Invoice Template for Social Media Services to Streamline Your Billing Process

Running a business that involves providing online support or digital promotion requires clear communication with clients regarding payment. One of the most important aspects of this process is ensuring that you present a professional, structured document that outlines the work completed and the amount due. This ensures both transparency and trust between you and your clients, while also keeping your finances organized.

Having a reliable system for generating billing statements can save you time and reduce errors. Customizable formats allow you to quickly adapt your documents for various projects, clients, and payment terms. Whether you’re a freelancer, a small business owner, or part of a larger team, the right tool can streamline your workflow and improve your financial management.

In this guide, we will explore how to create effective billing documents that meet your needs and help you maintain a professional image. From the essential components to tips on design, you’ll learn how to craft a document that’s both functional and visually appealing, ensuring that you get paid on time without unnecessary hassle.

Invoice Template for Social Media Services

When it comes to billing for digital projects, having a ready-made structure can simplify the entire process. By using a standardized format, you can ensure that all the necessary information is clearly presented to your clients. This helps prevent confusion, reduces administrative work, and ensures that payments are processed promptly.

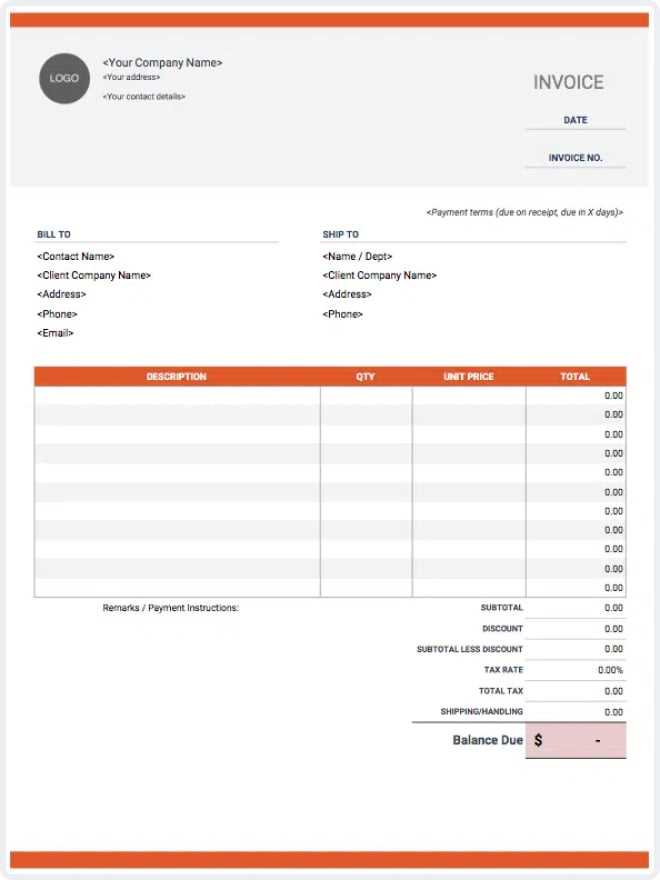

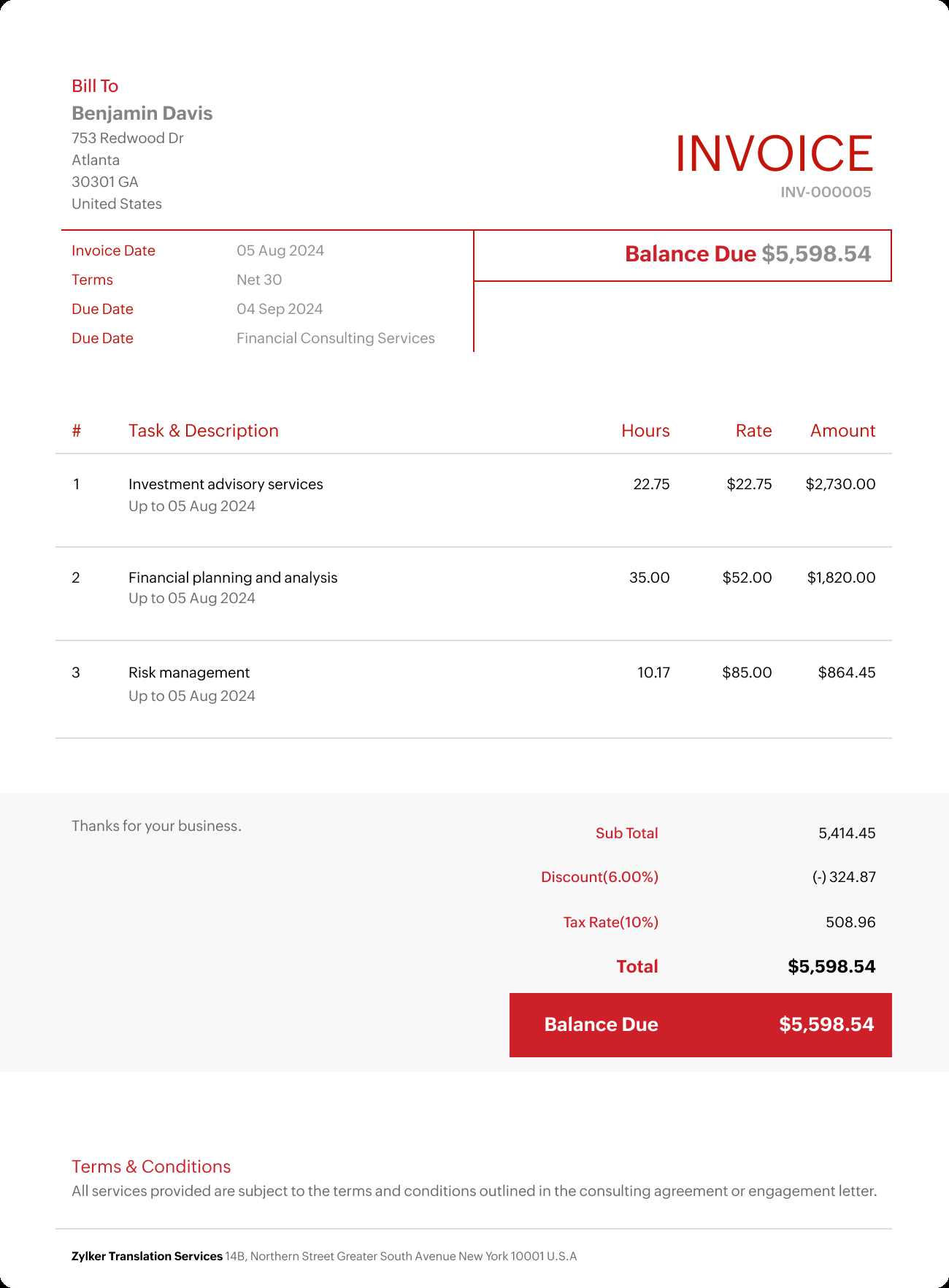

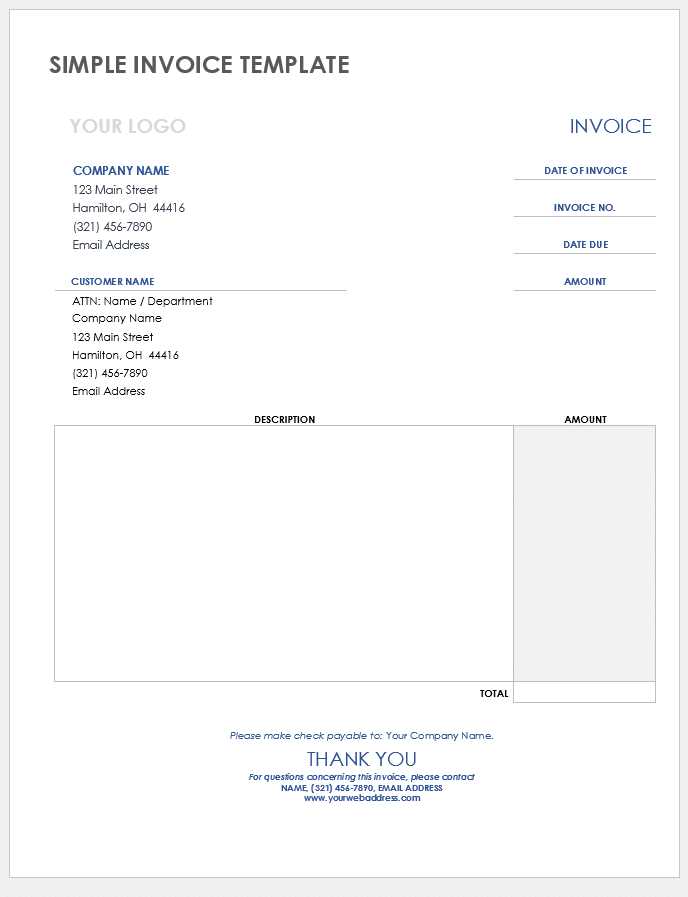

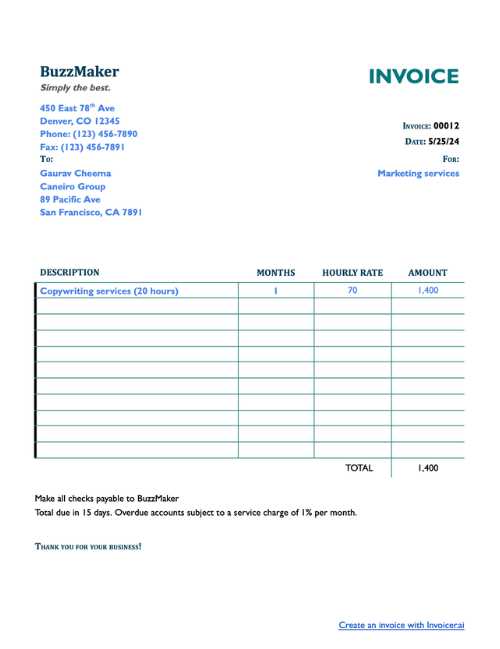

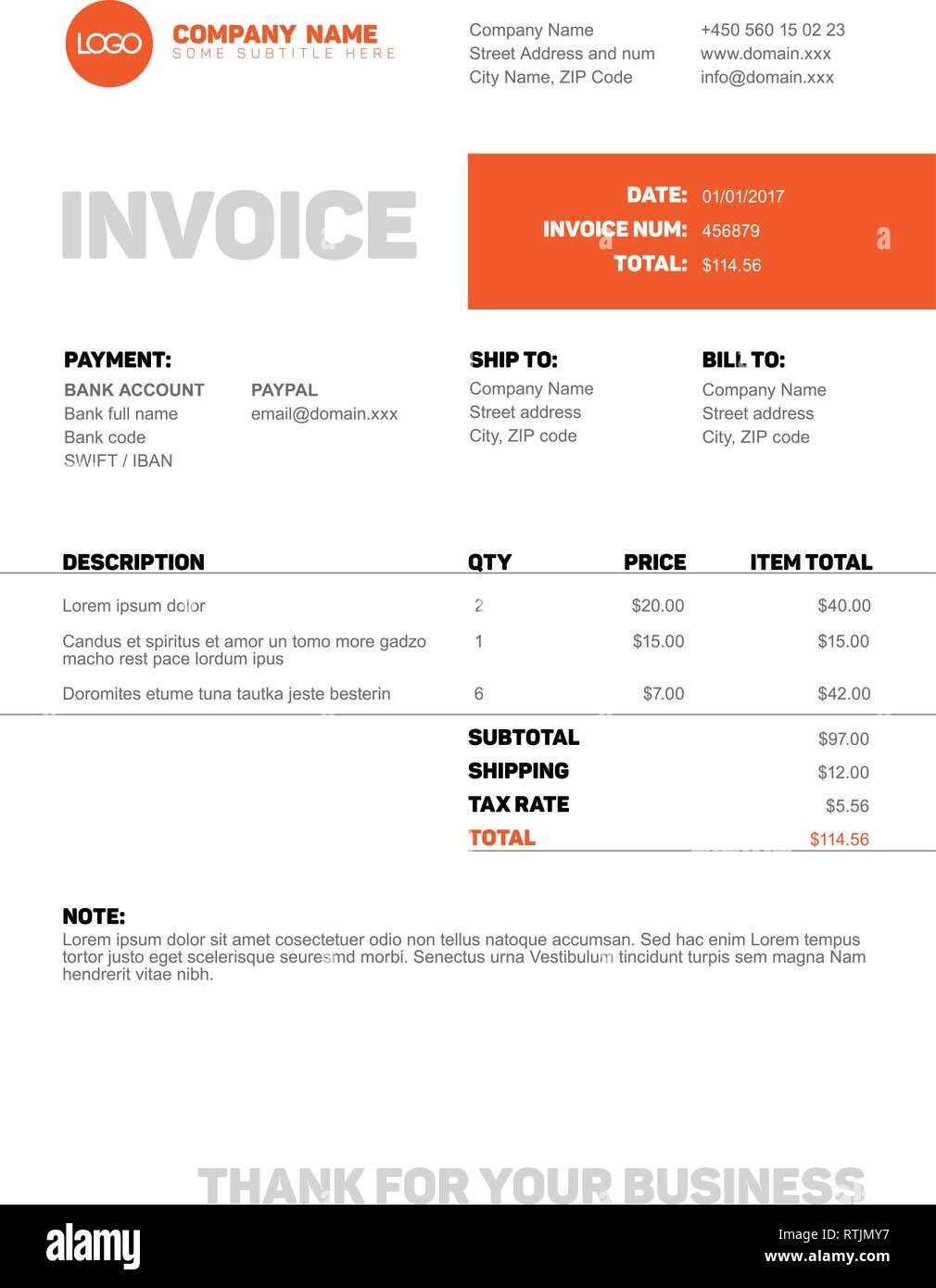

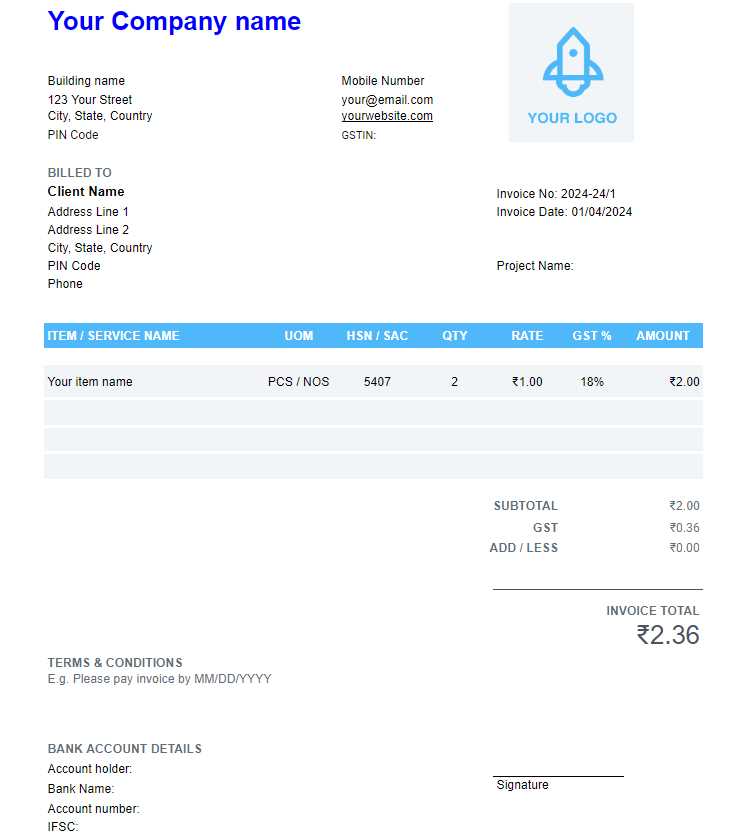

Such documents typically include various details that make transactions clear and transparent. Below are the essential elements that should be included in any billing document related to digital campaigns and online promotions:

- Client Information: The name, contact details, and business address of the client receiving the document.

- Your Information: Your name, business name, and contact details, ensuring that the client can reach you easily.

- Project Description: A clear outline of the tasks or work that was performed, such as content creation, account management, or advertising campaigns.

- Timeframe and Dates: The duration of the work or the specific time period the charges relate to, such as weekly, monthly, or per project.

- Payment Terms: A description of when payment is due, any late fees, and preferred payment methods.

- Total Amount Due: The agreed-upon amount, including any taxes or additional charges, if applicable.

Utilizing a structured document helps in maintaining consistency across multiple client accounts and streamlines your financial tracking. It also adds a professional touch that can enhance your brand image.

By incorporating all of these ele

Why You Need an Invoice Template

When you provide digital marketing or online consulting, managing payments efficiently is crucial. Having a structured document that clearly outlines your charges helps avoid misunderstandings and ensures that your clients know exactly what they’re paying for. This practice not only fosters professionalism but also improves the likelihood of timely payments.

Using a consistent structure for your billing helps streamline the process, saving time and reducing the risk of errors. Without a standardized document, you might forget key details, or worse, present a confusing bill that could delay payments. Below is a comparison of two scenarios: creating a billing statement from scratch each time versus using a standardized document.

| Creating from Scratch | Using a Standardized Document |

|---|---|

| Time-consuming and error-prone | Fast and efficient |

| Inconsistent format | Uniform and professional |

| Missing essential details | All necessary elements included |

| Possible delays in payment | Clear payment terms and deadlines |

As seen in the table, using a structured approach provides several advantages. Not only does it help you stay organized, but it also enhances your reputation by presenting a polished and professional image to clients. The simplicity and clarity it offers make it easier for clients to understand what they owe, which increases the likelihood of prompt payments.

How to Create a Professional Invoice

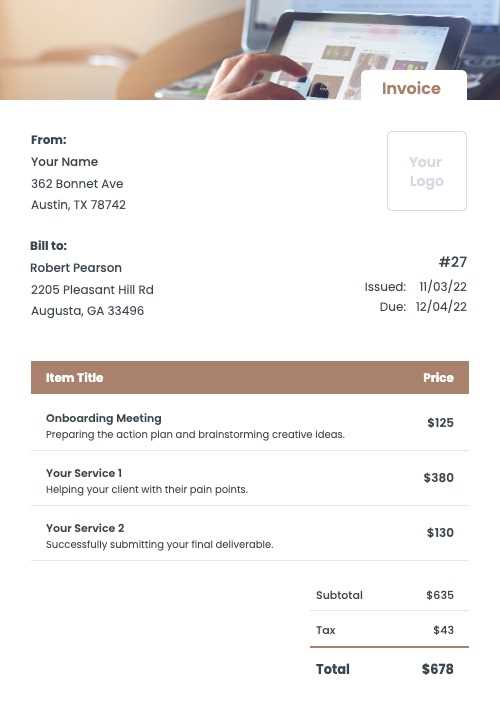

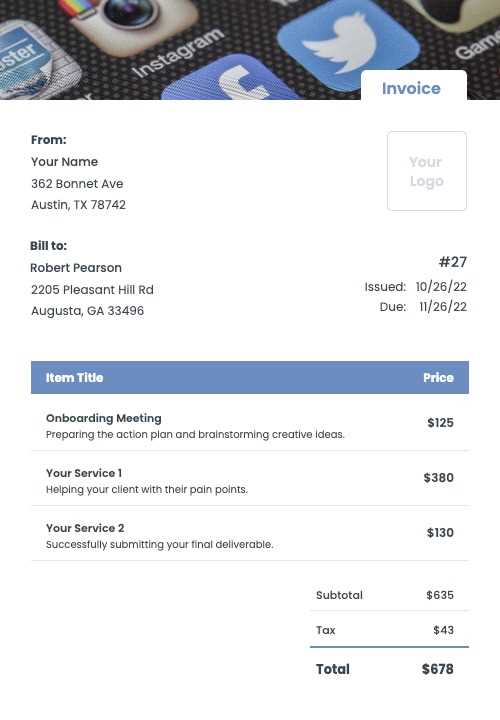

Creating a well-organized and professional document for billing is essential to ensure clear communication with your clients. A polished statement not only reflects your professionalism but also helps avoid confusion about the work completed and the charges. To craft a document that meets both your needs and your clients’ expectations, focus on structure, clarity, and essential details.

Here are the key steps to follow when designing your document:

- Start with Your Information: At the top of the document, include your name, business name, and contact details. This makes it easy for the client to reach you if they have questions or need clarification.

- Client’s Information: Clearly state the client’s full name or business name, address, and contact information. This ensures that the billing is personalized and accurate.

- Details of Work Done: Provide a description of the tasks completed, whether it’s content creation, campaign management, or any other work. Be as specific as possible to avoid ambiguity.

- List of Charges: Break down the costs in a clear manner. You can list individual tasks and their associated fees, or summarize the total cost for the entire project.

- Payment Terms: Clearly outline the due date, accepted payment methods, and any late fees. This helps set clear expectations for when and how the client should pay.

- Include a Unique Reference Number: A unique number for each billing statement helps track payments and easily reference specific transactions in the future.

By focusing on these elements and pres

Key Elements of a Social Media Invoice

When billing clients for digital marketing work, it’s essential to include all relevant details in a clear and structured way. This ensures that both you and your client are on the same page regarding the work completed, the associated costs, and payment terms. A comprehensive document should cover the basic information, breakdowns of charges, and any additional terms that may apply.

The following are the critical components to include in any billing statement related to online promotional work:

- Client Information: Clearly list the client’s name, business, and contact details to ensure accuracy and easy reference.

- Your Contact Information: Include your full name or business name, email address, and phone number so the client can easily reach you with any questions.

- Description of Work Done: Provide a detailed breakdown of tasks or projects completed, such as content creation, ad management, or audience engagement. This clarifies exactly what the client is being billed for.

- Timeline: State the time period for which the work was performed, whether it’s a monthly retainer, project-based, or hourly charge. This ensures transparency about the duration of the work.

- Cost Breakdown: Itemize the charges, either by task or as a lump sum. This helps the client see exactly what they are paying for, minimizing confusion.

- Payment Terms: Specify the total amount due, payment methods, and the due date. Including information about lat

Benefits of Using Templates for Billing

Using pre-designed structures for creating billing documents offers several advantages that can significantly improve the efficiency and accuracy of your financial processes. These ready-to-use formats eliminate the need to start from scratch every time, ensuring that you can focus more on delivering quality work rather than spending excessive time on administrative tasks.

Here are some key benefits of using ready-made structures for your billing process:

- Time Efficiency: With a pre-built structure, you can quickly input the necessary details and generate a professional document in just a few minutes, saving you time for other tasks.

- Consistency: Using the same format for all billing statements ensures consistency in how information is presented. This helps your clients easily understand your charges and reduces the chance of errors.

- Professional Appearance: A polished, uniform design enhances your business’s professional image and demonstrates attention to detail. This can leave a positive impression on your clients and make your brand appear more reliable.

- Reduces Errors: By having a standardized structure, you minimize the risk of forgetting important details, such as payment terms or specific charges, which can lead to confusion or delayed payments.

- Customization: While the structure is consistent, you can still customize it to suit different clients or projects. This allows you to tailor each document while maintaining a professional appearance.

- Better Financial Tracking: Using the same format for all documents helps you track your payments and monitor overdue amounts more easily, allowing for better financial management and reporting.

Incorporating these advantages into your billing routine can help streamline your workflow, reduce errors, and en

Customizing Your Invoice for Clients

Each client may have unique needs and preferences when it comes to billing. Customizing your billing documents allows you to tailor the content to reflect the specifics of the work completed, the nature of the client relationship, and any special agreements you may have. By adapting your statements, you ensure that they are not only professional but also personalized, enhancing client satisfaction and fostering long-term business relationships.

Personalizing Your Billing Statement

There are several ways to customize your billing documents to suit the individual requirements of each client. These customizations can range from adjusting the design and layout to providing specific details about the work performed or adding personal notes.

Customization Aspect Benefit Client’s Logo and Branding Incorporating the client’s brand elements helps strengthen their relationship with you and shows attention to detail. Project-Specific Descriptions Tailoring the description of tasks to match the specifics of the project ensures clarity and prevents misunderstandings. Payment Terms Adjustments Offering personalized payment options or deadlines can make the process smoother and more convenient for clients. Discounts or Promotional Offers Adding special discounts or promotional terms can incentivize prompt payment and build goodwill. Ensuring Consistency with Flexibility

While customization is important, it’s essential to maintain a consistent structure across all your documents. This ensures your brand’s identity remains clear and professional. By comb

Automating Social Media Service Invoices

Managing payment requests manually can become time-consuming and prone to errors, especially when handling multiple clients or projects. Automating the billing process allows you to streamline and speed up your workflow, reduce human error, and ensure that you never miss a payment cycle. With the right tools and software, you can generate and send statements automatically, saving valuable time and ensuring that your financial management is consistent and accurate.

Tools for Automation

There are several platforms and tools available that can help automate the creation and delivery of your billing documents. Many of these tools are designed to integrate with your business’s workflow and accounting system, allowing you to set up recurring payments, track outstanding balances, and generate personalized billing statements with just a few clicks.

- Accounting Software: Programs like QuickBooks, Xero, or FreshBooks can automate much of the billing process, offering templates that automatically populate with client and project details.

- Invoicing Software: Dedicated platforms like Stripe or Zoho Invoice allow you to schedule invoices, customize them to your needs, and even accept online payments directly from the document.

- CRM Systems: Customer Relationship Management tools like HubSpot can track client information and automatically send billing documents based on pre-set criteria, ensuring timely communication with clients.

Benefits of Automation

By automating your payment requests, you can enjoy several key benefits:

- Time Savings: Automation eliminates the need to manually generate and send each document, allowing you to focus on other important tasks.

- Consistency: With automation, you can ensure that every client receives their statement at the same time each month, with no risk of forgetting or overlooking specific details.

- Fewer Errors: Automation reduces the chances of making mistakes in calculating fees, tax rates, or payment terms, which can be common when doing things manually.

- Improved Cash Flow: Timely and accurate billing can lead to faster payments, helping you

Choosing the Right Format for Your Invoice

Selecting the right layout and structure for your billing document is crucial to ensuring clarity, professionalism, and efficiency in your financial transactions. The format you choose can have a significant impact on how easy it is for your clients to understand the details, make payments, and maintain a positive relationship with your business. The key is to balance simplicity, functionality, and design, all while making sure that the necessary information is easily accessible.

Different Formats to Consider

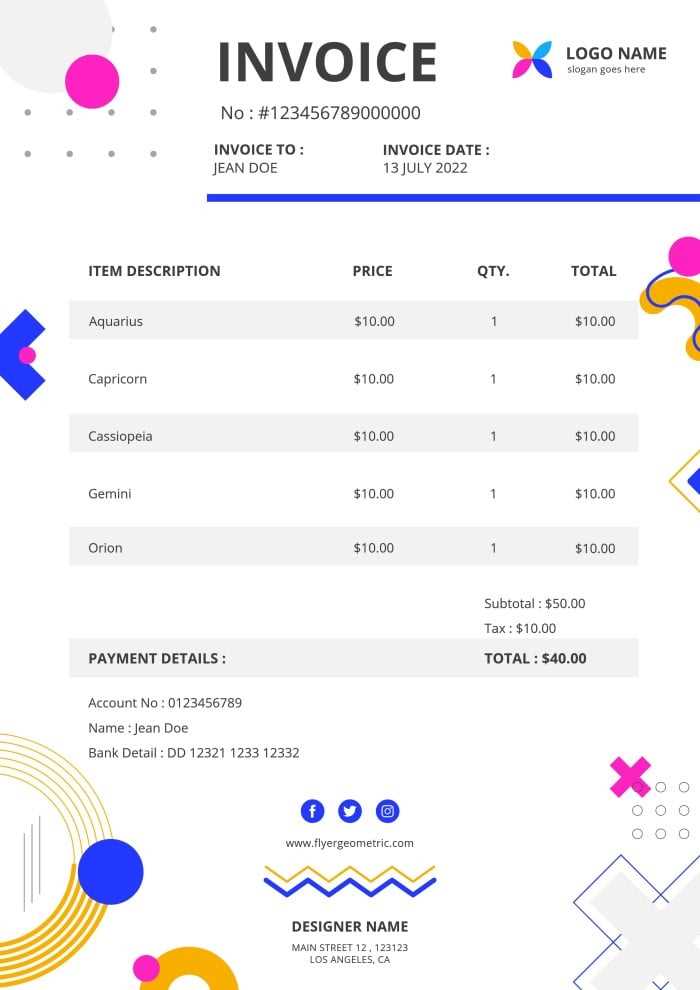

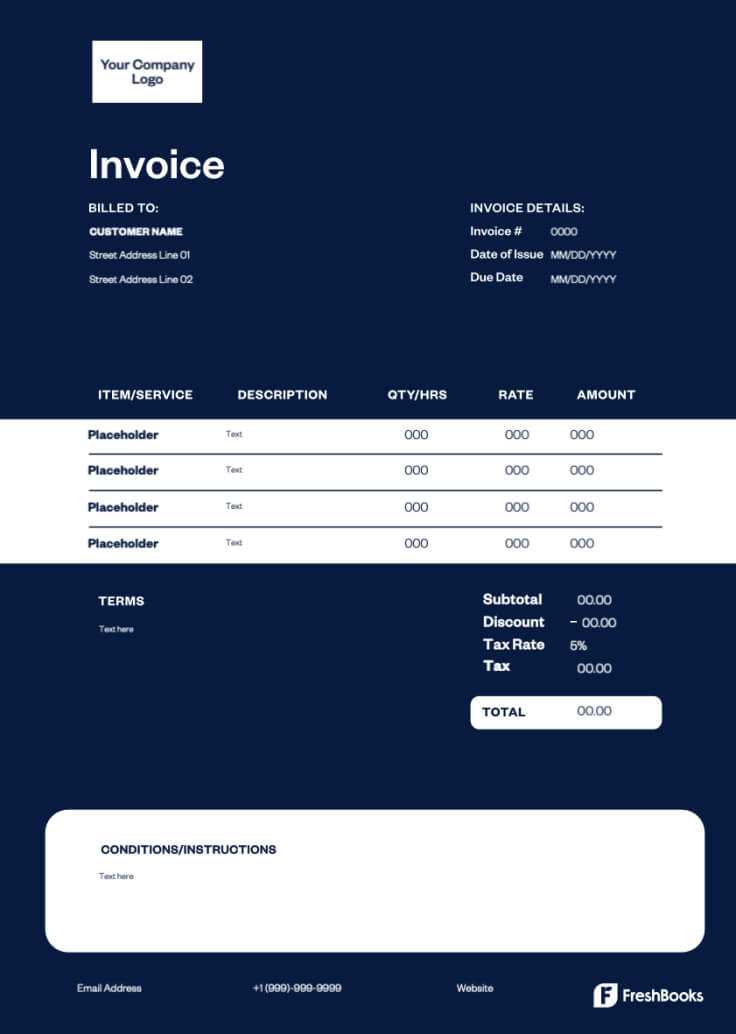

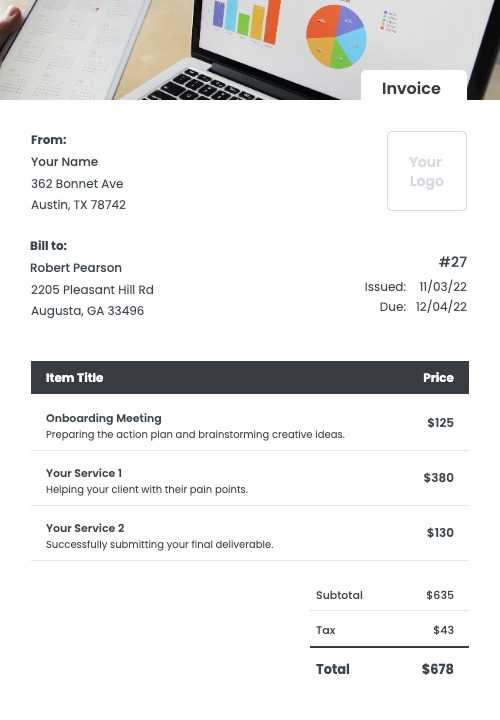

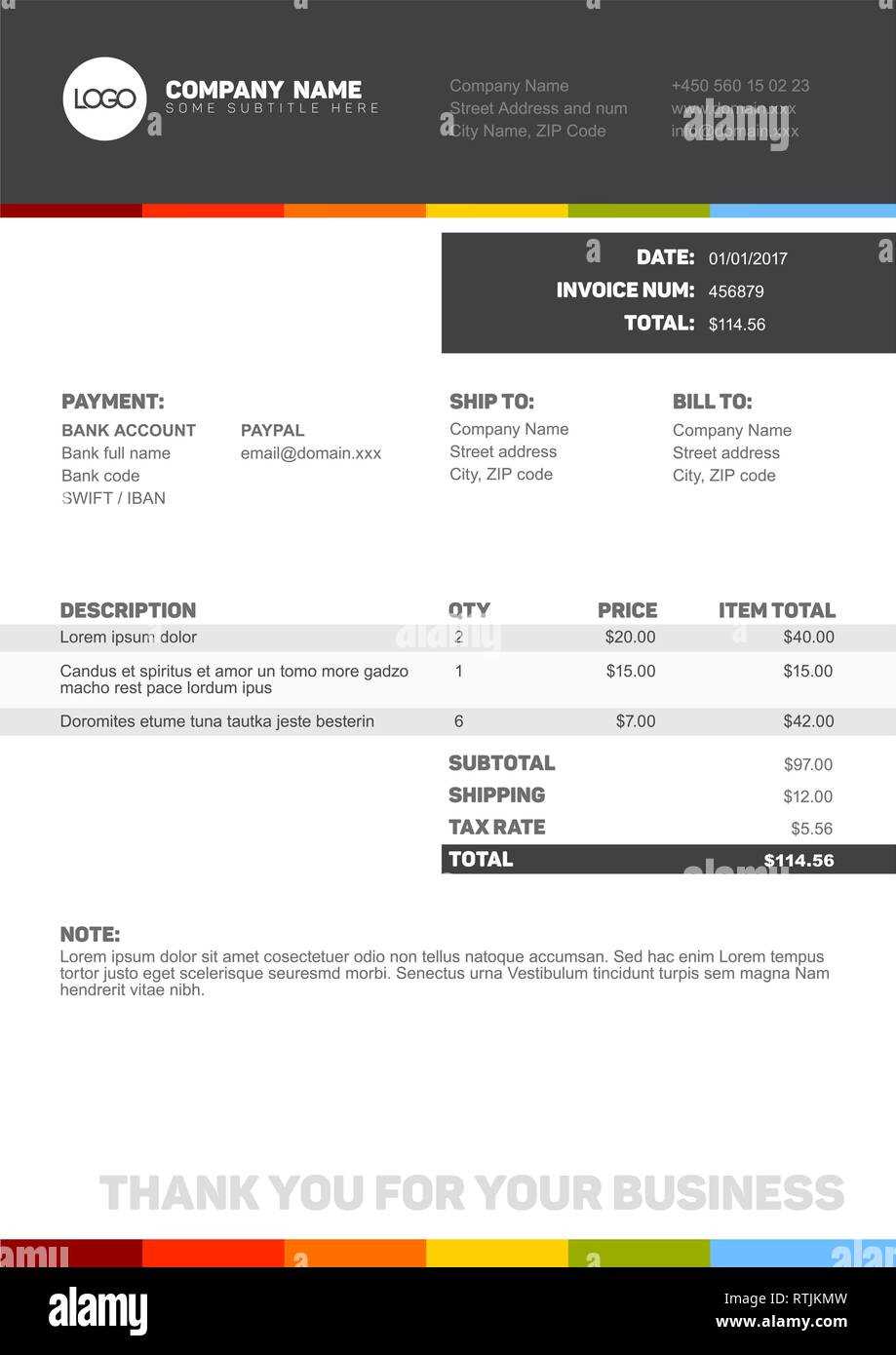

There are several types of formats you can choose from, each offering unique benefits depending on the nature of your work and your client needs. Whether you’re looking for a clean, simple layout or something more customized, here are some common formats:

- Basic Layout: A minimalist approach where only the essential details are included, such as the client’s information, a description of the tasks, the amount due, and payment terms. This is a good choice if you want to keep things simple and direct.

- Itemized Breakdown: This format is useful if you want to list each task or service separately with corresponding fees. It provides more transparency and is ideal when billing for multiple projects or activities.

- Professional Design: For businesses looking to impress, a visually appealing format with your company branding can add a professional touch. This might include your logo, customized fonts, and colors that align with your business identity.

Factors to Consider When Choosing a Format

When deciding on the best layout for your billing document, consider the following factors:

- Client Expectations: Some clients may prefer a straightforward approach, while others may appreciate a more detailed breakdo

Free vs Paid Invoice Templates

When choosing a document layout for your billing process, you’ll typically come across two main options: free and paid formats. Both have their own advantages and disadvantages depending on your business needs, budget, and the level of customization you require. Understanding the key differences between free and paid options can help you make an informed decision that aligns with your workflow and financial goals.

Free Formats

Free formats are a popular choice for freelancers, startups, and small businesses that need a quick and cost-effective solution. Many free options are available online, offering basic structures with essential fields for work details, payment terms, and client information. While these documents can meet your basic needs, they may lack advanced features and customization options.

- Pros:

- Zero cost, which is great for small businesses or individuals just starting out.

- Easy to find and use; many platforms provide simple downloadable formats.

- Basic and straightforward, often providing just the necessary fields for a clean presentation.

- Cons:

- Limited customization options, which may not reflect your brand’s unique style.

- Less professional-looking designs compared to premium options.

- May lack advanced features, such as automated reminders or integration with accounting software.

Paid Formats

Paid formats, on the other hand, offer more robust features and customization options, often providing templates with advanced functionalities such as recurring billing, tax calculations, or integrations with financial tool

How to Add Taxes and Discounts

When preparing a billing statement, it’s important to ensure that any applicable taxes and discounts are accurately applied. These adjustments can significantly affect the total amount due and should be presented clearly to avoid confusion. Whether you’re adding sales tax, VAT, or offering a promotional discount, it’s crucial to display these figures transparently to maintain professionalism and build trust with your clients.

Adding Taxes

Sales tax or value-added tax (VAT) is typically calculated as a percentage of the total amount charged for goods or work. Depending on your location and the nature of your business, tax rates may vary. Here’s how to correctly add taxes to your billing document:

- Determine the applicable tax rate: Check local regulations to determine the correct tax rate that should be applied to your charges.

