Invoice Template for Real Estate Commission to Simplify Your Payment Process

In the property business, clear and efficient financial documentation is essential to maintain smooth transactions between agents, brokers, and clients. Ensuring that all payments are recorded correctly and professionally can save time and avoid misunderstandings. Having a reliable method to track and send payment requests is key for any professional in this field.

Whether you’re an independent agent or part of a large firm, organizing your payment records is a task that shouldn’t be overlooked. With the right tools, you can create documents that reflect both your professionalism and the specifics of each deal, ensuring that all parties are on the same page when it comes to amounts owed and deadlines.

In this guide, we will explore how to create and customize documents that meet the unique needs of property professionals. You’ll learn how to ensure accuracy, avoid common errors, and keep your financial process as efficient as possible. With a few simple adjustments, you can handle your invoicing tasks with confidence and ease.

Invoice Template for Real Estate Commission

When working in the property sector, it’s essential to have a structured document to request payment for services rendered. A professional approach to generating these records ensures both clarity and consistency, helping agents and brokers maintain smooth business operations. Having a standardized way to calculate and request payment can streamline the entire process and reduce the likelihood of errors.

Key Features of a Payment Request Document

Creating an effective document involves several key elements that should be included to ensure accuracy and transparency. Here are some of the most important features:

- Client Information: Clearly state the name and contact details of the individual or company responsible for the payment.

- Service Details: Include a breakdown of services provided, such as the sale or rental transaction, and specify any conditions or terms agreed upon.

- Amount Due: List the total amount that is owed, including any applic

Why You Need an Invoice Template

Having a structured document for payment requests is crucial in ensuring that all transactions are clear and professionally handled. In any business, especially in the property industry, creating and sending accurate payment records helps avoid confusion and guarantees that both parties understand the agreed-upon terms. Without a reliable system, there is a higher risk of errors, disputes, and delayed payments.

Benefits of a Standardized Payment Record

Using a consistent approach to documenting payment requests offers several advantages:

- Improved Accuracy: A clear format helps ensure that all essential details are included and nothing is overlooked, reducing the chances of mistakes.

- Time Efficiency: With a ready-made structure, creating payment requests becomes faster, freeing up time for other important tasks.

- Professionalism: A well-organized document presents you as a reliable professional, making clients more likely to trust you and your services.

- Legal Protection: Proper documentation serves as proof of the agreement, which can protect you in case of any future disputes.

Ensuring Consistency Across Transactions

Having a consistent format also makes it easier to track payments across multiple clients or transactions. This consistency ensures that every payment request looks the same, which simplifies accounting, reduces errors, and allows you to quickly review past transactions when needed. By using a standard format, you create a reliable system that saves both time and effort in the long run.

Benefits of Using Real Estate Templates

Having a standardized format for financial documents is a game-changer when it comes to efficiency and professionalism. By relying on pre-designed structures, professionals in the property sector can save time, reduce errors, and ensure that all important details are consistently included. The use of ready-made documents not only streamlines the payment process but also boosts the credibility of your business operations.

Here are some key benefits of adopting a ready-to-use document structure in the property field:

Benefit Description Time Efficiency Using a pre-designed layout allows you to quickly fill in specific details without needing to start from scratch every time. Consistency A standardized format ensures that all documents follow the same structure, reducing the chance of missing key information. Accuracy Having a clear structure helps ensure that all necessary details, like amounts, dates, and client information, are included correctly. Professional Appearance Well-organized documents make a positive impression on clients, showing that you take your business seriously. Legal Protection Properly formatted documents can be used as evidence in case of disputes or misunderstandings, offering legal protection. Adopting a standardized system not only improves the efficiency of your day-to-day operations but also strengthens your relationship with clients by demonstrating reliability and professionalism.

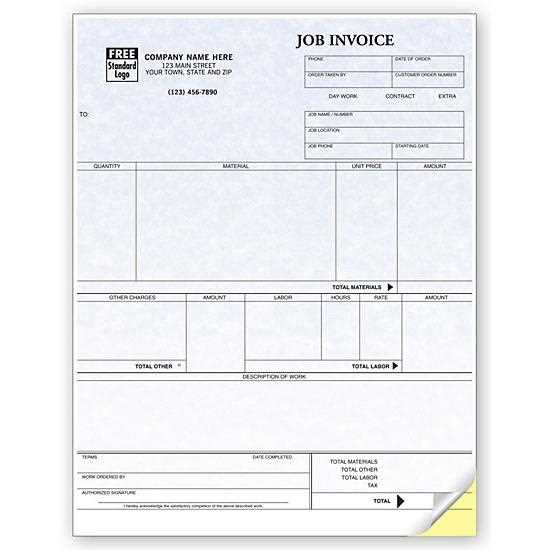

Key Elements of a Commission Invoice

Creating a clear and detailed document is essential when requesting payment for services rendered in the property sector. To ensure that both you and your client are on the same page, it’s important to include all necessary details, from the agreed-upon amount to payment terms. A well-structured document helps avoid confusion, fosters professionalism, and guarantees timely payments.

Essential Information to Include

Each payment request should contain key details that leave no room for ambiguity. Here are the most critical elements that should be included:

- Client and Service Provider Information: Clearly include the names, addresses, and contact details of both parties involved. This helps identify the sender and the recipient of the payment.

- Service Description: Provide a detailed breakdown of the services rendered, such as property sales or rental agreements, with dates and relevant specifics.

- Total Amount Due: List the agreed-upon payment amount. If necessary, break it down by different services or applicable percentages.

- Payment Due Date: Clearly state the date by which the payment should be made. This helps avoid misunderstandings regarding payment expectations.

- Payment Instructions: Specify how the payment should be made, whether via bank transfer, check, or another method, and provide any necessary account details or payment references.

Additional Details for Clarity

While the essential elements above are necessary for any payment request, adding extra details can help further clarify the terms and make the document more professional:

- Payment Terms: Include information about any payment plans, discounts, or late fees if applicable.

- Tax Information: If there are any taxes or VAT involved, make sure to clearly indicate the applicable rates and amounts.

- Unique Reference Number: Adding a unique ID number to each request can help with tracking and organizing payments.

By including all of these key elements, you create a comprehensive and transparent document that ensures both parties understand their financial obligations and timelines.

How to Customize Your Template

Tailoring your payment request document to suit your specific needs can enhance both the clarity and professionalism of your communication. Customization allows you to adjust the layout, structure, and details to reflect your unique business requirements. By making the document work for you, rather than relying on a generic format, you ensure that every request is as effective and professional as possible.

Here are some ways to make your payment request document truly your own:

- Adjust Layout and Design: Choose a layout that suits your brand. Consider font choices, color schemes, and spacing to create a clean, readable design that aligns with your business identity.

- Include Specific Terms: If you have particular payment terms, such as percentages or set fees, clearly outline these conditions in the document to avoid any confusion later on.

- Personalize Contact Information: Include your company logo, contact details, and any additional information that clients might need, such as a customer service number or email.

- Modify Payment Instructions: If you offer multiple payment options or want to highlight a preferred method, ensure that these instructions are clearly visible and easy to follow.

By customizing these elements, you not only ensure that the document meets your specific needs, but also convey a sense of attention to detail and professionalism, which helps build trust with clients and partners.

Common Mistakes in Real Estate Invoices

When preparing payment requests in the property industry, even small errors can lead to misunderstandings or delays in receiving payment. Many professionals overlook key details or make assumptions that ultimately cause confusion. Identifying and avoiding these common mistakes is essential to ensure smooth transactions and maintain trust with clients.

Key Errors to Avoid

Here are some of the most frequent mistakes that occur when creating payment requests, and tips on how to avoid them:

- Missing Client Information: Forgetting to include the correct contact details, such as the client’s full name, address, or phone number, can lead to communication problems.

- Unclear Service Descriptions: Failing to provide a detailed breakdown of the services rendered can create confusion. Always include specifics like dates, property details, and the nature of the agreement.

- Incorrect Payment Amounts: Double-check that the amounts you list match the agreed-upon terms. Overlooking discounts, taxes, or additional fees can result in disputes.

- Omitting Payment Deadlines: Not specifying the due date for payment can leave the client unsure about when to pay. Be clear and precise with deadlines to avoid delays.

- Not Adding Tax Information: If taxes are involved, failing to list the tax rates or amounts can lead to confusion and potential legal issues. Make sure to clearly show applicable taxes on the document.

- Inaccurate Payment Instructions: Providing unclear or incomplete payment details, such as incorrect bank account numbers or missing payment methods, can delay the entire process. Always verify the instructions before sending.

How to Avoid These Mistakes

To minimize errors, create a checklist for each payment request. Review the document thoroughly before sending, ensuring that all critical information is correct and that you haven’t missed anything important. Additionally, utilizing a standardized structure can help eliminate the risk of omitting key details.

By being mindful of these common errors, you can maintain a professional and efficient billing process, ensuring timely payments and stronger relationships with clients.

How to Calculate Real Estate Commission

Accurately calculating the payment due for services in the property industry is crucial for both agents and brokers. The amount earned for facilitating a transaction is typically based on a percentage of the sale or rental price. However, there are various factors that can affect the final payment, and understanding how to properly calculate it ensures transparency and fairness for all parties involved.

Steps to Calculate Your Payment

Follow these basic steps to accurately calculate the amount you are entitled to:

- Determine the Sale or Rental Price: Begin by identifying the total value of the transaction, whether it’s the sale price of a property or the rental amount.

- Understand the Agreed Percentage: Typically, brokers and agents agree on a fixed percentage of the transaction value as their payment. Make sure you know the exact percentage rate that applies to your agreement.

- Account for Any Split Agreements: If the payment is shared with another agent or broker, make sure to calculate the percentage based on your share of the total fee.

- Apply the Percentage: Multiply the total value of the sale or rental by the agreed percentage to determine the amount owed. For example, if the sale price is $500,000 and the agreed percentage is 3%, the payment would be $15,000.

- Consider Additional Fees: If there are any extra costs (such as administrative fees or taxes), ensure these are accounted for before finalizing the total payment.

Example Calculation

Here is a simple example to illustrate the process:

- Transaction Value: $600,000

- Agreed Percentage: 3%

- Payment Due: $600,000 × 0.03 = $18,000

In this case, the total amount due for services would be $18,000, assuming no other fees or splits are involved. If there is a split with another agent, this amount would be adjusted accordingly.

By following these steps and und

Legal Requirements for Commission Invoices

When requesting payment for services in the property sector, it is important to follow local laws and regulations to ensure that all documentation is compliant. Failure to meet legal requirements can result in disputes, penalties, or even legal action. Understanding what needs to be included in your payment request document is essential for maintaining professionalism and avoiding legal issues.

Key Legal Considerations

Each region may have its own set of rules regarding the contents and format of payment requests. However, there are several common legal requirements that apply across most jurisdictions. These include:

Requirement Description Accurate Client Information Ensure that the names, addresses, and contact details of both parties are correctly stated, as incorrect information can invalidate the document. Clear Payment Terms Clearly outline the amount due, payment deadline, and any agreed-upon terms, including late fees or discounts. This protects both parties in case of disputes. Tax Information In many jurisdictions, you must specify applicable taxes, such as VAT, and include your tax identification number. Failure to do so could result in legal penalties. Legal Disclaimers Some regions require specific legal disclaimers or statements, such as terms related to non-payment or potential legal action for debt collection. Payment Method Details Specify acceptable payment methods, whether it’s through a bank transfer, cheque, or digital payment. Legal regulations often require clear instructions to ensure proper transaction processing. Ensuring Compliance

To avoid legal issues, ensure that every document you issue complies with your local laws. Consulting with a legal professional or accountant can help ensure that all required details are included and that your documents adhere to all regulatory standards. Additionally, always keep accurate records of every transaction, as this will be essential should any legal disputes arise.

By following these legal guidelines, you ensure that your payment requests are not only professionally created but also fully compliant with the law, protecting both you and your clients.

Best Practices for Invoicing Real Estate Agents

When handling payments in the property industry, it is essential to maintain a clear and professional approach to requesting payment for services rendered. Adopting best practices in the process not only ensures accuracy but also strengthens relationships with clients. By following consistent, transparent procedures, you can streamline your operations and avoid misunderstandings down the road.

Here are some key practices to follow when preparing payment requests for agents and brokers in the property sector:

- Be Clear and Specific: Always provide a detailed breakdown of the services provided, including property details, transaction dates, and the exact amount due. Clear descriptions eliminate confusion and help clients understand the value they are paying for.

- Maintain Consistency: Use the same format for every request, making it easy for clients to understand the structure. Consistent details, such as payment deadlines, service descriptions, and tax information, help establish trust and professionalism.

- Always Include Payment Terms: Specify payment deadlines, payment methods, and any applicable late fees. Being upfront about these terms reduces the chances of misunderstandings and ensures timely payments.

- Check Legal Requirements: Be aware of any legal obligations when issuing payment documents. Some jurisdictions require specific tax information, disclaimers, or other legal clauses to be included. Ensure that you meet all local regulatory requirements to avoid potential issues.

- Use Professional Design: Whether you use a digital tool or manual records, ensure the document looks clean and professional. Well-organized and easy-to-read records reflect your business’s quality and enhance your credibility.

- Send Timely Reminders: If the payment deadline is approaching and the payment has not been received, send gentle reminders. This shows that you are proactive and helps avoid delays in processing payments.

By following these best practices, you can ensure that your payment requests are efficient, professional, and legally sound, improving both your workflow and client satisfaction.

How to Add Taxes to Real Estate Invoices

When preparing a payment request for services in the property sector, it is often necessary to include applicable taxes. Whether you’re dealing with sales tax, VAT, or other local tax rates, accurately calculating and adding these charges is essential for compliance and transparency. Understanding how to properly incorporate taxes ensures that both you and your clients are on the same page, preventing potential misunderstandings or legal issues.

Steps to Add Taxes

Here’s a step-by-step guide on how to correctly calculate and add taxes to your payment request document:

Step Description 1. Know the Applicable Tax Rate Before adding taxes, identify the tax rate that applies to your services. This can vary by location, so make sure you’re familiar with local regulations. 2. Calculate the Taxable Amount Determine the base amount to which the tax will apply. This is typically the total amount for services provided, before tax is added. 3. Multiply by the Tax Rate Multiply the taxable amount by the appropriate tax rate (e.g., 10% would be 0.10). This gives you the total tax due. 4. Add Tax to the Total Add the calculated tax amount to the original payment due. The final total will include both the service fee and the tax amount. 5. Provide Clear Breakdown Clearly list the tax amount and total service charges in your document, so clients can easily see the breakdown of costs. Example Calculation

Let’s walk through a simple example to make the process clearer:

- Service Amount: $1,000

- Tax Rate: 10%

- Tax Amount: $1,000 × 0.10 = $100

- Total Due: $1,000 + $100 = $1,100

In this case, the final amount due from the client would be $1,100, which includes both the service fee and the $100 tax.

By following these steps, you can ensure that taxes are added correctly and clearly, helping to maintain professionalism and avoid potential confusion with clients.

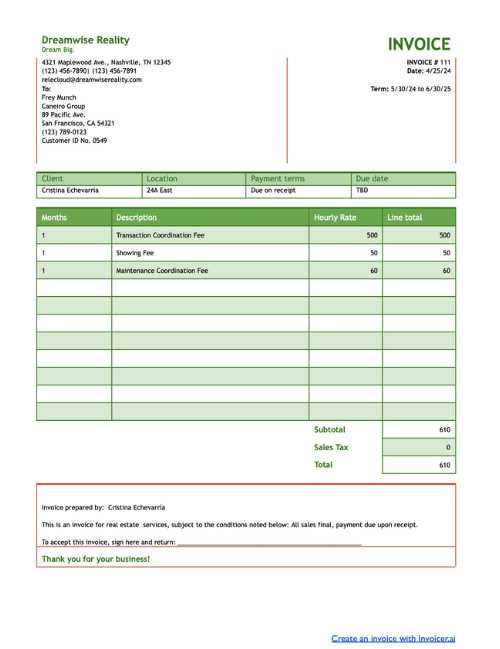

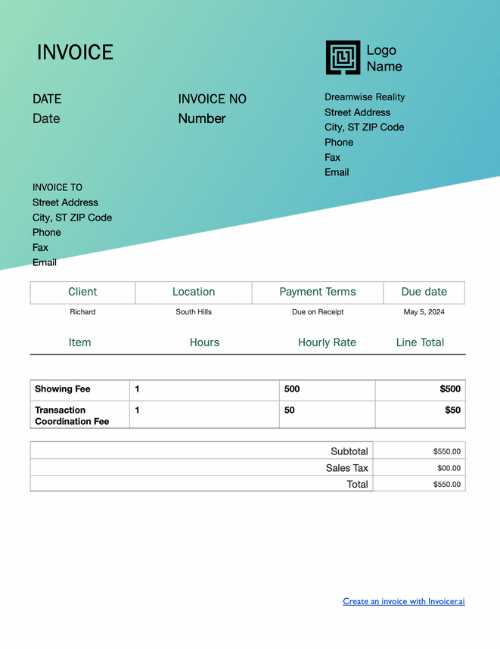

Real Estate Commission Invoice Sample

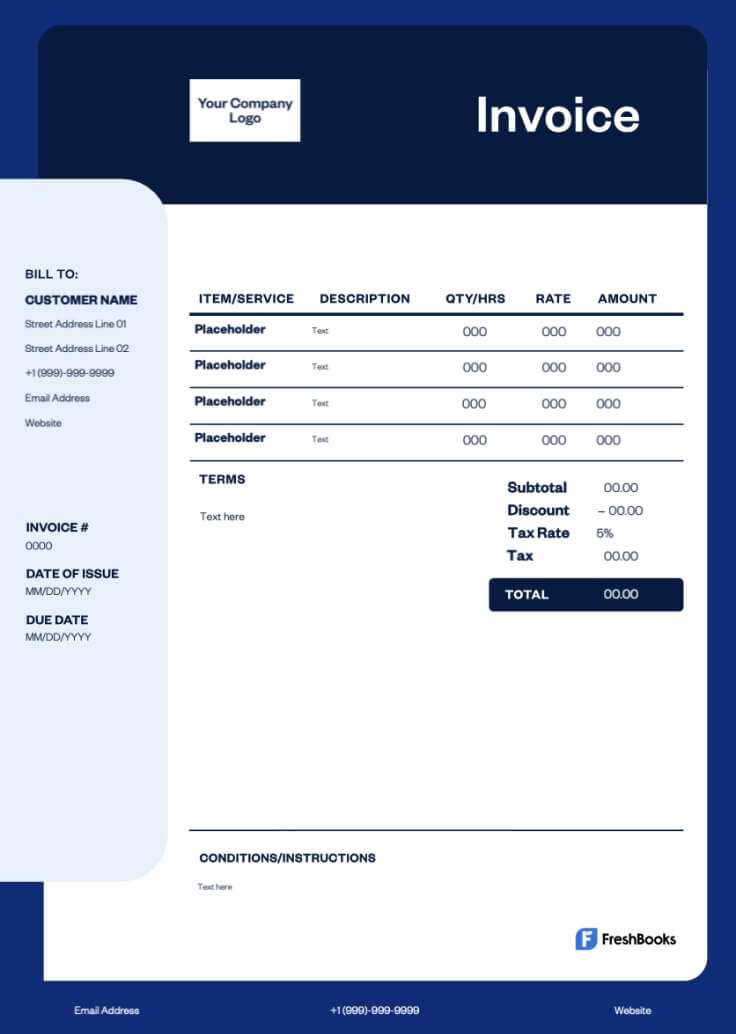

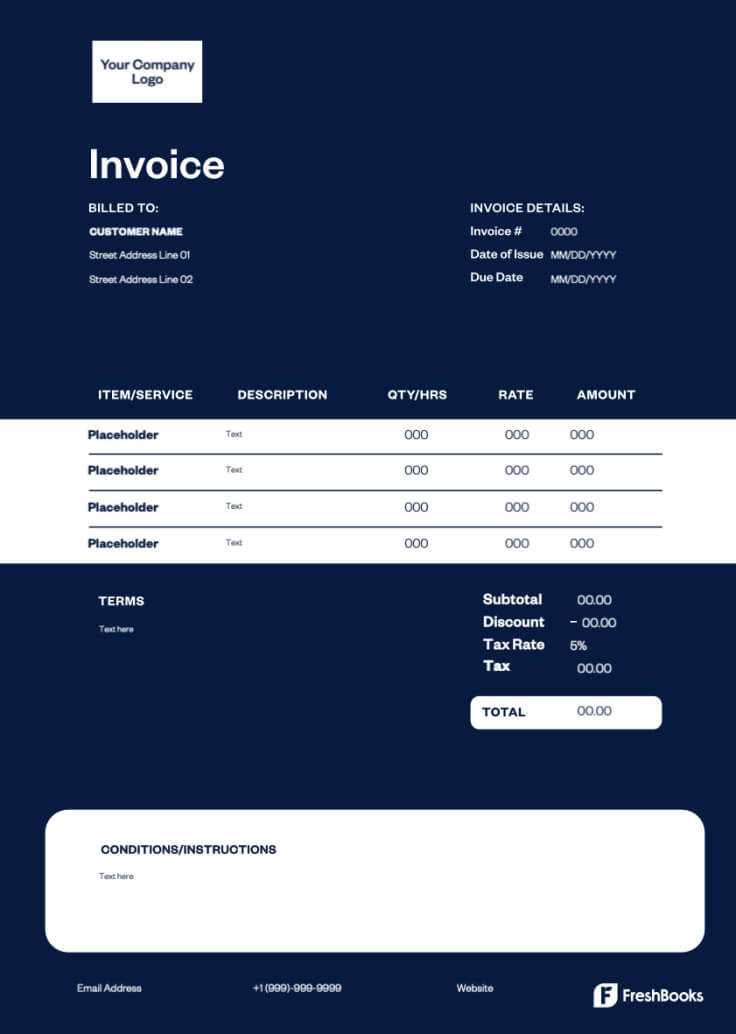

Having a sample document for requesting payment after a successful property transaction can be a valuable tool for professionals in the industry. A sample document offers a clear and organized structure that can be easily customized for each individual case. Below is an example of how such a payment request might be formatted, showing the key details that should be included to ensure transparency and clarity.

Sample Payment Request Document

The following is a basic structure for a payment request that can be adapted to any property transaction:

- Sender’s Information: Include your full name or business name, address, phone number, and email address for easy contact.

- Recipient’s Information: Provide the client’s name, address, and contact details.

- Document Title: A clear heading indicating that this is a payment request, such as “Payment Due” or “Services Rendered”.

- Transaction Details: Specify the details of the transaction, such as the property address, date of sale, and the role you played in the process (e.g., agent, broker).

- Amount Due: State the total amount owed, specifying the service fee percentage and the calculated amount based on the sale price.

- Payment Terms: Clearly outline the payment due date, acceptable payment methods, and any late fees that may apply.

- Tax Information: If applicable, include any taxes that apply to the amount due, with a breakdown of the tax rate and total tax.

- Final Total: Include the final amount owed, which should reflect the total service fee plus taxes (if applicable).

Example Layout

Here’s an example layout for a property transaction payment request:

Details Amount Transaction Amount (Property Sale): $500,000 Service Fee (3%): $15,000 Tax (10% VAT): $1,500 Total Amount Due: $16,500 This sample document ensures that all necessary details are covered and presents them in an easy-to-understand

Choosing the Right Invoice Software

