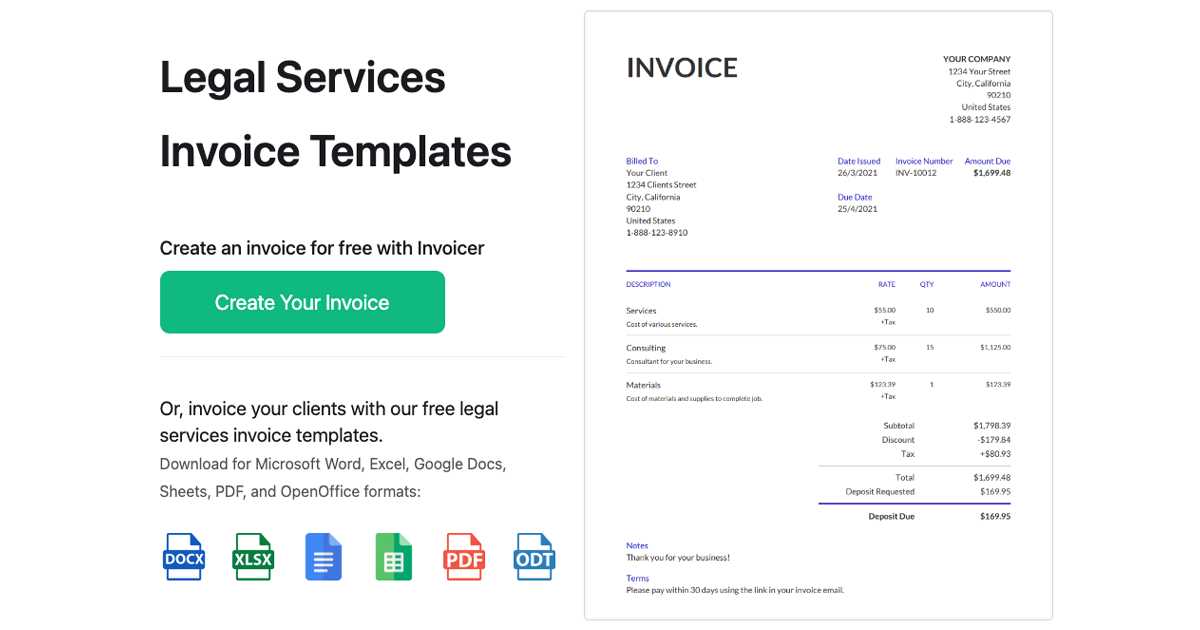

Legal Invoice Template for Accurate and Professional Billing

Efficient billing is a crucial aspect of managing any professional service. Whether you are offering legal counsel, consulting, or freelance work, having a clear and structured way to request payment ensures timely compensation and maintains professionalism in your business operations. A well-organized billing system can prevent misunderstandings and help clients easily understand the charges for services rendered.

By using a well-designed document for requesting payments, you can outline essential details such as services provided, time spent, and agreed-upon rates. This helps establish transparency with your clients and ensures that both parties are on the same page. Moreover, a properly formatted payment request also enhances your credibility and can contribute to a more positive client experience.

In this article, we will explore how to create a simple yet effective document for billing, and discuss the key components that should be included to ensure clarity and avoid confusion. Whether you are a newcomer to offering services or an established professional, implementing an organized payment request system can help optimize your business operations.

Billing Document for Professionals

For professionals offering specialized services, having a well-organized and clear billing document is essential. This document serves as a formal request for payment, ensuring that clients understand the details of the work performed and the amount due. A professionally structured payment request not only helps you maintain a smooth financial flow but also strengthens your reputation by presenting a polished, transparent approach to business transactions.

When creating a billing document, it’s important to include essential information such as the type of services provided, the agreed-upon rates, and any applicable payment terms. Clear breakdowns of charges help clients easily understand what they are being billed for, reducing the chance of disputes. Additionally, including the date of service and the payment due date sets clear expectations and promotes timely settlement of fees.

For those in industries where work is often complex or varies in scope, having a customizable document that can accommodate various services is a valuable tool. It allows professionals to adapt their billing method based on the specific needs of each client, ensuring flexibility and accuracy in all transactions.

Why Use a Billing Document Format

Having a standardized format for your payment requests is essential for efficiency and clarity. A consistent structure not only saves time but also ensures that all necessary details are included, reducing the likelihood of errors or missed information. By using a pre-designed structure, professionals can focus on the work itself rather than on formatting and organizing the request for payment each time.

Additionally, a well-structured payment document helps maintain professionalism. It assures clients that your business operations are organized and transparent, which can improve client trust and satisfaction. Whether you’re working on a long-term project or a one-time service, using a reliable document format simplifies the billing process and streamlines the financial aspects of your work.

Here’s an example of the basic components typically included in such a document:

| Section | Description |

|---|---|

| Service Description | Details of the work performed |

| Hours/Quantity | The amount of time or units worked |

| Rate | The agreed-upon charge per hour/unit |

| Total Amount | The final sum due based on the hours/quantity and rate |

| Payment Terms | Details of when and how payment should be made |

By ensuring all of these elements are present and organized, you eliminate potential misunderstandings and make it easier for clients to process payments promptly.

Key Elements of a Billing Document

To ensure clarity and professionalism, it’s important that a payment request includes several essential components. These elements help both the service provider and the client understand the details of the transaction, from the work completed to the amount owed. A well-structured request ensures that all necessary information is easily accessible, reducing the chance of confusion or delayed payments.

Essential Information to Include

- Contact Details: Include your name, business name, address, and contact information. It’s also helpful to list the client’s information to avoid any mix-ups.

- Invoice Number: Assign a unique number to each request for easy tracking and future reference.

- Date of Service: Clearly state the date when the service was performed or the product was delivered. If the work spanned multiple dates, include a range.

- Payment Terms: Define the agreed-upon payment terms, including due dates, late fees, and acceptable payment methods.

- Breakdown of Charges: Provide a detailed list of services or tasks completed, the time spent, and the hourly or flat rate applied. This breakdown helps the client understand what they are being billed for.

- Total Amount Due: Clearly state the final amount to be paid after any taxes, discounts, or additional fees have been applied.

Additional Considerations

- Tax Information: If applicable, include tax rates and the total tax amount added to the final charge.

- Payment Instructions: Provide clear instructions on how clients can make the payment, including bank account details, online payment links, or mailing instructions.

- Late Fees and Penalties: If payment is not made by the due date, mention any late fees or penalties that may apply.

By including these key components in your payment request, you ensure that all parties involved are well-informed and aligned on the terms of the transaction. This structure not only promotes professionalism but also helps in avoiding payment delays or disputes.

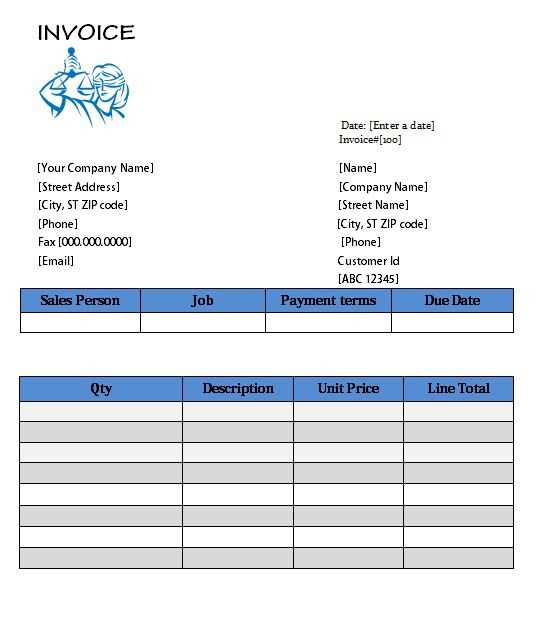

How to Customize Your Billing Document

Personalizing your payment request ensures it reflects your unique business style and meets the specific needs of your clients. Customization allows you to adjust the layout, details, and structure of the document to suit different services or industries. A tailored document not only improves the client experience but also helps present your business as professional and organized.

Here are some steps to help you create a custom billing document:

- Choose a Layout: Decide on the overall format of your payment request. Whether you prefer a simple design or a more detailed one, ensure it remains clear and easy to read.

- Adjust Client Information: Add specific client details, including their business name, address, and contact information. This makes the document personalized and helps avoid any confusion.

- Include Service Details: Depending on the project, you may need to modify the description of services or products provided. Be specific about what was delivered and adjust the quantities or rates if necessary.

- Modify Payment Terms: Tailor the payment instructions and terms according to your agreement with each client. Whether you offer discounts for early payment or need to set up installment options, make these terms clear.

- Branding and Design: Include your logo, business colors, and any other branding elements that reflect your business’s identity. A branded document leaves a lasting impression and strengthens your professional image.

By customizing your payment request, you can better meet your clients’ needs while maintaining a professional, cohesive presentation of your business. This attention to detail helps streamline the payment process and builds a solid reputation for reliability and care.

Best Practices for Legal Invoices

When providing services, it’s essential to present a clear, professional document that outlines the work completed, fees due, and other necessary details. This ensures transparency and helps maintain positive client relationships. A well-structured statement not only facilitates prompt payment but also reduces the chances of misunderstandings. Below are some guidelines to follow in order to create an effective and reliable bill.

First, always ensure that the statement includes accurate details. This means properly identifying both the service provider and the client, as well as clearly describing the tasks performed, along with any agreed-upon terms. Including clear payment instructions can also help avoid delays. Additionally, an organized layout enhances the clarity and professionalism of the document.

| Element | Description |

|---|---|

| Clear Identification | Include your full name, address, and contact information, as well as the client’s details. |

| Work Description | Provide a detailed breakdown of services rendered, including dates and time spent. |

| Payment Terms | State the due date, accepted payment methods, and any penalties for late payments. |

| Itemization | List each task or service individually with corresponding charges for full transparency. |

| Professional Tone | Use clear, polite language throughout to foster trust and professionalism. |

By adhering to these best practices, you not only streamline the payment process but also build a reputation for reliability and professionalism in your field.

Common Mistakes to Avoid in Legal Invoices

While creating a billing document for services rendered, it’s easy to overlook details that can cause confusion or delays in payment. Small errors can lead to misunderstandings with clients, disputes, or even missed payments. Understanding what mistakes to avoid will help ensure that the payment process runs smoothly and that both parties are on the same page. Below are some of the most common errors made when preparing such documents and how to avoid them.

One of the biggest mistakes is failing to include all necessary information. Without clear identification of both the service provider and the client, the document may appear unprofessional or incomplete. Additionally, ambiguous descriptions of the work completed can leave room for interpretation, leading to confusion about the services provided and the corresponding charges. Make sure every entry is detailed and specific.

Another common error is incorrect or inconsistent billing rates. If you charge different rates for various types of work, it’s important to specify these rates clearly in the document. Failing to do so can result in discrepancies that could delay payment. Always double-check your numbers and ensure that any discounts or adjustments are clearly stated.

Late or vague payment terms are another issue that can create problems. Without clearly defined due dates, payment methods, and penalties for late payments, clients may delay or forget to pay. Ensure that payment terms are not only present but easy to find within the document.

Omitting taxes or other additional fees is also a frequent mistake. If your rates include taxes or there are additional charges for expenses incurred, these should be clearly itemized in the document. If such fees are left out, it can result in misunderstandings or disagreements down the line.

