Download Fillable Invoice Template PDF for Easy Customization

Managing financial transactions is a crucial part of any business or freelance activity. Ensuring accuracy, professionalism, and clarity in payment requests can significantly improve cash flow and client relationships. With the right tools, the process of creating custom payment forms becomes simple and efficient, saving time while maintaining a polished appearance.

One of the best ways to streamline this task is by using pre-designed forms that can be easily personalized for each transaction. These documents allow you to input specific details quickly, ensuring every required field is filled out without errors. Whether you’re a small business owner or a freelancer, using customizable documents can make invoicing faster and more reliable.

In this guide, we will explore how these editable forms can simplify the billing process. From easy customization to effortless distribution, learn how to create professional payment requests that meet your needs and maintain consistency across your business communications.

Why Use a Fillable Invoice Template

Creating professional payment documents can be a time-consuming task, especially when each one requires careful attention to detail. By using customizable forms, you eliminate the need to start from scratch each time, ensuring consistency and accuracy across all of your financial records. These ready-made solutions simplify the process, allowing you to focus on other important business tasks.

One of the key advantages of using editable forms is the ease of customization. With just a few clicks, you can add client details, services rendered, payment terms, and other necessary information. This not only saves you time but also reduces the likelihood of errors that could lead to misunderstandings or delays in payment.

Additionally, using digital forms allows for quick updates and easy adjustments. As your business grows or your pricing structure changes, you can effortlessly modify the document to reflect these updates. This adaptability ensures that you always present an up-to-date and professional appearance to your clients.

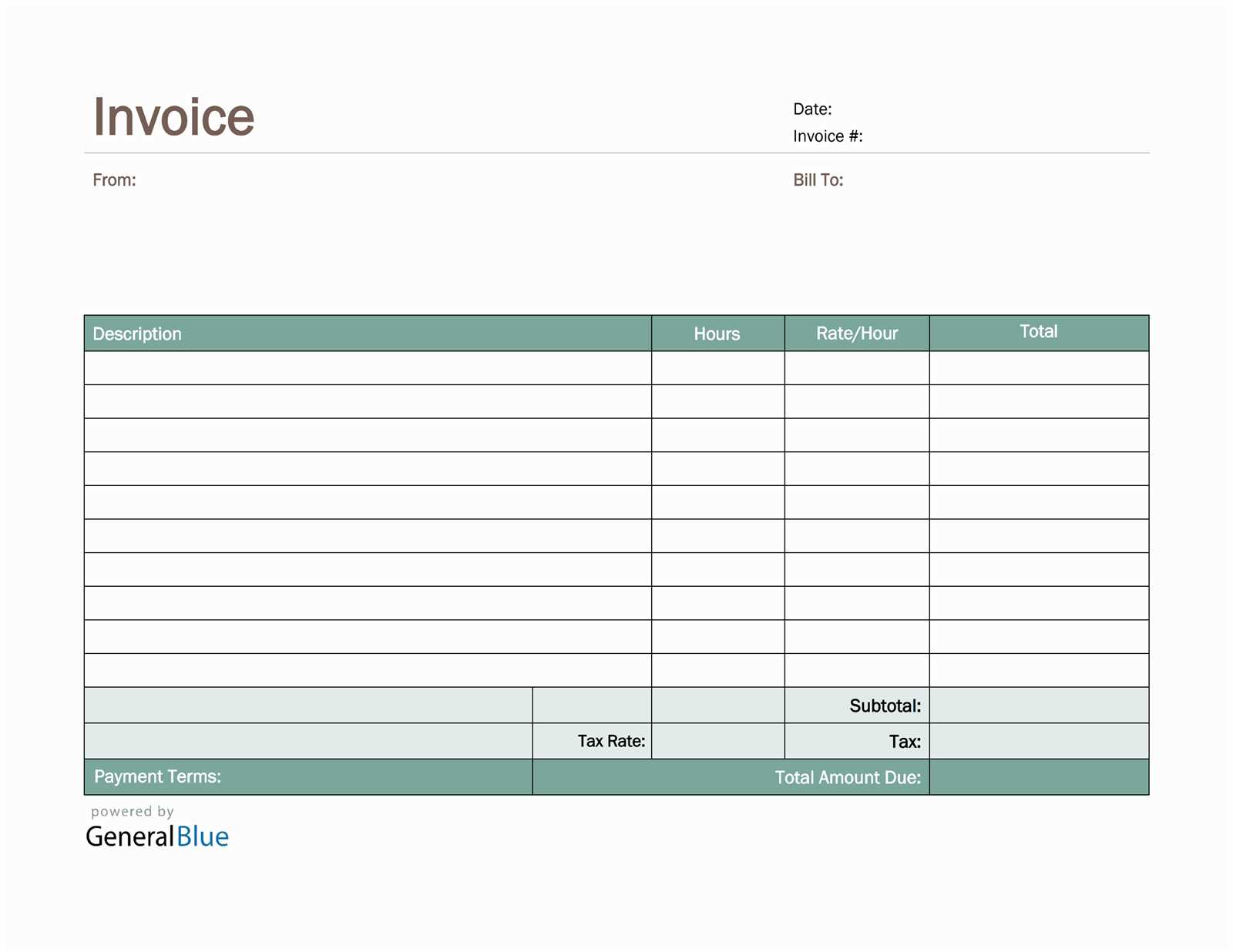

What is a Fillable Invoice Template PDF

At its core, this tool is a pre-designed document that allows users to quickly input relevant details and generate a formal payment request. Rather than creating a new record each time, the form offers predefined fields where information can be easily entered, reducing the time spent on paperwork and ensuring consistency. These documents are particularly useful for businesses that need to send frequent payment reminders or statements to clients.

Key Features of Editable Payment Forms

Editable forms are designed with flexibility in mind, making it easy to adjust the content according to your specific needs. These documents allow for fields such as client names, services provided, pricing, and payment terms to be customized. The goal is to streamline the process of preparing financial records, ensuring that every detail is accurate and professional without the need for manual adjustments each time.