- Calculate the tax amount: Multiply the subtotal (before tax) by the applicable tax rate. For example, if the subtotal is $500 and the tax rate is 10%, the tax amount would be $50.

- Add the tax to the subtotal: Clearly label the tax amount on the document and include it in the final total due. Be sure to separate it from the main charges so the client can easily see the breakdown.

Applying Discounts

Discounts can be offered for various reasons, such as to incentivize early payment, reward long-term clients, or run a special promotion. To apply discounts correctly, follow these steps:

- Choose the type of discount: Discounts can be fixed amounts (e.g., $20 off) or percentage-based (e.g., 10% off). Choose

Incorporating Payment Terms and Due Dates

Clear payment terms and due dates are essential for maintaining smooth financial transactions and ensuring timely payments. By specifying when and how you expect to be paid, you set clear expectations with your clients and reduce the likelihood of misunderstandings. These details should always be included in your billing document to avoid delays and to reinforce professionalism.

Setting Payment Terms

Payment terms outline the conditions under which your clients are expected to make payments. These can vary based on your business model, the type of work, or specific client agreements. Here’s how to structure them:

- Net Terms: These are standard terms that specify the payment deadline in days, such as “Net 30” (payment due 30 days after the billing date). Other common terms include “Net 15” or “Net 60”.

- Early Payment Discounts: Offering discounts for early payments can encourage quicker settlements. For example, “2% discount if paid within 10 days” is a popular incentive.

- Late Payment Penalties: Specify any penalties or interest charges for overdue payments. This might be something like “1.5% per month for overdue amounts” to motivate timely payments.

Establishing Due Dates

Clearly stating the due date helps clients understand when their payment is expected and prevents confusion. Here’s how to ensure clarity around due dates:

- State the Exact Due Date: Avoid ambiguity by listing the exact due date in the document, such as “Due on [Date]” or “Payment due

Best Practices for Invoice Design

Creating well-designed billing documents is not just about aesthetics; it’s also about clarity and professionalism. A clean, organized layout makes it easier for your clients to understand the charges, payment terms, and other important details. The design should reflect your brand identity while remaining functional and straightforward, ensuring that your clients can quickly process the information without confusion.

Key Elements of a Well-Designed Document

To ensure that your billing document is both effective and professional, consider the following design elements:

- Clear Branding: Incorporate your logo, business name, and brand colors to make the document easily identifiable. This enhances brand recognition and gives your document a polished, professional look.

- Legible Fonts: Use easy-to-read fonts like Arial or Times New Roman, and avoid using too many different styles. Consistency in font usage helps keep the document looking organized.

- Logical Layout: Organize the content in a way that makes sense to the reader. Key details like your business contact info, client info, and the breakdown of charges should be easy to find and follow.

- Whitespace: Don’t crowd the document with too much text or too many elements. Proper use of whitespace helps keep the document clean and makes it easier to navigate.

Best Practices for Information Presentation

It’s essential that the information presented is both clear and easy to follow. Below are some best practices for displaying key details:

- Itemized Breakdown: List each charge or task separately along with the corresponding amount. This provides transparency and helps your client understand what they are paying for.

- Highlight Important Information: Use bold text or a different color to highlight important elements like the due date, total amount, or any special instructions.

- Tax and Discounts: Clearly label any taxes, discounts, or special offers to avoid confusion. These should be displayed separately from the total so they are easy to identify.

- Payment Instructions: Make payment instructions clear, including acceptable payment methods, account details, and due dates. This ensures your client knows exactly how and when to pay.

By following these best practices, you can create a well-organized and professional billing document that facilitates clear communication and helps ensure timely payments. An aesthetically pleasing design combined with easy-to-read content reinforces the professionalism of your business and builds trust with your clients.

Integrating Branding into Your Invoice

Your billing document is more than just a request for payment–it’s a reflection of your business identity. Integrating your brand elements into your document not only enhances its professional appearance but also reinforces your company’s image and helps build client trust. A well-branded document ensures consistency across all client communications and makes your business look polished and cohesive.

Key Branding Elements to Include

There are several key elements that you can integrate into your billing document to align it with your brand identity:

- Logo: Your logo is the most recognizable part of your brand, so it should be prominently displayed. Place it at the top of the document where it’s easily visible.

- Business Colors: Use your brand’s color scheme throughout the document. This can be incorporated into headers, borders, or any design elements to create a cohesive look.

- Typography: Use the same fonts that are part of your brand guidelines to maintain consistency. This will create a professional appearance and ensure your document feels like an extension of your other marketing materials.

- Tagline or Mission Statement: If appropriate, include a short tagline or mission statement to reinforce what your business stands for. This can add a personal touch and remind clients of your core values.

Designing a Cohesive Layout

Common Mistakes to Avoid in Invoices

When creating a billing document, even small errors can lead to confusion, payment delays, or disputes. It’s essential to ensure that all the information is accurate, clear, and professionally presented. By avoiding common mistakes, you can enhance your credibility and improve the efficiency of your payment process.

1. Missing or Incorrect Information

Inaccurate or incomplete details can delay payments or create confusion for your clients. Common mistakes include:

- Incorrect Client Information: Always double-check the client’s name, address, and contact information to ensure accuracy.

- Missing Payment Terms: Clearly state payment terms, including due dates and late payment fees, to avoid misunderstandings.

- Unclear Item Descriptions: Ensure each charge or task is itemized with clear descriptions so your client understands exactly what they are being billed for.

2. Lack of Professional Formatting

How your document looks matters just as much as what it says. Poor formatting can make it difficult for your client to navigate the details. Common design errors include:

- Cluttered Layout: Avoid cramming too much information into one section. Leave space between sections for clarity and readability.

- Poor Font Choice: Using hard-to-read or inconsistent fonts can make the document look unprofessional.

How to Send Invoices Efficiently

Sending billing documents in an efficient manner not only speeds up payment but also ensures that everything is clear and easily accessible for both you and your client. By streamlining the process and using the right tools, you can save time and avoid unnecessary delays, ultimately improving your cash flow and client relationships.

1. Use Digital Tools for Quick Delivery

One of the most efficient ways to send your documents is through digital platforms. This ensures immediate delivery and eliminates the risk of lost mail or delays. Here’s how to maximize digital delivery:

- Email: Attach the document as a PDF and send it directly to your client’s email address. This method is quick and allows you to track whether the email has been opened.

- Online Payment Platforms: Use platforms like PayPal, Stripe, or other billing software to send your documents. These platforms allow clients to pay directly from the document, making the process seamless.

- Cloud Storage: Upload the document to a secure cloud storage service (e.g., Google Drive, Dropbox) and share the link. This is especially useful for larger documents or when you need to provide multiple documents in one place.

2. Automate the Sending Process

Automation can save you a lot of time, especially if you work with multiple clients. By setting up recurring billing or using automated software, you can ensure your documents are sent on time without manual intervention. Here are a few tips:

- Recurring Billing: If you have clients on long-term contracts, set up automatic billing cycles that generate and send your documents without having to manually create them each time.

- Automated Reminders: Set up reminder emails that notify clients of upcoming due dates or outstanding payments. This ensures that you don’t have to chase payments.

- Accountin

Tracking Payments and Outstanding Invoices

Keeping track of payments and overdue balances is essential for maintaining healthy cash flow and financial clarity. By monitoring which payments have been made and which are still pending, you can avoid confusion, ensure timely follow-ups, and keep your financial records organized. Efficient tracking not only helps in collecting payments on time but also strengthens your relationship with clients by demonstrating professionalism and reliability.

1. Using Software to Track Payments

Automated tools and accounting software are incredibly helpful in tracking payments and managing overdue amounts. These platforms can provide you with a clear overview of your finances, helping you stay on top of all transactions:

- Accounting Software: Tools like QuickBooks, FreshBooks, or Xero allow you to record payments automatically as soon as they are processed. These platforms also offer reminders for outstanding amounts, keeping you proactive in your follow-ups.

- Integrated Payment Systems: Payment platforms like PayPal or Stripe often integrate with accounting software, allowing you to view payment statuses in real time and keep everything in one place.

- Custom Dashboards: Many software options provide customizable dashboards that help you visualize your outstanding balances, payment histories, and upcoming due dates.

2. Manual Tracking Methods

If you prefer a more hands-on approach or have a smaller client base, manual trac

Tracking Payments and Outstanding Invoices

Keeping track of payments and overdue balances is essential for maintaining healthy cash flow and financial clarity. By monitoring which payments have been made and which are still pending, you can avoid confusion, ensure timely follow-ups, and keep your financial records organized. Efficient tracking not only helps in collecting payments on time but also strengthens your relationship with clients by demonstrating professionalism and reliability.

1. Using Software to Track Payments

Automated tools and accounting software are incredibly helpful in tracking payments and managing overdue amounts. These platforms can provide you with a clear overview of your finances, helping you stay on top of all transactions:

- Accounting Software: Tools like QuickBooks, FreshBooks, or Xero allow you to record payments automatically as soon as they are processed. These platforms also offer reminders for outstanding amounts, keeping you proactive in your follow-ups.

- Integrated Payment Systems: Payment platforms like PayPal or Stripe often integrate with accounting software, allowing you to view payment statuses in real time and keep everything in one place.

- Custom Dashboards: Many software options provide customizable dashboards that help you visualize your outstanding balances, payment histories, and upcoming due dates.

2. Manual Tracking Methods

If you prefer a more hands-on approach or have a smaller client base, manual tracking can still be effective. Some methods include:

- Spreadsheets: Use Excel or Google Sheets to create a payment tracking system. Create columns for client names, amounts due, payment dates, and statuses. This method offers flexibility but requires regular updates.

- Paper Records: For businesses that prefer physical documentation, maintaining a payment ledger or filing system can work, though it may be harder to track in real-time compared to digital methods.

- Checklists: For simplicity, create a checklist with client names and payment deadlines, noting the status (paid, pending, overdue). This can be useful if you want a quick overview but may lack detail.

3. Setting Up Payment Reminders and Alerts

Setting up automated reminders or manual alerts for upcoming payments is crucial in avoiding late payments. Here’s how you can do it:

- Email Reminders: Set up automated emails that remind clients of upcoming due dates, or send polite follow-ups for overdue payments. Most accounting software includes this feature.

- SMS Notifications: Some platforms allow you to send SMS notifications to clients for upcoming or overdue payments, offering a quicker and more direct way to reach them.

- Manual Alerts: If you track payments manually, set calendar reminders to follow up with clients on due dates or after a certain period of non-payment.

4. Communicating with Clients about Overdue Payments

Effective communication is key when it comes to managing overdue payments. If a payment becomes overdue, you need to follow up promptly and professionally:

- Initial Reminder: After the payment due date has passed, send a polite reminder. This can be done via email or SMS, depending on your previous communication with the client.

- Second Reminder: If the payment remains unpaid, send a second, firmer reminder with a specified deadline for payment.

- Phone Call: For larger balances or particularly important clients, a direct phone call can often resolve outstanding issues more effectively than an email.

5. Using Clear Payment Terms to Avoid Confusion

By setting clear payment terms at the beginning of each project or contract, you can avoid confusion later on. Be sure to include:

- Due Dates: Clearly state when payments are due and provide a grace period if necessary.

- Late Fees: Include any late fees that will apply if payments are overdue. This can motivate clients to pay on time.

- Payment Methods: Specify accepted payment methods to avoid confusion or delays in processing payments.

Method Benefit Accounting Software Automates payment tracking and provides reminders for overdue balances. Spreadsheets Flexible and cost-effective way to manually track payments with full control. Reminder Emails Keeps clients informed and reduces the likelihood of forgotten payments. By consistently tracking payments, setting clear expectations, and maintaining professional communication, you can ensure timely payments, reduce overdue balances, and manage your finances effectively. Implementing the right system will save you time and ensure your business runs smoothly.

How to Scale Your Invoicing Process

As your business grows, managing billing and payments can become more complex. It’s essential to implement scalable systems that can handle increased volume without compromising efficiency or accuracy. Automating key aspects of the process, streamlining communication, and using the right tools can help you scale your invoicing operations while minimizing errors and saving time.

1. Automate Key Aspects of Billing

Automation is one of the most effective ways to scale your billing system. By automating repetitive tasks, you can focus more on growing your business and less on manual administration:

- Recurring Billing: Set up automatic billing for clients on long-term contracts, eliminating the need to create a new bill each cycle.

- Payment Reminders: Automate reminder emails for upcoming or overdue payments to ensure you don’t have to manually follow up.

- Payment Processing: Use integrated payment platforms that automatically track payments and update the status of each transaction.

2. Use Scalable Software and Tools

Investing in the right tools can greatly simplify the invoicing process and ensure you can scale without adding more work. Many software options offer features that allow you to handle increased demand smoothly:

- Cloud-Based Accounting Tools: Software like QuickBooks, Xero, or FreshBooks can store all of your financial data securely online and provide easy access to reports. They also allow for remote collaboration if you ha

- Pros: