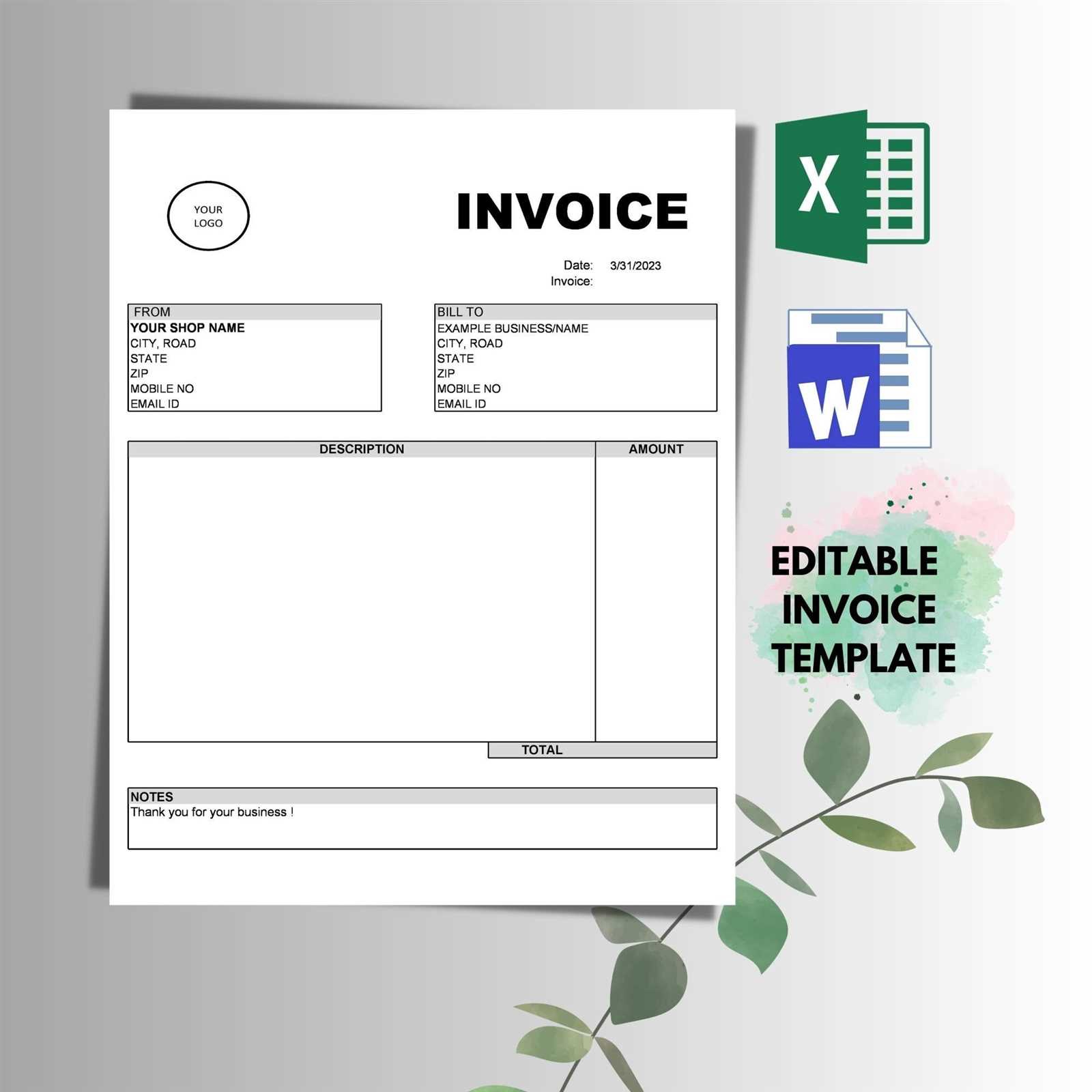

Creating accurate and professional billing documents can be a straightforward task when using the right tools. By utilizing pre-built forms designed for simple editing, you can save valuable time while ensuring your records meet industry standards. The process is intuitive and easy to follow, even for those with minimal experience in document creation.

To get started, follow these simple steps:

- Open the program: Launch the application and select a new blank document.

- Search for a pre-designed format: In the template search bar, type relevant keywords like “billing” or “payment record” to find the appropriate structure.

- Choose the format: Browse through the available designs and pick the one that suits your needs. There are various options tailored for different business types and use cases.

- Enter your details: Fill in the necessary fields with your client’s information, services provided, and payment terms. Be sure to double-check the accuracy of each entry.

- Customize the design: Adjust any visual elements, such as logos, colors, or fonts, to match your branding and ensure consistency with your other documents.

- Save and export: Once completed, save the document for future reference or export it to your preferred file format for sharing with clients.

By following these simple steps, you can quickly generate high-quality billing documents that are both professional and personalized to your specific needs. This approach streamlines the invoicing process, saving you time and effort while ensuring your business maintains a polished image.

Benefits of Excel 2007 Invoice Templates

Using pre-designed billing documents can significantly simplify the administrative side of your business operations. These ready-made structures offer a quick and easy solution for generating professional records, ensuring that the final product is both accurate and visually appealing. The benefits of using such tools extend beyond saving time–they also enhance the consistency and reliability of your records.

Time-saving efficiency is one of the key advantages. Instead of starting from scratch, you can immediately focus on customizing the content to fit your needs, cutting down the time spent on document creation. The well-organized layout allows for easy input of client details, services, and payment terms, streamlining the process considerably.

Professional appearance is another major benefit. These pre-built documents are designed to look polished and align with business standards, helping you maintain a credible and trustworthy image. The clean and organized layout ensures that all important details are highlighted, making it easier for clients to understand the document.

Customization options allow for flexibility. While the foundation is already laid, you can modify colors, fonts, and logos to match your branding, ensuring the document feels uniquely yours. This level of personalization helps maintain a cohesive visual identity across all business communications.

Cost-effective solution is also a strong point. These tools eliminate the need for expensive software or professional services, offering a high-quality option at no cost. For small businesses and freelancers, this can make a big difference in managing overhead expenses while still producing professional-grade documents.

Overall, using pre-designed billing solutions provides significant value by saving time, enhancing professionalism, and offering customization–ultimately contributing to smoother and more efficient business operations.

