Ultimate Guide to Quickbooks Invoice Templates for Mac

Effective financial management is crucial for any business, and having a reliable system for generating billing documents can significantly enhance productivity. Utilizing professional designs not only helps in organizing your transactions but also improves the overall impression you leave on your clients. This section will explore how customizable solutions can meet the diverse needs of various enterprises.

By selecting the right designs, businesses can ensure clarity and professionalism in their financial communications. These documents serve as a vital link between services rendered and payment collection, making it essential to present them attractively and informatively. This approach not only facilitates smoother transactions but also fosters stronger relationships with customers.

Whether you are a freelancer, a small business owner, or part of a larger organization, leveraging effective billing documents can lead to greater efficiency. Embracing innovative solutions tailored to your specific requirements will ultimately contribute to the success and growth of your venture.

Overview of Quickbooks for Mac

This platform offers a comprehensive solution for managing financial tasks efficiently, catering to the needs of various users. With a user-friendly interface and powerful features, it streamlines accounting processes and enhances productivity. The software is designed to accommodate the unique demands of professionals, making it an invaluable asset in today’s fast-paced business environment.

User-Friendly Interface

The intuitive layout allows users to navigate effortlessly through different functions, ensuring that tasks can be completed quickly and accurately. The well-organized dashboard provides access to essential tools, enabling efficient tracking of expenses, revenue, and client interactions.

Comprehensive Features

This solution includes a variety of functionalities that simplify financial management. Users can create detailed financial reports, manage payroll, and monitor cash flow, all within a single application. The flexibility of the system allows businesses to customize their experience, adapting to specific requirements and preferences.

Benefits of Using Invoice Templates

Employing pre-designed documents can significantly enhance the efficiency of financial operations. These structured formats not only save time but also ensure consistency across various client communications. By utilizing professional layouts, businesses can project a polished image while simplifying their billing process.

Time Efficiency

One of the primary advantages of using ready-made designs is the time saved during the preparation of billing documents. Instead of creating each document from scratch, users can quickly fill in the necessary details and generate professional-looking statements with minimal effort. This efficiency allows professionals to focus on core business activities rather than getting bogged down in administrative tasks.

Consistency and Professionalism

Utilizing structured formats helps maintain a consistent appearance across all financial communications. This uniformity not only fosters a sense of professionalism but also reinforces brand identity. Clients are more likely to trust a business that presents its financial documents in a clear and organized manner, enhancing overall customer satisfaction.

How to Access Quickbooks Templates

Gaining entry to pre-designed documents is a straightforward process that can significantly enhance your financial workflows. Understanding how to navigate the platform is essential for utilizing these ready-made formats effectively. This section will guide you through the steps necessary to locate and use these valuable resources.

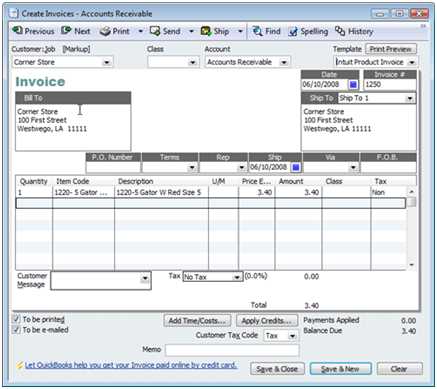

Navigating the Dashboard

Start by logging into your account and navigating to the main dashboard. Look for the section dedicated to financial management tools, where various options are available for generating billing documents. The interface is designed to be intuitive, allowing users to quickly find the desired features without unnecessary complications.

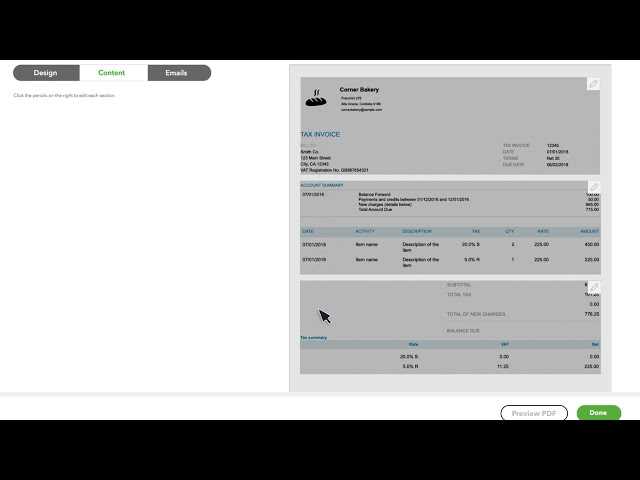

Selecting and Customizing Designs

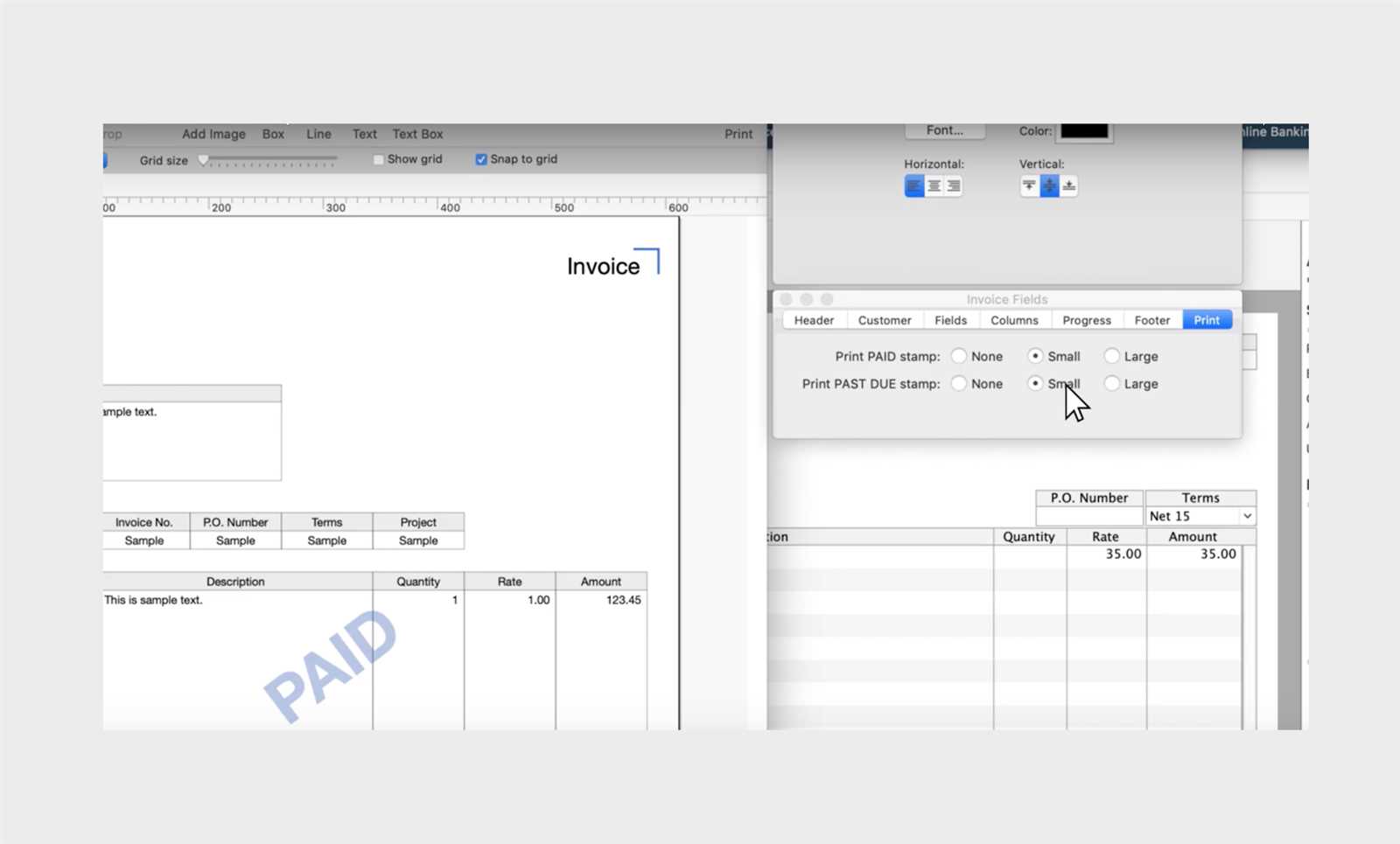

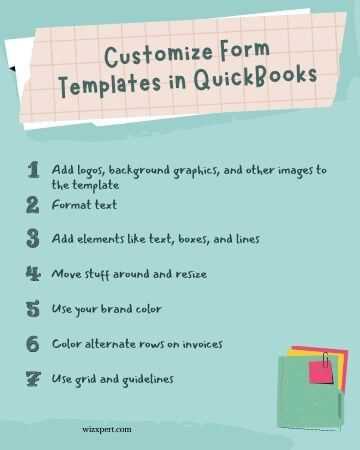

Customizing Your Invoice Designs

Tailoring your billing documents to reflect your brand and meet specific client needs can significantly enhance your professional image. Customization options allow users to modify various elements, creating a unique presentation that resonates with customers. This section will explore how to effectively personalize your financial documents for maximum impact.

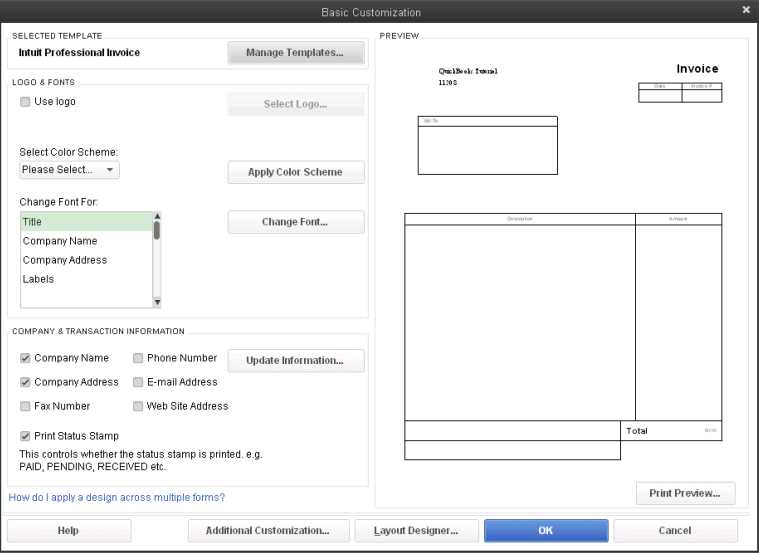

Adding Branding Elements

Incorporating your company logo, colors, and fonts into the design is essential for establishing brand identity. These visual elements create a cohesive look across all communications and make your documents instantly recognizable. By customizing these features, you not only strengthen your brand but also convey professionalism and attention to detail.

Adjusting Layout and Content

Modifying the layout allows you to highlight essential information effectively. You can rearrange sections, change font sizes, and select appropriate fields to ensure clarity. Adding personalized messages or instructions can also enhance the client experience, making the transaction feel more tailored and engaging.

Popular Invoice Styles for Businesses

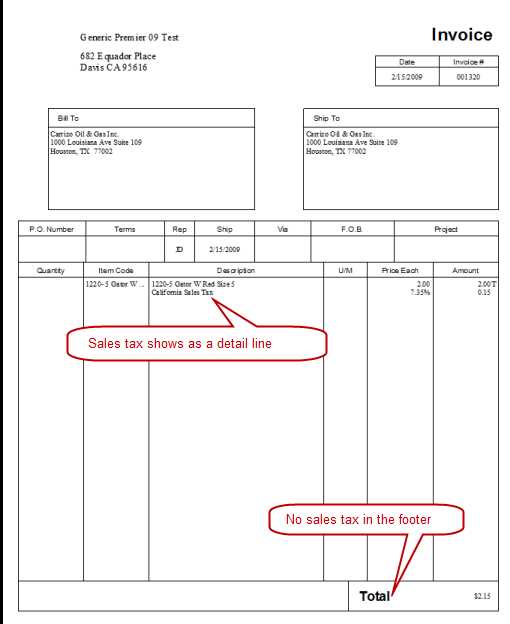

Selecting the right design for financial documents can significantly influence how clients perceive your business. Different styles cater to various industries and preferences, making it essential to choose a format that aligns with your brand and client expectations. This section highlights some of the most popular designs favored by businesses today.

Classic Layout

The classic format is characterized by a straightforward and professional appearance. This style typically features a clean layout with clearly defined sections for billing information, making it easy for clients to review. It is ideal for businesses that prioritize formality and simplicity, ensuring that the focus remains on the essential details of the transaction.

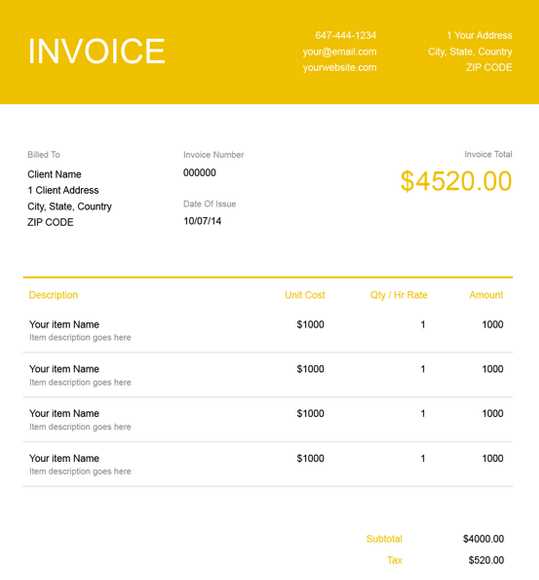

Modern and Minimalistic

For those looking to make a contemporary statement, the modern and minimalistic style is a great choice. This design emphasizes simplicity and white space, providing a fresh look that is easy on the eyes. It often includes subtle graphic elements that enhance the aesthetic without overwhelming the content. This style is particularly popular among creative industries, as it reflects a forward-thinking approach.

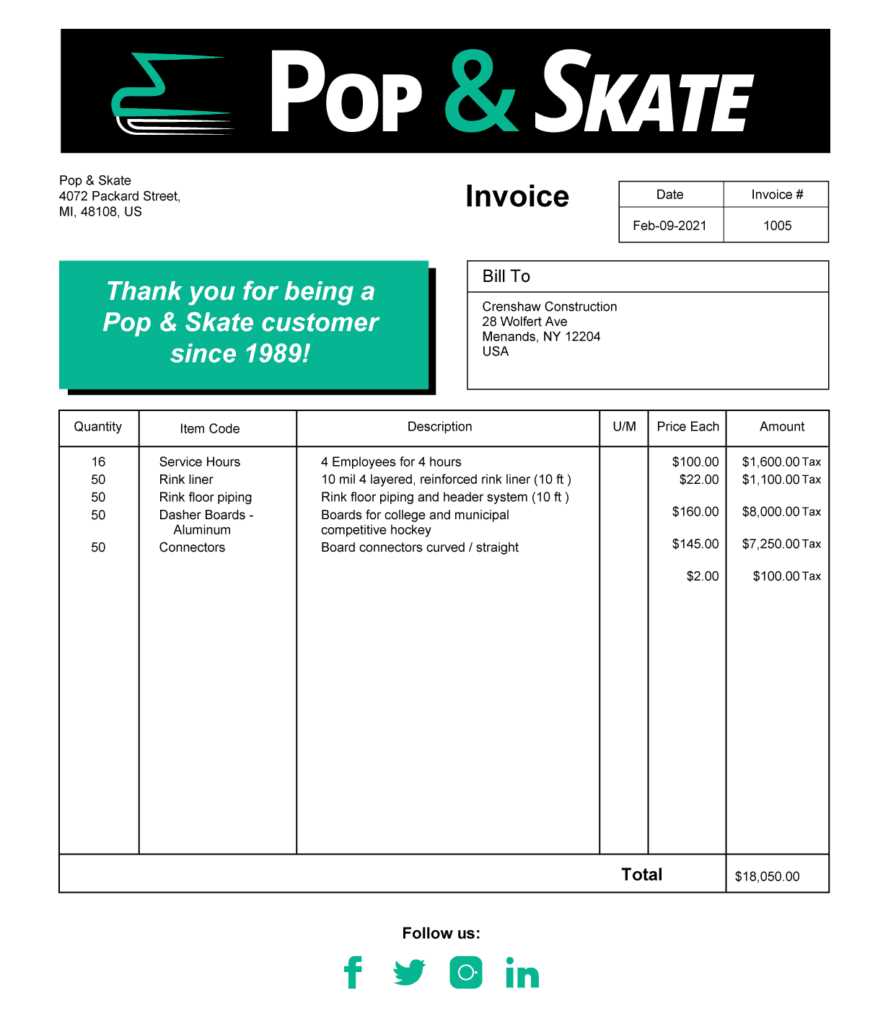

Bold and Colorful

Businesses aiming to stand out may opt for bold and colorful designs that capture attention. This style incorporates vibrant hues and striking visuals, making it memorable for clients. While it can effectively convey personality and creativity, it is crucial to balance color and content to ensure that important information remains clear and accessible.

Integrating Templates with Accounting Software

Combining pre-designed documents with financial management tools can streamline operations and improve overall efficiency. This integration allows businesses to automate processes, reducing the time spent on manual entries while ensuring consistency across various documents. In this section, we will explore how to effectively merge these resources with accounting solutions.

Seamless Data Transfer

One of the key benefits of integration is the ability to transfer data effortlessly between the two systems. This connection ensures that information such as client details, payment history, and service descriptions can be automatically populated in the documents, minimizing the risk of errors. By synchronizing data, businesses can maintain accurate records and enhance productivity.

Enhancing Workflow Efficiency

Integrating pre-designed documents with financial tools allows for streamlined workflows. Users can generate documents directly from the accounting software, eliminating the need to switch between applications. This unified approach not only saves time but also reduces the likelihood of inconsistencies, ensuring that all communications reflect the most current information.

Step-by-Step Template Setup Guide

Establishing a streamlined process for your billing documents is crucial for maintaining efficiency and accuracy in financial transactions. This guide provides a clear, step-by-step approach to set up your pre-designed documents effectively. Following these instructions will help ensure that your financial communications are professional and tailored to your business needs.

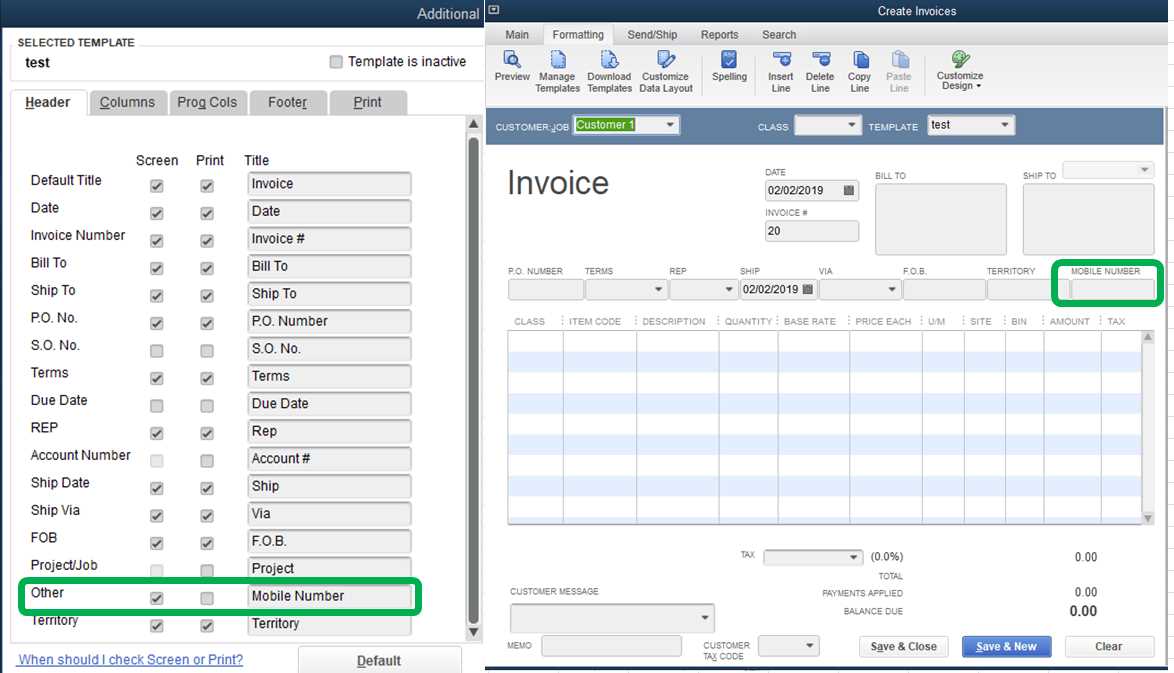

Accessing the Design Section

Begin by navigating to the design section within your financial management tool. This area typically houses various formats and customization options. Once there, look for the option to create or manage your documents. This will set the foundation for establishing your preferred layout.

