Trucking Invoice Templates for Easy Billing and Payment Tracking

Efficient billing is a cornerstone of any successful business, particularly in the transportation industry. Properly documenting services, tracking charges, and ensuring clear communication with clients are essential tasks that contribute to financial stability and smooth operations. The right approach to creating and managing billing documents can save time, reduce errors, and increase client satisfaction.

For businesses in the delivery and logistics sector, customizing the right kind of documentation can be a game changer. Whether it’s a standard charge for a service, mileage-based costs, or additional fees, having an organized and professional record is crucial for maintaining clarity and ensuring timely payments. By tailoring these documents to the specific needs of each client and service, companies can improve their financial processes significantly.

Efficient billing practices are more than just a way to collect payments; they help businesses build trust with clients, minimize disputes, and foster long-term relationships. With the right system in place, companies can focus more on growth and less on administrative tasks, leaving more room for service improvements and client satisfaction.

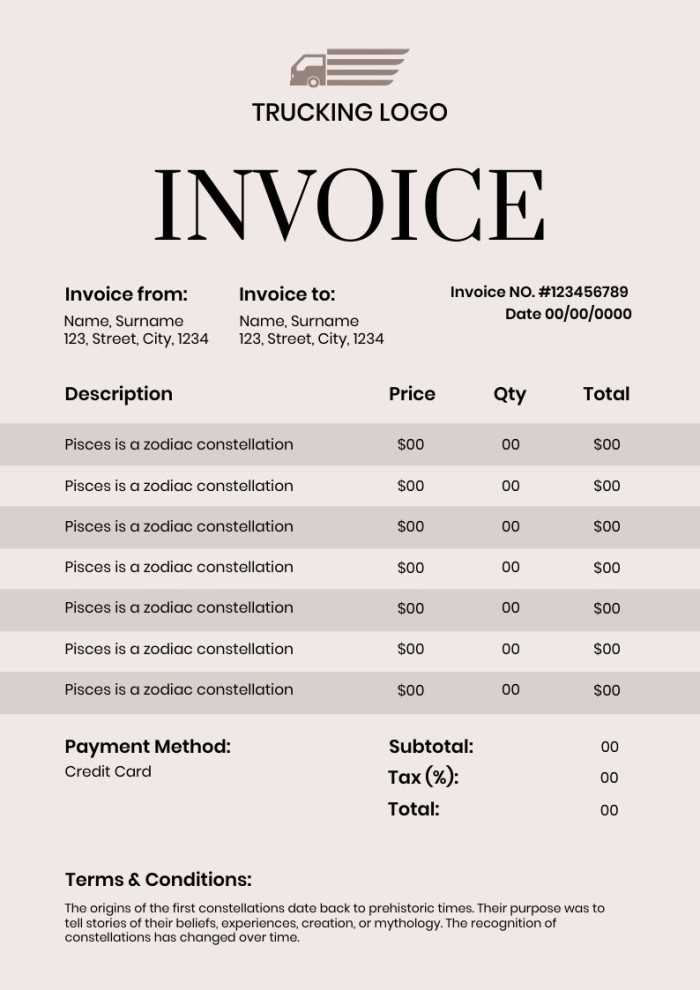

Trucking Invoice Templates for Businesses

For any transportation service provider, having a reliable system for documenting and billing services is essential. This system should not only reflect the details of each delivery but also provide a professional record that ensures timely payments and fosters positive relationships with clients. By using well-organized and customized billing documents, businesses can streamline their financial processes, reduce the risk of errors, and maintain consistency in how services are charged.

Customizable billing forms are invaluable for companies looking to adapt to different client needs. These documents can include detailed information such as delivery routes, service charges, fuel surcharges, and additional fees, making it easier to communicate costs clearly. With an efficient system in place, businesses can quickly generate accurate records that comply with industry standards and client expectations.

Having the right tools for creating these records is a key part of simplifying administrative work. Whether using software solutions or manually filling out pre-made documents, the focus should always be on clarity and professionalism. By investing time in creating robust billing forms, businesses can enhance their overall efficiency and improve cash flow management, allowing them to focus more on providing quality services.

Importance of Accurate Billing in Trucking

Accurate financial documentation is crucial for any business that provides transportation services. A well-maintained system for recording and charging for services not only ensures smooth cash flow but also fosters trust between the service provider and the client. Errors in billing can lead to disputes, delayed payments, and damage to professional relationships, which can ultimately harm the reputation and financial health of the business.

Impact of Billing Errors

When mistakes occur in the charging process, businesses risk losing time and resources attempting to resolve conflicts. These errors can have far-reaching consequences:

- Delays in payment processing

- Potential loss of clients due to dissatisfaction

- Increased administrative overhead in resolving discrepancies

- Damage to company reputation

Benefits of Precise Billing

On the other hand, maintaining accurate records can yield numerous benefits for a business:

- Faster payments from clients due to clear and understandable charges

- Improved client relationships built on trust and transparency

- Efficient financial tracking and reporting

- Reduced risk of legal disputes or compliance issues

Investing in a reliable billing process ensures long-term success and stability for businesses in the logistics and transportation sectors. It allows them to focus on growth while maintaining smooth financial operations.

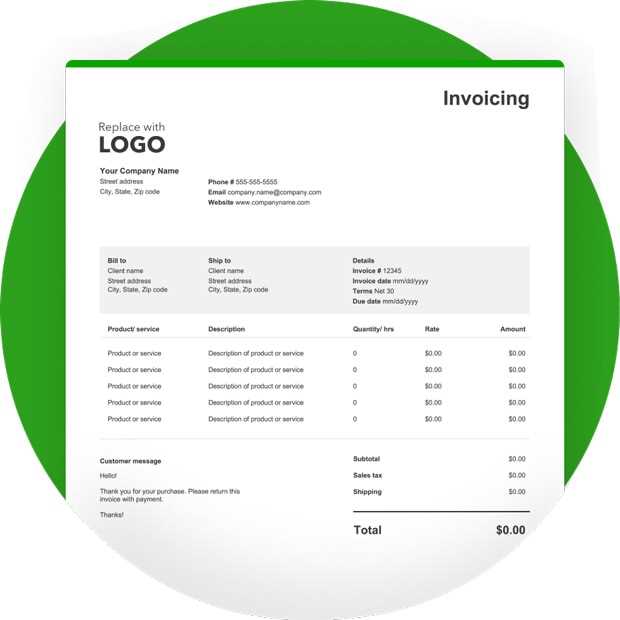

How to Create Custom Invoice Templates

Creating personalized billing documents allows businesses to efficiently track services, charge clients accurately, and present a professional image. A well-designed document should clearly outline all relevant details of the service provided while offering flexibility to suit various client needs. Customizing your forms ensures that every transaction is recorded properly and that both you and your clients are on the same page regarding payments.

Step-by-Step Guide to Creating Custom Forms

Follow these steps to build an effective billing document:

- Choose the right format: Select a format that works best for your needs, whether it’s a digital template or printed version. Many software programs offer easy-to-use tools for creating custom records.

- Include necessary details: Make sure to include essential information such as service description, costs, dates, and payment terms.

- Personalize your branding: Add your business logo, contact information, and any other identifiers that make the document uniquely yours.

- Keep it simple and clear: Ensure that the layout is easy to read and the charges are transparent, avoiding unnecessary clutter.

Using Tools for Customization

There are various tools available for creating custom forms:

- Word processors: Basic programs like Microsoft Word or Google Docs can be used to design a simple document with customizable fields.

- Specialized software: Platforms such as QuickBooks, Zoho, or FreshBooks offer pre-made templates that can be tailored to your business’s needs.

- Service Provider and Client Information: Include the name, address, and contact details of both the company providing the service and the client receiving it. This ensures both parties are easily identifiable and reachable.

- Unique Identifier: Assign a unique number or reference code to each record for tracking and easy reference in the future.

- Service Description: Clearly describe the services rendered, including dates, locations, and any other relevant specifics. This allows clients to understand exactly what they are being charged for.

- Cost Breakdown: List individual charges such as transportation fees, mileage, fuel costs, and any additional surcharges. Transparency in pricing builds trust.

- Payment Terms: Specify when payment is due, acceptable methods of payment, and any late fees or penalties for overdue amounts.

- Additional Notes: If there are any special conditions or remarks related to the transaction, they should be clearly stated at the bottom of the document.

- Cost-effective: Free tools don’t require any upfront investment, making them ideal for businesses with a limited budget.

- Ease of use: Many free options are designed with simplicity in mind, making them easy to navigate and implement.

- Basic features: Free tools often provide essential functions like creating simple documents and tracking payments.

- Advanced features: Paid platforms often include customizable fields, automated calculations, and integration with accounting software.

- Customer support: Paid services generally offer better customer support, ensuring that any issues are resolved quickly.

- Scalability: As your business grows, paid tools can scale with you, providing more options for managing a larger volume of transactions.

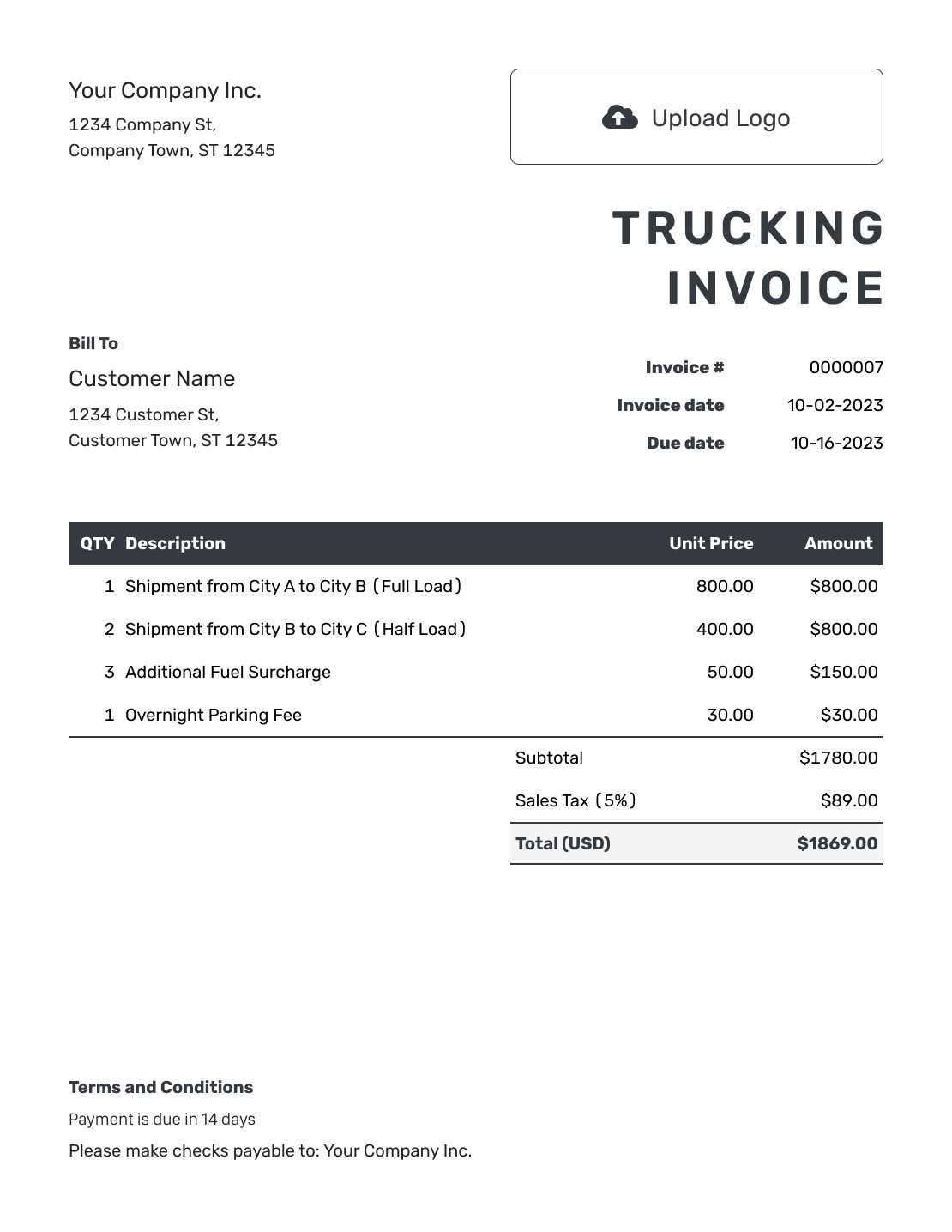

- Track Starting and Ending Points: Record the beginning and ending locations of each trip. This can be done manually using odometer readings or automatically with GPS tracking systems.

- Measure Distance: Calculate the total distance traveled between the two points. You can use online maps, GPS systems, or mobile apps to determine the exact mileage.

- Apply the Rate: Multiply the total mileage by your per-mile rate to determine the charge. For example, if the trip covered 100 miles and your rate is $1.50 per mile, the total charge for mileage would be $150.

- Include Additional Factors: Some businesses charge extra for factors like tolls, fuel surcharges, or heavy traffic. Be sure to account for these in your final calculation.

- Track Fuel Prices: Regularly monitor fuel prices in the areas where services are performed. Fuel prices can vary by region, so staying updated helps you calculate accurate charges.

- Use a Surcharge System: Many businesses use a fuel surcharge rate that fluctuates based on the market price of fuel. Ensure that this rate is clearly communicated to clients and reflected in each document.

- Flat Fee vs. Percentage: You can choose between charging a flat fee per trip or calculating a percentage of the total transportation cost based on fuel usage. Both methods have their benefits, depending on your business model and client expectations.

- Include Documentation: When applying fuel charges, it’s important to provide clients with a breakdown of how the fuel costs were calculated, including the fuel price per gallon/liter, total fuel used, and any additional fees.

- Review Fuel Efficiency: Keep track of fuel consumption for different routes and adjust your calculations accordingly. This can help you identify opportunities to optimize fuel usage and improve your pricing

Tips for Preventing Billing Errors

Accurate billing is essential for maintaining healthy business operations and strong client relationships. Errors in financial documents can lead to misunderstandings, delayed payments, or even disputes. To avoid such issues, businesses should implement practices that help ensure their records are correct and error-free. Below are some useful tips for preventing common mistakes in financial documentation.

Double-Check Your Calculations

One of the most frequent sources of errors in financial documents is incorrect calculations. Even small mistakes can add up and cause significant issues. Here’s how you can prevent them:

- Use Automated Tools: Implement software that performs calculations automatically to minimize the risk of human error.

- Verify Rates: Double-check the rates and ensure they are up-to-date and accurate for the specific services provided.

- Review Totals: Always verify the totals after entering all charges and discounts. Cross-check figures to ensure everything adds up correctly.

Maintain Consistent Documentation

Keeping clear and consistent records helps avoid confusion and errors in future transactions. By organizing your documents well, you can reduce mistakes and streamline the billing process:

- Standardize Formats: Use a consistent structure for all your billing documents, so it’s easier to spot missing information or discrepancies.

- Keep Detailed Notes: Always note the details of services rendered, including dates, quantities, and specific charges, to avoid overlooking important items.

- Track Payments and Adjustments: Regularly monitor incoming payments and any adjustments made to ensure they’re correctly reflected in your records.

By implem

Incorporating Discounts and Additional Fees

Adding discounts and extra charges to billing documents is a common practice, ensuring that both promotional offers and additional costs are accurately reflected. This process can help maintain transparency with clients while providing them with clear details of what they are being charged for. Whether it’s offering a seasonal discount or applying a surcharge for expedited services, it’s essential to include these adjustments clearly and consistently.

Here are some effective strategies for incorporating discounts and additional fees into your billing process:

- Define Discount Criteria: Establish clear guidelines for when discounts can be applied, such as for repeat customers or large-volume orders. Ensure that these criteria are communicated to clients beforehand to avoid confusion.

- Specify the Type of Discount: Whether it’s a percentage off the total amount or a fixed amount, specify the exact nature of the discount so that clients understand how the reduction is applied.

- Apply Fees Clearly: List all additional charges separately and provide a brief description for each. Common charges may include fuel surcharges, late payment fees, or handling costs.

- Keep Track of Promotions: If offering temporary discounts or promotions, keep accurate records of when and how these discounts are applied to avoid repeating them unintentionally or missing an expiration date.

- Use Consistent Terminology: Ensure that the terms used for both discounts and additional fees are standard across all documents. This consistency helps clients easily understand their billing breakdown.

- Review Total Adjustments: Before finalizing the document, double-check that all discounts and fees are accurately reflected in the totals, including any tax implications.

By clearly listing any reductions and extra charges, you create an open and honest b

Best Software for Billing Document Creation

Choosing the right software for generating billing records is essential for businesses looking to streamline their financial processes. The ideal solution should offer customization, ease of use, and the ability to automate calculations to ensure accuracy. With the right tools, businesses can generate professional and error-free documents quickly, reducing the time spent on manual entry and increasing overall efficiency.

Here are some of the top software options for creating billing documents:

- FreshBooks: A user-friendly platform designed for small to medium-sized businesses, FreshBooks offers customizable document generation, automatic payment reminders, and time-tracking capabilities.

- QuickBooks: QuickBooks is a popular choice for businesses of all sizes. It provides comprehensive features for financial management, including customizable billing options, expense tracking, and easy integration with accounting systems.

- Zoho Invoice: Known for its ease of use and flexibility, Zoho Invoice allows businesses to create, send, and track billing records. It also offers features such as recurring billing and integration with other Zoho products.

- Wave: A free software option that includes customizable billing features, Wave is ideal for startups and small businesses. It allows businesses to create professional documents and manage payments and expenses.

- Bill.com: This cloud-based software provides businesses with a simple way to automate billing, streamline payment processes, and handle recurring charges. Bill.com is known for its ease of use and scalability.

When choosing the best software, it’s essential to consider the unique needs of your busi

How to Automate Your Billing Process

Automating the billing process can significantly improve the efficiency of your business operations. By reducing manual tasks and minimizing errors, automation allows for faster document generation and more accurate financial tracking. With the right tools, businesses can streamline recurring billing, enhance cash flow management, and reduce the administrative burden on employees.

Steps to Automate Your Billing System

Follow these key steps to successfully automate your billing process:

- Choose the Right Software: Select a billing platform that supports automation features such as automatic calculations, payment reminders, and integration with other systems like accounting or CRM software.

- Set Up Recurring Payments: For businesses with subscription-based services, set up recurring billing to automatically charge clients at regular intervals. This eliminates the need for manual billing each month.

- Integrate with Payment Gateways: Link your billing system with payment processing platforms like PayPal or Stripe to allow customers to make payments directly from the generated document, speeding up the payment cycle.

- Customize Document Generation: Use automation tools to create professional-looking records with the relevant business information, customer details, and charges pre-filled. Customize your documents to match your branding.

- Automate Follow-Ups: Set up automated reminders for overdue payments and send thank-you notes or receipts once payments are completed.

Benefits of Automating Billing

- Improved Accuracy: Automation reduces human error, ensuring accurate calculations and consistent billing practices.

- Faster Turnaround: Automation speeds up the process, allowing businesses to send and receive payments more quickly.

- Better Cash Flow Management:Ensuring Compliance with Tax Requirements

Adhering to tax regulations is crucial for maintaining a legally compliant business operation. Accurate documentation and proper record-keeping are essential to meet the requirements set by tax authorities. Businesses must ensure that they are correctly calculating and reporting their earnings, expenses, and any applicable taxes to avoid potential fines or audits.

To ensure compliance, businesses should follow these guidelines:

- Understand Local Tax Laws: Different regions may have varying rules on tax rates, deductions, and exemptions. It’s essential to stay informed about the tax laws that apply to your business, whether local, state, or federal.

- Include Accurate Tax Information: All records should clearly show the correct tax rates applied to services or products, including any relevant exemptions or special conditions. This helps prevent discrepancies in reporting and reduces the risk of audits.

- Keep Detailed Records: Proper documentation is key to ensuring compliance. This includes keeping detailed and accurate records of all financial transactions, including receipts, expenses, and payments.

- Automate Tax Calculations: Utilize software that can automatically calculate and apply the appropriate tax rates based on your location and the nature of the services rendered. This reduces the likelihood of human error.

- Regularly Review Tax Filings: Regularly auditing your financial documents can help ensure that all reports are accurate and in line with current tax laws. This can be done through internal checks or by consulting a tax professional.

By integrating these practices into your financial workflow, you can confidently ensure compliance with tax regulations, reduce the risk of penalties, and keep your business operations running smoothly. Proper tax management is essential for maintaining your business’s credibility and legal standing.

Payment Terms to Include in Invoices

Clearly defining payment terms is an essential part of managing financial transactions. Setting clear expectations about when and how payments should be made helps ensure smooth business operations and minimizes misunderstandings between service providers and clients. By including specific payment terms, businesses can reduce the risk of delayed or missed payments.

Key Payment Terms to Specify

When creating your financial documents, it’s important to include the following payment details:

- Due Date: Specify the exact date by which the payment is expected. This gives clients a clear timeline and helps businesses plan their cash flow accordingly.

- Late Fees: Mention any penalties for overdue payments. A clear late fee structure motivates timely payment and compensates for any disruptions caused by delays.

- Payment Methods: Outline the acceptable methods of payment, whether by bank transfer, credit card, or online payment systems. This ensures clients know how to complete the transaction.

- Discounts for Early Payment: Some businesses offer a discount for early settlement. If this is applicable, clearly state the percentage or amount and the timeframe during which the discount applies.

- Payment Installments: If payments are to be made in installments, specify the amount, frequency, and due dates for each installment.

Why Payment Terms Matter

Including these details in your documentation helps to clarify expectations and create a more professional image. By providing clear payment instructions, you reduce confusion and create a smoother process for both you and your clients. Properly outlined terms also protect your business from potential financial setbacks caused by delayed payments.

Customizing Templates for Specific Clients

Personalizing your financial documents for individual clients can significantly improve the clarity and professionalism of your transactions. Customization ensures that each document aligns with the client’s preferences, business requirements, and expectations. This tailored approach helps foster stronger business relationships and reduces the likelihood of misunderstandings.

To customize your documents for specific clients, consider including the following elements:

Customization Aspect Description Client Name and Address Ensure the correct contact details are included, such as the client’s full name, address, and business information. Payment Terms Some clients may require different payment schedules or terms. Tailoring these terms can help accommodate specific needs. Itemized Services For clients with unique service packages, include detailed descriptions of the specific services provided to avoid confusion. Discounts or Special Offers If you offer any client-specific discounts or promotions, these should be clearly mentioned on the document. Payment Method Preferences Some clients prefer certain methods of payment. Personalize the document to reflect these preferences, whether it’s via bank transfer, cheque, or online payment platforms. By tailoring these elements to the needs of each client, you create a more personalized and efficient transaction process. Customization not only demonstrates professionalism but also helps build trust and reliability with your clients, which can lead to long-term partnerships and smoother business operations.

How to Track Payments Effectively

Maintaining a systematic approach to monitoring payments is essential for any business. Tracking payments accurately ensures that you can manage cash flow efficiently, identify outstanding debts, and prevent discrepancies. A well-organized payment tracking process saves time and helps you maintain strong financial health.

To track payments effectively, consider the following strategies:

- Use Accounting Software: Implementing reliable accounting software helps automate the payment tracking process. These tools allow you to view real-time updates on paid and pending amounts, making it easier to stay organized.

- Establish Clear Payment Deadlines: Clearly define payment terms with clients, including deadlines and late fees. This sets expectations and minimizes delays in payment processing.

- Monitor Payment Methods: Keep track of how each payment is made–whether by cheque, bank transfer, or online payment methods. This helps ensure that no payment is missed or delayed.

- Send Payment Reminders: Automated reminders for upcoming or overdue payments can encourage clients to settle their dues promptly. Regular follow-ups help reduce late payments.

- Maintain Detailed Records: Keep thorough records of all transactions. Include dates, amounts, and payment methods to ensure that each payment is accurately accounted for.

With these strategies, you can ensure that your payment tracking process is efficient and error-free. By staying on top of your payments, you improve cash flow, reduce financial stress, and build trust with clients. Additionally, automating many of these tasks frees up time for other important business functions.

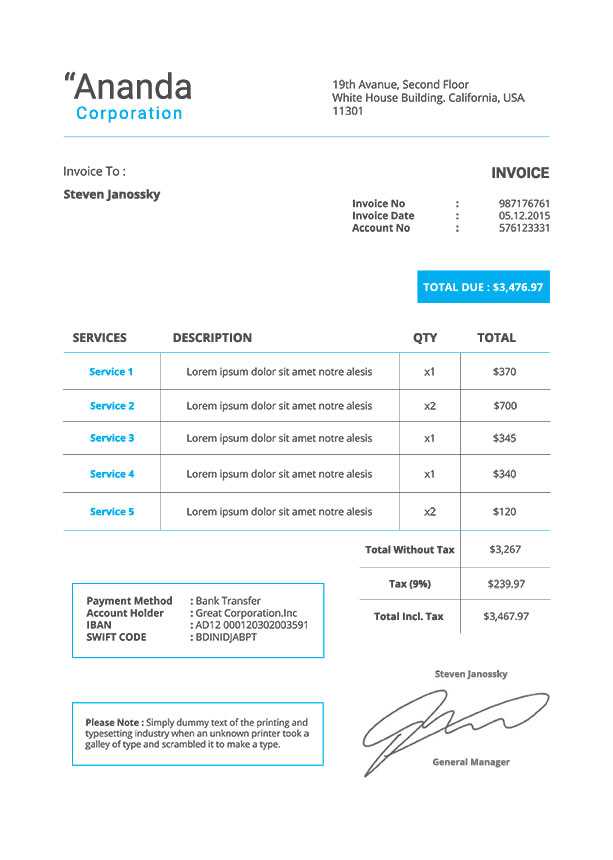

Essential Information for a Billing Document

To ensure clarity and professionalism, it’s important that every financial record includes all the relevant details of the service provided. A well-structured document helps both parties understand the charges and terms, reducing the chances of misunderstandings or disputes. Including the right information also ensures that payments are processed quickly and accurately, benefiting both the service provider and the client.

Here are the key elements that should always be included:

By ensuring that all these key details are present, you provide a clear, professional, and comprehensive record that will facilitate smoother transactions and better client relationships.

Free vs Paid Billing Tools

When it comes to managing billing processes, businesses often face the decision between using free or paid software solutions. Both options have their advantages and limitations, and the right choice depends on the specific needs of the business. While free tools can be a great starting point for small businesses or those just starting out, paid solutions tend to offer more advanced features and support for larger, more complex operations.

Advantages of Free Tools

Free software can be a great option for small businesses or independent contractors who are just getting started. Some benefits include:

Benefits of Paid Tools

On the other hand, paid solutions typically offer more advanced features and added value for businesses looking for growth and efficiency. Some benefits include:

Top Features to Look for in Templates

When selecting a billing document format, it’s essential to choose one that meets your specific business needs. A well-designed document not only ensures smooth financial transactions but also presents a professional appearance to clients. To make the most of your document, consider key features that improve functionality, ease of use, and adaptability. These features can help streamline your workflow, reduce errors, and enhance overall efficiency.

| Feature | Description |

|---|---|

| Customization Options | The ability to tailor the layout, colors, and fields to fit your business’s branding and specific needs. |

| Clear Formatting | Ensure that the layout is easy to read, with sections clearly defined for service details, pricing, and contact information. |

| Automated Calculations | Built-in features that automatically calculate totals, taxes, and discounts, saving time and reducing the risk of errors. |

| Itemized Breakdown | Detailed sections that list each charge, including delivery fees, mileage, and any additional costs, making it clear what clients are paying for. |

| Payment Terms Integration | The ability to specify payment due dates, methods, and late fees, ensuring clear expectations from both parties.

How to Calculate Mileage on InvoicesAccurately calculating distance traveled for transportation services is a critical part of billing. Whether it’s based on a flat rate or a per-mile charge, properly documenting this information ensures clients are correctly billed and prevents disputes. There are several methods for calculating mileage that businesses can use, depending on their pricing structure and the specific details of each trip. Here’s a step-by-step guide on how to calculate distance charges: Example: If a service covers 120 miles at a rate of $2 per mile, the calculation would be: 120 miles x $2 = $240 By accurately calculating mileage and applying the correct rate, you ensure that cli Managing Fuel Charges on Billing DocumentsFuel costs are an essential part of any transportation service, and managing them accurately on billing records is crucial for ensuring fair pricing and maintaining transparent client relationships. Including fuel charges properly in the billing process helps prevent misunderstandings and ensures that your expenses are covered. Fuel surcharges may fluctuate, so businesses need a consistent method to calculate and apply these charges to each transaction. Here are key strategies to effectively manage fuel charges: |