For property professionals, selecting the right software to manage payment requests can significantly improve efficiency and accuracy. The right tool not only streamlines the billing process but also ensures that all necessary details are included, taxes are calculated correctly, and records are easily accessible. With so many options available, it’s important to choose a solution that suits your business needs and simplifies administrative tasks.

Factors to Consider When Selecting Software

When evaluating software for managing payment requests, there are several key features and factors to keep in mind:

- Ease of Use: Choose a solution that is user-friendly and requires minimal training. A simple interface with intuitive navigation will save time and reduce errors.

- Customization Options: Look for software that allows you to customize the layout and content of your documents, such as adding your company logo, adjusting payment terms, or selecting specific services rendered.

- Integration Capabilities: Ensure the software integrates seamlessly with your other tools, such as accounting software or customer relationship management (CRM) systems, for a smooth workflow.

- Automation Features: Many software options offer automatic calculations for taxes, discounts, and totals. Automation can reduce manual work and help prevent errors, ensuring faster and more accurate billing.

- Mobile Access: If you need flexibility, choose software with mobile functionality, allowing you to create and manage payment requests on the go, especially if you are meeting clients in person.

- Security and Compliance: Make sure the software adheres to security protocols and complies with any legal requirements in your jurisdiction. Data protection is crucial when handling sensitive financial information.

Popular Software Options

Here are a few popular software solutions that many professionals in the property sector use to handle payment requests:

- QuickBooks: A well-known accounting tool that also offers robust features for generating payment requests and tracking transactions.

- FreshBooks: Known for its simplicity and ease of use, FreshBooks is a great option for small businesses and freelancers who need to send professional payment documents.

- Zoho Invoice: A comprehensive invoicing solution with customizable templates and excellent integration with other Zoho tools for CRM and project management.

- Wave: A free solution for small busi

Automating Your Invoice Creation Process

In today’s fast-paced business environment, automation is key to improving efficiency and minimizing errors. Automating the process of generating payment requests for services can save you significant time and effort, allowing you to focus on higher-value tasks. By setting up automated workflows, you can ensure that all necessary details are consistently included, that calculations are accurate, and that clients receive their payment documents promptly.

Benefits of Automation

There are several advantages to automating the creation of payment requests:

- Time Efficiency: Automation eliminates the need for manually entering the same details every time you create a payment request. This speeds up the process and reduces administrative overhead.

- Consistency: Automated tools ensure that every document follows the same structure and includes all required information, reducing the risk of mistakes or omissions.

- Accuracy: Calculations, such as taxes or service fees, can be automatically computed based on predefined rules, reducing the likelihood of human error.

- Faster Payments: By quickly generating and sending payment requests, you can accelerate your cash flow and improve your financial management.

- Customization: Automated systems often allow for customized templates, which means you can tailor documents to fit your business style while maintaining professional consistency.

How to Automate the Process

There are several ways to implement automation in your payment request workflow:

- Use Specialized Software: Many software solutions, like QuickBooks or FreshBooks, offer automated features for generating and sending payment requests. These tools allow you to set up recurring billing, apply taxes automatically, and store client details for easy future use.

- Integrate with Your CRM: By integrating your payment request system with a customer relationship management (CRM) platform, you can automatically pull client data into your documents, saving time and reducing the risk of errors.

- Set Up Recurring Billing: If you have ongoing contracts or retainer agreements, set up automatic billing cycles that generate and send payment documents on a regular basis without needing to manually intervene.

- Automate Payment Reminders: Many tools offer the ability to automatically send payment reminders based on predefined settings, ensuring that clients are notified when payments are due.

By automating your payment request process, you can streamline your business operations, improve accuracy, and ensure timely payments–ultimately leading to better financial management and enhanced clien

How to Track Commission Payments

Managing payments for services rendered can be a complex task, especially when dealing with multiple transactions and clients. To ensure that all payments are accounted for and no fees go unpaid, it’s essential to have a clear and efficient tracking system in place. Tracking payments helps you stay organized, monitor cash flow, and maintain transparency with clients.

Methods for Tracking Payments

Here are several strategies to efficiently track payments for your services:

- Use Accounting Software: Software solutions like QuickBooks, Xero, or FreshBooks offer built-in tools to track all payments, categorize income, and send reminders for overdue amounts. These tools can provide detailed reports on outstanding balances, payment history, and transaction statuses.

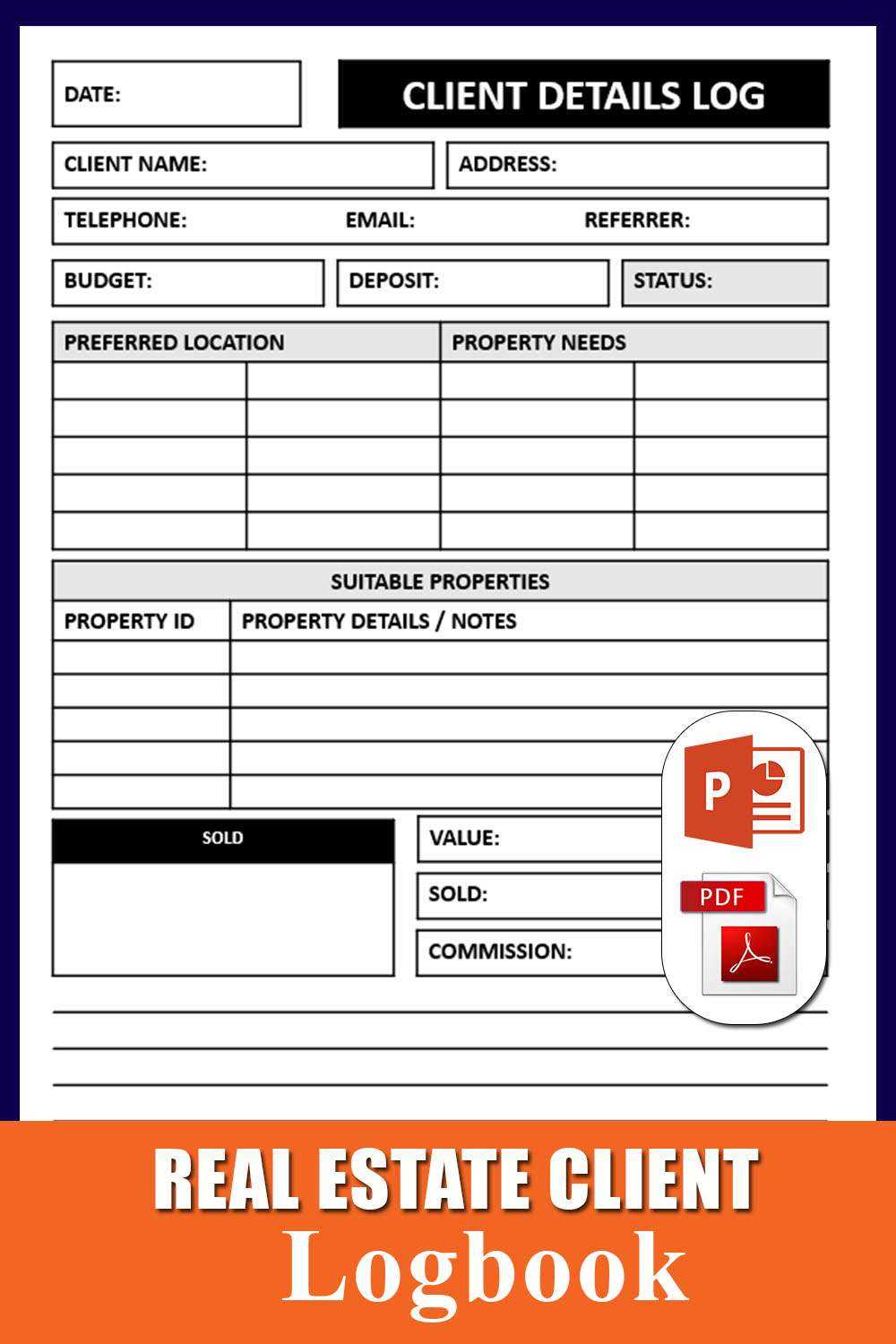

- Create a Payment Log: Maintain a simple spreadsheet or digital log where you can record each transaction. Include columns for the client name, service provided, total amount due, payment date, and outstanding balance.

- Set Up Automated Alerts: Many software platforms allow you to set up automatic reminders for both you and your clients when payments are due or overdue. This helps ensure no payments are missed and reduces the administrative burden of manual follow-ups.

- Monitor Payment Methods: Keep track of how payments are made, whether by check, bank transfer, or credit card. This will allow you to quickly identify discrepancies and confirm that all amounts have been received.

Best Practices for Effective Payment Tracking

- Regular Reconciliation: Frequently review your records to ensure they match with your bank statements and that no discrepancies have occurred. This can help catch any errors early.

- Keep Clients Informed: Maintain clear communication with clients regarding the payment schedule, any outstanding balances, and the payment methods available. Providing a detailed breakdown of what is owed can help avoid confusion.

- Organize Payment History: Store records of payments made, including receipts and confirmations, in an organized manner. This makes it easier to reference past transactions and resolve any issues that may arise in the future.

By following these strategies, you can stay on top of your payment records, avoid missed payments, and ensure smooth financial management for your business.

Common Payment Terms in Real Estate Contracts

When engaging in property transactions, payment terms play a crucial role in defining the financial expectations and timelines for both parties. These terms outline how and when payments are made, ensuring clarity and preventing misunderstandings. Understanding common payment conditions is essential for both buyers and sellers to ensure smooth transactions and avoid potential disputes.

Key Payment Terms to Know

Below are some common payment terms that are typically included in property contracts:

- Due Date: This is the date by which the payment is expected to be made. The due date is often linked to the completion of a transaction, such as the closing date or when specific conditions are met.

- Down Payment: The initial upfront payment made by the buyer, often a percentage of the total sale price. This payment shows commitment and secures the transaction.

- Installments: In some agreements, payments may be broken down into installments, with each payment made at specific intervals (e.g., monthly or quarterly) until the total amount is settled.

- Payment Methods: The acceptable modes of payment are clearly defined, which may include bank transfers, checks, credit cards, or other methods. This ensures both parties agree on how funds will be transferred.

- Late Fees: If payments are not made on time, late fees may be applied. These fees are typically a percentage of the total amount due and are designed to encourage timely payments.

- Contingencies: Sometimes, payments are tied to specific conditions or contingencies, such as securing financing, completing inspections, or meeting regulatory requirements. These clauses protect both parties in case certain conditions are not met.

Additional Considerations

Beyond the basic payment terms, property contracts may include additional provisions that can influence the timing and nature of payments:

- Escrow Payments: An escrow account may be used to hold funds until certain conditions are met, such as the completion of repairs or inspections. This ensures that neither party can access the funds until all terms are fulfilled.

- Refundable Deposits: In some cases, a deposit is required, which is refundable upon completion of certain conditions, such as the return of the property in its original condition or the successful closing of the sale.

- Balance Due: After the down payment and any installments, the remaining balance is due at the closing or another agreed-upon date. This is often the largest payment and finalizes the transaction.

Understanding these common payment terms ensures that both parties are aligned in their expectations and obligations throughout the property transaction process. Clear payment terms help avoid confusion and make the process smoother for everyone involved.

Why Timely Invoicing Matters for Agents

For property professionals, maintaining a steady cash flow is essential for running a successful business. One of the most effective ways to ensure timely payments is by issuing documents promptly after services are rendered. Delayed requests can lead to missed payments, disrupt financial planning, and strain client relationships. By prioritizing quick and efficient billing, agents can foster better financial stability and maintain professionalism in their operations.

Impact on Cash Flow

Delayed payment requests can significantly affect cash flow, which is crucial for day-to-day operations. When clients do not receive their payment documents on time, it may take longer for them to settle their dues, causing potential delays in funds needed to cover operational expenses or reinvest in business growth.

- Reduced Financial Stress: Sending documents promptly allows agents to anticipate when payments will be received, helping them manage their budgets more effectively.

- Consistency in Cash Flow: Regular and timely billing ensures that income comes in on a predictable schedule, minimizing the risk of financial instability.

Client Relationships and Professionalism

Timely billing not only affects financials but also plays a key role in client relationships. When agents are punctual with their requests, it demonstrates professionalism and reliability. On the other hand, delayed documents can cause frustration and may lead to confusion or mistrust, especially if clients feel the billing process is disorganized or inefficient.

- Building Trust: Prompt and clear payment documentation fosters trust and signals that the agent is organized and dependable.

- Reducing Disputes: Sending payment requests in a timely manner reduces the likelihood of misunderstandings regarding amounts owed, deadlines, and payment methods.

By issuing payment documents promptly, agents can maintain better control over their finances, improve client satisfaction, and avoid unnecessary delays. Consistency in this area reflects positively on the agent’s reputation and contributes to long-term success.

How to Handle Late Payments in Real Estate

Late payments are a common issue in many industries, including property transactions. When clients fail to pay on time, it can disrupt your cash flow and cause unnecessary stress. Handling overdue payments efficiently is crucial to maintaining a healthy business relationship and ensuring that your financial obligations are met. By having a clear system in place, you can address these situations promptly and professionally, minimizing the impact on your operations.

Steps to Manage Late Payments

Here are some effective strategies for managing delayed payments in property-related transactions:

- Review the Terms: Start by revisiting the agreed payment terms outlined in the contract. Ensure that both parties are clear on when payments are due and any conditions attached to them. This can help you understand whether the delay is due to an oversight or an intentional delay.

- Send a Friendly Reminder: Sometimes, a simple reminder is enough to encourage the client to make the payment. Reach out via email or phone, politely reminding them of the due payment and any consequences for further delays.

- Apply Late Fees: If outlined in the agreement, consider enforcing late fees. This serves as both a deterrent for future delays and an incentive for clients to pay promptly. Ensure that clients are aware of the late fee structure upfront to avoid misunderstandings.

- Negotiate a Payment Plan: If the client is experiencing financial difficulties, consider offering a payment plan. This can be beneficial for both parties, allowing the client to pay in installments while ensuring you receive the full amount.

- Legal Action: If the payment is significantly overdue and previous attempts to collect it have failed, you may need to escalate the matter. Consult with legal professionals to understand your options, including sending a formal demand letter or pursuing legal action if necessary.

Effective Communication Strategies

Clear communication is key when dealing with late payments. Here are some tips for handling these situations professionally:

- Be Polite but Firm: While it’s important to remain courteous, don’t shy away from being firm about the payment expectations. Setting boundaries will help convey the seriousness of the situation.

- Document All Interactions: Keep records of all communication regarding late payments. This documentation will be valuable if you need to take further action, such as involving a collections agency or pursuing legal channels.

- Maintain Professionalism: Avoid letting frustration influence your approach. Stay professional and solution-oriented, focusing on finding a resolution rather than escalating conflict.

Table: Sample Late Payment Process

Tips for Managing Your Real Estate Finances

Effectively managing finances is crucial for success in property transactions. As a professional in the field, staying organized and maintaining a clear understanding of your income, expenses, and cash flow can help you navigate financial challenges and build long-term stability. Implementing a structured approach to financial management allows you to make informed decisions and maintain profitability, even during fluctuating market conditions.

Key Strategies for Financial Management

Here are some practical tips to help you stay on top of your financials:

- Track All Transactions: Keep a detailed record of all incoming and outgoing funds. This will help you monitor your cash flow and ensure that you’re aware of all financial activities. Use accounting software or spreadsheets to simplify this process.

- Separate Business and Personal Finances: Open a dedicated business account to keep your professional finances separate from personal expenses. This makes it easier to track income and deductions, especially during tax season.

- Set Aside Funds for Taxes: Set aside a portion of your earnings for taxes to avoid financial stress at the end of the year. Consulting with a tax professional can help you estimate your tax obligations and avoid surprises.

- Establish a Budget: Create a realistic budget for your business, accounting for regular expenses such as marketing, office supplies, and client-related costs. Regularly review and adjust your budget to stay aligned with your financial goals.

- Monitor Cash Flow: Keep a close eye on your cash flow to ensure you have enough liquidity to meet your obligations. This is especially important in property-related transactions, where payment schedules can vary significantly.

Building Financial Stability

In addition to tracking and budgeting, it’s essential to plan for both short-term needs and long-term financial goals. Here are some strategies for building financial stability in your business:

- Create an Emergency Fund: Set aside a portion of your profits into an emergency fund to cover unforeseen expenses, such as legal fees or property maintenance. This safety net can help you avoid debt during challenging times.

- Invest in Growth: Reinvest profits into growing your business. This could mean upgrading your marketing efforts, expanding your team, or investing in professional development to stay ahead of industry trends.

- Review Your Financial Health Regularly: Conduct monthly or quarterly financial reviews to assess your business’s performance. This will help you identify trends, adjust strategies, and make informed decisions about future investments.

- Diversify Your Revenue Streams: Relying on one source of income can be risky. Consider diversifying your revenue streams by offering additional services, such as property management or consultancy, to create a more stable financial foundation.

By ad