ABN Invoice Template for Easy and Professional Billing

For any business, keeping track of transactions and ensuring timely payments is crucial. Proper documentation is not only essential for smooth operations but also for complying with tax regulations. Having a well-structured payment record can save you time, reduce errors, and make your financial management more efficient.

Creating professional billing documents that meet the legal requirements can often be a time-consuming task. With the right tools, however, this process can be simplified. These tools allow businesses to quickly generate accurate and compliant records, eliminating the need for manual calculations and reducing the risk of mistakes.

In this guide, we will explore how customizable billing formats can help businesses, freelancers, and contractors manage their financial transactions effectively. Whether you’re just starting or looking to improve your current system, the right approach can enhance your productivity and ensure you stay organized.

ABN Invoice Template Overview

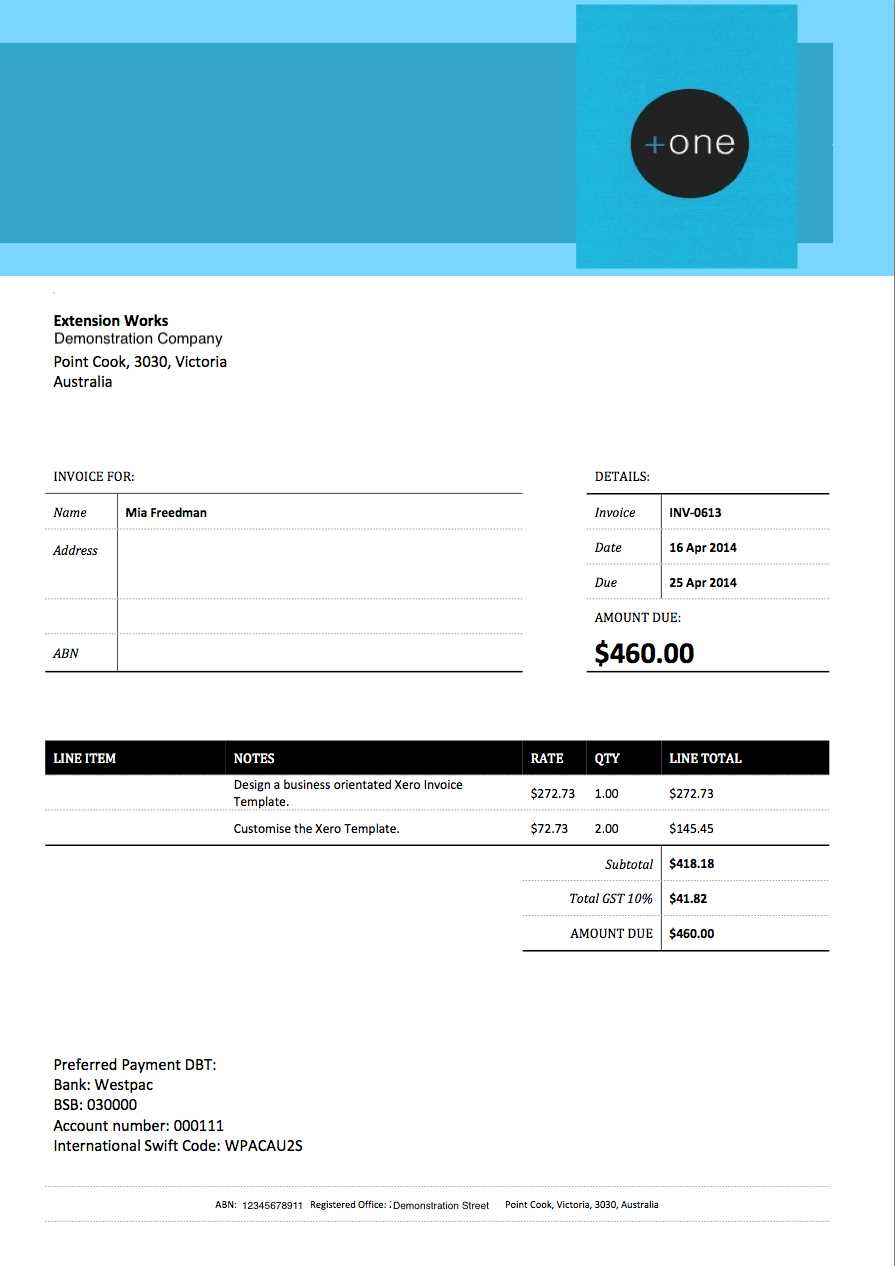

For businesses, freelancers, and contractors, generating professional billing documents is an essential part of day-to-day operations. A well-designed billing document not only facilitates smooth financial transactions but also ensures compliance with local tax regulations. The right format helps streamline the process, reduce errors, and maintain consistency across all financial records.

These customizable documents allow users to input necessary details like payment terms, service descriptions, and contact information. With the appropriate fields and layout, such records can be used both for internal tracking and to communicate with clients clearly and professionally.

- Professional appearance: Ensures that all required information is presented in a clear, consistent manner.

- Legal compliance: Meets the standards required by authorities for businesses operating in specific regions.

- Customization options: Easily tailored to fit the specific needs of your business or industry.

- Efficient payment tracking: Enables businesses to keep a detailed record of services rendered and payments received.

- Time-saving: Helps you quickly generate accurate documents without starting from scratch each time.

By choosing the right layout and format, business owners can simplify financial operations and ensure that all records meet legal standards. This approach minimizes the risk of errors, miscommunication, and delays in payment, creating a smooth and reliable billing process for both parties involved.

What is an ABN Invoice Template

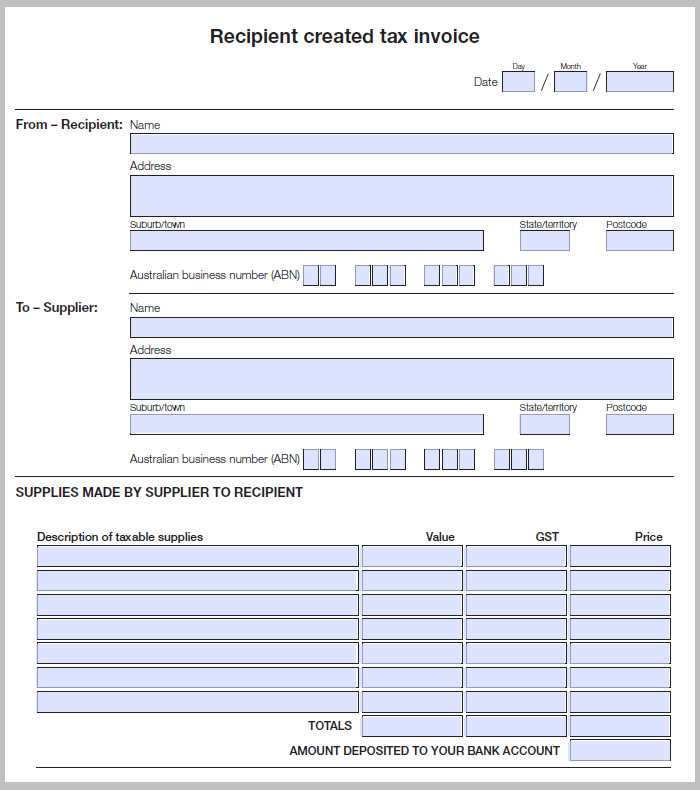

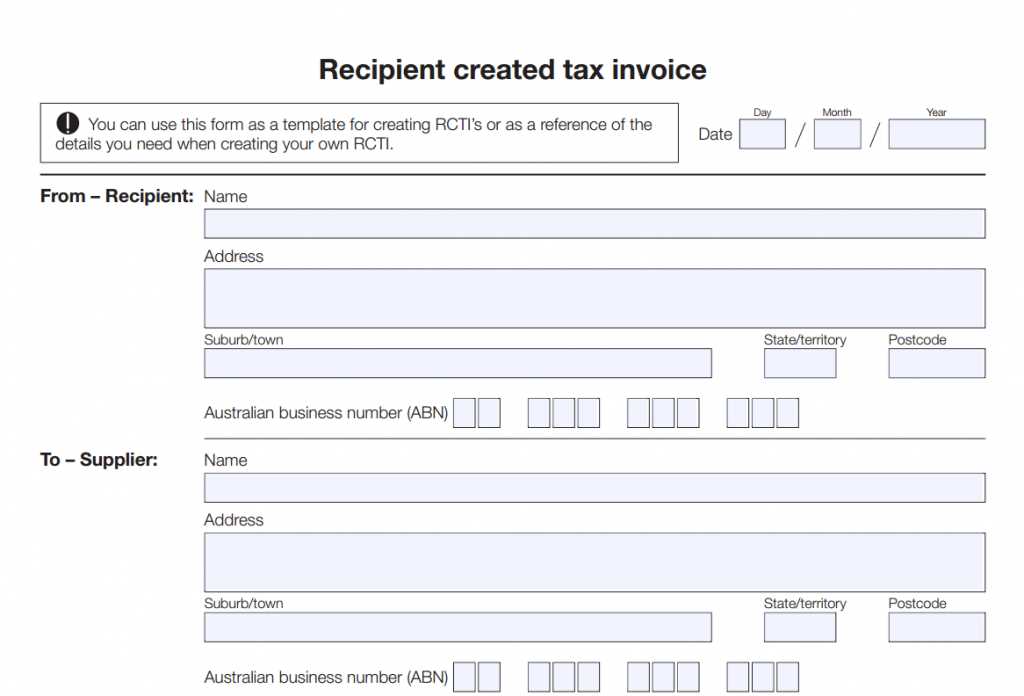

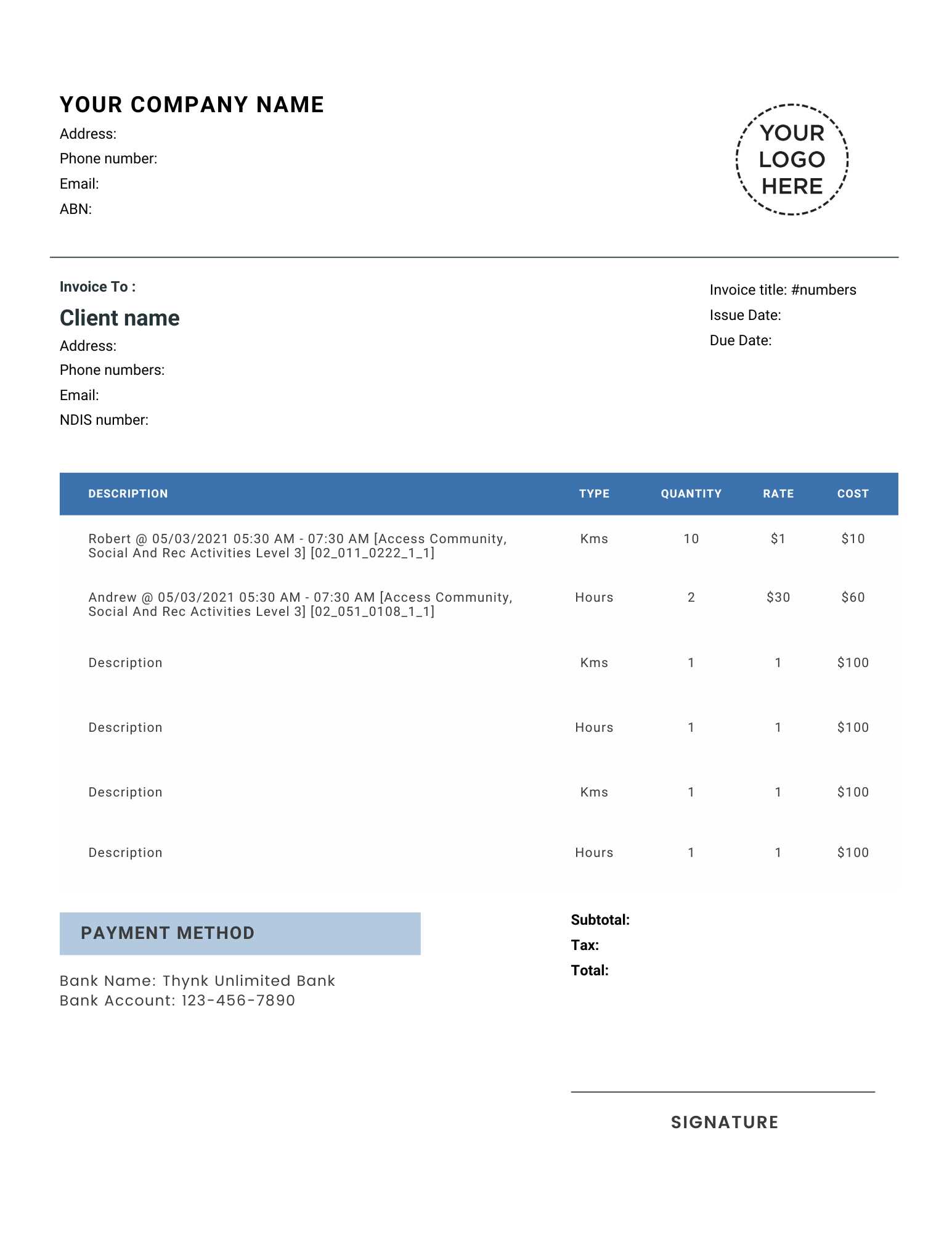

In the world of business, it’s essential to maintain a standardized method for documenting transactions and payments. A well-structured financial record serves as a formal request for payment, including all necessary details such as the services rendered, amounts due, and payment terms. These documents ensure clarity between parties and compliance with tax regulations.

For businesses in Australia, certain documents need to contain specific information to meet legal requirements. This includes a unique identification number, details of the work completed, and clear payment terms. This structured format simplifies the billing process and helps avoid confusion or errors.

Key Information Included

| Element | Description |

|---|---|

| Business Details | Includes name, contact information, and legal registration number. |

| Recipient Information | Client’s name, address, and contact details. |

| Work Description | Clear breakdown of services provided, including dates and quantity. |

| Amount Due | The total amount to be paid, including taxes and any additional charges. |

| Payment Terms | Details of payment methods, due date, and penalties for late payment. |

Why It’s Important

Having a standardized document ensures that businesses remain compliant with tax laws while also presenting a professional image to clients. The clear structure of the document helps avoid confusion, miscommunication, and payment delays, making the entire financial transaction process more efficient and transparent.

Why Use an ABN Invoice Template

For businesses, having a standardized format for financial documentation simplifies many processes. When you can quickly generate a professional record for each transaction, you save time and reduce the risk of errors. Furthermore, a structured document ensures that both parties are on the same page, avoiding confusion and ensuring timely payments.

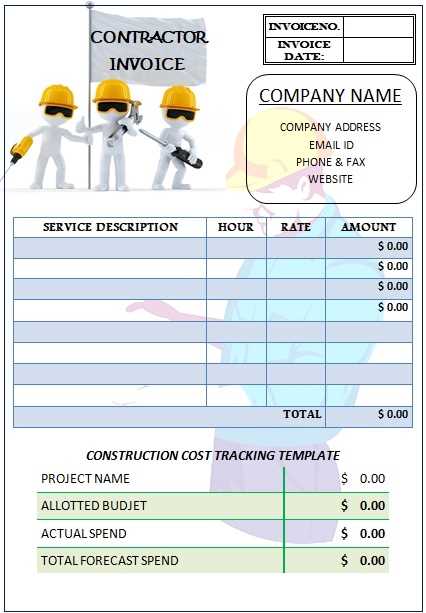

Using a predefined layout for billing documents brings several advantages, particularly in ensuring that all the necessary legal and financial details are included. Whether you’re a freelancer, a small business owner, or a contractor, a well-organized document helps maintain a smooth workflow and improves your credibility with clients.

Benefits of Consistency

By consistently using a structured billing format, you can:

- Reduce Mistakes: A pre-designed format ensures all required fields are filled, reducing human error.

- Save Time: Rather than creating each document from scratch, you can quickly fill in the blanks, allowing more focus on your core work.

- Maintain Professionalism: A clean and organized document portrays your business as trustworthy and serious.

Legal Compliance

In many countries, including Australia, certain billing documents must include specific information to be legally valid. Using a standardized record helps ensure that you meet these requirements and avoid potential legal issues. Having accurate and compliant documents can also help in case of disputes or audits.

In short, adopting a consistent approach to financial documentation is essential for streamlining business operations, ensuring legal compliance, and maintaining professionalism with clients.

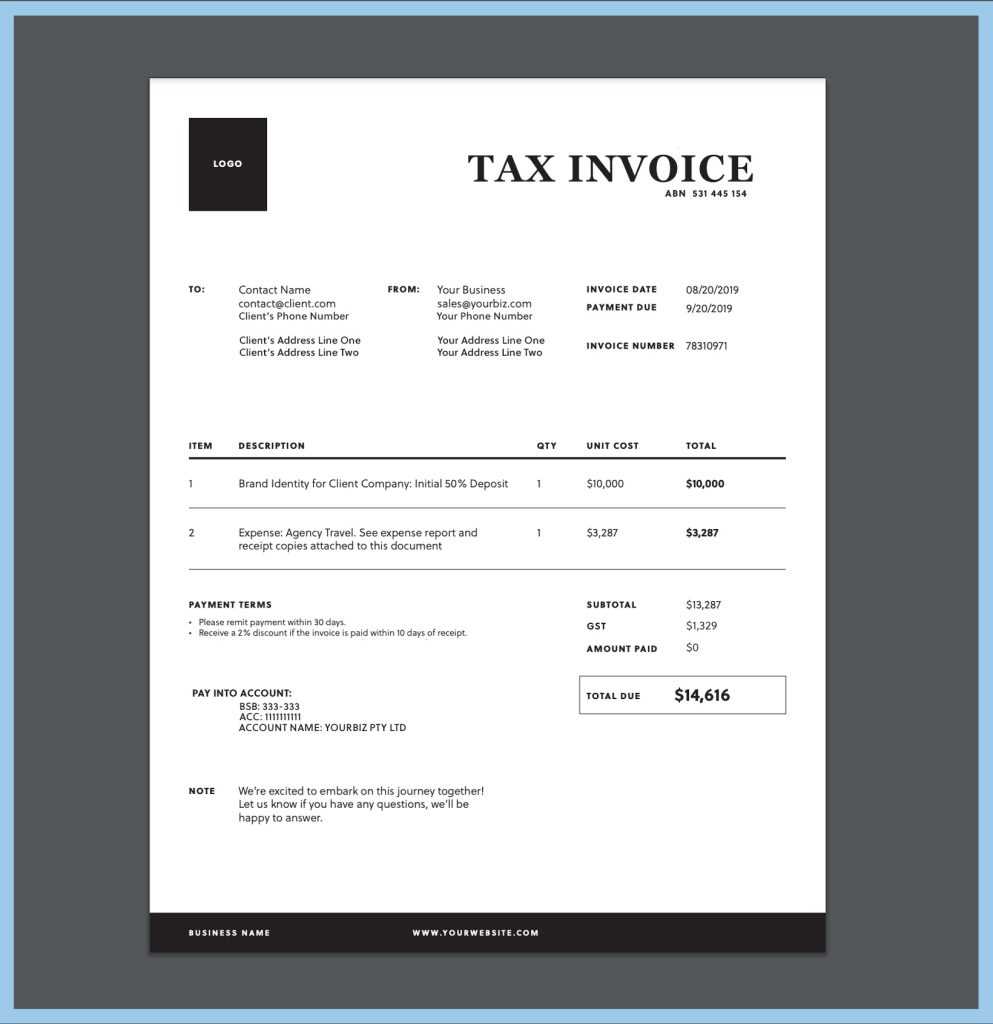

Key Features of a Professional Invoice

For any business, maintaining clear and organized financial documentation is crucial. A well-crafted billing document serves as both a request for payment and a formal record of the services or goods provided. To ensure clarity and prevent misunderstandings, certain elements should be consistently included in every document. These key features help establish trust, promote professionalism, and ensure compliance with legal standards.

A properly structured document should not only present the necessary information but also be easy to read and understand. Here are the most important features that every professional billing document should contain:

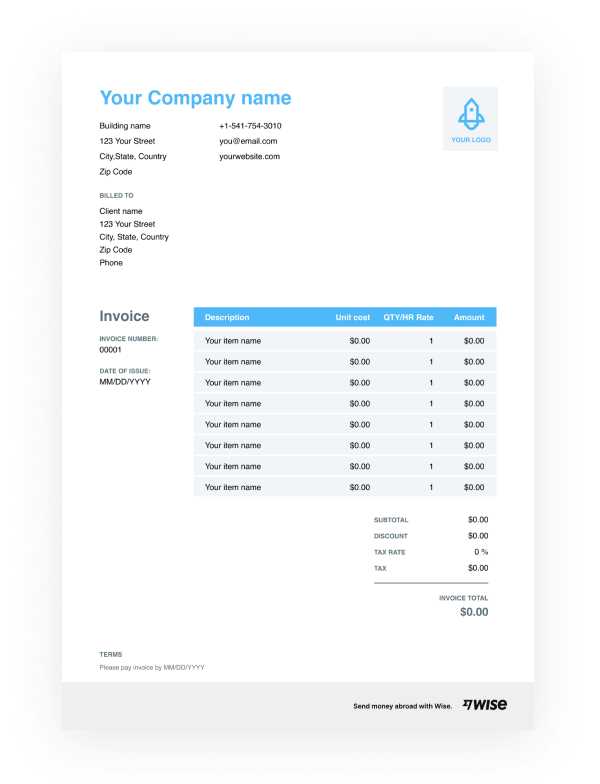

- Business Details: The document should include the name, contact information, and any relevant registration or identification numbers of the business. This establishes authenticity and allows the recipient to verify the source of the document.

- Recipient Information: Always include the client’s name, address, and contact details. This ensures that the correct party is being billed and helps avoid confusion.

- Clear Description of Services or Goods: Provide a detailed breakdown of the products or services provided, including quantities, unit prices, and dates. This transparency prevents disputes and clarifies what the payment is for.

- Amount Due: The total sum owed should be clearly highlighted. This includes the cost of services, taxes, and any additional fees, making it easy for the recipient to see the full amount due.

- Payment Terms: Define the payment method, due date, and any penalties for late payment. Clear terms help avoid confusion and ensure timely payments.

- Unique Identification Number: This unique reference number helps keep track of each transaction for record-keeping purposes and simplifies future communication or disputes.

Including these key elements in every billing document creates a clear, professional standard that both parties can rely on. It also fosters better business relationships and ensures that all necessary information is easily accessible when needed.