Finally, one should avoid a disorganized layout. If the document is cluttered or hard to read, clients may struggle to find the important details. A clean, well-structured format ensures that key information is easy to locate and understand, preventing any unnecessary back-and-forth.

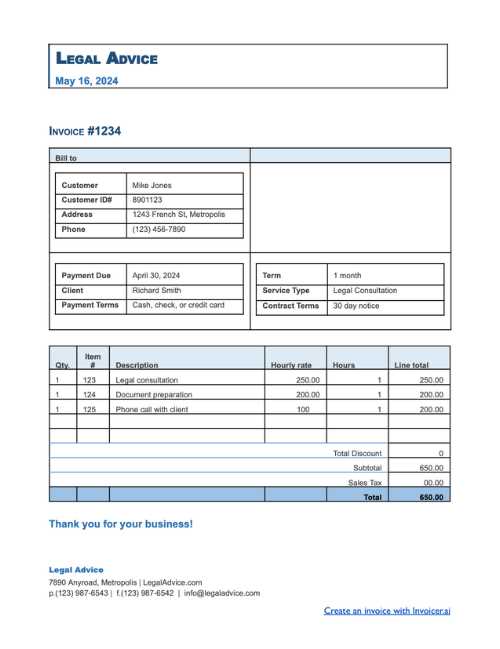

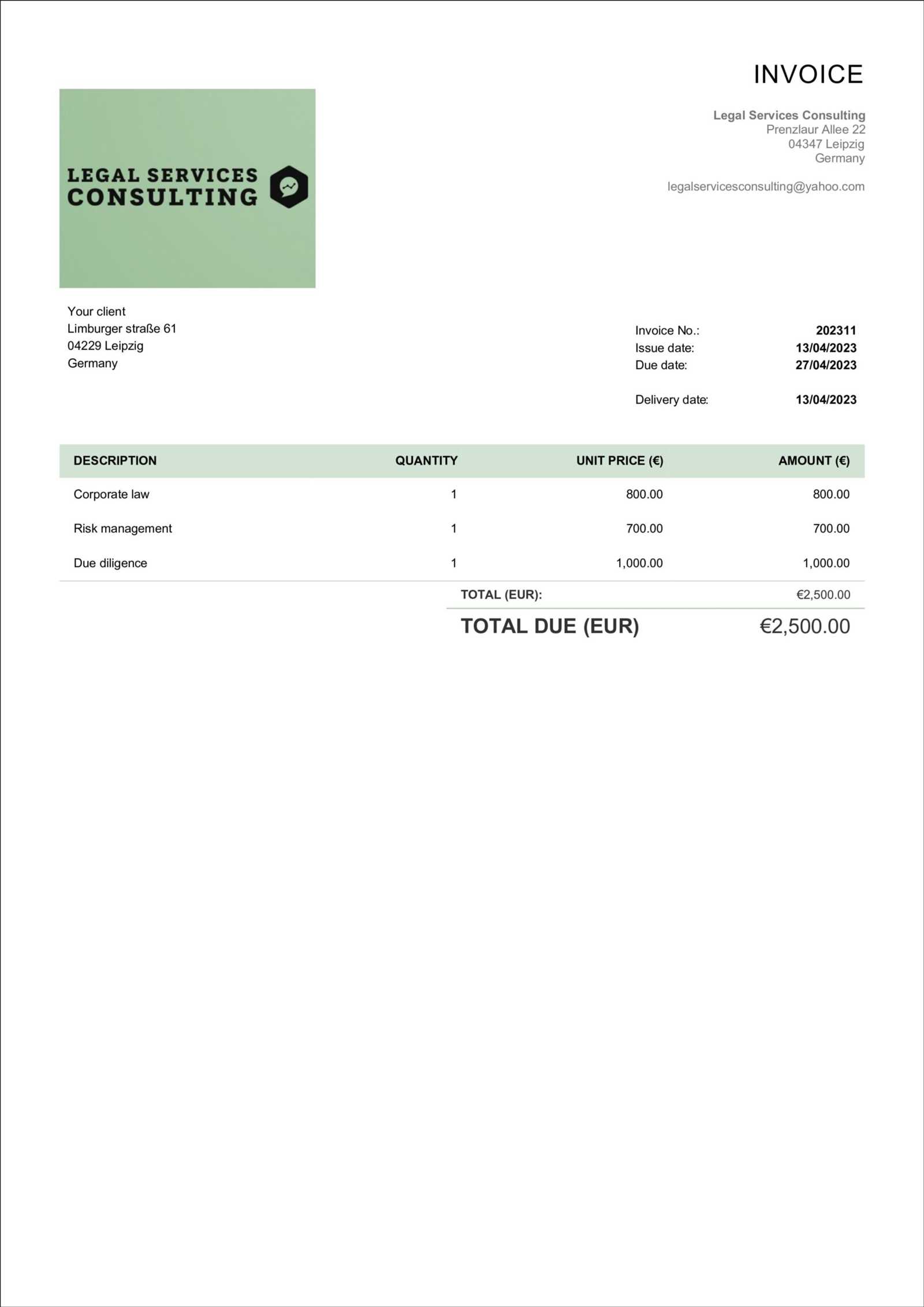

Legal Invoice Template for Law Firms

For law firms, a well-organized and detailed statement is essential to ensure accurate billing and maintain professionalism. The document should reflect the nature of the work performed while clearly presenting the charges for the services rendered. Customizing such documents for your practice will help streamline operations, ensure transparency with clients, and reduce the risk of payment disputes. Below are the key elements every firm should include in their billing records.

- Firm and Client Information: Always include full details of both the service provider and the client, such as names, addresses, and contact information.

- Case or Matter Reference: Clearly identify the specific case or matter to which the charges pertain, ensuring the client can easily match the document with the work done.

- Service Breakdown: List each task or service individually. This may include consultations, document preparation, court appearances, etc., with corresponding time spent or flat rates.

- Time Entries: If applicable, include detailed time logs with hourly rates and the total number of hours worked for each service. Accuracy here is critical for transparency.

- Payment Terms: State clear due dates, preferred payment methods, and any penalties for late payments. Include any applicable tax information or additional fees if necessary.

- Itemized Expenses: List any additional costs incurred, such as court fees, filing fees, or travel expenses, with supporting details to avoid confusion.

Adhering to these elements will help ensure that the document is complete, professional, and easy for clients to understand. A well-structured bill can lead to faster payments and better client relationships, making it an essential tool for law firms.

How to Calculate Legal Fees Correctly

Determining the appropriate fees for services rendered is a critical aspect of running a successful practice. Accurate calculations not only ensure you are compensated fairly but also prevent potential misunderstandings with clients. The method of fee calculation can vary depending on the type of service, the client’s needs, and the agreement made. Below are key steps to follow when calculating fees to ensure accuracy and transparency.

- Understand the Fee Structure: Before calculating, it is important to decide which pricing model applies. The most common structures include:

- Hourly rates

- Flat fees for specific tasks

- Contingency fees (a percentage of the settlement or award)

- Hourly Rates: If charging by the hour, keep detailed records of the time spent on each task. Break down the work into manageable increments, such as 15-minute intervals, and ensure that you apply the correct rate for each type of work.

- Flat Fees: When using flat rates, clearly define the scope of work included in the set price. This model is often used for routine services like document preparation or consultations.

- Contingency Fees: If charging based on outcomes, ensure that both parties have agreed on the percentage before beginning any work. Be transparent about how and when the fees will be applied and calculated.

- Additional Costs: Don’t forget to include any additional expenses incurred during the process, such as filing fees, travel expenses, or expert witness costs. These should be clearly itemized and agreed upon with the client in advance.

- Discounts and Adjustments: If you offer any discounts or flexible payment options, ensure these are clearly documented and factored into the final total. It’s important to avoid surprises when presenting the final amount to the client.

By following these steps, you can accurately calculate the fees for your services, ensuring both fairness and clarity for your clients. Correct fee calculation also helps maintain a transparent and professional reputation, leading to stronger client relationships and smoother financial operations.

Understanding Billing Terms for Legal Services

When providing professional services, it is crucial to have a clear understanding of the various billing terms used to describe how clients will be charged. These terms not only help set expectations but also ensure that both the service provider and client are aligned on payment processes. By being familiar with these terms, both parties can avoid confusion, prevent disputes, and ensure that payment is processed efficiently.

Common Billing Structures

There are several common ways in which professionals charge for their services. Understanding each billing method will help you select the right one for your practice and communicate it effectively to clients. Some of the most widely used structures include:

- Hourly Rate: This is the most traditional method where clients are billed based on the amount of time spent on a particular task. Time is typically tracked in increments (e.g., 15 or 30-minute blocks) and is charged at a set rate.

- Flat Fee: A fixed price for specific services, often used for well-defined tasks such as drafting documents or consultations. This structure provides clarity for both parties, as the cost is agreed upon in advance.

- Retainer Fee: A pre-paid amount for ongoing services, where the client pays upfront for a certain amount of work or time. Retainers are common in long-term client relationships.

- Contingency Fee: This structure is based on the outcome of a case or matter. The service provider receives a percentage of any settlement or award. If the case is unsuccessful, no fee is due.

Additional Considerations

Aside from the main fee structure, there are other important terms to consider when discussing costs with clients:

- Expenses: Clients may be responsible for additional costs incurred during the course of the work, such as travel, court fees, or expert witness charges. These should be clearly outlined in the agreement.

- Payment Terms: This includes when payment is due, whether it’s due on completion, monthly, or based on milestones. It’s also important to specify acceptable payment methods and any penalties for late payments.

- Billing Cycle: Whether services are billed weekly, monthly, or upon project completion, defining the billing cycle in advance ensures that clients understand when to expect charges and when payments are due.

By clearly communicating these billing terms, both parties can avoid confusion and maintain a smooth working relationship. Understanding these terms is key to establishing trust and ensuring the financial aspect of the professional relationship runs as smoothly as the services themselves.

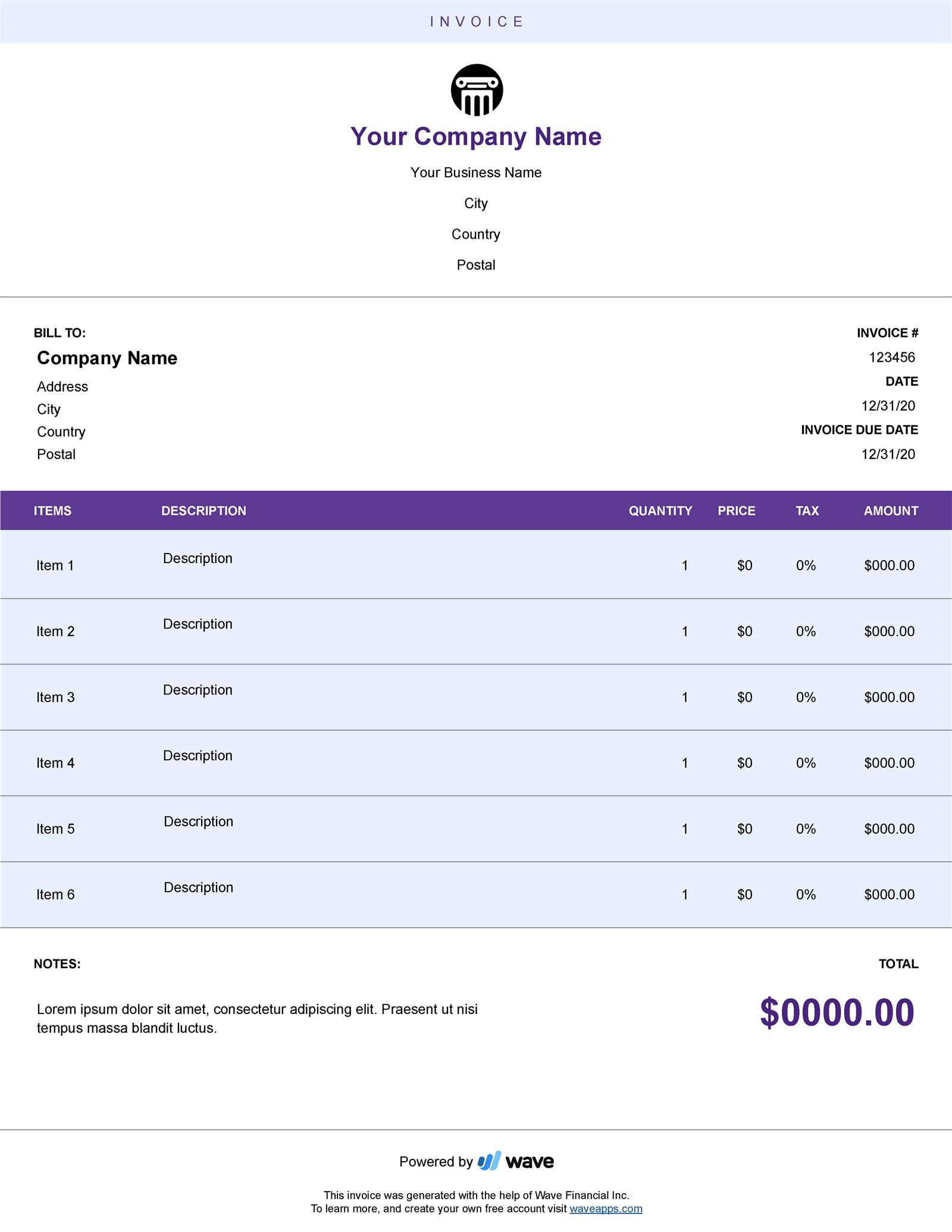

Essential Details to Include in Your Invoice

To ensure that your clients can easily process payments and understand the charges, it’s important to include all the necessary information in your billing document. A comprehensive and clear breakdown will not only facilitate prompt payment but also prevent confusion or disputes. The following are key elements that should be included in every statement for services rendered.

Client and Provider Information

Start by clearly identifying both the service provider and the client. This ensures that both parties are correctly recognized, which is essential for record-keeping and payment tracking. The following details should be included:

- Service Provider Details: Include your full name, business name (if applicable), address, phone number, and email address.

- Client Information: Include the client’s full name or company name, as well as their contact information (address, phone number, and email).

Breakdown of Services and Charges

Clearly listing the services performed and their associated charges helps prevent any misunderstandings. Ensure that each item is specified in detail, with accurate descriptions and corresponding costs. This includes:

- Service Description: Provide a detailed explanation of each task performed or service delivered. For example, “Consultation on contract negotiation” or “Drafting of legal documents.”

- Time Spent: If billing by the hour, include the time spent on each task or service, broken down by hour or fraction of an hour.

- Rate: Specify the rate charged for each service, whether it’s an hourly rate, flat fee, or other pricing model.

- Total Charge: Clearly state the total charge for each line item and the overall total for the work performed.

Including a clear breakdown ensures that clients understand what they are being charged for and can verify the accuracy of the charges, leading to smoother transactions.

Payment Terms and Due Date

To avoid confusion or payment delays, it’s crucial to outline the payment terms. Key elements to include are:

- Due Date: Clearly state when the payment is due, whether it’s immediately, within 30 days, or another agreed-upon time frame.

- Accepted Payment Methods: Specify the methods of payment you accept, such as bank transfers, checks, or credit cards.

