Accounts Receivable Invoice Template for Easy Billing and Payment Tracking

Managing payments efficiently is a critical task for any business. Whether you are a small entrepreneur or run a large company, maintaining a clear and organized system for billing helps ensure timely receipts and healthy cash flow. Having the right tools in place makes this process smoother and more reliable.

One of the most effective ways to stay on top of financial transactions is by using a structured document for requesting payment. These documents not only outline what is owed but also provide essential details that help avoid confusion between businesses and clients. When designed properly, they can be a powerful asset for simplifying the payment collection process.

By utilizing a well-organized document format, you can reduce errors, speed up payment cycles, and create a more professional impression for your clients. In this guide, we’ll explore how to use such documents, customize them to suit your needs, and ensure that you stay on top of your financial transactions.

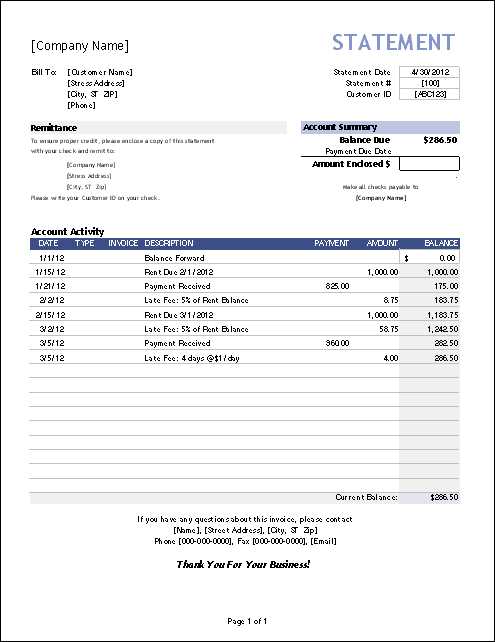

Accounts Receivable Invoice Template Overview

Having a standardized document for requesting payments from clients is essential for maintaining an organized financial process. Such documents not only ensure that all the necessary details are included but also promote professionalism and consistency in your billing practices. By using a well-structured format, you can make your billing system more efficient, reducing errors and speeding up payment processing.

These payment requests typically contain specific fields, such as the amount due, payment terms, and client information, which help both businesses and customers track outstanding obligations. The goal is to create a clear and concise request that leaves no room for confusion, fostering a smoother transaction process. Let’s dive deeper into the components that make up an effective document for this purpose.

Key Elements to Include

An effective payment request should contain several key elements: the business’s contact information, a unique reference number, a breakdown of products or services provided, and clear payment instructions. Including these components ensures transparency and provides both parties with the necessary details to complete the transaction without delays.

Customization Options

While there are common elements that should be included in all such documents, customization allows businesses to tailor the format to their specific needs. Whether it’s adjusting the layout, adding a logo, or including personalized payment terms, flexibility in design ensures the document is both functional and aligned with the brand’s image.

Why Use an Invoice Template

Creating a standardized form for requesting payments offers numerous benefits for businesses of all sizes. A well-designed form ensures that every transaction is handled efficiently, minimizing errors and ensuring that all essential information is included. Using such a structured document can save time, reduce administrative costs, and help establish a professional image for your business.

Instead of manually drafting payment requests for each client, utilizing a pre-designed format allows you to quickly generate consistent, clear, and accurate bills. This helps to streamline the billing process, making it easier for both you and your customers to track payments and outstanding balances.

Time and Efficiency Benefits

With a standardized format, you can avoid having to recreate documents from scratch every time you need to request a payment. This reduces the amount of time spent on administrative tasks, allowing you to focus on other aspects of running your business. The ability to easily customize pre-made forms also ensures that you can maintain flexibility without compromising efficiency.

Professional Appearance

Utilizing a well-crafted form demonstrates attention to detail and professionalism. Clear and organized payment requests reflect positively on your business and help build trust with clients. Having a consistent format shows that you are organized and serious about managing financial transactions.

Key Features of an Effective Template

An effective payment request form should be clear, comprehensive, and easy to use. The primary goal is to create a document that allows both the business and the client to understand the terms of the transaction with minimal effort. Key features ensure the request is professional, accurate, and meets all legal and practical requirements for smooth payment processing.