Why Choose Digital Payment Documents

Unlike paper forms, digital documents can be quickly shared and stored. They also offer the benefit of being easily updated, which is especially helpful when there are changes to pricing or service offerings. The ability to save and email these forms directly from your device enhances efficiency, making them an excellent choice for modern businesses.

Benefits of Using a Fillable Invoice

Using a ready-made document that can be easily edited offers several advantages for businesses and freelancers alike. Instead of manually drafting payment requests from scratch, customizable forms save time and reduce the risk of errors. By having predefined fields for the necessary information, users can focus on the details that matter most, ensuring a more streamlined process.

Time Efficiency

One of the greatest benefits of using these pre-structured forms is the significant time savings. Instead of reformatting or creating new documents for each transaction, you simply input the relevant details and send it off. This efficiency can be especially valuable when dealing with multiple clients or frequent billing cycles, freeing up time for other business tasks.

Consistency and Professionalism

Customizable forms help ensure that all payment requests are consistent in style, layout, and content. A well-structured document reflects professionalism and attention to detail, which can improve client trust and the overall image of your business. Furthermore, the ability to update or modify the document as needed ensures that your business always looks current and reliable.

How to Download an Invoice Template

Downloading a customizable payment document is a straightforward process that allows you to quickly get started with billing. These ready-made forms are available on various platforms, and once downloaded, you can easily adjust them to fit your specific needs. Here are the steps to get started:

- Choose a trusted website or platform that offers downloadable financial documents.

- Browse through the available options and select the form that suits your business requirements.

- Click the download button or link, which will typically provide the document in a compatible format (such as Word or Excel). Some platforms may also offer a direct link for digital editing.

- Save the file to your device in an easy-to-access location.

- Once downloaded, open the document and customize it with your business details and specific transaction information.

Ensure that the platform you choose offers secure downloads to protect your data and provides the option to easily update or save your edited document for future use. Some websites even offer a collection of designs, allowing you to pick the best style for your business needs.

Customizing Your PDF Invoice Template

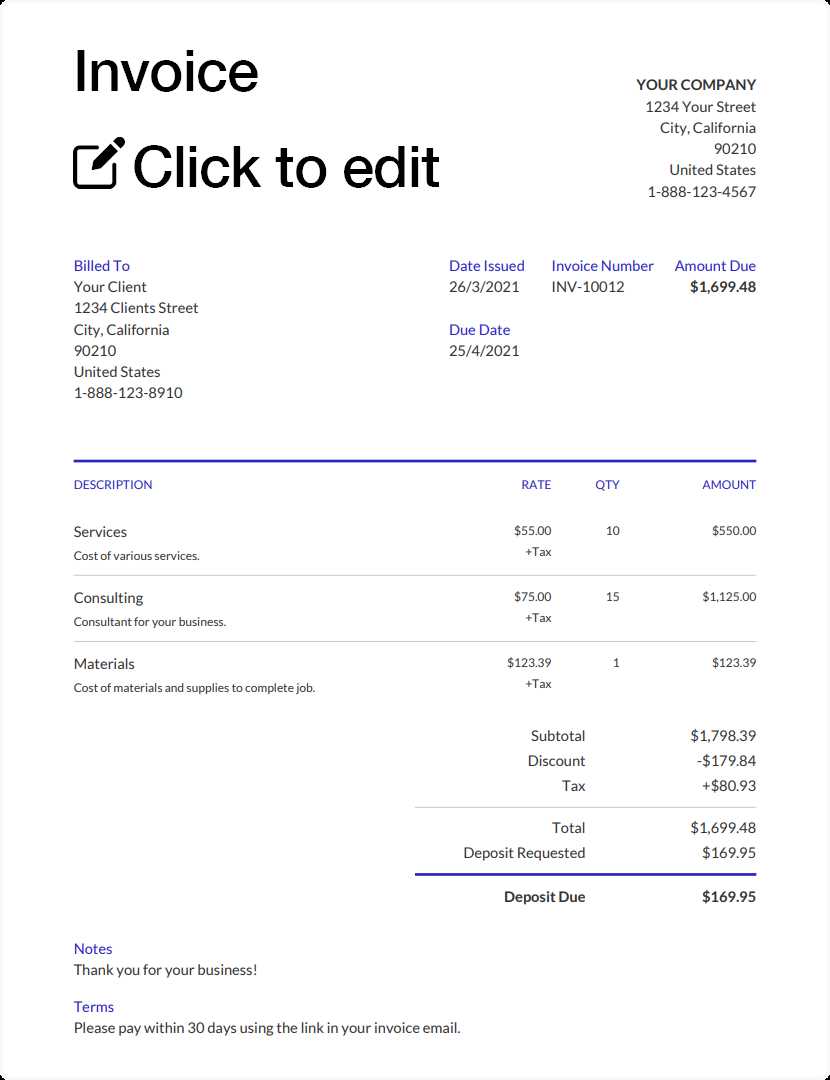

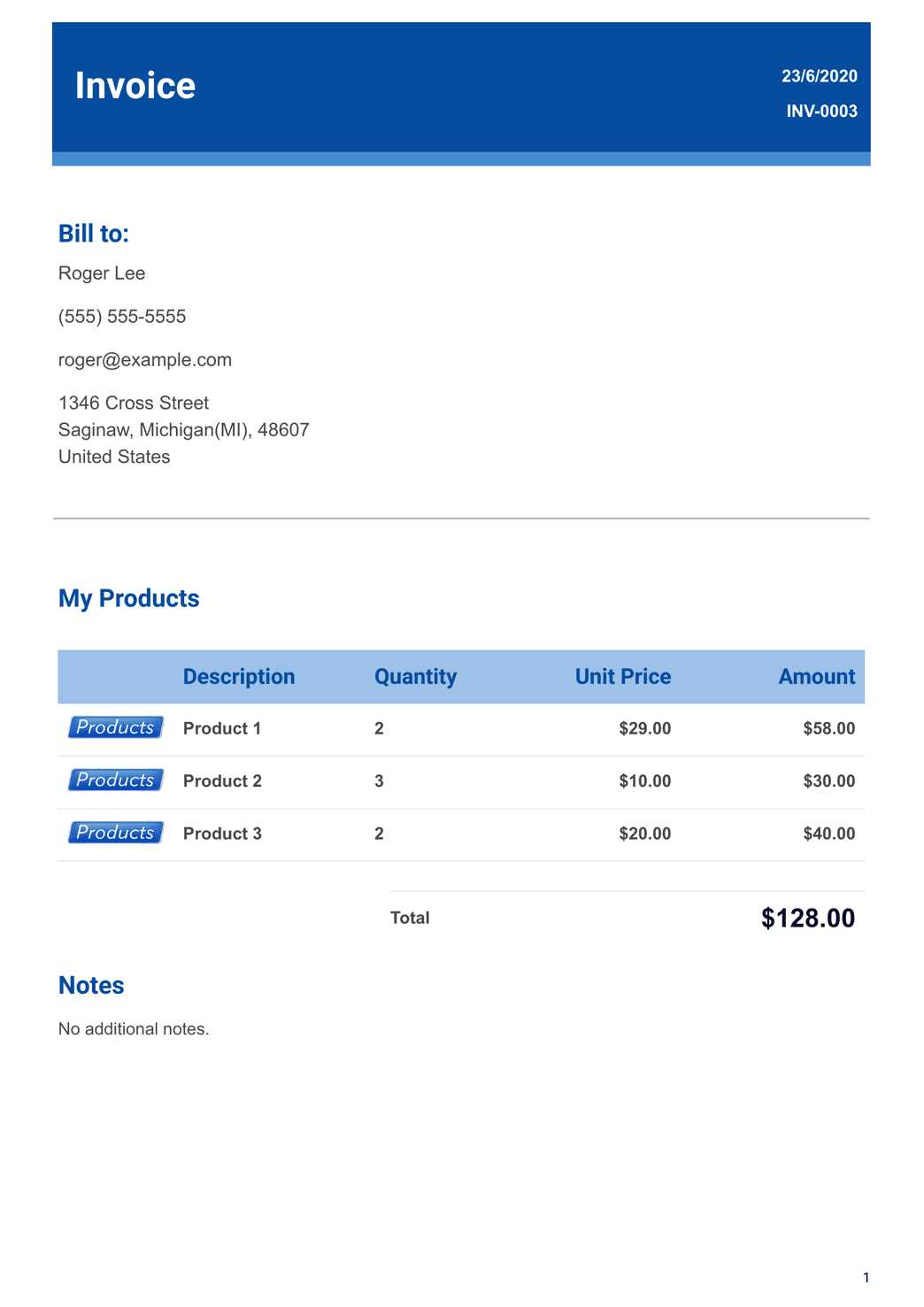

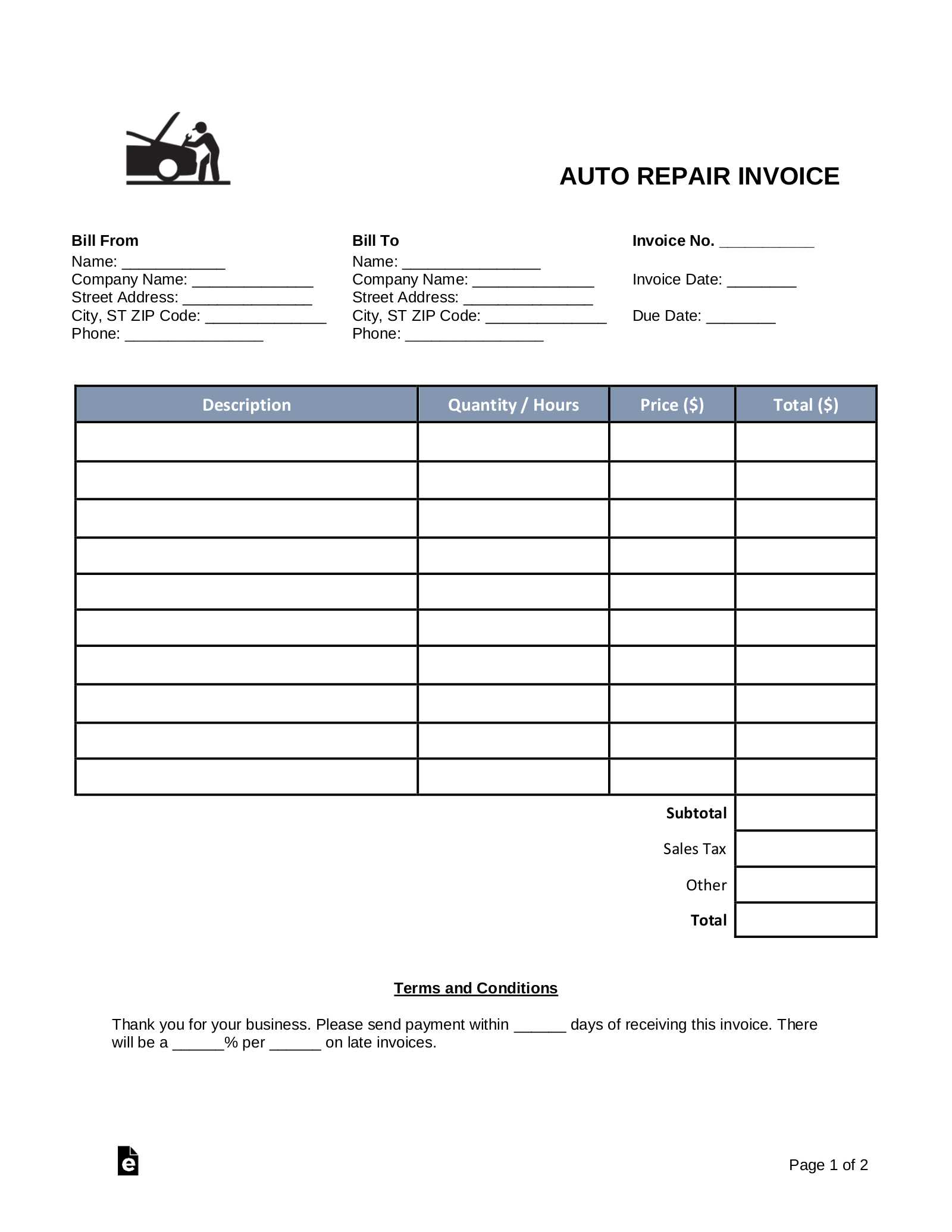

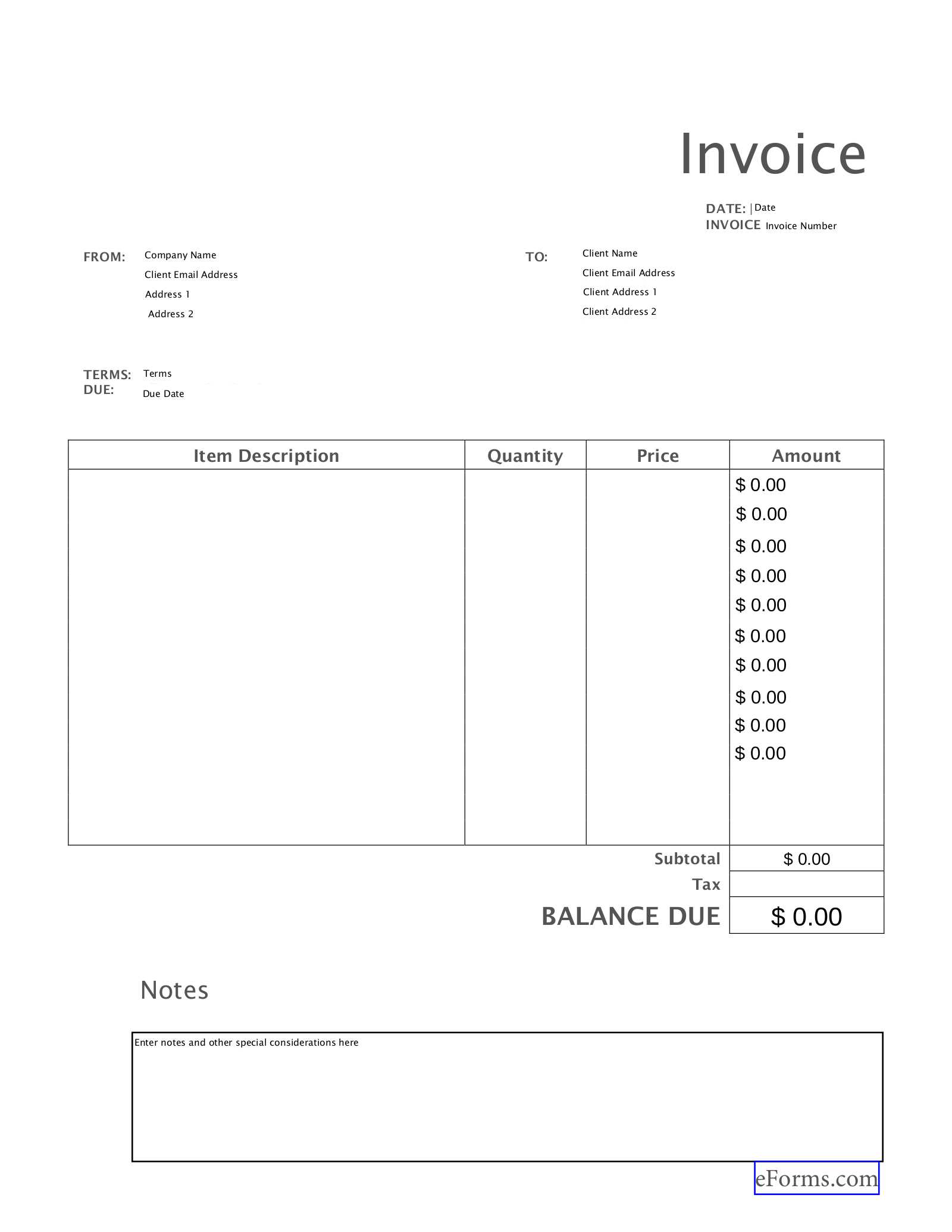

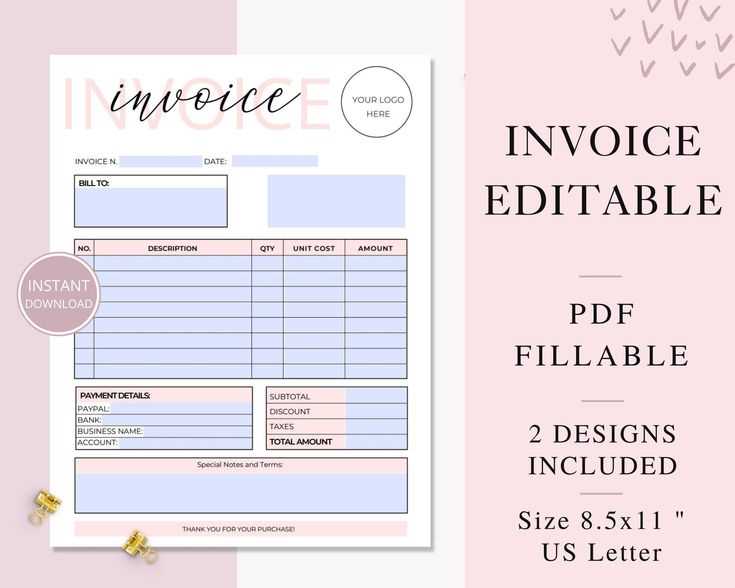

Personalizing your payment document is a key step in ensuring it meets the specific needs of your business. Whether you’re adjusting for unique pricing, including special payment terms, or adding your logo for a professional touch, customization allows you to create a document that reflects your brand and provides all the necessary details for your clients. Here’s how to make your document truly yours:

Adjusting Basic Information

The first step in customization is to input your business details. Include your company name, address, phone number, and email address. Don’t forget to add your client’s information, such as their name and billing address. Many forms also allow you to add tax IDs, so be sure to update any required fields that apply to your specific region or industry.

Personalizing Layout and Content

Once the basic details are in place, you can start adjusting the layout to fit your preferences. Many digital forms let you modify fonts, colors, and section arrangements. You can also add lines for additional details, such as descriptions of the products or services rendered. If you frequently offer discounts or need to specify payment terms, ensure these sections are clearly visible and easy to update for each new transaction.

Additionally, some platforms allow you to embed your business logo directly onto the form, giving it a polished and branded appearance. This small change helps maintain a professional image and makes the document instantly recognizable to your clients.

How to Add Business Information to Your Invoice

Adding your business details to a payment document ensures that your clients know who to contact and where to send their payments. Properly including this information not only enhances professionalism but also helps avoid confusion. Here’s a step-by-step guide to adding essential business details:

Essential Business Information to Include

- Business Name: Clearly state the name of your company or personal business.

- Contact Information: Provide your phone number, email address, and website (if applicable) so clients can reach you if needed.

- Physical Address: Include your office or business address. This is particularly important for clients who need to send payments by mail.

- Tax Information: If required, add your business tax ID number or VAT registration number to comply with local regulations.

Positioning Information on the Document

Once you have the necessary details, place them in a prominent location on the document. Typically, business information is positioned at the top, near the header section, making it easy for clients to find. If you use a design program, you can adjust the alignment, font style, and size to ensure this section stands out without overpowering other important details like payment instructions or amounts due.

Ensuring the accuracy and clarity of your business information is critical for both legal compliance and customer satisfaction. Always double-check that all details are up-to-date before sending out any documents to clients.

Top Features of a Fillable Invoice PDF

When choosing a customizable billing form, there are several key features that can greatly enhance your experience and improve the efficiency of your billing process. These features ensure that the document is easy to use, edit, and adapt to your business needs. Below are some of the most valuable aspects to look for in a customizable billing document:

Key Features to Look For

- Editable Fields: The ability to enter specific details such as client names, service descriptions, amounts, and due dates without any hassle. These fields are easy to update for each new transaction.

- Automatic Calculations: Many forms offer automatic total calculations, including tax and discount options. This eliminates the need for manual math and helps ensure accuracy.

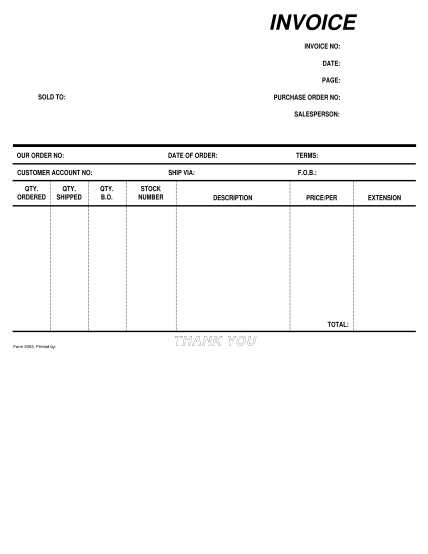

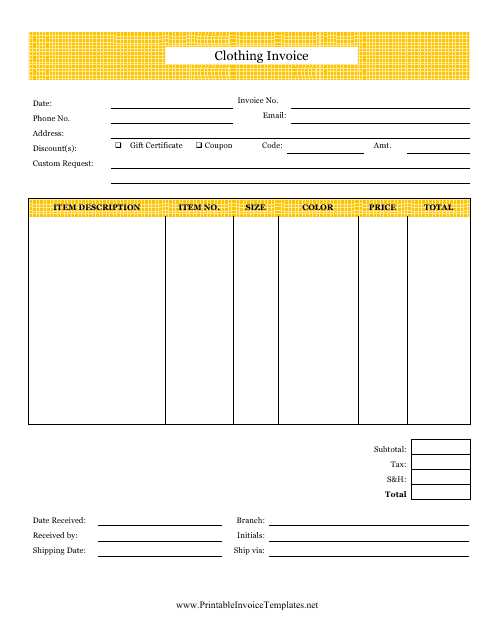

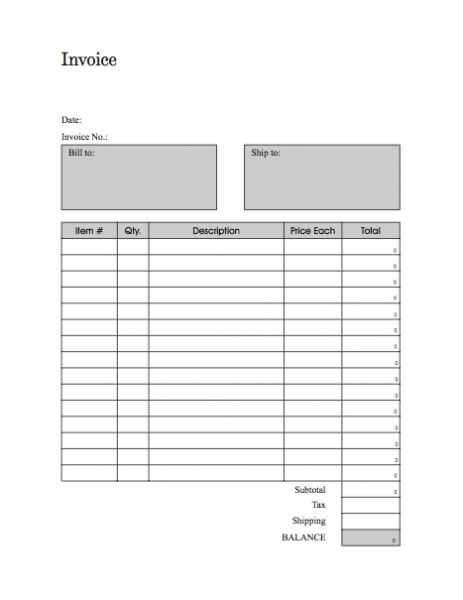

- Professional Design: A well-structured and visually appealing layout makes your document look professional. Look for forms with clean lines, clear sections, and an organized format.

- Multiple Currency Support: If you work with clients internationally, choose a form that supports different currencies and conversion options.

- Customizable Sections: The ability to adjust the structure of the document based on your business type, such as adding terms and conditions, payment methods, or special notes.

- Save and Reuse Options: Save frequently used forms for easy reuse, so you don’t have to re-enter your business information and formatting every time.

- Integration with Other Tools: Some forms can integrate with accounting software, which helps automate your financial record-keeping and tracking of payments.

By choosing a billing document with these features, you can streamline your invoicing process, maintain accuracy, and present a more professional image to your clients.

How to Fill Out Your Invoice Template

Filling out a billing document is an essential task to ensure that your clients receive accurate and clear payment requests. By properly completing all required fields, you ensure that all necessary details are included and minimize the chance of mistakes. Here’s how to correctly fill out your financial forms step by step:

Step 1: Enter Business and Client Information

Start by inputting your company’s information at the top of the document. This includes your business name, address, phone number, and email. Next, add the client’s details, such as their name, address, and contact information. Make sure these fields are correctly filled out to avoid confusion or delays in payment.

Step 2: Add Payment Details

Next, input the specific services or products provided. Include a detailed description, quantity, unit price, and total amount for each item. If applicable, add any discounts, taxes, or extra charges. Be sure to double-check the totals to make sure everything adds up correctly. Finally, set the payment terms, such as due date and accepted payment methods.

Once all sections are complete, review the document for any errors. Correct any typos, verify the numbers, and ensure that your client’s details are accurate before sending the document.

Best Tools for Editing PDF Invoices

Editing your financial documents can be simple and efficient with the right tools. Whether you need to update client details, adjust pricing, or add additional services, having a reliable editor can streamline your workflow. Below are some of the best tools available for editing digital payment records:

| Tool Name | Key Features | Best For |

|---|---|---|

| Adobe Acrobat DC | Advanced editing, secure document sharing, converting files to and from various formats | Professionals who need a comprehensive and secure solution |

| Smallpdf | Easy-to-use interface, online editing, converting and compressing files | Small business owners or freelancers who need quick and simple edits |

| PDFescape | Free online editor, fillable form creation, simple markup tools | Users looking for a free and straightforward editing tool |

| Foxit PhantomPDF | Multi-device support, batch editing, document collaboration features | Teams or companies requiring collaborative tools for document management |

| Sejda PDF Editor | Easy interface, quick text and image edits, cloud-based storage options | People looking for an intuitive, cloud-based PDF editor |

Choosing the right tool depends on your specific needs, whether you’re working on a single document or managing multiple files regularly. Most of these editors offer free versions with basic features, while premium versions provide more advanced options for businesses with complex invoicing requirements.

How to Save and Share Your Invoice

Once you’ve completed your billing document, the next step is to save it in a secure location and share it with your client. Properly saving and sharing your payment request ensures that both you and your client have a clear record of the transaction. Below are the steps to efficiently save and distribute your financial document:

First, save the document on your device or cloud storage to ensure you have an accessible copy for future reference. It’s recommended to save the file in a format that maintains its formatting, such as a digital file or other widely accepted formats. Be sure to use a naming convention that helps you easily identify the document, such as including the client’s name and the date.

Once saved, you can share the document with your client via email or through a secure file-sharing platform. When sending via email, attach the file directly and write a brief message indicating the amount due and payment terms. If you’re using an online payment system or platform, many services allow you to send the document directly through their interface, further simplifying the process.

Common Mistakes in Invoice Creation

When preparing billing documents, small errors can lead to confusion or delayed payments. Understanding common mistakes can help you avoid these issues and ensure your documents are accurate and professional. Below are some frequent errors that people make when creating payment requests:

Top Mistakes to Avoid

| Error | Impact | Solution |

|---|---|---|

| Missing Client Information | Confusion about who the payment is for, potential delays in processing | Always double-check client details before sending the document |

| Incorrect or Missing Payment Terms | Payment delays, disputes over due dates, or payment amounts | Clearly outline payment terms, due dates, and methods before finalizing |

| Not Including Itemized Charges | Clients may question the charges, leading to delayed or withheld payments | Ensure all services/products and their prices are listed in detail |

| Mathematical Errors | Incorrect totals, tax calculations, or missed discounts can cause confusion | Double-check all calculations and use automatic calculation features if available |

| Unprofessional Formatting | Could make your business appear less credible and lead to a lack of trust | Use a clean, clear format with well-organized sections and appropriate fonts |

How to Prevent These Mistakes

To avoid these common errors, always review your document carefully before sending it. You can also use digital tools that include built-in checks to help spot and correct mistakes automatically. Creating a checklist to ensure all fields are filled out correctly can also be helpful in reducing the chances of missing important details.

Automating Your Invoicing Process

Streamlining your billing process through automation can save you time, reduce human error, and improve cash flow management. By using automated systems, you can eliminate repetitive tasks and ensure that payment requests are generated and sent on time without manual intervention. Here’s how you can automate your billing process:

Steps to Automate Your Billing Workflow

- Use Invoicing Software: Invest in invoicing platforms or accounting software that offer automated billing features. These tools can generate and send payment requests based on pre-set schedules.

- Set Up Recurring Billing: For clients with ongoing services or subscription-based payments, set up recurring billing so that invoices are automatically created and delivered at regular intervals.

- Integrate Payment Gateways: Connect your billing system with online payment platforms, allowing clients to pay directly from the payment request. This reduces delays in receiving payments and makes the process more convenient for both parties.

- Automate Payment Reminders: Set up automatic reminders for clients with outstanding balances. This ensures timely follow-up without needing to manually track overdue payments.

- Utilize Cloud Storage: Store your payment records and documents in the cloud for easy access and organization. Cloud-based systems also allow for automated document generation and sharing.

Benefits of Automation

- Time Savings: Automation reduces the time spent on manual tasks such as creating and sending documents, allowing you to focus on other important aspects of your business.

- Consistency: Automated systems ensure that your payment requests follow a consistent format and include all the necessary details, reducing the risk of errors.

- Improved Cash Flow: By sending timely payment reminders and setting up automatic payment processing, you can improve your business’s cash flow and reduce delays in receiving payments.

- Reduced Administrative Work: Automating repetitive tasks eliminates the need for constant administrative oversight, freeing up resources for more value-added activities.

By incorporating these automated tools into your workflow, you can simplify your billing process and enhance overall business efficiency.

Ensuring Invoice Accuracy with Templates

Accurate billing is crucial for maintaining trust with clients and ensuring timely payments. Using structured documents can significantly reduce errors and streamline the process, allowing you to focus on providing services rather than correcting mistakes. Here’s how templates can help you achieve precision in every payment request you send out:

Key Benefits of Using Structured Documents

When you use pre-designed forms, much of the formatting and essential information is already organized for you. This minimizes the risk of missing critical details, such as client names, dates, or payment terms. Templates also standardize the layout, ensuring consistency across all documents you generate, which is vital for professionalism and reducing human error.

How to Ensure Accuracy

- Double-Check Client Information: Always verify that the recipient’s name, address, and contact details are correct to avoid any confusion or delays in payment.

- Include Clear Descriptions: Use specific language to describe the products or services provided. Be detailed in your descriptions to prevent misunderstandings regarding what is being billed.

- Automate Calculations: If your tool supports it, use automatic fields to calculate totals, taxes, and discounts. This helps prevent manual calculation errors.

- Review Terms and Conditions: Make sure that payment terms, such as due dates and late fees, are clearly stated and easy to understand for the client.

By ensuring that your documents are properly set up and accurate from the start, you improve your efficiency and help maintain good relationships with your clients.

Invoice Templates for Freelancers and Contractors

Freelancers and independent contractors often manage their own billing processes, which means having a clear and professional document to request payment is crucial. A well-organized document not only ensures that clients understand the services provided but also helps to maintain a smooth cash flow. For independent workers, using pre-designed forms can save time and reduce errors, allowing them to focus on their work rather than the paperwork.

For freelancers and contractors, the key is creating a billing form that is simple, yet comprehensive. The document should include all necessary details such as a breakdown of services rendered, the payment amount, and the terms of payment. Additionally, having the flexibility to personalize each document based on the client’s needs is vital.

What Freelancers Should Include in Their Payment Requests

- Client Information: Include the full name and contact details of the client to ensure there is no confusion.

- Services Provided: List the specific tasks completed or hours worked, with clear descriptions, so the client knows exactly what they are paying for.

- Payment Amount: Make sure the total due is accurate, including any applicable taxes or discounts.

- Payment Terms: Clearly state when the payment is due, the accepted methods, and any late fees if applicable.

- Personal Branding: Customize the document with your logo, brand colors, and other personalized elements to reinforce your professional image.

Using standardized forms for every project will help streamline the invoicing process, ensuring you don’t miss critical details and always present a polished image to your clients. These forms can also be saved for future use, reducing the need to create a new one each time you finish a job.

Legal Considerations in Invoicing

When creating payment requests, it is essential to ensure that the document meets legal requirements and protects both your business and your clients. Proper documentation can help prevent disputes and ensure smooth transactions, while also maintaining compliance with tax regulations and contractual obligations. Here are some key legal considerations when preparing your billing documents:

Key Legal Elements to Include

- Clear Payment Terms: Ensure that the payment terms are clearly defined, including the due date, acceptable payment methods, and any late fees. This reduces the potential for misunderstandings and ensures both parties are aware of their obligations.

- Tax Information: Depending on your location and business type, you may need to include tax details such as VAT or sales tax. This ensures compliance with local tax regulations and helps avoid future issues with tax authorities.

- Business Registration Information: Include your business registration number, address, and other relevant details, especially if required by law in your jurisdiction. This establishes the legitimacy of your business and helps ensure proper record-keeping for both you and your clients.

- Itemized Charges: Clearly outline the services or products provided, along with the associated costs. This not only makes the payment request clear to the client but can also be important in case of a legal dispute about the services rendered.

- Contractual References: If the payment request is related to a contract or agreement, include reference numbers or the date the contract was signed. This helps ensure that the payment request aligns with the terms of the agreement and can be easily traced back to the original contract if needed.

Protecting Your Business

Having legally sound payment documents can protect your business from potential disputes and ensure that you have the necessary documentation if a client fails to make a payment. It is advisable to keep copies of all payment requests for your records, and to follow up on overdue payments in a timely manner.

Ensuring that your billing practices are legally compliant not only builds trust with clients but also helps safeguard your business in case of any future legal issues.

Best Practices for Professional Invoices

Creating a polished and professional billing document is essential for maintaining a good relationship with clients and ensuring timely payments. A well-crafted payment request not only reflects your attention to detail but also enhances your credibility as a business. Below are some best practices to follow when preparing payment requests for your clients:

Key Elements of a Professional Billing Document

- Clear and Concise Layout: Keep the document organized with clearly defined sections, such as client information, services rendered, and total due. A clean layout ensures that your client can quickly understand the details of the payment request.

- Consistent Branding: Include your business logo, colors, and fonts to reinforce your brand identity. Consistency in design helps establish your business’s professionalism and creates a more personalized experience for the client.

- Accurate and Itemized Charges: Always provide a detailed breakdown of the services or products provided. List each item with its corresponding cost to avoid confusion and make it clear what the client is paying for.

- Payment Terms and Due Date: Clearly outline the payment terms, including the due date and acceptable payment methods. This reduces misunderstandings and sets clear expectations for the client regarding when and how payment should be made.

- Contact Information: Include your contact details, such as email and phone number, in case the client has any questions or concerns. Being accessible can foster better communication and demonstrate your professionalism.

Additional Tips for Enhancing Your Billing Documents

- Use a Professional Tone: Keep your language polite, professional, and direct. Avoid overly casual language or slang, as this can undermine the professionalism of your request.

- Proofread for Errors: Ensure there are no typos or errors in the payment document. Mistakes can give a bad impression and lead to confusion about the amounts or terms.

- Make It Easy to Pay: Include multiple payment options, such as bank transfer, online payment platforms, or credit card, to make it as convenient as possible for clients to settle their dues.

By following these best practices, you can create payment requests that not only reflect your professionalism but also encourage prompt payments and smooth transactions.

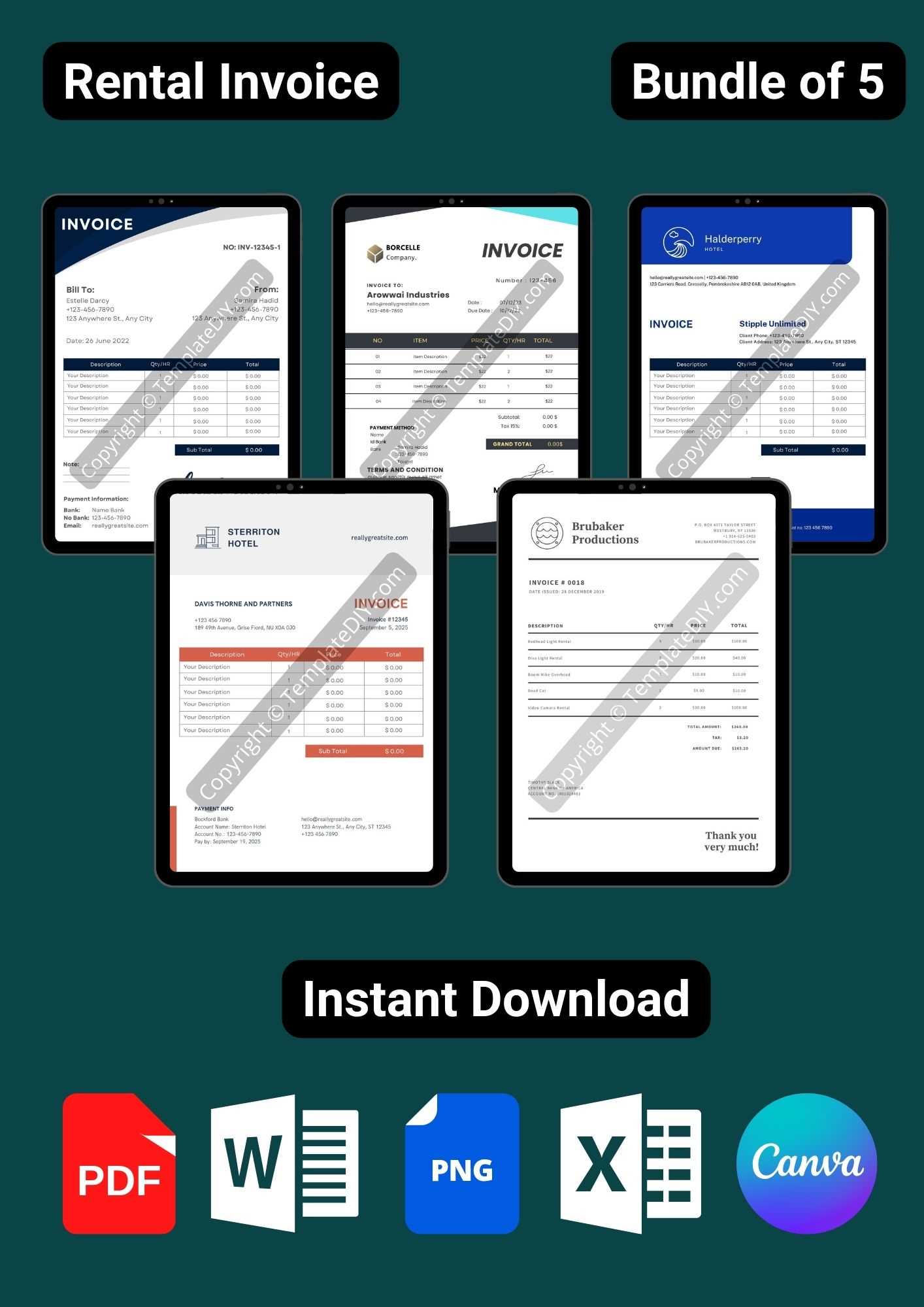

Where to Find Free Fillable Invoice Templates

When looking to create a professional payment request, it can be helpful to find a ready-made form that meets your needs. Fortunately, there are many resources available online where you can download free customizable billing forms that are easy to fill out and personalize. These forms can save you time and ensure that your payment requests are well-organized and professional.

Popular Sources for Free Payment Request Forms

- Online Accounting Software: Many accounting software platforms offer free billing forms as part of their free or trial versions. These tools allow you to generate and customize documents quickly. Examples include Wave, Zoho Invoice, and FreshBooks.

- Template Websites: Websites such as Template.net, Vertex42, and Office Templates offer a variety of free downloadable forms. These sites often provide options in multiple formats, including Word, Excel, and even Google Docs, so you can choose the one that works best for you.

- Google Docs: Google Docs has a built-in collection of free templates, including billing forms. You can easily customize these to fit your business needs and save them directly to your Google Drive.

- Microsoft Office Templates: If you have access to Microsoft Office, there are many free customizable forms available on their official template page. You can download a Word or Excel version and tailor it to your specific requirements.

- Freelance Platforms: Many platforms for freelancers, such as Upwork and Fiverr, offer free tools and resources to help contractors create professional payment requests. Some even provide sample forms that you can easily adapt to your business.

Considerations When Using Free Forms

- Customization Options: Ensure that the form you download can be customized with your business details, logo, and specific payment terms.

- Compatibility: Choose a format that works well with your preferred software or platform (Excel, Word, Google Docs, etc.) to make the process easier.

- Legal Compliance: Make sure that the form includes necessary legal information, such as payment terms, tax details, and business registration numbers, to comply with local regulations.

By taking advantage of these free resources, you can quickly and easily create professional, accurate payment requests that meet your business needs without having to spend money on expensive software or services.