- Late Payment Penaltie

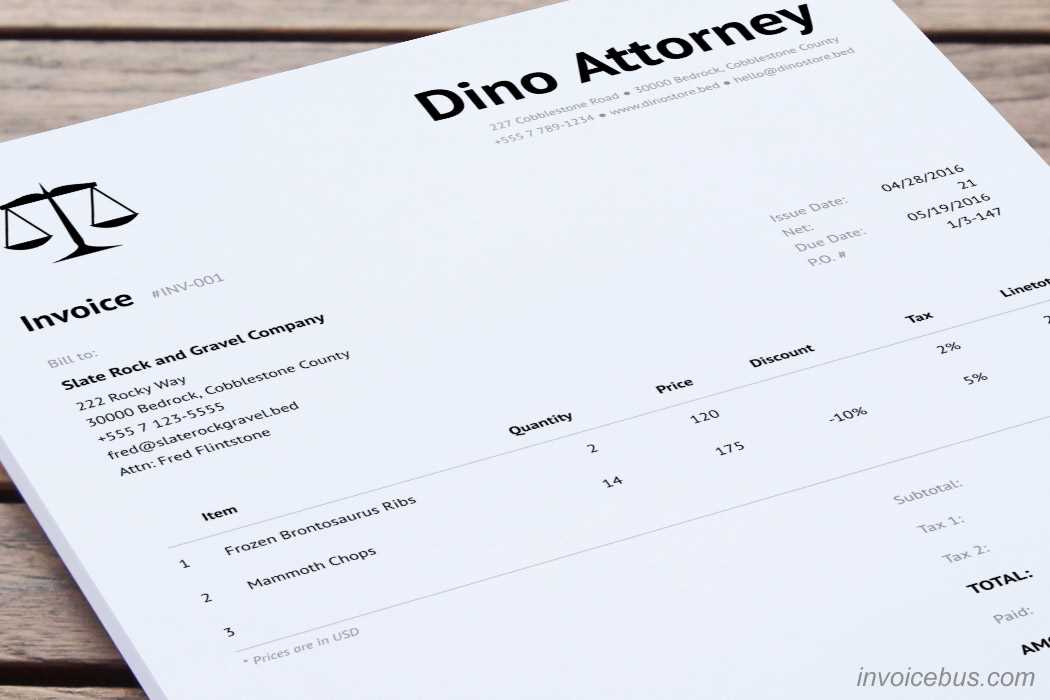

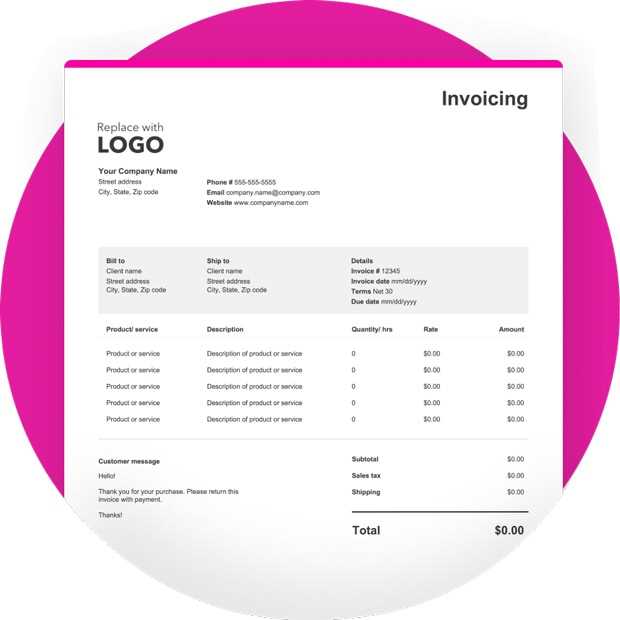

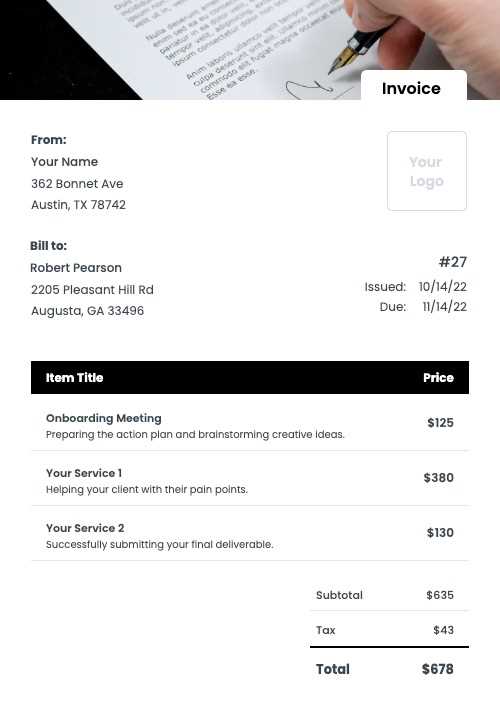

Invoice Format and Design Tips

When creating a billing document for services provided, the format and design play a crucial role in ensuring clarity and professionalism. A well-organized and visually appealing layout not only makes the document easier to read but also helps convey important information in an efficient manner. The following tips will help you create a streamlined, effective statement that clients can quickly understand and process.

Start with a clean, organized layout that makes it easy for the reader to find the essential details. Use headers and subheaders to separate different sections, such as client information, service description, and payment terms. This allows clients to navigate the document effortlessly.

Key Design Tips:

- Keep It Simple: Avoid clutter by using a minimalist design. Stick to a limited color palette and simple fonts to ensure readability.

- Use Clear Headers: Clearly label each section with bold headers (e.g., “Services Rendered,” “Payment Terms,” “Total Due”) to help clients easily find key information.

- Organize Information in Tables: A table is a great way to organize services and associated costs. List each task, the time spent, the rate, and the total cost in an easy-to-read table format.

- Highlight Important Information: Use bold or larger font sizes for critical details such as the total amount due, payment deadline, or client contact information.

Formatting Suggestions:

- Use Consistent Font Styles: Stick to one or two font styles throughout the document. For example, use one font for headings and another for the body text.

- Include Your Branding: If you have a logo or business name, be sure to incorporate it at the top of the document to reinforce your brand identity.

- Ensure Proper Spacing: Adequate white space around text and tables makes the document more readable and less overwhelming.

- Provide Clear Payment Instructions: Clearly state how the client can make payments and what methods are accepted. This can include bank details, online payment options, or physical addresses for checks.

By following these design and format guidelines, you can ensure that your document is professional, easy to navigate, and effective in communicating the necessary details to your clients. A well-designed statement not only helps improve the payment process but also enhances your reputation as a professional

Free vs Paid Invoice Templates

When it comes to preparing a billing document for services rendered, choosing the right structure is key to ensuring professionalism and accuracy. There are many resources available online that offer both free and paid options for creating such documents. The decision between using a free or paid option depends on factors such as customization needs, frequency of use, and the level of detail required. Understanding the differences between these options will help you make an informed choice for your business.

Free Templates:

Free resources are a great starting point for those who need a simple and quick solution. These templates are typically easy to use and can be downloaded directly without any cost. They often come in basic formats and may include the most essential sections, such as service descriptions, rates, and payment terms. However, free versions tend to have limitations in terms of design flexibility, functionality, and support. If you only need a basic document for occasional use, a free template can be an excellent choice.

- Pros: Cost-effective, easy to use, good for occasional needs.

- Cons: Limited customization options, basic designs, less professional appearance.

Paid Templates:

Paid options typically offer more advanced features, such as a wider range of customizable fields, better design options, and integration with accounting software. These templates often come with professional-grade formatting, ensuring your document looks polished and well-organized. Many paid options also include ongoing support and updates, which can be beneficial if you are looking for long-term solutions or need additional functionality. If you run a busy practice or require specific features, investing in a paid template may be worth it.

- Pros: Highly customizable, professional designs, additional features and support, integration with accounting tools.

- Cons: Upfront cost, may be more complex for new users.

Ultimately, the choice between free and paid options depends on your needs. If you require a quick and basic solution, a free template may suffice. However, for more advanced needs or frequent use, investing in a paid template can offer more long-term benefits, including enhanced functionality and professionalism.

How to Handle Late Payments in Legal Billing

Late payments can disrupt cash flow and cause unnecessary stress for service providers. In any professional setting, it’s crucial to have a clear strategy in place for managing overdue payments. By establishing firm policies and communicating them to clients upfront, you can minimize delays and maintain a healthy financial operation. Below are effective ways to handle late payments and ensure that your business continues to run smoothly.

1. Set Clear Payment Terms:

From the outset, it’s important to clearly communicate your payment expectations. Ensure that the terms–including the due date, acceptable payment methods, and any penalties for overdue payments–are explicitly outlined in the billing document. Having this agreement in writing will reduce confusion and provide a reference point in case of delays.

2. Send Friendly Reminders:

If a payment becomes overdue, start by sending a polite reminder. Often, clients simply forget or miss the due date. A professional reminder, sent through email or mail, can prompt them to take action without causing tension. Be courteous and concise, reiterating the due amount and providing payment instructions.

3. Implement Late Fees:

To encourage timely payments, consider including a late fee clause in your payment terms. If the payment is not received by the specified due date, a predefined fee or interest charge can be applied. Clearly communicate this policy before work begins, so clients are aware of the potential consequences for late payments.

4. Offer Payment Plans:

If a client is unable to make a full payment at once, offering a payment plan can be a viable solution. Break the total amount into smaller, manageable installments and provide clear deadlines for each payment. This can make it easier for the client to pay, while still ensuring that you receive the compensation for your services.

5. Follow Up Firmly:

If initial reminders and negotiations do not result in payment, it may be necessary to take a firmer approach. Send a final notice, explaining the next steps you will take if the payment is not made. At this stage, you can also consider involving a collections agency or seeking legal action, depending on the severity of the case.

6. Maintain Professionalism:

Regardless of the situation, it’s important to remain professional and respectful throughout the process. A cooperative approach is often more effective in resolving payment issues and maintaining a positive relationship with clients for future work.

By implementing clear payment policies and following these strategies, you can minimize the impact of late payments and ensure your business maintains consistent cash flow. Communication, flexibility, and professionalism are key when handling overdue amounts.

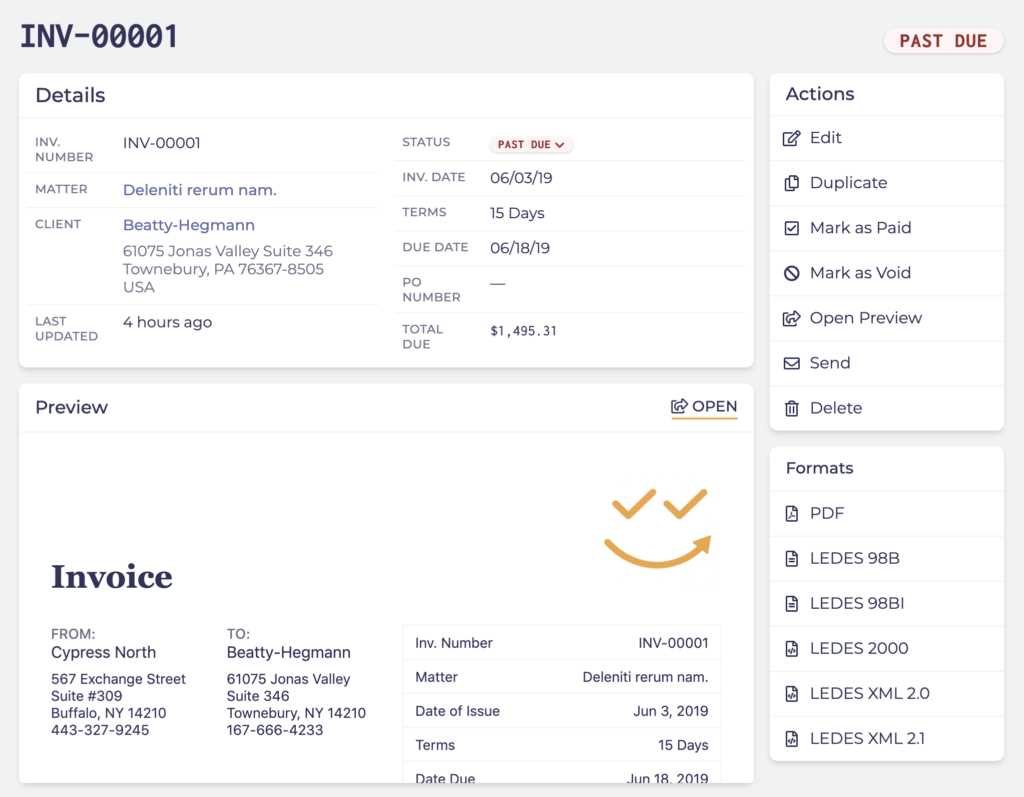

Automating Legal Invoices with Software

Modern technology has revolutionized many aspects of business operations, and financial documentation is no exception. By adopting automated tools, professionals can significantly enhance the efficiency of generating and processing billing statements. These systems streamline the creation of financial records, reduce human errors, and save valuable time, allowing firms to focus on their core activities while ensuring accuracy in accounting procedures.

Automation tools have become indispensable for professionals who manage complex billing structures. Instead of manually entering each charge, these systems can automatically calculate fees based on predefined rates, working hours, or services rendered. This reduces the risk of oversight and ensures that clients are billed accurately and on time. Additionally, automation allows for the seamless integration of data from various sources, simplifying the overall workflow.

Furthermore, automating financial documents provides greater transparency and consistency. Once the system is set up with the appropriate rules and templates, it guarantees uniformity in how charges are calculated, formatted, and presented. With built-in features like audit trails, tracking changes, and customizable reports, automated systems provide clear insights into billing history and help businesses comply with internal and external regulations.

Overall, leveraging software to handle financial documentation not only enhances operational efficiency but also improves client relationships. By minimizing errors and ensuring timely processing, firms can build trust and deliver a higher standard of service.

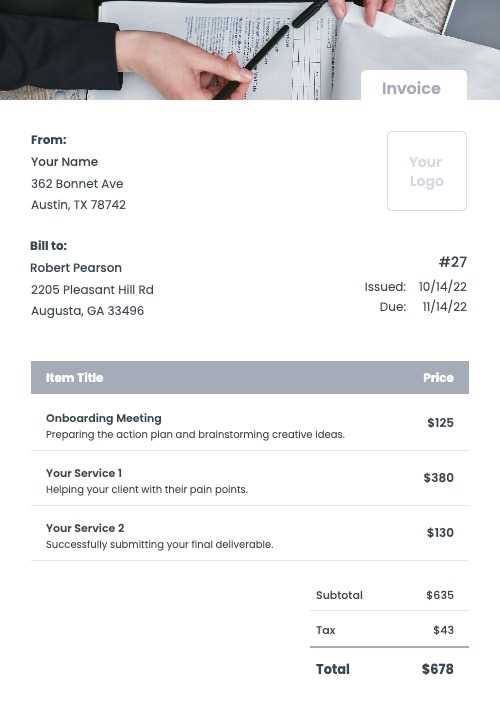

Legal Invoice Template for Freelancers

Freelancers often face the challenge of managing their finances while balancing the demands of multiple clients. A well-structured document for billing is crucial to ensure that payments are received on time and all services rendered are properly accounted for. Having a professional framework for creating these records helps streamline the process and maintain a high level of organization in financial dealings.

For freelancers, using a standard framework can save time and prevent confusion when billing clients. A clear document should include all necessary details to avoid misunderstandings. Here are some key elements to consider when crafting a billing statement:

- Contact Information: Include the freelancer’s name, business details, and client contact information for clarity.

- Service Description: List the specific tasks or projects completed, ensuring each item is clearly defined.

- Rates and Charges: State the hourly rate or fixed fee for each service, with breakdowns if applicable.

- Payment Terms: Specify when payment is due and any late fees or discounts for early payment.

- Invoice Number: Assign a unique reference number for easy tracking and organization.

- Due Date: Clearly indicate the payment deadline to avoid delays in processing.

By using this framework, freelancers can quickly create accurate and professional billing documents. Not only does this make it easier to manage accounts, but it also builds trust with clients by demonstrating professionalism and attention to detail.

Automating this process through software or digital tools can further enhance efficiency. With pre-designed frameworks and customizable options, freelancers can generate these records quickly, ensuring they focus on their work rather than administrative tasks.

Importance of Clear Payment Terms

Clear payment conditions are essential for maintaining healthy professional relationships and ensuring smooth financial transactions. When both parties have a clear understanding of the expectations around payments, it minimizes the potential for disputes, delays, and confusion. Well-defined terms protect both the service provider and the client by setting out mutually agreed-upon deadlines, rates, and any additional fees in advance.

Preventing Misunderstandings

By clearly outlining when and how payments should be made, both sides can avoid misunderstandings that may arise during the completion of work. Whether it’s specifying whether payment is due upon completion, in installments, or based on milestones, having these terms laid out ensures that there are no surprises. This transparency fosters trust between the service provider and the client, leading to smoother transactions and better ongoing business relationships.

Encouraging Timely Payments

Clear terms also help ensure that payments are made promptly. By including deadlines, late fees, and accepted payment methods, the service provider can establish a sense of urgency for the client. This reduces the risk of delays, which could impact cash flow and overall business operations. When clients know exactly what is expected of them, they are more likely to meet deadlines and settle accounts on time.

Ultimately, having well-defined payment conditions is a key aspect of financial management, whether you’re working with a single client or handling multiple projects. By setting these terms upfront, both parties can proceed with confidence, knowing that all financial expectations are agreed upon from the start.

Protecting Your Practice with Proper Invoicing

Establishing clear and professional billing practices is essential for safeguarding your business and ensuring smooth financial operations. Properly documenting the details of the services provided, payment expectations, and deadlines can protect you from misunderstandings, disputes, or even legal challenges. By maintaining a thorough and transparent approach to financial documentation, you create a solid foundation for trust with clients and secure the financial health of your practice.

Accurate records not only provide a clear outline of the work completed but also serve as evidence in case of any disagreements. In situations where payment issues arise, having a detailed account of services rendered–along with agreed-upon rates and payment schedules–can be invaluable. This documentation can protect your rights and make it easier to resolve any conflicts with clients.

Additionally, well-organized billing documents help ensure timely payments, reducing the risk of delayed cash flow. By clearly stating payment terms, deadlines, and late fees, you make it clear to clients that timely settlement is important. This proactive approach minimizes the risk of non-payment or prolonged payment delays, which can severely impact your financial stability.

Consistency in your billing process also creates a sense of professionalism, which can strengthen client relationships. Clients who see that you manage your financial affairs with care and attention are more likely to respect your terms and continue doing business with you in the future.

In the long run, protecting your practice with clear and thorough financial documentation helps ensure that both your work and your reputation remain secure. This simple yet powerful tool can safeguard your income, prevent legal complications, and contribute to the overall success of your business.