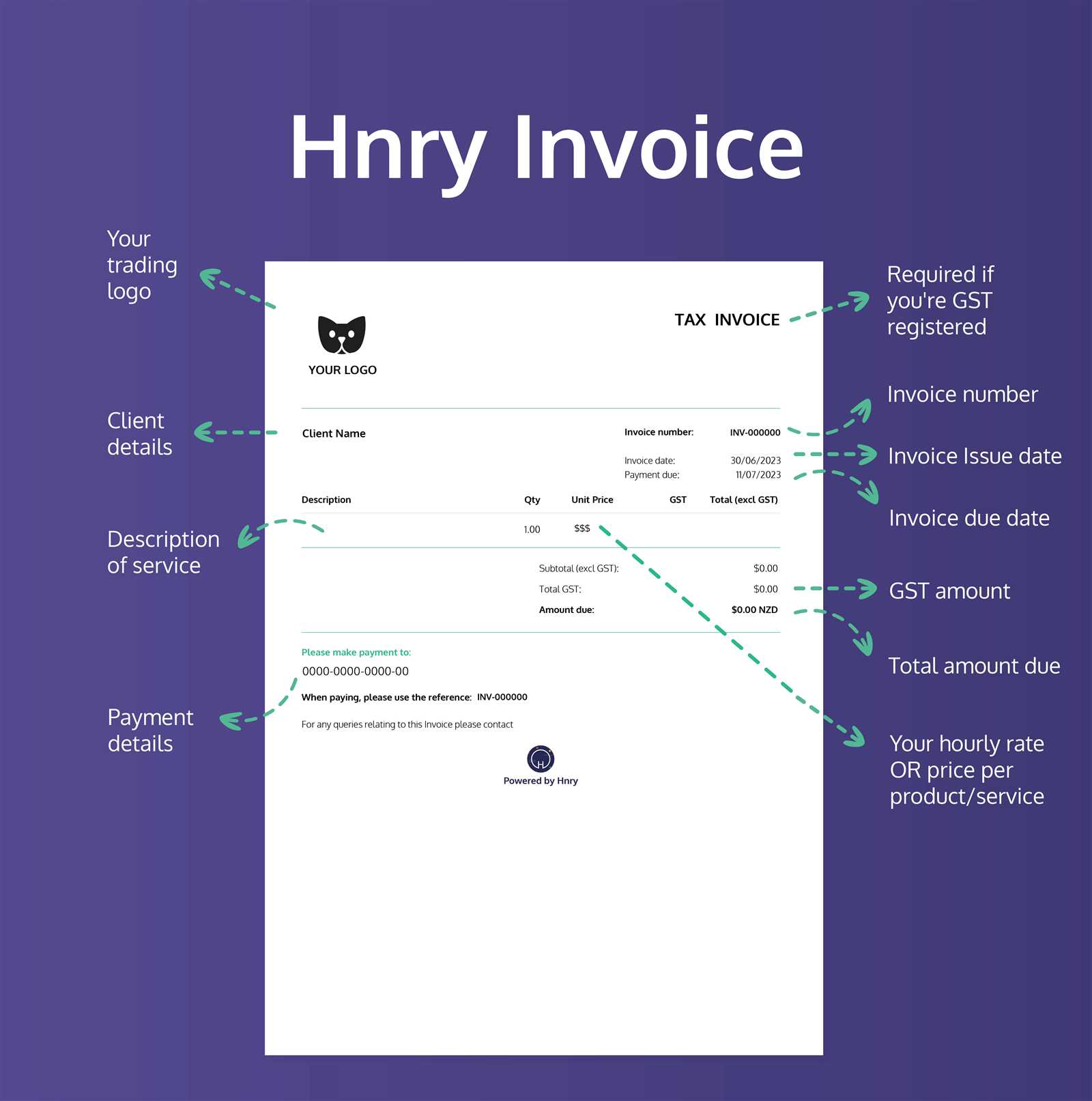

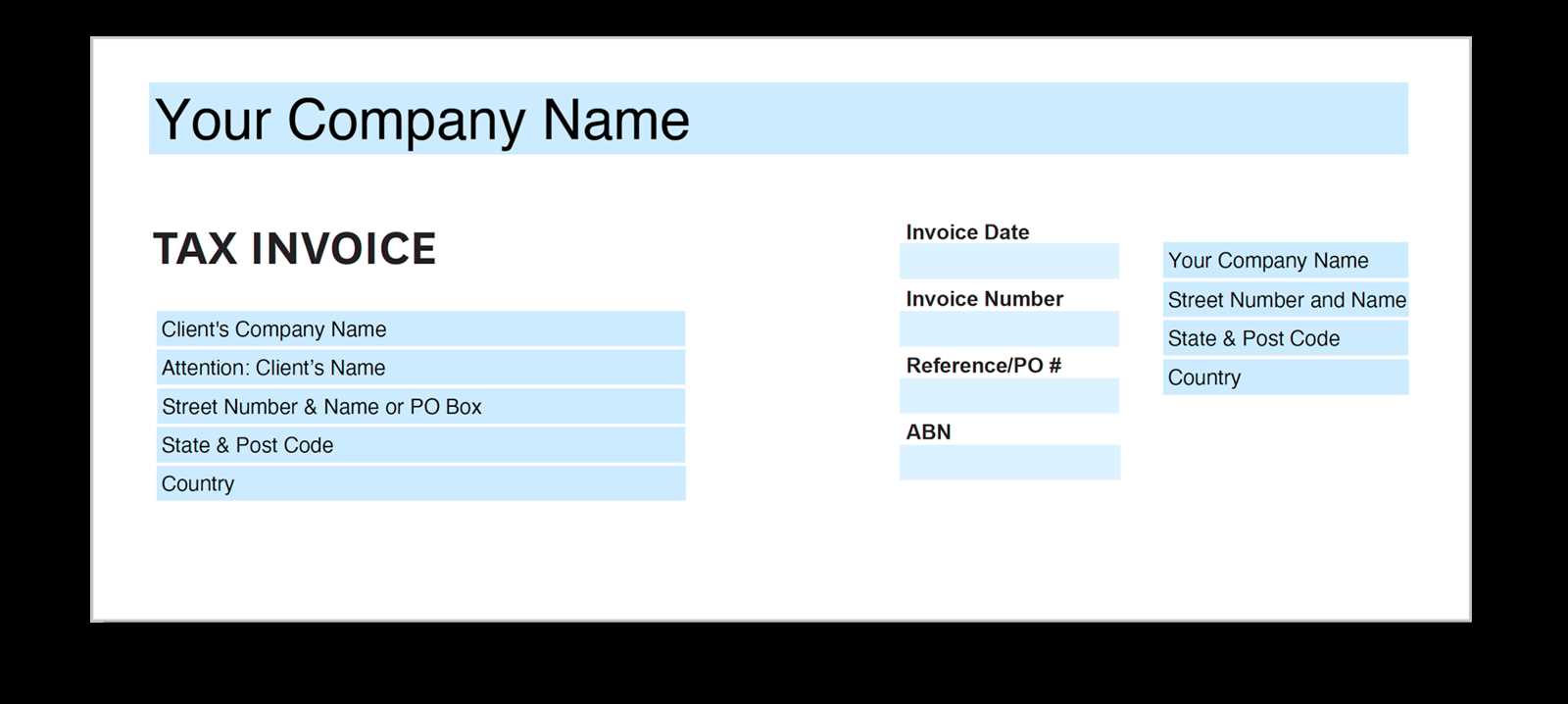

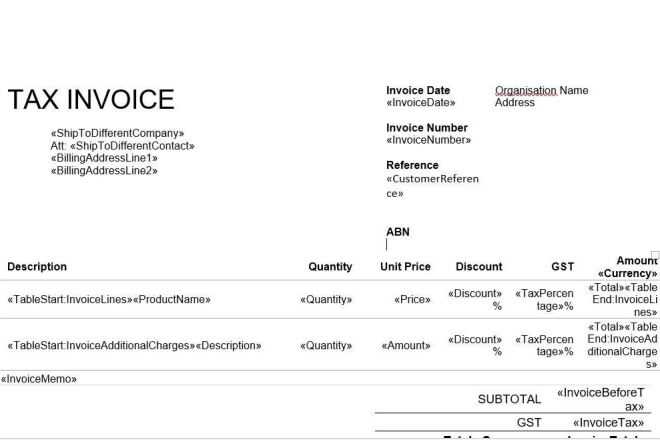

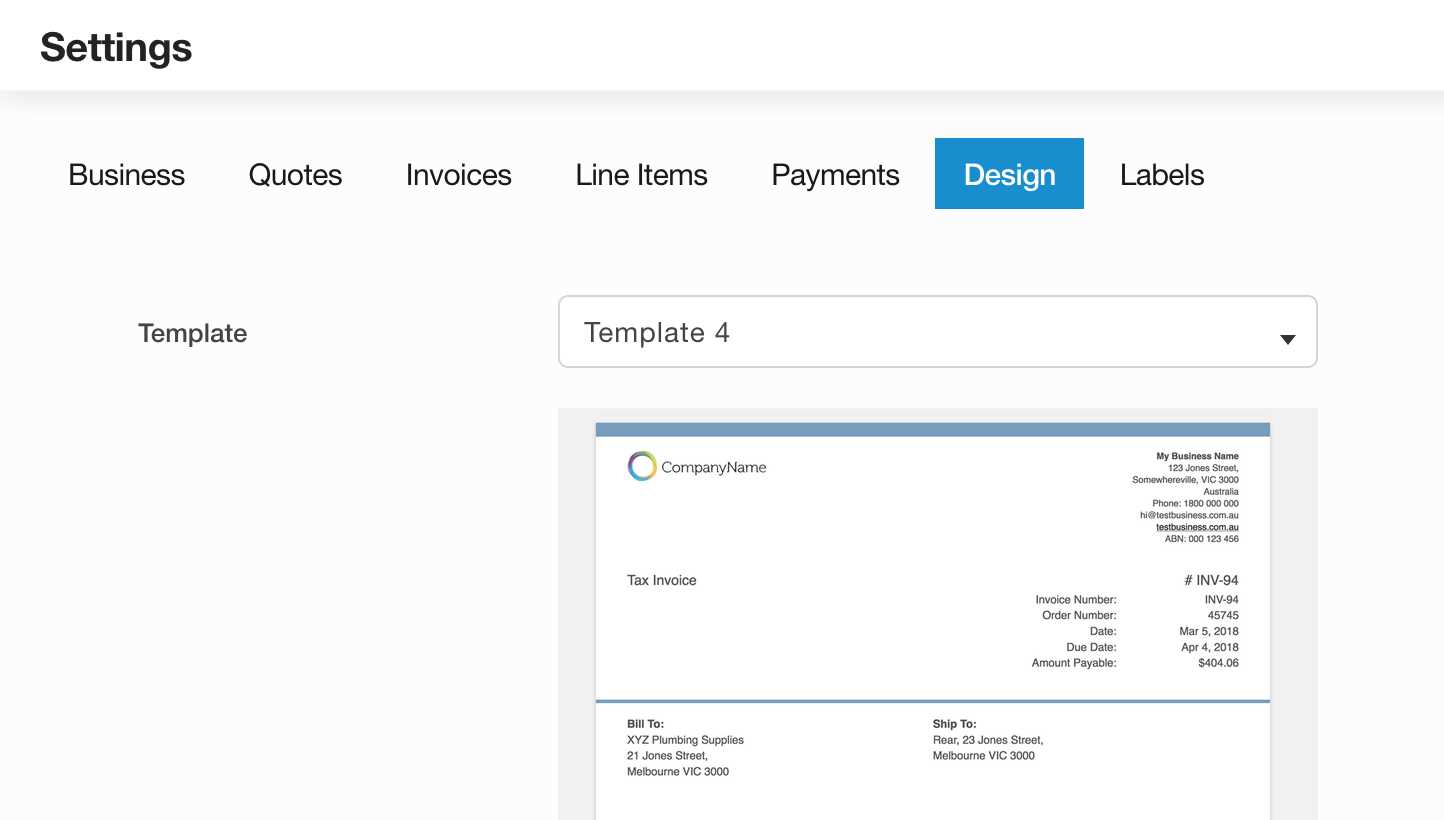

How to Customize Your ABN Invoice

Customizing your financial documents is an essential step in making sure they align with your business needs and professional standards. A personalized record allows you to tailor the layout and content to best reflect the services you offer, while also ensuring that all required legal and payment details are included. By adjusting specific sections, you can create a document that is both functional and aligned with your brand identity.

Customizing a financial document doesn’t have to be difficult. With the right tools, you can modify key fields to reflect your business name, add or remove specific information, and adjust the design to match your style. Below are some key customization steps to consider when adjusting your document:

Basic Customization Steps

- Company Information: Ensure that your company name, logo, and contact details are prominently displayed at the top. This adds a personal touch and makes it easier for clients to reach you.

- Payment Terms: Adjust the payment terms based on your agreement with each client, specifying due dates, discounts for early payment, or penalties for late fees.

- Service Description: Tailor the description of the products or services offered. Be as specific as needed, especially for complex projects or long-term engagements.

Advanced Customization Options

