Invoice Payment Receipt Template for Efficient Payment Tracking

Managing financial transactions requires clear documentation to ensure both parties are on the same page. Having a structured and customizable document for confirming exchanges provides a reliable way to track payments and maintain organized records. This is especially crucial for businesses, freelancers, and individuals who engage in regular financial exchanges.

By utilizing a ready-made document format, you can save time and reduce the risk of errors. These formats help in quickly detailing the essential information such as the amount exchanged, the involved parties, and the date of the transaction. Whether for personal use or professional needs, adopting an efficient system for documenting these details can significantly improve financial management.

Customizing your document allows flexibility to meet specific requirements, ensuring it aligns with your needs. With proper customization, this tool can be tailored for various industries or personal situations, adding a professional touch to all your financial records. A simple yet effective way to create consistency and reliability in your business operations.

Invoice Payment Receipt Template Guide

Creating a document to confirm a completed financial transaction is a crucial part of business operations. These documents serve as a formal acknowledgment of the exchange and provide both parties with a record for their reference. An effective document can help maintain transparency, ensure accountability, and simplify financial tracking.

Essential Components of the Document

To ensure your document is complete and professional, it must include key details. This typically involves the names of the parties involved, the amount exchanged, the transaction date, and a clear description of the services or goods provided. Including all relevant information reduces the likelihood of confusion or disputes later on. A detailed note can also serve as a reminder for future transactions or any follow-up actions needed.

Customizing the Format for Your Needs

Not all transactions are the same, and your document should reflect the specific nature of each exchange. You can easily adjust the structure to suit different industries, from freelancers to large businesses. Tailoring the layout helps ensure that the document meets your exact requirements while still presenting a polished and professional appearance. This flexibility is one of the reasons such documents are invaluable for both small and large-scale transactions.

Why Use a Payment Receipt Template

Having a standardized format for documenting financial transactions offers numerous advantages. It ensures consistency, reduces the chance of errors, and saves time. With a structured approach, businesses and individuals can quickly create professional documents without having to start from scratch each time. This practice also helps maintain accurate records for accounting and legal purposes.

Time Efficiency and Consistency

Using a predefined format eliminates the need to repeatedly write down the same information. Once you have a ready-made structure, you can fill in the necessary details and have a complete document in moments. This is especially beneficial for companies handling high volumes of exchanges, as it ensures that all necessary information is captured correctly every time. Consistency in documentation builds trust with clients and helps establish a reliable business practice.

Accurate Record Keeping

By relying on a pre-designed structure, you minimize the risk of omitting important details. Each section of the document has its purpose, from tracking amounts to noting transaction dates, which makes keeping organized records much easier. Accurate records are crucial for tax filing, auditing, and maintaining smooth financial operations within a business.

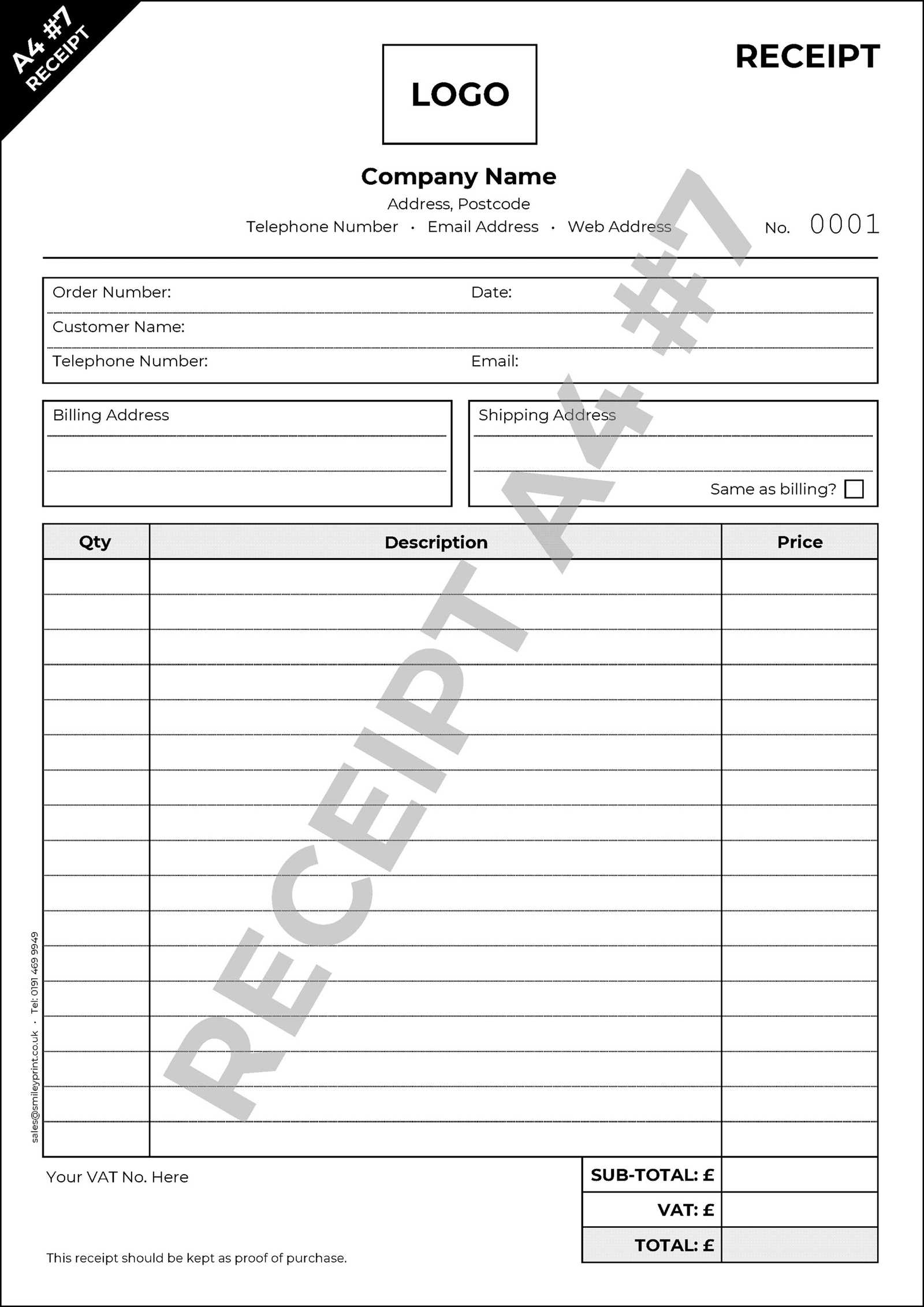

Key Elements of a Payment Receipt

For any financial exchange to be properly documented, certain details must be included to ensure clarity and completeness. These details serve to identify both parties involved, the nature of the transaction, and other important aspects that confirm the completion of the deal. A well-structured document makes it easier to track transactions, manage records, and provide legal proof if needed.

Transaction Details

Every document should clearly specify the amount involved, the date of the transaction, and a description of the goods or services exchanged. This ensures both parties are in agreement on what was provided and the sum involved. Without these critical elements, it would be difficult to confirm the specifics of the exchange in the future.

Party Information

Identifying the individuals or organizations involved is equally important. This includes the full name or business name, address, and contact details of both the sender and the receiver. Having accurate information ensures there is no confusion about who is responsible for the transaction and facilitates easy communication when needed.

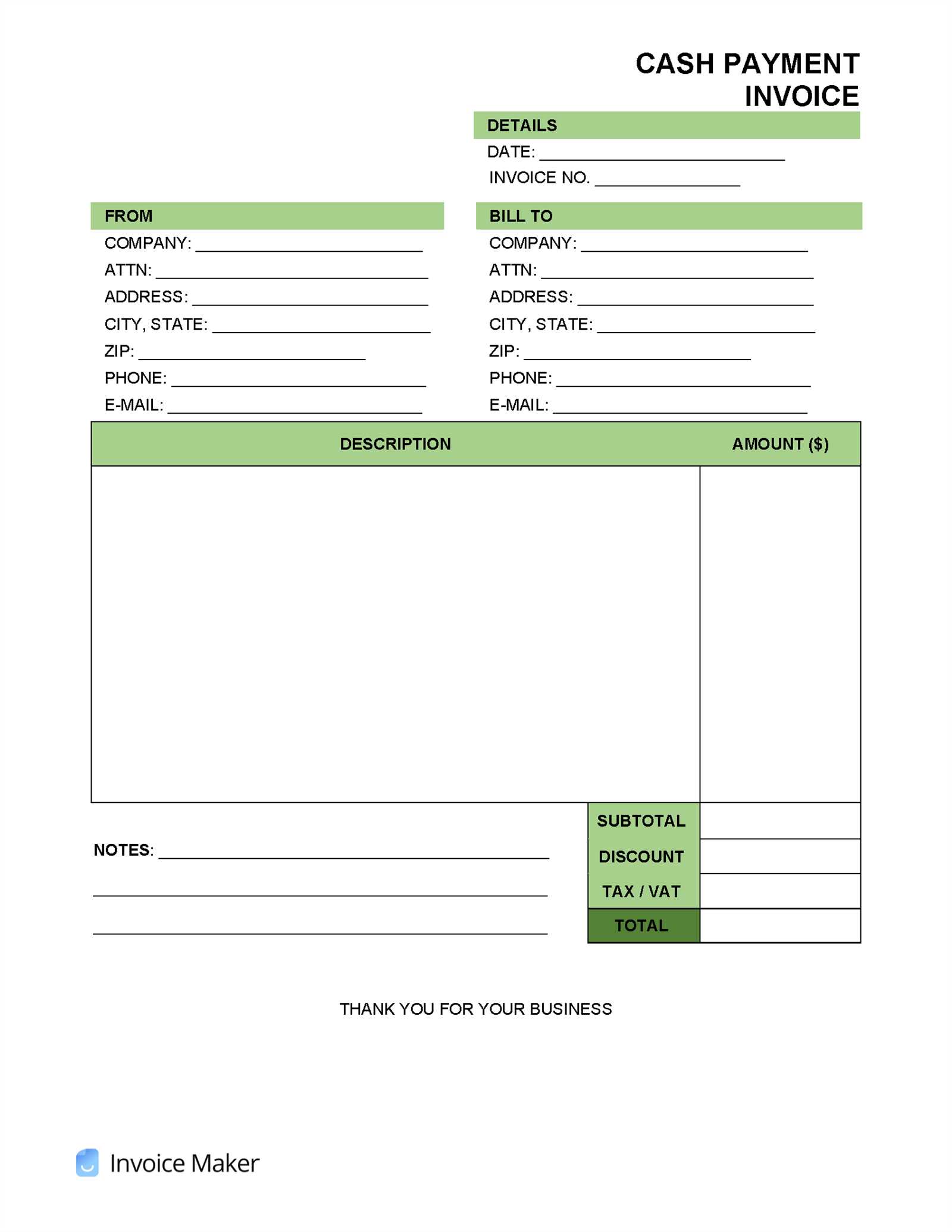

How to Customize a Template

Adjusting a pre-made format to fit specific needs can enhance both its functionality and presentation. Customizing the layout ensures the document accurately reflects the unique aspects of each transaction, whether it’s for a specific service or product type. This flexibility helps maintain a professional appearance while accommodating various business requirements.

Modifying Key Sections

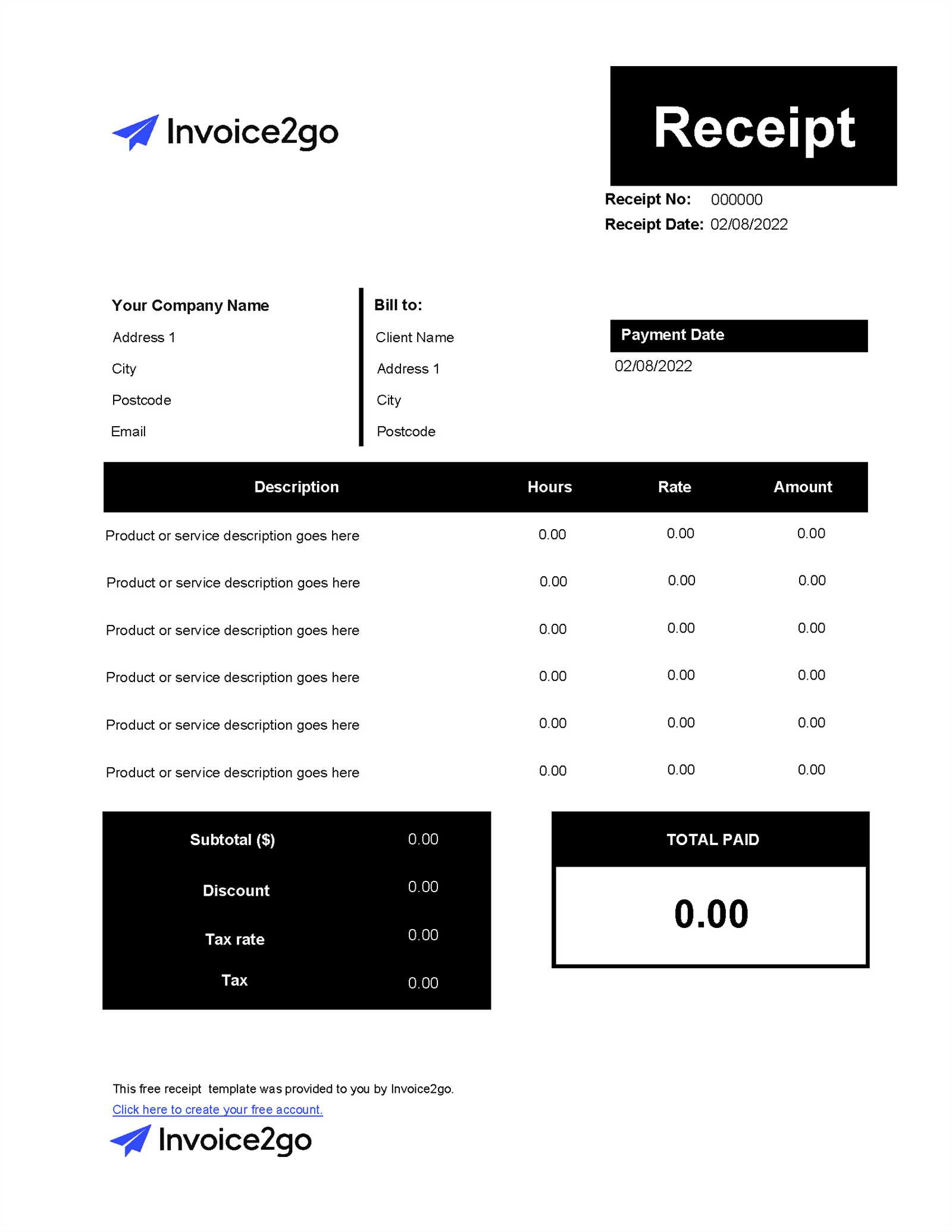

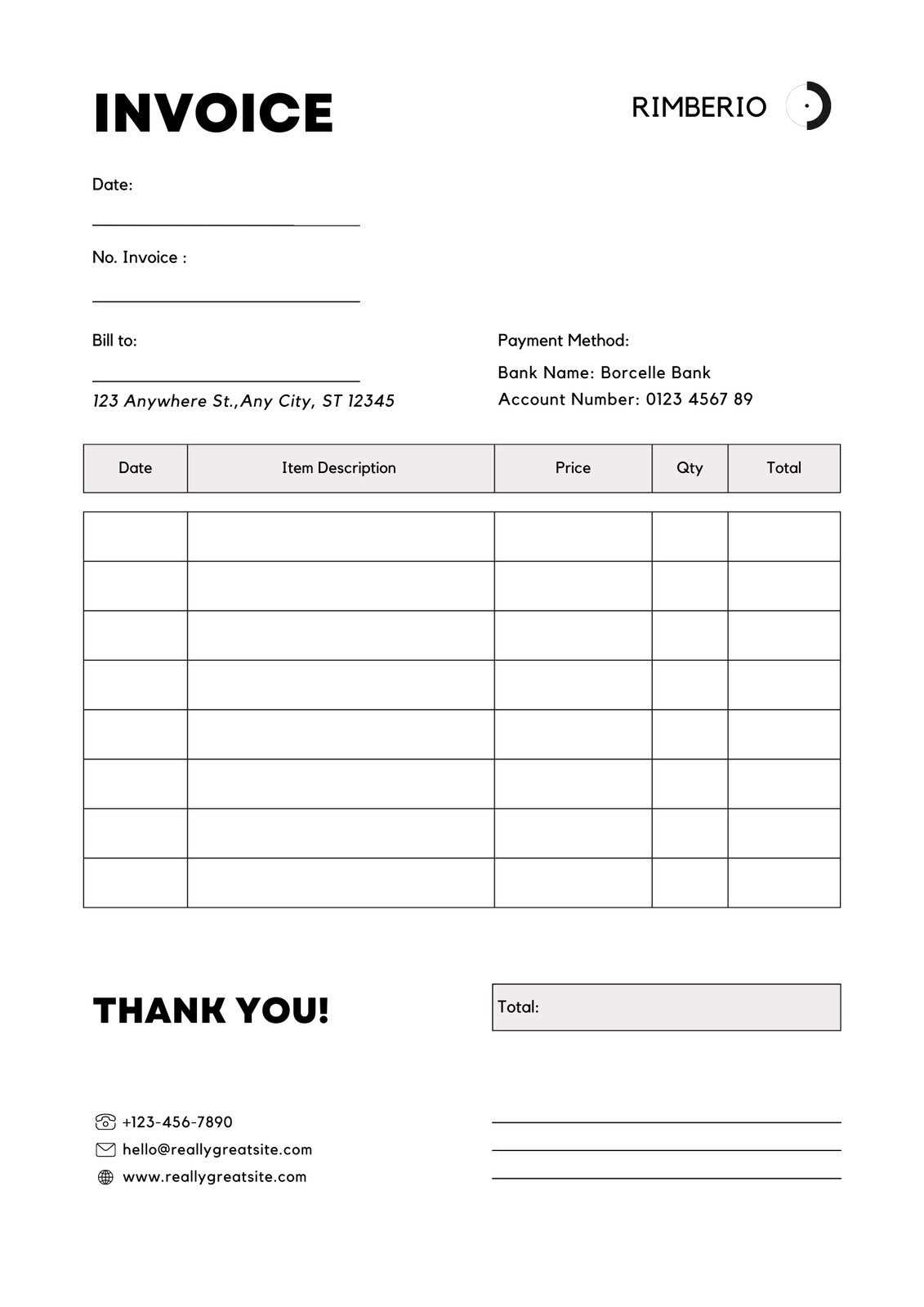

When adjusting a document, consider altering the key sections such as the title, party details, and transaction descriptions. You can make changes to the formatting or add new fields to capture additional information that is important for your business operations. Below is an example of how you can structure the core details:

| Field | Description |

|---|---|

| Transaction Date | Specify the exact date of the exchange. |

| Recipient Information | Include the name, contact, and address of the person or company receiving the goods or services. |

| Amount | Indicate the total value of the transaction. |

| Description of Goods or Services | Provide a detailed account of what was exchanged, ensuring clarity. |

By making these adjustments, you can create a document that is tailored to meet your specific needs while maintaining consistency and professionalism.

Benefits of Automated Payment Receipts

Automating the creation and distribution of financial acknowledgment documents can significantly streamline business operations. With automation, businesses can save time, reduce errors, and improve efficiency by quickly generating standardized records without manual effort. This not only enhances productivity but also ensures a higher level of accuracy in documenting exchanges.

Time Efficiency

Automating these documents eliminates the need for manual data entry and repetitive tasks. The process becomes faster, enabling businesses to focus more on core activities while the system handles the creation of documents automatically. Key advantages include:

- Instant document generation once a transaction is completed.

- Reduction in administrative workload and paperwork.

- Faster turnaround times for sending out confirmations.

Reduced Errors and Increased Accuracy

Manual processes often lead to mistakes such as incorrect data input or missed details. Automation ensures that the information remains consistent and accurate across all documents. The benefits of this include:

- Eliminates human errors in data entry.

- Ensures consistent formatting for all generated documents.

- Reduces the risk of missing essential transaction details.

Improved Customer Experience

Automated systems provide faster responses to clients, contributing to better customer satisfaction. Automated confirmation documents can be sent instantly, allowing clients to quickly verify the details of their transactions.

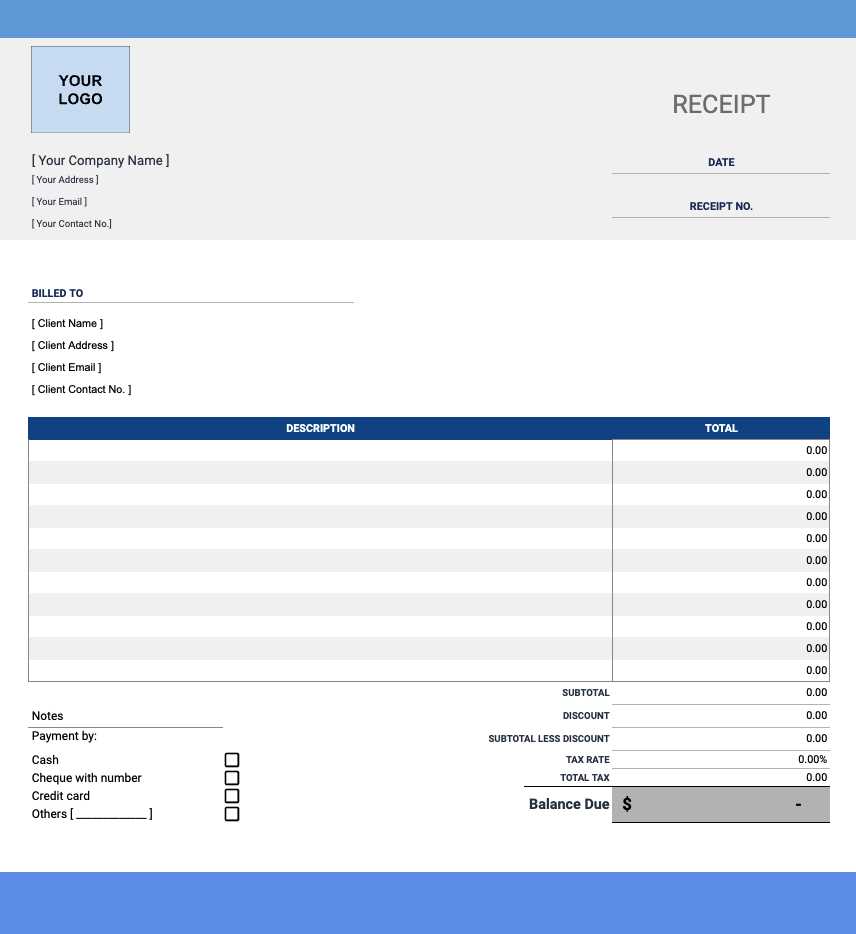

Creating a Professional Invoice Receipt

Designing a professional document that acknowledges a completed financial transaction involves attention to detail and consistency. A well-crafted document not only ensures clarity and transparency but also reflects the professionalism of your business. Incorporating the right elements and formatting can enhance the perception of your brand and improve the overall customer experience.

Essential Elements to Include

To make sure your document is both functional and professional, include key details such as the amount, transaction date, and descriptions of goods or services. In addition, personalizing the document with your business name, logo, and contact information helps establish your brand identity. Some critical aspects to consider are:

- Transaction Information: Clearly outline the amount, date, and what was exchanged.

- Party Details: Include names and contact information of both the sender and receiver.

- Legal Information: Add terms and conditions or any important legal disclaimers relevant to the transaction.

Formatting Tips for Professionalism

The layout and design of your document also play a significant role in its professionalism. Use clean, readable fonts and organize the content logically. Avoid clutter and ensure there is enough white space to make the document easy to navigate. Also, incorporate your company branding elements like logos and color schemes to make it visually appealing. A polished document can go a long way in enhancing trust and credibility.

Invoice Payment Receipts for Businesses

For businesses, documenting financial transactions is crucial for maintaining accurate records and ensuring transparency. Providing clear, concise documents that confirm the completion of financial exchanges helps both parties keep track of their dealings. Such documents are not only useful for internal accounting purposes but also essential for customers who require proof of their transaction.

Importance of Accurate Documentation

Having a standardized process for creating transaction confirmations ensures consistency and reliability. These records provide customers with an official acknowledgment of what was purchased and for how much, which can be crucial for refunds, exchanges, or tax purposes. The key benefits for businesses include:

- Legal Compliance: Ensuring all transactions are properly documented helps businesses stay compliant with legal and tax regulations.

- Improved Customer Trust: Professional, well-organized documents reassure customers of the integrity and reliability of your business.

- Organized Financial Records: Proper documentation allows businesses to track cash flow, income, and expenses effectively.

How These Documents Help Customers

For customers, receiving a detailed acknowledgment of their purchase provides peace of mind and clear evidence of the transaction. It also allows them to reference the transaction for future communications with the business, be it for inquiries or issues related to their order. Key aspects customers appreciate include:

- Transparency: Clear descriptions of purchased goods or services and their respective prices.

- Easy Reference: Clear and organized records for future reference, should they need to follow up with the business.

Common Mistakes to Avoid

Creating well-organized financial documents is essential for both businesses and customers. However, there are common errors that can lead to confusion or missed opportunities. Avoiding these mistakes ensures that the document serves its purpose effectively and maintains professionalism.

Incomplete Information

One of the most frequent mistakes is leaving out essential details that could cause confusion or make the document legally incomplete. Common oversights include missing the transaction date, unclear descriptions of products or services, and failing to include contact details. Ensure the following:

- All relevant dates: The date of the transaction and when it was issued.

- Clear descriptions: Brief but comprehensive descriptions of what was exchanged.

- Proper contact information: Both the buyer’s and seller’s contact details should be easy to find.

Formatting Issues

Another common mistake is improper formatting, which can make the document hard to read and navigate. Poor formatting can lead to miscommunication and a lack of professionalism. Some tips to avoid this include:

- Avoid clutter: Keep the document clean and organized with plenty of white space.

- Use legible fonts: Choose clear, simple fonts that are easy to read.

- Consistent layout: Make sure each section is consistently formatted, such as bold headings and aligned text.

How to Store Payment Receipts Effectively

Proper storage of financial documents is crucial for both personal and business purposes. Whether for accounting, tax filing, or customer service, organizing and keeping these records safe ensures easy retrieval when needed. It’s essential to choose the best method for storing these important files to avoid confusion or loss.

Digital Storage Methods

One of the most efficient ways to store these documents is by using digital tools. By scanning or saving files digitally, you can easily categorize, search, and back them up. Consider the following strategies:

- Cloud storage: Services like Google Drive, Dropbox, or OneDrive allow for secure and accessible storage from any device.

- File naming conventions: Consistently naming files with relevant details, such as the date and client name, makes it easier to search later.

- Regular backups: Ensure all files are backed up regularly to prevent data loss.

Physical Storage Options

While digital storage offers many benefits, physical storage may still be necessary for certain circumstances. A well-organized filing system will help prevent clutter and ensure that hard copies are easy to locate when needed:

- Filing cabinets: Use labeled folders or dividers to categorize documents by date, client, or transaction type.

- Archive boxes: Store older records in labeled boxes for easy retrieval without cluttering your workspace.

- Secure storage: Keep sensitive documents in a locked, fireproof container for added security.

Different Types of Receipt Templates

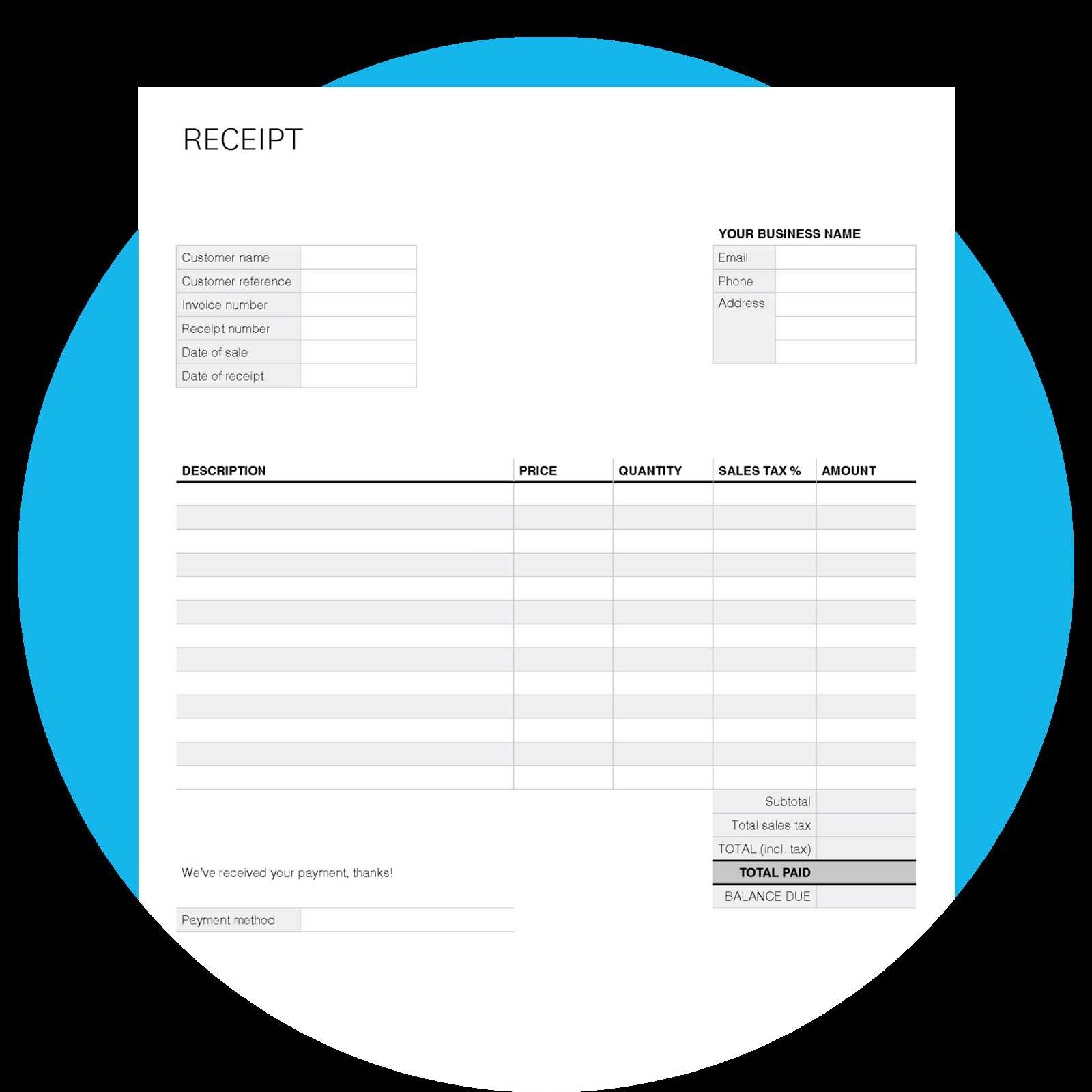

There are various styles of documents used to acknowledge financial transactions, each designed for specific needs or industries. The right choice depends on the type of transaction, whether it’s a sale, service rendered, or any other exchange of goods or services. Understanding the different options can help in selecting the most suitable format for any situation.

Basic Receipts are commonly used for straightforward transactions, such as in-store purchases or one-time services. These typically include essential details like the amount paid, the transaction date, and a brief description of the service or product provided.

Detailed Receipts provide a more in-depth breakdown of the transaction. These often list individual items or services, along with their corresponding prices. This type of document is particularly useful in situations where a detailed record of each component is necessary for accounting or customer inquiries.

Online Transaction Receipts are generated digitally for transactions made through e-commerce platforms or services. These often include additional information like an order number, shipping address, and online payment method used, offering a comprehensive overview of the transaction.

Service Receipts focus on the services provided, listing the service type, date, duration, and total cost. These are particularly useful for contractors, consultants, or any business providing intangible services.

Donation Receipts are used by charities or non-profit organizations to acknowledge a donation made by an individual or entity. These receipts typically include donor details, the amount donated, and the purpose of the donation.

Each type of document serves a specific purpose, ensuring that both parties–whether a customer or a service provider–have a clear and accurate record of the transaction. Choosing the right format for the transaction type can greatly enhance clarity and ease of use.

How to Generate Receipts Online

In today’s digital age, creating transaction records has become easier and faster. Various tools and platforms allow businesses and individuals to quickly generate formal documents confirming the completion of a financial exchange. These online tools streamline the process, providing customizable options and ensuring that every important detail is included for both parties involved.

Step 1: Choose a Reliable Online Platform

There are numerous online platforms available that cater to different needs. Some focus on simple, basic documents, while others offer more detailed customizations. Choose one that best suits the transaction type you’re handling, whether it’s a simple sale or a complex service agreement. Popular options include paid services as well as free templates available on various websites.

Step 2: Input Transaction Details

Once you’ve selected a platform, you’ll need to fill in the required fields. These usually include the name of the payer, the payee, transaction amount, date, and a brief description of the exchange. Some platforms also allow you to include additional details like payment methods or transaction IDs.

Step 3: Customize Your Document

Many platforms offer customization features, such as changing fonts, adding logos, or adjusting the layout. Customizing these elements can make your document more professional and aligned with your branding or personal preferences.

Step 4: Generate and Download the Document

After entering the details and making any customizations, you can generate the final document. Most online tools allow you to download it as a PDF or other file formats, ready to be shared or printed. Some platforms also offer cloud storage options for easy access at any time.

Generating documents online is a simple and efficient way to ensure you maintain accurate records for every transaction, making it easier to manage your finances and provide proof of exchange when necessary.

Legal Considerations for Payment Receipts

When creating formal documents that confirm a financial transaction, it is important to ensure that they meet legal standards and requirements. These records are not only proof of the exchange but can also serve as essential evidence in the case of disputes, audits, or tax filings. Understanding the legal aspects of these documents helps to ensure that they are accurate, complete, and compliant with the law.

Compliance with Local Regulations

Different regions and countries may have specific regulations governing the creation and use of formal documents confirming financial transactions. These laws may include requirements on the type of information that must be included, how it should be formatted, and the retention periods for such records. Businesses should be aware of any applicable rules to avoid legal issues.

Importance of Accuracy and Completeness

Accuracy is crucial when documenting any transaction. Inaccurate or incomplete records could lead to legal complications, such as disputes over the terms of a transaction or failure to meet tax obligations. It is essential to include all necessary details such as the date, parties involved, amounts exchanged, and a description of the goods or services provided.

Tax Implications

Many businesses use formal documents to report transactions for tax purposes. Failing to include required details or retaining records for insufficient time can lead to penalties or difficulty in proving compliance during audits. Be sure to understand your jurisdiction’s requirements for retaining these records, particularly for tax filings.

By paying attention to legal requirements and ensuring that all necessary information is included, businesses and individuals can avoid potential legal challenges and ensure their records are accepted as valid documentation in case of disputes or inquiries.

How Payment Receipts Improve Business Efficiency

Providing formal documentation for financial transactions plays a crucial role in streamlining business processes and maintaining smooth operations. These documents not only serve as proof of exchanges but also contribute to the overall efficiency of various business functions. By implementing well-structured records, businesses can enhance their financial management, customer service, and operational workflows.

Streamlined Financial Tracking

With clear and consistent documentation, businesses can easily track and manage their financial activities. Having organized records of each transaction makes it simpler to monitor cash flow, reconcile accounts, and assess financial performance. Efficient tracking reduces the time spent on manual checks and minimizes errors, allowing for faster decision-making and more effective financial planning.

Enhanced Customer Trust and Satisfaction

Providing detailed documentation increases transparency and builds trust between businesses and their clients. When customers receive professional and clear records of their purchases, it reassures them about the legitimacy of the transaction and the reliability of the business. This level of professionalism leads to greater customer satisfaction, encouraging repeat business and positive referrals.

By adopting efficient record-keeping practices, businesses not only improve their financial tracking but also contribute to smoother interactions with customers, vendors, and regulatory bodies. This results in better operational efficiency, reduced errors, and an overall improvement in day-to-day operations.

Why Templates Save Time and Effort

Using pre-designed formats for documentation allows businesses to streamline the process of creating important records. Instead of starting from scratch for every transaction, these ready-made structures enable quick and efficient completion. This leads to less time spent on formatting and more focus on the actual content of the document, improving both productivity and accuracy.

Consistency and Professionalism

One of the key advantages of using pre-structured formats is the consistency they provide. Every document follows a clear, standardized structure, which helps maintain a professional appearance for all transactions. Consistency ensures that clients and customers receive the same level of quality every time, promoting trust and confidence in the business.

Reduced Errors and Improved Efficiency

By eliminating the need to create a new layout each time, businesses reduce the chances of making mistakes. With a consistent structure in place, there is less room for oversight, such as missing details or misplacing important information. This leads to faster creation times and higher efficiency in generating essential documents. Time saved can then be reinvested in other areas of the business, improving overall operations.

Payment Receipt Template for Freelancers

For independent workers, keeping track of transactions with clients is essential. Having a well-organized and professional document to confirm each exchange helps maintain clear records and ensures transparency. A structured document that outlines the essential details can help freelancers manage their finances and foster trust with clients.

Essential Elements for Freelancers

When creating such a document, it is important to include key information like the name of the freelancer, the client, the services rendered, the date of the exchange, and the total amount received. Additionally, providing a unique reference number for each document can help track individual transactions. This organization helps both parties stay on the same page regarding past agreements.

Benefits for Freelancers

Having a standard format for these documents brings many advantages. It allows freelancers to save time and effort by quickly generating a record after each completed job. Moreover, it can help protect both the freelancer and the client in case of disputes or audits. By presenting a clear and well-structured document, freelancers can enhance their professional image and ensure smoother business operations.

Best Practices for Payment Confirmation

Confirming a transaction accurately is a vital part of managing business relationships. Ensuring that both parties have a clear understanding of the exchange helps build trust and avoid misunderstandings. A well-structured acknowledgment of receipt is essential for maintaining smooth operations and good client relations.

Clear and Concise Information

When providing confirmation for a transaction, it’s important to include all relevant details. This includes the transaction date, the amount exchanged, and a description of the services or goods provided. These key elements help avoid confusion and ensure both parties agree on the terms of the exchange.

Timely Delivery

It is also crucial to send the acknowledgment in a timely manner. Providing confirmation soon after the exchange shows professionalism and reinforces your reliability. A prompt response can also prevent unnecessary follow-up inquiries from clients and partners.

Standardized Format

Using a consistent format for all transaction confirmations makes the process more efficient. A clear, uniform structure helps both you and your clients stay organized, ensuring that all necessary information is included without the risk of missing any details. A standardized approach also reflects well on your business, demonstrating consistency and attention to detail.

Electronic and Paper Options

While digital methods are often more convenient, offering a paper option for clients who prefer it can add flexibility. Be sure to choose the best method of delivery based on your clients’ preferences and business needs. Both electronic and physical confirmations should maintain the same level of professionalism.

How to Integrate Templates with Accounting Software

Integrating standardized forms into your financial management system can significantly streamline operations. By ensuring that these forms work seamlessly with your accounting software, you can save time, reduce errors, and enhance the overall efficiency of your financial processes. Here’s how to effectively integrate your forms with accounting platforms to optimize your workflow.

Choosing Compatible Software

The first step in the integration process is selecting accounting software that supports customized forms. Many modern accounting platforms offer built-in features for generating, managing, and organizing transaction documentation. Make sure the software you choose allows for easy customization and supports importing or creating digital documents that suit your business needs.

Automating Data Entry

Automation is one of the key benefits of integrating forms with accounting tools. By linking forms to your software, you can ensure that all transaction details are automatically populated. This minimizes manual data entry, reducing the chances of human error. Many software solutions allow you to set up templates that automatically pull data such as customer information, transaction amounts, and dates, making your process much more efficient.

Setting Up the Integration

Once you’ve selected the appropriate software and templates, it’s important to configure the integration. Many accounting tools offer plugins or API connections that allow you to link your forms directly to the system. This setup ensures that each transaction is accurately recorded without requiring additional effort. Follow the software’s guidelines for connecting and syncing your forms to achieve the best results.

Regular Updates and Maintenance

To keep the integration running smoothly, regularly update both your accounting software and the forms you use. This ensures compatibility and allows you to take advantage of new features and security improvements. Routine checks help identify any issues before they become significant problems, ensuring the accuracy and efficiency of your financial management system.