The right structure can help avoid misunderstandings and make it easier to track payments. Whether you are dealing with small clients or large corporations, incorporating essential elements into your form will contribute to faster and more reliable financial transactions.

Clear and Organized Layout

A simple, well-organized layout is crucial. Important details such as the amount due, payment terms, and client information should be clearly visible and easy to find. Grouping similar information together and using bold or larger fonts for key data ensures that the document is easy to read at a glance.

Essential Details for Accuracy

An effective form includes all the necessary information to avoid confusion or errors. This includes a unique reference number for tracking, a breakdown of goods or services provided, payment instructions, due date, and any applicable taxes. Including payment terms such as late fees or discounts for early payment can help encourage timely action and provide additional clarity for both parties.

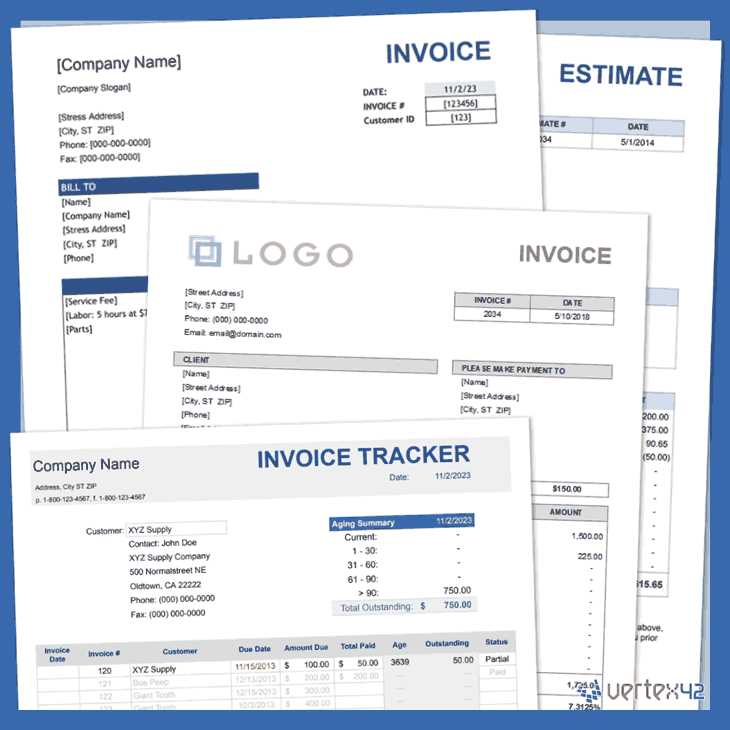

How to Customize Your Invoice

Customizing a payment request form allows you to tailor it to the specific needs of your business and clients. Personalization not only enhances the professional look of the document but also ensures that all relevant information is presented in a way that suits your workflow. A customized form can reflect your branding and be adjusted to fit unique business practices or client requirements.

The process of customization typically involves adjusting the layout, adding or removing certain fields, and including branding elements like logos or color schemes. With the right tools, this process can be quick and easy, helping you maintain a consistent and professional approach across all your transactions.

Adjusting Layout and Design

One of the simplest ways to customize a payment request is by adjusting the layout. This can include rearranging sections, changing fonts, or adding your business logo. A clean and professional design will make the document more attractive and easier to read. You can also choose whether you prefer a minimalist or more detailed format, depending on the nature of your services.

Adding Custom Fields and Terms

Another important step in customization is adding custom fields that may be specific to your business. For instance, you might want to include a section for order numbers, special payment terms, or discount information. Including specific terms, such as due dates, payment methods, and late fees, helps set clear expectations with your clients and can encourage timely payments.

Common Mistakes to Avoid in Invoices

Even with a well-structured form, mistakes can still occur if not carefully reviewed. These errors can lead to confusion, delayed payments, or even disputes with clients. Being aware of the most common pitfalls when creating payment requests can help ensure that your documents are clear, accurate, and professional. Avoiding these mistakes will save you time and foster better relationships with your clients.

From missing essential details to using unclear language, there are several key aspects to pay attention to when preparing a payment request. Taking the extra step to double-check your document before sending it can prevent unnecessary complications down the line.

Leaving Out Critical Information

One of the most common mistakes is omitting important details such as the payment amount, due date, or client contact information. Without these key pieces of information, your clients may be confused about the total amount owed or when payment is expected. Be sure to include everything needed to complete the transaction, from a detailed list of products or services to clear payment instructions.

Unclear Payment Terms and Conditions

Vague or incomplete payment terms can lead to misunderstandings and delays. Always specify the payment method(s) you accept, the due date, and any late fees or discounts for early payment. A well-defined payment schedule helps your client understand their obligations clearly and encourages timely action on their part.

How Invoice Templates Streamline Billing

Efficient billing processes are essential for maintaining smooth cash flow and improving financial management in any business. By using a structured format for client charges, companies can reduce manual errors, save time, and create a more organized approach to collecting revenue.

Reducing Administrative Work

A consistent billing format minimizes repetitive tasks and cuts down on the administrative workload. Instead of drafting each statement from scratch, businesses can use pre-set layouts that are easy to populate with relevant data, ensuring that transactions are recorded accurately without consuming excessive time or resources.

Ensuring Clarity and Professionalism

Standardized billing forms help present a polished and cohesive image to clients. Structured formats organize key details, making it easier for clients to understand charges, due dates, and payment methods. This clarity not only enhances the client’s experience but also speeds up the payment cycle by reducing back-and-forth communication.

Benefits of Digital Invoice Templates

Adopting a digital approach to billing offers numerous advantages, enhancing both efficiency and accuracy. By leveraging electronic formats, businesses can streamline payment processes, reduce paperwork, and ensure faster transactions. This method also promotes a more organized and accessible system for handling client charges.

| Benefit | Description |

|---|---|

| Speed and Convenience | Digital forms allow businesses to generate and send bills instantly, reducing the time needed to prepare and deliver physical documents. |

| Reduced Errors | Automated calculations and standardized formats minimize the risk of mistakes, ensuring accurate billing for all transactions. |

| Cost Savings | Switching to a digital system reduces printing and mailing costs, as well as time spent on manual processing. |

| Eco-Friendly | Using digital formats helps reduce paper waste, supporting environmentally sustainable business practices. |

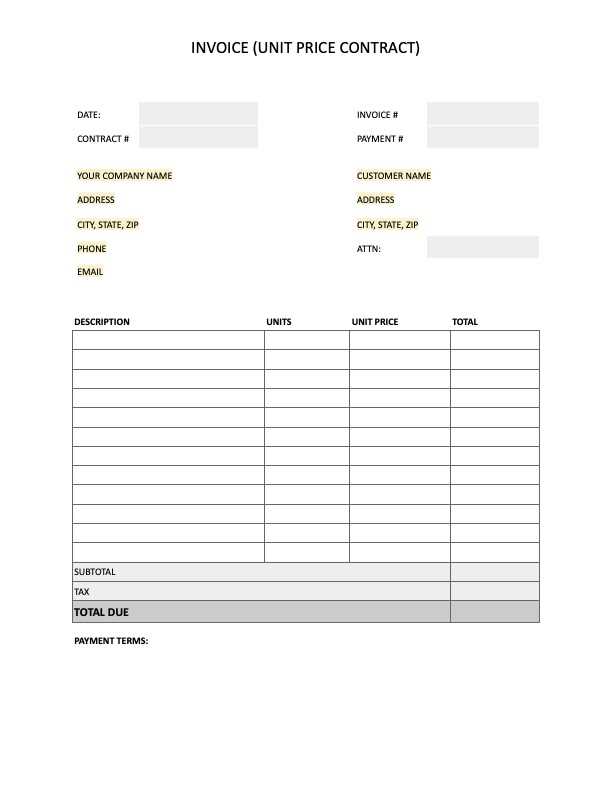

Steps to Create an Invoice from Scratch

Creating a billing document manually allows for complete customization and ensures that all necessary information is included. This approach can be especially useful for unique transactions or when standard forms don’t meet specific needs. Follow these steps to ensure that every essential detail is covered, promoting clarity and professionalism.

Essential Elements to Include

- Business Information: Include your company’s name, address, contact details, and any relevant registration numbers. This helps clients identify your business and ensures compliance with legal requirements.

- Client Details: Clearly state the client’s name and contact information to personalize the document and establish the intended recipient.

- Unique Reference Number: Assign a unique code or number to track this particular transaction, simplifying future reference and bookkeeping.

- Service or Product Description: Provide a detailed description of the items or services provided, including quantities, unit prices, and any applicable discounts.

Finalizing and Reviewing

- Set Payment Terms: Define the due date and acceptable payment methods, ensuring the client understands when and how to make the payment.

- Review for Accuracy: Double-check all amounts, dates, and details to avoid errors. Accurate documents build trust and minimize potential delays.

- Save and Send: Once finalize

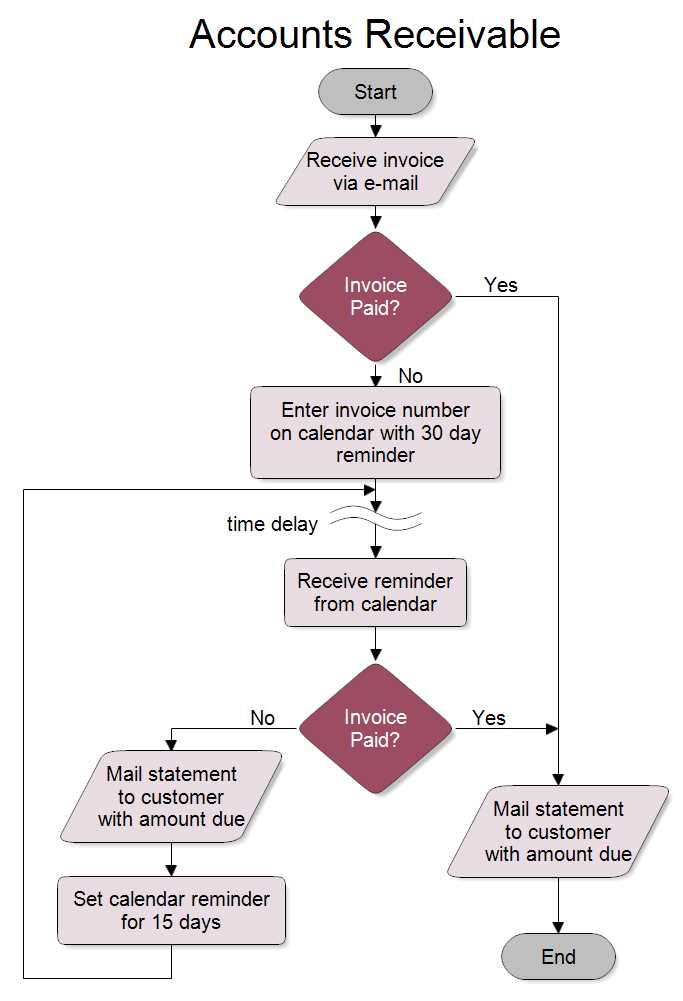

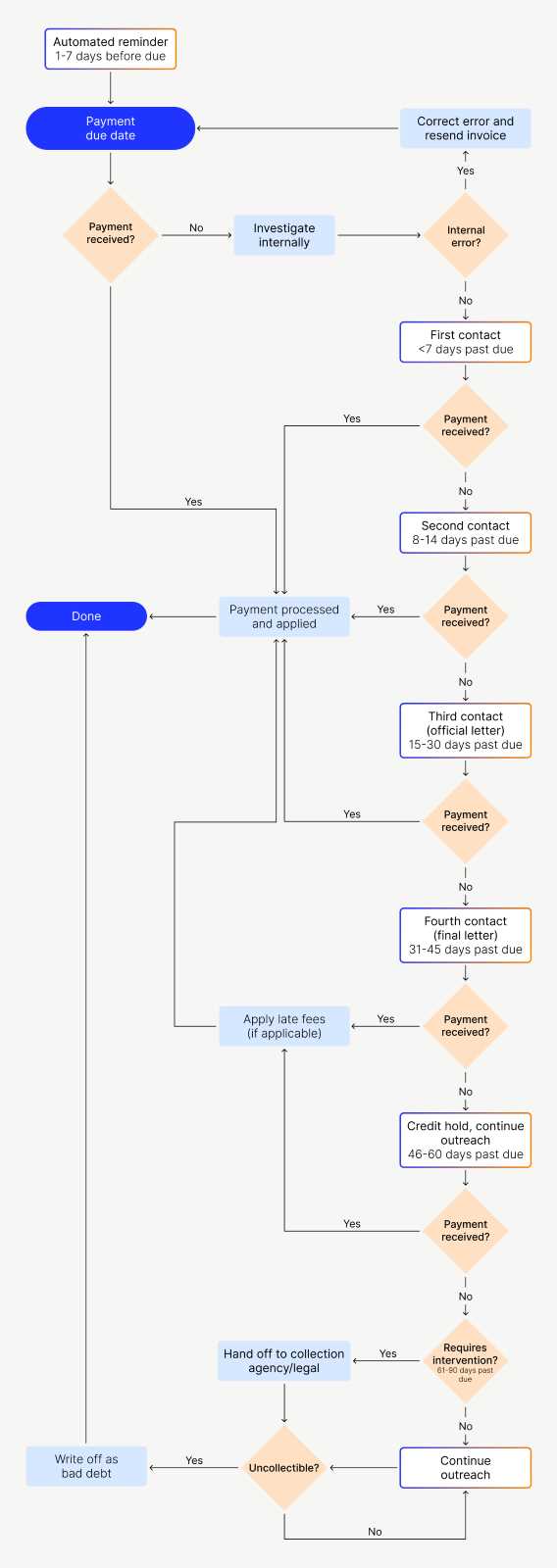

Best Practices for Invoice Management

Effective handling of billing documents is essential for maintaining cash flow and ensuring timely payments. Implementing organized methods for managing transaction records can help prevent errors, speed up payment processes, and improve client relations. Here are some strategies to enhance your billing operations.

Organizing and Tracking Documents

- Use Consistent Formats: Establish a standard structure for your billing forms to ensure all relevant information is consistently included. This reduces confusion and helps clients quickly identify key details.

- Assign Unique IDs: Label each document with a unique identifier. This makes it easier to track and reference specific transactions during audits or follow-ups.

- Keep Digital Records: Storing documents electronically provides quick access and reduces the risk of losing important information, while also supporting a more sustainable workflow.

Maintaining Timely Communication

- Send Reminders: For outstanding balances, follow up with polite reminders as the due date approaches. This helps clients remember upcoming payments without feeling pressured.

- Offer Flexible Payment Options: Providing various methods for settling balances,

Understanding Invoice Payment Terms

Clear payment conditions are vital for establishing transparent agreements with clients. By defining specific terms, businesses can set expectations around payment timelines, accepted methods, and any applicable late fees, helping to prevent misunderstandings and support timely cash flow.

Common Payment Terms Explained

Payment terms vary depending on industry standards and the nature of the client relationship. For instance, “Net 30” means the full amount is due within 30 days, while “Due on Receipt” expects immediate payment upon delivery of the document. Terms like “2/10 Net 30” offer a small discount if payment is made within 10 days, encouraging quicker transactions.

Late Fees and Penalties

Including a clause for late fees can serve as an incentive for clients to pay on time. Specify any additional charges that may apply if payments are delayed beyond the agreed period. This not only encourages prompt payments but also helps compensate for any disruptions caused by delays.

By understanding and setting clear payment terms, businesses can improve their billing processes, support a steady flow of funds, and foster better client relationships.

How to Include Taxes on an Invoice

Applying taxes correctly on billing documents is essential for compliance and transparency. Including clear information about applicable tax rates and amounts helps clients understand the total charges and ensures that your business meets local tax regulations.

Identifying Applicable Tax Rates

Determine the correct tax rate based on the products or services provided and the location of your business or client. Common types include sales tax, VAT, or service tax, each varying by region. Consult local tax guidelines to ensure accuracy in rate application.

Calculating and Displaying Tax Amounts

Once the applicable rate is determined, calculate the tax based on the subtotal. Clearly itemize the tax as a separate line to show its impact on the final total. For example, list the subtotal, then the tax amount, and finally the grand total. This format offers transparency and makes it easier for clients to verify the calculation.

Including Tax Registration Information

If required, add your business’s tax identification number on the document. This detail not only enhances professionalism but also meets legal requirements, ensuring your clients have all the necessary information for tax records.

Choosing the Right Template for Your Business

Finding a suitable format for your billing documents is crucial for efficiency and professionalism. The right structure depends on your business type, the nature of your transactions, and your clients’ expectations. A tailored format can improve clarity, streamline record-keeping, and ensure that essential information is presented consistently.

Key Factors to Consider

Factor Description Business Size Small businesses may prefer simple designs with essential details, while larger organizations often need more comprehensive formats to accommodate detailed breakdowns. Industry Requirements Certain fields, like consulting or retail, may require specific sections for tracking time, quantities, or product codes. Choose a structure that aligns with these needs. Client Expectations If your clients have specific preferences or requirements, such as itemized lists or due dates, be sure to incorporate these into your document format. Branding A professional layout with your company logo, colors, and fonts can strengthen brand recognition and convey att How to Track Payments with Templates

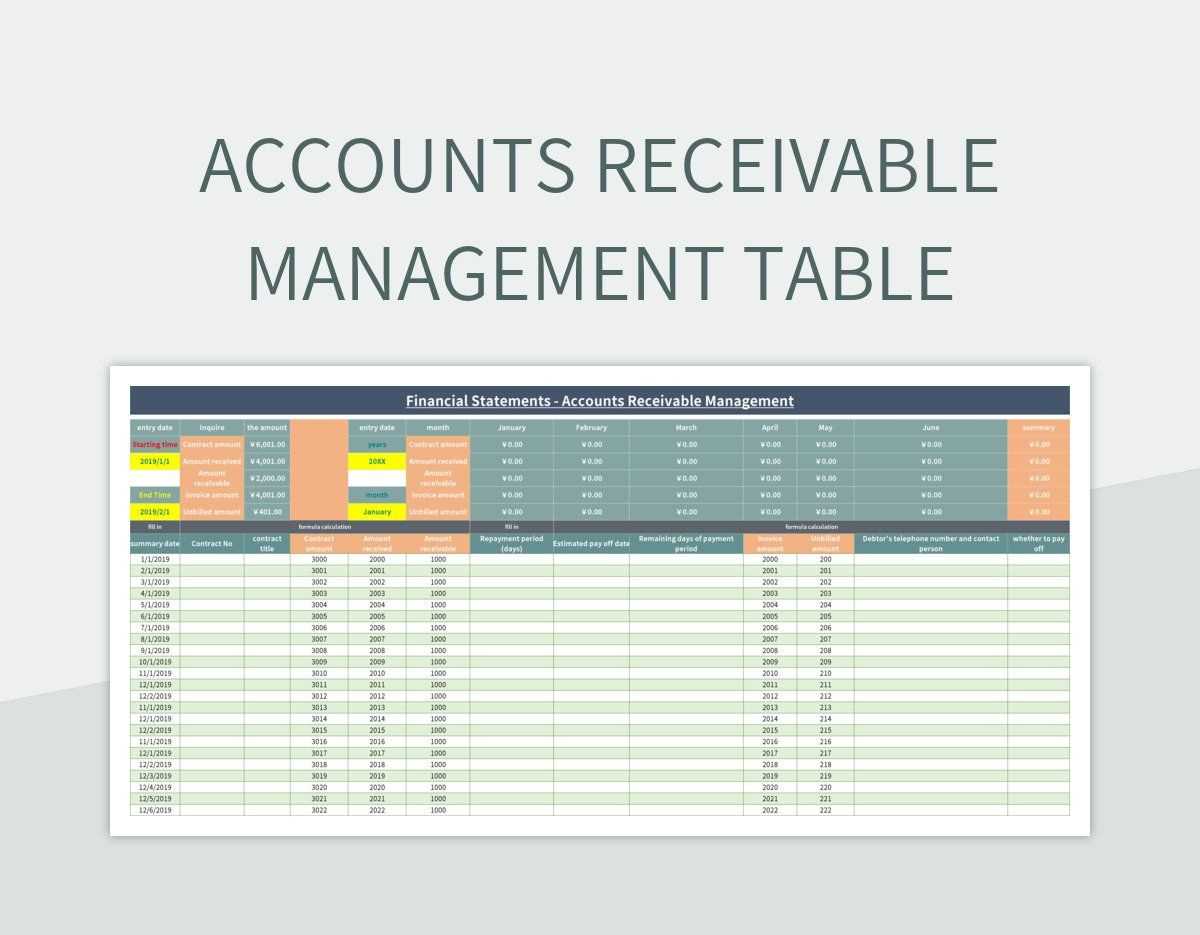

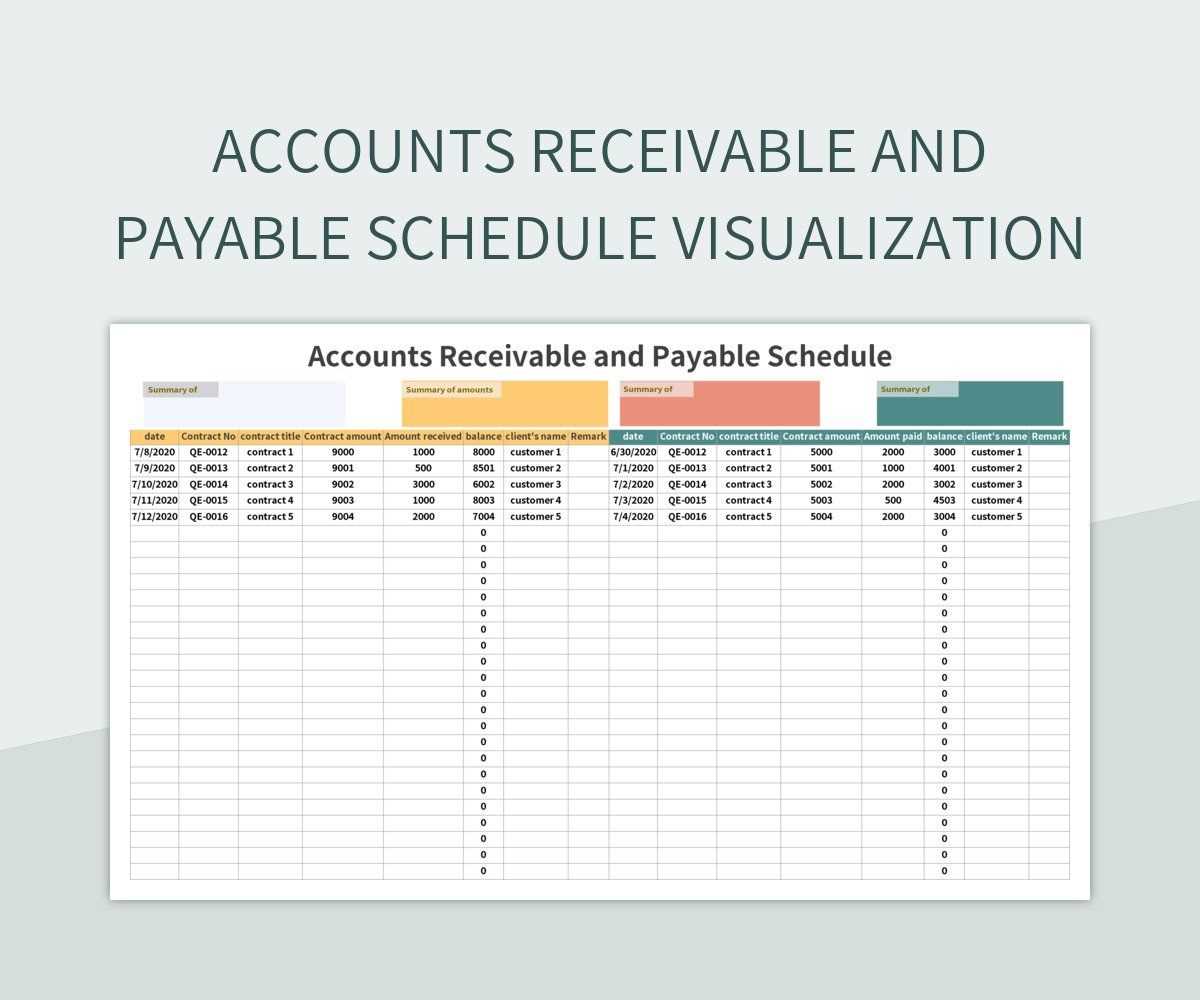

Effectively monitoring incoming funds is essential to maintaining financial stability and ensuring timely follow-ups. A structured approach to tracking can help you stay organized, spot unpaid balances, and keep a clear record of each transaction. Here’s how to efficiently use document formats for tracking payments.

