Accounting Services Invoice Template for Streamlined Billing

Running a business efficiently involves more than just delivering quality work; it’s equally important to manage financial transactions smoothly. One essential aspect of this process is ensuring that your payment requests are clear, professional, and easy to track. Without a proper system in place, even the best services can face delays in receiving payment, potentially harming cash flow.

Structured documents that outline the work completed and payment due are key to maintaining a professional relationship with clients. These documents not only provide clarity but also ensure that both parties have a clear understanding of the financial terms. By using a streamlined format, you can save time and avoid confusion when it comes to collecting payment for completed work.

Whether you’re managing a small project or handling large-scale contracts, having a reliable tool to generate financial requests will help you maintain consistency and professionalism. In this guide, we’ll explore various ways to design and implement such a system that suits your business needs, making it easier to get paid on time and keep your operations running smoothly.

Accounting Services Invoice Template Overview

For any business, it’s essential to have a standardized method for requesting payments from clients. A well-structured document outlining the services provided and the corresponding fees plays a crucial role in maintaining smooth financial operations. These documents not only ensure clarity and professionalism but also streamline the entire billing process.

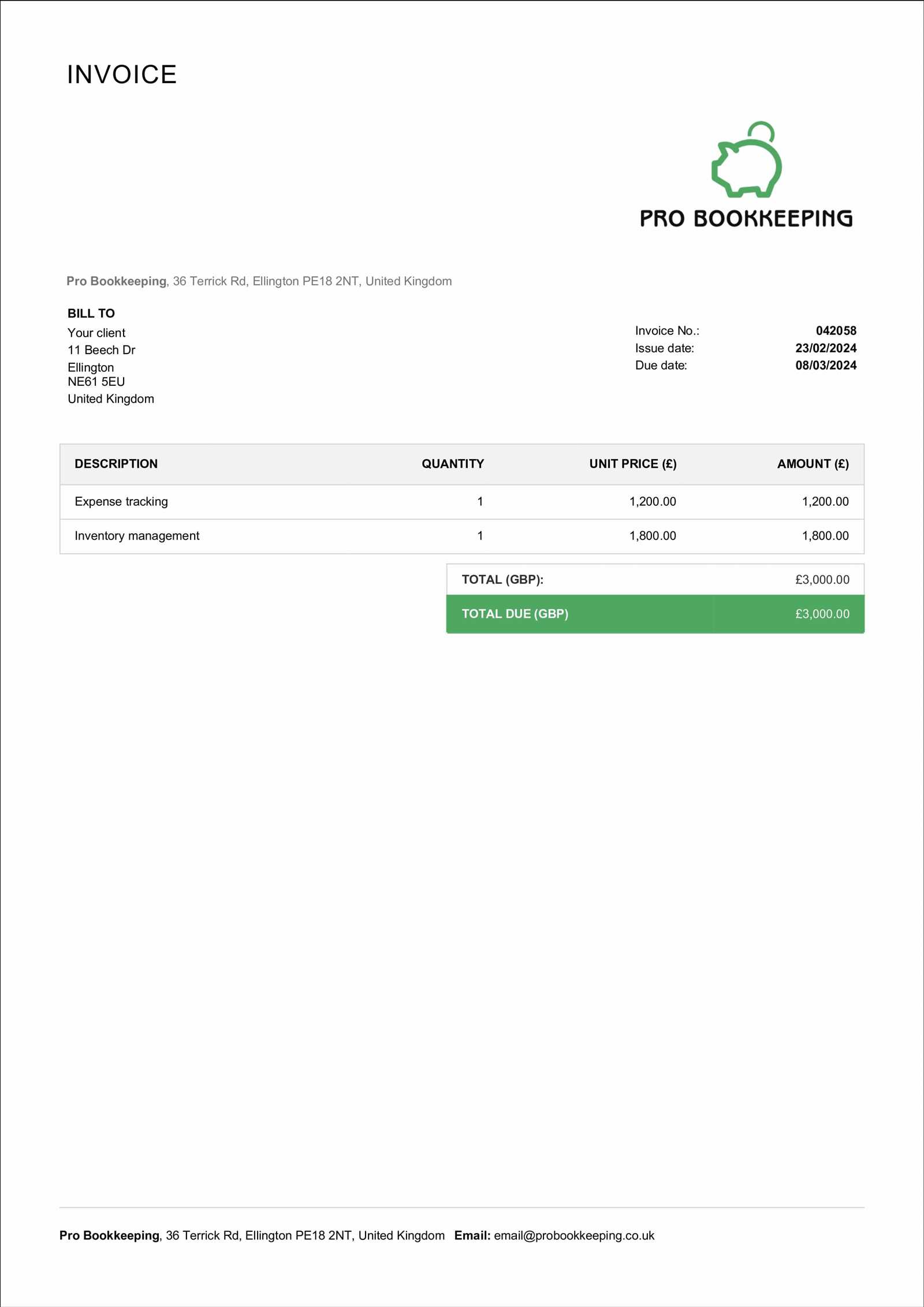

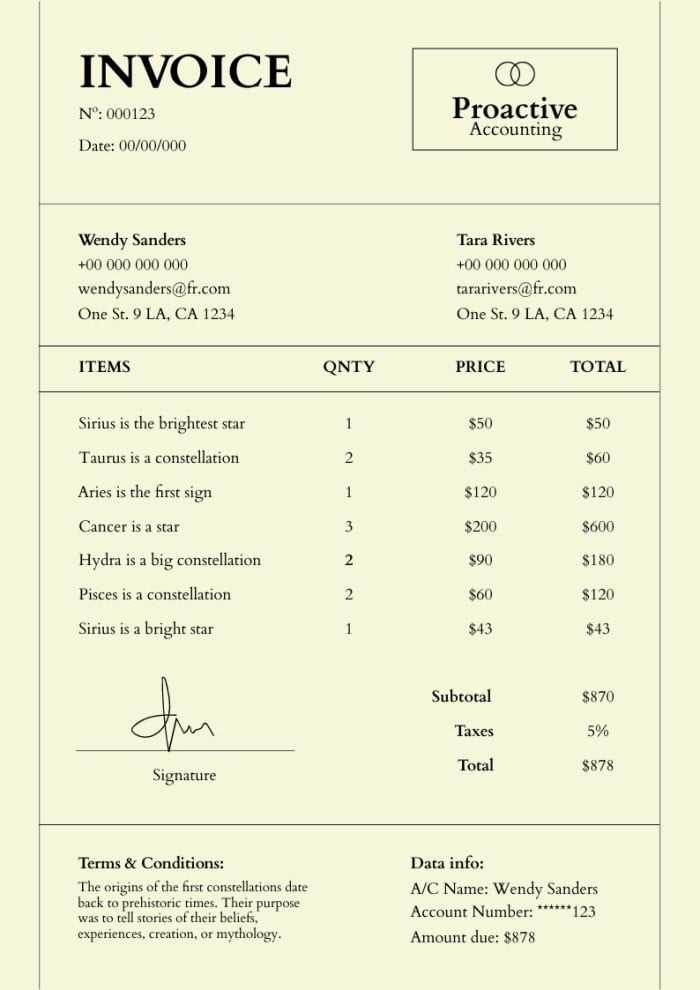

By using a pre-designed format for generating these payment requests, you can save time and reduce errors. A standardized format helps in capturing all the necessary details such as the date, amount due, terms of payment, and work completed, making it easier to track outstanding payments and manage client relationships efficiently.

Key Features of a Billing Document

The structure of a good financial request includes several important elements that make it clear and comprehensive. Information like the client’s name, a breakdown of services rendered, and the total amount owed are all essential details. Including a payment due date and any applicable terms or discounts can also improve transparency and avoid misunderstandings.

Benefits of Using a Pre-built Format

Utilizing a ready-made structure offers a variety of advantages. It ensures consistency in your financial dealings, reduces the chances of missing key information, and can be easily customized to fit the unique needs of different clients or projects. In addition, having a standardized system helps maintain a professional image and promotes prompt payments, thus supporting healthy cash flow.

Why Use an Invoice Template

Implementing a consistent and professional approach to payment requests is essential for any business. Using a pre-designed structure to create these documents offers multiple advantages that contribute to smoother financial management and clearer communication with clients. A well-organized document can help ensure that all the necessary details are captured accurately, reducing the risk of errors and misunderstandings.

Here are several reasons why adopting a structured format is beneficial:

- Time-saving: Using a set format allows you to generate payment requests quickly, without having to start from scratch each time.

- Consistency: A standardized structure ensures that every request you send is uniform, helping to maintain professionalism and clarity across all communications.

- Clarity: Clearly presenting the work completed, amounts due, and payment terms makes it easier for clients to understand their obligations.

- Efficiency: With all necessary details already included in the format, you can avoid mistakes and reduce back-and-forth communication with clients.

- Customization: Pre-built formats can easily be adapted to fit different clients or projects, ensuring flexibility without sacrificing structure.

Overall, using a structured approach to financial requests not only simplifies the billing process but also helps build a professional image for your business, fostering stronger client relationships and ensuring timely payments.

Key Elements of an Invoice

A well-organized document that requests payment should include all essential details to ensure both clarity and transparency. By having the right elements in place, you make it easier for clients to understand the charges, terms, and deadlines, ultimately leading to smoother transactions. These key components help prevent misunderstandings and delays while maintaining a professional appearance.

The main elements that should be included in any payment request document are:

- Contact Information: Include both your company’s details (name, address, phone number, email) and the client’s contact information. This ensures there’s no confusion about where to send the payment.

- Document Number: A unique identifier for each request. This helps with tracking and referencing in case of disputes or questions.

- Issue Date: The date when the document is generated. It’s important for determining payment timelines and is typically referenced in payment terms.

- Description of Work: Clearly outline the products delivered or tasks completed. This ensures that both parties are on the same page regarding what is being billed.

- Amounts Due: A clear breakdown of costs, including unit prices, quantities, and the total amount due. This helps avoid confusion about how the total was calculated.

- Payment Terms: Specify when payment is expected (e.g., due on receipt, within 30 days) and any late fees or discounts available for early payment.

- Tax Information: If applicable, include any tax rates or exemptions, as well as the total tax amount being charged.

- Payment Methods: Provide options for how payment can be made (bank transfer, check, online payment, etc.), making it easier for clients to settle the balance.

- Due Date: Clearly indicate the date by which payment should be received. This helps both parties stay on schedule and avoids late payments.

Including these elements ensures that your payment request documents are complete, professional, and easy to process, ultimately leading to faster and more reliable payments from clients.

Benefits of Customizing Your Template

While using a standardized format for payment requests offers numerous advantages, tailoring the document to fit your specific needs can further enhance its effectiveness. Customization allows you to align the document with your brand identity, ensure that it reflects the unique terms of each project, and provide clients with a more personalized experience. The ability to adapt the structure to suit your workflow and client preferences can lead to more efficient interactions and smoother payment processing.

Here are some key benefits of customizing your payment request format:

| Benefit | Description |

|---|---|

| Brand Identity | Customizing the layout, fonts, and colors to match your business branding makes your document more recognizable and professional. |

| Project-Specific Details | By adjusting the format for each project, you can include all relevant details, such as specific milestones, delivery dates, or project codes, improving clarity. |

| Flexible Payment Terms | You can easily modify payment terms based on the client’s needs or the nature of the work, allowing for more personalized and flexible agreements. |

| Improved Client Experience | Customizing documents for each client helps build stronger relationships by showing that you’re attentive to their specific requirements. |

| Efficiency and Accuracy | By adjusting the format to suit your business operations, you can ensure that the most important information is presented clearly, reducing the chances of errors. |

Ultimately, customizing your payment request document allows you to maintain consistency while adapting to the unique needs of each client and project. This flexibility can lead to better communication, stronger client trust, and improved financial management.

How to Create a Professional Invoice

Creating a professional billing document is an essential step in ensuring smooth financial transactions. It is important to make sure that the document is clear, concise, and well-organized, as it reflects the professionalism of your business and helps avoid confusion. A well-crafted bill can lead to faster payments and better relationships with clients.

Follow these simple guidelines to design an effective and professional billing document:

- Include Essential Information

Make sure your document contains the necessary details, such as the recipient’s name, address, and contact information, along with your own. Clearly display the total amount owed, payment terms, and any applicable taxes or discounts.

- Use a Clear Layout

The structure should be easy to read. Divide the information into logical sections: personal information, billing details, and payment instructions. Use tables or lines to separate these sections for better visual clarity.

- Specify Payment Terms

Outline the expected payment date, late fees, and available payment methods. This ensures both parties are on the same page about the timing and method of payment.

- Keep the Language Professional

The tone should remain formal and polite. Avoid casual language or unnecessary jargon, focusing on clarity and accuracy.

- Ensure Accuracy

Double-check all figures and details for errors before sending. Mistakes in numbers or contact details could delay payment or cause misunderstandings.

By following these steps, you can create a clean, professional document that conveys your message clearly and encourages timely payment.

Common Mistakes to Avoid in Invoices

When creating a billing document, it’s easy to overlook small details that can lead to confusion, delays in payment, or damaged client relationships. Ensuring that your document is accurate and clear is essential for smooth financial transactions. Here are some common errors to avoid:

- Missing or Incorrect Contact Information

Always include the correct contact details for both you and the recipient. Errors in names, addresses, or phone numbers can lead to communication breakdowns and payment delays.

- Unclear Payment Terms

Ambiguity regarding payment due dates, late fees, or accepted payment methods can cause confusion. Make sure to specify clear instructions on when and how the payment should be made.

- Inaccurate Amounts

Double-check all numbers. A simple error in totals, taxes, or discounts can cause frustration and delay payments. Always verify that calculations are correct before sending.

- Lack of a Unique Reference Number

Every billing document should have a unique identifier. Without this, tracking and referencing payments becomes difficult, especially for large businesses handling multiple transactions.

- Not Detailing Items or Work Completed

Be specific about what is being charged. Whether it’s products sold or work performed, clients should clearly understand what they’re paying for.

- Not Including Due Date or Payment Terms

Failing to clearly indicate when the payment is due can result in delays. Be sure to specify the exact due date and any late fees or discounts for early payment.

- Forgetting to Add Taxes

If applicable, ensure that taxes are properly calculated and listed. Not including this can lead to misunderstandings and legal complications later.

Avoiding these mistakes will help ensure that your billing documents are clear, professional, and efficient, leading to smoother transactions and better relationships with your clients.

Best Practices for Invoice Design

A well-designed billing document not only conveys professionalism but also ensures that all relevant details are easy to understand and process. The layout, structure, and style of the document can significantly impact how quickly payments are made and how smoothly the transaction process flows. Adopting best practices for the design can help you create a clear and effective document that minimizes confusion and delays.

1. Keep It Simple and Organized

The most important aspect of any billing document is clarity. Avoid clutter and overly complex layouts. Organize the content into distinct sections that make it easy for the recipient to find key information quickly. Use headings, tables, and bullet points to break up the text and ensure each detail is easy to identify. A clean, organized structure is critical for a positive first impression.

2. Use Consistent Branding

Your document should reflect your business’s brand identity. Use consistent fonts, colors, and logos that align with your overall branding. This consistency helps reinforce your business’s image and adds a layer of professionalism. While it’s important to keep the design simple, incorporating brand elements can make your document stand out and feel cohesive with other communications.

3. Highlight Key Information

- Clear Payment Instructions: Ensure that payment details such as due dates, payment methods, and late fees are prominently displayed.

- Distinct Total Amount: Make the total amount due stand out by using a larger font size or bold text. This draws the reader’s attention to the most important detail.

- Breakdown of Charges: Clearly list individual items or tasks along with their costs to prevent any confusion about what is being charged.

4. Ensure Readability

Choose fonts and sizes that are easy to read. Avoid overly stylized fonts that may cause confusion. Stick to standard, professional fonts like Arial, Helvetica, or Times New Roman. The font size should be large enough for comfortable reading but not too large to make the document seem unprofessional. Proper line spacing and paragraph breaks are also essential for readability.

5. Include Legal and Tax Information

Make sure to include any legal or tax information that might be required by your local regulations. This could include your business registration number, tax identification number, or specific tax percentages. Clearly display this information at the bottom or in a separate section to ensure it’s easy to find without distracting from the main content.

By following these best practices, you can create a billing document that is not only functional but also visually appealing, helping to facilitate smoot

How to Add Taxes and Discounts

Including taxes and discounts correctly in your billing document is crucial to ensure accuracy and compliance with local regulations. Properly calculating and displaying these amounts not only helps avoid confusion but also demonstrates professionalism. Here’s how to properly add taxes and discounts to your document.

1. Adding Taxes

Taxes are often a percentage of the total amount before tax, and it’s important to clearly specify the tax rate and the final amount. Follow these steps:

- Determine the Tax Rate: Verify the applicable tax rate for the type of transaction and your location. This can vary by country, state, or even municipality.

- Calculate the Tax Amount: Multiply the total before tax by the tax rate. For example, if the total is $500 and the tax rate is 10%, the tax amount would be $50.

- Clearly Display the Tax: List the tax amount as a separate line item. Include a label like “Tax (10%)” or “VAT” to indicate the specific tax applied.

- Show the Total Amount: Add the tax amount to the total to show the final amount due. Clearly display the final sum in a bold or highlighted font to draw attention.

2. Applying Discounts

Discounts can be applied either as a flat amount or as a percentage. Here’s how to add them:

- Identify the Discount Type: If the discount is a percentage (e.g., 10% off), calculate the discount based on the pre-tax total. If it’s a fixed amount (e.g., $50 off), simply subtract that amount from the total.

- Calculate the Discount: For a percentage, multiply the original amount by the discount rate. For a fixed discount, just subtract the amount directly from the total.

- Clearly Display the Discount: Make sure to itemize the discount in the document, with a clear label like “Discount (10%)” or “Early Payment Discount.”

- Show the New Total: After applying the discount, show the adjusted total amount due. This helps the recipient see the

Incorporating Payment Terms into Your Template

Clearly outlining payment expectations in your billing document is essential for smooth transactions. By setting transparent guidelines for when and how payments are to be made, you can reduce confusion and ensure timely settlements. Here’s how to properly incorporate payment terms to avoid misunderstandings and enhance professionalism.

1. Specify the Due Date

One of the most important aspects of payment terms is clearly stating when the payment is due. This prevents any ambiguity about when the recipient should settle their account. You can:

- Set a Clear Date: Indicate the exact due date (e.g., “Due by January 15, 2024”). This gives the client a clear deadline.

- Use a Standard Payment Period: Specify common terms like “Net 30” (payment due 30 days after the date of the document) or “Due on Receipt” (payment is expected immediately upon receipt).

2. Outline Late Fees or Penalties

To encourage prompt payments, it’s important to outline any late fees or penalties that will apply if the due date is missed. This not only motivates timely payment but also protects your business from delays.

- Specify the Fee Amount: Clearly state the fee that will be added for late payments (e.g., “A late fee of 5% will be applied to overdue amounts after 30 days”).

- Set a Grace Period: You might want to include a short grace period before the late fee applies, such as “A 5-day grace period is allowed before penalties apply.”

3. List Accepted Payment Methods

Make it easy for your clients to know how they can pay by clearly listing the available payment methods. This avoids any delays caused by payment confusion. You can:

- Include Bank Details: If you accept wire transfers, provide your banking information clearly.

- Accept Online Payments: If you use online platforms such as PayPal or credit card processing, include those options and any necessary details.

4. Mention Discounts for Early Payment

Offering a discount for early payment is an excellent way to incentivize quicker settlements. If you provide such offers, be sure to clearly include them in your payment terms:

- Define the Discount: For example, “A 2% discount will be applied if payment is made within 10 days.”

- Include Conditions: Clearly state any conditions or restrictions regarding the discount, such as “Discount applies to the total amount before tax.”Free vs Paid Invoice Templates

When choosing a document layout for financial transactions, businesses often face a decision between using free or paid options. Both offer advantages and drawbacks depending on your specific needs, but understanding the differences can help you choose the best solution for your situation. Here’s a breakdown of the key differences between free and premium document designs.

Feature Free Options Paid Options Customization Limited customization, often with basic design options. Advanced customization options, including full brand integration and tailored design features. Design Quality Simple, sometimes basic designs that may look generic. High-quality, professional designs that reflect your brand’s identity. Functionality Limited features, may lack advanced functions like automatic calculations or export options. Full functionality, including automatic calculations, multi-currency support, and export options (PDF, Excel, etc.). Support Minimal or no customer support, relying on user forums or FAQs. Dedicated support with customer service options, training, and assistance. Integration May not integrate with accounting software or payment gateways. Seamless integration with accounting systems, payment processors, and other business tools. Cost Completely free, no upfront costs. Requires an upfront or subscription cost, which can vary based on the provider. Choosing between free and paid options depends largely on the scale of your business and the specific features you need. Free designs can be a great starting point for small businesses or individuals with simple needs, while paid options provide enhanced functionality, professional designs, and long-term benefits for those seeking a more polished and efficient solution.

Choosing the Right Template for Your Business

Selecting the right document layout for managing financial transactions is essential for streamlining processes and maintaining professionalism. The right design can improve communication with clients, ensure accuracy, and create a cohesive brand identity. However, with various options available, it’s important to understand which one aligns best with your business needs. Here’s how to make an informed choice based on different factors.

1. Consider Your Business Size and Needs

The size of your business and the complexity of your transactions should guide your decision. A small business with simple, straightforward billing requirements may only need a basic design, while larger businesses with varied pricing structures may benefit from a more sophisticated layout with additional features.

2. Match the Design to Your Brand

Your document layout should reflect your business’s image. Whether you’re a creative entrepreneur or part of a corporate enterprise, the visual appearance of your financial documents speaks volumes about your professionalism and attention to detail. A well-aligned design helps reinforce your brand identity.

Business Type Recommended Layout Key Features Freelancer/Small Business Simple, clean design Easy-to-use, minimal sections, clear pricing breakdown Creative Agencies Modern, stylish layout Customizable branding, visually appealing design elements Large Enterprises Formal, structured design Advanced calculations, professional look, multiple line items E-commerce Product-focused design Itemized lists, easy tax calculations, shipping details Choosing the right document layout involves balancing functionality with visual appeal. By considering your business size, the complexity of your transactions, and how you wish to present your brand, you can select the most suitable option to ensure smooth and efficient financial operations.

How to Track Payments with Invoices

Tracking payments is a critical aspect of managing financial transactions. Properly monitoring which payments have been received and which are still pending helps ensure a steady cash flow and reduces the risk of missed payments. Using a well-organized system for recording and tracking these transactions can save time, reduce errors, and enhance your overall financial management. Here are some practical steps to keep track of payments effectively.

1. Include a Unique Reference Number

Every billing document should have a unique reference number. This number makes it easier to track individual payments, especially when dealing with multiple clients or transactions. It serves as an identifier for both you and the client, ensuring that payments can be linked to the correct record.

- Assign a sequential number for each document issued, ensuring no duplication.

- Include this number in all communication with the client regarding that specific transaction.

2. Record Payment Status

Clearly marking the payment status on each document helps to avoid confusion and ensures you know whether the amount is outstanding or has been paid. This can be done by adding a section to indicate the payment status, such as “Paid,” “Partial Payment,” or “Unpaid.”

- Paid: When payment has been received in full.

- Partial Payment: If a client has paid part of the amount due.

- Unpaid: If the payment is overdue or has not been received yet.

3. Set Payment Due Dates and Reminders

To avoid delays in payments, always include a clear due date on each document. You can also set reminders for clients who haven’t paid by the due date. By following up regularly, you can ensure that payments are processed promptly.

- Include a Due Date: Clearly display the payment due date to set expectations for when the payment is expected.

- Send Reminders: Follow up with clients who have not made payment by the due date. A reminder email or phone call can help expedite the process.

4. Use a Payment Log

Maintaining a log of all transactions is a reliable way to track payments over time. This log can be a digital or physical record, depending on your preferences, and should contain details such as the reference number, payment amount, date of payment, and client details.

- Update the log regularly to reflect incoming payments.

- Use it to reconcile your financial records and ensure that all payments are accounted for.

5. Leverage Software Too

Legal Requirements for Invoice Creation

When creating a billing document, it’s crucial to ensure that it complies with legal regulations. Different countries and regions have specific laws regarding what information must be included, how taxes should be applied, and how records should be maintained. Failing to meet these legal requirements can result in penalties, disputes, or even legal actions. Understanding these obligations is key to staying compliant and running a smooth business operation.

1. Required Information

Most jurisdictions require specific details to be included in a financial statement, ensuring transparency and clear communication between the business and the client. The following information is commonly required:

- Unique Identifier: Every document must have a unique reference number to prevent confusion and ensure proper tracking.

- Business Details: Include your business name, address, and contact information. This helps establish your identity as the seller or service provider.

- Client Information: Full name and address of the recipient should also be included for accurate record-keeping.

- Description of Goods or Work: A detailed list of what was sold or performed, including quantity and price.

- Tax Identification Number: Many countries require businesses to provide their tax ID number or VAT registration number.

2. Tax and Payment Details

In many regions, you are required to clearly show how taxes are applied, including the tax rate and total tax amount. This is necessary to comply with tax laws and to ensure that the client knows the exact amount being paid. Additionally, payment terms must be clearly stated.

- Tax Rate: Indicate the applicable tax rate (e.g., VAT, sales tax) and the total amount charged in taxes.

- Total Amount Due: The total amount due should include both the itemized costs and the taxes applied.

- Payment Terms: Specify when payment is due and the accepted payment methods, such as bank transfers, credit cards, or online platforms.

3. Retention of Records

For tax

Automating Invoice Generation with Software

Modern software solutions have made the process of generating payment documents more streamlined and efficient. Through automation, businesses can significantly reduce the time spent on administrative tasks, allowing professionals to focus on more strategic aspects of their operations. With just a few configurations, these tools enable the quick production of consistent, error-free documents tailored to various business needs.

Key Benefits of Automation

- Time-Saving: Automated tools handle repetitive tasks swiftly, reducing manual input and freeing up valuable time.

- Reduced Errors: Automatic data entry and calculations minimize human error, ensuring each document is accurate and professional.

- Consistency: Software ensures a uniform format across all records, enhancing professionalism and making documents easily recognizable.

Steps to Implementing Automation

- Identify a suitable software solution that meets your operational needs and integrates well with existing tools.

- Customize templates to align with your branding, including adding logos and preferred layouts.

- Set up automated reminders and notifications to ensure timely processing and minimize delays in document handling.

Sending Invoices Efficiently and Securely

Optimizing the dispatch of financial documents can improve workflow and ensure prompt receipt by recipients. Leveraging modern digital tools not only speeds up the sending process but also enhances the safety of sensitive information shared electronically.

Ensuring Fast and Smooth Delivery

Digital solutions allow businesses to send documents in real-time, reducing delays that often come with traditional mailing. With features like batch processing, multiple documents can be sent at once, saving time and increasing productivity. Additionally, automated scheduling tools can send reminders or re-send unpaid records, further streamlining the process.

Protecting Sensitive Information

When handling financial records, ensuring data security is critical. Many digital platforms offer encryption to protect files during transmission, reducing the risk of unauthorized access. Features like password protection or two-factor authentication add another layer of security, giving both sender and recipient confidence that information is shared securely.

How to Manage Unpaid Invoices

Efficiently handling outstanding payments is crucial for maintaining a stable cash flow and ensuring business continuity. By implementing systematic follow-up procedures, companies can improve their collection rates and reduce the number of overdue accounts.

Establishing a Follow-Up Process

A structured approach to follow-ups can make a significant difference in collecting overdue payments. This process might include sending polite reminders shortly after the due date, followed by more formal notices if the payment remains unresolved. Automating reminders through digital tools can save time and ensure consistency in communication.

Maintaining Positive Client Relationships

When addressing unpaid accounts, it’s essential to balance assertiveness with professionalism. Clear, respectful communication helps preserve client relationships while still emphasizing the importance of timely payments. Consider offering flexible options, such as payment plans, to accommodate clients who may be experiencing temporary financial challenges.

Customizing Templates for Different Clients

Adapting billing documents to suit the unique needs of each client can enhance professionalism and strengthen client relationships. Personalized layouts, branding elements, and tailored details not only create a cohesive presentation but also communicate attention to detail.

Customization can include adjustments to logos, color schemes, and font styles that align with a client’s brand, creating a consistent visual experience. Adding fields specific to a client’s industry, such as project codes or department references, ensures that each document is clear and relevant to their processes.

Flexible templates also allow for variations in payment terms, preferred currency, and language, accommodating clients from diverse backgrounds. This approach promotes a smoother billing experience and demonstrates a commitment to meeting each client’s specific preferences.

Ensuring Consistency Across Your Invoices

Maintaining uniformity in billing documents is essential for reinforcing brand identity and promoting a professional image. When each document follows the same structure and design, clients can easily recognize and understand the information, leading to a smoother payment experience.

A consistent layout includes using the same logo, color scheme, and font styles across all documents. This not only improves readability but also builds familiarity with your brand. Each document should display essential details in a fixed order, ensuring that clients can quickly locate key information regardless of who handles the paperwork.

Automating these elements within a digital platform can further guarantee uniformity, as all documents will automatically adhere to the same specifications. This approach helps avoid manual errors, maintains clarity, and presents a polished appearance every time.