Download Tax Invoice Template for Quick and Easy Billing

Efficient billing is essential for any business, whether small or large. Having a reliable system in place for generating documents that detail transactions can save time, reduce errors, and ensure smooth financial operations. A well-structured form for recording payments is not only professional but also helps maintain clarity for both the sender and the recipient.

In this guide, we explore how to easily create and personalize these important financial documents. By using pre-designed formats, you can eliminate the hassle of creating one from scratch, allowing you to focus more on growing your business. With a few adjustments, these documents can be tailored to meet your specific needs, whether you’re a freelancer, a startup, or an established enterprise.

Why settle for generic records when you can customize the details that matter most? From adding your logo to modifying the layout, having control over the design of your transaction records helps you present a polished and cohesive brand identity to your clients.

Tax Invoice Template Download Guide

When managing financial transactions for your business, having a pre-designed form for recording payments and charges can significantly streamline the process. Instead of starting from scratch each time, a ready-made document allows you to focus on accuracy and consistency. In this guide, we will show you how to easily acquire and use such forms to enhance your billing practices.

First, let’s explore the key features of an ideal document layout and how to locate the right one that suits your needs. Whether you’re looking for a simple record or a detailed breakdown, it’s important to find an option that allows for easy customization. Here’s how you can start using these forms in your operations:

| Step | Action | Details |

|---|---|---|

| 1 | Choose the Right Form | Select a document that fits your business type and transaction volume. |

| 2 | Download the File | Locate a reputable source and ensure the file is in a user-friendly format like PDF or Word. |

| 3 | Customize the Details | Input your business information, logo, and other specifics to make the form uniquely yours. |

| 4 | Save and Organize | Keep your customized forms in a safe location for future use and easy retrieval. |

By following these simple steps, you can quickly access a document that meets your business requirements and simplifies your billing workflow. Whether you need a basic format or a more complex design, there are plenty of options available that can be tailored to your specific needs.

Why You Need a Tax Invoice Template

Effective financial documentation is critical for any business, ensuring clear communication between you and your clients. Using a structured document for recording transactions helps prevent confusion and maintain a professional image. By having a ready-made format, you can save valuable time and minimize errors, making your operations more efficient.

Maintain Consistency and Professionalism

Every time you send a bill or request payment, it reflects on your business’s professionalism. A pre-designed document ensures consistency across all your transactions. Whether you are a freelancer or run a larger operation, using the same format for every transaction helps establish a reliable brand identity and fosters trust with clients.

Reduce Mistakes and Save Time

When you have a ready-to-use form, there is less room for error. Manually creating documents from scratch every time can lead to mistakes in formatting, missing information, or incorrect calculations. With a structured layout, the risk of overlooking essential details is reduced, allowing you to focus on what matters most–running your business.

In addition, a consistent format helps your team stay organized. Whether you handle records alone or delegate, everyone involved will benefit from clear guidelines and uniformity, streamlining the entire billing process.

Benefits of Using a Tax Invoice Template

Utilizing a pre-designed document for billing offers numerous advantages that can help streamline your financial processes. By relying on a standardized format, you can save time, reduce errors, and improve your business’s overall efficiency. In this section, we explore the key benefits of using these ready-made forms for your payment requests.

| Benefit | Explanation |

|---|---|

| Time Savings | Pre-made forms eliminate the need for creating a new document from scratch, allowing you to quickly generate records with minimal effort. |

| Accuracy | Having a standardized structure ensures all necessary details are included, reducing the likelihood of mistakes such as missing information or miscalculations. |

| Professional Appearance | Consistent use of well-designed forms gives your business a polished and credible image, enhancing client confidence. |

| Legal Compliance | A correctly formatted document can help you meet legal requirements and avoid potential fines or issues with tax authorities. |

| Customizability | You can easily modify the document to match your business branding or to include specific information relevant to each transaction. |

By adopting this approach, your business can not only streamline its processes but also provide a more reliable and organized experience for your clients. The simplicity and flexibility of using structured documents can greatly enhance your billing system, making it easier to manage and track financial interactions.

How to Download a Tax Invoice Template

Acquiring a ready-made document for billing purposes is an essential step in improving your business’s financial operations. Once you know where to find reliable sources, you can quickly obtain the right format for your needs. Here’s a simple guide to help you get started with downloading the necessary files.

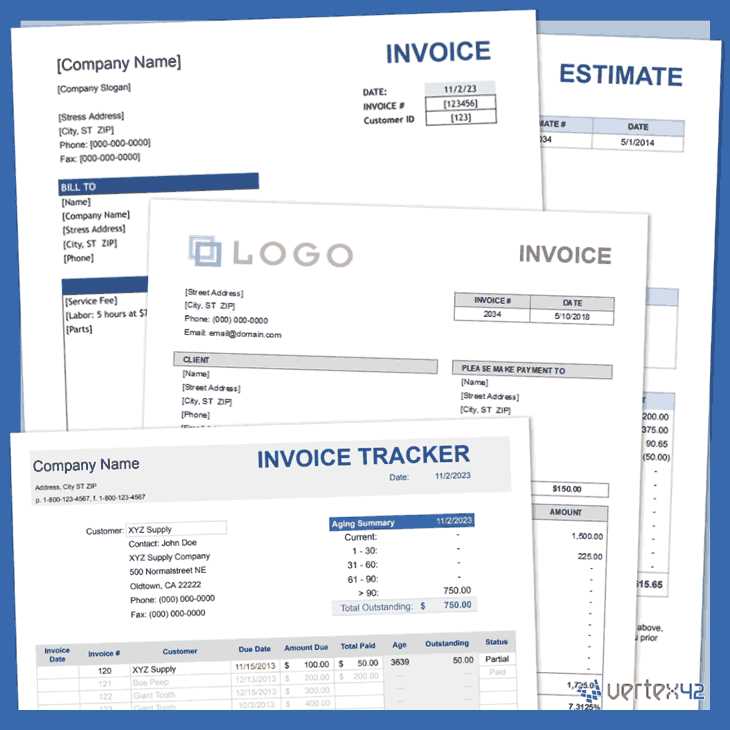

- Choose a trusted website: Look for reputable platforms offering high-quality, professional billing forms. Many websites specialize in providing customizable documents for various business types.

- Identify the appropriate format: Ensure the document is available in a format you can easily work with, such as PDF, Word, or Excel. These formats are versatile and compatible with most systems.

- Check for customization options: Some forms offer additional features that allow you to adjust the layout, add your logo, or include other relevant details. Make sure the one you choose is flexible enough for your needs.

- Review the content: Before downloading, inspect the sample to ensure it includes all the fields required for your specific use. Common fields typically include item descriptions, quantities, and pricing information.

- Download the file: Once you’ve selected a suitable option, simply click the download link and save the file to your device. Ensure the file is secure and free from any malware.

By following these straightforward steps, you can quickly obtain a professional document to streamline your billing process. Once downloaded, you can begin customizing it according to your business needs, ensuring that your payment requests are always accurate and well-organized.

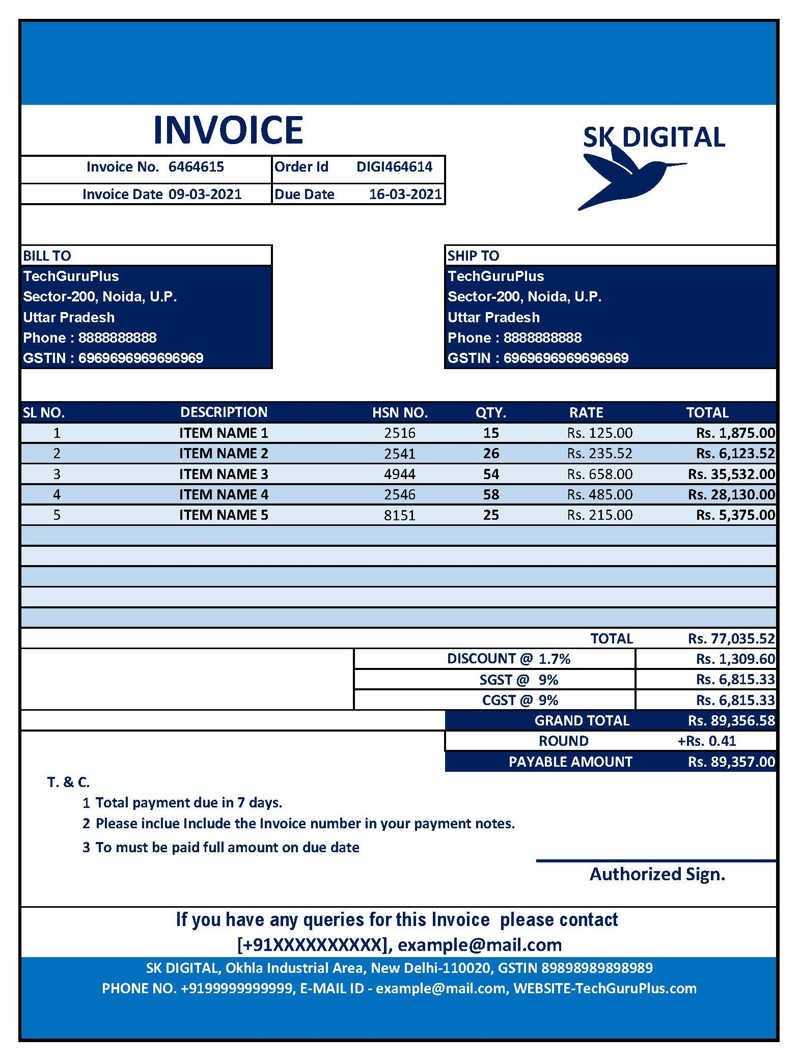

Best Tax Invoice Templates for Small Business

For small businesses, having a reliable and professional document for requesting payments is essential to maintaining smooth financial operations. The right format can make a significant difference in how your business is perceived and how easily you can manage your transactions. In this section, we explore some of the best options for small business owners looking to simplify their billing process.

Small businesses often require forms that are straightforward, customizable, and cost-effective. These documents should be simple to use while still containing all the necessary fields to ensure that every transaction is recorded accurately. Here are some of the best types of formats for small businesses:

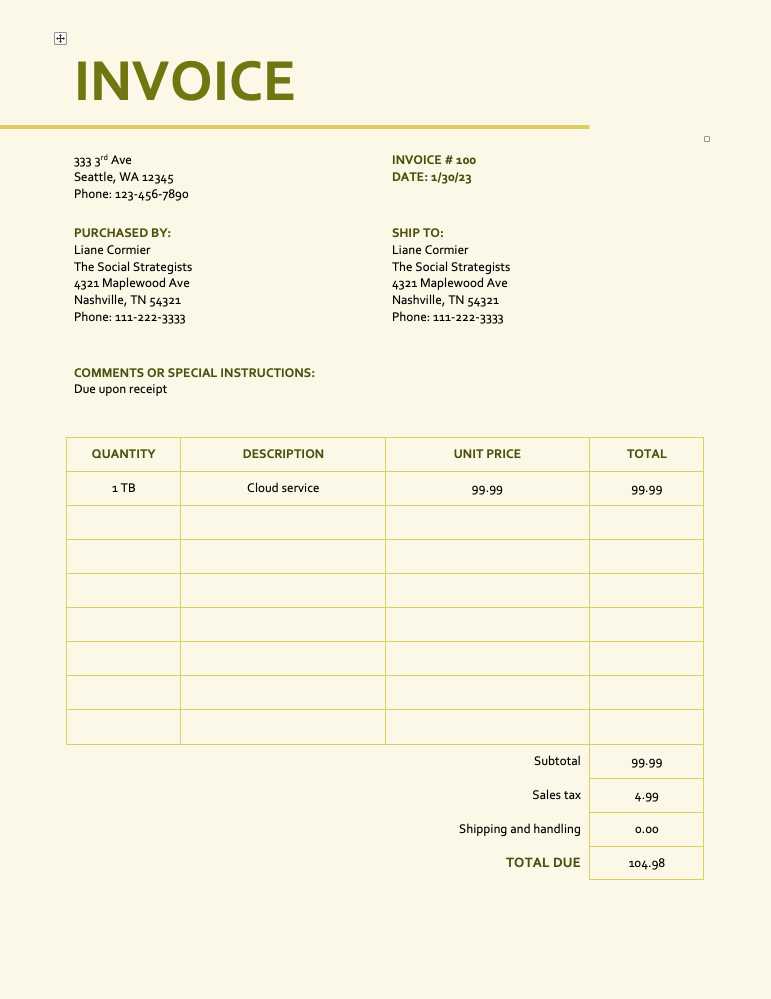

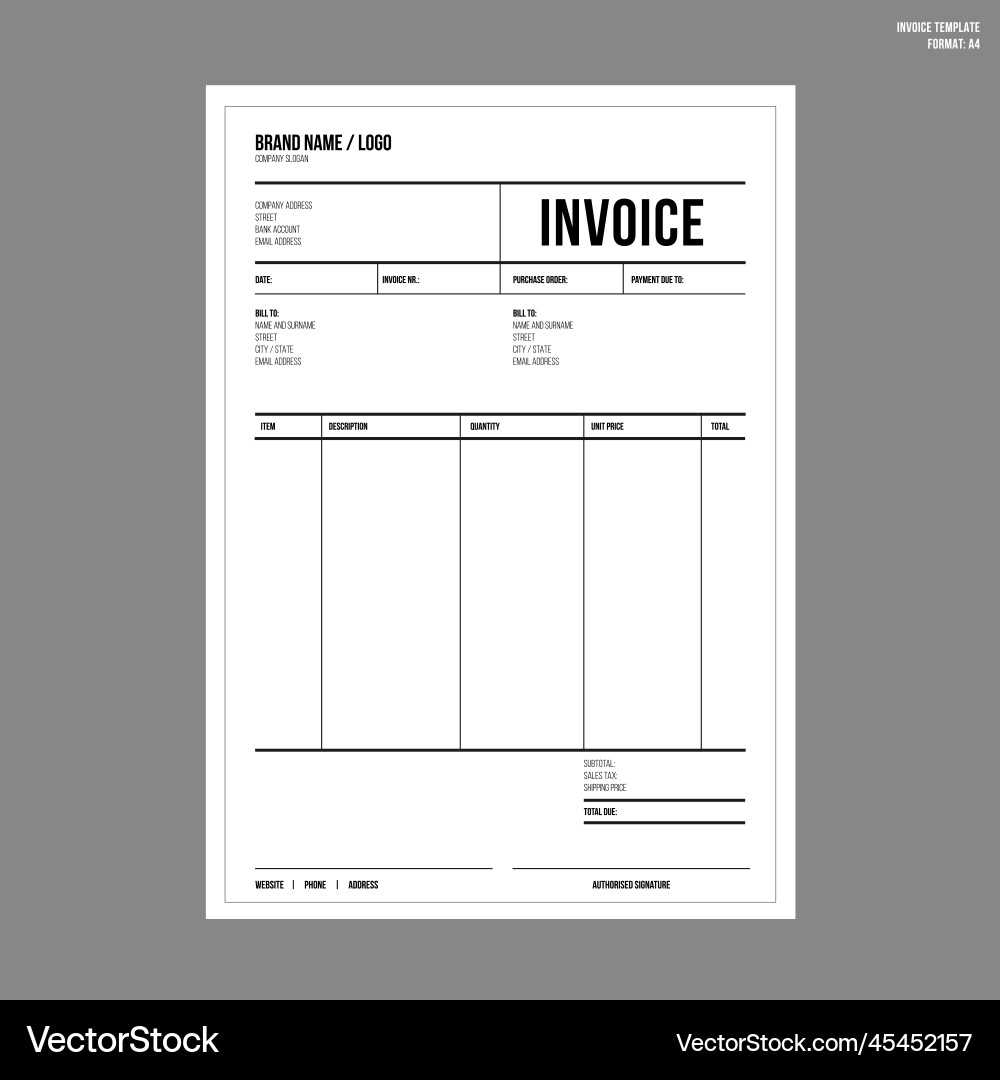

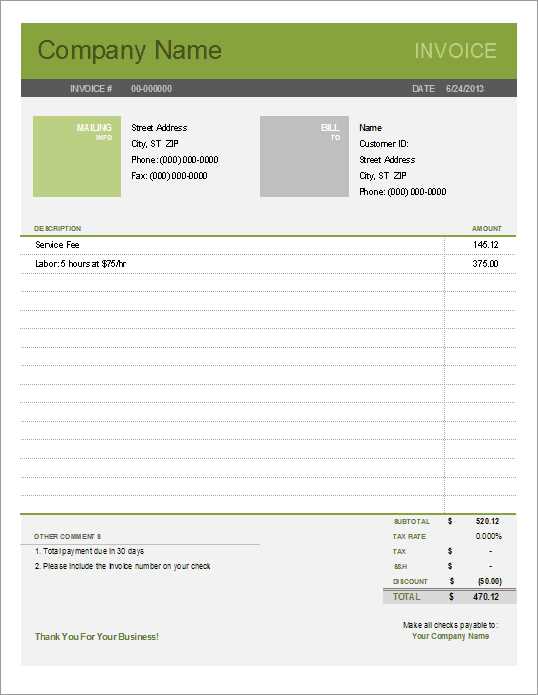

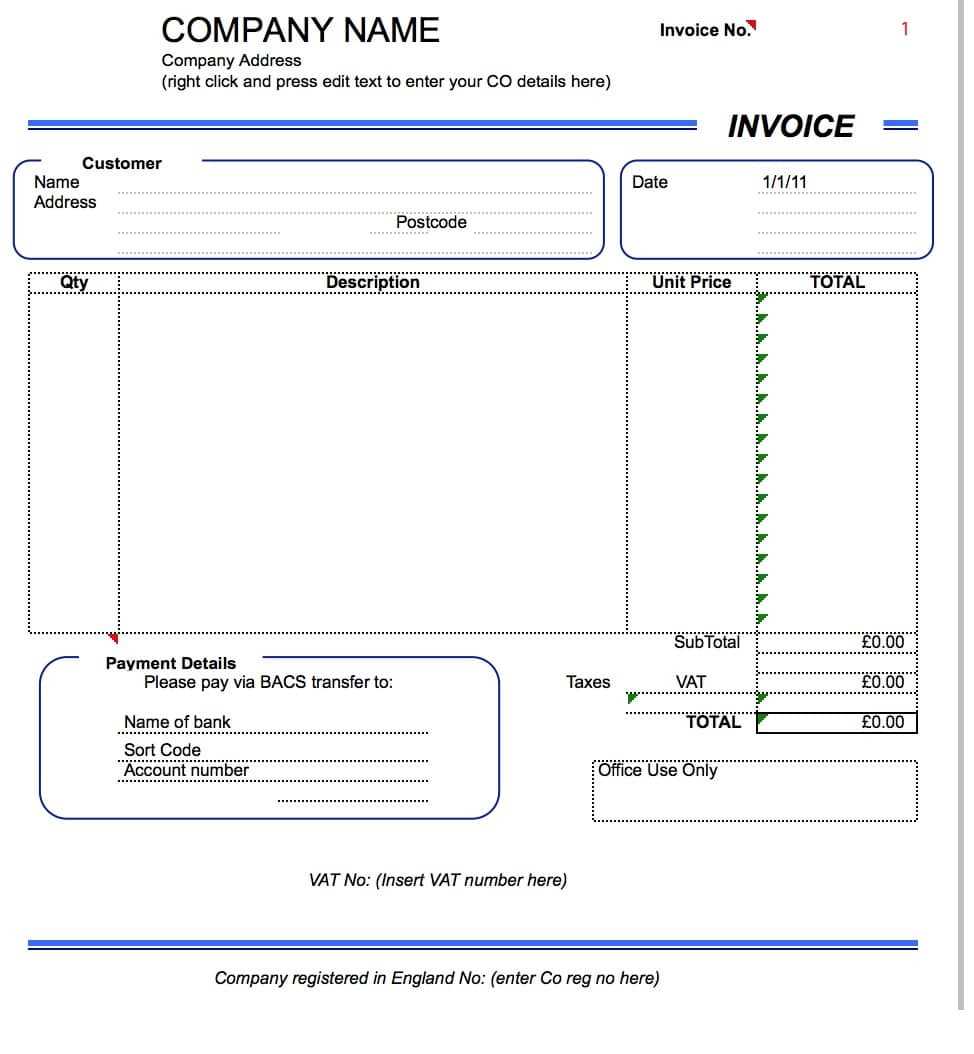

- Minimalist Design: A clean and simple format that focuses on clarity. These forms typically feature basic fields for the item, quantity, price, and total, without unnecessary clutter.

- Professional Branding: These layouts allow for customization, such as adding your company logo, color scheme, and contact information, helping you present a more professional image.

- Detailed Breakdown: This type of document is ideal for businesses that need to provide a detailed list of services or products with multiple line items. It ensures that each item is clearly itemized and priced.

- Digital Formats: Electronic versions in formats like Excel or Google Sheets, which are easy to fill in and update. These also allow for automated calculations and quick adjustments.

- Invoice with Terms: Some businesses need to include payment terms, deadlines, or late fees. These types of layouts make it easy to include all necessary terms in a professional manner.

Choosing the right format depends on your business’s unique needs and the complexity of your transactions. Whether you need a simple record or a more detailed document, there are plenty of options that can help you maintain accuracy and professionalism in your billing process.

Customizing Your Tax Invoice Template

Customizing your billing document allows you to tailor it to the specific needs of your business. A personalized layout not only helps maintain a professional image but also ensures that all necessary information is clearly presented to your clients. With a few simple adjustments, you can make these records uniquely yours, enhancing both functionality and brand identity.

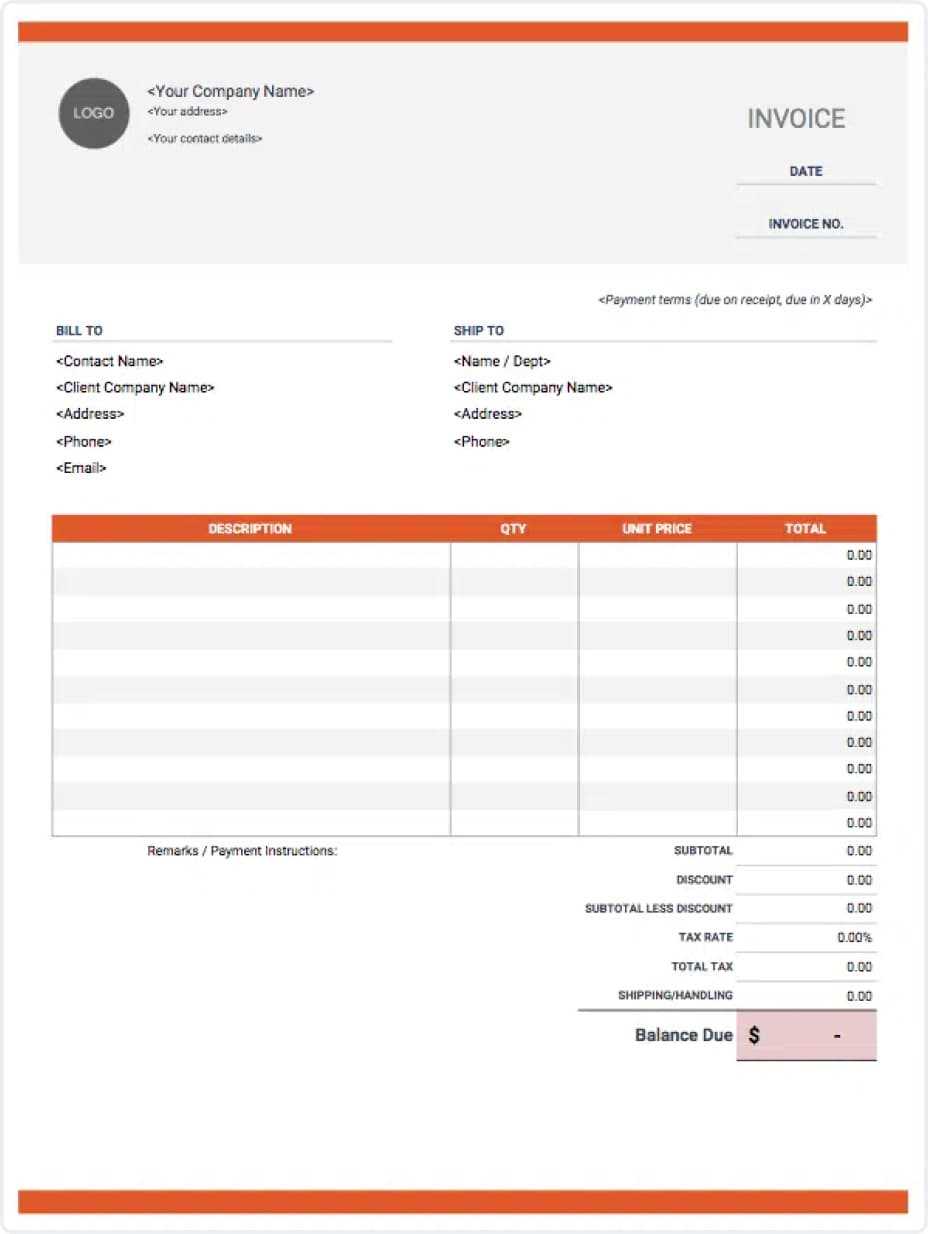

Adding Your Brand Identity

One of the first things you can customize is the appearance of your document to align with your company’s branding. Adding your logo, adjusting the color scheme to match your corporate palette, and using your business’s fonts helps create a cohesive brand presence. This small but significant touch ensures that your clients recognize your business at a glance.

Including Essential Details

While a pre-designed document may already include basic fields, it’s important to ensure that all the necessary details are included for your specific business needs. You can modify the layout to add extra sections such as:

- Payment terms: Clearly define deadlines, late fees, or discount policies.

- Contact information: Include your business address, email, and phone number for easy communication.

- Additional notes: If required, space for any custom remarks, like a thank-you note or special instructions.

By tailoring these documents, you ensure that they reflect your business practices and provide clarity to your clients, reducing the likelihood of misunderstandings. Customization not only saves time but also reinforces your business’s professionalism and attention to detail.

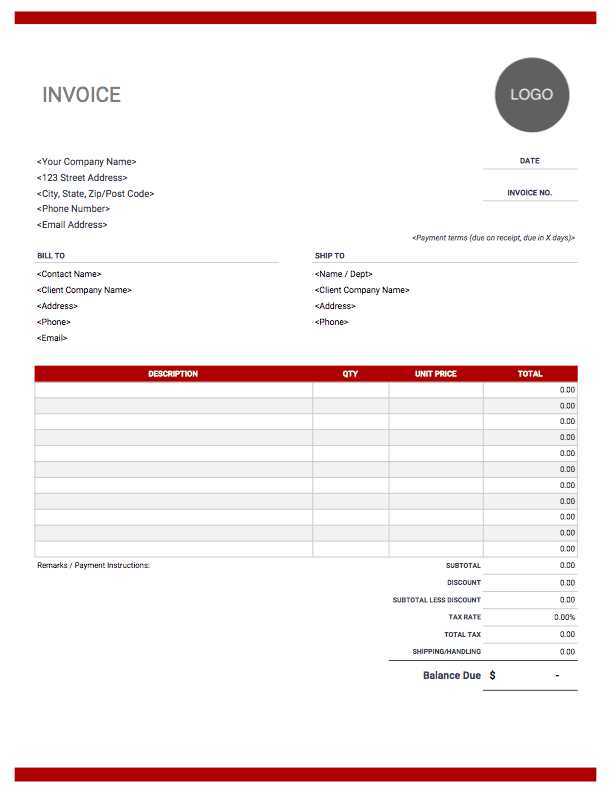

Free vs Paid Tax Invoice Templates

When it comes to choosing the right document for managing your business transactions, you’ll often face the decision between free and paid options. Both have their pros and cons, and the choice depends on your business’s needs and priorities. In this section, we’ll explore the key differences between free and premium options to help you make an informed decision.

Advantages of Free Templates

Free documents are an excellent option for startups and small businesses looking to keep costs low while still having access to a basic, functional format. These documents typically offer the essentials needed for recording transactions, such as item descriptions, pricing, and total amounts. Here are some of the key benefits:

- No upfront cost: Free forms are available without any financial commitment, making them ideal for businesses with tight budgets.

- Quick and easy to access: You can often find these forms on various websites or within software programs, ready for immediate use.

- Basic functionality: Free options typically cover the most common needs for small businesses without any unnecessary features.

Advantages of Paid Templates

Paid forms generally offer more advanced features and greater customization options, which can be a huge advantage as your business grows. Premium options are designed to provide a more polished, professional experience for both you and your clients. Here are some benefits of opting for a paid solution:

- Enhanced customization: Paid formats often include more options for personalization, such as additional fields, more detailed layouts, and advanced design elements.

- Professional appearance: These forms tend to have a more refined design, which can help elevate your business’s image and establish trust with clients.

- Official Business Websites: Many business websites or accounting software providers offer free or paid options directly from their platform. These sources are often reliable because they specialize in business tools.

- Online Document Marketplaces: Websites like Etsy or Template.net often feature professionally designed forms that you can purchase and instantly use. These marketplaces provide a wide range of styles and layouts to choose from.

- Software Platforms: Tools like Microsoft Word, Google Docs, or Excel offer built-in templates that you can customize for your specific needs. While not always as advanced, these are easy to use and often free.

- Accounting Software: Many accounting tools such as QuickBooks, FreshBooks, or Zoho Invoice offer pre-made forms as part of their service. These can be customized, and many of these services come with additional features like automatic calculations and integrations with other software.

- Freelance Platforms: Freelance websites like Fiverr or Upwork allow you to hire a professional to create a custom document layout that meets your specific requirements. This is a great option if you want something unique to your business needs.

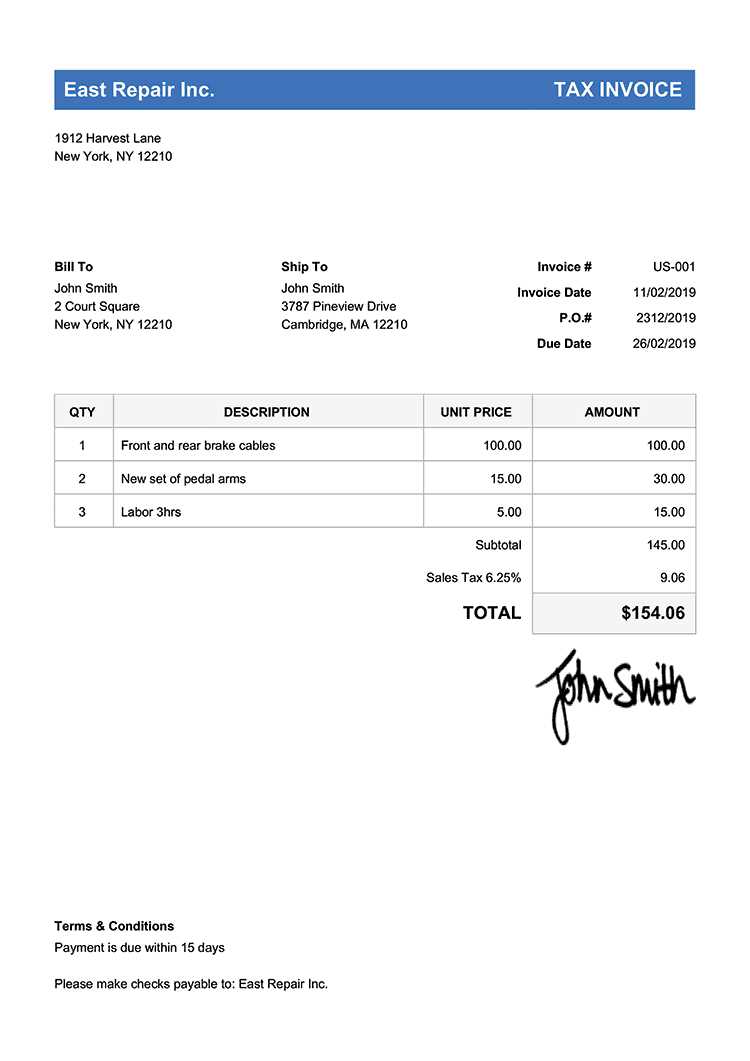

- Seller’s Information: Include your business name, address, phone number, and email. This allows clients to contact you with any questions or concerns.

- Buyer’s Details: Include the buyer’s name, company name (if applicable), address, and contact details. Accurate information ensures that the document is properly attributed to the right party.

- Unique Identification Number: Assign a unique number to each document to keep your records organized and help with future reference or audits.

- Description of Goods or Services: List the items or services provided, including quantities, unit prices, and any applicable discounts. Be as detailed as necessary for clarity.

- Pricing and Total: Include the cost for each item or service and calculate the total amount due. If applicable, provide a breakdown of any taxes or additional fees.

- Payment Terms: Specify the payment due date, any late fees, or early payment discounts to avoid confusion regarding payment deadlines.

- Correct Calculations: Double-check all totals and taxes to ensure they are accurate.

- Consistent Formatting: Maintain a clean, organized layout with no unnecessary details. A clear, concise docum

Common Mistakes to Avoid in Invoices

When creating billing documents, small mistakes can lead to confusion, delays in payments, or even disputes with clients. Ensuring accuracy and clarity in every detail is essential for maintaining smooth business operations. In this section, we will highlight some common errors businesses make and how to avoid them to ensure your documents are professional and error-free.

Common Mistake Explanation How to Avoid Missing Contact Information Failure to include your business’s name, address, or contact details can cause delays or confusion for the client when they need to reach out. Ensure all relevant contact information is clearly listed on every document. Incorrect or Missing Item Descriptions Vague or incomplete item descriptions can lead to misunderstandings about what was delivered or provided. Be specific and clear about the products or services being billed, including quantities and unit prices. Calculation Errors Math mistakes, such as incorrect totals or miscalculations of taxes, can lead to inaccurate amounts being billed. Double-check your calculations or use automated tools for accuracy. Unclear Payment Terms Failure to clearly state payment due dates or conditions can lead to late payments or misunderstandings. Always specify payment terms, such as due dates, accepted methods, and penalties for late payments. Failure to Include a Unique Reference Number Not assigning a unique identifier to each billing document can make it difficult to track and reference transactions. Ensure each document has a unique reference number for record-keeping and ease of future communication. By avoiding these common mistakes, you ensure that your billing documents are clear, professional, and accurate. This helps maintain good relationships with clients and ensures timely payments, which are critical for the smooth operation of your business.

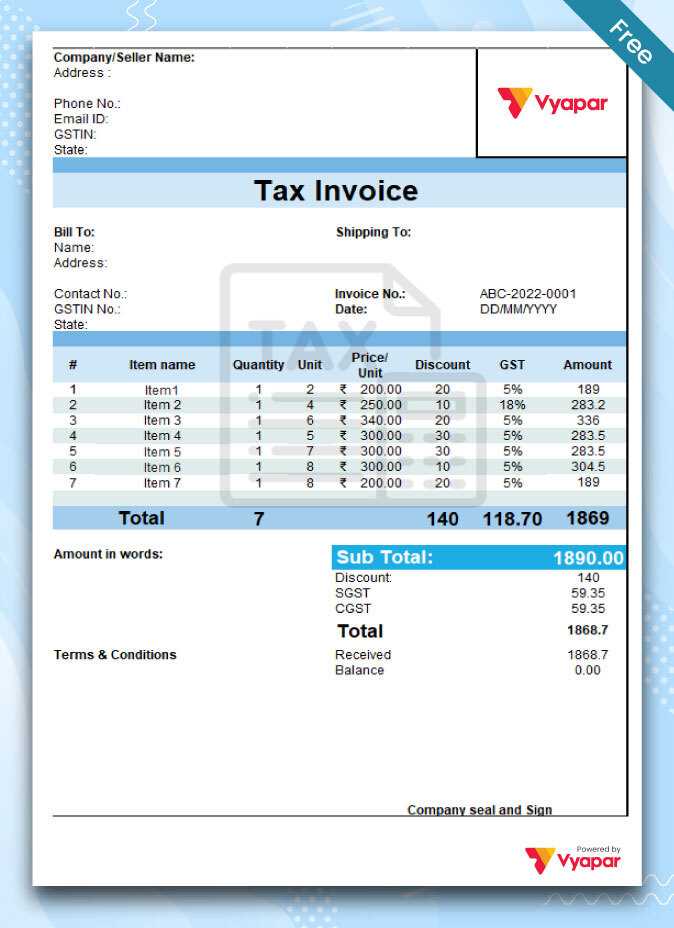

Understanding Tax Invoice Requirements

When creating a formal payment record, it is essential to comply with the legal and regulatory standards that apply to your business. Ensuring that your document meets all necessary requirements helps avoid disputes, delays in payment, or issues with tax authorities. In this section, we will explore the key elements and conditions that need to be included in such records to ensure they are legally sound and professional.

Essential Elements to Include

To create a valid and compliant billing document, make sure it contains the following core details:

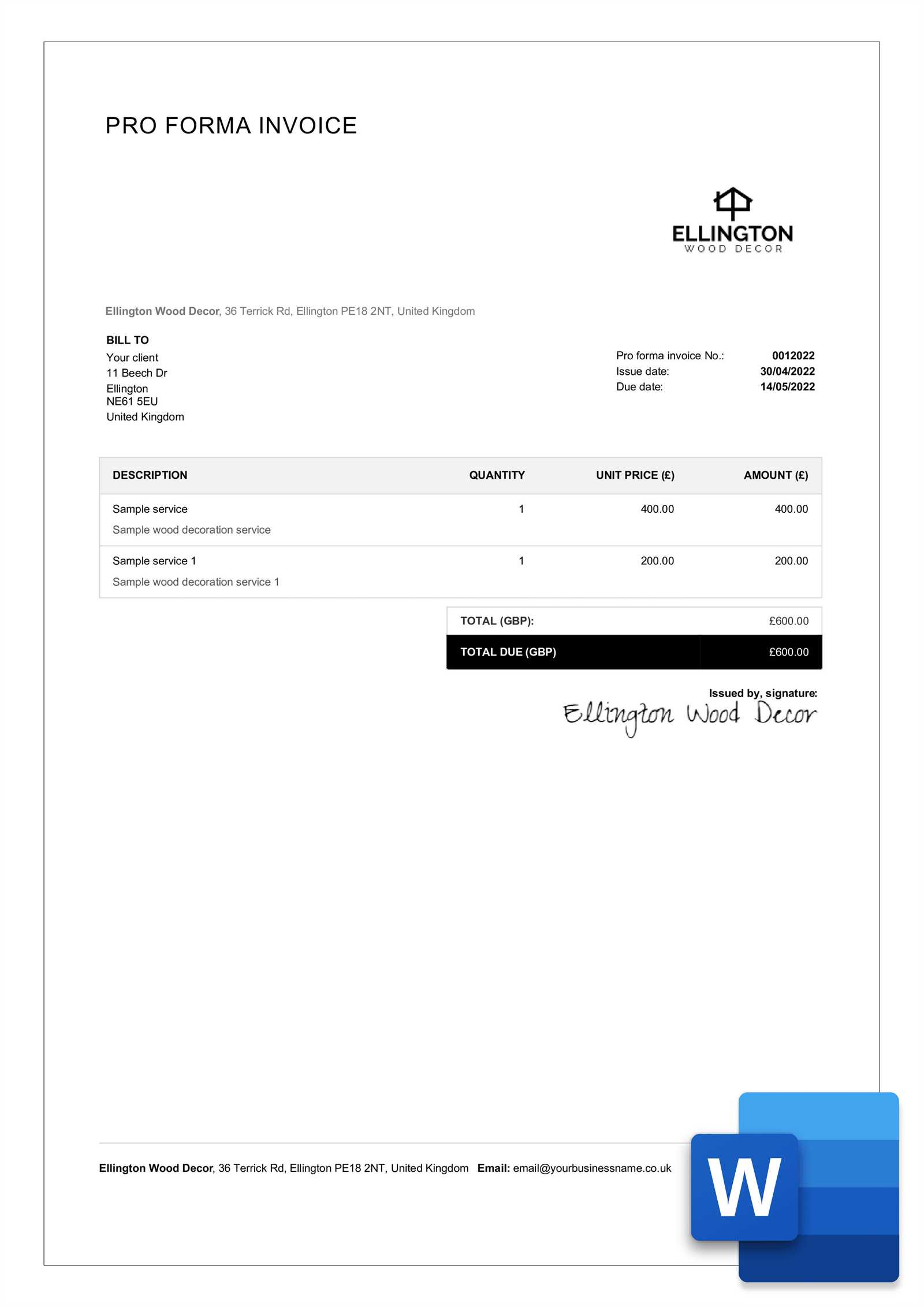

- Seller’s Information: Your business name, address, contact number, and any applicable registration numbers (e.g., VAT or business ID).

- Buyer’s Information: The buyer’s name or company, address, and contact details. This ensures the document is correctly attributed.

- Unique Document Number: Every record should have a unique identifier for tracking purposes, ensuring easy reference in the future.

- Date of Issue: Include the date when the document is issued to ensure clear payment deadlines.

- Itemized List of Goods/Services: A detailed description of the goods or services provided, including quantities, unit prices, and any discounts or offers applied.

- Total Amount Due: The total payment due, including any taxes or additional charges, clearly outlined and calculated.

- Payment Terms: Explicit details regarding payment deadlines, acceptable payment methods, and any late fees or discounts for early payment.

Additional Considerations

While the above elements form the foundation of a valid document, there are additional aspects to consider to ensure full compliance and professionalism:

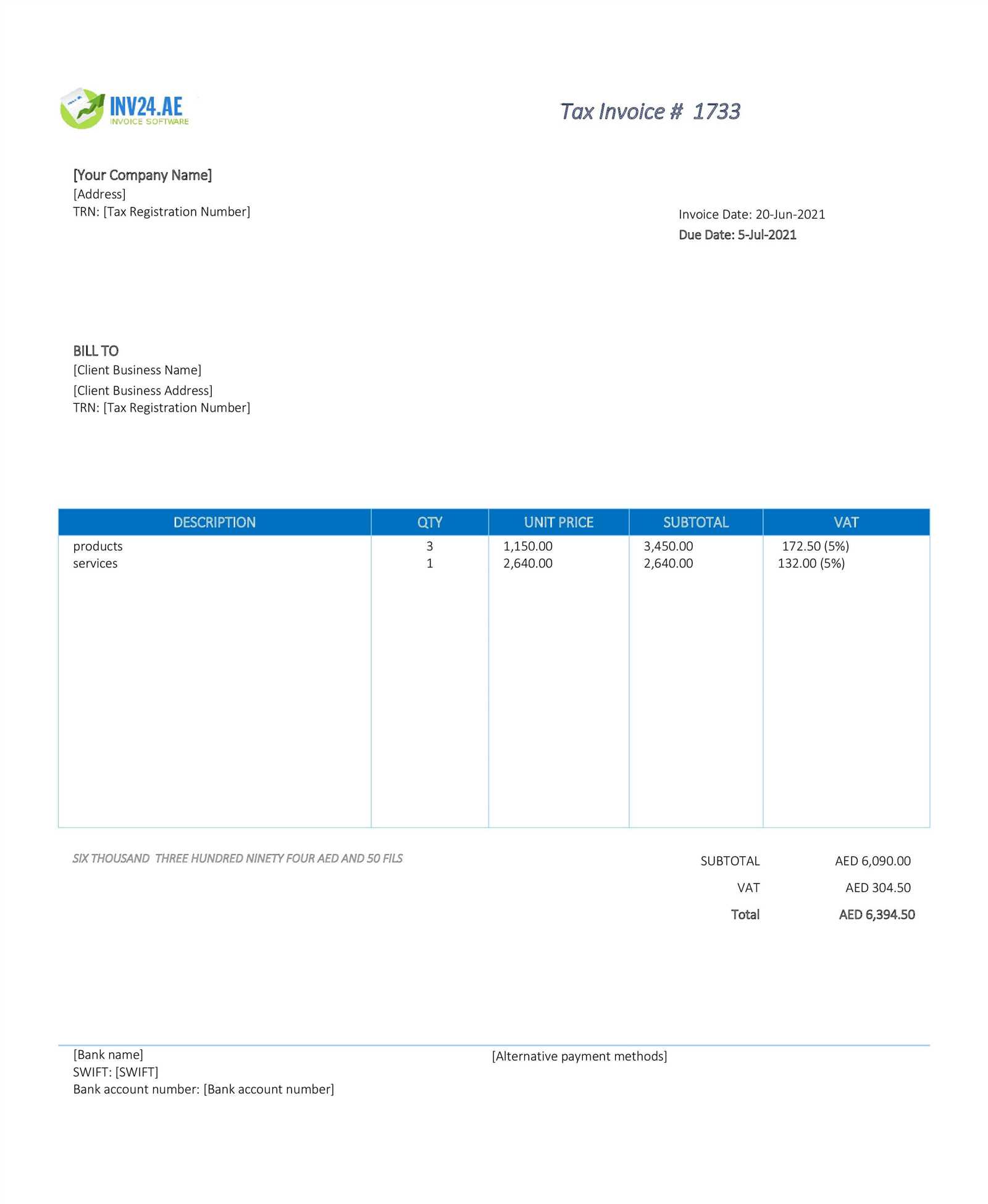

- Currency: Clearly specify the currency in which payment is expected to avoid confusion, especially for international transactions.

- Tax Calculation: If applicable, clearly state the tax rate used and the total amount of tax applied to the transaction.

- Legal Compliance: Ensure the document adheres to local regulations, including any specific requirements for businesses in your region (e.g., regulatory codes or tax IDs).

- Custom Notes: Include any other nec

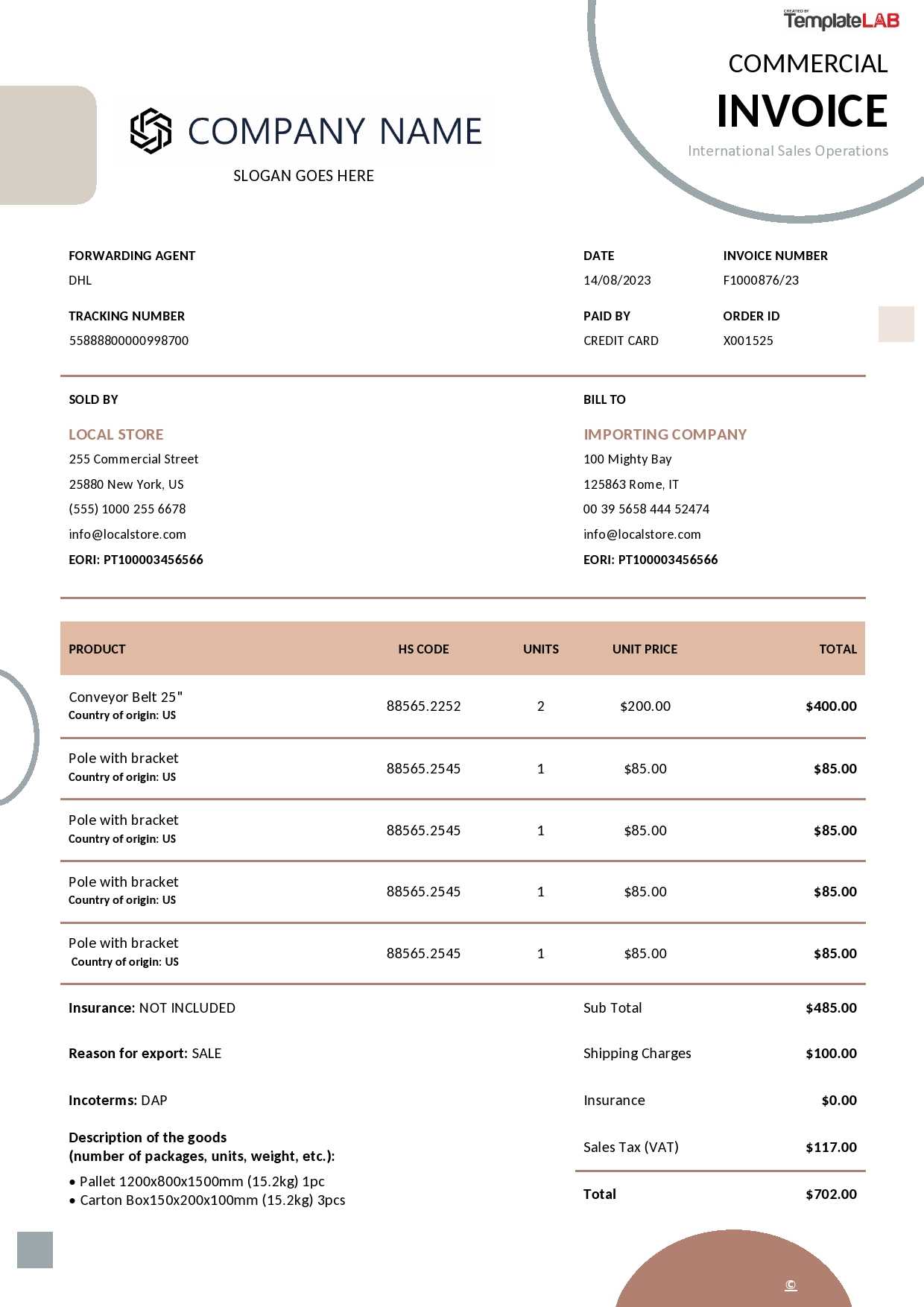

Using Templates for International Invoices

When conducting business across borders, it’s important to ensure that your payment records are compliant with the regulations and expectations of different countries. An international billing document should be more than just a simple receipt–it must address various legal and cultural factors. Using the right layout can help streamline this process and ensure that your documents are clear and professional, regardless of where your clients are located.

Key Considerations for International Transactions

When creating records for clients in other countries, there are specific elements to include to avoid confusion and ensure clarity. Here are some important factors to keep in mind:

- Currency: Always specify the currency in which the transaction will be paid, especially if dealing with clients from different countries. Include the currency symbol or code (e.g., USD, EUR, GBP).

- Payment Terms and Conditions: Different countries have varying payment expectations, so make sure to specify payment due dates, interest rates for late payments, and any specific payment methods accepted (e.g., wire transfer, PayPal, credit card).

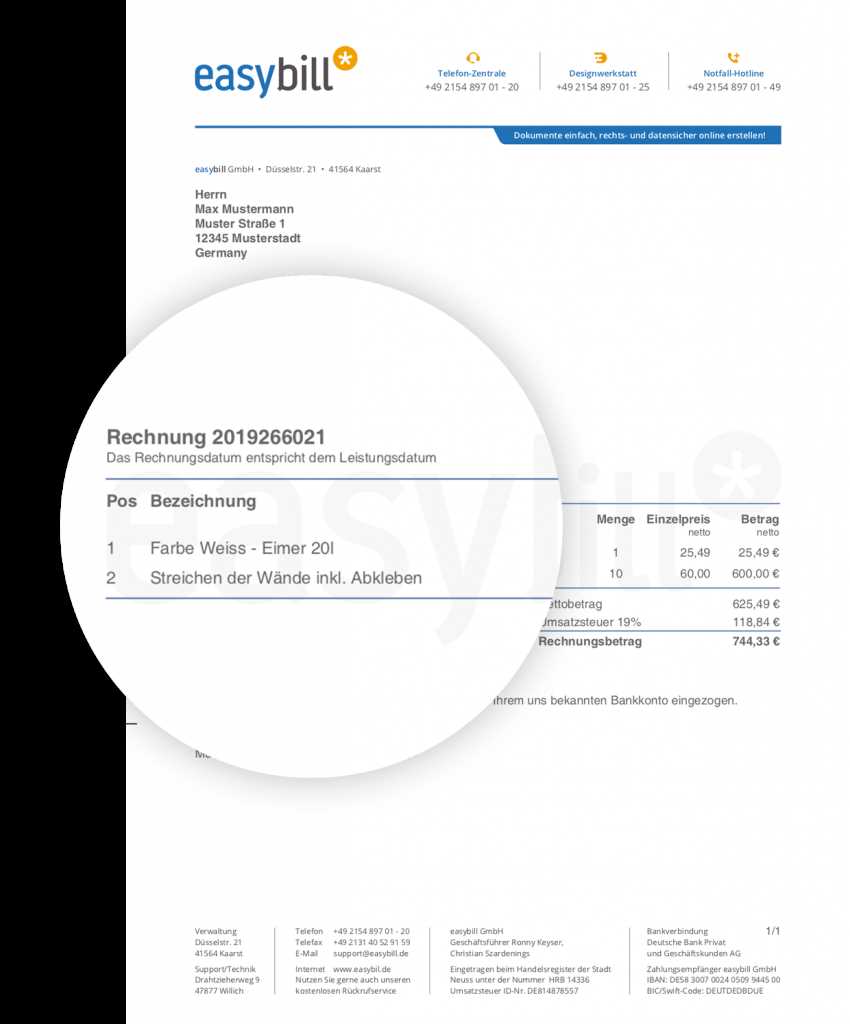

- Language and Localization: Adjust your language or include translations where necessary. If working with clients who speak different languages, consider providing a bilingual version of the document to avoid misunderstandings.

- VAT and Sales Tax: If applicable, be sure to indicate the appropriate tax rate according to local tax laws. Some countries require specific details regarding tax exemptions or special rates for international clients.

- Regulatory Compliance: Ensure that your billing document meets the legal requirements of the country in question. For example, some countries may require specific identifiers such as tax registration numbers or business ID numbers.

Benefits of Using Pre-Designed Forms for International Transactions

Using pre-designed forms for global transactions can simplify many of these challenges. Here’s why they can be particularly useful:

- Standardization: Pre-made layouts designed for international transactions can provide a consistent structure that meets the legal requirements of multiple countries.

- Customizability: Many international document layouts allow for customization, so you can adapt them to fit the unique needs of each country or business transaction.

What Information Should Be on a Tax Invoice

For any business transaction, it’s essential that the payment document includes all the relevant details to ensure transparency and prevent misunderstandings. A comprehensive and clear record not only helps with payment processing but also ensures compliance with local regulations and tax laws. In this section, we’ll outline the crucial information that must be included in a complete payment document.

Required Information Description Business Name and Contact Details Your company name, address, and contact information such as phone number and email should be clearly stated for transparency and future communication. Client Information The name, company name (if applicable), and contact details of the buyer or recipient should be included to ensure that the document is properly attributed. Unique Document Number Assign a unique identifier to each document, allowing for easy tracking and reference in case of any disputes or future correspondence. Issue Date The date when the document is issued should be included to establish clear payment timelines and avoid confusion over deadlines. List of Goods or Services Provide detailed descriptions of the products or services provided, including quantity, unit price, and any applicable discounts or offers to ensure clarity. Total Amount Due The total cost of the transaction, including any taxes or additional fees, should be clearly displayed to avoid any confusion regarding the final amount owed. Payment Terms Clearly state the payment due date, any late fees or early payment discounts, and acceptable payment methods to ensure both parties understand the financial obligations. Including these key elements in your records ensures that both you and your client have a mutual understanding of the terms of the transaction. It also helps maintain good business practices by keeping the process transparent, organized, and legally compliant.

How Tax Invoices Benefit Your Business

Creating detailed and structured payment documents is crucial for the smooth operation of any business. These formal records not only facilitate clear communication between you and your clients but also provide significant advantages for managing finances, ensuring compliance, and fostering professional relationships. In this section, we’ll explore the key benefits of using well-organized payment records in your business practices.

Advantages of Using Payment Records

Here are some of the primary benefits of maintaining proper records for every transaction:

- Enhanced Financial Organization: By consistently issuing detailed records for each sale or service provided, you create an organized system for tracking income and expenses, which makes financial reporting much easier.

- Improved Cash Flow Management: Clear documentation helps avoid payment delays by clearly outlining due dates, amounts, and payment terms. This can significantly improve your cash flow by ensuring timely payments.

- Tax Compliance: Proper records are essential for tax reporting and filing. They ensure that you can accurately account for revenue and expenses, which helps you meet tax obligations and avoid penalties.

- Professional Reputation: Providing formal payment records with a clear breakdown of goods or services enhances your business image and builds trust with clients, showcasing professionalism and reliability.

- Dispute Resolution: If any payment issues or disputes arise, having a detailed record with clear terms and conditions can serve as a reference point for resolving conflicts quickly and fairly.

- Legal Protection: Properly documented transactions protect both you and your clients in case of a legal dispute. These records can be vital evidence in the event of disagreements over payments or services provided.

How Structured Documentation Helps Long-Term Growth

Having a well-organized system for handling payment records can help your business grow by providing key insights into its financial health. Consistently issuing professional documents gives you a competitive edge, allowing you to better manage operations, plan for the future, and respond swiftly to challenges.

- Better Business Insights: By analyzing your records, you can identify trends in customer behavior, peak sales periods, and areas for improvement.

- Scalability: As your business grows, maintaining a clear record-keeping system will make it easier to expand, manage more clients, and streamline financial operations without losing track of important details.

In summary, using structured and clear payment records benefits your business in numerous ways, from improving financial organization to enhancing professionalism and legal protection. By adopting this practice, you’re not only ensuring smooth daily operations but also setting your business up for long-term success.

Tax Invoice Templates for Different Industries

Every industry has its own set of needs when it comes to payment documentation. Whether you’re running a small service-based business or a large-scale manufacturing operation, the structure and content of your billing documents may differ to meet specific requirements. Understanding how to tailor these records to fit the nuances of your industry will help streamline processes, ensure compliance, and improve client relations.

Industry-Specific Customization

Different industries require specific elements to be included in payment records. Below are a few examples of how these documents vary across various sectors:

- Service-Based Businesses: For industries like consulting, marketing, or design, these records often need to provide detailed descriptions of the services rendered, time spent, hourly rates, and specific project milestones or deliverables. Clarity is essential, as clients may need to track the progress of ongoing work.

- Retail and E-commerce: Retail businesses generally issue records that list individual items, quantities, and unit prices. In addition, applicable sales taxes and discounts should be clearly stated, particularly if there are promotional offers or seasonal sales.

- Construction and Manufacturing: For construction and manufacturing industries, these records may need to include detailed materials used, labor charges, and any relevant worksite details. They might also need to outline project milestones, such as completion stages, which help keep clients informed of progress and due payments.

- Freelance and Creative Professions: Freelancers in writing, photography, or design often require a structure that breaks down the work completed by hours or project type, with clearly defined deliverables. Additionally, they may want to include usage rights or licensing terms where applicable.

- Healthcare and Medical Services: For healthcare providers or medical services, billing documents should include detailed codes for procedures or treatments, insurance information, and patient details. Special attention to regulatory requirements is often necessary in this sector.

- Hospitality and Travel: In the hospitality industry, payment documents typically cover accommodation charges, meal plans, and additional services such as transportation or excursions. Dates of service and check-in/check-out details are often included to avoid disputes over the duration of the stay.

Why Industry-Specific Documents Matter

Tailoring payment records to your industry not only ensures that you provide all necessary details to your clients but also helps in adhering to legal or regulatory standards that are unique to each sector. For example, healthcare providers must include certain diagnostic or procedural codes for insurance claims, while construction companies may need to document specific stages of a project for invoicing and compliance purposes.

By understanding and implementing the appropriate structure for your business, you can improve accuracy, enhance professionalism, and foster stronger client relationships, which in turn can help grow your business.

How to Save and Organize Tax Invoices

Efficiently managing payment records is critical for any business. Proper storage and organization not only ensure quick access to past transactions but also help in maintaining financial transparency and complying with legal requirements. In this section, we’ll explore best practices for storing and organizing these important documents, whether in physical or digital formats.

Best Practices for Organizing Your Records

Keeping your payment records organized allows for easy retrieval, reduces the risk of errors, and helps avoid lost documents during audits. Here are some methods for efficient record-keeping:

- Use a Categorized Filing System: If you keep paper records, a well-organized filing system is crucial. Sort documents by client name, project, or date for easy access when needed. Clearly labeled folders or binders can help keep everything in order.

- Leverage Digital Storage: Storing payment documents electronically offers a faster and more efficient way to manage records. Use cloud storage or dedicated software designed for business documentation, ensuring that your files are backed up and easily accessible from any location.

- Implement Consistent Naming Conventions: Whether physical or digital, consistently naming your files will save time when searching for specific documents. Use a format that includes the client’s name, document number, and date (e.g., “ClientName_Invoice_2024_09_15”).

- Regularly Backup Your Files: Digital files should be backed up regularly to prevent data loss due to system failures. Cloud storage services often provide automatic backup features, but you can also use external hard drives for added security.

Organizing by Time and Type

Besides categorizing by client or project, organizing by time and type of transaction is another efficient approach. This method works well for both physical and electronic records.

- By Date: Organize records chronologically, either by month, quarter, or year. This makes it easier to track payments, outstanding balances, and financial performance over time.

- By Payment Type: Separate records based on payment methods (e.g., credit card, wire transfer, or cash) to simplify reconciliation and ensure you can quickly identify any discrepancies.

Organizing your records with a clear, systematic approach reduces confusion, enhances productivity, and makes auditing or tax preparation much easier. By using digital tools or traditional filing systems that suit your business needs, you ensure that all your documentation is secure and accessible when required.

Upgrading Your Tax Invoice Template for Growth

As your business grows, so do the complexities of managing transactions and client relationships. It’s essential to regularly update your payment records to accommodate new needs, streamline processes, and ensure your documentation aligns with changing business practices. Upgrading your records not only improves efficiency but also provides a more professional experience for your clients, which can drive further growth.

Key Areas to Focus on When Upgrading

Here are the key areas to focus on as you consider upgrading your payment records to match your business’s growth:

Area for Improvement Benefits Automation of Processes Integrating automated tools can help speed up the creation and sending of records, reducing manual effort and ensuring consistency in every transaction. Incorporation of Custom Branding Adding your company logo, color scheme, and other branding elements can help create a more professional look and reinforce brand recognition with clients. Clearer Payment Terms As your offerings expand, it’s crucial to clearly outline payment terms, due dates, and potential discounts or late fees to avoid confusion and streamline cash flow management. Additional Payment Methods Offering clients more payment options, such as PayPal, credit card, or bank transfer, can improve customer satisfaction and ensure quicker payments. Multi-Currency and International Support If you’re expanding globally, consider adding multi-currency support to your records. This will simplify transactions for international clients and eliminate confusion regarding exchange rates. Tracking and Reporting Features Upgrading to software that allows you to track outstanding payments, generate reports, and analyze financial performance can help you make more informed business decisions. How an Upgraded System Helps Your Business Grow

Upgrading your payment records system can have a significant impact on your business growth. By embracing automation, customization, and advanced features, you can reduce administrative overhead, improve accuracy, and create a seamless experience for clients. The ability to track payments, offer more flexibility in payment methods, and present a polished, professional image contributes to customer satisfaction and trust, leading to increased business opportunities.

As your business evolves, so should the tools you use. Keeping your records up to date ensures you’re not only staying efficient but also keeping pace with the changing needs of your business and clients.

How to Automate Tax Invoice Creation

Automating the process of generating payment records can save significant time, reduce errors, and streamline your workflow. Instead of manually creating each document for every transaction, automation tools allow you to generate and send them quickly with minimal effort. This is particularly helpful for businesses that handle a high volume of sales or need to maintain consistent records for accounting and compliance purposes.

Steps to Automate the Creation Process

There are several key steps to take when implementing automation for your payment records:

- Choose the Right Software: To start, you need to select a platform or tool that integrates well with your business’s existing systems. Many accounting and invoicing tools offer automation features, including QuickBooks, Xero, and FreshBooks, that can create and send documents automatically.

- Set Up Templates: Once you’ve chosen a tool, create a standardized document format for your transactions. These templates should include all necessary information, such as client details, services or products provided, pricing, and payment terms. Automation systems often allow you to create these templates once and use them repeatedly for each new transaction.

- Integrate with Your CRM: Linking your automation system to your customer relationship management (CRM) software allows for the automatic population of client data, making each document personalized and up-to-date. With this integration, customer information is pulled directly from your CRM, reducing manual entry and the possibility of errors.

- Enable Recurring Transactions: If your business uses subscription-based services or has regular customers, automation tools can schedule recurring transactions. This ensures that clients are billed on time without the need to manually create each payment record.

- Set Up Notifications: Automation software can be configured to send notifications when a document is created, sent, or paid. These notifications help keep you informed of the status of your transactions and allow you to quickly address any issues or overdue payments.

Advantages of Automating Payment Records

Automating the creation of these documents offers several key advantages:

- Time Efficiency: By automating repetitive tasks, you free up valuable time that can be spent on other important aspects of your business, such as customer acquisition and product development.

- Consistency and Accuracy: Automation ensures that your payment records are consistently formatted and free from human errors, reducing the likelihood of mistakes that could cause disputes with clients.

- Improved Cash Flow: With automated reminders and scheduled sending, you can ensure that payments are requested pr

Where to Find Reliable Tax Invoice Templates

Finding a trustworthy source for your business’s payment records is essential to ensure you’re using a high-quality and accurate format. There are various platforms available where you can obtain pre-designed documents, ranging from free to premium options. It’s important to choose a reliable provider that offers secure, well-structured, and customizable files suitable for your needs.

Here are some of the best places to find dependable formats:

When selecting a provider, make sure to verify the credibility of the platform. Look for reviews, check for secure payment options, and ensure the forms are editable to match your specific business details. By choosing the right source, you’ll be able to maintain professionalism while streamlining your billing process.

How to Fill Out a Tax Invoice

Completing a billing document correctly is crucial for clear communication with your clients and for ensuring that you maintain accurate records. By filling out the necessary fields properly, you ensure both parties understand the details of the transaction. In this section, we’ll walk you through the key elements to include and how to enter the information efficiently.

Key Information to Include

When filling out your billing form, make sure you include the following essential details to avoid confusion and ensure compliance with business standards:

Finalizing the Document

After ensuring all the necessary fields are filled in, double-check for accuracy before finalizing the document. Look for: