Free Business Invoice Template for Easy and Professional Billing

Maintaining an organized and efficient system for handling payments is essential for any company. One of the most effective ways to ensure smooth transactions with clients is by utilizing structured documents designed for financial exchanges. These documents help clarify terms, outline amounts owed, and serve as a formal request for payment.

By leveraging ready-made formats, entrepreneurs and freelancers can save valuable time, allowing them to focus on other aspects of their operations. Customizing these documents to fit specific needs provides flexibility while ensuring that all the necessary details are clearly presented. With the right approach, the process of requesting payments can be both simple and professional.

Whether you’re just starting out or managing an established venture, having access to a reliable and adaptable format can help you maintain consistency in your financial communications. Ensuring accuracy and clarity in your billing documentation fosters trust and transparency with clients, which can lead to better payment turnaround and long-term business relationships.

Free Business Invoice Template for Professionals

Professionals in various fields require a streamlined method for requesting payments. A well-organized document that outlines services rendered, amounts due, and payment terms ensures clarity and efficiency in financial transactions. By utilizing a ready-made structure, you can quickly create a customized form that meets your needs and reflects your professional image.

Benefits of Using Ready-Made Forms

One of the key advantages of adopting a pre-designed format is the ability to save time. Instead of starting from scratch with every transaction, professionals can quickly generate a document that is already formatted correctly. This allows for more focus on the quality of the service provided rather than the administrative process.

Customizing for Your Needs

Even though the structure is predefined, there is ample flexibility for adjustments. You can personalize fields to match your specific services, payment terms, or branding. Customizing the layout or adding additional sections like taxes or discounts is easy, ensuring the document meets your exact requirements. This adaptability is especially valuable for those with unique billing needs or specific client expectations.

Why You Need an Invoice Template

Having a structured format for documenting financial transactions is essential for maintaining professionalism and clarity in all business dealings. Without a consistent way of outlining the details of a transaction, mistakes can easily occur, leading to confusion and delays in payments. A standardized document ensures that all necessary information is included, leaving no room for miscommunication.

Key Reasons for Using a Structured Document

- Efficiency: A predefined layout saves time, allowing you to focus on your core work instead of formatting each document from scratch.

- Consistency: A consistent approach to presenting payment requests helps build trust with clients, ensuring they understand the terms and conditions every time.

- Clarity: A clear, well-organized document eliminates confusion and potential errors, reducing the risk of disputes.

- Professionalism: A polished and cohesive document reflects well on your brand, instilling confidence in clients.

Common Challenges Without a Standard Format

- Missing important details, such as payment terms or client information, which can cause delays.

- Difficulty tracking multiple transactions without a consistent approach, leading to administrative confusion.

- Increased time spent on creating documents manually instead of focusing on growing your business.

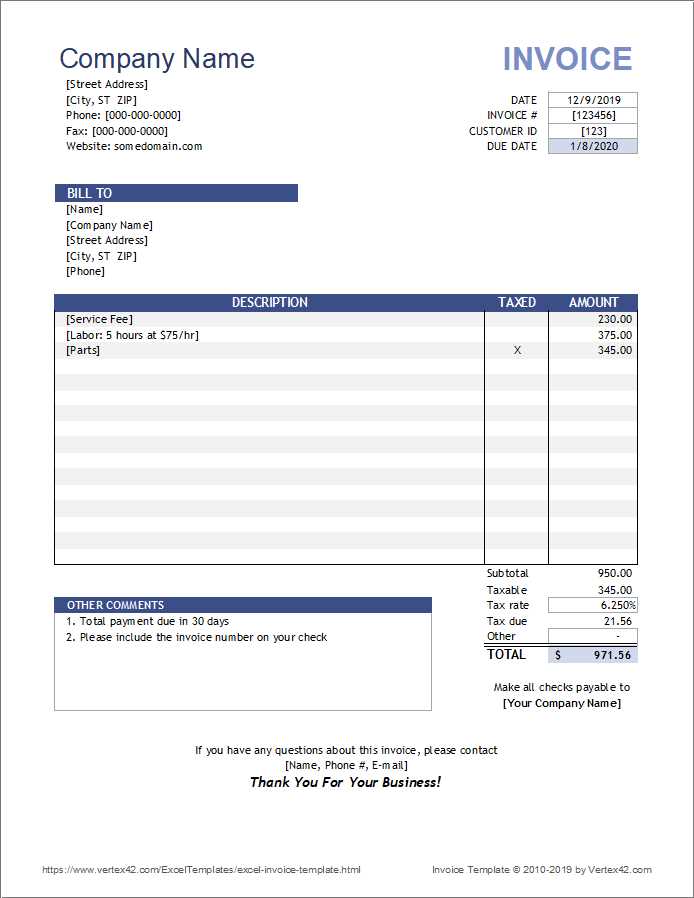

How to Customize Your Invoice Template

Personalizing a payment request document to suit your specific needs is an essential step in ensuring clarity and professionalism. By making simple adjustments, you can align the structure with your branding, the type of services offered, and client requirements. Customizing the layout allows you to reflect your business style while maintaining consistency in every transaction.

