Invoice Template for Computer Services to Enhance Your Billing Efficiency

Managing payments and transactions can be one of the most time-consuming aspects of running a technology business. Having a streamlined system to handle client charges is essential for maintaining professionalism and ensuring timely payments. A well-structured document can save valuable time, reduce errors, and improve client satisfaction.

For those in the tech industry, creating consistent and accurate billing records is crucial. Whether you’re a freelancer, a small IT company, or part of a larger firm, adopting a reliable method for sending out payment requests can help you focus on what you do best. With the right approach, your financial documentation will reflect your professionalism and contribute to the overall efficiency of your business.

Efficiency and accuracy are key when it comes to invoicing in the tech field. By utilizing the right tools, you can automate many aspects of the process, from creating professional documents to tracking outstanding payments. This reduces administrative burden and minimizes the risk of mistakes that could affect your cash flow.

Organizing your finances in a clear and effective manner not only improves your operational workflow but also helps build trust with your clients. A well-organized payment request conveys transparency and ensures both you and your customers are on the same page regarding charges and expectations.

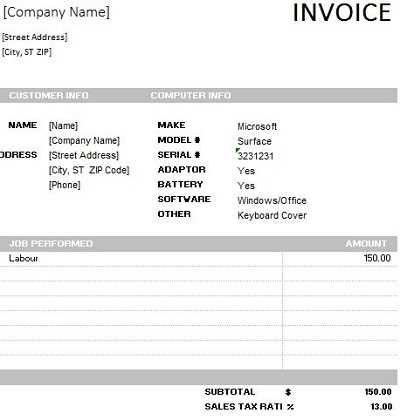

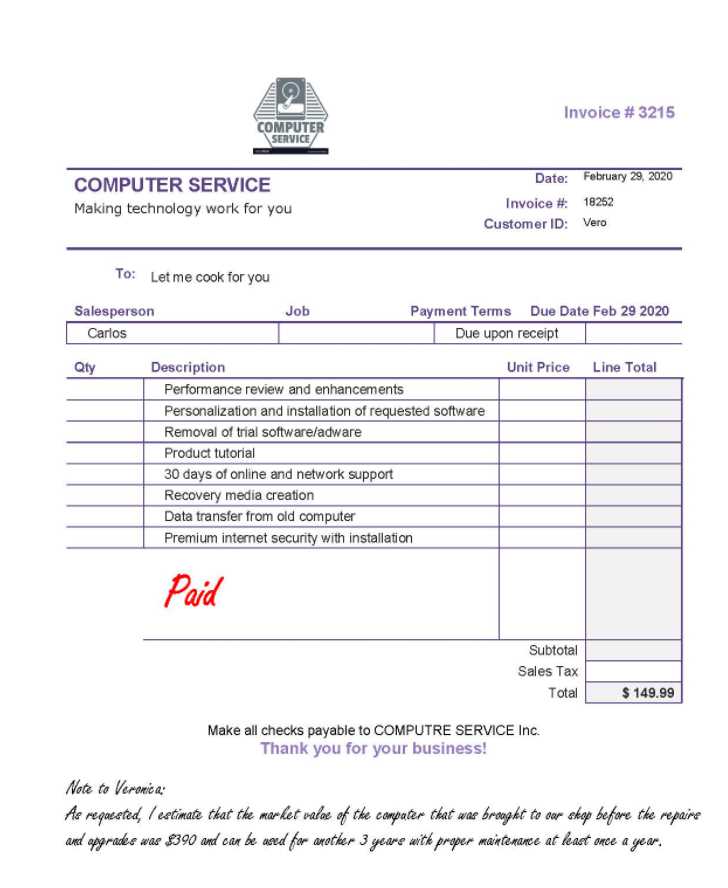

Invoice Template for Computer Services

When handling transactions in the tech industry, it’s crucial to have a reliable structure for documenting client charges. A well-designed document ensures clarity, minimizes confusion, and helps maintain professionalism. Creating a consistent layout not only simplifies the billing process but also establishes trust with your clients, ensuring smooth financial interactions.

Key Elements of a Professional Billing Document

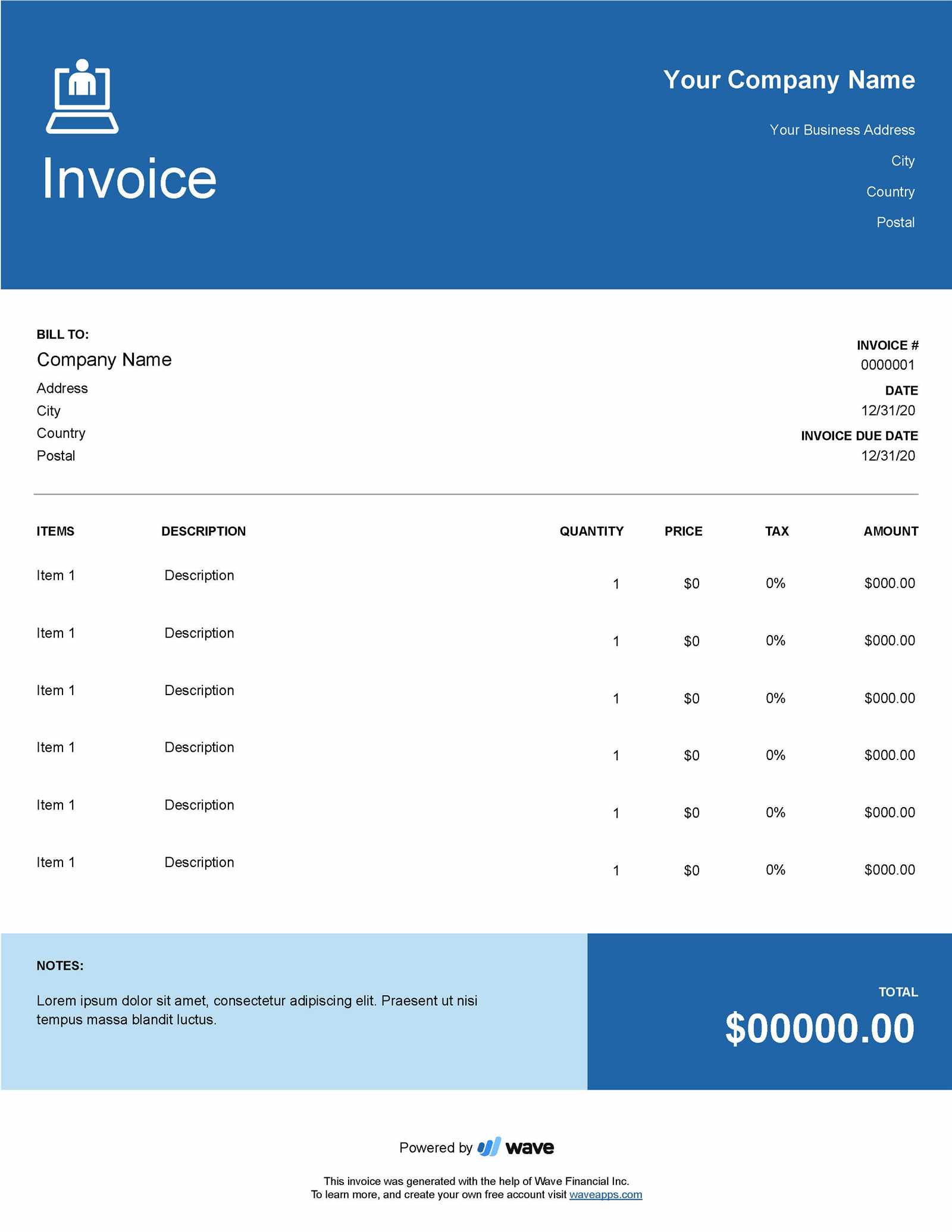

To ensure accuracy and professionalism, every payment request should include a few essential elements. First, client information, including their name, address, and contact details, should be clearly stated. This makes it easier to track and manage multiple clients, reducing the chance of mix-ups. The description of work is equally important–detailing the tasks completed or products delivered ensures both parties understand the nature of the charges.

Another important factor is payment terms. These should outline the due date, any applicable late fees, and the methods through which payment can be made. Clear instructions regarding payment options help avoid confusion and delay, speeding up the settlement process.

Streamlining Your Billing Process

Once you have a structure in place, it’s important to streamline the process. Using automated tools to generate these documents can save significant time. By implementing these systems, you can focus on the core aspects of your business while still maintaining a high level of professionalism and efficiency in your financial operations.

Why Use an Invoice Template for IT Services

Efficient financial documentation is a key element for any business, especially in technical fields. A consistent and professional way to present charges ensures clear communication between providers and clients, reducing the risk of misunderstandings. By using a structured format, you streamline the entire billing process, making it faster and more organized.

When you adopt a standardized approach to creating payment records, you save valuable time. With the right tools, much of the work is automated, allowing you to focus more on your core tasks. Additionally, having a repeatable system minimizes the chances of errors, helping you avoid potential issues with clients, taxes, or accounting.

Another important benefit is improved professionalism. A well-structured document gives your clients confidence that they are dealing with a reliable and organized business. Whether you’re a freelancer or part of a larger firm, consistently using a clear and professional billing system can help strengthen your reputation in the market.

Key Features of a Good Invoice Template

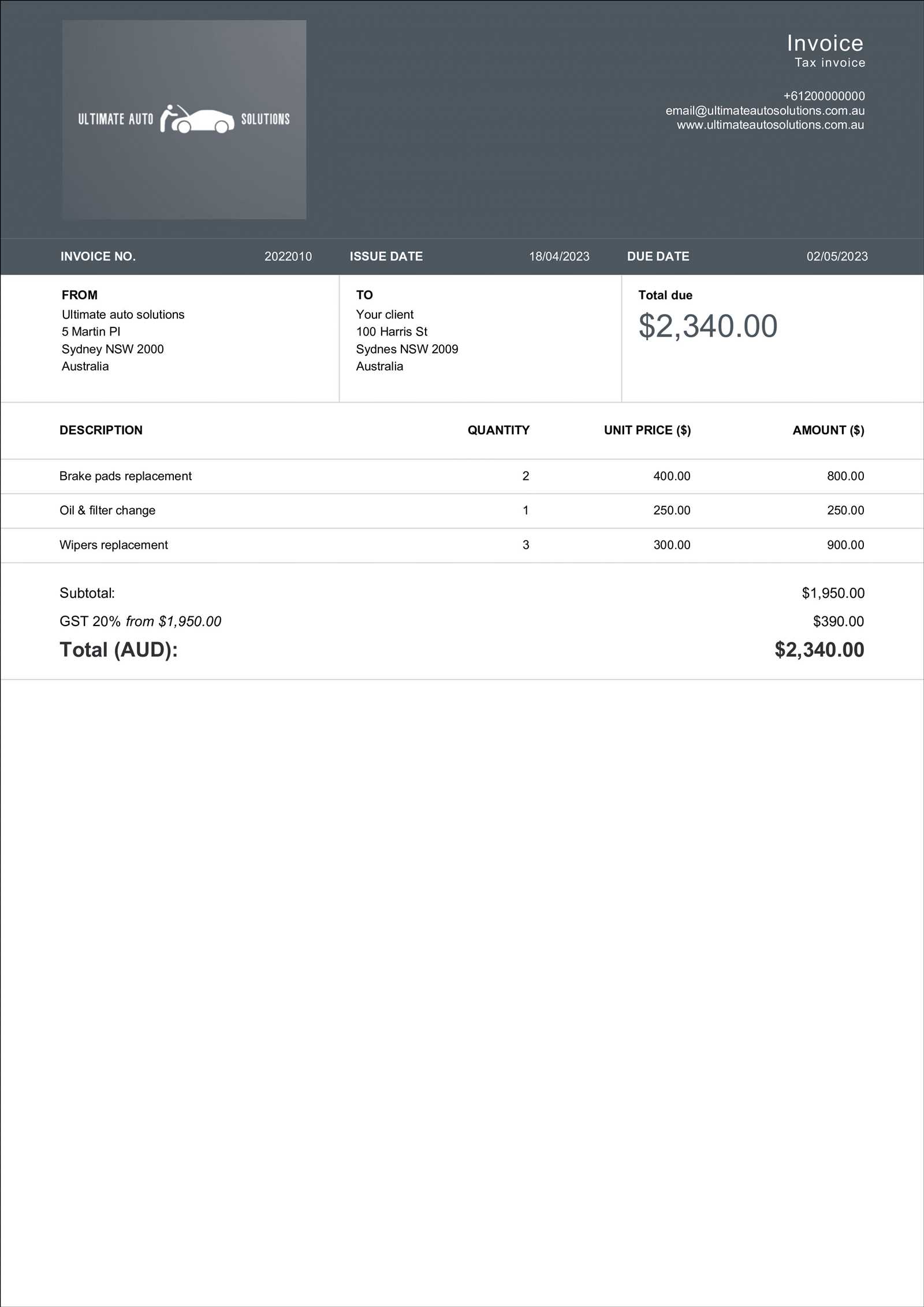

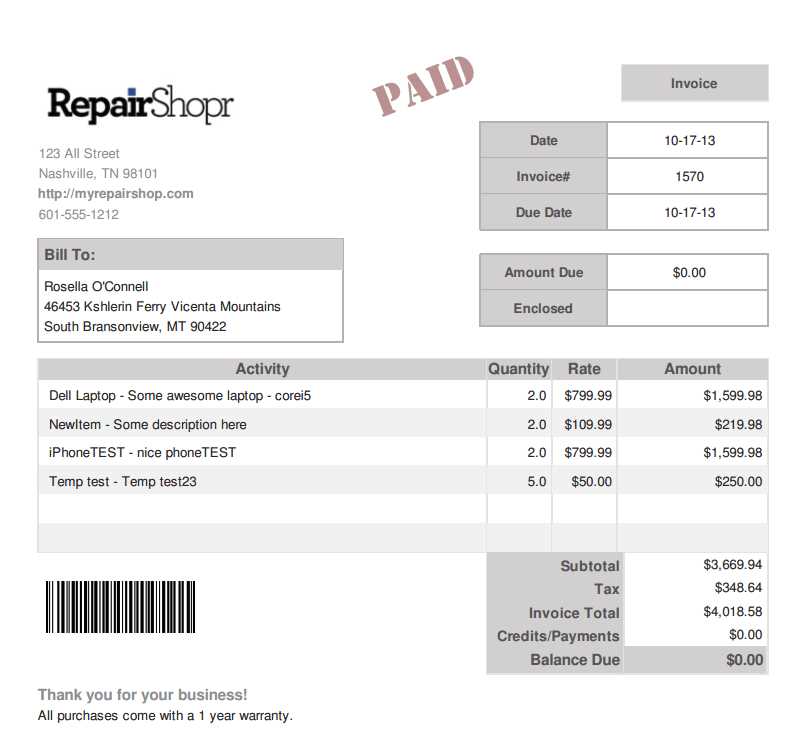

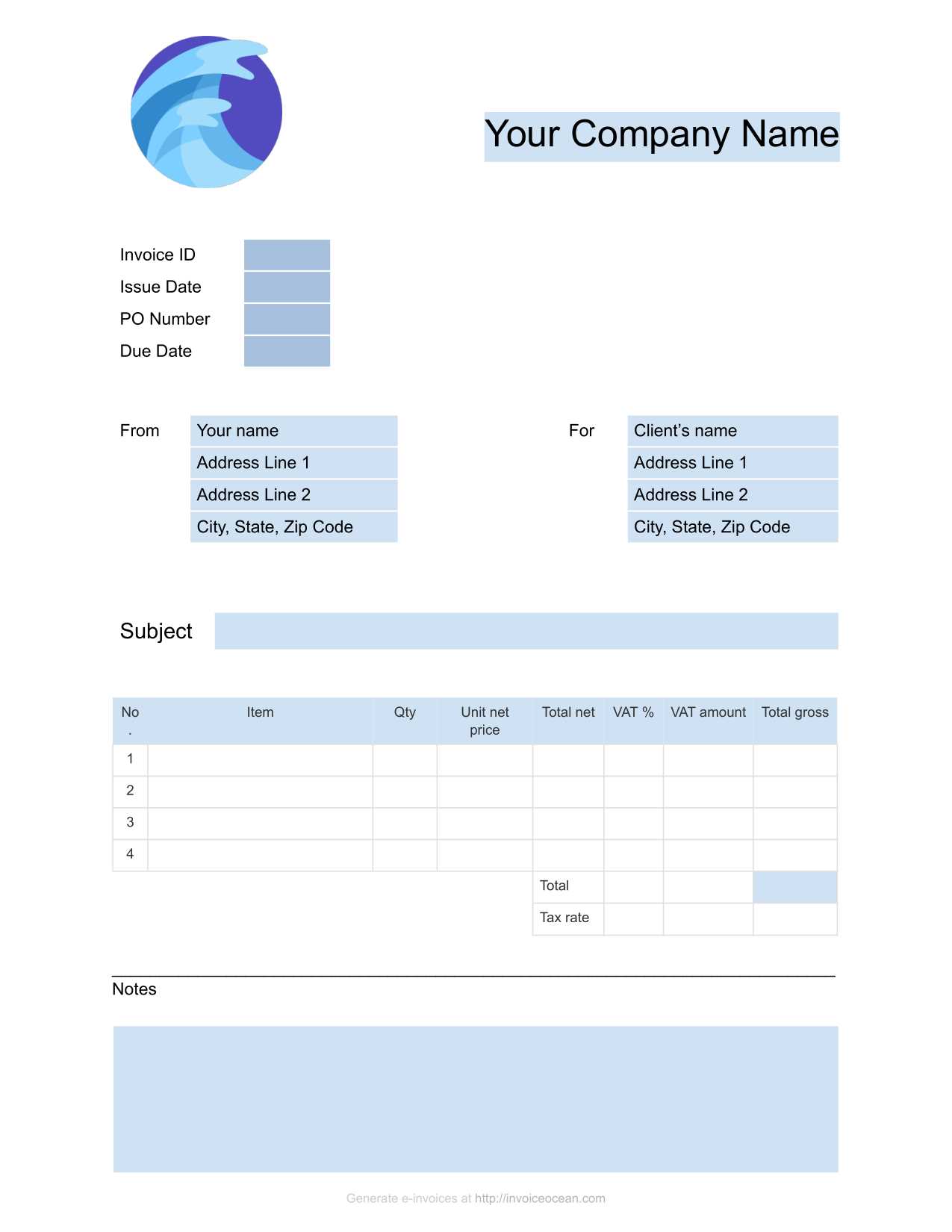

A well-crafted billing document is crucial for ensuring smooth financial transactions. It not only ensures clarity but also helps maintain transparency and professionalism. The design and structure of the document play a significant role in how easily both you and your clients can track payments and services provided. Key components of an effective bill should include clarity, consistency, and essential details that make the process seamless.

Clear Client and Business Information

One of the most important aspects of a professional document is clear identification of both the client and the service provider. Ensure that the client’s name, address, and contact details are prominently displayed. Additionally, your business information, including the name, contact number, and email, should be easy to locate. This makes it easier for clients to reach out with any questions or concerns, enhancing communication.

Accurate Breakdown of Work and Charges

Each charge should be clearly outlined with a brief description of the work or product delivered. Whether it’s hourly labor or a fixed fee, both parties should understand exactly what is being charged and why. Providing detailed descriptions reduces the likelihood of disputes and ensures both parties are aligned on expectations. Payment terms should also be clearly listed, including deadlines and accepted methods of payment.

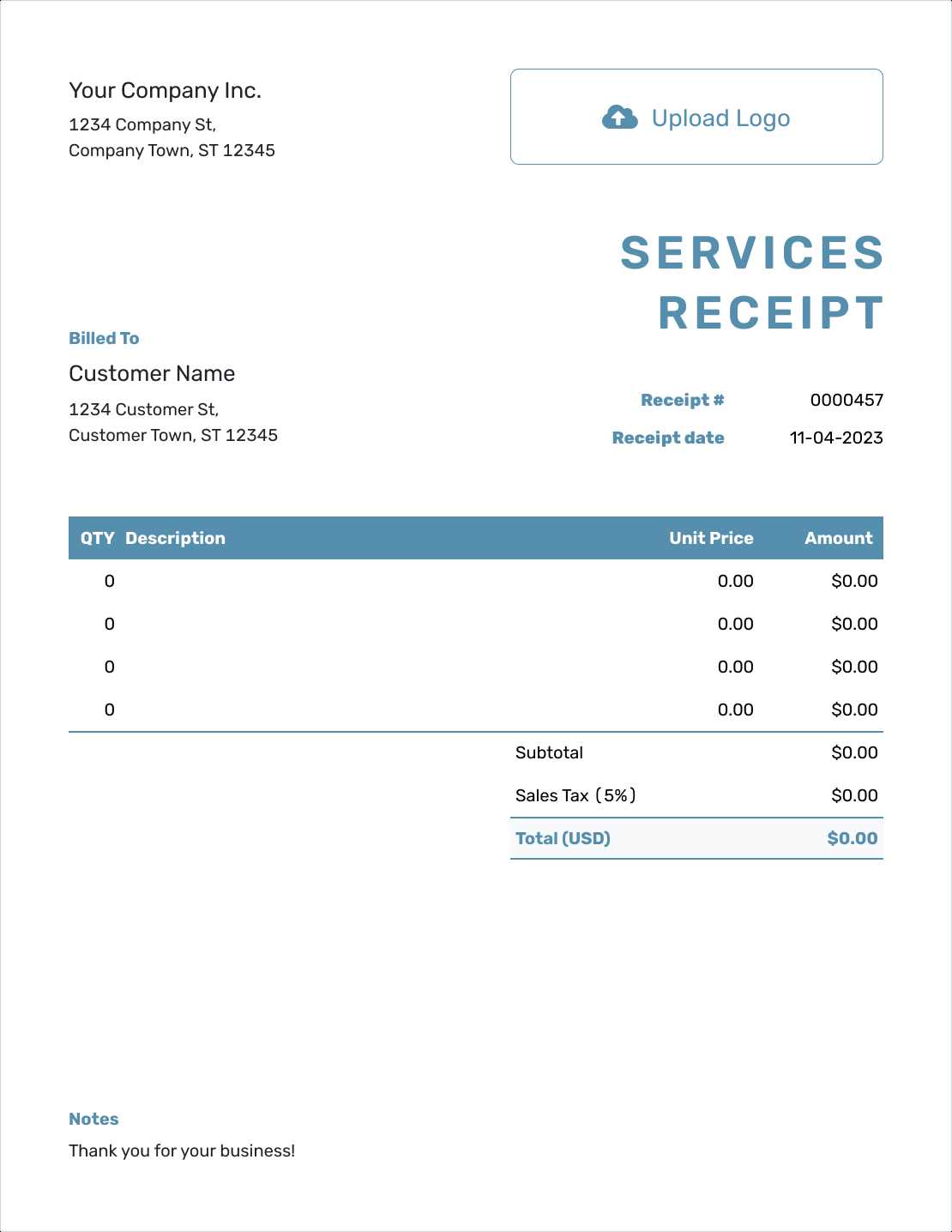

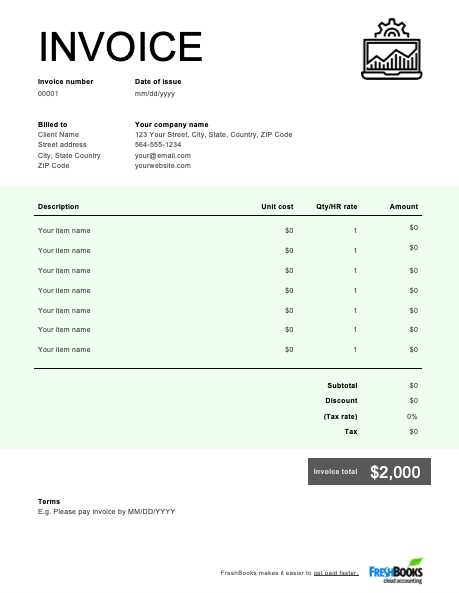

How to Customize Your IT Invoice

Adapting your payment documentation to reflect the unique needs of your business is essential for maintaining consistency and professionalism. Customization allows you to tailor the layout, design, and content to better suit the specific types of work you provide and the expectations of your clients. By making these adjustments, you ensure that all necessary information is included and clearly presented.

Start by adding your business logo and branding elements to give the document a more personalized touch. Including your company’s name, address, and contact details at the top not only enhances visibility but also reinforces your business identity. If you operate in different locations or with different pricing models, customizing sections like rates, payment terms, and tax information is crucial to avoid confusion.

Another important aspect is adding custom fields that are specific to your industry or the type of work you do. If you offer subscription-based pricing or charge for ongoing support, include these details so your clients understand the scope and frequency of the charges. Make sure to clearly define any discounts, additional fees, or payment schedules that might apply.

Common Mistakes in Tech Invoices

Creating clear, accurate documentation for IT projects can be challenging, especially when handling complex or highly detailed tasks. Some frequent errors can undermine the effectiveness of this essential business document, leading to confusion, delays, or even disputes with clients. Addressing these common pitfalls helps improve clarity, ensure proper understanding, and foster stronger professional relationships.

1. Lack of Detailed Descriptions

Avoid vague language when outlining work completed. Specificity helps clients understand exactly what was accomplished. Describe each task, tool used, and outcome achieved to enhance transparency. This level of detail can also justify costs and reduce the likelihood of follow-up questions.

Common Mistakes in Tech Invoices

Creating clear, accurate documentation for IT projects can be challenging, especially when handling complex or highly detailed tasks. Some frequent errors can undermine the effectiveness of this essential business document, leading to confusion, delays, or even disputes with clients. Addressing these common pitfalls helps improve clarity, ensure proper understanding, and foster stronger professional relationships.

1. Lack of Detailed Descriptions

Avoid vague language when outlining work completed. Specificity helps clients understand exactly what was accomplished. Describe each task, tool used, and outcome achieved to enhance transparency. This level of detail can also justify costs and reduce the likelihood of follow-up questions.

2. Missing Dates or Time Frames

Failing to include project dates or specific time allocations can create misunderstandings about the scope and timeline of services provided. Clear time frames are essential, as they allow clients to track project phases, manage budgets, and align expectations on delivery schedules.

3. Incorrect or Inconsistent Rates

Mistakes in hourly or project rates, or failing to update them when changes occur, can lead to disputes and affect trust. It’s essential to double-check all rates, ensuring consistency with prior agreements or industry standards, and clearly outline any rate adjustments if necessary.

4. Overlooking Tax or Legal Requirements

Not addressing local tax requirements or other legal aspects, such as including necessary disclaimers, can cause regulatory issues or delays. Make sure to add all applicable taxes, fees, and any required legal language to ensure compliance and avoid complications later.

5. Neglecting Payment Terms

Payment terms are crucial to avoiding delays in receiving compensation. Ensure that terms are clearly defined, including accepted payment methods, deadlines, and late payment policies. This establishes a professional framework and prevents potential misunderstandings about financial expectations.

By being mindful of these common issues, tech professionals can improve the clarity and accuracy of their documentation, ensuring smoother transactions and more satisfied clients.

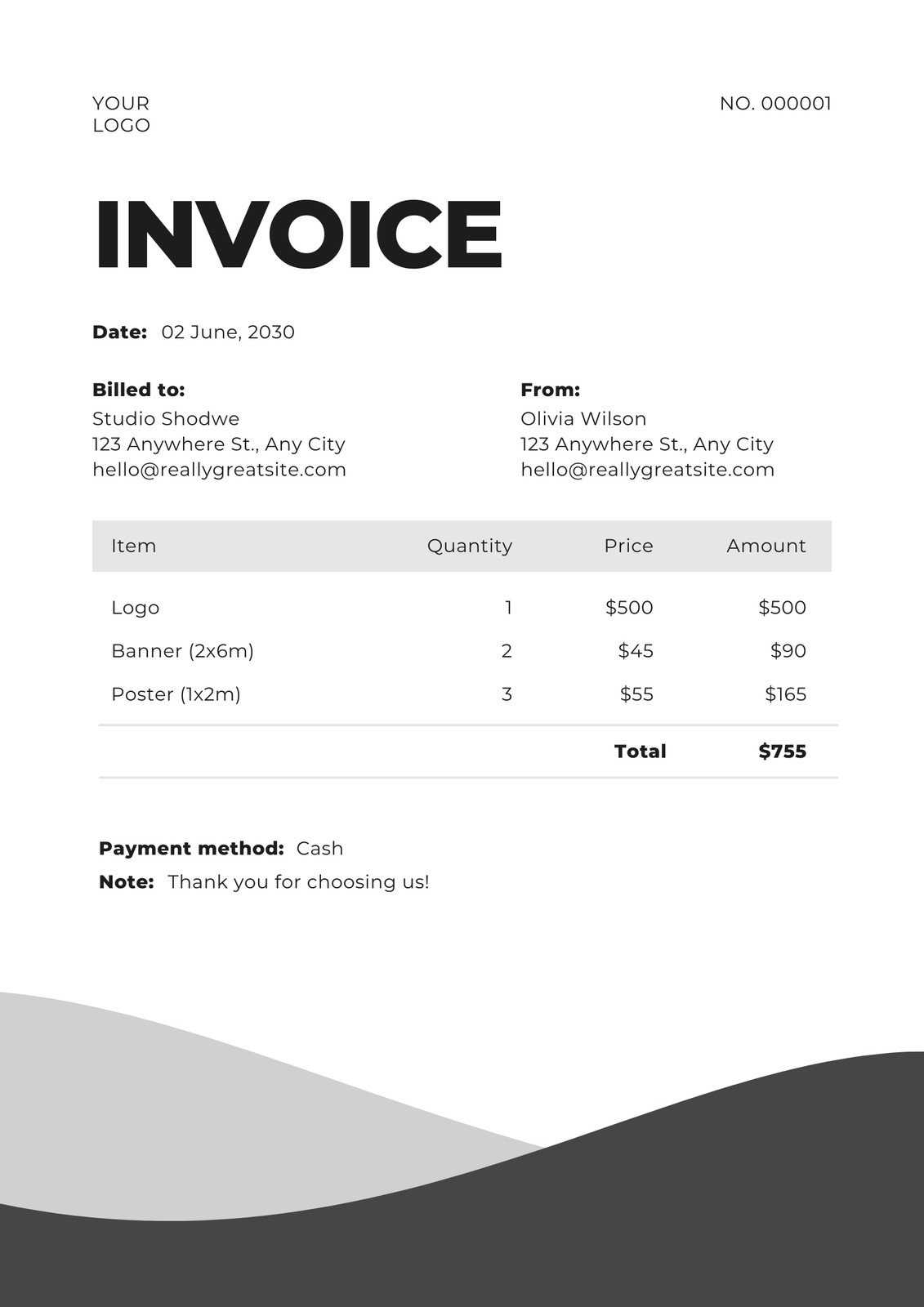

How to Create an Invoice from Scratch

Building a custom document to request payment can seem daunting, but with a structured approach, it’s easy to create a clear and professional record of completed work. A well-organized layout ensures that clients have all essential information, enhancing transparency and reducing potential misunderstandings.

Step 1: Set Up Basic Information

Begin with a header that includes your company name, logo, and contact details. Ensure that this section is clear and prominent, as it’s often the first point of reference. Include your business address, phone number, and email to make future communication straightforward.

- Client Details: Add the recipient’s name, company, and contact information. Confirm these details with the client to avoid errors.

- Document Number: Assign a unique identifier to keep your records organized and aid both parties in tracking payment status.

- How to Create an Invoice from Scratch

Building a custom document to request payment can seem daunting, but with a structured approach, it’s easy to create a clear and professional record of completed work. A well-organized layout ensures that clients have all essential information, enhancing transparency and reducing potential misunderstandings.

Step 1: Set Up Basic Information

Begin with a header that includes your company name, logo, and contact details. Ensure that this section is clear and prominent, as it’s often the first point of reference. Include your business address, phone number, and email to make future communication straightforward.

- Client Details: Add the recipient’s name, company, and contact information. Confirm these details with the client to avoid errors.

- Document Number: Assign a unique identifier to keep your records organized and aid both parties in tracking payment status.

- Date: Specify the date when the document is created and consider adding a payment due date.

Step 2: List Project Details

Next, provide a breakdown of all tasks completed. This section should offer transparency and clarity by listing each item individually. Structure the list with descriptions that make it easy for the client to understand the nature and extent of your work.

- Task Descriptions: Use concise yet descriptive language for each task. Avoid technical jargon unless your client is familiar with it.

- Rates and Hours: Clearly state hourly or flat rates and the time spent on each task. This ensures accurate billing and reduces client queries.

- Additional Costs: Include any additional fees or materials costs that apply. Make sure these items are justified and pre-approved if possible.

Step 3: Define Payment Terms

Conclude by specifying terms to ensure clear expectations. List accepted payment methods, deadlines, and any applicable late fees. This section helps avoid delays and ensures both parties understand the financial requirements.

- Payment Methods: Outline all available methods, such as bank transfer, credit card, or online payment.

- Due Date: Set a reasonable timeframe for payment to encourage prompt processing.

- Late Fees: If applicable, mention any charges for overdue payments to ensure a professional approach to financial responsibility.

Following these steps results in a well-organized document that serves as a clear, professional request for compensation.

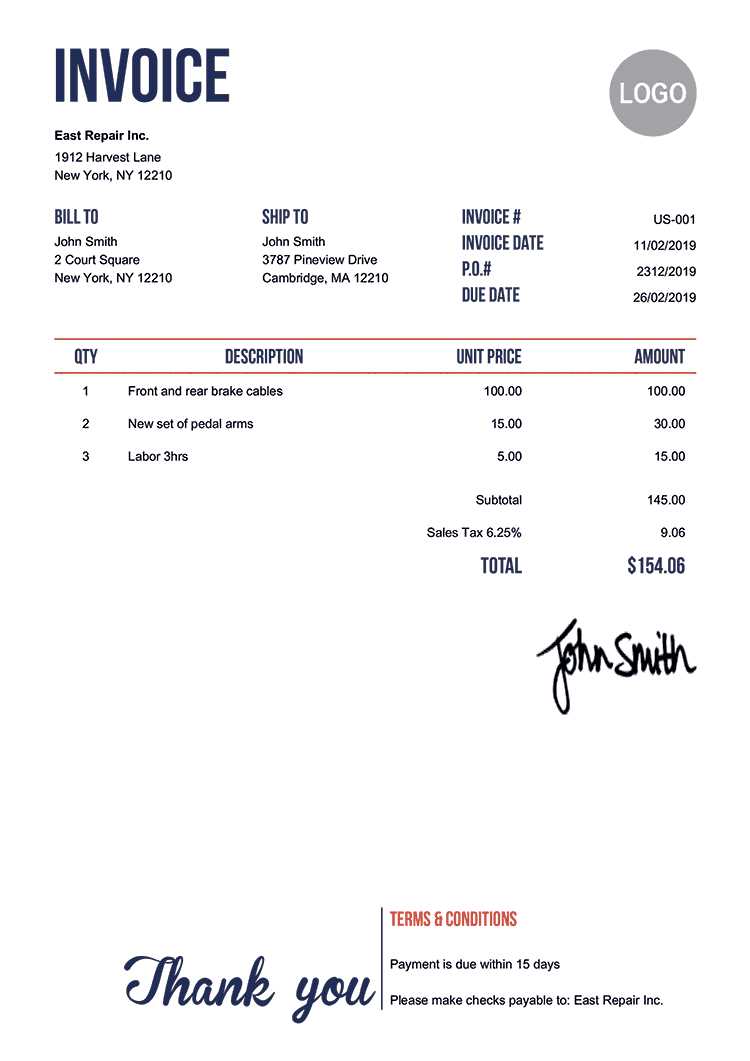

Important Elements Every Tech Invoice Should Have

For a successful financial transaction, essential details should be clearly included. These components ensure that both parties have a clear understanding of the project scope, payment terms, and key identifiers. Proper documentation builds trust and aids in maintaining efficient record-keeping.

Element Description Header Include your company’s logo, name, and contact details at the top. This information helps clients easily identify your document and reach out if needed. Client Information Provide the recipient’s name, business name, and contact details. Ensure accuracy to prevent potential delays in communication and payment processing. Important Elements Every Tech Invoice Should Have

For a successful financial transaction, essential details should be clearly included. These components ensure that both parties have a clear understanding of the project scope, payment terms, and key identifiers. Proper documentation builds trust and aids in maintaining efficient record-keeping.

Element Description Header Include your company’s logo, name, and contact details at the top. This information helps clients easily identify your document and reach out if needed. Client Information Provide the recipient’s name, business name, and contact details. Ensure accuracy to prevent potential delays in communication and payment processing. Document Number Assign a unique identifier to simplify tracking and referencing in future communications. Date of Issue Include the date the document is issued. Adding a payment due date is also helpful for encouraging timely payment. Itemized List of Services List all tasks performed, with brief descriptions. Clearly outline rates and hours for each item to ensure the client understands the total cost. Subtotal and Total Present a subtotal of all listed tasks, followed by a total that includes any taxes, discounts, or additional fees. This helps prevent misunderstandings about the final amount. Payment Terms Define accepted payment methods, due dates, and late fees if applicable. Clear terms streamline the process and ensure a smooth transaction. Including these key elements ensures that your documentation is professional, comprehensive, and easy to understand, leading to efficient and effective communication with clients.

How to Automate Your Invoicing System

Automating the process of billing clients can save valuable time, reduce errors, and streamline your business operations. By implementing a reliable automation solution, you can ensure that documents are generated, tracked, and sent out with minimal manual effort, leading to a more efficient workflow and faster payments.