Step-by-Step Guide for Invoice Creation

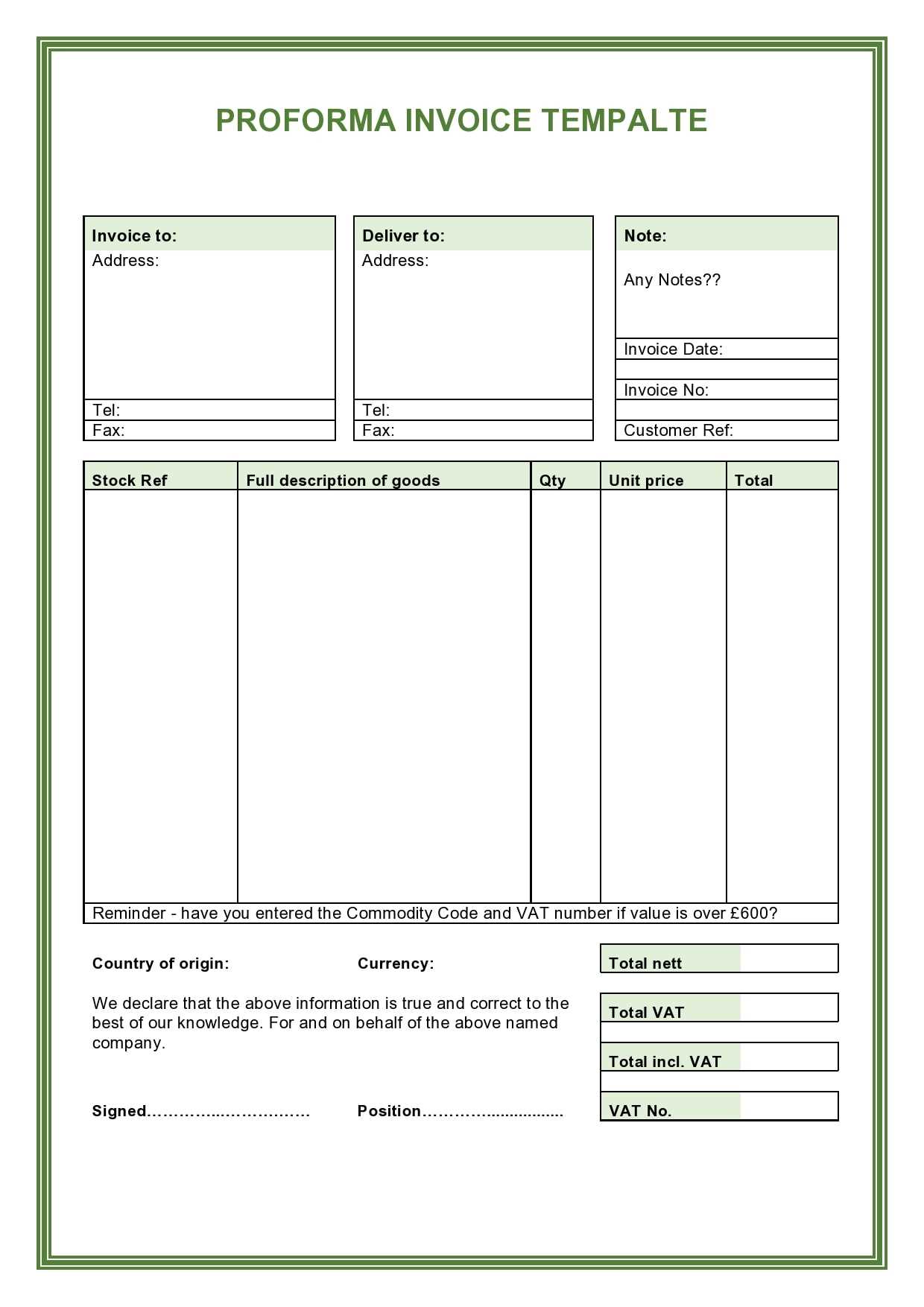

Creating a professional billing document from scratch can be simplified by following a few clear steps. Whether you are a freelancer or a small business owner, having a structured process for generating accurate records is essential. This guide will walk you through each stage of creating a polished and functional document, ensuring that your billing procedure is smooth and efficient.

1. Start with a blank document: Open your chosen program and begin with a fresh, empty sheet. This provides a clean canvas to work from.

2. Select a pre-designed layout: Choose a design that suits your business needs. Many layouts offer basic fields such as contact information, payment terms, and itemized service lists. Pick one that suits your preferences or industry.

3. Enter your business details: Include your business name, address, phone number, and email. It’s essential that these details are clear and easy to locate for the client.

4. Input client information: Add the client’s name, address, and contact details. Ensuring this section is correct will avoid any confusion regarding payment or contact information.

5. Specify services or products: List each service or product provided, including quantities, prices, and any applicable taxes. This section is crucial for transparency and clarity in your business transactions.

6. Review payment terms: Clearly outline the payment due date, payment methods accepted, and any late fees or discounts, if applicable. This ensures the client understands the conditions of payment.

7. Personalize your document: Adjust the design, such as adding a company logo, changing the color scheme, or modifying fonts to match your branding. This step helps maintain consistency across your business materials.

8. Save and send: Once everything is complete, save the document and share it with your client. Be sure to keep a copy for your own records as well.

By following these straightforward steps, you can easily create a detailed and professional billing record that reflects the quality of your work and ensures your business is organized and efficient.

Where to Find Free Invoice Templates

When looking for pre-designed billing documents, there are several reliable sources that provide high-quality options at no cost. These resources can be accessed online and allow you to quickly download and customize documents that meet your business needs. Below is a list of popular places where you can find these tools:

| Source | Description |

|---|---|

| Office Suite Software | Most office programs come with a built-in collection of pre-made documents. Simply search for “billing forms” or similar keywords within the program to find several options. |

| Online Template Libraries | Many websites offer a wide range of customizable templates for businesses. You can download these forms and adjust them according to your specifications. |

| Business Resource Websites | Websites dedicated to business tools often provide downloadable forms as part of their free resources section. These forms are typically designed to cater to a variety of industries. |

| Community Forums | Forums and discussion groups focused on small businesses and freelancing can be a great place to find recommendations and links to trusted document sources. |

| Social Media Groups | Groups on platforms like Facebook, LinkedIn, or Reddit often share resources, including links to useful document downloads that are free to access. |

By exploring these options, you can easily find customizable documents that fit your needs and help streamline your business operations. These resources save you time, ensure your records are professional, and allow for quick adjustments to suit various types of transactions.

Customizing Excel 2007 Invoice Templates

When using pre-designed billing forms, customization is key to making them work for your business. Personalizing the document to reflect your brand, adding specific details, and adjusting the layout ensures that each record meets your unique needs. Whether you’re a freelancer, small business owner, or part of a larger company, tailoring these forms can enhance their professionalism and functionality.

Adjusting the layout: The first step in customization is modifying the layout. You can easily move or resize sections such as contact information, service lists, or payment terms. This allows you to highlight the most important details and remove any elements that are unnecessary for your particular use case.

Changing visual elements: Visual appeal plays a big role in how your billing documents are perceived. You can add your company logo, adjust the color scheme to match your branding, or change the font style and size. Customizing these aspects helps maintain consistency across all business communications, making your documents instantly recognizable.

Modifying fields: Many pre-designed forms come with default fields that may not align with your specific needs. You can modify these fields, adding or removing rows to include additional services or altering labels to better describe your offerings. This flexibility ensures that the document is tailored to the specifics of your transactions.

Incorporating advanced features: For those who are more experienced, advanced features such as formulas for automatic calculations of totals, taxes, or discounts can be added. These formulas ensure accuracy and save time when filling out multiple records.

By following these simple steps, you can easily transform a standard document into one that reflects your unique business needs. Customization ensures that every document you send out not only serves its functional purpose but also strengthens your brand’s presence and professionalism.

Why Choose Excel for Invoicing

Choosing the right tool for creating billing records can make a significant difference in terms of efficiency, accuracy, and professionalism. With the right software, you can easily generate and customize documents, track payments, and maintain clear records–all while saving time. This particular program stands out as a go-to solution for many small business owners and freelancers due to its flexibility, simplicity, and powerful features.

Flexibility and Customization

The ability to fully customize the layout and design is one of the main reasons many choose this program for creating billing documents. It allows for easy adjustments, whether you’re changing the formatting, adding new fields, or personalizing the document with your brand’s logo and colors. The versatility in adjusting every aspect of the form ensures that it suits a variety of business needs and transaction types.

Efficiency and Functionality

This tool is particularly useful for automating calculations, such as totals, taxes, or discounts, using built-in formulas. This minimizes human error and streamlines the process, making it much faster and more reliable. Additionally, saving and organizing documents for future reference is simple, with the option to store and retrieve records quickly.

With all of these advantages, it’s no wonder that many businesses turn to this software to handle their billing processes. It offers a perfect balance of customization, functionality, and ease of use, making it an excellent choice for efficient invoicing.

Common Features in Free Invoice Templates

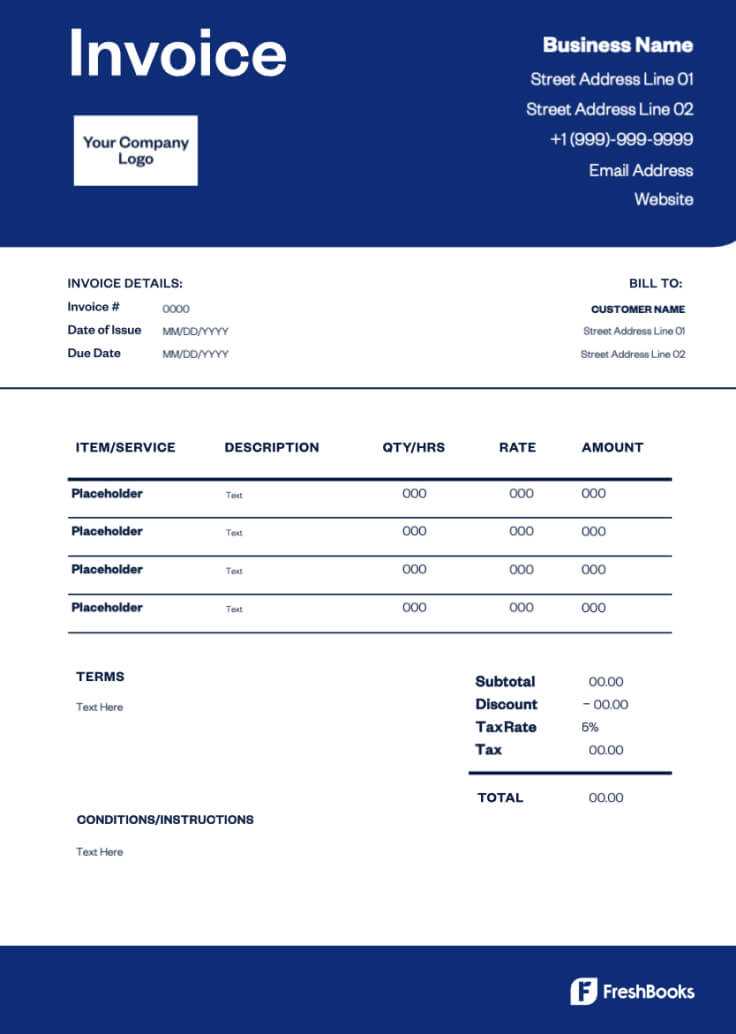

Pre-designed billing documents typically come with a set of common features that make them easy to use and adaptable to various business needs. These essential elements ensure that the documents are both functional and professional, helping businesses streamline their billing processes while maintaining consistency and accuracy. Understanding these features can help you make the most of these tools and customize them to suit your specific requirements.

Key Elements in Billing Forms

Most pre-built forms include the following core components to ensure smooth transaction management:

| Feature | Description |

|---|---|

| Business and Client Information | Fields for entering both your company’s and the client’s contact details, such as names, addresses, and phone numbers, are essential for ensuring that communication is clear. |

| Itemized List of Services or Products | A section to list services rendered or products provided, including quantities, prices, and totals. This section helps both parties understand exactly what is being billed. |

| Payment Terms | These include due dates, accepted payment methods, and any late fees or early payment discounts. Clear terms help prevent misunderstandings. |

| Subtotal, Taxes, and Total | Calculation fields for the subtotal, applicable taxes, and final amount owed ensure that the billing process is transparent and accurate. |

| Branding Options | Most designs offer spaces for including your logo and adjusting color schemes to match your company’s visual identity, enhancing professionalism. |

Additional Useful Features

In addition to the essential elements, many documents also offer extra features such as:

- Space for notes or special instructions

- Automatic calculations for totals and taxes

- Customizable fields for discounts, shipping, or handling fees

- Fields for tracking payment status

These features work together to ensure that the documents not only look professional but also function efficiently, minimizing manual errors and ensuring that all necessary information is captured correctly.

How to Save Your Invoice in Excel

Once you have completed your billing document, it’s important to save it properly to ensure that it can be easily accessed, edited, or shared. Saving your work in the right format allows you to store and retrieve the file without any issues, whether for future reference or to send to clients. Below is a simple guide on how to save your completed document efficiently.

Steps to Save Your Document

- Click on the “File” tab: Navigate to the top left corner and click on the “File” menu to open the options.

- Select “Save As”: In the drop-down menu, choose the “Save As” option, which allows you to select a destination and file type.

- Choose the save location: Decide where to store the file on your computer or cloud storage. You can save it in a folder dedicated to business documents for easy access.

- Pick the file format: Choose the format you want to save the document in. For most billing purposes, you can choose a standard format like .xlsx or .xls for further editing or .pdf for sending a non-editable version to clients.

- Name the file: Give the file a clear name that will make it easy to find later, such as “ClientName_Billing_Document” or “Invoice_12345”.

- Click “Save”: After selecting the destination, file type, and naming the document, click the “Save” button to confirm your choices.

Other Saving Tips

- Save frequently: While working on your document, it’s always a good idea to save your progress regularly to avoid losing data.

- Use cloud storage: Consider saving your document in cloud storage (like Google Drive or Dropbox) for easy access from any device and backup purposes.

- Use versioning: If you make changes to your billing document over time, consider saving different versions (e.g., “Invoice_12345_v1”, “Invoice_12345_v2”) to track modifications.

Following these simple steps ensures that your documents are saved properly and securely, allowing you to manage your business’s records with ease.

Best Practices for Creating Invoices

Creating professional and accurate billing documents is essential for maintaining clear communication with clients and ensuring timely payments. Whether you are a freelancer, small business owner, or part of a larger organization, following best practices can make a significant difference in the effectiveness and professionalism of your billing process. By adhering to these guidelines, you can reduce mistakes, improve cash flow, and enhance client relationships.

Essential Elements to Include

- Clear Contact Information: Always include your business’s name, address, and contact details. Also, make sure the client’s information is clearly stated, including their name, address, and any relevant contact information.

- Unique Document Number: Assign each document a unique identification number to help track and reference it easily. This is especially helpful for record-keeping and avoiding confusion.

- Detailed Breakdown of Services: Provide an itemized list of products or services provided, including descriptions, quantities, and rates. This transparency helps clients understand what they are being charged for.

- Accurate Payment Terms: Clearly outline the payment due date, accepted payment methods, and any penalties or discounts for early or late payments. This helps set clear expectations.

- Subtotal and Total: Calculate and clearly display the subtotal, applicable taxes, and the final amount due. Ensure these calculations are accurate to prevent any misunderstandings.

Additional Tips for Professional Billing

- Keep It Simple: Avoid cluttering the document with unnecessary information. A clean, simple design is easier for clients to read and understand.

- Use Consistent Branding: Include your company logo and maintain consistent colors and fonts to strengthen your brand identity.

- Be Clear and Concise: Avoid vague or ambiguous descriptions. Clear, straightforward language helps prevent confusion and ensures clients know exactly what they are being billed for.

- Double-Check Your Work: Before sending the document, proofread it carefully. Verify that all details are correct, including pricing, dates, and client information.

- Send Promptly: The sooner you send the billing document, the sooner you’ll receive payment. Try to send invoices as soon as the service or product is delivered.

By following these best practices, you can ensure that your billing documents are not only accurate but also convey professionalism and clarity, helping you maintain positive relationships with your clients and secure timely payments.

Tracking Payments with Excel Templates

Efficiently tracking payments is essential for maintaining proper financial records and ensuring that you are paid on time. Utilizing a pre-designed document can simplify this process, allowing you to monitor the status of outstanding payments, track overdue amounts, and keep an eye on your cash flow. By incorporating these features into your regular billing routine, you can ensure greater transparency and reduce the chances of errors or missed payments.

Key Features for Payment Tracking

When creating a document to track payments, it’s important to include several key components that allow for effective monitoring:

| Feature | Description |

|---|---|

| Payment Status | Include a column where you can mark whether a payment has been made, is pending, or is overdue. This helps you keep track of all open and settled accounts. |

| Due Dates | Ensure that due dates are clearly listed and visible. This allows you to follow up on overdue payments promptly and maintain a consistent cash flow. |

| Partial Payments | If a client makes a partial payment, be sure to track it. This helps to calculate remaining balances and avoid confusion regarding the outstanding amount. |

| Payment Method | Record the payment method used (e.g., credit card, bank transfer, cash) to ensure that there is a clear record of the transaction. |

| Amount Paid | Track how much has been paid against the total amount due, helping you calculate remaining balances and prevent errors. |

Steps to Track Payments

- Set up payment tracking fields: Create columns or sections to capture key details such as payment amount, date, method, and status.

- Update status regularly: Keep the payment status up to date so you can easily see which accounts are paid and which are pending.

- Review overdue amounts: Keep an eye on overdue payments by sorting your document by due date. This makes it easier to follow up with clients in a timely manner.

- Use formulas to calculate balances: Automate calculations such as remaining amounts or totals to avoid manual errors and ensure accuracy.

- Save and back up: Always save your payment tracking documents regularly and back them up to prevent loss of important financial data.

By systematically tracking payments, you ensure that your billing process remains organized, and you can manage your finances with greater ease and accuracy. With these simple additions to your billing process, you’ll be able to quickly identify overdue payments and keep your business running smoothly.

Excel Invoice Templates for Small Businesses

For small business owners, managing billing can be a challenging task, especially when trying to maintain organization and ensure timely payments. Using pre-designed tools that streamline the invoicing process can help reduce the administrative burden. These ready-made solutions allow businesses to focus on growth and customer service, while the detailed financial aspects are efficiently handled.

Why Small Businesses Should Use Billing Tools

Small businesses often have limited resources and time, making it crucial to adopt solutions that save both. Leveraging a structured document for billing offers several advantages:

- Simplifies the billing process: Pre-designed solutions can significantly reduce the time spent on creating and formatting documents from scratch.

- Enhances professionalism: A polished, consistent format helps businesses present themselves more professionally to clients, strengthening their credibility.

- Improves cash flow management: With built-in fields for payment tracking, businesses can monitor outstanding payments and follow up on overdue amounts promptly.

- Prevents errors: Automation features such as calculations for totals and taxes help prevent common mistakes and ensure accuracy in each bill.

Features to Look for in Billing Solutions

When choosing a document for managing business payments, there are certain key features to consider to ensure it meets the specific needs of a small business:

- Customizable design: The ability to add your company logo, adjust fonts, and change the color scheme helps keep the document consistent with your brand identity.

- Itemized list of services/products: An organized structure for detailing each product or service offered, including quantities, rates, and totals, ensures clear communication with clients.

- Tax and discount calculation: Built-in formulas to automatically calculate taxes, discounts, and the final total make the process faster and more accurate.

- Payment tracking features: Having the ability to easily update and track the status of payments (paid, pending, overdue) allows you to keep a close eye on outstanding balances.

By using a well-structured billing tool, small business owners can save time, increase efficiency, and maintain a professional image. These tools allow them to focus on core business activities, ensuring that their invoicing process is both smooth and effective.

Free Templates vs Paid Invoice Solutions

When it comes to managing billing and payments, businesses often face the decision between using no-cost, ready-made tools or investing in more comprehensive paid options. Both choices offer distinct advantages, but the decision depends on factors such as business needs, scale, and budget. Understanding the differences between the two can help you make an informed choice that fits your workflow and ensures your operations run smoothly.

Key Differences Between Free and Paid Solutions

There are several key differences to consider when evaluating whether to use a no-cost tool or invest in a premium service. Below is a comparison that highlights the main aspects of each:

| Feature | Free Tools | Paid Solutions |

|---|---|---|

| Customization | Limited options; design is often pre-set. | Highly customizable to suit your branding and needs. |

| Ease of Use | Basic functionality with a simple setup. | User-friendly interface with advanced features for ease of use. |

| Automation | Minimal automation, usually requiring manual data entry. | Automated features, including calculations and payment tracking. |

| Support | Limited or no customer support, with user forums or FAQs. | 24/7 customer support, training, and updates. |

| Security | Basic security features, often reliant on your system. | Advanced security protocols to protect financial data and personal information. |

| Cost | Completely free with no hidden charges. | Requires a subscription or one-time payment, depending on the service. |

Choosing the Right Option for Your Business

The decision between no-cost and paid solutions depends on your specific business requirements:

- For small or startup businesses: If your company is just starting out or has limited needs, a basic, no-cost tool may be sufficient. These solutions can help you get started without making a financial commitment.