Key Customization Elements

| Customization Aspect | Explanation |

|---|---|

| Logo and Branding | Incorporate your logo and company colors to make the document instantly recognizable as part of your professional image. |

| Payment Terms | Adjust the payment due date, method, or any other specific conditions you wish to include for clients. |

| Service Details | Modify the description fields to match the services or products you provide, adding any additional charges or discounts. |

| Client Information | Ensure that all client details are accurate and include specific references or order numbers if necessary. |

Tips for Effective Customization

- Consistency: Keep the layout uniform across all documents for a professional and cohesive look.

- Simplicity: Avoid overcrowding the document with too much information; prioritize the most relevant details.

- Flexibility: Ensure that the format is adaptable to different types of transactions or client needs.

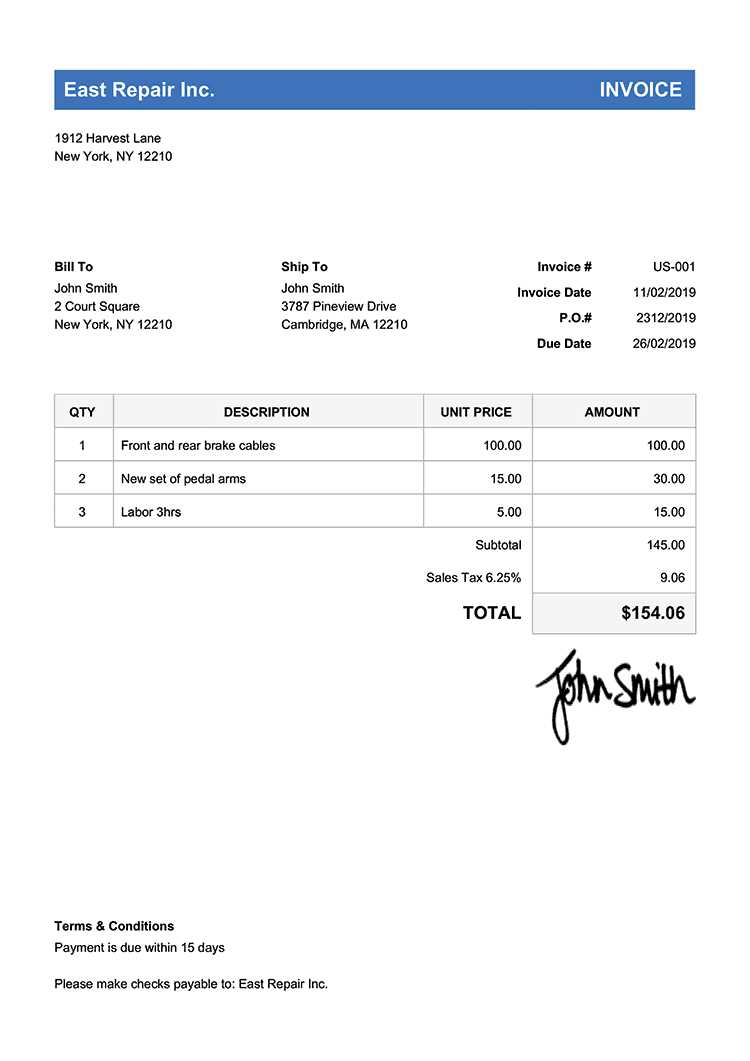

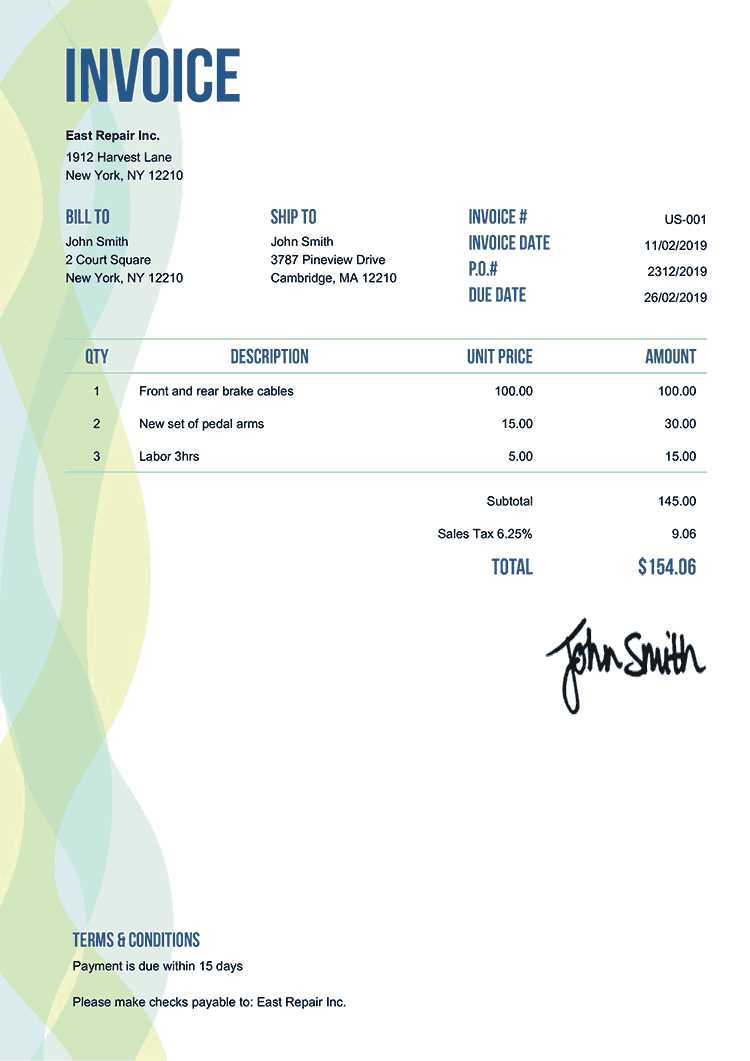

Key Features of a Business Invoice

Every formal document used to request payment needs to contain certain essential elements to ensure that all necessary information is communicated clearly and efficiently. These features help prevent misunderstandings, streamline the payment process, and establish a professional image. By including these critical components, you can create an effective and reliable financial document.

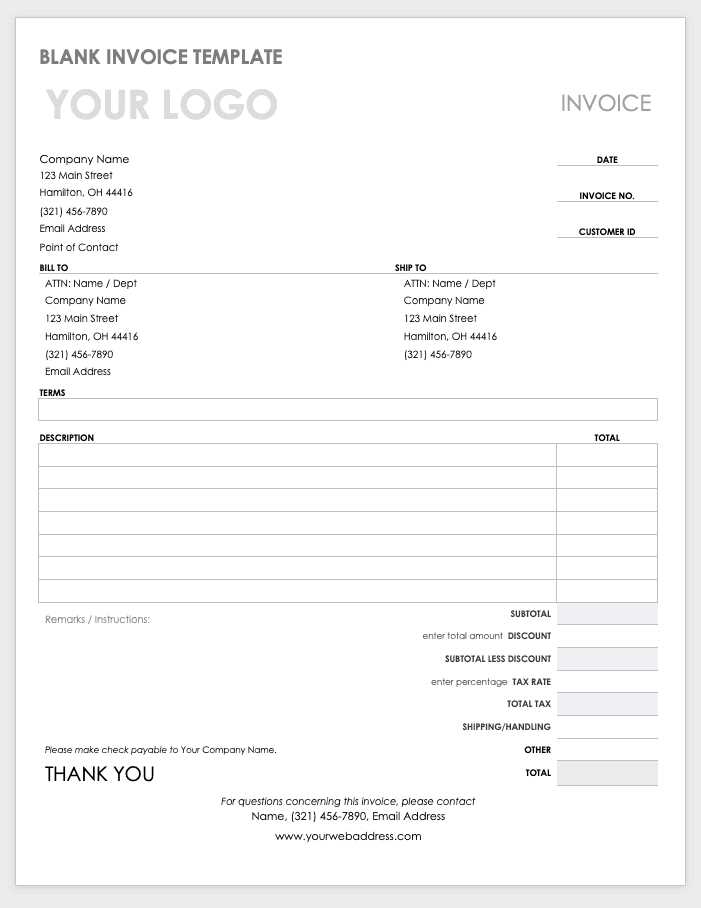

| Feature | Description |

|---|---|

| Header Information | Includes details such as your company name, logo, and contact information, as well as the recipient’s details, ensuring clear identification of both parties. |

| Unique Document Number | A specific reference number for the document, which aids in organization and tracking. |

| Date of Issue | The date when the payment request was created, which helps establish the timeline for payment terms. |

| Itemized List of Services or Goods | Detailed breakdown of the services or products provided, with quantities and unit prices, to avoid confusion. |

| Amount Due | The total amount owed, including applicable taxes, fees, or discounts, clearly presented for easy understanding. |

| Payment Terms | Clear instructions on how and when payment should be made, such as due dates and accepted payment methods. |

Best Practices for Sending Invoices

Sending payment requests efficiently is a key component of maintaining smooth financial operations. Ensuring that your documents are sent correctly and in a timely manner can reduce delays and foster stronger relationships with clients. By following a few essential practices, you can improve the effectiveness of your payment collection process.

Send Invoices Promptly: The sooner you send a request for payment, the sooner you can expect to receive it. Sending the document immediately after the completion of a project or delivery ensures that the payment process begins without unnecessary delays.

Use Clear and Professional Communication: Always accompany the payment document with a polite and professional message. Whether it’s via email or physical mail, ensure your message is courteous and straightforward, clearly stating the due date and payment details.

Ensure Accuracy: Double-check all details, including client information, service descriptions, amounts due, and dates. Mistakes in your documents can lead to confusion and delay payments. A well-organized request will facilitate prompt processing.

Send a Reminder: If a payment is overdue, it’s crucial to send a polite reminder. Sometimes clients simply forget, and a gentle follow-up can help them fulfill their obligations. Make sure the tone remains professional and understanding.

Offer Multiple Payment Options: Providing different ways for clients to pay–whether via bank transfer, credit card, or online payment services–can make the process easier and faster. The more convenient you make it for clients, the quicker you’ll receive your funds.

Free Templates vs Paid Invoice Solutions

When it comes to creating documents for requesting payments, you have two main options: using ready-made structures at no cost or investing in premium software that offers more advanced features. Both approaches have their benefits, but understanding the differences can help you choose the right solution for your needs. The decision often comes down to the level of customization, convenience, and support you require.

Advantages of Using Free Formats: Ready-made forms are a cost-effective solution for small businesses or freelancers just starting out. They provide a simple way to create structured payment requests without needing to invest in additional software. These documents are often easy to use and can be personalized to a degree, making them a quick and practical choice for those who don’t need extra features.

Limitations of Free Formats: While convenient, free solutions may have some limitations in terms of customization, support, or integration with other tools. For example, they might lack automated features like tracking payments or sending reminders, which can be important for businesses that manage a large volume of transactions.

Benefits of Paid Solutions: Premium software often offers a wider range of features, such as automation, recurring billing, and detailed reporting. These solutions can save time and reduce manual work, especially for companies with complex invoicing needs. Additionally, paid platforms often come with customer support, which can be valuable when issues arise or when you need technical assistance.

Choosing the Right Option: Ultimately, the choice depends on your specific needs. If you’re a freelancer or small business with straightforward billing requirements, a free solution may be sufficient. However, if you require more advanced features, or if you need to manage large-scale operations, investing in a paid platform could provide greater efficiency and long-term value.

How to Ensure Invoice Accuracy

Ensuring that your payment requests are accurate is essential to maintaining a professional reputation and avoiding delays in payments. Small errors in details such as amounts, client information, or services provided can lead to confusion or disputes. By carefully reviewing and following best practices, you can minimize the risk of mistakes and ensure smooth transactions with your clients.

Key Steps to Guarantee Accuracy

- Double-check Client Details: Verify the recipient’s name, address, and contact information before sending any documents. Ensure the data is correct to avoid confusion later.

- Review Service Descriptions: Make sure the descriptions of goods or services provided are accurate and clearly written, with no ambiguity in the terms.

- Confirm the Amount: Double-check the prices and quantities for each service or product listed. Ensure the totals are calculated correctly and reflect any applicable taxes or discounts.

- Verify Payment Terms: Ensure that the payment terms, such as the due date, method, and any penalties for late payments, are clearly stated and correct.

Final Review and Verification

Before sending any document, take the time to review all details one final time. This review should include checking all numbers, confirming the format, and ensuring that no critical information is missing. Having a second pair of eyes, whether a colleague or a team member, can also help spot potential errors that you might have overlooked.

Benefits of Using an Invoice Template

Utilizing a structured format for your payment requests offers numerous advantages, streamlining the entire process and ensuring consistency. By using a pre-designed layout, you can save valuable time while maintaining professionalism in every transaction. These formats not only help avoid common errors but also make it easier to track and manage your financial records.

Time Efficiency

One of the key benefits of using a pre-designed format is the time saved in creating a new document from scratch. With all the necessary fields already structured, you only need to input the relevant details for each transaction. This eliminates the need for repetitive formatting and ensures that every document adheres to a consistent layout.

Professional Appearance

Creating a polished, professional image: A consistent and well-organized layout reflects positively on your brand. Using a standard format enhances your credibility and ensures that clients understand the details of the transaction at a glance. A clean, easy-to-read document also makes it simpler for clients to process payments, potentially reducing delays.

Minimized Errors

Reducing mistakes: Pre-designed formats help eliminate common errors, such as missing details or incorrect calculations. With the basic structure in place, there’s less room for oversight. This contributes to smoother transactions and a more reliable financial record-keeping system.

Where to Find Free Invoice Templates

For those seeking simple and effective ways to generate payment requests, there are numerous resources available online. Whether you’re a freelancer or a small business owner, you can find a wide variety of pre-designed forms that suit different industries and needs. These options can be accessed through a number of platforms, ensuring that you can easily find a solution that fits your requirements.

Online Platforms and Websites

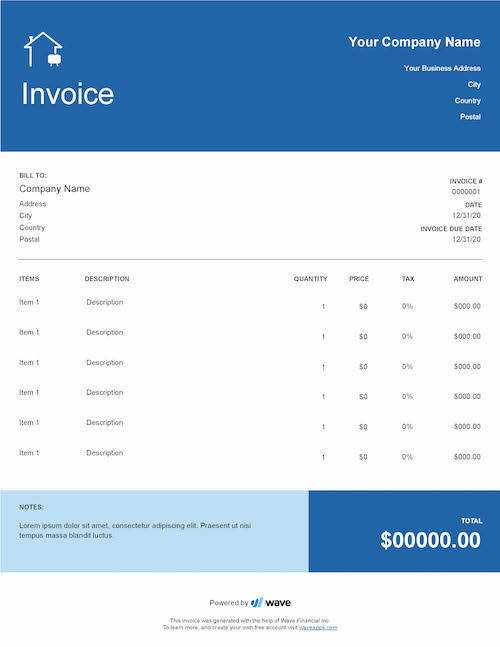

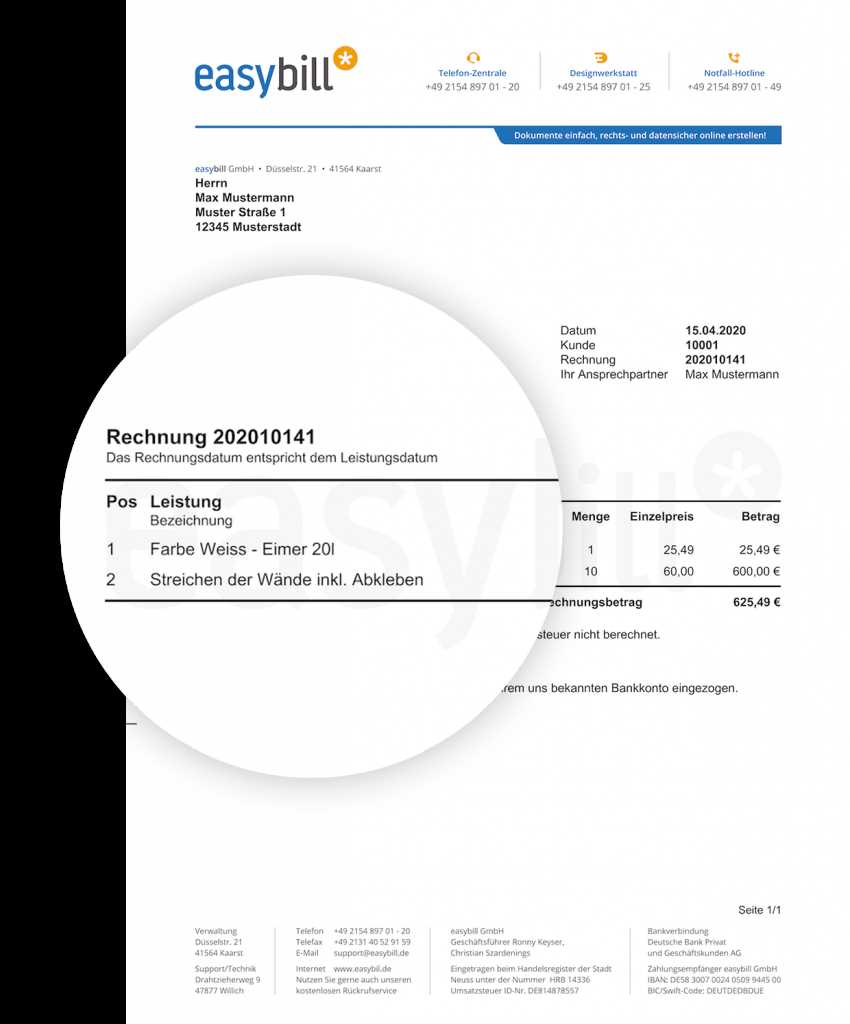

Specialized Websites: Many websites offer downloadable forms for creating professional financial documents. These sites typically provide a range of options, from basic designs to more detailed layouts. Some well-known platforms include Canva, Microsoft Office Templates, and Google Docs, which all offer free downloads and easy customization.

Software Tools and Applications

Accounting Software: Several accounting tools come with pre-built layouts that help generate payment requests. These programs often allow users to customize the format to their liking while providing advanced features such as payment tracking and reminders. Some free options in this category include Wave and Zoho Invoice.

Open-Source Resources

Open-Source Communities: Open-source platforms like GitHub often have repositories where users can share their own designs. These resources are free to use and allow for further customization depending on your needs. By exploring these, you can access a wide range of options created by other users.