If you’re using software or a tool to generate these documents, you can also customize more advanced features, such as:

- Currency and Tax Settings: Ensure that the correct currency is used and that taxes are calculated based on local tax laws or industry-specific regulations.

- Formatting and Layout: Adjust the font style, color scheme, and document layout to match your brand’s visual identity. A well-designed document helps create a lasting impression.

- Automatic Numbering: Set up a system for automatically generating unique reference numbers for each document, which helps keep track of all transactions for future reference.

Additional Considerations

When customizing your billing records, always ensure they are still compliant with any relevant legal requirements. In some countries, specific fields must be included, such as tax identification numbers, for the document to be valid. This can often be done automatically in invoicing software or by using a predefined structure.

Customiza

Benefits of Using an ABN InvoiceHaving a well-structured billing document provides significant advantages for businesses, freelancers, and contractors. It simplifies the process of tracking payments, ensuring clarity between the business and the client. When you use a formal payment request, both parties have a clear record of the transaction, reducing the chances of disputes or misunderstandings. Moreover, a properly formatted document offers both operational and legal benefits, making the financial transaction process smoother and more efficient. The following are some of the key benefits that businesses can experience by using a standardized billing method:

In addition to these practical advantages, using a formalized billing structure allows businesses to project an image of reliability and transparency. Clients appreciate having clear and detailed records, which enhances their confidence in your professionalism and helps maintain long-term relationships. In short, the use of a standardized payment document streamlines the entire billing process, improving efficiency, compliance, and client satisfaction. How to Add an ABN to Your Invoice

For businesses operating in certain regions, including a unique identification number on your billing documents is a legal requirement. This number helps confirm your registration with the relevant tax authorities and ensures that your transactions are compliant with local laws. Including this number on your financial records provides clarity and avoids potential issues with tax reporting or payments. To add the registration number to your documents, it’s important to place it in a clear and consistent location. Below are the steps and considerations for ensuring that this critical piece of information is included correctly. Steps to Add the Identification Number

Where to Place the Registration NumberGenerally, it’s best practice to position this number in a prominent place on your document where it’s easy for the recipient to find. Common placements include:

|

|---|