Organizing Document Details

To streamline tracking, include essential fields in each document, such as due dates, payment terms, and unique identifiers for each transaction. These details allow you to quickly identify overdue balances and review individual client histories with ease.

Maintaining a Payment Log

Alongside each record, keep a log noting when funds are received, the payment method, and any applicable discounts or late fees. This approach offers a clear history, making it easy to see which transactions are complete and which still need attention.

Automated Reminders and Alerts

Consider using automated reminders or notifications for upcoming or past due balances. This reduces manual follow-up tasks and helps keep clients informed, ensuring timely payments without extensive tracking efforts.

By creating a structured system for tracking and documenting payments, you can improve efficiency, reduce errors, and enhance cash flow visibility for your business.

What Information Should Be on an Invoice

Creating a comprehensive billing document requires including specific details that clarify the transaction and ensure both parties are fully informed. This approach not only supports clarity but also helps avoid potential disputes by outlining the key aspects of the sale or service.

Basic Contact Information

Include the full name, address, and contact details for both your business and the client. Accurate information is essential for proper documentation and communication, making it easier for clients to reach out with questions or payment confirmations.

Detailed Description of Goods or Services

Provide an itemized list that clearly outlines the products sold or services rendered. Include quantities, rates, and any applicable discounts. This breakdown ensures that the client understands the charges and can verify each item or service provided.

Additionally, it’s important to specify the date of issue and any relevant reference numbers to maintain a clear record for both parties. Including these elements helps create a professional, transparent document that aids in smooth, efficient transactions.

Integrating Templates with Accounting Software

Connecting standardized billing documents to your financial software can significantly enhance efficiency by automating data entry, tracking, and reporting. This integration streamlines processes, reduces manual errors, and provides real-time insights into your business’s financial health.

- Automated Data Sync: Linking your documents with accounting tools allows for automatic data synchronization. This ensures that transaction details are accurately transferred into your system, saving time and reducing input errors.

- Real-Time Financial Tracking: Integrated software provides instant updates on payments, outstanding balances, and overall cash flow, allowing for better financial planning and quicker follow-up on late payments.

- Customizable Document Formats: Many accounting platforms offer customizable document designs, allowing you to maintain brand consistency while adhering to business requirements.

- Easy Access to Reports: With everything stored in one system, you can quickly generate comprehensive reports, from monthly summaries to annual financial overviews, aiding in more strategic decision-making.

By connecting your financial documents with accounting software, you can create a seamless workflow that enhances productivity and ensures all transaction data is secure,

Improving Cash Flow with Accurate Invoices

Ensuring that all billing documents are accurate and timely can have a significant impact on the financial health of your business. Properly formatted and clear transaction records help accelerate payment cycles, reduce delays, and minimize confusion between you and your clients.

The Importance of Clarity

Each detail in a billing document should be precise, from the itemized list of services or goods to the total amount due. Clear communication eliminates misunderstandings, ensuring that clients are fully aware of the charges and their respective due dates.

Maintaining Consistency

Consistency in formatting and information is key to fostering trust and reliability. By establishing a standard approach to creating each document, clients know what to expect, which can encourage faster processing and payment. Keeping track of this consistency helps avoid errors and ensures all data points are covered.

Key Details for Faster Payments Impact on Cash Flow Clear payment terms and due dates Reduces confusion and speeds up payments Itemized charges with accurate amounts Prevents disputes and accelerates approval Visible contact information for queries Improves communication and resolution times By ensuring each billing document is precise, consistent, and clear, your business can see improvements in cash flow, reduce late payments, and maintain strong relationships with clients.