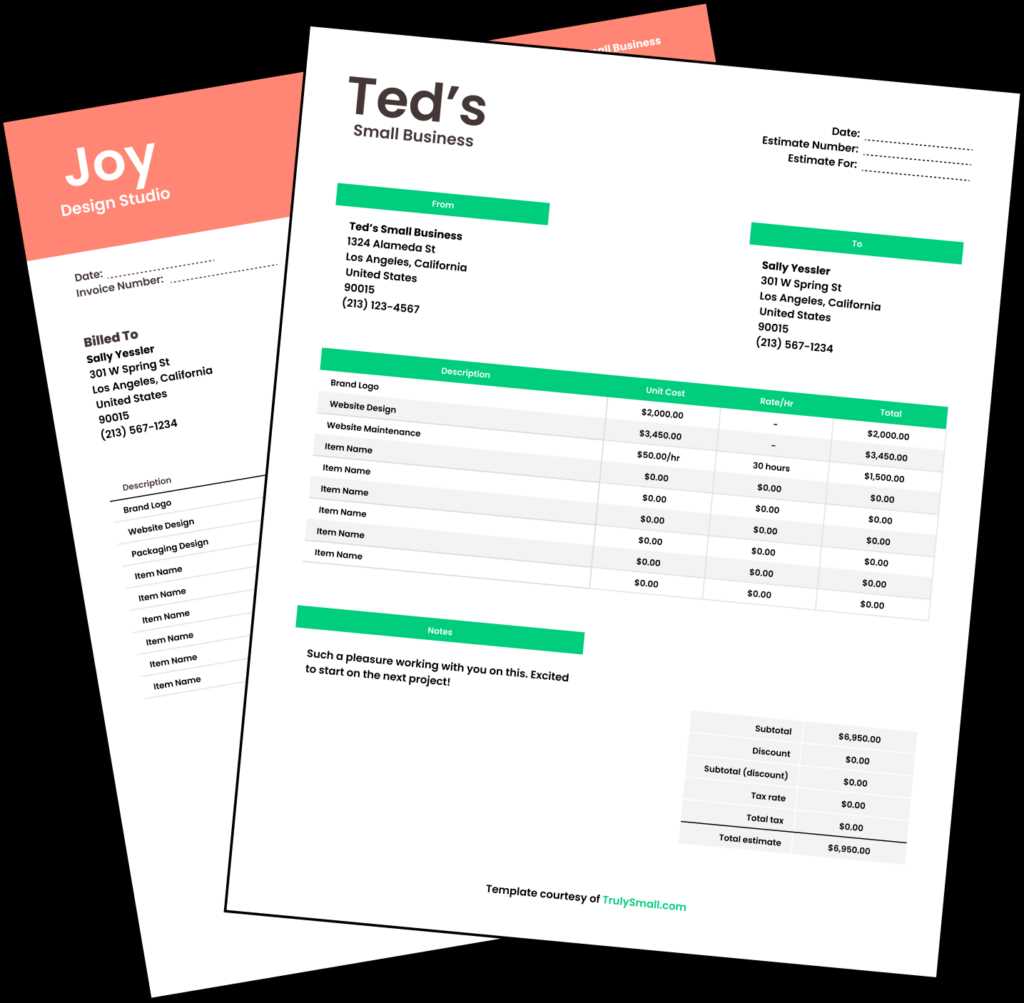

Choosing the Right Template for Your Business

Selecting the right document layout is crucial for ensuring smooth transactions and maintaining professionalism in your operations. The right structure not only helps you organize the necessary details but also ensures clarity and consistency for your clients. Different industries and services may require distinct features, so it’s important to pick the option that best aligns with your needs.

Factors to Consider When Choosing

- Industry Requirements: Certain sectors may have specific needs, such as legal or healthcare-related details, that should be included in the payment document. Tailor your format to meet the common expectations of your field.

- Level of Detail: If your transactions are straightforward, a simple structure with minimal fields may be sufficient. For more complex services, you may need a more detailed layout that includes itemized charges and additional information.

- Design and Professionalism: The overall look of your document should match the tone and branding of your services. A clean, professional design enhances the perception of your company and ensures clients take your payment request seriously.

- Customization and Flexibility: Choose a structure that allows you to easily edit and adjust fields as necessary. Whether you need to add discounts, taxes, or other charges, ensure the format can accommodate changes without disrupting the layout.

Where to Look for the Right Option

Many online resources offer a wide selection of styles for various industries. By exploring multiple platforms, you can find a solution that offers the features and flexibility you need. Consider browsing through popular tools such as Canva, Google Docs, or specialized accounting software platforms to find the perfect match for your needs.

Common Mistakes to Avoid in Invoices

When creating a request for payment, small mistakes can lead to significant issues, including delayed payments or disputes with clients. Ensuring that your document is accurate and clear is crucial for maintaining a professional reputation and keeping financial operations smooth. Being aware of common errors can help prevent problems and ensure that all transactions are processed efficiently.

Key Mistakes to Watch Out For

- Incorrect Client Information: Double-check all client details, including names, addresses, and contact information. Even small discrepancies can lead to confusion or missed payments.

- Missing Payment Terms: Clearly state the due date, payment method, and any penalties for late payments. Omitting these details can lead to misunderstandings and delays.

- Errors in Pricing: Always review the pricing for each item or service. Incorrect calculations, overlooked discounts, or missed taxes can cause the client to question the charges.

- Omitting a Unique Identifier: Ensure each document has a unique reference number. This helps both you and your client track the transaction and prevents confusion if there are multiple transactions over time.