1. Choose an Automation Platform

Select a software solution that suits your business needs. Look for features like customizable document creation, client management, and scheduling tools. Popular platforms offer integration with accounting tools, allowing you to manage all transactions in one place.

2. Set Up Recurring Billing

For clients with ongoing projects or subscriptions, configure recurring payment requests. Automating repeat transactions reduces the need for frequent document generation and minimizes delays, ensuring that you receive timely compensation.

3. Integrate with Payment Gateways

Connect your system to payment gateways to facilitate seamless transactions. This allows clients to

Legal Requirements for IT Service Invoices

To maintain compliance and avoid potential legal issues, it is essential to include specific information in your billing documents for technology-related projects. Ensuring these elements are properly documented can protect your business and foster trust with clients, as well as streamline financial and tax records.

1. Business Identification

Include your business’s registered name, address, and contact information. Depending on your region, you may also need to provide a tax identification number or business registration number to meet regulatory requirements.

2. Client Information

Accurate client details are necessary to validate the transaction. Add the client’s official name, address, and any relevant identifiers required by law. Verifying this information helps to ensure accuracy in tax filings and audits.

3. Description of Services Rendered

List all tasks completed and describe them in clear, non-technical language if possible. Precise descriptions are often legally required to support the transaction’s legitimacy, especially when handling tax documentation or disputes.

4. Applicable Taxes

Specify any taxes applied, such as VAT or

How to Organize Your Invoice Records

Maintaining an organized system of billing records is essential for efficient financial management and seamless client interactions. A structured approach allows for easy access to past documents, simplifies tracking of payments, and supports accurate reporting during audits or tax filing.

Organizational Strategy Description 1. Use a Consistent Naming Convention Adopt a standardized format when naming your documents, such as including the client’s name, date, or a unique identifier. This makes it easy to locate specific records and reduces the risk of duplicates. 2. Separate by Status Create folders or tags to categorize documents by payment status (e.g., “Paid How to Organize Your Invoice Records

Maintaining an organized system of billing records is essential for efficient financial management and seamless client interactions. A structured approach allows for easy access to past documents, simplifies tracking of payments, and supports accurate reporting during audits or tax filing.

Organizational Strategy Description 1. Use a Consistent Naming Convention Adopt a standardized format when naming your documents, such as including the client’s name, date, or a unique identifier. This makes it easy to locate specific records and reduces the risk of duplicates. 2. Separate by Status Create folders or tags to categorize documents by payment status (e.g., “Paid,” “Pending,” “Overdue”). This approach streamlines follow-ups and allows you to monitor outstanding balances effectively. 3. Organize by Client Keep separate folders for each client, especially if you have recurring business. This arrangement makes it easier to review account history, manage individual payment records, and prepare future quotes. 4. Maintain Digital and Physical Backups Store digital copies in a secure, cloud-based system and, if needed, keep physical backups. This dual system ensures that records are protected against data loss or technical issues. 5. Schedule Regular Reviews Review your records periodically to ensure they are up to date and complete. This helps prevent oversights and allows for timely adjustments, particularly for tax or audit purposes. By establishing a robust organization system, you ensure that your financial records are accessible, accurate, and secure, facilitating smoother business operations and fostering better client relationships.

How to Handle Late Payments in IT Services

Late payments can disrupt cash flow and complicate financial planning, making it essential to have strategies in place to address them professionally. Establishing clear guidelines and communication practices helps ensure that clients respect agreed-upon terms, minimizing delays and fostering positive relationships.

1. Set Clear Payment Terms

Begin by establishing transparent payment expectations from the start. Outline due dates, acceptable methods of payment, and any late fees in your contract. Clear terms can prevent misunderstandings and make it easier to handle delays if they occur.

2. Follow Up Promptly

If a payment is overdue, reach out to your client quickly. A polite reminder can ofte

How to Handle Late Payments in IT Services

Late payments can disrupt cash flow and complicate financial planning, making it essential to have strategies in place to address them professionally. Establishing clear guidelines and communication practices helps ensure that clients respect agreed-upon terms, minimizing delays and fostering positive relationships.

1. Set Clear Payment Terms

Begin by establishing transparent payment expectations from the start. Outline due dates, acceptable methods of payment, and any late fees in your contract. Clear terms can prevent misunderstandings and make it easier to handle delays if they occur.

2. Follow Up Promptly

If a payment is overdue, reach out to your client quickly. A polite reminder can often resolve the issue and keep the relationship intact. Consider implementing automated reminders in your billing system to ensure that clients are aware of their obligations before the due date passes.

- First Reminder: Send a gentle message as soon as the payment is overdue, restating the amount due and providing a simple way to complete the transaction.

- Second Reminder: If payment is still pending after a week, follow up with a firmer reminder, including any late fees as specified in your terms.

- Final Notice: For persistent delays, a formal notice may be necessary, clearly stating possible consequences such as service suspension or legal action.

3. Offer Flexible Solutions

Sometimes, delays are due to temporary client difficulties. If appropriate, consider offering payment plans or adjusted timelines. This flexibility can lead to successful resolution while maintaining a strong client relationship.

4. Implement Late Fees

Charging interest or fees on overdue balances can be an effective deterrent. Clearly specify these charges in your initial contract and include them in follow-up communications. However, apply this policy consistently to build a reputation of fairness.

5. Know When to Seek Assistance

If repeated follow-ups yield no results, consider involving a collection agency or seeking legal advice. While this is typically a last resort, it may be necessary for larger or long-standing debts.

Handling delayed payments with a structured, professional approach ensures that your business remains financially stable while preserving positive relationships with clients whenever possible.