Customizing Your Document

After selecting a format, focus on personalizing it to reflect your brand identity. You can add your logo, choose color schemes, and adjust font styles. Make sure to include relevant fields such as contact information and service details. This customization process enhances not only the aesthetics but also the functionality of the document, ensuring it meets your specific requirements.

Tips for Effective Invoicing Practices

Implementing best practices in billing procedures is essential for ensuring timely payments and maintaining strong client relationships. By following a few key strategies, businesses can enhance their invoicing efficiency and clarity, leading to a smoother financial process. This section outlines practical tips to improve your billing practices.

First, always ensure that your documents are clear and easy to understand. Use straightforward language and organize information logically, highlighting essential details such as payment terms and due dates. A well-structured document reduces confusion and sets clear expectations for clients.

Additionally, consider sending reminders before payment deadlines. Gentle nudges can prompt clients to settle their accounts promptly, helping maintain cash flow. It’s also beneficial to keep records of all communications related to billing, as this can aid in addressing any disputes or questions that may arise.

Lastly, offer multiple payment options to accommodate your clients’ preferences. Providing various methods, such as credit card payments, bank transfers, or online payment platforms, can increase the likelihood of timely payments and enhance customer satisfaction.

Common Mistakes to Avoid

Avoiding pitfalls in your billing process is crucial for maintaining professionalism and ensuring timely payments. Many businesses fall into certain traps that can lead to confusion, delays, or disputes. Recognizing these common errors can help streamline your financial practices and enhance client satisfaction.

Overlooking Important Details

One frequent mistake is neglecting to include essential information in your billing documents. Failing to provide necessary details can lead to misunderstandings and payment delays. Ensure that each document contains the following:

| Detail | Description |

|---|---|

| Client Information | Accurate contact details for easy communication. |

| Service Description | Clear and concise descriptions of services rendered. |

| Payment Terms | Specify due dates and accepted payment methods. |

| Itemized Costs | Breakdown of charges to ensure transparency. |

Ignoring Follow-Up Communication

Another common oversight is not following up on overdue payments. Failing to remind clients about their outstanding balances can result in cash flow issues. Establish a system for sending friendly reminders before and after payment due dates to encourage prompt settlement of accounts.

Tracking Payments with Quickbooks

Effectively monitoring financial transactions is vital for maintaining a healthy cash flow and understanding the financial standing of your business. Implementing a robust system to track incoming payments ensures that you stay organized and aware of outstanding balances. This process can significantly enhance your ability to manage finances efficiently.

Setting Up Payment Tracking

To begin tracking financial transactions, you need to establish a systematic approach. Create a dedicated section within your accounting platform that allows you to log each payment as it is received. This feature often includes options for categorizing payments by client, date, and type of service, enabling you to analyze your income sources effectively.

Utilizing Reporting Features

Many accounting solutions offer comprehensive reporting capabilities that can help you visualize your payment trends over time. By generating regular reports, you can identify patterns in your revenue flow, detect potential issues with delayed payments, and make informed decisions based on your financial data. Use these insights to refine your billing processes and improve your overall financial management.

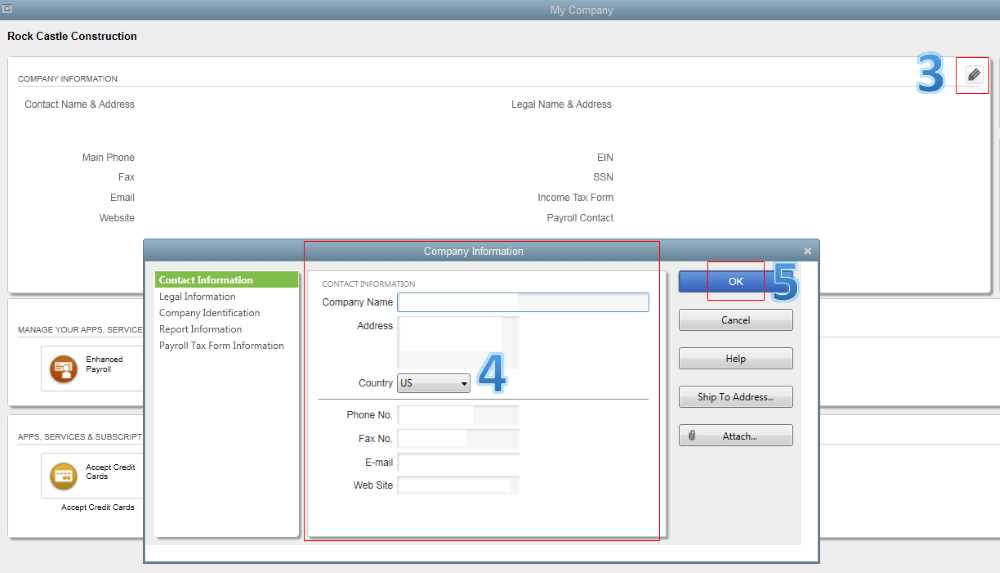

Managing Client Information Efficiently

Organizing and maintaining client details is crucial for any successful business. A well-structured system allows you to access important information quickly, enabling you to provide better service and strengthen client relationships. Efficient management not only streamlines communication but also enhances your ability to track interactions and preferences, fostering loyalty and repeat business.

To manage client data effectively, consider utilizing a centralized database that stores essential information such as contact details, transaction history, and preferences. This approach simplifies access to data and facilitates timely follow-ups, ensuring that you remain responsive to client needs. Regularly updating this information is equally important, as it helps you stay informed about any changes in client status or requirements.

Moreover, implementing automated tools for data entry and management can significantly reduce manual errors and save time. With a digital solution, you can easily segment your client base for targeted communications, promotions, or updates, enhancing your overall marketing strategy. By prioritizing efficient client information management, you position your business for sustainable growth and success.

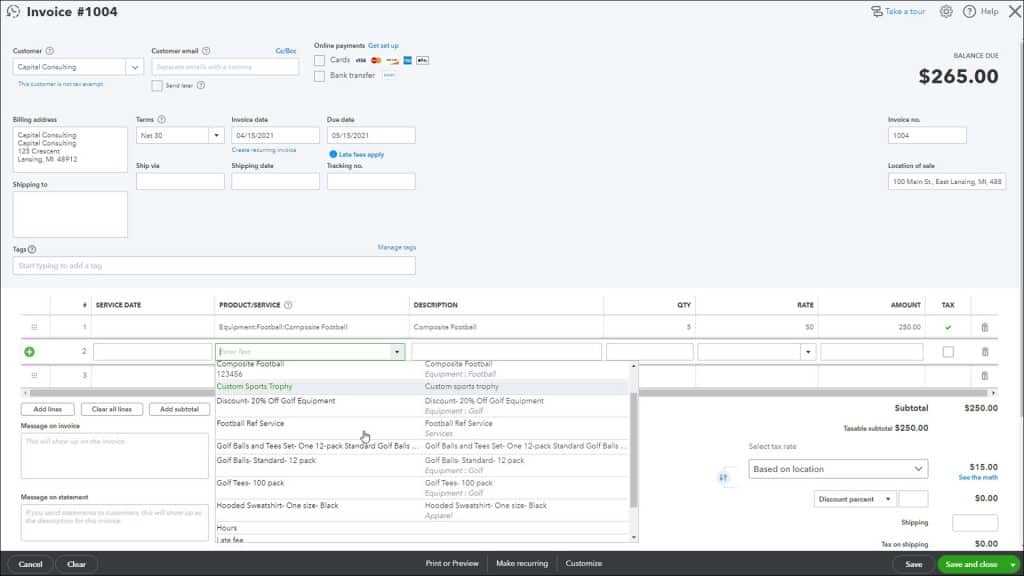

Using Quickbooks for Project Billing

Managing billing for various projects can be a complex task, but leveraging the right software can simplify the process significantly. A robust financial management tool allows businesses to track expenses, manage client accounts, and generate detailed financial reports with ease. This functionality is essential for ensuring that projects remain within budget and that all costs are accurately accounted for.

When handling project-related finances, it is crucial to categorize expenses properly to provide clarity and facilitate effective tracking. By utilizing dedicated features, users can assign costs directly to specific projects, allowing for comprehensive oversight of financial performance. Additionally, customizing billing rates based on project specifications or client agreements enables more flexible and accurate invoicing.

Moreover, the ability to generate reports that reflect the financial status of each project helps in making informed decisions. Such insights can aid in assessing profitability, understanding resource allocation, and identifying areas for improvement. By harnessing these capabilities, businesses can enhance their project billing processes, leading to improved cash flow and client satisfaction.

Creating Recurring Invoices Easily

Establishing a seamless billing process is essential for maintaining positive cash flow and ensuring timely payments. Automating the creation of repeated billing statements simplifies the financial management for businesses, allowing them to focus on growth and customer service. With a well-designed system, users can set up consistent billing schedules without the need for manual intervention each time.

To initiate the process, one must configure the parameters that dictate the frequency of the statements. This can range from weekly to monthly or even quarterly cycles, depending on the service agreement with clients. By setting clear terms for each billing period, businesses can maintain transparency and strengthen their financial planning.

Moreover, integrating customization options into the recurring billing setup enhances the professionalism of each document. Tailoring the appearance and details of the statements to reflect branding and specific client needs fosters stronger relationships. Ultimately, automating this process not only reduces administrative burdens but also helps ensure that all due payments are collected promptly and accurately.

Exporting Invoices to Other Formats

The ability to transfer financial documents to various file types is crucial for effective business operations. This flexibility allows users to share information seamlessly with clients, accountants, and other stakeholders, ensuring that everyone has access to necessary details in their preferred format. By utilizing multiple export options, businesses can enhance collaboration and improve data management.

Common formats for exporting documents include:

- PDF: A widely accepted format that preserves the layout and design of documents, making it ideal for professional communication.

- Excel: This format allows for easy data manipulation and analysis, providing flexibility in financial reporting.

- CSV: A simple text format that can be used for importing data into various applications, useful for bulk processing.

To export financial documents effectively, users typically follow a series of straightforward steps:

- Select the desired document from the system.

- Choose the export option from the menu.

- Pick the appropriate file format based on the intended use.

- Confirm the export, and save the file to the desired location.

By implementing these export capabilities, businesses can streamline their financial workflows and ensure that critical information is readily available across different platforms and applications.

Enhancing Your Brand with Invoices

Using financial documents as a branding tool can significantly influence how clients perceive a business. Well-designed statements not only communicate essential details but also reflect the company’s identity and values. By incorporating brand elements into these documents, businesses can create a lasting impression that extends beyond the transaction itself.

Consistency in design is key to reinforcing brand recognition. Utilizing the same color schemes, logos, and fonts as those found on your website and marketing materials helps establish a cohesive image. This visual consistency fosters familiarity and trust among clients.

Moreover, adding personalized messages or tailored thank-you notes on financial documents can enhance customer relationships. This personal touch shows clients that they are valued and appreciated, encouraging repeat business and referrals.

Additionally, businesses can utilize professional layouts that emphasize clarity and organization. A well-structured document makes it easy for clients to find important information, thereby improving their overall experience. Incorporating elements such as payment terms and due dates in a visually appealing manner contributes to effective communication.

Ultimately, leveraging financial documents as a branding strategy can help businesses distinguish themselves in a competitive market while fostering strong client relationships.

Customer Support and Resources

Access to reliable assistance and comprehensive resources is essential for users navigating financial management solutions. A strong support system not only enhances user experience but also empowers individuals to make the most of the available features. Organizations often provide various channels for help, ensuring that users can find the guidance they need efficiently.

Support Channels

Most service providers offer multiple avenues for customer support, including:

- Live Chat: Immediate assistance can be obtained through live chat options, allowing users to communicate directly with support representatives.

- Email Support: For less urgent inquiries, email support provides a way to get detailed responses and guidance.

- Phone Support: Direct phone lines can be invaluable for users who prefer speaking with a representative.

Online Resources

In addition to direct support, users can benefit from various online resources:

- Knowledge Base: A comprehensive knowledge base filled with articles, FAQs, and troubleshooting guides can help users find solutions independently.

- Webinars and Tutorials: Regularly scheduled webinars and tutorial videos offer insights into features and best practices, enhancing overall proficiency.

- Community Forums: Engaging with community forums allows users to share experiences and tips, fostering a collaborative environment for problem-solving.

Utilizing these support channels and resources can greatly enhance the user experience, making financial management smoother and more efficient.