- Unclear or Vague Des

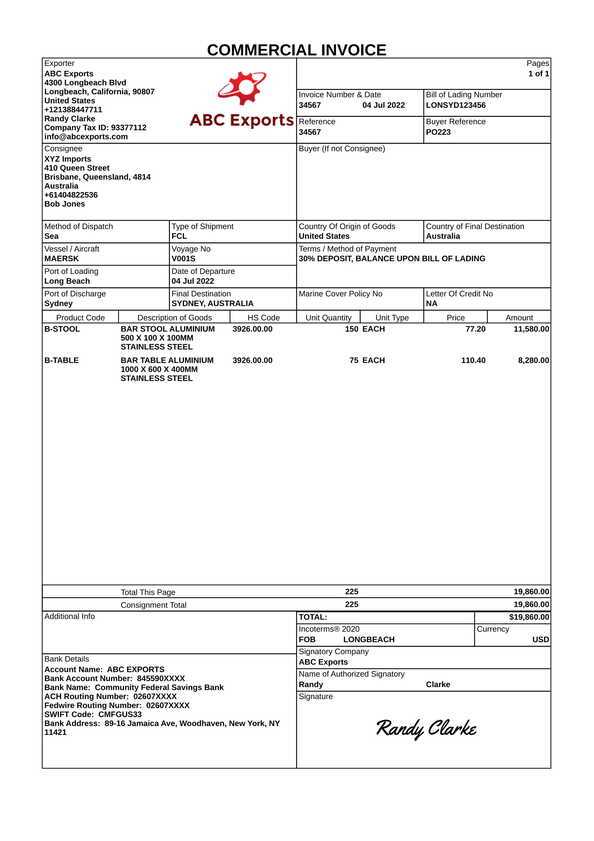

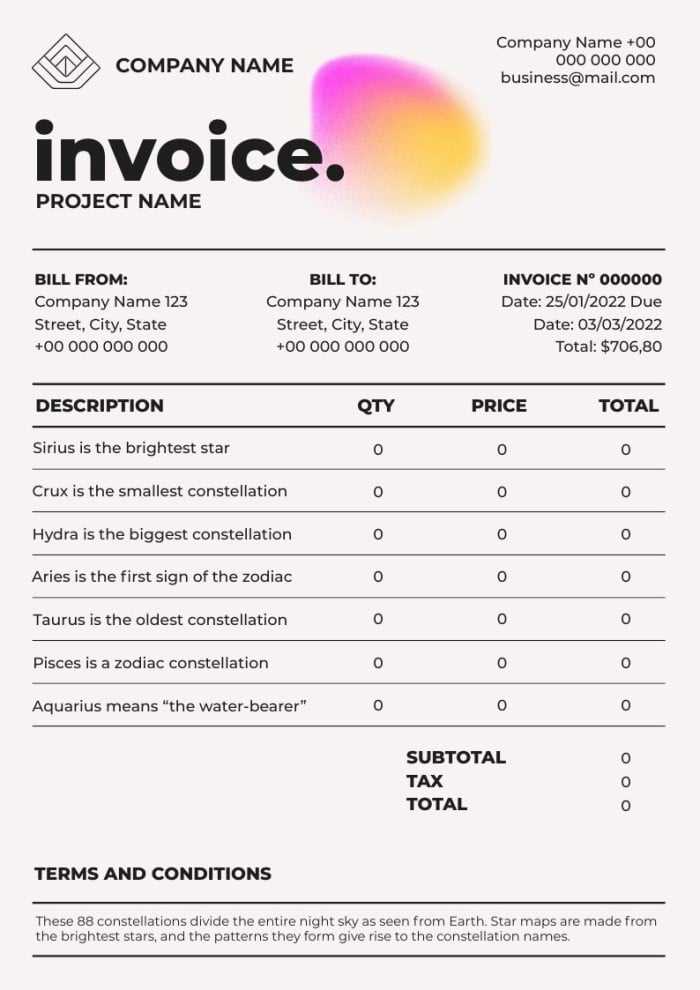

How to Add Tax Information to Invoices

Incorporating tax details into your payment requests is essential for compliance and transparency. Properly including tax information ensures that clients are fully aware of the total amount due, including any applicable taxes. It also helps you maintain clear records for accounting purposes, reducing the risk of disputes and simplifying your tax reporting process.

Steps to Add Tax Information

To ensure accuracy, follow these steps when adding tax details to your document:

- Determine the Tax Rate: Identify the applicable tax rate for your goods or services based on local regulations or your client’s location.

- Specify the Tax Amount: Clearly calculate the tax amount for each item or service provided and display it alongside the total.

- Include Tax Registration Information: Some regions require businesses to include their tax ID number or registration information on the payment request. Be sure to include this if necessary.

- Use Clear Tax Labels: Use clear labels such as “Sales Tax” or “VAT” to avoid confusion. Include the percentage rate next to the label.

Example of Tax Information on a Payment Request

Item Description Amount Tax Rate Tax Amount Service A $100 10% $10 Service B $50 10% $5 Total $150 $15 Keep records: Always retain copies of documents that include tax details for your financial records and tax filings.

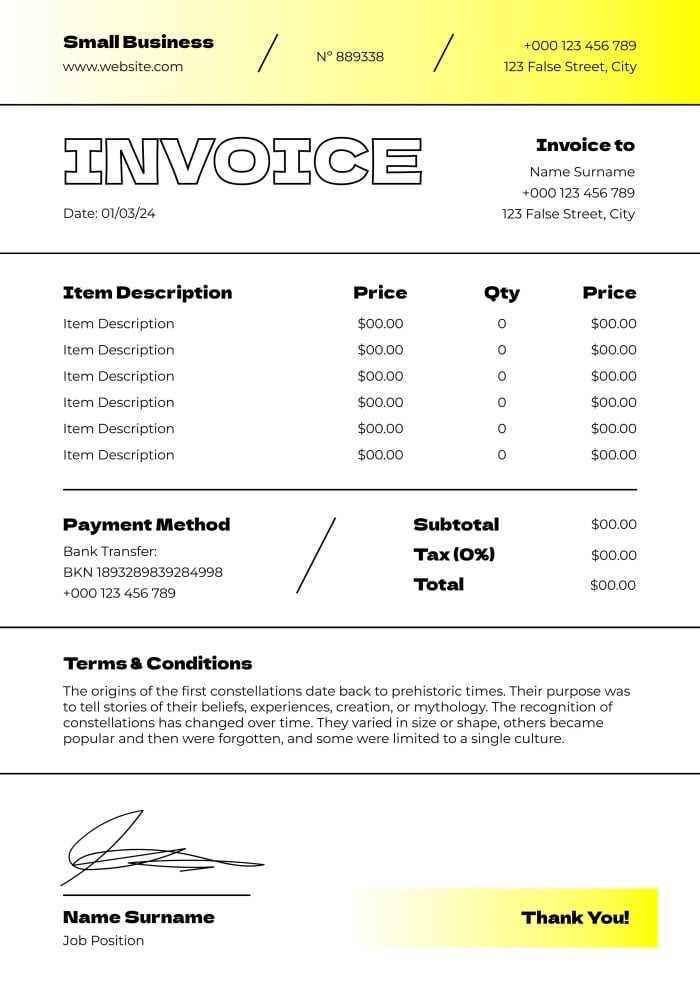

Invoice Design Tips for a Professional Look

A well-designed payment request not only conveys professionalism but also ensures that clients can easily understand the details of the transaction. A clean and organized layout enhances the overall experience for the client and encourages prompt payments. Paying attention to the design elements can help establish your credibility and strengthen your business relationships.

Key Design Elements to Consider

- Use Clear Branding: Include your logo and business name prominently at the top. This establishes your identity and makes your document easily recognizable.

- Maintain Consistency: Stick to a consistent color scheme and font style. This makes your request visually cohesive and reflects your attention to detail.

- Ensure Readability: Choose fonts that are easy to read, such as sans-serif fonts. Avoid using too many different font sizes or colors, as this can make the document look cluttered.

- Organize Information Effectively: Divide your content into clear sections with headings for each. This makes it easier for clients to navigate and understand the document quickly.

- Incorporate Ample White Space: Allow for enough empty space between sections and text blocks. A crowded layout can overwhelm the reader, while white space helps to create a balanced and polished look.

Examples of Professional Design Features

Header: The header should include your business name, logo, and contact information. This ensures that your client has all your details easily available.

Body Layout: Use tables or lines to separate each section, such as item descriptions, amounts, and totals. This makes the request easy to follow.

Footer: Include your payment terms, banking details, and any additional contact information in the footer to keep the main body uncluttered.

By focusing on a clean and professional design, your payment requests will stand out and leave a lasting impression on your clients.

How to Manage and Track Invoices

Effectively handling and monitoring your payment requests is crucial for maintaining smooth financial operations. By organizing and keeping track of each document, you can avoid missed payments, ensure timely follow-ups, and stay on top of your cash flow. Proper management also simplifies accounting and reporting processes, making your business more efficient.

Steps for Efficient Management

- Use a Centralized System: Keep all your records in one place, whether it’s a software tool or a physical filing system. This ensures you can quickly access any document when needed.

- Track Payment Status: Record the payment status of each request. Mark documents as “paid,” “unpaid,” or “overdue” to easily see what actions need to be taken.

- Set Up Payment Reminders: Automate reminders for overdue payments. This keeps your clients informed and helps you stay proactive about follow-ups.

- Keep Detailed Notes: Add notes or comments to your records regarding payment terms, communication with clients, or any special arrangements made. This will help you stay organized and avoid misunderstandings.

Tracking Tools and Methods

Utilizing software or spreadsheets can greatly enhance the tracking process. Some tools allow you to:

- Generate reports: Easily analyze outstanding payments and trends over time.

- Automate follow-ups: Set up automatic reminders for both you and your clients.

- Integrate with accounting: Seamlessly connect payment tracking with your accounting system for smoother financial management.

By establishing a reliable system for managing and tracking payments, you can minimize errors, reduce delays, and improve your financial organization overall.

Invoice Terms and Payment Methods Explained

Understanding the key terms and payment methods associated with financial documents is essential for smooth transactions and timely settlements. Clear communication of these elements ensures both parties are aligned on expectations and payment schedules. By defining terms such as due dates, late fees, and accepted payment methods, you can avoid confusion and create a more efficient billing process.

Common Terms Used in Payment Requests

- Due Date: The date by which payment is expected. Clear due dates help both parties manage expectations and prevent delayed payments.

- Net Terms: This refers to the amount of time a client has to pay. For example, “Net 30” means payment is due within 30 days of receiving the request.

- Late Fee: An additional charge applied if payment is not made by the due date. Including this term encourages timely payments.

- Discount for Early Payment: Offering a small discount for clients who pay early can be an effective incentive to speed up the payment process.

Popular Payment Methods

Payment methods can vary based on your client’s preferences and your business operations. Common options include:

- Bank Transfer: A direct transfer from the client’s bank account to yours. This method is secure and widely used for larger payments.

- Credit/Debit Cards: Convenient for both parties, especially for online transactions. Many payment processors offer secure gateways for this method.

- Checks: Traditional but less commonly used today. Ensure you provide the correct information for clients who prefer this option.

- Digital Payment Systems: Tools like PayPal, Stripe, or other online platforms are increasingly popular due to their convenience and speed.

Clearly outlining these terms and payment methods on your financial requests helps to ensure that both you and your clients are aware of the conditions and available options, making the payment process smoother and more predictable.

How to Convert Templates for Different Software

Converting document layouts for compatibility with different software tools is an essential task for ensuring your files are accessible and functional across various platforms. Whether you’re working with spreadsheets, word processors, or specialized programs, the ability to adapt your designs to different formats can save time and prevent formatting issues.

Understanding File Formats and Software Compatibility

When converting documents, it’s important to understand the different file types supported by various software programs. Each program may have its own preferred format, and compatibility between these can vary. Here are some common file types and their corresponding software:

File Type Common Software PDF Adobe Acrobat, Google Docs, Microsoft Word Excel (.xls, .xlsx) Microsoft Excel, Google Sheets, LibreOffice Calc Word (.docx) Microsoft Word, Google Docs, OpenOffice CSV Microsoft Excel, Google Sheets, LibreOffice Calc Steps to Convert Your Document

To successfully convert your file, follow these simple steps:

- Choose the correct software: Determine which program or platform your recipient or team member will use and select the most compatible format.

- Save or export your file: In most programs, you can either save the document in the desired format or use the “Export” option to convert it.

- Check formatting: After conversion, always review the document to ensure the layout, fonts, and data align correctly.

- Test the file: Open the converted file in the target software to verify that it works seamlessly and the content is intact.

Converting documents properly ensures that your designs remain consistent and functional, no matter what softwa