- For growing businesses: As your business expands, the need for advanced features such as automation, more customization, and better support may become more important. Paid options offer greater flexibility and efficiency at this stage.

- For companies handling sensitive data: If you handle a significant amount of financial data, a paid solution with advanced security features may be the better option to protect your business and clients.

Ultimately, both types of solutions have their place depending on your specific needs. By understanding the pros and cons of each, you can choose the one that will best support your business’s goals and streamline your billing process.

Printing Your Invoice from Excel

Once your billing document is ready, printing it in a professional format is an essential step. Whether you’re sending it physically to clients or keeping a hard copy for your records, ensuring the document looks clean and is easy to read is important. Fortunately, modern spreadsheet tools make the printing process straightforward, offering several options for customizing the final appearance of your document before printing.

Preparing Your Document for Printing

Before hitting the print button, there are several things to consider to ensure your document looks its best:

- Check the margins: Make sure the margins are set correctly to avoid cutting off any content. Adjust them to fit the content within the printable area of your paper size.

- Preview the layout: Use the print preview function to see how your document will appear on paper. This step can help identify any formatting issues before you waste paper and ink.

- Adjust scaling options: If your document doesn’t fit on one page, adjust the scaling options. You can reduce the size of the content to ensure everything fits neatly on one page or choose to print on multiple pages.

- Choose paper size: Make sure the paper size selected matches the one you’re using for printing. Standard options like A4 or letter size are most common, but make sure the correct size is chosen in the print setup.

Steps for Printing Your Document

Once the necessary adjustments have been made, follow these steps to print your document:

- Step 1: Open the document in your spreadsheet tool and click on the “File” menu.

- Step 2: Select the “Print” option. This will open the print dialog box where you can adjust various settings.

- Step 3: In the print dialog, select the printer you’d like to use from the list of available printers.

- Step 4: Set any additional preferences such as the number of copies, color options, or page orientation.

- Step 5: Click “Print” to send the document to the printer. Make sure your printer is properly connected and has enough paper and ink to complete the task.

Printing your document correctly can help ensure that it looks polished and professional when you present it to clients or store it for future reference. By following the right steps and adjusting the settings to match your needs, you can avoid issues with formatting and achieve a clean, readable result.

Maintaining Professionalism with Excel Templates

When managing business documents, especially those that involve financial transactions, maintaining a high level of professionalism is crucial. The appearance and structure of your paperwork directly reflect the image of your business. Using well-designed, structured documents not only helps in conveying information clearly but also leaves a lasting impression on your clients and partners. Fortunately, digital tools offer easy ways to ensure your documents are neat, organized, and presentable.

Key Elements of a Professional Document

There are several key elements that contribute to maintaining professionalism when creating business documents. Here are some factors to consider:

- Clarity: Ensure that all the information is presented in a clear, logical manner. Avoid unnecessary jargon, and use straightforward language that can be easily understood by anyone.

- Consistency: Keep the format consistent throughout the document. Use the same font styles, sizes, and colors to avoid creating a disjointed appearance.

- Branding: If you are representing a business, it’s important to include branding elements like your logo, color scheme, and business contact information to reinforce your brand’s identity.

- Accuracy: Make sure that all numbers, dates, and other relevant information are accurate. Errors in business documents can severely damage your reputation.

- Organization: A well-organized document with clearly separated sections helps recipients quickly find the information they need, improving overall user experience.

Steps to Enhance Professionalism in Your Documents

By taking a few extra steps, you can enhance the professionalism of your business paperwork:

- Use Templates: Pre-designed documents can help you maintain a consistent and professional look. These templates are created to follow best practices for layout, spacing, and typography.

- Ensure Legibility: Select a clean, easy-to-read font and ensure that text size and spacing are appropriate for comfortable reading. Avoid cluttering the page with excessive information.

- Personalize Your Documents: Add your company’s logo, tagline, or contact information to make the document feel more personalized and aligned with your business branding.

- Keep It Simple: A cluttered document can seem unprofessional. Stick to the essential information and present it in a way that is visually appealing and functional.

- Review and Proofread: Before sending out any document, always review it for grammatical errors, formatting issues, or missing details. A well-proofread document demonstrates attention to detail and professionalism.

By focusing on these aspects, you can ensure that your business documents convey a polished, professional image and reflect the level of service you aim to provide to your clients.

Top Excel 2007 Features for Invoice Creation

When managing business documentation, having the right set of tools can greatly enhance both the efficiency and professionalism of the process. In particular, certain features in spreadsheet software can simplify and streamline the creation of billing statements. These features help ensure accuracy, consistency, and clarity, making it easier to generate, manage, and track business transactions.

Key Features for Efficient Billing

Here are some of the most useful functionalities to take advantage of when creating billing documents:

- Data Autofill: Autofill capabilities allow you to quickly populate repetitive fields like dates, item numbers, and pricing by dragging the fill handle. This speeds up the document creation process while minimizing the chances of human error.

- Cell Formatting: Customizable formatting options, such as font styles, cell borders, and colors, help organize information neatly and enhance readability. You can also format cells to display numbers and currency values accurately, making your document look more professional.

- Formulas and Functions: Using built-in formulas like SUM and PRODUCT helps automatically calculate totals, taxes, and other amounts without manual entry, ensuring that calculations are both fast and accurate.

- Conditional Formatting: Conditional formatting allows you to highlight specific data points, such as overdue payments or high-value items, helping you quickly draw attention to important information in your document.

- Template Use: Pre-built documents can be customized to meet your needs, offering a foundation that saves time and effort. These templates are designed to help you maintain a consistent format for all your business records.

Additional Tools to Improve Workflow

In addition to basic features, here are a few other tools that can enhance your experience:

- Pivot Tables: Pivot tables can summarize large amounts of data, such as total payments or item quantities, making it easier to analyze your transactions in a structured way.

- Data Validation: This feature helps ensure the accuracy of your entries by restricting certain inputs. For instance, you can set it up so that only valid date formats or numeric values are entered into specific fields.

- Sharing and Collaboration: If you’re working with a team or collaborating with clients, the ability to share and co-edit documents in real-time makes the process more efficient and reduces the chance of miscommunication.

By utilizing these features, you can significantly improve both the speed and quality of your billing process, while also ensuring that your documents remain accurate, professional, and easy to understand.

How to Automate Invoicing with Excel

Automating the billing process can save time and reduce errors, especially when dealing with multiple transactions. By leveraging certain features in spreadsheet software, you can streamline the creation and management of financial documents, allowing for faster processing and greater consistency. This section will explore how to automate the billing tasks, so you can focus on other important aspects of your business.

Using Formulas for Automatic Calculations

One of the most effective ways to automate the billing process is by utilizing formulas. These functions can automatically calculate totals, taxes, and discounts without requiring manual input for each transaction. Below are a few useful formulas that can help:

- SUM: Automatically sums the values in a range of cells, ideal for adding up totals or product prices.

- IF: The IF function can be used to apply conditional logic, such as offering a discount based on the total value of a sale.

- VLOOKUP: This function allows you to pull pricing information from a list or table, saving you from manually entering item prices for each transaction.

Setting Up Recurring Billing

If you offer services or products on a subscription or recurring basis, you can automate the process of generating invoices with the help of simple scheduling. You can set up a system where each month (or any other interval), new records are created automatically based on predefined billing cycles. This can be achieved using:

- Auto Fill: Create a list of dates or intervals and use the Auto Fill feature to populate your invoice schedule automatically.

- Calendar Integration: Integrate your document with a calendar tool to trigger invoice creation based on set deadlines or payment schedules.

Tracking Payments and Due Dates

Tracking overdue payments or upcoming due dates is essential to managing cash flow. With the right setup, you can automate this process too:

- Conditional Formatting: Highlight overdue payments automatically by setting up rules based on due dates. For example, you can apply a red background color to cells where payments are overdue.

- Payment Tracking System: Keep a column for payment status and use formulas to calculate outstanding amounts, marking items as “Paid” or “Pending” based on input.

Automating Invoice Generation with Macros

Macros are powerful tools for automating repetitive tasks. By recording a series of actions in the spreadsheet, you can automate the creation of an invoice document from start to finish. For example, you can create a macro that will fill in customer details, apply relevant discounts, and generate a PDF version of the document ready for sending. Here’s how to set up a basic macro:

- Enable Macro Recording: In your spreadsheet, go to the “Developer” tab and click “Record Macro”.

- Perform the Actions: Complete the steps you want to automate, such as entering customer data and itemized charges.

- Save and Assign: Save the macro and assign it to a button for easy access every time you need to create a new document.

By using these methods, you can significantly reduce the time spent on administrative tasks, allowing you to automate and scale your business operations effectively.