Download and Customize Your Lodging Invoice Template

When providing lodging services, it’s essential to have an efficient system for generating accurate and professional documents for your guests. These records serve as a detailed summary of the stay, listing the charges, taxes, and additional fees incurred during the visit. By utilizing a clear, organized format, you ensure smooth communication with guests and streamline your business operations.

Whether you’re managing a hotel, a bed and breakfast, or short-term rentals, having a reliable structure to create these documents is crucial. It allows you to maintain consistency in your financial transactions and enhances guest satisfaction by providing them with easy-to-understand billing summaries. A well-designed document can also help with record-keeping and simplify tax filing, making it an indispensable tool for any accommodation provider.

In this guide, we will explore how to craft these essential documents, covering the key elements they should include, ways to personalize them for your needs, and tips for ensuring they are both accurate and professional. With the right approach, you can create documents that not only meet legal and business requirements but also improve your guest’s experience.

Understanding the Importance of Accommodation Billing Records

In the hospitality industry, clear and well-structured billing documentation plays a crucial role in maintaining transparency between service providers and guests. These financial records are more than just a list of charges; they serve as an essential tool for both businesses and customers to track payments, resolve disputes, and ensure that all transactions are properly accounted for.

Having accurate and professional billing documents is important for several reasons:

- Clarity and Transparency: Providing a detailed breakdown of costs ensures guests understand exactly what they are paying for and why.

- Legal Compliance: Depending on the location, businesses may be required by law to provide specific documentation for accommodation services.

- Tax and Financial Tracking: Proper records help both businesses and clients track expenses for tax reporting and budgeting purposes.

- Customer Satisfaction: A well-prepared billing record fosters trust and professionalism, leading to positive guest experiences.

For accommodation providers, these documents also serve as a tool for financial management. They help businesses keep track of revenue, manage refunds or adjustments, and streamline accounting processes. By creating well-organized and consistent records, providers can avoid errors, reduce misunderstandings, and maintain a smooth operation.

Ultimately, having a proper system in place for generating and managing these documents not only enhances customer trust but also ensures that businesses remain organized and efficient in their financial practices.

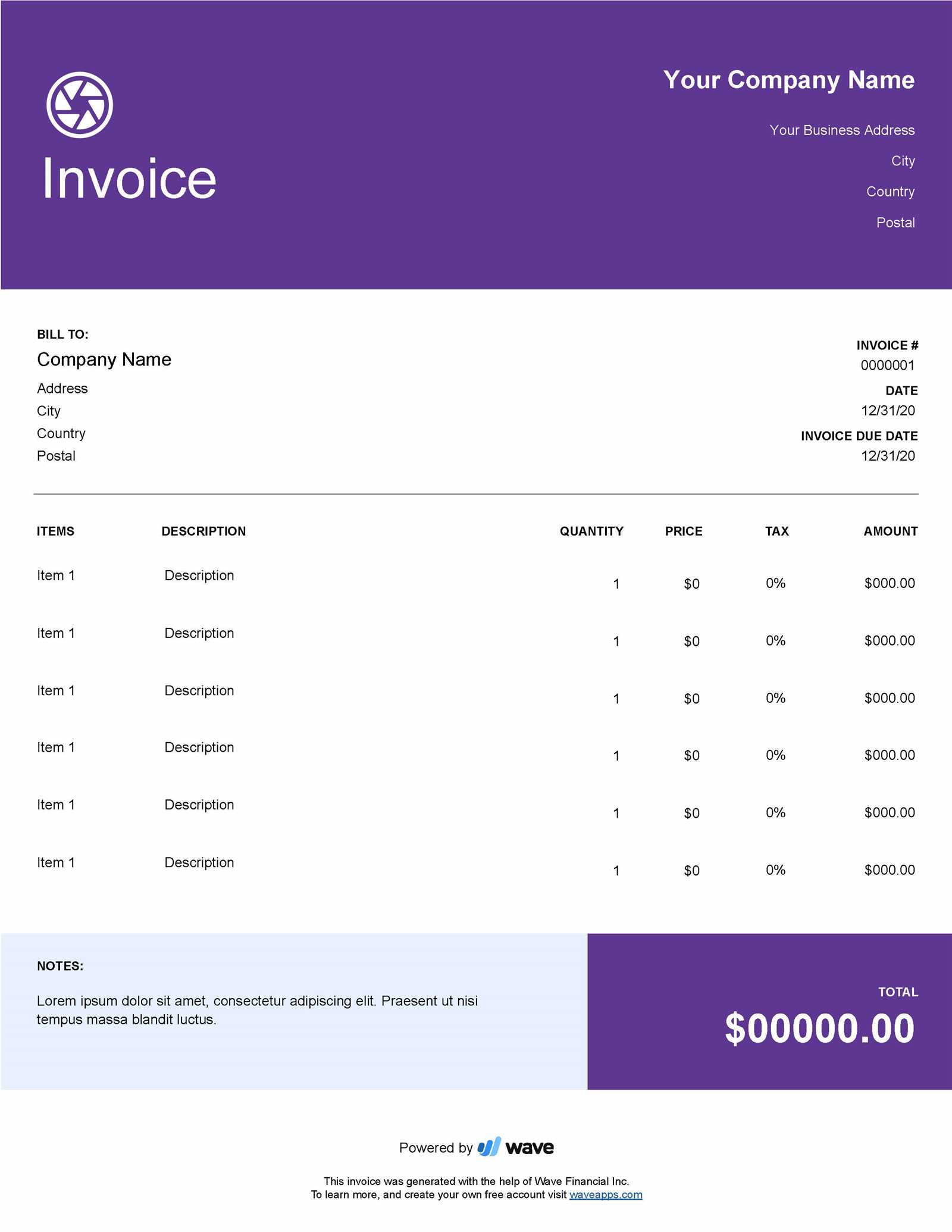

What is an Accommodation Billing Document Format

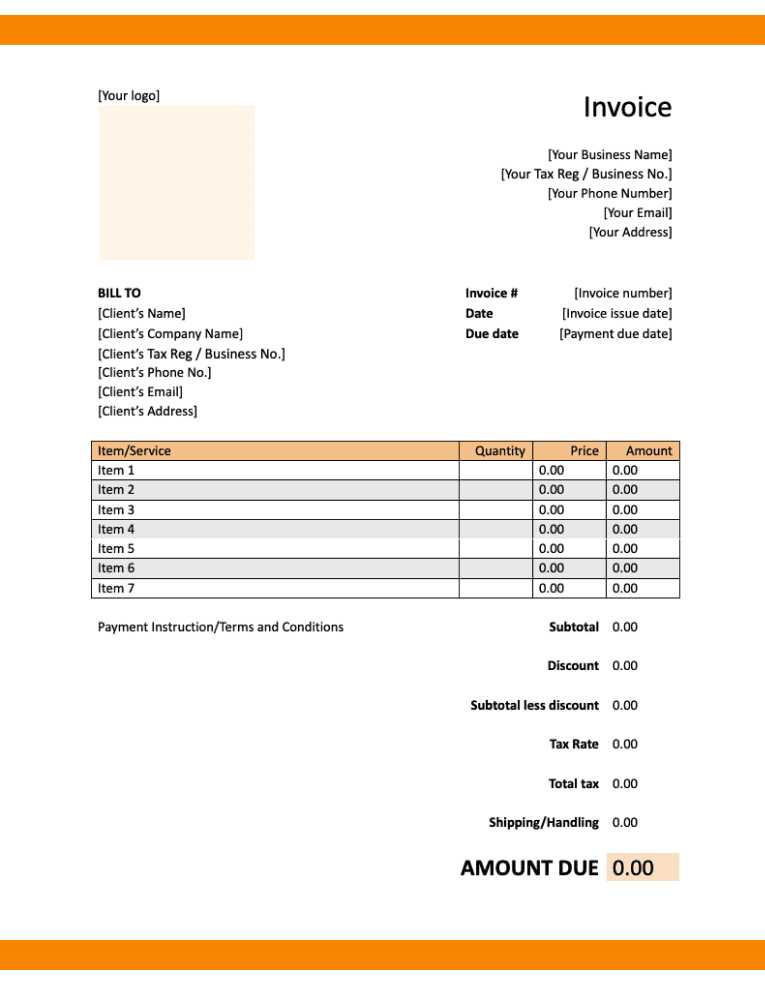

An accommodation billing document format is a pre-designed structure that simplifies the process of creating professional and accurate billing records for guests. It provides a consistent layout, ensuring that all necessary details are included, such as charges, taxes, and any additional fees. This format can be customized to meet the specific needs of the business, making it easier for service providers to generate and manage documents efficiently.

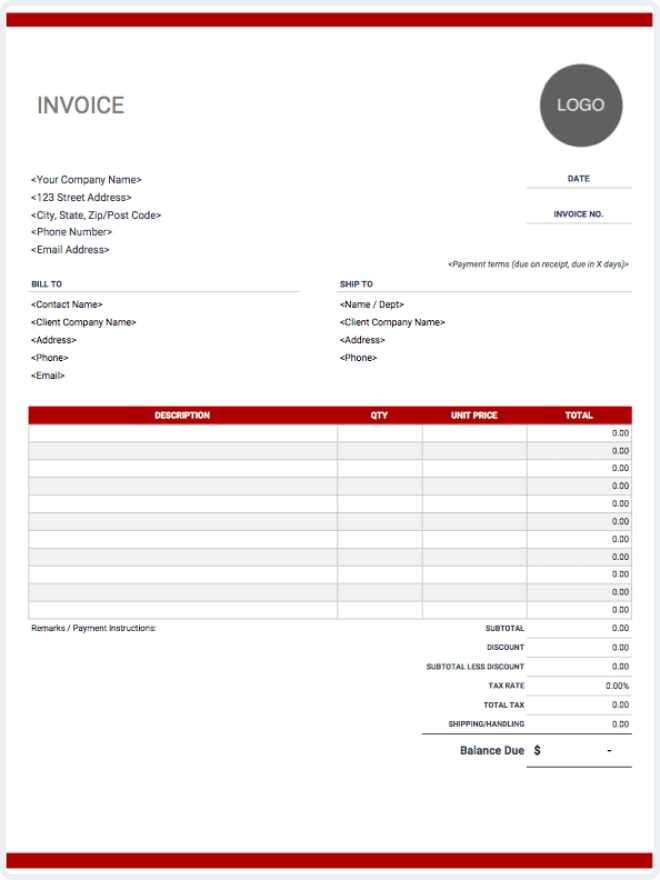

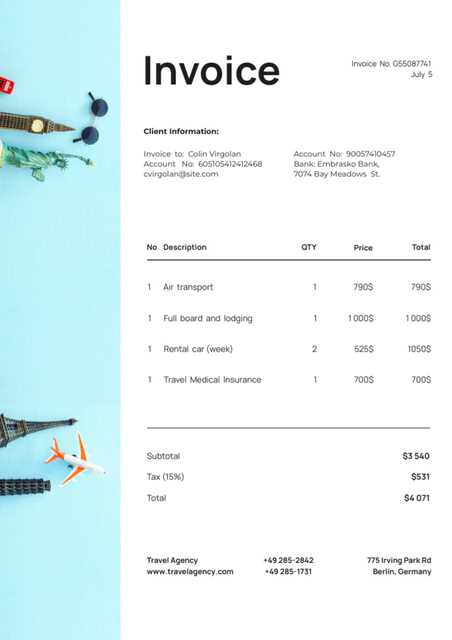

Key Features of an Accommodation Billing Document

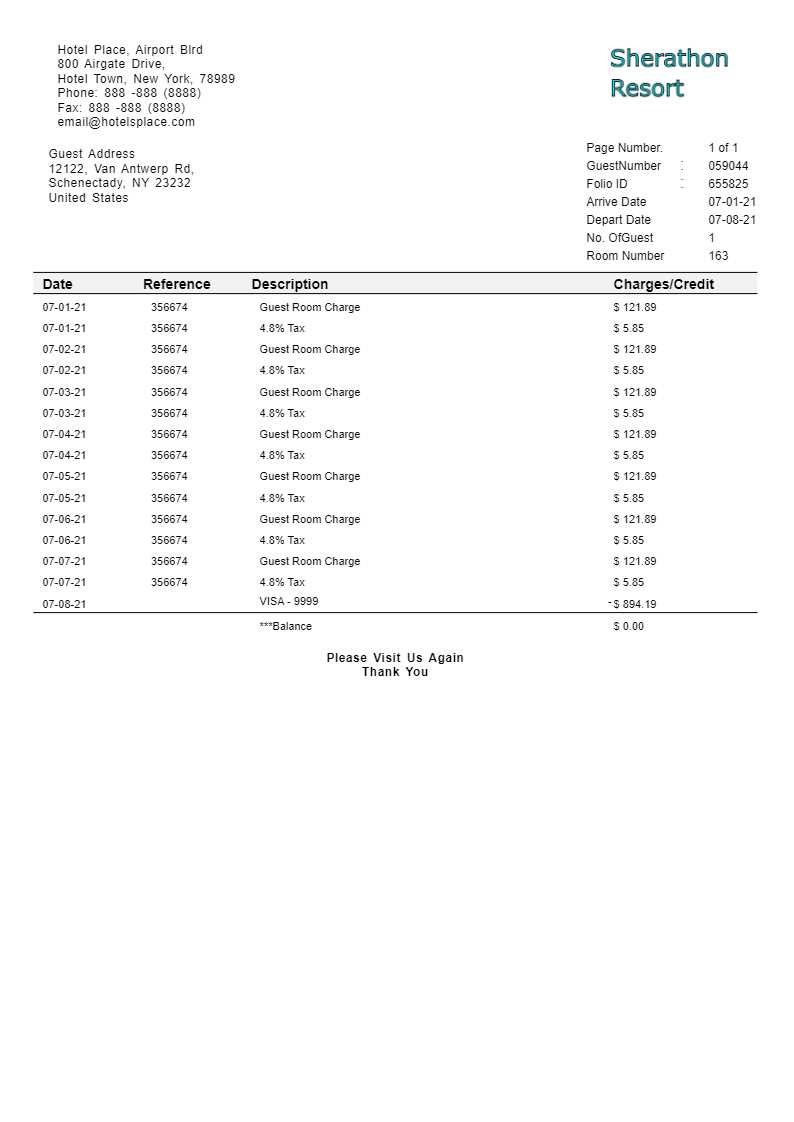

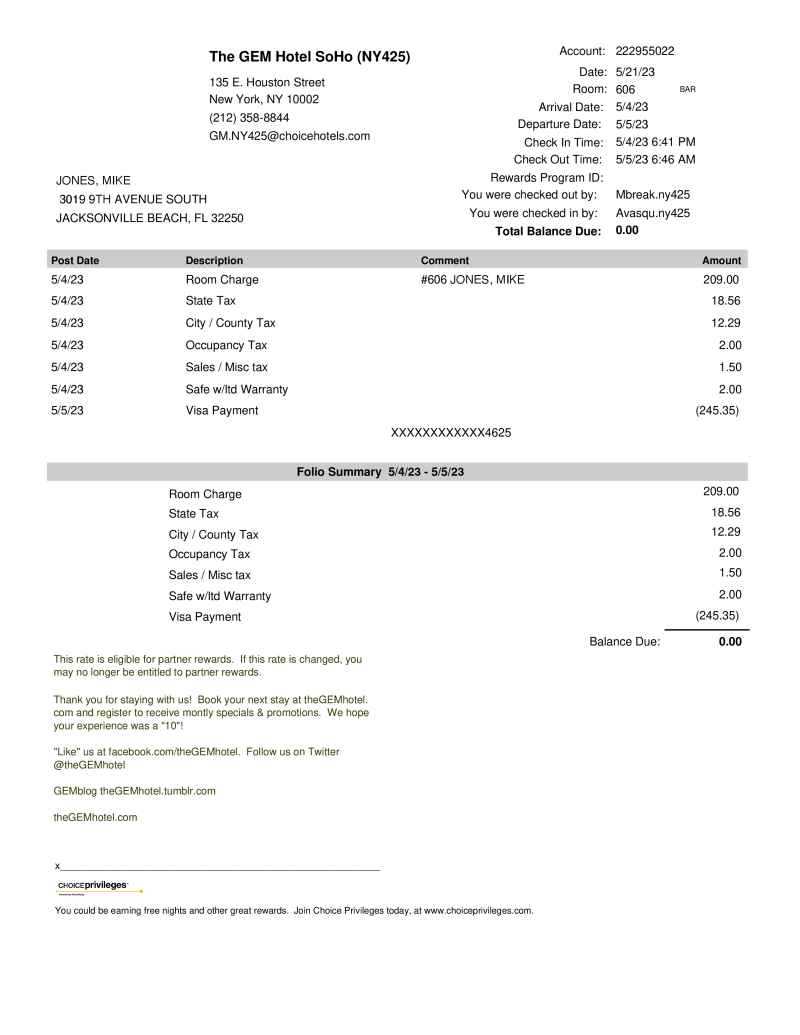

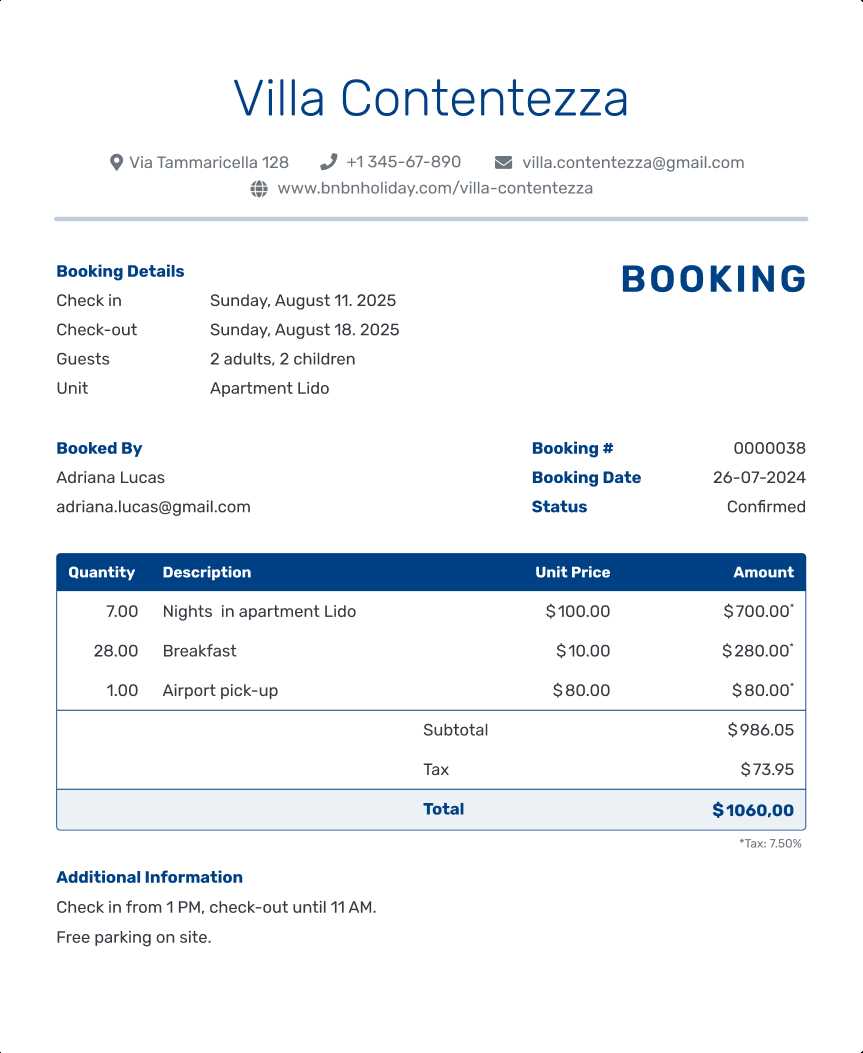

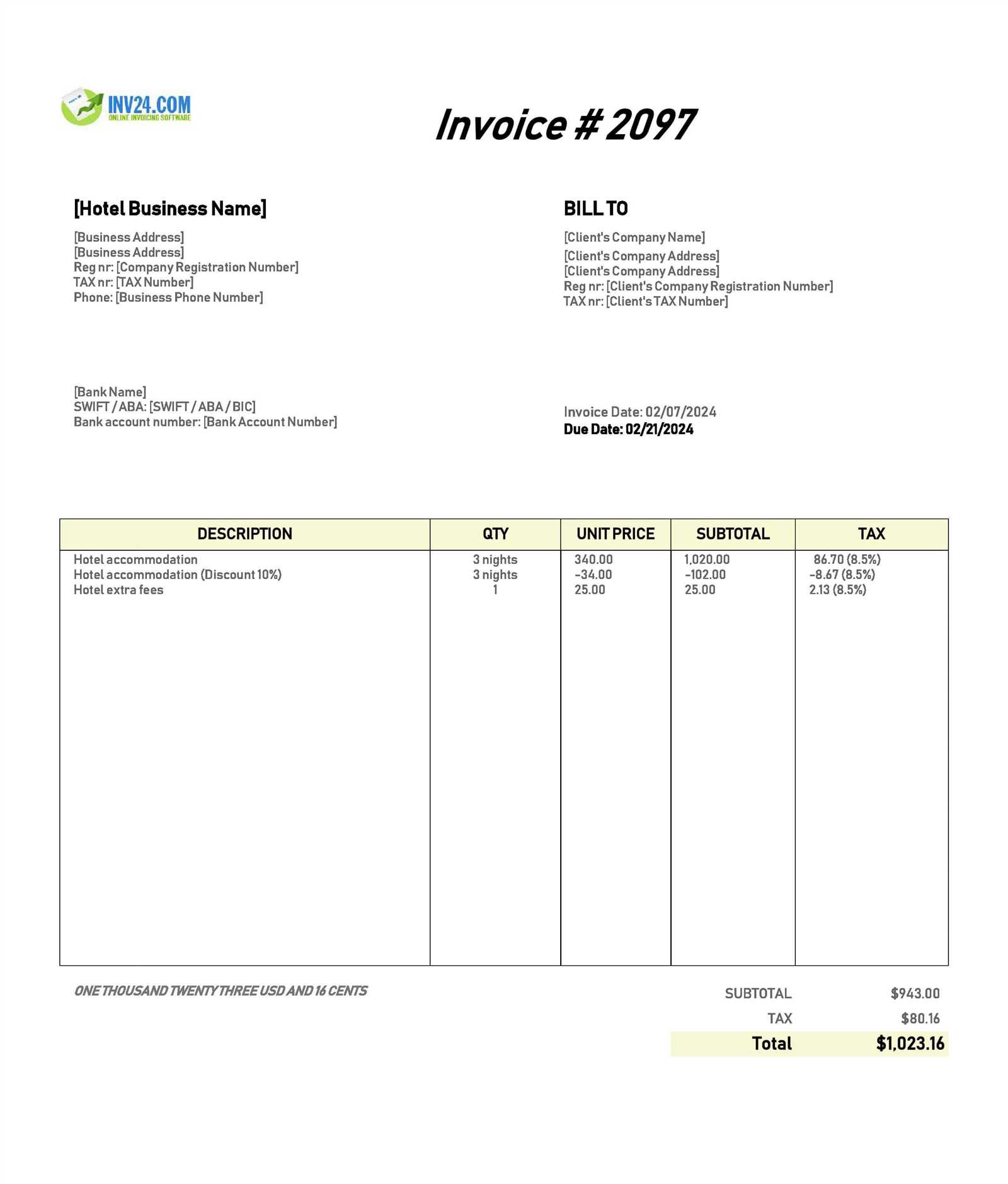

The format typically includes several key elements to ensure all essential information is captured. These elements help both businesses and guests review and verify charges quickly and clearly. Some of the most important features include:

- Guest Information: Name, address, and contact details of the guest.

- Service Details: Dates of stay, room type, and any special requests or services provided.

- Itemized Charges: A detailed breakdown of costs, including accommodation, taxes, and additional fees.

- Payment Summary: Total amount due, any deposits or pre-payments made, and outstanding balance.

Why Use a Standardized Billing Document

Using a standardized format offers several advantages for both the accommodation provider and the guest. It reduces the risk of errors, ensures all necessary information is included, and speeds up the process of generating and distributing records. Additionally, it helps maintain professionalism and consistency across all financial documentation, which can enhance guest trust and satisfaction.

Overall, an accommodation billing document format is a valuable tool for managing transactions efficiently while providing a transparent, accurate record for both parties involved.

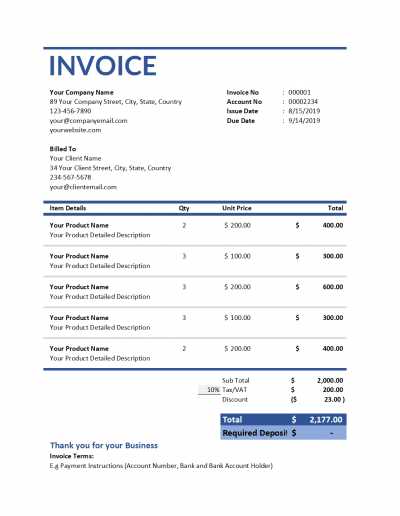

Key Elements of an Accommodation Billing Record

A well-structured accommodation billing record includes several essential components that ensure clarity and accuracy in financial transactions. These key elements help both the service provider and the guest easily review the charges, understand the details, and ensure that all payments are accounted for. Each part of the record serves a specific purpose in making the transaction transparent and professional.

Essential Components of a Billing Document

When creating a billing record, it is important to include the following elements to ensure completeness and accuracy:

- Guest Information: This includes the full name, contact details, and any other relevant guest information to ensure the document is properly attributed.

- Accommodation Details: Dates of stay, type of room or accommodation provided, and any additional services (e.g., meals, amenities) are important for providing a complete breakdown of the guest’s experience.

- Charge Breakdown: A detailed list of all costs, including the nightly rate, taxes, fees, and any other charges incurred during the stay.

- Payment Information: Include details of the total amount due, any payments made in advance, and the outstanding balance if applicable.

- Business Information: The service provider’s name, contact information, and sometimes a tax identification number or business registration details for legal and accounting purposes.

Additional Optional Information

Depending on the type of service and the specific needs of the guest, there are additional details that can be included to make the billing record even more informative:

- Booking Number: A unique reference number to help track the reservation in the system.

- Payment Method: Indication of how the guest paid for the stay, whether by credit card, bank transfer, or another method.

- Cancellation or Refund Policies: If applicable, details regarding cancellation terms, refunds, or adjustments to the bill.

Incorporating all of these key elements ensures that the billing record is clear, complete, and easily understood by all parties involved. It helps maintain transparency and can be crucial for accounting, customer service, and legal purposes.

Benefits of Using a Standardized Billing Format

Using a standardized format for generating accommodation records offers several advantages for both businesses and their guests. This structured approach ensures consistency, reduces errors, and helps streamline financial transactions. By relying on a ready-made structure, accommodation providers can save time, improve accuracy, and maintain professionalism in their billing process.

Time Efficiency and Accuracy

One of the primary benefits of using a predefined billing format is the time saved in creating records. Instead of starting from scratch for each guest, businesses can fill in the relevant details in a consistent format. This reduces the likelihood of missing important information or making calculation errors, ensuring that the financial records are both accurate and complete.

Improved Customer Experience

A well-organized document not only simplifies the process for the business but also enhances the guest’s experience. A professional, clear, and itemized breakdown of charges fosters trust and transparency, which can improve customer satisfaction and loyalty. Guests are more likely to appreciate the clarity and professionalism in their financial records, leading to better reviews and repeat visits.

| Benefit | Description |

|---|---|

| Consistency | Using a standardized structure ensures all billing records look uniform and contain the same essential details. |

| Efficiency | Quickly generate accurate records without the need for manual calculations or formatting from scratch. |

| Professionalism | A neat, organized document reflects well on the business, enhancing its reputation. |

| Transparency | Guests can easily see all charges and fees, making them feel more comfortable with the transaction. |

By utilizing a ready-made format for accommodation billing, businesses can reduce administrative workload while improving service quality. This leads to more efficient operations, better financial management, and stronger relationships with customers.

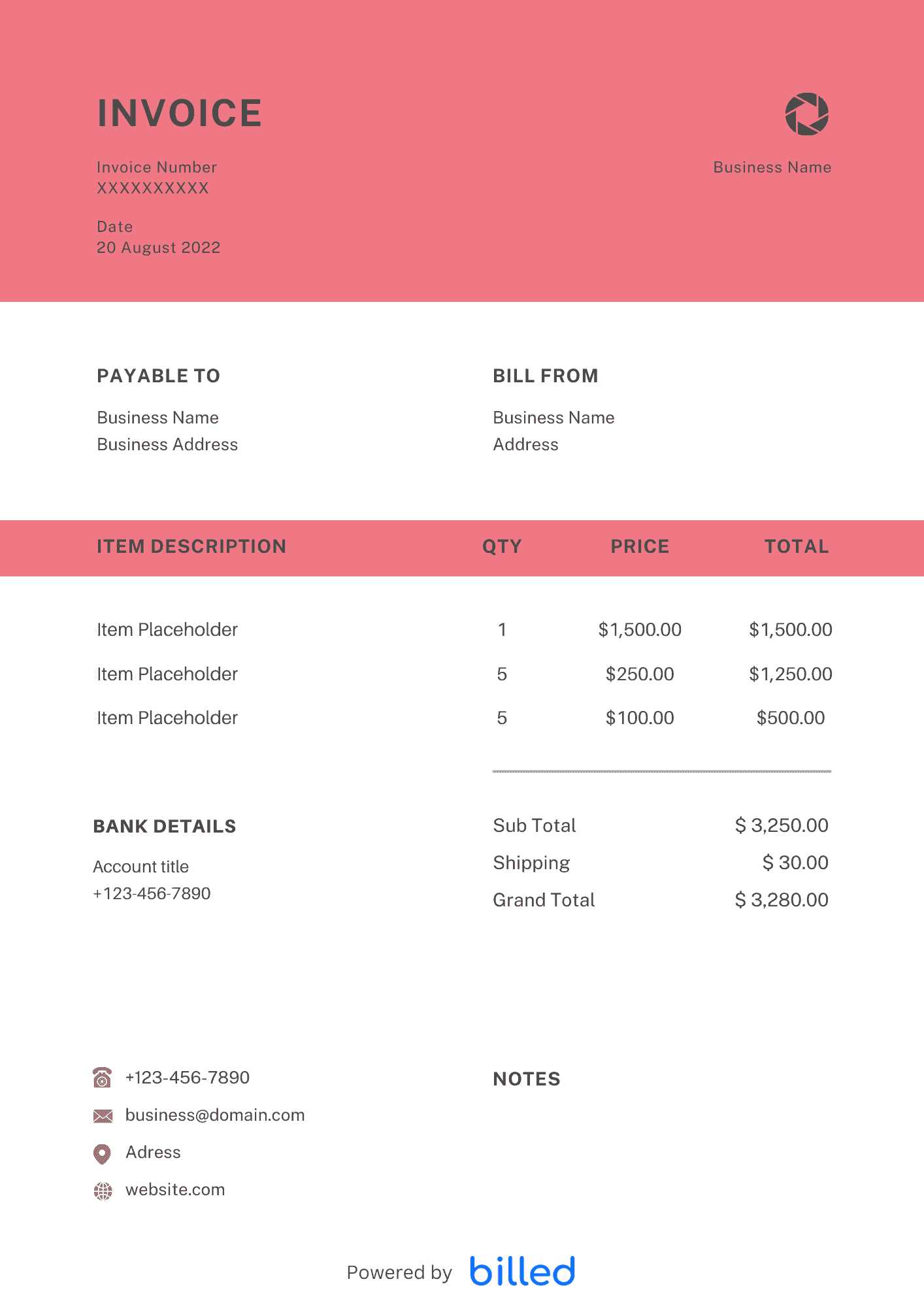

How to Customize Your Accommodation Billing Document

Customizing your accommodation billing document allows you to tailor it to the specific needs of your business and ensure that all necessary details are included. By modifying the structure, design, and content of the document, you can make it more professional, clear, and reflective of your brand. Personalizing the document not only improves the guest experience but also helps maintain consistency across all transactions.

Steps to Personalize Your Billing Record

Customizing your billing document involves a few simple steps. Here are the key areas you should focus on to create a document that meets your business needs:

- Business Branding: Include your business logo, name, and contact details at the top of the document to reinforce your brand identity.

- Guest Information: Ensure the guest’s name, contact information, and reservation details are clearly visible.

- Charge Breakdown: Adjust the itemized list of services to reflect any special offerings, discounts, or fees specific to your business.

- Payment Terms: Add any payment instructions or terms that apply, such as due dates, late fees, or accepted payment methods.

- Legal Requirements: Make sure to include any legal information required by local regulations, such as tax identification numbers or other compliance details.

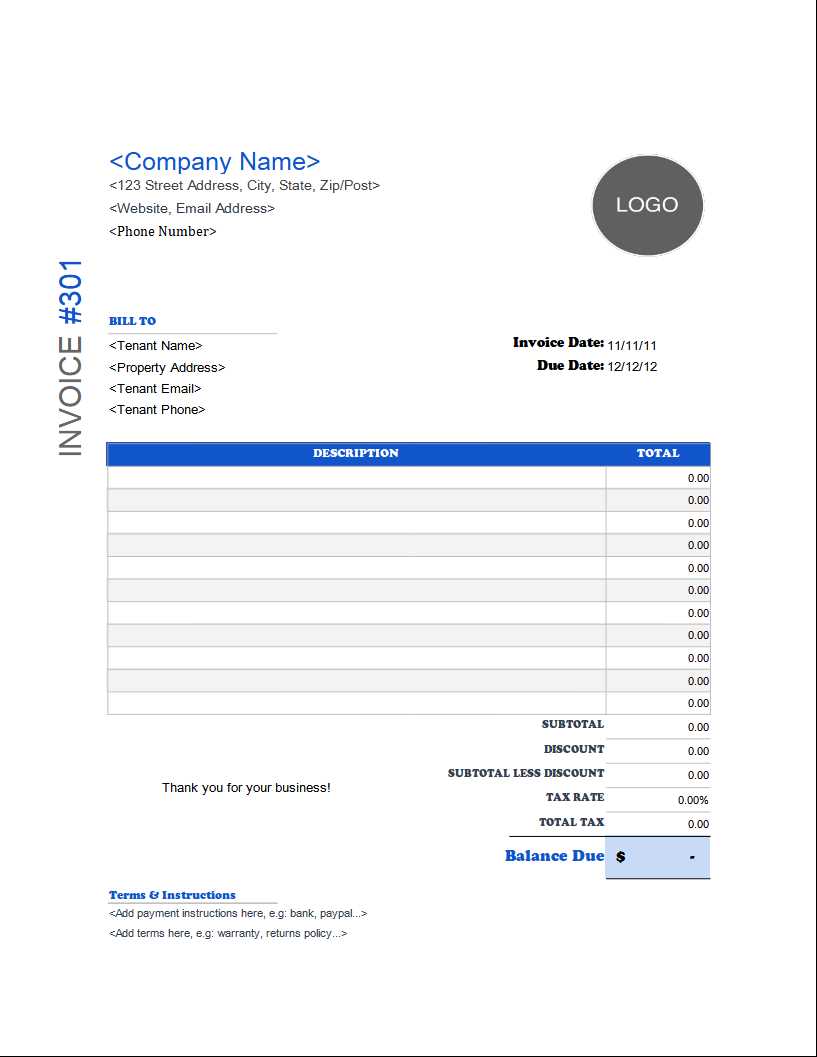

Designing for Clarity and Simplicity

While personalizing your document, it’s important to keep the design simple and easy to understand. An overly complicated layout can confuse guests or make it difficult to spot key information. Here are a few tips to ensure your document is clear and user-friendly:

- Clear Sections: Divide the document into distinct sections, such as charges, payments, and business details, to make it easier to navigate.

- Readable Fonts: Use legible fonts and appropriate font sizes to ensure that all text is easy to read, even for guests who may have vision challenges.

- Consistent Formatting: Ensure that all dates, prices, and text are consistently formatted throughout the document.

- Simple Color Scheme: Stick to a minimal color scheme that aligns with your brand while maintaining professionalism and readability.

By following these steps, you can create a fully customized billing record that meets your specific needs and enhances the overall guest experience. A personalized document not only adds a professional touch but also helps

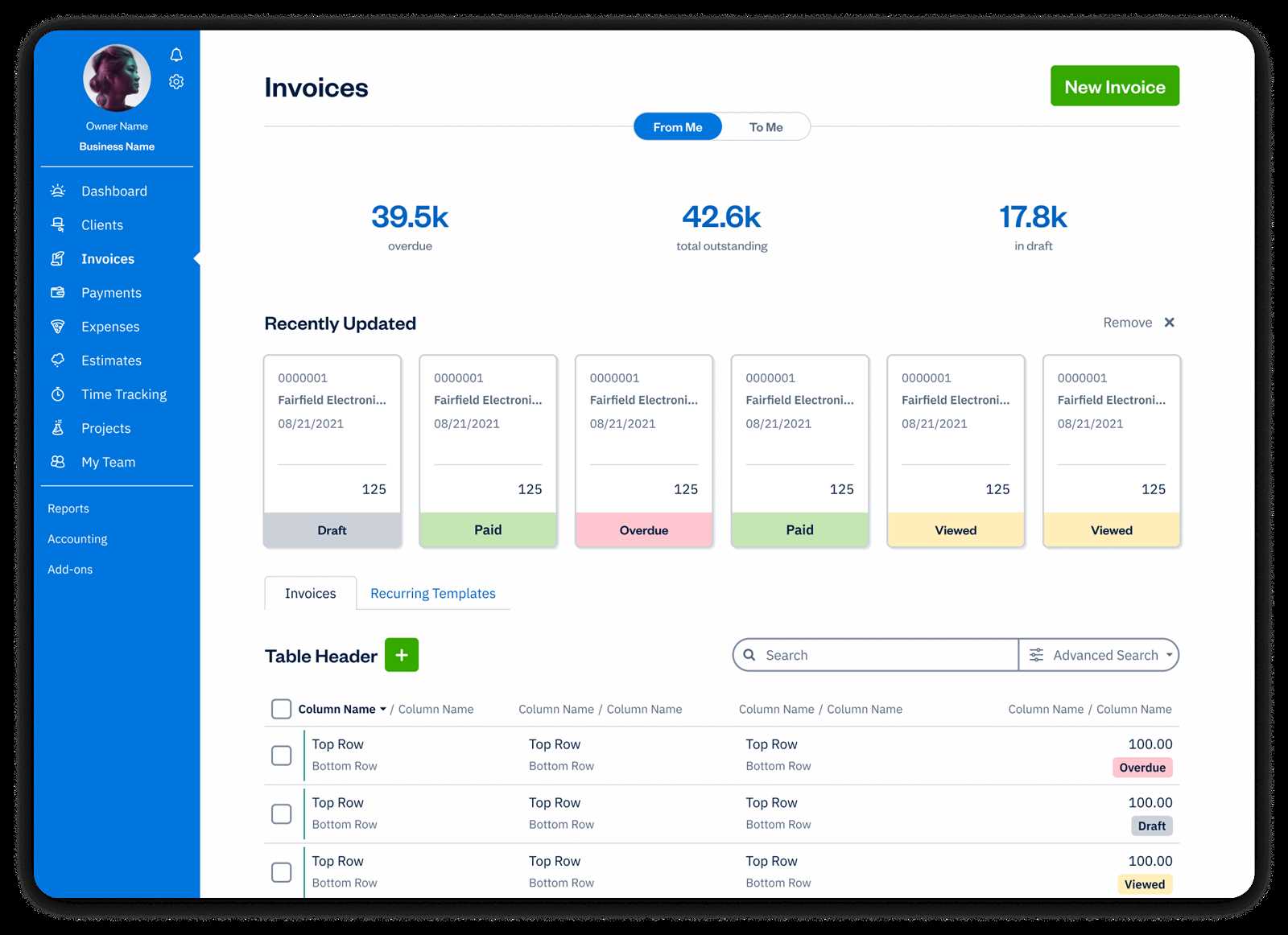

Free Accommodation Billing Formats for Hotels

For hotel owners and managers, using a ready-made structure for creating financial records can save significant time and effort. Free accommodation billing formats are a practical solution, providing pre-designed structures that allow you to easily input guest details, services rendered, and costs. These formats are designed to ensure consistency, accuracy, and professionalism without the need for starting from scratch every time you generate a new document.

Why Choose Free Formats for Your Hotel

Many hotels, especially small and independent ones, can benefit from free billing formats. Here are a few reasons why using a ready-made structure is advantageous:

- Cost-Effective: No need to pay for expensive software or design services. Free formats are available online and can be downloaded instantly.

- Time-Saving: The format already includes all the essential sections, allowing you to quickly generate accurate billing records without manually formatting each document.

- Easy to Customize: Most free formats are customizable, enabling you to add your hotel logo, adjust charge categories, or modify layout as needed.

- Professional Appearance: These pre-designed structures help maintain a consistent, professional look across all your billing documents, enhancing your hotel’s image.

Where to Find Free Billing Formats

Free billing formats can be found on various online platforms and business resource websites. These formats typically come in different file types such as Word, Excel, or PDF, making them easy to edit and print. Some resources even offer customizable versions, allowing you to adjust them to better fit your specific needs. Here are some common places to look:

- Online Business Tools: Websites that offer free templates for small businesses often have accommodation-specific options.

- Hotel Management Blogs: Many blogs dedicated to hotel operations offer free downloadable documents, including billing formats.

- Accounting Software Providers: Some accounting platforms offer free downloadable documents, including billing structures designed for hospitality businesses.

By utilizing free formats, hotels can quickly implement a consistent and effective system for managing guest transactions, improving overall efficiency, and maintaining professional standards.

Best Practices for Writing an Accommodation Billing Record

Creating clear and accurate financial documents is essential for both businesses and guests. A well-prepared record helps avoid misunderstandings, ensures accurate payments, and reflects professionalism. By following some best practices when crafting these documents, accommodation providers can ensure transparency, enhance customer trust, and streamline financial processes.

Here are some important practices to follow when writing an accommodation billing record:

- Be Clear and Detailed: Always provide a detailed breakdown of all charges. Itemize every service, fee, or tax to ensure that the guest understands exactly what they are paying for. Avoid using vague terms and ensure the cost structure is easy to follow.

- Use Consistent Formatting: Maintain consistent formatting throughout the document. This includes using the same font size, layout, and currency symbols for all amounts. Consistency makes the document easier to read and understand.

- Include All Relevant Dates: Clearly list the dates of the guest’s stay, including check-in and check-out dates. If there are any special charges (e.g., for extended stays or late checkouts), ensure they are indicated with the relevant dates.

- Provide Payment Details: Specify the total amount due, along with any payments made in advance or deposits received. If there are any outstanding balances, make them clear to avoid confusion.

- Include Contact Information: Ensure that your business’s contact details are easily visible. This allows guests to reach out in case they have any questions or need further clarification regarding their billing record.

- Stay Compliant with Local Regulations: If required, include necessary legal information, such as tax identification numbers, VAT or sales tax details, and other regional compliance requirements.

By following these practices, accommodation providers can ensure that their financial records are accurate, professional, and transparent. This not only fosters trust but also minimizes the risk of errors or disputes, ultimately improving the guest experience and ensuring smooth business operations.

How to Add Taxes to Your Accommodation Billing Record

When preparing financial records for guests, it’s important to ensure that applicable taxes are accurately included. Taxes are often a significant part of the total charge, and failing to add them correctly can lead to misunderstandings or compliance issues. Understanding how to calculate and include taxes in your billing documents will ensure that the amounts reflect both the services provided and the legal requirements of your area.

Here’s how to properly add taxes to your accommodation billing records:

Steps to Add Taxes

- Identify the Applicable Tax Rate: Research the local tax rate for accommodations. This can vary by region, so make sure to check the specific tax laws in your area. Some regions may have a standard rate, while others may charge different rates for different types of services.

- Calculate the Tax Amount: Once you know the tax rate, apply it to the total cost of the guest’s stay (including room charges, additional services, and fees). To calculate the tax amount, simply multiply the subtotal by the tax rate. For example, if the total cost before tax is $200 and the tax rate is 10%, the tax would be $20.

- List Taxes Separately: It’s a good practice to list the tax amount separately on the document. This ensures transparency and allows the guest to see exactly how much tax is being charged. Include the tax rate next to the tax amount for full clarity.

- Ensure Accuracy: Double-check all calculations to avoid errors. Incorrect tax charges can lead to dissatisfaction or even legal complications. Make sure the tax is calculated based on the correct total (room, services, etc.) and at the right rate.

- Include Tax Identification Information: In some cases, you may need to include your business’s tax identification number (TIN) or VAT number on the billing record. This is particularly important for businesses operating in regions that require this for tax purposes.

Example of a Tax Calculation

Let’s take a look at a simple example of how to calculate and add taxes:

| Description | Amount | |

|---|---|---|

| Room Charge | $200.00 | |

| Additional Services (e.g., meals, amenities) | $50.00 | |

| Description | Correct Entry | Incorrect Entry |

|---|